Research Article: 2025 Vol: 29 Issue: 2

Market Assessment Study of Anti-Diabetic Brands across Nagpur City, India with A Focus on Formulating Marketing Strategy

Saurabh Kumar Banerjee, IIHMR University, Jaipur, Rajasthan

Shefali Karmore, IIHMR University, Jaipur, Rajasthan

Nikita Choudhary, Poornima University, Jaipur, Rajasthan

Citation Information: Banerjee, S.K., Karmore, S., & Choudhary, N. (2025). Market assessment study of anti-diabetic brands across Nagpur city, India with a focus on formulating marketing strategy. Academy of Marketing Studies Journal, 29(2), 1-13.

Abstract

Brand existence of prescription medicines is considered one of the pharmaceutical industry's crucial assets in its marketing strategy, as it drives the success of the organization. During the year 2024, 485 new brands were introduced in the anti-diabetic segment in India. Hence there is a fierce competition in the pharma market for maintaining the legacy of the brands. An extensive literature search revealed that there was a dearth of scientific studies related to market assessment of brands of anti-diabetic FDC prevailing in Nagpur city. Thus, the study aimed to explore diabetes medication trends across the East, West, North and South zones of Nagpur. By analysing prescription patterns, patient demographics, and market drivers, this research seeks to provide actionable insights in formulating marketing strategies for pharmaceutical companies and policymakers. The current study was prospective, observational cross-sectional research aimed to understand market trends about the prescribing brands in anti-diabetic drug therapy being used in the Nagpur city of Maharashtra, India. The study was conducted through personal visits to a total of 200 pharmacies spread across East, West, North and South of Nagpur city. The anti-diabetic brands prescribed were observed and captured across 50 pharmacies in each zone during January to February 2024 and the data was analysed on MS office Excel to derive the insights. The most prescribed anti-diabetic brand in Eastern Nagpur was Glycomet 500 SR Tablet (Metformin 500mg), The most prescribed anti-diabetic brand in Western Nagpur was Glyciphage SR 1gm Tablet [(Metformin (1000mg)]. In the Northern Nagpur the most prescribed anti-diabetic brand was Janumet XR CP Tablet [Sitagliptin (100mg) + Metformin (1000mg]. In Southern Nagpur the most prescribed anti-diabetic brand was Istamet XR Tablet [Sitagliptin (100mg) + Metformin (1000mg] The market assessment study of the Eastern, Western, Northern and Southern part of Nagpur city revealed that the prescription base for the antidiabetic brands was more prominent in the Western (42%) and Northern (41%) part. In the Southern part of the Nagpur City the prescription base for the antidiabetic brands were observed at an optimum level at 33% and in the Eastern Nagpur the prescription base for the antidiabetic brand was lowest at 14%. Based on the findings of the current study it can be concluded that market assessment studies based on the prescription analysis of the brands being prescribed in a certain geographical location are a valuable tool for formulating an effective marketing strategy.

Keywords

Anti-Diabetic Brand, Marketing Strategy, Nagpur, Market Assessment, Prescription Patterns, Pharmaceutical Market, Fixed Dose Combinations (Fdc).

Introduction

Brand presence of prescription medicines is considered one of the pharmaceutical industry's crucial assets, as it provides the organization with an identity, contributes to profitability, stimulates consumer purchases, bolsters marketing and advertising efforts, and fosters employee pride. Thus, branding is not just a marketing strategy; it's a powerful tool that can drive success in the pharmaceutical industry. It's about creating a unique identity, building trust, influencing decisions, and ultimately, improving the bottom line.

By 2024, the pharmaceutical industry in India is projected to reach $65 billion, and it is expected to grow to $130 billion by 2030. Currently, the pharmaceutical industry in India is valued at $50 billion. Indian pharmaceutical exports serve more than 200 countries, making India a significant exporter of pharmaceuticals (FICCI, 2024). India is home to over 3,000 pharmaceutical companies and more than 10,500 manufacturing facilities (IBEF, 2024).

A study conducted by the Competition Commission of India revealed that in India between August 2019 and July 2020, there were 47,478 brands linked to 2,871 formulations. On average, this equates to 17 brands per formulation. The number of brands and formulations differs across therapeutic categories. For instance, vitamins and minerals have the highest average number of brands per formulation at 37, while vaccines and anti-neoplastic medications have the lowest at five and seven brands per formulation, respectively. Currently, it is estimated that over 17,000 pharmaceutical companies in India produce more than 40,000 branded formulations, which is significantly higher than the global average (Competition Commission of India, 2021).

The Indian pharmaceutical industry faces intense competition from domestic companies and global markets, and faces several challenges in terms of Price controls, Regulatory environment, Buyer power, Market-based ceiling determination. Pharma companies have been introducing new products at a healthy pace in the domestic drug market, but the return on investment is a challenge across therapy areas (disease groups), shows a recent analysis by market research firm Pharmarack AWACS. On an average, companies spent around 30-40 per cent of a brand’s targeted annual sales to promote a new brand (Sohini, 2024).

Pharmaceutical companies utilize market assessment studies to gather and analyze information about the pharmaceutical market scenario. This involves assessing the size of the drug market, demographics of patients, competitive analysis, pricing strategies, and trends in pharmaceutical sales. The research also encompasses developing an understanding of prescribing patterns, patient experiences with medications, and emerging trends in brands of medicines prevailing in the market.

The goal of market research in the pharmaceutical sector is to provide organizations, healthcare providers, and policymakers with valuable insights to inform decision-making. This can encompass processes related to Brand management and approval, as well as strategies for marketing and patient education. Improved patient outcomes, increased innovation, and commercial success are all advantages of conducting research in the pharmaceutical sector (Lelde, 2024).

The market for pharmaceuticals is seeing notable expansion, with anti-diabetic medications taking the lead by demonstrating a value increase of more than ₹155 crore for newly launched brands in the year 2024. During this period, 485 brands were introduced in the anti-diabetic category. Experts in the pharmaceutical industry note that the anti-diabetes market has seen a 32% compound annual growth rate over the last five years, reaching ₹474 crore in January 2024 (Teena, 2024).

Hence it become imperative to undertake a through market valuation of the brands available in the anti-diabetic therapy market and formulate the marketing strategies based on information derived from the trends prevailing in the market. The insights shared in the present study can be used by the brand managers for formulating an effective marketing strategy.

Review of Literature

In their research (Bhatt, 2024) found that diabetes mellitus is a group of conditions that impact the body's utilization of glucose, also known as blood sugar. Glucose is essential for providing energy to the cells in muscles and tissues, and it is also the primary energy source for the brain. The market for diabetes care drugs in India is projected to have a value of USD 1.7 billion in 2024 and is forecasted to grow at a compound annual growth rate (CAGR) of 3.5%, reaching USD 2.01 billion by 2029. The prevalence of diabetes in India is 101 million, and contributing risk factors include race, age, obesity, lack of physical activity, poor diet, behavioural habits, genetics, and family medical history.

A ground breaking study by (Levy, 1994) on pharmaceutical marketing suggests that pharmaceutical marketing plays a crucial role in the process of transforming research concepts into practical therapeutic tools and providing progressively more useful information to the health care system.

Therefore, the transfer of information to physicians through marketing is essential for pharmaceutical innovation. Marketing helps physicians make informed choices by offering carefully characterized agents, enabling them to tailor drug therapy to individual patient needs

Pharmaceutical marketing currently stands as the most comprehensive and organized information system for keeping physicians updated on the availability, safety, efficacy, hazards, and techniques of using medicines. While the costs of pharmaceutical marketing are significant, they are in line with those of high-technology industries that need to convey important and complex information to sophisticated users. These costs are balanced by the savings resulting from the proper use of medicines and the reduced drug costs due to price competition (Al Thabbah et al., 2022)

In (Competition Commission of India, 2021) report indicates that the majority of the pharmaceutical market in India is made up of generic drugs, which make up about 97% of the country's drug consumption in terms of value. However, only approximately 10% of the drugs available in the local market are unbranded or generic generics, which are marketed using only their chemical names as commodity generics. These drugs are mainly obtained and distributed in public health facilities. Around 87% of the drugs distributed in India are branded generics, meaning they are generic drugs sold under specific brand names. The concept of 'branded generics' is almost exclusive to India.

In (Masárová et al., 2015) their research study focuses on the importance of marketing research not only on the B2C market but also on the B2B companies.

Research Gap

An extensive literature search revealed that there is a dearth of scientific studies related to market assessment of brands of anti-diabetic FDC prevailing in Nagpur city. The study aimed to explore diabetes medication trends across the East, West, North and South zones of Nagpur. By analysing prescription patterns, patient demographics, and market drivers, this research seeks to provide actionable insights in formulating marketing strategies for pharmaceutical companies and policymakers.

Objectives

The objectives of the study are as portrayed below: -

• To identify the market trends in anti-diabetic brands spread across Nagpur city of India.

• To analyse the competitive landscape of the antidiabetic brands in Nagpur city of India.

• To suggest the actionable marketing strategy based on the findings of market assessment.

Research Methodology

Study Design and Settings

The current study was prospective, observational cross-sectional research aimed to understand market trends about the prescribing brands in anti-diabetic drug therapy being used in the Nagpur city of Maharashtra, India.

The study was conducted through personal visits to a total of 200 pharmacies spread across East, West, North and South of Nagpur city. The anti-diabetic brands prescribed were observed and captured across 50 pharmacies in each zone during January to February 2024 and the data was analysed on MS office Excel to derive the insights.

Ethical Consent

Verbal consent was sought from the patients visiting the pharmacy while capturing the information about the prescribed anti-diabetic brand from the Prescriptions. The objective of the study was explained to them, and it was recounted that no personal information will be used and disseminated during the outcome of the study. The consent of the pharmacy owner was also taken during the data collection exercise.

Results and Discussions

East Zone Analysis of Anti-Diabetic Brands In Nagpur City

In the East Nagpur zone, 77 pharmacies were approached in order to collect the desired market information, out of which 27 pharmacy owners did not responded to the survey. Hence the findings across 50 pharmacies were collected and are presented in the current study. The total number of prescriptions observed across 50 pharmacies was 4,085. Out of the total prescriptions in 585 prescriptions either a single or more than one brand of anti-diabetic drug therapy was prescribed, and in 3500 prescriptions brands of other drug therapy were written, hence the percentage of anti-diabetic drug prescription out of the total prescription across 50 pharmacies in East of Nagpur was 14.3 % of the total.

Top Prescribed Brands of Anti-Diabetic Therapy

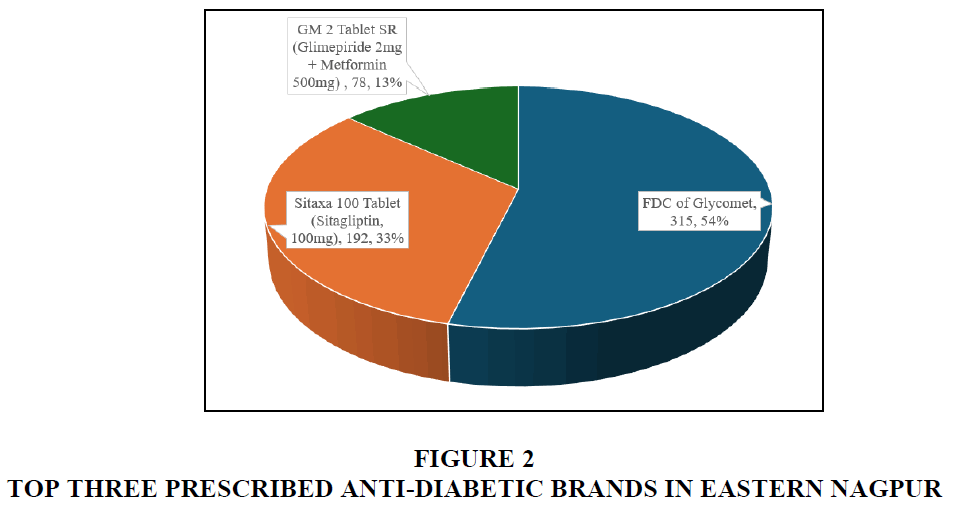

The most prescribed diabetes brand was Glycomet 500 SR Tablet (Metformin 500mg), from USV Ltd, Sitaxa 100 Tablet (Sitagliptin, 100mg) was second most prescribed brand from Torrent Pharmaceuticals, followed by GM 2 Tablet SR (Glimepiride 2mg + Metformin 500mg) from Pharma Planet India.

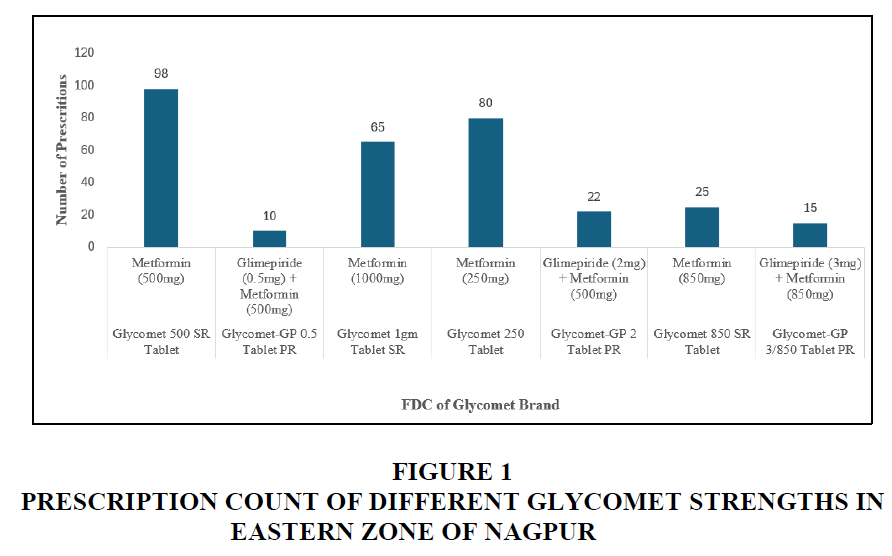

Glycomet 500 SR tablet emerged as the leading brand, with 98 prescriptions, followed by other FDC of Glycomet. There were 217 prescriptions on which different strengths of Glycomet were prescribed. Hence in 315 prescriptions various FDC of Glycomet brand were prescribed out of total 585 anti-diabetic prescriptions. The results are depicted in Figures 1 & 2.

Age Group Distribution

The demographic analysis related to the age group of the prescribed brands in anti-diabetic therapy revealed that both male and females in the age groups of 40-50 and 50-60 years had the highest prescription frequencies, and frequency of medication was generally for two months. In 365 out of 585 prescriptions, one or more anti-diabetic brands were prescribed to male patients, while in 220 prescriptions, a brand of anti-diabetic medication was dispensed to female patients.

West Zone Analysis of Anti-Diabetic Brands in Nagpur City

In the West Nagpur zone, 68 pharmacies were approached in order to collect the desired market information, out of which 18 pharmacy owners did not responded to the survey. Hence the findings across 50 pharmacies were collected and are presented in the current study.

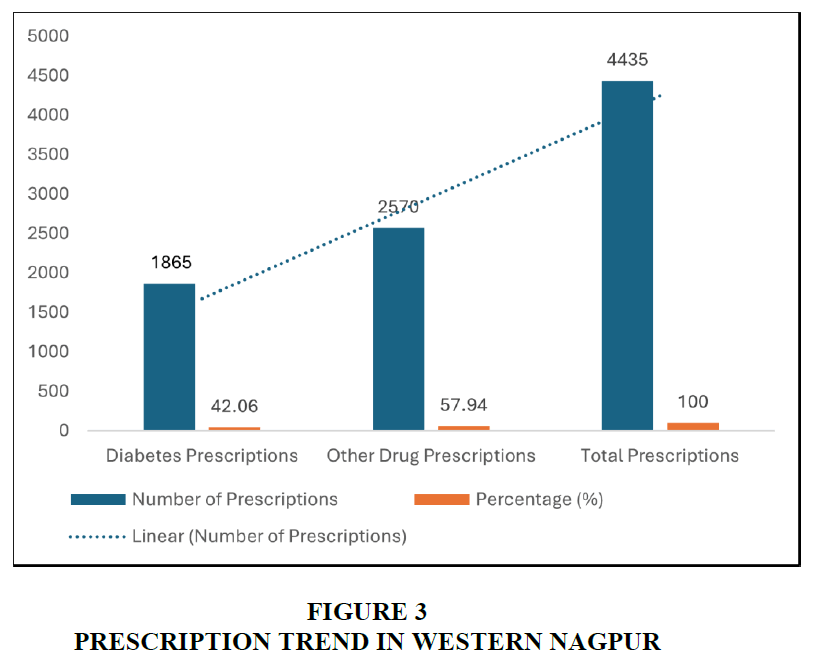

The total number of prescriptions observed across 50 pharmacies were 4435. Out of the total prescriptions in 1,865 prescriptions either a single or more than one brand of anti-diabetic drug therapy was prescribed, and in 2,570 prescriptions, brands of other drug therapy were written, hence the percentage of diabetic drug prescription out of the total prescription across 50 pharmacies in West of Nagpur was 42.05 %. The results are depicted in Figure 3.

Top Prescribed Brands of Anti-Diabetic Therapy

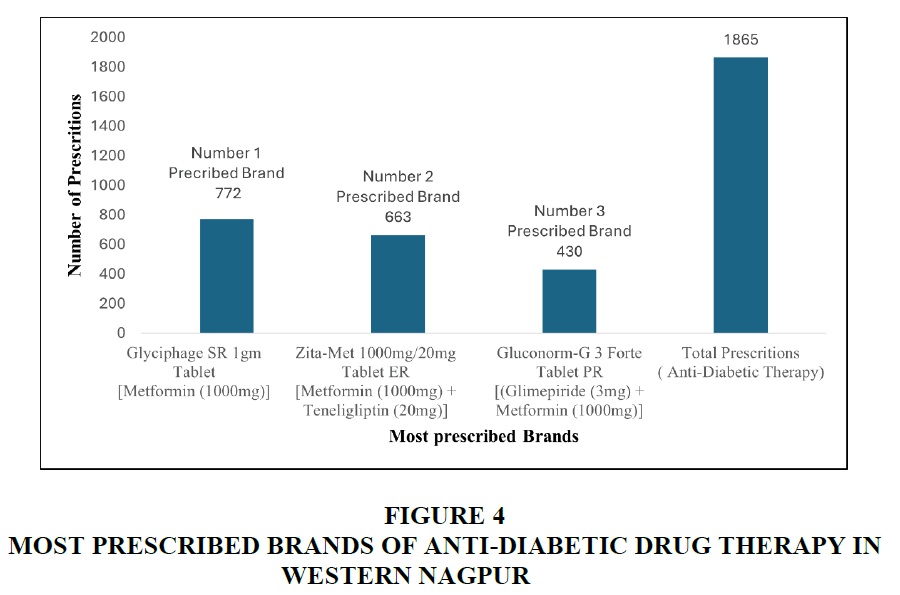

The most prescribed anti-diabetic brand was Glyciphage SR 1gm Tablet [(Metformin (1000mg)] by Franco-Indian Pharmaceuticals Pvt Ltd, second most prescribed brand was Zita-Met 1000mg/20mg Tablet ER [Metformin (1000mg) + Teneligliptin (20mg)] by Glenmark Pharmaceuticals Ltd, followed by Gluconorm-G 3 Forte Tablet PR [(Glimepiride (3mg) + Metformin (1000mg)] by Lupin Ltd.

Out of 1865 prescriptions consisting of various brands of anti-diabetic therapy Glyciphage SR 1gm Tablet was prescribed in 772 prescriptions, Zita-Met 1000mg/20mg Tablet ER was prescribed in 663 prescriptions followed by Gluconorm-G3 Forte Tablet PR which accounted for 430 prescriptions. The results are depicted in Figure 4.

Age Group Distribution

The demographic analysis related to the age group of the prescribed brands in anti-diabetic therapy revealed that both male and females in the age groups of 40-50 and 50-60 years had the highest prescription frequencies, and frequency of medication was generally for two months. In 952 out of 1865 total anti-diabetic prescriptions, one or more anti-diabetic brands were prescribed to male patients, while in 913 prescriptions, a brand of anti-diabetic medication was dispensed to female patients.

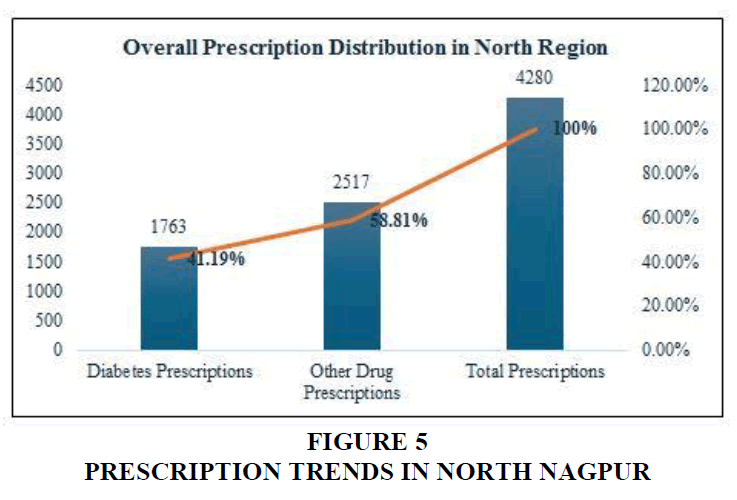

North Zone Analysis of Anti-Diabetic Brands in Nagpur City

In the North Nagpur zone, 58 pharmacies were approached in order to collect the desired market information, out of which 08 pharmacy owners did not responded to the survey. Hence the findings across 50 pharmacies were collected and are presented in the current study. The total number of prescriptions received across 50 pharmacies was 4,280. Out of the total prescriptions in 1,763 prescriptions either a single or more than one brand of anti-diabetic drug therapy was prescribed, and in 2,517 prescriptions, brands of other drug therapy were written, hence the percentage of diabetic drug prescription out of the total prescription across 50 pharmacies in North of Nagpur was 41.1 %. The results are depicted in Figure 5.

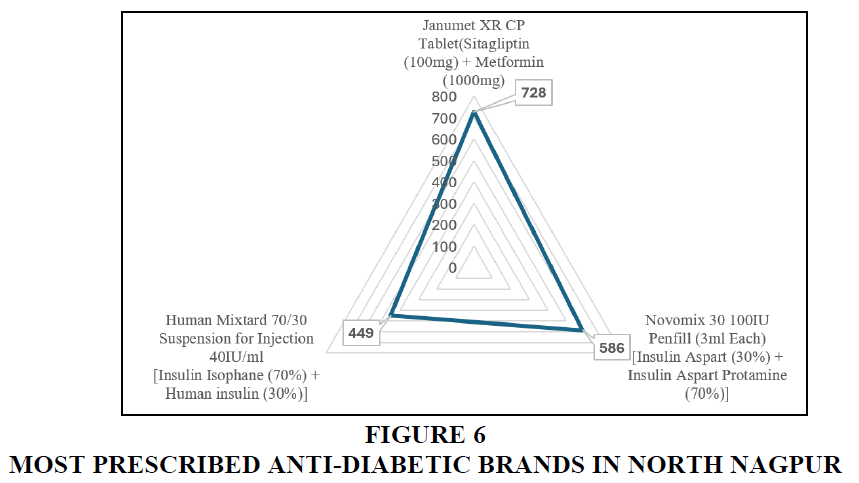

Top Prescribed Brands of Anti-Diabetic Therapy

The most prescribed anti-diabetic brand was Janumet XR CP Tablet [(Sitagliptin (100mg) + Metformin (1000mg)] by MSD Pharmaceutical Pvt Ltd, second most prescribed brand was Novomix 30 100IU Penfill (3ml Each) [Insulin Aspart (30%) + Insulin Aspart Protamine (70%)] by Novo Nordisk India Pvt Ltd followed by Human Mixtard 70/30 Suspension for Injection 40IU/ml [Insulin Isophane (70%) + Human insulin (30%)] by Novo Nordisk India Pvt Ltd.

Out of 1763 prescriptions consisting of various brands of anti-diabetic therapy Janumet XR CP Tablet was prescribed in 728 prescriptions, Novomix 30 100IU Penfill (3ml Each) was prescribed in 586 prescriptions followed Human Mixtard 70/30 Suspension for Injection 40IU/ml which accounted for 449 prescriptions. The results are depicted in Figure 6.

Age Group Distribution

The demographic analysis in the North zone related to the age group of the prescribed brands in anti-diabetic therapy revealed that both male and females in the age groups of 40-50, 50-60 and 60-70 years had the highest prescription frequencies, and frequency of medication was generally for two to three months.

In 1,025 out of 1763 total anti-diabetic prescriptions, one or more anti-diabetic brands were prescribed to male patients, while in 738 prescriptions, a brand of anti-diabetic medication was dispensed to female patients.

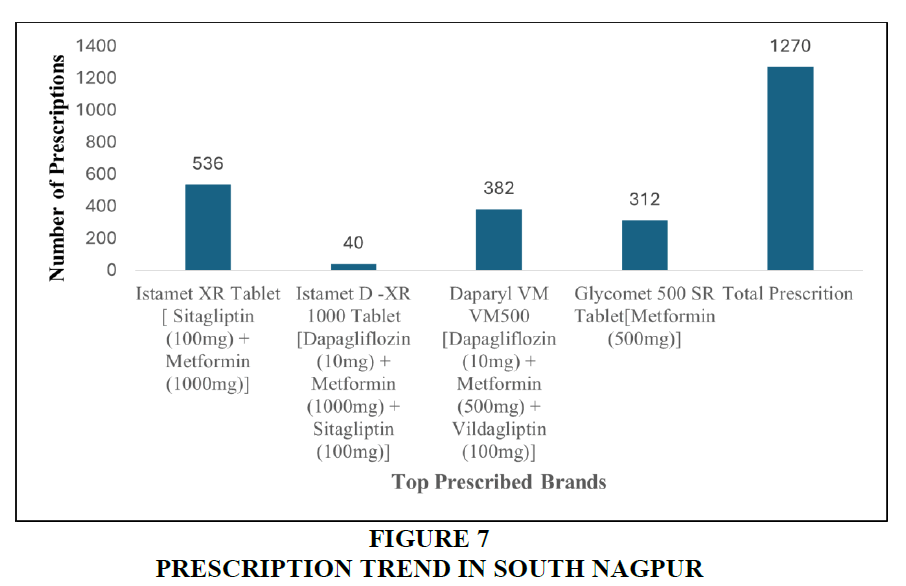

South Zone Analysis of Anti-Diabetic Brands in Nagpur City

In the South Nagpur zone, 60 pharmacies were approached in order to collect the desired market information, out of which 10 pharmacy owners did not responded to the survey. Hence the findings across 50 pharmacies were collected and are presented in the current study.

The total number of prescriptions received across 50 pharmacies was 3,885. Out of the total prescriptions in 1,270 prescriptions either a single or more than one brand of diabetic drug therapy was prescribed, hence the percentage of diabetic drug prescription out of the total prescription received per day across 50 pharmacies in South of Nagpur was 33.0 % of the total.

Top Prescribed Medications

The most prescribed anti-diabetic brand was Istamet XR Tablet [Sitagliptin (100mg) + Metformin (1000mg] by Sun Pharmaceutical Industries Ltd, second most prescribed brand was Daparyl VM 500 Tablet [Dapagliflozin (10mg) + Metformin (500mg) + Vildagliptin (100mg)] by Intas Pharmaceuticals Ltd followed by Glycomet 500 SR Tablet [Metformin (500mg)] by USV Ltd.

Out of 1270 prescriptions consisting of various brands of anti-diabetic therapy, Istamet XR Tablet was prescribed in 536 prescriptions and Istamet D-XR 1000 Tablet was prescribed in 40 prescriptions, Daparyl VM 500 Tablet was prescribed in 382 prescriptions and Glycomet 500 SR Tablet was prescribed in 312 prescriptions. The results are depicted in Figure 7.

Age Group Distribution

The demographic analysis in the South zone related to the age group of the prescribed brands in anti-diabetic therapy revealed that both male and females in the age groups of 40-50, 50-60 and 60-70 years had the highest prescription frequencies.

Frequency of medication was generally for two to three months. In 672 out of 1270 total anti-diabetic prescriptions, one or more anti-diabetic brands were prescribed to male patients, while in 598 prescriptions, a brand of anti-diabetic medication was dispensed to female patients.

Discussion

Implications from Market Assessment Study of Eastern Nagpur

The results of the market assessment of Eastern region of Nagpur indicates the growing prescription trends for Metformin 500 mg single drug molecule in the antidiabetic drug therapy.

The other combinations of Metformin 250 mg, 850 mg and 1000 mg in Sustained formulations are also prevalent in the same zone. The FDC namely Glimepiride (0.5mg) + Metformin (500mg), Glimepiride (2mg) + Metformin (500mg) and Glimepiride (3mg) + Metformin (850mg) are also being prescribed along with the Metformin.

The prescribing pattern practices for type 2 DM show that Metformin oral anti-diabetic brands are the most commonly used. However, there is also a prevalent shift in the market assessment study towards the use of fixed dose combinations (FDC) brands of Metformin.

A research study by (Tiwari et al., 2022) has indicated that oral antidiabetic medications are the most prescribed for type 2 diabetes. However, there has been a noticeable shift towards the use of fixed dose combinations (FDC) for managing type 2 diabetes, and most prescriptions align with ADA treatment guidelines.

The major competitor brands of Glycomet and its FDC in Eastern zone are brands of Sitagliptin (100mg) and other brands of Metformin and its various FDC. Hence the marketing managers of brands handling Metformin and its FDC should improvise their strategy against brands of sitagliptins and its FDC.

Implications from Market Assessment Study of Western Nagpur

The results of the market assessment in West of Nagpur indicated the growing prescription trends for Metformin (1000mg) in the antidiabetic drug therapy, however the competitor FDC Metformin (1000mg) + Teneligliptin (20mg) and Glimepiride (3mg) + Metformin (1000mg) are also active in the area.

Hence the Marketing Managers/Brand Managers promoting their brands of Metformin (1000mg) + Teneligliptin (20mg) and Glimepiride (3mg) + Metformin (1000mg) should discuss the pharmacodynamic and pharmacokinetic properties with the physicians and work out the safety, efficacy and compliance of the FDC as compared with Metformin (1000mg).

Implications from Market Assessment Study of Northern Nagpur

The results of the market assessment in North of Nagpur indicated the growing prescription trends for Sitagliptin (100mg) + Metformin (1000mg) FDC.

The insulin therapy with the FDC of Insulin Aspart (30%) + Insulin Aspart Protamine (70%) and Insulin Isophane (70%) + Human insulin (30%)] using the advanced Insulin Pen is posing a tough competition to the brand of Sitagliptin (100mg) + Metformin (1000mg).

Hence the marketing managers handing the brands of Sitagliptin + Metformin should work on more aggressive marketing strategy targeted against short, intermediate and long-acting insulin and its FDC.

Implications from Market Assessment Study of Southern Nagpur

The FDC of Dapagliflozin (10mg) + Metformin (500mg) + Vildagliptin (100mg) is giving a tough competition to the FDC of Sitagliptin (100mg) + Metformin (1000mg), hence the Marketing managers handling the brand of Dapagliflozin (10mg) + Metformin (500mg) + Vildagliptin (100mg)] should introspect more on the pharmacodynamic, pharmacokinetic, and other parameters of the molecule compliance and superiority of the FDC to withstand the competition from the brands of Sitagliptin (100mg) + Metformin (1000mg).

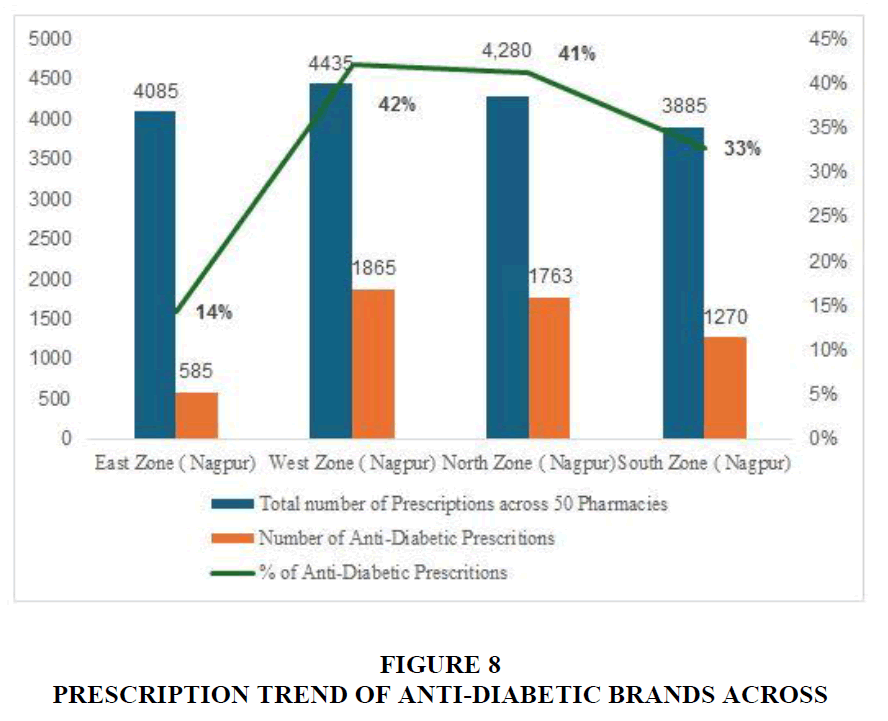

Overall Insights from Market Assessment Study of Nagpur

The market assessment study of the Eastern, Western, Northern and Southern part of Nagpur city revealed that the prescription base for the antidiabetic brands was more prominent in the Western and Norther part. In the Southern part of the Nagpur City the prescription base for the antidiabetic brands were observed at an optimum level and in the Eastern Nagpur the prescription base for the antidiabetic brand was lowest Figure 8.

East, West, North and South Zones of Nagpur City

In the Western Nagpur, out of the total prescription sampled (4435), 42% (1865) of the prescriptions accounted for anti-diabetic brands, almost similar trend was observed in Northern part of Nagpur were 41% (1763) of the prescriptions accounted for anti-diabetic brands out of the total prescriptions (4280) offered in the market.

In the Southern Nagpur, out of the total prescription sampled (3885), 33% (1865) of the prescriptions accounted for anti-diabetic brands, however a lower trend was observed in Eastern part of Nagpur were 14% (585) of the prescriptions accounted for anti-diabetic brands out of the total prescriptions (4085) offered in the market. The results are tabulated in Figure 8.

Conclusion

Based on the findings of the current study it can be concluded that market assessment studies based on the prescription analysis of the brands being prescribed in a certain geographical location are a valuable tool for devising an effective marketing strategy.

The significance of these studies is that it gives a realistic information about the most prescribed brand and its competitor brand in the market. Once the competitor brand is identified the marketing managers can devise various interventions based on the FDC used, strength of the brand, frequency of the medication, packaging size used, indications used.

References

Al Thabbah, D. H., Almahairah, M. S., Naser, A. Y., Alrawashdeh, H. M., & Araidah, M. (2022). The effect of pharmaceutical companies’ marketing mix strategies on physicians prescribing practices in Jordan: a cross-sectional study. BMC Health Services Research, 22(1), 1–1293.

Indexed at, Google Scholar, Cross Ref

Bhatt P., Ranawat S., Singh V., (2024). Market Analysis of Antidiabetic Drugs in India. Zenodo.

Competition Commission of India. (2021). Market Study on the Pharmaceutical Sector in India, Key Findings and Observations. Competition Commission of India.

FICCI. (2024). The Indian Pharmaceutical Sector.

IBEF. (2024). Pharmaceuticals Industry Report.

Lelde Voino. (2024). How do pharmaceutical companies use market research? Savanta Group.

Levy, R. (1994). The role and value of pharmaceutical marketing. Arch Fam Med, 3(4), 327-32.

Masárová, G., Štefániková, Ľ., & Rypáková, M. (2015). The necessity of obtaining information through marketing research in the field of pharmaceutical companies on the slovak market. Procedia Economics and finance, 23, 1480-1484.

Sohini Das. (2024). Fierce competition among new drug brands for share of India market. Business Standard.

Teena Thacker. (2024). Anti-diabetic drugs lead growth in pharmaceuticals market. Economic Times.

Tiwari, K., Bisht, M., Kant, R., & Handu, S. S. (2022). Prescribing pattern of anti-diabetic drugs and adherence to the American Diabetes Association’s (ADA) 2021 treatment guidelines among patients of type 2 diabetes mellitus: A cross-sectional study. Journal of Family Medicine and Primary Care, 11(10), 6159-6164.

Received: 03-Oct-2024, Manuscript No. AMSJ-24-15312; Editor assigned: 04-Oct-2024, PreQC No. AMSJ-24-15312(PQ); Reviewed: 29-Oct-2024, QC No. AMSJ-24-15312; Revised: 06-Nov-2024, Manuscript No. AMSJ-24-15312(R); Published: 15-Nov-2024