Research Article: 2021 Vol: 24 Issue: 1S

Legal Implication of ASEAN Law Economic Community to Indonesia's Economic Competitiveness on Investment and Trade

Prita Amalia, Universitas Padjadjaran

An An Chandrawulan, Universitas Padjadjaran

Danrivanto Budhijanto, Universitas Padjadjaran

Keywords

ASEAN Economic Community; Indonesia Economic Competitiveness; Investment and Trade

Abstract

In 2007, ASEAN becomes international organization with legal personality after the ASEAN charter. ASEAN turns out to be stronger since established based on Bangkok Declaration 1967. One of the ASEAN vision after charter is to establish economic integrity between ASEAN member countries through ASEAN Economic Community. Indonesia as member of ASEAN should also prepare and contribute to conduct ASEAN Economic Community based on ASEAN blue print 2015 to give mutual benefit between ASEAN member countries and as international obligation. The implementation of AEC would be influence policy each ASEAN member countries include Indonesia. This study aims to discover legal implication of AEC establishment to national economic competitiveness on investment and trade sector. The research will conduct to identify the obligation of AEC which are govern on ATIGA and ACIA, that binding for every member countries, include Indonesia and to identify to what extend Indonesia should improve economic competitiveness by modernizing domestic law on investment and trade sector.

Introduction

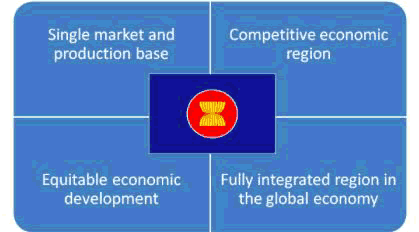

The acquaintance of ASEAN Economic Community (AEC) became important for every citizen from ASEAN Countries. It is also more important to understand the obligation of ASEAN Countries to support the establishment of AEC, which implemented on their national law. ASEAN aims to have economic integrity among ASEAN Countries by single market concept. (Woo, 2015) described that further production base, highly competitive economic region, a region equitable economic development and region fully integrated into the global economy are the key characteristics from the AEC as described by this Figure 1.

The economic integration shows to what extend the international organization and their member countries has an ability to have economic cooperation. By AEC there would be free movement of goods, services, and investment with the free flow of capital and skills. Indonesia as one of member countries should prepare all the aspects in facing the AEC include the domestic law on investment and trade. Indonesia would conduct the investment and trade competitively between ASEAN member countries. It means that Indonesia should increase the national economic competitiveness to face AEC.

Indonesia ratified the ASEAN Charter by Law No 38/2018 and should implement the AEC for investment and trade sector in national law. There is also a concept of trade liberalization between ASEAN member countries as single market. ASEAN consists of 10 countries, which has different capability on economic cooperation but they would conduct investment and trade with the same aim and law between ASEAN members countries based on ASEAN treaty (Sally, 2010). The ASEAN member countries have different policy in facing the liberalization, since they have different potentiality. As an example, Singapore and Vietnam implement different policy to solve the Asian Crisis. Singapore accelerated unilateral liberalization in services while Vietnam accelerated its external liberalization and structural reforms based on WTO accession in 2007.

Since, all ASEAN countries will play the game with the same rules based on ASEAN treaty, each member countries should convince that their national law supports the realization of AEC for the countries and also another ASEAN member countries as partner of investment and trade. There are several agreement signed by ASEAN to support AEC realization. There are ASEAN Trade in Goods Agreement (ATIGA), ASEAN Framework Agreement on Services (AFAS) and ASEAN Comprehensive Investment Agreement (ACIA). Based on Law No 24/ 2000 on Treaty, Indonesia ratified ATIGA with President Regulation No 2/ 2010 and ACIA with President Regulation No 49/ 2011. Indonesia regulated International Treaty based on Law No 24/ 2000. Further on Article 10 and 11, stated about Indonesia instrument of ratification, which the ratification could be confirmed by Law or Act and for the technical treaty, will be ratified with President Regulation.

To discover the legal implication of AEC to Indonesia National Competitiveness on investment and trade sector, the study will begin with exploring the international obligation that bind to Indonesia as ASEAN Countries in both sector Investment and Trade. Further, this article also identifies to what extend does Indonesia implement those international obligation from ATIGA and ACIA on national law by exploring Law No 7/ 2014 as one of law on trade in Indonesia, and Law No 25/ 2007 on Investment. The harmonization of law and regulation on investment and trade sector between ASEAN treaty and national law will increase national competitiveness and support the realization of AEC.

Since the study of AEC nowadays is important for ASEAN member countries, this article would explain clearly the framework of AEC include the aims, purposes and programs generally, which should comply by all ASEAN member countries. Furthermore, the understanding of the international obligation for each member countries based on ATIGA and ACIA would emphasize and explain all the principles from the agreement. Law and regulation in Indonesia would be explored to identify in terms of harmonize with all ASEAN treaty for investment and trade. Another regulation to support the AEC, Indonesia also releases the President Instruction on Improving National Competitiveness in order to face AEC. The instructions are also for investment and trade sector, which could use as strategy in facing AEC.

After describing and explaining the obligation from the ASEAN treaty and also identifying to what extend the existing Indonesia Law in order to face AEC, the article would respond the legal implication of AEC for Indonesia’s Economic Competitiveness on Investment and Trade sector. Furthermore, this article will address the solution for Indonesia, on investment and trade sector as contribution for enhancing Indonesia in AEC.

Research Methods

This article is an extraction of a desk research. The researchers are concerned with both the current state of law, and how the law used to be in the future. The research will conduct to identify the obligation of AEC which are govern on ATIGA and ACIA, to identify to what extend Indonesia should improve economic competitiveness by modernizing domestic law on investment and trade sector. The aim of this research is to acquire legal knowledge about Legal Implication of ASEAN Law Economic Community to Indonesia’s Economic Competitiveness on Investment and Trade Sector.

Results and Discussion

The Framework of ASEAN Economic Community

ASEAN Economic Community initiates on 2015, it focuses towards constructing regional economic integration, which implemented the ASEAN Economic Blueprint. AEC Blueprint itself is a guideline for ASEAN countries in constructing strategic working plan until 2015 that must be implemented by every country to form ASEAN economic integration. AEC Blueprint itself has four pillars:

1. Movement towards single market and production base

2. Creating high competitive regional economic atmosphere

3. Towards region of equitable economic development through development of small medium sized enterprises and initiative for ASEAN integration programs

4. Towards full integration on global economics (coherent approach on external economic relationship and also pus involvement in global supply network)

Economic integration that is competitive and has active role in global economics is a crucial step for AEC achievement. Legal sector plays key role in constructing AEC, particularly law matters that has relevancy with investment and trade. ASEAN economic community initiative would give huge implication towards development of national economic competitiveness through investment and trade. Investment and trade is a sector that affects national economic development of a state, therefore it is necessary to make an analysis of the implication of ASEAN Economic Community initiative towards Indonesian Law and Regulation that regulates trade and investment in order to help Indonesia to anticipate, utilizes, and develops competitiveness in regards with ASEAN economic community. Based on the previous reasons, this paper will focus on the implication of the construction of ASEAN Economic Community on the urgency of national economic competitiveness development particularly on trade and investment.

AEC was formed as a mandate of ASEAN Charter that has been ratified by Indonesia by virtue of Law No.38/2008. AEC is trying to create a single market for trade of goods, trade of services, investment, labor and capital movement. Some scholar’s view ASEAN are hoping that the existence of AEC will give the same benefits with that European Union gives toward European countries. The expectation is that the AEC initiative will give benefits for trade and investment (Petri, Plummer & Zhai, 2010). In making the process of AEC, ASEAN emphasize the importance of consistency of the implementation of the AEC blueprint. For this purposes, ASEAN gave an objective for Sectorial Ministerial Bodies to conduct a review on the execution of the existing commitments, pursuant to the each relevant sectors, in order to make sure that the ratification and its implementation could be executed accordingly, as pursuant to the Protocol and Agreement that has been signed by the parties. ASEAN also instructsSectoral Ministerial Bodies to give maximum efforts, including the allocation of resources in implementing the required steps that will affect AEC, with consideration towards each point of the four pillars of AEC Blueprint. Moreover, each ASEAN countries Minister of Economy are obligated to conduct more discussion with public sector and private sector for the effectively of AEC.

The main objectives of the formation of AEC is to increase economic stabilities between ASEAN countries, one of which is by virtue of the existence of free market in capital, service, and labor sectors (Korhonen, 2015). The existence of free market concept will help the economic relationship of ASEAN Countries, particularly on Trade and Investment. Single market concept that AEC offers is to ease the goods production exchange and technology, and the advantage in making joint venture agreement easier between corporations in ASEAN region (Korhonen, 2015). In investment sector, AEC will automatically push the investment flow towards ASEAN countries, where it would lead to multiplier effect, which one of it is increasing economic development for ASEAN countries (Fujita, 2007). Based on research made by Economic Research Institute for ASEAN and East Asia (ERIA), AEC has shown progress on economic relationship between ASEAN countries (DB, 2013). On trade sector, AEC has succeeded on decreasing tariffs on goods 0-5% for each state member. In investment sector, AEC also succeed on showing its commitment to ASEAN Comprehensive Investment Agreement (ACIA) which one of it is by giving space for foreign owned asset in investment activities.

One of the indicators of progress of AEC is the increasing quantity of free trade agreement, which not only binds ASEAN countries as ASEAN Free Trade Agreement, but also binds ASEAN with its trade partner such as United States of America, China, South Korea, Canada, and other countries. The existence of the free trade agreements has two consequences. First, there will be removal of barriers on economic activities between ASEAN countries and its trade partner. Second, there will be a necessity for ASEAN countries to compete with each other to improve competitiveness.

ATIGA as ASEAN Treaty on Trade in Goods

The blueprint of MEA consists of 4 main goals, such as: (1) ASEAN as a single market and production based which is supported by liberalization of goods and trade element, (2) ASEAN as a place for competition regulation, consumen protection, intellectual property, and infrastructure development, (3) ASEAN as a place to develop member states’ economics with the development of local brandings, and (4) ASEAN as an integrated place to maximize its function for global production. In the name of making those happen, ASEAN made ATIGA in 2009 which aimed to reduce all products’ tarrif in intra-ASEAN until 0% in 2010, except all goods which categorized in Sensitive List and High Sensitif List (Kemendag, 2016). ATIGA also aims to liberalize 12 Priority Integration Sectors (PIS) to be a single marker, such as farms, aircrafts, automotive, e-commerce, electronic, fishers, health services, textiles, and many others.

The Policy concerning the reduction of barriers that exists inATIGA is basically divided into two categories and carried out gradually. For tariff barriers, which country belonging to ASEAN-6, there should be tariffs cut in 2010 in importing activities for all products traded in member countries of ASEAN. Countries classified asinto ASEAN-6 are BruneiDarussalam, Indonesia, Malaysia,Philippines, Singapore and Thailand. Unlike ASEAN-6 countries,CLMV countries which consist ofCambodia, Laos, Myanmar and Vietnamrequired to reduce import tariffs of goods in 2015 with a flexibility perioduntil 2018. For non-tariff barriers,three agreed stages were enactedby the AFTA Council, and have been approvedlong before the formation of ATIGA. ATIGA also classifiesseveral settlement mechanisms for special cases. This matter can be seen from the article which regulates certain issueslike for sensitive productsand trade remedy. The completion mechanism of these sensitive products is regulated in article 24 which discusses traderice and sugar products (Bhala, 2000). Furthermore, thesafeguard mechanism as a traderemedy used insideATIGA, basically based on Agreement onSafeguards in the WTO andrefers to article XIX GATT 1994.

Compared with Indonesia, as a Contracting State of WTO, Indonesia should pay attention to what has been regulated in ATIGA, remembering that the content of ATIGA is a reflection of Article 10 of GATT 1994 which simply stated that all laws and regulations applied in each member states should be published transparently. This is obliged as the implementation of Article 16 of Marakesh Agreement Establishing the WTO which regulates that all WTO Member States should harmonize their national regulations with WTO laws. This is stated under the Article XVI Marakesh Agreement on Establishing the WTO (WTO, 2017). By all means, if we take a look to the Article 3 of Law No. 7 in 2014 concerning Trade, the goals of trade activities in Indonesia aims to increase the economic development, maximizing the general welfare for Indonesian citizens, and to promote the local brandings in Indonesia to the world. The international trade in Indonesia has no a rigid definition regulated in Trade Law, but it is specifically regulated in the Chapter 5 of Trade Law. The main purposes are related with what has been regulated in ATIGA for AEC 2015, such as increasing local branding, expanding international market, and increasing the exportir ability.

The content of Law No. 7 in 2014 concerning Trade mostly regulates on how ATIGA has spoken up, which are to give the protection of consumen, the trade in e-commerce, and the development of local brandings in Indonesia. These aim to increase national competitiveness of Indonesia with another States in trade and investment activity. Article 4 Indonesia Trade Law regulates the principles which Indonesia uses whenever it conducts international trade relations with another states, including ASEAN member states. Most of the principles applied are the reflection of Most Favoured Nation and National Treatment which are regulated in Article 5 and 6 of ATIGA. Furthermore, ATIGA promotes the trade liberalization which prohibits the member states of WTO to maintain its tariff and non-tariff barriers when they conduct export and import with another countries. However, this kind of liberalization is not full accommodated with the national system of Indonesia where Indonesia still has the need to protect national interest and local branding markets, thus the import and export should be all controlled by the Government and all the barriers are regulated in the Regulation of Finance Ministry. However, when Indonesia tries to protect its national security, based on the Article 4 of Act 7/2014, Indonesia is still obliged to be transparent, such as when it gives non-tariff barriers, just what ATIGA has implicitly regulated in the Article 40 Paragraph (2). Also, Indonesia has shown its commitment to give any trade facilitation which has been regulated in the Article 45 – 48 of ATIGA. The trade facilitation given by Indonesia are Exporting Training (Article 74 of Indonesian Act No. 7 in 2014 concerning Trade), Trade Exhibition (Article 78 of Indonesian Act No. 7 in 2014 concerning Trade), and many others.

The most substantive content in ATIGA is concerning Rules of Origin, as a method to discover where is the basic location of goods and services. ATIGA regulates that goods have to get the Certificate of Origin, (Article 38 of ATIGA), where Indonesia tries to oblige all goods and services to have Indonesia National Standard (Standard Nasional Indonesia) in the international trade activities based on Article 51 of Act 7/2014 where the Government has its authority to designate. However, there is no specific regulation in the Act on how to discover the Rules of Origin. The Article 87 paragraph (1) of The Act regulates that the Government can give any preferences unilaterally for under-developing countries but also to maintain the national interest. Yet, from this regulation, there is no further explanation on how Indonesia as a “preferences giver” have a rigid criteria for any facilities preferences. A non-existence of Rules of Origin clause in the Trade Law makes it so hard to get to know the origin of any goods. We can find any Indonesia regulations concerning Rules of Origin in such Finance Ministry regulations, such as No. 60/M/DAG/PER/12/2012 concerning the Institution who Published the Certificate of Origin for Exported Goods in Indonesia.

It can be concluded that despite all the things, Indonesia also maintains the national interest protection to keep up the state’s sovereignty when doing trade and investment activity with another states. However, the obligation as a Contracting Party of WTO and the ASEAN member states shall make Indonesia harmonize its regulation with ATIGA and another WTO or ASEAN laws regarding international trade (Bhala, 2000). This also can be seen on how Indonesia made Presidential Instruction No. 5 in 2008 concerning Economic Focussed Program for 2008-2009, which also regulates the preparation of Indonesia to face the AEC 2015. This Instruction also fulfills the AEC commitment to reduce all customs for PIS products and non-barier tarrifs (The Attachment of Presidential Instruction No. 5 in 2008 concerning Economic Focussed Program for 2008-2009, 2018).

As the general explanation of Indonesia Trade Law No. 7 in 2014 that National development in the economic field is compiled and implemented to promote prosperity through the implementation of economic democracy with the principle of togetherness, fair efficiency,sustainable, environmentally sound, independent, and by maintaining a balance of progressand national economic unity as mandated by the Republic of Indonesia's Constitutionin 1945. In the perspective of the constitutional basis, national tradeIndonesia reflects a series of economic activities carried out to realizegeneral welfare and social justice for all Indonesian people. Hence, Indonesia has tried to maintain its international obligation as the member of ASEAN and WTO to conduct any obligations regulated in ATIGA, but still, trying to maintain its national interest, thus several regulations regarding trade liberalization can not be conducted well in Indonesia.

ACIA as ASEAN Treaty on Investment

On investment sector, AEC means that ASEAN comprehensive Investment Agreement will be applied among ASEAN countries. On 29 February 2009, the Indonesian government signed as ACIA as the results of discussion between delegates of ASEAN countries. Indonesia has ratified ACIA through the enactment of President Regulation No. 49/ 2011 on Ratification of ASEAN Comprehensive Agreement. Other factors that need to be considered is Law No. 25/2007 on Investment, which is the national legislation of Indonesia that governs investment activities. By ratifying ACIA, then there will be some international agreement that binds Indonesia and some ASEAN countries to be revoked. Some of this agreement are:

1. Agreement among the Governments of Brunei Darussalam, the Republic of Indonesia, Malaysia, the Republic of the Philippines, the Republic of Singapore, and the Kingdom of Thailand for the Promotion and Protection of Investments

2. Framework Agreement on the ASEAN Investment Area,

3. Protocol to Amend the Agreement among the Governments of Brunei Darussalam, the Republic of Indonesia, Malaysia, the Republic of the Philippines, the Republic of Singapore, and the Kingdom of Thailand for the Promotion and Protection of Investment

4. Protocol to Amend the Framework Agreement on the ASEAN Investment Area.

ACIA also governs the principle of non-discrimination that generally governed in other international trade agreement such as national treatment and most favored nation treatment. ACIA also governs regarding expropriation and compensation. This international agreement is also a subject of ASEAN Protocol on Enhanced Dispute Settlement Mechanism that means a dispute that arises between contracting states that as relation with the application of the international agreement that would be settled with mechanism which has been set by the protocol. Regarding on the principles of protection, ACIA will give legal protection towards investors. Then, regarding the calculation that will apply regarding the compensation that an act of nationalization, is it still necessary to follow the formula that applied in other IIA or not. Last, regarding the principles that oblige to settle investment dispute, which as practice shows that international arbitration the mechanism that receive favorable notion since it is used in many IIA instruments (Newcombe, 2009; Schauer, n.d.).

In relation with Law No. 25/2007, recent study shows that Indonesia as developing countries, for the past decades often adopted international investment agreement without any consideration with their national law system for investment (Knorich & Berger, 2014). Law No. 25/2007 has similar substance with Law No.7/2014 that is it emphasizes on national interest. It could be seen from certain barriers on investment that exist in Indonesia. The number of barriers itself is quite plenty compared to other countries such as Singapore, Malaysia, and Cambodia (Ho, 2017). Law No.25/2007, although it gives regulation regarding foreign investment activities, does not give comprehensive and detailed provision regarding investment after ratification of ACIA. As noted above, there are three main principles that need to be followed by each ASEAN country. Therefore, it is necessary for Indonesia to revamp its investment law and regulations to ensure that the three principles that AEC holds can be applicable and executed. Three principles of AEC which have been mentioned in AEC Blue Print 2025 are good governance, transparency, and responsive regulatory regime through active engagement with the private sector, community-based organisations, and other stakeholders of ASEAN.

Indonesia is the main destination for investors, with the enactment of Law No. 25/2007 concerning Investment which guarantees the application of: (i) equal treatment, (ii) without minimum capital requirements, (iii) free return of benefits, (iv) legal guarantees, (v) settlement of disputes and (vi) investment services. Besides the two reasons mentioned above, Government Regulation No. 24 of 1994 is also a guarantee of certainty in trying. The following are matters contained in the Government Regulation, such as:

1. Joint ventures between foreign capital and domestic or Indonesian legal entities, provided that Indonesian participants must have at least 5% of the total paid up capital since the establishment of the PMA company; and

2. Foreign direct investment, in the sense that all capital is owned by citizens and/or foreign legal entities, provided that within a maximum period of 15 years from commercial production, some foreign shares must be sold to Indonesian citizens and/or Indonesian legal entities through direct ownership based on their respective agreements, each party and or through the capital market. Thus the requirements for majority local shareholding are valid before deregulation has been deleted.

Liberalization of capital flows in ASEAN is regulated based on several main principles, such as (i) the liberalization process must be in line with the national agenda and readiness in each ASEAN country, (ii) allow for safeguard measures in the event of macroeconomic instability and systemic risk due to the liberalization process, and (iii) liberalization must provide benefits to all Member States. The principles which have been regulated in Article 3 of Indonesian Act No. 25/2007 concerning Investment are reflection of such principles recognized in Article 5,6,7 of ACIA, such as treament for investor, Most Favoured Nation, and National Treatment. ACIA also regulates the right for host states to transfer. This has been adopted in the Article 8 paragraph (3) of Act 25/2007 that the States are allowed to transfer modals, benefits, fund, royalty, and any others allowance regulated in the Act. Indonesia also adopted the facilitation given for investors which has been regulated in the Article 25 of ACIA. The facilities include of procedure simplifying, dissemination promotion, one-stop investment centre which can be shown by the existence of Pelayanan Terpadu Satu Pintu (PTSP) in Indonesia, advisory services, and any other facilities including the tax free and the right to asset in Indonesia (Article 18 of Indonesian Act No. 25 in 2007 concerning Investment).

Furthermore, in the dispute settlement sector, ACIA recognizes several mechanism in settling the investment dispute, (Article 30 – 35 of ACIA), such as conciliation, consultation, claim, arbitration, consolidation, and expert reports. Indonesia adopted several mechanisms by giving choices in the Article 32 of its Investment Law. At first, it gives any rooms for parties to settle their disputes with discussion without any arbitral mechanism. If this kind of resolution can’t give any results, the parties are free to choose either Arbitration or Alternative Dispute Resolution (ADR), which some of them have been recognized in ACIA, such as consolidation, reports, consultation, and conciliation. If the parties choose Arbitration as its dispute settlement resolution, there should be consensus by the parties to choose what arbitrer they will use for settling the dispute. They also can claim their disputes into ICSID for getting an arbitral award for the disputes.

The Indonesian Law on Investment and Trade Sector

This part will explore existing Indonesia Law on Investment and Trade Sector. Indonesia until now only have Law No 7/2014 as one of trade in Indonesia and regulate investment law under Law No 25/ 2007. Both of law made after ASEAN become International Organization with legal personality, which was ratified by Indonesia with Law No 38/2008. As international obligation under treaty law, after one state ratifies the international treaty, it means that the state bind to every obligation from the treaty and should implement to their national law (Klabbers, 1996). Further the article would explain about Law No 7/2014 on Trade and Law No 25/ 2007 on Investment.

1. Law No 7/2014 on Trade

2. Law No 25/2007 on Investment

Competitiveness is the genesis of economic contest between nations, which involves infrastructure, bureaucrat’s institution, macroeconomic stability, human resources, and education. The government already addressed those issues by virtue of the issuance of President Instruction No. 6/2014 on Increasing National Competitiveness in Preparation for ASEAN Economic Community. The strategies that exist in that instruction are:

1. Development of national industry that focus on the development industry priority to fulfill the demand of ASEAN market

2. Development of small medium sized enterprises and research, also the application of StandarNasional Indonesia (SNI)

3. Development of agriculture, with focus on increasing the value of direct investment in agriculture sector and increasing market access

4. Development of maritime and fishery, with focus on institution strengthening, maritime and fishery competitiveness, domestic market strengthening, and development of export market

5. Development on energy, with focus on electricity sub-sector and decrease on fossil fuel usage

On trade sector, the main activities, which consist of export and import, already has its own policy and regulated by Law No. 7/2014. However, Indonesia policy should be more capable in governing export and import activities more detailed a specific manner. Therefore, it is capable to decrease import activities in Indonesia while increasing export activities from Indonesia. The convenience in export and import activities could be seen from the existence of Indonesia National Single Window (Das, 2017), which is national system that allows single submission of data and information, single and synchronous processing of data and information, single decision making for customs clearance and release of cargoes (Das, 2017).

Meanwhile, on investment sector, as mentioned by Prof. Jean Ho, Indonesia’s policy must be able to attract competitiveness aspect, not only from the mere regulation on investment. There are many aspects in support Indonesia competitiveness in investment sector, such as infrastructure, education relating human resources, and etcetera. Generally, Law No.25/2007 already made efforts to give space for investors to invest their capital in Indonesia outside industries that are included in the negative list (Sjöholm, 2016). Propitious infrastructure that supports investment activities would lead to the attraction of investors to invest in certain countries (German, 2014).

In terms of trade liberalization, Indonesian products are practically not too problematic, because almost 80 percent of Indonesia's trade is free of obstacles. The government has made efforts to accelerateequitable development as part of strengthening the people's economy. Between 2011 and 2013, Indonesian investment was directed to many regionsoutside the island of Java by providing tax holiday stimulation. Thus, the center of economic growth in the future is not only centered onJava only but also in another islands. Another effort made by the government isby forming clusters to foster SMEs in order to have competitiveness. Not only challenges that will be faced but also opportunities. The sectors that will be Indonesia's flagship in AEC 2015 are Natural Resources, Information Technology, and Creative Economy. These three sectors areIndonesia’s strongest sector when compared to ASEAN member states (Nedruai, 2005). For Indonesia itself, AEC will be a good opportunity because trade barriers will tend to decrease even become non-existent. This kind of situation will have an impact on increasing exports. On the investment side, this condition can create a climate that supports the entry of Foreign Direct Investment (FDI) which can stimulate economic growth through development technology, job creation, human resource development (human capital) and easier access to world markets (Nedruai, 2005). Even though, these conditions can lead to exploitation risk. Indonesia still has level of regulation that is less binding so that it can cause action large-scale exploitation of the availability of natural resources by foreign companies that enter Indonesia as countries that have a number abundant natural resources compared to other countries. More over, the possibility of exploitation by foreign companies can damage ecosystem in Indonesia, while investment regulations exist in Indonesia not yet strong enough to maintain natural conditions including the availability of natural resources contained.

As the members of ASEAN, there was born an international obligation for Indonesia to show its commitment to harmonize its national law to what has been regulated in ASEAN law concerning trade and investment. The business law-friendly will automatically increase the interest of another states to conduct international business in Indonesia. Yet, the term of “friendly” does not mean that we should give all the free-access for international element, such as another countries or foreign investors, but also to show our commitment as a contracting state of any international treaty, including ASEAN treaties and regulations. The maintainance of national interest should also be maintained by Indonesia in order to protect local branding and traditional market which has been operated in Indonesia, but the way on how to promote those traditional business and markets internationally can also be one of good way to increase Indonesia competitiveness with another ASEAN member states to face AEC.

Conclusion

In conclusion, the existence of AEC will have certain implication towards ASEAN countries. The amount of international agreement as a manifestation of the formation of AEC would have implication towards Indonesian national policy. Indonesia has Law No.7/2014 on trade and Law No 25/2007 on investment. As Indonesia member of ASEAN member countries, both Indonesia Law should harmonize and support the realization of AEC. To implement the trade and investment based on ASEAN framework, Indonesia should convince that Indonesia Law boost the implementation AEC not only for Indonesia but also for another member of ASEAN. It should be concerned by Indonesia since AEC purposes for regional trade liberalization to result the mutual benefit for all ASEAN Countries based on reciprocity approach. The harmonization Indonesia Law with rules of trade law on ASEAN would increase and also increase the Indonesia National Competitiveness, in terms of prepare all subjects from Indonesia to compete in ASEAN Market. It would build confident to all trade and investment subject of law. National Interest should also define as ability for government to engage with other ASEAN countries as external economic sovereignty.

References

- Petri, A.P., Plummer, G.M., & Zhai, F. (2010). The economics of the asean economic community.

- Bhala, R. (2000). International trade law: Theory and practice. Lexis Publishing.

- Das, S.B. (2017). ISEAS Report No. 72 - ASEAN Single Window: Advancing trade facilization for regional integration.

- (2013). ASEAN Economic Community: A Potential Game Changer for ASEAN Countries.

- Fujita, M. (2007). Regional intergration in east asia: From the viewpoint of spatial economics. United Kingdom: Palgrave Macmillan.

- German, V. (2014). The nexus between infrastructure investment and economic growth in the mexican urban areas. In Scientific Research Modern Economic (No. 5).

- Ho, J. (2017). Investment protection under successive treaties. ICSID Review, 32(1), 2.

- Kemendag. (2016). Menuju ASEAN economic community.

- Klabbers, J. (1996). The concept of treaty in international law. The Hague: Kluwer International Law.

- Knorich, J., & Berger, A. (2014). Friends of Foes? Interaction between Indonesia international investmentagreement and national investment law. Bonn: Deutchhes institute fur intweklungspolitik.

- Korhonen, I. (2015). ASEAN economic community: Myths and realities. The MIT Press Journal, 14(2), 4.

- Nedruai, H.E. (2005). Globalization, domestic politics and regionalism: The ASEAN free trade area. London: routledge.

- Newcombe, A. (2009). Law and practice of investment treaties: standard of treatment. The Netherlands: Wolters Kluwer.

- Sally, R. (2010). The ASEAN charter and the ASEAN economic community, A watershed for regional economic integration, on life after charter ASEAN (S. Tiwari, Ed.). Singapore: ISEAS.

- Schauer, C. (n.d.). Investment, international protection.

- Sjöholm, F. (2016). Foreign direct investment and value added in indonesia (No. 1141).

- The attachment of presidential instruction no. 5 in 2008 concerning economic focussed program for 2008-2009, (2018).

- Woo, J. (2015). 6 things you need to know about Asean Economic Community.

- WTO. (2017). WTO the legal text: The result of the uruguay round of multilateral trade negotiation. UK: Cambridge University Press.