Research Article: 2019 Vol: 23 Issue: 4

Influence of Capital Adequacy on Financial Stability Indexes a Field Study in Commercial Banks in Jordan

Shireen Mahmoud AlAli, Ajloun National University

Abstract

This study aimed to investigate the Influence of Capital Adequacy on Financial stability Indexes in Commercial Banks in Jordan (Return on Invested Capital ROIC, profitability Rate PR), follows the descriptive analytic approach in order to analyze the results. The population of the study consists of all commercial banks in Jordan, A sample selected from these population (13) commercial banks in Jordan. The results of the study showed Most of Jordanian banks, committed to capital adequacy ratio defined in the international (Basel II), this ratio largest percentage of decided by the BaselII Committee, and there is statistically significance influence of capital adequacy ratio on financial stability indexes (Profit Rate) and (return on invested capital ratio) in Jordanian banks.

Keywords

Capital Adequacy, Return on Invested Capital (ROIC), Profit Rate (PR).

Introduction

Commercial banks are among the most important and oldest financial mediating cash establishment, whose fundamental function is accepting the delayed and current deposits of individuals and enterprises, and using them again for their own advantage in giving credit for individuals and non-banking economical units. Consequently, the role of banks is represented in: playing the role of filling economic units whose incomes are extra to their expenditure, and providing banking services. As well, they play the role of funding economic units with individuals and enterprises whose expenditure is more than their incomes through the processes of credit giving. In addition, they practice investment processes, contribute to establishing enterprises, mediate in marketing financial stocks, buying and selling transferable foreign coins and other banking coins.

On the other side, the term capital adequacy expresses the capacity and efficiency of banks that measures, direct and control the risks it faces, in order to be scaled, control and making decisions consistent with the strategy and policy and to strengthen its competitiveness attitude. The capital adequacy is beneficial in pricing banking services and maximizing returns from banks operations, in addition to policy development and procedures necessary for the prevention of different types of risks, which arise as a result of technological and electronic evolution and increasing complexities in banking and competition between banks (Almazari & Alamri, 2017).

Torbira & Zaagha (2016) explain in their study that: Capital adequacy ratio for banks is one of the most important indicators of the financial solvency of the financial sector and it is considered as a safety valve to protect the depositors to promote stability and efficiency in the banking system and financial institutions.

Generally, banks are expected to make profit to absorb losses from their normal earnings.

Without profits, no firm can survive and attract outside capital to meet its investment needs, including banks. Thus, profitability plays a key role in persuading depositors to supply funding, bank deposits in good terms. It is an essential element to the survival of financial institutions. Profit is believed to be the cheapest source of funds to banks. Babakova (2013) posits that the basic desire of any bank management is to make profit. Okoye & Eze (2013) describe the three principles guiding banking regulations as profitability, liquidity and safety.

On profitability, one of its main determinants is the bank’s capital structure (Saona, 2011). Bank capital plays a central role in the safety and soundness of individual banks. It supports future growth and fosters public confidence in the banks. It provides the capacity under the banks legal lending limits to serve customers need and protect the bank from unexpected losses (Furlong, 2008). It is also a central issue of prudential regulation (Torbira & Zaagha, 2016). Adequate capital is therefore considered a sine qua non in the financial sector and for banks in particular. Capital adequacy involves setting minimum requirements for market risk in the books of banks and investment companies. This includes specifying standards, covering risk management and solvency ratio requirements (Torbira & Zaagha, 2016).

On return on invested capital (ROIC) is an account that is used to assess the efficiency of the bank and allocate the capital under its control to profitable investments. In the sense if the capital invested by the bank is used effectively (Shin, 2017). The return on investment (ROIC) as a percentage is correlated with the size of the assets and the volume of working or operating capital, so the capital adequacy of the banks affects the nature of the placement at the rate of return on investment

Also, banks have to maintain a certain rate of capital adequacy identified by the Agreement of (Basel II) as (8%) which is 12% in Jordan in order to be able to face the movement of normal and surprising drawing and to have a financial coverage.

Based on the above, and because of the importance of capital adequacy, this study aims to identify the extent of Jordanian banks' adherence to the capital adequacy standard according to (BaselII) agreement, and the influence of capital adequacy at Financial stability Indexes (profit rate and return on invested capital) in Jordanian banks.

Study Problems

The problem of the study is represented in that to what extent can commercial banks reach to capital adequacy ration mentioned in the international Agreement of Basel II and their recognition of the influence of increase of capital adequacy ratio of commercial banks in Jordan on some of the financial stability Indexes, such as money investment rate, profitability.

Therefore, the problem of the study can be highlighted by answering the question: (Does capital adequacy influence financial stability Indexes?). This question is subdivided into the following sub-questions:

1. Have Jordanian banks committed to a capital adequacy ratio defined in (Basel II)?

2. Does capital adequacy influence profit rate in Jordanian banks?

3. Does capital adequacy influence return on invested capital in Jordanian banks?

Study Objectives

This study aimed to identify the influence of the capital adequacy ratio on financial stability Indexes in Jordanian banks, through the following:

1. Identify to what extent the commercial banks in Jordan are committed to capital adequacy ratio defined in (Basel II).

2. Identify the influence of capital adequacy ratios on profit rate (PR) in Jordanian banks.

3. Identify the influence of capital adequacy ratios on return on invested capital in Jordanian banks.

Literature Review

Profit Rate (RE) is a key target for all financial institutions as banks must keep adequate liquidity amounts so as to maintain the continuity. They are one of the most important sources Key to generate capital. Without profits banks will not be able to attract external capital to strengthen its investments and co-existence with the competition.

Return on invested capital (ROIC) is one of the important financial ratios, which is an indicator of the efficiency and effectiveness of management, and is used to analyze the profitability of the bank and compared with other similar banks, as it is used as an indicator to determine the strength of the stock of the bank in the case of buying or holding shares.

There have been several studies that have looked at the relationship between capital adequacy ratio and both the profit rate (PR) and the return on capital invested (ROCI).

Ikue & Nkoro (2019) study examined the dynamic responses of profitability indexes to capital adequacy ratios of authorized internationalized deposit money banks in Nigeria. The data were sourced from the financial year books of the deposit money banks and analyzed with static and dynamic panel estimators. The static estimator shows that the banks have differences in managerial style, size and profitability. Also, it was revealed that return on asset and return on equity responded positively to asset size, efficiency of the use of asset and current ratio in the static models and they were highly significant. However, they were insignificant in the dynamic specifications except asset size that was significant in the return on asset model showing a weak dynamic response of profitability to capital adequacy ratios.

Udom & Onyekachi (2018) study examined the effect of capital adequacy requirements on the performance of commercial banks in Nigeria. The study used secondary time series data sourced from the NDIC and CBN Annual and Bank Supervision Reports. The data analysis technique employed includes the Ordinary Least Squares (OLS) regression method. The overall capital adequacy variables of the study shows that ASF, CRWA, TQC together have significant effect on the dependent variable, Return on Asset (ROA), which measures bank performance. The results further show that capital adequacy impact positively on the financial performance of commercial banks in Nigeria. This implies that capital adequacy strongly and actively stimulates, improve and grow the financial performance of commercial banks and that sufficiency of capital and adequate management can translate to improved performance.

Torbira & Zaagha (2016) investigated in their empirical study the impact of capital adequacy indicators on bank financial performance measures in Nigeria. The analysis revealed the existence of significant long run relationship between bank financial performance variables and capital adequacy indicators in the Nigerian banking industry.

David & Osemwegie (2016) looked at the importance of capital adequacy and its impact on the financial business in the Nigerian banks through GLS estimator technique Statements for the period from 2007 to 2015. The application and study proved through empirical evidence the impact of capital adequacy in promoting financial business to the banks of Nigeria supporting the overriding impact of capital adequacy in improving the financial deeds of banks.

Siti et al. (2016) aimed to study the impact of capital adequacy ratio on financial performance and economic resultsin64 Japanese banks during the years from 2005 to 2014. The results indicated that there are various signs of relationships between study’s variables with a slight variation from the previous empirical work.

The study of Dabeek (2015) aims to analyze and measure the relationship between implementing Capital Adequacy Ratio (CAR) on the profitability of local commercial banks working in Palestine during the period (2008-2014), reached many conclusions, the most important one is that increasing the Capital Adequacy Ratio leads to increase in the profit rate (assets ratio, return on equity ratio and earnings per share).

Nzioki (2011) analyses the impact of capital adequacy on the financial performance of commercial banks quoted at the Nairobi Stock Exchange. The main finding in the study is that capital adequacy contributes positively to the profitability of commercial banks and therefore it is paramount for banks to have a sound capital base in order to remain competitive and maintain the confidence of its customers.

Methodology

This study depends in its methodology on scientific methods of formulating the problem, showing the importance of the study and its goals, formulating the hypotheses and checking their validity. In this study, the researcher follows the analytic descriptive approach in order to analyze the results. Data and information will be collected for this study from different resources, directly or indirectly on secondary data which also includes previous studies on the subject of the study to cover the theoretical side, in addition to relying on the annual reports issued by the banks under study which cover the practical side of the study. The second method is the statistical analysis where data was collected as a sample of study for 6 years' period from 2013 to 2018 for The Jordanian Banks.

Hypotheses

This study has constructed the following hypotheses:

H01: Jordanian banks are not committed to capital adequacy ratio defined in the international (Basel II) Agreement.

H02: There is no statistically significant influence at the level of significance (α ≤ 0.05) of the capital adequacy ratio at financial stability Indexes in Jordanian banks.

This hypothesis is divided to the following sub-hypotheses:

H02-1: There is no statistically significant influence at the level of significance (α ≤ 0.05) of the capital adequacy ratio at Profit Rate in Jordanian banks.

H02-2: There is no statistically significant influence at the level of significance (α ≤ 0.05) of the capital adequacy ratio at return on invested capital ratio in Jordanian banks.

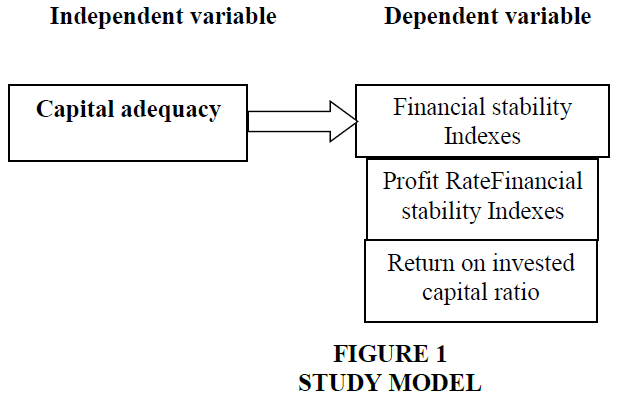

Study Model

The model of the study would present independent variable (capital adequacy CAR) and the dependent variable (financial stability Indexes).

Figure 1 below presents the dependent variable and the independent variable.

The Population of the Study and Sample

The population of the study consists of all commercial banks in Jordan. A sample that is suitable for purposes of analysis is selected from this population. This sample will be composed of 13 commercial banks in Jordan Table 1.

| Table 1 The Population of the Study | ||

| Date of Establishment | Commercial Banks in Jordan | |

| 1 | 1930 | Arab Bank |

| 2 | 1956 | Jordanian National Bank |

| 3 | 1960 | Bank of Jordan |

| 4 | 1960 | Amman-Cairo Bank |

| 5 | 1974 | Housing Bank for Commerce and Funding |

| 6 | 1977 | Kuwait-Jordan Bank |

| 7 | 1978 | Arab-Jordanian Investment Bank |

| 8 | 1989 | Bank of Arab banking corp. |

| 9 | 1989 | Jordanian Bank for Investment and Funding |

| 10 | 1991 | Union Bank for Deposit and investment |

| 11 | 1965 | Industrial Development Bank |

| 12 | 1983 | Bayt Al-Mal for Deposit and Investment |

| 13 | 1978 | Jordanian-Islamic Bank |

Five banks are excluded from the sample of the study:

1. Jordan-Gulf Bank

2. Philadelphia Bank

3. Middle East Bank for Investment

4. Arab-Islamic Bank

5. Exports and Imports Bank

The exclusion of these banks is due to many reasons; some of these banks amalgamated with other banks, the establishment of others follows the years of the start of this study. In conclusion, the exclusion of these banks is due to unavailability of financial data about them that can cover the whole of the study.

Results

This section aims at presenting the analyzed results of the sample data.

The researcher use appropriate statistical treatment of these data to reach to information by various means:

1. Analyzing capital adequacy ratio (CAR), return on invested capital (ROIC) and profitability rate (PR).

2. Simple regression analysis to check the influence of independent variable (CAR) at dependent variable (RIOC) and (PR) by using SPSS program.

The First Major Hypothesis

H01: Jordanian banks are not committed to capital adequacy ratio defined in the international (Basel II) Agreement.

After review the financial statements used for the purpose of study in Jordanian banks, will be analyzed to investigate the impact of capital adequacy on financial stability Indexes (ROIC), (PR), Table 2 show that:

| Table 2 Capital Adequacy Capital Investment and Profitability Ratios for All Banks (2013-2017) | ||||||

| 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | |

| Capital Ratio | 12.8% | 12.5% | 13.1% | 12.5% | 12.6% | 13.8% |

| Capital Investment Ratio | 51.2% | 45.6% | 49.1% | 54.3% | 57.1% | 62.2% |

| profitability ratio | 4.1% | 7.2% | 10.9% | 6.2% | 3.1% | 2.3% |

| capital adequacy | 13.6% | 13.7% | 14.1% | 13.5% | 13.4% | 14.7% |

From the previous table, it is clear that the ratio of capital adequacy in Jordanian banks reached 14.7% in 2013 and 13.6% in 2018, which is higher than the legal ratio according to the financial and accounting standards in (Basel II).

This indicates that Jordanian banks are interested in this ratio due to its positive benefits and its commitment to legal requirements and standards.

Capital Adequacy Model as issued from Jordanian Central Bank

1. Jordanian Central Bank

2. Supervising Department on Bank apparatus

3. The criterion of measuring capital adequacy

Name of Bank

First: Organizational Capital

Second: the assets and items outside the risky budget

a. Cash, money accounts and stocks

b. Direct credit facilities and stable and other assets

c. Items outside the budget

The sum

Third: Capital Adequacy Ratio

Organizational Capital

Capital Adequacy Ratio = ………………………… = %

The Assets and the items outside the risky budget

From reviewing the capital adequacy ratio in Jordanian banks, it turns out that the Capital Adequacy has the largest percentage of decided by the (BaselII) Committee, which indicates that most banks adhere to the ratio, which means that the first null hypothesis is not proven, and therefore we accept the alternative hypothesis which says: "Jordanian banks are committed to capital adequacy ratio defined in the international (Basel II) Agreement”.

The Second Major Hypothesis

H02: There is no statistically significant influence at the level of significance (α ≤ 0.05) of the capital adequacy ratio at financial stability Indexes in Jordanian banks.

To test this hypothesis, the sub- hypothesis derived from it was tested, as follows:

Test Results of the First Sub-Hypothesis

H02-1: There is no statistically significant influence at the level of significance (α ≤ 0.05) of the capital adequacy ratio at Profit Rate in Jordanian banks.

In this hypothesis we have two variables dependent variable (profit rate), and independent variable (capital adequacy ratio) to investigate the impact of independent variable on dependent variable, we will use regression as liner regression equation:

Y = α + βX

Wherein

Y = dependent variable

α = equation constant

β = coefficient of independent variable (X)

X = independent variable

Then we using Statistical Analysis System (SPSS), and access to test results linear regression, as shown in the Table 3.

| Table 3 Regression Test for Impact (Capital Adequacy Ratio) on (Profitability Ratio) | |||||

| Unstandardized Coefficients | Standardized Coefficients | t | sig | ||

| Model | B | Std. Error | Beta | ||

| Constant | 0.220 | 0.354 | 0.462 | 0.243 | 0.824 |

| capital adequacy | 0.462 | 3.772 | 4.650 | 0.021 | |

Through previous table we can write the equation as follows:

PR = 0.220 – 0.46 (CAR)

Where

PR = Profit rate

CAR = capital adequacy ratio

Table 3 above demonstrate that statistical significance exists at the level of significance (α ≤0.05) for the influence of independent variable (CAR) at dependent variable (PR) in the Jordanian banks. The value of T calculated at 4.65 is the highest of value T tabled. Significance value (0.021).

To detect statistical significance of the relationship between the two variables were tested by the correlation, which is illustrated by Table 4.

| Table 4 Correlation Test between Capital Adequacy Ratio(CAR) and Profit Rate (PR) | |||

| capital adequacy ratio | Profit rate | ||

| capital adequacy ratio | Pearson Correlation | 1 | 0.462 |

| Sig. (2-tailed) | - | 0.034 | |

| N | 6 | 6 | |

| Profit rate | Pearson Correlation | 0.462 | 1 |

| Sig. (2-tailed) | 0.034 | - | |

| N | 6 | 6 | |

From the table we can see the significant value is (0.034) which is lower than statistical value (0.05), that mean there is significantly relationship between capital adequacy ratio (CAR) and Profit rate (PR). This indicates that increasing in (CAR) lead to increasing in (PR)

Through Tables 3 and 4 we reduce that the sub first null hypothesis is not proven, and therefore we accept the alternative hypothesis which says: "There is statistically significant influence at the level of significance (α ≤ 0.05) of the capital adequacy ratio at Profit Rate in Jordanian banks".

Test Results of the Second Sub-Hypothesis

H02-2: There is no statistically significant influence at the level of significance (α ≤ 0.05) of the capital adequacy ratio at return on invested capital ratio in Jordanian banks.

In this hypothesis we have two variables dependent variable (return on invested capital ratio), and independent variable (capital adequacy ratio) to investigate the impact of independent variable on dependent variable, we will use regression as liner regression equation:

Y = α + βX

Where

Y = dependent variable

α = equation constant

β = coefficient of independent variable (X)

X = independent variable

Then we using Statistical Analysis System (SPSS), and access to test results linear regression, as shown in the Table 5.

| Table 5 Regression Test for Impact (Capital Adequacy Ratio) on (Return on Invested Capital Ratio) | |||||

| Unstandardized Coefficients | Standardized Coefficients | t | sig | ||

| Model | B | Std. Error | Beta | ||

| Constant | 0.093 | 0.812 | 0.422 | 12.6 | 0.936 |

| capital adequacy | 4.22 | 5.23 | 0.088 | 0.001 | |

Table 5 demonstrate that statistical significance exists at the level of significance (α ≤0.05) for the influence of independent variable (CAR) at dependent variable (ROIC) in the Jordanian banks. The value of T calculated at 12.6 is the highest of value T tabled. Significance value (0.001).

Through previous table we can write the equation as follows:

ROIC = 0.093 + 4.22 (CAR)

Where

ROIC = Return on Invested Capital ratio

CAR = capital adequacy ratio

To detect statistical significance of the relationship between the two variables were tested by the correlation, which is illustrated by Table 6.

| Table 6 Correlation Test between Capital Adequacy and Return on Invested Capital Ratio | |||

| capital adequacy ratio | Capital investment rate | ||

| capital adequacy ratio | Pearson Correlation | 1 | 0.422 |

| Sig. (2-tailed) | - | 0.00 | |

| N | 6 | 6 | |

| Return on Invested Capital ratio | Pearson Correlation | 0.422 | 1 |

| Sig. (2-tailed) | 0.00 | - | |

| N | 6 | 6 | |

From the table we can see the significant value is (0.00) which is lower than statistical value (0.05), that mean there is significantly relationship between capital adequacy ratio (CAR) and Return on Invested Capital ratio (ROIC). This indicates that increasing in (CAR) lead to increasing in (ROIC)

Through Tables 5 & 6 we reduce that the sub second null hypothesis is not proven, and therefore we accept the alternative hypothesis which says: "There is statistically significant influence at the level of significance (α ≤ 0.05) of the capital adequacy ratio at return on invested capital ratio in Jordanian banks".

Conclusion

Most of Jordanian banks, committed to capital adequacy ratio defined in the international (Basel II), this ratio largest percentage of decided by the BaselII Committee, which indicates that most banks adhere to the ratio, as Almazari & Alamri (2017) explain that the legislation in the central banks of all countries in the world are monitoring this index of banks operating in their economies in order to maintain the financial institution's ability to continue to operate and maintain the presence of a strong and solid money to meet any emergency obligations when there is pressure confronting the financial institutions or large withdrawals of deposits shortly, and it is considered as a safety valve to protect the depositors to promote stability and efficiency in the banking system and financial institutions.

According to study result we conclude that a statistically significance influence of capital adequacy ratio on financial stability indexes (Profit Rate) and (return on invested capital ratio) in Jordanian banks. This result agree with Udom & Onyekachi (2018) study which conclude that capital adequacy impact positively on the financial performance of commercial banks in Nigeria, its agree also with Torbira & Zaagha (2016) study which show existence of significant long run relationship between bank financial performance variables and capital adequacy indicators in the Nigerian banking industry.

In general, increasing the capital adequacy ratio leads to the stability of financial indicators, and the impact on them positively, increasing profitability and return on capital invested, this achieves efficiency in the performance of banks, as the result of the study of David & Osemwegie (2016); Siti et al. (2016) explain that increasing the Capital Adequacy Ratio leads to increase in the profit rate.

References

- Almazari, A & Alamri, A. (2017). The effect of capital adequacy on profitability: A comparative study between samba and saab banks of Saudi Arabia. International Journal of Economics, Commerce and Management, 4 (11), 86-102.

- Babakova I.V. (2013). Raising the Profitability of Commercial Banks. BLATEC, 11.

- Dabeek, H. (2015). The Relationship between Implementing Capital Adequacy Ratio (CAR) on the Profitability of Local Commercial Banks Working in Palestine During the Period (2008-2014). Master Thesis, Trading Collage, Islamic University of Gazza, Palestine.

- David, U., & Osemwegie, M. (2016). Capital adequacy and financial performance of banks in Nigeria: Empirical evidence based on the FGLS estimator. European Scientific Journal, 12(25), 295-307.

- Furlong F.T (2008). Capital regulation and bank lending, federal reserve bank of San Francisco. Economic Review, (3) 23-33.

- Ikue, N., & Nkoro, E. (2019). Dynamics of capital adequacy and profitability of internationalized deposit money banks in Nigeria. Bussecon Review of Finance & Banking, 1(1), 18-25.

- Nzioki, S. (2011). The impact of capital adequacy on the financial performance of commercial banks quoted at the Nairobi stock exchange. Master thesis, Administration-School of Business, University of Nairobi.

- Okoye V., & Eze O.R (2013). Effect of bank lending rate on the performance of Nigerian deposit money banks. International Journal of business and Management Review, 1(1), 34-43.

- Saona P.H. (2011). Determinants of the profitability of the US banking industry. International Journal of Business and Social Science, 2(22), 222-269.

- Shin, L. (2017). Impact of return on invested capital at price index in in public shareholding companies. International Journal of Economics and Financial Issues, 9(2), 222-236.

- Siti, N.Y.L., Nusaibah, M., & Kazuhiro, O. (2016). Financial performance and economic impact on capital adequacy ratio in Japan. International Journal of Business and Management, 11(4), 14-21.

- Torbira, L.L., & Zaagha, A.S. (2016). Capital adequacy measures and bank financial performance in Nigeria: A cointegration analysis. Journal of Finance and Economic Research, 3(1), 15-34.

- Udom, I., & Onyekachi, E. (2018). Effect of capital adequacy requirements on the profitability of commercial banks in Nigeria. International Research Journal of Finance and Economics, 165, 79-89.