Research Article: 2021 Vol: 25 Issue: 1

Investigating the Impact of Agriculture on Economic Growth in BRICS: Does Financial Development Matter?

Kunofiwa Tsaurai, University of South Africa

Abstract

The study investigated the impact of agricultural production on economic growth in BRICS (Brazil, Russia, India, China, South Africa) countries using the dynamic generalized methods of moments (GMM) approach with panel data ranging from 1996 to 2018. The study also explored if financial development is a channel through agricultural production enhanced economic growth in BRICS countries. Consistent with majority of literature on the subject matter, agricultural production was found to have had a significant positive impact on economic growth in BRICS countries regardless of the measure of financial development used. The results also show that the complementarity between agricultural production and financial development had a significant positive influence on BRICS’ economic growth or enhanced economic growth in BRICS countries. In other words, the study confirmed that financial development is a channel through which agricultural production enhanced economic growth in BRICS. These results are backed by Okunlola et al (2019) whose study argued that the provision of loans and other financial products towards the agricultural sector facilitate agriculture’s role as a major towards economic growth in developing countries. BRICS nations are therefore urged to ensure there is effective implementation of policies geared towards enhancing agricultural production and financial development in order to boost their country’s economic growth.

Keywords

Agriculture, Growth, Financial Development, Brazil, Russia, India, China, South Africa.

Introduction

This section deals with the foundation of the study, namely the study’s background, gaps found in the literature, contribution of the study and the structure of the whole paper.

Background of the Study

Consistent with United Nations (2017), agriculture is one of the most important sectors that anchor economic growth and development in developing countries, Africa and low to middle income countries. The paper went on to say that agriculture enhance economic growth through providing employment to the poor, poverty reduction as the food from agriculture feeds the poor, provides income to the rural poor as they can sell the agricultural produce, provides inputs to the industry therefore promoting industrialization in the economy as a whole, generates foreign currency when the farm produce is sold in international agricultural markets and reduces demand for foreign currency to buy food from other countries. Theoretical and empirical literature is also unanimous on the positive that agriculture plays in the economy. There is consensus in the literature, in support of the United Nations (2017)’s arguments.

On the other hand, authors such as Shahbaz et al., (2013) and Zakaria et al., (2019) argued that agriculture’s influence on economic growth on its own is limited. The provision of finance and or removal of credit access constraints to the farmers are a critical step towards ensuring that agriculture plays its significant positive role in the economy. Chisasa (2014) whose study focused on South Africa concurred with such an argument. Empirical research on the role of financial development on agriculture’s role in the economy is very scant. The few researchers who have done it like Chisasa (2014) and Shahbaz et al., (2013) focused on single country analysis. Zakaria et al., (2019) focused on South Asia. In fact, none of agriculture-finance-growth nexus the author is aware of focused on BRICS. It means the BRICS story regarding agriculture, growth and financial development remains untold. Their empirical researches were also too narrow in their definition of financial development. Unlike prior related similar research, this study captures both stock market and banking sector development.

Contribution of the Study

Although the literature on the positive role played by agricultural production seems to show consensus, there is no study the author is aware of that exclusively focused on the factors that should be in place to enable agriculture to enhance its positive influence on economic growth. Literature also unequivocally agrees that financial development enhances economic growth but no study to the best of the author’s knowledge has so far investigated if financial development is a channel through which agricultural sector can enhance economic growth. In fact, majority of prior empirical studies on agricultural production-growth nexus wrongly assumed that the two variables are linearly related. The ignored the fact that economic growth is positively influenced by its own lag, consistent with Rahman et al., (2019). They also did not consider the endogeneity problem associated with an economic growth function (that explanatory variables of economic growth also affect each other). Majority of the existing studies on agriculture-growth nexus were on developing countries or African continent. Neither of them to the author’s best knowledge used BRICS as a unit of analysis. All these gaps were filled in this study.

Structure of the Paper

Section 2 is the theoretical literature discussion on the impact of agriculture on economic growth whilst Section 3 is the empirical literature which focuses on role of agriculture on economic growth. Section 4 discusses the influence of financial management on agricultural production whereas Section 5 describes the finance-led growth hypothesis. The explanatory variables of economic growth variable from a theory intuition point of view are discussed in Section 6. Section 7 describes the research methodological framework of the study. General model specification, data and its sources and the econometric model specification are the three aspects discussed in this section. Section 8 is the data analysis, results discussion and interpretation. Aspects discussed in this section include pre-estimation diagnostics such as correlation and trend analysis, panel unit root tests, panel co-integration tests, results presentation and interpretation. Section 9 concludes the paper.

Impact of Agriculture on Economic Growth-Theoretical Focus

There are three theoretical rationales describing the impact of agriculture on economic growth, as discussed below.

According to D’Haese et al., (2013), an increase in agricultural productivity ensures that there is a sufficient market of agricultural goods both locally and in international markets. When the agricultural goods are sold in international markets, it increases foreign currency inflow into the country. Domestic market agricultural products sufficiency ensures that the people access food at cheaper prices, hence contributing to poverty and hunger reduction.

Consistent with Johnston and Mellor (1961), the positive contribution towards the economy is more pronounced during the early stages of growth not only through providing employment and food but also through helping to establish consumption and production linkages in the economy. An increase in agricultural productivity increases income levels among rural households, which in turn pushes up the demand of industrial products produced locally (Suryahadi et al., 2006). On the other hand, an increase in agricultural productivity enhances the sector’s ability to supply more inputs to other sectors of the economy hence creating jobs not only for the agricultural sector but to the entire economy as a whole. Mozumbar (2012) also noted that agricultural productivity directly contributes towards gross domestic product of the country.

Impact of Agriculture on Economic Growth-Empirical Research

Several empirical studies on the influence of agriculture on economic growth have been done and their results are almost unanimous. Agriculture enhances economic growth in Table 1.

| Table 1 Agriculture’s Influence on Economic Growth-Empirical Literature | ||||

| Author | Country/Countries of study | Period | Methodology | Results |

| Awan & Alam (2015) | Pakistan | 1972-2012 | Autoregressive distributive lag (ARDL) | + |

| Zyl et al., (1988) | South Africa | 1951-1985 | Descriptive statistics | + |

| Safdar et al., (2012) | Pakistan | 1972-2011 | Autoregressive conditional heteroscadesticity (ARCH) model | + |

| Mackie (1964) | Developing economies | Literature review analysis | Descriptive statistics | + |

| Tsakok and Gardner (2007) | Not targeted at specific countries | Literature review analysis | Literature review analysis and descriptive analysis | + |

| Susilastuti (2018) | Indonesia | 2007-2016 | Multiple regression analysis and descriptive analysis | + |

| Awunyo-Victor and Sackey (2018) | Ghana | 1975-2017 | Error Correction Model | + |

| Diao et al., (2010) | African countries | 1999-2004 | Descriptive statistics | + |

| Bakari and Mabrouki (2018) | North Africa | 1982-2016 | Panel data analysis | + |

| Amire (2017) | Nigeria | 2000-2014 | Ordinary Least Squares (OLS) | + |

| Sillah (2013a) | Gambia | 1966-2009 | ARDL and VECM methodologies | + |

| Agboola et al., (2020) | Nigeria | 1981-2016 | VECM, Fully Modified Ordinary Least Squares (FMOLS), Dynamic Ordinary Least Squares (DOLS) | + |

| Salako et al., (2015) | Nigeria | 1981-2013 | Vector Autoregressive (VAR) Approach | + |

| Sillah (2013b) | Gambia | 1966-2009 | ARDL, VECM | + |

| Inumula et al., (2020) | India | 1985-2017 | VECM | + |

| Herath (2018) | Sri Lanka | 2013-2017 (Quarterly data) | Descriptive statistics | + |

| Matahir (2012) | Malaysia | 1970-2009 | Granger causality and Toda-Yamamoto (1996) approaches | + |

| Source: Author compilation | ||||

Research Methodological Framework

General Model Specification

Equation 1 is an economic growth function, whose selection of variables was mainly influenced by Susilastuti (2018), Awan & Alam (2015), Tahamipour & Mahmoudi (2018), among others.

GROWTH=f(AGRIC, FIN, FDI, REMIT, INFL, INFR, OPEN) [1]

Where GROWTH, AGRIC, FIN, FDI, REMIT, INFL, INFR and OPEN stands for economic growth, agricultural production, financial development, foreign direct investment, personal remittances, inflation, infrastructural development and trade openness respectively.

Econometric Model Specification

In econometric terms, equation 1 is transformed into equation 2.

(2)

(2)

Where is the vector of explanatory variables, is the intercept term, is the co-efficient of agricultural variable, β2 is the co-efficient of financial development variable, β3 is the coefficient of the complementarity variable whilst β4 is the co-efficient of a matrix of explanatory variables. ? is the error term, μ represents the time invariant and unobserved country specific effect. Time and country is respectively represented by and subscripts. The complementarity between agricultural production and financial development enhances growth in BRICS nations if the co-efficient (β3) is positive and significant.

Data and its Sources

The study used BRICS panel data ranging from 1996 to 2018. The dependent variable is economic growth whilst explanatory variables include agriculture (AGRIC), financial development (FIN), foreign direct investment (FDI), personal remittances (REMIT), inflation (INFL), infrastructure development (INFR) and trade openness (OPEN). GDP per capita, domestic credit by financial sector (% of GDP), net foreign direct investment (% of GDP), personal remittances received (% of GDP), inflation consumer prices (annual%), fixed telephone subscriptions (per 100 people) and total trade (% of GDP) were the proxies used to measure economic growth, financial development, foreign direct investment, remittances, inflation, infrastructure development and trade openness respectively. World Bank Indicators, African Development Bank, South African Statistics Agency, Global Financial Indicators and United Nations Development Programme reports were the reputable international databases from which the panel data used was obtained.

Data Analysis, Results Discussion and Interpretation

Pre-estimation Diagnostics

As expected, a significant positive correlation was established between (1) agriculture and economic growth, (2) financial development and economic growth, (3) foreign direct investment and economic growth, (4) remittances and economic growth, (5) infrastructure development and economic growth and (6) trade openness and economic growth. However, a significant negative relationship between inflation and economic growth was observed, in line with available theoretical predictions. Consistent with Stead (1996), the multi-collinearity problem was found in the correlational relationship between FDI and trade openness and between infrastructure and inflation in Table 2.

| Table 2 Correlation Results | ||||||||

| GROWTH | AGRIC | FIN | FDI | REMIT | INFL | INFR | OPEN | |

| GROWTH | 1.00 | |||||||

| AGRIC | 0.2361*** | 1.00 | ||||||

| FIN | 0.1573*** | 0.0854 | 1.00 | |||||

| FDI | 0.0342*** | 0.0317** | 0.6214* | 1.00 | ||||

| REMIT | 0.0006** | 0.1648 | 0.0531* | 0.5542 | 1.00 | |||

| INFL | -0.0458** | 0.1673** | 0.3216 | -0.2144* | -0.0066 | 1.00 | ||

| INFR | 0.0217*** | 0.2782* | 0.5316** | 0.0443 | 0.4436 | -0.8565 | 1.00 | |

| OPEN | 0.5218** | 0.3421 | 0.2214 | 0.7454*** | 0.0532 | -0.3216** | 0.0427* | 1.00 |

Source: Author compilation from E-Views

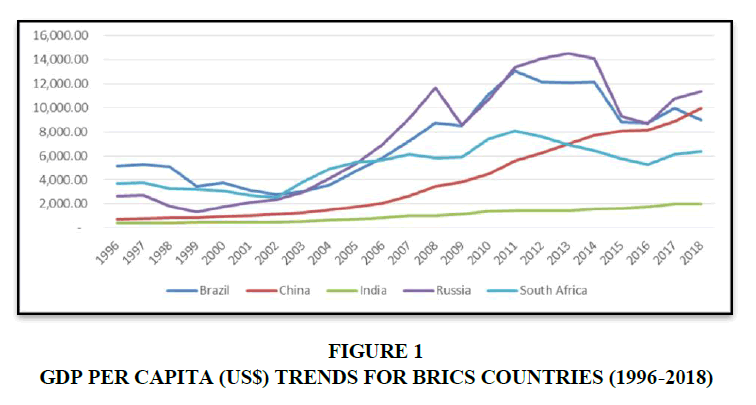

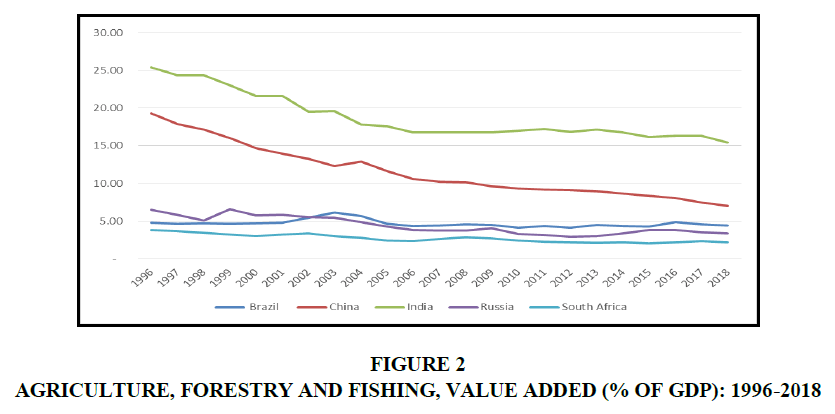

Figures 1 and 2 respectively shows GDP per capita and agricultural production trends for BRICS countries during the period from 1996 to 2018.

Brazil’s GDP per capita went down by 27.53%, from US$5 144.64 in 1996 to US$3 728.51 in 2000 before experiencing a 26.88% increase to end the year 2005 at US$4 730.65. The five-year period from 2005 to 2010 saw Russia’s GDP further increasing by a massive 135.09%, from US$4 730.65 in 2005 to US$11 121.42 in 2010. However, GDP per capita then plummeted by 20.75% during the subsequent five-year period to end the year 2015 at US$8 814. Russia’s GDP per capita then slightly went up by 2.12% during the next three-year period, from US$8 814 IN 2015 to US$9 001.23 in 2018. GDP per capita’s trend analysis during the period from 1996 to 2018 for Russia and South Africa followed the same pattern as that of Brazil.

China’s GDP per capita went up by 35.01%, from US$707.03 in 1996 to US$954.55 in 2000 before further increasing by 82.29% during the five-year period, from US$954.55 in 2000 to US$1 740.10 in 2005. The GDP per capita for China then increased by a massive 159.46% during the subsequent five-year period before recording a further huge increase of 78.76% during the following five years, from US$ 4 514.94 in 2010 to US$8 066.94 in 2015. Furthermore, China’s GDP per capita increased from US$8 066.94 in 2015 to US$9 976.76, an increase by 23.67%. Although the absolute values are different, India’s GDP per capita trends during the period under study exactly mimicked that of China.

From Figure 2, it is evident that Brazil’s agricultural production went down by 0.02 percentage points during the four-year period, from 4.77% of GDP in to 4.75% of GDP in 2000 before recording another decline of 0.1 percentage points during the next five-year period to end the year 2005 at 4.65%. The five-year period ranging from 2005 to 2010 saw agricultural production going down by 0.54 percentage points whilst the subsequent five-year period increased by 0.2 percentage points, from 4.12% in 2010 to 4.32% in 2015. The three-year period from 2015 to 2018 experienced a 0.1 percentage points increase in agricultural production to end the year 2018 at 4.42%.

For China, agricultural production declined from 19.33% in 1996 to 14.68% in 2000, decline by 3.03 percentage points during the five-year period ranging from 2000 to 2005 before decreasing by 2.32 percentage points, from 11.64% in 2005 to 9.33% in 2010. During the same period from 1996 to 2010, India, Russia and South Africa’s agricultural production trends mimicked that of China. South Africa (-0.30 percentage points), China (-0.94 percentage points) and India (-0.85 percentage points) experienced a decline in agricultural production during a five-year period ranging from 2010 2015. The same period saw Russia’s agricultural production going up by 0.53 percentage points. Both Brazil and South Africa experienced a 0.1 percentage points increase in agricultural production during a three-year period from 2015 to 2018. On the other hand, China, India and Russia’s agricultural production plummeted by 1.34 percentage points, 0.77 percentage points and 0.5 percentage points during a three-year period from 2015 to 2018.

Panel Unit Root Tests

In Table 3, it is evident that all the variables were stationary at first difference. This is what Odhiambo (2014) referred to as integrated of order 1.

| Table 3 Panel Root Tests – Individual Intercept | ||||||||

| Level | First difference | |||||||

| LLC | IPS | ADF | PP | LLC | IPS | ADF | PP | |

| LGROWTH | 1.3183 | 4.2718 | 8.5233 | 7.2194 | -5.3912** | -5.9021** | 92.9217** | 109.1284* |

| LAGRIC | -2.75** | -1.006** | 68.65** | 89.87*** | -12.74*** | -14.87*** | 166.94*** | 415.05*** |

| LFIN | -2.61*** | -1.85*** | 57.84** | 99.34*** | -15.98*** | -13.85*** | 210.34*** | 528.90*** |

| LFDI | -5.87*** | -5.87*** | 110.54** | 166.94*** | -11.56*** | -15.96*** | 212.87*** | 985.56*** |

| LREMIT | -1.87 | 1.78 | 34.87 | 67.98* | -9.78*** | -9.56** | 177.86*** | 398.56*** |

| LINFL | -4.56*** | -3.67*** | 68.95*** | 143.83*** | -14.76*** | -15.87*** | 198.56*** | 675.12*** |

| LINFR | -1.34* | -1.71* | 41.76** | 61.85*** | -7.83*** | -9.34*** | 145.86*** | 517.98*** |

| LOPEN | -1.56* | -1.84* | 45.23** | 65.67** | -9.56** | -10.89** | 151.54** | 545.04** |

Source: Author’s compilation - E-Views figures

Panel Co-integration Tests

Kao (1999) integration tests were used to investigate whether a long run relationship existed between and among the used variables in the study (see results in Table 4).

| Table 4 Results of Kao Co-Integration Tests | |

| Series | ADF t-statistic |

| GROWTH AGRIC DCF FDI REMIT INFL INFR OPEN | -3.6321*** |

| GROWTH AGRIC DPC FDI REMIT INFL INFR OPEN | -5.8747*** |

| GROWTH AGRIC SMC FDI REMIT INFL INFR OPEN | -4.5428*** |

| GROWTH AGRIC ST FDI REMIT INFL INFR OPEN | -6.7428*** |

| GROWTH AGRIC VT FDI REMIT INFL INFR OPEN | -5.8532*** |

| Source: Author compilation | |

Where DCF is domestic credit by financial sector (% of GDP), DPC represents domestic private credit (% of GDP), SMC is stock market capitalization (% of GDP), ST stands for stock turnover ratio (% of GDP) whilst VT represents value traded ratio (% of GDP). As supported by Guisan (2014) and Odhiambo (2014), the variables used were found to be co-integrated regardless of the measure of financial development variable employed. The results pave way for the dynamic GMM tests to be done.

Results Presentation and Interpretation

The dynamic GMM results of the economic growth function are presented in Table 5.

| Table 5 Dynamic Generalised Methods of Moments (GMM) Results | |||||

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | |

| 0.2324*** | 0.3284*** | 0.2834*** | 0.1643*** | 0.4382*** | |

| AGRIC | 0.2843** | 0.4274* | 0.1739*** | 0.0472* | 0.2167** |

| FIN | 0.0001** | 0.2712** | 0.2381* | 0.2834** | 0.3491* |

| INTERACTION TERM | 0.2381*** | 0.4327*** | 0.5431*** | 0.2781*** | 0.3289** |

| FDI | 0.0218* | 0.1382** | 0.1187** | 0.2833* | 0.0004** |

| REMIT | 0.0168** | 0.3278** | 0.0037*** | -0.0126 | -0.026** |

| INFL | -0.0033* | 0.2777** | -0.3287* | -0.0009 | -0.0655 |

| INFR | 0.0021 | 0.2776 | 0.0326** | 0.0211*** | 0.0018* |

| OPEN | 0.0089 | 0.0269 | 0.0118** | 0.0176** | 0.0177** |

| Adjusted R-squared | 0.65 | 0.72 | 0.63 | 0.68 | 0.74 |

| J-statistic | 468 | 468 | 468 | 468 | 468 |

| Prob(J-statistic) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

Source: Author’s compilation from E-Views

The different measures of financial development were used in this study. Model 1 used domestic credit by financial sector (% of GDP), model 2 employed domestic private credit (% of GDP), model 3 used stock market capitalization ratio, stock turnover ratio (% of GDP) was used in model 4 whilst value traded ratio (% of GDP) was employed in model 5.

Consistent with Rahman et al., (2019), the lag of economic growth had a significant positive impact on economic growth in all the five models. The results provide evidence that economic growth has a lot of positive spill overs that accrues to the subsequent years.

Across all the five models, agricultural production was found to have had a significant positive effect on economic growth. The results resonate with authors such as D’Haese et al., (2013), whose studies argued that agriculture positively influence economic growth through providing employment, foreign currency, ensures food security and pushes up gross domestic product of the country, provides inputs to the industry and other sectors of the economy.

Financial development was also found to have a significant positive influence on economic growth across all the five models, consistent with Schumpeter (1911), McKinnon (1973), Townsend (1983), Shaw (1973) and Goldmith (1969) whose studies all concurred that financial development is an engine through which economic growth takes place. They argued that financial markets are efficient in the allocation of financial resources needed by the production sector of the economy, mobilize savings and investment and design and implement financial risk management strategies for the key players in the economy.

The complementarity between agricultural production and financial development had a significant positive influence on economic growth in all the five models used. Considering the size of the co-efficients of the complementarity variable, it is evident that the complementarity between agricultural production and financial development enhanced economic growth in BRICS countries. In other words, the results show that financial development is a channel through which agricultural production can enhance economic growth in BRICS countries. These results resonate with Chisasa (2014), Zakaria et al., (2019) and Shahbaz et al., (2013).

Consistent with Romer (1986), FDI had a significant positive effect on economic growth across all the five models in BRICS group of nations. The impact of remittances on economic growth was found to be mixed, in line with available literature (Sutradhar 2020) on remittances-led growth hypothesis. Inflation had a deleterious influence on economic growth, in agreement with Mallik & Chowdhury (2001).

Consistent with Tsaurai (2018) infrastructural development positively affected economic growth in BRICS. Trade openness’s influence on economic growth in BRICS was also observed to be positive, in line with Baltagi et al., (2009).

Conclusion

The study investigated the impact of agricultural production on economic growth in BRICS countries using the dynamic GMM approach with panel data ranging from 1996 to 2018. The study also explored if financial development is a channel through agricultural production enhanced economic growth in BRICS countries. Consistent with majority of literature on the subject matter, agricultural production was found to have had a significant positive impact on economic growth in BRICS countries regardless of the measure of financial development used. The results also show that the complementarity between agricultural production and financial development had a significant positive influence on BRICS’ economic growth or enhanced economic growth in BRICS countries. In other words, the study confirmed that financial development is a channel through which agricultural production enhanced economic growth in BRICS. These results are backed by Okunlola et al., (2019) whose study argued that the provision of loans and other financial products towards the agricultural sector facilitate agriculture’s role as a major towards economic growth in developing countries. BRICS nations are therefore urged to ensure there is effective implementation of policies geared towards enhancing agricultural production and financial development in order to boost their country’s economic growth. Other factors which may have (in line with available literature) an influence on agricultural production’s influence on economic growth in BRICS countries should be investigated in future empirical studies.

References

- Agboola, M.O., Bekun, F.V., Osundina, O.A., & Kirikkaleli, D. (2020). Revisiting the economic growth and agriculture nexus in Nigeria: Evidence from asymmetric cointegration and frequency domain causality approaches. Journal of Public Affairs, e2271.

- Amire, C. (2016). The effect of agricultural productivity on economic growth in Nigeria. Available at SSRN 3056819.3.

- Awan, A. & Alam, A. (2015). Impact of agriculture productivity on economic growth: A case of Pakistan. Industrial Engineering Letters, 5(7), 27-33.

- Awunyo-Vitor, D., & Sackey, R.A. (2018). Agricultural sector foreign direct investment and economic growth in Ghana. Journal of Innovation and Entrepreneurship, 7(1), 15.

- Baltagi, B.H., Demetriades, P.O., & Law, S.H. (2009). Financial development and openness: Evidence from panel data. Journal of development economics, 89(2), 285-296.

- Bakari, S., & Mabrouki, M. (2018). The impact of agricultural trade and economic growth in North Africa: Econometric analysis by static gravity model. Econometric Analysis by Static Gravity Model, 85116, 1-15.

- Chisasa, J. (2014). The finance-growth nexus in South Africa’s agricultural sector: A structural equation modeling approach. Banks and Bank Systems, 9(4), 38-47.

- D'Haese, M., Vink, N., Nkunzimana, T., & Van Rooyen , C.J. (2013). Improving food security in the rural areas of Kwazulu Natal province, South Africa: Too little, too slow. Development Southern Africa, 30(4-5), 468-490.

- Diamond, D.W., & Dybvig, P.H. (1983). Bank runs, deposit insurance and liquidity. The Journal of Political Economy, 91(3), 401-419.

- Diao, X., Hazell, P., & Thurlow, J. (2010). The role of agriculture on African development. World Development, 1-9.

- Goldsmith, R.W. (1969). Financial structure and development. Yale University Press, New Haven.

- Guisan, M.C. (2014). World Development, 2000-2010: Production, Investment and Savings In 21 Areas of America, Africa, Asia-Pacific. Europe and Eurasia, Regional and Sectoral Economic Studies, 14(2), 193-211.

- Herath, H.M.W.A. (2018). Poverty and agricultural productivity growth nexus in the non-plantation agriculture in Sri Lanka. Journal of Social and Development Sciences, 9(2), 38-53.

- Im, K.S., Pesaran, M.H., & Shin, Y. (2003). Testing unit roots in heterogeneous panels. Journal of Econometrics, 115(1), 53-74.

- Inumula, K.M., Singh, S., & Solanki, S. (2020). Energy consumption and agricultural economic growth nexus: Evidence from India. International Journal of Energy Economics and Policy, 10(6), 545-552.

- Johnston, B.F., & Mellor, J.W. (1961). The role of agriculture in economic development. American Economic Review, 51(4), 566-593.

- Kao, C. (1999). Spurious regression and residual-based tests for co-integration in panel data. Journal of Econometrics, 90(1999), 247-259.

- Levine, R. (1997). Financial development and economic growth: Views and agenda. Journal of Economic Literature, 35(2), 688-726.

- Levin, A., Lin, C.F., & Chu, C.S.J. (2002). Unit root tests in panel data: Asymptotic and finite-sample properties. Journal of Econometrics, 108(1), 1-24.

- Mackie, A.B. (1964). The role of agriculture on economic growth and development. Illinois Agricultural Economics, 4 (3), 1-10

- Mallik, G., & Chowdhury, A. (2001). Inflation and economic growth: Evidence from four South Asian countries. Asia-Pacific Development Journal, 8(1), 123-135.

- Matahir, H. (2012). The empirical investigation of the nexus between agricultural and industrial sectors in Malaysia. International Journal of Business and Social Sciences, 3(8), 225-231.

- McKinnon, R.I. (1973). Money and capital in economic development. The Brooklings Institution, Washington, DC.

- Mozumbar, L. (2012). Agriculture productivity and food security in the developing world. Bangladesh journal of Agricultural Economics, 35(1-2), 1-17.

- Odhiambo, N.M. (2014). Financial systems and economic growth in South Africa: A dynamic complementary test. International Review of Applied Economics, 28(1), 83-101.

- Okunlola, A., Osuma, G., & Omankhanlen, A.E. (2019). Agricultural finance and economic growth: Evidence from Nigeria. Business: Theory and Practice, 20, 467-475.

- Osinubi, T.S. (1998). Stock market development and long-run growth in Nigeria. M.Sc. Economics Dissertation, University of Ibadan Nigeria.

- Pagano, M. (1993). Financial markets and growth: An overview. European Economic Review, 37(2-3), 613-622.

- Rahman, M.M., Rana, R.H., & Barua, S. (2019). The drivers of economic growth in South Asia: Evidence from a dynamic system GMM approach. Journal of Economic Studies, 46(3), 564-577.

- Romer, P. (1986). Increasing returns and long run economic growth. Journal of Political Economy, 94(5), 1002-1037

- Safdar, H., Maqsood, S., & Ullah, S. (2012). Impact of agricultural productivity on economic growth: A case study of Pakistan. Journal of Asian Development Studies, 1(2), 24-34.

- Schumpeter, J.A. (1911). The theory of economic development. Harvard University Press, Cambridge, MA.

- Salako, M.A., Lawrence, A., Egbekuhle, S.O. (2015). Agriculture, economic growth and development nexus: VAR variance decomposition, Evidence from Nigeria. International Journal of Economics, Commerce and Management, 3(6), 460-478.

- Shahbaz, M., Shabbir, M.S., & Butt, M.S. (2013). Effect of financial development on agricultural growth in Pakistan new extensions from bounds test to level relationships and Granger causality tests. International Journal of Social Economics, 40, 707-728.

- Shaw, E.S. (1973). Financial deepening in economic development. Oxford University Press, New York, NY.

- Sillah, B. (2013a). An econometric analysis of agriculture-growth nexus in Gambia: 1966-2009, is it more per acre and fewer yields per acre, and the reverse should have been the case. African Journal of Agricultural Research, 8(50), 6651-6662.

- Sillah, B. (2013b). Agriculture and growth nexus in Gambia. Journal of Economics and Financial Studies, 1(1), 74-86.

- Stead, R. (1996). Foundation quantitative methods for business. Prentice Hall. England.

- Suryahadi, A., Suryadarma, D., & Sumarto, S. (2006). Economic growth and poverty reduction in Indonesia: The effects of location and sectoral components. SMERU Working Paper.

- Susilastuti, D. (2018). Agricultural production and its implications on economic growth and poverty reduction. European Research Studies Journal, 11(1), 309-320

- Sutradhar, S.R. (2020). The impact of remittances on economic growth in Bangladesh, India, Pakistan and Sri-Lanka. International Journal of Economic Policy Studies, 14(2), 275-295

- Tahamipour, M., & Mahmoudi, M. (2018). The role of agricultural sector productivity in economic growth: The case of Iran’s economic development plan. Research in Applied Economics, 10(1), 16-24

- Townsend, M.R. (1983). Financial structure and economic activity. American Economic Review, 73(5), 895-911.

- Tsakok, I., & Gardner, B. (2007). Agriculture in economic development: Primary engine of growth or chicken and egg?. American Journal of Agricultural Economics, 89(5), 1145-1151.

- Tsaurai, K. (2018). Complementarity between foreign aid and financial development as a driver of economic growth in selected emerging markets. Comparative Economic Research, 21(4), 45-61.

- United Nations (2017). The status of agriculture, growth and poverty in developing countries. Yearly United Nations Development Programme Prognosis, 1-45.

- Zakaria, M., Jun, W., & Khan, M.F. (2019). Impact of financial development on agricultural productivity in South Asia. Agricultural Economics, 65(5), 232-239.

- Zyl, J.V., Nel, H.J.G., & Groenewald, J.A. (1988). Agriculture’s contribution to the South Africa economy. Agrekon, 27(2), 1-9.