Research Article: 2021 Vol: 24 Issue: 4S

Is the village financial system appropriate for the village government? The role of task technology-fit

Dwi Kismayanti Respati, Universitas Negeri Jakarta

Ayatulloh Michael Musyaffi, Universitas Negeri Jakarta

Christian Wiradendi Wolor, Universitas Negeri Jakarta

Hera Khaerunnisa, Universitas Negeri Jakarta

Dewi Agustin Pratama Sari, Universitas Negeri Jakarta

Muhammad Ihlashul Amal, Universitas Negeri Semarang

Citation Information: Respati, D. K., Musyaffi, A. M., Wolor, C. W., Khaerunnisa, H., Sari, D. A. P., & Amal, M. I. (2021). Is the village financial system appropriate for the village government? The role of task technology-fit. Journal of Management Information and Decision Sciences, 24(S4), 1-9.

Abstract

The village fund program carried out by the government aims to distribute village development in Indonesia. In its implementation, the village funds are carried out through the village financial system to monitor village funds effectively and efficiently. However, in its application, there are several problems such as errors in the system, and the incompatibility of job descriptions with implementation in the field, causing village officials to be dissatisfied with the village financial system application. This study aims to determine the role of the technology-fit task and the level of user satisfaction in terms of behavioural intention and facilitation conditions. This study uses direct questionnaires to village officials involved in village financial system applications such as village heads, village secretaries, treasurers, financial staff, and the information technology department totalling 86 people. Meanwhile, the analytical tool used is SEM PLS. the results prove that facilitating condition is the variable that most influences behaviour intention compared to the impact caused by the technology-fit task. Meanwhile, user satisfaction has a significant impact on behaviour intention. This shows that the village government has agreed that the village financial system is following the needs of the government, especially in the village in managing village funds.

Keywords

Behavior intention; Facilitating condition; Task technology-fit; User satisfaction; Village financial system.

Introduction

Since its introduction in 2015 in Indonesia, village funds have become one of the most popular topics in Indonesia. This is because village funds can provide significant annual funds for villages. During the five years of its implementation, village funds have a significant increase wherein 2015; the funds disbursed reached 20.7 billion rupiahs, while in 2020, it reached 72 billion rupiahs. The large number of funds issued by the government to equalize villages in Indonesia makes supervision and monitoring so that people in rural areas can adequately feel activities and distribution of funds from the government. One form of monitoring and supervision is the village financial system that has been created by the financial supervisory agency (BPK) in collaboration with the Ministry of Finance and related stakeholders. The village financial system is an accounting information valuable system for recording and reporting village funds accurately and real-time. The existence of this Village financial system application allows village officials to understand and report financial accounting that applies correctly and adequately. Based on previous research, user of financial statements generally make decision based on information derived from financial statements (Pandya, 2016; Mahmoudi et al., 2017; Wibowo et al., 2019).

Although the use of village funds through the village financial system has many uses, the emergence of reporting problems still causes several problems. The village financial statistics report provides empirical facts in the field where some villages do not make financial reports (0.52%) (BPS-Statistics Indonesia, 2020). Whereas in government regulations, all villages without exception must make financial reports following applicable regulations. The reason some villages do not make financial reports is that there are no guidelines (79,535%), limited human resource capabilities (5.3%) and no guidance/assistance (9.92%) (BPS-Statistics Indonesia, 2020). This shows that the existing guidelines have not been able to be captured by some regions. Research has done (Rosnidah et al., 2019) shows that an easy information system and user needs will make it possible to continue using the system. This has become a large gap between the facilities provided by the government and the ability of human resources in managing village funds, causing the village government not to perform optimally.

Meanwhile, Indonesia Corruption Watch (ICW) revealed the misappropriation of village funds of up to IDR 40 billion. Out of 170 corruption cases in 2018, 30 per cent were cases of village funds (The Australia-Indonesia Center, 2019). So, based on empirical facts in the field, the researcher wants to prove whether the management of village funds using the village financial system has been appropriately used by the government, especially the village government, by looking at the dominant influencing factors under the problems in this research, namely task technology-fit and facilitating conditions.

Literature Review

Task technology-fit research has been carried out extensively, especially in information technology, to find out how the system's needs, task and user are. including expanding human understanding of organizational science in the context of technology(Salamzadeh, 2020). Task technology-fit can describe the compatibility between information technology capabilities and the user's work type (Musyaffi & Muna, 2020). When the technology used is by the user's expertise, the possibility of the user to continue to use it is even greater. On this basis, previous research also stated the same thing about technology-fit tasks that can affect behaviour intention (Kim et al., 2007; Yen et al., 2010; Yuce et al., 2019; Wan et al., 2020; Wang et al., 2021). So based on theoretical explanations and empirical evidence from previous research, the second hypothesis in this study is:

H1: Task Technology-fit have a sufficient impact on Behavior Intention.

Facilitating condition is defined as a user environment condition that has adequate facilities to support the use of technology (Rahi & Abd. Ghani, 2018; Gunasinghe et al., 2019; Rosnidah et al., 2019; Sankaran & Chakraborty, 2021). One of them is the existence of a guide that can be used to run the technology. In addition, another characteristic is that the technology infrastructure owned by the user can be under the minimum standards of the technology. When the technology infrastructure is available, it will then assist users in running the technology. Facilitating conditions in the context of the village financial system is manuals, both physical and technology related. Devices available in the workplace support the implementation of the technology and the support of assistants or supervisors who can help when the village government needs assistance. The higher the facilitating conditions for the village financial system, the higher the use of technology. Raharjo et al. (2016) state that the better the business process reengineering, the better the probability of Information system implementation success. Several previous studies also describe the same thing regarding the possibility of facilitating conditions that can increase the intention to use a technology (Venkatesh et al., 2003; 2012; Rahi et al., 2019; Alajmi & Alotaibi, 2020; Sharma et al., 2020; Musyaffi et al., 2021;). So based on theoretical explanations and empirical evidence from previous research, the second hypothesis in this study is:

H2: Facilitating Condition has a sufficient impact on behaviour intention.

The intensity of the use of technology shows a high interest in the technology. The more someone has the intention of technology, the tendency of satisfaction with the technology increases. User satisfaction shows the user's feelings about a positive interest in using information technology (Wan et al., 2020). When the intensity of the user increases in the use of information technology, he will tend to feel satisfied with the facilities and functions of the technology. Research conducted by McGill et al. (2004) shows that behaviour intention is a strong predictor in influencing user satisfaction. Meanwhile, other researchers also agree that high intensity of technology use can indicate a high level of satisfaction. So based on theoretical explanations and empirical evidence from previous research, the second hypothesis in this study is:

H3: User Satisfaction has a sufficient impact on Behavior Intention.

Research Methodology

This study focuses on users of the village financial system in Indonesia. A total of 86 respondents consisting of the village head, village secretary, treasurer, finance department, and Information technology section. We visited the village that became the respondent candidate to ask to fill out a questionnaire and conduct in-depth interviews about the problems that occur in the village financial system. After that, the existing data were analyzed using the Structural Equation Model using the partial least square method. In analyzing using PLS, the first is to analyze the outer model to see the validity and reliability of the construct. Second, evaluate the structural model to see if the model building has a good model fit. Finally, hypothesis testing is carried out to conclude the hypothesis built with statistical results using PLS (Hair et al., 2019).

This research adopts various opinions from previous research. The technology-fit task has 4 Questionnaire items (Goodhue & Thompson, 1995; Abugabah et al., 2015; Yuce et al., 2019). Then on the facilitating condition variable, there are 4 Questionnaire items (Venkatesh et al., 2012). At the same time, the behavioural intention variable (Singh & Srivastava, 2018) and user satisfaction have 3 Questionnaire items (Kim et al., 2007).

Results and Discussion

Measurement Model

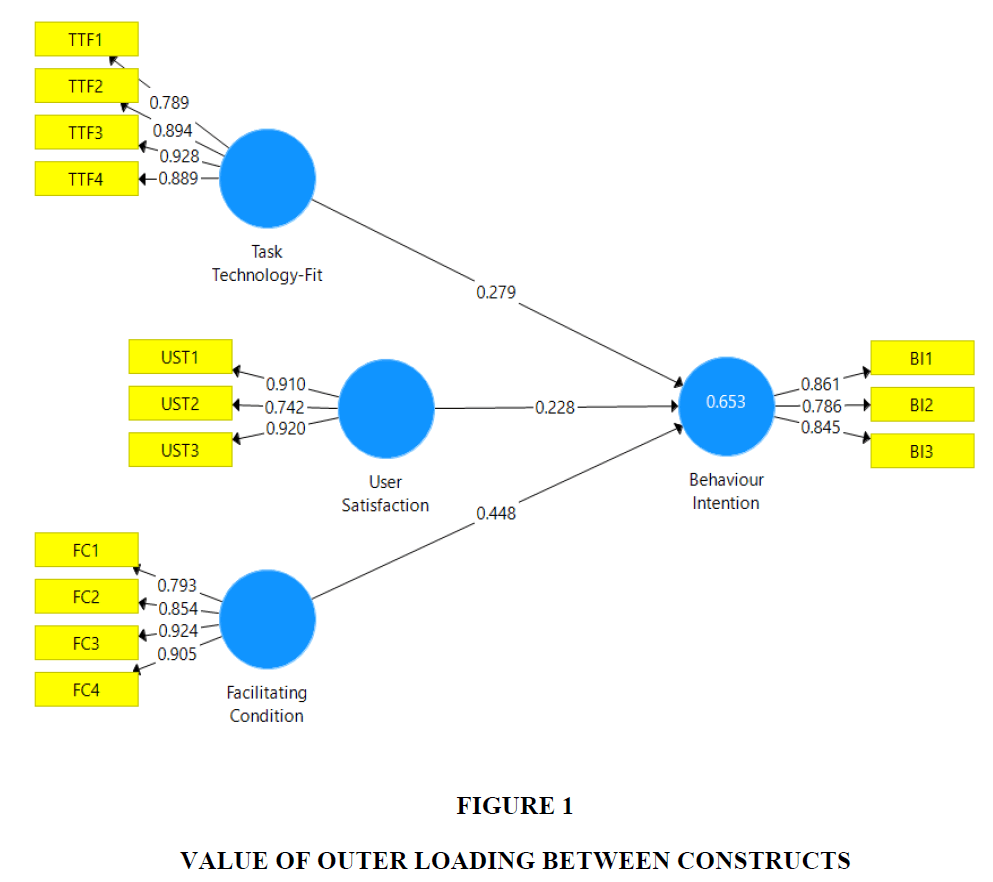

Based on (Hair et al., 2019), the first step in analyzing using SEM PLS is to perform a measurement model. The measurement model aims to analyze the validity and reliability of the construct through outer loading, AVE, CA, CR. Figure 1 and Table 1 below show the value of outer loading between constructs. Based on the Figure 1, the value of outer loading for all constructs exceeds 0.7 as recommended. Thus, further analysis can be continued.

Then the next step is to analyze the validity and reliability using the evaluation of CA, CR and AVE with the recommended values of 0.5 for AVE and 0.7 for CA and CR (Hair et al., 2019). Table 1 below shows the value of validity and reliability based on the values of CA, CR and AVE.

Based on Table 1 above, the CA and CR values exceed the recommended values, which are more than 0.7. Thus, each construct in the technology-fit task variable, facilitation condition, behaviour intention and user satisfaction have good validity and reliability. Meanwhile, the AVE value for all variables has a value above 0.5, as recommended. Thus, it can be said that all of these variables are valid and reliable.

| Table 1 Validity and Reliability Instrument | ||||||

| Construct | Outer loading | VIF | CA | CR | AVE | |

| Task Technology-Fit | TTF1 | 0.789 | 2.023 | 0.899 | 0.930 | 0.768 |

| TTF2 | 0.894 | 3.361 | ||||

| TTF3 | 0.928 | 4.328 | ||||

| TTF4 | 0.889 | 2.997 | ||||

| Facilitating Condition | FC1 | 0.793 | 1.929 | 0.892 | 0.926 | 0.758 |

| FC2 | 0.854 | 2.559 | ||||

| FC3 | 0.924 | 3.626 | ||||

| FC4 | 0.905 | 3.139 | ||||

| Behaviour Intention | BI1 | 0.861 | 1.606 | 0.780 | 0.870 | 0.691 |

| BI2 | 0.786 | 1.584 | ||||

| BI3 | 0.845 | 1.656 | ||||

| User Satisfaction | UST1 | 0.910 | 2.684 | 0.825 | 0.895 | 0.742 |

| UST2 | 0.742 | 1.460 | ||||

| UST3 | 0.920 | 2.612 | ||||

Structural Model

After evaluating the validity and reliability of the constructs, the next step is to evaluate the structural model through Collinearity Statistics (VIF). Good research must be free from collinearity. So the function of VIF is to evaluate whether the existing constructs are free from collinearity with a VIF value not exceeding 5. Based on Table 1 above, all constructs for the variables of behaviour intention, facilitating condition, task technology-fit and user satisfaction has a VIF value below 5. Thus, it can be concluded that all constructs in this study have been free from collinearity problems.

Then the next step is to evaluate the R square. R square is used to test the joint effect between variables. The criteria for R square are substantial, moderate and weak, which have a value of 0.75, 0.50 and 0.25 (Hair et al., 2019). Based on Table 2 below, the value of the r2 on the behaviour intention variable is 0.653, while the adjusted R square is 0.64. This shows that the task technology-fit, facilitating condition and user satisfaction directly influence behaviour intention by 64% with a moderate category.

| Table 2 R Square and R Square Adjusted | ||

| R2 Square | R2 Adjusted | |

| Behaviour Intention | 0.653 | 0.640 |

Hypotheses Testing

After evaluating the VIF, the next step is to evaluate the proposed hypothesis with a statistical value. Table 3 below shows the statistical results to evaluate the proposed hypothesis.

| Table 3 Hypothesis Testing | ||||

| Original Sample | T Statistic | p-value | Decision | |

| Task Technology-Fit → Behavior Intention | 0.279 | 1.798 | 0.046 | H1 Accepted |

| Facilitating Condition → Behavior Intention | 0.448 | 2.425 | 0.003 | H2 Accepted |

| User Satisfaction → Behavior Intention | 0.228 | 4.783 | 0.003 | H3 Accepted |

Hypothesis testing is used to test the evaluation of the proposed hypothesis statistically. To produce these conclusions is to compare the p-value with the specified error rate (5%). If the p-value is smaller than the error rate, then the hypothesis can be concluded that there is a significant effect. In the first hypothesis, the technology-fit task on behaviour intention has a p-value below 0.5, which is 0.046, means that the first hypothesis can be accepted. Then proceed to the second hypothesis, namely facilitating conditions for behaviour intention, which has a p-value below 0.5, which is 0.003. it means that the second hypothesis is accepted. Then the last hypothesis, namely user satisfaction with behaviour intention, has a p-value below 0.5, which is 0.003, which means that the third hypothesis can be accepted. Based on this explanation, it can be concluded that all the hypotheses that have been proposed are accepted.

Conclusion

Based on the three hypotheses proposed, the second hypothesis, namely facilitating conditions, is the variable with the most significant influence compared to the other hypotheses, which is 0.448 or 44.8 percent. The higher the facilitating condition, the greater the possibility to continue using the village financial system. the role of technology becomes very important in all fields including government (Deakins & North, 2013; Shabani, 2016). This shows that to optimize the village financial system, the village government must adequate facilities, such as guidelines that can be implemented quickly, system training, technological infrastructure (such as internet networks, sophisticated computers) and mentors. This is following the results of research conducted by the Central Statistics Agency of Indonesia, where the most prominent problem why human resources in villages are not optimal in making reports due to the absence of easy guidelines (79.535%), lack of human resource capabilities (5.3%) and the absence of guidance/assistance. (9.92%) (BPS-Statistics Indonesia, 2020). The results of this research are also following the previous literature where facilitating conditions have a significant impact on behaviour intention (Khalilzadeh et al., 2017; Tak & Panwar, 2017; Eneizan et al., 2019; Merhi et al., 2019; Rosnidah et al., 2019; Yang et al., 2019; Kamboj & Joshi, 2020; Mohd Thas Thaker et al., 2021; Musyaffi et al., 2021; Musyaffi & Muna, 2021).

Based on statistical results, it is proven that task technology-fit (p-value 0.046 < 0.05) has a significant influence on behaviour intention to use village financial system with a closeness level of 0.279 or 27.9 percent. The suitability of the task is closely related to the desire to continue to use the village finance system (Kim et al., 2007; Yuce et al., 2019; Musyaffi & Muna, 2020; Wan et al., 2020; Pal & Patra, 2021; Wang et al., 2021;). Based on field data, most of those who input into the village finance system know and understand the regulations and provisions of village funds and the village financial system. The results of this research are also supported by a report from the Indonesian Central Statistics Agency, which describes that the majority of filling in the village financial system is carried out by the village head (6.58%), the village secretary (26.75%), and the head of affairs (49.67%). The more satisfied the village government is with the village financial system, the village government is increasingly using the village financial system (p-value 0.002<0.05) with a construct closeness level of 0.228 or 22.8%. This is supported by the results of other studies where user satisfaction has a significant impact on behaviour intention to use village financial system (Kim et al., 2007; Yen et al., 2010; Yuce et al., 2019; Wan et al., 2020; Wang et al., 2021). This research also shows satisfaction from the village government in using the village financial system, especially in managing village funds.

References

- Abugabah, A., Sanzogni, L., & Alfarraj, O. (2015). Evaluating the impact of ERP systems in higher education. International Journal of Information and Learning Technology, 32(1), 45-64.

- Alajmi, M. A., & Alotaibi, J. H. (2020). Reconceptualization of system use in the context of the digital library: what are the roles of UTAUT and IS success models? Journal of Electronic Resources Librarianship, 32(3), 151-181.

- BPS-Statistics Indonesia. (2020). Financial Statistics of Village Goverment. https://www.bps.go.id/publication/2021/03/05/10f5448be62f4370c7146697/statistik-keuangan-pemerintah-desa-2020.html

- Deakins, D., & North, D. J. (2013). The role of finance in the development of technology-based SMEs: evidence from New Zealand. Journal of Entrepreneurship, Business and Economics, 1(1/2), 82-100.

- Eneizan, B., Mohammed, A. G., Alnoor, A., Alabboodi, A. S., & Enaizan, O. (2019). Customer acceptance of mobile marketing in Jordan: An extended UTAUT2 model with trust and risk factors. International Journal of Engineering Business Management, 11, 1-10.

- Goodhue, D. L., & Thompson, R. L. (1995). Task-technology fit and individual performance. MIS Quarterly: Management Information Systems, 19(2), 213-233.

- Gunasinghe, A., Hamid, J. A., Khatibi, A., & Azam, S. M. F. (2019). The adequacy of UTAUT-3 in interpreting academician’s adoption to e-Learning in higher education environments. Interactive Technology and Smart Education, 17(1), 86-106.

- Hair, J. F., Risher, J. J., Sarstedt, M., & Ringle, C. M. (2019). When to use and how to report the results of PLS-SEM. European Business Review, 31(1), 2-24.

- Kamboj, S., & Joshi, R. (2020). Examining the factors influencing smartphone apps use at tourism destinations: a UTAUT model perspective. International Journal of Tourism Cities, 7(1), 135-157.

- Khalilzadeh, J., Ozturk, A. B., & Bilgihan, A. (2017). Security-related factors in extended UTAUT model for NFC based mobile payment in the restaurant industry. Computers in Human Behavior, 70, 460-474.

- Kim, C., Jahng, J., & Lee, J. (2007). An Empirical Investigation into the Utilization-Based Information Technology Success Model: Integrating Task–Performance and Social Influence Perspective. Journal of Information Technology, 22(2), 152-160.

- Mahmoudi, S., Mahmoudi, S., & Mahmoudi, A. (2017). Prediction of earnings management by use of multilayer perceptron neural networks with two hidden layers in various industries. Journal of Entrepreneurship, Business and Economics, 5(1), 216-236.

- McGill, T. J., Klobas, J. E., & Hobbs, V. J. (2004). Perceptions, User Satisfaction and Success: Testing the DeLone and McLean Model in the User Developed Application Domain. In M. Khosrow-Pour, D.B.A. (Ed.), Advanced Topics in Information Resources Management, Volume 3 (pp. 87-116). IGI Global.

- Merhi, M., Hone, K., & Tarhini, A. (2019). A cross-cultural study of the intention to use mobile banking between Lebanese and British consumers: Extending UTAUT2 with security, privacy and trust. Technology in Society, 59, 101151.

- Mohd Thas Thaker, H., Mohd Thas Thaker, M. A., Khaliq, A., Allah Pitchay, A., & Iqbal Hussain, H. (2021). Behavioural intention and adoption of internet banking among clients’ of Islamic banks in Malaysia: an analysis using UTAUT2. Journal of Islamic Marketing, In Press.

- Musyaffi, A. M., & Muna, A. (2020). Task Technology-Fit of a Village Financial System (Siskeudes) to Increase Officers’ Performance. Proceedings of KnE Social Sciences/International Conference on Economics, Business and Economic Education 2019 pp.720-730.

- Musyaffi, A. M., & Muna, A. (2021). Critical Factors of Cloud Accounting Acceptance and Security for Prospective Accountants: Tam Extension. Jurnal Riset Akuntansi Kontemporer, 13(1), 1-6.

- Musyaffi, A. M., Sari, D. A. P., & Respati, D. K. (2021). Understanding of Digital Payment Usage During COVID-19 Pandemic: A Study of UTAUT Extension Model in Indonesia. The Journal of Asian Finance, Economics and Business, 8(6), 475-482.

- Pal, D., & Patra, S. (2021). University Students’ Perception of Video-Based Learning in Times of COVID-19: A TAM/TTF Perspective. International Journal of Human-Computer Interaction, 37(10), 903-921.

- Pandya, Bhargav. (2016). Impact of financial leverage on market value added: empirical evidence from India. Journal of Entrepreneurship, Business and Economics, 4(2), 40-58.

- Raharjo, S. T., Mudiantono, & Perdhana, M. S. (2016). SME’s Enterprise Resource Planning Implementation, Competitive Advantage, and Marketing Performance. Journal of Entrepreneurship, Business and Economics, 4(1), 22-44.

- Rahi, S., & Abd. Ghani, M. (2018). The role of UTAUT, DOI, perceived technology security and game elements in internet banking adoption. World Journal of Science, Technology and Sustainable Development, 15(4), 338-356.

- Rahi, S., Othman Mansour, M. M., Alghizzawi, M., & Alnaser, F. M. (2019). Integration of UTAUT model in internet banking adoption context: The mediating role of performance expectancy and effort expectancy. Journal of Research in Interactive Marketing, 13(3), 411-435.

- Rosnidah, I., Muna, A., Musyaffi, A. M., & Siregar, N. F. (2019). Critical Factor of Mobile Payment Acceptance in Millenial Generation: Study on the UTAUT model. International Symposium on Social Sciences, Education, and Humanities (ISSEH 2018), 123-127.

- Salamzadeh, A. (2020). What Constitutes A Theoretical Contribution?. Journal of Organizational Culture, Communications and Conflict, 24(1), 1-2.

- Sankaran, R., & Chakraborty, S. (2021). Factors Impacting Mobile Banking in India: Empirical Approach Extending UTAUT2 with Perceived Value and Trust. IIM Kozhikode Society & Management Review, 232020682097521.

- Shabani, Shiva. (2016). Analysis and identification of entrepreneurial opportunities in construction industry using composite technology. Journal of Entrepreneurship, Business and Economics, 4(1), 85-107.

- Sharma, S., Singh, G., Pratt, S., & Narayan, J. (2020). Exploring consumer behavior to purchase travel online in Fiji and Solomon Islands? An extension pf the Utaut framework. International Journal of Culture, Tourism, and Hospitality Research, 15(2), 227-247.

- Singh, S., & Srivastava, R. K. (2018). Predicting the intention to use mobile banking in India. International Journal of Bank Marketing, 36(2), 357-378.

- Tak, P., & Panwar, S. (2017). Using UTAUT 2 model to predict mobile app based shopping: evidences from India. Journal of Indian Business Research, 9(3), 248-264.

- The Australia-Indonesia Center. (2019). A look at the village fund program four years on. Retrieved from https://australiaindonesia.com/infrastructure/indonesian-media-in-brief-a-look-at-the-village-fund-program-four-years-on/

- Venkatesh, V., Morris, M. G., Davis, G. B., & Davis, F. D. (2003). User acceptance of information technology: Toward a unified view. MIS Quarterly: Management Information Systems, 27(3), 425-478.

- Venkatesh, V., Thong, J. Y. L., & Xu, X. (2012). Consumer acceptance and use of information technology: Extending the unified theory of acceptance and use of technology. MIS Quarterly: Management Information Systems, 36(1), 157-178.

- Wan, L., Xie, S., & Shu, A. (2020). Toward an Understanding of University Students’ Continued Intention to Use MOOCs: When UTAUT Model Meets TTF Model. SAGE Open, 10(3), 215824402094185.

- Wang, X., Wong, Y. D., Chen, T., & Yuen, K. F. (2021). Adoption of shopper-facing technologies under social distancing: A conceptualisation and an interplay between task-technology fit and technology trust. Computers in Human Behavior, 124, 106900. https://doi.org/10.1016/j.chb.2021.106900

- Wibowo, A., Panday, R., Mardiyah, S., & Prasetyo, A. (2019). Analysis of the factors affecting understanding of Small and Medium businesses in preparing financial reports. Journal of Entrepreneurship, Business and Economics, 6(2), 91-100.

- Yang, H. H., Feng, L., & MacLeod, J. (2019). Understanding College Students’ Acceptance of Cloud Classrooms in Flipped Instruction: Integrating UTAUT and Connected Classroom Climate. Journal of Educational Computing Research, 56(8), 1258-1276.

- Yen, D. C., Chin-Shan Wu, Fei-Fei Cheng, & Yu-Wen Huang. (2010). Determinants of users’ intention to adopt wireless technology: An empirical study by integrating TTF with TAM. Computers in Human Behavior, 26(5), 906-915.

- Yuce, A., Abubakar, A. M., & Ilkan, M. (2019). Intelligent tutoring systems and learning performance: Applying task-technology fit and IS success model. Online Information Review, 43(4), 600-616.