Research Article: 2018 Vol: 22 Issue: 3

Integrated Impact of Founding Teams Knowledge and Types of Strategies on IPO Firms Performance

KyungMoon Kim, West Virginia University Institute of Technology

Abstract

This research is an integrated investigation on the impact of the characteristics of founding team on firm performance in IPO firms. It also examines the moderating effect of the type of strategies on the relationship between founding team knowledge and IPO firms' performance. The empirical results show that the breadth of founding team industry experience and entrepreneurial experience leads to better performance. The depth of founding team education, industry experience, and entrepreneurial experience is positively associated with firm performance. Most importantly, differentiation strategy moderates the relationship between the breadth of founding team education and firm performance in IPO firms. Implications on the roles of the founding team knowledge and the interaction impact of business strategies are discussed.

Keywords

Founder, Founding Team Knowledge, IPO, Human Capital, Types of Strategies, Moderator.

Introduction

A stream of entrepreneurship research has examined founders’ characteristics as a key factor in IPO firms’ success. Founders are likely to be passionate about their firms and possess a unique vision for them (Nelson, 2003). Founders also tend to own a significant fraction of their firm’s equity, granting them substantial power and control (Wasserman, 2003). Therefore, founders are likely to be psychologically attached to their founding firms. As Gimeno et al. (1997) argued, founders tend to sacrifice to keep their firms afloat longer than non-founders. Jayaraman et al. (2000) argued that founders highly value their reputational stake in the firm and exert a greater effort to ensure the firm’s success. Founding members tend to be familiar with the managerial structure, the balance of power among managers and board members and previous ways of doing things (Kroll et al., 2007). Thus, founding members are likely to be greatly influential to their founding firms.

Drawing upon human capital theory, cognition theory and knowledge-based view, this research investigates the combined effect of founding team knowledge on firm performance in IPO firms. In IPO firm, education and experience are valued because they enable founders to know where to go to obtain information relevant to the venture and also how to deploy the resources they obtain (Kirzner, 1983). In this research, therefore, the three sources of founding team knowledge, such as formal education, industry experience and entrepreneurial experiences, are specified into six categories. These categories include the breadth of founding team education, the breadth of founding team industry experience, the breadth of founding team entrepreneurial experience, the depth of founding team education, the depth of founding team industry experience and the depth of founding team entrepreneurial experience.

In the entrepreneurship literature, it is well established that the strategies pursued by IPO firms have a direct and strong influence on the financial performance of those firms (Lambkin, 1988; McDougall, 1987; Sandberg and Hofer, 1987). However, researchers on strategies have overlooked the moderating role of strategies on the relationship between the founding team’s knowledge and firm performance in IPO firms. As Carpenter (2002) argued that inconsistency among Top Management Team (TMT) demographics and performance relationships shown in prior work may point to the possibility that important moderating or intervening variables have been overlooked, this study derives from looking for such moderating variables on the relationship between founding team knowledge and IPO firms’ performance.

This research furthers the understanding of founding teams’ characteristics and of the moderating role of strategy in IPO firms in several ways. First, this research offers insights into the combined impact of founding teams’ knowledge on IPO firms’ performance. Second and most importantly, this study argues a moderator which enhances the relationship between founding teams’ knowledge and performance in IPO firms. Third, this research applies different types of strategies as the moderators on the relationship between founding teams’ knowledge and IPO firms’ performance. Theoretical background, hypotheses, the methodology and results and implications and discussion will then be followed.

Theoretical Background And Hypotheses Development

Hambrick and Mason (1984) have argued managerial background characteristics of the top management team have been a critical component to predicting firm performance. Cohen and Levinthal (1990) argued that absorptive capacity enhances a firm’s ability to identify, assimilate, transform, and apply valuable knowledge. Human capital theory posits that top managers with more or higher quality human capital contribute to higher firm performance. A key component of human capital is the possessions of knowledge that is specific and not easily appropriable and which yields competitive advantage (Barney, 1991; Pennings, Lee and Witteloostuijn, 1998).

In IPO firm, human capital of the founding team is critical. As the sources of human capital, education and experience are valued. Those attributes describe the extent to which a founder has acquired his or her knowledge and can subsequently apply such knowledge to the tasks as required. The knowledge of founding teams consists of cognition mechanism. Neisser (1967) defines cognition as all processes through which sensory input is transformed, reduced, elaborated, stored, recovered, and used.

The cognitive perspective argues that everything people think, say or do is influenced by mental processes, the cognitive mechanism through which they acquire, store, transform and use information, which can be invaluable to understanding why some people and not others identify opportunities (Baron, 2006). The cognitive research explains how each founder’s mental makeup is related to his or her ability to identify and exploit an entrepreneurial opportunity (Corbett, 2005). The conceptualization of cognition provides the foundation for understanding opportunity identification from a motivation-based cognitive approach (Cacioppo and Petty, 1982). Thus, better cognitive capability of founding teams may contribute to sharing knowledge and identifying opportunities, leading to better performance.

The resource-based view (Barney, 1991) suggests that resources can provide competitive advantage when the resources are valuable, not perfectly mobile, neither perfectly imitable nor substitutable. However, new ventures in initial stages of life are likely to have limited resources, especially financial and organizational resources. Thus, new business ventures may largely depend on their founders’ knowledge and experience as a source of competitive advantage. The knowledge-based approach of a venture tends to analyse how organizations create, acquire, apply, protect and transfer knowledge.

Previous research has shown the positive impact of strategies on firm performance. This research argues that strategies of ventures may enhance the relationship between founding team knowledge and firm performance. For this type of strategy impact, this research uses Porter’s (1980) framework containing two opposite types: the low-cost leadership strategy and the differentiation strategy. As Porter (1980) pointed out, the primary focus of a firm with a low-cost leadership strategy is cost control. Miller (1991) argued that the differentiation strategy was composed of two dimensions: product differentiation and market differentiation. Product differentiation enables the venture to use its technological expertise to develop new and innovative products. Market differentiation enables the new venture to adapt its products to the needs of specific markets.

The Effects of Founding Team Knowledge on Firm Performance

Founders with greater human capital are likely to have better entrepreneurial decision making. Founders with great human capital are in an ideal position to identify neglected business opportunities and to make effective strategic decisions that are crucial for the success of the IPO firms. In other words, what founders know and can do is associated with what they learned in the organization with previous experiences (Cooper, 1985; Cooper and Bruno, 1977). For this reason, an entrepreneur’s prior experiences in an activity will provide competencies that influence the decisions he or she makes regarding a given activity (Buchele, 1967; Mullins, 1996; Scherer et al., 1989; Susbauer, 1979).

The cognitive approach is concerned with the founder’s preferred way of gathering, processing, and evaluating information (Allinson et al., 2000). Through formal education and experience, founders acquire prototypes that serve as templates for opportunity identification. The founder constructs opportunities and risks in his or her mind (Palich and Bagby, 1995). A prototype for an opportunity is likely to include features such as novelty, practicality, market appeal, and the ease with which necessary resources can be obtained. Therefore, perception and other cognitive phenomena are critical to opportunity evaluation and risk perception (Krueger, 2000).

Knowledge permits a reduction in uncertainty (Beijerse, 1999) and makes reality meaningful. Founders in a venture are likely to have different backgrounds of education and industry experience. Kogut and Udo (1992) argued that what firms do better than markets is the creation and transfer of knowledge within the organization. Each founding member in the venture may have constructed his or her own cognitive mechanism through education and experience. Thus, the venture may be available to have diverse mechanisms to make more innovative decisions and to identify more opportunities.

In addition, broader knowledge can help the founding team to obtain more information and generate a greater number of alternatives in decision making (Alvarez and Busenitz, 2001). Cassar (2006) argues that broader knowledge is necessary to respond to the multiple demands an entrepreneurial firm faces. This breadth of knowledge is likely to enhance the capabilities of the founding team to manage the complexity of the business environment. Thus, knowledge breadth enhances founding teams’ creativity and increases new ventures’ innovativeness and performance. As a result, this research proposes the following hypotheses.

H1.1: The breadth of founding teams’ education will be positively related to firm performance in IPO firms.

H1.2: The breadth of founding teams’ industry experience will be positively related to firm performance in IPO firms.

H1.3: The breadth of founding teams’ entrepreneurial experience will be positively related to firm performance in IPO firms.

Cohen and Levinthal (1990) define absorptive capacity as the ability to recognize the value of external information, assimilate it, and apply it to commercial ends. Absorptive capacity is a function of the level of the firm’s former knowledge that emphasizes the cumulative nature of knowledge and its history or path is dependent on the importance of prior decisions. Important determinants of absorptive capacity are the internal channels of communication and the distribution of knowledge in the environment and in the firm. Deeper knowledge helps IPO firm have absorptive capacity.

IPO firms can either develop innovative products and services or improve the efficiency of their business processes to reduce costs. To improve the efficiency of their business processes, IPO firms need to have deeper knowledge of the business. Experience with deeper knowledge domains is likely to make the search process more predictable and more efficient. These arguments suggest that knowledge depth facilitates the exchange and combination of the existing knowledge (Nonaka, et al., 1996) and encourage exploitation of what is already known.

Thus, the depth of founding teams’ experience is likely to be positively associated with firm performance, because founding teams may have developed efficient cognitive mechanism on managerial and market information. Founding teams with deeper knowledge can contribute to increasing efficiency, reducing costs, and thus, achieving better firm performance. As a result, this research proposes the following hypotheses.

H2.1: The depth of founding teams’ education will be positively related to firm performance in IPO firms.

H2.2: The depth of founding teams’ industry experience will be positively related to firm performance in IPO firms.

H2.3: The depth of founding teams’ entrepreneurial experience will be positively related to firm performance in IPO firms.

Moderating Effects of the Types of Strategies

A differentiation strategy involves differentiating a product or service or creating something that is perceived as unique industry-wide. Differentiation strategies are designed to create and market innovative, high quality products and services industry-wide (Porter, 1985). According to Porter (1985), successful differentiators rely on strong marketing abilities, creative flair, product engineering skills, and effective coordination across functional areas.

The implementation of a differentiation strategy requires the joint efforts of managers from different functions in order to create a unique position along dimensions which are widely valued by the customer (Porter, 1980). Therefore, founding members with diverse cognitive mechanisms may share their knowledge and cooperate with one another to achieve better performance. The differentiation strategy is likely to enhance the founding members to make innovative decisions and to identify more product and market opportunities.

The implementation of a differentiation strategy requires a founding team’s ability to develop unique and innovative products. As broad knowledge tends to increase creativity and innovation, founding teams with such knowledge contribute to increasing performance with implementing a differentiation strategy. In other words, the differentiation strategy may enhance the relationship between the founding members with engaging in sharing knowledge, making decision for innovative manner, and identifying product and market opportunities and firm performance. As a result, this research proposes the following hypotheses.

H3.1: Differentiation strategy will positively moderate the relationship between the breadth of founding teams’ education and firm performance in IPO firms.

H3.2: Differentiation strategy will positively moderate the relationship between the breadth of founding teams’ industry experience and firm performance in IPO firms.

H3.3: Differentiation strategy will positively moderate the relationship between the breadth of founding teams’ entrepreneurial experience and firm performance in IPO firms.

Low cost strategy is usually associated with improvements to existing product lines (Porter, 1980; Dess and Davis, 1984). On the other hand, efficiency and productivity issues are achieved through process improvements that are typically incremental and induced by a structural approach implemented by top management in a top-down fashion (Burgelman, 1984). For implementing a low-cost strategy, control mechanisms and instruments like budget control can be used in order to achieve low costs. The implementation of hierarchical control elements may reduce the importance of consensus in the case of a low-cost strategy. Moreover, given the lower level of conflict among different functional departments in firms with low cost strategies (Ruekert and Walker, 1987), achieving consensus becomes less important.

The depth of founding team knowledge reduces the conflict in the venture. On the other hand, higher the level of knowledge depth enables one to perform a certain task with fewer resources and errors. As Kroll and colleagues (2007) discussed, founding members tend to be familiar with the managerial structure, the balance of power among managers and board members and previous ways of doing things. In other words, the founding members with deeper knowledge may know how to maximize efficiency of the venture. A low-cost leadership strategy may enhance the relationship between the founding members with engaging in maximizing efficiency and firm performance. Thus, implementing a low-cost leadership strategy is likely to enhance founding teams with high levels of knowledge depth to be more effective in reducing costs. As a result, this research proposes the following hypothesis.

H4.1: Low-cost strategy will positively moderate the relationship between the depth of founding teams’ education and firm performance in IPO firms.

H 4.2: Low-cost strategy will positively moderate the relationship between the depth of founding teams’ industry experience and firm performance in IPO firms.

H4.3: Low-cost strategy will positively moderate the relationship between the depth of founding teams’ entrepreneurial experience and firm performance IPO firms.

Methodology

Sample

To test the hypotheses above, this research used a sample of new business ventures that went public in the period 2003 through 2008 because that period offers the most recent data available for this study. Consistent with Carpenter and colleagues (2003) and Kroll and colleagues (2007), I defined young, entrepreneurial IPO firms as start-up firms (rather than spinoff or leveraged buy-out firms) which were within 10 years of their founding. Including IPOs over six consecutive years in the sample increases the generalizability of this research. Using a sample of firms that went public in different years reduces the biases which arise in a particular year due to idiosyncratic market conditions (Rajagopalan, 1997; Zajac et al., 2000). To construct the sample, the list of IPO firms that went public in the years between 2003 and 2008 were obtained from Hoover’s Online. The initial list consisted of 590 firms. Of the initial IPO firms, the firms that did not meet the criteria of an entrepreneurial IPO firms (less than 10 years of age at the IPO and independently operated) were excluded. Financial firms, such as mutual funds, foreign ADRs, and real estate investments trusts, spin-offs of the existing public firms, and reversed leveraged buyouts were eliminated because they are often not entrepreneurial firms (Carpenter et al., 2003). In addition, acquired and merged firms were excluded because these firms are not typically different from other IPO firms in terms of firm performance and other characteristics (Fisher and Pollock, 2004). Bankrupted and discontinued firms during the sample period were also eliminated. Finally, the firms with missing data were excluded. As a result, 259 firms were excluded. The final number of eligible firms was 331.

Independent Variables

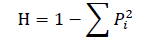

The independent variables in this study consisted of the breadth of founding team education, industry experience and entrepreneurial experience and the depth of founding team education, industry experience and entrepreneurial experience. The breadth of the founding team education was measured as the number of founding team members’ unique formal education areas using the Herfindahl-Hirschman index. The formula is:

Where, H is the diversity measure and p is the proportion of team members in each category. For the breadth of founding team industry experience, this research used SIC code to classify the industries in which the founding members had worked (Certo et al., 2001; Kumar, 2005): nine dichotomous variables to distinguish industry categories-pharmaceuticals (SIC 2834- 2836), computer hardware (SIC 3571-3577), electronics (SIC 3661-3675), instruments (SIC 3826-3845), all other manufacturing (SIC 0111-3999 less preceding manufacturing categories), trade and transportation (SIC 4011-5999), software (7372-7375), physical research (SIC 8731) and all other services (SIC 6011-9999 less preceding service categories) (Nelson, 2003). The breadth of the founding team’s entrepreneurial experience was measured as the Herfindahl- Hirschman index of the total number of the founding team members’ unique entrepreneurial experiences. Like industry experience, SIC codes were used to classify the industries of founding members’ prior start-up experience. The depth of founding team education was operationalized as the average number of years of schooling, converted to a continuous scale with: (1) under diploma, (2) diploma, (3) bachelor, (4) master and (5) doctoral degree (Foo et al., 2005). Following earlier research (Gomez-Mejia, Balkin and Welboume, 1990; Sapienza and Timmons, 1989; Smith et al., 2005), the depth of founding team industry experience was measured by taking the number of years that the founding members had worked in the industry of their current venture. The depth of the founding team entrepreneurial experience was measured the average number of start-ups that the founding members established in the industry of their current venture (Zhao et al., 2005).

Moderating Variables

Moderating variables in this study included differentiation strategies and low-cost leadership strategies. The moderating variables estimate using content analyses in which prospectuses were evaluated and business strategies were coded using uniform, pretested coding sheets (Shrader et al., 2000). To reduce marker bias, the researcher conducted content analysis and then, another expert of the content analysis checked the correction with random lists of the sample (Short and Palmer, 2008). Several key words were used to identify the firm’s differentiation strategies, such as innovative, different products and services, improving and developing new products and services, and so on. The key words to identify low-cost strategies included low prices of products or services, improved technologies or processes, low costs, efficiency and so on (Carter et al., 1994).

Dependent Variables

This research used holding period returns for performance measure. Holding period returns were calculated for a period of three years and one year lagged in relation to the corresponding independent variables. Holding Period Returns (HPRs) as the market performance measure calculated as followed:

Where rit is the return of firm i in month t. This study calculates holding period returns for a period of three years (year t2 to t4).

Control Variables

Industry effects, firm size, firm age, block holder ownership, corporate governance structure, TMT size and TMT ownership were included as control variables. Industry effects were controlled, using dummy variables for eight different categories of SIC codes. For the first SIC code, the researcher coded SC1, SC2, SC3, SC4, SC5, SC6, SC7 and SC8 for the first SIC code of the different categories, respectively. Data for this variable were collected from COMPUSTAT.

Firm size was controlled using total asset, because firm size affects firm performance (Carpenter et al., 2003) in that larger firms are presumed to be more mature, better known and with more employees compared to smaller firms thereby requiring different skills sets from CEO candidates which in turn is likely to influence the founding team decision (Wasserman, 2003). Data for firm size were collected from Compustat. Younger firms are subject to a greater likelihood of failure for a variety of reasons (Hannan and Freeman, 1984; Stinchcombe, 1965). Consistent with prior studies, firm age was measured as the number of years from the date of incorporation to the IPO (Davilla et al., 2003). The concentration of shares in the hands of investors can affect the discretion of management (Tosi et al., 1999). This study measured block holder ownership as total ownership of shareholders with 5 percent or greater ownership in the firm. Data for this variable was collected from 10-K reports. The ratio of nonexecutive directors (outside directors) to board size is important (Sanders and Carpenter, 1998). Greater numbers of outsiders on the board are expected to result in greater representation of shareholders’ interests. Corporate governance structure measured the ratio of the number of the outside board members based on the data from 10-K reports. Prior research has suggested that TMT size is related to firm performance (Sanders and Carpenter, 1998). Thus, this variable was controlled for the TMT size effect. TMT size was measured as the total number of managers on a company's top management team (Simon et al., 1999). The data for TMT size was obtained from proxy statements. Higher TMT ownership increases their independence from the CEO and consequently their influence on decisions related to the new venture performance (Jain and Tabak, 2008). The data for TMT ownership were obtained from proxy statements.

Analytical Method and Results

This research used Ordinary Least Squares (OLS) multiple regression to test the hypotheses. This study checked for multicollinearity by examining Variance Inflation Factor (VIF) statistics. The average VIF was 1.43 for holding period return, which are less than 10, the widely acceptable cut-point, suggesting that multicollinearity did not bias the estimated model results (Freund and Littell, 2000). The models for holding period return as dependent variable, Fvalue 1.55 (p>0.0579), show that the models do not have lack of fit problems. Durbin-Watson value is 2.039 that the research models do not have autocorrelation problems in this study. Table 1 provides descriptive statistics.

| Table 1A DESCRIPTIVE STATISTICS AND CORRELATION OF THE MAIN VARIABLES |

||||||||||

| Variable | Mean | s.d. | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 1. SC1 | 0.07 | 0.25 | ||||||||

| 2. SC2 | 0.21 | 0.41 | -0.13* | |||||||

| 3. SC3 | 0.29 | 0.45 | -0.17** | -0.33** | ||||||

| 4. SC4 | 0.12 | 0.33 | -0.10† | -0.19** | -0.24** | |||||

| 5. SC5 | 0.05 | 0.22 | -0.06 | -0.12* | -0.15* | -0.09 | ||||

| 6. SC6 | 0.19 | 0.39 | -0.13* | -0.25** | -0.31** | -0.18** | -0.11† | |||

| 7. SC7 | 0.06 | 0.25 | -0.07 | -0.14* | -0.17** | -0.10† | -0.06 | -0.13* | ||

| 8. SC8 | 0.01 | 0.08 | -0.02 | -0.04 | -0.05 | -0.03 | -0.02 | -0.04 | -0.02 | |

| 9. Firm Age | 7 | 2.56 | -0.17** | -0.03 | 0.02 | -0.17** | 0.11† | 0.09 | 0.12 | 0.05 |

| 10. TMT Size | 12.05 | 3.56 | -0.14* | 0.15* | 0.02 | -0.12* | -0.04 | 0.07 | -0.04 | 0.02 |

| 11. Board Structure | 0.44 | 0.16 | -0.05 | 0.06 | -0.13* | 0.18** | -0.02 | -0.02 | -0.01 | -0.01 |

| 12. Blockholder | 9.52 | 15.71 | -0.08 | -0.10† | -0.02 | -0.06 | 0.07 | 0.16** | 0.06 | -0.04 |

| 13. TMTownership | 25.35 | 195.31 | -0.02 | -0.04 | -0.04 | -0.03 | -0.01 | 0.13 | -0.01 | -0.01 |

| 14. Firm size | 387.3 | 1263 | 0.05 | -0.07 | -0.09 | 0.21** | -0.03 | 0.02 | -0.04 | -0.02 |

| 15. Breadth of Education | 0.97 | 0.05 | 0.12* | 0.01 | -0.08 | 0.18** | 0 | -0.08 | -0.12* | 0.05 |

| 16. Breadth of Industry Exp. | 0.98 | 0.05 | 0.09 | 0 | 0.07 | 0.11† | 0.03 | -0.13* | -0.19** | 0.04 |

| 17. Breadth of Start-up Exp. | 0.99 | 0.02 | 0.09 | -0.01 | -0.06 | 0.03 | 0.07 | -0.09 | 0.06 | 0.03 |

| 18. Depth of Education | 3.06 | 4.28 | -0.15 | 0.18 | 0.01 | -0.21 | -0.02 | 0.05 | 0.06 | -0.06 |

| 19. Depth of Industry Exp. | 1.9 | 6.72 | -0.03 | -0.05 | 0.15* | -0.11† | -0.05 | 0.07 | -0.07 | -0.02 |

| 20. Depth of Start-up Exp. | 0.11 | 0.51 | -0.06 | -0.01 | 0.1 | -0.08 | -0.05 | 0.08 | -0.06 | -0.02 |

| 21. Holding Period Return | -0.11 | 0.8 | 0.02 | -0.13* | -0.01 | 0.06 | 0.02 | 0.04 | 0.08 | -0.09 |

† p .10

* p .05

** p .01

| Table 1B DESCRIPTIVE STATISTICS AND CORRELATION OF THE MAIN VARIABLES |

||||||||||

| Variable | Mean | s.d. | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 |

| 1. SC1 | 0.07 | 0.25 | ||||||||

| 2. SC2 | 0.21 | 0.41 | ||||||||

| 3. SC3 | 0.29 | 0.45 | ||||||||

| 4. SC4 | 0.12 | 0.33 | ||||||||

| 5. SC5 | 0.05 | 0.22 | ||||||||

| 6. SC6 | 0.19 | 0.39 | ||||||||

| 7. SC7 | 0.06 | 0.25 | ||||||||

| 8. SC8 | 0.01 | 0.08 | ||||||||

| 9. Firm Age | 7 | 2.56 | ||||||||

| 10. TMT Size | 12.05 | 3.56 | 0.26** | |||||||

| 11. Board Structure | 0.44 | 0.16 | 0 | -0.26** | ||||||

| 12. Blockholder | 9.52 | 15.71 | 0 | -0.15** | -0.24** | |||||

| 13. TMTownership | 25.35 | 195.31 | -0.02 | -0.06 | -0.06 | 0.15 | ||||

| 14. Firm size | 387.3 | 1263 | -0.08 | 0.16** | 0 | -0.05 | -0.02 | |||

| 15. Breadth of Education | 0.97 | 0.05 | -0.04 | -0.05 | 0.04 | -0.28** | -0.01 | 0.10† | ||

| 16. Breadth of Industry Exp. | 0.98 | 0.05 | -0.06 | -0.07 | 0.05 | -0.19** | -0.05 | 0.07 | 0.41** | |

| 17. Breadth of Start-up Exp. | 0.99 | 0.02 | 0.05 | -0.02 | -0.02 | -0.11† | -0.03 | 0.04 | 0.24** | 0.20** |

| 18. Depth of Education | 3.06 | 4.28 | 0.06 | 0.12 | -0.03 | 0.28 | 0.07 | -0.1 | -0.701 | -0.452 |

| 19. Depth of Industry Exp. | 1.9 | 6.72 | 0.12* | 0.01 | -0.08 | 0.16** | 0 | -0.03 | -0.24** | -0.19** |

| 20. Depth of Start-up Exp. | 0.11 | 0.51 | 0.09 | 0.03 | -0.09 | 0.18** | 0.23** | -0.02 | -0.17** | -0.05 |

| 21. Holding Period Return | -0.11 | 0.8 | -0.04 | -0.07 | 0.04 | 0.02 | 0.04 | 0.09 | -0.10† | 0.10† |

† p .10

* p .05

** p .01

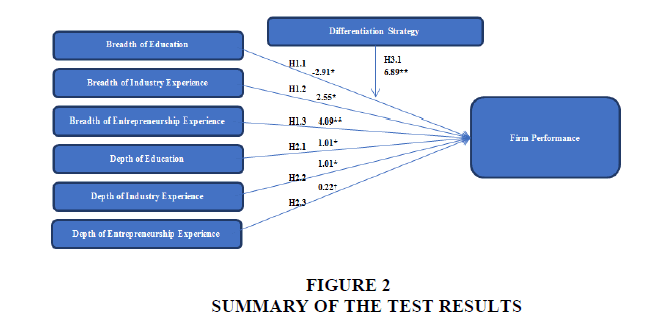

Table 2 shows the results of multiple regression analyses of the impact of the characteristics of founding team on holding period return. Model 1 contains control variables. In model 1, there is no variable that has significant effect on holding period return. Model 2 includes control variables and independent variables. In Table 2, the coefficient of the breadth of founding team is significant on holding period return, but negative (b= -2.90, p<0.05). Thus, hypothesis 1.1, which predicts the positive impact of the breadth of founding team education on firm performance, is not supported. Hypothesis 1.2, which states a positive relationship between the breadth of founding team industry experience and firm performance, is supported (b=2.55, p<0.05). In hypothesis 1.3, this research argues that the breadth of founding team entrepreneurial experience will positively affect firm performance. The test result shows positive and significant impact of the breadth of founding team stat-up experience on firm performance (b=4.09, p<0.01). Therefore, hypothesis 1.3 is supported (Tables 1A-1C and Table 2).

| Table 1C DESCRIPTIVE STATISTICS AND CORRELATION OF THE MAIN VARIABLES |

||||||

| Variable | Mean | s.d. | 17 | 18 | 19 | 20 |

| 1. SC1 | 0.07 | 0.25 | ||||

| 2. SC2 | 0.21 | 0.41 | ||||

| 3. SC3 | 0.29 | 0.45 | ||||

| 4. SC4 | 0.12 | 0.33 | ||||

| 5. SC5 | 0.05 | 0.22 | ||||

| 6. SC6 | 0.19 | 0.39 | ||||

| 7. SC7 | 0.06 | 0.25 | ||||

| 8. SC8 | 0.01 | 0.08 | ||||

| 9. Firm Age | 7 | 2.56 | ||||

| 10. TMT Size | 12.05 | 3.56 | ||||

| 11. Board Structure | 0.44 | 0.16 | ||||

| 12. Blockholder | 9.52 | 15.71 | ||||

| 13. TMTownership | 25.35 | 195.31 | ||||

| 14. Firm size | 387.3 | 1263 | ||||

| 15. Breadth of Education | 0.97 | 0.05 | ||||

| 16. Breadth of Industry Exp. | 0.98 | 0.05 | ||||

| 17. Breadth of Start-up Exp. | 0.99 | 0.02 | ||||

| 18. Depth of Education | 3.06 | 4.28 | -0.32 | |||

| 19. Depth of Industry Exp. | 1.9 | 6.72 | -0.26** | 0.36** | ||

| 20. Depth of Start-up Exp. | 0.11 | 0.51 | -0.44** | 0.28** | 0.42** | |

| 21. Holding Period Return | -0.11 | 0.8 | 0.03 | 0.03 | -0.03 | 0.09 |

† p .10

* p .05

** p .01

| Table 2 HIERARCHICAL REGRESSION RESULTS REGARDING THE IMPACT OF THE CHARACTERISTICS OF FOUNDING TEAM ON FIRM PERFORMANCE AND INTERACTION EFFECT BY THE TYPES OF STRATEGIES |

||||

| Variables | Model 1 | Model 2 | Model 3 | Model 4 |

| SC1 | 0.3 | 0.23 | 0.21 | 0.12 |

| SC2 | 0.11 | 0.02 | 0.03 | -0.01 |

| SC3 | 0.3 | 0.19 | 0.2 | 0.16 |

| SC4 | 0.35 | 0.31 | 0.3 | 0.24 |

| SC5 | 0.4 | 0.3 | 0.27 | 0.24 |

| SC6 | 0.37 | 0.32 | 0.31 | 0.29 |

| SC7 | 0.55 | 0.49 | 0.51 | 0.47 |

| SC8 | -0.54 | -0.6 | -0.57 | -0.64 |

| Firm Age | -0.01 | -0.01 | -0.01 | -0.01 |

| TMT Size | -0.01 | -0.01 | -0.01 | -0.01 |

| TMT Structure | 0.17 | 0.13 | 0.21 | 0.23 |

| Blockholder Ownership | 0 | 0 | 0 | 0 |

| TMT ownership | 0 | 0 | 0 | 0 |

| Firm Size | 0 | 0 | 0 | 0 |

| Breadth of Education | -2.91* | -7.11** | -2.70† | |

| Breadth of Industry Exp. | 2.55* | 3.94* | 2.52* | |

| Breadth of Start-up Exp. | 4.09** | 5.55** | 4.11** | |

| Depth of Education | 1.01* | 1.02* | 1.01* | |

| Depth of Industry Exp. | 1.01* | 1.01* | 1.01* | |

| Depth of Start-up Exp. | 0.22† | 0.22† | 0.26* | |

| Differentiation Strategy (Diff) | -3.38 | |||

| Breadth of Edu*Diff | 6.89** | |||

| Breadth of Industry Exp.*Diff | -1.71 | |||

| Breadth of Start-up Exp.*Diff | -1.77 | |||

| Low-Cost Leadership Strategy (LC) | 0.09 | |||

| Depth of Edu*LC | 0.01 | |||

| Depth of Industry Exp.*LC | 0.02 | |||

| Depth of Start-up Exp.*LC | -0.14 | |||

| R2 | 0.045 | 0.098 | 0.129 | 0.107 |

| ∆R2 | 0.053 | 0.031 | 0.009 | |

† p .10

* p .05

** p .01

Hypothesis 2.1, which states a positive impact of the depth of founding team education on firm performance, is significant and positive (b=1.01, p<0.05). The test result supports hypothesis 2.1. Hypothesis 2.2, which predicts a positive impact of the depth of founding team education on firm performance, is supported (b=1.01, p<0.05). Hypothesis 2.3 predicts that there is a positive relationship between the depth of founding team entrepreneurial experience and firm performance. The empirical result supports hypothesis 2.3 (b=0.22, p<0.1).

For the main purpose of this research, Models 3 and 4 represent the results of the moderating effects of the types of strategies. Model 3 consists of a moderator, differentiation strategies. The model is significant (R2=0.129, ΔR2=0.031). Model 3 provides a significant and positive moderating impact of the differentiation strategies on the relationship between the breadth of founding team education and holding period return (b=6.89, p<0.01), supporting hypothesis 3.1. Hypothesis 3.2, which states that differentiation strategies will enhance the relationship between the breadth of team industry experience and firm performance, is not supported. Hypothesis 3.3, which states that the relationship between the breadth of founding team entrepreneurial experience and firm performance will be enhanced by differentiation strategies, is not supported.

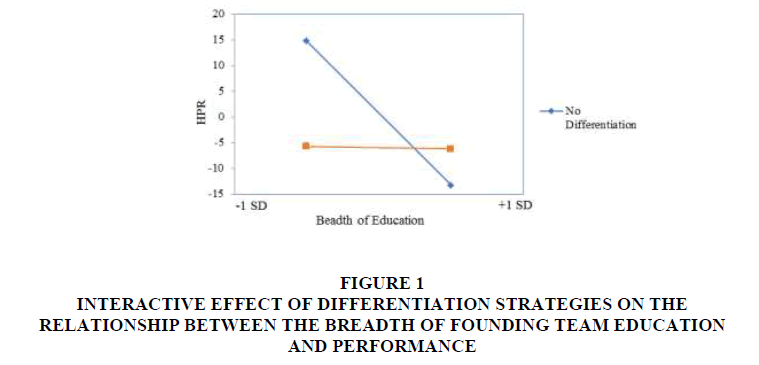

Model 4 represents the moderating effect of low-cost leadership strategies on the relationship between the founding team knowledge and firm performance. The model is significant (R2=0.107, ΔR2=0.009). Hypothesis 4.1 states that low-cost leadership strategies will enhance the relationship between the depth of founding team education and firm performance. Although the coefficient is positive, the result does not provide the significant evidence of the moderating effect. Hypotheses 4.2, which states that low-cost leadership strategies will moderate the impact of the depth of founding team industry experience on firm performance, is also not supported by the test result. Finally, the result shows that hypothesis 4.3, which states that lowcost leadership strategies will have an interaction impact on the relationship between the depth of founding team entrepreneurial experience and firm performance, is not supported by the result (Figure 1).

Figure 1: Interactive Effect Of Differentiation Strategies On The Relationship Between The Breadth Of Founding Team Education And Performance

A simple slope analysis (Alken and West, 1991) for each regression line to test whether its slope was significantly different from zero was conducted. Figure 1 provides the evidence of the moderating effect of differentiation strategies on the relationship between the breadth of founding team education and holding period return. When a firm implements differentiation strategies, the performance is likely to be less influenced by the broader founding team's education. Otherwise, the impact of the breadth of the founding team’s education on firm performance tends to decreased much more when firms do not implement differentiation strategies. In summary, hypothesis 1.2, 1.3, 2.1-2.3, and 3.1 were supported by the empirical tests (Figure 2).

Discussion And Conclusion

This research has argued that there is a combined impact of the founding team’s knowledge on firm performance in IPO firms, considering the moderating effect of the types of strategies. Thus, this research provides several contributions to entrepreneurship research, as well as management.

This research investigates the combined impact of founding team knowledge on firm performance and shows several significant relationships between the variables. Specifically, the broader founding team industry experience and entrepreneurial experience significantly and positively affects firm performance in new business ventures. Because knowledge of prior conditions can help managers understand the industry’s current dynamics, greater variation in the industry experience of the founding team is associated with higher growth among new firms (Eisenhardt and Schoonhoven, 1990). Managerial familiarity enables managers to detect emerging opportunities and new trends in the industry (Rubenson, 1989) and helps in evaluating alternative paths of investments and growth (Kor, 2003). Apparently, the volume of formal education, industry experience, and entrepreneurial experience of founding teams lead to better performance. Such knowledge may help speed decision processes (Forbes, 2005). In addition, deeper knowledge of founding teams helps firms cope with the environmental dynamism often inherent in entrepreneurial contexts. Management should be aware of the variables for better performance accordingly.

Most importantly, as Carpenter (2002) points out the possibility that there may be important moderating or intervening variables overlooked in prior works, this research finds a moderating variable that explains the inconsistency among top management team demographics and performance relationships. The empirical results show the moderating impact of differentiation strategies on the relationship between the breadth of founding team education and firm performance in IPO firms. As a result, research in entrepreneurial strategy should investigate the indirect impact of the type of strategy, as well as the direct effects. In addition, management needs to be aware the moderating role of differentiation strategy.

Finally, consistent with the findings of Amason et al. (2006), the empirical results show negative impacts of broad education of founding teams on firm performance, opposite to the prediction of this research. Future research effort could attempt to tease out the effects of the breadth of education, regarding different measures and/or samples. Management should be aware that the broader educational background of the founding teams is likely to have negative impacts on firm performance.

This research is not without limitations. This study hypothesized the impact of the characteristics of founding teams on performance in new business ventures. Founders are likely to identify their opportunities and to establish their strategies during the founding of their firms. However, I used data at the time of IPO because there was difficulty in obtaining the data before the IPO. Therefore, future research can use different data collection methods, which can overcome the potential timing bias, to examine the impact of the characteristics of founding teams in new business ventures.

This research has explored the characteristics of founding teams concerning a unique director role in an increasingly important context. This study argues that the topic of young entrepreneurial firm governance is important both for theoretical and policy reasons. The founding team is a part of corporate governance although prior literature has provided evidence on the impact of the significance of the founding team. Therefore, future research could address impact of knowledgeable board members, such as top management teams and outside board members.

This research used two types of strategies, differentiation and low-cost leadership strategies, to investigate the moderating impact on the relationship between founding team knowledge and firm performance in IPO firms. There may be more considerable types of strategies, such as prospectors, reactors, analysers and defenders and strategic actions, including product development, collective actions, competitive actions and innovation. Thus, future research could include other strategic variables as moderators on the relationship between the characteristics of founding team and firm performance.

References

- Aiken, L.S., & West, S.G. (1991). Multiple regression: Testing and interpreting interactions. Newbury Park CA: Sage.

- Allinson, C.W., Chell, E., & Hayes, J. (2000). Intuition and entrepreneurial behaviour. European Journal of Work and Organizational Psychology, 9(1), 31-43.

- Alvarez, S.A., & Busenitz, L.W. (2001). The entrepreneurship of resource-based theory. Journal of Management, 27, 755-775.

- Amason, A.C., Shrader, R.C., & Tompson, G.H. (2006). Newness and novelty: Relating top management team composition to new venture performance. Journal of Business Venturing, 21, 125-148.

- Barney, J.B. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17(1), 99-120.

- Baron, R.A. (2006). Opportunity recognition as pattern recognition: How entrepreneurs connect the dots to identify new business opportunities. Academy of Management Perspectives, 20(1), 104-119.

- Becker, G.S. (1964). Human capital. Chicago: Chicago University Press.

- Beijerse, R.P. (1999). Questions in knowledge management: Defining and conceptualizing a phenomenon. Journal of Knowledge Management, 3(2), 94-109.

- Bruderl, J., Preisendorfer, P., & Ziegler, R. (2002). Survival chances of newly founded business organizations. American Sociological Review, 57(2), 227-242.

- Buchele, R.B. (1967). Business policy in growing firms. Chandler, San Francisco.

- Burgelman, R.A. (1984). Designs for corporate entrepreneurship in established firms. California Management Review, 26(3), 154-166.

- Cacioppo, J.T., & Petty, R.E. (1982). The need for cognition. Journal of Personality and Social Psychology, 42, 116-131.

- Carpenter, M.A. (2002). The implications of strategy and social context for the relationship between top management team heterogeneity and firm performance. Strategic Management Journal, 23, 275-284.

- Carpenter, M.A., Pollock, T.G., & Leary, M. (2003). Governance, the experience of principals and agents and global strategic intent: Testing a model of reasoned risk-taking. Strategic Management Journal, 24, 803-820.

- Carter, N.M., Stearns, T.M., Reynolds, P.D., & Miller, B. (1994). New venture strategies: Theory development with an empirical base. Strategic Management Journal, 15(1), 21-41.

- Cassar, G. (2006). Entrepreneur opportunity costs and intended venture growth. Journal of Business Venturing, 21, 610-631.

- Certo, S.T., Covin, J., Daily, C.M., & Dalton, D.R. (2001). Wealth and the effects of founder management among IPO-stage new ventures. Strategic Management Journal, 22, 641-658.

- Cohen, W., & Levinthal, D. (1990). Absorptive capacity: A new perspective on learning and innovation. Administrative Science Quarterly, 35, 128 -152.

- Colombo, M.G., & Grilli, L. (2005). Founders’ human capital and the growth of new technology-based firms: A competence-based view. Research Policy, 34, 795-816.

- Cooper, A.C., & Bruno, A. (1977). Success among high-technology firms. Business Horizons, 20(2), 16-23.

- Cooper, A.C. (1985). The role of incubator organizations in the founding of growth oriented firms. Journal of Business Venturing, 1(1), 75-86.

- Corbett, A.C. (2005). Experiential learning within the process of opportunity identification and exploitation. Entrepreneurship Theory & Practice, 29(4), 473-491.

- Davila, A., Foster, G., & Gupta, M. (2003). Venture capital financing and the growth of startup firms. Journal of Business Venturing, 18(6), 689-708.

- Dess, G.G., & Davis, P.S. (1984). Porter’s (1980) generic strategies as determinants of strategic group membership and organizational performance. Academy of Management Journal, 27, 467-488.

- Eisenhardt, K.M., & Schoonhoven, C.B. (1990). Organizational growth: Linking founding teams, strategy, environment and growth among U.S. semi-conductor ventures. Administrative Science Quarterly, 28, 274-291.

- Fischer, H.M., & Pollock, T.G. (2004). Effects of social capital and power on surviving transformational change: The case of initial public offerings. Academy of Management Journal, 47, 463-481.

- Foo, M.D., Wong, P.K., & Ong, A. (2005). Do others think you have a viable business idea? Team diversity and judges’ evaluation of ideas in a business plan competition. Journal of Business Venturing, 20, 385-402.

- Forbes, D.P. (2005). The effects of strategic decision making on entrepreneurial self-efficacy. Entrepreneurship Theory and Practice, 29, 599-626.

- Freund, R.J., & Littell, R.C. (2000). SAS system for regression (3rd ed.). SAS Institute, Cary, N.C.

- Gimeno, J., Folta, B.T., Cooper, C.A., & Woo, Y.C. (1997). Survival of the fittest? Entrepreneurial human capital and the persistence of underperforming firms. Administrative Science Quarterly, 42(4), 750-783.

- Gomez-Mejia, L.R., Balkin, D., & Welbourne, T. (1990). The influence of venture capitalists on management practices in the high technology industry. Journal of High Technology Management Research, 1(1), 107-118.

- Hambrick, D.C., & Mason, P.A. (1984). Upper Echelons: The Organization as a Reflection of its Top Managers. Academy of Management Review, 9(2), 193-206.

- Hanan, M.T., & Freeman, J. (1984). Structural inertia and organizational change. American Sociological Review, 49, 149-164.

- Jain, B.A., & Tabak, F. (2008). Factors influencing the choice between founder versus non-founder CEOs for IPO firms. Journal of Business Venturing, 23, 21-45.

- Jayaraman, N., Khorana, A., Nelling, E., & Covin, J. (2000). CEO founder status and firm financial performance. Strategic Management Journal, 21, 1215-1224.

- Kirzner, I.M. (1983). Entrepreneurs and the entrepreneurial function: a commentary. In J. Ronen (Ed.) Entrepreneurship. Lexington, MA, Lexington Books.

- Kogut, B., & Udo, Z. (1992). Knowledge of the firm, combinative capabilities and the replication of technology. Organization Science, 3(3), 383-397.

- Kor, Y.Y. (2003). Experience-based top management team competence and sustained growth. Organization Science, 14(6), 707-719.

- Kroll, M., Walters, B.A., & Le, S.A. (2007). The impact of board composition and top management team ownership structure on post-IPO performance in young entrepreneurial firms. Academy of Management Journal, 50, 1198-1216.

- Krueger, N.F.Jr. (2000). The cognitive infrastructure of opportunity emergence. Entrepreneurship Theory and Practice, 24, 5-23.

- Kumar, R. (2005). Research methodology: A step-by-step guide for beginners. London: Sage.

- Lambkin, M. (1988). Order of entry and performance in new markets. Strategic Management Journal, 9, 127-140.

- McDougall, P.P. (1987). An analysis of strategy, entry barriers and origin as factors explaining new venture performance. Unpublished doctoral dissertation: University of South Carolina.

- Miller, D. (1991). Generalists and Specialists: Two business strategies and their contexts. InP. Shrivastava. A. Huff and J. Dutton (eds.), Advances in Strategic Management. JAI Press, Greenwich.

- Mullins, J.W. (1996). Early growth decisions of entrepreneurs: the influence of competency and prior performance under changing market conditions. Journal of Business Venturing, 11, 89-106.

- Neisser, U. (1967). Cognitive psychology. New York: Appleton-Century-Crofts.

- Nelson, T. (2003). The persistence of founder influence: Management, ownership and performance effects at initial public offering. Strategic Management Journal, 24, 707-724.

- Nonaka, I., Takeuchi, H., & Umemoto, K. (1996). A Theory of Organisational Knowledge Creation. International Journal of Technology Management, 11, 833-845.

- Norburn, D., & Birley, S. (1988). The top management team and corporate performance. Strategic Management Journal, 9, 225-237.

- Palich, L., & Bagby, R. (1995). Using cognitive theory to explain entrepreneurial risk-taking: Challenging conventional wisdom. Journal of Business Venturing, 10, 425-438.

- Pennings, J.M., Lee, K., & Van Witteloostuijn, A. (1998). Human capital, social capital, firm dissolution. Academy of Management Journal, 41, 425-440.

- Porter, M.E. (1985). Competitive advantage: Creating and the free press, New York: Sustaining Superior Performance.

- Rajagopalan N. (1997). Strategic orientations, incentive plan adoptions and firm performance: Evidence from electric utility firms. Strategic Management Journal, 18(10), 761-785.

- Roure, J.B., & Maidique, M.A. (1986). Linking prefunding factors and high-technology venture success: An exploratory study. Journal of Business Venturing, 1, 295-306.

- Rubenson, G.C. (1989). Departure of organizational founders: Explaining variance in founder tenure, successor characteristics, successor power and future firm performance. Ph.D. dissertation, University of Maryland, College Park, MD.

- Ruekert, R.W., & Walker, O.C. (1987). Interactions between marketing and R&D departments in implementing different strategies. Strategic Management Journal, 8, 233-248.

- Sandberg, W., & Hofer, C. (1987). Improving new venture performance: The role of strategy, industry structure and the entrepreneur. Journal of Business Venturing, 2(1), 5-28.

- Sanders, W.G., & Carpenter, M.A. (1998). Internationalization and firm governance. Academy of Management Journal, 41, 158-178.

- Sapienza, H.J., & Timmons, J.A. (1989). Launching and building entrepreneurial companies: Do venture capitalists add value?Brockhaus, R. H. & Sr et al. (Eds.), Frontiers of entrepreneurship research. Wellesley. MA: Babson College.

- Scherer, R.F., Adams, J.S., & Wiebe, F.A. (1989). Developing entrepreneurial behaviours: A social learning theory perspective. Journal of Organizational Change Management, 2(3), 16-27.

- Shrader, R.C., Oviatt, B.M., & McDougall, P.P. (2000). How new ventures exploit trade-offs among international risk factors: Lessons for the accelerated internationalization of the 21st century. Academy of Management Journal, 43, 1227-1247.

- Short, J.C., & Palmer, T.B. (2008). The application of DICTION to content analysis research in strategic management. Organizational Research Methods, 11, 727-752.

- Shrader, R.C., Oviatt, B.M., & McDougall, P.P. (2000). How new ventures exploit trade-offs among international risk factors: Lessons for the accelerated internationalization of the 21st century. Academy of Management Journal, 43, 1227-1247.

- Simons, T., Pelled, L.H., & Smith, K.A. (1999). Making use of difference: Diversity, debate, and decision comprehensiveness in top management teams. Academy of Management Journal, 42(6),662-674.

- Smith, K.G., Collins, C.J., & Clark, K.D. (2005). Existing knowledge, knowledge creation capability, and the rate of new product introduction in high-technology firms. Academy of Management, 48, 346-357.

- Stinchcombe, A.L. (1965). Social structures and organizations. In James G. March (ed.), Handbook of Organization.Chicago: Rand McNally.

- Stuart, R.W., & Abetti, P.A. (1990). Impact of entrepreneurial and management experience on early performance. Journal of Business Venturing, 5, 151-162.

- Susbauer, J.C. (1979). Strategic management: New ventures and small business. D.E. Schendel & C.W. Hofer (Eds.), Strategic management: A new view of business policy and planning. Boston: Little, Brown.

- Tosi, H.L., Gomez-Mejia, L., Loughry, M.L, Werner, S., Banning, K., Katz, J., Harris, R., & Silva, P. (1999). Managerial discretion, compensation strategy and firm performance: The case for the ownership structure. In Ferris, G. (Ed.), Research on Personnel/Human Resource Management. Greenwich, CT.: JAI Press.

- Wasserman, N. (2003). Founder-CEO Succession and the Paradox of Entrepreneurial Success”, Organization Science.

- Zajac, E.J., Kraatz, M.S., & Bresser, R.K.F. (2000). Modeling the dynamics of strategic fit: A normative approach to strategic change. Strategic Management Journal, 21, 429-453.

- Zhao, H., Seibert, S.E., & Hills, G.E. (2005). The mediating role of self-efficacy in the development of entrepreneurial intentions. Journal of Applied Psychology, 90, 1265-1272.