Review Article: 2023 Vol: 27 Issue: 4

Influence of Capital Structure on Profitability: A Differential Analysis between Conventional Banks and Islamic Banks of Pakistan

Mehak Rehman, University of the Punjab Gujranwala

Citation Information: Rehman, M. (2023). Influence of capital structure on profitability: a differential analysis between conventional banks and islamic banks of pakistan. Academy of Marketing Studies Journal, 27(4), 1-15.

Abstract

This study aims to investigate the influence of capital structure on profitability in the context of conventional and Islamic banks of Pakistan. This study also examines the difference in profitability of conventional and Islamic banks. Panel data were extracted from archival records of conventional and Islamic banks of Pakistan for 10 years (i.e., from 2009/10 to 2018/19). The analysis of a fixed-effect estimation model suggested that capital structure of conventional and Islamic banks of Pakistan has a significant positive correlation with profitability. The results show a substantial difference in the profitability of conventional and Islamic banks of Pakistan.

Keywords

“Capital structure”, “Conventional Bank”, “Islamic Bank”, “Profitability”.

JEL Classifications

G20, G21.

Introduction

Many researchers have provided various definitions of capital structure. Brealey, Myers, and Marcus (2009) avowed that capital structure is an assortment of long-term liabilities and equity financing. The concept of capital structure is commonly illustrated as a fusion of debt and equity, which constructs a firm's capital. The financial decisions regarding capital composition are called capital restructuring decisions or debt restructuring decisions. Firms can maximize their overall market value by issuing various securities (Abor, 2005). The capital structure consists of an elongated supply of money, including debt, equity, and retained earnings, which are used to meet the capital expenditures of a firm; such sources are also denoted as permanent sources of financing.

Capital structuring is one of the major strategic decisions with a firm's profitability directly influenced by such choices; thus, decision-makers need to be highly careful while making such decisions.

Statement of Dilemma

From the last few decades, capital structuring and profitability has become an issue of substantial attention and investigation. Capital structuring decisions of financial (e.g., banks) and non-financial firms (e.g., retail organization) are almost similar.

However, because of every business industry's distinct nature, they vary on the industry level of the organization (Velnampy & Niresh, 2012). Numerous empirical studies have found a negative association between leverage and profitability. For instance, Titman and Wessels (1988) argue that firms with high profitability maintain low debt levels because, for such firms, funds can be managed from internal financing resources.

Similarly, Kester (1986) also indicates a significant negative correlation between debt to asset ratios and a firm's profitability. Furthermore, Rajan and Zingales (1995) also found an inverse relationship between leverage and profitability. On the other hand, some of the previous studies propose a positive correlation between leverage and profitability. For example, Velnampy and Niresh (2012) found a significant positive relationship between leverage and firm performance. Similarly, Abor (2005) also observed a positive association between leverage and profitability.

The above discussion indicates that the empirical findings of the studies on capital structure and profitability are inconsistent and fragmented; thus, it is worth investigating the relationship between capital structure and profitability.

Although the banking sector of Pakistan has faced tremendous growth from the last two decades, decision-makers still find it hard to decide whether to raise new funding through equity or debt. Because of the shortage of empirical findings for the guidance decision-makers to select the right financing instrument to maximize the profits. Since Pakistan is an Islamic country and interest is prohibited in Islamic law, many Pakistani citizens tend to use Islamic banking. On the other hand, a large number of people prefer conventional banking. The banking sector in every country generates enormous revenues and is considered an indicator of economic growth. However, the research on the relationship between capital structure and profitability in conventional and Islamic banks did not get much attention in Pakistan. Therefore, this research aims to investigate the influence of capital structure on profitability in the context of conventional and Islamic banks of Pakistan. Furthermore, this study also analyzes the profitability difference between conventional banks and Islamic banks in the country.

The primary purpose of this research has been divided into the following research objectives:

1. To investigate the influence of capital structure on the profitability of conventional banks.

2. To examine the impact of capital structure on the profitability of Islamic banks.

3. To explore the difference in the profitability of conventional banks and Islamic banks.

Scope of the Study

As this study examines the banks' profitability, it has significant importance for the investors/depositors, analysts, and practitioners of both conventional and Islamic banks. Moreover, the findings of this research are useful for CEOs, financial managers, and investors/depositors to analyze the bank's performance.

Literature Review

The subject of capital structure and profitability has been a popular topic of research for corporate finance researchers for the last few decades. However, previous studies have proposed contradictory results (Taani, 2013). For instance, Long and Malitz (1985) found that capital structure and profitability are not significantly correlated. On the other hand, Petersen and Rajan (1994) suggest that capital structure and profitability have a significant positive association. Similarly, Hung, Albert, and Eddie (2002) conducted a study in Hong Kong to investigate the relationship between capital structure and profitability in the context of property builders and contractors. For their research, the data was accessed from an electronic financial database named "DataStream" and their findings showed that capital structure and profitability have an insignificant association. Abor (2005) conducted another study to examine the relationship between capital structure and leverage ratios in the Republic of Ghana. All the listed firms in Ghana Stock Exchange (GSE) were included in this study, and five years' data were analyzed (i.e., from 1998 to 2002). Abor (2005) employed a regression analysis on the panel data to examine the relationship between capital structure and profitability. The empirical results showed a positive association between short term leverage to assets (SDA) ratios. Firm performance was calculated with the ratios of the return on equity (ROE). The analysis showed a negative correlation between long term leverage to assets (LDA) and return on equity (ROE). This study shows that the profitability of a firm decreases with an increasing percentage of long-term leverage. However, a positive correlation was found between total leverage to assets ratio (DA).

In a study, while examining the influence of Capital Structure on the bank's profitability in Turkey, Büyüksalvarci and Abdioglu (2011) observed 120 Turkish banks from 2011 to 2010. They found that the leverage ratio of banks has a positive association with profitability measure return on assets (ROA), whereas the inverse correlation between return on equity (ROE) and net interest margin (NIM). However, in the study conducted by Doğan (2013), there is a negative correlation between capital structure and profitability in Turkish banks in a dataset for the period of 2008 to 2011.

A similar study was conducted in the Jordanian context with five years' data (i.e., from 2007 to 2011) was collected from 12 conventional banks of the country listed on the Amman Stock Exchange (Taani, 2014). The multiple regression model was employed to analyze the relationship between capital structure and firm performance. The performance of the firms (i.e., sample banks) was measured with the help of various indicators, such as net interest margin (NIM), net profit (NP), return on capital employed (ROCE), and return on equity (ROE). Capital structure was measured through total debt to equity (DE) and debt to funds (DF) ratio. The results showed that financial performance is significantly and positively correlated with debt, whereas the return on equity (ROE) has an insignificant relationship with the total debt.

Research Model

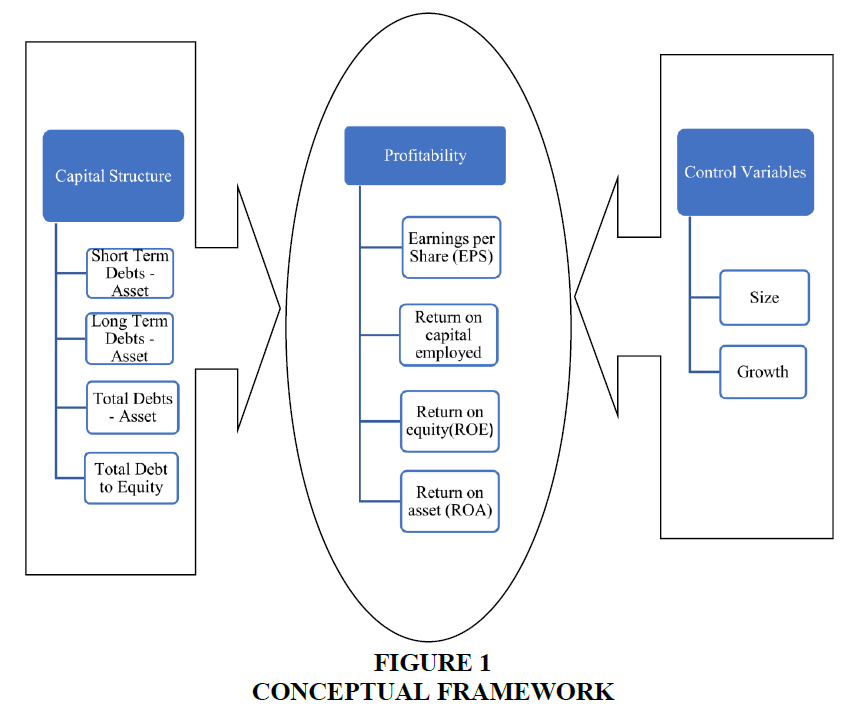

The profitability of conventional banks and Islamic banks depend upon the capital structure of banks. Hence;

Profitability =f (Capital structure)

This equation shows that profitability is the function of capital structure Figure 1.

The variables which are used for the development of the above-mentioned conceptual framework were in reference to (Abbadi & Abu-Rub, 2012; Abor, 2005; Arabahmadi & Arabahmadi, 2013; Chechet & Olayiwola, 2014; Goyal, 2013; Nirajini & Priya, 2013; Niresh, 2012; Opoku, Adu, & Anarfi, 2013; Salim & Yadav, 2012; Taani, 2013).

Hypotheses of the Study

Capital structure and profitability

Previous research on capital structure and profitability proposes mixed results regarding the relationship between Capital Structure and profitability. The current study is aimed at investigating the relationship between these two constructs in the context of developing countries like Pakistan; thus, the following hypothesis is proposed.

H1: There is a positive influence of capital structure on the profitability of conventional and Islamic banks of Pakistan.

Generally, the profits of larger banks are higher than those of smaller ones, with an increase in bank size, causing a significant increase in profitability (Short, 1979). The literature suggests a positive association between a bank's assets and profitability. Thus, it is proposed that:

H2: There is a positive influence of asset size on the profitability of conventional banks and Islamic banks of Pakistan.

Asset Growth and Profitability

A positive correlation between growth and performance reflects the efficiency of a bank's operational activities. The literature shows a positive correlation between profitability and growth (REF). Thus, it is hypothesized that:

H3: There is a positive impact of growth on the profitability of conventional and Islamic banks of Pakistan.

In addition to the above hypotheses, the current study also investigates the difference in the impact of capital structure on the profitability of conventional and Islamic banks of Pakistan. Accordingly, the following hypothesis is proposed:

H4: The impact of capital structure on profitability differs in Islamic banks than those of conventional banks of Pakistan.

Methodology

To test the proposed hypotheses, we selected five conventional and five Islamic banks in the country. Accordingly, 50 observations for each of the sample categories (i.e., five conventional and five Islamic banks) were considered from the year 2009/10 – 2018/19. Using archival research strategy, we obtained the financial data from respective banks' annual reports, including audited balance sheets and income statements.

A fixed-effect estimation method was adopted, and a multivariate linear regression analysis was performed on STATA software and MS Excel. The data normality was ensured by calculating the values of skewness and kurtosis. Further, autocorrelation, heteroscedasticity, and multicollinearity tests were performed to examine the reliability of the data. The results showed that the data was normal and reliable.

To enlarge the number of observations in the sample of the study and by a balanced panel data approach, a combination comprising of utmost bank numerals and years during which archival record accessible were considered. Consequently, 50 observations for 5 Conventional banks and 50 observations for 5 Islamic banks of Pakistan were considered during the period of 2009/10 – 2018/19.

Panel data was used since it includes the benefit of providing greater information because it contains time-series information that encloses the dynamic natures of the data and also the cross-sectional information that captures individual variability of the data. According to Gujarati (2004), panelata ensures greater freedom, greater effectiveness, greater variability, and lesser multicollinearity between variables.

Variable Measurement

Dependent Variable

Profitability is the dependent variable, which was calculated through 4 different measures. The measures are as follows:

Earnings per Share (EPS), Return on Capital Employed (ROCE), Return on Assets (ROA), Return on Equity (ROE).

Independent Variable

Capital structure is the independent variable, which was measured with the help of Short-term Liability to Asset (STA), Long Term Liability to Asset (LTA), Total Liabilities to Asset (TTA), and Total Liabilities to Total Equity (TTE).

Control Variables

Control variables include size and growth.

Econometrics Model

Based on the research mode, econometrics model is explained as;

PEPS = β0+ β1(STA)+β2 (LTA)+β3(TTA)+β4(TTE)+ β5(LOG S)+ β6(GRW)+ ε …. (Model # 1)

PROCE = β0+ β1(STA)+β2 (LTA)+β3(TTA)+β4(TTE)+ β5(LOG S)+ β6(GRW)+ ε …(Model # 2)

PROE = β0+ β1(STA)+β2 (LTA)+β3(TTA)+β4(TTE)+ β5(LOG S)+ β6(GRW)+ ε …. (Model # 3)

PROA = β0+ β1(STA)+β2 (LTA)+β3(TTA)+β4(TTE)+ β5(LOG S)+ β6(GRW)+ ε …. (Model # 4)

Where,

β0 is the intercept, β1, β2, β3, β4, β5, and β6 are explaining the sensitivity of the independent variables, and ; ε is the error term.

PEPS = Profitability is measured with Earnings per Share (EPS) as a proxy.

PROCE = Profitability is measured with return on capital employed (ROCE) as a proxy.

PROE = Profitability is measured with a return on equity (ROE) as a proxy.

PROA = profitability is measured with Return on Asset (ROA) as a proxy.

STA= Short Term Liabilities to Asset

LTA= Long Term Liabilities to Asset

TTA = Total Liabilities to Asset

TTE = Total Liabilities to total equity

LOGS = Log of the total assets

GRW = growth of the asset (percentage change in the bank's asset)

Analysis and Results

Descriptive Statistics

Descriptive Statistics of Conventional Banks Panel: Table 1 shows the descriptive statistics structure of the conventional banks' panel. It comprises the number of observations, minimum, maximum, mean, and standard deviation of criterion, predictor, and control variables of the study.

| Table 1 Summary of Descriptive Statistics | |||||

| Variables | Observations (N) | Minimum | Maximum | Mean | Standard Deviation |

| EPS | 50 | 5.9 | 24.3 | 11.2906 | 8.262335 |

| ROCE | 50 | 9.78e+07 | 12.27093 | .9805703 | 1.39e+07 |

| ROA | 50 | .0138792 | .037189 | .0162068 | .0107829 |

| ROE | 50 | .3294585 | 1.071073 | .2141277 | .1985511 |

| STA | 50 | .0049837 | .1280179 | .0171512 | .021206 |

| LTA | 50 | -6.631136 | 2.245116 | .1785490 | 1.006222 |

| TTA | 50 | -4.56729 | 2.258584 | .1210085 | .7454327 |

| TTE | 50 | .2045052 | 63.92369 | 15.19691 | 10.31172 |

| LOGS | 50 | 16.82076 | 21.52006 | 20.02666 | .7472265 |

| GRW | 50 | -6.186316 | 1 | .084416 | .9776516 |

Descriptive Statistics of Islamic Banks Panel

Table 2 shows the descriptive statistics structure of the Islamic banks' panel.

| Table 2 Summary of Descriptive Statistics | |||||

| Variables | Observations (N) | Minimum | Maximum | Mean | Standard Deviation |

| EPS | 50 | -2.19 | 5.01 | .509974 | 1.53106 |

| ROCE | 50 | 6.560324 | 20.138 | 9.231789 | 12.96803 |

| ROA | 50 | .0302971 | 0.0641062 | .0024796 | .0152398 |

| ROE | 50 | .2113378 | 0.2544547 | .0027441 | .1053165 |

| STA | 50 | .002124 | 0.0790222 | .0115816 | .0103139 |

| LTA | 50 | -3.196884 | 2.10574 | .1904579 | .5815851 |

| TTA | 50 | -2.980444 | 2.115315 | .1735363 | .5579246 |

| TTE | 50 | -1.698575 | 19.77959 | 8.167265 | 5.641429 |

| LOGS | 50 | 15.07876 | 20.09187 | 17.60814 | 1.183724 |

| GRW | 50 | -8.061644 | 1 | .1472724 | 1.225031 |

Correlation Analysis

Conventional Banks Panel

Correlation analysis of the independent, dependent, and control variables of conventional banks of the study is explained in Table 3.

| Table 3 Correlation Matrix | ||||||||||

| Variables | EPS | ROCE | ROA | ROE | STA | LTA | TTA | TTE | LOG S | GRW |

| EPS | 1.0000 | |||||||||

| ROCE | -0.3297* 0.0194 |

1.0000 | ||||||||

| ROA | 0.8275* 0.0000 |

-0.1343* 0.3525 |

1.0000 | |||||||

| ROE | 0.3501* 0.0127 |

0.0489 0.7357 |

0.3953* 0.0045 |

1.0000 | ||||||

| STA | 0.0009 0.9949 |

-0.5421* 0.0000 |

0.1584* 0.2719 |

-0.1530* 0.2889 |

1.0000 | |||||

| LTA | -0.1132* 0.4336 |

-0.0260 0.8577 |

0.0744 0.6077 |

-0.0891 0.5385 |

0.2941* 0.0381 |

1.0000 | ||||

| TTA | -0.1333* 0.3559 |

-0.0213 0.8830 |

0.0919 0.5255 |

-0.1046* 0.4697 |

0.3895* 0.0052 |

0.9893* 0.0000 |

1.0000 | |||

| TTE | -0.4726* 0.0005 |

0.2319* 0.1051 |

-0.4154* 0.0027 |

0.5418* 0.0000 |

-0.1372* 0.3421 |

0.2144* 0.1349 |

0.2025* 0.1584 |

1.0000 | ||

| LOG S | 0.4733* 0.0005 |

-0.4080* 0.0033 |

0.1025* 0.4788 |

0.1632* 0.2574 |

-0.3936* 0.0047 |

-0.0277* 0.8486 |

-0.1265* 0.3813 |

-.0828 0.5674 |

1.0000 | |

| GRW | 0.1637* 0.2561 |

-0.0944 0.5144 |

-0.0973 0.5015 |

0.1620* 0.2611 |

-0.6797* 0.0000 |

-0.3600* 0.0102 |

-0.4738* 0.0005 |

0.0298 0.8371 |

0.5077* 0.0002 |

1.0000 |

Islamic Banks Panel

The correlation analysis of Islamic banks in the study is explained in Table 4.

| Table 4 Correlation Matrix | ||||||||||

| Variable | EPS | ROCE | ROA | ROE | STA | LTA | TTA | TTE | LOG S | GRW |

| EPS | 1.0000 | |||||||||

| ROCE | -0.853* 0.0000 |

1.0000 | ||||||||

| ROA | 0.5669* 0.0000 |

-0.365* 0.0083 |

1.0000 | |||||||

| ROE | 0.8945* 0.0000 |

-0.703* 0.0000 |

0.719* 0.0000 |

1.0000 | ||||||

| STA | 0.0856 0.5543 |

-0.0313 0.8294 |

0.6378* 0.0000 |

0.1037* 0.4735 |

1.0000 | |||||

| LTA | 0.0720 06343 |

-0.0041 0.9783 |

0.4254* 0.0032 |

0.0529 0.7269 |

0.5876* 0.0000 |

1.0000 | ||||

| TTA | 0.0760 0.6157 |

-0.0081 0.9575 |

0.4452* 0.0019 |

0.0589 0.6973 |

0.6120* 0.0000 |

0.9994* 0.0000 |

1.0000 | |||

| TTE | 0.6307* 0.0000 |

-0.6942* 0.0000 |

0.3849* 0.0058 |

0.5701* 0.0000 |

0.0223 0.8780 |

0.2936* 0.0476 |

0.2921* 0.0489 |

1.0000 | ||

| LOG S | 0.6431* 0.0000 |

-0.7505* 0.0000 |

0.2243* 0.1173 |

0.5595* 0.0000 |

-0.1921* 0.1814 |

-0.1411* 0.1814 |

-0.1398* 0.3543 |

0.8787* 0.0000 |

1.0000 | |

| GRW | -0.0077 0.9579 |

-0.0183 0.8998 |

-0.6139* 0.0000 |

-0.0544 0.7074 |

-0.9268* 0.0000 |

-0.6100* 0.0000 |

-0.6336* 0.0000 |

-0.0214 0.8827 |

0.1919* 0.1818 |

1.0000 |

Regression Analysis Results of Model # 1

PEPS = β0+ β1(STA)+β2 (LTA)+β3(TTA)+β4(TTE)+ β5(LOG S)+ β6(GRW)+ ε

Interpretation of Model # 1 Results

Conventional Banks

Table 5 shows in case of conventional banks, Short Term liability to Asset (STA), Total liability to total Assets (TTA), Total liability to total Equity (TTE), Size (LOGS), and Growth (GRW) has a positive impact on Earning Per Share (EPS). Furthermore, holding other variables constant, every single unit increase in the above said variables caused the Earning Per Share (EPS) to increase by 14.50909, 11.58155, .0253175, .7835425, and .5737956 units, respectively. Whereas Long Term liability to Asset (LTA) negatively impacts EPS, means every single unit increase in the said variable will lead Earning Per Share (EPS) to decrease by 9.747232 units. For the conventional bank variables, Table 5 shows that p values for all variables are less than 0.05; thus, indicate the significance of the coefficients. R Square value of 72 % approximately in the said table for conventional banks indicates that STA, LTA, TTA, TTE, LOGS, and GRW cause a total of 72% variance in EPS. Thus, the findings show that in Pakistan's conventional banks, the capital structure variables, size, and growth significantly influence profitability (EPS).

| Table 5 Regression Result* | ||

| Variables | Conventional Banks | Islamic Banks |

| STA | 14.50909 (0.028) |

152.9257 (0.007) |

| LTA | -9.747232 (0.038) |

98.53969 (0.000) |

| TTA | 11.58155 (0.025) |

-105.4107 (0.000) |

| TTE | .0253175 (0.011) |

.0177084 (0.037) |

| LOGS | .7835425 (0.041) |

1.001645 (0.028) |

| GRW | .5737956 (0.035) |

.8793579 (0.014) |

| R-square | 0.7150 | 0.6296 |

Islamic Banks

Table 5 shows in case of Islamic banks, Short Term liability to Asset (STA), Long Term liability to Asset (LTA), Total liability to total Equity (TTE), Size (LOGS), and Growth (GRW) has a positive impact on Earning Per Share (EPS). Furthermore, holding other variables constant, every single unit increase in the above said variables caused the Earning Per Share (EPS) to increase by 152.9257, 98.53969, .0177084, 1.001645 and .8793579 units, respectively. Whereas Total liability to total Assets (TTA) negatively impacts EPS, which means every single unit increase in the said variable will lead Earning Per Share (EPS) to decrease by 105.4107 units. For the Islamic bank variables, Table 5 shows that p values for all variables are less than 0.05; thus, indicate the significance of the coefficients. R Square value of 63 % approximately in the said table for Islamic banks indicates that STA, LTA, TTA, TTE, LOGS, and GRW cause a total of 63% variance in EPS. Thus, the findings show that in Pakistan's Islamic banks, the capital structure variables, size, and growth significantly influence profitability (EPS).

Regression Analysis Results of Model # 2

PROCE = β0+ β1(STA)+β2 (LTA)+β3(TTA)+β4(TTE)+ β5(LOG S)+ β6(GRW)+ ε

Interpretation of Model # 2 Results

Conventional Banks

Table 6 shows in case of conventional banks, Short Term liability to Asset (STA), Long Term liability to Asset (LTA), Total liability to total Equity (TTE), Size (LOGS), and Growth (GRW) has a positive impact on Return on Capital Employed (ROCE). Furthermore, holding other variables constant, every single unit increase in the above said variables caused the Return on Capital Employed (ROCE) to increase by 7.81e+08, 1.55e+07, 163568.8, 1.36e+07 and 9729605 units, respectively. Whereas Total liability to total Assets (TTA) negatively impacts ROCE, which means every single unit increase in the said variable will lead Return on Capital Employed (ROCE) to decrease by 2.08e+07 units. For the conventional bank variables, Table 6 shows that p values for all variables are less than 0.05; thus, indicate the significance of the coefficients. R Square value of 93% approximately in the said table for conventional banks indicates that STA, LTA, TTA, TTE, LOGS, and GRW cause a total of 93% variance in ROCE. Thus, the findings show that capital structure variables, size, and growth in Pakistan's conventional banks significantly influence profitability (ROCE).

| Table 6 Regression Result* | ||

| Variables | Conventional Banks | Islamic Banks |

| STA | 7.81e+08 (0.000) |

2.38e+08 (0.000) |

| LTA | 1.55e+07 (0.046) |

-1.24e+08 (0.000) |

| TTA | -2.08e+07 (0.016) |

1.32e+08 (0.000) |

| TTE | 163568.8 (0.015) |

38935.39 (0.048) |

| LOGS | 1.36e+07 (0.000) |

1738562 (0.000) |

| GRW | 9729605 (0.000) |

717909.1 (0.039) |

| R-square | 0.9266 | 0.8123 |

Islamic Banks

Table 6 shows in case of Islamic banks, Short Term liability to Asset (STA), Total liability to total Assets (TTA), Total liability to total Equity (TTE), Size (LOGS), and Growth (GRW) has a positive impact on Return on Capital Employed (ROCE). Furthermore, holding other variables constant, every single unit increase in the above said variables caused the Return on Capital Employed (ROCE) to increase by 2.38e+08, 1.32e+08, 38935.39, 1738562 and 717909.1 units, respectively. Whereas Long Term liability to Asset (LTA) negatively impacts ROCE, means every single unit increase in the said variable will lead Return on Capital Employed (ROCE) to decrease by 1.24e+08 units. For the Islamic bank variables, Table 6 shows that p values for all variables are less than 0.05; thus, indicate the significance of the coefficients. R Square value of 81% approximately in the said table for Islamic banks indicates that STA, LTA, TTA, TTE, LOGS, and GRW cause a total of 81% variance in ROCE. Thus, the findings show that in Pakistan's Islamic banks, the capital structure variables, size, and growth significantly influence profitability (ROCE).

Regression Analysis Results of Model # 3

PROE = β0+ β1(STA)+β2 (LTA)+β3(TTA)+β4(TTE)+ β5(LOG S)+ β6(GRW)+ ε

Interpretation of Model # 3 Results

Conventional Banks

Table 7 shows in case of conventional banks, Short Term liability to Asset (STA), Long Term liability to Asset (LTA), Total liability to total Equity (TTE), Size (LOGS), and Growth (GRW) has a positive impact on Return on Equity (ROE). Furthermore, holding other variables constant, every single unit increase in the above said variables caused the Return on Equity (ROE) to increase by .5266865, .0381001, .0175321, .0460098 and .0163842 units, respectively. Whereas Total liability to total Assets (TTA) negatively impacts ROE, which means every single unit increase in the said variable will lead Return on Equity (ROE) to decrease by .1661274 units. For the conventional bank variables, Table 7 shows that p values for all variables are less than 0.05; thus, indicate the significance of the coefficients. R Square value of 82 % approximately in the said table for conventional banks indicates that STA, LTA, TTA, TTE, LOGS, and GRW cause a total of 82% variance in ROE. Thus, the findings show that in Pakistan's conventional banks, the capital structure variables, size, and growth significantly influence profitability (ROE).

| Table 7 Regression Result* | ||

| Variables | Conventional Banks | Islamic Banks |

| STA | .5266865 (0.050) |

5.420504 (0.039) |

| LTA | .0381001 (0.092) |

4.496654 (0.030) |

| TTA | -.1661274 (0.059) |

-4.865259 (0.057) |

| TTE | .0175321 (0.000) |

.0107855 (0.028) |

| LOGS | .0460098 (0.028) |

.0132253 (0.010) |

| GRW | .0163842 (0.049) |

.0654412 (0.057) |

| R-square | 0.8225 | 0.4560 |

Islamic Banks

Table 7 shows in case of Islamic banks, Short Term liability to Asset (STA), Long Term liability to Asset (LTA), Total liability to total Equity (TTE), Size (LOGS), and Growth (GRW) has a positive impact on Return on Equity (ROE). Furthermore, holding other variables constant, every single unit increase in the above said variables caused the Return on Equity (ROE) to increase by 5.420504, 4.496654, .0107855, .0132253 and .0654412 units, respectively. Whereas Total liability to total Assets (TTA) negatively impacts ROE, which means every single unit increase in the said variable will lead Return on Equity (ROE) to decrease by 4.865259 units. For the Islamic bank variables, Table 7 shows that p values for all variables are less than 0.05; thus, indicate the significance of the coefficients. R Square value of 46 % approximately in the said table for Islamic banks indicates that STA, LTA, TTA, TTE, LOGS, and GRW cause a total of 46% variance in ROE. Thus, the findings show that in Pakistan's Islamic banks, the capital structure variables, size, and growth significantly influence profitability (ROE).

Regression Analysis Results of Model # 4

PROA = β0+ β1(STA)+β2 (LTA)+β3(TTA)+β4(TTE)+ β5(LOG S)+ β6(GRW)+ ε

Interpretation of Model # 4 Results

Conventional Banks: Table 8 shows in case of conventional banks, Short Term liability to Asset (STA), Total liability to total Assets (TTA), Total liability to total Equity (TTE), Size (LOGS), and Growth (GRW) has a positive impact on Return on Asset (ROA). Furthermore, holding other variables constant, every single unit increase in the above said variables caused the Return on Asset (ROA) to increase by .057546, .0446105, .0000484, .0024476 and .0019738 units, respectively. Whereas Long Term liability to Asset (LTA) negatively impacts ROA, means every single unit increase in the said variable will lead Return on Asset (ROA) to decrease by .0317367 units. For the conventional bank variables, Table 8 shows that p values for all variables are less than 0.05; thus, indicate the significance of the coefficients. R Square value of 57 % approximately in the said table for conventional banks indicates that STA, LTA, TTA, TTE, LOGS, and GRW cause a total of 57% variance in ROA. Thus, the findings show that in Pakistan's conventional banks, the capital structure variables, size, and growth significantly influence profitability (ROA).

| Table 8 Regression Result* | ||

| Variables | Conventional Banks | Islamic Banks |

| STA | 0.057546 (0.033) |

0.4940557 (0.044) |

| LTA | -.0317367 (0.031) |

-.3892583 (0.038) |

| TTA | .0446105 (0.034) |

0.4068712 (0.046) |

| TTE | .0000484 (0.043) |

.0022053 (0.051) |

| LOGS | .0024476 (0.027) |

-.0080002 (0.020) |

| GRW | .0019738 (0.025) |

.005392 (0.021) |

| R-square | 0.5700 | 0.7859 |

Islamic Banks

Table 8 shows in case of Islamic banks, Short Term liability to Asset (STA), Total liability to total Assets (TTA), Total liability to total Equity (TTE) and Growth (GRW) has a positive impact on Return on Asset (ROA). Furthermore, holding other variables constant, every single unit increase in the above said variables caused the Return on Aesst (ROA) to increase by .4940557, .4068712, .0022053 and .005392 units, respectively. Whereas Long Term liability to Asset (LTA) and Size (LOGS) negatively impacts ROA, means every single unit increase in the said variable will lead Return on Asset (ROA) to decrease by .3892583 and .0080002 units. For the Islamic bank variables, Table 8 shows that p values for all variables are less than 0.05; thus, indicate the significance of the coefficients. R Square value of 79 % approximately in the said table for Islamic banks indicates that STA, LTA, TTA, TTE, LOGS, and GRW cause a total of 79% variance in ROA. Thus, the findings show that in Pakistan's Islamic banks, the capital structure variables, size, and growth significantly influence profitability (ROA).

Conclusion

The findings of the fixed effect (FE) estimation model indicated that in conventional banks panel, LTA has a negative association with EPS and ROA. While Total liability to total Assets (TTA) also has a negative relationship with the Return on Equity (ROE) and Return on Capital employed (ROCE). Whereas, in the Islamic banks' panel, Total liability to total Assets (TTA) negatively relates to the EPS and Return on Equity (ROE). In contrast, LTA has a negative association with ROCE and ROA.

In conventional banks panel, the R Square of Earning Per Share (EPS) is approximately 71 %, which shows that the data which explains the model is very well. R Square of Return on Capital Employed (ROCE) is about 93%, which shows that the data excellently explains the model. R Square of Return on Equity (ROE) is approximately 82%, which shows that the data explains the model well. R Square of Return on Asset (ROA) is 57%, which shows that model is by some means well, the data is explaining the model.

R Square of Earning Per Share (EPS) is approximately 63% in the Islamic banks' panel, which shows that the data reasonably explains the model. R Square of Return on Capital Employed (ROCE) is about 81%, which shows that the model is good. R Square of Return on Equity (ROE) is approximately 46%, which shows that the model is not reasonably well but somehow explained by data. R Square of Return on Asset (ROA) is around 79%, which shows that the data well explain the model.

Now, through the results of the analysis of the individual variables, we can conclude that there is a significant and positive influence of capital structure on the profitability of conventional and Islamic banks of Pakistan, along with a significant difference in the profitability of conventional and Islamic banks of Pakistan due to their capital structure. Islamic banks have greater profitability as compare to conventional banks when the dependent variable is EPS and ROE.

References

Abor, J. (2005). The effect of capital structure on profitability: an empirical analysis of listed firms in Ghana. The journal of risk finance.

Indexed at, Google Scholar, Cross Ref

Brealey, R.A., Myers, S.C., & Marcus, A.J. (2009). Dasar-Dasar Manajemen Keuangan Perusahaan (judul asli: Fundamental off corporate finance), edisi kelima, jilid 1. Jakarta: Erlangga.

Büyüksalvarci, A., & Abdioglu, H. (2011). Determinants of capital adequacy ratio in Turkish Banks: A panel data analysis. African Journal of Business Management, 5(27), 11199.

Indexed at, Google Scholar, Cross Ref

Gujarati, D.N. (2004). Basic econometrics. In: The Mc-Graw Hill.

Hung, C.Y., Albert, C.P.C., & Eddie, H.C.M. (2002). Capital structure and profitability of the property and construction sectors in Hong Kong. Journal of Property Investment & Finance.

Kester, W.C. (1986). Capital and ownership structure: A comparison of United States and Japanese manufacturing corporations. Financial management, 5-16.

Long, M.S., & Malitz, I.B. (1985). Investment patterns and financial leverage. In Corporate capital structures in the United States (pp. 325-352): University of Chicago Press.

Petersen, M.A., & Rajan, R.G. (1994). The benefits of lending relationships: Evidence from small business data. The Journal of finance, 49(1), 3-37.

Rajan, R.G., & Zingales, L. (1995). What do we know about capital structure? Some evidence from international data. The Journal of finance, 50(5), 1421-1460.

Short, B.K. (1979). The relation between commercial bank profit rates and banking concentration in Canada, Western Europe, and Japan. Journal of banking & Finance, 3(3), 209-219.

Indexed at, Google Scholar, Cross Ref

Taani, K. (2013). Capital structure effects on banking performance: A case study of Jordan. International Journal of Economics, Finance and Management Sciences, 1(5), 227-233.

Titman, S., & Wessels, R. (1988). The determinants of capital structure choice. The Journal of finance, 43(1), 1-19.

Velnampy, T., & Niresh, J.A. (2012). The relationship between capital structure and profitability. Global Journal of Management and Business Research, 12(13).

Indexed at, Google Scholar, Cross Ref

Received: 30-Jan-2023, Manuscript No. AMSJ-23-13175; Editor assigned: 02-Feb-2023, PreQC No. AMSJ-23-13175(PQ); Reviewed: 20-Mar-2023, QC No. AMSJ-23-13175; Revised: 28-Apr-2023, Manuscript No. AMSJ-23-13175(R); Published: 09-May-2023