Research Article: 2024 Vol: 28 Issue: 6

Introduction of AI: A Transformative Approach to Achieve Digital Financial Inclusion in India

Rajender Kumar, Rajdhani College, University of Delhi

Bhoomika Garg, Rajdhani College, University of Delhi

Citation Information: Kumar, R., & Garg, B. (2024). Introduction of ai: a transformative approach to achieve digital financial inclusion in india. Academy of Marketing Studies Journal, 28(6), 1-7.

Abstract

For inclusive growth and sustainable development of people mainly from rural & backward area and their empowerment, there is a need to provide an environment to access quality services from financial institutions in India. While traditionally banking system cannot reach to all people through a ‘brick and mortar' model, new and advanced banking technology which currently based on artificial intelligence has enabled financial inclusion through branchless banking with different type of new services for financial inclusion. By using artificial intelligence in banking sector, banks have a cost-effective and efficient solution to provide access to services to the financially excluded people of India. Artificial intelligence improves the accessibility and affordability of formal financial services to the underbanked population where these services cannot be provided easily either due to demand side constraints or supply side constraints of financial inclusion. This paper aims to examine the use of Artificial Intelligence to achieve the goal of financial inclusion in India. The paper offers an overview of real-time instances of AI technologies that can be used to remove obstacles to financial inclusion in several nations specially with respect to developing countries like India. The study used modest techniques of research to offer theoretical insights into the function of AI in fostering financial inclusion.

Keywords

Finance, Digital Financial Inclusion, Artificial Intelligence, Formal Financial System.

Introduction

Financial inclusion is seen as a crucial indication of people's well-being. It is characterized as the inclusion of privileged or impoverished individuals in the official financial system, as well as the supply of loans and providing other financial services at reasonable rates. Monetary inclusion is seen as a crucial component of human growth. It contributes to the achievement of more than half of the Sustainable Development Goals (SDG).

According to the World Bank's Global Financial index database, around 1.7 billion individuals were unbanked in 2017, meaning they did not have a formal financial institution or mobile money provider account. The majority of the unbanked live in developing nations The effect of artificial intelligence (2023) Financial inclusion is a methodology that ensures the provision of financial services and products to the end-user so that would get access to it, whenever needed at a reasonable cost Sadok, & Assadi, (2023).

Improving the living standard, the general quality of life, and the well-being of disadvantaged populations in the developing world requires addressing the foregoing challenges by increasing financial inclusion. In a word, financial inclusion is providing individuals and businesses with cheap access to meaningful financial goods and services to suit their requirements. Financial access is necessary for day-to-day functioning as well as establishing long-term objectives and dealing with crises.

Artificial intelligence (AI) & machine learning (ML) are rapidly advancing and changing the political, economic, & social landscapes of developing countries. As a result, AI-based solution is projected to be a game-changer, with substantial implications for boosting poor financial access. Traditional banks are unwilling and reluctant to serve small-scale borrowers such as low-income persons and small businesses because of the high transaction costs &inefficient processes associated with granting modest loans to these customers. Artificial intelligence is transforming the consumer financial services sector, as well as clients' interactions with the financial services ecosystem. The development of AI algorithms, rising AI investment, increased rivalry, and rapid adjustments in client preferences for digitally investment products enabled by AI have all contributed to this trend.

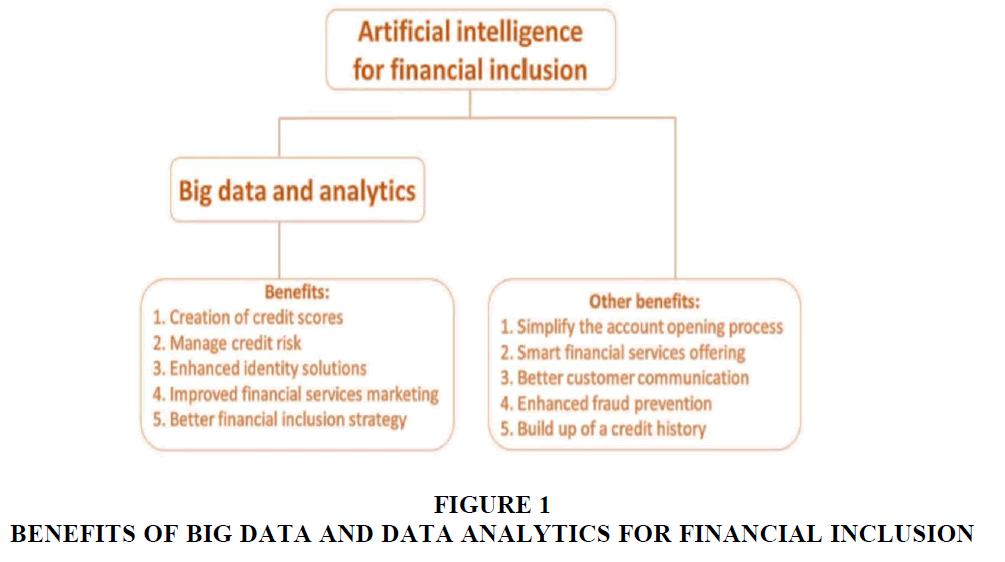

A country like India, which is a pioneer of enormous financial products like Unified payment interface (UPI) and Bharat Interface for money (BHIM) can harness the power of AI to capture the voluminous Indian financial market. AI is becoming a driving factor in the global financial ecosystem, so India can become the low-cost solution provider to the world to tackle the various financial problem. One of the leap of success in India’s fast- growing AI-empowered financial product and services ecosystem is that it is exporting low-cost products and services to the rest of the world. India’s AI-based financial inclusion strategy rests on the motivation of social empowerment and India’s strength in AI financial tool not only benefitting domestic cause but hold huge potential to satisfy global needs. The paper takes an overview of existing strategies, analytics, and comparative studies in the field of AI-empowered financial inclusion. And suggests a way ahead for the further inclusion of the scope of AI in various possible financial analytics and innovative cause of social inclusion in the financial domain more productively Figures 1 & 2.

1. AI facilities the creation of credit scores for the excluded

2. Helps financial services providers to manage credit risk more

3. Offers far superior identity solutions to Know-Your-Customer (KYC)

4. Improved marketing of financial

5. Improves financial inclusion policies and

6. AI overall provides smoothens the entire process of financial inclusion right from account opening to the provision of financial

Literature Review

There is a wealth of information on digital financial inclusion, particularly on how mobile phones are progressively affecting financial inclusion. Suggested that digital financial inclusion is a vital component of initiatives to include individuals who are currently excluded. a component of the formal financial system went on to say that digital banking is good for the environment. Users of financial services, suppliers of government services, and the broader economy, on the other hand, believe there are various challenges in digital money that need to be overcome, including regulatory issues. Furthermore, suggested that having a national identity in a globalized society is a contradiction. One-third of the population does not have access to formal financial services Rojas-Torres, et al. (2021).

Despite the push towards digitized payments in developing countries, such as after India's demonetization, low-income groups are ill-prepared and unwilling to adopt digital payments for a variety of reasons, including low smartphone penetration, non-acceptance of digital payments across value chains, limiting features of bank accounts, and the non-viability of small-value transactions Rangarajan.

The mobile money revolution in Sub-Saharan Africa shows that market-led approaches to financial inclusion and development are the most successful, as they are devoid of harsh restrictions and provide the industry maximum flexibility. To find new ways to reach out to the unbanked people He claimed that the success of any financial inclusion effort is predicated on a regulatory strategy that is enabling rather than restrictive toward FinTech businesses Mhlanga, (2020).

Every day, artificial intelligence becomes smarter, transforming governance, the economy, and society in emerging countries. Artificial intelligence-based banking solutions have emerged as a game-changer in terms of increasing financial access Sinha, et al. (2018). As a result, millions of financially disadvantaged individuals have migrated from cash-based transactions to formal financial institutions, where they may access a variety of services such as payments, transfers, credit, insurance, securities, and savings Sinha, et al. (2018). AI (especially algorithms) can aid in reducing the risks associated with granting financial access Mehrotra, (2019).

Financial inclusion, regulation, and technological advancements in India's banking industry. The government of India’s recent measures has boosted financial inclusion, and will inevitably lead to a situation where all Indians have bank accounts and use IT-enabled services Garg et al. (2022)

The assessment of present financial systems' adaption to new financial technological developments constitutes the current financial reality. Changing business concepts, such as FinTech, represent the new financial realities in general. Users must understand the major issues in order to adjust to these problems. Cryptocurrency, artificial intelligence, blockchain, and databases are just a few of the significant technical advances. From a corporate and regulatory standpoint, management is essential. It's equally important to recognize how to evaluate and analyze technological innovation in finance, and what influence new technologies have on the financial sector Individuals, businesses, markets, and economies Garg et al. (2022).

Research Methodology

A desktop research has been conducted to investigate the impact of Artificial Intelligence on achieving digital financial inclusion in India. The theoretic framework has been used to study about the artificial intelligence with special reference to FI and to critically analyse its impact on digital financial inclusion keeping in consideration challenges posed by its implementation. The techniques also comprise theoretical and documented analysis as per the latest literature, various articles, reports and other internet sources on achieving financial inclusion particularly in the field of AI.

Objectives of the paper

1. To study the application of Artificial Intelligence in formal financial sector.

2. To study the impact and future of Artificial Intelligence in formal financial sector.

Digital Financial Inclusion in India

India’s financial landscape has had a monumental transformation in recent years. The implementation of the country’s digital public infrastructure, which includes Aadhar (digital ID system), Unified Payments Interface (fast payments system) and Digi Locker (digital document wallet) has not only revolutionized the financial inclusion landscape in India; it has captivated global interest and adoption. Financial inclusion can be understood as the percentage of adults having access to formal financial services specially banking services. As per the Global Findex Survey, 79.9 percent of the population had access to formal financial services in the year 2021. This can be seen as sturdy growth compared to the previous copy of survey which showed 53.1% and 35.2% in the year 2019 & 2014 respectively.

The success of India’s DPI (Digital Payment Index) model has found resonance in other countries. Described by some as “India’s belt and road initiative”, policy-makers in India have worked to elevate the status of DPI on the global stage. At the roundtable, panelists noted that India, with its experience and success in implementing DPI, stands ready to collaborate with other nations, offering protocols, source codes and expertise to pave the way for a more interconnected and efficient global financial ecosystem.

To this end, a “Modular Open Source Identity Platform” was launched in 2018 to offer a publicly accessible version of Adhaar-like technology to other countries. In India, substantial advancement in both private and public financial sector are the key drivers in promoting digital financial inclusion. This could also be seen in Government policies that clearly prioritizes the access to formal financial sectors as one of the key tool for inclusive growth as well as poverty reduction. India has taken various attempts to improve financial inclusion, such as the Pradhan Mantri Jhan Dan Yojna Scheme (PMJDY) in which Zero Balance Bank Accounts were opened for the majority population and have been used as default channels to transfer government subsidies and payments through “Direct Benefit Transfer” scheme. Such rapid scale in account opening has been enabled as the GOI has invested massive amount in technology viz expanding coverage of internet and smartphones dispersion showing that banking future is going to be digitalized. Bank Accounts have been linked to biometric identification via “Aadhaar Scheme” and to mobile numbers aiming to take the benefits of digitalized system. Financial Tech companies are encouraged to obtain a payment bank license for more traditional financial access of banking services and at the same time Microfinance institutions (MFIs) are also leveraging digital technologies to align with financial market needs for the growth of digital banking services.

The US agency for international development (USAID) in collaboration with (FHI 360, IFMR-LEAD and Intellecap) committed in recent past that it will support Government of India financial inclusion drive in India for focused expansion of digital services of merchants through payment merchant services across underdeveloped regions of India to have more coverage of Financial Inclusion. USAID has set up various programmes for urban and rural areas across Haryana, Rajasthan and Uttar Pradesh as a CATALYST program looking at the value chain-based approaches. Based on the project documents of these programmes important findings include:

• The human intervention remains critical in utilizing the Digital financial services of banking and other financial institutions as few segment of society like senior-citizens and people of rural & urban poor areas could know how to use the technological devices with proper training and banking user interface training specific to their product to make financial inclusion a great success.

• In recent times, AI has made progress by leaps and bounds with new chat bots in the marketplace from Microsoft, Google, and other various esteemed companies but careful planning needs to be done to make use of these technologies.

• There is need to take into consideration the Demand Side of Financial Inclusion as financial products and services available in the market do not meet the varied needs of Indian population. Mostly financial products are designed keeping in focus the wealthier section of the society but the demands of poorer section should also be taken care of.

• Need to understand the complexities of mindset of the people who uses cash instead of digital payments which clearly displays there is a disconnect between the ground realities of financial inclusion and actual day to day life of a common man. Analysis and relatively careful planning have to be done to exterminate the gaps to have proper Financial Inclusion to be done through AI at broader level for Urban and rural areas of the nation

To make financial Inclusion more widespread and advanced the use of digital devices should be increased such as mobile phones with data usages should be promoted to have more transactions to manage incomes and additional services like savings, insurance, credit, loans and fixed deposits. We have to think of exploring the areas of including the excluded individuals with the fact that uneven or irregular tiny amounts allows these customers to transact digitally with low-cost mobile phones for proper financial inclusion. The mobile devices should also be used as transaction cards in point-of-sale terminals to that transactions could be performed digitally by exchanging the information through the mobile devices in the era of AI, which have been started in urban areas but should also reach to the rural areas with lower end mobile devices as well.

AI should also be utilized in fraudulent risk detection areas of Financial Inclusion such as analysing the credit scoring, market impact, user behavior, chatbots, risk measurement and consumer protection. Fintech companies are increasingly making use of AI applications for managing the potential risk concerns of Financial Inclusion.

Use of Artificial Intelligence in recent years has increased the exploration of new viable options available in financial Inclusion through virtual assistant banking services such as self-help chatbots customer service for various financial offerings. Security of these financial services has a big role to be played by Artificial Intelligence through Fraud Detection and Cybersecurity as number of digital transactions are quite huge for most interbank transfers or financial transactions.

However Financial Inclusion has to be considered for small farmers who are vulnerable to high risk due to non-availability of credit loans education from banking sector so financially excluded people should be the prime target for promoting the banking services through self-help customer service or educating them door to door on various available financial services and providing them easy access to farmer loans or small business start-up loans.

Conclusion and Recommendations

The aim of current research work is to examine and explore the impact of Artificial Intelligence on Digital Financial Inclusion. Digital Financial Inclusion is one of the keys to ensure that people who are at the lower levels of pyramid can become financially active and secured. Fintech Companies are reaping the benefits of AI to apply its applications to ensure that marginalized people (including rural people, low income earners, urban poor, small farmers and others) can also be covered under the ambit of formal financial system. The study revealed that AI plays a big role on digital financial inclusion specially in the areas of measurement and management of risk, solving the problems of information asymmetry, taking the help of chatbots, fraud discovery and cybersecurity etc. In the field of risk detection, AI can be used as it uses multiple algorithms for risk measurement and management. This particularly helps vulnerable section of the society who could not be added to formal financial sector due to the risk related issues. The problem of information asymmetry can be solved by taking the help of various online shopping platforms and social networks that store huge amount of information on individuals that can reduce the gap between formal financial institutions and individuals and thus enables more financial inclusion. But there still many misconceptions about the use of AI in digital financial inclusion but it is important to acknowledge that AI is providing backbone in digital financial inclusion almost in every sphere. Therefore, this study recommends that formal financial and non-financial institutions should use AI as it stores the untapped possibilities that can be utilized to cover those who are still excluded from the formal financial system.

References

Garg, N., Gupta, M., & Jain, N. (2022). Emerging Need of Artificial Intelligence Applications and their Use cases in the Banking Industry: Case Study of ICICI Bank. In Revolutionizing Business Practices Through Artificial Intelligence and Data-Rich Environments (pp. 140-161). IGI Global.

Mehrotra, A. (2019). Financial inclusion through FinTech – a case of lost focus. 2019 International Conference on Automation, Computational and Technology Management (ICACTM).

Mhlanga, D. (2020). Industry 4.0 in finance: The impact of artificial intelligence (AI) on Digital Financial Inclusion. International Journal of Financial Studies, 8(3), 45.

Indexed at, Google Scholar, Cross Ref

Rojas-Torres, D., Kshetri, N., Hanafi, M.M., & Kouki, S. (2021). Financial Technology in Latin America. IT Professional, 23(1), 95–98.

Indexed at, Google Scholar, Cross Ref

Sadok, H., & Assadi, D. (2024). The Contribution of AI-Based Analysis and Rating Models to Financial Inclusion: The Lenddo Case for Women-Led SMEs in Developing Countries. In Artificial Intelligence, Fintech, and Financial Inclusion (pp. 11-25). CRC Press.

Sinha, S., Pandey, K.R., & Madan, N. (2018). Fintech and the demand side challenge in financial inclusion. Enterprise Development and Microfinance, 29(1), 94–98.

Indexed at, Google Scholar, Cross Ref

Sinha, V., Kumar, A., & Siddharth, T. (2023). The Effect of Artificial Intelligence on Digital Financial Inclusion in India. Journal of Informatics Education and Research, 3(2).

Received: 04-Apr-2024, Manuscript No. AMSJ-24-14702; Editor assigned: 05-Apr-2024, PreQC No. AMSJ-24-14702(PQ); Reviewed: 26-Jun-2024, QC No. AMSJ-24-14702; Revised: 03-Jul-2024, Manuscript No. AMSJ-24-14702(R); Published: 03-Sep-2024