Research Article: 2025 Vol: 29 Issue: 2

Mapping the Fintech Terrain in India: A Systematic Literature Review

Neha Sangwan, University of Delhi, Delhi

Anjala Kalsie, University of Delhi, Delhi

Citation Information: Sangwan, N, Kalsie, N. (2025). Mapping the fintech terrain in India: A systematic literature review. Academy of Marketing Studies Journal, 29(2), 1-22.

Abstract

Purpose – The purpose of this paper is to provide comprehensive analysis and synthesis of the antecedents affecting mapping of digital finance or fin-tech in India. Methodology/Design/approach – This study proposes to provide a comprehensive literature review on Scopus database using relevant keywords and perform PRISMA, weight and meta-analysis. Findings – By reviewing 50 studies, it was found that Technology Acceptance Model (TAM), the Unified Theory of Acceptance and Use of Technology (UTAUT), meta-UTAUT, and Information System Success Theory are major theories used in research studies. The best predictors for digital finance adoption in India are performance expectancy, perceived usefulness, compatibility, facilitating condition, trust, and attitude significantly influence intention to adopt digital payments while social influence, and technology barrier have no significant influence and perceived security, perceived risk, perceived ease of use, and effort expectancy has low significant influence on adoption of fin-tech. Research Limitation – Firstly, the current study provides literature review of papers related to India only. Secondly, the studies for this research were collected only from Scopus. Thirdly, not all published papers reported enough data to perform a meta-analysis and weight analysis, so they could not be included in the analysis. Originality/Value – This study has extended the future scope for researchers to explore the moderating or mediating effect of above and other variables in understanding behavioral intention to use fin-tech services along with effect of demographic variables.

Keywords

Digital Banking, Digital payments, Mobile payments, M-Banking, Mobile wallets, Internet Banking.

Introduction

It is observed that around globe mobile phones usage is rapidly increasing at a healthy rate despite the level of economic growth in developed as well as developing economies (Joseph et al., 2018). There are several reasons for the above varying from ease of use, cost effectiveness, security, time effectiveness and more in terms of end users. Digital payments are done through online modes such as Internet Banking, mobile banking, PoS terminal, mobile wallets, UPI, banking cards, etc; with no physical exchange of cash (Alkhowaiter, 2020). In emerging economies, mobile payment application is providing platform to wide uncover population by banking sector but having a mobile phone, for example PayTM, Amazon pay, etc. The recent era of digital banking has shifted banking sector bargaining power from seller to buyer (Paul et al., 2022).

In India, there is significant change in digital payment transaction which started in 1980’s with launch of credit cards. India with population of 1.38 billion has huge potential for digital payments. According to IBEF, during FY 2010-11 the number of digital transactions in country was 4.98 billion, with value Rs. 96 trillion which increased to 16.23 billion in FY 2020 with value increasing to Rs. 3,435 trillion. (IBEF, 2021). As per RBI data, the payment system recorded a vigorous growth of volume 26.2 percent during 2020-21 while in previous year it accounts for 44.2 percent.

As per CLSA report, various digital payment methods like credit card, UPI transfers, etc would reach their saturation point in India by 2027, but cash would be continuously used. Leading digital platform Phone Pe and BCG (Boston consulting group) said that digital payments in India is expected to be more than triple, i.e, $10 trillion by 2026. Past decade Indian governance have seen a technological revolution, from a click of mouse last mile delivery happens within seconds. The key enabler for transforming India as Digital India through JAM Trinity- Jan Dhan, Aadhaar and Mobile; which was launched in 2014 is one of biggest financial inclusion initiatives in overall world. According to PIB report published in October 2022, UPI currently accounts for 40 percent of India’s digital transactions, valued nearly 0.11 billion in august 2022(PIB, 2022).

Taking into account the shoot up of digital banking and payment methods, academic and practitioners have high interest to study factors affecting its usage and adoption. A large number of researchers investigated inhibitors and antecedents of digital banking and payment adoption (Chauhan et al., 2019; Chawla & Joshi, 2020; Dr. D. Kannan, 2020; Ghosh, 2022; Jebarajakirthy & Shankar, 2021; Kamboj et al., 2022; Kaur, Dhir, Bodhi, et al., 2020; Singu & Chakraborty, 2022). The purpose to study the topic was to provide the further researchers a broad view about the research work conducted till yet as there were few studies on systematic literature review regarding digital banking adoption in India. The Systematic literature review provide overall guidance on subjective behavior of studies, synthesis of research papers, contribute in theoretical advancement, contribute to digital finance area, and a base paper to further government policy. The aim of this paper is to provide a systematic literature review and weight analysis and meta-analysis on digital banking and payment adoption. For future researchers, we will draw a “big picture” in understanding the factors responsible for adoption and usage behaviors related to digital banking and payments. For practitioners, this paper will provide guidance through comprehensive analysis of various variables affecting usage and adoption, which could be used to develop and implements strategies for improving the intention to adopt and quality services of digital payment and banking services.

Literature Search and Review Method

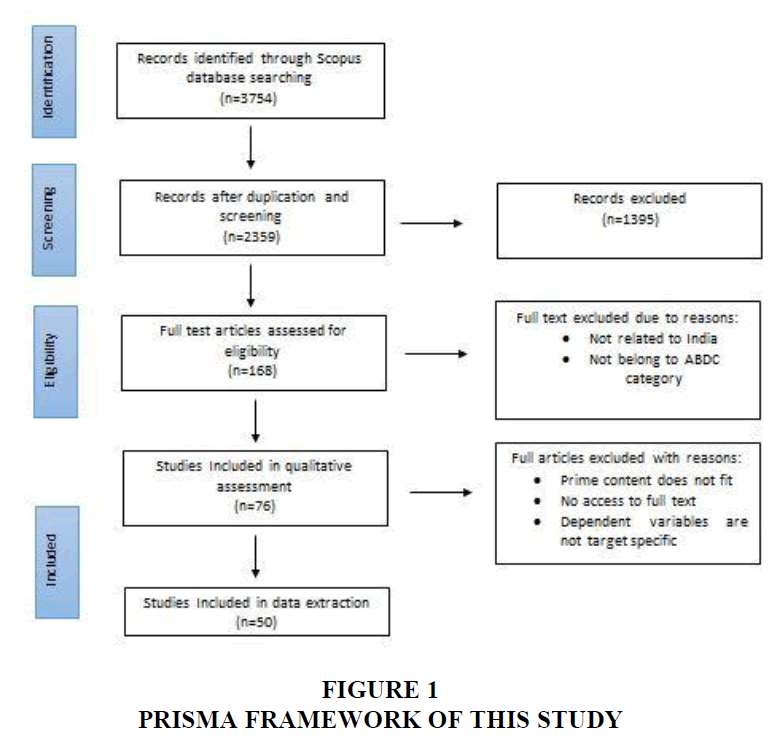

The previous studies on systematic literature review are followed (Alkhowaiter, 2020; Jeyaraj et al., 2006; Joseph et al., 2018; Raman & Aashish, 2021) , appropriate keywords are studied and searched to achieve the purpose of current study. The research paper use Scopus database as it broadly include all the relevant studies from various journals to obtain the relevant research outputs by using following keywords: (“Mobile Payments” OR “Digital Payments” OR “M-Payments” OR “M-Banking” OR “Mobile wallets” OR “Mobile Banking” OR “Electronic Banking” OR “Online Banking” OR “E-Banking” OR “Internet Banking”) AND (“Adoption” OR “Usage” OR “Acceptance” OR “Intention” OR “Satisfaction” OR “Use Behavior” OR “Diffusion” OR “Use Behaviour”) AND AFFILCOUNTRY (“India”) AND SUBJECTAREA (“Business, Management and Accounting” OR “Economics, Econometrics and Finance” OR “Social Sciences” OR “Psychology”). The keyword search performed returned 375 articles. By using PRISMA Framework out of these 375 articles, only 168 articles belong to ABDC category journals and among them only 50 papers were finalized which are fulfilling the criteria objective of our research paper and have access availability Figure 1.

Literature Review

This section of paper presents a literature review on adoption and usage of digital banking & payment methods, theories and models employed; data collection and analysis methodologies; and studying factors affecting adoption, usage and user satisfaction.

Adoption of Different Digital Banking/Payment Methods

Table 1 presents themes identified in digital banking/payment method literature: mobile wallets, mobile payments, mobile banking, internet banking, online banking. Each key theme is delineated below by providing examples of pertinent studies.

Mobile wallets: Mobile wallets are robustly becoming popular ever since their installment in India. The smartphones are available at discounter price along with low-cost data packages which have open the way for revolution of mobile wallets (George & Sunny, 2022). (Kaur, Dhir, Bodhi, et al., 2020) aimed to investigate the use and recommendation of m-wallets through DOI (Diffusion of Innovation Theory) through cross sectional survey of 1256 young adults which founded that relative advantage, compatibility, complexity, observability is reposted as key inhibitors to promote intention to use mobile wallets while trialability is negatively related.

(M. Talwar et al., 2021) study proposes to examine mobile wallet as antecedents of valence of positive and negative word of mouth by using dual factor theory through enablers like perceived information quality, perceived ability, perceived benefit and inhibitors like perceived cost, perceived risk, perceived uncertainty while all are significantly related to positive word of mouth by studying responses of 914 respondents.

Some studies use UTAUT as a theoretical model (Jaiswal et al., 2022; Madan & Yadav, 2016; N. Singh & Sinha, 2020), others use TAM as conceptual model (Dr. D. Kannan, 2020; Sarmah et al., 2021; Shaw & Kesharwani, 2019), while (Chawla & Joshi, 2020) uses both UTAUT and TAM as model for research. UTAUT studies variables like performance expectancy, effort expectancy, social influence, facilitating conditions and individual mobility as indicator to continuance intention find that all variables except effort expectancy and social influence are positively correlated in (Madan & Yadav, 2016) & (Jaiswal et al., 2022) respectively.

Other studies like (Chatterjee & Bolar, 2019; George & Sunny, 2022) uses UTAUT, TAM and DOI theories as a base for their conceptual model while (S. Talwar et al., 2020) uses ISS (Information System Success model), Transaction cost economies and ECT (expectation confirmation theory or IT continuance model) as their theoretical model for contributing that transaction cost economics variables, i.e., perceived uncertainty and perceived asset specificity are insignificant to initial trust thus continuance intention.

To sum up, all the studies on mobile wallets in context of India used quantitative research methods. Intention to adopt and satisfaction was the most researched topic among the described above. It was found that adoption of mobile wallets or intention to use is influenced by performance expectancy, effort expectancy, perceived usefulness, perceived ease of use, facilitating condition and positive word of mouth while factors effecting non adoption were social influence and perceived cost. Additionally, demographic factors playing moderating role such as age, income, gender, education will provide more insightful results for further studies.

Mobile Payments: Mobile payments refer to payment for goods and services using smartphones, mobile phones, or nay wireless-enables device (S. Singh, 2020). 11 studies out of 50 examines mobile payment in context of India (Chakraborty et al., 2022; Ghosh, 2022; K. Gupta & Arora, 2019; Kaur, Dhir, Singh, et al., 2020; Raman & Aashish, 2021, p. 88; Sankaran & Chakraborty, 2020; S. Singh, 2020; Singu & Chakraborty, 2022; Sinha & Singh, 2022; Thakur & Srivastava, 2014; Upadhyay et al., 2022).

One of the study (Chakraborty et al., 2022) focused on using consumption value theory as a conceptual model with five dimensions that examine user’s preferences: a) functional value, b) emotional value, c) social values d) conditional value, and e) epistemic value with mediating effect of initial trust. By collecting data from 880 respondents and performing structural equation modelling it was found that all dimensions except social values are significantly related with mobile payment adoption intention.

Another study by (Sankaran & Chakraborty, 2020) aims to examine motivational factors using consumer-centric view for making mobile payments through an exploratory approach of Ends-Means Chain theory examining relationship between three layers i.e., Attributes-Consequence-Value (A-C-V). By using laddering technique (one to one semi structured interview) study concluded that respondents main reason to use mobile payments is that there is no need to keep hard currency at home or carry, thus avoiding fear of theft or losing cash. There is huge acceptability for micro-payments, daily money transaction like buying groceries as there is no need for reconciliation and saves time of users as no more requirement to stand in queues at banks.

Two articles (Ghosh, 2022; Kaur, Dhir, Singh, et al., 2020) studied adoption of mobile payments by using “Innovation Resistance Theory” framework for understanding user’s resistance to address five categories of barrier: usage, risk, tradition, value and image with additionally considering investigated barrier i.e., habitual use of cash, surveillance and technology. By employing structured questionnaire data is collected from 310 respondents, it was found that risk barrier and investigated barrier are positively affect MPS adoption whereas other four barriers negatively affect MPS adoption.

Other studies used TAM (Singu & Chakraborty, 2022; Thakur & Srivastava, 2014), UTAUT (S. Singh, 2020; Singu & Chakraborty, 2022), UTAUT-2 (K. Gupta & Arora, 2019) & Meta UTAUT (Upadhyay et al., 2022) to investigate factors influencing adoption and intention to use of mobile payments.

By conducting structured questionnaire survey with customer’s it was found that perceived security, social influence and hedonic motivation were insignificantly correlated with adoption or continuance intention. Additionally, performance expectancy, effort expectancy, perceived usefulness, perceived ease of use, facilitating condition, satisfaction, and trust are positively correlated with adoption of MPS. Further studies should investigate how system quality, service quality, self-efficacy and technical support affect intention to use and adoption.

Mobile Banking: Mobile banking refers to the system which facilitate users to direct financial transaction by using mobile devices such as mobile phones, smart phones (Chawla & Joshi, 2019a). Mobile technology has modified both financial industry and global banking by providing affordability, accessibility and convenience to bank users (Chawla & Joshi, 2017). In today’s time, mobile banking is majorly performed via internet or SMS but it can also be performed using special programs known as clients downloaded to smart phones (Singh, 2022). Fifteen out of fifty studies examined usage and adoption of mobile banking in India (Amit Shankar, 2016; Banerjee & Sreejesh, 2022; Deb & Lomo-David, 2014; A. Gupta & Arora, 2017; Jebarajakirthy & Shankar, 2021; Jiwaji University, Gwalior, Madhya Pradesh, India et al., 2010; Kamboj et al., 2022; Kumar et al., 2017; Priya et al., 2018; Ravindran, n.d.; Shahid et al., 2022; Shankar et al., 2020; Shankar & Rishi, 2020; Sharma & Khurana, 2022; S. Singh & Srivastava, 2018).

Study by (Shahid et al., 2022) and (Jebarajakirthy & Shankar, 2021) examined antecedents of consumer experience with mobile banking apps using S-O-R (Stimuli-Organism-Response) framework to test customer experience, loyalty and usage intention through five factors: trust, social influence, convenience, customer support and app attributes. Study concluded that all factors affect mobile banking usage except customer support and app attributes is relatively less important for usage or adoption of mobile banking apps.

Another study by (Kamboj et al., 2022) investigate usage of M-Banking and user’s satisfaction through Tan’s failure and ISS (information system success) model by four failure dimensions (functional, system, information and service failure). Data is collected by 328 respondents through online survey via questionnaire. Analysis of the primary data included use of structure equation modelling (SEM). Findings revealed that all the failure dimension affect the usage of mobile banking and satisfaction of the customers. Additionally, study concluded that user satisfaction towards mobile banking acts as a mediator between usage of mobile banking and customer engagement.

(Banerjee & Sreejesh, 2022) uses self-determination theory which considered human motivation concerning psychological needs, self-regulation and life’s aspiration. The study measures the construct such as knowledge for customers, relationship-marketing orientation, and customer intrinsic motivation. The final analysis was done through 341 responses using two-step procedure of structural equation modelling and evaluated that all the factors have positive and significant influence on user’s intrinsic motivation in continued mobile banking usage.

Five studies (Deb & Lomo-David, 2014; Kumar et al., 2017; Ravindran, n.d.; Sharma & Khurana, 2022; S. Singh & Srivastava, 2018) focused on mobile banking adoption and continuance based on conceptual model of TAM and investigated the most important factors such as perceived usefulness, perceived ease of use, perceived risk, perceived service quality, perceived credibility, trust, social influence, financial cost, perceived security, compatibility, attitude and computer self-efficacy. The result showed that all variables except trust, social influence, perceived security and perceived risk significantly affect user continued intention to use mobile banking services. The study also concluded that continuance intention is merely dependent on satisfaction in mobile banking context.

Another study by (Shankar et al., 2020) examined crucial role of electronic word of mouth (eWOM) through 1153 useable survey using ELM (elaboration likelihood model), a dual-process information processing theory, as a conceptual model. The analysis showed that argument quality, valence, consistency, initial trust is positively related with mobile banking adoption whereas volume has insignificant relation with adoption of mobile banking.

The studies related to mobile banking majorly focused on antecedents of adoption and usage of mobile banking and user satisfaction. The above researches provided some useful understanding on m-banking industry by applying various model and theories such as TAM, UTAUT, UTAUT2, and D&M ISS models, while they have various limitation which provide directions for further research. Firstly, most of studies are conducted on young adults. Secondly, future research can focus on antecedents such as technological readiness, compatibility and mobile interface quality. Thus, future research should study variables by conducting longitudinal studies.

Internet Banking: The Internet banking system consistently connects to its users and has become major part of the core banking system (Rajiv Kumar, 2020). Internet banking is also called electronic banking or online banking, refers to the usage of internet as a remote delivery channel for providing user services, like opening bank account or transferring funds within accounts (Rajiv Kumar, 2020). The technological advancement in information technology has resulted in significant changes in financial sector, majorly in banking industry (Roy et al., 2017).

Ten out of fifty studies focused on Internet banking adoption by the users (Bashir & Madhavaiah, 2015; Chauhan et al., 2019;

Radhakrishna, 2013; George & Kumar, 2013; Inder et al., 2022; Kesharwani & Singh Bisht, 2012; Kundu & Datta, 2015; Patel & Patel, 2018; Vatnani & Verma, 2014; Yadav et al., 2015).

One study by ( Radhakrishna, 2013) focused on factors that inhibits and drives internet banking usage in India. An exploratory factor analysis along with confirmatory factor analysis has been used on 362 users of internet banking. The study has applied Diffusion of innovation based theory as a conceptual model and analyzed that perceived benefit, performance risk, fraud risk, computer self-efficacy, social influence, pricing concern and technology complexity are significant related to usage of internet banking.

Majority of studies (Bashir & Madhavaiah, 2015; Chauhan et al., 2019; George & Kumar, 2013; Kesharwani & Singh Bisht, 2012; Patel & Patel, 2018; Vatnani & Verma, 2014; Yadav et al., 2015) has employed TAM as a conceptual model for their research. The studies concluded that trust, perceived usefulness, perceived ease of use, perceived risk, attitude, and social influence are most important factors that positively affect usage of internet banking in India.

Another study by (Inder et al., 2022) examine the antecedents related to behavioral intentions to adopt internet banking in India. By adopting UTAUT research model was proposed and tested by collecting data from 436 respondents. It was found that performance expectancy, security, perceived website usability, hedonic motivation, and experience, habit & attitude significantly affect intention to adopt internet banking.

Studies on adoption of internet banking investigated the factors affecting adoption and user satisfaction. Majority of research are on primary data through structured questionnaire. Further studies can focus on groups and interview to explore more factors which affect adoption and user satisfaction. Additionally, the respondents mainly reside in urban areas which cannot provide clear result into internet banking adoption therefore future research should also focus on collecting data from rural areas.

Online Banking: Online Banking is defined as providing direct access to data and information related to transaction, account, requests and application, and transfer of funds as per requirement of user (Sikdar & Makkad, 2015).

Only one study out of 50 focused on examining user satisfaction and online banking usage in context of Indian bank users by using five-factor model. By collecting data from 280 bank users and analyzing through structural equation modelling, the study concluded that usage constraints, accessibility, and intention to use has strong and significant relationship with user satisfaction. While ease of use and trust has relatively weak and insignificant relationship with user satisfaction.

Further studies can focus on interview based methodology to measure the actual behavior towards intention to use and satisfaction. Additionally, studies can include more antecedents to predict overall user satisfaction to a higher degree and also compare it between different banks.

Models and theories utilized: Majority of theories have been used by digital banking/digital payment studies to examine individual use behavior and behavioral intention (Table 2). Tam was the most frequently employed theory in both digital payment and digital banking research. Majority of studies used this conceptual model along with adding more factor affecting behavior intention. Another frequently used model in India was UTAUT (The unified theory of acceptance and use of technology). Some of the studies used the combination of UTAUT and TAM both, for example study conducted by (Chawla & Joshi, 2019; Madan & Yadav, 2016) and many more to examine the impact of technological factor in adoption digital payment/digital banking.

| Table 2 Models and Theories Used in Digital Payment and Digital Banking | ||||

| Theory | Digital Payment | Digital Banking | ||

| Frequency | Studies | Frequency | Studies | |

| UTAUT | 8 | (Chawla & Joshi, 2019b, 2020; Jaiswal et al., 2022; Madan & Yadav, 2016; N. Singh & Sinha, 2020; S. Singh, 2020; Singu & Chakraborty, 2022; Thakur & Srivastava, 2014) | 2 | (Inder et al., 2022; S. Singh & Srivastava, 2018) |

| UTAUT 2 | 1 | (K. Gupta & Arora, 2019) | 0 | NA |

| TAM | 10 | (Chatterjee & Bolar, 2019; Chawla & Joshi, 2019b, 2020; Dr. D. Kannan, 2020; George & Sunny, 2022; Madan & Yadav, 2016; Shaw & Kesharwani, 2019; Sinha & Singh, 2022; Thakur & Srivastava, 2014) | 12 | (Bashir & Madhavaiah, 2015; Chauhan et al., 2019; Deb & Lomo-David, 2014; George & Kumar, 2013; Kesharwani & Singh Bisht, 2012; Kumar et al., 2017; Patel & Patel, 2018; Ravindran, n.d.; Sharma & Khurana, 2022; S. Singh & Srivastava, 2018; Vatnani & Verma, 2014; Yadav et al., 2015) |

| Innovation resistance theory | 2 | (Ghosh, 2022; Kaur, Dhir, Singh, et al., 2020) | 0 | NA |

| Self-determination theory | 0 | NA | 1 | (Banerjee & Sreejesh, 2022) |

| Innovation Diffusion theory | 2 | (Chatterjee & Bolar, 2019; Kaur, Dhir, Bodhi, et al., 2020) | 2 | (Deb & Lomo-David, 2014; Vatnani & Verma, 2014) |

| ISS Model | 4 | (George & Sunny, 2022; Madan & Yadav, 2016; Singu & Chakraborty, 2022; S. Talwar et al., 2020) | 1 | (Kamboj et al., 2022) |

| ECM | 2 | (Jaiswal et al., 2022; S. Singh, 2020) | 0 | N.A |

| Meta-UTAUT | 1 | (Jaiswal et al., 2022) | 0 | N.A |

| Consumption Value theory | 1 | (Chakraborty et al., 2022) | 0 | N.A |

| S-O-R framework | 0 | N.A | 2 | (Jebarajakirthy & Shankar, 2021; Shahid et al., 2022) |

| Tan’s failure model | 0 | N.A | 1 | (Kamboj et al., 2022) |

| Dual Factor Theory | 1 | (M. Talwar et al., 2021) | 0 | NA |

| Behavioral Reasoning theory | 0 | NA | 1 | (A. Gupta & Arora, 2017) |

Another group of studies used Delone and Mclean (D&M) Information system success (ISS) model. Some use ISS in addition to TAM & UTAUT theory for example, (George & Sunny, 2022; Madan & Yadav, 2016), etc. Another researches have explored new theories to investigate the factors affecting adoption on digital payments such as, Expectation-confirmation model in addition to UTAUT by (Jaiswal et al., 2022; S. Singh, 2020); Innovation diffusion theory by (Deb & Lomo-David, 2014; Kaur, Dhir, Bodhi, et al., 2020), & more; Behavioral Reasoning Theory and many more as described in the table below.

Method Utilized: Previous studies related to digital banking and digital payment have employed various qualitative and quantitative methods to collect data (Table 3). A survey by using structured questionnaire is one of the most used data collection methods for both digital payment and digital banking (Banerjee & Sreejesh, 2022; Jaiswal et al., 2022; Kamboj et al., 2022; Singu & Chakraborty, 2022; Upadhyay et al., 2022). Only one study used interview in their research to study digital payment. For example, (Sankaran & Chakraborty, 2020) employed laddering interview method with sample of 27 users of mobile payments to explore the motivational factors using customer centric view.

Majority of studies focused on collecting data through online mode and covering the young respondents which does not provide real analyses of overall India in adoption of mobile banking/ internet banking/ online banking/ mobile wallets. Further researches could be conducted over rural users as majority of Indian population reside in rural areas.

Analyses Techniques Used

Primary data studies on digital payment and banking methods employed various analyses techniques, such as Regression Analysis (Amit Shankar, 2016; George & Kumar, 2013; Jiwaji University, Gwalior, Madhya Pradesh, India et al., 2010; Priya et al., 2018; Ravindran, n.d.), SEM (Bashir & Madhavaiah, 2015; Ghosh, 2022; Jebarajakirthy & Shankar, 2021; Sinha & Singh, 2022) and more), ANOVA (Jiwaji University, Gwalior, Madhya Pradesh, India et al., 2010), PCA (Chatterjee & Bolar, 2019; Kumar et al., 2017; Shankar & Rishi, 2020) to name a few.

SEM is most used techniques for digital payment studies. For example, (Jaiswal et al., 2022) performed structural equation modelling analysis of data collected from 574 users to understand the antecedents of pre and post adoption dynamics usage of mobile wallets. Another frequently employed technique is confirmatory factor analysis.

Most of digital payment and banking studies used SEM and confirmatory factor analysis. For example, (Inder et al., 2022; Jaiswal et al., 2022; Kamboj et al., 2022; Shahid et al., 2022), and many more. For instance: (Chatterjee & Bolar, 2019) used two stage research techniques: principal component analysis and structural equation modelling to analyze key determinants of the mobile banking adoption (Table 4).

| Table 4 Analysis Techniques | ||||

| Techniques | Digital Payments | Digital Banking | ||

| Frequency | Studies | Frequency | Studies | |

| SEM | 9 | (Chatterjee & Bolar, 2019; Dr. D. Kannan, 2020; Ghosh, 2022; Jaiswal et al., 2022; Madan & Yadav, 2016; N. Singh & Sinha, 2020; Sinha & Singh, 2022; M. Talwar et al., 2021; Thakur & Srivastava, 2014) | 14 | (Banerjee & Sreejesh, 2022; Bashir & Madhavaiah, 2015; Inder et al., 2022; Jebarajakirthy & Shankar, 2021; Kamboj et al., 2022; Kesharwani & Singh Bisht, 2012; Kundu & Datta, 2015; Shahid et al., 2022; Shankar et al., 2020; Sharma & Khurana, 2022; Sikdar & Makkad, 2015; S. Singh & Srivastava, 2018; Vatnani & Verma, 2014) |

| Regression Analysis | 0 | 5 | (Amit Shankar, 2016; George & Kumar, 2013; Jiwaji University, Gwalior, Madhya Pradesh, India et al., 2010; Priya et al., 2018; Ravindran, n.d.) | |

| Confirmatory Factor Analysis | 8 | (Chakraborty et al., 2022; Jaiswal et al., 2022; Kaur, Dhir, Bodhi, et al., 2020; Kaur, Dhir, Singh, et al., 2020; Shaw & Kesharwani, 2019; Singu & Chakraborty, 2022; S. Talwar et al., 2020; Thakur & Srivastava, 2014) | 18 | (Banerjee & Sreejesh, 2022; Bashir & Madhavaiah, 2015; Chauhan et al., 2019; Deb & Lomo-David, 2014; Radhakrishna, 2013; A. Gupta & Arora, 2017; Inder et al., 2022; Jebarajakirthy & Shankar, 2021; Kamboj et al., 2022; Kesharwani & Singh Bisht, 2012; Kundu & Datta, 2015; Patel & Patel, 2018; Shahid et al., 2022; Sharma & Khurana, 2022; Sikdar & Makkad, 2015; S. Singh & Srivastava, 2018; Vatnani & Verma, 2014; Yadav et al., 2015) |

| ANOVA | 0 | 1 | (Jiwaji University, Gwalior, Madhya Pradesh, India et al., 2010) | |

| PLS-SEM | 8 | (Chawla & Joshi, 2019b, 2020; George & Sunny, 2022; K. Gupta & Arora, 2019; Raman & Aashish, 2021; Sarmah et al., 2021; S. Singh, 2020; Upadhyay et al., 2022) | 1 | (Ravindran, n.d.) |

| PCA | 1 | (Chatterjee & Bolar, 2019) | 2 | (Kumar et al., 2017; Shankar & Rishi, 2020) |

| Exploratory Factor Analysis | 2 | (N. Singh & Sinha, 2020; Sinha & Singh, 2022) | 7 | (Amit Shankar, 2016; Bashir & Madhavaiah, 2015; Radhakrishna, 2013; Kesharwani & Singh Bisht, 2012; Kundu & Datta, 2015; Priya et al., 2018) |

Factors Affecting Behavioral Intention Of Digital Banking/Digital Payments

Table 5 presents the antecedents affecting behavioral intention to adopt digital payments and banking methods in India. It has been observed factors such as perceived security, trust, and perceived usefulness were found to be affecting acceptance behavior across number of studies. Additionally, it is highlighting that just a few studies evaluated the effect of demographic variables such as age (Jaiswal et al., 2022; Sharma & Khurana, 2022; M. Talwar et al., 2021), income (Jaiswal et al., 2022; Sharma & Khurana, 2022), income(Jaiswal et al., 2022; Sharma & Khurana, 2022) and gender (Jaiswal et al., 2022; Raman & Aashish, 2021) on behavioral intention to use. It is found that these variables not have significant effect on behavioral intention to use digital banking services.

| Table 5 Factors Affecting the Adoption Intention of Digital Payment/Digital Banking | ||||

| Factors (Independent variables) | Digital Payment | Digital Banking | ||

| Significant Studies | Non-Significant Studies | Significant Studies | Non-Significant Studies | |

| Perceived Security | (George & Sunny, 2022) | (Chawla & Joshi, 2019b, 2020; S. Singh, 2020; Singu & Chakraborty, 2022) | (Inder et al., 2022; Patel & Patel, 2018; S. Singh & Srivastava, 2018) | |

| Performance Expectancy | (K. Gupta & Arora, 2019; Jaiswal et al., 2022; Madan & Yadav, 2016; S. Singh, 2020; Singu & Chakraborty, 2022; Upadhyay et al., 2022) | (Inder et al., 2022) | ||

| Effort Expectancy | (K. Gupta & Arora, 2019; Jaiswal et al., 2022; Raman & Aashish, 2021; S. Singh, 2020; Singu & Chakraborty, 2022; Upadhyay et al., 2022) | (Amit Shankar, 2016) | (Inder et al., 2022) | |

| System Quality | (Kamboj et al., 2022; Singu & Chakraborty, 2022) | |||

| Service Quality | (George & Sunny, 2022; Raman & Aashish, 2021; Singu & Chakraborty, 2022; S. Talwar et al., 2020) | |||

| Facilitating condition | (Chawla & Joshi, 2019b, 2020; K. Gupta & Arora, 2019; Jaiswal et al., 2022; Madan & Yadav, 2016; Singu & Chakraborty, 2022; Upadhyay et al., 2022) | |||

| Trust | (Chatterjee & Bolar, 2019; Chawla & Joshi, 2019b; George & Sunny, 2022; Madan & Yadav, 2016; Raman & Aashish, 2021; Sarmah et al., 2021; N. Singh & Sinha, 2020; S. Singh, 2020; Singu & Chakraborty, 2022; S. Talwar et al., 2020) | (Sinha & Singh, 2022) | (Bashir & Madhavaiah, 2015; Jiwaji University, Gwalior, Madhya Pradesh, India et al., 2010; Kumar et al., 2017; Kundu & Datta, 2015; Shahid et al., 2022; S. Singh & Srivastava, 2018) | (Inder et al., 2022; Sikdar & Makkad, 2015; S. Singh & Srivastava, 2018) |

| Social Influence | (Madan & Yadav, 2016) | (K. Gupta & Arora, 2019; Jaiswal et al., 2022; Upadhyay et al., 2022) | (Amit Shankar, 2016; Bashir & Madhavaiah, 2015; Deb & Lomo-David, 2014; Kumar et al., 2017; Patel & Patel, 2018) | (Inder et al., 2022; S. Singh & Srivastava, 2018) |

| Attitude | (Chawla & Joshi, 2019b, 2020; Raman & Aashish, 2021; Upadhyay et al., 2022) | (Chauhan et al., 2019; Inder et al., 2022; Sharma & Khurana, 2022; Yadav et al., 2015) | ||

| Perceived Ease of Use | (Chatterjee & Bolar, 2019; George & Sunny, 2022; Sarmah et al., 2021; Sinha & Singh, 2022) | (Chawla & Joshi, 2019b, 2020; Shaw & Kesharwani, 2019) | (Amit Shankar, 2016; Chauhan et al., 2019; George & Kumar, 2013; Kumar et al., 2017; Patel & Patel, 2018; Priya et al., 2018; Ravindran, n.d.; Sharma & Khurana, 2022; S. Singh & Srivastava, 2018; Vatnani & Verma, 2014; Yadav et al., 2015) | (Bashir & Madhavaiah, 2015; Sikdar & Makkad, 2015) |

| Perceived Usefulness | (Chawla & Joshi, 2019b, 2020; George & Sunny, 2022; Shaw & Kesharwani, 2019; N. Singh & Sinha, 2020; Sinha & Singh, 2022; S. Talwar et al., 2020) | (Sarmah et al., 2021) | (Amit Shankar, 2016; Chauhan et al., 2019; George & Kumar, 2013; Jiwaji University, Gwalior, Madhya Pradesh, India et al., 2010; Kumar et al., 2017; Patel & Patel, 2018; Priya et al., 2018; Ravindran, n.d.; Sharma & Khurana, 2022; Vatnani & Verma, 2014; Yadav et al., 2015) | (Bashir & Madhavaiah, 2015) |

| Perceived Risk | (Dr. D. Kannan, 2020; Madan & Yadav, 2016; M. Talwar et al., 2021) | (Raman & Aashish, 2021) | (Chauhan et al., 2019; Gajulapally Radhakrishna, 2013; Jiwaji University, Gwalior, Madhya Pradesh, India et al., 2010; Kesharwani & Singh Bisht, 2012; Sharma & Khurana, 2022; Thakur & Srivastava, 2014) | (George & Kumar, 2013; Priya et al., 2018; Ravindran, n.d.) |

| Satisfaction | (George & Sunny, 2022; Raman & Aashish, 2021; S. Singh, 2020) | |||

| Usage Barrier | (Ghosh, 2022) | (A. Gupta & Arora, 2017) | ||

| Value Barrier | (Ghosh, 2022) | (Kaur, Dhir, Singh, et al., 2020) | ||

| Tradition Barrier | (Kaur, Dhir, Singh, et al., 2020) | (Ghosh, 2022) | (A. Gupta & Arora, 2017) | |

| Perceived cost | (K. Gupta & Arora, 2019; Shaw & Kesharwani, 2019) | (N. Singh & Sinha, 2020; Sinha & Singh, 2022) | (Amit Shankar, 2016; S. Singh & Srivastava, 2018) | (Jiwaji University, Gwalior, Madhya Pradesh, India et al., 2010)32 |

| Gender | (Jaiswal et al., 2022) | (Sharma & Khurana, 2022) | ||

| Age | (Jaiswal et al., 2022) | (Sharma & Khurana, 2022) | ||

| Income | (Jaiswal et al., 2022) | (Sharma & Khurana, 2022) | ||

| Education | (Jaiswal et al., 2022) | |||

| Perceived Risk | (Dr. D. Kannan, 2020; Madan & Yadav, 2016; M. Talwar et al., 2021) | (Raman & Aashish, 2021) | (Chauhan et al., 2019; Gajulapally Radhakrishna, 2013; Jiwaji University, Gwalior, Madhya Pradesh, India et al., 2010; Kesharwani & Singh Bisht, 2012; Sharma & Khurana, 2022; Thakur & Srivastava, 2014) | (George & Kumar, 2013; Priya et al., 2018; Ravindran, n.d.) |

| Satisfaction | (George & Sunny, 2022; Raman & Aashish, 2021; S. Singh, 2020) | |||

| Usage Barrier | (Ghosh, 2022) | (A. Gupta & Arora, 2017) | ||

| Value Barrier | (Ghosh, 2022) | (Kaur, Dhir, Singh, et al., 2020) | ||

| Tradition Barrier | (Kaur, Dhir, Singh, et al., 2020) | (Ghosh, 2022) | (A. Gupta & Arora, 2017) | |

| Perceived cost | (K. Gupta & Arora, 2019; Shaw & Kesharwani, 2019) | (N. Singh & Sinha, 2020; Sinha & Singh, 2022) | (Amit Shankar, 2016; S. Singh & Srivastava, 2018) | (Jiwaji University, Gwalior, Madhya Pradesh, India et al., 2010)32 |

| Gender | (Jaiswal et al., 2022) | (Sharma & Khurana, 2022) | ||

| Age | (Jaiswal et al., 2022) | (Sharma & Khurana, 2022) | ||

| Income | (Jaiswal et al., 2022) | (Sharma & Khurana, 2022) | ||

| Education | (Jaiswal et al., 2022) | |||

A few number of studies have significant relationship between intention to use and effort expectancy (Jaiswal et al., 2022; Singu & Chakraborty, 2022), self-efficacy (S. Singh & Srivastava, 2018; Upadhyay et al., 2022), service quality (George & Sunny, 2022; Raman & Aashish, 2021; Singu & Chakraborty, 2022) and information quality (Kamboj et al., 2022; Singu & Chakraborty, 2022; M. Talwar et al., 2021). Some studies found a non-significant relationship with variables such as, social influence (Chakraborty et al., 2022; Chauhan et al., 2019; Jaiswal et al., 2022; Upadhyay et al., 2022), customer support (Shahid et al., 2022), volume (Shankar et al., 2020), perceived cost (N. Singh & Sinha, 2020; Sinha & Singh, 2022) and perceived risk (George & Kumar, 2013; Priya et al., 2018; Raman & Aashish, 2021; Ravindran, n.d.; Yadav et al., 2015).

Weight Analysis

Weight analysis is a technique which investigate the strength of an independent variable (predictor) on the dependent variable (outcome) (Alkhowaiter, 2020). This analysis allows to examine the anticipating power of a predictor (independent variable) in a linear relationship. Table 6 presents a concise description of the 33 most commonly used relationship between a digital banking and payment research in India. This includes various significant and non-significant relationship, total number of variables examined by previous researchers between each pair of dependent and independent variables. Out of 33 frequently used relationship, in majority of studies (21) behavioral intention or intention to adopt was used as dependent variable.

| Table 6 Weight Analysis Result | ||||||

| S.No | Independent Variables | Dependent Variables | Significant Studies | Non-Significant Studies | Total | Weight |

| 1 | Perceived security | BEHAVIOURAL INTENTION/ INTENTION TO ADOPT | 4 | 4 | 8 | 0.5 |

| 2 | Performance expectancy | 7 | 0 | 7 | 1 | |

| 3 | Effort expectancy | 6 | 2 | 8 | 0.75 | |

| 4 | System quality | 2 | 0 | 2 | 1 | |

| 5 | Service quality | 4 | 0 | 4 | 1 | |

| 6 | Facilitating condition | 7 | 0 | 7 | 1 | |

| 7 | Information quality | 4 | 0 | 4 | 1 | |

| 8 | Trust | 16 | 4 | 20 | 0.8 | |

| 9 | Social influence | 7 | 5 | 12 | 0.583 | |

| 10 | Attitude | 8 | 0 | 8 | 1 | |

| 11 | Perceived ease of use | 15 | 5 | 20 | 0.75 | |

| 12 | Perceived Usefulness | 18 | 2 | 20 | 0.9 | |

| 13 | Compatibility | 6 | 0 | 6 | 1 | |

| 14 | Perceived Risk | 9 | 3 | 12 | 0.75 | |

| 15 | Satisfaction | 3 | 0 | 3 | 1 | |

| 16 | Usage Barrier | 2 | 0 | 2 | 1 | |

| 17 | Value Barrier | 1 | 1 | 2 | 0.5 | |

| 18 | Risk Barrier | 1 | 1 | 2 | 0.5 | |

| 19 | Tradition Barrier | 2 | 1 | 3 | 0.667 | |

| 20 | Technology Barrier | 0 | 1 | 1 | 0 | |

| 21 | Perceived Costs | 4 | 3 | 7 | 0.571 | |

| 23 | Confirmation | Satisfaction | 3 | 0 | 3 | 1 |

| 24 | Usage or Intention | 2 | 0 | 2 | 1 | |

| 25 | Perceived usefulness | 2 | 0 | 2 | 1 | |

| 26 | Trust | 4 | 0 | 4 | 1 | |

| 27 | Perceived ease of use | 3 | 0 | 3 | 1 | |

| 28 | Perceived Risk | 0 | 2 | 2 | 0 | |

| 30 | Security | Attitude | 4 | 1 | 5 | 0.8 |

| 31 | Perceived ease of use | 4 | 3 | 7 | 0.571 | |

| 32 | Perceived Usefulness | 7 | 0 | 7 | 1 | |

| 33 | Compatibility | 2 | 0 | 2 | 1 | |

| 34 | Trust | 3 | 0 | 3 | 1 | |

| 35 | Facilitating Condition | 2 | 1 | 3 | 0.667 | |

| 37 | Service quality | Trust | 3 | 0 | 3 | 1 |

| 38 | Perceived security | 4 | 0 | 4 | 1 | |

| 39 | Perceived ease of use | 2 | 0 | 2 | 1 | |

| 40 | Perceived Usefulness | 2 | 0 | 2 | 1 | |

| 41 | Perceived ease of use | Perceived Usefulness | 6 | 0 | 6 | 1 |

To execute weight analysis, the number of significant studies are divided by total number of analyzed studies between dependent and independent variables (George & Sunny, 2022; Inder et al., 2022; Kamboj et al., 2022; M. Talwar et al., 2021). For instance, the weight analysis for the relationship between effort expectancy and behavioral intention is calculated by dividing 6 (number of significant relationships) by 8 (total number of relationship studied) which equals to 0.75. (Jeyaraj et al., 2006) suggested that predictors are classified as best predictors when weight is equal or more than 0.8 and promising if it was examined 5 times or few (experimental) and its weight analysis is equal to 1.

Based on weight analysis, it can be concluded that most used predictors for intention to use or behavioral intention are trust (examined 20 times), perceived usefulness (examined 20 times), perceived ease of use (examined 20 times), social influence (examined 12 times), perceived risk (examined 12 times), effort expectancy (examined 8 times), perceived security (examined 8 times), attitude (examined 8 times), facilitating condition (examined 7 times), and performance expectancy (examined 7 times). Out of these variables perceived usefulness (weight equals to 0.9), performance expectancy (weight equals to 1), facilitating conditions (weight equals to 1), and attitude (weight equals to 1) are considered as the best predictors of intention to use/behavioral intention.

There are nine predictors of intention to use or behavioral intention which are experimental: service quality (examined 4 times), information quality (examined 4 times), satisfaction (examined 3 times), usage barrier (examined 2 times), value barrier (examined 2 times), risk barrier (examined 2 times), tradition barrier (examined 3 times), system quality (examined 2 times), and technological barrier (examined 1 times). Out of these 9 predictors (experimental), 6 weights equals to 1 thus being considered promising: system quality, service quality, information quality, satisfaction, usage barrier, and value barrier.

Effort expectancy, social influence, perceived ease of use, perceived risk, and perceived cost are considered as the predictor which have least effect on behavioral intention/intention to use, as they were analyzed more than five times and have weight less than 0.8.

All predictors for dependent variable- user’s satisfaction are experimental as examined less than 5 times. Among 6 predictors, 5 are promising because weight equals to 1: confirmation (examined 3 times, significant 3 times), usage or intention (examined 2 times, significant 2 times), perceived usefulness (examined 2 times, significant 2 times), trust (examined 4 times, significant 4 times), and perceived ease of use (examined 3 times, significant 3 times); whereas perceived risk (examined 2 times, insignificant 2 times) negatively affect satisfaction.

Three out of six predictors for attitude are well utilized while other 3 are experimental. Perceived usefulness is the best predictor as examined seven times and weight equals to 1 other being perceived security examined four times and weight equals to 0.8, while perceived ease of use is the least predictor of attitude with weight 0.57, i.e., less than 0.8 and examined seven times. Compatibility and trust are promising experimental predictors as examined 2 & 3 times respectively with weights equal to 1). On the other hand, facilitating condition is not affective predictor of attitude thus should be given least preference for further studies.

There are four predictors of trust and all are experimental and promising with weight equals to one: Service quality (examined 3 times), Perceived Security (examined 4 times), Perceived ease of use (examined 2 times) and Perceived usefulness (examined 2 times). The only predictor of perceived usefulness i.e., perceived ease of use is well utilized and best indicator as examined six times and weight equals to one.

Meta-Analysis

A meta-analysis is a tool of statistical analysis that amalgamate the results of various research studies. Meta-analysis can only be performed when multiple research studies addresses the same problem, and each individual research measurement have some degree of error. It is use as an alternative to qualitative literature review, in which researchers visualize past researches by examining and combining the quantitative results of studies using meta-analysis (Patil et al., 2019).

In this study meta-analysis is performed by using correlation-coefficient between independent and dependent variables and sample size of the study and employing Jamovi 2.3.18 software. Table 7 shows the generated results through meta-analysis.

Table 7 presents the meta-analysis results of the five most recurring used relationship that has arisen two or more times across 19 studies. It describes the number of times a relationship between a dependent and independent variables examined, estimate, standard error, p-value, 95 percent lower (r) and 95 percent upper (r) confidence intervals.

| Table7 Results of Meta-Analysis | ||||||||

| S.No | Independent variable | Dependent variable | Total test | Estimate | se | P | 95%L(r) | 95%H(r) |

| 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 |

Attitude Effort Expectancy Facilitating Condition Perceived Security Perceived ease of use Perceived usefulness Performance Expectancy Satisfaction Social Influence Trust Perceived ease of use Perceived usefulness Trust Service quality Perceived security Perceived ease of use Perceived usefulness Trust Perceived ease of use |

Behavioral Intention Satisfaction Trust Attitude Perceived Usefulness |

3 3 3 3 5 8 3 3 6 5 2 3 2 3 2 3 4 2 4 |

0.664 0.276 0.178 0.891 0.288 0.406 0.398 0.508 0.103 0.275 0.267 0.305 0.520 0.421 0.177 0.168 0.314 0210 0.882 |

0.0287 0.0263 0.0265 0.0318 0.0263 0.0197 0.0263 0.0265 0.0202 0.0210 0.0473 0.0311 0.0325 0.0213 0.0295 0.0269 0.0217 0.0264 0.0231 |

<.001 <.001 <.001 <.001 <.001 <.001 <.001 <.001 <.001 <.001 <.001 <.001 <.001 <.001 <.001 <.001 <.001 <.001 <.001 |

0.608 0.225 0.126 0.829 0.237 0.367 0.346 0.456 0.063 0.234 0.175 0.244 0.456 0.379 0.119 0.115 0.272 0.159 0.837 |

0.720 0.328 0.230 0.953 0.340 0.444 0.449 0.560 0.142 0.316 0.360 0.366 0.584 0.463 0.235 0.221 0.357 0.262 0.928 |

The evaluation of meta-analysis generated that all relationship studied were found significant. The very strong relationship is between perceived security and behavioral intention, i.e.,0.891 and perceived ease of use and perceived usefulness, i.e., 0.882.

Discussion, Taxonomy, and Propositions

Main Limitations of Existing Work

After accompanying a systematic review of studies on digital payment and banking method in India the following limitation were observed in existing work. Majority of studies used survey and questionnaire methods (Chakraborty et al., 2022; Dr. D. Kannan, 2020; Jaiswal et al., 2022; Jebarajakirthy & Shankar, 2021; Sharma & Khurana, 2022; Singu & Chakraborty, 2022; Upadhyay et al., 2022) which limit the generalizability of the findings for the whole population. Future research should use other sampling techniques. Majority of research papers focused on the data collection from educated and young population only, whose behavioral intention is different from rest of population. The future research should investigate older age people and with various educational background. Few studies conducted demographic characteristics moderating effect such as gender, age, education qualification and income.

More than 3/4th studies are employing cross sectional data instead of longitudinal data on digital payment and banking methods. Further studies by researchers should use longitudinal data to get better results about change in adoption intention among people over time. All of the research paper has collected data from urban population thus providing biased result as rural population is one which lack digital financial service and their utilization knowledge. This would help analysis of different variables affecting adoption across different stages. Majority of studies evaluated the consumer behavior toward adoption intention but further studies can focus on other group such as government, retailers, and companies.

Discussion of Results

The move toward Digital India has led to growth of digital payment and banking adoption behavior among the population which create the huge potential for researchers to conduct studies on digital banking and payments. The current study has undertaken weight analysis and meta-analysis as a tool to conduct systematic literature review evaluating the relationship between dependent and independent variables across various studies. The best predictors of behavioral intention or Intention to adopt are performance expectancy, facilitating conditions, trust, attitude, perceived usefulness and compatibility demonstrating the weights above 0.8 when analyzed across studies on digital payment and banking adoption.

It was observed that all the best predictors in weight analysis were significant while testing through meta-analysis. Many predictors which are experimental in nature as per weight analysis conclusion are need to be studied further to get firm conclusion and to conduct meta-analysis.

Proposed Conceptual Model and Propositions

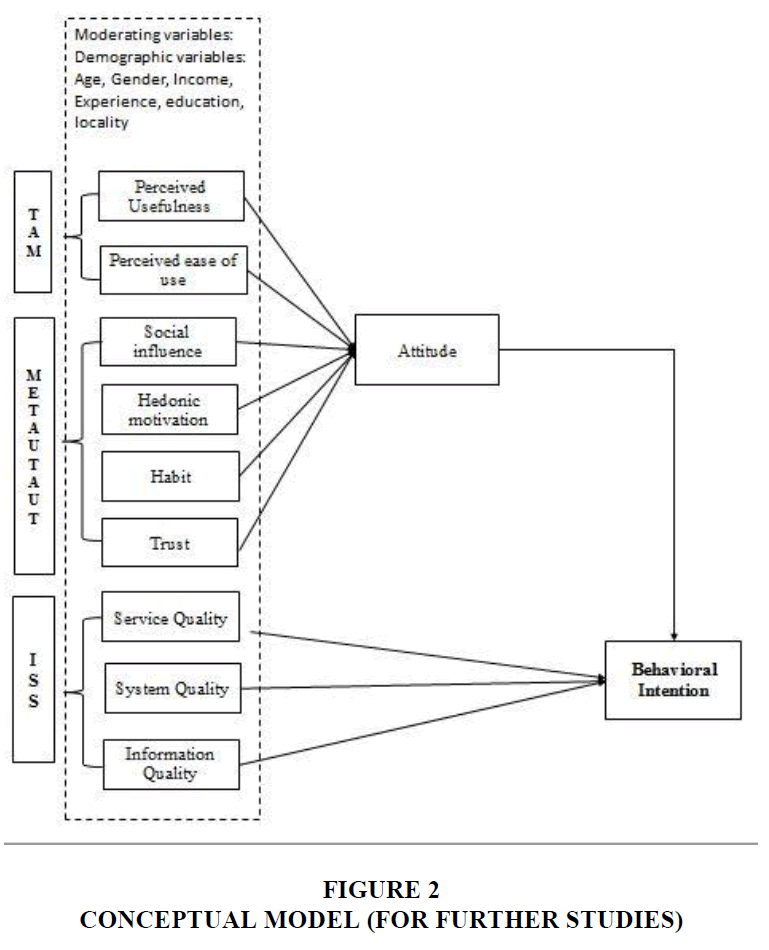

The studies reviewed has employed number of theories or model to evaluate the adoption intention of digital payment and banking such as UTAUT, UTAUT 2, TAM, Innovation resistance theory, ISS model and Innovation diffusion theory.

According to theory of UTAUT model (The unified theory of acceptance and use of technology) which study user intention through determinants such as performance expectancy, effort expectancy, social influence and facilitating conditions formulated by Venkatesh (Venkatesh et al., 2003) used by various researches such as (Chawla & Joshi, 2020; Inder et al., 2022; Jaiswal et al., 2022; Madan & Yadav, 2016; S. Singh, 2020; S. Singh & Srivastava, 2018; Singu & Chakraborty, 2022) and more. The improvement over UTAUT model is UTAUT 2(K. Gupta & Arora, 2019) model which uses more variables, i.e., Hedonic Motivation, price value and habit while meta-UTAUT (Upadhyay et al., 2022) included other variables such as self-efficacy, perceived severity and attitude which affect as mediator in user intention to adopt.

TAM known as Technology Acceptance model proposed by Davis (1986) (Al-Suqri & Al-Aufi, 2015) said that perceived usefulness (PU) and Perceived ease of use (PEOU) have direct effect on user behavioural intention but it does not measure subjective norm which is studied in UTAUT model.

The core construct of Innovation resistance theory provided by Ram and Seth (1989) identified five barriers for resistance: usage barrier, risk barrier, value barrier, image barrier and tradition barrier which affect innovation thus affecting behavior due to rational thinking and decision making by users.

Information System Success model by Delone and Mclean (2003) (“The DeLone and McLean Model of Information Systems Success,” 2003) which study variables: information quality, system quality and service quality affecting usage intention and satisfaction of users thus analyzing net system benefits.

Summing up all the results from theories/models, weight analysis and meta-analysis, the following model (Figure 2) is the proposed model for further researchers to study the adoption behaviors of mobile banking and digital payments in context of India. The model is combination of various models such as meta-UTAUT, TAM and ISS model. The model used should consider the moderating effect of demographic variables to get the fair view about adoption of digital payments by different groups divided on different demographic criteria.

Conclusions

Recent literature on digital banking and payment adoption has suggested that despite so many benefits there have not been readily adopted by users as shown by so low confidence level in meta-analysis. Researchers has suggested that low adoption by users is due to challenges such as perceived security, perceived risk, habitual use of cash and trust. Majority of studies related to digital payment and banking adoption in India has employed UTAUT and Tam as theoretical foundations. It is found that out of all variables performance expectancy, facilitating conditions, trust, attitude, and perceived usefulness were performed satisfactory under both type of analysis, i.e., weight analysis and meta-analysis. The least effective predictors of adoption intention were perceived security, social influence, perceived ease of use and perceived cost in weight analysis which showed significant meta-analysis required further analysis and in order to evaluate the real performance it required validation through primary data.

The findings of previous researchers provided various predictors or variables to be used in further studies for evaluating user’s intention to use and adopt digital payment and banking methods through primary data survey. The study also provides various limitations of existing literature and provides considerable directions for future researches.

The provided conceptual model for further research provide banks and government with information related to perceived usefulness, perceived ease of use, trust, social influence, hedonic motivation, system quality, etc., to study the user’s adoption intention and evaluate further improvement in the services provided and methods to enhance the usage and adoption of users. The government policymakers can use the findings to formulate the strategies and policies for improving the adoption and usage among the population.

Limitations

The current study has limitations that future researchers may resolve. Firstly, the studies reviewed belongs only to India, further other countries can be evaluated and compared the results. Secondly, the literature for this research was collected from Scopus only, which limited the review, weight and meta-analysis of studies. Further researchers can use a broader range of database available. Thirdly, all the studies cannot be included as do not report adequate data to execute weight analysis and meta-analysis. Meta-analysis only included correlation coefficient due to which many of researches with methodologies path coefficient, t-test, etc., are not included thus not providing fair view about adoption. Fourthly, meta-analysis is not performed on moderating predictors affecting adoption due to less number of studies evaluated demographic variables. Future research should overcome the limitations the study and evaluate the conceptual model provided on longitudinal data for validated study through primary data collection.

References

Alkhowaiter, W. A. (2020). Digital payment and banking adoption research in Gulf countries: A systematic literature review. International Journal of Information Management, 53, 102102.

Indexed at, Google Scholar, Cross Ref

Al-Suqri, M. N. (Ed.). (2015). Information Seeking Behavior and Technology Adoption: Theories and Trends: Theories and Trends. IGI Global.

Indexed at, Google Scholar, Cross Ref

Banerjee, S., & Sreejesh, S. (2022). Examining the role of customers' intrinsic motivation on continued usage of mobile banking: a relational approach. International Journal of Bank Marketing, 40(1), 87-109.

Bashir, I., & Madhavaiah, C. (2015). Consumer attitude and behavioural intention towards Internet banking adoption in India. Journal of Indian Business Research, 7(1), 67-102.

Chakraborty, D., Siddiqui, A., Siddiqui, M., Rana, N. P., & Dash, G. (2022). Mobile payment apps filling value gaps: Integrating consumption values with initial trust and customer involvement. Journal of Retailing and Consumer Services, 66, 102946.

Chatterjee, D., & Bolar, K. (2019). Determinants of mobile wallet intentions to use: The mental cost perspective. International Journal of Human–Computer Interaction, 35(10), 859-869.

Indexed at, Google Scholar, Cross Ref

Chauhan, V., Yadav, R., & Choudhary, V. (2019). Analyzing the impact of consumer innovativeness and perceived risk in internet banking adoption: A study of Indian consumers. International Journal of Bank Marketing, 37(1), 323-339.

Indexed at, Google Scholar, Cross Ref

Chawla, D., & Joshi, H. (2017). Consumer perspectives about mobile banking adoption in India–a cluster analysis. International Journal of Bank Marketing, 35(4), 616-636.

Chawla, D., & Joshi, H. (2019). Scale development and validation for measuring the adoption of mobile banking services. Global Business Review, 20(2), 434-457.

Chawla, D., & Joshi, H. (2020). The moderating role of gender and age in the adoption of mobile wallet. foresight, 22(4), 483-504.

Deb, M., & Lomo-David, E. (2014). An empirical examination of customers’ adoption of m-banking in India. Marketing Intelligence & Planning, 32(4), 475-494.

DeLone, W. H., & McLean, E. R. (2003). The DeLone and McLean model of information systems success: a ten-year update. Journal of management information systems, 19(4), 9-30.

Kavitha, K., & Kannan, D. D. (2020). Factors influencing consumers attitude towards mobile payment applications. international Journal of Management, 11(4).

Kesharwani, A., & Radhakrishna, G. (2013). Drivers and inhibitors of internet banking adoption in India. Journal of Internet Banking and Commerce, 18(3), 1.

George, A., & Kumar, G. G. (2013). Antecedents of customer satisfaction in internet banking: Technology acceptance model (TAM) redefined. Global business review, 14(4), 627-638.

Indexed at, Google Scholar, Cross Ref

George, A., & Sunny, P. (2023). Why do people continue using mobile wallets? An empirical analysis amid COVID-19 pandemic. Journal of Financial Services Marketing, 28(4), 807-821.

Indexed at, Google Scholar, Cross Ref

Ghosh, M. (2024). Empirical study on consumers’ reluctance to mobile payments in a developing economy. Journal of Science and Technology Policy Management, 15(1), 67-92.

Gupta, A., & Arora, N. (2017). Consumer adoption of m-banking: a behavioral reasoning theory perspective. International Journal of Bank Marketing, 35(4), 733-747.

Gupta, K., & Arora, N. (2020). Investigating consumer intention to accept mobile payment systems through unified theory of acceptance model: An Indian perspective. South Asian Journal of Business Studies, 9(1), 88-114.

Inder, S., Sood, K., & Grima, S. (2022). Antecedents of behavioural intention to adopt internet banking using structural equation modelling. Journal of Risk and Financial Management, 15(4), 157.

Indexed at, Google Scholar, Cross Ref

Jaiswal, D., Kaushal, V., Mohan, A., & Thaichon, P. (2022). Mobile wallets adoption: Pre-and post-adoption dynamics of mobile wallets usage. Marketing Intelligence & Planning, 40(5), 573-588.

Jebarajakirthy, C., & Shankar, A. (2021). Impact of online convenience on mobile banking adoption intention: A moderated mediation approach. Journal of Retailing and Consumer Services, 58, 102323.

Jeyaraj, A., Rottman, J. W., & Lacity, M. C. (2006). A review of the predictors, linkages, and biases in IT innovation adoption research. Journal of information technology, 21(1), 1-23.

Indexed at, Google Scholar, Cross Ref

Jain, P., & Agarwal, G. (2019). Factors affecting mobile banking adoption: An empirical study in gwalior region. The International Journal of Digital Accounting Research, 19(4), 79-101.

Joseph, J., Sriram, K. V., Rodrigues, L. L., Mathew, A. O., & Gana, K. C. (2018). An empirical study on customer adoption of mobile payment application in India. International Journal of Enterprise Network Management, 9(3-4), 363-375.

Kamboj, S., Sharma, M., & Sarmah, B. (2022). Impact of mobile banking failure on bank customers' usage behaviour: the mediating role of user satisfaction. International Journal of Bank Marketing, 40(1), 128-153.

Indexed at, Google Scholar, Cross Ref

Kaur, P., Dhir, A., Bodhi, R., Singh, T., & Almotairi, M. (2020). Why do people use and recommend m-wallets?. Journal of Retailing and Consumer Services, 56, 102091.

Kaur, P., Dhir, A., Singh, N., Sahu, G., & Almotairi, M. (2020). An innovation resistance theory perspective on mobile payment solutions. Journal of Retailing and Consumer Services, 55, 102059.

Indexed at, Google Scholar, Cross Ref

Kesharwani, A., & Singh Bisht, S. (2012). The impact of trust and perceived risk on internet banking adoption in India: An extension of technology acceptance model. International journal of bank marketing, 30(4), 303-322.

Kumar, V. R., Lall, A., & Mane, T. (2017). Extending the TAM model: Intention of management students to use mobile banking: Evidence from India. Global Business Review, 18(1), 238-249.

Kundu, S., & Datta, S. K. (2015). Impact of trust on the relationship of e-service quality and customer satisfaction. EuroMed Journal of Business, 10(1), 21-46.

Madan, K., & Yadav, R. (2016). Behavioural intention to adopt mobile wallet: a developing country perspective. Journal of Indian Business Research, 8(3), 227-244.

Patel, K. J., & Patel, H. J. (2018). Adoption of internet banking services in Gujarat: An extension of TAM with perceived security and social influence. International Journal of Bank Marketing, 36(1), 147-169.

Indexed at, Google Scholar, Cross Ref

Patil, P. P., Rana, N. P., & Dwivedi, Y. K. (2019). Digital payments adoption research: A meta-analysis for generalising the effects of attitude, cost, innovativeness, mobility and price value on behavioural intention. In Smart Working, Living and Organising: IFIP WG 8.6 International Conference on Transfer and Diffusion of IT, TDIT 2018, Portsmouth, UK, June 25, 2018, Proceedings (pp. 194-206). Springer International Publishing.

Paul, P., Giri, S., Mitra, P., & Haque, M. M. (2022). Analysing the customer satisfaction index of E-banking using kano (1984) model framework. Global Business Review, 09721509221093892.

Priya, R., Gandhi, A. V., & Shaikh, A. (2018). Mobile banking adoption in an emerging economy: An empirical analysis of young Indian consumers. Benchmarking: An International Journal, 25(2), 743-762.

Indexed at, Google Scholar, Cross Ref

Kumar, R., Sachan, A., & Kumar, R. (2020). The impact of service delivery system process and moderating effect of perceived value in internet banking adoption. Australasian Journal of Information Systems, 24.

Raman, P., & Aashish, K. (2021). To continue or not to continue: a structural analysis of antecedents of mobile payment systems in India. International Journal of Bank Marketing, 39(2), 242-271.

Ravindran, D. S., & Kumar, R. (2012). An empirical study on service quality perceptions and continuance intention in mobile banking context in India. Journal of internet banking and commerce, 17(1), 1-22.

Roy, S. K., Balaji, M. S., Kesharwani, A., & Sekhon, H. (2017). Predicting Internet banking adoption in India: A perceived risk perspective. Journal of Strategic Marketing, 25(5-6), 418-438.

Sankaran, R., & Chakraborty, S. (2021). Why customers make mobile payments? Applying a means-end chain approach. Marketing Intelligence & Planning, 39(1), 109-124.

Sarmah, R., Dhiman, N., & Kanojia, H. (2021). Understanding intentions and actual use of mobile wallets by millennial: an extended TAM model perspective. Journal of Indian Business Research, 13(3), 361-381.

Indexed at, Google Scholar, Cross Ref

Shankar, A., & Kumari, P. (2016). Factors affecting mobile banking adoption behavior in India. Journal of Internet Banking and Commerce, 21(1), 1.

Shahid, S., Islam, J. U., Malik, S., & Hasan, U. (2022). Examining consumer experience in using m-banking apps: A study of its antecedents and outcomes. Journal of Retailing and Consumer Services, 65, 102870.

Singh, S. (2014). Customer perception of mobile banking: An empirical study in National Capital Region Delhi. Journal of Internet banking and commerce, 19(3), 2-23.

Shankar, A., Jebarajakirthy, C., & Ashaduzzaman, M. (2020). How do electronic word of mouth practices contribute to mobile banking adoption?. Journal of Retailing and Consumer Services, 52, 101920.

Shankar, A., & Rishi, B. (2020). Convenience matter in mobile banking adoption intention?. Australasian Marketing Journal, 28(4), 273-285.

Indexed at, Google Scholar, Cross Ref

Shaw, B., & Kesharwani, A. (2019). Moderating effect of smartphone addiction on mobile wallet payment adoption. Journal of Internet Commerce, 18(3), 291-309.

Sikdar, P., & Makkad, M. (2015). Online banking adoption: A factor validation and satisfaction causation study in the context of Indian banking customers. International Journal of Bank Marketing, 33(6), 760-785.

Singh, N., & Sinha, N. (2020). How perceived trust mediates merchant's intention to use a mobile wallet technology. Journal of retailing and consumer services, 52, 101894.

Singu, H. B., & Chakraborty, D. (2022). I have the bank in my pocket: Theoretical evidence and perspectives. Journal of Public Affairs, 22(3), e2568.

Indexed at, Google Scholar, Cross Ref

Sinha, N., & Singh, N. (2023). Moderating and mediating effect of perceived experience on merchant's behavioral intention to use mobile payments services. Journal of Financial Services Marketing, 28(3), 448-465.

Talwar, M., Talwar, S., Kaur, P., Islam, A. N., & Dhir, A. (2021). Positive and negative word of mouth (WOM) are not necessarily opposites: A reappraisal using the dual factor theory. Journal of Retailing and Consumer Services, 63, 102396.

Talwar, S., Dhir, A., Khalil, A., Mohan, G., & Islam, A. N. (2020). Point of adoption and beyond. Initial trust and mobile-payment continuation intention. Journal of Retailing and Consumer Services, 55, 102086.

Thakur, R., & Srivastava, M. (2014). Adoption readiness, personal innovativeness, perceived risk and usage intention across customer groups for mobile payment services in India. Internet Research, 24(3), 369-392.

Indexed at, Google Scholar, Cross Ref

Upadhyay, N., Upadhyay, S., Abed, S. S., & Dwivedi, Y. K. (2022). Consumer adoption of mobile payment services during COVID-19: Extending meta-UTAUT with perceived severity and self-efficacy. International Journal of Bank Marketing, 40(5), 960-991.

Vatnani, R., & Verma, S. (2014). Comprehensive framework for internet banking adoption: an empirical analysis in the Indian context. International Journal of Business Information Systems, 15(3), 307-324.

Indexed at, Google Scholar, Cross Ref

Venkatesh, V., Morris, M. G., Davis, G. B., & Davis, F. D. (2003). User acceptance of information technology: Toward a unified view. MIS quarterly, 425-478.

Yadav, R., Chauhan, V., & Pathak, G. S. (2015). Intention to adopt internet banking in an emerging economy: a perspective of Indian youth. International Journal of Bank Marketing, 33(4), 530-544.

Indexed at, Google Scholar, Cross Ref

Received: 01-Sep-2024, Manuscript No. AMSJ-24-15197; Editor assigned: 02-Sep-2024, PreQC No. AMSJ-24-15197 (PQ); Reviewed: 26-Oct-2024, QC No. AMSJ-24-15197; Revised: 06-Nov-2024, Manuscript No. AMSJ-24-15197(R); Published: 05-Jan-2025