Research Article: 2021 Vol: 25 Issue: 2

Is OTT Industry a Disruption to Movie Theatre Industry?

Sony Varghese, Xavier Institute of Management & Entrepreneurship, Kochi

Selvin Chinnaiah, Xavier Institute of Management & Entrepreneurship, Kochi

Abstract

The Internet is rapidly transforming the entertainment industry in India. The size and effect of the future use of digital content is massive for the country's mobile phone user base, led by the launch of 3 G and 4 G networks and millions of subscribers. Audiences are using numerous different technologies to view films, documentaries, and web series on their smartphone devices. Some examples include Netflix, Amazon Prime, Hotstar and Zee5, which provide movies and other video content through internet. It has become a challenge to the Movie theater industry. Now that theatres are shut down and film releases are suspended in the midst of the national shutdown, cinema owners worry that the universal experience of viewing movies will eventually change digital platforms, leading to a dip in viewers visiting once the screens open up again. The aim of this study is to learn how digital streaming platforms are affecting Indian movie theatres, and how young people use these new digital platforms to access video content. This research analyses the viewing habits of young people through digital platforms and movie theatres for video content. This report also analyses the changing dynamics in the film industry in India. Almost 50% respondents agree that over the top applications will be a disruption to Movie theatres. Reasons behind it are smartphone penetration, cost effectiveness, convenience of service, personal medium and availability of International content. But it is also difficult to achieve certain theater factors such as screen size & sound quality, theatrical experience and ambience in OTT platforms. This study suggested that viewers of the modern era are constantly searching for original, connected, and interactive entertainment and they are ready to pay extra money to seek a completely immersive experience in movie theatres or OTT platforms. Thus, in the long term, OTT platforms and movie theatres will coexist. The study will finally conclude by giving suggestions on how movie theatres compete to stay relevant, in the minds of their consumers in the current marketplace, where video content is easily accessible on OTT platforms from the convenience of their homes.

Keywords

OTT, Movie Theatres, Industry, Digital Streaming.

Introduction

There has been a big transition in the Indian movie theatre industry, from tiny street rolling-image frames to compact theatres in villages and towns to single projector theatres and finally massive multiplex chains. India is one of the world's biggest growing markets, with a GDP scale of 6-7 percent, a per capita consumption rise of around ~ 9 percent, as well as the third largest purchasing power parity economy in the entertainment and leisure sector, attracting rapid growth. The tendency to spend on recreation and entertainment is growing, with favorable demographics and increasing disposable spending, higher than the economy itself. The rise of the internet still continues to increase doubt as to where the future of the movie theatre industry is going given the technological developments that took the industry to the present position. Although the internet has helped to produce (digital) products and services more efficiently, it has the ability to improve efficiency and decrease costs as well. This will continue to build potential options for the consumer that can threaten other current possibilities. And OTT platforms are has become one of the film theatre industry’s disruptive innovations.

Over-the-top (OTT) media platform refers to something like a digital video platform which is distributed explicitly to consumers bypassing cable, radio and satellite tv channels over the Internet that usually act as distributors of those content. Over the past few years, owing to the rise in internet consumption, the media and entertainment sector has seen a significant push. This transition was motivated by factors such as fast internet connectivity, cheaper smartphones, extra screens, competitive data plans, and greater bandwidth capacity. Over the years, Over the Top (OTT) services have redefined their goals and customer desires. The growth of OTT networks has affected the movie theatre industry.

The fundamentals of the Movie theatre industry are being redefined; this paper will discuss development and evaluate the performance of the OTT market. Some of the online streaming platforms such as Netflix, YouTube, Amazon Prime Video, Hotstar, Zee5 provides a great opportunity to see and appreciate the issues facing the movie theatre industry, what the issuer is doing to combat the demand to see whether or not the customers are benefiting from these transitions.

Research Objective

The aim of this project is to examine the OTT and Movie theatre industry in detail. The key purpose of this analysis is to examine whether the advent of the OTT platforms such as Amazon, Netflix, Hotstar etc. has impacted the Movie theatre industry and what effect they have on consumers.

The following are the main objectives of the study:

1. To analyze the Movie theatre industry and OTT industry in India.

2. To analyze what relevance does the OTT industry have for the Movie theatre industry.

3. To analyze whether the Movie theatre industry are getting benefited or not because of the OTT platforms.

4. To analyze the consumer's perception of a movie theater after OTT emerged into the market.

Significance of Study

This study will allow us to better understand the future of the OTT industry and the movie industry. The OTT and Movie Theatre sector will benefit from this research on India, the path ahead as more than 250 million individuals watched online videos in 2017, a 64 percent growth over the prior year, EY said. This is expected to increase to 500 million by 2020, giving India the second-biggest viewers for online content streaming worldwide. Now that theatres are shut down and film releases are suspended in the midst of the national shutdown, theatre owners are concerned that digital platforms will inevitably change the universal experience of watching films, resulting in a dip in audiences returning once the screens open again. Therefore, during the lockdown and post lockdown, this would be the best possible time to analyze how people will approach the relation between OTT platforms and movie theaters.

Methodology

The primary and outgoing data can be represented as research in the pursuit for information. By deep research, it helps determine the root causes and encourages us to identify the solutions by evaluating, deducting and eventually determining the possible methods and choosing the correct one. To see how it solves the dilemma, such technique is being analyzed.

Questionnaire and interviews are research instruments that are used in the research which helps in defining the variables, sampling methodology and technique to be adopted, enables us to create a sampling framework and their relations. Interviews were conducted via phone with theatrical owners, distributors or producers about how they perceive OTT platforms. Primary data is used where a questionnaire of 28 questions is floated and acquired 326 responses which helps to find out the consumer’s video consumption pattern, their behavior towards movie theater, after OTT became the convenient regular driver for all and consumer’s perception towards changing Media and Entertainment industry.

3 Interviews were conducted via phone to a OTT provider, past distributor & producer and a legendary director. These interviews were conducted to find out the industry’s perception towards transformation in Media and Entertainment industry. Secondary data was also be used for this research.

1. From journals, books, magazines, websites.

2. Collected from the multiplex’s official websites and OTT Company’s websites.

The type of analysis that is used to evaluate the outcomes is descriptive statistics method. This method is chosen based on the samples, statistical relations, and sampling variables that are discovered during the research.

Literature Review

Sharma (2020) in her article, “Are OTT platforms taking over theatrical experience?” showcases that, India's OTT market size is estimated at $0.5 billion and is projected to rise to $5 billion by 2023, according to the Boston consultancy group. She also notices that it is now not uncommon to find certain movies reaching for the OTT path and meet the desired intended audience. Video streaming platforms have undoubtedly made it inexpensive, easy, and open to watch movies on the go, particularly for those who enjoy binge-watching.

Usmani (2018) in his article, “India’s Online Streaming Infatuation Is Taking Over Its Love For Cinema” says that film revenue is projected to rise at a moderate rate to around Rs 19,200 crore by 2020, whereas to Rs 22,400 crore for online streaming service during the same period. He also highlights on a recent EY study which states that, India's average speed is very poor and sometimes a five-second lag in video streaming because of loading would affect a fourth of its audience to a content publisher.

Bhattacharya (2019) in her article, “India’s largest cinema chain is thriving in the era of OTT” says that India is a dreadfully less-screened country. China has around 60,000 screens, whereas India still doesn't have 10,000, in comparison. It seems there are just 8 theatres every million individuals, with two-thirds of Indians as they are released losing access to film.

Data Analysis

Data was collected online through Google forms. Totally, there were 326 responses. Of which, respectively, men and women were 61.3% and 38.7%. The majority of respondents fell within the 15-24 age range, which constitutes about 66.5% of the overall respondents. The bulk of respondents are students who are about 63.1% of the overall respondents.

Customer behavior towards OTT platforms and Movie theatre industry TIME SPENT

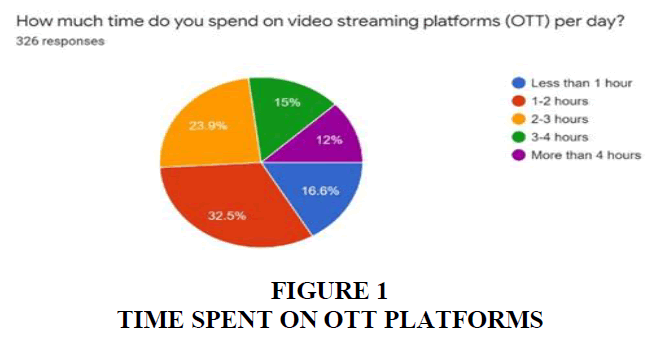

On these OTT platforms around 32.5% of viewers spend. 1-2 hours a day. The next highest is around 23.9% of viewers on these OTT platforms spend 2-3 hours a day in Figure 1.

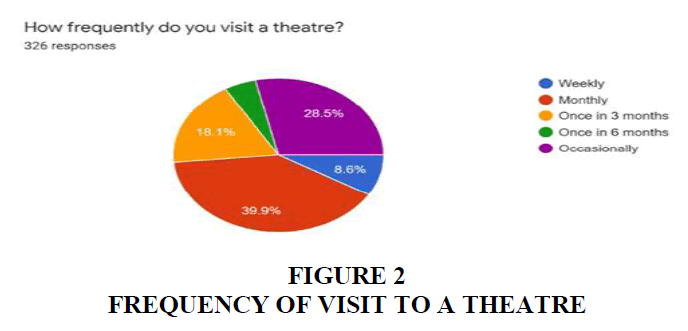

The majority of respondents who are about 39.9% of people visit the theatre once a month. The next majority of viewers, around 28.5%, occasionally visit theatres. So, it's clear that nearly 50% of viewers are spending 1- 3 hours a day on these OTT platforms in Figure 2.

Most Preferred Watching Time

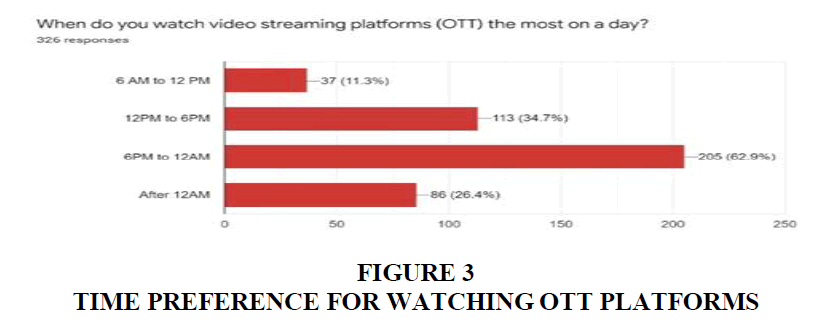

As to the details in the chart above, more than 50% of Indian audiences about 62.9% watch the content on late evening and Night from 6PM and 12AM. About 34.7% of consumers consume such apps throughout the afternoon and early evening, which is 12PM and 6PM in Figure 3.

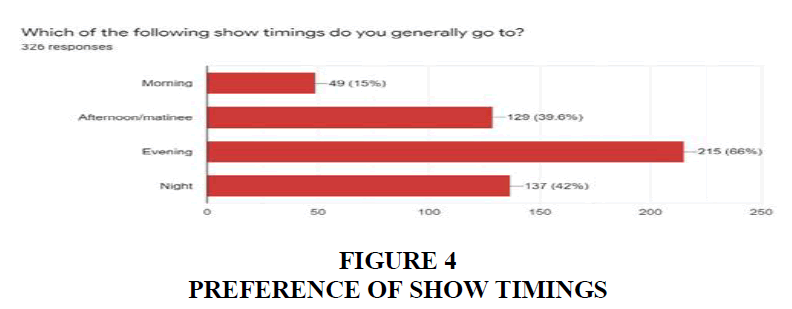

More than 50% of Indian audiences, which is about 66%, prefer to watch evening movie shows, according to the data in the Figure 4.

PRICE

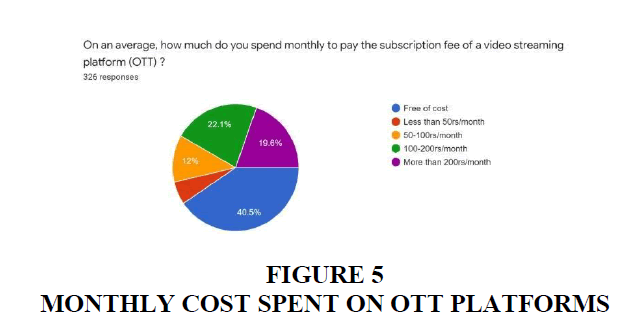

From the chart it can be seen that about 40.5% of consumers use a free subscription which implies they choose the freemium video content or the group subscription in Figure 5. Roughly 22.1% of viewers spending 100-200rs / month and around 19.6% of viewers spending more than 200rs / month, according to the data. So, about the other 40% of consumers paying more than 100rs a month for the premium video content.

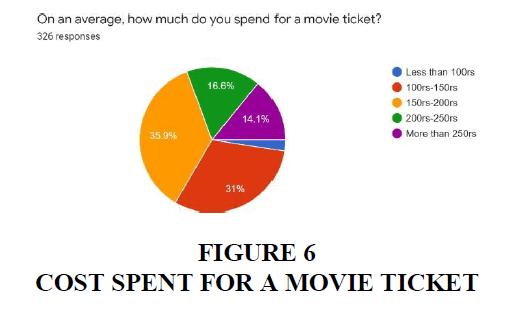

It can be seen from the chart that around 35.9% of the users spend 150-200rs for a movie ticket. The next majority viewers which is around 31% of them spend 100-150rs for a movie ticket. So, it denotes that more than 60% of the viewers spend 100-200rs for a movie ticket in Figure 6.

Preferred Video Content

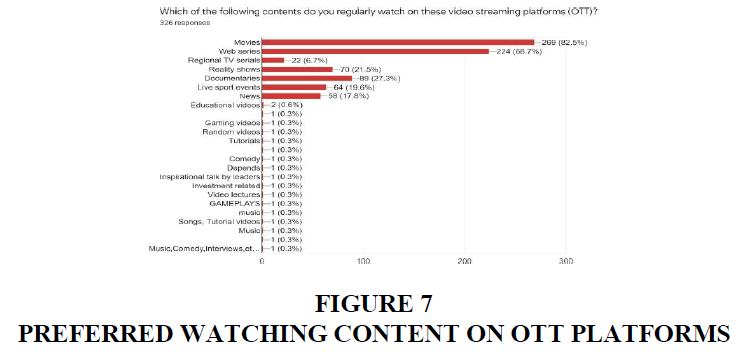

Movies and Web series are the most preferred video contents that are regularly watched on OTT platforms with 82.5% users regularly watch movies and 68.7% viewers watch Web series in Figure 7.

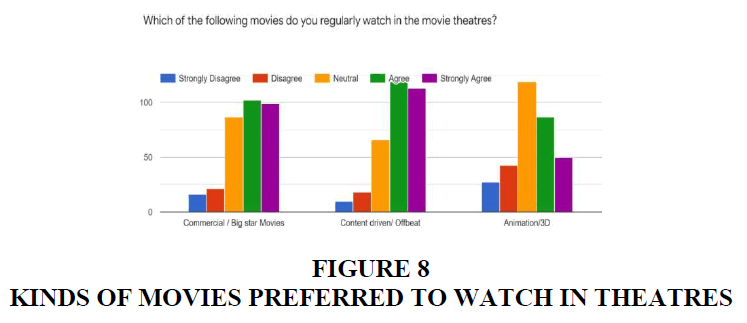

Using the Likert scale method analysis, weightage was given and rank of each variables were found and tabulated. From this chart, we can claim that content- driven films are the audiences' choice and we can see the shift in viewers' pattern against films they see in theaters where it proved that “Content is always the King” to get the audience to see a movie in Figure 8.

Leads to Watch

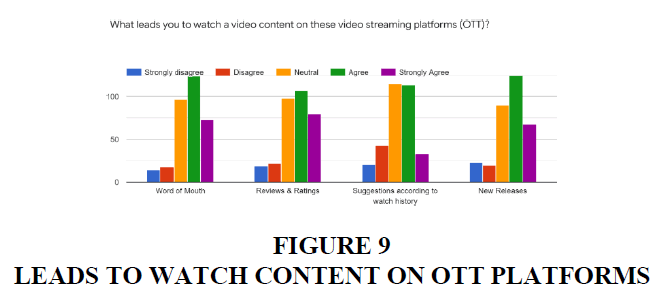

Using the Likert scale method analysis, weightage was given and rank of each variables were found and tabulated. From this table, we can say that word of mouth is highly influencing viewers to watch a video content on OTT platforms in Figure 9.

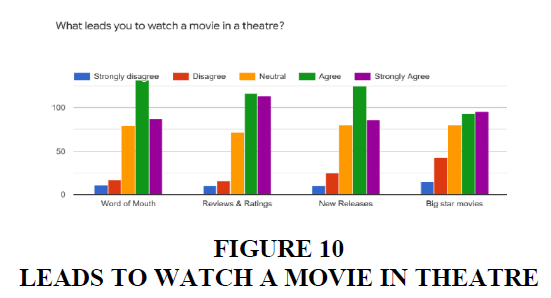

Using the Likert scale method analysis, weightage was given and rank of each variables were found and tabulated. From this table, we can say that Reviews & Ratings are highly influencing viewers to watch a video content on Movie theatres. This denotes the importance of reviews & ratings which every pubic media publishes in Figure 10.

Reasons to Prefer

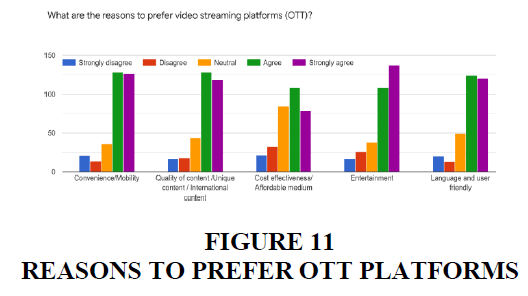

Using the Likert scale method analysis, weightage was given and rank of each variables were identified and tabulated. From this table, we can say that Convenience is the most preferred reason to watch on OTT platforms and also entertainment and quality of content are also preferred as they very close in weightage in Figure 11.

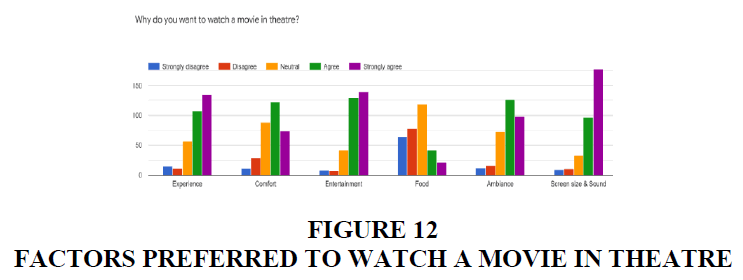

Using the Likert scale method analysis, weightage was given and rank of each variables were found and tabulated. From this table, we can say that Screen size and Sound quality are the primary reasons for the viewers that becomes a deciding factor on watching a movie in a theatre in Figure 12.

OTT Platforms vs Movie Theatres

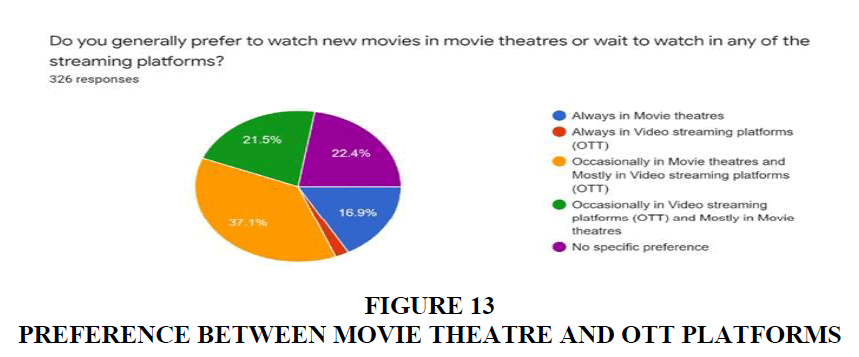

As per the data in the table above, it is evident that most of the Indian viewers which is around 37.1% prefer watching a movie occasionally in Movie theatres and Mostly in Video streaming platforms. It indicates that OTT wave changes the audiences' pattern or behavior by preferring to watch a new film mostly through OTT platforms rather than in a movie theatre in Figure 13.

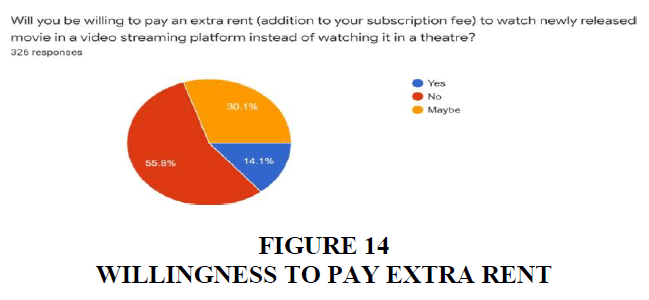

About 55.8% of audiences are unwilling to pay an extra charge in addition to their subscription fee to watch a new movie. Yet then the second majority, which is about 30% of viewers, said they would pay an additional rent because they believe it's money worth. So this needs to be taken into consideration as well in Figure 14.

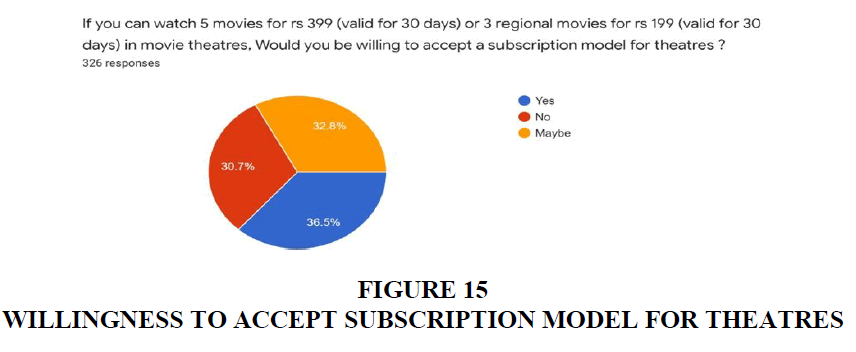

The table indicates explicitly that consumers are ready for a theater subscription model because 36.5% of audiences are likely to consider a subscription model because they think it offers value for money in Figure 15. But the other two options are both closer to 30%, and the concern for them is whether there will be 5 good films launching a month or that they will have time to visit a theatre 5 times a month, but most people tend to visit a theatre just once a month from the previous data we gathered.

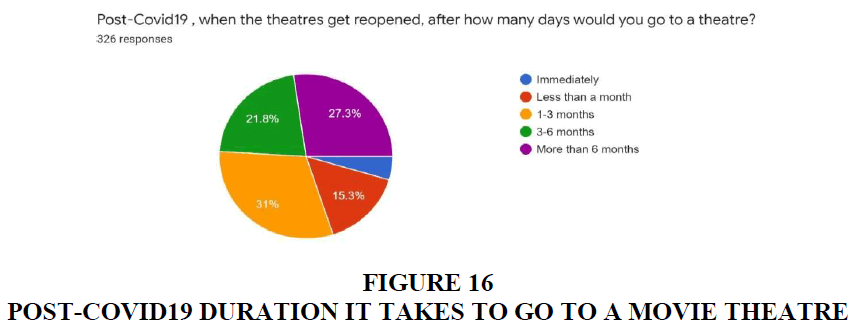

As per the data, post-covid19 most of the people prefer to visit a theatre after 1-3 months from its reopening. On a scale of 1 to 5, rate your expectations in a movie theatre for the factors given below?

Using the rating scale method of analysis, weightage were given and rank of each variables were found and tabulated. From this table, we can say that Screen size and Sound quality are the most important factor that is expected out of movie theatres from the viewers. The choice of movies is the second most preferred which is going play a significant role on viewers decision to go to a theatre in Figure 16.

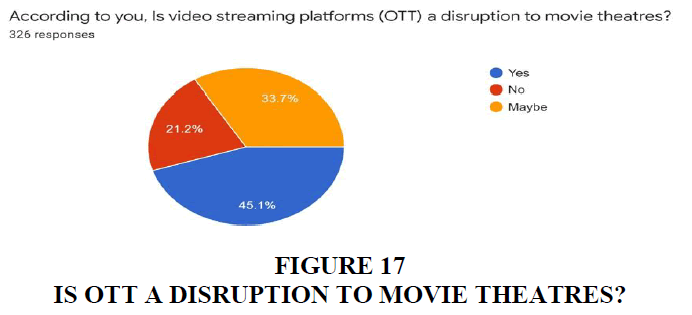

It is evident from the chart, about 45.1% viewers believe that OTT platforms are a disruption to movie theatres and the reasons are stated in Figure 17.

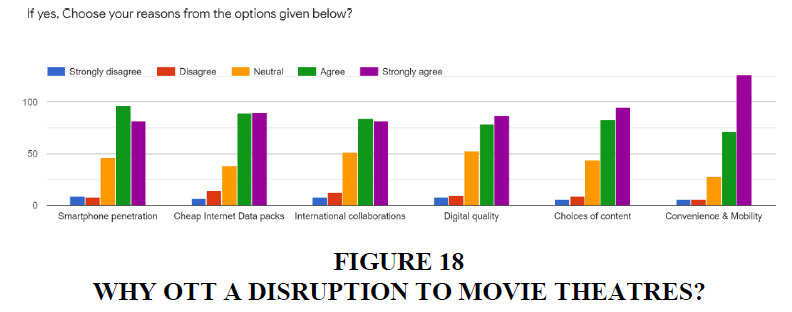

Using the Likert scale method of analysis, weightage was given and rank of each variables were found and tabulated in Figure 18. From this table, we can say that viewers believe that convenience and mobility is the major reason for OTT being a disruption to Movie theatres. This has to be seriously considered by the movie theatres on how to compete and overcome this factor. If no, some of the viewers reasons are stated below:

Theatrical experience, ambience, screen size and sound quality are the important reasons that be given while watching on an OTT platform. These are the important factors that differentiate and can never be matched by OTT platforms.

Findings

When it comes to OTT platforms, on an average every user holds minimum of 2 OTT platforms and they regularly spend 1-2 hours a day. The most preferred time to watch is early night and the most preferred language is English. The biggest advantage of OTT platforms is that consumers access a ton of content in a freemium model where OTT platforms offer free content with a specific collection and there would be an incentive to switch to the paying subscription. This model has seen a change towards viewers viewing behaviors as it leads to accessing the model of paid subscription. The key factor that offers an advantage over watching in movie theatres are convenience and mobility for viewers who opt for OTT platforms. OTT platforms have allowed users, at their own convenience, to access a variety of content at low expense.

When it comes to Movie theatres, viewers prefer both single screen and multiplexes to watch a movie. Majority of the viewers go for a movie once very month and evening show is the most preferred time slot. Viewers are ready to spend 150-200rs to watch a movie. Both, English and Regional languages are preferred. Majority of the viewers opting to watch a movie in the theatre when it’s a highly content driven movie. Thus, a change in consumer watching habits can be seen where theatres were highly preferred for commercial/big star movies, but now it replaced by content driven movies. Reviews and Ratings plays a crucial factor and it becomes a deciding factor for the new age audience to watch a movie in theatre. The viewers who opt for movie theatres believe that theatrical experience, screen size & sound quality and ambience are the important factors that creates an edge over watching in OTT platforms. Movie theatres provides the users to watch a movie with a completely transformative experience.

From the data, it can be said that people prefer watching content mostly in OTT platforms and occasionally in movie theatres. Almost 50% respondents believe that OTT platforms are a disruption to Movie theatres. Convenience is the biggest reason behind the use of over the top application. Second biggest reason is choice of wide range of content. Third on is availability of content on demand. Reasons behind the change are convenience of service, personal medium and availability of International content. Yet still, viewers aren't willing to watch a new movie on OTT platforms, they prefer it on a movie theatre that offers them the cinematic experience, ambience, screen size, and sound quality that OTT platforms can't achieve.

Suggestions & Conclusions

1. Theatre and distributors associations should propose a rule to release on OTT platforms only after 100 days of its theatrical release.

2. Digital streaming platforms, especially for those who enjoy binge-watching, have definitely made watching movies inexpensive, easy, and usable on the go.

3. It is far more relatively sure that OTT services has affected continuous TV viewership rather than cinematic experience.

4. The average speed should be increased because India's average speed is very poor and sometimes a five- second lag in video streaming because of loading would affect a fourth of its audience to a content publisher.

5. OTT on the rise, without these variables, the filmmaker is able to relate to their audience, encouraging them to take greater chances with the choice of plot, visuals and casting. This will and has already begun to modify the style of movies created by producers.

6. MoviEcard is India's first film subscription service that are used in 60 selected cities in India through every Carnival Cinema chain. Entry to releases at Carnival Cinemas for 30 days with a sticker price of just INR 149 is what makes this service totally appealing. Multiplexes will also adopt a subscription model for customers, which offers benefit for all of them and it is also obviously shown by the study that individuals are willing to embrace the subscription model in theatres.

7. As India is an under-screened country, the number of screens can be increased, this can only be accomplished by the multiplexes where they can acquire non-functioning single-screen theatres. In villages and cities, they can concentrate primarily on expanding theatres.

8. Producers who use the money to finance larger and greater films for movie theaters, the OTT sector is now an exponential revenue generator.

9. In the industry, it is highly recognized that smaller films and highly risky films should only be released on OTT platforms, whereas bigger films can only be released in theatres and OTT platforms. Since producers receive a promised commitment and a minimum wage when smaller films are acquired by OTT platforms, so when a smaller film is released in theatres, it requires a lot of costs and increases the budget of the film, which in essence is a pressure factor for producers to get the money back.

10. OTT platforms impact and benefit theatres as well. For instance, if a new cast, technicians or staff are recognized for their work that has been released on the OTT platform, when that technicians or team makes a film when it is released in theatres, it becomes a huge influence.

11. OTT platforms allow the cast & crew to reach a larger audience across boundaries with their work.

12. After the reopening of theatres, Post Covid-19, theatres should follow all the government's suggested security measures. Effectively, for a positive ambiance, they should encourage a healthy and clean environment that will create consumer confidence in returning to the theatres. Theatre companies can consistently communicate with their customers via social media during this time.

13. For many years, cinema as a medium has existed and competed with many forms-VHS, DTH, PPV, VCD, etc., and survived. The CEO of PVR claims that last year (2018) was the best financial year since the vigorous promotions of OTT players. It obviously indicates that cinemas and streaming platforms will not only co- exist but thrive, but their business models will also have to be changed by multiplex chains. By building experience-driven entertainment centres, multiplex chains like PVR, Inox and Cinepolis have been trying to take the experience feature to a new level. The emphasis has been on different formats, such as IMAX, 4DX, ScreenX, as well as detailed F&B principles.

14. For now, both the mediums are trying to hold on to their format uniqueness and the USP connected to it. Consumers might search for 3D animation cinematic experience and much-anticipated releases, but with something like documentaries, web series and special shows, it will fall for OTT streaming platforms more for On-The-Go. Both of them, although they serve the same sort of content, vary considerably in context and consumer relevant factors.

15. Considering the minimum assurance concept of OTT platforms that it offers a little premium for the films it acquires, but the theater box office is always the predominant mode of revenue generation and thus producers will certainly prefer theaters depending on their content and scale. OTT platforms can therefore be seen as an additional source of income but not as the main mode for larger-scale movies.

16. Movie theaters should include new services and implement different approaches for drawing viewers in theatres. Reducing ticket costs, selecting quality content, technical innovations and safety precautions are the essential considerations that will be taken into account by the theater operators that can bring the audience back to the theaters.

The Indian audience's perception of trends in the Indian media and entertainment industry is encouraging. The Indian audience claims that these applications are transforming the Indian media and entertainment sector, and the reasons for these improvements are media convenience, content efficiency, economical media, and innovative projects. Research reveals that the future of Over the Top application in India is promising. Indian audience thinks that these applications have good future in this country and the reasons for this are convenience & mobility, choice of content, smartphone penetration and cost effectiveness. But certain factors of theatres like Screen size and Sound quality, theatrical experience and ambience can’t be achieved by OTT platforms. So, people will definitely reach out to theatres but it’ll happen slowly due to the situation but it can never be completely erased on the existence of OTT platforms. To summarize, the report suggests that the OTT industry has disrupted the Movie Theater industry and that as the industry dynamics changes, both mediums will not only coexist but even prosper together.

References

- Abraham, R. (2018). The rise of OTT players: Streaming platforms and the threat to the box office. Retrieved from https://www.moneycontrol.com/news/trends/entertainment/the-rise-of-ott-players-streaming-platforms-and-the-threat-to-the-box-office-2688531.html

- Bhattacharjee, M. & Thakur, A. (2019). Will Jio First Day First Show pose a threat to movie theatres? Retrieved from https://www.exchange4media.com/media-others-news/will-jio-first-day- first-show-pose-a-threat-to-movie-theatres-98828.html

- Bhattacharya, A. (2019). India’s largest cinema chain is thriving in the era of OTT. Retrieved from https://qz.com/india/1757480/indias-pvr-inox-unfazed-by-netflix-hotstar-amazon-prime/

- Can India New Wire Service. (2020). Direct-to-OTT release: Film industry feels big screen not under threat. Retrieved from https://www.canindia.com/direct-to-ott-release-film-industry-feels-big-screen-not- under-threat/

- CARE Ratings. (2018). Media and Entertainment – Industry Research. Retrieved from http://www.careratings.com/upload/NewsFiles/Studies/Media%20entertainment%20FILM%20segment.pdf

- Chhajer, A. (2020). How OTT market will be a game-changer for the film industry ET Brand equity? Retrieved from https://brandequity.economictimes.indiatimes.com/news/media/how-ott-market-will-be-a-game-changer-for-the-film-industry/75658326

- Edelweiss Research. (2019). OTTs to disrupt multiplex’s party? Retrieved from https://www.edelresearch.com/showreportpdf-42801/MEDIA_-_SECTOR_UPDATE-FEB-19-EDEL

- Gupta, N.S. (2020). Coronavirus outbreak is credit negative for Indian media and entertainment: ICRA. Retrieved from https://brandequity.economictimes.indiatimes.com/news/media/coronavirus- outbreak-is-credit-negative-for-indian-media-and-entertainment-icra/75020686

- Indian Brand Equity Foundation. (2020). Media and Entertainment – Industry Report. Retrieved from https://www.ibef.org/download/Media-and-Entertainment-March-2020.pdf

- Laghate, G., & Bureau, E.T. (2019). Will over-the-top streaming services hit multiplexes? Retrieved from https://economictimes.indiatimes.com/industry/media/entertainment/will-over-the-top-streaming-services-hit-multiplexes/articleshow/71447968.cms

- MICA. (2019). Indian OTT platforms report 2019. Retrieved from https://www.mica.ac.in/images/OTT/Indian_ott_report2019.pdf

- Mukherjee, D. (2019). Future of Movie Theatre Business in India, CMO Carnival Cinemas, Retrieved from https://media-entertainment.cioreviewindia.com/cxoinsight/future-of-movie-theatre-business-in-india- nid-4059-cid-37.html

- Pennington, P. (2019). Streaming vs cinema: What does the future hold for film? Retrieved from https://www.ibc.org/industry-trends/streaming-vs-cinema-what-does-the-future-hold-for- film/3517.article

- PTI. (2020). Media, entertainment sector revenue could take 16% hit in FY21. Retrieved from https://brandequity.economictimes.indiatimes.com/news/media/media-entertainment-sector-revenue-could-take-16-pc-hit-in-fy21-crisil/75687403

- Samosa, S. (2019). Expert Opinion: Do theaters feel the heat of the OTT wave? Retrieved from http://www.socialsamosa.com/2019/03/expert-opinion-india-ott-v-s-theaters/

- Sharma, K.S. (2020). Are OTT platforms taking over theatrical experience? Retrieved from https://brandequity.economictimes.indiatimes.com/news/media/are-ott-platforms-taking-over-theatrical experience/73887372

- Singh, P. (2019). New Media as a Change Agent of Indian Television and Cinema: A study of over the top Platforms by Retrieved from https://www.researchgate.net/publication/335526353_New_Media_as_a_Change_Agent_of_Indian_Television_and_Cinema_A_study_of_over_the_top_Platforms

- Usmani, A. (2018). India’s Online Streaming Infatuation Is Taking over Its Love for Cinema. Retrieved from https://www.bloombergquint.com/technology/indias-online-streaming-infatuation-is-taking- over-its-love-for-cinema

- Varghese, S., & Joseph, M. (2019). Is OTT market a disruption to the Paytv Industry. Retrieved from file:///C:/Users/Selvin/Desktop/XIME/Term%203/Research%20project/IJRAR19K7628paper%20published.pdf