Research Article: 2021 Vol: 25 Issue: 4S

IPOs Underpricing and Long-run Performance: Case of Market for Alternative Investment (MAI) in Thailand

Marisa Laokulrach, International College, National Institute of Development Administration

Citation Information: Laokulrach, M. (2021). Ipos underpricing and long-run performance: case of market for alternative investment (mai) in thailand. Academy of Accounting and Financial Studies Journal, 25(S4), 1-07

Abstract

The study examines the underpricing of 142 initial public offerings (IPOs) listed in Market for Alternative Investment (MAI) in Thailand during 2010-2020. In addition, this study aims to explore the aftermarket performance of IPOs. Results show the existence of IPOs underpricing on the first trading day. The buy-and-hold abnormal returns for six-month, twelve-month, eighteen-month, and twenty-four-month holding period are used to measure the aftermarket performance of IPOs. IPO offering price is used in outperformance analysis. The outcomes of study identify the outperformance of IPOs returns relative to market return over six- and twelve-month holding period. IPOs investment tends to underperform the market after two-year holding period. These identify the inefficient capital market in MAI providing the opportunity for investors in using public information for abnormal returns generation.

Keywords

IPOs, Underpricing, Outperformance, MAI.

Introduction

The development of financial markets and economic growth are highly related. Equity market is the important channel for business sector to raise fundings for their expansion and productivity which leads to the growing in economic activities. An important tool for companies to issue its stocks in the equity market for the first time which is called “Initial Public Offerings” (IPOs).

Stock Exchange of Thailand (SET) is the mainboard equity market in Thailand which is considered as one of the growing emerging capital markets in ASEAN. Apart from the mainboard market, Thailand also has Market for Alternative Investment (MAI) established in 1999 as the capital market for mainly young small and medium enterprises (SMEs) with high-growth, innovation, and knowledge-based management. The purposes of the inception of the MAI market are to provide opportunities for entrepreneurs to access to funds, to sustain their growth with good governance, and to strengthen their competitiveness as SMEs are one of the main driving forces of economic activities and growth in Thailand. Also, MAI aims to provide alternative investment choices to investors. Each year, there are more than ten companies issuing IPOs during the past decade. Thus, this study aims to investigate the underpricing of IPOs in MAI on the first trading day, and to identify their performance aftermarket.

Numerous international research have studied the performance of IPOs in developed and emerging markets. The study of Ritter (1991) shows the underpricing of IPOs, and underperformance relative to market in long-run. IPOs prices are arranged to be at low price to generate higher initial returns on the first trading day higher than the market returns which means they outperformed the market. For the longer period, returns of the IPOs move lower than the returns of market representing their underperformance. The study of IPOs in

Switzerland (Kunz and Aggarwal, 1994), in Latin America (Aggarwal et al., 1993) also confirm the high initial returns of IPOs on first trading day.

This study aims to provide the analysis of IPOs performance in MAI, as well as to identify the market efficiency of MAI in the event of IPO and its price movement after listing. The results are useful for individual and institutional investors in terms of portfolio management. Author also expects the results would encourage higher number of IPO issuing in MAI as the important funds raising channel for SMEs.

Literature Review

The efficient market theory (Fama, 1970) states that security prices fully reflect all available information, including historical, public, and private information; imply that, the current prices are the equilibrium price. Investors cannot use the information to earn the returns higher than the whole market’s returns or so called “abnormal returns”. According to the theory, IPOs information is the public information therefore investors should not be able to earn abnormal returns.

Many studies have explained the performance and price movement of IPOs over time. The study of the 1,526 IPOs in the U.S.A during 1975-1984 by Ritter (1991) concludes that IPOs generated an average 16.4 percent initial return. The results show the underperformance of IPOs at 29.1 percent lower returns than the market at the three years after listing.

Levis (1993) investigates the performance of IPOs in the United Kingdom during 1980 – 1988 applying the methodology as same as (Ritter, 1991). The average positive initial return is 14.3%. The underperformance of IPOs after three years of listing is also confirmed. The study of IPOs in three emerging counties including Brazil, Mexico, and Chile in Latin American shows the initial returns of 78.5 percent, 2.8 percent, and 16.7 percent respectively. The returns of IPOs in Brazil, Mexico, and Chile provide lower returns than the market by 47 percent, 19.6 percent, and 23.7 percent respectively (Aggarwal et al., 1993).

The study of IPOs in the Athens Stock Exchange during 1994-2002 by Thomadakis (et al., 2007) analyzed the short-run performance on the first trading day. They used IPOs offering price, and the first trading day price to measure long-run after three-year holding period. The underpricing of IPOs on the first trading day is 26 percent. The underperformance at 1.24 percent is found measuring by the IPOs offering price, while 17.44 percent underperformance is found using the first trading day closing price.

The study of IPOs in Istanbul Stock Exchange shows that investors can earn abnormal return only until the third trading day (Kaya, 2012). Studied The IPOs in Tehran Stock Market, Iran generate higher returns than market return for two-month holding. The downward movement of accumulative abnormal return is found in thirty-four-month period (Abdeh & Demuri, 2003).

Peter (2007) investigated the IPOs performance in Sri Lanka during 1996-2000. The result showed that IPOs outperform the market for six- and twelve- month holding period. However, if IPOs are invested at the end of the first trading day, they underperform the market by 13.0 percent three years after listing.

The study of IPOs in Malaysia concludes that investors can only gain profit on IPOs on the first trading day. IPOs cumulative adjusted returns relative to the market are -3.77 for first week, -14.12 for a month, and -20.7 percent for and a year holding period after listing (Younesi et al., 2012).

In Thailand, there are studies in SET, mainboard equity market, showing the evidence of underpricing and the underperformance of IPOs. The study of 123 IPOs in SET during 2000-2005 by Vithessonthi (2008) concludes that the underpricing exists with the 19.97

percent average initial return. Moreover, the buy-and-hold investment shows that IPO stocks underperform the market by 39 percent after three years holding period.

Chorruk & Worthington (2009)’s study of 136 IPOs in Stock Exchange of Thailand (SET) also shows the initial return of IPOs 17.6 percent. The average buy-and-hold abnormal returns have been decreased from 0.95% to -25.39% after three years holding period. The results of 82 Thai SMEs issuing IPOs in the Market for Alternative Investment (MAI) during 2001-2014 identify the declining in operating performance after listing compared to a year prior IPO (Laokulrach, 2019). In summary, it can be hypothesized that IPO offering prices are underpriced; thus IPOs outperform market in the short-run and underperform market in long-run.

Methodology

Research Hypotheses

Underpricing: From the studies of IPOs underpricing in different markets, the initial return is higher than zero on the first trading day. Thus, it can be hypothesized that,

H1: IPOs are underpriced in MAI

Long-term performances: This study aims to investigate the buy-and-hold abnormal return of IPOs by investing at the IPO offering price.

H2: IPOs outperform the market after buy and hold period

H2.1: IPOs outperform the market after 6-month holding period

H2.2: IPOs outperform the market after 12-month holding period

H2.3: IPOs outperform the market after 18-month holding period

H2.4: IPOs outperform the market after 24-month holding period

Data Collection

The total of 142 IPOs in MAI during 2010-2020 are included in the study. The data was collected from the database of the MAI and Refinitiv data stream. The IPO offering price was collected from SET website. The stocks’ closing price, and MAI index were collected from Refinitiv data stream.

Measurement

Underpricing of IPOs: To test the first hypothesis as to whether IPO underpricing exists, IPOs the methodology as suggested by Ritter (1991) is applied. The initial stock return is calculated to identify the underpricing as shown below.

where IRi, is the initial return of stock i on the first trading day.

Pi,1 is the closing price of stock i on the first trading day.

Pi,0 is the IPOs offering price.

Then, The average initial return of 142 IPOs is calculated. The t-statistics value is used to test whether the average initial return is significantly higher than zero at the 95 percent confident level.

Long-run Performance: A buy-and-hold investment strategy is applied to examine the long-run performance of IPOs. This study uses IPOs offering price rather than the first trading day price to measure the buy-and-hold abnormal returns applying the method from Barber and Lyon (1997).

The holding period taken into the analysis includes six, twelve, eighteen, and twenty-four months after listing. In a month, there are 21 days of trading transaction, therefore, the following number of days in different holding period is used in the calculation.

1. 126 trading days for 6-month holding period after listing

2. 252 trading days for 12-month holding period after listing

3. 378 trading days for 18-month holding period after listing

4. 504 trading days for 24-month holding period after listing

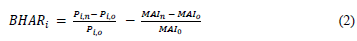

The buy-and-hold abnormal return is calculated as follows:

where BHARi, is the buy-and-hold abnormal return of stock i

Pi,n is the closing price of stock i on nth trading day.

Pi,o is the IPOs offering price.

MAInis the closing MAI index on nth day of trading.

MAIo is the closing MAI index on the offering day of IPO of stock i.

Then, the average buy-and-hold abnormal returns of are calculated. Lastly, the outperformance of IPOs is analyzed by using t-statistics value to test whether the buy-and-hold abnormal return is significantly higher than zero at the 95 percent confidence level.

Results

Data Description and Characteristics

Table 1 shows the number of IPOs issuing in MAI, and their average market value during 2010-2020. Each year there are 13 companies on the average who issued IPOs to raise funds in MAI. The average market value at IPOs offering price is 211,193.64 million baht. There are 12 IPOs in 2020 even it is the period of COVID-19 pandemic in Thailand.

| Table 1 Number of IPOS and Issue Size of 145 IPOS on Mai During 2010-2012 | ||

| Year | MAI | |

| No. of IPOs | Market Capitalization at IPOs Price | |

| (companies) | (Million Baht) | |

| 2010 | 7 | 2,816.96 |

| 2011 | 7 | 4,598.07 |

| 2012 | 10 | 10,186.60 |

| 2013 | 15 | 44,978.50 |

| 2014 | 20 | 40,834.13 |

| 2015 | 13 | 18,729.54 |

| 2016 | 13 | 21,902.38 |

| 2017 | 17 | 35,688.14 |

| 2018 | 11 | 19,619.30 |

| 2019 | 17 | 18,590.72 |

| 2020 | 12 | 15184.3 |

| Total | 142 | 23,3128.64 |

| Average | 12.91 | 21,193.51 |

| Minimum | 7 | 2,816.96 |

| Maximum | 20 | 4,4978.50 |

Underpricing

The results of IPOs underpricing are presented in Table 2.

| Table 2 Initial Return for IPOS Listed in Mai During 2004-2012 | ||||||

| N | Average Initial Return; IRi,1 (%) | t-statistics | p-value | SD. | Minimum Returns (%) | Maximum Returns (%) |

| 142 | 61.920** | 5.963 | .000 | .670 | -30.070 | 200.00 |

From Table 2, the average initial return of 142 IPOs is 61.920 percent on the first trading day. The t-statistics value is 5.963 with p-value of 0.000 which identify that the average initial return of IPOs is significantly higher than zero. This confirms the significant increase in price of IPOs on the first trading day generating high returns for investors. The result identifies that the magnitude of IPOs underpricing in MAI are higher than the developed markets (Ritter, 1991; Lewis, 1993), and higher than the IPOs in SET (Chorruk & Worthington, 2009; Vithessonthi, 2008).

Long-Term Performance

To analyze Hypothesis 2: IPOs outperform the market after buy and hold period, this study measures the average buy-and-hold abnormal returns for six-, twelve-, eighteen- and twenty-four- month holding period based on formula 2. This study investigates the buy-and-hold abnormal return using the IPOs offering price rather than the first trading day price to investigate the returns for investment in IPOs at the IPOs offering price.

The results in Table 3 identify the buy-and-hold abnormal return of the investing in IPOs at offering price, and holding for six-, twelve-, eighteen- and twenty-four- month holding period. The average buy-and-hold abnormal returns for six-, twelve-, eighteen- and twenty-four- month holding period are 10.0291 percent, 6.4804 percent, 1,1567 percent, and -2.3763 percent respectively. Buy-and-hold abnormal returns of six-month and twelve-month holding period are significantly higher than zero having t-statistic value of 3.911 and 2.129 respectively. The eighteen-month buy-and-hold abnormal return is insignificantly higher than zero, while the buy-and-hold abnormal return of 24-month holding period are significantly lower than zero with t-statistic of -2.167. The results confirm the outperformance of IPOs returns relative to the market returns for 6-month and 12-month holding period. IPOs investment underperforms the market performance after 24 months period or 2 years.

| Table 3 Buy-and-Hold Abnormal Return of IPOS Listed in Mai During 2010-2020 | ||||||||

| Listing Markets | Buy-and-Hold Period | N | Average Buy-and-Hold Abnormal Return; BHARi,n (%) | t-statistics | p-value | SD. | Minimum Returns (%) | Maximum Returns (%) |

| MAI | 6-month | 142 | 10.0291** | 3.911 | .000 | .3075 | -52.18 | 193.75 |

| 12-month | 142 | 6.4804* | 2.129 | .036 | .5878 | -62.94 | 221.80 | |

| 18-month | 142 | 1.1567 | 1.043 | .271 | .7410 | -60.12 | 219.12 | |

| 24-month | 127 | -2.3763* | -2.167 | .045 | .6933 | -97.04 | 268.48 | |

** Significance at 99 Percent Confidence Interval Level

* Significance at 95 Percent Confidence Interval Level

Conclusion and Discussion

This study answers the research questions whether IPO price is underpriced on the first trading day, and whether IPOs underperform the market after listing during 2010-2020. The investigation of 142 IPOs in Market for Alternative Investment (MAI) confirms the underpricing of IPOs. The prices on the first trading day increase by 61.92 percent comparing to IPO price. The magnitude of IPOs underpricing in MAI is higher than the underpricing in developed and other emerging countries. IPOs underpricing is also higher than the one in SET, the mainboard market of Thailand. This implies the anomaly of semi-efficient market hypothesis (Fama, 1970) in terms of corporate event study. The equity market in Thailand especially MAI is inefficiency, investors can use public information about IPOs to generate the high initial returns on the first trading day.

The study also explores the performance of IPOs after listing. IPOs investment outperform the market returns over six- and twelve-months holding period. The outperformance of IPOs is found after 2 years holding period.

Individuals and institutional investors obtain useful outcomes from this study in terms of portfolio construction and management. Investors can invest in IPOs in MAI and sell them on the first trading day to generate high returns. Also, the study provides the guideline on the holding period of IPOs investment to outperform the market.

The author expects that the outcome in terms of underpricing and outperforming of IPOs over the market return would encourage higher level of investment in MAI. This can be the important funds raising channel for SMEs in Thailand by issuing IPOs to expand and sustain their competitiveness and growth.

References

- Abdeh, H., & Dariush, D. (2003). Identifying the Effective Factors in Stock Return of Newly Accepted Firms in Tehran Stock Market. Financial Research Quarterly Periodical, 5(15), 24-30.

- Aggarwal, R., Leal, R., & Hernandez, L. (1993). The aftermarket performance of initial public offerings in Latin America. Financial Management, 22, 42-53.

- Barber, B., & Lyon, J. (1997). Detecting Long-Run Abnormal Stock Returns: The Empirical Power and Specification of Test Statistics. Journal of Financial Economics, 43, 341-372.

- Chorruk, J., & Worthington, A.C. (2009). New evidence on the pricing and performance of initial public offerings in Thailand: 1997-2008. Discussion Papers Finance, Griffith University, 1-22.

- Fama, E.F. (1970). Efficient Capital Markets: A review of theory and empirical work. The Journal of Finance, 25(2), 383-417.

- Kaya, T. (2012). The Short-Term Performance of Initial Public Offerings in Istanbul Stock Exchange: 2010-2011 Application. Journal of Business, Economics & Finance, 1(1), 64-76.

- Kunz, R.M., & Aggarwal, R. (1994). Why Initial Public Offerings are underpriced: Evidence from Switzerland, Journal of Banking and Finance, 18(4), 705-723.

- Laokulrach, M. (2019), Operating Performance of SMEs in Thailand after Going Public, Management & Marketing. Challenges for the Knowledge Society, 14(1), 1-13. DOI: 10.2478/mmcks-2019-0001.

- Levis, M. (1993). The long-run performance of initial public offerings: the UK experience 1980-1988. Financial Management, 22, 28-41.

- Peter, S. (2007). Performance of initial public offerings and privatized offers: evidence from a developing country. Managerial Finance, 33, 798-809.

- Ritter, J.R. (1991). The long-run performance of initial public offerings. Journal of Finance, 46, 3-27.

- Ritter, J.R. (2003). Differences between European and American IPO markets. European Financial Management, 9, 421-434.

- Thomadakis, S., Nounis, C., & Gounopoulos, D. (2007). Insights on the long term performance of Greek IPOs. European Financial Management Journal, 18, 1-41.

- Vithessonthi, C. (2008). Stock price performance of initial public offerings: the Thai experience. Journal of International Finance and Economics, 8, 30-43.

- N.Younesi, N., Ardekani, A.M., & Hashemijoo, M. (2012). Performance of Malaysian IPO and Impact of Return Determinants, Journal of Business Studies Quarterly, 4(2), 140-158.