Research Article: 2023 Vol: 27 Issue: 4

LSDVC Estimation of the Interaction Effect of Exchange Rate and Trade Openness on Fiscal Discipline: Dynamic Panel Models

Mahmoud Abdelrehim, University Putra Malaysia

Mohamed Hisham Dato Haji Yahya, University Putra Malaysia

Citation Information: Abdelrehim, M., & Yahya, M.H.D.H. (2023). Lsdvc estimation of the interaction effect of exchange rate and trade openness on fiscal discipline: dynamic panel models. Academy of Accounting and Financial Studies Journal, 27(4), 1-15.

Abstract

The conventional theoretical framework, as well as the world bank and IMF claim that the floating exchange rate is considered the best choice to achieve the fiscal discipline in light of the trade openness. Accordingly, the world bank and the IMF call the developing countries through the economic reform programs to adopt the floating exchange rate which would depreciate their currencies as they predominantly overvalued. The world bank and the IMF believe that the interaction effect between exchange rate depreciation and trade openness will oblige the governments to limit their public expenditure according to their public revenues which help to achieve the fiscal discipline. However, the empirical literature introduced mixed result. This study seeks to reinvestigate the interaction effect of between the exchange rate movements and the trade openness in the African countries which have adopted the floating exchange rate regime. The study relied on the LSDVC estimator to estimate the model results. The results revealed that in light of the trade openness the exchange rate depreciation does not always success to achieve the fiscal discipline.

Keywords

Exchange Rate Movements, Trade Openness, Fiscal Discipline.

Introduction

Throughout the eighteenth century until the middle of the twentieth century, classical doctrine dominated the global economic thought. Under this philosophy, the Principle of Annuality which means achieving the annual budgetary balance became the primary goal of the fiscal policy. This indicates the government's effective administrative performance and provides assurance of ongoing stability and confidence in the fiscal policy. However, the traditional approach was primarily focused on achieving a mathematical balance and was not concerned with achieving an economic and social equilibrium. Accordingly the expenditure was enclosed within the limit of the revenue (Hill, 1946).

When Keynes published his well-known theory in 1936, he refuted the classic theory and confirmed the necessity to abandon the principle of the annual budget balance. moreover, the government has to abandon its guarding role which limits its duty to only monitoring, maintaining peace in the country, and achieving justice among citizens. According to the Keynesian vision the government should be more active in promoting economic stability, raising wages, attracting investment, addressing recessions, boosting aggregate supply and demand, eliminating unemployment, attracting investment, improving infrastructure, enhancing the productivity of goods and services institutions, and even intervening in the market through the public sector (Clift, 2019).

As result of the government new role, the government finds itself more preoccupied with expanding its expenditures, regardless of whether the revenues are sufficient or not, which could lead to a budget deficit and expand its debt in order to pay off this deficit. The public budget deficit is acceptable in accordance with Keynes's concept as long as it is temporary and essential, and the government is able to restore the fiscal balance. In other words, the impact of fiscal discipline should not be achieved annually, but rather over the course of the average of a particular period of years.

Regrettably, this is not the case, especially in developing economies, where this deficiency turned from a temporary one into a chronic one. As a result, achieving fiscal discipline turns into a challenging objective (Brown & Bulman, 2006). This is what prompted a number of academics and decision-makers to reiterate their appeal for the adoption of the fiscal discipline principle. However, in the last twenty years many countries have attempted to achieve the fiscal discipline (Kumar & Ter-Minassian, 2007).

In light of these new demands, which have proved challenging for the state to handle, developing countries have suffered more than wealthy countries. In light of these new demands, which represent challenging for the state to handle the developing countries. have suffered more than advanced economies. The state's weak production base, deterioration of service institutions including education and health, inadequate infrastructure, administrative corruption, and high rates of poverty, unemployment, and inequality, all this hinders the ability of the developing countries to handle this deficit except through more debt. This vicious circle of addressing the deficit with additional debts ultimately leads to continuous raise in the debt rates. At the end, the government finds itself unable to serve the debts. This weakens its creditworthiness, preventing it from borrowing again (Kwesi Ofori et al., 2018). with the hope get through these crises, improve their creditworthiness and strengthen their fiscal and macroeconomic policies, the majority of these countries typically turn to the economic World Bank and the IMF (Ul Haque et al., 1997). The world bank and the IMF call the developing countries through economic reform programs to abandon the fixed exchange regime and adopt the floating exchange rate regime. The world bank and the IMF believe that adopting floating exchange rate regime would depreciate the local currency which would help to address the fiscal distortions. International institutions argue that the exchange rate depreciation could be a strong incentive for the government to rationalize its expansionary expenditure policies. This means a substantial improvement in all fiscal and macroeconomic indicators to achieve more fiscal discipline.

Through the economic reform program, international institutions borrow the debt-defaulting countries a set of loans received in semi-annual installments. These installments disburse after the countries implemented the parts requirements (set by the World Bank and IMF).

However, in line with the shift that took place in fiscal policy objectives from classical to Keynesian thought, the Bretton Woods agreement was signed. This paved the way for a global economic liberalization system. In the context of the new global economic system trade openness became one of the determinants of macroeconomic performance, particularly fiscal policy. The elements of trade openness, such as capital mobility, import, and export became main macroeconomic determinates for the developing and developed countries.

In 1953 Milton Friedman attempted to interpret the role of trade openness in influencing fiscal policy in his well-known theory (Positive Economics). In 1953 Milton Friedman attempted to interpret the role of trade openness in influencing fiscal policy in his well-known theory (Positive Economics). The theory claimed that the flexible exchange rate would be the best choice to achieve fiscal discipline in light of the trade openness policies. According to the theory demonstrated that trade openness affects the public budget through external shocks. The flexible regime can absorb and reduces the adverse effects of external shocks on the public budget (Knight, 2007).

In this context, Numerous studies examined the interaction effect of trade openness and on the relationship between exchange rate movements and fiscal discipline. Broda (2002) demonstrated that a flexible exchange rate regime is the best choice to achieve fiscal discipline in light of trade openness as it would permit the necessary automatic adjustments in the real exchange rate. by contrast by contrast, Duttagupta & Tolosa (2006) argued about the efficiency of the fixed exchange rate to achieve fiscal discipline, especially under low trade openness. Furthermore, Magud (2006) disputed that the exchange rate regime is not the main driver of fiscal policies, achieving or losing fiscal discipline, in reality, relies on the ability to manage the fiscal policy wisely and the level of trade openness.

Nevertheless, empirical studies that reveal practical reality illustrates that the flexible exchange rate in developing countries leads to chronic movements and volatility in the exchange rate. The macro-microeconomic deformations of these developing countries do not help the exchange rate to stabilize at a specific level. Beyond that, it was demonstrated that the flexible exchange rate has only failed to achieve fiscal discipline but also increased the budget deficit (Chihi & Normandin, 2013; Sow, 2016; Vuletin, 2013). The investigation of many previous studies illustrated that continuous depreciation with trade openness deepens the budget deficit through its influence on the actual value of public revenues.

To understand the extent to which exchange rate movements affect public revenue, revenue should be redistributed for both external and domestic revenues. External revenues are those derived from international transactions that are directly influenced by foreign exchange rate movements especially with the high levels of trade openness, such as income from external financial funds, customs duties, export rights, and external aids and subsidies (Mostafa, 2006).

As for local revenue, it represents business gain tax, taxes on commercial and industrial profits, local fees, the benefits of local debts, the revenues of the public sector companies’ production, consumption, and circulation, and subsidies provided by citizens to the state treasury. In light of high levels of trade openness, the exchange rate indirectly influences these local revenues. Where the exchange rate movements impact domestic fiscal and monetary variables, such as profits, incomes, prices, and investment returns and interest, which significantly influence the actual value of tax revenue (Kwesi Ofori et al., 2018).

On the other hand, as well as the exchange rate movements influence the public revenue it also influences the actual value of the public expenditure whether the current or the investment expenditures. Given the capital and investment expenditures, in light of the era of trade openness, the governments of developing countries rely on imports to provide equipment, machinery, and products that they do not have in the domestic market. additionally, they rely on international companies to implement high-tech and infrastructure projects (Knight, 2007).

With regard to current expenditure, it is understandable that the interaction effect between trade openness and exchange rate movements affects wages through price level changes. This effect is observed more in developing countries, where the public sector represents the largest part of the economy. In this case, it could be difficult for governments to set the government and the public sector wages (Fleming, 1962). As a result, the low trade openness policies could decrease the impacts of the exchange rate movements (Mishra & Spilimbergo, 2011). In another context, the exchange rate movements with high levels of trade openness significantly impact the current transfers such as the commodity subsidy expenditures and the public debt service. Where the current transfers could fluctuate according to these movements.

In this context, the 22 African countries that have floated their exchange rate have witnessed 229% raise in public revenues in 2019 compared to 2010. Nevertheless, these countries are still unable to limit the continuous increase in the government expenditure which increased by 257% in 2019 compared to 2010. Furthermore, the observation of the public debt volume, revealed that the difference between the expenditure and revenue does not accurately reflect the actual situation of the public budget, as it suffers in reality from a significant deficit. Accordingly, this expanded the debt to address the deficit. The domestic debt doubled by 660 % in 2019 compared to 2010, while external debt raised by around 153 % in the same period. This volume of the public debt embellishes and hides the intrinsic and real deficit of the budget. However, taking into account the governments’ lending and borrowing could help to assess the real level of fiscal discipline. Accordingly, the IMF and the world bank used the overall budget balance as a measure of fiscal discipline. According to the IMF data, the average overall budget balance of these selected countries has reduced from 0.99% to -5.10% from 2000 to 2019.

Beyond that, the empirical studies, the investigation demonstrated that rare studies investigated the influence of the exchange rate on the fiscal discipline. Moreover, these limited studies concentrated on the exchange rate regime's effects and did not give enough attention for the continued exchange rate movements, which dominated the performance of the monetary policy in developing countries. Given the interaction effect of the exchange rate movements and the trade openness on the fiscal discipline, although the theories emphasize that the efficiency of the exchange rate to achieve the fiscal discipline usually occurred according to the level of trade openness, most of the studies ignored this important role of the trade openness on this relationship. Nevertheless, the studies that took care of this topic introduced mixed results.

As a result, this study aims to investigate the interaction effect of exchange rate movements and trade openness on fiscal discipline in 22 African countries which adopted floating exchange rate regimes between 1990 and 2020.

This paper is structured as the following: the next section will discuss the important literature. Section 3 will elaborate the data and the methodology. The empirical findings will be presented in section 4. Finally, section 5 will concentrate on the discussion and conclusion.

Literature Review

The revision of the literature demonstrates that classical theory emphasized that the fixed exchange rate is the appropriate regime to achieve the fiscal discipline (Hill, 1946). Furthermore, this doctrine dominated economic thought until the end of WWII and the signing of the Bretton Woods Agreement. The Bretton Woods Agreement laid the foundation stone for a new global economic system and trade openness globalization. It was not so long ago when, the neoclassical, the Keynesian and the new Keynesian put forward their thoughts which deep-rooted for the flexible exchange rate regime as a best choice in light of the trade openness to achieve fiscal discipline and macroeconomic stability. although the new theories sought to evidence that the flexible exchange rate regime more appropriate to achieve fiscal discipline, they ignored many facets that control the influence of exchange rate policies on fiscal policies in the developing countries.

On this context, Milton Friedman (1953) claimed that the flexible exchange rate regime in light of trade openness would support the government to accomplish fiscal discipline. The theory revealed the significance of trade openness to impact the budget through external shocks. The theory argued that the flexible exchange rate regime able to absorb external shocks and decreases its adverse influences on the public budget (Knight, 2007). In this context, later literature has investigated the interaction effect of trade openness on the relationship between the exchange rate regime and the fiscal discipline.

Contrastingly, Frenkel & Goldstein (1989) through their study sought to reinvestigate the theoretical framework to the relationship between the exchange rate regime and the fiscal discipline. The study demonstrated that the fixed exchange rate following high capital mobility could lead to a differential positive interest rate and, reflect more fiscal discipline. Nevertheless, the study emphasized that the positive influence of the fixed exchange rate system on fiscal discipline is not an absolute rule. When the government faces an economic shock as a result of an expected fiscal deficit, it would choose between two options by monetizing the deficit. The first option is to adjust its fiscal policy by decreasing the expenditure. The second one is to depreciate the exchange rate of the local currency, which could occur many times to achieve fiscal discipline. On the other hand, fiscal policy expansion in light of a fixed exchange rate usually does not lead only to pressure on the exchange rate but also on all the monetary policies. However, Tornell & Velasco (1995) claimed that the difference between the exchange rate regimes is in the inter-temporal distribution of the fiscal laxity costs. The fixed exchange rate would delay the cost while the flexible exchange rate allows the dysfunctional fiscal policy impacts to occur instantly through the movements of the exchange rate. The study revealed that with imperfect credibility or limited independence of the central bank, the determination of an exchange rate system precisely determines during the collection of the inflation tax revenue. On the other hand, this determination illustrates the government’s cost if it chases to extend its expenditure or raise its deficit.

Furthermore, Tornell & Velasco (2000) emphasized that the assumption of the classical theory that the fixed exchange rate regime is more beneficial for fiscal discipline cannot be considered an absolute rule. Especially in those countries which adopt fiscal policies that maximize fiscal authority. This argument about the ability of the fixed exchange rate to achieve fiscal discipline under any economic circumstances could result in chronic fiscal laxity which definitely leads to the exhaustion of the monetary reserves.

Ultimately, this would break down the fixed exchange rate regime and lead to harsh economic consequences. As a result, it could be noticed that the difference between the flexible and fixed regimes is in the cost's inter-temporal distribution. Where the adoption of the fixed exchange rate does not oblige the government to address its imprudent fiscal policy because it can delay the punishment. On the other hand, the occurrence of the penalty immediately under the flexible exchange rate regime obliges the government to adopt a rational fiscal policy. Accordingly, under the flexible exchange rate regime, it could be easier to achieve more fiscal discipline.

In this vein, Broda, (2002) confirmed Friedman’s hypothesis as he introduced more elaboration on the flexible exchange rate's role to absorb external shocks. His study illustrated how the real exchange rate and the prices would directly be affected when the government is exposed to external shocks. Under the adoption of the flexible exchange rate regime, the nominal exchange rate movements would directly adjust the real exchange rate. This would not be the case under the fixed exchange rate regime as it cannot absorb the external shocks. In other words, the negative impact of the external shocks on the public budget in light of the high level of trade openness would be less and can be addressed compared to what could occur under a fixed exchange rate regime.

In this framework, Magud, (2006) displayed a theoretical argument that detailed two scenarios of the performance of the different exchange rate regimes under low and high trade openness. The study investigated Friedman’s hypothesis about the ability of the exchange rate regimes to absorb external shocks. The findings demonstrated that under the flexible exchange rate the external socks would depreciate the exchange rate of the local currency. This will lead to reduce the aggregate demand and the firms’ sales. Furthermore, the exchange rate depreciation would raise the firms’ external debt. By the time, the instalments’ burden will limit the ability of these firms to borrow from abroad. On the other hand, the exchange rate depreciation will raise these firms' ability to compete in the global markets. This raises the competitiveness chances and compensate the reduction in the aggregate domestic demand.

In 2006 Duttagupta & Tolosa introduced their theoretical framework of fiscal policy performance under different exchange rate regimes. The study sought to interpret the performance of the fiscal policies in a currency union in light of the fixed exchange rate regime. The findings demonstrated that in the currency union under a fixed exchange rate regime, the fiscal policy could be influenced by the free-riding performance because of the policy marker’s ability to turn the costs of the over-expenditure to future governments or the burden of the other member countries. Furthermore, the analysis forecasted that in the currency union the fixed exchange rate leads the countries to bear the cost of sharing the expenditure with the other countries through free riding. As a result, the fixed exchange rate system in a currency union often led to backfires.

Furthermore, Aizenman et al. (2011) investigated the influence of the exchange rate regimes and the level of trade openness on the fiscal stimulus during the global economic crisis of 2008-9. The study revealed that the flexible exchange rate regime with high level of trade openness could promote the budget balance. When shocks to aggregate demand occur, the exchange rate depreciates, particularly if indeed the demand shock is followed by a reduction in output and interest rates. This depreciation encourages competitiveness and external demand, which opens the chances to the export sector and addresses the trade deficit. These changes in macroeconomic performance would increase tax revenue and fiscal discipline. Accordingly, in light of trade openness, the flexible exchange rate is the best choice.

However, the revision of the empirical studies (which reflects the practical reality) showed mixed findings. Even though Jalles et al. (2016) confirmed the Keynesian argument about the positive influence of the flexible exchange rate movements on the fiscal discipline in light of the moderation role of the trade openness, (Chihi & Normandin, 2013; Sow, 2016; Tarequl et al., 2016; VULETIN, 2013) emphasized that the fixed exchange rate is the best regime to achieve fiscal discipline.

Methodology

Data

The study employs annual data for the period from 1990 to 2020 for 22 African countries (Appendix (A)). The data of fiscal discipline, inflation, trade openness, total reserves, and GDP per capita growth, were collected from the World Bank Development Indicator database, 2020. As for the exchange rate's data, it was obtained from Lane and Milesi-Ferretti database (2020). Given the data on democracy, it was collected from the Center for Systemic Peace (CSP), Polity IV dataset, 2020.

Model Specification

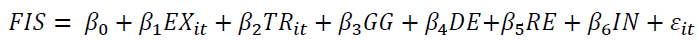

The econometric model without the interaction effect between the exchange rate movement and the trade openness is as below:

Where; FIS indicates Fiscal discipline, EX refers to exchange rate movements, TR is the trade openness, GG represents GDP per capita growth, DE reflects the democracy, RE is the total reserves, IN represents the inflation, and ε refers to the stochastic error term. Equation (3.1) denotes panel specification, where t is time, and i is individual units ’identifiers. (β0:β6) are parameter coefficient, with β0 being the intercept while (β1:β6) are slope coefficients.

This study claims that the relationship between exchange rate movements and fiscal discipline is conditional on trade openness according to the theory developed by Magud (2006) and the empirical model of estimation studied by Tarequl et al. (2016). Accordingly, the exchange rate with trade openness would be multiplied to create the interaction term. The model with interaction is presented below;

Where;

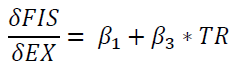

FIS, EX, TR, GG, DE, RE, and IN are as defined above. (EX * TR)it indicates the interaction term (exchange rate movements and trade openness). The model with interaction term suggests that the effect of exchange rate movements on fiscal discipline is not constant but rather depends on the level of trade openness. Accordingly. The marginal effect should be computed to clarify the rate of change in fiscal discipline with respect to a change in exchange rate movements as thus below;

Where;

implies partial change in fiscal discipline based on the movements of exchange rate.

implies partial change in fiscal discipline based on the movements of exchange rate.

However, these models estimating the direct effects of the exchange rate movements and then computing the exact role of the changes in trade openness on influencing this EX-FIS relationship.

Method of Estimation

This study applies the bias-corrected Least Square Dummy Variables (LSDVC) estimator. This approach is considered the suitable approach as it can estimate the model in light of the existence of unbalanced data especially if the number of the cross-sectional groups is limited. Moreover, the model understudy includes the lag of dependent variables therefore the LSDVC estimator more able to decrease the potential reverse causality and omitted variable biases which could lead to significant endogeneity.

However, a review of the literature revealed that in 1981, Anderson and Hsiao (AH) developed two instrumental variables (IV) procedures to overcome the lagged dependent variable's endogeneity. After ten years Arellano & Bond (1991) introduced their estimation procedures initialized by the generalized method of moments (GMM), and they developed a first-differenced model that was more efficient than the Arellano-Hansen (AH) model. This model relied on a greater number of internal instruments and allowed for the estimation of dynamic panel data models with a larger number of lags. The Arellano-Bond (AB) model has since become a popular estimation technique for dynamic panel data models.

However, the main problem for both DIF-GMM and IV estimators is that may lead to a strong small-sample bias because of the weak instruments with very persistent data. Accordingly, in 1998 Blundell and Bond (BB) developed the system GMM estimator. Their system GMM estimator is designed to address this issue by using a combination of lagged levels and first differences of the instruments to reduce the bias.

However, the main problem is that all of these three estimators are not suitable to the sample under study where the cross-sectional units are small. The GMM is designed for panels with large cross-sectional units (N) and small-time period (T), hence using them with small N will lead to inconsistent and bias estimates (Sbia & Hamdi, 2020). Due to these problems, Kiviet (1995) proposes a bias correction procedure for the LSDV estimator, which is based on the asymptotic expansion of the bias. Moreover, Bruno (2005) developed the LSDVC to be able to estimate the unbalanced dynamic panel data. Where the economic data usually contain missing data for some individuals in the interval [0, T].

To correct the bias, the estimation has to be initialized by an efficient and consistent dynamic estimator where the consistency of the LSDVC relies on unknown population parameters. Accordingly, as the literature revealed that initializing the LSDVC estimator by the IV-GMM (AH), DIF-GMM (AB), and SYS-GMM (BB) would correct the Nickel bias and make it a consistent estimator, the study will initialize the LSDVC estimator by the three GMM estimators IV-GMM (AH), DIF-GMM (AB) and SYS-GMM (BB) to estimate the model understudy and for robustness check.

Dang et al. (2015) and Bun & Kiviet (2003) report that the LSDVC method has smaller variance and gives more accurate results relative to other mean squared error estimators, including, the asymptotically efficient GMM estimators. Bruno (2005a) invented a new Stata code ‘xtlsdvc’ which able to compute the LSDVC to deal with the unbalanced panels and samples with missing data like the data of this study. Bruno (2005a) applied Monte Carlo analysis to compare the results of the LSDVC to the results of the original LSDV, Arellano–Bond, Anderson–Hsiao and Blundell–Bond which revealed that the LSDVC estimator was the most accurate estimator. Furthermore, as the most actual datasets generally have missing data Flannery and Hankins, (2012) expanded the experiment to examine the LSDVC, Arellano–Bond, Anderson–Hsiao, Blundell–Bond, POLS, FE, LD4, and LD to investigate the most accurate method among these eight which able to analyze datasets contains missing data. Flannery and Hankins, (2012) randomly delete 10% of a balanced sample panel data which has been analyzed previously. The results demonstrated that the LSDVC was the best method which estimated the most accurate coefficients with smallest RMSE.

Results

Table 1 showed the descriptive statistics of the variables that have been used in the estimated model. The findings revealed that the mean values of the EX and FIS are 523.9977 and -1.355161, respectively. As for the minimum and maximum values of the variables the descriptive statistics test demonstrated that the RE has the largest value among the variables with 201436.6 while the FIS has the lowest value with -73.98. Looking at the standards deviation the findings illustrated that except the exchange rate movements (EX) and the total reserve (RE) the rest of the variables already have slight variance. This provides stability and robustness to the model understudy while eliminating the issue of variability and inconsistency in data findings.

| Table 1 Summary of Descriptive Statistics | |||||

| Variable | Obs | Mean | Std. dev. | Min | Max |

| FD | 682 | -1.355161 | 9.107533 | -73.98 | 45.81 |

| EXM | 682 | 523.9977 | 1231.092 | 0 | 9283.99 |

| GDPG | 682 | 1.372449 | 4.68562 | -47.5 | 37.54 |

| RES | 682 | 8107.326 | 23089.67 | 7.61 | 201437 |

| OPEN | 682 | 63.90213 | 34.26132 | 9.96 | 225.02 |

| DEMO | 682 | 0.2463343 | 4.768752 | -9 | 9 |

| INF | 682 | 78.8411 | 950.6311 | -2.814698 | 23773.1 |

Looking at Table 2 which presents the variables correlation matrix, the 21 correlations coefficient of the variables demonstrated that which 11 of them were correlating positively, the rest 10 were negative. Beyond that, the findings revealed that the correlations coefficients of the variables of the model are ranged from -0.1116 lowest to 0.5891 highest. Consequently, these findings proved that the relationships between variables were rational enough to permit for robust estimate of the effects of the exchange rate movements and other explanatory variables on fiscal discipline.

| Table 2 Correlation Matrix for the Data | |||||||

| Variable | FD | EXM | GDPG | RES | OPEN | DEMO | INF |

| FD | 1 | ||||||

| EXM | -0.0683 | 1 | |||||

| GDPG | 0.0179 | 0.044 | 1 | ||||

| RES | 0.5891 | -0.1014 | -0.0093 | 1 | |||

| OPEN | 0.0462 | -0.0821 | 0.0609 | -0.0387 | 1 | ||

| DEMO | 0.0105 | 0.1059 | 0.0015 | 0.0884 | 0.0672 | 1 | |

| INF | 0.008 | -0.0308 | -0.1116 | -0.0258 | -0.0119 | -0.0165 | 1 |

In Table 3 represents the estimation results of the impact of independent variables on fiscal discipline using LSDVC estimator. The study initialized the LSDVC estimator based on Anderson Hsiao IV-GMM (Columns 1 and 2), Arellano and Bond DIF-GMM (Columns 3 and 4), and Blundell and Bond SYS-GMM (Columns 5 and 6).

| Table 3 The Interaction Effect of the Trade Openness on the Relationship between Exchange Rate Movements and Fiscal Discipline Based on LSDVC Methods Initialized based on Anderson HSIAO IV-GMM, Arellano and Bond GMM-DIF, and Blundell and Bond SYS-GMM Estimators | ||||||

| Variable | (AH) without interaction | AH) with interaction | (AB) without interaction | (AB) with interaction | (BB) without interaction | (BB) with interaction |

| L1. FD | 0.476*** (19.69) |

0.4771*** (19.37) |

0.477*** (19.33) |

0.4770*** (18.82) |

0.501*** (29.47) |

0.501*** (28.73) |

| EXM | -0.000283*** (-7.72) |

-0.000979*** (-6.31) |

-0.000225*** (-5.18) |

-0.000956*** (-4.58) |

-0.000213 (-1.42) |

-0.000809** (-2.06) |

| GDPG | 0.0651*** (18.40) | 0.0634*** (21.48) | 0.0646*** (16.18) | 0.0629*** (17.66) | 0.0702*** (17.54) |

0.0687*** (20.00) |

| OPEN | 0.0259*** (30.96) | 0.0247*** (22.50) | 0.0251*** (16.34) |

0.0236*** (13.08) | 0.0309*** (288.62) | 0.0296*** (52.07) |

| DEMO | 0.0142 (0.69) |

0.0192 (1.02) |

0.0190 (1.11) |

0.0245 (1.61) |

0.0180 (0.81) |

0.0234 (1.14) |

| RES | 0.0000174*** (5.61) | 0.0000177*** (5.44) | 0.0000180*** (861.67) |

0.0000184*** (101.45) |

0.0000110*** (18.70) |

0.0000112*** (15.30) |

| INF | - 0.0000778* (1.88) |

-0.0000732* (1.85) |

-0.0000781* (1.84) |

-0.0000735* (1.80) | -0.0000796* (1.77) |

- 0.0000754* (1.73) |

| EXTR | 0.00000844*** (3.53) | 0.00000865*** (4.24) |

0.00000676** (2.32) | |||

| Low | -0.0008949*** (0.001) | -0.0008697*** (0.000) |

-0.000742** (0.000) |

|||

| Medium | -0.0004397*** (0.000) | -0.0004032*** (0.000) |

-0.0003775* (0.000) |

|||

| High | 0.0009198** (0.004) | 0.0009902*** (0.000) |

0.0007113*** (0.000) |

|||

| Obs.N | 660 | 660 | 660 | 660 | 660 | 660 |

| N_g | 22 | 22 | 22 | 22 | 22 | 22 |

As for the model without interaction (columns 1,3, and 5), the findings demonstrated that trade openness, total reserve, and GDP growth have a positive influence on the fiscal discipline. On the other hand, inflation and exchange rate depreciation have negative influence on the fiscal discipline. Moreover, the results revealed that the democracy has insignificant positive impact on the fiscal discipline.

Given the interactions models in columns 2,4, and 6 the results confirmed the presence of a dynamic effect where it showed the significance of the first lag of the fiscal discipline on influence the current level of the fiscal discipline. The lagged level of the fiscal discipline in the previous year effects the current fiscal discipline level by 0.4771 percent ranging from 0.4770 lowest to 0.501 highest at 1 percent significant level. This revealed how the irrational or the wise previous fiscal policies could influence the current and the future level of the fiscal discipline.

Looking at the influence of the exchange rate depreciation on the fiscal discipline the findings indicated that the raise in the depreciation movements by 1 unite would decline the fiscal discipline by -0.000956 percent ranging from -0.000809 lowest to -0.000979 highest at 1 percent significant level. This result is consistent with the findings of (Bowdler, 2005) as it demonstrates that, contrary to conventional wisdom and the claims of the IMF and the World Bank, depreciation movements cannot compel governments to reduce their public expenditure in proportion to their revenues.

The finding is in line with many empirical pieces of literature which illustrated that in developing countries the flexible exchange rate regime leads to chronic depreciation movements and volatilities. These continues depreciation movements do not only influence both expenditure and revenue negatively but also raise the public budget burdens (Kwesi Ofori et al., 2018). Consequently, many studies emphasized that the flexible exchange rate would fail to achieve fiscal discipline and increase the budget deficit (Chihi & Normandin, 2013; Sow, 2016; Vuletin, 2013).

Moreover, the findings revealed that the increase of trade openness by 1 percent would positively increase the fiscal discipline by 0.0247 percent ranging from 0.0236 lowest to 0.0296 highest at a 1 percent significant level. This result, along with conventional theory and the claims of the IMF and World Bank, argued that in the context of the global liberalization system, trade openness policies like capital mobility, export, and import will positively maintain macroeconomic stability, especially fiscal policy (Knight, 2007; Vuletin, 2013).

Given the total reserves, the results revealed that total reserves have a positive impact on the fiscal discipline. The increase by 1 percent in the total reserves raises the fiscal discipline by 0.0000177 percent ranging from 0.0000112 lowest to 0.0000184 highest at 1 percent significant level. This result in line with the conventional theory which emphasized that the growth of the total reserve sustains the stability of the macroeconomic and fiscal indicators particularly the exchange rate and the public budget. Furthermore, the growth in the national savings in general, particularly the total foreign reserves usually has a bidirectional positive relationship with the fiscal discipline (Gale & Orszag, 2003). Nevertheless, it should be clarified that the growth of the reserves in an exaggerated manner that is not commensurate with the real economic state might cause dire consequences. It is known that many developing countries could resort to that to mask fiscal and macroeconomic distortions, by adopting expansionary debt policies. Consequently, when the government built up a reserve of debt, this would drain the public budget and raise its deficit (El-Shagi, 2011; Jalles et al., 2016).

Furthermore, the findings illustrated that GDPG has a significant positive influence on the fiscal discipline at 1 percent significant level. The growth in the GDP by 1 percent leads to an increase in the fiscal discipline by 0.0634 percent ranging from 0.0629 lowest to 0.0687 highest. The growth in the GDP generally represents the economic growth and prosperity. Where this growth of the GDP increases in the tax revenue, reduces the budget burden to address the social economic distortions such as the poverty, unemployment, and inequality. This result consistent with the results of (El-Shagi, 2011; Jalles et al., 2016).

As for democracy the findings demonstrated that the it has a positive significant influence on the fiscal discipline. It is so logical why the raise in the democracy level positively would increase fiscal discipline. The increase in the democracy level reflects the rise of the institution quality which guarantees the raise of monitoring and corruption reduction. Moreover, it would motivate the government to rationalize its expenditure. In the end, all of that would raise fiscal discipline.

Beyond that, the results illustrated that the inflation has a negative significant influence on the fiscal discipline at 10 percent significant level. The decline in the inflation by 1 percent raises the fiscal discipline by 0.0000735 percent ranging from 0.0000732 lowest to 0.0000754 highest. Usually, the inflation effects the fiscal discipline through the changes in the price level. The rise in the price level might negatively increase the budget burden. On the other hand, the reduction in the price level positively impacts the public budget.

Given the interaction effect of the exchange rate movements and the trade openness on the fiscal discipline, the results indicated that with the low level of trade openness, the increase in the exchange rate depreciation by 1 percent negatively reduces the fiscal discipline by -0.0008697 percent ranging from -0.000742 lowest to -0.0008697 highest. Again, the results demonstrated that with medium level of the trade openness the increase in the exchange rate depreciation reduces the fiscal discipline by -0.0004032 percent ranging from -0.0003775 lowest to -0.0004397 highest. This result revealed how the conventional wisdom and the IMF and the world bank claims do not always success and cannot be generalized.

On the other hand, it has been found that with a high level of trade openness, exchange rate depreciation influence on the fiscal discipline turns significantly to be positive. This illustrates that in light of the high level of trade openness the increase by 1 percent in exchange rate depreciation succussed to raise the fiscal discipline by 0.0009198 percent ranging from 0.0007113 lowest to 0.0009902 highest. This result in line with the conventional theoretical framework and the IMF and the world bank claims.

However, the result demonstrated that the exchange rate depreciation movements in light of the trade openness do not always success to achieve the fiscal discipline. Where these most developing governments suffer from weakness in their service institutions and production base, such as health and education, dilapidated infrastructure and administrative institutions, and high rates of poverty, inequality, and unemployment, all of that hinder them to set the expenditure according to the revenue.

Furthermore, the interaction between the exchange rate depreciation movements and the trade openness has a negative impact on the external revenues like export rights, customs duties, income from external financial funds, and external aids and subsidies. On the other hand, this interaction between the exchange rate movements and trade openness can affect local revenues such as the tax on the public sector production and consumption, the tax on industrial and commercial profits, business tax gain, the interest on local debts, and local fees, and citizens' subsidies for the state treasury. This impact occurs through fluctuations in profits, prices, incomes, interest, and investment returns. These fluctuations reflected in the tax revenue actual value (Kwesi Ofori et al., 2018).

As for the current expenditure, this interaction between the depreciation movements and the trade openness influences the public wages through the fluctuations of price level. It is know that in the developing countries usually the public sector represents the largest part of the economy (Mishra & Spilimbergo, 2011). As a result, the governments might find themselves incapable to make the proper decision to set the wages of government and public sector employees (Fleming, 1962). Beyond that, this interaction affects current transfers like commodity support, public debt service, and the prices level of subsidized commodity because of the continues exchange rate movements.

Finally, given the capital and investment expenditures, it is understandable that trade openness often courage developing countries to rely on imports especially to fulfill the need for equipment, commodities, and machinery that are unavailable in their local market. In addition, the practical reality showed that most developing countries rely on international companies, especially in infrastructure and high-tech projects (Knight, 2007).

Discussion and Conclusion

This study seeks to investigate the effect of interaction between the exchange rate depreciation movements and the trade openness on the fiscal discipline. the study used the LSDVC estimators to analyse panel data for 22 African countries between 1990-2020 which have applied the floating exchange rate through the IMF and the world bank economic reform programs. The literature demonstrated that though the confirmation of the theories about the role of the trade openness on impacting the relationship between exchange rate movements and fiscal discipline, most of the empirical literature ignored the role of the trade openness. Furthermore, the empirical literature of the direct relationship between exchange rate movements and fiscal discipline introduced mixed results.

The data analysis demonstrated the limitation of the conventional theories and the claims of world bank and IMF about the positive effect of the exchange rate depreciation movements on the fiscal discipline in light of the trade openness. The findings indicated that this hypothesis does not always success and cannot be generalized.

Unfortunately, these theoretical attempts to determine the framework of the relationship between the exchange rate on fiscal policies do not understand the practical reality which dominates the economic performance of developing countries. they mainly built their intellectual structure, mathematical, and econometric models based on analysis of the economic performance of developed countries.

Although these allegations' validity is proven through structured mathematical and econometric models, these models could not perceive the reality of what occurred when these developing countries applied these policies. The practical reality revealed that these policies do not achieve actual fiscal discipline, but rather a misleading discipline. Where the expenditure does not respond to the real government needs to achieve economic growth and development. In the same vein, their tax policies do not match the exhaustion suffered by economic institutions and citizens, and their impacts are evident on all socioeconomic indicators, the most important of which are unemployment, poverty, low-income rate, and low standard of living.

The Proponents of Friedman’s theory claim that the fixed exchange rate would give the government the chance to apply a lax fiscal policy which could delay the fiscal crises but, in the end, it would exacerbate it. On the other hand, they claimed that adopting a flexible exchange rate would not allow covering the fiscal laxity, which obliges the governments to adjust their fiscal policy, which in the end would strengthen fiscal discipline. The theory neglected many significant variables, which have a main role in the relationship between the exchange rate and fiscal policy. Usually, adopting a floating exchange rate in developing countries would result in continuous depreciation due to the macroeconomic distortions that they already suffer from. The heavy burden of public budget in these countries due to the essential development and social expenditures such as the poverty, inequality, unemployment, weak production base and infrastructure, deterioration of the level of the education and the health sectors, the domestic privet sector fragility, and the lack of the foreign investment do not allowt them to limit their public expenditure according to the public revenue. Accordingly, the government finds itself obliged to interevent to address the local market's chronic distortions, develop and improve the production and service institutions, and subsidize their citizens.

However, the findings are consistent with the literature which confirmed that the exchange rate depreciation in light of trade openness might increase the budget deficit by affecting the public revenues' actual value where most of them are in the local currency. Furthermore, this depreciation would directly influence the expenditure actual value. This influence in light of the high level of trade openness extends to current and investment expenditures. It would be influenced if the government mainly relies on imports to provide machinery and equipment that are not available in the local market. Additionally, most of developing countries rely on multinational companies in the infrastructure and high-tech projects. Moreover, it impacts current transfers, and government and public sector wages through fluctuations in the price level, and external shocks.

Overall, this study recommends the significance of restructuring the theoretical framework of fiscal policies by considering differences between developed and developing countries particularly the proper exchange rate regime which benefits to achieve the fiscal discipline. Furthermore, the study endorses the need to examine the interaction effects of inflation and elections on the relationship between the exchange rate movements on fiscal discipline.

Conflicts of Interest: the authors declare no conflict of interest

Funding: This research is self-funded

Data Availability Statement: If readers want, they can E-mail the authors

Appendix A

| Appendix A The Selected Countries Understudy | ||||||

| Egypt | South Africa | Sudan | Mauritania | Tunisia | Guinea | |

| Tanzania | Zambia | The Gambia | Mozambique | Angola | ||

| Uganda | Algeria | Ghana | Nigeria | Seychelles | The Democratic Republic of the Congo | |

| Madagascar | Burundi | Kenya | Rwanda | Mauritius | ||

References

Aizenman, Joshua, & Jinjarak, Y. (2011). THE FISCAL STIMULUS OF 2009-10: TRADE OPENNESS, FISCAL SPACE AND EXCHANGE RATE ADJUSTMENT.

Indexed at, Google Scholar, Cross Ref

Broda, C.M. (2002). Terms of Trade and Exchange Rate Regimes in Developing Countries. SSRN Electronic Journal.

Indexed at, Google Scholar, Cross Ref

Brown, R.P.C., & Bulman, T.J. (2006). The evolving roles of the clubs in the management of international debt. International Journal of Social Economics, 33(1), 11–32.

Indexed at, Google Scholar, Cross Ref

Chari, V.V., & Kehoe, P.J. (2008). Time inconsistency and free-riding in a monetary union. Journal of Money, Credit and Banking, 40(7), 1329–1356.

Chihi, F., & Normandin, M. (2013). External and budget deficits in some developing countries. Journal of International Money and Finance, 32(1), 77–98.

Indexed at, Google Scholar, Cross Ref

Clift, B. (2019). Contingent Keynesianism: the IMF’s model answer to the post-crash fiscal policy efficacy question in advanced economies. Review of International Political Economy, 26(6), 1211–1237.

Indexed at, Google Scholar, Cross Ref

Duttagupta, R., & Tolosa, G. (2006). Fiscal discipline and exchange rate arrangements: Evidence from the Caribbean. Emerging Markets Finance and Trade, 43(6), 87–112.

Indexed at, Google Scholar, Cross Ref

El-shagi, M. (2009). The Impact of Fixed Exchange Rates. 84.

El-Shagi, M. (2011). The Impact of Fixed Exchange Rates on Fiscal Discipline. SSRN Electronic Journal, 58(5), 685-710.

Indexed at, Google Scholar, Cross Ref

Fleming, M.J. (1962). Domestic Financing Policies under Fixed and Floating Exchange Rates. IMF Staff Papers, 9, 369–380.

Indexed at, Google Scholar, Cross Ref

Frenkel, J.A., & Goldstein, M. (1989). THE INTERNATIONAL MONETARY SYSTEM: DEVELOPMENTS AND PROSPECTS. July.

Indexed at, Google Scholar, Cross Ref

Gale, W.G., & Orszag, P.R. (2003). The Economic Effects of Long-Term Fiscal Discipline. Urban-Brookings Tax Policy Center Discussion Paper, 1–64.

Hamann, A.J. (2019). Exchange-Rate-Based Stabilization: A Critical Look at the Stylized Facts. In Intergovernmental Panel on Climate Change (Ed.), Climate Change 2013 - The Physical Science Basis, 53(9), 1–30. Cambridge University Press.

Indexed at, Google Scholar, Cross Ref

Hill, L.E. (1946). JOHN MAYNARD KEYNES AND ALVIN HANSEN: CONTRASTING METHODOLOGIES AND POLICIES FOR SOCIAL ECONOMICS. The Review of Economics and Statistics, 28(4), 178.

Indexed at, Google Scholar, Cross Ref

Jalles, T., Mulas-granados, C., & Tavares, J. (2016). Fiscal Discipline and Exchange Rates : Does Politics Matter ? International Monetary Fund Working Paper.

Indexed at, Google Scholar, Cross Ref

Keynes, J.M. (1936). The General Theory of Employment, Interest and Money. Journal of the American Statistical Association, 31(196), 791.

Indexed at, Google Scholar, Cross Ref

Knight, F. (2007). Economics and human action. In The Philosophy of Economics: An Anthology.

Kumar, M., & Ter-Minassian, T. (2007). Fiscal Discipline: Key Issues and Overview. Promoting Fiscal Discipline, 2005, 1–8.

Kwesi Ofori, I., Obeng, C.K., & Armah, M.K. (2018). Exchange rate volatility and tax revenue: Evidence from Ghana. Cogent Economics and Finance, 6(1), 1-17.

Indexed at, Google Scholar, Cross Ref

Magud, N.E. (2006). Currency mismatch, openness and exchange rate regime choice. Journal of Macroeconomics, 32(1), 68–89.

Indexed at, Google Scholar, Cross Ref

Mishra, P., & Spilimbergo, A. (2011). Exchange rates and wages in an integrated world. American Economic Journal: Macroeconomics, 3(4), 53–84.

Indexed at, Google Scholar, Cross Ref

Mostafa, O.M. (2006). The effect of the exchange rate on the sources of financing the budget deficit. CAIRO UNIVERSTIY. EGYPT.

Ologbenla, P. (2019). Determinants of fiscal policy behavior in Nigeria. Investment Management and Financial Innovations, 16(2), 1–13.

Indexed at, Google Scholar, Cross Ref

Sow, M.N. (2016). Essays on Exchange Rate Regimes and Fiscal Policy.

Tarequl, M., Chowdhury, H., Bhattacharya, P.S., Mallick, D., & Ulubaşoğlu, M.A. (2016). Exchange Rate Regimes and Fiscal Discipline: The Role of Trade Openness. International Review of Economics and Finance.

Indexed at, Google Scholar, Cross Ref

Tornell, A., & Velasco, A. (1995). Money-Based versus Exchange Rate-Based Stabilization with Endogenous Fiscal Policy. National Bureau of Economic Research Working Paper Series, No. 5300(4).

Indexed at, Google Scholar, Cross Ref

Ul Haque, N., Mathieson, D., & Mark, N. (1997). Rating the raters of country creditworthiness. Finance and Development, 34(1), 10-13.

Vuletin, G. (2013). Exchange rate regimes and fiscal discipline: The role of capital controls. Economic Inquiry, 51(4), 2096–2109.

Indexed at, Google Scholar, Cross Ref

Received: 20-Feb-2023, Manuscript No. AAFSJ-23-13238; Editor assigned: 22-Feb-2023, PreQC No. AAFSJ-23-13238(PQ); Reviewed: 08-Mar-2023, QC No. AAFSJ-23-13238; Revised: 18-May-2023, Manuscript No. AAFSJ-23-13238(R); Published: 25-May-2023