Research Article: 2022 Vol: 25 Issue: 5S

Linking Interplay between External Environment and Internal Choices to Organizational Knowledge Search Orientation

Omer Shabbir, Prince Sultan University

Fouzia Zakiullah Khan, Imam Abdul Rahman Bin Faisal University

Mujahid Latif, Prince Sultan University

Shandana Nawaz, University of Central Punjab

Citation Information: Shabbir, O., Khan, F.Z., Latif, M., & Nawaz, S. (2022). Linking interplay between external environment and internal choices to organizational knowledge search orientation. Journal of Legal, Ethical and Regulatory Issues, 25(S5), 1-22.

Abstract

Organizations face several challenges by environment which is usually characterized by changing needs of the customers, rough competition, speed of technological changes, dynamism, complexity etc. Firms rethink about their strategies and involve them in innovation continuously to strengthen their competitive advantage and performance. In this particular perspective, the current paper seeks the need of the firms to deal with the paradoxical innovation strategies that have been based on exploration of the new skills or exploitation of their existing ones. The paper concludes presenting a proposed theory based on the available literature suggesting when the organizations need to involve in exploiting their existing capabilities and at the same time exploring the new ones under specific set of conditions. Future research may test the theory presented in the following paper to provide empirical support to the paper.

Keywords

External environment, Internal Organizational Choices, Organizational Knowledge Search, Exploration, Exploitation, Exploration Knowledge, Exploitation Knowledge.

Introduction

It is an admitted fact that organizations face several challenges by environment which is usually characterized by changing needs of the customers, rough competition, speed of technological changes, dynamism, complexity and much more (Berraies & Bichini, 2019; Tian et al., 2020). In response to these changes, firms have to rethink about their strategies and involve them in innovation continuously to strengthen their competitive advantage and performance (Drucker, 1986; Berraies & Bichini, 2019). In this particular perspective, the firms need to deal with the paradoxical innovation strategies that have been based on exploration of the new skills or exploitation of their existing ones (Benner & Tushman, 2003; Berraies & Bichini, 2019; Jansen et al., 2005; March, 1991; Tian et al., 2020). Literature has largely suggested on the need for organizations to involve in exploiting their existing capabilities and at the same time exploring the new ones (Benner & Tushman, 2003; Berraies & Bichini, 2019).

Organizational scholars have been laying stress on capabilities of firms to keep a balance between exploration and exploitation to ensure long term firm survival (Benner & Tushman, 2003; Berraies & Bichini, 2019). Similarly, other researches have been highlighting the need to overcome the tension between exploitation and exploration competing for the limited resources, by searching for synergy to improve the financial performance (Berraies & Bichini, 2019; Lavie et al., 2010). There are studies that have supported the idea of firm to be ambidextrous by simultaneously developing exploitation and exploration skills (Benner & Tushman, 2003, Berraies & Bichini, 2019; Lavie et al., 2010; Schamberger et al., 2013).

With the increasing environmental changes and competition, researchers have been attempting to address the issue of maintaining a balance between exploration and exploitation from different perspectives (Almahendra & Ambos, 2015). Scholars have been laying stress on firms to simultaneously perform the conflicting concepts of exploitation and exploration (March, 1991; Berraies & Bichini, 2019).

Following the seminal work of March 1991, scholars have developed several definitions, concepts and applications in rejuvenating the concepts of exploration and exploitation. While studying the exploration and exploitation, little attention has been paid on providing empirical evidence to examine the patterns connected on when to be exploring and when to be exploiting the resources (Berraies & Bichini, 2019). The current study is an attempt to provide empirical evidence about when firms should be involves in exploring the resources and when to exploit the resources.

Exploration includes the terms such as variation, search, risk, play, experimentation, innovation, discovery, and flexibility (March, 1991; Berraies & Bichini, 2019) on the other hand, exploitation includes issues such as choice, refinement, efficiency, production, selection, and implementation followed by execution (March, 1991; Berraies & Bichini, 2019). Researches on exploration and exploitation have been receiving huge attention during the last two decades, however these studies have not reached to a mutual consensus of when to explore and when to exploit. Almahendra & Ambos (2015), Berraies & Bichini, (2019), Benner & Tushman (2002), are some of the articles examining the theoretical extensions to provide empirical support to the March’s model.

When firms involve them in exploration and exploitation they basically drive them towards exploration knowledge search and exploitative knowledge search. Explorative knowledge search is defined as the knowledge that is characterized by searching, experimenting, risk taking, and flexibility etc. (Almahendra & Ambos, 2015; March, 1991; Tian et al., 2020). Exploratory knowledge search leads to exploratory learning characterized by the same i.e. experiences, experimentation, risk taking, flexibility etc. (Levinthal & March, 1993; Tian et al., 2020). Moreover, exploratory learning is about acquisition of knowledge (Lane et al., 2006). Firms invest in exploration based on the investment in resources with the aim of learning new skills, processes, and knowledge to adapt to the environmental changes in long run (March, 1991; Tian et al., 2020). Therefore organizations adopt the exploratory knowledge search beginning with recognizing the useful resources and scanning the organizational environment. The same set of processes lead to exploratory innovation constituting the broader content i.e. new products and services, development of new technologies, creation of news plans and managerial systems and procedures (Damanpour, 1996; Li et al., 2010). Exploratory innovations are innovations designed to pursue the emerging probabilities (March, 1991; Li et al., 2010). These innovations gain new knowledge and move away from existing knowledge (Benner & Tushman, 2002; Jansen et al., 2005; Levinthal & March, 1993; Li et al., 2010). Overall these exploratory innovations enhance the competitive power and enhance the future income (March, 1991; Li et al., 2010).

On the other hand, when it is about exploitative learning the firms keep their focus on the existing knowledge and capabilities. It is all about reutilization, elaboration, and refinement of the existing organizational capabilities that were earlier discovered during the exploration phase (Holmqvist, 2003; Ojha et al., 2018). Competence of the exploitative learning is concerned with the investment that firms make in refining as well as extending their existing knowledge, procedures and skills (March, 1991; Tian et al., 2020). This type of learning aims at synchronization of the organizational knowledge and market demands based on the previous experience of the firms (Lenox & King, 2004; Rothaermel & Deeds, 2004; Tian et al., 2020).

Exploitative leaning enables the firms to strengthen their existing capabilities to innovate the products competing in the short term market favorably (March, 1991). Exploitative learning leads firms to exploitative innovations which are incremental innovations designed to improve the current situation of the firms (March, 1991; Li et al., 2010). These innovations improve the established firm designs, broaden the existing skills as well as knowledge, enhance the existing product lines, and improve the efficiency of existing supply chain and distribution channels and better services for the existing target market (Benner & Tushman, 2003; Jansen et al., 2005; Li et al., 2010). Exploitive innovations are usually built on the existing organizational knowledge and tend to refine, integrate, reinforce, and enhance the same (Benner & Tushman, 2002; Levinthal & March, 1993; Li et al., 2010). In short, these innovations improve the efficiency of the firms in short terms and enhance the current income of an organization (March, 1991; Li et al., 2010).

Exploitative innovations and explorative innovations improve the firm performance in several aspects. Exploitative innovation enhances the competitive power in short run and enhances the current income while exploratory innovation improves the competitive power in long run adding to the future income (March, 1991; Li et al., 2010). Several researches have concluded that there is a strong link between the explorative and exploitative innovation strategies and firm performance (Sanal et al., 2013).

The strategic choices for exploitation and exploration compete for the scarce resources of a firm, leading to the need to manage the tradeoff between the exploitation of the existing resources and exploration of the new ones (Almahendra & Ambos, 2015; Berraies & Bichini, 2019). Going through strategic management literature, it has been observed that scholars have been looking to see what drives the strategic choices of the firms (Nadkarni & Barr, 2008; Li & Wang, 2019). Multiple perspectives have been there however the industry structure along with the organizational features has been the most dominant ones. The industry structure refers to the environmental conditions such as dynamism, complexity, scarcity of resources, competition etc. while organizational features posit the organizational routines and their knowledge bases that are developed following certain trajectories affecting the ability of an organization in analyzing and processing its internal as well as external environment (Li & Wang, 2019).

To be specific, organizations have to make choices of managing the strategic dualities i.e. exploitation versus exploration based activities in a certain complex organizational environment (Li & Wang, 2019). Scholars have suggested that strategic choice to be made between exploration and exploitation needs to be contextualized following the internal and external contingency factors (D’souza et al., 2017). Researches have debated if firms must explore or exploit in a dynamic environment (D’souza et al., 2017; Jansen et al., 2005; Li & Wang, 2019). It has been concluded that firms look forward to exploit their resources and refrain from exploring the resources in uncertain conditions and dynamic environments (Li & Wang, 2019).

Strategic choice: This is to choose the strategy to gain competitive advantage and exploit the opportunities an organization has (Barney & Hesterly, 2010). The successful organizations are the ones that ensure strategy complementing the organizational environment and support the strategy with the appropriate management process (Andrews et al., 2008). Yamakawa et al. (2011) studied organizational learning approach of information processing and strategic choice and discussed the March’s exploitation and exploration applied to the strategic options configuration.

The strategy helps organizations to position them in the competitive and rival environment, and the way it uses the limited and varied information interpretation for the competitive advantage of the company. It also builds capability of the organization to excel the execution as well as to keep the information open and ensure appropriate information sharing. Since strategy is an ongoing process, such as to ensure superior achievement in competitive environment, it also includes productive activities cross the organizations (Thompson et al., 2016).

Hence, company makes use of fit and alignment to be competitive by learning and adapt to the ever changing environment, following the information processing, which requires organizations to process external as well as internal information acquisition, interpretation, information distribution and retaining the information in to the organizational knowledge. Strategic choices followed by organizational learning are about exploiting the organization’s best experiences and from others, and also exploring the changing environment of the organization.

When management has no control over the environmental factors causing lowered strategic choice, they tend to defend their cost of products (Lawless & Finch, 1989; Miles et al., 1978). They simple adapt following the conditions in front of them. Organizations in these circumstances tend to exploit other than exploring new avenues (Holmqvist, 2003; Ojha et al., 2018).

When environment is turbulent and determinism and choice both is high organizations have wide choices to make, and can develop strategies affecting their overall outcomes. At the same time on the other hand, external environment put certain options beyond organizational control. Hence organizations adapt by choice keeping within the external constraints imposed on them. The organizations move towards more exploration than exploitation (Ojha et al., 2018).

When environmental determinism is low and strategic choice is high, organizations under these circumstances have easy access to the resources and they play openly. They adopt differentiation strategies and offer unique products to their niches, after investing in research and development, they innovate their products. In other words, organizations in such circumstances invest in explorative knowledge search to offer explorative innovation to their products (Ojha et al., 2018).

When both the strategic choice and environmental determinism are low, these are placid environments where there are threats or constraints to firms. Similarly managerial choice is low and organizations exert little emphasis on their positions. They tend to explore the options in their environments and tend to find the fit. Hence organizations in this quadrant again move towards more exploration through explorative knowledge search rather than exploitation (Ojha et al., 2018).

Hence strategic choice is all about maintaining an important fit between the organization and its environment, aligning internal organizational resources and the external dynamic environment (Barney & Hesterly, 2010; Ojha et al., 2018; Prasetya, 2017).

Munificence, dynamism and complexity are known as significant dimensions of the environment that affect the organizational strategy (Aldrich, 1979; Chen et al., 2017; Meinhardt et al., 2018; Keats & Hitt, 1985; Pfeffer & Salanick, 1978). Munificence is the scarcity or slack of the environmental resources to support the growth (Chowdhury & Sheppard, 2013; Dess & Beard, 1984; Keats & Hitt, 1985, Sheppard & Chowdhury, 2020), dynamism is the change which can hardly be predicted, while complexity is the number of linkages that an organizations needs to manage its resources (Chowdhury & Sheppard, 2013; Dess & Beard, 1984; Lawless & Finch, 1989; Sheppard & Chowdhury, 2020).

Dynamism is a change that is hard to be predicted (Chowdhury & Sheppard, 2013; Dess & Beard, 1984; Lawless & Finch, 1989; Sheppard & Chowdhry, 2020). Situations where the firms are highly dependent on the environment for everything such as resources, pricing etc. require well defined responses. The firms consider it better to invest in existing competencies rather than spending on developing the new ones.

In order to reduce the effects of dynamism; the firm’s segment homogenous elements of their external environment (Chowdhury & Sheppard, 2013; March & Simon, 1958). They tend to engage in more explorative organizational knowledge search as compared to the exploitative knowledge search leading to more explorative innovation and not exploitative innovation. Then there are situations where new entrants are attracted by munificence and hence cause enhanced dynamism (Aldrich, 1979; Chowdhury & Sheppard, 2013). This once again pushes the firms to exploit their existing set of capabilities rather than exploring the new ones. More an environment is complex; more firms will be dependent on each other (Lawless & Finch, 1989). Complexity increases with the increase in the number of competitors, supplies, and customers.

Complexity is defined as the variety with which a firm interacts (Lawless & Finch, 1989). The larger the set of interaction, higher will be the complexity, for instance; new product, diversification or market activity (Chandler, 1962; Chowdhury & Sheppard, 2013). Moreover, complexity also increases with the increase in environmental density (Aldrich, 1979; Hrebiniak & Joyce, 1985). Competing firms which are concentrated will have complexity higher in nature as compared to the firms that are dispersed (Lawless & Finch, 1989). Aldrich (1979) proposed that increase in structural complexity creates the need for the strategic activities.

Hence considering the changing external environmental conditions causing changes in the strategic choices that firms have in an industry, this study will try to find empirical evidence of when a firm should involve itself in exploring the resources and when to get involved in the exploitation of the resources. Literature has largely suggested that this balance can be maintained through organizational learning that which situations lead firms to explore and to exploit. Therefore the current study will rely on organizational theory as a lens to find the answers to the underlying research questions.

It is crucial for the firms to work in an unpredictable environment and to respond to the new situations quickly as compared to their competitors (Basten & Haamann, 2018). Under these circumstances organizational learning is one of the major sources of organizational knowledge to be developed to meet the changing requirements of the external environment (Basten & Haamann, 2018; Chiva et al., 2014). Moreover, organizational knowledge is seen as the management tasks focusing on the organizational learning is also perceived as one of the management tasks that focus on organizational strategic creation, capturing, and then internalization of knowledge (Basten & Haamann, 2018).

Despite many theoretical recommendations on balancing the exploration and exploitation, there has been no consensus on any explanation in this regards, therefore the current paper tends to seek how to create the balance between exploration-exploitation which involves knowledge search/learning. It ultimately becomes imperative to look for mechanisms that may help firms to achieve this balance and relieve the paradoxical exploration-exploitation tension

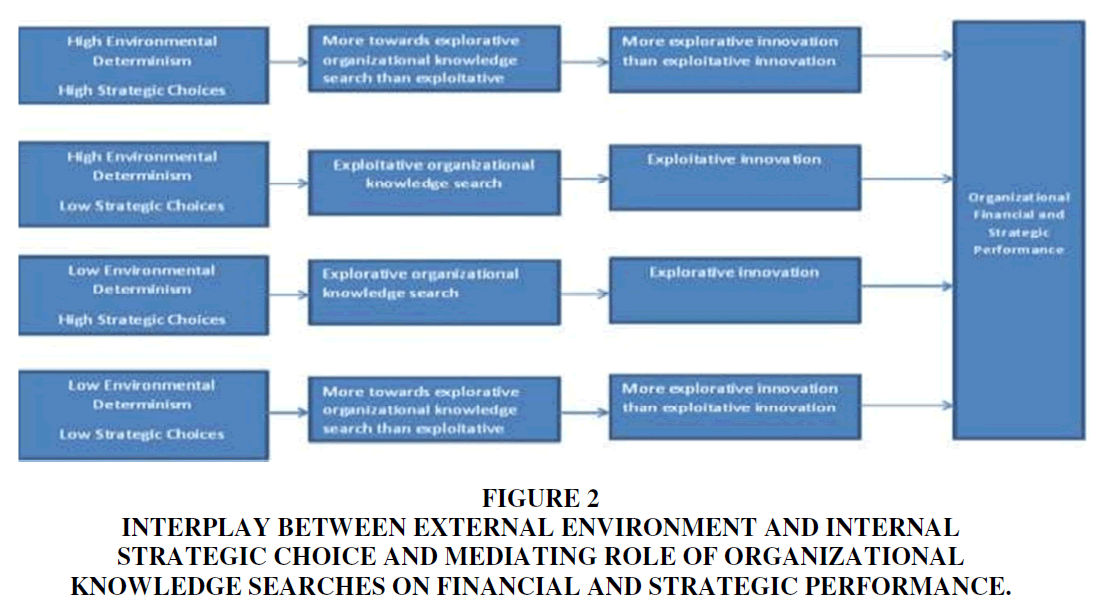

The current paper has analysed the effects of environmental determinism and strategic choices on organizational explorative and exploitative knowledge search. Also the study has examined the effect of organizational explorative and exploitative knowledge search on organizational innovation. In the end, the paper has examined whether the mediation of organizational knowledge search and explorative and exploitative innovation increase (decrease) the organizational strategic performance / financial performance based on available literature.

Since current study seeks to define; how organizations learn and decide when to explore and when to exploit; makes organizational learning theory to be a perfect lens to study how one can maintain balance between these two activities i.e. exploration and exploitation, how organizations search knowledge and how performance is affected.

Theoretical Framework

The ability to learn faster as compared to your competitors may be one and only sustainable competitive advantage (Andersen, 2016). It emphasized the vehemence compelling the management scholars and practitioners to react and appreciate the shifts around to get the work done successfully (Andersen, 2016). The process of grasping the changes around and behaving in order to complement it is called organizational learning (Fiol & Lyles, 1985; Swieringa & Wierdsma, 1992; Levitt & March, 1988; Wingrove, 2015).

The current study is focused towards seeing how an organization can learn to create a balance between exploration and exploitation in a dynamic environment and where at times strategic choice is high and at other times very low. Successful organizations are the ones which learn to successfully create a balance between exploration and exploitation. This balance between exploration and exploitation involves knowledge search and learning (Almahendra & Ambos, 2015, Blaschke & Schoeneborn, 2006; Wilden et al., 2018).

In organizational learning literature, the issue of creating a balance between exploration and exploitation has been exhibited in distinctions that have been there between refinement of the existing technology (exploitation) and invention of new ones (exploration) (Winter, 1971; Levinthal & March, 1981; March, 1991). It is confirmed that explorations reduces the speed of improvement of existing skills (March, 1991). Similarly it is also admitted that continuous improvement of existing procedures (exploitation) makes experimentation lesser attractive (Levitt & March, 1988; March, 1991).

The discussion about choice between exploration and exploitation has been mainly framed in terms of creating a balance between both the processes of variation and selection (Ashby & Ashby, 1960; Hannan & Freeman, 1987; March, 1991; Gupta et al., 2006; Lavie et al., 2010; Hughes, 2018). The tradeoff between the exploration and exploitation exhibit certain specific features in the organizational learning context following which organizations adapt accordingly (Hughes, 2018).

Organizational learning is defined as the process following which organization modify or change their rules, knowledge, procedures, and models to maintain as well as enhance their performance (Chiva et al., 2014; Basten & Haamann, 2018). Purpose of organizational learning is to adapt the organizational procedures via targeted activities (Templeton et al., 2002; Basten & Haamann, 2018).

It is critical for the organizations that work in unpredictable environment so that they may respond to unforeseen situations quickly as compared to the competitors (Basten & Haamann, 2018). Organizational learning is one of the sources of new organizational knowledge based on its nature of developing new perspectives (Basten & Haamann, 2018; Chiva et al., 2014).

This gained significance keeping in view the dynamic changes and complexities in the business environment (Basten & Haamann, 2018; Loermans, 2002). Organizational learning is also perceived as one of the management tasks that focus on organizational strategic creation, capturing, and then internalization of knowledge (Basten & Haamann, 2018). Information management is needed for positive impact and enhanced performance (Basten & Haamann, 2018; Chiva et al., 2014).

The current study seeks to define; how organizations learn and decide when to explore and when to exploit; makes organizational learning theory to be a perfect lens to study how one can maintain balance between these two activities i.e. exploration and exploitation, how organizations search knowledge and how performance is affected.

The current study interprets the organizational learning built on the following approaches that have been agreed upon by several authors, i.e. (i) survival of an organization depends on organizational ability to learn at a faster or same pace as there are changes in its environment (Burnes, 2009), (ii) learning must be collective and not an individual process (Burnes, 2009), (iii) by adopting organizational learning, an organization not learns to adapt appropriately and quickly to the changing circumstances but it changes where and if necessary (March, 1991), (iv) learning does not occur across the levels and over the time, but it also causes tension between exploration and exploiting or using what has already been learnt Crossan et al. (1999).

Hypotheses

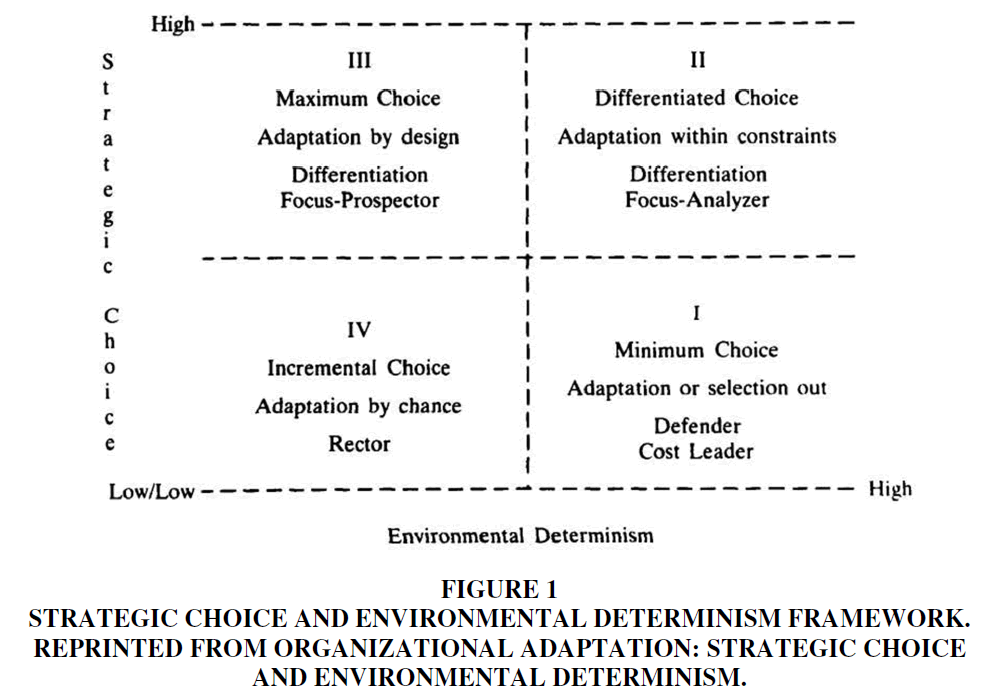

Environmental determinism is defined following the dimensions of environment specified by Dess & Beard (1984). They calculated three measures of environment i.e. munificence, dynamism, and complexity. Model of the current study has been adopted from Hrebiniak & Joyce’s (1985) model which has the same conceptual foundations; therefore it supports the same set of operationalizing the environmental dimensions (Figure 1).

Figure 1 Strategic Choice and Environmental Determinism Framework. Reprinted from Organizational Adaptation: Strategic Choice and Environmental Determinism.

Munificence, dynamism and complexity are known as significant dimensions of the environment that affect the organizational strategy (Aldrich, 1979; Chen et al., 2017; Meinhardt et al., 2018; Keats & Hitt, 1985; Pfeffer & Salanick, 1978).

Munificence is the scarcity or slack of the environmental resources to support the growth (Chowdhury & Sheppard, 2013; Dess & Beard, 1984; Keats & Hitt, 1985, Sheppard & Chowdhury, 2020), dynamism is the change which can hardly be predicted, while complexity is the number of linkages that an organizations needs to manage its resources (Chowdhury & Sheppard, 2013; Dess & Beard, 1984; Lawless & Finch, 1989; Sheppard & Chowdhury, 2020). Hrebiniak & Joyce (1985) proposed that control over the scarce resources is central to the relationship between the determinism and choice; while Dess & Beard, 1984 said that complexity and munificence of resources dependencies are distinctive constructs affecting both.

Munificence: Munificence is measured in terms of scarcity or slack of the resources (Andrevski et al., 2014; Chen et al., 2017; Chowdhury & Sheppard, 2013; Dess & Beard, 1984; Keats & Hitt, 1985; Lawless & Finch, 1989; Sheppard & Chowdhury, 2020). It is the extent to which organizations expand their area of operation in order to obtain the required resources (Aldrich, 1979). Quadrant I show low munificence; where resources are scarce. The Hrebiniak and Joyce model (1985) describes it as a market condition where firms have little choices due to the competitive forces or market determining the fair return that organizations may achieve. This quadrant clearly shows the high control over the resources. Market dictates the prices and firms are highly dependent on the resource distribution. This makes the strategic choices to be difficult because of the overall resource dependence.

Market dictates the prices and firms are highly dependent on the resource distribution. This makes the strategic choices to be difficult because of the overall resource dependence. Therefore, organizations under these circumstances are constrained to make strategic choices and they try to exercise and defend their existing strategies (Hrebiniak & Joyce, 1985). Whatever choices these firms have primary focus on the means, and different techniques to transform the inputs or in other words produce outputs efficiently so as to gain some excessive profits or short term competitive advantage (Bain, 1957; Ojha et al., 2018; Prasetya, 2017).

They do not tend to invest resources in exploring the new avenues and hence it can be said that they turn out to exploit their existing resources (Ojha et al., 2018; Prasetya, 2017). They consider it better to strengthen their set of existing resources rather than investing in to exploring the new resources to compete in the market. It is because the autonomy is at the hands of the environment and innovation is at lower end.

When munificence is higher i.e. resources are in abundance it causes higher strategic choices. Firms hence have multiple methods and means of reaching the desired outcomes (Hrebiniak & Joyce, 1985). Both the strategic choices and environmental dynamism is high and depict the turbulent context for organizational adaptation (Chowdhury & Sheppard, 2013; Emery & Trist, 1965; Sheppard & Chowdhury, 2020). Firms can switch between the resources easily and enjoy fair autonomy to make their choices. Organizations are highly regulated industries which are closely regulated in areas such as capital requirements, product characterization, performance, and legal constraints while conducting their business. However, individual choices are high considering factors such as market structure, size, multiple methods of achieving the desired coals and lowered resource dependency on external resources (Hrebiniak & Joyce, 1985). These organizations are capable of following differentiation or focus strategies (Chowdhury & Sheppard, 2013; Porter, 1980), within the constrained environment they select the segments or niches or pursue effective generic strategies although strong external forces (Berle & Means, 1932; Miles et al., 1978; Porter, 1980; Sheppard & Chowdhury, 2020; Snow & Hrebiniak, 1980). These firms will ultimately engage them in activities towards explorative organizational knowledge search as compared to the exploitative knowledge search leading to explorative innovation.

Firms are capable of choosing and defining their domains while environmental influence is low (Lawless & Finch, 1989). Considering power as one of the dependencies, firms enjoy influence over one another in their task environments (Emerson, 1962; Pfeffer, 1981). Movement of these firms between the market segments or niches is not constrained by entrance and exit barriers. Lack of dependencies on scarce resources and limited political constraints; organizations can enjoy defining, enacting, and affecting their exogenous conditions under which they desire to compete (Levine & White, 1961; Rumelt, 1974; Weick, 1979; Snow & Hrebiniak, 1980). All these conditions enable the firms to be proactive and innovative because of the benign environment (Lawrence, 1981) therefore prospectors (Miles et al., 1978) emerge because of the conditions that favor determinism and choice. Hence firms will engage them more in explorative organizational knowledge search leading to explorative innovation.

Then there are circumstances where the firms and the elements in the task environments appear to be unable or unwilling to create dependencies hence it can be argued that it is the insufficient number of inappropriate mix of internal capabilities that prevent the organizations from acting despite the munificence or lack of environmental threat (Hrebiniak & Joyce, 1985). Organizations in this context can lead to phenomena such as muddling through: description of organizational behavior (Lindblom, 1965; March & Olsen, 1976; Weick, 1979). Another explanation is that organizations here have an array of competencies and internal strengths that are not appropriate to external conditions and opportunities (Hrebiniak & Joyce, 1985). In case strategy formulation is based on the alignment of internal capabilities with external contingencies (Chandler, 1962; March, 1981; Hrebiniak & Joyce, 1984), it can be argued that insufficient number or inappropriate mix of capabilities prevent the organization from acting, despite munificence or lack of environmental threat. Task of organization hence is capabilities development or distinctive competencies that are needed to take reasonable advantage of the environmental conditions (Quinn, 1980). Such firms then develop few innovations or get engaged in no or little proactive behavior and in which distinctive competences or internal capabilities are not developed in order to take advantage of benign environment (Miles et al., 1978; Snow & Hrebiniak, 1980). Rather such firms must act to develop and get benefit from a competitive advantage or distinctive competence; for lack of poorer performance relative to others that exhibit more aggressive behavior (Porter, 1980). Another explanation is that environment is not stable and pushes organization to seek movement to another domain (Hrebiniak & Joyce, 1985). Hence these firms engage them in more explorative organizational knowledge search than exploitative knowledge search leading to more explorative innovation than the exploitative innovation.

Therefore, organizations falling in Quadrant I are constrained to make strategic choices and they try to exercise and defend their existing strategies (Hrebiniak & Joyce, 1985). Whatever choices these firms have primary focus on the means, and different techniques to transform the inputs or in other words produce outputs efficiently so as to gain some excessive profits or short term competitive advantage (Bain, 1957).

They do not tend to invest resources in exploring the new avenues and hence it can be said that they turn out to exploit their existing resources. They consider it better to strengthen their set of existing resources rather than investing in to exploring the new resources to compete in the market. It is because the autonomy is at the hands of the environment and innovation is at lower end. Hence the firms in Quadrant I will be more inclined towards exploiting their existing resources, and not in exploring the new ways of doing things.

H1: Low munificence leads firms towards exploitation of resources and not exploration of resources.

In Quadrant II and III munificence is higher i.e. resources are in abundance causing higher strategic choices.

Quadrant II represents multiple methods and means of reaching the desired outcomes (Hrebiniak & Joyce, 1985). Both the strategic choices and environmental dynamism is high and depict the turbulent context for organizational adaptation (Chowdhury & Sheppard, 2013; Emery & Trist, 1965). Firms can switch between the resources easily and enjoy fair autonomy to make their choices. The firms in this quadrant come across clear external factors affecting their decision making however enjoying choices. Organizations in this Quadrant are highly regulated industries which are closely regulated in areas such as capital requirements, product characterization, performance, and legal constraints while conducting their business. However, individual choices are high considering factors such as market structure, size, multiple methods of achieving the desired coals and lowered resource dependency on external resources (Hrebiniak & Joyce, 1985). These organizations are capable of following differentiation or focus strategies (Chowdhury & Sheppard, 2013; Porter, 1980), within the constrained environment they select the segments or niches or pursue effective generic strategies although strong external forces (Berle & Means, 1932; Miles et al., 1978; Porter, 1980; Sheppard & Chowdhury, 2020; Snow & Hrebiniak, 1980). For instance, Miles & Cameron (1982) discussed how larger companies in an industry follow focus and differentiation strategies affecting their market via extensive marketing, advertising, and lobbying despite the governmental control, regulations, mandatory warnings to consumers. Also it includes the organizations that operate in multiple niches having set of distinct constraints, opportunities and competing organizations. A multi divisional or a multi products organization with products or a business with little market as well as technological relatedness within or between the industries is another example of the scenario (Rumelt, 1974; Hrebiniak & Joyce, 1984).

These firms will ultimately engage them in activities towards explorative organizational knowledge search as compared to the exploitative knowledge search leading to explorative innovation.

Similarly in Quadrant III rather than exception, the rulers are control and autonomy (Hrebiniak & Joyce, 1985). Firms are capable of choosing and defining their domains while environmental influence is low (Lawless & Finch, 1989). Resource dependence is not an issue here (Lawrence, 1981). Considering power as one of the dependencies, firms enjoy influence over one another in their task environments (Emerson, 1962; Pfeffer, 1981). Movement of these firms between the market segments or niches is not constrained by entrance and exit barriers. Lack of dependencies on scarce resources and limited political constraints; organizations can enjoy defining, enacting, and affecting their exogenous conditions under which they desire to compete (Levine & White, 1961; Rumelt, 1974; Weick, 1979; Snow & Hrebiniak, 1980). All these conditions enable the firms to be proactive and innovative because of the benign environment (Lawrence, 1981) therefore prospectors (Miles et al., 1978) emerge because of the conditions that favor determinism and choice.

Hence firms will engage them more in explorative organizational knowledge search leading to explorative innovation.

In Quadrant IV both the firms and the elements in the task environments appear to be unable or unwilling to create dependencies hence it can be argued that it is the insufficient number of inappropriate mix of internal capabilities that prevent the organizations from acting despite the munificence or lack of environmental threat (Hrebiniak & Joyce, 1985). Organizations in this context can lead to phenomena such as muddling through: description of organizational behavior (Lindblom, 1965; March & Olsen, 1976; Weick, 1979). Another explanation of Quadrant IV is that organizations in this quadrant have an array of competencies and internal strengths that are not appropriate to external conditions and opportunities (Hrebiniak & Joyce, 1985). In case strategy formulation is based on the alignment of internal capabilities with external contingencies (Chandler, 1962; March, 1981; Hrebiniak & Joyce, 1984), it can be argued that insufficient number or inappropriate mix of capabilities prevent the organization from acting, despite munificence or lack of environmental threat. Task of organization hence is capabilities development or distinctive competencies that are needed to take reasonable advantage of the environmental conditions to space the Quadrant IV (Quinn, 1980). Such firms then develop few innovations or get engaged in no or little proactive behavior and in which distinctive competences or internal capabilities are not developed in order to take advantage of benign environment (Miles et al., 1978; Snow & Hrebiniak, 1980). Rather such firms must act to develop and get benefit from a competitive advantage or distinctive competence; for lack of poorer performance relative to others that exhibit more aggressive behavior (Porter, 1980). Another explanation is that Quadrant IV is not stable and pushes organization to seek movement to another domain (Hrebiniak & Joyce, 1985).

Hence these firms engage them in more explorative organizational knowledge search than exploitative knowledge search leading to more explorative innovation than the exploitative innovation.

H2: Higher munificence leads firms towards exploration of resources and not exploitation of resources

Dynamism: Dynamism is a change that is hard to be predicted (Chowdhury & Sheppard, 2013; Dess & Beard, 1984; Lawless & Finch, 1989; Sheppard & Chowdhry, 2020). In Quadrant I the firms are highly dependent on the environment for everything such as resources, pricing etc. and hence require well defined responses. The firms consider it better to invest in existing competencies rather than spending on developing the new ones.

In Quadrant III new entrants are attracted by munificence and hence cause enhanced dynamism (Aldrich, 1979; Chowdhury & Sheppard, 2013). This once again pushes the firms to exploit their existing set of capabilities rather than exploring the new ones.

H3: Higher dynamism leads firms towards exploitation of resources and not exploration of resources.

In Quadrant II, in order to reduce the effects of dynamism; the firms segment homogenous elements of their external environment (Chowdhury & Sheppard, 2013; March & Simon, 1958). They tend to engage in more explorative organizational knowledge search as compared to the exploitative knowledge search leading to more explorative innovation and not exploitative innovation.

In Quadrant IV dynamism is low and hence few changes in environment can be felt due to weaker connections of the firms (Chowdhury & Sheppard, 2013; Emery & Trist, 1965). Therefore, organizations here

H4: Lower dynamism leads firms towards exploration of resources and not exploitation of resources.

Complexity: More an environment is complex; more firms will be dependent on each other (Lawless & Finch, 1989). Complexity increases with the increase in the number of competitors, supplies, and customers. Complexity is defined as the variety with which a firm interacts (Lawless & Finch, 1989). The larger the set of interaction, higher will be the complexity, for instance; new product, diversification or market activity (Chandler, 1962; Chowdhury & Sheppard, 2013). Moreover, complexity also increases with the increase in environmental density (Aldrich, 1979; Hrebiniak & Joyce, 1985). Competing firms which are concentrated will have complexity higher in nature as compared to the firms that are dispersed (Lawless & Finch, 1989). Aldrich (1979) proposed that increase in structural complexity creates the need for the strategic activities.

Quadrant I have high complexity as firms face similar constraints or price competition (Hrebiniak & Joyce, 1985). Such price competitive environment seeks firm to monitor their suppliers, competitors, and customers in order to adapt accordingly (Lawless & Finch, 1989). Considering the factors, organizations tend to exploit their existing suppliers, and compete the rivals and serve the customers.

In Quadrant IV, internal dependencies of the firm prevent the development of relationships outside the firm (Hrebiniak & Joyce, 1989). Few linkages between the firms and their environment lead to lower complexity (Lawless & Finch, 1989). Lower complexity enables organizations to learn new ways of doing business, and developing their existing products and processes, ultimately leading organizations towards explorative learning and not exploitative learning.

H5: Higher complexity leads firms towards exploitation of resources and not exploration of resources.

In Quadrant II, the environment which is highly constrained increases the complexity yet again (Hrebiniak & Joyce, 1985). Environment is highly deterministic and at the same time strategic choice for firms is high as well as they can adapt by selecting the niches within the environmental constraints (Hrebiniak & Joyce, 1985).

Organizations are aware of the fact that when they can make their own strategies, they have enough room to explore the knowledge and look for new ways of doing work effectively rather focusing on the existing organizational knowledge.

In Quadrant III, there is lower dependency of firms on each other due to flexibility and slack resources. Firms decide to change, increase or reduce the linkages by choice. “Hence organizational learning is focused more towards exploration rather than exploitation. They invest in research and development, innovate their products and so on.”

H6: Lower complexity leads firms towards exploration of resources and not exploitation of resources.

Strategic choice: Organizational learning related to strategic choices is significant, to understand the fit between the organization, its environment and alignment of internal resources. Strategic choice is to choose the strategy to gain competitive advantage and exploit the opportunities an organization has (Barney & Hesterly, 2010). The successful organizations are the ones that ensure strategy complementing the organizational environment and support the strategy with the appropriate management process (Andrews et al., 2008). Organizations keep on fine tuning the strategies, adjusting them and then responding to the unfolding events (Anderson & Simester, 2011). Hence, Schumpeter (2015) said that strategic choice is a palate of plans since choosing strategy is more complex for any organization that it is used to be. Similarly Yamakawa et al. (2011) studied organizational learning approach of information processing and strategic choice and discussed the March’s exploitation and exploration applied to the strategic options configuration.

The strategy helps organizations to position them in the competitive and rival environment, and the way it uses the limited and varied information interpretation for the competitive advantage of the company. It also builds capability of the organization to excel the execution as well as to keep the information open and ensure appropriate information sharing. Since strategy is an ongoing process, such as to ensure superior achievement in competitive environment, it also includes productive activities cross the organizations (Thompson et al., 2016). Hence, company makes use of fit and alignment to be competitive by learning and adapt to the ever changing environment, following the information processing, which requires organizations to process external as well as internal information acquisition, interpretation, information distribution and retaining the information in to the organizational knowledge. Since the information in an organization is collective understanding, therefore organizations need to reload how the information is related to the current capabilities of the organization and future scenarios as well. Strategic choices followed by organizational learning are about exploiting the organization’s best experiences and from others, and also exploring the changing environment of the organization.

Miller (1986) empirically supports four business level strategy types: differentiation, cost leadership, asset parsimony, and focus. First one is the differentiation strategies. Differentiation is the products and services offerings that are considered unique in the industry and hence reflect the differentiation strategies (Porter, 1980; Lawless & Finch, 1989). Miller (1986) proposed two varieties of differentiation i.e. innovating differentiations and marketing differentiations. Innovating differentiation is when new products and technologies come out putting emphasis on research and development (R & D) (Miles et al., 1978; Miller & Friesen, 1984) while marketing differentiation focuses on personal promotion, sales, and distribution making larger expenditures in all those area (Miller & Friesen, 1984).

Second ones are the cost leadership strategies with focus on being the lowest cost producers in the industry where per unit cost is minimized (Porter, 1980).

Third ones are the focus strategies designating niches in the industry where the firms look for some particular type of customer, geographic concentration or products via cost leader or differentiation strategies (Porter, 1980).

Asset parsimony are the forth type of strategies which look forward to reduce the assets per unit of output. These strategies are appropriate for cost leaders working in a stable environment or for the differentiators in flexible environments (MacMillan & Hambrick, 1985). Following the Hrebiniak & Joyce’s model in the current study, in Quadrant I virtually management has no control over the environmental factors causing lowered strategic choice. Since organizations cannot influence their market and position in the competitive environment they tend to defend their cost of products (Lawless & Finch, 1989; Miles et al., 1978). They simply adapt following the conditions in front of them. “Organizations in these circumstances tend to exploit other than exploring new avenues.”

H7: Lower strategic choice leads firms towards exploitation of resources and not exploration of resources.

In Quadrant II, environment is turbulent and determinism and choice both is high. Organizations have wide choices to make, and can develop strategies affecting their overall outcomes. At the same time on the other hand, external environment put certain options beyond organizational control. Hence organizations adapt by choice keeping within the external constraints imposed on them. The organizations then follow the differentiation or focus strategies and tend to control their position by focusing on exploring the parts of environment that is in their control. In short, organizations in this quadrant move towards more exploration than exploitation.

In Quadrant III, environmental determinism low and strategic choice is high, organizations under these circumstances have easy access to the resources and they play openly. They adopt differentiation strategies and offer unique products to their niches, after investing in research and development, innovating their products. In other words, organizations in this quadrant invest in explorative knowledge search to offer explorative innovation to their products.

In Quadrant IV both the strategic choice and environmental determinism are low. These are placid environments where there are threats or constraints to firms. Similarly managerial choice is low and organizations exert little emphasis on their positions. They tend to explore the options in their environments and tend to find the fit. Hence organizations in this quadrant again move towards more exploration through explorative knowledge search rather than exploitation.

H8: Higher strategic choice leads firms towards exploration of resources and not exploitation of resources.

Explorative and Exploitative Knowledge Search and Firm Performance

Exploratory knowledge search has been defined as knowledge characterized by experimentation, search, variations, risk takings, and flexibility discovery (Almahendra & Ambos, 2015; March, 1991; Tian et al., 2020). Exploratory knowledge search leads to exploratory learning which has been characterized by various experiences, experimentation, and risk taking (Levinthal & March, 1993; Tian et al., 2020). Exploratory learning is also related to the acquisition of knowledge (Lane et al., 2006). The competence of exploration is based on the resource investment with the aim of gaining new knowledge, skills and processes, facilitating in adapting to the environmental changes in long run (March, 1991; Tian et al., 2020). Hence most of the organizations adopt the exploratory knowledge search initiating with scanning of the organizational environment and recognize the useful resources. This exploratory knowledge search process is led exploratory learning to recognize the knowledge and assimilate the acquired knowledge (Arbussa & Coenders, 2007). These procedures move towards exploratory innovation which constitutes broader content i.e. developing new technologies, new products and new services, creating new plans, managerial systems and procedures (Damanpour, 1996; Li et al., 2010). Exploratory innovations are radical innovations which have been designed to pursue the emerging probabilities (March, 1991; Li et al., 2010). Exploratory innovations tend to gain completely new knowledge and to move from existing knowledge (Benner & Tushman, 2002; Jansen et al., 2005; Levinthal & March, 1993; Li et al., 2010). Exploratory innovation enhances the competitive power in long run and increase the future income (March, 1991; Li et al., 2010).

Organizations preserve the knowledge for years and use at the time of need (Lane et al., 2006; Lichtenthaler, 2009). When organizations work in turbulent environment, certain skills become temporarily irrelevant in enhancing the organizational performance (Lane et al., 2006). This explored and acquired knowledge is preserved in firms until they exploit it when needed.

In exploitative learning, focus of the firms is to utilize the existing capabilities and knowledge in innovation and business processes. This is simply elaboration, reutilization, and refinement of the existing experiences of organizations that were when discovered during the exploration phase (Holmqvist, 2003; Ojha et al., 2018). Competence of exploitative learning is focused on the investment of a firm in refining and extending the existing organizational innovation knowledge, processes, and skills (March, 1991; Tian et al., 2020). Exploitative learning focuses on synchronization of the market demands and organizational technological knowledge in development of goods and services that are based on the previous experiences of the firm (Lenox & King, 2004; Rothaermel & Deeds, 2004; Tian et al., 2020). Exploitative learning allows the firms to sharpen their existing knowledge and capabilities to innovate the products that competes the short term market conditions in a favorable manner (March, 1991).

Exploitative innovations are basically incremental innovations which have been designed to enhance and improve the existing situations (March, 1991; Li et al., 2010). Exploitative innovation of the firms enhances the already established designs; broaden the existing skills and knowledge, enhance and extend the available product lines, enhance the efficiency of existing supply and distribution channels and better services for the existing customers (Benner & Tushman, 2003; Li et al., 2010, Jansen et al., 2005). Exploitative innovations are built on existing knowledge and tend to refine, reinforce, integrate and enhance it (Benner & Tushman, 2002; Levinthal & March, 1993; Li et al., 2010). Exploitative innovations enhance the efficiency in short term and add to the current income (March, 1991; Li et al., 2010).

Exploratory innovations and exploitative innovations enhance the firm performance in different aspects. Explorative innovations enhance the competitive power in long run adding to the future income while exploitative innovations increase the competitive power in short term and add to the current income (March, 1991; Li et al., 2010). There are close relations between long term as well as short term performance and hence it can be stated that exploratory innovations and exploitative innovations positively affect the holistic organizational performance (Li et al., 2010). Researches have concluded that firms can build on explorative as well as exploitative activities to improve their financial performance (Berraies & Bchini, 2019; Uotila et al., 2009).

Similarly another study found a strong positive link between the explorative and exploitative innovation strategies and firm performance (Sanal et al., 2013). In another study it was demonstrated that exploratory innovation predicts firm performance in dynamic environment in a positive manner while exploitative innovation positively predicts the financial performance in a competitive environment (Jansen et al., 2005). Berraies et al. (2014) concluded the performance of a firm is associated with explorative innovation and exploratory innovation. Moreover, in another study Berraies & Hamouda (2018) revealed that exploratory and exploitative innovation is strong determinants of a firm’s financial performance.

This is explained by Schamberger et al. (2013) that firms can improve their financial performance in short term via exploiting and refining their existing competencies and knowledge while in long term companies rely on exploring new opportunities and learning new knowledge because the current skills and knowledge must be renewed in order to meet the customer needs as well as environmental changes. In the very same manner Oehmichen et al. (2017) and Millar, et al. (2017) stressed that firms need to balance the exploration and exploitation to renew their knowledge base (Figure 2). Hence it is hypothesized that:

Figure 2 Interplay Between External Environment and Internal Strategic Choice and Mediating Role of Organizational Knowledge Searches on Financial and Strategic Performance.

H9: Higher determinism and lower choice environment, leads organizations more towards exploitative innovation through exploitative knowledge search and positively enhances the firm’s financial and strategic performance.

H10: Lower determinism and higher choice environment, leads organizations move towards explorative innovation through explorative knowledge search and positively enhances the firm’s financial and strategic performance.

H11: Higher determinism and high choice environment, leads organizations move more towards explorative innovation through explorative knowledge search and positively enhances the firm’s financial and strategic performance.

H12: Low determinism and low choice environment, leads organization move more towards explorative innovation through explorative knowledge search and positively enhance the firm’s financial and strategic performance.

Significance of the Study

This research is an attempt to present a theory based on available literature explaining contexts and mechanisms through which organizations will know when they should explore and when they should exploit. Furthermore, empirical evidence will explain new insights for managerial decision making about when they must exploit and explore leading to appropriate resource allocation. Understanding the dynamic of balancing the mechanism, better decision to prioritize resource allocation and enhance the performance along the exploitation and exploration tensions. From academic point of view, this study will try to add valuably for the organizational learning theory.

Limitations

This paper is theoretical representation of how organizations interplay between their external environment and internal choices. Due to constrained time, presented theory has not been tested. Empirical study must be conducted to test the presented theory in the current paper. The study can be based on either based on quantitative or qualitative methodology. Since the issue of creating balance between the explorative and exploitative strategies is same in all parts of the world, therefore the empirical study based on quantitative or qualitative will be helpful in understanding the internal strategic choices of the organizations.

Conclusion

The current study attempts to present the literature explaining the effects of environmental determinism and strategic choices on organizational explorative and exploitative knowledge search, and whether the mediation of organizational knowledge search and explorative and exploitative innovation increase (decrease) the organizational strategic performance/financial performance. Most part of research provides a solid theoretical but inconclusive empirical explanation of when organizations must involve them in exploration and when these should exploit their resources.

Moreover, empirical literature of organizational balance of exploration and exploitation is insufficient and demands further work on relieving paradoxical exploitation – exploration tension. Prior studies on understanding the dynamic balancing mechanism are mostly done examining the effects of exploration exploitation balance to be successful in the industry. Empirical explanation of when organizations should explore and exploit literature is lacking, which will push future studies to analyse the scenarios when organizations should be involved in exploration and exploitation.

Acknowledgement

The authors would like to acknowledge the support of Prince Sultan University for paying the Article Processing Charges (APC) of this publication.

References

Aldrich, H.E. (1979). 1979 Organizations and environments. Englewood Cliffs NJ: Prentice-Hall.

Almahendra, R., & Ambos, B. (2015). Exploration and exploitation: A 20-year review of evolution and reconceptualisation. International Journal of Innovation Management, 19(1), 1550008.

Indexed at, Google Scholar, Cross Ref

Andersen, E. (2016). Learning to learn. Harvard Business Review, 94(3), 98-101.

Anderson, E.T., & Simester, D. (2011). A step-by-step guide to smart business experiments. Harvard Business Review, 89(3), 98-105.

Indexed at, Google Scholar, Cross Ref

Andrevski, G., Richard, O.C., Shaw, J.D., & Ferrier, W.J. (2014). Racial diversity and firm performance: The mediating role of competitive intensity. Journal of Management, 40(3), 820-844.

Indexed at, Google Scholar, Cross Ref

Andrews, R., Boyne, G.A., Meier, K.J., O'toole, L.J., & Walker, R.M. (2008). Strategic fit and performance: a test of the Miles and Snow model. In Conference on Organizational Strategy, Structure, and Process: A Reflection on the Research Perspective of Miles and Snow.

Arbussa, A., & Coenders, G. (2007). Innovation activities, use of appropriation instruments and absorptive capacity: Evidence from Spanish firms. Research Policy, 36(10), 1545-1558.

Indexed at, Google Scholar, Cross Ref

Ashby, W., & Ashby, W.R. (1960). Design for a brain: The origin of adaptive behaviour (No. 10). Springer.

Indexed at, Google Scholar, Cross Ref

Bain, J.S. (1959). Industrial organization. New York: Wiley.

Barney, J.B., & Hesterly, W.S. (2010). Strategic management and competitive advantage: Concepts. Englewood Cliffs, NJ: Prentice hall, 408-409.

Basten, D., & Haamann, T. (2018). Approaches for organizational learning: A literature review. SAGE Open, 8(3), 2158244018794224.

Indexed at, Google Scholar, Cross Ref

Benner, M.J., & Tushman, M. (2002). Process management and technological innovation: A longitudinal study of the photography and paint industries. Administrative Science Quarterly, 47(4), 676-707.

Indexed at, Google Scholar, Cross Ref

Benner, M.J., & Tushman, M.L. (2003). Exploitation, exploration, and process management: The productivity dilemma revisited. Academy of Management Review, 28(2), 238-256.

Indexed at, Google Scholar, Cross Ref

Berle, A.A., & Means, G.C. (1932). The Modern Corporation and private property. New York: Macmillan.

Berraies, S., & Bchini, B. (2019). Effect of leadership styles on financial performance: Mediating roles of exploitative and exploratory innovations case of knowledge-intensive firms. International Journal of Innovation Management, 23(3), 1950020.

Indexed at, Google Scholar, Cross Ref,

Berraies, S., & Hamouda, M. (2018). Customer empowerment and firms’ performance. International Journal of Bank Marketing.

Indexed at, Google Scholar, Cross Ref

Berraies, S., Chaher, M., & Yahia, K.B. (2014). Employee empowerment and its importance for trust, innovation and organizational performance. Business Management and Strategy, 5(2), 82-103.

Indexed at, Google Scholar, Cross Ref

Blaschke, S., & Schoeneborn, D. (2006). The forgotten function of forgetting: Revisiting exploration and exploitation in organizational learning. Soziale Systeme, 12(1), 99-119.

Indexed at, Google Scholar, Cross Ref

Burnes, B. (2009). Reflections: Ethics and organizational change–Time for a return to Lewinian values. Journal of Change Management, 9(4), 359-381.

Indexed at, Google Scholar, Cross Ref

Chandler, A.D. (1962). 1998, strategy and structure: Chapters in the history of the American industrial enterprise.

Indexed at, Google Scholar, Cross Ref,

Chen, H., Zeng, S., Lin, H., & Ma, H. (2017). Munificence, dynamism, and complexity: How industry context drives corporate sustainability. Business Strategy and the Environment, 26(2), 125-141.

Indexed at, Google Scholar, Cross Ref

Chiva, R., Ghauri, P., & Alegre, J. (2014). Organizational learning, innovation and internationalization: A complex system model. British Journal of Management, 25(4), 687-705.

Indexed at, Google Scholar, Cross Ref

Chowdhury, S.D., & Sheppard, J.P. (2013). Strategy, Choice, Determinism, and Change in Organizational Task Environments: Empirical Evidence. In Academy of Management Proceedings. Briarcliff Manor, NY 10510: Academy of Management, 1(1), 14379.

Indexed at, Google Scholar, Cross Ref

Crossan, M.M., Lane, H.W., & White, R.E. (1999). An organizational learning framework: From intuition to institution. Academy of Management Review, 24(3), 522-537.

Indexed at, Google Scholar, Cross Ref

D’Souza, D.E., Sigdyal, P., & Struckell, E. (2017). Relative ambidexterity: A measure and a versatile framework. Academy of Management Perspectives, 31(2), 124-136.

Indexed at, Google Scholar, Cross Ref,

Damanpour, F. (1996). Organizational complexity and innovation: developing and testing multiple contingency models. Management science, 42(5), 693-716.

Indexed at, Google Scholar, Cross Ref

Dess, G.G., & Beard, D.W. (1984). Dimensions of organizational task environments. Administrative Science Quarterly, 52-73.

Indexed at, Google Scholar, Cross Ref

Drucker, P.F. (1986). Innovation and entrepreneurship: Practice and principles. New York: Harper & Row.

Indexed at, Google Scholar, Cross Ref

Emerson, R.M. (1962). Power-dependence relations. American Sociological Review, 31-41.

Indexed at, Google Scholar, Cross Ref,

Emery, F.E., & Trist, E.L. (1965). The causal texture of organizational environments. Human relations, 18(1), 21-32.

Indexed at, Google Scholar, Cross Ref

Fiol, C.M., & Lyles, M.A. (1985). Organizational learning. Academy of Management Review, 10(4), 803-813.

Gupta, A.K., Smith, K.G., & Shalley, C.E. (2006). The interplay between exploration and exploitation. Academy of Management Journal, 49(4), 693-706.

Indexed at, Google Scholar, Cross Ref

Hannan, M. T., & Freeman, J. (1987). The ecology of organizational founding: American labor unions, 1836-1985. American Journal of Sociology, 92(4), 910-943.

Indexed at, Google Scholar, Cross Ref

Holmqvist, M. (2003). A dynamic model of intra-and interorganizational learning. Organization Studies, 24(1), 95-123.

Indexed at, Google Scholar, Cross Ref

Hrebiniak, L.G., & Joyce, W.F. (1985). Organizational adaptation: Strategic choice and environmental determinism. Administrative Science Quarterly, 336-349.

Indexed at, Google Scholar, Cross Ref

Hughes, M. (2018). Organisational ambidexterity and firm performance: burning research questions for marketing scholars. Journal of Marketing Management, 34(1-2), 178-229.

Indexed at, Google Scholar, Cross Ref

Jansen, J.J., Van Den-Bosch, F.A., & Volberda, H.W. (2005). Managing potential and realized absorptive capacity: how do organizational antecedents matter?. Academy of Management Journal, 48(6), 999-1015.

Indexed at, Google Scholar, Cross Ref

Keats, B.W. & Hitt, M.A. (1985). Linkages among environmental dimensions and macro-organizational characteristics: A causal modelling approach. Academy of Management Proceedings, 1985(1), 171-175.

Indexed at, Google Scholar, Cross Ref

Lane, P.J., Koka, B.R., & Pathak, S. (2006). The reification of absorptive capacity: A critical review and rejuvenation of the construct. Academy of Management Review, 31(4), 833-863.

Indexed at, Google Scholar, Cross Ref

Lavie, D., Stettner, U., & Tushman, M.L. (2010). Exploration and exploitation within and across organizations. Academy of Management Annals, 4(1), 109-155.

Indexed at, Google Scholar, Cross Ref

Lawless, M.W., & Finch, L.K. (1989). Choice and determinism: A test of Hrebiniak and Joyce's framework on strategy?environment fit. Strategic Management Journal, 10(4), 351-365.

Indexed at, Google Scholar, Cross Ref

Lawrence, P. R. (1981). The Harvard organization and environment research program. Perspectives on Organization Design and Behavior, 311-337.

Lenox, M., & King, A. (2004). Prospects for developing absorptive capacity through internal information provision. Strategic Management Journal, 25(4), 331-345.

Indexed at, Google Scholar, Cross Ref

Levine, S., & White, P.E. (1961). Exchange as a conceptual framework for the study of interorganizational relationships. Administrative Science Quarterly, 583-601.

Indexed at, Google Scholar, Cross Ref

Levinthal, D.A., & March, J.G. (1993). The myopia of learning. Strategic Management Journal, 14(S2), 95-112.

Indexed at, Google Scholar, Cross Ref

Levinthal, D., & March, J.G. (1981). A model of adaptive organizational search. Journal of Economic Behavior & Organization, 2(4), 307-333.

Indexed at, Google Scholar, Cross Ref

Levitt, B., & March, J.G. (1988). Organizational learning. Annual Review of Sociology, 14(1), 319-338.

Li, W., & Wang, L. (2019). Strategic choices of exploration and exploitation alliances under market uncertainty. Management Decision.

Indexed at, Google Scholar, Cross Ref

Li, Y., Zhou, N., & Si, Y. (2010). Exploratory innovation, exploitative innovation, and performance. Nankai Business Review International.

Indexed at, Google Scholar, Cross Ref

Lichtenthaler, U. (2009). Absorptive capacity, environmental turbulence, and the complementarity of organizational learning processes.

Indexed at, Google Scholar, Cross Ref

Lindblom, C.E. (1965). The intelligence of democracy: Decision making through mutual adjustment. Free Pr.

Indexed at, Google Scholar, Cross Ref

Loermans, J. (2002). Synergizing the learning organization and knowledge management. Journal of Knowledge Management.

Indexed at, Google Scholar, Cross Ref

MacMillan, I.C., & Hambrick, D.C. (1985). Capital intensity, market share instability and profits: The case for asset parsimony. Wharton School of the University of Pennsylvania, Snider Entrepreneurial Center.

March, J.G. (1981). Decisions in organizations and theories of choice. Perspectives on Organization Design and Behavior, 205, 44-52.

March, J.G. (1991). Exploration and exploitation in organizational learning. Organization Science, 2(1), 71-87.

Indexed at, Google Scholar, Cross Ref

March, J.G., & Olsen, J.P. (1976). Organizational choice under ambiguity. Ambiguity and Choice in Organizations, 2(1), 10-23.

March, J.G., & Simon, H.A. (1958). Organization New York.

Meinhardt, R., Junge, S., & Weiss, M. (2018). The organizational environment with its measures, antecedents, and consequences: A review and research agenda. Management Review Quarterly, 68(2), 195-235.

Indexed at, Google Scholar, Cross Ref

Miles, R.E., Snow, C.C., Meyer, A.D., & Coleman Jr, H.J. (1978). Organizational strategy, structure, and process. Academy of Management Review, 3(3), 546-562.

Indexed at, Google Scholar, Cross Ref

Miles, R.H., & Cameron, K.S. (1982). Coffin nails and corporate strategies. Prentice Hall.

Millar, C.C., Chen, S., & Waller, L. (2017). Leadership, knowledge and people in knowledge-intensive organisations: Implications for HRM theory and practice.

Indexed at, Google Scholar, Cross Ref

Miller, D. (1986). Configurations of strategy and structure: Towards a synthesis. Strategic Management Journal, 7(3), 233-249.

Indexed at, Google Scholar, Cross Ref

Miller, D., & Friesen, P.H. (1984). Organizations: A quantum view. Prentice Hall.

Indexed at, Google Scholar, Cross Ref

Nadkarni, S., & Barr, P.S. (2008). Environmental context, managerial cognition, and strategic action: An integrated view. Strategic Management Journal, 29(13), 1395-1427.

Indexed at, Google Scholar, Cross Ref

Oehmichen, J., Heyden, M. L., Georgakakis, D., & Volberda, H.W. (2017). Boards of directors and organizational ambidexterity in knowledge-intensive firms. The International Journal of Human Resource Management, 28(2), 283-306.

Indexed at, Google Scholar, Cross Ref

Ojha, D., Struckell, E., Acharya, C., & Patel, P.C. (2018). Supply chain organizational learning, exploration, exploitation, and firm performance: A creation-dispersion perspective. International Journal of Production Economics, 204, 70-82.

Indexed at, Google Scholar, Cross Ref

Pfeffer, J. (1981). Power in organizations (Pitman, Marshfield, MA). Pfeffer Power in Organizations1981.

Pfeffer, J., & Salancik, G.R. (1978). Social control of organizations. The external control of organizations: A resource Dependence Perspective.

Porter, M. (1980). Competitive strategy. New York: Free Press.

Prasetya, A.B. (2017). Organizational lerning and strategy: Information processing approach of organizaitonal learning to perform strategic choice analysis. The Winners, 18(1), 25-32.

Indexed at, Google Scholar, Cross Ref

Quinn, J.B. (1980). Strategies for change: Logical incrementalism. Irwin Professional Publishing.

Rothaermel, F.T., & Deeds, D.L. (2004). Exploration and exploitation alliances in biotechnology: A system of new product development. Strategic Management Journal, 25(3), 201-221.

Indexed at, Google Scholar, Cross Ref

Rumelt, R.P. (1974). Strategy, structure, and economic performance.

Sanal, M., Alpkan, L., Aren, S., Sezen, B., & Ayden, Y. (2013). Linking market orientation and ambidexterity to financial returns with the mediation of innovative performance. Journal of Economic and Social Research, 15(1), 31-43.

Schamberger, D.K., Cleven, N.J., & Brettel, M. (2013). Performance effects of exploratory and exploitative innovation strategies and the moderating role of external innovation partners. Industry and Innovation, 20(4), 336-356.

Indexed at, Google Scholar, Cross Ref

Schumpeter. (2015). A palette of plans.

Sheppard, J.P., & Chowdhury, S.D. (2020). Nothing endures but change: studying changes in industry choice and determinism. In Adapting to Environmental Challenges: New Research in Strategy and International Business. Emerald Publishing Limited, 19-34.

Indexed at, Google Scholar, Cross Ref

Snow, C.C., & Hambrick, D.C. (1980). Measuring organizational strategies: Some theoretical and methodological problems. Academy of Management Review, 5(4), 527-538.

Indexed at, Google Scholar, Cross Ref

Snow, C.C., & Hrebiniak, L.G. (1980). Strategy, distinctive competence, and organizational performance. Administrative Science Quarterly, 317-336.

Indexed at, Google Scholar, Cross Ref

Swieringa, J., & Wierdsma, A.F. (1992). Becoming a learning organization: Beyond the learning curve. Addison-Wesley Longman Limited, 62753.

Templeton, G.F., Lewis, B.R., & Snyder, C.A. (2002). Development of a measure for the organizational learning construct. Journal of Management Information Systems, 19(2), 175-218.

Indexed at, Google Scholar, Cross Ref

Thompson, A., Peteraf, M., Gamble, J., & Stricland, A. J. (2018). Crafting and executing strategy: the quest for competitive advantage. New York, USA: McGraw-Hill Education.

Tian, H., Dogbe, C.S.K., Pomegbe, W.W.K., Sarsah, S.A., & Otoo, C.O.A. (2020). Organizational learning ambidexterity and openness, as determinants of SMEs' innovation performance. European Journal of Innovation Management.

Indexed at, Google Scholar, Cross Ref

Uotila, J., Maula, M., Keil, T., & Zahra, S.A. (2009). Exploration, exploitation, and financial performance: analysis of S&P 500 corporations. Strategic Management Journal, 30(2), 221-231.

Weick, K.E. (1979). The social psychology of organizing. Reading, MA: Addison-Wesley.

Wilden, R., Hohberger, J., Devinney, T.M., & Lavie, D. (2018). Revisiting James March (1991): whither exploration and exploitation? Strategic Organization, 16(3), 352-369.

Indexed at, Google Scholar, Cross Ref

Wingrove, L. (2015). The history of learning and development: 1800-1945.

Winter, S.G. (1971). Satisficing, selection, and the innovating remnant. The Quarterly Journal of Economics, 85(2), 237-261.

Indexed at, Google Scholar, Cross Ref

Yamakawa, Y., Yang, H., & Lin, Z.J. (2011). Exploration versus exploitation in alliance portfolio: Performance implications of organizational, strategic, and environmental fit. Research Policy, 40(2), 287-296.

Indexed at, Google Scholar, Cross Ref

Received: 18-Jan-2022, Manuscript No. JLERI-22-10902; Editor assigned: 20-Jan-2022, PreQC No. JLERI-22-10902(PQ); Reviewed: 03-Feb-2022, QC No. JLERI-22-10902; Revised: 04-Mar-2022, Manuscript No. JLERI-22-10902(R); Published: 11-Mar-2022