Research Article: 2021 Vol: 25 Issue: 1

International Critique of the IAS16 Prescription Application and Treatment

Ayogeboh Epizitone, ICT and Society Research Group, Durban University of Technology

Abstract

The global employment of International Standards associated to accounting and reporting was grounded from the initiation of the first draft from 1980. Progressively, global acceptance has been realized over the last decades. In the wake of 4th industrial revolution, the lack of assessment on the current accounting standards in the present settings of globalization of the world economy is perilous. Hence the exploration of the current accounting system standards is essential to improvement their implementation. That subsequently enhance the competitiveness of organizations within the international markets. Through a comprehensive review literature this paper seeks to investigate and present current international critique on the international accounting standards 16 (IAS 16). And its influence on an entity financial reporting whilst presenting the author’s opinion exclusively on the subject. Employing both literature and practical evidence. This paper expatiates on the knowledge of IAS16 in order to enable the researcher and practitioners gain more depth about Property Plant Equipment (PPE) treatment especially on how they are being assessed and the various implications where stakeholders are entitled to know and to understand the responsiveness of IAS16 PPE treatment. Moreover, provide useful information to the accounting body on the relationship between PPE treatment and the financial reporting of organizations. The findings also aid regulators and governance bodies in dealing with specific concerns regarding the restructuring of several rules, laws and regulations. Furthermore, finding enable stakeholders to be able to know the significant IAS16 to them and the organization at large. Which involves knowing the important role IAS16 play in the development of the financial statements. Also, suggesting possible resolutions which can be taken into consideration to enable organizations to effective report financial information on PPE.

Keywords

Asset, PPE, IAS16, IFRS, Financial Reporting.

Introduction

The International Accounting Standards (IAS) 16 prescription is the baseline for the treatment of property, plant and equipment (PPE) initiated from the exposure draft dated back to 1980 August (IAS16 plus online). IAS 16 development has evolved throughout the years to date accommodate and address with issues such as consistency and diverse methods of treatment. This standard has been employed globally by practitioners for financial statements preparation. The implementation of IAS16 globally is hand in hand with other standards like the International Financial Reporting Standards (IFRS). Regardless of IAS 16‘s objective, the need to pay attention to the interpretation and treatment for effective application is paramount.

Maisuradze (2018) highlights the financial reporting rudiments such as PPE is an important aspect in accounting. The IAS 16 standard is a significant prescription for accounting for PPE to provide comprehensive statement to stakeholders. IAS 16 present it prescription as one of the most effective bases of PPE recognition and measurement in financial reporting internationally. However, there have been many discourse by authors regarding the assets measurement-related problem (Maisuradze & Vardiashvili, 2017; Kirli, 2018; Maisuradze, 2018; Maria et al., 2018; Zveki?, 2019). Zveki? (2019) contends on the lack of venerations accorded to core “accounting principles” for reporting on palpable assets.

Despite the prescription of IAS 16 for recognition and treatment of assets in contributing significantly to reporting of PPE, there is need to assess the upshot of IAS 16 of the application in organizations as it plays a crucial role in providing insight to stakeholders on the reported assets. Furthermore, it can be deduce that there is inadequate responsiveness on upshots of IAS 16 application with regards to interpretation and recognition in spite of the standardization that highlights their contributions to the financial reporting of assets. This phenomenon presents staid apprehension around issues of alignment of IAS16 PPE standards to the distinct requirements of specific companies’ assets, as it must balance both theoretical and practical impacts of the standards. According to Zveki? (2019), great number of companies makes mistake on PPE Fair Value (FV) that present an off-balance on the balance sheet that should be avoided. He likewise revealed that incorrect estimation of palpable assets depreciation percentage within a useful timeframe is among the principal mistakes on IFRS financial statements and caution for an error-free financial statements in an entity to elude accounting scandal or grave penalties. Also, contrary to the broad-spectrum perceptions and actualities of IAS 16 being an imperative source of guidance, the core glitches encounter with PPE treatment centers on the adverse affiliation flanked by practitioners and application of the IAS16 prescription. According to the Elliot & Elliott (2013), the interpretation of the definition and application of materiality concept serve as conceivable grounds for problem in relation to IAS 16; this is highly attributed to individual perceptions provided by practitioners reporting these assets and this create a problem about the way PPE is assessed and the advantages of IAS16.

An example in practice, is the definition that poses some practical difficulties to certain areas such as formerly held PPE used in the production and supply for offerings being transition to asset held for sales which under IFRS 5 must be classified separately in the financial statement as an asset held for sale. Also, if there are different assessment of materiality resultantly there will be different accounting treatments which will, in turn, give rise to the same expenditure reported respectively as an asset and expense in the statement of financial position (SOFP) of one company and statement of comprehensive income (SOCC) of another company (revaluation concerns). Moreover, regardless of other challenges such as different depreciation methods, de minimis policies and low value asset written-off in the purchase year, IAS16 present practical application and interpretation challenges that are mostly affecting the treatment of PPE. Conversely, prevailing studies has been devoted to examining the IAS16 prescription and not the challenges hence this paper attempts to seal this fissure. This paper examines the effects of IAS16 prescription to assess the effects of IAS16 prescription, the effects IAS16 prescription rollout and evaluate the IAS16 prescription influence the financial reporting of entities. Hence addressing the following questions how do IAS16 affect the recognition of PPE as asset?, What are the effects of PPE determination prescript by IAS16? And Do IAS16 implementation influences an entity financial reporting?

Methodology

This paper looks at the standard that applies to PPE treatment (IAS 16). In the case of financial reporting of organization, sorely focusing on the discussed on PPE. Inspecting the influences of this standards the study is limited to secondary data obtained from existing literature and contextualized for South African assessment. The main aspect to be explored IAS16 PPE treatment and it influences in financial reporting within an entity. A systematic content review is followed that review of the existing prescription and body of knowledge on PPE using cross sectional study model given that is done within a limited time frame of a few months. In order to assess the effects of the IAS16 prescription, the IAS16 prescription and definition is presented to achieve the first objective while responding to the first research questions. Subsequently, current articles are exploring to examine the empirical and theoretical effects of the IAS 16 rollout. Explanation and concerned previously raised by scholars and practitioners are explored to identify the effects of IAS16, in an attempt to evaluate the influence on an entity financial reporting.

Hence this paper uses the keywords, IAS16, Property, plant and equipment, IAS16 critiques obtained from online databases and adopt a ccomprehensive literature review of journal, books and scholastic articles to analyses the extant accounting literature and highlights the pros and cons on the content and implications of the IAS 16. The IAS 16 prescription from the academic, practitioners and standards setter point of view are analyzed in relation to the objectives and questions aforementioned to satisfy the paper aim.

Literature Review

For a long time IFRS has been known under the name IAS issued since 1973-2000 by the International Accounting Standards Committee (IASC). The purpose of it was allotted in a bid to solve and convergence standards related to accounting globally, so all entities can get better financial insight. The replacement of the IASCs with International Accounting Standard Board (IASB) on the 1st of April 2001 subbed the obligation to construct IAS that was termed IFRS (Latifah et al., 2012). The prescription of the IAS16 as aforementioned, focuses on the treatment of PPE, to provide stakeholders of the financial statement the necessary insights regarding the organization interest on PPE, as well as communicate any related changes regarding such interest. The main issues and concerns in accounting for PPE, can be seen in the recognition, carrying amount measurement, depreciation and impairment losses.

To facilitate PPE treatment and recognition it is essential to define the common aspect related to its treatment such as the carry amount, cost, depreciation and FV. The IAS 16 provides this definition in it prescription; “the carrying amount of an asset carry amount is recognized in the SOFP after deduction of any accumulated depreciation and accumulated impairment losses at this amount. The cost is the amount of cash or cash equivalents paid or the FV of the other consideration given to acquire an asset at the time of its acquisition or construction or, where applicable, the amount attributed to that asset when initially recognized in accordance with the specific requirements of other IFRS`s, for example IFRS 2 Share-based Payment. The depreciation amount is the cost of an asset, or other amount substituted for cost, less its residual value. While depreciation is the systematic allocation of the depreciable amount of an asset over its useful lifespan. The Entity-specific value is the present value (PV) of the cash flows that an entity expects to arise from the continuing use of an asset and from its disposal at the end of its useful life or expects to incur when settling a liability. The FV is the amount that would be received to sell an asset and paid to transfer liability in a logical transaction between participants in the trade at the measurement date” (IAS 16). This is a value for which an asset could be exchanged between knowledgeable, willing parties in an arm’s length transaction. An impairment loss is the amount by which the carrying amount of an asset exceeds its recoverable amount. PPE are tangible assets that: (a) Are held for use in the production or supply of goods or services, for rental to others, or for administrative purposes; and (b) Are expected to be used during more than one period (IAS16). The recoverable amount, “is the higher of an asset’s net selling price basically the FV less costs to sell and its value in use”. The residual value of an asset, “is the estimated amount that an entity would currently obtain from disposal of the asset, after deducting the estimated costs of disposal, if the asset were already of the age and in the condition expected at the end of its useful life” (IAS16). For the useful life, it is, “(a) The period over which an asset is expected to be available for use by an entity; or (b) The number of production or similar units expected to be obtained from the asset by an entity” (IAS16).

The nature of PPE which is simply the tangible with physical presence indicate and suggest the limitation of its useful life span. The deterioration of PPE is inevitable and as such warrant the attention to it recognition and treatment for an entity to fully optimize these assets. According to Dunn (2010), the IAS16 prescription of PPE has been heavily litigated area with complication in accounting for years, given that the recognition requirements associated with tangible assets implies all entities will have it feature in the financial positions. According to the IAS 16, PPE or tangible non-current assets, “are tangible items that are: held for use in the production or supply of goods or services, for rental to others, or for administrative purposes; and are expected to be used during more than one period” (IAS 16). Hence, an element cannot be recognized as an asset at all if it is not controlled by an entity and expected to produce economic benefits in the future. The preliminary step in accounting for PPE is to determine first how it can recognize according to the recognition criteria in the framework. According to this in the preparation and presentation of financial statement the cost of PPE is to be recognized on the following bases: “it is probable that future economic benefits associated with the item will flow to the entity; and the cost of the item can be measured reliably” (IAS 16). These criteria are expected to be applied to all subsequent cost such as that incurred at the beginning, at construction, part replacement and maintained after recognition. It is however, important to note that spare parts and servicing equipment that accounted for in one accounting period are treated differently as inventory and cost written out in the comprehensive income statement.

IAS16 prescription also indicate with regards to the initial cost that often sometimes entities are obliged for safety or environmental reasons to obtain certain items of property, plant and equipment might. While they do not unswervingly upsurge the future economic benefits of the asset, they are required to increase that from other assets. Resultantly these assets meet the criteria to be capitalized as asset and as such recognized as one. As for the subsequent costs for a normal day-to-day servicing of the item such as maintenance and repairs. This costs are not recognized in terms of the general recognition criteria above, as such as they are incurred they are accounted for in the profit or loss since they simply uphold asset’s capacity to bring future economic benefits not enhanced it. Nonetheless, certain PPE may need some parts of the item of replacement at regular intervals such as, aircraft interiors (seat and galleys), furnace relining and office block interior walls. In this regard, an organization derecognizes older parts’ carrying amount and recognizes new part cost in the carrying amount of the element when cost is incurred. The same applies to major inspections for faults, overhauling and similar items.

In the IAS16 the Initial Measurement qualifies PPE items after subjection to the recognition criteria are measure at its cost, which comprise: its purchase price including import duties, non-refundable purchase taxes, after deducting trade discounts and rebates; Any costs directly attributable to bringing the asset to the location and condition necessary for it to be capable of operating in the manner intended by management. Examples of these costs are: costs of site preparation, professional fees, initial delivery and handling, installation and assembly, etc. and the initial estimate of the costs of dismantling and removing the item and restoring the site on which it is located (IAS16). For abnormal credit item, where for instance the cost of PPE item at recognition date is the cash price equivalent and payment is deferred beyond normal credit terms. Interest over the period of credit arises from the variance amid the cash price equivalent and the complete payment. Unless such interest it has been recognized and accounted for in the carrying amount of the item according to IAS 23 an alternative allowed treatment. Furthermore, according to IAS16.24 that deal with swapping of PPE items. Where one or more PPE items may be acquired in exchange for monetary or non-monetary assets or both acquisitions combined. The cost is stated, to be measured at the FV unless (a) the exchange transaction lacks commercial substance or (b) the FV of neither the asset received, nor the asset given up is reliably measurable. If the acquired item is not measured at FV, its cost is measured at the carrying amount of the asset given up (IAS).

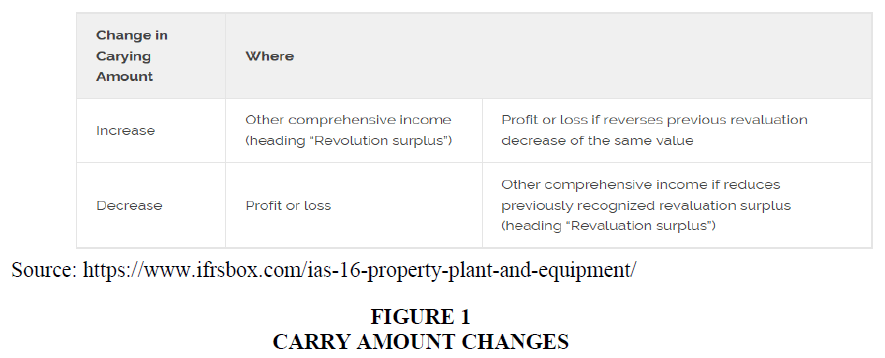

There are two accounting models for PPE for an entity to select for further treatment cost and subsequently revaluation. The cost model requires, “an entity shall carry an asset at its cost less any accumulated depreciation and any accumulated impairment losses”. Whilst, revaluation model requires, “an entity shall carry an asset at a revalued amount”. The revalued amount, “is its FV at the date of the revaluation less any subsequent accumulated depreciation and subsequent accumulated impairment losses”. Where element of PPE is revalued, the entire category of PPE to which that asset pertains to is also revalued. However, sufficient regularity is essential to prevent dissimilarity of the carry amount amid the asset materially and FV at the closed of the period of reporting. The carry amount change from revaluation is expected to be treated in the following way (Figure 1).

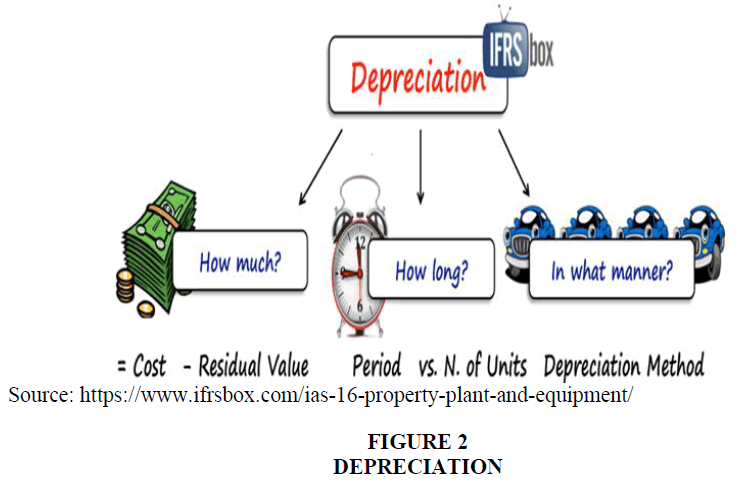

As for Depreciation, it is defined distinctive by the IAS 16 as the systematic allocation of the depreciable amount of an asset over its useful life. The depreciation amount is basically the cost of the asset less the residual value (Dunn, 2010). Depreciation usually follows the matching principles due to the PPE item life span. There are certain needs to be considering when accounting for depreciation such as: accounting holistically for the depreciable PPE item not fragmented and where it is recorded. For example, items may be depreciated separated but report together in the financial position. Depreciable amount is basically used to determine the amount to put forth as depreciation for the period. The IFRS section 16 present how to established the depreciation incorporating the following, “useful life: expected usage of the item, expected physical wear and tear, technical or commercial obsolescence of the item and Legal or other limitation on the asset”. Also Depreciation approached which refers to the HOW, IN WHAT MANNER the depreciation is going to be done is supposed to be considered. With the asset’s future economic benefits are expected to be consumed by the entity pattern which is reflected on the method of depreciation (Figure 2). Form a variation of method an organization can opt for either straight-line method, diminishing balance method and the units of production methods. The selected option is reviewed at the financial year end and changes are accounted in the accounting estimated in line with IAS 8. The profit and loss also feature the depreciable amount if it is not capitalized in the carrying amount.Furthermore, each part of an item of PPE with a cost that is significant in relation to the total cost of the item shall be depreciated separately. For example, aircraft interior cost might be depreciated separately from the remaining airplane cost.

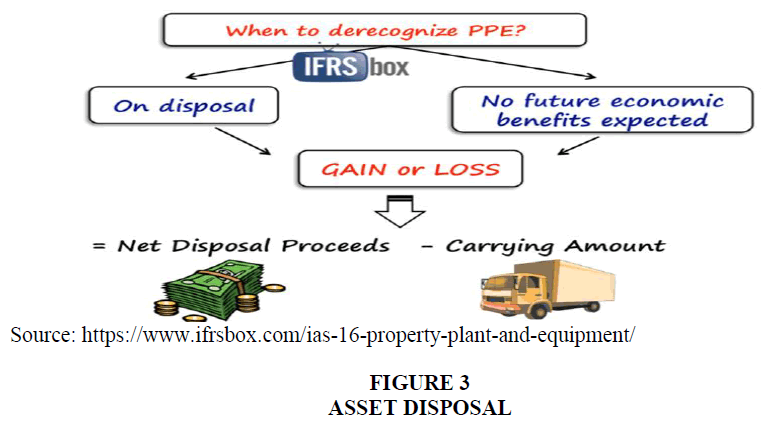

Impairment on the other hand is prescribe in another section (IAS36) not in IAS 16. The IAS 36 states, the prescribes rules for reviewing the carrying amount of assets, determining their recoverable amount and impairment loss, recognizing and reversing impairment loss. IAS 16 permits the inclusion of impairment in the profit and lost from third party such as insurance compensations. The carrying amount of PPE is derecognized on the disposal and it gain and loss stemming from the disposal not categories in other financial element such as the revenue (IAS16). The profit and loss feature these from the de- recognition PPE item and calculate it as “the net disposal proceeds (usually income from sale of item) less the carrying amount of the item” (IAS 16) Figure 3.

The aforementioned discussed on this section an overview of the IAS 16 prescription as a foundation for the subsequent section that delve deep into the analysis of this prescription critically. Adopting the basic knowledge provided as the grounded theoretical aspect of IAS16, which give way for the conceptualization of this study. Table 1 gives a brief history that summarizes the IAS16 from conception, drafting, development and implementation

| Table 1 IAS 16 Overview History | ||

| Date | Development | Comments |

| August 1980 | Exposure Draft E18 Accounting for PPE in the Context of the Historical Cost System published | |

| March 1982 | IAS 16 Accounting for PPE issued | Operative for financial statements covering periods beginning on or after 1 January 1983 |

| 1 January 1992 | Exposure Draft E43 PPE published | |

| December 1993 | IAS 16 PPE issued (revised as part of the 'Comparability of Financial Statements' project) | Operative for financial statements covering periods beginning on or after 1 January 1995 |

| April and July 1998 | Amended to be consistent with IAS 22, IAS 36 and IAS 37 | Operative for annual financial statements covering periods beginning on or after 1 July 1999 |

| 18 December 2003 | IAS 16 PPEissued | Effective for annual periods beginning on or after 1 January 2005 |

| 22 May 2008 | Amended by Improvements to IFRSs (routine sales of assets held for rental) | Effective for annual periods beginning on or after 1 January 2009 |

| 17 May 2012 | Amended by Annual Improvements 2009-2011 Cycle (classification of servicing equipment) | Effective for annual periods beginning on or after 1 January 2013 |

| 2 December 2013 | Amended by Annual Improvements to IFRSs 2010–2012 Cycle (proportionate restatement of accumulated depreciation under the revaluation method) | Effective for annual periods beginning on or after 1 July 2014 |

| 12 May 2014 | Amended by Clarification of Acceptable Methods of Depreciation and Amortisation (Amendments to IAS 16 and IAS 38) | Effective for annual periods beginning on or after 1 January 2016 |

| 30 June 2014 | Amended by Agriculture: Bearer Plants (Amendments to IAS 16 and IAS 41) | Effective for annual periods beginning on or after 1 January 2016 |

Discussion

The prescription and application of the IFRS is known to have been swiftly adopted globally, however, that cannot be equally said for developing countries where that call for studies to address the challenges and benefits are herald (Irvine & Lucas, 2006; Amanamah 2017). Several authors highlighted the need to assess IFRS implementation in developing nations (Gyasi, 2010; Laga, 2012; Kholeif, 2008; Braun & Rodriguez, 2014). Which alludes the existence of current critique within the IAS 16 that cannot be overlooked. From the discussed it evident that this critiques are favorable and unfavorable.

One of such critique is the application of accounting standards itself that is considered to be complex due to the large scale adoption of the IFRS that has subsequently prompted the development of the IFRS-related case studies such as this (Jermakowicz et al., 2014). According Jermakowicz et al. (2014), several cases has been involve with the IFRS application most especially transition from one standard to another such as the Dainler Chrysler (DC). Other authors like Beaudoin & Hughes (2014), examine the impairment and FV compliances with the IFRS. Globalization and harmonization is another aspect that the highlights the span of the IAS. The IAS has come a long way evolving to the IFRS despite the first issue in the early 70s by the IASC. To facilitate the globalization of accounting the International Accounting Standard Board (IASB) that substitutes the IASC assuming the duty of structuring the international accounting standard and named it IFRS (IFRS Foundation, 2010). Over 120 countries globally have adopted the IFRS (Jermakowicz et al., 2014), especially given that most companies do not rarely conduct business in their home land (Latifah et al., 2012). The IAS 16 is one of those aspects that can significantly represented an entities economic stance along with the monetary unit assumptions while providing the necessary ongoing concerns and accrual basis (Keiso et al., 2011). The emerging international market environments serve as the basis for the IAS 16 PPE uniformed recognition and disclosure for major players who need assurance of their investment. According to Quigley (2007), the harmonization of accounting information is essential for capital market globalization. Several authors emphasize the “harmonization of accounting information” globally highlighting the benefit of a clear accounting framework such as the IAS 16 PPE prescription (Zeghal & Mhedhbi, 2006; Hassan et al., 2009; Gyasi, 2010).

Jermakowicz et al. (2014), highlighted the importance of selecting proper accounting policies when adopting IFRS as indicating that the policy options within IFRS are construed by situations such as “depreciation method” and others that does not rely on settings afford a choice among available replacements like the “cost model” versus the “revaluation model” for PPE. Practically implying the “revaluation model” adopted typically upturns transition date equity and while affecting the future profits negatively due to greater changes in depreciation. Moreover, first-time IFRS implementers also embraces a possible exclusion from full retrospective application of IFRS accounting policies that are available at transition’s date of which affect reporting. Regardless enhance transparency and disclosures is alleged to be attained by IFRS adoption in entities (Epstein, 2009, Adam, 2009).

The implementation of IFRS has been reported to have enriched the quality of accounting information in developed countries such as Europe (Iatridis, 2010; Paglietti, 2009; Pannanen & Lin, 2009). Developing countries, adopting IFRS is considered to is apt and valuable for investors hence, indicating that IAS 16 prescription when properly applied serve a great gain to investor. Lenormand & Touchais, (2009) and Barth et al. (2008) attest to the quality of information provided by the IFRS which implies that the IAS 16 prescription as part of the IFRS contribute significantly to the quality of information on the PPE reporting. Presenting transparent, comparable and high-quality information on PPE is considered to be useful in enabling stakeholder such as financial analysts, investors and creditors make informed decision and thoroughly assess investment (Carson & Dowling, 2010; Latifah et al., 2012; Scott (2012). In studies it can be deduce that adopting the IFRS especially the IAS 16 prescription lead to a transparency, fair and true presentation, and comparability of financial statements. Which upsurge investors’ confidence and decrease capital cost while increasing the credibility of the developing countries domestic markets (DeFond et al., 2011; Lee & Fargher, 2010; Amanamah, 2017)?

Other positive aspect includes but not limited to: enhanced financial insight for stakeholders such as regulators and shareholders, improved results transparency, enriched comparability, increased secure trans-frontier listing ability, improve global operations management, capital cost reduction, reduced manipulation levels of financial performance to meet financial expectations and reduced information asymmetries amid organizations and shareholder (Ding et al., 2007; Barth et al., 2008; Gordon, 2008; Lenormand & Touchakis, 2009; Armstrong et al., 2010; De Franco et al., 2010; Faraj & Akbar, 2010; Iona?cu et al., 2010; Mihai et al., 2012; Kar?in, 2013; Amanamah, 2017).

Consolidating the effects of the IFRS –IAS16 in relation to complexity, globalization and harmonization, Adoption of IFRS - IAS 16 and Information Quality and Flow, the positive effects of IAS 16 PPE are clearly pragmatic for accountants and other practitioners. See that the prescription of IAS 16 provides a framework that enable the recognition and treatment of PPE. Furthermore, the longevity of the prescript methods and models served as a reliable and consistent principle worldwide.

As mention before there are many question and issues regarding the process of accounting for PPE items which includes the depreciation methods used, how impairment of these long-term asset is accounted for and the useful life of the asset (Monday, 2008; Maisuradze, 2018; Zveki?, 2019). Monday (2008), opined one of the most important issues regarding PPE is determining the amount to value of the item that is historical cost or FV. The two model of valuation of PPE posit a question which has been reported to be the most debated phenomena among the standards setter and accountants (Monday, 2008). Considering the globalization of emerging markets, the needs for companies to implement methods for become universally acknowledged.

The ills of the IAS 16 stems from the IFRS standards holistically which serves as one of the undesirable critiques of the IAS 16. The IAS 16 and IFRS setters present of main accounting policy differences between IFRS and U.S. GAAP “Generally Accepted Accounting Principle” with examples including, FV measurement frequently employed in IFRS for investment property for example; revaluation model for PPE and impalpable assets. IFRS uses a single-phase approach for impairment write-downs contrary to the double-phase approach employed in U.S. GAAP, construing a more likely write-downs (Jermakowicz et al., 2014).

According Monday (2008), accounting profession is currently confronted with an identity crisis. This double life plaguing the profession serves as a rift where some professionals employ the use of the U.S GAAP, and the other IFRS propagated by the IASB. U.S. GAAP are the principles published by the Financial Accounting Standards Board (FASB). The FASB was prepared in 1973 and functioned from origin to institute and improve standards of financial reporting for stakeholders such as issuers, auditors, and users of financial information (FASB Facts). IASB is a major international standard setter, founded in 2001, from the predecessor lASC. The IASC formed in London in 1973 developed and sanctioned International Accounting Standards. In October 2002, the FASB and IASB dispensed a Memorandum of Understanding, that charted the “Norwalk Agreement". They publicizing their purpose to (a) make their existing financial reporting standards fully compatible as soon as is practicable and (b) to coordinate their future work programs to ensure that once achieved, compatibility is maintained (FASB Memorandum 1). Despite the purpose and aim of these body for convergent, Authors argue that the union between these two standards in to a universal standard is contentious irrespective if the IAS 16 being an inevitable endeavor (Monday, 2008; Haverty, 2006; Jermakowicz et al., 2014). Furthermore, the influx of questions and conflicting opinions serves as a hindrance to the unification of the different standards process despite the international environment necessitates it (Monday, 2008).

There are also the revaluation approach complexities PPE accounting is reported to be surrounded by debates with regards to the amounts. According to Monday (2008) this contention has been prominent with the proliferation of the discussion of a unit-set of accounting standards worldwide. Despite this being another most prominent differences between U.S. GAAP and International Standards there exist substantial support for each measure, with both parties making valid claims. Authors who advocate for FV valuation of PPE assert the method to be clearly preferable to in estimation in the case of acquisition or liquidation (Herrmann et al., 2005) Also they posit verifiability, neutrality, and representational faithfulness characterized reliability of FV. On the other hand, pro historical cost acknowledge the flaws of the method especially during inflation but promote the historical methods stating they are less open to manipulation and discretion (Thompson, 2007). The reality is that favorable and unfavorable output exists for the individual approach irrespective of advocates stand. Holistically the current international critique on the IAS 16 is evident in the complexity, globalization and harmonization, information flow and IFRS adoption for the favorable aspects and adversely in observe in aspect involving the various model of the IAS 16 such as the standards, revaluation model and historical and FV treatment. The favorable and adverse critiques can further be substantiated in practical with the illustration and presented findings from the empirical studies of existing company annual reports for a compressive assessment.

Practically the difference is approach is a major disparagement of the treatment of PPE globally while the international standard that provides guidance on PPE is lAS 16 the US GAAP differs. The Standard has been amended several times to address certain issues such as consistence and definition and interpretation of the standards. The existing version revised in 2014, has an effective date of “January 1, 2016”, and was updated for Agriculture: Bearer Plants (Amendments to IAS 16 and IAS 41) . Given that the objective of IAS 16 serve to prescribe treatment for PPE for accounting treatment. Accounting for these assets include their recognition, carrying amounts determination, depreciation and impairment which are the principal tasks. Despite accommodating other standards, the IAS 16 outline the condition for each treatment and especially for revaluation in paragraph 7 for historical cost. Stating the historical cost of a static asset to be recognized when both criteria are satisfied: "1t is probable that future economic benefits associated with the item will flow to the entity; and the cost of the item can be measured reliably" (lAS 16.7).

Furthermore, the determination of the accurate measure after PPE is recognized becomes the duty of the company for the useful life span. lAS 16, paragraph 15 on PPE state that it should be carried at historical cost; considering the cost to include the purchase price, costs directly attributable to transportation of the asset to the site, initial estimate of the costs of handling, removal and restoring the site on which it is located. Other directly attributable costs include costs benefits for the employee arising directly from the construction or acquisition of the item of PPE; site preparation cost; initial delivery and handling costs; installation and assembly costs; costs of testing proper functioning of the asset (after deducting the proceeds from selling any items produced while bringing the asset to that location and condition) and professional fees. (lAS 16.16-17). Often in practice one or two of these costs are not accounted for due the practitioner interpretation and justification which can be considered as noncompliance that will lead to inaccurate reporting.

The decision for the model to employ is also based on the company after the cost has been established. Given that the choice of the cost model or the revaluation model chosen is reliance on the entity. In the case of a merger this may serve as an obstacle in providing values information to investor should they which to invest in a merger if these company financials statement are not comparable. As beforehand mentioned, the cost model which is straight forward states, that PPE should be carried at an amount equal to cost less accumulated depreciation and accumulated impairment losses (lAS 16.30). However, the complexity of the revaluation model requires a rational reliability employed in the FV determination with the "revalued amount" equivalent to “the FV at the revaluation date less accumulated depreciation and impairment losses after revaluation”. Subsequently, frequent determination is essential to make sure the carrying amount does not differ from FV materially at the balance sheet date (lAS 16.31). Hence, materiality become a major concern. Employing this model implies the amount of accumulated depreciation must also be determined by the companies leading to two ways that the depreciation must then be treated: It could be restated in proportion with the change in the gross carrying amount so that this amount after revaluation equates that of revaluation. Conversely, the accumulated depreciation could be removed against the gross carrying amount and the net amount restated to the revalued amount (lAS 16.35). To illustrate further let us presume a Durban Company purchased equipment at January 1, for R 200,000 with useful life span of 10 years and no residual value. Employing the revaluation model that revalued after two years and after these years it is appraised at a FV of R 170,000 in Table 2.

| Table 2 Determining the Gross Carrying | ||

| To elimination of accumulated depreciation | DR | CR |

| Accumulated Depreciation | 40,000 | |

| Equipment | 40,000 | |

| Adjustment to the PPE with the revalued amount | ||

| Equipment (170,000-160,000) | 10,000 | |

| Revaluation Surplus (SE) | 10,000 | |

Two phase in determining the Gross Carrying is as follows:

1. Foremost, accumulated depreciation is written off.

2. Subsequently, adjustment to the revalued amount is then record in the journal entries as follows.

The relative approach then calculated amounts underneath to write up the amount grounded on the proportional change in the carrying amount in Table 3.

| Table 3 Calculation of the Relative Method | |||

| Cost before Revaluation | Revalued Amount | ||

| Equipment | 200,000 | x 170,000/160,000 | 212,500 |

| Less: Accumulated Depreciation (R200,000/10 * 2 years) Carrying Amount |

40,000 | x 170,000/160,000 | 42,500 |

| 160,000 | x 170,000/160,000 | 170,000 | |

The journal entries to report the proportional change from the appraised value are as follows Table 4:

| Table 4 Calculation Revalued Equipment and Depreciation Amounts | ||

| DR | CR | |

| Equipment (212,500-200,000) | 12,500 | |

| Accumulated Depreciation (42,500-40,000) | 2,500 | |

| Revaluation Surplus (SE) (170,000-160,000) | 10,000 | |

In the calculation, the “revalued equipment and depreciation amounts, the cost before revaluation and original accumulated depreciation are multiplied by an indexed amount, which is the proportion of the revalued amount to the original carrying amount”. Changes are reflected in the adjusted accounts with the revalued amount. The company account revaluation surplus is credited with the overflow which is the excess from the carrying amounts. This affirms the IAS 16 which prescript that the increase in the asset carry amount be credited to the carry amount of the shareholder’s equity under the revaluation surplus. In the situation where there is a decrease in the same asset which was recognized priory as profit or loss the IAS 16.39-41 requires that this increase be acknowledge and recognized in the SOCC to reverse the prior decrease if that was the case and vice versa where there is a credit balance which then should be debited from the shareholders’ equity.

For clarification of this complexities of the process the previous illustrated example can be use again where the same condition still stands at present book value the calculation is detailed below in Table 5:

| Table 5 Calculation at Present Book | |

| Original Book Value | 200,000 |

| Less Accumulated Depreciation | (40,000) |

| Book Value, end of Year 2 | 160,000 |

Considering the Gross Carrying Amount approach, the journal entries report the change in values are as follows in Table 6:

| Table 6 Gross Carrying Amount Approach | ||

| To eliminate accumulated depreciation | DR | CR |

| Accumulated Depreciation | 40,000 | |

| Equipment | 40,000 | |

| To adjust the building to a revalued amount | ||

| Equipment (170,000-160,000) | 10,000 | |

| Revaluation Surplus (SE) | 10,000 | |

Suppose 2-year past and the company after reevaluation now reports a re-appraisal of the equipment at R110,000 FV. The prescript treatment conferring to the lAS 16 requires recognition of the decrease in the carrying amount initial by eliminating the previous “Revaluation Surplus” by debiting a loss account (lAS 16.40) in Table 7.

| Table 7 Revaluation Surplus | |

| Book Value, end of Year 2 | 170,000 |

| Less Accumulated Depreciation | (42,500) |

| (170,000/8-year useful life * 2 years) Book Value, end of Year 4 | 127,500 |

The decrease in the equipment's value will be recorded in the journal entry to record as shown in Table 8:

| Table 8 Decrease in the Equipment's Value | ||

| Elimination of accumulated depreciation | DR | CR |

| Accumulated Depreciation | 42,500 | |

| Equipment | 42,500 | |

| Adjustment to the building for the revalued amount | ||

| Loss on Revaluation (IS) | 7,500 | |

| Revaluation Surplus (SE) | 10,000 | |

| Equipment | 17,500 | |

Further down the line, six years completed the appraised is set to R90,000 the prior carrying amount of R110,000 with the accumulated depreciation would be R36,667 (R110,000/6 * 2 years). The new carrying amount is R73333 (R110,000 – 36,667) indicating that Durban company acknowledges an R16,666 (R90,000-73,333) increase in the value. Going by the lAS 16, they have to first allocate some of this amount to an income statement account "to the extent that it reverses a revaluation decrease of the same amount previously recognized in profit or loss" (lAS 16.40). Shareholders’ equity will then be recognized as;

Given the complexity of revaluation which afford less comprehension on its application most company settle for the FV in reporting for their asset in Table 9. While there are other concerns on the revaluation models majority of the entities considered this approach tear-jerking due to all the differences involved. Despite explanation to the existing differences many practitioners still consider the approach problematic due to the many changes occurring in the profit and loss accounts with regards to assets revaluation.

| Table 9 Shareholders’ Equity | ||

| DR | CR | |

| Equipment | 16,666 | |

| Profit on Revaluation (IS) | 7,500 | |

| Revaluation Surplus (SE) | 9,166 | |

IAS 16 Application in SA Companies

Since the prescription of IFRS many companies have implemented the standards set forth in the IAS 16. Among this are the Clicks Group and SA corporate real estate (establishment retailers and property companies) which present the policies used in the preparation of their audited annual financial statement reports 2017 and 2018. Designated sections information will be presented here with links to access the complete report online. The reports begin with the reports from the auditor to the directors and stating the auditor responsibly to conformity to the international Standards on Auditing. Also stating that prepare financial statement are in compliance with IFRS and the Company Act, 71 of 2008. For the SA corporate real estate their auditor Deloitte and Touche, in his report on page 10 on valuation of investment property report a total of R19.4 billion of which investment property represented R15.7 billion. As mention above due to the complexity of revaluation most company chose to use FV in recognition of asset as in the case of SA Corporate Real Estate with a FV adjustment of 0.4 billion that was record in the company profit and loss statement.

According to the company statement PPE was reported to be in R Table 10:

| Table 10 Adjusted on Cash Flow | ||

| 2017 | 2016 | |

| PPE (IAS7-14) | 16,703,000 | 8,369,000 |

| Depreciation (IAS 43-62) | (4,126,000) | (2,422,000) |

| Capital (profit)/loss on PPE disposal | (11) | 24 |

Another practical example is in the case of Clicks group where a clear treatment of PPE is illustrated with conformance to the IAS 16. This group listed and narrates the policy adopted and also indicate the life span of all PPE to indicate how they have been accounted for base on the IAS 16. Although neither group mention the IAS 16 in their reports it can be clear deduce that they made used of the prescription base on the report presented and published online (https://www.clicksgroup.co.za/IRDownloads/IntegratedAnnualReport2018/Clicks_AFS_2018_online.pdf;https://www.clicksgroup.co.za/IntegratedAnnualReport2017/assets/pdfs/Clicks_AFS_2017_online.pdf Access on the 1/11/19https://www.sacorporatefund.co.za/content/uploads/2018/02/Audited-Financial-Statements-2017.pdf access on the 1/11/19)

Conclusion

The main objective of the study is to analyze the effects of IAS16 prescription. Hence, the study was conducted to achieve this objective. The overview of the standard presented demonstrated how PPE ought to be recognized thus satisfying the first objective one, to assess the effects of IAS16 prescription. The conceptual framework base on the extant literature incorporated with practical illustration present the effects of the rollout of IAS 16 prescription. Current international critique on IAS 16 was also discussed with the paper objectives and research questions in mind to provide empirical finding to support this study. Furthermore, a clear indication of the IAS16 prescription influences on an entity reporting is present and prove the study hypothesis to be true. Hence, looking at the objective, to evaluate if IAS16 prescription influence the financial reporting of entities. Practical evidence from annual reports of existing companies indicates and illustrate the influence of IAS 16 adopting in reports generated with reference to the standards. It can be concluded from this study that facets of IAS 16 significantly affect the treatment of PPE in company financial reporting such as revaluation. Evidence in the various methods of treatment for PPE treatment permitted by IAS 16 for issues such as revaluation and depreciation, GAAP and IAS 16 transition.

In the light of above discussion and conclusion it is, therefore, recommended that in order to enhance the IAS 16 prescription focus should be place on all facets of IAS 16 prescribe treatment. Though there has been certain limitation in the study such as the study being broad and had to be narrow down to a certain aspect of PPE treatment as revaluation to assess the IAS 16, the following conclusions drawn from the study provide some insight to the scholar and practitioners to improve the financial reporting in entities. There is a significant impact of IAS 16 on PPE in the financial statement. Also, indirect benefits and insight can be provided from this section of the financial statement that will may be attract investors or deter them.

This paper expatiates on the knowledge of IAS16 in order to enabling researcher and practitioners with more insight on PPE treatment, their assessment and the different implications where stakeholders are entitled to know and to understand the IAS16 PPE treatment responsiveness. Moreover, the study would provide useful information to the accounting body on the relationship between PPE treatment and the financial reporting of organizations. The findings also profit regulatory authorities and governing bodies in comprehending issues, pertaining to diverse regulatory modifications. Furthermore, this research will enable the stakeholders to be able to know the significant IAS16 to them and the organization at large. That is, knowing the important IAS16 play in the development of the financial statements. Also, suggesting possible resolutions which can be taken into consideration to enable organizations to effective report financial information on PPE.

The IAS 16 prescription has positive impact on the globalization of IFRS and despite the vary method involve insight can still be provided. Therefore, I will like to recommend some few points that will help guide the implementation and application of IAS 16; Standard setters should consider adopting one method for the treatment of PPE rather vary methods such as in the case of revaluation and depreciation; Parameters to limit individual interpretation of the standards should be put in place to avoid different presentation and lastly this study supports the work of Maria (2007) which calls for further investigation to issues regarding PPE treatment with different models.

References

- Amanamah, R.B. (2017). Benefits and Challenges of International Financial Reporting Standards Adoption in Ghana: Accounts and Business Managers Perspective. International Journal of Accounting and Financial Reporting, 7(2), 178-193.

- Beaudoin, C.A., & Hughes, S.B. (2014). APT, Inc.: An application of impairment testing and FV estimation using International Financial Reporting Standards. Issues in Accounting Education Teaching Notes, 29(1), 1-17.

- Adam, M. (2009). The Challenges of Adopting International Financial Reporting Standards. Zenith Economic Quarterly, 4(2), 102-116.

- Barth, M.E., Landsman, W.R., & Lang, M.H. (2008). International Accounting Standards and Accounting Quality. Journal of Accounting Research, 46(3), 467-498.

- Braun, G., & Rodriguez, R. (2014). Using Gray’s (1988) Accounting Values to Explain Differing Levels of Implementation of IFRS. International Journal of Accounting and Financial Reporting, 4(2), 104-136.

- Carson, E., & Dowling, C. (2010). The Production of Audit Services: The Relationship between Audit Support System Design and Audit Pricing by Global Audit Firm Networks. Working paper, The University of Melbourne.

- DeFranco, G., Kothari, S.P., & Verdi, R.S. (2010). The Benefits of Financial Statement Comparability. Working paper, MIT Sloan School of Management.

- DeFond, M., Hu, X., Hung, M., & Li, S. (2011). The impact of mandatory IFRS adoption on foreign mutual fund ownership: The role of comparability. Journal of Accounting and Economics, 51(3), 240-258.

- Ding, Y. Hope, O.K., Jeanjean, T., & Stolowy, H. (2007). Differences between domestic accounting standards and IAS: Measurement, determinants and implications. Journal of Accounting and Public Policy, 26, 1-38.

- Esptein, B.J. (2009). The Economic Effect of IFRS Adoption. CPA Journal, 3, 26-31.

- Faraj, S., & Akbar, S. (2010). An Empirical Investigation of The Libyan Audit Market: Perceptions of Auditor’s Independence. Journal for Global Business Advancement, 3(2), 133-154.

- Gyasi, A. (2010). Adoption of International Financial Reporting Standards in Developing Countries - The Case of Ghana. BSc Dissertation, University of Applied Sciences.

- Hassan, O.A.G., Romilly, P., Giorgioni, G., & Power, D. (2009). The value relevance of disclosure: Evidence from the emerging capital market of Egypt. The International Journal of Accounting, 44, 79-102.

- Haverty, J.L. (2006). Are IFRS and U.S. GAAP converging?: Some evidence from People's Republic of China companies listed on the New York Stock Exchange. Journal of International Accounting, Auditing and Taxation, 15(1), 48-71.

- Jermakowicz, E.K., Reinstein, A., & Churyk, N.T. (2014). IFRS framework-based case study: DaimlerChrysler – Adopting IFRS accounting policies. Journal of Accounting Education, 32(3), 288-304.

- Keiso, W., Weygant, J.J., & Warfield, T.D. (2011). Intermediate Accounting: IFRS Edition. New Jersey. John Willey & Sons Inc. 22-58,

- Kirli, M. (2018). Comparison of Depreciation Methods in" International Accounting Standard 16 Property, Plant and Equipment" and an Application. Annals of the University Dunarea de Jos of Galati: Fascicle: I, Economics & Applied Informatics, 24(3).

- Kar?in, S. (2013). The Impact of IFRS on the Value Relevance of Accounting Information: Evidence from Turkish Firms. International Journal of Economics and Finance, 5(4), 71-80.

- Kholeif, A. (2008). A New Institutional Analysis of IFRS Adoption in Egypt: A Case Study of Loosely Coupled Rules and Routines. Working paper, School of Accounting, Finance and Management University of Essex, UK.

- Laga, M. (2012). Obstacles of Adopting and implementation of IFRS in Libya. European Journal of Business and Economics, 7, 1-3.

- Latifah, I.N., Asfadillah, C., & Sukmana, R. (2012). History and development of IFRS and AAOIFI and their future challenge.In: Proceedings of Cambridge Business & Economics Conference, Cambridge, MA. 27-28.

- Lee, G., & Fargher, N.L. (2010). Did the Adoption of IFRS Encourage Cross-Border Investment?. SSRN eLibrary.

- Iatridis, G., & Rouvolis, S. (2010). The post-adoption effects of the implementation of International Financial Reporting Standards in Greece. Journal of International Accounting, Auditing and Taxation, 19(1), 55-65.

- Iona?cu, I., Stere, M., & Iona?cu, M. (2010). The Impact of IFRS Adoption on the Cost of Equity Capital of Romanian Listed Companies. Revista Audit Financiar, 1, 32-36.

- Fonseca, M., 2007. FV or cost-based measurement for PPE and IP: evidence from accounting practice under IFRS.

- Maisuradze, M., & Vardiashvili, M. (2017). The Issues of Recognition and Measurement of the Investment Property According to Ias 40. Economy & Business Journal, 11(1), 416-423.

- Maisuradze, M. (2018). Application of the Entity Assets Measurement Methods in Preparing the Financial Statements. Ecoforum Journal, 7(3).

- Mihai, S., Ionascu, M., & Ionascu, L. (2012). Economic benefits of International Financial Reporting Standards (IFRS) adoption in Romania: Has the cost of equity capital decreased? African Journal of Business Management, 6(1), 200-205.

- Monday, S.E. (2009). IAS 16 and the Revaluation Approach: Reporting Property, Plant and Equipment at FV.

- Maria, M.M., Diana, H.I., & Susana, L.D.C. (2018). Accounting Policies On Fixed Assets And Their Influence On The Financial Performance Of The Economic Entity. Annals-Economy Series, 209-215.

- Irvine, H., & Lucas, N. (2006). The Globalization of Accounting Standards: The case of the United Arab Emirates. Working paper, 3rd International Conference on Contemporary Business, Charles Sturt University, Australia.

- IASB. (2013). Retrieved from https://www.iasplus.com/en/resources/ifrsf/governance/ifrsf ICAEW. (2007). EU Implementation of IFRS and the FV directive. Retrieved from ec.europa.eu/internal_market/accounting/docs/.../2007-eu_implementation_of_ifrs.pdf

- Lenormand, G., & Touchais, L. (2009). Do IFRS improve the quality of financial information? A value relevance approach. Comptabilité – Contrôle. Audit, 15(2), 145-164.

- Paanamen, M., & Lin, H. (2009). The Development of Accounting Quality of IAS and IFRS over Time: The case of Germany. Journal of International Accounting Research, 8(1), 31-55.

- Paglietti, P. (2009). Earnings management, timely loss recognition and value relevance in Europe following mandatory adoption: evidence from Italian listed Companies. Economia Aziendale, 4, 97-117.

- Quigley, J. (2007). Deliotte & Touche World Meeting, Berlin Germany SEC - IFRS - Global financial reporting standards. Retrieved from http://www.deloitte.com

- Scott, W.R. (2012). Financial Accounting Theory (6th ed.). Pearson Education Canada.

- Thompson, K. (2007). Advantages and Disadvantages of Historical Cost Accounting. Associated Content, 3.

- Zeghal, D., & Mhedhbi, K. (2006). An analysis of the factors affecting the adoption of international accounting standards by developing countries. The International Journal of Accounting, 41, 373-386.

- Zveki?, I.K. (2019). Tangible assets depreciation issues. In BH Ekonomski forum, 10, 107-124. Ekonomski fakultet-Univerzitet u Zenici.