Research Article: 2021 Vol: 25 Issue: 5

Investigating The Impact of Multicurrency Regime on Financial Reporting: Case of National Property Consultancy (Pvt.) Limited

Wadesango N, University of Limpopo, Polokwane, CAE, RSA

Mellisa Jane Kucherera, Midlands State university, Gweru, Zimbabwe

Malatji S, Tshwane University of Technology, Pretoria, RSA

Abstract

The purpose of this study was to s to examine the impact of Multicurrency regime on financial reporting using National Property Consultancy (Pvt.) Limited as the case. In conducting the research, a census of 20 people was used from NPC and a quantitative research approach was used. Questionnaires were administered to twenty respondents. Also, a regression analysis was carried out to determine the relationship between Multicurrency system and financial reporting and the results showed that there is a positive relationship. The research findings showed that, during the Multicurrency regime firms saw financial reporting becoming a challenge due to shifts in government policies which preclude them from reporting in accordance with prescribed standards such as IAS 21, failure to attract skilled staff with foreign currency exposure experience as well as failure to acquire multicurrency system tailored software. The research findings further established the best industry practises that firms can use, in case redollarization occurs in future. The firm was recommended to establish seminars and training programmes for the workforce, carry out multicurrency diversification to hedge risks, make use of multicurrency programs to track exposure, consult regulatory boards and foreign currency specialists, and approach the government to work hand in hand when making monetary policies.

Keywords

Multicurrency, Regime, Financial Reporting, Redollarisation.

Introduction

Eventually after her birth in 1980 according to Munangagwa (2009), the Rhodesian dollar was substituted at parity by the Zimbabwean dollar according to (Munanga, 2013). According to Kanyenze (2010) suggested that during the independence era the Zimbabwean dollar was once compared with both the British Pound and the American dollar on the official exchange market. Nevertheless, the currency hastily devalued losing that position accordingly due to a series of developments that took place according to Mutsagondo & Makanga (2014) which subsequently led to the extreme devaluation of the currency in 2008 as argued by (Kairiza, 2014). In this review, from the year 1998 to 2008, the Zimbabwean economy has been characterised by hyperinflation as argued by (Business Times, 2014). For that decade inflation figures were increasing exponentially that is 48% in 1998 to 585.84% in 2005 according to (International Monetary Fund) IMF (2005) and around November 2008, the estimated rate of inflation has reached a yearly rate of 79, 600 000 percent which labelled Zimbabwe the second highest occurrence of hyperinflation in history as advocated by (Hanke, 2012). Despite Zimbabwe experiencing a hyperinflationary economy according to Business Times (2014), it did not exceed that of Hungary that took place in July 1946 with a daily rate of 195% according to (Hanke, 2012). According to the Independent (2009); Coltart (2008) suggested that things started to fall apart the era towards 2008, with the Zimbabwean economy beleaguered by hyperinflation which was slowing down the economic development according to IMF (2008), subsequently leading the Zimbabwean dollar to become a valueless tool, unreliable for commerce and difficult for financial reporting as coined by (Munangagwa, 2009). Hence, to curb those problems to turn around the economy, dollarization was adopted by the government of Zimbabwe on the 30th of January 2009 according to (Reserve Bank of Zimbabwe) (RBZ, 2009; Biti, 2009; Noko, 2011).

Kramarenko et al. (2010), in a Multicurrency system environment, commerce and the payment of domestic taxes is mostly in foreign currency. According to Chigumira (2013), the adoption of the Multicurrency system by the government of Zimbabwe brought about greater transparency in pricing and reporting, and according to Barth & Schipper (2015) the adoption obstructed the inflationary financing of the budget by bringing hyperinflation to a halt. The multicurrency regime was a prescribed solution to increase investor self-assurance, bring back stability in pricing and improve credibility in financial reporting according to (Robson, 2012). Originally the adoption of multicurrency system was meant to be a prescribed momentary measure since there were no formal agreements between the Zimbabwean government and countries whose currency has been adopted, but with time the American dollar, the functional currency saw a basket of currencies being introduced to accompany it to operate as legal tender comprising of the British Pound, South African Rand, Euro and the Botswana Pula according to the (Reserve Bank of Zimbabwe, 2014).

Nhavira (2015) suggested that, at firm level, multicurrency system can be seen as software solutions that allows companies to trade internationally to finance their projects. According to RBZ (2015), the hyperinflationary environment was made up of multiple interest rates and multiple digits values which the banking system and accounting systems saw capacity limitations in handling enlarged volumes and multiple digits in values of transactions that were being processed at the time, hence the adoption of multicurrency system facilitated a fair presentation of financial statements by reducing volumes and multiple digits in values of transactions according to (Chaavure, 2017; Minda, 2000).

Research Methodology

The researchers adopted quantitative research methodology. The target population was made up of management, administrators, officers and audit team at National Property Consultancy (Pvt.) Ltd. The researchers used census instead of sampling the targeted population, that is the authors distributed all questionnaires to the whole targeted population. A questionnaire was used to collect data (Chitambara, 2012; Moreno-Villaz, 2000).

Aalytical Model

To assess how multicurrency influence financial reporting, the researcher investigated the relationship between Multicurrency system and financial reporting, the study used the simple linear regression. The researchers used IBM SPSS 19 software and Microsoft excel to apply multiple regression to determine the relationship. The multicurrency system was measured using the company’s exposure to foreign currency by using FX exposure as the dependant variable. Measuring FX Exposure, Adler (1984) model was used, which states the formula for calculating FX Exposure using single factor to approximate changeability of the company’s returns on equity to the conversion rate. Financial leverage, Asset tangibility and Profitability were the independent variables. The leverage was substituted by debt ratio, asset tangibility as an alternative to strength of Assets and Profitability ratio was substituted by ROA (return on assets). In this particular project, the scholar’s interest was to determine the impact of Multicurrency system on Financial Reporting. The regression analysis was used by using the following formulae:

Y = β0 +β1 X1+ β2X2 + β3X3 + εt

Where,

Y =Foreign Currency Exposure

X1= Debt ratio

X2= Asset Tangibility

X3= ROA (Return on Assets)

Β= Beta coefficient – Which measures the number of standard deviations a dependant variable will change, per standard deviation increase in the independent variable.

εt = The error term

Results

Defining Multicurrency System / Dollarization

Evidence from Figure 1 shows that all the 20 respondents managed to differentiate dollarization and multicurrency system by defining each of the terms. They also managed to name the three stages of dollarization that is official dollarization, semi-official dollarization and unofficial dollarization. All of them had knowledge about it, hence the 20 out of 20 of the respondents denoted they strongly agreed by showing a respond rate of 100%. Bloch (2015), Mutengezanwa et al. (2012), alluded that there are three stages of dollarization and defined dollarization as a substitution of the local currency with the United States dollar. Stating the origin and adoption of the Multicurrency system on Financial Reporting of entities in Zimbabwe (Kararachi et al., 2010).

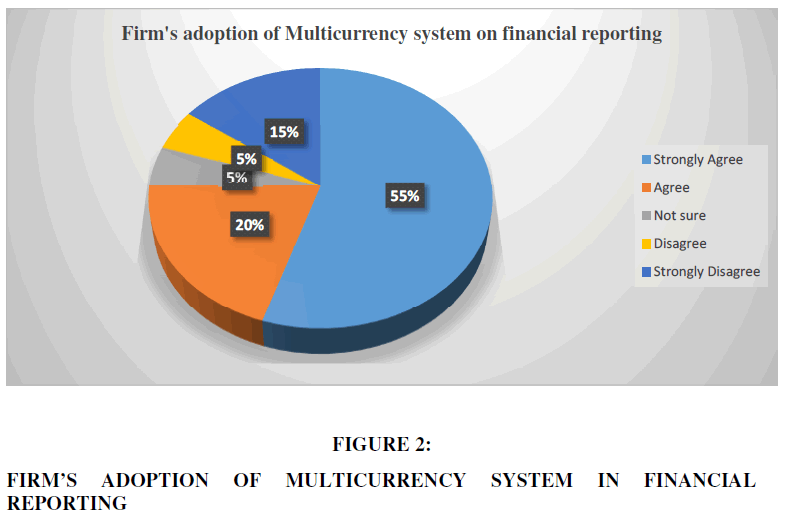

Adoption of Multicurrency system by the firm on reporting

According to the above chart Figure 2, 11/20 (55%) of the respondents strongly agreed with the view that the entity adopted multicurrency system on its financial reporting system.4/20 (20%) of the respondents also agreed with the same notion, 1/ 20 (5%) were not certain, 1/ 20 (5%) disagreed and 3/20 (15%) strongly agreed. A cumulative of 73% of the respondents agreed that the firm adopted multicurrency system on financial reporting. According to PAAB (2018), suggested that when the government introduced the multiple currency regime, firms also adopted the system and commenced producing their reports in USD. On the other hand, 3/20 (15%) who disagreed on the notion that the entity adopted the multicurrency system on financial reporting. According to Lavis (2018) suggested that due to the currency exposure risk that is associated with firms operating in a multiple currency environment there is need for managers to ensure financial reporting is being carried out according to prescribed reporting standards to prevent the possible negative impact on value of company assets, liabilities and cash flows which might arose from exchange rate fluctuations. 1/20 (5%) were not certain about the subject matter which means there either agreeing or disagreeing (Cosmin, 2010; Friedman, 1992).

A mode of 11 respondents representing 53% were attained who were strongly agreeing that the company fully adopted multicurrency system on its financial reporting. A mean of 3.95 was obtained which is closer to 4 which indicates the most of the respondents agreed Therefore, this gave the researcher a reasonable assurance that the entity adopted the system partially (Coomer & Gstraunthaler, 2011; Forbes et al., 2013).

Econometric Factors which led to the extreme devaluation of the Zimbabwean Dollar

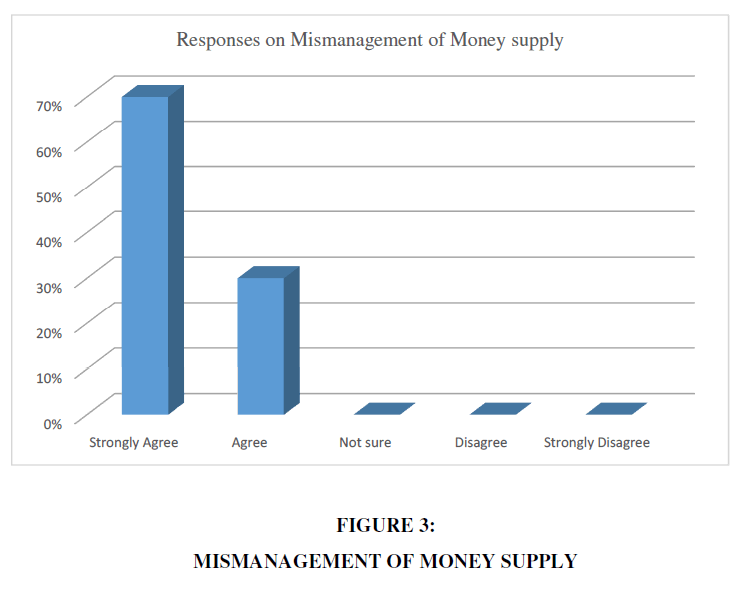

Mismanagement of Money supply

According to Figure 3, 14/20 (70%) strongly agreed on the notion that mismanagement of money supply also facilitated to the extreme devaluation of the Zimbabwean dollar, 6/20 (30%) also agreed on the subject matter. A cumulative of 100% of the respondents agreed that mismanagement of money supply was one of the factors that lead to hyperinflation in 2008.According to Moss (2015), argued that the government of Zimbabwe proceeded to increase money printing and supply in the 2000s when there was need for backing hostilities within the Congolese state and to upsurge wages of government wages and securities, hence the unceasing printing of money worsened the economy by up surging money in the public, as a final point inflation. The modal value of 14 respondents was attained who agreed on the subject matter and a mean of 4.7 which is closer to 5 shows most of the respondents were agreeing with the notion, hence giving researcher reasonable assurance that mismanaging of money supply also facilitated to the extreme devaluation of the Zimbabwean dollar (Jefferis & Chigumira, 2013; Miles, 1978).

Regression Analysis

The multiple correlation coefficient is shown by R, which quantifies the superiority of the estimate by the dependant variable FX exposure, the value of 0.760a designates a virtuous degree of forecasting. Adjusted R2 is a determination coefficient is the quantity of difference in the dependant variable due to alterations in the independent variable. According to the results above in Table 1, the value of adjusted R2 was 0.577, which indicates 57,7 % changeability in the FX exposure of NPC and the 42.3% (100%- 57.7%) of the variation is due to changes of the asset tangibility, debt ratio and ROA at a 95% confidence interval.

| Table 1: Model summaryb | ||||

| Model | R | R2 | Adjusted R2 | Standard Error Estimate |

| 1 | .760a | .577 | .507 | .61981 |

Predictors: (Constant), debt ratio, asset tangibility, ROA (Return on Assets)

Dependant Variable: Foreign Currency Exposure

The F-ratio within the Table 2, checks the fitness of the general regression model, that is if it’s a good fit for the data. The data shows that the independent variables statistically significantly forecast the dependent variable, F (3,18) = 8.185, p (.001) < .005 that is the regression model is a good fit of the data.

| Table 2: ANOVA ANOVAb |

||||||

| Model | Sum of squares |

Df | Mean Square | F | Sig. | |

| 1 | Regression | 9.433 | 3 | 3.144 | 8.185 | .001a |

| Residual | 6.915 | 18 | 3.84 | |||

| Total | 16.348 | 21 | ||||

From the data above the established regression equation was

Y=1.225 +0.120X1 -0.29X2 -0.011X3

From the above formulae, it was highlighted that if ROA, Asset tangibility and debt ratio held at zero the FX exposure is estimated at 1.225 point in Table 3.

| Table 3: Coefficientsb | ||||||

| Model | Unstandardized Coefficients | Standardised Coefficients | T | Sig | ||

| 1 | Beta | Std Error | Beta | |||

| Constant | 1.255 | 1.047 | 1.199 | .034 | ||

| ROA | - .011 | .025 | - .012 | -.080 | .027 | |

| Asset Tangibility | - .29 | .130 | -.035 | -.221 | .031 | |

| Debt ratio | .120 | .134 | .752 | 4.823 | .00* | |

Debt Ratio

A positive correlation between debt ratio and FX exposure was revealed by the study. In future if the debt ratio rises by one, FX exposure will upturn by 0.120 point. Thus if the debt ratio of the firm rises and poor financial leverage exists, the firm is more vulnerable to foreign currency risk and will display high foreign currency exposure

Asset Tangibility

A negative association between asset tangibility and FXE was revealed by this study. Hence, when the asset tangibility increases by a point, the FX exposure will decrease by 0.29 point. Therefore, when the firm has a high proportion of fixed asset compared to its total asset, it will be prevented from the exposure to foreign currency risk through the high fair value of the fixed asset

ROA (Return on Assets)

A negative relationship between the ROA and FX exposure revealed by the study. So, when the ROA increases by a point, the FX exposure will decrease by 0.011 point. As a result, when the firm has high profitability, it will have great flexibility in pricing services and high ability to absorb any shocks more easily than when it has low profitability. Therefore, it will have low FX exposure (Ndlela, 2011).

Conclusion

The results of the research showed that the adoption of the Multicurrency system in Financial reporting was important to restore credibility and transparency of financial reports and improving the budgeting system by stabilising the inflation. The research findings also concluded that the currency reforms though they have positive impact on financial reporting, they have not been enough to restore quality financial reporting due to lack of expertise and software to manage risk associated with foreign currency exposure and inconsistences of government policies which precluded firms to comply with accordance to prescribed standards during the era. The research study also concluded that if firms hire specialists for foreign currency risk and implement ERP systems for Multicurrency accounting their financial reporting systems will be improved. The study also concluded that firms should also train their employees to improve their experience with foreign currency exposure and engage in multicurrency diversification which involves hedging assets with correlated foreign rate.

References

- Adrian, A. (2013). Big Data Challenges. Database Systems Journal, 4(3).

- AICPA. (2014). Reimagining auditing in a wired world, White paper. New York: American Institute of Certified Public Accountants.

- AICPA. (2017). Guide to Audit Data Analytics. New York. American Institute of Certified Public Accountants

- Alles, M. (2015). Drivers of the use and facilitators and obstacles of the evolution of Big Data by the audit profession. Accounting Horizons, 29(2), 439-449. doi:10.2308/acch-51067

- Alles, M., & Gray, G. (2014). Developing a Framework for the Role of Big Data in Auditing: A Synthesis of the Literature. Working paper, Rutgers, The State University of New Jersey.

- Appelbaum, D. (2016). Securing big data provenance for auditors: The Big Data provenance black box as reliable evidence. Journal of Emerging Technologies in Accounting, 13(1), 17-36. doi:10.2308/jeta-51473

- Appelbaum, D., Kogan A., & Vasarhelyi, M. (2017). Big Data and Analytics in the Modern Audit Engagement: Research Needs. Auditing, 36(4): 1-27. doi:10.2308/ajpt-51684.

- Bender, T.H.H. (2017). The effects of Data Analytics on audit efficiency. Erasmus School of Economics.

- Briggs, L.L. (2013). Closing the business analytics gap at UT Austin. Business Intelligence Journal, 18(4).

- Brown-Liburd, H. (2015). Behavioral Implications of Big Data`s Impact on Audit Judgment and Decision Making and Future Research Directions. Accounting Horizon`s, 29(2).

- Byrnes, P., Criste, T., Stewart, T., & Vasarhelyi, M. (2014). Remaining Auditing in a Wired World [Online] Available at: https://www.business.com/articles/big-data-big-problems-coping-with-shortage-of-talent-in-data-analysis/ [Accessed on 16 February 2020]

- Cao, M., Chychyla, R., & Stewart, T. (2015). Big Data analytics in ?nancial statement audits. Accounting Horizons, 29(2), 423-429. doi:10.2308/acch-51068

- Deloitte. (2013). Formula for growth: Innovation, Big Data & Data Analytics. https://www2.deloitte.com/content/dam/Deloitte

- Wang, T., & Cuthbertson, R. (2015). Eight issues on audit data analytics we would like to see researched. Journal of Information Systems.

- Wen, C. (2018). Factors affecting audit efficiency in external audit. Managerial Auditing Journal.

- Whitehouse, T. (2014). Auditing in the Era of Big data. Compliance Week.

- Yoon, K., Hoogduin, L., & Zhang, L. (2015). Big Data as complementary audit evidence. Accounting Horizons 29(2), 431-438. doi:10.2308/acch-51

- Wadesango, N., Chirembwe, P., Sitsha, L., & Wadesango, V.O. (2020). Literature review on the impact of debt finance on the growth of small and medium enterprises in Zimbabwe. African Journal of Development Studies (AJDS), 10(3), 147-165.

- Wadesango, N., Mhaka, C., & Mugona, B. (2020). Literature review of the effect of corporate governance on financial performance of commercial banks in a turbulent economic environment. Academy of Strategic Management Journal, 19(3), 1-14.

- Wadesango, N., Mhaka, C., Bizah, S., Nyamwanza, L., & Chabaya, O. (2020). Literature review of the impact of tax amnesties towards improving SMES’ tax compliance and tax revenue collection. SYLWAN, 164(7), 1-11.

- Wadesango, N., Mhaka, C., Mugona, B., & Haufiku, H. (2020). The effects of corporate governance on financial performance of commercial banks in a turbulent economic environment. Acta Universitatis Danubius Oeconomica 165, 16(4), 164-191.

- Wadesango, N., Ncube, S., Sitsha, L., & Wadesango, O. (2020). Desktop review on the impact of quality of financial reporting on decision making in state universities. SYLWAN, 164(8), 1-19.