Research Article: 2021 Vol: 20 Issue: 4S

Lack of Readiness of Digital Banking Channel Acceptance: Study on TAM 3 and Technology Readiness

Ayatulloh Michael Musyaffi, Universitas Negeri Jakarta,Universitas Padjadjaran

Sri Mulyani, Universitas Padjadjaran, Universitas Singaperbangsa Karawang

Ida Suraida, Universitas Padjadjaran

Citra Sukmadilaga, Universitas Padjadjaran

Keywords:

Behavioral Intention, E-Banking, Self-Efficacy, Technology Acceptance Model, Technology Readiness.

Abstract

E-Banking technology has developed very rapidly, along with the growth of digital banking. E-banking has led to changes in business models, especially about the ease and benefits for users. However, it turns out, and users are still dealing with security issues and functions of e-banking so that user dissatisfaction arises. Therefore, this study aims to analyze the factors that make users receive e-banking, especially in aspects of Perceived Usefulness, Technology Readiness, and Self-efficacy by using the integration of Technology Acceptance Model (TAM) 3 and technology Readiness (TR). This research was gathered through an online questioner to all e-banking clients with 565 respondents. After that, data were analyzed using Structural Equation Model (SEM) - Lisrel using Lisrel 8.8 software. The results of this research indicate that technology readiness and self-efficacy influence Perceived usefulness, and technology readiness and Perceived Usefulness have a positive influence on behavioral intention. In contrast, Self-Efficacy does not have an impact on Behavioral Intention. This research's findings also prove that the level of acceptance of user technology using the integration of TAM 3 models with Readiness Technologists has a strong attachment. However, the self-efficacy variable has an insignificant impact.

Introduction

Information systems are an inseparable part of business organizations (Mulyani, Hassan, & Anugrah, 2016). Information systems are a vital part of organizations and have an essential role in providing information for decision making (Ladewi & Mulyani, 2015). An information system's existence is an advantage and added value through flexibility, integration, speed, and accuracy of the resulting information to increase efficiency and effectiveness (Edison, Manuere, Joseph, & Gutu, 2012). Transformations triggered by technology in services are likely to extend within the future because current technology continues to develop rapidly in terms of speed, connectivity, functionality, and easy use. (Parasuraman & Colby, 2015). The banking sector follows the latest trend where banks have adopted online banking applications for transactions (Luarn & Lin, 2005; Zhou, 2012). The form of an online information system in banking is electronic banking (e-banking). E-banking is a banking technology that can obtain information and carry out banking transactions online (Mulyani & Rachmawati, 2016). E-banking applications, like Internet banking as another means of service delivery, offer several benefits for banks, including reduced costs, market differentiation, work process flow, increased sales, increased reach, increased customer loyalty, and opportunities to draw in new customers (Marakarkandy, Yajnik, & Dasgupta, 2017). Based on the results of the Price Waterhouse Coopers (PWC) survey on the use of transactions with different media such as transactions via branch offices and transactions via the internet and telephone with transactions above 50% of total transactions in Indonesia in 2015 and 2017. Based on The PWC publication results in 2015, transactions with a value above 50% are carried out through branch offices 75%, while in 2017, it was 45%. Meanwhile, transactions via telephone and internet in 2015 amounted to 10%, while in 2017, it increased by 20% (Databoks, 2017).

According to PWC, a shift in customer interest in banking transaction media has been predicted by global bankers, where 59 global bankers estimate that customers will tend to transact through digital channels compared to visiting branch offices (Databoks, 2017). In theory, the most significant factor in influencing users' intention to continue using technology is perceived convenience and perceived Usefulness (Musyaffi & Kayati, 2020; V. Venkatesh & Bala, 2008). The more comfortable a technology is for users, the more useful it will be and encourage the use of that technology. However, Databoks (2017), through daily social research, states that almost half of Indonesia's e-commerce payments are made through bank transfers, which is 49.01%. Meanwhile, transactions via internet banking were 21.43%, followed by cash on delivery (COD) by 13.49, through minimarkets at 7.14%, while transactions via mobile banking had the lowest % age at 0.4%. According to Zuhra (2016), the reason of user’s payment via ATM was comfortable, there were only 12.2% have a debit card, 8.8% of respondents feel safer via ATM, 5.4% of respondents assumed that use ATM faster, and 5.1% of respondents felt comfortable and got used to it. The everyday use of transactions via e-banking, according to Dwivedi & Irani (2009), is due to the difficulty in changing user behavior from using conventional banking to e-banking. According to Bakri and Mulyani (2019) technology can improve quality of information system (Bakri & Mulyani, 2019; Mulyani & Endrari, 2017).

In addition to convenience and usability, based on previous studies (Basgoze, 2015), technology readiness is influencing technology's behavioral intention. Technology readiness is a psychological condition that results from positive thoughts and a barrier which will determine an individual to use Technology (Liljander, Gillberg, Gummerus, & van Riel, 2006). The smaller the level of threat from a technology (insecurity and inconvenience) will make someone intend to continue using Technology (Parasuraman & Colby, 2015). Kaspersky's research results show that 49% of users feel vulnerable when transacting online, users trust offline transactions more than online transactions, namely 59% of users and agree that offline transactions are safer (Suryadhi, 2015). The cause of the low penetration of banking access, the main fundamental factor, is concerned about the security of banking applications (Kamaludin, 2018). Indonesian Internet Provider Association (APJII) states that 28.6% of banks are not safe (APJII, 2016). It has that the existence of technology unpreparedness, especially the problem of insecurity, which disrupts the intention to use e-banking.

Previous research explained that technology adoption requires self-efficacy, which plays an essential role in using the system (Compeau & Higgins, 1995a). Self-efficacy is a self-belief about abilities, skills, or knowledge in carrying out an activity (Luarn & Lin, 2005). Experience and mastery of technology will further increase self-confidence and reduce defensive behavior (Mulyani & Rachmawati, 2016). In e-banking users, when users have sufficient self-confidence, users are more likely to continue using e-banking, and its benefits may be felt in existence (Püschel, Mazzon, & Hernandez, 2010; Wang, Wang, Lin, & Tang, 2003b). The use of e-banking is still low because customers are more comfortable making transactions via ATMs. There is still a thought that conventional transactions are safer by obtaining receipts as proof of transactions (Marketeers, 2016).

Based on the GAP empirical facts that have been explained previously, it raises significant questions for us. The better user ready to adopt technology, self-efficacy, and quality of information will increase the Perceived Usefulness and behavioral intention of e-banking users. This research is essential to test the magnitude of the influence of technology readiness, self-efficiencies on the behavioral intentions of e-banking users through perceived usefulness, by combining the Technology Acceptance Model (TAM) and the technology readiness (TR).

Literature Review

Electronic Banking (E-Banking)

E-Banking is a banking product that can automatically send services and products immediately to customers through digital media (Daniel, 1999; Gupta & Yadav, 2017; Sathye, 1999). According to the Financial Services Authority (2015), electronic banking is a banking service that permits users to get information, conduct communications, and transactions thru electronic media.

E-banking in this research is in the form of mobile banking, internet banking, SMS banking, and phone banking. OJK describes various benefits obtained by customers when using E-banking: 1) E-banking can provide convenience in terms of time, place, and cost. 2) Customers do not need to go to a bank to obtain information or conduct banking transactions. 3) For some products, customers can trade 24 hours using a portable laptop or cell phone.

The competent authorities can also benefit from banks and customers using E-banking services, encouraging people to realize less cash societal, namely lifestyle by using electronic media in transactions where paper money is not needed (Otoritas Jasa Keuangan, 2015). it can improve the payment system more quickly. It can maintain financial system stability and prevent crime and money laundering crimes (taxes, credit cards, insurance, internet), purchases (credit, tickets), and various other features.

Technology Readiness (TR)

Technology readiness is a concept promoted by Parasuraman (2000) in measuring user readiness to accept new technology. Technology readiness comes from the adage that it is difficult for people to change to accept new things (Roy & Moorthi, 2017). Technology Readiness has developed and has been extensively researched to measure technology readiness, especially in user acceptance (Basgoze, 2015; Parasuraman, 2000; Parasuraman & Colby, 2015; Sripalawat, Thongmak, & Ngramyarn, 2011; Walczuch, Lemmink, & Streukens, 2007). The latest technology readiness model has developed the Technology readiness (TR) 2 (Parasuraman & Colby, 2015), where Parasuraman classifies two things that can trigger Technology Readiness, namely motivational factors (optimism and innovation) and threat factors (insecurity and discomfort). Technology is seen as technological advancement for optimistic and innovative-minded groups, whereas according to the pragmatic group, technology is considered inferior until the group gets sufficient confidence (Kim, Geum, & Park, 2015).

Technology Readiness is a mental condition for a person to accept new Technology (Melas, Zampetakis, Dimopoulou, & Moustakis, 2014). Technology Readiness is considered a person's tendency to accept and use new technology. Meanwhile, according to Liljander et al., (2006), Technology Readiness is a psychological condition that results from positive thoughts and obstacles that together determine a person to use technology. Based on explanation above, Technology Readiness is a person's readiness to accept and use e-banking technology to achieve goals.

Self-Efficacy (SE)

Self-efficacy is self-confidence about abilities, skills, or knowledge in carrying out an activity (Luarn & Lin, 2005). Computer self-efficacy is part of the social cognitive theory found by the psychological expert, Bandura. This theory is based on three variables that influence each other, known as triadic reciprocals, namely, variables of behavior, environment, and people. Self-efficacy is an individual's ability to think, know, and solve problems used to assess human resources (Ramos, Su, Correa, & Trinidad, 2018). According to Luarn & Lin (2005), self-efficacy as a personality's belief in their abilities and skills towards an activity. The more people receive information and have the experience, and the more their self-efficacy can change (Marakarkandy et al., 2017).

According to Wood & Bandura (1989), self-efficacy as a person's belief and skill to manage motivation, cognitive resources, and actions needed by an individual to satisfy the stress of the environment. Self-efficacy is also defined as personal feelings and behaviors for managing self-conditions and satisfaction (W.-T. Chen et al., 2013). Meanwhile, according to Wang, Wang, & Wei (2014), self-efficacy is an individual's belief in their ability to enable them to have a higher willingness to adopt a technology. Further, according to Schwarzer, Antoniuk, & Gholami (2015), Self-efficacy is the ability felt by individuals to obtain information and services expected in using technology.

According to Boonsiritomachai & Pitchayadejanant (2017) defines self-efficacy as a person's assessment of their ability to use e-banking. In e-Banking, self-efficacy is a person's belief that he has the knowledge and ability to control e-banking (Singh & Srivastava, 2018). Self-efficacy is seen as an essential variable in studying individual behavior, especially in information technology (Agarwal & Prasad, 1997; Compeau & Higgins, 1995b). Based on that explanation (Bandura, 1986; Boonsiritomachai & Pitchayadejanant, 2017; Compeau & Higgins, 1995b; Luarn & Lin, 2005; Marakarkandy et al., 2017; Ramos et al., 2018; Schwarzer et al., 2015; Singh & Srivastava, 2018; V. Venkatesh et al., 2003; Y.-S. Wang, Wang, Lin, & Tang, 2003) self-efficacy is a person's self-assessment of his knowledge and ability to understand and use e-banking (mobile banking, internet banking, SMS banking, and phone banking).

Perceived Usefulness (PU)

In the technology acceptance model, the variables which will influence behavioral intention are perceived usefulness and perceived ease of use. Perceived ease of use is the user's belief about information technology that using technology will be separated from more solemn efforts than not using it (Venkatesh & Bala, 2008). Perceived Usefulness is a view of a person's ability to technology to improve the user's way of achieving goals (Liébana-Cabanillas, Marinkovi?, & Kalini?, 2017). Perceived usefulness can also be viewed as a user's point of view of their belief in a technology that can provide benefits. Perceived usefulness is also defined as users' benefits for using a technology (Muñoz-Leiva, Climent-Climent, & Liébana-Cabanillas, 2017). In the customer perspective, perceived usefulness is defined as the level of benefit felt by individuals in using Technology (Chitungo & Munongo, 2013). With an adequate convenience level, technology will reduce effort and costs in learning this Technology (Sripalawat et al., 2011). Davis (1989), also explained that perceived usefulness is a level of trust where individuals will improve their performance when using information systems. The more the use of information technology is carried out with minimum effort, the more likely they are to use this Technology (Davis, 1989; Luarn & Lin, 2005; Mansour, Eljelly, & Abdullah, 2016; Sripalawat et al., 2011; Venkatesh & Bala, 2008). In the context of e-banking, the more users feel that Mobile banking is useful, the more likely they are to accept Mobile banking technology (Mansour et al., 2016).Based on the explanation above, it can be concluded that the perceived usefulness is the level of judgment and individual confidence when using e-banking will improve its performance compared to traditional methods such as coming to a branch office to make transactions.

Behavioural Intention

Behavioural intention has been mentioned in previous analysis on technology acceptance as a person’s choice to use Technology (Davis, 1989; Venkatesh & Bala, 2008; Venkatesh et al., 2003; Venkatesh, Thong, & Xu., 2012). Its intention to use has always been the main character in any technology acceptance model in its development. Theory of Reasoned Action (TRA), for example, was discovered by Ajzen & Fishbein (1975), which later developed Davis (1989) in the technology acceptance model (TAM), which developed until TAM 3 developed by Venkatesh & Bala (2008). TAM has been modified and replicated in information systems research and has proven to be a compelling model in understanding information system users (Alalwan, Dwivedi, Rana, & Williams, 2016; Davis, 1989; Miltgen, Popovi?, & Oliveira, 2013; Venkatesh & Bala, 2008; Venkatesh et al., 2003; Venkatesh et al., 2012).

Behavioral intention indicates an individual's readiness to perform certain behaviors and is assumed to be spontaneous behavior (Lu, Huang, & Lo, 2010). According to Sripalawat et al., (2011), Behavioral intention is an individual's readiness to take everyday behavioral actions. According to Bamberg, Sebastian, Ajzen, & Schmidt (2003), intention is a person's desire to show or not show particular future behavior. Behavioral intention is an individual's intention to perform appropriate behavior when individuals act voluntarily (Islam, Kim Cheng Low, & Hasan, 2013). Behavioral intention shows behavior to re-use or visit services or programs provided by the company (Baker & Crompton, 2000). That statement is supported by the opinion of Rahman, Mannan, Hossain, & Zaman (2018), where the behavioral intention is the desire of patients to re-visit the hospital and recommend these services to friends, family, and others. From a consumer's point of view, as well as intention and willingness, behavioral intention is defined as a belief in three specific behaviors, namely: following advice from service providers, sharing personal information with service providers, and buying goods and services from service providers (Harrison McKnight, Choudhury, & Kacmar, 2002; McKnight, Cummings, & Chervany, 1998). Based on the explanation from various kinds of literature above, Behavioral intention is an indication of a person's desire to continue to use Mobile banking when making transactions.

Hypothesis Development

Technology Readiness and Perceived Usefulness

The use of the technology Acceptance (TAM) model and Technology Readiness (TR) are closely related, even though the measurement of perceived usefulness and perceived ease in the TAM model is system-specific. In contrast, technology readiness is to measure trust in technology in general (more specifically towards individuals) (Huang, Lin, & Chuang, 2007). Technology readiness considers individual differences to measure the intention to use new Technology (Parasuraman, 2000). Thus, technology readiness evaluates the use of technology in ease and usability (Lin, Shih, & Sher, 2007).

Walczuch et al. (2007), provide concrete evidence of a link between Technology Readiness and Perceived Usefulness. That research is consistent with other research (Elliott, Meng, & Hall, 2012; Huang et al., 2007), where Technology Readiness has an impact on a person's behavior in adopting new technology. Based on one of the dimensions of Technology Readiness, namely optimism, it is related to a complementary view of technology and the belief that technology will increase control, flexibility, and efficiency (Lin & Chang, 2011). Therefore, an optimistic attitude towards certain technologies is more useful and more emphasized because if they are pessimistic, they are concerned about the possible negative results (Walczuch et al., 2007). Then several studies (Elliott et al., 2012; Walczuch et al., 2007) say that user engagement and innovation have a positive effect on the intention to use. Technology anxiety is significant to pay attention to in using technology (Meuter, Ostrom, Bitner, & Roundtree, 2003). Based on this explanation, Technology Readiness, namely the user's mental readiness, is a significant factor in accepting new Technology (Parasuraman, 2000). Several previous researchers stated that Technology Readiness positively influences perceived Usefulness (Basgoze, 2015; S.-C. Chen, Liu, & Lin, 2013; Elliott et al., 2012; F. Lin, Fofanah, & Liang, 2011; Roy & Moorthi, 2017). Based on this explanation, the hypotheses proposed in this research are:

H1: Technology Readiness has a positive effect on Perceived Usefulness.

Self-Efficacy and Perceived Usefulness

Self-efficacy is a person's self-confidence that has a vital role in influencing motivation and behavior (Bandura, 1986). In the context of using technology, self-efficacy is defined as an assessment of a person's ability to use Technology (Compeau & Higgins, 1995b). Self-efficacy research is primarily concerned with information systems researched (Compeau & Higgins, 1995b). Subsequent research on computer self-efficacy has been investigated by various other researchers with different subjects (Agarwal & Prasad, 1997; Johnson & Marakas, 2000; Ndubisi, 2007; Y. S. Wang, Wang, Lin, & Tang, 2003a). These studies' results indicate that self-confidence has a strong influence on understanding information technology users' responses.

The more people receive information and experience, and the more their self-efficacy can change (Marakarkandy et al., 2017). According to Chandio, Irani, Abbasi, & Nizamani (2013), it reveals that technological self-efficacy has a significant impact on the perceived ease of banking information system. Internet banking will be easier to use if individuals have high self-efficacy than individuals with low self-efficacy (Tan & Teo, 2000). Various previous studies have shown the influence of self-efficacy on behavioral intention (Chan & Lin, 2009). Meanwhile, other research stated a relationship between self-efficacy and perceived Usefulness (Agarwal & Prasad, 1997; Cheng, 2012; Chuan-Chuan Lin & Lu, 2000; F. Lin et al., 2011; Motaghian, Hassanzadeh, & Moghadam, 2013). Based on this explanation, the hypotheses proposed in this research are:

H2: Self-efficacy has a positive effect on Perceived Usefulness

Perceived Usefulness and Behavioural Intention

Perceived Usefulness is the level of assessment and user confidence in a technology that can improve its performance. Perceived Usefulness is one of the most vital e-banking (Marakarkandy et al., 2017). it shows that users tend to use information systems because they see the features and uses of the information system (Davis, 1989). Likewise, in e-banking, users will tend to use e-banking compared to traditional methods because of the benefits of e-banking itself. According to Lockett & Littler (1997), the most useful feature of internet banking usage is the 24-hour feature availability. When compared with traditional methods, users have to adjust to bank working hours to conduct banking transactions.

Venkatesh & Bala (2008) explain the influence of a strong relationship between perceived usefulness and behavioral intention. The higher a person's perception of information systems' usefulness, the behavior to use the information system will continue to be used. Wang et al. (2006) also agreed that some users choose to use mobile services because they see this technology's benefits. Also, Suoranta (2003) agrees that the lack of awareness and realization of the benefits promised by technology user companies is an essential factor that hinders mobile banking acceptance. Also, previous research (Cheng, 2012; J.-S. C. Lin & Chang, 2011; Pai & Huang, 2011; Sripalawat et al., 2011; V. Venkatesh & Bala, 2008; Zhang, 2016) has shown clear evidence of perceived usefulness to have a positive impact on behavioral intention. Based on this explanation, the hypotheses proposed in this research are:

H3: Perceived Usefulness has a positive effect on behavioral intention

Research Methodology

In this survey, Respondents were all e-banking users (Internet banking, mobile banking, and SMS Banking) in Indonesia. Based on the results of publications from the Financial Services Authority (OJK), the number of e-banking users in Indonesia has reached 50.4 million (Otoritas Jasa Keuangan, 2017). Based on the sampling method, this research used simple random sampling, amounting to 675 respondents. After the researcher determines the respondents, the questionnaire is distributed according to the study's target respondents. This study used survey research because the measurement process was carried out through structured interviews. Questions are well-chosen and correctly assigned to respondents and asked each respondent (Cooper & Schindler, 2014). Questions are arranged according to conditions that occur in the field. We hoped that there would be no misunderstanding of the questionnaire items that have been submitted. The questionnaire was distributed to respondents who use E-banking throughout Indonesia. In this study, a questionnaire with closed questions was used and used on an ordinal scale. Respondents were asked for their opinion by answering seven answer choices that had a ranking value.

This study uses data analysis methods using SEM (Structural Equation Model) through Lisrel 8.80 software. Hair, Sarstedt, Hopkins, & Kuppelwieser (2014) described SEM as an analysis that combines the approach factor analysis, structural model, and path analysis (Hair et al., 2014). Through this SEM method, researchers can carry out three activities together, namely testing and analyzing the validity and reliability of data (Confirmatory factor analysis), testing the relationship between latent variables (path analysis), and structuring the appropriate model (Hair et al., 2014). The steps carried out in the SEM method are first, doing a measurement model, and a Structural Model. The measurement model shows the impact of the relationship between constructs and indicators. At the same time, the structural model shows the path relationship between constructs (Hair et al., 2014).

Measurement

This study's measurements were adopted by various researchers who poured them into seven semantic differential question scales. In the Technology Readiness variable, researchers adopted several previous studies consisting of 13 question items (Liljander et al., 2006; Meng, Elliott, & Hall, 2009; Parasuraman, 2000; Parasuraman & Colby, 2015; Roy & Moorthi, 2017). At the same time, the self-efficacy variable consists of 6 questions adopted by several previous studies (Alalwan et al., 2016; Bandura, 1986; Compeau & Higgins, 1995a; Fagan, Neill, & Wooldridge, 2003; Singh & Srivastava, 2018; Thatcher, Gundlach, McKnight, & Srite, 2007). While for the variable perceived usefulness, the writer adopted 6 question items adapted from several previous researchers (Adams, Nelson, & Todd, 1992; Agarwal & Prasad, 1997; Brown, Cajee, Davies, & Stroebel, 2003; Ho Cheong & Park, 2005; Luarn & Lin, 2005; Marakarkandy et al., 2017; Sharma, Gaur, Saddikuti, & Rastogi, 2017; Sripalawat et al., 2011; V. Venkatesh & Bala, 2008). Then on the Behavioral Intention variable, the researcher adopted six questionnaire items adapted by various researchers that are relevant to this research (Shen, Huang, Chu, & Hsu, 2010; Singh & Srivastava, 2018; Sripalawat et al., 2011; Viswanath Venkatesh et al., 2012; Zeithaml, Berry, & Parasuraman, 1996).

Result and Discussion

Respondent Demographics

Data on respondents' characteristics were obtained based on data obtained through a google form, divided into several categories such as age, gender, type of work, and length of work. The following is the demographic data of the respondents in this study(Table 1).

| Table 1 Demographic Table |

|||

|---|---|---|---|

| Gender | N | % | |

| Male | 284 | 42.07% | |

| Female | 391 | 57.93% | |

| Age | 21 – 30 | 344 | 51% |

| 31 - 40 | 196 | 29% | |

| 41 - 50 | 95 | 14% | |

| >50 | 40 | 6% | |

| Education | Senior High School | 262 | 38.81% |

| Bachelor Degree | 199 | 29.48% | |

| Postgraduate Degree | 193 | 28.59% | |

| Doctoral Degree | 21 | 3.11% | |

| e-banking product | Mobile Banking | 506 | 74.96% |

| Internet Banking | 260 | 38.52% | |

| SMS Banking | 265 | 39.26% | |

| Phone Banking | 35 | 5.19% | |

| e-banking usage (years) | < 1 Year | 179 | 26.52% |

| 1 – 3 years | 253 | 37.48% | |

| 4 – 6 years | 164 | 24.30% | |

| 7 – 10 years | 59 | 8.74% | |

| >10 Years | 20 | 2.96% | |

Age shows a person's level of maturity in understanding something. In general, the productive age has a better working attitude than those who are not productive or are no longer productive. The majority of respondents in this study were aged 21-30 years, namely 51%. Meanwhile, in the age range 31-40, it was 29.4%. It shows that most e-banking is used at a productive age, namely, 21-40 years.

Meanwhile, based on gender, the majority of respondents were female, namely 57.93 %. At the same time, men were 42.07 % of respondents. Based on the explanation, it shows that the average respondent who uses e-banking in this study is female.

Most of e-banking users in the study had an education equivalent to SMA of 38.9%. It means that e-banking can be used even by users who have a high school education to S2. The low level of usage owned by users with Doctoral education is due to the limited number of people with Doctoral degrees compared to SMA, S1, and S2.

Based on table 2 above, the number of e-banking users who use mobile banking is the type of e-banking most frequently used by users, namely 74.9%. Meanwhile, users who used internet banking and SMS banking were 38.5% and 39.3%, respectively. Meanwhile, only 5.3% of e-banking users use the phone banking facility. The low number of users who use the phone banking facility is because this technology is less attractive to users. Today's users are more familiar with the internet. So that facilities such as phone banking are less desirable. It evidenced by the high number of mobile banking and internet banking users. The SMS banking facility, which is quite prominent, is also because e-banking users in Indonesia usually use more than two facilities, such as mobile banking and one with SMS Banking, to real-time notification of e-banking transactions.

Then based on the level of e-banking usage, 37.3% have used e-banking for 1-3 years. Meanwhile, 26.6% used it under one year. Then 24.3% used e-banking for 4-6 years. Based on these data, it shows that most e-banking users in Indonesia are familiar with e-banking. 73.4% have used e-banking for more than one year. It means that e-banking users in Indonesia understand how to take advantage of e-banking in everyday life.

Structural Equation Modeling

Furthermore, following the research objectives, namely, to test the effect of Technology Readiness, self-efficacy on perceived usefulness, and its impact on behavioral intention, structural equation modeling (SEM) is used. In the first stage, the researcher tests the research model's suitability then evaluates the measurement model and evaluates the structural model. The explanation is explained as follows.

Model Fit Test

The model fit test is conducted to evaluate whether the model that has been built has a suitable level (Hair et al., 2014). There are various model tests conducted to evaluate the fit of the model. The following are the results of the model fit test evaluation, as shown in Table 2 below:

| Table 2 Model Fit Test Result |

|||

|---|---|---|---|

| Measure Goodness of Fit | Cut Off | Estimated Value | Notes |

| Chi-Square | p-value>0,05 | 2270.98 (p-value 0,000) | Not Fit |

| RMSEA | =0.08 | 0.080* | Good Fit |

| RMR | =0.05 | 0.07* | Marginal Fit |

| GFI | =0.9 | 0.82 | Marginal Fit |

| NFI | =0.9 | 0.98* | Good Fit |

| NNFI | =0.9 | 0.98* | Good Fit |

| IFI | =0.9 | 0.98* | Good Fit |

| RFI | =0.9 | 0.98* | Good Fit |

| CFI | =0.9 | 0.98* | Good Fit |

| *meet the criteria of a good model | |||

The Chi-Square value in Table 2 above shows the estimated value of 2270.98 and has a p-value of 0.000. According to Hair et al. (2014), a good chi-square value is below 0.05. Meanwhile, the p-value in this research is smaller than 0.05, so the results do not meet the criteria for a good research model. However, according to Hair et al. (2014), if the chi-square does not meet the desired criteria, another model fit test is conducted with a note that the trials carried out tend to be larger than support the model than those that do not support the model. The measure of goodness as shown in table 2 is Root mean square error of approximation (RMSEA), Root Mean Square Residual (RMR), Goodness of Fit Index (GFI), Normed Fit Index (NFI), Non-Normed Fit Index (NNFI), Incremental Fit Index (IFI), Relative Fit Index (RFI), and Comparative Fit Index (CFI) with the recommended value for each model fit test is ≥0.9. Based on table 2 above, the value of RMSEA, RMR, GFI, NFI, NNFI, IFI, RFI, and CFI is more than the recommended value for RMSEA of ≤0.08 while other values are following the table above which is 0.98 which means that this research model is a good fit. Of the 9 model trials, 1 test was not fit (Chi-Square), two marginal fit (RMR and GFI), and six tests resulted in a good fit model (RMSEA, NFI, NNFI, IFI, RFI, and CFI). Thus it can be concluded that the model estimate produced in this research is acceptable because it has a good fit value that is greater than the net fair value. It means that the model obtained in this study is following the model theoretically.

Evaluation of the Measurement Model

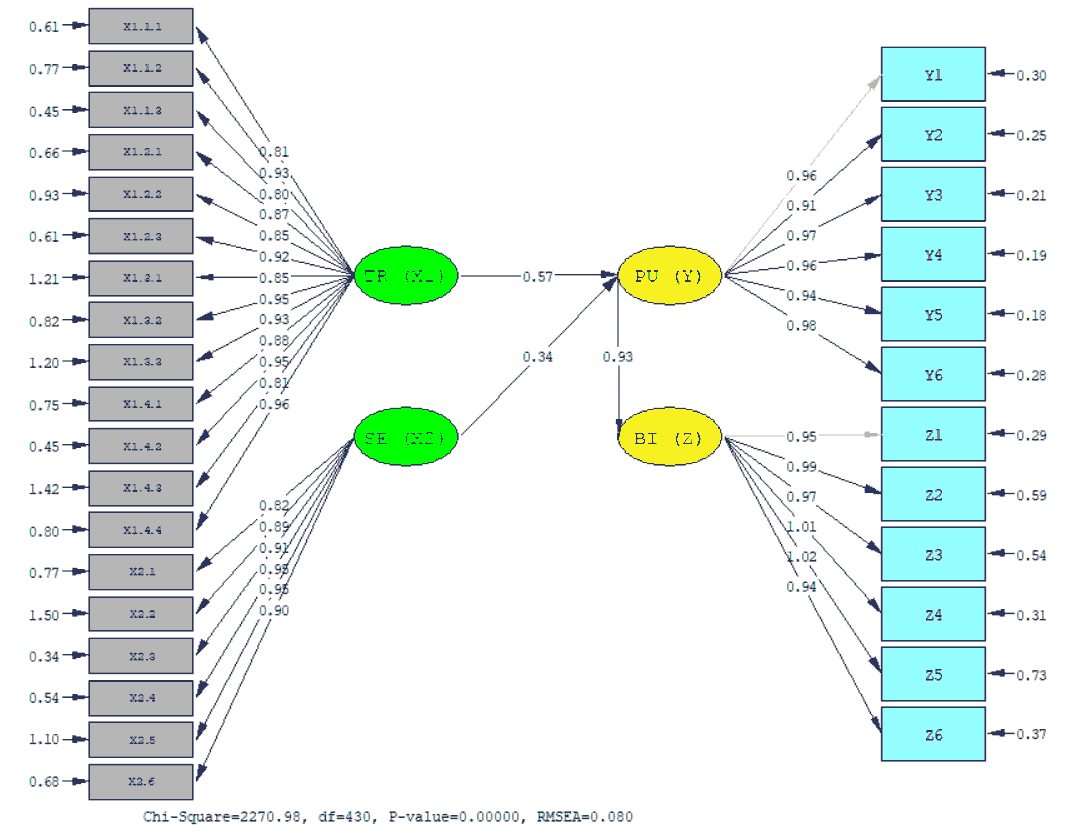

Measurement models are used to evaluate the relationship between latent variables and manifest. If the relationship's loading factor value is below 0.05, according to Hair et al. (2014), the construct is recommended to be removed from the model. The following is a full model path diagram of the influence of technology readiness and self-efficacy on perceived usefulness and its impact on behavioral intention, as shown in Figure 1 below.

Based on Figure 1 above, the lowest loading factor value in the Technology Readiness (X1) variable is in the X1.2.1 construct of 0.80, and the highest value in the construct X1.4.4 is 0.96. Then the lowest loading factor value in the self-efficacy variable (X2) is in the X2.1 construct of 0.82, and the highest value is in the constructs X2.4 and X2.5. In the Perceived Usefulness (Y) variable, the lowest loading factor value is Y2 of 0.91, and the highest value is in the Y6 construct of 0.98. Then in the behavioral intention (Z) variable, the highest factor loading value in the Z5 construct is 1.02, and the lowest factor value is in the Z6 construct, which is 0.94. Thus, it can be concluded that the factor loading value in this research model has met the applicable requirements because it has met the minimum loading factor value, which is above 0.5. Then, to determine the degree of conformity, the calculation of construct reliability (CR) and Average Variable Extracted (AVE) is carried out on each latent variable. Table 3 below shows the results of CR and AVE calculations.

| Tabel 3 Construct Reliability (CR) and Average Variance Extracted (AVE) of Each Latent Variable |

||||

|---|---|---|---|---|

| Indicator | Loading Factor | |||

| TR | SE | PU | BI | |

| 1 | 0.81 | 0.82 | 0.96 | 0.95 |

| 2 | 0.93 | 0.89 | 0.91 | 0.99 |

| 3 | 0.8 | 0.91 | 0.97 | 0.97 |

| 4 | 0.87 | 0.95 | 0.96 | 1.01 |

| 5 | 0.85 | 0.95 | 0.94 | 1.02 |

| 6 | 0.92 | 0.9 | 0.98 | 0.94 |

| 7 | 0.85 | - | - | - |

| 8 | 0.95 | - | - | - |

| 9 | 0.93 | - | - | - |

| 10 | 0.88 | - | - | - |

| 11 | 0.95 | - | - | - |

| 12 | 0.81 | - | - | - |

| 13 | 0.96 | - | - | - |

| CR | 0.925 | 0.856 | 0.959 | 0.924 |

| AVE | 0.807 | 0.872 | 0.922 | 0.981 |

Based on table 3 above, the CR value for the variable Technology Readiness (TR), Self-efficacy (SE), Perceived Usefulness (PU), and Behavioral Intention (BI) has a value above 0.7 as recommended by Hair et al. (2014). Meanwhile, the AVE value based on Table 3 above exceeds the recommended value by Hair et al. (2014), which is 0.5. It is shown that all constructs on these variables are valid and reliable.

Hypothesis testing

After the measurement model for each latent variable has been described, the next step is to test each path's hypothesis. Table 4 describes the structural model results and its hypothesis decisions, as shown in the table below:

| Tabel 4 Hypothesis Testing |

|||||

|---|---|---|---|---|---|

| Hypotheses | Path | Coefficient | t-value | Decision | R2 |

| H1 | Technology Readiness = > Perceived Usefulness | 0,57 | 9,86 | Accepted | 0,78 |

| H2 | Self-efficacy = > Perceived Usefulness | 0,34 | 5,97 | Accepted | |

| H3 | Perceived Usefulness = > Behavioral Intention | 0,93 | 28,2 | Accepted | |

The hypothesis can be decided by comparing the t value with the statistical t. The t statistic value for the 5% error rate is 1.96. Based on Table 4, the t value for the technology readiness variable path to perceived usefulness is 9.86, which is greater than the t statistical value of 1.96. It is shown that technology readiness has a significant positive effect on perceived usefulness, with an influence level of 57%. Then the self-efficacy variable for perceived usefulness has at a value of 5.97. It is greater than the t table, so it can be concluded that the self-efficacy variable has a significant positive effect on perceived usefulness with an influence level of 34%. The variable perceived usefulness for behavioral intention has a value of 28.2, more significant than the t table. So, it can be concluded that perceived usefulness has a significant positive effect on the behavioral intention by 93%.

After testing the hypothesis between variables, we calculated the effect together through the R-square value. Based on the calculations in table 4, it can be seen that technology readiness and self-efficacy have a common effect of 78% on perceived usefulness.

The Effect of Technology Readiness on Perceived Usefulness

Based on the system's usefulness, the majority of e-banking users feel that e-banking is useful in supporting work or daily life. It can be seen from each indicator on the perceived usefulness where the average value is 6.23 of the maximum total value 7. The user's answers are consistent with the existing indicators on the perceived usefulness where the variation of answers is in number 6, which indicates that the user agrees that e-banking is useful.

The most dominant thing in e-banking users is that technology makes work more accessible because it speeds up work. Users feel that e-banking can increase productivity because it does not have to be done at the official Bank office, which requires a lot of time and energy when transacting to a physical bank office. The existence of notification features and One-time password (OTP) in e-banking is a significant factor in overcoming user concerns using e-banking.

Technology readiness considers individual differences to measure the intention to use new Technology (Parasuraman, 2000). Thus, technology readiness evaluates the use of technology in ease and usability (Lin et al., 2007). Several researchers ( Lin & Chang, 2011; Parasuraman, 2000) explain that technology readiness is an essential factor in showing users' tendency towards technology. That research in line with what Walczuch et al. (2007) stated the relationship between Technology Readiness and perceived usefulness.

The technology readiness of e-banking users in this study can be said to be good. Users agree that e-banking technology is useful in supporting work. It is just that the high concern, especially the risk of problems in e-banking, is the main point that users feel unprepared. Besides, users feel that when doing e-banking, they must confirm whether the incoming or outgoing transaction happened. So that a sense of comfort and safety affects the user's perception that e-banking is very useful in supporting daily work.

The Effect of Self-efficacy on Perceived Usefulness

Based on hypothesis testing, the calculated t-value (3.304) is greater than the t-table (1.96). Thus, it can be concluded that self-efficacy affects the perceived usefulness of e-banking users in Indonesia.

Self-efficacy is a person's self-confidence that has an essential role in influencing motivation and behavior (Bandura, 1986). In the context of using technology, self-efficacy is defined as an assessment of a person's ability to use Technology (Compeau & Higgins, 1995a). The more people receive information and experience, the more their self-efficacy can change (Marakarkandy et al., 2017). According to Chandio, Irani, Abbasi, & Nizamani (2013), it reveals that technological self-efficacy has a significant impact on the perceived ease of banking information systems. The use of internet banking will be easier to use if individuals have high self-efficacy than individuals who have low self-efficacy (Tan & Teo, 2000). Having experience in operating a computer or laptop technology raises concerns that it causes adverse effects on user perceptions of internet banking (Wang et al., 2003a). The existence of fear for users about the loss of interaction with humans makes e-banking technology services, namely phone banking, an excellent solution to these concerns.

The existence of customer service that serves by telephone guarantees users to make transactions or confirm problems. So that users feel ready for the presence of e-banking technology.

The e-banking technology used by users in Indonesia is considered useful even though they have low or high self-confidence. These results are consistent with previous research conducted by Shih & Fang (2006), which found that self-efficacy has a positive relationship with perceived benefits and a positive relationship with perceived ease of use. The results also support other studies (Wang et al., 2003a; Wu, Wang, & Lin, 2007) that show a significant effect of computer self-efficacy on perceived usefulness.

The Effect of Perceived Usefulness on Behavioral Intention

Based on hypothesis testing, the variable of perceived usefulness on the behavior to continue to use has a t-value (13.640) greater than t table (1.96). Thus, it can be concluded that perceived usefulness positively affects 59.4% on Behavioral Intention. Perceived usefulness is the level of assessment and user confidence in a technology that can improve its performance. Perceived Usefulness is one of the most vital indicators in internet banking (Marakarkandy et al., 2017). It shows that users tend to use information systems because they see the features and uses of the information system (Davis, 1989). Likewise, in e-banking, users will tend to use e-banking compared to traditional methods because of the benefits of e-banking itself. According to (Lockett & Littler, 1997), the most useful feature of internet banking usage is the 24-hour feature availability. When compared with traditional methods, users have to adjust to bank working hours to conduct banking transactions.

The many benefits offered by e-banking will help users continue to use e-banking to help with their work and daily life. Akturan & Tezcan (2012) argue that mobile banking can help complete various financial tasks very quickly and profitably. The more the use of information technology is carried out with minimum effort, the more likely they are to use this Technology (Mansour, 2016; Davis, 1989; Luarn & Lin, 2005; Sripalawat et al., 2011; Venkatesh & Bala, 2008). In the context of e-banking, the more users feel that Mobile banking is useful, the more likely they are to accept Mobile banking technology (Mansour et al., 2016). In Finland, perceived usefulness is the factor that has the most significant impact on making someone intend to continue using internet banking (Pikkarainen, Pikkarainen, Karjaluoto, & Pahnila, 2004).

Venkatesh & Bala (2008) describe the influence of a strong relationship between perceived usefulness and behavioral intention. The higher a person's perception of information systems' usefulness, the behavior to use the information system tends to continue to be used (Musyaffi & Kayati, 2020; Rosnidah, Muna, Musyaffi, & Siregar, 2019). Wang, Lin, & Luarn (2006) also agreed that some users choose to use mobile services because they see this technology's benefits. Also, Suoranta (2013) agrees that the lack of awareness and realization of the benefits promised by technology user companies is an essential factor that hinders mobile banking acceptance. Also, previous research (Cheng, 2012; Lin & Chang, 2011; Pai & Huang, 2011; Sripalawat et al., 2011; Venkatesh & Bala, 2008; Zhang, 2016) has shown tangible evidence that perceived usefulness has an impact positive towards Behavioral Intention.

Conclusion

This study answers the big problems in intention behaviour in using e-banking, namely technology readiness, Perceived Usefulness, and self-efficacy. The results of this research indicate that Technology Readiness has a significant positive effect on perceived usefulness. It is because the most dominant thing in e-banking users is that this technology makes work more comfortable. After all, it can speed up work. Users feel that e-banking can increase productivity because it does not have to be done at the official Bank office, which requires a lot of time and energy when transacting to a physical bank office. Then, the Self-Efficacy variable has a significant positive effect on perceived usefulness. A person's confidence in adopting a system cannot be separated from the desire to achieve something against the system. For example, users' familiarity with smartphones can increase self-confidence to feel that the e-banking system is advantageous because it can transact anywhere. Besides that, the Perceived Usefulness variable has a significant positive effect on Behavioural Intention. The many benefits offered by e-banking will help users continue to use e-banking to help with their work and daily life. The use of mobile banking can help complete various financial tasks very quickly and profitably. In the context of e-banking, the more users feel that Mobile banking is useful, the more likely they are to accept e-banking technology.

Respondents who use e-banking in this research are young people with an age range of 21-40 years, and very few users are over 50 years old. It means that young people improve the quality of e-banking; a different approach is needed for each segment. As an example of mobile banking adoption, the results show that age is the most crucial predictor of e-banking. Younger people are more likely to adopt e-banking than older people. Therefore, more effort should be invested in educating parents about the usefulness of e-banking applications. Besides, mobile services' design must be more inclusive to accommodate users who are higher in age. E-banking system developers must focus on designing systems that can accommodate demographic variables such as age, type of use, education, and gender. Education also provides the adoption of e-banking. Users with Doctoral education are one of the lowest, even though these users have sufficient income to impact economic transactions, especially in banking. Hence, a strategy to attract highly educated users and support these users becomes a critical point to increase the overall adoption rate.

References

- Adams, D.A., Nelson, R.R., & Todd, P.A. (1992). Perceived Usefulness, Ease of Use, and Usage of Information Technology: A Replication. MIS Quarterly, 16(2), 227.

- Agarwal, R., & Prasad, J. (1997). The Role of Innovation Characteristics and Perceived Voluntariness in the Acceptance of Information Technologies. Decision Sciences, 28(3), 557–582.

- Ajzen, I., & Fishbein, M. (1975). A Bayesian analysis of attribution processes. Psychological Bulletin, 82(2), 261.

- Akturan, U., & Tezcan, N. (2012). Mobile banking adoption of the youth market. Marketing Intelligence & Planning, 30(4), 444–459.

- Alalwan, A. A., Dwivedi, Y. K., Rana, N. P. P., & Williams, M. D. (2016). Consumer adoption of mobile banking in Jordan. Journal of Enterprise Information Management, 29(1), 118–139.

- APJII. (2016). Penetrasi & Perilaku Pengguna Internet Indoensia.

- Baker, D. A., & Crompton, J. L. (2000). Quality, satisfaction and behavioral intentions. Annals of Tourism Research, 27(3), 785–804.

- Bamberg, Sebastian, Ajzen, I., & Schmidt, P. (2003). Choice of travel mode in the theory of planned behavior: The roles of past behavior, habit, and reasoned action. Basic and applied social psychology. Basic and Applied Social Psychology, 25(3), 175–187.

- Bandura, A. (1986). Social foundations of thought and action: A social cognitive theory. In Englewood Cliffs, NJ, US: Prentice-Hall, Inc 12, xiii 617.

- Bakri., & Mulyani, S. (2019). The influence of using enterprise resource planning (ERP) technology and knowledge management on the quality of accounting information systems. International Journal of Supply Chain Management, 8(5), 62–68.

- Basgoze, P. (2015). Integration Of Technology Readiness (Tr) Into The Technology Acceptance Model (Tam) For M-Shopping. International Journal of Scientific Research and Innovative Technology, 3(2), 26–35.

- Ben Mansour, K. (2016). An analysis of business’ acceptance of internet banking: an integration of e-trust to the TAM. Journal of Business & Industrial Marketing, 31(8), 982–994.

- Boonsiritomachai, W., & Pitchayadejanant, K. (2017). Determinants affecting mobile banking adoption by generation Y based on the Unified Theory of Acceptance and Use of Technology Model modified by the Technology Acceptance Model concept. Kasetsart Journal of Social Sciences.

- Brown, I., Cajee, Z., Davies, D., & Stroebel, S. (2003). Cell phone banking: Predictors of adoption in South Africa - An exploratory study. International Journal of Information Management, 23(5), 381–394.

- Chan, C.L., & Lin, C.L. (2009). Determinants of satisfaction and intention to use self-service technology - Technology readiness and computer self-efficacy. In IIH-MSP 2009 - 2009 5th International Conference on Intelligent Information Hiding and Multimedia Signal Processing, 893–897.

- Chandio, F.H., Irani, Z., Abbasi, M.S., & Nizamani, H.A. (2013). Acceptance of online banking information systems: An empirical case in a developing economy. Behaviour and Information Technology, 32(7), 668–680.

- Chen, S.C., Liu, M.L., & Lin, C.P. (2013). Integrating Technology Readiness into the Expectation–Confirmation Model: An Empirical Study of Mobile Services. Cyberpsychology, Behavior, and Social Networking, 16(8), 604–612.

- Chen, W.T., Wantland, D., Reid, P., Corless, I.B., Eller, L.S., Iipinge, S., … Webel, A.R. (2013). Engagement with Health Care Providers Affects Self- Efficacy, Self-Esteem, Medication Adherence and Quality of Life in People Living with HIV. Journal of AIDS & Clinical Research, 4(11), 256.

- Cheng, Y. (2012). Effects of quality antecedents on e?learning acceptance. Internet Research, 22(3), 361–390.

- Chitungo, S., & Munongo, S. (2013). Extending the Technology Acceptance Model to Mobile Banking Adoption in Rural Zimbabwe. Journal of Business Administration and Education, 3(1), 51–79.

- Chuan-Chuan Lin, J., & Lu, H. (2000). Towards an understanding of the behavioural intention to use a web site. International Journal of Information Management, 20(3), 197–208.

- Compeau, D.R., & Higgins, C.A. (1995a). Application of social cognitive theory to training for computer skills. Information Systems Research, 6(2), 118–143.

- Compeau, D.R., & Higgins, C.A. (1995b). Computer Self-Efficacy: Development of a Measure and Initial Test. MIS Quarterly, 19(2), 189.

- Cooper, D.R., & Schindler, P.S. (2014). Business Research Methods. McGraw Hill.

- Daniel, E. (1999). Provision of electronic banking in the UK and the republic of Ireland. The International Journal of Bank Marketing, 17(2), 72–83.

- Databoks. (2017). Transaksi Perbankan Berbasis Digital Terus Meningkat.

- Darma, J., Susanto, A., Mulyani, S., & Suprijadi, J. (2018). The role of top management support in the quality of financial accounting information systems. Journal of Applied Economic Sciences, 13(4), 1009–1020.

- Davis, F.D. (1989). Perceived Usefulness, Perceived Ease of Use, and User Acceptance of Information Technology. MIS Quarterly, 13(3), 319.

- Dwivedi, Y., & Irani, Z. (2009). Understanding the adopters and non-adopters of broadband. Communications of the ACM2, 52(1), 122–125.

- Edison, G., Manuere, F., Joseph, M., & Gutu, K. (2012). Evaluation of factors influencing adoption of accounting information system by small to medium enterprises in Chinhoyi. Interdisciplinary Journal of Contemporary Research in Business, 4(6), 1126–1141.

- Elliott, K., Meng, G., & Hall, M. (2012). The Influence of Technology Readiness on the Evaluation of Self-Service Technology Attributes and Resulting Attitude Toward Technology Usage. Services Marketing Quarterly, 33(4), 311–329.

- Fagan, M.H., Neill, S., & Wooldridge, B.R. (2003). An Empirical Investigation into the Relationship between Coputer Self-Efficact, Anxiety, Experience, Support, and Usage. Journal of Computer Information Systems, 96–104.

- Gupta, S., & Yadav, A. (2017). The Impact of Electronic Bankin and Information Technology on the Employees of Banking Sector. Management and Labour Studies, 42(4), 1–9.

- Hair, J.F., Sarstedt, M., Hopkins, L., & Kuppelwieser, V.G. (2014). Partial least squares structural equation modeling (PLS-SEM). European Business Review, 26(2), 106–121.

- Harrison McKnight, D., Choudhury, V., & Kacmar, C. (2002). The impact of initial consumer trust on intentions to transact with a web site: A trust building model. Journal of Strategic Information Systems, 11(3–4), 297–323.

- Ho Cheong, J., & Park, M. (2005). Mobile internet acceptance in Korea. Internet Research, 15(2), 125–140.

- Huang, J.H., Lin, Y.R., & Chuang, S.T. (2007). Elucidating user behavior of mobile learning: A perspective of the extended technology acceptance model. The Electronic Library, 25(5), 585–598.

- Hussain Chandio, F., Irani, Z., Abbasi, M.S., & Nizamani, H.A. (2013). Acceptance of online banking information systems: an empirical case in a developing economy. Behaviour & Information Technology, 32(7), 668–680.

- Islam, Z., Kim Cheng Low, P., & Hasan, I. (2013). Intention to use advanced mobile phone services (AMPS). Management Decision, 51(4), 824–838.

- Johnson, R.D., & Marakas, G.M. (2000). The role of behavioral modeling in computer skills acquisition: Toward refinement of the model. Information Systems Research, 11(4), 402–417.

- Kamaludin, A. (2018). Hanya 7,39% Pengguna Internet Indonesia Pakai Aplikasi Perbankan.

- Kim, J., Geum, Y., & Park, Y. (2015). Integrating customers’ disparate technology readiness into technological requirement analysis: an extended Kano approach. Total Quality Management and Business Excellence, 28(5–6), 678–694.

- Ladewi, Y., & Mulyani, S. (2015). Critical Sucess Factor For Implementation Enterprise Resource Planning System Survey BUMN Companies in Bandung. International Journal of Scientific of Technology Research, 4(05), 74–80.

- Ladewi, Y., Susanto, A., Mulyani, S., & Suharman, H. (2017). Critical Factors Accounting Information System Success Survey of State-Owned Enterprises (SOE) in Indonesia. In International Journal of System Signal Control and Engineering Application, 10, 32–40

- Lancelot M.C., Popovi?, A., & Oliveira, T. (2013). Determinants of end-user acceptance of biometrics: Integrating the “big 3” of technology acceptance with privacy context. Decision Support Systems, 56(1), 103–114.

- Liébana-Cabanillas., Marinkovi?, V., & Kalini?, Z. (2017). A SEM-neural network approach for predicting antecedents of m-commerce acceptance. International Journal of Information Management, 37(2), 14–24.

- Liljander, V., Gillberg, F., Gummerus, J., & van Riel, A. (2006). Technology readiness and the evaluation and adoption of self-service technologies. Journal of Retailing and Consumer Services, 13(3), 177–191.

- Lin, C.H., Shih, H.Y., & Sher, P.J. (2007). Integrating technology readiness into technology acceptance: The TRAM model. Psychology & Marketing, 24(7), 641–657.

- Lin, F., Fofanah, S.S., & Liang, D. (2011). Assessing citizen adoption of e-Government initiatives in Gambia: A validation of the technology acceptance model in information systems success. Government Information Quarterly, 28(2), 271–279.

- Lin, J.S.C., & Chang, H.C. (2011). The role of technology readiness in self-service technology acceptance. Managing Service Quality, 21, 424–444.

- Lockett, A., & Littler, D. (1997). The adoption of direct banking services. Journal of Marketing Management, 13(8), 791–811.

- Lu, C., Huang, S., & Lo, P. (2010). An empirical study of on-line tax filing acceptance model : Integrating TAM and TPB. African Journal of Business Management, 4(May), 800–810.

- Luarn, P., & Lin, H. (2005). Toward an understanding of the behavioral intention to use mobile banking. Computers in Human Behavior, 21(6), 873–891.

- Mansour, I.H.F., Eljelly, A.M.A., & Abdullah, A.M.A. (2016). Consumers’ attitude towards e-banking services in Islamic banks: the case of Sudan. Review of International Business and Strategy, 26(2), 244–260.

- Marakarkandy, B., Yajnik, N., & Dasgupta, C. (2017). Enabling internet banking adoption: An empirical examination with an augmented technology acceptance model (TAM). Journal of Enterprise Information Management, 30(2), 263–294.

- Marketeers. (2016). Alasan Aplikasi Mobile Banking BCA Masih Dikritik Konsumen.

- McKnight, D.H.D., Cummings, L.L.L.L.L., & Chervany, N.L.N. (1998). Initial trust formation in new organizational relationships. Academy of Management Review, 23(1), 1–18.

- Melas, C.D., Zampetakis, L.A., Dimopoulou, A., & Moustakis, V.S. (2014). An empirical investigation of Technology Readiness among medical staff based in Greek hospitals. European Journal of Information Systems, 23(6), 672–690.

- Meng, J., Elliott, K.M., & Hall, M.C. (2009). Technology readiness index (TRI): Assessing cross-cultural validity. Journal of International Consumer Marketing, 22(1), 19–31.

- Meuter, M.L., Ostrom, A.L., Bitner, M.J., & Roundtree, R. (2003). The influence of technology anxiety on consumer use and experiences with self-service technologies. Journal of Business Research.

- Motaghian, H., Hassanzadeh, A, & Moghadam, D.K. (2013). Factors affecting university instructors’ adoption of web-based learning systems: Case study of Iran. Computers & Education, 61, 158–167.

- Mulyani, S., Hassan, R., & Anugrah, F. (2016). The critical success factors for the use of information systems and its impact on the organizational performance. International Business Management, 10(4), 552–560.

- Mulyani, S., & Rachmawati, R. (2016). The Influence of the Quality of Management Accounting Information System, Quality of Management Accounting Information, and Quality of Service of Accounting Information System on the Information System User Satisfaction. International Journal of Economics Research, 13(3).

- Mulyani, S., & Endraria. (2017). The empirical testing for the effect of organizational commitment and leadership style on the implementation success of Enterprise Resource Planning (ERP) systems and its implications on the quality of accounting information. Journal of Engineering and Applied Sciences, 12(20), 5196–5204.

- Muñoz-Leiva, F., Climent-Climent, S., & Liébana-Cabanillas, F. (2017). Determinants of intention to use the mobile banking apps: An extension of the classic TAM model. Spanish Journal of Marketing - ESIC, 21(1), 25–38.

- Musyaffi, A.M., & Kayati. (2020). Dampak Kemudahan dan Risiko Sistem Pembayaran QR Code: Technology Acceptance Model (TAM) Extension. Jurnal Inspirasi Bisnis Dan Manajemen, 3(2), 161–176.

- Ndubisi, N.O. (2007). Customers’ perceptions and intention to adopt Internet banking: the moderation effect of computer self-efficacy. Ai & Society, 21(3), 315–327.

- Nurhayati, N., & Mulyani, S. (2015). User participation on system development, user competence and top management commitment and their effect on the success of the implementation of accounting information system. European Journal of Business and Innovation Research, 3(2), 56–68.

- Otoritas Jasa Keuangan. (2015). Buku Bijak Ber-ebanking. Retrieved from https://www.ojk.go.id/Files/box/buku bijak ber-ebanking.

- Otoritas Jasa Keuangan. (2017). Laporan Triwulan II.

- Pai, F.Y., & Huang, K.I. (2011). Applying the Technology Acceptance Model to the introduction of healthcare information systems. Technological Forecasting and Social Change, 78(4), 650–660.

- Parasuraman, A. (2000). Technology Readiness Index (Tri): A Multiple-Item Scale to Measure Readiness to Embrace New Technologies. Journal of Service Research, 2(4), 307–320.

- Parasuraman, A., & Colby, C.L. (2015). An Updated and Streamlined Technology Readiness Index: TRI 2.0. Journal of Service Research, 18(1), 59–74.

- Pikkarainen, T., Pikkarainen, K., Karjaluoto, H., & Pahnila, S. (2004). Consumer acceptance of online banking: an extension of the technology acceptance model. Internet Research-Electronic Networking Applications and Policy, 14(3), 224–235.

- Püschel, J., Mazzon, J.A., & Hernandez, J.M.C. (2010). Mobile banking: proposition of an integrated adoption intention framework. International Journal of Bank Marketing, 28(5), 389–409.

- Rahman, M.S., Mannan, M., Hossain, M.A., & Zaman, M.H. (2018). Patient’s behavioral intention: public and private hospitals context. Marketing Intelligence & Planning, 36(3), 349–364.

- Ramos, A.K., Su, D., Correa, A., & Trinidad, N. (2018). Association between Social Capital and Self-Efficacy among Latinas in Nebraska. Social Work in Public Health, 33(1), 31–42.

- Rosnidah, I., Muna, A., Musyaffi, A.M., & Siregar, N.F. (2019). Critical Factor of Mobile Payment Acceptance in Millenial Generation: Study on the UTAUT model. In International Symposium on Social Sciences, Education, and Humanities (ISSEH 2018).

- Roy, S., & Moorthi, Y.L.R. (2017). Technology readiness, perceived ubiquity and M-commerce adoption. Journal of Research in Interactive Marketing, 11(3), 268–295.

- Sathye, M. (1999). Adoption of Internet banking by Australian consumers: An empirical investigation. International Journal of Bank Marketing, 17(7), 324–334.

- Schwarzer, R., Antoniuk, A., & Gholami, M. (2015). A brief intervention changing oral self-care, self-efficacy, and self-monitoring. British Journal of Health Psychology, 20(1), 56–67.

- Sharma, S.K., Gaur, A., Saddikuti, V., & Rastogi, A. (2017). Structural equation model (SEM)-neural network (NN) model for predicting quality determinants of e-learning management systems. Behaviour and Information Technology, 36(10), 1053–1066.

- Shen, Y.C., Huang, C.Y., Chu, C.H., & Hsu, C.T. (2010). A benefit-cost perspective of the consumer adoption of the mobile banking system. Behaviour and Information Technology, 29(5), 497–511.

- Shih, Y.Y., & Fang, K. (2006). Effects of network quality attributes on customer adoption intentions of internet banking. Total Quality Management & Business Excellence, 17(1), 61–77.

- Singh, S., & Srivastava, R.K. (2018). Predicting the intention to use mobile banking in India. International Journal of Bank Marketing, 36(2), 357–378.

- Sripalawat, J., Thongmak, M., & Ngramyarn, A. (2011). M-Banking in Metropolitan Bangkok and a Comparison with other Countries. Journal of Computer Information Systems, 51(3), 67–76.

- Suoranta, M. (2013). Adoption of mobile banking in Finland (No. 28). Jyväskylän Yliopisto.

- Sukmadilaga, C., Pratama, A., & Mulyani, S. (2015). Good Governance Implementation in Public Sector: Exploratory Analysis of Government Financial Statements Disclosures Across ASEAN Countries. Procedia - Social and Behavioral Sciences, 211(September), 513–518.

- Suryadhi, A. (2015). Teller Masih Dipercaya Dibandingkan Online Banking.

- Tan, M., & Teo, T.S.H. (2000). Factors Influencing the Adoption of Internet Banking. Journal of the Association for Information Systems, 1(5), 1–42.

- Thatcher, J.B., Gundlach, M.J., McKnight, D.H., & Srite, M. (2007). Individual and human-assisted computer self efficacy: An empirical examination. In Wirtschaftinformatik Proceedings, 50.

- Venkatesh, V., & Bala, H. (2008). Technology Acceptance Model 3 and a Research Agenda on Interventions. Decision Sciences, 39(2), 273–315.

- Venkatesh, V., Morris, M.G., Davis, G.B., & Davis, F.D. (2003). User acceptance of information technology: Toward a unified view. MIS Quarterly, 425–478.

- Venkatesh., Viswanath., Thong, J.Y., & Xu., X. (2012). Consumer acceptance and use of information technology: extending the unified theory of acceptance and use of technology. MIS Quarterly, 36(1), 157–178.

- Walczuch, R., Lemmink, J., & Streukens, S. (2007). The effect of service employees’ technology readiness on technology acceptance. Information and Management, 44(2), 206–215.

- Wang, W.T., Wang, B., & Wei, Y.T. (2014). Examining the impacts of website complexities on User satisfaction based on the task-technology Fit model: an experimental research using an eyetracking Device. In Pacific Asia Conference on Information Systems (PACIS) (p. 287).

- Wang, Y.S., Wang, Y.M., Lin, H.H., & Tang, T.I. (2003). Determinants of user acceptance of Internet banking: an emirical study. International Journal of Service Industry Management, 14(5), 501–519.

- Wang, Y.S., Lin, H.H., & Luarn, P. (2006). Predicting consumer intention to use mobile service. Information Systems Journal, 16(2).

- Wang, Y.S., Wang, Y.M., Lin, H.H., & Tang, T.I. (2003a). Determinants of user acceptance of Internet banking: an empirical study. International Journal of Service Industry Management, 14(5), 501–519.

- Wang, Y.S., Wang, Y.M., Lin, H.H., & Tang, T.I. (2003b). Determinants of user acceptance of Internet banking: An empirical study. In International Journal of Service Industry Management, 14, 501–519.

- Wood, R., & Bandura, A. (1989). Impact of conceptions of ability on self-regulatory mechanisms and complex decision making. Journal of Personality and Social Psychology, 56(3), 407–415.

- Wu, J.H., Wang, S.C., & Lin, L.M. (2007). Mobile computing acceptance factors in the healthcare industry: A structural equation model. International Journal of Medical Informatics, 76(1), 66–77.

- Zeithaml, V.A., Berry, L.L., & Parasuraman, A. (1996). The Behavioral Consequences of Service Quality. Journal of Marketing, 60(2), 31.

- Zhang, J.H.Y. (2016). Chinese students’ behavior intention to use mobile library apps and effects of education level and discipline. Library Hi Tech, 34(4), 639–656.

- Zhou, T. (2012). Understanding users’ initial trust in mobile banking: An elaboration likelihood perspective. Computers in Human Behavior, 28(4), 1518–1525.

- Zuhra, W.U.N. (2016). Transfer Bank: Metode Tak Praktis, Tetapi Paling Digemari.