Research Article: 2021 Vol: 20 Issue: 5

Management of Innovative Activities of Second Tier Banks

Serik Makysh, L. N. Gumilyov Eurasian National University

Muldir Makysh, L. N. Gumilyov Eurasian National University

Berik Beisengaliyev, Kazakh University of Economy, Finance and International Trade

Akbayan Nurtazinova, O. Baikonurov Zhezkazgan University

Aida Zhagyparova, L. N. Gumilyov Eurasian National University

Citation Information: Makysh, S., Makysh, M., Beisengaliyev, B., Nurtazinova, A., Zhagyparova, A. (2021). Management of innovative activities of second tier banks. Academy of Strategic Management Journal, 20(5), 1-8.

Abstract

The relevance of the study is that at present banks are actively looking for new customers, thereby improving the product line of banking products, since taking into account changes in customer preferences, the rapid growth of technology development and constant changes in the state of the competitive environment, it becomes unprofitable for the bank to offer already previously used services and products. These circumstances are a great incentive for second-tier banks to develop new products and services, or improve existing ones. In this regard, any bank must have its own technologies and ideas in order to develop something new or improve the existing one. As a result of the analysis of the innovative activities of second-tier banks of the Republic of Kazakhstan, factors influencing the quality of software and technological elaboration of processes and procedures for working with clients were identified, which are little researched and regulated in terms of execution time. On the basis of mathematical models, the high efficiency of the impact of reducing the time of customer service on the quality of service is shown for various methods of its organization, that is, customer service through the RB system, which is currently a priority.

Keywords

Innovation, Innovation Activity, Second-Tier Banks, Competition, Systems Approach, Innovative Complex of the Bank, Electronic Money, Remote Banking Services.

Introduction

Innovation, Innovation Activity, Second-Tier Banks, Competition, Systems Approach, Innovative Complex of the Bank, Electronic Money, Remote Banking Services.

One of the key challenges for Kazakhstan is the strengthening of the global competition for the factors that determine the competitiveness of innovation systems, first of all, for a highly qualified workforce and “smart” money (investments that attract new knowledge, technologies, competencies to projects), a sharp increasing the mobility of these factors. These challenges dictate the need for the advanced development of certain specific areas of scientific research and technological development.

Literature Review

In his research, Semin (2017) considers the institutional mechanisms for increasing the productivity of scientific research in the development of innovative products, consisting in improving institutions: public procurement, state registration, state support for small and medium-sized businesses, state scientific and technical policy, science and education, international relations.

Pogodina et al. (2019) in their calculations, the indicators of the innovation group are used, which include the coefficients of the intensity of costs for innovation and the effectiveness of costs for technological innovation, the level of internal costs for research and development, as well as the presence of a unit responsible for innovative development. The system of indicators for assessing innovation should be multi-level and include micro-, meso and macro-levels and should be integrated with the system of indicators of other countries and the world economy as a whole.

The problem of finding indicators of innovative activity has now become universal and applies not only to innovation, but also to the economy, ecology, social, banking sphere (Kirilchuk & Nalivaychenko, 2017).

According to Bobylev & Solovyeva (2020), an important issue is the choice of key indicators that show the direction in which the economy is developing.

Zhuravlyov et al. (2019) an improved model is proposed that determines the interdependence between the strategic management of investment and innovation policies and the sustainable economic development of a company, which represents an algorithm for managing the process of developing investment strategies.

The priority of centralized methods of managing innovation processes has been proven by world practice. The dynamic development of the innovation sphere is one of the main components of the innovation economy. Such a high-tech economy presupposes the existence of an effective innovation system and the creation of institutions to support the innovation process. Many scientists pay special attention to the analysis of information sources for assessing innovative potential, where they analyze the existing forms of statistical reporting (Bogatenkov et al., 2018).

Innovative processes are an integral feature of modern business (Nieves & Segarra-Cipres, 2015). The widespread introduction of innovative products and technologies into the economic circulation has become a key factor in economic development and improving the quality of life of the population (Novichkov et al., 2018). In the context of globalization, the role of innovation as an important tool in increasing the country's competitiveness increases significantly (Solodovnik, 2018).

Methodology

In order to effectively manage the innovative activities of second-tier banks in the Republic of Kazakhstan, it is necessary to analyze the overall state of the banking sector. Therefore, the author analyzed the problems that affect the assets of banks, since despite the fact that problem loans of the banking sector are at a relatively comfortable level, in reality, the quality of banks' assets may be worse.

If we consider the dynamics of changes in the assets of second-tier banks of the Republic of Kazakhstan for the period from 2009-2019, then we do not observe sharp jumps in increase or decrease, as evidenced by the following data (Figure 1).

Figure 1 Dynamics of Assets and Loan Portfolio (Principal Debt) of the Banking Sector of the Republic of Kazakhstan for the Period from 2009-2019 (in Billion Tenge)

In general, in Kazakhstan, taking into account all second-tier banks, with respect to liabilities and deposits, they amount to 23165.5 billion tenge (at the beginning of 2019 - 22223.4 billion tenge), an increase from the beginning of 2019 - 942.1 billion tenge. In the total liabilities of second-tier banks, the largest share is occupied by customer deposits - 76.7% (Figure 2).

Figure 2 Dynamics of Liabilities of the Banking Sector of the Republic of Kazakhstan for the Period from 2009-2019 (In Billion Tenge)

At the beginning of 2019 year, 68.5% of all non-cash transactions carried out via Internet/mobile banking using payment cards were carried out for the purpose of paying for services and goods. At the same time, the main share in terms of the volume of non-cash Internet transactions is occupied by operations to transfer money from one bank account of a client to another bank account (61.7%) (Table 1).

| Table 1 Number of Online /Mobile Banking Transactions by Type of Payment | ||||||

| Year | Payment for services and goods | Transfers from one bank account to another | Other types | Tax payments | Customs payments | Insurance |

| 01.01.2015 | 9569713 | 352254 | 60528 | 16152 | 2875 | 1822 |

| 01.01.2016 | 18587273 | 829731 | 831542 | 27236 | 8930 | 2868 |

| 01.01.2017 | 34357062 | 1601894 | 2716383 | 98237 | 10365 | 2003 |

| 01.01.2018 | 76926920 | 7589734 | 6727061 | 489124 | 16150 | 4488 |

| 01.01.2019 | 130291752 | 47682369 | 10205935 | 2015175 | 41903 | 7845 |

Application Functionality

Based on the above, it is possible to determine ways to minimize existing problems, to disclose existing reserves and to develop an optimal methodology for planning and implementing services for corporate clients. In this regard, the system for the integration of automated subsystems developed by us provides for the exchange of information between them and allows you to make a decision on the issuance of a loan in an on-line mode using a remote service system.

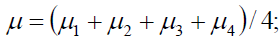

We need to get a simulation experiment that simulates the functioning of the QS and calculate, based on these simulation data, the characteristics of the system:

1. The average waiting time in the queue;

2. Average time of customer service;

3. The average share of operator downtime; compare it to the theoretical downtime rate, assuming that the agents have the same service rate

4. Build work schedules for four operators.

To simplify the calculation, we will use Table 2. In this case, the following rules are assumed in the program:

| Table 2 Simulation Experiment data that Stimulate the Functioning of the Qs Based on the Materials of JSC Sberbank | |||||||||||

| Clients | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | |

| Clients arrival time | 0 | 5 | 15 | 18 | 30 | 32 | 40 | 46 | 51 | 62 | |

| Client waiting time | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 3 | 1 | 0 | |

| I | Time service |

20 | 22 | 15 | |||||||

| Time endings service |

20 | 52 | 72 | ||||||||

| II | Time service |

16 | 23 | 17 | |||||||

| Time endings service |

21 | 55 | 79 | ||||||||

| III | Time service |

25 | 18 | ||||||||

| Time endings service |

40 | 58 | |||||||||

| IV | Time service |

31 | 27 | ||||||||

| Time endings service |

49 | 73 | |||||||||

1) If all operators are busy, then the program asks the client to wait a few minutes;

2) If the client enters the program of servicing operators with the help of RBS and all operators are free, then the client is served by the 1st operator; if the 2nd, 3rd and 4th operators are free, then the client is served by the 2nd operator;

3) The next client is served by the operator who was the first to be released.

Let's denote the first client by ?1, respectively, the second client through ?2 etc.

At a moment in time t = 0 appears ?1, which is served by the first operator in 20 minutes. Its service will end in t = 20 + 0 = 20 min. Since the operator is free, then ?1 does not wait in line.

After 5 min. will enter ?2, but since the first operator is busy and the 2nd, 3rd and 4th operators are free, then ?2 served by a free second operator for 16 min., service will end at a time equal to t = 16 + 5 = 21 min.

?3 enters the program at the moment t = 15 min., while only the 3d and the 4th operators are free, so the client will be served by a third operator. Then it is serviced by the third operator in 25 minutes, and its service will end at the moment t = 25 + 15 = 40 min.

At the moment t=18 min. appears ?4, the first three operators are still busy, so he is served by the fourth operator for 31 min., service will end at the moment t = 31 + 18 = 49 min.

?5 is included in the service program at the time t=30 min.; the 1st and 2nd operators will be free, and since according to the rules of the program, if all operators already have one request, then the next order is given - to the first operator in 22 minutes and the service will end at the moment t = 22 + 30 = 52 min.

At the moment t = 32 minutes. K6 arrives. Only the 2nd operator is free, which means that this client will be served by the second operator in 23 minutes and the service will end at the moment t = 23 + 32 = 55 min.

At the moment t = 40 minutes enters the K7 program, at the same minute the 3rd operator is released (service time - 18 minutes). End of service time: t = 18 + 40 = 58 min.

K8 appears at time t = 46 minutes, and here we see that all operators are busy, and the program asks the client to wait a few minutes, i.e. the downtime for this client is 3 minutes. Then K8 will be served by the fourth operator in 27 minutes and the service will end in t = 27 + 46 = 73 min.

K9 arrives at t = 51 minutes, and again all the operators are busy, again the program asks the client to wait a few minutes for this client, i.e. the downtime for this client is 1 minute. K9 is serviced by the first operator in 15 minutes, i.e. service end time is t = 15 + 51 = 66 min.

K10 enters the program at the moment t = 62 minutes, and only the 3rd and 4th operators are free, then it is serviced by the second operator in 17 minutes, i.e. customer service end time is: t = 17 + 62 = 79 min.

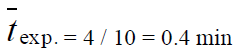

Then we get the required characteristics of the QS according to the simulation data:

Average waiting time in the queue

w is equal to the sum of the elements of the third row of the table divided by the number of buyers, that is:

w is equal to the sum of the elements of the third row of the table divided by the number of buyers, that is:

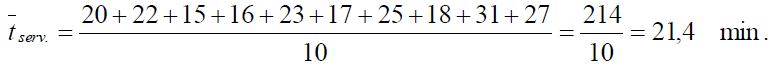

is equal to the sum of the elements of the 4th, 6th, 8th and 10th rows divided by the number of customers, that is:

is equal to the sum of the elements of the 4th, 6th, 8th and 10th rows divided by the number of customers, that is:

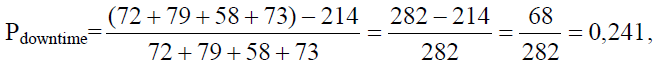

Average proportion of downtime ?downtime of operators

?downtime is equal to the difference between the total operating time of four operators (72 + 79 + 58 + 73) and the total customer service time (214), divided by the first amount:

the average share of downtime for both cash registers is 24% of their total operating time.

the average share of downtime for both cash registers is 24% of their total operating time.

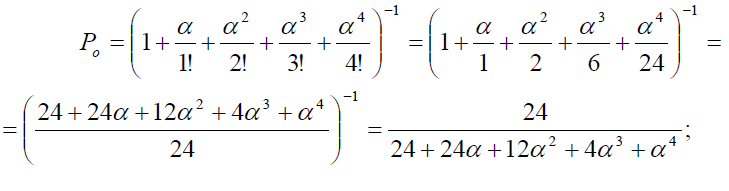

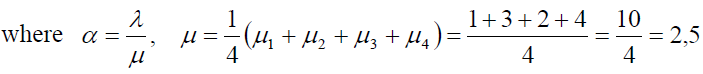

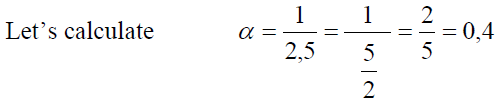

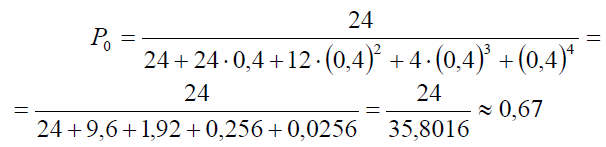

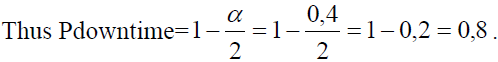

Let us calculate the theoretical fraction of the operator downtime using the formulas: (for n 4):

Thus, we can draw the following conclusions that the 1st and 2nd operators served 3 clients each, and the 3rd and 4th operators - 2 clients each. This can be explained by the fact that:

- If the client enters the program of servicing operators with the help of RBS and all operators are free, then the client is served by 1 operator;

- If the 2nd, 3rd and 4th operators are free, then the client is served by the 2nd operator, etc. At the same time, as we can see, the 2nd and 4th operators were idle most of all. The first operator worked best of all, because he was the least idle and served 3 clients.

The theoretical downtime is 0.8, of which 0.67 is the downtime probability for all four operators. The simulation estimate of the downtime probability is p = 0.24. The discrepancy is explained by the small number of clients.

Conclusion

Thus, based on the study, we note that under these conditions, the assessment of the security of a credit institution for reliable banking services when introducing innovative products and services with resources (equipment, information, knowledge, qualified personnel) is updated, ensuring its popularity and competitiveness.

The Kazakhstani user is not only distinguished by the fact that literally in recent years he has become an active user in the adoption of modern technologies, but also has a more balanced attitude to the choice of a service provider and possible risks.

A comprehensive study of the theoretical and practical aspects of the development of integration processes between banks on the basis of building a customer-oriented business and the results obtained by it can contribute to solving the problem of improving the interaction of financial institutions in the Kazakhstan market.

References

- Bobylev, S., & Solovyeva, S. (2020). Circular economy and its indicators for Russia. The World of the New Economy, 14(2), 63-72.

- Bogatenkov, S., Belevitin, V., & Khasanova, M. (2018). Risk management based on model of competences when introducing innovative information technology. International Journal of Engineering & Technology, 7(4), 78-81.

- Kirilchuk, S., & Nalivaychenko, E.V. (2017). The Development of Globality of Innovative Modifications. Journal of Fundamental and Applied Sciences, 9(1S), 1025-1048.

- Nieves, J., & Segarra-Cipres, M. (2015). Management innovation in the hotel industry. Tourism Management, 11(46), 51-58.

- Novichkov, N., Novichkova, A., & Malygina, O. (2018). Tourism business innovation in the experience economy. Services in Russia and Abroad, 12(2), 6-19.

- Official Resource of the National Bank of the Republic of Kazakhstan. (2020). Retrieved from www.nationalbank.kz

- Pogodina, T., Abdikeev, N., & Bogachev, Yu. (2019). Indicators system improvement to assess the innovative activity of economic entities, taking into account the compliance with the strategic goals of socio-economic development. Accounting. Analysis. Auditing, 6(3), 6-14.

- Semin, A. (2017). State support for research in pharmacology: an analysis of foreign and domestic experience. Research Result: Pharmacology and Clinical Pharmacology, 3(3), 157-168.

- Solodovnik, J. (2018). Methodical foundations of the classification of innovations in the tourism sector of the Russian Federation. Proceedings of VSUET, 4(80), 366-370.

- Zhuravlyov, V., Khudyakova, T., Varkova, N., Aliukov, S., & Shmidt, S. (2019). improving the strategic management of investment activities of industrial enterprises as a factor for sustainable development in a crisis. Sustainability, 11(23), 6667-6674.