Research Article: 2020 Vol: 24 Issue: 3

Investor Protection, Stock Liquidity, and Firm Value

Chuong Hong Pham, National Economics University

Hoang Duc Le, National Economics University

Hung Quoc Dang, National Economics University

Phuong Thu Ta, National Economics University

Chau Minh Nguyen, National Economics University

Abstract

This paper investigates how investor protection affects the relationship between stock liquidity and firm value. Our sample includes 2,297 listed firms in the UK, Germany, France, and Italy from 2009 to 2018. Employing a firm fixed effects model, our results show that stock liquidity exerts a positive impact on firm value. Moreover, we find that this positive impact is strengthened in countries with strong investor protection. These results are robust when we employ a random effects model. Our paper suggests that policy makers should enhance investor protection environment in their countries and recommends firms’ managers to increase the firms’ corporate governance.

Keywords

Investor Protection, Stock Liquidity, Firm Value

Introduction

Several theoretical arguments suggest that stock liquidity has a positive relationship with firm value (Maug, 1998; Edmans, 2009; Admati & Pfleiderer, 2009; Subrahmanyam & Titman, 2001; Khanna & Sonti, 2004; and Holmstrom & Tirole, 2001). Studies by Brockman & Chung (2003) and Chung (2006) show that the strong protection of investor rights can reduce the problems caused by information asymmetries and thereby increasing the stock liquidity of a firm. Additionally, a strong investor protection environment is argued to encourage the development of capital markets and therefore firms in this environment can have a higher level of value (e.g., La Porta et al., 2000: 2002). However, these three lines of literature have been examined separately. To the best of our knowledge, no study has yet investigated how investor protection affects the way stock liquidity interacts with firm value. Therefore, our paper aims to fill this gap in the literature by examining the impact of investor protection on the relationship between stock liquidity and firm value. Our research question is “What is the impact of country-level investor protection on the stock liquidity - firm value relationship?”.

Our sample consists of 2,297 listed non-financial companies in the UK, France, Germany, and Italy during the period from 2009 to 2018. The reason to choose this sample is followed by previous studies (Rajan & Zingales, 1995; and Wanzenried, 2006). Although there is a homogeneous economic development in the four countries in our sample, they have differences in investor protection environment. Our main analysis employs a firm fixed effects model to mitigate the endogeneity problems caused by potential omitted time-invariant variables. Our results show that strong investor protection strengthens the positive impact of stock liquidity on firm value. In economic terms, in our sample, the positive effects of stock liquidity on firm value in strong investor protection countries can be at least 122% higher than that in weak investor protection countries. These results are robust when we use a random effects model.

The findings of our paper contribute to the extant literature on investor protection, stock liquidity, and firm value. Whereas prior studies have well documented the impact of investor protection on stock liquidity (Brockman & Chung, 2003; and Chung, 2006) and on firm value (La Porta et al., 2000: 2002), there has been no research that investigates the impact of investor protection on the relationship between stock liquidity and firm value. In our paper, we find that strong protection of investor rights can enhance the positive impact of stock liquidity on firm value. We believe we are one of the first to provide this evidence.

The remainder of our paper is presented as follows. Next, we present a literature review relevant to our studies and develop the hypotheses. The next section discusses the data, variable construction, and methodology employed in our paper. Then we provide our analysis with the empirical results. The final section concludes.

Literature Review and Hypothesis Development

Stock Liquidity and Firm Value

Stock liquidity of a firm is widely thought to be one of the most important factors that affect firm value. This impact can be explained by either operating performance-based theories or price-based theories. Operating performance-based theories, which can be divided into agencybased theories and feedback theories, argue that an increase in stock liquidity can exert a positive impact on firm performance and firm profitability and therefore can exert a positive impact on firm value. Agency-based theories suggest that the relationship between stock liquidity and firm performance is related to the degree of the agency costs within the firm. In essence, stock liquidity can discipline managers so that the managers have to enhance the firm performance. Maug (1998) examines the incentives of large shareholders to monitor listed companies. He argues that a less liquid stock market can make large shareholders engage in less monitoring activities. In contrast, if stock markets are more liquid, large shareholders will engage in more monitoring activities since these shareholders can cover monitoring costs through informed trading. Maug (1998) then concludes that liquid stock markets can lead to effective corporate governance, which can increase firm performance. Palmiter (2001), Edmans (2009), and Admati & Pfleiderer (2009) also argue that large shareholders can discipline management and thereby enhancing corporate governance through their exit. If managers’ compensation is linked to current share prices, an exit of large shareholders, who can trade on private information, may impact the share prices negatively. And because the exit of large shareholders will be easier if stock liquidity is higher, managers in companies with high stock liquidity will try to satisfy the large shareholders by trying to increase the firm value. This suggests a positive relationship between stock liquidity and firm value.

Different from agency-based theories that focus on conflicts between managers and investors, feedback theories predict that stock liquidity can exert a positive impact on firm performance even when there is no agency costs between managers and investors. In this setting, feedback effects can arise because firms’ nonfinancial stakeholders (such as their suppliers, customers, and employees) will make decisions that are dependent on the information revealed by the stock prices (Subrahmanyam & Titman, 2001; Khanna & Sonti, 2004; and Hirshleifer et al, 2006). An increase in stock liquidity stimulates the entry of informed investors, which makes the stock prices more informative to the stakeholders. In cases where informed investors are large traders, their entry may increase the stock prices. This can relax the firm’s financial constraints and thereby increasing the firm performance (Khanna & Sonti, 2004).

While operating performance-based theories provide causative channels where stock liquidity increases firm value by increasing firm performance, price-based theories suggest another channel to explain how stock liquidity can affect firm value. Fundamentally, price-based theories predict that stock liquidity can impact firm value by affecting the discount rate. Brennal et al. (1998) and Brennan & Subrahmanam (1996) show that when investors invest in illiquid stocks, they require a higher rate of return to compensate for the higher risk. Acharya & Pedersen (2005) and Pastor & Stambaugh (2003) also indicate that illiquid stocks have higher liquidity risk premiums, implying that their discount rate should be higher than liquid stocks. In line with this, the model of Holmstrom & Tirole (2001) suggests that illiquid stocks should trade at a discount, implying that stock liquidity is positively associated with firm value.

Investor Protection, Stock Liquidity and Firm Value

It has been argued in the literature that investor protection can affect both stock liquidity and firm value and thereby implying that it can also affect the relationship between stock liquidity and firm value. Strong protection of investor rights can mitigate the problem of information asymmetry, which can lead to a reduction in the probability of trading against informed traders. This results in narrower bid-ask spreads that liquidity suppliers can offer and liquidity demander can get benefits from this narrower bid-ask spreads. As a result, a good investor protection environment can lead to an increase in the liquidity of a stock. In line with this, some empirical studies find evidence showing that strong investor protection is positively associated with stock liquidity (e.g., Brockman & Chung, 2003; and Chung, 2006).

With respect to the effects of investor protection on firm value, some studies indicate that stronger rights of outside investors are associated with a higher level of firm value (e.g., La Porta et al., 2000; La Porta et al., 2002). La Porta et al. (2000) argue that an improvement in investor protection can reduce the probability of expropriation opportunities of families that control large corporations, which can increase the total value of these corporations. The model of La Porta et al. (2002) predicts that firms in countries with more protective legal institutions can have higher firm value as measured by Tobin’s Q. In line with this, they find that firms in countries with better protection of minority shareholders have higher Tobin’s Q.

Focusing on creditor rights, Djankov et al. (2007) argue that lenders are willing to provide more credit in countries with strong creditor rights because in these countries they can more easily seize the firm’s collateral, force the firm to make repayment, or even gain control of the firm. In line with this, they show that strong protection of creditor rights encourages the development of private credit. Additionally, they find a positive correlation between the creditor rights and countries’ prosperities as measured by GDP per capita. These findings suggest that strong creditor rights provide a good environment for firms to develop, implying that firms in these countries may have better firm performance than those in weak creditor rights countries.

Overall, the literature discussed above indicates that good investor protection can lead to an increase in stock liquidity and firm value. This suggests that investor protection can affect the positive impact of stock liquidity on firm value. However, it is not clear whether good investor protection will strengthen or weaken this positive impact of stock liquidity. On one hand, agencybased theories suggest that good investor protection can dampen the positive impact of stock liquidity on firm value. This is because the agency costs are lower in countries with good protection of investor rights (e.g., Shleifer & Wolfenzon, 2002), which can reduce the monitoring incentives of large investors.

Moreover, the stock markets of strong investor protection countries are more developed than those of weak investor protection countries, implying that it may be easier to trade stock A in the former countries than stock B in the latter countries even when the liquidity of stocks A and B is similar. This suggests that if the liquidity of stocks A and B increases by a similar amount, which can lead to a reduction in these stock’s liquidity risk premium, the reduction in the risk premium of stock A is less than one of stock B. This implies that the discount rate of stock A may reduce by an amount less than one of stock B. In other words, the negative impact of an increase in the stock liquidity on the discount rate is weaker in strong investor rights countries than in weak investor rights countries. Since a reduction in the discount rate is associated with an increase in firm value, an increase in the stock liquidity will increase the firm value less in countries with strong investor rights than in those with weak investor rights. As a result, according to price-based theories, it is expected that the positive impact of stock liquidity on firm value is weakened in countries with strong investor rights.

On the other hand, feedback theories predict that good investor protection can strengthen the positive impact of stock liquidity on firm value. In countries where the investor protection is strong, information asymmetry problems may be tempered, helping firms’ nonfinancial stakeholders receive the firms’ information quicker. This suggests that the feed-back effects may be stronger in countries with strong investor protection. As a result, the positive impact of stock liquidity on firm value can be stronger in these countries. In sum, the literature discussed above suggests that good investor protection can either dampen or strengthen the relationship between stock liquidity and firm value. Therefore, we develop our hypotheses 1a and 1b as follows:

Hypothesis 1a: The positive impact of stock liquidity on firm value is weaker in a country with stronger investor protection environment.

Hypothesis 1b: The positive impact of stock liquidity on firm value is stronger in a country with stronger investor protection environment.

Data, Variable Construction and Methodology

Data

Our starting sample covers all listed firms in the UK, France, Germany, and Italy for the period 2009 - 2018. We collect a list of these companies from Datastream database. We follow Rajan & Zingales (1995) and Wanzenried (2006) to choose these four countries. Although there is a homogeneous economic development in these four countries, they have differences in investor protection environment. Consequently, we can examine how the between-country differences in investor protection environment can exert an impact on the nexus between stock liquidity and firm value. Additionally, we also follow Rajan & Zingales (1995) and Wanzenried (2006) to exclude financial companies from our sample.

The data used to construct our variables for firm value and other firm characteristics are collected from Datastream database. We exclude firm-year observations whose values are missing, which makes our final sample an unbalanced panel consisting of 2,297 companies with 18,443 firm-year observations.

Data about investor protection come from previous studies. Specifically, we use an antidirector rights index and a creditor rights index as the proxies for the protection of investor rights. We source the data for the anti-director rights index from Djankov et al. (2008) and for the creditor rights index from Djankov et al. (2007), respectively.

Variable Construction

In our paper, we measure firm value by Tobin’s Q (TOBINQ). This variable is calculated by the ratio of the market value of assets over the book value of assets, where the market value of assets equals the market value of equity plus the market value of debt.1 A higher value of Tobin’s Q indicates a higher firm value.

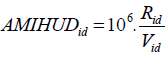

Following the previous studies (Fang et al., 2009; Nguyen et al., 2016), we use two common measurements for stock liquidity. The first variable, which can capture the price impact of a stock, is Amihud’s (2002) illiquidity ratio (AMIHUD). This variable is computed as follows:

(1)

(1)

where Rid and Vid are the daily stock return and the daily dollar trading volume of stock i in day d, respectively. We take the arithmetic average of daily AMIHUD over trading days in each year as the annual AMIHUD. A higher value of AMIHUD implies a more illiquid stock. To reduce the right skewness of this variable, we take the natural logarithm of one plus the annual AMIHUD and use the logarithm form of this variable in our analysis.

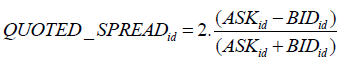

Our second stock liquidity variable, which can capture the trading costs of a stock, is the quoted spread (QUOTED_SPREAD). We calculate this variable using the following formula:

(2)

(2)

where ASKid and BIDid are the asking and bid price of stock i in day d, respectively. Similar to AMIHUD, we take the arithmetic average of daily QUOTED_SPREAD over trading days in each year as the annual QUOTED_SPREAD. Additionally, firm-year observations that have a negative value of the quoted spread are excluded from our sample. A higher value of QUOTED_SPREAD implies a more illiquid stock.

We employ two variables to proxy for the protection of investor rights. The first variable is anti-director rights index (ANTI_DIRECTOR_INDEX), which is sourced from Djankov et al. (2008). The value of anti-director rights index will vary from 0 to 6, with a higher score being associated with stronger protection for the minority shareholders. Our second variable used to proxy for investor protection is creditor rights index (CREDITOR_RIGHTS_INDEX), which is gathered from Djankov et al. (2007). The creditor rights index takes the value from 0 to 4. A higher creditor rights index suggests stronger protection for creditors.

We follow previous empirical studies and use a set of control variables to capture some factors that might potentially affect firm value and stock liquidity. Firstly, we control the impact of firm size (FIRM_SIZE) on firm value. This variable is computed as the natural logarithm of the total value of book assets. Our second control variable is firm leverage (LEVERAGE), which is measured as the ratio of total debt over the book value of total assets. Finally, we include cash ratio (CASH_RATIO), which is computed as the ratio of cash and short-term investment over current assets, in our multivariate regression model. We winsorize continuous variables at the 1st and 99th percentile to alleviate the impact of the outliers. Table 1 provides the definition of variables employed in this study.

| Table 1 Variable Definition | |

| Variable | Definition |

| TOBINQ | The ratio of the market value of assets over the book value of assets. |

| AMIHUD | Amihud’s (2002) illiquidity ratio. |

| QUOTED_SPREAD | The quoted spread. |

| ANTI_DIRECTOR_INDEX | The anti-director rights index. |

| CREDITOR_RIGHTS_INDEX | The creditor rights index. |

| FIRM_SIZE | The natural logarithm of the total value of book assets |

| LEVERAGE | The ratio of total debt over the book value of total assets |

| CASH_RATIO | The ratio of cash and short-term investment over current assets |

Methodology

We examine the effects of investor protection on the relationship between stock liquidity and firm value. To do this, we employ a firm fixed effects model to estimate the following model:

TOBINQit = α0 + β1STOCK_LIQUIDITYit + β2 STOCK_LIQUIDITYit * INVESTOR_PROTECTIONi + λ CONTROLit + Φit (3)

where i indexes firm i and t indexes year t. The dependent variable in Equation 3 is firm value. The stock liquidity variable is either AMIHUD or QUOTED_SPREAD. In Equation 3, we do not add a variable proxied for investor protection because the value of this variable does not vary overtime for each company. However, we include its interaction term with stock liquidity variables to investigate the impact of stock liquidity on firm value at different levels of investor protection. The investor protection variable is either anti-director index (ANTI_DIRECTOR_INDEX) or creditor rights index (CREDITOR_RIGHTS_INDEX). If the investor protection variable is anti-director index, the value of the investor protection variable for company i will be the value of the anti-director index of the country where the company i has its headquarter. Similarly, if the investor protection variable is creditor rights index, the value of the investor protection variable for company i will be the value of the creditor rights index of the country where the company i has its headquarter. CONTROL is a set of control variables that is mentioned above. Finally, Φ is the error term in Equation 3.

We employ a firm fixed effect model to estimate Equation 3 because the advantage of this model is that it can alleviate the endogeneity problems caused by the omitted time-invariant variables. However, the disadvantage of this model is that we cannot estimate the coefficients on time-invariant variables, such as INVESTOR_PROTECTION, in our equations. The coefficient of interest in our model is β2, which is the coefficient on the interaction term between variables of stock liquidity and investor protection. According to agency-based theories and price-based theories, this coefficient is expected to be significantly positive. However, according to feedback theories, this coefficient is predicted to be significantly negative. We include year dummies to control for year effects in our Equation 3. The standard errors are adjusted for heteroskedasticity and clustered at the firm level.

Empirical Results

Summary Statistics

We report summary statistics for all variables used in Equation 3 in Table 2. In Panel A, the summary statistics are reported by country. Regarding firm value, Panel A of Table 2 shows that the value of Tobin’s Q is highest for UK firms and smallest for Italian firms. Looking at investor protection variables, both anti-director rights and creditor rights index of the UK have the highest value among the four countries in our sample, suggesting that the protection of investor rights is strongest in the UK. By contrast, Italy and France have the lowest score for the antidirector rights and creditor rights index, respectively, implying that the rights of investors are not protected well in these two countries. These findings suggest that there is a substantial difference in the protection of investor rights among the four countries in our sample, which enables us to examine how investor protection can affect the impact of stock liquidity on firm value. Panel A of Table 2 also indicates that the mean values of stock liquidity variables, whether they are measured by Amihud or quoted spread, vary widely across countries. When the stock liquidity variable is Amihud, the mean is lowest at 0.732 for UK stocks and highest at 3.663 for German stocks, suggesting that UK and German firms possess the highest and lowest liquid stock, respectively. However, the pattern of stock liquidity is different when stock liquidity is measured by quoted spread. For this proxy, Italian stocks have the highest liquidity, whereas French stocks have the lowest liquidity. The differences in investor protection environment and stock liquidity in the four countries suggest that it is of vital importance to investigate this relationship in an international context.

| Table 2 Summary Statistics | ||||||||||

| Panel A: Summary statistics by country | ||||||||||

| Variable | United Kingdom | Germany | France | Italy | ||||||

| N | Mean | N | Mean | N | Mean | N | Mean | |||

| TOBINQ | 8,102 | 2.047 | 3,706 | 1.524 | 4,934 | 1.313 | 1,701 | 1.030 | ||

| ANTI_DIRECTOR_INDEX | 8,102 | 5.000 | 3,706 | 3.500 | 4,934 | 3.500 | 1,701 | 2.000 | ||

| CREDITOR_RIGHTS_INDEX | 8,102 | 4.000 | 3,706 | 3.000 | 4,934 | 0.000 | 1,701 | 2.000 | ||

| AMIHUD | 8,092 | 0.732 | 3,701 | 3.663 | 4,835 | 1.034 | 1,691 | 1.970 | ||

| QUOTED_SPREAD | 8,102 | 0.061 | 3,706 | 0.036 | 4,934 | 0.061 | 1,701 | 0.018 | ||

| FIRM_SIZE | 8,102 | 11.749 | 3,706 | 12.444 | 4,934 | 12.315 | 1,701 | 13.209 | ||

| LEVERAGE | 8,102 | 0.166 | 3,706 | 0.191 | 4,934 | 0.210 | 1,701 | 0.293 | ||

| CASH_RATIO | 8,102 | 0.395 | 3,706 | 0.334 | 4,934 | 0.309 | 1,701 | 0.272 | ||

| Panel B: Summary statistics for the whole sample | ||||||||||

| Variable | N | Mean | Median | Std. Dev. | Min | Max | Skewness | Kurtosis | ||

| TOBINQ | 18,443 | 1.651 | 0.986 | 2.228 | 0.194 | 16.619 | 4.394 | 26.101 | ||

| ANTI_DIRECTOR_INDEX | 18,443 | 4.021 | 3.500 | 0.962 | 2.000 | 5.000 | -0.466 | 2.310 | ||

| CREDITOR_RIGHTS_INDEX | 18,443 | 2.544 | 3.000 | 1.653 | 0.000 | 4.000 | -0.675 | 1.769 | ||

| AMIHUD | 18,319 | 1.518 | 0.732 | 1.773 | >0.000 | 8.700 | 1.240 | 3.760 | ||

| QUOTED_SPREAD | 18,443 | 0.052 | 0.022 | 0.102 | >0.000 | 0.903 | 5.051 | 35.086 | ||

| FIRM_SIZE | 18,443 | 12.175 | 11.940 | 2.501 | 6.184 | 18.486 | 0.332 | 2.820 | ||

| LEVERAGE | 18,443 | 0.194 | 0.155 | 0.203 | 0.000 | 1.329 | 2.057 | 10.412 | ||

| CASH_RATIO | 18,443 | 0.349 | 0.281 | 0.259 | 0.002 | 0.985 | 0.785 | 2.657 | ||

In Panel B of Table 2, the summary statistics are reported for the whole sample. We observe that Tobin’s Q ranges from 0.194 to 16.619 with a mean (median) value of 1.651 (0.986) and a standard deviation of 2.228. For the whole sample, the means (median) of Amihud and quoted spread are 1.518 (0.732) and 0.052 (0.022), respectively.

Table 3 provides correlation matrix of variables employed in our study. The results show that all the correlation values between the independent variables are lower than 0.7, implying that our model is not likely to have a multicollinearity problem.

| Table 3 Correlation Matrix | ||||||||

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| (1) TOBINQ | 1.000 | |||||||

| (2) ANTI_DIRECTOR_INDEX | 0.162 | 1.000 | ||||||

| (3) CREDITOR_RIGHTS_INDEX | 0.137 | 0.651 | 1.000 | |||||

| (4) AMIHUD | -0.026 | -0.342 | -0.002 | 1.000 | ||||

| (5) QUOTED_SPREAD | 0.098 | 0.106 | -0.004 | 0.380 | 1.000 | |||

| (6) FIRM_SIZE | -0.308 | -0.176 | -0.096 | -0.418 | -0.465 | 1.000 | ||

| (7) LEVERAGE | 0.064 | -0.167 | -0.102 | 0.043 | -0.004 | 0.183 | 1.000 | |

| (8) CASH_RATIO | 0.227 | 0.166 | 0.139 | -0.057 | 0.009 | -0.194 | -0.222 | 1.000 |

Multivariate Results

Table 4 reports the results estimated from Equation 3 using a firm fixed effects model. In columns 1 and 2, the stock liquidity variable is Amihud. In columns 3 and 4, the stock liquidity variable is quoted spread. Our results show that the coefficient estimated on Amihud is significantly negative at the 1 percent level in column 2. In columns 1, 3, and 4, our analysis shows that its marginal effect at mean is significantly negative. These results suggest that stock liquidity can exert a positive impact on firm value. This finding is consistent with Fang et al. (2009) and Nguyen et al. (2006). Table 4 also reports the coefficients estimated on the interaction terms between stock liquidity and investor protection variables. The results show that these interaction terms have significantly negative coefficients in all four columns of Table 4, suggesting that the negative (positive) impact of stock illiquidity (liquidity) on firm value is stronger in the strong investor protection countries. Thus, this result supports our hypothesis 1b and is in line with feedback theories of the relationship between stock liquidity and firm value. Our results are not only statistically significant but also economically significant. For instance, in column 1, the coefficient on Amihud will reduce from -0.217 to -0.595, which is corresponding to 174% reduction, if the anti-director rights index increases from 2 (minimum in our sample) to 5 (maximum in our sample).2 Similarly, in column 2, the coefficient on Amihud will reduce from - 0.253 to -0.561, which is corresponding to 122% reduction, if the creditor rights index increases from 0 (minimum in our sample) to 4 (maximum in our sample).3

| Table 4 Results Estimated From a Fixed Effects Model | ||||

| Dependent variable: TOBINQ | ||||

| VARIABLES | (1) | (2) | (3) | (4) |

| AMIHUD | 0.035 | -0.253*** | ||

| (0.090) | (0.052) | |||

| QUOTED_SPREAD | 4.280* | -0.159 | ||

| (2.257) | (0.483) | |||

| AMIHUD * ANTI_DIRECTOR_INDEX | -0.126*** | |||

| (0.027) | ||||

| AMIHUD * CREDITOR_RIGHTS_INDEX | -0.077*** | |||

| (0.020) | ||||

| QUOTED_SPREAD * ANTI_DIRECTOR_INDEX | -1.472*** | |||

| (0.545) | ||||

| QUOTED_SPREAD * CREDITOR_RIGHTS_INDEX | -0.822*** | |||

| (0.205) | ||||

| FIRM_SIZE | -1.271*** | -1.261*** | -1.144*** | -1.152*** |

| (0.082) | (0.082) | (0.079) | (0.078) | |

| LEVERAGE | 1.286*** | 1.268*** | 1.205*** | 1.219*** |

| (0.261) | (0.261) | (0.270) | (0.270) | |

| CASH_RATIO | 0.199 | 0.207 | 0.283 | 0.279 |

| (0.180) | (0.180) | (0.184) | (0.184) | |

| Constant | 17.390*** | 17.306*** | 15.274*** | 15.386*** |

| (1.021) | (1.022) | (0.962) | (0.961) | |

| Observations | 18,319 | 18,319 | 18,443 | 18,443 |

| Industry fixed effects | No | No | No | No |

| Year fixed effects | Yes | Yes | Yes | Yes |

| R-squared | 0.171 | 0.170 | 0.144 | 0.146 |

Robustness Tests

In the previous section, we find that the positive impact of stock liquidity on firm value is stronger in strong investor protection countries than in weak investor protection countries. In this section, we employ a robustness test to investigate the robustness of this finding. Specifically, we use a random effects model to estimate Equation 3. Compared with a firm fixed effects model, the advantage of a random effects model is that it can estimate the coefficients on the time-invariant variables, such as the investor protection variables in our model. In this random effect model, we capture industry effects on firm value by adding industry dummies in Equation 3. We report the results estimated from the random effects model in Table 5.

| Table 5 Results Estimated From a Random Effects Model | ||||

| Dependent variable: TOBINQ | ||||

| VARIABLES | (1) | (2) | (3) | (4) |

| AMIHUD | -0.079 | -0.305*** | ||

| (0.081) | (0.043) | |||

| QUOTED_SPREAD | 1.384 | -0.364 | ||

| (2.244) | (0.543) | |||

| ANTI_DIRECTOR_INDEX | 0.044 | 0.247*** | ||

| (0.047) | (0.042) | |||

| CREDITOR_RIGHTS_INDEX | 0.163*** | 0.170*** | ||

| (0.028) | (0.025) | |||

| AMIHUD * ANTI_DIRECTOR_INDEX | -0.074*** | |||

| (0.024) | ||||

| AMIHUD * CREDITOR_RIGHTS_INDEX | -0.017 | |||

| (0.017) | ||||

| QUOTED_SPREAD * ANTI_DIRECTOR_INDEX | -0.692 | |||

| (0.540) | ||||

| QUOTED_SPREAD * CREDITOR_RIGHTS_INDEX | -0.538** | |||

| (0.216) | ||||

| FIRM_SIZE | -0.659*** | -0.639*** | -0.570*** | -0.580*** |

| (0.039) | (0.038) | (0.037) | (0.037) | |

| LEVERAGE | 1.600*** | 1.606*** | 1.550*** | 1.556*** |

| (0.254) | (0.254) | (0.257) | (0.258) | |

| CASH_RATIO | 0.530*** | 0.527*** | 0.599*** | 0.596*** |

| (0.157) | (0.157) | (0.159) | (0.159) | |

| Constant | 9.357*** | 8.890*** | 7.017*** | 7.712*** |

| (0.561) | (0.466) | (0.477) | (0.437) | |

| Observations | 18,319 | 18,319 | 18,443 | 18,443 |

| Industry fixed effects | Yes | Yes | Yes | Yes |

| Year fixed effects | Yes | Yes | Yes | Yes |

| R-squared | 0.2091 | 0.2253 | 0.1968 | 0.1963 |

The results show some evidence supporting our previous finding. The coefficients estimated on the interaction terms between stock liquidity and investor protection variables are negative and significant in columns 1 and 4 of Table 5. In columns 2 and 3, these coefficients are, albeit negative, insignificant at the traditional level. A possible explanation for the weaker results in the random effects regressions may be because the omitted time-invariant factors are correlated with both the independent and dependent variables in our model. In this situation, using a firm fixed effects model is more suitable in our analysis. Additionally, we find that the p-value of Hausman test for all the four specifications in Table 5 is lower than 0.01, suggesting that we should use a firm fixed effects model to estimate Equation 3. With respect to the investor protection variables, our results show that their coefficients are positive in all four columns of Table 5 and statistically significant in all but one column. This finding suggests that firms on average are valued higher in stronger investor protection countries. La Porta et al. (2000) and La Porta et al. (2002) also find evidence supporting this.

Conclusion

Using a sample containing the listed non-financial companies in the UK, France, Germany, and Italy during the period from 2009 to 2018, this paper examines the impact of investor protection on the relationship between stock liquidity and firm value. Our main analysis employs a firm fixed effects model in order to alleviate the endogeneity problems caused by omitted timeinvariant factors. Our results confirm the finding of previous studies that stock liquidity can exert a positive impact on firm value. In addition, we find that strong investor protection can strengthen the positive impact of stock liquidity on firm value. In a robustness test, we show that our results do not change when we employ a random effects model.

This paper provides some policy implications for policymakers, firms’ managers as well as investors. For policymakers, our paper suggests that it is necessary to enhance investor protection in their countries since this will help to enhance the positive impact of stock liquidity on firm value. For firms’ managers, our paper recommends them to enhance their firms’ corporate governance because the good corporate governance of a firm can be a substitute for strong investor protection. By doing so, the managers can also increase the positive effect of stock liquidity on firm value. For investors, our paper suggests that they should follow firms with high stock liquidity because these firms are associated with high value.

This study is limited by assuming that the impact of investor protection on the stock liquidity - firm performance relationship is linear. However, this impact can be nonlinear. Consequently, further studies can investigate the nonlinear impact of investor protection on the stock liquidity - firm performance relationship.

End Notes

1We assume that the market value of debt equals the book value of debt.

2-0.217 = 0.035 + 2* -0.126 and -0.595 = 0.035 + 5 * -0.126, where 2 and 5 are the minimum and maximum values of anti-director rights index in our sample, respectively. 0.035 and -0.126 are the coefficients on Amihud and its interaction term with anti-director rights index, respectively.

3-0.253 = -0.253 + 0 * -0.077 and -0.561 = -0.253 + 4 * -0.077, where 0 and 4 are the minimum and maximum values of creditor rights index in our sample, respectively. -0.254 and 0.072 are the coefficients on Amihud and its interaction term with creditor rights index, respectively.

References

- Acharya, V.V., & Pedersen, L.H. (2005). Asset pricing with liquidity risk. Journal of Financial Economics, 77(2), 375-410.

- Admati, A.R., & Pfleiderer, P. (2009). The “Wall Street Walk” and shareholder activism: Exit as a form of voice. The Review of Financial Studies, 22(7), 2645-2685.

- Amihud, Y (2002). Illiquidity and stock returns: Cross-section and time-series effects. Journal of Financial Markets, 5(1)m 31-56.

- Brennan, M.J., & Subrahmanyam, A. (1996). Market microstructure and asset pricing: On the compensation for illiquidity in stock returns. Journal of Financial Economics, 41(3), 441-464.

- Brennan, M.J., Chordia, T., & Subrahmanyam, A. (1998). Alternative factor specifications, security characteristics, and the cross-section of expected stock returns. Journal of Financial Economics, 49(3), 345-373.

- Brockman, P., & Chung, D.Y. (2003). Investor protection and firm liquidity. The Journal of Finance, 58(2), 921-937.

- Chung, H. (2006). Investor protection and the liquidity of cross-listed securities: Evidence from the ADR market. Journal of Banking & Finance, 30(5), 1485-1505.

- Djankov, S., McLiesh, C., & Shleifer, A. (2007). Private credit in 129 countries. Journal of Financial Economics, 84(2), 299-329.

- Djankov, S., La Porta, R., Lopez-de-Silanes, F., & Shleifer, A. (2008). The law and economics of self-dealing. Journal of Financial Economics, 88(3), 430-465.

- Edmans, A. (2009). Blockholder trading, market efficiency, and managerial myopia. The Journal of Finance, 64(6), 2481-2513.

- Fang, V.W., Noe, T.H., & Tice, S. (2009). Stock market liquidity and firm value. Journal of Financial Economics, 94(1), 150-169.

- Hirshleifer, D., Subrahmanyam, A., & Titman, S. (2006). Feedback and the success of irrational investors. Journal of Financial Economics, 81(2), 311-338.

- Holmström, B., & Tirole, J. (1993). Market liquidity and performance monitoring. Journal of Political Economy, 101, 678-709.

- Khanna, N., & Sonti, R. (2004). Value creating stock manipulation: Feedback effect of stock prices on firm value. Journal of Financial Markets, 7(3), 237-270.

- La Porta, R., Lopez-de-Silanes, F., Shleifer, A., & Vishny, R. (2000). Investor protection and corporate governance. Journal of Financial Economics, 58(1), 3-27.

- La Porta, R., Lopez-de-Silanes, F., Shleifer, A., & Vishny, R. (2002). Investor protection and corporate valuation. The Journal of Finance, 57(3), 1147-1170.

- Maug, E (1998). Large shareholders as monitors: Is there a trade-off between liquidity and control? The Journal of Finance, 53(1), 65-98.

- Nguyen, T., Duong, H.N., & Singh, H. (2016). Stock market liquidity and firm value: An empirical examination of the Australian market. International Review of Finance, 16(4), 639-646.

- Palmiter, A.R. (2001). Mutual fund voting of portfolio shares: Why not disclose. Cardozo Law Review, 23, 1419-1491.

- Pastor, L., & Stambaugh, R.F. (2003). Liquidity risk and expected stock returns. Journal of Political Economy, 111, 642-685.

- Rajan, R.G., & Zingales, L. (1995). What do we know about capital structure? Some evidence from international data. The Journal of Finance, 50(5), 1421-1460.

- Shleifer, A., & Wolfenzon, D. (2002). Investor protection and equity markets. Journal of Financial Economics, 66(1), 3-27.

- Subrahmanyam, A., & Titman, S. (2001). Feedback from stock prices to cash flows. The Journal of Finance, 56(6), 2389-2413.

- Wanzenried, G. (2006). Capital structure dynamics in the UK and continental Europe. The European Journal of Finance, 12(8), 693-716.