Research Article: 2020 Vol: 24 Issue: 1S

Main Effects of Mergers and Acquisitions in International Enterprise Activities

Irina Slatvitskaya, Don State Technical University, Russian Federation

Tetiana Dugar, Poltava state agrarian academy, Ukraine

Liliia Khodakivska, Poltava state agrarian academy, Ukraine

Bogdan Derevyanko, Donetsk Law Institute of the Ministry of Internal Affairs of Ukraine

Abstract

The scientific article considers methodological approaches to obtaining the economic and organizational effect of mergers and acquisitions in the international business environment. The format of the impact of cost of equity of business structures on the effect of synergy and market capitalization has been determined. The econometric model for assessing the impact of financial leverage on the economic efficiency of a merger or acquisition has been developed. Various options for choosing the structure of financing mergers and acquisitions for entrepreneurial structures have been investigated.

Keywords

International Entrepreneurial Activity, Entrepreneurship, Mergers and Acquisitions, Synergy, Econometric Model of Financial Leverage.

Introduction

The economic intention behind the merger and acquisition transactions in international corporations can be considered from two perspectives - as a type of corporate strategy and as a type of investment. In both cases, the main corporate effect, the transaction is focused on, is the increase in market capitalization for public corporations and the increase in business value for non-public corporations, initiated by the performing of the merger or acquisition synergy. At the same time, as for public efficiency assessment the results of the transaction are rather heterogeneous and have consequences both in regard to reduction of real production costs and in regard to changing the competitive situation on the market. As mergers and acquisitions can be considered as a type of investment, standard methods of evaluating commercial and public efficiency, investment projects, can be used to evaluate their effectiveness geared to their specific nature.

Methodology

The purpose of the article is to determine the initial conditions for the occurance, further development and implementation of the operating and financial strategy, as well as to evaluate the economic effect of merger and acquisition implementation in the environment of international corporations. Performance evaluation is based on an econometric modeling of the weighted average cost of raising capital under such agreements, and determining the role of financial leverage as a basis for the performance of future synergy.

Literature Review

The significance and importance of corporate consolidation issue in the form of mergers and acquisitions contribute to the occuring of fundamental research in the effective management of international corporations mergers. The most significant achievements in this area are presented in the works of economists such as: (Frankel, 2007); (Gaughan, 2007); (Cassiman, 2006); (Machiraju, 2007); (Makedon, 2014); (Perry & Herd, 2004); (Saint-Onge & Chatzkel 2009); (Sullivan & Martin, 2016). But it should be noted that the current scientific opinion in the field of international corporate integration determines their effectiveness mainly through the lens of corporate synergy, without separating organizational factors and components into operational synergy as well as financial support, capital formation of the integrated corporate structure and its lending capacity into financial synergy (Drobyazko et al., 2019 a,b,c).

Findings and Discussions

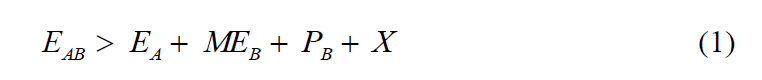

The measurement of the expected corporate economic effect of a merger or acquisition is often based on an assessment of increase in equity cost (equity capital value) of the consolidated corporation (EАВ) compared to the sum of equity capital values of each entity which is being consolidated. A merger (acquisition) is beneficial to the acquiring corporation (А) if the agreement fulfills the following condition (Gilbert, 2017):

where:

ЕАВ – fair value of the consolidated corporation’s equity after the merger;

ЕА – fair value of equity capital of the corporation A before the merger;

MEВ – market value of equity capital of the corporation B before the merger;

РВ – premium paid to the owners of the target corporation;

X – costs of the agreement arrangement and implementation.

If the market is efficient, the market value of the target corporation's equity is in line with the fair value of the equity, that is, the MEВ =ЕВequation is satisfied. If the market is inefficient and the target company is undervalued, then the absorbing company may reap the additional benefit of ЕВ –MEВ .

The excess of the equity value of the consolidated corporation over the total equity value of the individual corporations may be driven by the effects of synergy, i.e. the qualitative increase in the corporations’ performance as a result of the merger (Roberts et al., 2010. The existence of synergy usually implies that the merged (target) company becomes more profitable or may grow after the merger faster than corporations that exist independently. However, the main driver for business effect of the merger is an increase in equity value of the consolidated corporation due to the performance of synergistic effects. In order to make a positive impact on the equity value, synergy should significantly influence one of the key factors that determine the future cash flows of the consolidated corporation, for example (Aguiar & Reddy, 2017):

1. Increase operating profit margin due to maximization of efficiency and productivity or scale effect;

2. Increase the growth rate of revenue due to access to innovative products or strengthening of the market position;

3. Reduce the cost of raising capital by means of increase in reserves and diversification of active operations.

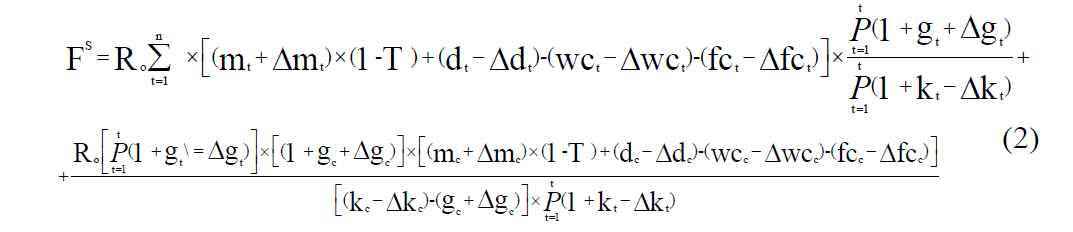

The cost of each part of the consolidated corporation after the merger can be described with the following equation:

where:

Ro – sales revenue in the base year;

n – number of years in the rapid growth phase; mt – net operating margin in year t, excluding synergistic effects; Δmt – increase in net operating margin in year t due to cost synergy; Т – income tax rate; dt – ratio of depreciation to sales revenue for year t, excluding synergistic effects; Δdt – depreciation reduction ratio in year t as a result of the removal of surplus assets as adjusted for depreciation of assets additionally created; wct – ratio of investments in net working capital gain to sales revenue in year t without taking into account synergistic effects; Δwct – reduction of the relative need for net working capital in year t due to synergistic effects performing; fct – ratio of investments in fixed assets growth to sales revenue in year t without taking into account synergistic effects ; Δfct – relative release of funds in year t as a result of the sale of surplus assets, as adjusted for investments in additional assets; gt – the growth rate of sales revenue in year t without taking into account synergistic effects; Δgt – increase (decrease) in the growth rate of sales revenue due to the expansion of the product line and increase in market capacity; kt – weighted average cost of raising capital in year t; Δkt – a decrease in the weighted average cost of capital due to the increased creditworthiness of the consolidated corporation; indicators with a lower index c – predictive characteristics of the first year of the stable growth phase.

This equation shows that the value of each part of the integrated corporate entity depends both on the valuesof the individual components of the synergy of growth and cost and on their distribution over time. The most significant impact on the corporation value is driven by the synergistic effects that can be expected to continue throughout the period of steady growth (Shirley & Xu, 2001).

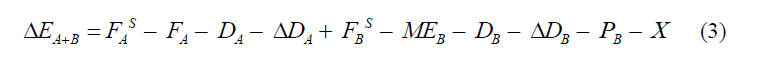

The net present commercial effect of a merger with company B for the shareholders of an A corporation is determined by the condition:

where:

FA S – corporation A value, taking into account the synergistic effects; FA– corporation A value excluding synergistic effects; DA– market cost of debt of corporation A before the merger; ΔDA – increase in the market cost of debt of corporation A after the merger; FB S – corporation B value, taking into account the synergistic effects; MEB – fair value of equity capital of the corporation B before the merger; DB – market cost of debt of corporation B before the merger; ΔDB – increase in the market cost of debt of corporation B after the merger; РB – premium paid to the owners of corporation B; X – costs of the agreement arrangement and implementation.

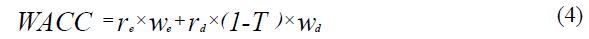

Weighted Average Cost of Capital raised by a company is determined by the condition:

where:

re – cost of equity; rd – cost of debt; T – corporate tax rate; we – percentage of capital that is equity; wd – percentage of capital that is debt. When using Markowitz's (1952) model to estimate the capital assets of an international corporation, the cost of equity is determined by the condition:

where:

rf – risk-free rate of return; rm – market rate of return; ß – beta coefficient, reflecting the attitude of corporate owners toward systematic, or market, risk.

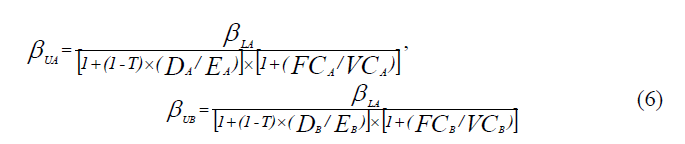

The Beta coefficient (ß) of the consolidated corporation, taking into account the characteristics of the merging corporations, and the probable change in financial and operating leverage after the merger, can be estimated as follows. Initially, the beta coefficients of merging corporations should be calculated in the absence of financial and operating leverage (Brealey et al., 2001):

where:

ßUA – weightless beta coefficient of corporation А; LA – weighted beta coefficient of corporation А; ßUB – weightless beta coefficient of corporation В; ßLB – weighted beta coefficient of corporation В; DA – cost of corporation А debt; EA – cost of corporation А equity; DB – cost of corporation B debt; EB – cost of corporation B equity; FCA – fixed cost of corporation A; VCA – variable cost of corporation A; FCB – fixed cost of corporation В; VCB – variable cost of corporation В.

To estimate the weighted beta coefficient (ß) of corporations A and B, there can be used the results of a regression analysis of the dependence of the stock returns of corporations A and B on the broad market index returns. If A or B corporations are not traded on the stock market, corporations with a similar activity profile can be used to estimate the weightless beta (ß).

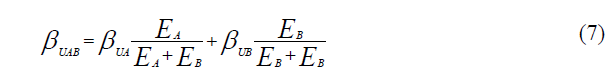

Then the weightless beta (ß) of the consolidated corporation can be calculated as the weighted average of the weightless beta (ß) of corporations A and B, where the weights are an equity values of corporations A and B:

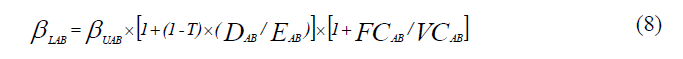

Finally, the weighted beta of the consolidated corporation should be adjusted to changes in the level of financial and operating leverage:

The merger is efficient due to reducing the fixed-variable cost ratio compared to that of individual corporations by eliminating duplicate costs and performing the benefits of the scale effect, which plays the role of annihilating factor for the resulting beta (ß) of the consolidated corporation. The consolidated corporation debt capacity, increased at the same time, creates an incentive to increase its financial leverage. Therefore, for most mergers / acquisitions, there should be expected some increase in the beta coefficient (ß) of the consolidated corporation compared to the weighted average beta coefficient (ß) of corporations that merge with a further significant increase in the debt-to-equity ratio.

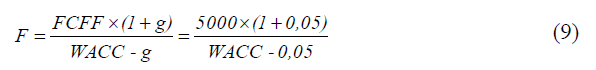

To illustrate the implementation of financial synergy let’s consider the merger of two identical corporations, each of which generates free cash flow of FCFF = 5,000 million. USD, which is growing by g = 5% per year in the infinite future. Then the market value of each corporation, reflecting the requirements of shareholders and creditors, and according to Graham et al (2002), is determined by the condition:

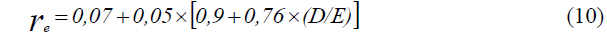

Suppose the risk-free rate is 7% per annum, the market risk premium is 5% per annum, and the income tax rate is 24%. The beta coefficient (ß) of each corporation, excluding the impact of the financial leverage, is 0.9. Then the equity value of the consolidated corporation, taking into account the accepted financial leverage, is determined by the condition.

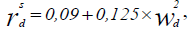

Let the interest rate on the borrowed funds for these corporations be determined by a

condition  that reflects the increase in the cost of debt as the financial

leverage increases and resulting decrease in creditworthiness of the corporation.

that reflects the increase in the cost of debt as the financial

leverage increases and resulting decrease in creditworthiness of the corporation.

The optimal level of financial leverage for each of the merging corporations can be determined as follows. Suppose there are considering different options for selecting a financing structure. For the non-borrowed option, equity is generated by issuing S = 500,000 common stocks. If borrowing is used, the borrowed funds are used to buy back the stocks and reduce the share capital.

Unless a certain critical level is exceeded, such a long operation will lead to an increase in the value of P shares and will be beneficial to shareholders (Thakor, 2003). The analysis results of the effect of the debt position change on the corporations' stock value before the merger are shown in Table 1.

| Table 1: Impact of the Debt Position change on the Corporations' Stock Value before the Merger | ||||||||||

| wd | D/E | ß | re | rd (1-T) | WACC | F | Е | D | S | Р |

|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 0,0000 | 0,9000 | 0,1150 | 0,0684 | 0,1150 | 76924 | 76924 | 0 | 500 | 153,85 |

| 0,05 | 0,0526 | 0,9360 | 0,1168 | 0,0686 | 0,1144 | 77650 | 73768 | 3883 | 475 | 155,30 |

| 0,1 | 0,1111 | 0.976 | 0,1188 | 0,0694 | 0,1139 | 78303 | 70473 | 7830 | 450 | 156,61 |

| 0,15 | 0,1765 | 10,207 | 0,1210 | 0,0705 | 0,1135 | 78790 | 66971 | 11818 | 425 | 157,58 |

| 0,20 | 0,2500 | 10,710 | 0,1236 | 0,0722 | 0,1111 | 79015 | 63212 | 15803 | 400 | 158,03 |

| 0,21 | 0,2658 | 10,818 | 0,1241 | 0,0726 | 0,1133 | 79020 | 62426 | 16594 | 395 | 158,04 |

| 0,22 | 0,2821 | 10,929 | 0,1246 | 0,0730 | 0,1133 | 79010 | 61628 | 17382 | 390 | 158,02 |

| 0,25 | 0,3333 | 11,280 | 0,1264 | 0,0743 | 0,1134 | 78885 | 59363 | 19721 | 375 | 157,77 |

| 0,30 | 0,4286 | 11,931 | 0,1297 | 0,0770 | 0.1138 | 78315 | 54821 | 23495 | 350 | 156,63 |

| 0,35 | 0.5385 | 12,683 | 0,1334 | 0,0800 | 0.1147 | 77241 | 50207 | 27034 | 325 | 154,48 |

| 0.4 | 0,6667 | 13,560 | 0,1378 | 0,0836 | 0,1161 | 75621 | 45373 | 30248 | 300 | 151,24 |

| 0,45 | 0,8182 | 14,596 | 0,1430 | 0,0876 | 0,1181 | 73447 | 40396 | 33051 | 275 | 146,89 |

| 0.5 | 10,000 | 15,840 | 0,1492 | 0,0922 | 0,1207 | 70747 | 35374 | 35374 | 250 | 141,49 |

The results of the calculations show that under the assumptions made, the optimal share

of debt in the overall financing structure is 21%, with the stock value reaching $ 158.04 thousand

USD. Now suppose that both corporations merge, with each stock of the merging corporations

exchanging for one stock of the consolidated corporation. Assume that operating synergy is not

performed and the level of operating leverage does not change (Matsusaka, 2001; Metelenko et

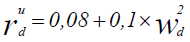

al., 2019). However, enhancing the creditworthiness of a corporation as a result of scale-up and

diversification of operations results in improved borrowing conditions, which is reflected in new borrowing rate feature:  . The analysis results of changes in the consolidated

corporation's stock value under different options for selecting a financing structure are shown in Table 2.

. The analysis results of changes in the consolidated

corporation's stock value under different options for selecting a financing structure are shown in Table 2.

| Table 2: Impact of the Debt Position change on the Consolidated Corporation's Stock Value | ||||||||||

| wd | D/E | ß | re | rd (1-T) | WACC | F | Е | D | S | Р |

|---|---|---|---|---|---|---|---|---|---|---|

| 0,00 | 0,0000 | 0,9000 | 0,1150 | 0,0608 | 0,1150 | 153847 | 153847 | 0 | 1000 | 153,85 |

| 0,05 | 0,0526 | 0,9360 | 0,1168 | 0,0610 | 0,1140 | 156228 | 148416 | 7811 | 950 | 156,23 |

| 0,10 | 0,1111 | 0,9760 | 0,1188 | 0,0616 | 0,1131 | 158540 | 142686 | 15854 | 900 | 158,54 |

| 0,15 | 0,1765 | 10,207 | 0,1210 | 0,0625 | 0,1123 | 160627 | 136533 | 24094 | 850 | 160,63 |

| 0,20 | 0,2500 | 10,710 | 0,1236 | 0,0638 | 0,1116 | 162317 | 129854 | 32463 | 800 | 162,32 |

| 0,2.1 | 0,2658 | 10,818 | 0,1241 | 0,0642 | 0.1115 | 162592 | 128448 | 34144 | 790 | 162,59 |

| 0,25 | 0,3333 | 11,280 | 0,1264 | 0,0656 | 0,1112 | 163433 | 122575 | 40858 | 750 | 163,43 |

| 0,29 | 0,4085 | 11,794 | 0,1290 | 0,0672 | 0,1111 | 163791 | 116292 | 47500 | 710 | 163,79 |

| 0,30 | 0,4286 | 11,931 | 0,1297 | 0,0676 | 0,1111 | 163796 | 114657 | 49139 | 700 | 163,80 |

| 0,31 | 0,4493 | 12,073 | 0,1304 | 0,0681 | 0,1111 | 163763 | 112997 | 50767 | 690 | 163,76 |

| 0,35 | 0,5385 | 12,683 | 0,1334 | 0,0701 | 0,1113 | 163243 | 106108 | 57135 | 650 | 163,24 |

| 0,40 | 0,6667 | 13,560 | 0,1378 | 0,0730 | 0,1119 | 161646 | 96987 | 64658 | 600 | 161,65 |

| 0,45 | 0,8182 | 14,596 | 0,1430 | 0,0762 | 0,1129 | 158919 | 87405 | 71513 | 550 | 158,92 |

| 0,50 | 10,000 | 15,840 | 0,1492 | 0,0798 | 0,1145 | 155040 | 77520 | 77520 | 500 | 155,04 |

Due to financial synergy after the merger, the optimal share of borrowings in the financing structure increases from 21 to 30%, and the stock value - from $ 158.04 thousand to $ 163.80 thousand, or by 3.64%.

Recommendations

Probability of achieving financial synergy is much higher than achieving operational one, moreover financial synergy is performed in any type of merger. However, unlike operating synergy, financial synergy does not generate effects that are significant from the public performance point of view. Expanding available borrowing, lowering interest rates and saving on tax due to the increased use of the tax shield are purely redistributive effects that do not entail the release of real resources or provide the benefits to consumers. Thus, financial synergy is an important impetus for corporate mergers, but is of limited value to society as a whole. Thus, the performance of many synergistic effects takes time, and some effects should not be taken into account when modeling the phase of stable growth.

Conclusion

Thus, summarizing the system for evaluating the economic efficiency of mergers and acquisitions based on the weighted average cost model, we can draw the following conclusions:

1. Operational and financial synergies need to be identified when mergers or acquisitions of international corporations are implemented. Operating synergy arises from the combination of the productive, technological and intellectual assets of the merging corporations and has a significant effect on the capital value of the future corporation. Financial synergy results in the appreciation of the new corporation's stocks, while the total stock value of the corporations before the merger is less than after the integration.

2. Merger efficiency is shown in the reduction of the fixed-variable cost ratio compared to that of individual corporations by eliminating duplicate costs and performing the benefits of scale effect. The consolidated corporation debt capacity is increasing, which creates an incentive to increase the level of financial leverage.

3. The weighted average cost of capital of the consolidated corporation may change after the merger compared to the weighted average of the WACC of individual corporations as a result of a change in the valuation of the consolidated corporation by the capital market. Increasing the size of a corporation and stabilizing its free cash flows lead to an increase in the credit rating and a decrease in interest rates for credit resources at any given level of financial leverage. Increasing the corporation creditworthiness allows to expand the share of loan-based funding in the total funding allocation.

References

- Drobyazko S., Shapovalova A., Bielova O., Nazarenko O., & Yunatskyi M. (2019). Formation of hybrid costing system accounting model at the enterprise. Academy of Accounting and Financial Studies Journal, 23(6), 2019.

- Drobyazko, S., Bondarevska, O., Klymenko, D., Pletenetska, S., & Pylypenko, O. (2019). Model for forming of optimal credit portfolio of commercial bank. Journal of Management Information and Decision Sciences, 22(4), 501-506.

- Hilorme, T., Sokolova, L., Portna, O., Lysiak, L., & Boretskaya, N. (2019). The model of evaluation of the renewable energy resources development under conditions of efficient energy consumption. Proceedings of the 33rd International Business Information Management Association Conference, IBIMA 2019: Education Excellence and Innovation Management through Vision 2020. 7514-7526.

- Hilorme, T., Sokolova, L., Portna, O., Lysiak, L., & Boretskaya, N. (2019). Smart grid concept as a perspective for the development of ukrainian energy platform. IBIMA Business Review, 2019.

- Kasych A., & Vochozka M. (2019). Modernization processes in the modern world: Methodology, evolution, tendencies. Revista ESPACIOS. Vol. 40 (Nº 24).

- Pantano, E., Priporas, C.V., & Stylos, N. (2017). You will like it!’using open data to predict tourists' response to a tourist attraction. Tourism Management, 60, 430-438.

- Pera, R. (2017). Empowering the new traveller: Storytelling as a co-creative behavior in tourism. Current Issues in Tourism, 20(4), 331-338.

- Popiel, M. (2016). Tourism market, disability and inequality: Problems and solutions. Acta academica karviniensia, 16, 25-36.

- Prebensen, N.K., Chen, J.S., & Uysal, M. (Eds.). (2018). Creating experience value in tourism. Cabi.

- Somov, D. (2018). The functional approach to strategic management. Economic Annals-XXI, 171, 19-22.