Research Article: 2020 Vol: 24 Issue: 1

Managerial Motivation behind an All-Equity Structure: The Role of Free Cash Flows and Growth Opportunities on Accounting Quality

David Cabán, Rollins College

Abstract

This paper investigates if all-equity firms are a heterogeneous group as it relates to accounting quality. All-equity firms are a unique group of firms that choose a “corner solution” as their capital structure. Extant research supports the argument that poor accounting quality makes debt so prohibitive that such firms are driven to this capital structure. This paper proposes that an all-equity structure is not necessarily symptomatic of poor accounting quality overall and in fact, some high accounting quality firms choose to preclude debt from their capital structure. The paper investigates if different motivations, within an all-equity setting, associated with free cash flows and growth opportunities, result in different levels of accounting quality. By anchoring on theories that link implicit costs of debt to free cash flow levels and growth opportunities, this study hypothesizes that free cash flows and growth opportunities are strongly linked to the justification or lack thereof for the pursuit of an all-equity capital structure. This study hypothesizes and shows that firms in the extremes of the free cash flow to growth rate spectrum exhibit significantly different levels of accounting quality when compared to their levered peers. These results support the main prediction that there exist accounting quality differences within the all-equity setting, associated with free cash flow levels and growth opportunities, and motivating the use of such structure. Thus, the pessimistic conclusions for pursuing an all-equity strategy reached by prior research should not be generalized to all such firms.

Keywords

All-Equity, Accounting Quality, Growth Opportunities, Free Cash Flows, Capital Structure.

Introduction

Firms that have an all-equity capital structure have interested both investors and academics throughout the years. While many investors appear to accept such an extreme capital structure, academics tend to have a negative view of it. All-equity capital structures perplex academics so much they call it the “zero leverage puzzle” (Graham, 2000; Strebulaev & Yang, 2013). Trade-off theory, supported by most financial models, suggests that firms should include some level of debt in their capital structure in order to achieve the lowest cost of capital possible (optimum capital structure). Anchoring on this theory, prior research has focused on identifying the dysfunctional forces leading to the implementation of such an extreme capital structure. Extant research has shown that high levels of information risk (also referred to as accounting quality) and information asymmetry lead to prohibitive levels of cost of debt (Armstrong et al., 2010; Balakrishnan et al., 2013; Lambert et al., 2011). Therefore, the decision to pursue an all-equity capital structure has often been linked to poor accounting quality. While the basis for such conclusions is not a source of debate, this paper contends that these conclusions should not be generalized as done in prior research. It contends that for some firms, an all-equity capital structure is implemented with value maximizing intent in mind and not motivated by some dysfunctional force within the firm.

This study investigates whether different motivations within an all-equity setting, strongly influenced by free cash flow and growth opportunity levels, can be associated with different levels of accounting quality. In particular, by anchoring on theories that focus on the implicit costs of debt, this paper investigates whether: (i) There are two general groups; those who are positively motivated to establish such a structure and those who are negatively motivated (ii) If so, can such motivation be associated with levels of free cash flows and growth opportunities leading to differences in accounting quality among these groups?

Agency behaviors such as the desire to maintain greater control of free cash flows and the ability to engage in earnings management have been associated with the decision to preclude the incremental monitoring that comes with debt. Despite this characterization, some of the most successful and popular firms have had an all-equity capital structure at one point or another1. This lends credence to the fact that the implementation of this structure may not always be motivated by agency related behavior as prior research suggests. If true, the population of all-equity firms can be divided into two distinct groups: those motivated to maximize the firm’s value and those motivated by the desire to maintain a greater control of the firm. The group that implements such strategy to preclude an additional external monitor in order to have greater control of their free cash flows and a greater ability to engage in earnings management should exhibit poorer accounting quality in general. Their high level of free cash flow precludes the need for debt and their low growth rate motivates them to engage in earning management, both of which lead to poorer accounting quality. This leads to the question, what motivates the second group to establish such an extreme capital structure?

Many studies have established a strong relationship between a firm’s free cash flow / growth opportunity environment and their implicit costs of debt. It has been established in the literature that debt does not benefit all firms equally and, in fact, may impose implicit costs on some firms that may exceed its benefits. While debt serves as an extra governance mechanism that can help control agency behaviors such as overinvesting and earnings management; these benefits have been found to be greater for firms in a high free cash flow / low growth environment. In fact, studies have shown that in a low free cash flow/high growth environment tension between management and creditors may lead to sub-optimal investment strategies. Furthermore, firms in a high growth environment face more competition and have a greater need to protect proprietary information. Prior research has shown that creditors, often times, leak such information or use it to extract rents (Ivashina et al., 2008; Rajan 1992). Finally, firms in a high growth environment have lower innate information precision and higher innate information asymmetry leading to higher market premiums for external funds. Research has shown that improving accounting quality helps improve a firms overall informational environment leading to greater accessibility to debt and at a lower cost. Therefore, while firms in such an environment may have a valid reason to preclude debt from their capital structure, they would benefit most by maintaining a higher level of accounting quality should the need for debt funds arise.

Based on the aforementioned theories and findings this study develops expectations regarding different levels of accounting quality within the all-equity setting. Theories supporting the generalized conclusion of prior research are more applicable in a high free cash flow / low growth environment. Thus, this study hypothesizes that all-equity firms with high free cash flows and low growth opportunities will exhibit lower accounting quality than their levered peers. On the other hand, prior research has shown that high growth opportunities are associated with higher implicit costs of debt, lower innate information precision, and greater innate information asymmetry. For these reasons, firms operating in a low free cash flow / high growth environment are more likely avoiding debt in an effort to avoid its implicit costs and improving their accounting quality in an effort to offset their innate information precision and asymmetry. Based on these arguments, this study hypothesizes that all-equity firms in a low free cash flow/high growth environment will exhibit higher accounting quality than their levered peers.

The paper follows Richardson (2006) to measure growth and free cash flow. It then identifies and categorizes high free cash flow / low growth firms, and low free cash flow / high growth firms. Two econometric designs are used to test the main hypotheses. The first research design is known as propensity score matching (PSM), an econometric technique that simulates a random sample and thus controls for endogeneity issues often found in these studies. The second design uses a multivariate regression to estimate the earnings response coefficient (ERC) of each category. An accrual based accounting quality proxy is used in the PSM design and a market based proxy (ERC) of accounting quality is used in the multi-variate regression model. In addition, a multivariate regression model is estimated to analyze potential changes in accounting quality before and after the introduction of debt.

Consistent with the paper’s predictions, results show that firms in the high free cash flow / low growth category show significantly lower accounting quality than their levered peers under both research designs. On the other hand, firms classified as low free cash flow / high growth exhibit significantly greater accounting quality than their levered peers. These results are supported by the results of the within firm change analysis, which shows that accounting quality tends to improve with the introduction of debt for those firms that exhibited poorer accounting quality while in the all-equity status.

This study broadens the scope of applicable theories in examining the motivation to pursue an all-equity structure. It is important to understand what motivates the decision to pursue such an extreme capital structure policy2. Particularly, in light of the fact that studies such as Strebulaev & Yang (2013) conclude that these firms leave considerable amount of money on the table by not levering up; with potential tax benefits amounting to more than 7% of the market value of equity. From a theoretical stand-point, virtually all financial models produce leverage ratios that are well above zero (Leland & Toft, 1996; Goldstein et al., 2001; Ju et al., 2005). These facts may lead to the erroneous conclusion that all firms exhibiting an all-equity capital structure are being managed sub optimally. This paper shows that not all firms exhibiting an all-equity capital structure have a sub optimal capital structure. Furthermore, the decision to preclude debt is not always motivated by the desire to avoid an additional governance level. It is important that shareholders understand the reasons firms may be precluding debt. There have been real world examples where active investors have tried to pressure management to introduce debt in their capital structure and shareholders have had to vote on which side they are on. For example, on October 24, 2013, active investor Carl Icahn sent Tim Cook and Apple shareholders a letter urging Mr. Cook to issue debt and use the debt funds to buy back shares3. At that time, Apple had an all- equity capital structure and the logic seemed straightforward. This paper brings to light the possibility that management’s hesitance was related to implicit costs they desired to avoid. Shareholders reading this paper would have a more comprehensive view in deciding with whom they should side. Potential creditors of first time debt issuers can also benefit from having a more comprehensive understanding of the reasons those firms had been precluding debt in the past and better expectations on the accounting quality of their financial reports. Auditors and regulators can also use this knowledge in their risk assessment evaluation of the financial statements of all-equity firms. Finally, future research utilizing all-equity firms in their samples may increase their understanding as to why they should not treat them as a homogeneous group when comparing them to their levered peers.

The remainder of this paper is organized as follows. Section II reviews prior literature and research on all-equity firms and accounting quality as it relates to debt contracting. Section III develops the hypotheses. Section IV outlines the research design. Section V describes the sample selection process. In Section VI, the results for the main models and additional analyses are discussed. Section VII offers concluding remarks.

Literature Review

All-Equity Firms

Prior research using all-equity firms can be divided into two categories; those trying to understand the motivation leading to such extreme financial structure and those using this unique financial structure to examine theories. Research on all-equity firms begins with Agrawal & Nagarajan (1990). Like many subsequent studies, they try to identify the motivation leading to such a structure by comparing them to their levered peers. Agrawal & Nagarajan (1990) conclude that a major motivation to pursue an all-equity strategy is management’s desire to reduce the risk associated with their large undiversified investments in their personal portfolio. Alderson & Betker (2012) examine if variances in net debt levels vary with managerial risk exposure when compared to a sample of matched levered firms. Consistent with prior research, they find that a manager’s personal risk aversion leads to lower debt levels. Strebulaev & Yang (2013) contend that the all-equity capital structure may be the main driver of the low leverage puzzle described by Graham (2000)4. They state that by understanding what motivates an all-equity capital structure, we can understand why such low average debt levels are observed across the population of firms. They find that these firms leave considerable amounts of money on the table by not levering up and conclude that the motivation leading to this extreme financial policy is related to differences in risk aversion between the less diversified portfolios of managers and that of the firm’s shareholders.

Literature using the all-equity setting to study existing theories relating to capital structure include the following: Gardner & Trzcinka (1992) take advantage of the unique capital structure of all-equity firms to test the theory introduced by Myers (1977, 1984) stating that growth options are positively related to the implicit costs of debt. They find that growth options are a consistent predictor of the probability of choosing an all-equity structure. Agrawal & Jayaraman (1994) investigate the relationship between dividend payments, managerial ownership, and free cash flow theory. They find that dividends serve as a substitute mechanism to debt, in controlling for potential agency costs related to high free cash flows and that all-equity firms with lower managerial ownership also pay higher dividends Jensen & Meckling (1976). Lai (2011) uses the all-equity setting to obtain a less biased examination of the determinants of debt interest. Consistent with Myers (1977), Lai finds that high investment opportunities are positively related to higher cost of debt.

Accounting Quality, Agency Cost, and Debt Contracting

Accounting quality and information asymmetry are important elements of capital structure theory. There is general agreement in the literature that improved accounting quality ultimately leads to greater accessibility to capital markets at lower costs (Bhattacharya et al., 2012, Kim et al. 2010).

Accounting quality is important in the choice of lending market because higher accounting quality increases the transparency of a firm’s operations and facilitates monitoring by the lenders (Bharath et al., 2008; Ball et al., 2008; Sufi, 2007). Creditors require timely financial information, reliable measures, proprietary information such as budgets and forecasts, and timely loss recognition among other things (Wittenberg-Moerman, 2008). If the firm’s accounting reports provide unreliable asset values, opaque performance measures, or performance measures that make it difficult to forecast the timing and riskiness of future cash flows, lenders will find it difficult to assess the firm’s credit quality and will increase the cost of lending or deny funds altogether (Armstrong et al., 2010).

Bharath et al. (2008) examine the relationship between a firm’s accounting quality and the debt market they choose. They find that firms with poor accounting quality choose the private debt market (bank loans) because banks are more effective monitors and can complement the poor accounting quality with superior information access and processing abilities. Firms with good accounting quality choose the public markets (corporate bonds) and tend to pay lower rates all things equal. They also find that accounting quality is associated with lower spreads in both private and public debt markets and its effects on spreads is stronger in the public markets where monitoring is costlier. Prior research has also shown that firms with low-quality financial statements are more likely to lease rather than obtain debt financing (Beatty et al., 2010a, 2010b). Measures of both financial transparency and accounting quality, right before credit ratings are issued, are positively associated with a firms’ bond rating at the time the debt is issued (Ashbaugh et al., 2006). These finding imply that there is an inverse relationship between accounting quality and financing costs (Bharath et al., 2008).

Debt contracts typically contain covenants, based on accounting information, that restrict dividend payments, capital expenditures, asset sales, or the issuance of additional debt (Smith & Warner, 1979; Watts & Zimmerman, 1978). For this reason, prior research has shown that once the firm obtains the desired debt financing they engage in earnings management such as income- increasing accruals and other income-increasing accounting choices to avoid defaulting on debt covenants (Sweeney, 1994; DeFond & Jiambalvo 1994; Dichev & Skinner, 2002). Lai (2011), using a sample of all-equity firms, finds that accounting quality is negatively related to the interest charged when these firms enter the debt market, implying that all-equity firms with no debt would benefit from maintaining high accounting quality in preparation for any unforeseen needs to access the debt market.

Theory and Hypotheses Development

This paper uses various well-established theories and findings to develop its hypotheses. Among these, trade-off theory, free cash flow theory, and the control hypothesis, serve as the foundation for the development of the paper’s hypotheses.

The assumption that some dysfunctional force in the firm drives an all-equity capital structure is based on the fact that this capital structure does not fall within the acceptable parameters of one of the most well-known and accepted capital structure theories; the trade-off theory. Trade-off theory states that the optimum levels of debt to equity, known as the “optimum capital structure”, helps maximize a firm’s value. The firm’s optimum capital structure is the point at which the weighted average cost of capital is at its lowest by combining both debt and equity and that this optimum level cannot be achieved without combining both sources of capital. The need to combine both debt and equity in order to achieve the optimum capital structure is supported by virtually all financial models (Leland & Toft, 1996; Goldstein et al., 2001; Ju et al., 2005). Thus an assumption is made that by implementing an all-equity capital structure, management is not maximizing the value of the firm and have chosen this capital structure, more likely than not, to engage in self-serving behavior.

To understand the conditions that are more likely to support the conclusion that an all- equity capital structure is motivated by agency related behaviors, this paper turns to free cash flow theory and the control hypothesis. Free cash flow theory states that, absent effective monitoring, free cash flow levels will be positively related to agency related behaviors such as managerial perquisite consumption, over-investing, and earnings management (Jensen, 1986; Stulz, 1990). Earnings management, described as the use of accounting techniques that lead to a more positive outlook than what would be provided under conservative accounting, is directly linked to a reduction in accounting quality (Beyer et al., 2018; Farichah, 2017; and Lo, 2008). Prior findings have given validity to this theory showing that firms with higher levels of free cash are more likely to engage in the aforementioned agency behaviors that lead to poorer accounting quality (Biddle et al., 2009; Kaplan & Stein, 1993, 1989).

One way to curtail these agency behaviors is to introduce debt into the firm’s capital structure. Jensen’s control hypothesis states that debt helps reduce these behaviors by both reducing discretionary free cash flows and adding an additional level of monitoring. Prior research supports Jensen’s control hypothesis by showing that debt serves as an effective governance mechanism improving accounting quality (Ang et al., 2000). Debt covenants may impose payout restrictions and information sharing requirements that can reduce earnings opacity that arise with management entrenchment (Chava et al., 2010). The control function of debt is more important for firms that generate large levels of free cash flows and have low growth opportunities (Jensen, 1986). This is because; firms with large levels of free cash flows have a greater tendency to over- invest (Richardson, 2006). Furthermore, since managerial compensation is often directly linked to growth in accounting earnings, management in firms with low growth opportunities tends to choose income-increasing techniques in an effort to achieve compensation thresholds (Gul et al., 2003; Jensen, 1986; Easterwood, 1997).

Watts & Zimmerman (1978) show that management often lobbies for accounting standards that maximize their personal utility over firm shareholders. Holthausen (1990) briefly describes the opportunistic behavior perspective on motivating accounting choice. While this behavior is not necessarily true of all management, it is reasonable to predict that if management is willing to preclude debt for their personal benefit in the high free cash flow / low growth category, they will be more willing to engage in accounting manipulation for the same reasons as well.

While lower growth opportunities may motivate management to engage in accounting manipulation, high free cash flow levels preclude the need to access debt markets. Both characteristics, when combined, lead to an environment in which management has neither the motivation nor need to improve its financial reporting quality. This argument is consistent with Sun et al. (2012) that show accounting quality is negatively related to cash holdings.

In summary, an expectation of lower accounting quality for all-equity firms classified as high free cash flow / low growth is consistent with the manipulation of growth through accounting data supported by prior research, and the independence from credit markets brought on by high free cash flow levels. These arguments lead to the development of the first hypothesis:

H1: All-equity firms with high free cash flow and low growth opportunities will exhibit significantly lower accounting quality than their levered peers.

While the aforementioned theories and research findings help support the notion that dysfunctional forces that can be associated with poorer accounting quality motivate an all-equity capital structure, this paper contends that this view should not be generalized to all firms with an all-equity capital structure.

Both the free cash flow theory and the control hypothesis maintain that there assertions more likely valid in a high free cash flow / low growth environment. This leads to the question: what motivates firms with a low free cash flow / high growth environment and how this motivation can be associated with accounting quality. All-equity firms in a low free cash flow / high growth environment may be motivated to exclude debt to maximize their investment opportunity range, increase their financial flexibility, and protect private information. The implications for accounting quality are discussed in the following paragraphs that lead up to the second hypothesis.

A high growth environment increases a firm’s innate information risk, leading to higher costs of debt and thus another justification for the exclusion of debt. These firms are not motivated by a desire to manage earnings or any other agency related behavior in their decision to preclude debt, thus management should have no opposition to making their financials as transparent as possible.

Firms in a low free cash flow / high growth environment may be motivated to take pre- emptive steps to minimize the cost of debt and expedite the debt contracting process should the need for such funds arise. Because of their low free cash flow levels and high growth opportunities, the potential for underinvesting is ever present for these firms. While they seek to preclude debt to maximize their investment opportunity range, not being prepared to access debt markets in the most expeditious manner possible, can also lead to a sub-optimal investment strategy. Therefore, for these firms, the best case scenario is to preclude debt for the moment but be prepared to access credit markets when necessary.

Research has shown that improving accounting quality is one of the most effective ways to improve a firms’ overall information environment; leading to greater accessibility to debt capital at the lowest cost possible (Bhattacharya et al., 2012). This is particularly important for firms in this category because they have low levels of free cash flows, their growth opportunities lead to higher innate information risk, and they have a minimal credit history.

Biddle & Hilary (2006) document how higher accounting quality leads to a reduction in investment sensitivity to a firm’s internally generated cash flows. This leads to the greater financial flexibility these firms seek so they can implement their preferred strategy of funding investments with internally-generated cash flows with the confidence that external funds are available at any given moment. For example, an expeditious source of credit funds without immediately altering the firm’s capital structure would be a credit line. Accounting quality has been shown to increase the total liquidity needs provided by credit lines and decrease their costs (Li & Radhakrishan, 2013). Due to their cash flow levels, these firms are prone to underinvest. Biddle et al. (2009) document a positive relationship between accounting quality and investments for firms prone to underinvest. Thus by improving their accounting quality, firms in a low free cash flow environment reduce their probabilities of underinvesting without having to give up their all-equity status.

An alternative reason to preclude debt is to protect private information. A high growth environment also leads to a more competitive environment and the need to protect proprietary information. Banks have been known to leak private information to potential acquirers (Ivashina et al., 2008). Rajan (1992) presents a theoretical model explaining how banks can extract rents using their informational advantage. Therefore, precluding external creditors may help protect such proprietary information. External creditors, however, are considered an effective form of governance (Shleifer & Vishney, 1997) and their exclusion may be viewed negatively by both current shareholders and potential future providers of funds. Research has also shown that accounting quality can serve as a substitute for private information, thus firms can signal the integrity of their decision to preclude creditors by improving their accounting quality (Bharath et al., 2008; Beatty et al., 2010).

In summary, a high growth environment increases the implicit costs of debt and the need to protect private information, while low free cash flows increase the need to be able to expeditiously access external markets at any given moment. Therefore, while firms in such an environment may have valid reasons to exclude debt; they would benefit most by maintaining a higher level of accounting quality. Based on these arguments, the second hypothesis is developed as follows:

H2: All-equity firms with low free cash flow and high growth opportunities will exhibit significantly higher accounting quality than their levered peers.

To summarize, established theories from prior research were combined to develop the hypotheses predicting differential levels of accounting quality among firms with an all-equity capital structure. While under trade-off theory there appears to be no reason why a firm should not have at least a small percentage of debt in its capital structure, prior research has shown that the implicit costs and benefits of debt are strongly affected by a firms free cash flow levels and growth opportunities. These two factors also strongly influence a firm's accounting quality.

This study examines all-equity firms at both ends of the free cash flow/growth rate spectrum to develop the hypotheses that there exist different levels of accounting quality within the all-equity firm setting. It predicts that firms within the high free cash flow/low growth environment exhibit lower accounting quality than their levered peers and those firms in the low free cash flow/high growth environment exhibit higher accounting quality than their levered peers.

Research Design

In order to estimate the main models, the measures of free cash flow and growth opportunities must be calculated. The first two sections below briefly describe how these are calculated. These sections are followed by a description of the two tests of accounting quality; one using an accrual based approach and one using a market based approach.

Measures of Free Cash Flow and Growth Opportunities

The value of a firm can be divided into two main components, the value of all identifiable assets already in place and the value attributed to future growth opportunities (Myers, 1977). Therefore, following Richardson (2006), the value of a firm can be expressed as follows4:

Pt = VAIPt + VGOt (1)

Where:

P = firm value measured as common stock outstanding multiplied by the current stock price

VAIP = value of assets in place measured using the residual income framework

VGO = value of growth opportunities measured as the residual of the equation

Using the residual income framework, originated by Ohlson (1995), the value of assets in place can be calculated.

VAIPt = (1 – αr) BVt + α (1 + r) Xt – αrdt (2)

Where:

BV = book value of common equity

X = operating income after depreciation

d = annual dividends r = discount rate

w = a fixed persistence parameter; 0 < w ≤ 1 α = (w / (1 + r + w))5

Growth opportunities are then measured as the ratio of the value of assets in place (VAIP) to market value of the firm (P) or (VAIP / P). High and low growth opportunities are those observations above and below the annual sample median, respectively.

Free cash flow is also measured following Richardson (2006). The initial step in this process is to estimate an investment expectations model (Equation 3).

INEW t = α + β1GOt-1 + β2LEVt-1 + β3CASHt-1 + β4AGEt-1 + β5SIZEt-1 + β6RETt-1 + β7INEW t-1+ ΣYear Indicator + ΣIndustry Indicator + εt (3)

Where:

INEW = total new investment above that necessary to maintain existing assets measured as:

(CAPEX + RD + Acquisitions – Sale of PPE). All investment expenditure variables are scaled by average total assets

GO = growth opportunities measured as value of assets in place (VAIP) / market value of the firm (P) or VAIP / P, at the end of year t-1

LEV = both short and long term debt scaled by the sum of total debt and book value of equity, at the end of year t-1

CASH = the balance of cash and short term investments deflated by total assets, at the end of year t-1

AGE = the number of years since the firm’s initial public offering SIZE = the log of total assets measured at the end of year t-1

RET = stock returns measured as: [(market value of the firm) t-1 / (market value of the firm) t-2] - 1

Year Indicator = a vector of indicator variables used to capture fixed year effects Industry Indicator = a vector of indicator variables used to capture fixed industry effects

The fitted values of the regression provide an estimate of expected new investments. Free cash flow is cash flow beyond what is necessary to maintain current assets in place and to finance expected new investments. High and low free cash flow will be determined by observations above and below the annual sample median, respectively. The free cash flow calculation follows the following formula:

FCFt = CFAIPt – IMAINTENANCEt- I*NEW (4)

Where:

FCF = free cash flow in period t

CFAIP = cash flows from assets in place measured as operating cash flows from the statement of cash flows plus research and development expenditure6

IMAINTENANCE = depreciation and amortization expense

I*NEW = expected new investments estimated using the investments expectations model in equation 3

High free cash flow / low growth firms are those that are above the sample free cash flow to growth opportunity median on an annual basis. Low free cash flow / high growth firms are those that are below the sample free cash flow to growth opportunity median on an annual basis. The subsequent analysis and tables refer to the results when partitioning the data in this manner. It should be noted, however, that all models were estimated a second time using the highest and lowest quartiles of the sample observations when ranked by the free cash flow to growth rate ratio. Results were similar under both methodologies.

Tests of Accounting Quality Differences and Proxy Measurements

This paper will test the hypotheses using two measures that will serve as proxies to accounting quality. The first model uses an accrual based proxy of accounting quality and the second model uses a market based proxy of accounting quality.

Accrual Based Model

Under the accrual based model, the Dechow & Dichev (2002) approach is used to measure accounting quality7. This model is based on the extent to which working capital accruals explain current, prior, and future operating cash flow realizations. Accruals are based on assumptions and estimates of future cash flows. Working capital accruals generally reverse within one year, therefore it is expected for these accruals to have strong correlations to operating cash flows surrounding the year of accrual. Based on this concept, accounting quality is related to the magnitude of estimation error as represented by the residuals in the model8. Therefore, a higher absolute value of residual in the following model represents poorer accounting quality. The absolute value of the residual is multiplied by -1 so that a higher residual corresponds to higher accounting quality.

TCAt = β0 + β1CFOt-1 + β2CFOt + β3CFOt+1 + εt (5)

Where:

TCA = Δworking capital9

CFO = cash flow from operations

This study’s first research design employs Propensity Score Matching (PSM), an econometric technique used to control the endogeneity and self-selection issues often found in observational studies. Because the sample used in this study, all-equity firms, are self-selected into the category studied, a nonrandomized pool of observations is created. Typically, this issue would be addressed by using a two-stage OLS regression. This technique, however, requires obtaining a good instrumental variable. Instrumental variables are not always easy to find and can further confound the study’s results. By using PSM, a technique which has been increasing in popularity lately, a randomized study is simulated.

The technique is quite simple. The first step is to develop a propensity score for all-equity firms by estimating a multivariate logistic regression model using all the observations available for the time period studied. The regression will include all covariates that may affect the outcome, all-equity status. In this model, the dependent variable is an indicator variable that equals 1 if the observation is an all-equity firm and 0 otherwise.

The first covariates included in the model are the most common variables known to affect capital structure. A survey of prior research identifies five variables commonly used as capital structure determinants: cash balances (CASH), firm size (SIZE), age (AGE), asset tangibility (TANGIBILITY), and profitability (PROFIT) (Demsetz & Lehn, 1985; Johnson, 1997; Frank & Goyal, 2009).

In addition, because the ultimate goal is to measure differences in accounting quality, the model will be augmented to include covariates known to affect accounting quality. There are two general areas that may affect the study’s measure of accounting quality, the complexity of a firm’s operations and a firm’s governance system. These controls are added to the model to ensure that differences in accounting quality are not driven by any of these factors.

To control for operational complexities that may lead to differences in accounting quality, the following covariates identified by prior research are added: the volatility of a firms sales (SALESσ), the volatility of a firm’s cash flows (CFOσ), the operating cycle of a firm (OC), and the number of segments in a firm (SEG).

Prior research has shown that a firm’s corporate governance mechanisms serve as effective controls of the overall quality of financial reporting (Xie et al. 2003; Cornett et al. 2008; Imhoff, 2003; and Niu 2006; Doyle et al., 2007a, 2007b). Therefore, the model is augmented with the following covariates known to affect a firm’s governance mechanism: Auditor quality (AUDITOR), large investors (BLKHLDR), shareholder rights (SHRGTS), board independence (BOARDIND), and executive share ownership (EXSHR) DeAngelo (1981). These covariates are more precisely defined in the appendix 1.

| Appendix 1 Variable Definitions | ||

| P | = | firm value measured as common stock outstanding multiplied by the current stock price (i.e. the market value of the firm) |

| VAIP | = | value of assets in place measured using the residual income framework |

| VGO | = | value of growth opportunities measured as the residual of the equation |

| BV | = | book value of common equity |

| X | = | operating income after depreciation |

| d | = | annual dividends |

| r | = | discount rate |

| w | = | a fixed persistence parameter; 0 < w ≤ 1 |

| α | = | α = (w / (1 + r + w))[1] |

| INEW | = | total new investment above that necessary to maintain existing assets measured as: (CAPEX + RD + Acquisitions – Sale of PPE) – (Depreciation & Amortization). All investment expenditure variables are scaled by average total assets |

| GO | = | growth opportunities measured as value of assets in place (VAIP) / market value of the firm (P) or VAIP / P |

| LEV | = | the sum of the book value of short term and long term debt deflated by the sum of the book value of total debt and the book value of equity |

| CASH | = | the balance of cash and short term investments deflated by total assets measured at the start of the year |

| AGE | = | the number of years since the firm’s initial public offering |

| SIZE | = | the natural log of total assets |

| RET | = | stock returns measured as: [(market value of the firm) t / (market value of the firm) t-1] - 1 |

| FCF | = | free cash flow |

| CFAIP | = | cash flows from assets in place measured as operating cash flows from the statement of cash flows plus research and development expenditure[1] |

| IMAINTENANCE | = | investment expenditures related to the maintenance of assets in place proxied by depreciation and amortization expense |

| I*NEW | = | expected new investments as derived by the investments expectations model depicted in equation 3 |

| HFCFLGO | = | an indicator variable equal to 1 if the firm falls in the high free cash flow / low growth category and 0 otherwise. These observations fall above the annual sample FCF to GO ratio median |

| LFCFHGO | = | an indicator variable equal to 1 if the firm falls in the low free cash flow / high growth category and 0 otherwise. These observations fall below the annual sample FCF to GO ratio median |

| AUDITOR | = | an indicator variable equal to 1 if the firm is audited by a Big 6/5/4 auditing firm during the period examined and 0 otherwise |

| TCA | = | total current accruals |

| CFO | = | cash flow from operations |

| PPE | = | Property, Plant, and Equipment |

| AQ | = | accounting quality as proxied by the absolute values of the residuals from the Dechow and Dichev model multiplied by -1 so the proxy is increasing in quality |

| LOSS | = | captured by using an indicator variable equal to 1 if the observation has a loss; 0 otherwise |

| SALESσ | = | the lagged 4 years standard deviation of sales scaled by average assets |

| CFOσ | = | the lagged 4 years standard deviation of cash flow from operations scaled by average assets |

| OC | = | operating cycle measured as the log of the average of [(Sales/360) / (Average Accounts Receivable) + (Cost of Goods Sold / 360) / (Average Inventory)] |

| SEG | = | segments measured as the log of the sum of the number of operating and geographic segments reported by the Compustat Segments database for each annual observation |

| BLKHLDR | = | unaffiliated owners of 5% or more of the firms common shares outstanding |

| R | represents the 12-month market return for the observation | |

| E | earnings per share adjusted for any unusual items | |

| AE | = | Indicator variable which equals 1 if the observation is an all- equity firm and 0 otherwise |

| TANGIBILITY | = | fixed assets scaled by total assets (COMPUSTAT: PPENT/AT) |

| EXSHR | = | the percent ownership of common stock outstanding held by executive officers (EXECUCOMP: SHROWN_EXCL_OPTS / Schedule 14A) |

The first stage, as previously described, estimates a multivariate logistic regression model which develops a propensity score for an all-equity observation. This permits for a second stage whereby the model is used to select a set of matched levered peers with similar propensities. In the final stage, the measure of accounting quality previously developed is introduced to each observation. It is now possible to compare levels of accounting quality between all observations on a pooled basis and by free cash flow to growth basis. By controlling for all factors that may affect our outcome (capital structure) and known variables that affect the treatment (accounting quality), the study ensures that any differences in accounting quality between both groups is associated with the two variables not controlled for, free cash flows and growth opportunities.

Market Based Model

Prior research has used the response the market has on announced earnings as a test of how informative earnings are to the markets (Warfield et al., 1995; Niu, 2006). Thus the earnings response coefficient (ERC) is used as a proxy of accounting quality in this paper. To do so the following regression is estimated:

Rit = β0 + β1Eit / Pit-1 + β2 Eit / Pit-1 * AEit + εt (6)

Where Rit represent the 12-month market returns for firm i. This return (Rit) is calculated as (Pit + Dit – Pit-1) / Pit-1. Thus in this equation the numerator is the difference in stock price i at time t (Pit), adjusted for any dividends paid that year (Dit), and the price of the stock one-year prior (Pit- 1). The denominator is the price of the stock one-year prior (Pit-1). Because earnings are typically announced up to three months after the end of the fiscal year, the time period begins nine months prior to the end of the fiscal year and ends three months afterwards. Eit is the earnings per share adjusted for any unusual items. Thus Eit/Pit-1 represents the reported earnings to price relationship and the coefficient β1 captures the strength and direction of that relationship. A positive and significant β1 indicates a strong association between reported earnings and stock price movement. The earnings response coefficient is interacted with an indicator variable to distinguish between all-equity firms and levered firms. Thus, (β1 + β2) measures the earnings response coefficient of all- equity firms and β2 measures the incremental effect having an all-equity capital structure has on the firm’s earnings response coefficient. Prior literature includes various control variables such as size, age, and managerial share ownership. Because the sample to be used in the regression will be from the matched pool derived from the PSM model, all covariates will have already been controlled for; leaving the only distinguishing factors uncontrolled for being the firm’s capital structure (levered vs. all-equity) and the free cash flow to growth classification.

The regression will be estimated three times: on a pooled basis, for observations classified as “high free cash flow – low growth”, and for observations classified as “low fee cash flow – high growth”. In line with the hypotheses, the expectation is for β2 to show a significant reduction in the strength of the relationship for all-equity firms in the “high free cash flow – low growth” (HFCFLG) category and show that the relationship between returns and reported earnings for all- equity firms in the “low free cash flow – high growth” (LFCFHG) category is stronger than their levered peers. Thus the expectation is for β2 to be significantly negative in the HFCFLG sample pool and significantly positive in the LFCFHG sample pool.

Sample Selection and Descriptive Statistic

The sample period covers the years 1996 – 2018 and includes data from Compustat and CRSP available in Wharton Research Data Services (WRDS). Beginning in 1996 ensures the availability of certain financial data necessary for the completion of the analysis. Table 1 presents the sample selection process.

| Table 1 Sample Determination | ||

| All-Equity | Levered | |

| All Compustat Firms for the period 1996 - 2018 | 289,240 | 289,240 |

| Less: Firms with debt | 205,465 | NA |

| Less: Firms with less than 5% debt to asset | NA | 94,849 |

| Firms with no Short Term or Long Term Debt | 83,775 | 194,391 |

| Less: | ||

| All-equity firms with less than 3 consecutive years | 50,266 | NA |

| Regulated Industries and Financial Firms | 5,635 | 36,584 |

| Total Assets below 5 million | 5,409 | 47,568 |

| Non-US Companies | 6,469 | 21,587 |

| Non publicly traded firms and subsidiaries | 438 | 5,711 |

| Firms with Corporate structure change within 3 years after end of all-equity status | 4,755 | NA |

| Observations with missing data | 4,456 | 33,371 |

| All-Equity Sample / Total Levered Pool | 6,347 | 49,570 |

| Matched Levered Firms | 6,347 | |

| Total Sample | 12,694 | |

Table 2 presents the descriptive statistics for all the covariates used in the first stage model. To mitigate the effect of outliers, all continuous variables are winsorized at the 1% and 99% levels. This data is pre-first stage model, thus, the levered observations, with 49,570 observations, are significantly greater than the all-equity observations of 6,347. The results seen in this table confirm the need to perform some form of econometric technique in order to reduce significant differences between the covariates of both groups. By doing so, the study ensures that any differences found in accounting quality between levered firms and all-equity firms are not driven by differences in any of these covariates. It is expected that once a propensity score model is developed and used to obtain matched pairs, these covariates will no longer be significantly different between both groups.

| Table 2 Descriptive Statistics - First Stage Model | ||||||

| Levered | All-Equity | |||||

| (N=49,570) | (N=6,347) | |||||

| Variable | Mean | SD | Median | Mean | SD | Median |

| SALESσ | 0.18 | 0.16 | 0.13 | 0.17*** | 0.11 | 0.11 |

| CFOσ | 0.17 | 0.23 | 0.11 | 0.13*** | 0.15 | 0.04 |

| OC | 3.75 | 1.84 | 3.94 | 4.03** | 1.89 | 4.26 |

| SEG | 1.02 | 0.50 | 0.98 | 1.00 | 0.41 | 0.98 |

| CASH | 23.01 | 17.73 | 24.29 | 31.88** | 24.98 | 30.56 |

| SIZE | 5.52 | 1.49 | 5.33 | 4.91* | 1.46 | 5.07 |

| AGE | 7.15 | 8.23 | 8.12 | 6.71*** | 8.69 | 6.91 |

| TANGIBILITY | 25.22 | 17.74 | 23.59 | 21.18** | 14.91 | 13.18 |

| PROFIT | 9.43 | 9.07 | 7.28 | 9.94** | 10.17 | 6.27 |

| AUDITOR | 0.93 | 0.34 | 1.01 | 0.83* | 0.30 | 0.97 |

| BLKHLDR | 11.94 | 9.18 | 11.18 | 12.56*** | 10.95 | 11.03 |

| EXSHR | 3.95 | 5.65 | 3.80 | 6.25** | 7.83 | 4.65 |

| SHRGTS | -0.35 | 0.15 | -0.36 | -0.35 | 0.15 | -0.35 |

| BOARDIND | 74.99 | 12.26 | 68.52 | 67.27* | 13.20 | 70.22 |

Results and Analyses

Accrual Based Results

First stage model

The logit regression shows that all-equity firms tend to be firms with both lower sales and cash flow volatility overall. This is consistent with the research showing that firms with lower sales and cash volatility signal their value by issuing new equity rather than debt (Brick et al. 1998; Strebulaev and Yang, 2013). All-equity firms tend to hold higher cash positions, are slightly smaller than their levered counterparts, and are more profitable than their levered peers. These characteristics permit these firms to maintain their all-equity status at least for a period of time. The results also show that a higher concentration of blockholders increases the likelihood that a firm has an all-equity capital structure. This is in line with their preference to finance growth through equity rather than debt. Higher executive share ownership and a lower level of board independence lead to a greater likelihood that management will choose an all-equity capital structure (Table 3).

| Table 3 Propensity Score Model - First Stage Model | ||||

| Predicted | All-Equity = 1; Levered = 0 | |||

| Variable | Sign | Coefficient | t-stat | p-value |

| Operational Complexity Controls: | ||||

| SALESσ | - | -0.130 | -1.96 | 0.050 |

| CFOσ | - | -0.014 | -2.01 | 0.044 |

| OC | - | 0.031 | 4.14 | 0.000 |

| SEG | - | 0.005 | 0.77 | 0.441 |

| Capital Structure Controls: | ||||

| CASH | + | 0.715 | 6.59 | 0.000 |

| SIZE | + | -0.507 | -4.51 | 0.000 |

| AGE | + | -0.023 | -1.38 | 0.166 |

| TANGIBILITY | - | -2.214 | -5.23 | 0.000 |

| PROFIT | + | 1.491 | 2.78 | 0.005 |

| Governance Controls: | ||||

| AUDITOR | + | -0.004 | -0.04 | 0.970 |

| BLKHLDR | + | 0.473 | 2.47 | 0.014 |

| EXSHR | + | 0.144 | 1.89 | 0.058 |

| SHRGTS | + | -0.057 | -0.49 | 0.624 |

| BOARDIND | + | -0.017 | -2.29 | 0.022 |

| Year Indicators | Yes | |||

| Industry Indicators | Yes | |||

| N | 55,917 | |||

| Pseudo R-squared | 0.249 | |||

| Log-likelihood | -481.2 | |||

These preliminary results show that, in general, all-equity firms have higher managerial control and lower governance mechanism. As previously described, these conditions can lead to agency behavior with poor accounting quality as an outcome or they may lead to better stewardship by management with higher accounting quality as an outcome. To shed more light as to which theory applies to which group, self-selection bias will be controlled for in the second stage and results will be compartmentalized by free cash flow to growth category.

Second Stage Model

In this stage, results will be analyzed using the accrual based proxy of accounting quality (AQ) for comparative purposes. The logit regression model estimated in the first stage is used to create a sub-set of matched levered firms. The firms are matched based on the propensity score of being an all-equity firm as determined in the first stage. All covariates are matched with the exception of the accounting quality proxy. In essence all co-variates are controlled for before comparing the accounting quality differences between all-equity firms and their matched levered peers. This increases the likelihood that a firm’s choice in capital structure is motivated by management’s desire to maintain a certain level of accounting quality and not by any other factor. In addition, following the preceding theories mentioned, the data is partitioned by free cash flow to growth levels as seen in Table 4. Columns 2 – 4 show the difference in means of the pooled data, columns 5 – 7 show the difference in means for the observations with high levels of free cash flow combined with low growth opportunities (HFCFLG), and columns 8 – 10 show the difference in means for the observations classified as having low free cash flows combined with high growth opportunities (LFCFHG). Results show that, on a pooled basis, all-equity firms exhibit poorer accounting quality than their levered peers. The difference in means is significant at the 5% level of significance. This is consistent with the notion that all-equity firms generally prefer to avoid debt because their poorer accounting quality leads to higher costs in the debt markets.

| Table 4 Differences In Means Post-PSM | |||||||||

| Panel A: Test Variables | |||||||||

| POOLED | HFCFLG | LFCFHG | |||||||

| All- Equity | Levered | Diff. (t- stat) |

All-Equity | Levered | Diff. (t-stat) |

All-Equity | Levered | Diff. (t-stat) | |

| AB-AQ | -0.307 | -0.265 | -0.042 | -0.458 | -0.297 | -0.161 | -0.156 | -0.233 | 0.077 |

| (2.01) | (3.02) | (2.37) | |||||||

| Panel B: Control Variables | |||||||||

| Operational Complexity: | |||||||||

| SALESσ | 0.17 | 0.19 | 0.20 | 0.20 | 0.17 | 0.18 | |||

| CFOσ | 0.13 | 0.16 | 0.21 | 0.23 | 0.07 | 0.08 | |||

| OC | 4.03 | 3.93* | 3.98 | 4.01 | 4.08 | 3.84* | |||

| SEG | 1.00 | 1.10 | 1.05 | 1.18 | 0.95 | 1.01 | |||

| Capital Structure: | |||||||||

| CASH | 31.88 | 29.88 | 30.35 | 28.49 | 33.41 | 31.27 | |||

| SIZE | 4.91 | 5.01 | 5.70 | 5.75 | 4.12 | 4.27 | |||

| AGE | 6.71 | 6.85 | 7.51 | 7.52 | 6.12 | 6.17 | |||

| TANGIBILITY | 21.18 | 21.45 | 22.76 | 23.58 | 19.06 | 19.31 | |||

| PROFIT | 9.94 | 9.92 | 8.94 | 8.82 | 11.14 | 11.02 | |||

| Governance: | |||||||||

| AUDITOR | 0.83 | 0.85 | 0.87 | 0.89 | 0.79 | 0.81 | |||

| BLKHLDR | 12.56 | 12.06 | 10.70 | 10.20 | 14.42 | 13.92 | |||

| EXSHR | 6.25 | 5.99 | 5.65 | 5.41 | 6.85 | 6.57 | |||

| SHRGTS | -0.35 | -0.35 | -0.43 | -0.42 | -0.27 | -0.28 | |||

| BOARDIND | 67.27 | 69.06 | 66.19 | 67.28 | 68.35 | 70.83 | |||

To test the papers two hypotheses, the data is subdivided into a HFCFLG category and a LFCFHG category. Columns 5 – 7 show that when all-equity firms that exhibit high levels of free cash flows combined with low growth opportunities are compared to their matched levered peers, the difference in accounting quality increases. All-equity firms in this category exhibit even worse accounting quality than their levered peers. The difference in means is significant at the 1% level of significance. These results support the first hypothesis and are consistent with the notion that management in this category has neither the need nor the motivation to improve their accounting quality as high levels of free cash flow preclude the need to raise cash and low growth rates motivate management to engage in earnings manipulation in order to achieve their targeted goals. Furthermore, the introduction of a new governance mechanism, creditors, is not welcomed by management.

Finally, columns 8 – 10 show the results of a comparison in accounting quality mean when comparing the subset of observations which have low free cash flows combined with high growth opportunities. In support of the second hypothesis, results show that all-equity firms exhibit significantly higher accounting quality than their levered peers. These results are significant at the 5% level of significance and are consistent with the notion that the all-equity status for these firms are not motivated by the desire to engage in earnings management and/or preclude the introduction of an additional governance mechanism. The all-equity status may be a temporary phenomenon motivated by the desire to maintain financial flexibility, protect private information, and avoid the unjustifiable implicit costs of debt associated with their high growth environment. These firms maintain a high level of accounting quality in order to be able to access credit markets at the best terms possible at any given moment.

Panel B of Table 4 shows the means of the covariates used to match the observations. Those with significant differences are pointed out. As noted in the panel, there’s basically no significant difference in means between the covariates of the all-equity observations and the levered observations. When broken out by free cash flow and growth categories, the difference in means remain insignificant. This confirms the efficiency of using PSM, developed in first stage, in selecting matching observations. To give it some perspective, these results can be compared to the pre-PSM descriptive statistics shown in Table 2. Because all covariates between the groups compared are not significantly different, the likelihood that the difference in means between accounting quality is driven by managerial motivation rather than any other observable factor is increased.

Market Based Results

Table 5 shows the results pertaining to the market based research design. The coefficient β? captures the earnings response coefficient for levered observations. Consistent with prior studies, results show that there is a significant positive relationship between reported earnings and stock price adjustment based on the market’s reaction to those earnings across all three of the observation pools created. The combination of β1 and β2 (β1 + β2), measures the overall association between reported earnings and related stock price adjustments for firms that have an all-equity capital structure; while the coefficient β2, on its own, captures the incremental effect an all-equity capital structure has on the association between reported earnings and stock price adjustments. On a pooled basis, results show that the relationship between reported earnings and subsequent stock price movements is also positive and significant for all-equity firms (β1 + β2 =0.140, p=0.030). The strength of the relationship appears to weaken for all-equity firms when compared to levered firms (β1= 0.144, p<0.01). This is consistent with the notion that the absence of an additional external monitor, the creditor, and the general skepticism of this extreme capital structure leads to a moderate deterioration in the firm’s earnings response coefficient. The coefficient for the interaction variable supports this conclusion as it shows that an all-equity capital structure does not contribute incrementally to the association between both terms (β2 = -0.002, p = 0.136). These results are on a pooled basis and are consistent with the general conclusions of prior research.

| Table 5 Regression of Stock Returns on Reported Earnings and Capital Structure Interaction Term | |||||||||

| Rit = β0 + β1Eit / Pit-1 + β2 Eit / Pit-1 * AEit + εt | |||||||||

| Pooled | HFCFLG | LFCFHG | |||||||

| Variable | Coefficient | t-statistic | p- value | Coefficient | t-statistic | p- value | Coefficient | t-statistic | p- value |

| Intercept | 0.041*** | 8.37 | 0.000 | 0.057*** | 6.47 | 0.000 | 0.047*** | 7.57 | 0.000 |

| Eit / Pit-1 | 0.144*** | 6.36 | 0.000 | 0.117*** | 3.39 | 0.001 | 0.156*** | 4.72 | 0.000 |

| Eit / Pit-1 * AEit | -0.002 | 1.49 | 0.136 | -0.006 | -1.01 | 0.313 | 0.003*** | 3.26 | 0.001 |

| (β? + β?) | 0.141** | 2.17 | 0.030 | 0.111 | 1.36 | 0.174 | 0.158*** | 5.28 | 0.000 |

| Year Indicators | Yes | Yes | Yes | ||||||

| Industry Indicators | Yes | Yes | Yes | ||||||

| N | 12,694 | 6,347 | 6,347 | ||||||

| Adjusted R2 | 0.153 | 0.146 | 0.178 | ||||||

The results based on free cash flow to growth levels pools will shed more light on whether to accept or reject the study’s hypotheses. For observations categorized in the HFCFLG category results show that while levered firms continue to have a positive and significant relationship, this relationship becomes insignificant for observations with an all-equity capital structure (β1 + β2 = 0.111, p = 0.174). The coefficient β2 is also insignificant, indicating that an all-equity capital structure does not incrementally strengthen these firms earnings response coefficient. These results support the first hypothesis and are consistent with the notion that management that chooses to implement an all-equity capital structure, in this particular pool, is motivated by the desire to avoid the scrutiny and additional governance presented by creditors. This permits them to engage in higher levels of earnings management leading to a deterioration of the earnings response coefficient.

On the other hand, when firms are pooled into the low free cash flow / high growth category both levered and all-equity firms have a positive and significant earnings response coefficient. For observations categorized in the LFCFHG category results show that the earnings response coefficient is both positive and significant (β1 + β2 = 0.158, p < 0.01). The coefficient β2 is also significant, indicating that an all-equity capital structure incrementally strengthens these firms earnings response coefficient. This is consistent with the second hypothesis and the notion that all- equity firms in this category are perceived to have a valid justification for their capital structure and thus their reported financial results are perceived to have the same informational value as their levered peers.

Additonal Analyses

Two by Two Matrix

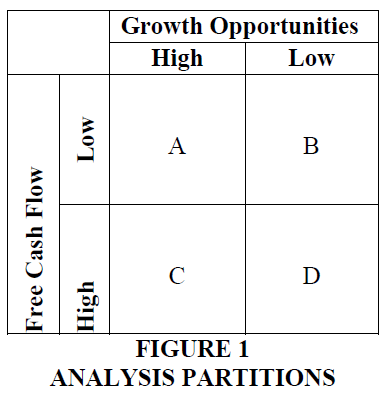

The main analysis partitions the data into two main groups based on the free cash flow to growth opportunity ratio using the sample median. In this analysis, the paper expands the original hypotheses and partitions the data in quartiles as depicted in Figure 1 below. The same observations are divided into four main categories: High Free Cash Flow / Low Growth (HFCFLG), Low Free Cash Flow / High Growth (LFCFHG), High Free Cash Flow / High Growth (HFCFHG), and Low Free Cash Flow / Low Growth (LFCFLG). Based on all aforementioned theories, the expectation is find a moderating effect for those observations with offsetting levels. Thus, hypothesis 3 specifically refers to those observations in quadrants B and C in Figure 1.

H3: All-equity firms with offsetting levels of free cash flow to growth opportunities will exhibit no significant difference in accounting quality than their levered peers.

Applying the same propensity score matches obtained in the main hypothesis, untabulated results show that there are no significant differences in accounting quality between firms classified as HFCFHG or LFCFLG (quadrants B and C) and their levered peers.

Furthermore, the differences in accounting quality between the observations in quadrants A and D show a slight increase nominal value and significance consistent with the main results.

Within Firm Change Analysis

In this section, the paper analyzes if all-equity firms, which subsequently obtain debt, exhibit a change in accounting quality. As depicted in formula 7 below, a multivariate regression model is estimated where the independent variable is the accrual-based accounting quality proxy and the control variables are all those identified earlier in the paper. The model includes an indicator variable capturing the effects on accounting quality before and after the introduction of debt into the firm’s capital structure (POST) and the interaction of POST with the FCF / Growth classifications. Therefore, the interaction term will capture the incremental effect debt has on accounting quality for each category once the firm leaves the all-equity status.

To obtain the sample used, the paper identifies all firms that transition from at least two years of all-equity status to at least two years of levered status (at least 5% debt to firm value). The firm must remain in the same free cash flow / growth opportunities category, for this reason the sample size declines to 2,173 observations. The regression model is then estimated using all years before and after the transition to levered status; the transition year is excluded.

AQt = β0 + β1HFCFLGt + β2LFCGHGt + β3POST + β4HFCFLGt*POST + β5LFCFHGt*POST + β6SALESσt + β7CFOσt + β8OCt + β9SEGt + β10CASHt + β11SIZEt + β12AGEt + β13TANGIBILITYt + β14PROFITt + β15AUDITORt + β16BLKHLDERt + β17EXSHRt + β18SHRGTSt + β19BOARDINDt +ΣYear Indicator + ΣIndustry Indicator + εt (7)

Because the paper hypothesizes that all-equity firms in the high free cash flow / low growth category exclude debt to prevent the monitoring of creditors permitting for poorer accounting quality, the expectation is that the introduction of debt will motivate management to improve accounting quality. In line with the hypotheses, the expectation is for the coefficient (β4) on the interactive term HFCFLGOt*POST, to be significantly positive. This is consistent with the notion that the introduction of creditors will incrementally reduce agency behaviors and improve accounting quality. On the other hand, in line with the main hypotheses, firms in the low free cash flow / high growth category are expected to have high accounting quality even before the inclusion of debt. Therefore, the expectation is that the coefficient of the interactive term LFCFHGOt*POST to be insignificant. In other words, the introduction of debt should have no incremental effect on their accounting quality. This is consistent with the notion that management was not precluding creditors in order to facilitate agency behaviors that affect accounting quality such as earnings management or biased accounting procedures. Thus, the inclusion of this additional monitoring mechanism should not affect the firms reporting quality.

Table 6 shows the results of the within-firm change analysis. The results for the pre- leverage period are consistent with the main results. The coefficient on HFCFLGO is negative, however it is not significant (β1 = -0.954, p = 0.207), perhaps affected by the lower number of observations; while the coefficient on LFCFHGO is positive and significant (β2 = 0.146, p = 0.034). Consistent with expectations, the coefficient on the interactive term HFCFLGO*POST is positive and significant (β4 = 0.129, p = 0.082). The overall effect in the post period for this category is positive and significant (β3 + β4 = 0.0854, p = 0.039). Also consistent with expectations, the coefficient on the interactive term LFCFHGO*POST is not significant (β5 = - 0.031, p = 0.671). These results support the prediction that the introduction of debt to firms in the high free cash flow / low growth category help improve accounting quality. The effect on firms in the low free cash flow / high growth category is not significant as these firms are hypothesized to maintain high standards of accounting quality even before the introduction of debt.

| Table 6 Within-Firm Change Analysis | |||||

| AQt =β0 + β1HFCFLGt + β2LFCFHGt + β3POST + β4HFCFLGt*POST + β5LFCFHGt*POST + β6SALESσt + β7CFOσt + β8OCt + β9SEGt + β10CASHt + β11SIZEt + β12AGEt + β13TANGIBILITYt + β14PROFITt + β15AUDITORt + β16BLKHLDRt + β17EXSHRt + β18SHRGTSt + β19BOARDINDt + ∑Year Indicator + ∑Industry Indicator + εt | |||||

| Predicted | |||||

| Variable | Sign | Coefficient | t-statistic | p-value | |

| HFCFLG | - | -0.954 | -1.26 | 0.207 | |

| LFCFHG | + | 0.146 | 2.12 | 0.034 | |

| POST | ? | -0.044 | -0.60 | 0.549 | |

| HFCFLG*POST | + | 0.129 | 1.60 | 0.109 | |

| LFCFHG*POST | NS | -0.031 | -0.42 | 0.671 | |

| (β3 + β4) | + | 0.0854 | 4.26 | 0.039 | |

| (β3 + β5) | NS | -0.0746 | -2.92 | 0.088 | |

| Adjusted R2 | 0.224 | ||||

Concluding Comments

At times we are confronted with situations in which the reality does not always follow well established theory. This is the case for the average capital structure employed by the population of firms. This phenomenon, known as the low-leverage puzzle, has led researcher to study and try to identify economic forces that drive these ratios below financial model expectations. Research has focused only on identifying aberrant conditions, such as the desire to maintain biased financial reports, leading to this extreme capital choice. This study introduces other possibilities; it hypothesizes that firms with high accounting quality may voluntarily preclude the use of debt in its capital structure; mostly to avoid its implicit costs. It concludes that the reasons to pursue an all-equity capital structure should not be generalized and that free cash flow levels and growth opportunities play an important role in motivating this decision. While a subset of all-equity firms appear to be motivated by the agency related behavior; another subset implements this strategy with value maximizing intent in mind.

This study is of importance to various stakeholders, particularly since the use of an all- equity capital structure is becoming more prevalent. By understanding the potential motivation for the use of such a controversial capital structure shareholder may better understand if management is pursuing such structure with their best interest in mind. Active investors may be able to identify firms that are being poorly managed and thus undervalued because of their current capital structure. Potential creditors may be able to better understand the reasons the firms had been avoiding debt in the past. This study also helps stress the importance that future researches not treat all-equity firms as one homogenous group when making comparisons to their levered peers.

End Notes

1.Apple Inc. and Yahoo Inc. had zero debt up to 2012; Microsoft pursued an all-equity strategy until 2009.

2.This capital structure appears to be gaining favor. A review of the Compustat database shows that since the 1970’s the percentage of all-equity firms has increased monotonically every decade from 5.6% to 17.9% in the first decade of the new millennium.

3.This letter is readily available on the internet.

4.Dang (2011) conducts a similar analysis using all-equity firms in the UK with similar results and conclusions.

5.Firm subscripts are omitted in all formulas for brevity

6.The paper uses a discount rate of 12% and persistence parameter of 0.62 as reported by Dechow et al. (1999) and consistent with Richardson (2006)

7.Note that the definition of growth opportunities includes both idiosyncratic and industry growth; thus, the industry effect is not controlled for when calculating growth opportunities (Chen et al., 2008). This paper views growth as a universal construct with equal effect regardless of its origin.

8.An expanded version of the model, to include change in revenue and levels of property plant and equipment as suggested by McNichols (2002) and used in Francis et al. (2005), is also estimated.

9.Change in working capital is defined as: ΔAccounts Receivable + ΔInventory - ΔAccounts

Payable - ΔTaxes

Payable - ΔOther Assets

References

- Agrawal, A., & Jayaraman, N. (1994). The dividend policies of all-equity firms: A direct test of the free cash flow theory. Managerial and Decision Economics, 15(2), 139-148.

- Agrawal, A., & Nagarajan, N.J. (1990). Corporate capital structure, agency costs, and ownership control: The case of all-equity firms. The Journal of Finance, 45(4), 1325-1331.

- Alderson, M.J., & Betker, B.L. (2012). Managerial incentives, net debt and investment activity in all-equity firms. Studies in Economics and Finance, 29(4), 232-245.

- Ang, J.S., Cole, R.A., & Wuh Lin, J. (2000). Agency costs and ownership structure. Journal of Finance, 55(1), 81-105.

- Armstrong, C.S., Guay, W.R., & Weber, P.J. (2010). The role of information and financial reporting in corporate governance and debt contracting. Journal of Accounting and Economics, 50, 179-234.

- Ashbaugh, H., Collins, D., & LaFond, R. (2006). The effects of corporate governance on firms' credit ratings. Journal of Accounting and Economics, 42, 203-243.

- Balakrishnan, K., Core, J.E., & Verdi, R.S. (2013). The relation between reporting quality and financing and investment: Evidence from changes in financing capacity. Working paper.

- Ball, R.T., Bushman, R.M., & Vasvari, F.P. (2008). The debt-contracting value of accounting information and loan syndicate structure. Journal of Accounting Research, 46, 247-287.

- Beatty, A., Liao, S., & Weber, J. (2010a). Financial reporting quality, private information, monitoring, and the lease- versus-buy decision. The Accounting Review, 85(4), 1215-1238.

- Beatty, A., Liao, S., & Weber, J. (2010b). The effect of private information and monitoring on the role of accounting quality in investment decisions. Contemporary Accounting Research, 27, 17-47.

- Beyer, A., Guttman I., & Marinovic, I. (2018). Earnings management and earnings quality: Theory and evidence. The Accounting Review (Forthcoming).

- Bharath, S.T., Sunder, J., & Sunder, S.V. (2008). Accounting quality and debt contracting. The Accounting Review, 86(1), 1-28.

- Bhattacharya, N., Ecker, F., Olsson, P.M., & Schipper, K. (2012). Direct and mediated associations among earnings quality, information asymmetry, and the cost of equity. The Accounting Review, 87(2), 449-482.

- Biddle, G.C., & Hilary, G. (2006). Accounting quality and firm-level capital investment. The Accounting Review, 81(5), 963-982.

- Biddle, G.C., Hilary, G., & Verdi, R.S. (2009). How does financial reporting quality relate to investment efficiency? Journal of Accounting and Economics, 48, 112-131.

- Brick, I.E., Frierman, M., & Kim, Y.K. (1998). Assymetric information concerning the variance of cash flows: The capital structure choice. International Economic Review, 39(3), 745-761.

- Chava, S., Kumar, P., & Warga, A. (2010). Managerial agency and bond covenants. Review of Financial Studies, 23, 1120-1148.

- Chen, C., Huang, A.G., & Jha, R. (2008). Trends in earnings volatility, earnings quality, and idiosyncratic return volatility: managerial opportunism or economic activity. Working paper.

- Cornett, M.M., Marcus, M.J., & Tehranian, H. (2008). Corporate governance and pay-for-performance: The impact of earnings management. Journal of Financial Economics, 87, 357-373.

- Dang, V. (2011). An empirical analysis of zero-leverage firms: Evidence from the UK. Working paper.

- DeAngelo, L.E. (1981). Auditor size and audit quality. Journal of Accounting and Economics, 3(3), 183-199.

- Dechow, P., & Dichev, I. (2002). The quality of accruals and earnings: The role of accrual estimation errors. The Accounting Review, 77(Supplement), 35-59.

- Defond, M.L. (1992). The association between changes in client firm agency costs and auditor switching. Auditing: A Journal of Practice an Theory, 11(1), 16-31.

- DeFond, M.L., & Jiambalvo, J. (1994). Debt covenant effects and the manipulation of accruals. Journal of Accounting and Economics, 17(2), 145-176.

- Demsetz, H., & Lehn, K. (1985). The structure of corporate ownership: Causes and consequences. Journal of Political Economy, 93, 1155-1177.

- Dichev, I., & Skinner, D. (2002). Large-sample evidence on the debt covenant hypothesis. Journal of Accounting Research, 40(4), 1091-1123.

- Doyle, J.T., Ge, W., & McVay, S. (2007a). Accruals quality and internal control over financial reporting. The Accounting Review, 82(5), 1141-1170.

- Doyle, J.T., Ge, W., & McVay, S. (2007b). Determinants of weaknesses in internal control over financial reporting. Journal of Accounting and Economics, 44, 193-223.

- Easterwood, C.M. (1997). Takeovers and incentives for earnings management: An empirical analysis. Journal of Applied Business Research, 14(1), 29-47.

- Farichah, F. (2017). Relationship of earnings management and earnings quality before and after IFRS implementation in Indonesia. European Research Studies Journal, 20(4b), 70-81.

- Francis, J., Khurana, I., & Pereira, R. (2005). Disclosure incentives and effects on cost of capital around the world. The Accounting Review, 80(3), 1125-1162.

- Francis, J., LaFond, R., Ohlsson, P., & Schipper, K. (2004). Costs of equity and earnings attributes. The Accounting Review, 79(4), 967-1010.

- Francis, J., LaFond, R., Ohlsson, P., & Schipper, K. (2005). The market pricing of accruals quality. Journal of Accounting and Economics, 39, 295-327.

- Frank, M., & Goyal. V.K. (2009). Capital structure decisions: which factors are reliably important? Financial Management (Spring), 1-37.

- Gardner, J.C., & Trzcinka, C.A. (1992). All-equity firms and the balancing theory of capital structure. The Journal of Financial Research, 15(1),77-90.

- Goldstein, R., Ju, N., & Leland, H. (2001). An EBIT- based model of dynamic capital structure. Journal of Business, 74, 483-512.

- Graham, J. (2000). How big are the tax benefits of debt? Journal of Finance, 55, 1901-1941.

- Graham, J., Campbell, H., & Rajgopal, S. (2005). The economic implications of corporate financial reporting. Journal of Accounting and Economics, 40, 3-73.

- Gul, F.A., Chen, C.J., & Tsui, J.S. (2003). Discretionary accounting accruals, managers' incentives, and audit fees. Contemporary Accounting Research, 20(3), 441-464.

- Holthausen, R.W. (1990). Accounting method choice: Opportunistic behavior, efficient contracting, and information perspectives. Journal of Accounting and Economics, 12, 207-218.

- Imhoff, E.A. (2003). Accounting quality, auditing, corporate governance. Accounting Horizons, 17, 117-128.

- Ivashina, V., Nair, V.B., Saunders, A., Massoud, N., & Stover R. (2008). Bank debt and corporate governance. The Society of Financial Studies: 41-77.

- Jensen, M.C. (1986). Agency costs of free cash flow, corporate finance, and takeovers. American Economic Review, 76(2), 323-329.

- Jensen, M.C., & Meckling, W.H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305-360.

- Johnson, S.A. (1997). An empirical analysis of the determinants of corporate debt ownership structure. Journal of financial and quantitative analysis, 32(1), 47-69.