Research Article: 2019 Vol: 23 Issue: 2

Information Exchange Market and the Performance of Small Businesses in Soweto

Bulelwa Maphela, University Of Johannesburg

Abstract

Entrepreneurs and small enterprises are at the heart of growth and development in advanced and emerging global economies. However, a common issue is that they often have difficulty in communicating their enterprises’ value despite best efforts and practice to “signal” for mainstream finance. Subsequently, alternative financing mechanisms have been becoming more popular and successful globally. This is mainly because technological gains have been prompting increased regulatory measures, such as contained in the US JOBS Act 2012 and the UK FCA 2014/13 crowd funding and promotion of non-readily realisable securities and the establishment of the South African reserve bank’s fintech unit. Recently, following a call for proposals, the gauteng provincial government has sought to spearhead the establishment of an alternative financing platform, the Township Stock Exchange (TSE), for entrepreneurs, small businesses and emerging township enterprises in the Gauteng province of South Africa. To demystify the existing challenge this research study set out to develop an information exchange market for potential investment professionals to access township enterprise information and local economy business owners to signal for research on their companies by operating or simulating a Township Venture Research (TVR) online platform using small business information. Information Economics theory delves into the importance of information in the effective and efficient functioning of markets with key topics, such as adverse selection pioneered, signalling and screening by. Entrepreneurs and small enterprises often have to compete for a limited pool of finance and lack of a track record disenfranchises their opportunity to development finance. Better signalling and screening of local economy businesses would facilitate effective and fluid alternative markets that would have increased impact on meaningful growth and development in South Africa.

Keywords

Information Economics, Information, Knowledge, Township Stock Exchange.

Introduction

This research project reviewed two important themes in the context of entrepreneurship in South Africa. The first one was the perceptual trends of entrepreneurship in a township setting such as Soweto, Johannesburg. The second one was the importance of information in opportunity discovery, growth and access to resources, especially finance, for township enterprises in Soweto. The research project focused on how members of the study perceived entrepreneurship or running a small business (perceptual variables) in Soweto, Johannesburg and their chances of future success or growth. The main part of the research incorporated enquiry into the expectations of economic role players (investment professionals), given information about these township enterprises has been catalogued on an information exchange.

Entrepreneurs are increasingly faced with numerous challenges, which range from lack of access to finance, non-financial support and strategic information on their markets (Zaza, 2014). Information as a screening and signalling mechanism would work to identify and document local economy entrepreneurs and businesses with the ability and capacity to be stewards of financial and development capital.

To accelerate efforts to have an inclusive economy, the Gauteng provincial government in South Africa has established a Township Economic Revitalisation (TER) programme. It is an initiative aimed at rethinking and reintegrating the township into mainstream economic activity mainly to enable previously marginalised communities to participate in the economics of South Africa (Gauteng Provincial Government, 2016). The TER programme is made up of various components that address economic revitalisation, such as harnessing the power of social capital and solidarity already existing in the townships through ventures such as spaza shops and rotating savings and credit organisations (also known as stokvels). The proposed establishment of a Township Stock Exchange (TSE) is one such feature that could be the buttress for the entire TER as it would provide for an alternative finance and capital market that would deliberately address financing and capitalisation in the township economy of Gauteng.

For any market to function information on buyers, sellers, the product itself, other related products and the market environment is essential for participants to make equilibrating decisions (reaching consensus on what price to buy or sell what quantities of what goods or services) (Akerlof, 1970; Spence, 1973; Stiglitz, 1975). Therefore using that market rationale for any bourse (stock exchange) to work data and information is critical, as is the case with any market. Unlike public stock markets, such as the Johannesburg Stock Exchange (JSE), where listing companies are required by law to provide their trading information, the challenge with the TSE would be acquiring data and information of listing companies. These are private companies or entities that are not required by law to publicise their information.

The Township Stock Exchange (TSE) is one the critical reasons why the research under review focused on Soweto, a township in Johannesburg. The problem is that there is no information on or information platform for township enterprises to serve as a signalling mechanism to implement the TSE where local economy investors could participate in its financial instruments as an alternative means of raising capital for small business. To demystify the existing challenges the research study aimed to develop an information exchange market for potential investment professionals to access township enterprise information and for local economy business owners to signal for research on their companies by operating or simulating a Township Venture Research (TVR) online platform using small business information.

Literature Review

Local Economic Development (LED) is a niche branch of economics that focuses on specific local community development issues. For LED to be possible a multi stake holder process involving various spheres of local society is required to enable LED (Leigh & Blakely, 2016). Economic development policy formulations involve wisdom and insight from various sectors and not just from economics (Leigh & Blakely, 2016). Various entrepreneurialism and economic development theories are discussed to accentuate the importance of entrepreneurship and enterprise development. Developmental areas such as townships have long been idling in the periphery and with budding initiatives from community entrepreneurs and innovators that lack alternative enterprise support, i.e. financial and non-financial support (Gauteng Provincial Government, 2016).

The New Market model promotes periphery areas as potential zones for opportunity and special economic development. Despite critiques into the New Market model, inspiring model examples can be drawn from global cities within the Alpha and Gamma global city rankings that implemented economic turnaround based on new markets model. An active, skillful and professional local authority (a key LED actor) will ensure that public-private partnerships with entrepreneurs are promoted. The National Development Plan also highlights the importance of professionalising local public service in the critical action items (National Development Plan, 2012). The Transformation, Modernisation and Re-industrialisation (TMR) mandate of Gauteng province (South Africa) is the primary policy that informs the TER strategy supports the Gauteng Provincial Government’s intention to facilitate the creation of a Township Stock Exchange (TSE) (Gauteng Provincial Government, 2016).

The TER acknowledges the establishment of a network-based growth to be employed within the Gauteng City Region; were spatial economies like knowledge, technology and infrastructure should be developed (Huggins & Thompson, 2015). The local entrepreneurship ecosystem should attract and crowd-in local knowledge to ensure that innovative and creative products are pioneered. The locale in this case competes for knowledge talent that improves the network capacity and quality of human capital despite proximity from other inputs (Leigh & Blakely, 2016). Information gaps (Mabuza, 2016) need to be filled by market role players who can price-in information collection efforts (Aparicio et al., 2016).

As part of TER strategy, the Gauteng provincial government called for proposals seeking to spearhead the establishment of a range of alternative financing mechanisms specialised for local economy business, namely the Township Stock Exchange (TSE). Stiglitz (2002) sheds insight into the tug-of-war (value malalignment) between investors and entrepreneurs in his work on paradigms of information economics. Considering the complexity of the Entrepreneurship-Information Market (inclusive of local economy businesses)-a systems thinking discipline can assist further study and understanding of hard issues in the South African environment comprising of capital concentrations, allocate inefficiencies (value/knowledge mismatch) (Price Waterhouse Coopers, 2015), unemployment (youth unemployment) (NIDS, 2016) and soft issues comprising of society dynamics, the perpetuation of the poverty cycle and social ills (Haughton & Khandker, 2009). These features characterise the local economy in the areas of interest in Johannesburg’s Township Regions.

The information gap has remained a key hindrance for alternative investments in Africa (Price Waterhouse Coopers, 2015). In the discussion above, information theory played centre stage to the discourse on the functioning of private markets with contributions from Akerlof (1970); Fama (1965); Hayek (1968); Spence (1993) & Stiglitz (1975). The private equity market in South Africa constitutes a ZAR 31 billion (US $2 billion) market with over ZAR 170 billion (US $11 billion) in assets under management (SAVCA, 2018). Since crowd funding is still evolving, these will cross reference with mainstream alternative market trends in South Africa. In the LED context under the enterprise development and support pillar, financial and nonfinancial mechanisms are essential to developing entrepreneurship (Fatoki, 2014).

At the LED level, crowd funding can be a good model as it is micro-in-nature. It is a good complementary mechanism for future higher funding support requirements (Zaza, 2014). Although the decision to crowd fund under the JOBS Act requires information disclosure, it could, if done at the incorrect phase of the business or product lifecycle hurt the business in future when it requires successive rounds of funding (Zaza, 2014). Langevoort & Thompson (2013) deliberate on the attributes of the correct quantity of information-sharing and the definition of publicans and how that affects the emerging enterprise.

Crowd funding uses social technologies, which are internet based, to provide small offerings to a limited public pool of private contributors or investors (UNDP, 2017) in private companies. The emerging characteristics of equity crowd funding would be relevant for the Township Stock Exchange (TSE) which was conceptualised in the Gauteng Provincial Government’s Township Economic Revitalisation (TER) strategy. The following proves the case for a crowd funding model for micro-enterprises to private limited companies (Zaza, 2014):

The crowd funding model appeals to a local group of people or role players therefore is collective wisdom on the local environment and conditions. This will take effect in addressing the informational aspects and going concern prospects of enterprise campaigning for the crowd’s funds.

The crowd funding model is often promoted from a local level and would be relevant in the LED and Township Stock Exchange context. It becomes easier to unlock social funds that are held in local saving societies. Local saving societies will easily identify with proposed campaigns from local enterprise and will identify with the plight of local entrepreneurs or innovators;

The crowd funding model offers continuous learning opportunities through knowledge and information dissemination considering the crowd or user base is typically end user technology savvy;

The nature of equity crowd funding should be disclaimed as risky to all stakeholders, however the cost of investing is on average reduced and opens up opportunities for a wider pool of contributors and investors;

Crowd funding offers great flexibility for smaller enterprises through the tailoring and structuring of deals. Assuming the Township Stock Exchange follows to a greater extent the equity crowd funding model such as flexibility (normally witnessed in private equity markets) will be required to ensure economic benefits are maximised.

The mainstream enterprise finance market is increasingly facing competition from emerging alternative and shadow intermediaries empowered by advances in technology to offer the same services but at significantly reduced costs. The improvements in technology presents great benefits but have also opened the way for rogue technology elements such as hackers and scammers therefore presenting greater operating expenses (i.e. anti-spam technology and regulatory costs).

Information as a signalling, screening and selection mechanism is very important for the development of the venture market in Africa. In the initial stages, at least minimal information is appreciated as a signal; the crowd will evaluate by screening and re-signalling their interest for more information or otherwise proceed to selection. Considerations on enterprises that use crowd funding campaigns for promotional and marketing opportunities as signals also communicate to potential partners, contributors and investors. The more economic role players involved, the more information created in relation to buyer and seller side research (Eccles et al., 2002), the more knowledge and insight outputs produced for alternative markets.

Methodology

This research study is consistent with a formative enquiry into an existing policy mandate and programme, the Township Economic Revitalisation (TER) programme. This new development programme seeks to embark on initiatives that include alternative finance markets

for township entrepreneurs and small business. The themes discussed are exploratory. They embody formative evaluative criteria that require assessments to be conducted for the purposes of developing or adapting programmes in order to refine and improve activities (Corey, 2011). Formative assessments can be conducted before (in order to formulate an appropriate intervention), during (monitoring and evaluation for directing and adapting the intended outcomes) and after (post evaluation) embarking on a specific programme in the formative stages.

The research is quantitative and exploratory in nature. It was exploratory because it involved an area of inquiry that is relatively new globally but is growing rapidly. Assuming a radical humanist paradigm aimed at achieving an understanding of investment professionals’ expectations of a township equity market based on the research simulation in order to provide discourse on the operationalization of the Township Stock Exchange (TSE). This research interrogated the status quo of development finance in small enterprises in the Township Local Economy using a subjectivist perspective. The status quo includes hard systems issues such as mainstream capital concentration and crowding out investments. The research strategy aimed to simulate a TSE platform by using information metrics from survey data on township enterprises during the TVR. This is basically the same way in which research on mainstream financial markets would be conducted; cataloguing data on all listing companies and entities.

The study had two phases: an exploratory exercise was carried out to collect data on high-performing small businesses in the local economy of Soweto, Johannesburg and to profile the information of an online platform (www.townshipventures.africa) using equity crowd funding or private equity industry standards. Questionnaire A was the signalling component (Spence, 1973). It was distributed to approximately 20 enterprises in Soweto, represented by owners or principal managers to furnish a basic biography of their entity. A quantitative survey of investment professionals’ expectations regarding the small business profile was posted on the online platform. This was conducted using a second questionnaire, Questionnaire B, which was administered online and manually. The investment practitioners viewed the biographies of township enterprises as if they were viewing them on an actual equity crowd funding platform or TSE. They made assessments on the information disclosed and conclusively provided the researcher feedback on their expectations. The key mission of the research project was to achieve the minimum viable aspects for the TSE platform through a township ventures research.

The research study was implemented in Soweto as the area of interest for the information on township enterprises. Consistent with the new markets model (Leigh & Blakely, 2016), for peripheral areas such as townships, information is critical to ensure new dispensation developments are encouraged. The South African investment professionals’ industry constituted the population under consideration. The statistical data on their expectations were key to the study’s inference. The study, achieved a response rate of 89.5% on the primary sample generalizable to the entire population. Data were collected from predetermined list of leads that were randomly selected to make up the samples.

Information Exchange Presentation

The principal objective of the research project was to collect and arrange information of township enterprises performing a screening and selecting function. The literature surveyed in the report generally categorises two types of entrepreneurs, viz. opportunity and necessity entrepreneurs (Davidsson, 2006). More than 66.7% of the key persons interviewed have been in business between one and seven years most (91.7%) with a formal education. The researcher had limited influence on the biographical diversity. Inferences on gender participation in entrepreneurship were drawn from a township database that was compiled for Soweto, where the same inclusion criteria applied: 41% of the entities from a sample of about n=~50 000 were female-led (Research Go, 2015). However the quality and orientation of enterprises were severely limited (Krauss et al., 2005). Spreading the net wider for unique female-led enterprises within Soweto would have yielded a better response in this regard but would have required more time and resources. All the respondents were black, in line with the Research Go (2015) Soweto database where 99% were black and 1% was coloured/mixed.

In Krauss et al. (2005) entrepreneur orientation across various industries plays an important role. The TMR policy strategy seeks to employ a re-industrialisation approach to the township market in Gauteng, were household role players have been mostly consumers. The value addition by most township enterprises is not as sophisticated and mostly involves endconsumer products. Most of the key person respondents (91.7%) confirmed that their small enterprises had business strategies. The questionnaire probed business elements adapted from the business model canvas (Strategyzer, 2018) and how influential these elements were in the overall business strategy and vision of the firms (Figure 1).

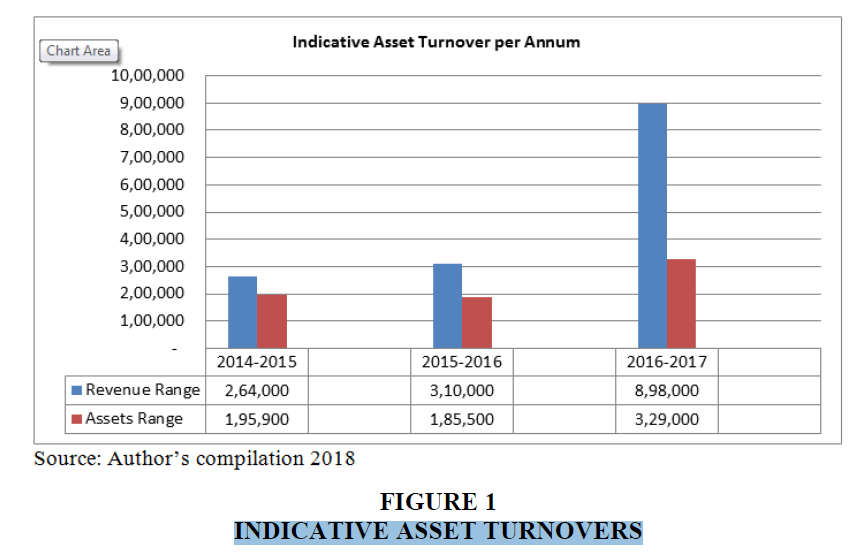

Private enterprises are not obliged to disclose information (Mabuza, 2016; Zaza, 2014) especially if the disclosures materially reveal intellectual property and trade secrets (Langevoort & Thompson, 2012). Revenue values (lower rank values) averaged R.264,000 per annum (2014/2015 financial year), R.310,000 (2015/2016 financial year) and R.898,000 per annum (2016/2017 financial year). Gross asset values (lower rank values) averaged R.195,900 (2014/2015 financial year), R.185,000 (2015/2016 financial year) and R.329,000 (2016/2017 financial year). To satisfy curiosity especially with regards to the performance of the TVR cohort, the indicative asset turnover ratio did suggest a profit growth potential over time. Despite this research project being a simulation of expectations concerning a proposed Township Stock Exchange or a similar market, knowledge transfers on how stakeholders can utilise such alternative markets for business growth need to be applied. The entrepreneurs and small business owners were asked if they would consider participating on a township stock market and for what possible reasons. Most of the respondents answered positively considering fundraising within the range of R.50,000 and R.4 million and above, mostly for the following reasons: Raising additional capital, asset finance, market exposure and working capital requirements.

Results and Discussion

Top responding profiles from the total analyses sample n=77 were affiliated to technology partners (22%), advisory/consulting (19.5%), banking (18.2%) and investment/angel investment companies (11.7%). The respondent profiles were representative of a young middle class, working in the financial services industry in South Africa with-an average of one to three years’ work experience in the industry. From the information provided, investment professionals had to screen (Ibrahim, 2015) each profile based on their expectations aligned with the industry standards. This discovery process allows the “crowd” of professionals to sieve through the “market lemons” and cite the best enterprises or initiatives (Ibrahim, 2015). The top three sector profiles mentioned here in the higher ranks were sports and recreation (48.1%), food and food processing (32%), business services/trade (22.1%) and fashion and beauty (20.8%). Investor expectations are often guided by common investment metrics such as revenue, assets and return on investment, product orientation and business strategy. Responses on the most value perceived, based on the top profile selected, returned with value perception scores: somewhat valuable (18.2%), very valuable (63.6%) and extremely valuable (18.2%). There was a strong positive perception of the value presence within the de-identified profiles selected. The delivery of information on emerging small businesses in the township was widely celebrated by investment professional participants. From the open responses regarding the platform, wider participation from entrepreneurs and small business owners was expected to grow the TVR database further.

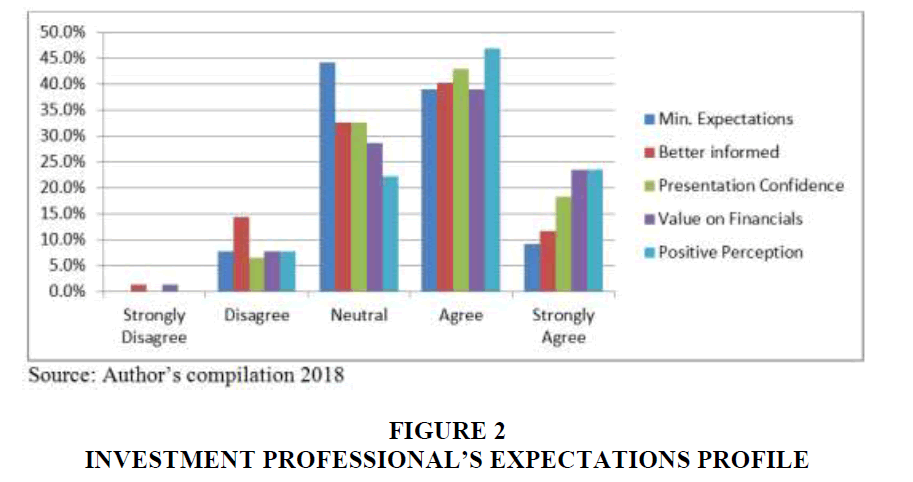

Stiglitz (2002) makes reference to the importance of perception especially from the entrepreneur’s viewpoint. The entrepreneur decides how much based on their real potential they would like to disclose, hence the entrepreneurs insider/behaviour information is important to analyse. An entrepreneur’s actions for example a decision to explore an untapped market can be decoded as information regarding their boldness to prospect new ideas and create economic potential or otherwise. Business expectations are a significant determinant when it comes to private capital formation (Fourie & Burger, 2009). Positive (forward looking) expectations are directly related to capital formation overtime and the opposite is also true (Figure 2).

Do entrepreneurs or key business owners want to disclose since they are not obliged to? In a fast-paced technologically-oriented world, economic role players rely on information to make decisions. Zaza, (2014) refers to the reluctance of emerging enterprises in disclosing their operations. Stiglitz (2002) states the paradigm of disclosure, the willingness of entrepreneurs or their respective entities to be listed on the Township Ventures Research (this research project), is behavioural information, which is a form of disclosure. The degree of disclosure also informs role players of the entrepreneur’s confidence in their business operations despite the consequences of that disclosure. Conversely entrepreneurs could be very confident about their products and processes but wish to remain private, retaining much of their trade secrets or technological prowess. From the information profiles presented more than half felt positive about the performance quality presented.

Performance quality has quantitative and qualitative aspects. The quantitative aspects relate to financial metrics which can be used to compare firms across the same industry or different industries. The qualitative aspects relate to brand equity, customer loyalty and other qualitative indicators. These often translate to how well the firm interacts with its stakeholders within the operating environment. Value presented based on revenue and asset values, more information always allows more discovery, especially into high-value emerging businesses (Stiglitz, 2002). There is also a risk that low-value businesses would make up the market standard creating a lemon market (Ibrahim, 2015; Akerlof, 1970).

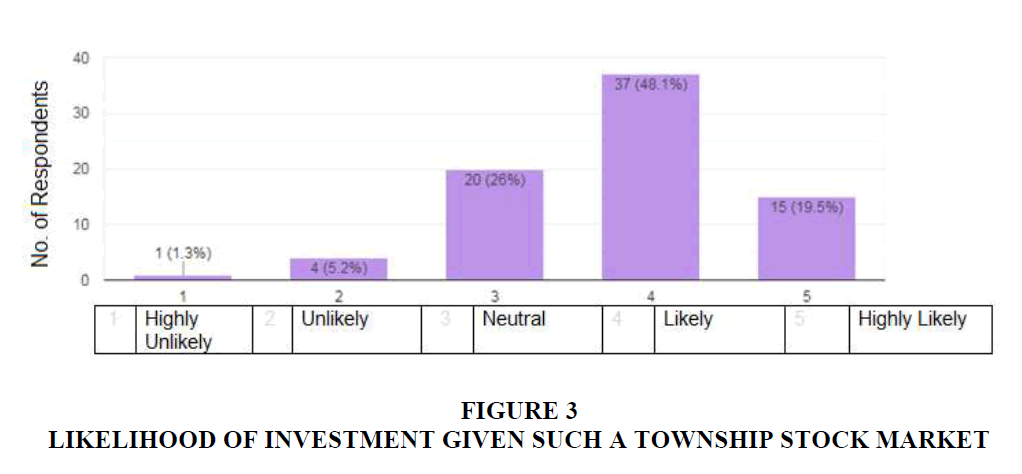

Likelihood of Investment given such a Township Stock Market (TSM). If the solution in addressing information-gap market failures is an information exchange (towards the equity crowd funding or stock exchange model), is that likely to influence the behaviour of economic role players? This discourse is elusive and its merits could be reserved for another essay. Stiglitz (2002) considers the motivations for gathering or not gathering information and how they influence efficiency. However, despite the dynamics of information-sharing, lack of information leads to an agency problem when it comes to unlocking value in small enterprises (in the form of alternative finance for growing these small enterprises) (Stiglitz, 2002) (Figure 3) (Source: Author’s Compilation 2018).

The likelihood of investing in township enterprises, given such an information exchange, is critical in ascertaining a complete expectations’ profile of the investing crowd (be it Soweto community-based or external investors). This question generated some significant negative feedback but overall the likelihood of investing in township ventures was 48.1% indicating likely to invest and 19.5% highly likely.

Conclusion

In pursuit of implementing an information exchange aligned to small business performance and determining how that translates into alternative financing solutions in the township economy, new market model solutions are postulated. The principle step to begin the project was understanding the problem Limited information was available and there was no information platform to serve as a signalling mechanism to implement an alternative financing, i.e. a township stock market. A stock market for the township has already been proposed by the Gauteng provincial government and its stakeholders. The project set out to demystify the existing challenge by developing an information exchange platform that lists township small enterprises’ information. The rationale for implementing an information exchange platform was to enable investment professionals to access township enterprises’ information and for entrepreneurs to signal to township venture stakeholders. Value perception starts when entrepreneurs signal their behaviour relative to the novelty of their idea/business. Value perception held a very high rating, 63.6% of the profiles viewed. Information presentation should meet a very high standard; this is critical for efficient markets.

The idea of early stage investing in high potential enterprises “the anti-lemon market” is a sought after possibility by an economic role player even starting at community investor level. Investing in the township market pursuant to a new markets model is a positively expressed sentiment by 62.4% of the respondents. Should such a township market exist, most respondents would be interested in investing. However some required insight on how the market would actually work and some, owing to the new market model postulations, were concerned about the lack of community ownership.

In conclusion, information is critical for all stakeholders to make transactional decisions. The economic role players’ behaviour (non-price data) is information as much as price data is and should be factored into decision-making. Entrepreneurs starting small businesses in harsh township environments with limited resources should be decoded as information to community role players. The TVR simulation using Soweto-Johannesburg based data achieved an information exchange to disseminate the information and potential of a new markets model in the township and the possibility of a Township Stock Exchange in Gauteng South Africa. For an alternative finance mechanism to work, such as the Township Stock Exchange, information flow is needed. The rewards of collecting information have to exceed the search costs, at least to create efficient equilibriums.

References

- Akerlof, G.A. (1970). The market for lemons: Quality uncertainty and the market mechanism. The Quarterly Journal of Economics, 84(3), 488-500.

- Aparicio, S., Urbano, D., & Audretsch, D. (2016). Institutional factors, opportunity entrepreneurship and economic growth: Panel data evidence. Technological Forecasting and Social Change, 102(C), 45-61.

- Blankley, W.O., & Booyens, I. (2010). Building a knowledge economy in South Africa. South African Journal of Science, 106(12), 1-6.

- CoGTA. (2017). The national framework for local economic development: Creating innovation-driven local economies.

- Corey, E. (2011). Formative research: What, why and how. In training course in sexual and reproductive health research, Geneva Workshop.

- Davidsson, P. (2006). Nascent entrepreneurship: Empirical studies and developments. Foundations and Trends® in Entrepreneurship, 2(1), 1-76.

- Eccles, R.G., Herz, R.H., Keegan, E.M., & Phillips, D.M. (2002). The value reporting revolution: Moving beyond the earnings game. John Wiley & Sons: New York.

- Fama, E.F. (1965). The behaviour of stock-market prices. The Journal of Business, 38(1), 34-105.

- Fatoki, O. (2014). The causes of the failure of new small and medium enterprises in South Africa. Mediterranean Journal of Social Sciences, 5(20), 922-927.

- Fatoki, O., & Chindoga, L. (2011). An investigation into the obstacles to youth entrepreneurship in South Africa. International Business Research, 4(2), 161-169.

- Fourie, C.F., & Burger, P. (2009). How to think and reason in macroeconomics. Juta Publishing Co: Cape Town.

- Gauteng Provincial Government. (2016). Gauteng provincial government online.

- Haughton, J., & Khandker, S.R. (2009). Handbook on poverty+inequality. World Bank Publications: Washington, DC.

- Hayek, F.A. (1968). The confusion of language in political thought: With some suggestions for remedying it, 20. Institute of Economic Affairs.

- Huggins, R., & Thompson, P. (2015). Entrepreneurship, innovation and regional growth: A network theory. Small Business Economics, 45(1), 103-128.

- Ibrahim, D.M. (2015). Equity crowd funding: A market for lemons. Minnesota Law Review, 100, 561-607

- Krauss, S.I., Frese, M., Friedrich, C., & Unger, J.M. (2005). Entrepreneurial orientation: A psychological model of success among southern African small business owners. European Journal of Work and Organizational Psychology, 14(3), 315-344.

- Langevoort, D.C., & Thompson, R.B. (2012). Publicness in contemporary securities regulation after the JOBS Act. Georgetoen Law Faculty Publications and Other Works.

- Leigh, N.G., & Blakely, E.J. (2016). Planning local economic development: Theory and practice. SAGE Publications: Thousand Oaks.

- Mabuza, J. (2016). The entrepreneur's perspective on crowd funding as an equity access mechanism. Doctoral Dissertation, University of Pretoria.

- NIDS. (2016). National income dynamic survey wave 4. University of Cape Town.

- Price Water house Coopers. (2015). Africa: A closer look at value Valuation methodology survey 2014/15.

- ResearchGo. (2015). Tshepo one million survey. ResearchGo: Johannesburg.

- SAVCA. (2018). South African venture capital association and private equity association.

- Spence, M. (1973). Job market signaling. The Quarterly Journal of Economics, 87(3), 355-374.

- Stiglitz, J.E. (1975). The theory of screening education, and the distribution of income. The American Economic Review, 65(3), 283-300.

- Stiglitz, J.E. (2002). Information economics and paradigm change. The American Economic Review, 92(3), 460-501.

- Strategyzer. (2018). Business model canvas.

- Zaza, K. (2014). Emerging growth companies under the JOBS Act: An Analysis of the IPO On-Ramp, 3 J. Marshall Global Mkt. LJ 63 (2014). John Marshall Global Markets Law Journal, 3(1), 1-26.