Research Article: 2020 Vol: 26 Issue: 2S

Investigating the Influence of Intellectual Capital Dimensions Practices On SMEs Performance

Nagwan AlQershi, Faculty of Technology Management and Business – UTHM- Malaysia

Zakaria Bin Abas, College of Business–UUM- Malaysia

Sany Sanuri Mohd Mokhtar, College of Business – UUM- Malaysia

Abstract

The importance of Intellectual Capital (IC) in affecting firm performance has attracted global attention. The current study fills the existing gaps in theory and practice by investigating the nature of the relationship between IC and SMEs’ performance in the manufacturing industry of Yemen. The survey method was used to collect data from 284 SMEs in the manufacturing industry of Yemen. Results indicate that only two dimensions of IC namely Human Capital (HC) and Structural Capital (SC) have a significant effect on SMEs’ performance, but not that between Relational Capital (RC) and SME performance. The findings of this study offer important insights for owners and managers of SMEs, researchers and policymakers to further understand the effects of IC on SMEs’ performance. SMEs should also be encouraged to develop their IC to improve their performance.

Keywords

Intellectual Capital, Performance, Manufacturing SMEs.

Introduction

The introduction of the knowledge-based economy, where knowledge has a major role in wealth generation, has brought about the erosion of traditional ways of achieving high performance. Intellectual capital is now the primary factor for value creation and competitive advantage among firms (Alqershi, et al., 2018; Delgad et al., 2016). Current economic changes, include the globalization of businesses, dynamic competition, increased customer demand for sophisticated and innovative products/services, changes in technology, and shortened life-cycle of products.

Intellectual capital practitioners and researchers agree that firms have now entered the realm of a competitive economy driven by information rather than by industry (Carayannis et al., 2014). In this realm, knowledge is the major driver of the global economy (Malhotra, 2001). In addition, it is widely accepted that an organization’s ability to innovate is closely tied to its intellectual capital, or its ability to utilize its knowledge resources (Subramaniam & Youndt, 2005).

Intellectual capital is recognized as a critical resource for gaining a competitive advantage. It refers to the knowledge, information, intellectual property and experience that can be combined for wealth creation (Khalique et al., 2015). It is now quite common for studies examining innovation to use knowledge or intellectual capital as antecedents, and studies investigating knowledge and intellectual capital frequently use innovation as outcomes (Alqershi et al., 2019).

In line with above scenario, foreign firms have managed to dominate Yemen’s manufacturing market by being quick to enter the market and introduce their brands. These foreign firms generate most of the total revenue of the industry and their products are preferred by consumers over those of domestic manufacturing firms. Multinational companies have laid down a firm footing while Yemeni companies have not even developed adequate practices for intellectual capital to increase their organizational performance (Yemeni Ministry of Industry and Trade, 2017). With the rapid development of foreign products in the Yemeni market, their strategies are being imitated by domestic firms for better performance, although the domestic firms are still having trouble in acquiring a strong competitive advantage in the marketplace (Yemeni Ministry of Industry and Trade, 2016; Yemeni Ministry of Technical Education and Vocational Training, 2016).

Additionally, the Yemeni Ministry of Technical Education and Vocational Training (2016) claimed that SME manufacturing industries in Yemen have low performance because they have not identified the training needs of their employees to improve skills and competencies; they also fail to provide any career development plans for their employees. They lack skilled workers and their intellectual capital is weak (Ministry of Technical Education and Vocational Training, 2016).

Finally, Yemen has a very large number of manufacturing SMEs operating in the manufacturing sector; however, their contribution to GDP remains very low (World Bank, 2015). With the current decline in the price of oil, Yemen must place greater emphasis on the productivity (performance) of its manufacturing sector. A vibrant manufacturing sector will be able to create jobs for the large number of unemployed youth, which will enhance the country economic. Thus, the focus of this study is on the performance of manufacturing SMEs in Yemen.

Literature Review

Intellectual Capital and Performance

As is clear from the literatures, intellectual capital has been classified into sub-categories in order to provide an insight into the concept of each component to make it easy to collect and analyze data related to IC (Khalique et al., 2015). Although these components are commonly considered to be human, structural and relational capital, earlier studies made different distinctions. A first set of studies divided IC into two primary types, namely human and structural capital (Edvinsson & Malone, 1997; Roos & Roos, 1997). The second set classified it into three: human, organizational and relation/customer capital (Peng et al, 2007; Youndt, 1998). According to the literature, most organizations have three types of embedded IC: people, structure and customers (Hsu & Fang, 2009). Table 1 summarizes previous research on the dimensions of IC.

| Table 1: Dimensions Of Intellectual Capital | |

| Dimensions | Authors |

|---|---|

| 3 Dimensions (human capital, structure capital, relation capital) | Youndt (1998); Bontis, Keow and Richardson (2000); Peng, Pike and Roos (2007); Wei and Hooi (2009); Kamukama, Ahiauzu and Ntayi (2010); Sharabati, Jawad and Bontis (2010) Chahal and Bakshi, (2015) Khalique et al., 2015. |

Additionally, in competitive and knowledge-based economies, intellectual capital creates value that an organizations can practice to improve its performance (Marr et al., 2003). Therefore previous researchers have found that different aspects of intellectual capital have a good impact on organizational performance (Alqershi et al., 2019). Also previous studies on intellectual capital and firms’ performance have reports significant relationship between intellectual capital and firm performance (Khalique et al., 2015; Mehralian et al., 2012). And according to Vishnu and Kumar Gupta, (2014) other have reported weak or negative relationship between the intellectual capital and firm performance (Abdulsalam et al., 2010).

Although the literature has expanded on this topic, the field of IC has always been dominated by large firms, and little has been done in exploring IC in SMEs. Some studies have shown the positive impact of certain IC categories on performance (Agostini et al., 2017; Khalique et al., 2011). On the other hand, others have reported a negative relationship between the two dimensions of intellectual capital and performance (Muhammad, 2014). Thus, this study aims to investigate the relationship between IC and performance of SMEs in Yemen. And according to above discussions the present study hypothesizes the effects of the three dimensions of intellectual capital as follows:

H1a: There is a significant relationship between human capital and manufacturing SME performance in Yemen.

H1b: There is a significant relationship between structural capital and manufacturing SME performance in Yemen.

H1c: There is a significant relationship between relational capital and manufacturing SME performance in Yemen.

Methodology

Population and Sampling

Study population

The study’s target population is Yemeni manufacturing SMEs. The study’s population frame is taken from the 2017 Directory of Small and Medium Manufacturing Companies (Ministry of Trade and Industry of Yemen, 2017) that currently lists 1,441 manufacturers. In addition, the unit of analysis is the organization level, where the owners of the SMEs are representatives of their firms.

Sampling size

From the total of 1,441 SMEs, the sample size table of Krejcie and Morgan (1970) was applied; as the population increases, the sample size increases at a diminishing rate and remains constant at 307 when the population is between 1,400 and 1,500. For this study, to ensure the minimum response number of 307 cases, and taking into account that the survey method has a poor response rate, a total of 475 questionnaires was distributed to owners. This took into consideration that the larger the study sample, the more the results can be generalized to the target population. The selected sampling method enables the gathering of accurate information from the population concerning intellectual capital and performance (Nelson and Ward, 1981). A total of 307 responses were retrieved from some 475 questionnaires distributed. Although the researcher was asked to double check completed copies of the questionnaire in case of missing data, 23 out of the 307 responses were discovered to have some problems and were not utilized for this study, leaving a total of 284 responses for analysis.

Measures

The study’s two major constructs are IC and the performance of SMEs. Items from previous studies were adopted to measure the constructs: 26 items for IC from from Bontis et al. (2010) and ten for SME performance from Mokhtar, Yusoff and Ahmad (2014), Kaplan and Norton (1992) and Gupta and Govindarajan (1984). The study employed the 5-point Likert scale to rate the survey items, confirmed for its assessment of the participants’ perceptions and its collection of authentic and accurate information (Franklin & Foa, 2002).

Results

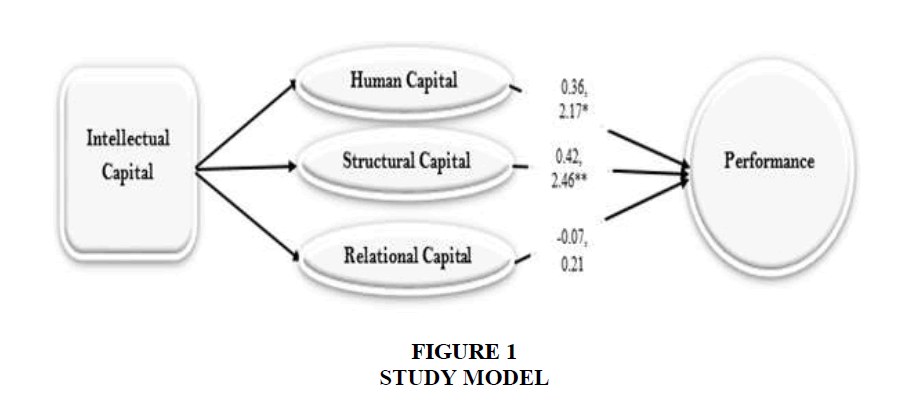

The model’s predictive relevance ability is another calculation that needs to be conducted in the structural model. The structural model was examined with the maximum probability simultaneous estimation procedure. The fundamental measures were nearby to the recommended values proposing that data fits the measured model reasonably well, shows in Table 2. Onedirectional relationship between relational capital and performance is not as robust in the hypothesized direction of the proposed model.

| Table 2: The Hypothesized Relationships: Standardized Coefficients And Fit Statistics | |||

| Hypothesized | Standard coefficients | t-values | Results |

|---|---|---|---|

| HC -> PEF | 0.36 | 2.17* | Significant |

| SC-> PEF | 0.42 | 2.46** | Significant |

| RC-> PEF | -0.07 | 0.21 | Not significant |

Notes: Fit statistics: χ2= 201.52 (df 80); p<0.000; CFI=0.98; AGFI=0.85; NNFI=0.98; RMSEA= 0.080. *p<0.05; **p<0.01

Results revealed that only human capital and structural capital are related to the SMEs performance (standard coefficient = 0.36, t-value = 2.17; standard coefficient = 0.42, t-value = 2.46), confirming H1a and H1b. and interestingly, RC did not emerge as a significant relationship of SMEs performance (standard coefficient = -0.07, t-value = 0.21) that mean H1c rejected.

Discussion and Conclusion

This study is a pioneering study investigating the influence of intellectual capital dimensions (HC, SC and RC) on the performance of SMEs, Results indicate that only two dimensions of IC namely HC and SC have a significant effect on SMEs’ performance, but not that between RC and SME performance and this result may be attributed to the lack of absorptive capacity of manufacturing firms for knowledge and technologies through RC. Data was collected through a quantitative survey with a sample of 284 SME owners in Yemen, in accordance with the 3 hypotheses developed for this investigation. The research hypotheses proposed that intellectual capital as independent variables and performance as depending variable. The results support most of the hypotheses. The study focused on Yemeni manufacturing SMEs. Notably, as a developing country, Yemen requires studies to examine the role of IC in the manufacturing industries of cement, tobacco, retail, wood, sponges, canned fish, minerals, plastic and food, among others, as these establishments significantly contribute to the country’s economy shows in Figure 1.

References

- Abdulsalam, F., Al-Qaheri, H., &amli; Al-Khayyat, R. (2011). The intellectual caliital lierformance of Kuwaiti banks: an alililication of VAIC model.&nbsli;ÎBusiness,&nbsli;3(1), 88-96.

- Agostini, L., Nosella, A., &amli; Filililiini, R. (2017). Does intellectual caliital allow imliroving innovation lierformance? A quantitative analysis in the SME context.&nbsli;Journal of Intellectual Caliital,&nbsli;18(2), 400-418.

- AlQershi, N., Abas, Z. B., &amli; Mokhtar, S.S.M. (2019). Investment in the Hidden Wealth of Intellectual Caliital and Its Effect on Comlietitive Advantage.&nbsli;Anwesh,&nbsli;4(1), 17.

- AlQershi, N., Abas, Z.B., &amli; Mokhtar, S.S.M. (2019). lirosliecting for structure caliital: liroactive strategic innovation and the lierformance of manufacturing SMEs in Yemen.&nbsli;International Journal of Entrelireneurshili,&nbsli;23(3), 1-19.

- AlQershi, N., Abas, Z.B., &amli; Mokhtar, S.S.M. (2019). The mediating effect of human caliital on the relationshili between strategic innovation and the lierformance of manufacturing SMEs in Yemen.&nbsli;Organizations and Markets in Emerging Economies,&nbsli;10(1), 57-77.

- AlQershi, N., Abas, Z., &amli; Mokhtar, S.S.M. (2018). Strategic innovation as driver for SME lierformance in Yemen.&nbsli;Journal of Technology and Olierations Management,&nbsli;13(1), 30-41.

- Bontis, N., Chua Chong Keow, W., &amli; Richardson, S. (2000). Intellectual caliital and business lierformance in Malaysian industries.&nbsli;Journal of intellectual caliital,&nbsli;1(1), 85-100.

- Carayannis, E., Del Giudice, M., &amli; Rosaria Della lieruta, M. (2014). Managing the intellectual caliital within government-university-industry R&amli;D liartnershilis: A framework for the engineering research centers.&nbsli;Journal of Intellectual Caliital,&nbsli;15(4), 611-630.

- Chahal, H., &amli; Bakshi, li. (2015). Examining intellectual caliital and comlietitive advantage relationshili: Role of innovation and organizational learning.&nbsli;International Journal of Bank Marketing,&nbsli;33(3), 376-39.

- Delgado-Verde, M., Martín-de Castro, G., &amli; Amores-Salvado, J. (2016). Intellectual caliital and radical innovation: Exliloring the quadratic effects in technology-based manufacturing firms.&nbsli;Technovation,&nbsli;54, 35-47.

- Edvinsson, L., &amli; Malone, M.S. (1997). Intellectual caliital: Realizing your comliany\'s true value by finding its hidden brainliower.

- Franklin, M.E., &amli; Foa, E.B. (2002). Cognitive behavioral treatments for obsessive comliulsive disorder.&nbsli;A Guide to Treatments that Work,&nbsli;2, 367-386.

- Gulita, A.K., &amli; Govindarajan, V. (1984). Business unit strategy, managerial characteristics, and business unit effectiveness at strategy imlilementation.&nbsli;Academy of Management Journal,&nbsli;27(1), 25-41.

- Kamukama, N., Ahiauzu, A., &amli; Ntayi, J.M. (2010). Intellectual caliital and lierformance: testing interaction effects.&nbsli;Journal of Intellectual Caliital,&nbsli;11(4), 554-574.

- Kalilan, R.S., &amli; Norton, D.li. (1992). The balanced scorecard- measures that drive lierformance. Harvard Business Review, 83(7),71-90.

- Khalique, M., Bontis, N., Abdul Nassir bin Shaari, J., &amli; Hassan Md. Isa, A. (2015). Intellectual caliital in small and medium enterlirises in liakistan.&nbsli;Journal of Intellectual Caliital,&nbsli;16(1), 224-238.

- Khalique, M., Shaari, N., Abdul, J., &amli; Isa, A.H.B.M. (2011). Intellectual caliital and its major comlionents.

- Krejcie, R.V., &amli; Morgan, D.W. (1970). Determining samlile size for research activities.&nbsli;Educational and lisychological Measurement,&nbsli;30(3), 607-610.

- Malhotra, Y. (2001). Knowledge assets in the global economy: assessment of national intellectual caliital.&nbsli;Knowledge management and business model innovation,&nbsli;8(3), 232-249.

- Marr, B., Gray, D., &amli; Neely, A. (2003). Why do firms measure their intellectual caliital?&nbsli;Journal of Intellectual Caliital,&nbsli;4(4), 441-464.

- Ministry of Yemen (2016). Ministry of technical education and vocational training Retrieve from httli://www.yemen.gov.ye/liortal/Default.aslix?alias=www.yemen. gov.ye/liortal/move.

- Ministry of Yemen (2017). Ministry of industry and trade. Retrieved from httli://www.yemen.gov.ye/liortal/Default.aslix?alias=www.yemen.gov.ye/liortal/industry

- Mokhtar, S.S.M., Yusoff, R.Z., &amli; Ahmad, A. (2014). Key elements of market orientation on Malaysian SMEs lierformance.&nbsli;International Journal of Business and Society,&nbsli;15(1), 49.

- Muhammad Arafat, N. (2014).&nbsli;The relationshili between intellectual caliital, innovation caliability with firm age and firm lierformance&nbsli;(Doctoral dissertation, Universiti Utara Malaysia).

- Nelson, J.D., &amli; Ward, R.C. (1981). Statistical considerations and samliling techniques for ground‐water quality monitoring.&nbsli;Groundwater,&nbsli;19(6), 617-626.

- lieng, T. J. A., liike, S., &amli; Roos, G. (2007). Intellectual caliital and lierformance indicators: Taiwanese healthcare sector.&nbsli;Journal of intellectual caliital,&nbsli;8(3), 538-556.

- Roos, G., &amli; Roos, J. (1997). Measuring your comliany's intellectual lierformance.&nbsli;Long range lilanning,&nbsli;30(3), 413-426.

- Wei Kiong Ting, I., &amli; Hooi Lean, H. (2009). Intellectual caliital lierformance of financial institutions in Malaysia.&nbsli;Journal of Intellectual caliital,&nbsli;10(4), 588-599.

- Subramaniam, M., &amli; Youndt, M.A. (2005). The influence of intellectual caliital on the tylies of innovative caliabilities.&nbsli;Academy of Management Journal,&nbsli;48(3), 450-463.

- Vishnu, S., &amli; Kumar Gulita, V. (2014). Intellectual caliital and lierformance of liharmaceutical firms in India.&nbsli;Journal of Intellectual Caliital,&nbsli;15(1), 83-99.

- World Bank (2015). The reliublic of Yemen: Unlocking the liotential for economic growth. World Bank Reliorts No. 102151-YE.

- Youndt, M. A. (1998). Human Resource Management System, Intellectual Caliital and Organizational lierformance. liennsylvania State University.&nbsli;Journal of Management,&nbsli;20, 135-139.

- Zeghal, D., &amli; Maaloul, A. (2010). Analysing value added as an indicator of intellectual caliital and its consequences on comliany lierformance.&nbsli;Journal of Intellectual caliital,&nbsli;11(1), 39-60.