Research Article: 2022 Vol: 28 Issue: 2S

International banks, new liquidity rules and monetary policy in EMES

Sarin Faisal Ali Jassim, Al-Turath University College

Citation Information:Ali Jassim, S.F. (2022). International banks, new liquidity rules and monetary policy in EMES. Academy of Entrepreneurship Journal, 28(S2), 1-7.

Keywords

Monetary Policy, International Banks, Liquidity Rules, Liquidity management

Abstract

Liquidity management in international banks One of the most important issues that obstruct the work of international bank departments are liquidity and capital adequacy, and if liquidity has been addressed by the banking administration within its daily vocabulary in order to preserve its reputation and growth and achieve its goals, capital adequacy has become one of the topics that is not It is less important than the issue of liquidity, but rather that there is a great connection between them, as it is not possible to think about the adequacy of capital without looking at the issue of the relationship between them, which lies in the profits that the bank achieves. Liquidity, the first axis or the theoretical foundations of liquidity.

Introduction

Liquidity means the ability of the bank to pay off obligations when they are due or when requested. faced by the bank, which may lead to collapse and bankruptcy, and the problem of liquidity appears on the side of assets, and it is one of the concepts associated with budget management, i.e. managing assets and liabilities.

The exposure to this concept takes place in the management of banks in a large way, and it is one of the most important titles that the banking literature focuses on, since the beginning of the seventies of the twentieth century, because of its great role in the national and international economy. How can that be? Some concepts and reminders, such as distinguishing between national banking on the one hand and international banking, for the purpose of clarifying these concepts at the international level, it is necessary to redefine and here the focus has been on the activity, which is banking away from the concept of the institutional structure, which is the bank. National banking is the local activity of banks within the economy where they deal with residents inside the country, while international banking means dealings with outside the country and in currencies other than national and alongside national currencies, while international banks on this basis are the banks that deal with all international banking activities In different currencies and with customers from all countries of the world, and not only this, but it may have branches in other countries in the form of foreign direct investments and its dealings in foreign currencies.

International Lending Banks

There are banks whose banking activities are described as local and foreign activities of lending or depositing operations, and such banks are spread in the world not on the geographical basis based on the location, but on the basis of the extension of the world according to the advanced technological uses. Banks in the second chapter of this book and in detail within the structures, institutions and structures of international finance, but what is important now Develop some distinctions of international banking from national banking, and it may be very difficult to distinguish between foreign banks according to the traditional concept of foreign banking and the concept of euro-currency banking, as the foreign bank is the bank that is located outside its home country and euro banks are also located outside their countries and their transactions are in foreign currencies Also, many banks have branches or their activities banks by talking about the characteristics of their affiliates outside their countries (Diamond & Dybvig, 1983).

and here lies the problem that was the focus of discussions And interventions that lasted for many years, especially in the eighties, the most important of which is what revolves around the implementation of monetary policies through the implementation of their tools within the national borders and the role of those foreign banks in that (Fernandez & Guidotti 1996), and many institutions have intervened for the purpose of setting procedures for these banks, because regulating the work of national and foreign banks falls within the work of The Central Bank is the planner and implementer of monetary policy within the two well-known keys, the interest rate and the money supply, and how these foreign banks deal according to their classification and composition.

Liquidity Measurement

Banking literature sets many standards and indicators for the purpose of measuring liquidity and the need for it. We can simply say that the need for liquidity consists of quick and sudden commitments such as deposit withdrawals and demand for loans, since the bank is a financial institution, and it may be difficult to measure that need. Liquidity because of the depositors’ awareness, confidence and attitudes towards the bank, as well as the difficulty of measuring the behavior of the money market with all its elements towards this situation. The traditional literature of banks has been used to measure the level of liquidity, or what is called its liquidity position, by looking at a static scale called liquidity ratios, and the content of this lies in the separation between assets that are easy to turn into cash and without a significant loss, and others that are slow to turn into cash, or what are called non-liquid elements (Calvo, 2005).

Liquid Components As for liabilities and net wealth, Net Wealth, which is the right of ownership, it is divided into variable and stable components. The variable liabilities are those that are subject to withdrawal and change, and in contrast to the stable liabilities. Total Assets Temporary Assets / Unstable Variable Liabilities The most common ratio in measuring liquidity is Liquid assets, dynamic changing liabilities, and the need for them changes with the changes of time due to different circumstances.

The problem that banks suffer from lies in that liquidity is a concept that transfers or increases the demand for loans to other than those reasons affecting liquidity and the dynamics of the environment in which the bank operates, as withdrawals may increase. From deposits, or perhaps, and therefore the bank is in need of a dynamic measure of liquidity and the need for it (Allayannis et al., 2003):

The daily need for liquidity or perhaps the hour by hour need, which corresponds to an appropriate management of the cash position to meet that daily need and depends mainly on the estimate based on the previous experience recorded by the bank in its information system And specifically about the need for liquidity and on a daily and accurate basis, just like the experience that can be predicted about the daily weather or for several days in most cases.

1. The need for liquidity in the short term, and the bank may be exposed to the need for liquidity in the short term and from multiple sources, including seasonal changes and others, which have an impact on deposit and lending operations, and most of these changes are among the elements that can be predicted and prepared for in advance.

2. The need for liquidity to meet a large withdrawal or a large loan, the need for liquidity may be a specific request for withdrawal or the payment of a certain obligation, and this is fundamentally related to the size of the bank and its ability to predict withdrawals and deposits and model its banking operations on scientific bases and within the time frame of all the operations it implements.

3. The rounded estimate of the liquidity need, which is intended to continue estimating the need for liquidity on a seasonal, monthly and annual basis

4. Estimation of the general trend of liquidity, which means estimating the need for liquidity required by the bank, and forecasting it and the demand for it.

Based on the foregoing, some foundations must be adopted, including:

A. Classification of loans and investments on the basis of size and degree of transformation into cash.

B. Classification of deposits on the basis of time and volume

C. Estimate the amount of cash required.

D. Continuous and managerial assessment of the need for liquidity

Capital Adequacy in International Finance

The Concept of Capital Adequacy in International Finance

The concept of capital adequacy occupies great importance at the micro level, that is, at the level of the financial institution, whether it is a bank, an investment institution, a financing institution or others, because of its great role in managing funds, both for the financial institution as well as at the level Total, that is, for the country as a whole and also at the international and global level, and what is important in this is the impact of capital adequacy or what is called solvency or solvency on the growth and development of the financial institution and the soundness of its financial position and the direct and indirect effects that follow on the state economy and the international and global economy (European Bank for Reconstruction and Development, 2009).

The economic and financial conditions in general, since the end of the decade and the beginning of the seventies, have been characterized by instability thanks to many events and changes, some of which we have discussed in the first chapter, the collapse of the Bretton Woods system and the adoption of the policies of floating exchange rates, the instability of interest rates and the rise in the rate of interest rates. Global inflation, all of which were manifestations of the seventies, was reflected in crises in liquidity and indebtedness, and spread at the same time, the payments crisis and the crisis of confidence, as well as the growth of transnational companies, and the increase in their operational activities, which led to the exacerbation of competitive situations, which called for the need for more funds. Interest rates led to more deposits, and then oil prices rose and doubled in a short period. All of this led to more risks that surrounded the work of banks, knowing that all these changes led the banks to exaggerate the banking work without paying any attention to the ratio of capital to the size of assets or maybe the size of the deposit or something (Agénor, 2004).

The Development of the Concept of Capital Adequacy

Imposes multiple and many categories, and the concept emerged that the nature of banking work, especially in terms of sources and uses of funds, risks originating from the nature of work first and the nature of dealers second, and therefore the sources of risks are internal from the bank and external from the environment in which it operates It is sought by the bank and the bank’s dealers, and capital plays a very important role in that it provides the guarantee that capital adequacy as a relative concept to express the reality of capital, and to measure the bank’s financial ability to pay its final obligations in times of crises and difficulties and to be a defensive and preventive line for the bank to pay It has more difficulties. The concept of capital adequacy has begun to gain attention since the beginning of the second half of the twentieth century, as a relative concept that depends on a set of ratios that served as regulatory ratios, as the first regulatory use of it dates back to before World War II in the United States of America, where the deposit ratio was used to Total Assets were classified into risky and non-risk assets. At the international level, due to the developments that took place in the seventies and eighties, interest in this concept began to a great extent and also on a supervisory level. Thirdly, capital adequacy and supervision of banks) Banks use many tools to monitor their performance and activities, and one of the most important of these is the capital adequacy ratio.

International Finance Models

Operations and Tools These financial institutions have a significant and effective role in the national economy and economic development, and the role of the supervisory basis on banks is dependent on three components:

1. Protection of bank funds being depositors' money, and therefore there is a need for continuous supervision that protects those funds (Cetorelli & Goldberg, 2008).

2. Ensuring the success of the activities practiced by banks through the profits they achieve.

3. Ensure that the bank continues its work and increases and supports its activity in order to activate the financial system that operates in the country, and try to activate financial innovation in financial and banking operations and tools with the aim of maximizing profit (Basel Committee on Banking Supervision, 2010).

Objectives of the Capital Adequacy Criterion

1. Establishing basic rules for international banking, because international banks, especially after the mid-seventies, have increased in their activity very dramatically and many international financial and banking problems have occurred, which necessitated the establishment of foundations and rules for regulating international banking.

2. Rationalizing banks on how to deal with risk as an important factor in profit and loss, and how to deal with high-risk assets

3. Attempting to link the capital to the assets and the risks it faces in the banking business.

4. Creating a kind of balance between banking policies that go towards protecting deposits, which is the property of depositors and one of the most important sources of bank funds.

5. Activating banking supervision and control by the local and international concerned authorities.

The Tenth Basic Components of the Decisions of the Basel

Committee the elements on which the Basel Committee relied in its decisions can be viewed and summarized as follows (Brown & De Haas, 2010).

1. Capital: after the capital in the bank, one of the most important elements on which the Basel Committee relied in its decisions is in the form of a defensive and preventive line for the bank, and it is divided into

A- Initial or Base Capital:

It means the capital corresponding to the shares or the so-called paid-up capital, in addition to the disclosed reserves, retained profits, and general and legal reserves.

B- Supplementary Capital:

It means all the elements that have the quality of capital and that can support the bank and its financial ability, and can cover any potential loss.

The auxiliary or supplementary capital structure often consists of the following elements:

1. Undisclosed reserves.

2. revaluation allowances.

3. And provisions for doubtful debts.

4. And the various capital tools of stocks and debt instruments.

5. Support loans with terms not less than 5 years.

2. Risk Weights System: Assets have been classified according to the credit risk that they may be exposed to, and for this reason, the weights of assets varied between categories ranging from zero as the lowest possible limit where there is no risk, and between 100% as the highest weight of risk to which assets may be exposed. These assets are like investing bank funds, as they are undoubtedly subject to many risks, including:

1. The risk of commitment.

2. Risk of conversion.

3. Exchange rate risk.

4. The risk of interest rates

5. The risk of loans.

In the face of these many types of risks, the assets will be associated with these risks and therefore are calculated on this basis.

3. The Minimum Ratio of Capital to Risk-Weighted Assets: The Basel Committee has approved a minimum ratio for this ratio, and it has reached 8%, and the Committee has left the local monetary authorities to increase it as required by circumstances or need.

4. Exchange and Interest Rates Risks: In its decisions, the Basel Committee approved the adoption of a specific percentage with the aim of transferring transactions with high risks in exchange and interest rates, and entering the amounts of those transactions within the budget. Two methods have been adopted. The first is based on calculating the cost of replacing cash flow in the relevant market. The high risks related to the exchange rate and the interest rate after the obligating party is unable to pay its obligation, and the conversion factor is added that reflects the degree of future exposure to risks. The second method is based on the adoption of the conversion factor for each case in an independent format.

International Banks and Domestic Monetary Policy Transmission

How has the increased role of international banks in emerging markets affected their domestic financial systems and monetary policy? This section aims to answer this question by looking at the role and key characteristics of international banks in emerging markets and considering their impact on monetary policy transmission (Chui et al., 2010).

The Role of International Banks

1- Check information on international reserves foreign currency liquidity is the best possible benefit to informed decision-making in the public and private sectors if countries disclose that information in a unified, coherent framework. In the context of efforts to strengthen the architecture of the international financial system, the International Monetary Fund partnered in 1999 with a working group of the Committee on the Global Financial System of the Group of Ten Central Banks to develop that framework as a standard model for countries to use to disclose data.

2- The standard model for reserves data presented in Annex 2 was designed in consultation with the authorities of the different countries, statisticians, relevant international organizations, market participants and data users. The model embodies the efforts of all stakeholders to balance the expected benefits of increased data transparency with the potential costs of increasing the authorities' burden of data reporting. This first amendment to the 2001 Guidelines takes into account the update included in the sixth edition of the Balance of Payments and International Investment Position Manual, and changes to the model 200 original standard in general

3- The standard format for reserves data is comprehensive; It combines the concepts of international reserves and foreign currency liquidity in one framework. Besides covering traditional balance sheet information related to international reserves and other external assets and liabilities of the authorities, the model also includes the authorities' off-balance sheet activities5 (e.g. activities in forward contracts, future contracts and other financial derivatives, undrawn lines of credit and loan guarantees). The model also includes foreign exchange inflows for future and potential outflows associated with positions within The balance sheet and beyond. In addition, the form includes data intended to show the liquidity of the country's foreign currency assets (such as identifying pledged assets that are subject to other obligations) and to reveal the country's exposure to exchange rate risks (including those associated with options contracts and pegged instruments).

4- The standard model for reserves data is characterized by its forward-looking nature, as it is not limited to covering the foreign currency resources of the authorities on a certain reference date, it also includes foreign exchange inflows and outflows throughout the subsequent year. This one-year time frame is consistent with the prevailing convention in defining “short-term” as covering a period of 12 months.

5- The rest of this chapter details the framework on which the standard model of reserves data is based and defines its structure and most important characteristics. Chapters two through five provide guidelines on how to communicate the required data in the different sections included in the Standard Data Form reserves.

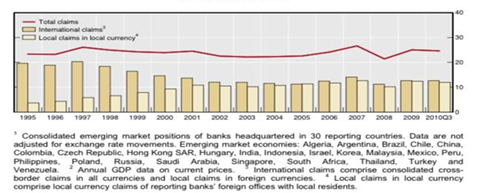

International bank lending fell sharply during the Asian crisis of 1997–98 and more recently during the global financial crisis in 2008–2009. In the recent financial crisis, many emerging markets experienced substantial declines in cross-border lending even though the crisis did not originate in EMEs. This suggests the presence of some common BIS Papers No 57 11lender effects and, in particular, the supply constraints of international banks (Takáts (2010); Chui et al., (2010)).

The share of local claims in local currencies increased from around one sixth in 1995 to around half of total lending of BIS reporting banks since 2005 (Graph 1). International banks’ activity is thus more evenly balanced between foreign and domestic currency lending than in the past. The composition of international bank lending differs across regions. Local-in-local claims have increased in all EME regions.

Regional differences reflect not only the heterogeneity of EMEs but also that of internationally active banks. Some internationally active banks operate under centralised liquidity management, capital structure and lending activities (eg. Deutsche Bank & UBS).

References

Allayannis, G., Brown, G., & Klapper, L. (2003): Capital structure and financial risk: Evidence from foreign debt use in East Asia. Journal of Finance, 58, 2667–709.

Agénor, P. (2004). The economics of adjustment and growth, (2nd edition). Harvard University Press.

Allen, W. (2010). Liquidity regulation and its consequences, Central banking: Policy, markets and regulation. XXI(2).

Banai A., Király, J., & Nagy, M. (2010). The demise of the halcyon days in Hungary: Foreign’ and ‘local’ banks before and after the crisis. BIS Papers.

Basel Committee on Banking Supervision. (2010). Basel III: International framework for liquidity risk measurement, standards and monitoring, Basel.

Basso, H., Calvo-Gonzalez, O., & Jurgilas, M. (2007). Financial dollarisation and the role of banks and interest rates. ECB Working Paper, 748.

BIS. (2008). Transmission mechanism for monetary policy in emerging market economies. BIS Papers, no 35.

Brown, M., Kirschenmann, K., & Ongena, S. (2010). Foreign currency loans: Demand or supply driven? CEPR Discussion Paper, 7952.

Brown. M., & De Haas, R. (2010). Foreign currency lending in emerging Europe: bank-level evidence. EBRD Working Paper.

Brunner, A., & Lown, C. (1993). The effects of lower reserve requirements on money market volatility. American Economic Review, 83(2).

Calvo, G. (2005). Globalization hazard and delayed reform in emerging markets in emerging capital markets in turmoil: Bad luck or bad policy? MIT Press.

Crossref , Google scholar , Indexed at

Cetorelli, N., & Goldberg, L. (2008). Banking globalization, monetary transmission, and the lending channel. NBER Working Paper.

Crossref , Google scholar , Indexed at

Cetorelli, N., & Goldberg, L. (2009). Globalized banks: Lending to emerging markets in the crisis. Federal Reserve Bank of New York Staff Report, 377.

Chui, M., Domanski, D., Kugler, P., & Shek, J. (2010). The collapse of international bank finance during the financial crisis: Evidence from syndicated loan markets. BIS Quarterly Review.

Committee on the Global Financial System. (2009). Capital flows and emerging market economies. CGFS Papers.

Diamond, D., & Dybvig, P. (1983). Bank runs, deposit insurance and liquidity. Journal of Political Economy, 91(3), 401–19.

European Bank for Reconstruction and Development. (2009). Transition report 2009: Transition in crisis? EBRD.

Fernandez, R., & Guidotti, P. (1996). Regulating the banking industry in transition economies: Exploring interactions between capital and reserve requirements. Policy Reform, 1, 109–34.

Crossref , Google scholar , Indexed at

Received: 29-Dec-2021, Manuscript No. AEJ-21-8972; Editor assigned: 02-Jan-2022, PreQC No. ASMJ-21-9737(PQ); Reviewed: 12-Jan-2022, QC No. ASMJ-21-9737; Revised: 21-Jan-2022, Manuscript No. ASMJ-21-9737 (R); Published: 29-Jan-2022