Research Article: 2021 Vol: 24 Issue: 1S

Influence of Board Structure on Corporate Governance Disclosure, Profitability and Capital Structure of Listed Companies in the Stock Exchange of Thailand

Chidchaya Chantapet, Rajamangala University of Technology Suvarnabhumi

Dararat Phoprachak, Rajamangala University of Technology Suvarnabhumi, Thailand

Kittisak Jermsittiparsert, Dhurakij Pundit University

Siriporn Malaipia, Rajamangala University of Technology Suvarnabhumi

Abstract

The objective of this study is to investigate the influence of board structure on corporate governance, profitability and capital structure of 254 listed companies in the stock exchange of Thailand. By analyzing data based on Multiple Indicators and Multiple Causes (MIMIC) Model. The findings reveal a harmony between hypothetical assumption and empirical analysis with the results of statistical tests as follows: χ 2=7.52, df=8, χ2 /2=0.94, CFI=1.00, GFI=0.99, AGFI=0.99, RMSEA=0.000 and SRMR=0.025. In sum, board structure of independent director (IDTR) and director's relative (DTRR) has a positive influence on corporate governance disclosure (CGRD) at coefficient value of 0.26* and 0.27*. Also, corporate governance disclosure (CGRD) positively effect on profitability (PFBR) and capital structure (CPTS) at coefficient values of 0.33* and 0.20* respectively.

Keywords

Board Structure, Corporate Governance Disclosure, Profitability, Capital Structure

Citation Information

Chantapet, C., Phoprachak, D., Jermsittiparsert, K., & Malaipia, S. (2021). Influence of board structure on corporate governance disclosure, profitability and capital structure of listed companies in the stock exchange of Thailand. Journal of Management Information and Decision Sciences, 24(S1), 1-9.

Introduction

Representative issue is one of critical problems in Thailand which leading to conflict of interest between major and minor shareholders (Klinphanich, Puangyanee, Phoprachak & Jermsittiparsert, 2019). Also, the structure of management is not independent since most companies have grown from a type of family business. Family structure of management, power of ownership and major shareholders are important factors influencing the pattern of corporate management. Also, asset and cash transfer from one company to another is quite easy to conduct for the benefits of group, family, relatives. The study of Connelly, et al., (2012) revealed that the performance of the companies managed by family would be lower than that of the professional managers hired from outside. This is because family business management would not pay attention to the disclosure of companies’ information. They have various internal channels to communicate such information within the group; asset and cash transfer has been done for the benefits of the groups of executives or directors, the fabrication of accounting data and even the disclosure of unreal financial statements. All of these actions led the outside investors made wrong decision to invest (Mohammad, 2008).

Therefore, company management, management structure, executive structure are important factors influencing profitability of the companies.

These conflicts of the interests and unethical management mostly result from the unbalance between the professional management and the family business ownership (Bonna, 2012). These result in the unethical behavior for sake of group benefits. They considered rules and regulations as the business’s obstacles. Therefore, the Stock Exchange of Thailand (SET) adopted the concept of corporate governance as a tool to check and control the practices and behaviors of the executives to follow the rules. These made the companies more conscious and improved their practices to be at acceptance level by setting the policy which is transparent and disclose the information suitably and correctly (Cheung et al., 2007; Gleason & Mills, 2007; Dhaliwal et al., 2008; Rego & Wilson, 2010; Ammann et al., 2011; Lanis & Richardson, 2011). In addition, most of the listed companies in SET hold a type of centralized shareholders and of family business ownership. Nowadays, most of these companies pay more attention to the practice of corporate governance in order to maintain their reputation and create their credibility to the customers consistently and sustainably.

The management practice which hold the principle of corporate governance have effect on the company’s performance, in a sense that the higher degree of corporate governance, the higher level of company’s performance (Cheung et al., 2007; Ammann et al., 2011; Chatchawanchanchanakij, Arpornpisal & Jermsittiparsert, 2019). However, the results of some studies revealed no relationship between the corporate governance and the company’s performance and could not conclude the direction of the influence at the significant statistical level (Price et al., 2011; Connelly et al., 2012). Good corporate governance is; hence: important and critical factors affecting the companies to thrive and survive. Most companies in nowadays adopted the practices of corporate governance as a tool to reduce the intensity of the conflict of the interest. Corporate governance also helps made better relationships between shareholders and better cooperation of management in a way of ethical principle and real information disclosure. From this, the companies will get better opportunities of the funds from the investors. The study of Bonna (2012) revealed that the four factors of ownership structure, leverage, committee and executive compensation have negative direct effect on the companies’ value (Bonna, 2012). On the contrary, the study of Pham, Suchard & Zein (2007) to find relationship between good corporate governance and companies’ performance of the companies in Australia by considering from Tobin’s Q and Economic Value Added (EVA) showed no relationship between good corporate governance and companies’ performance. While the study of Beiner, Drobetz, Schmid & Zimmermann (2004) revealed that two factors of a ratio of shareholders and independence degree of the committee have positive influence on the value of companies. Also, independence degree of internal committee (Helland & Sykuta, 2005; Lee & Carlson, 2007) and independence degree of external committee (Mohammad, 2008; Kajola, 2008) has positive influence on good corporate governance, productivity and profitability of the companies at statistical significance level.

Therefore, good corporate governance is critical issue (Puangyanee, Yaowapanee, Duangsawang & Jermsittiparsert, 2019). When the committee of the companies is independent and is not controlled by one group of shareholder, the practice of corporate governance will help attract from the investors, sustain the companies and also drive the Thai economy to be stable and prosperous.

Research Objective

Aim of this study is to explore the causal influence of the board structures: the independent and the relatives on profitability and capital structure through corporate governance by using a case of listed companies in the Stock Exchange of Thailand (SET).

Research Framework and Literature Review

This research adopted three main theories as research framework as follows:

1. Increases operational and profitability.

2. Good corporate governance influences the performance. The management is based on the principles of good corporate governance of listed companies. As a result, the good corporate governance has a positive effect on the performance of the company. Influence in Changing, plus Performance results (Cheung et al., 2007; Ammann et al., 2011) the need for users, accounting data and financial reports. High expectations for reporting information reflect the goal. Transparency is comparable. And is relevant to the decision. (Heng & Noronha, 2011) At present, such accounting and financial information is gaining interest from various businesses. Due to the stream of business calls for attention to broad stakeholders, not just the shareholders or employees in the organization.

3. Firm Performance Theory measures net value of companies in terms of cash flow. Value is often used in the sense of "value" of various assets. In a field of finance, this value is equivalent with cash (Cash Equivalent). When used financially, it is referred to as "value" and "business" is often referred to as an organization or establishment (The Stock Exchange of Thailand, 2012).

Research Framework

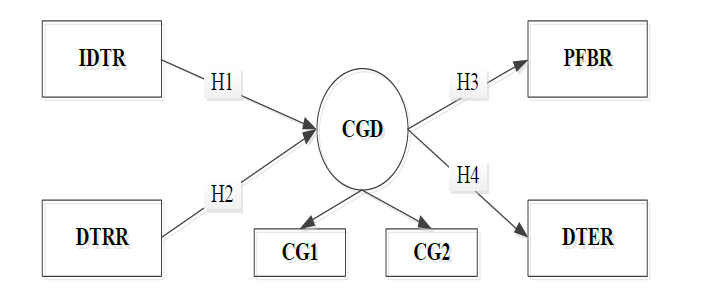

As shows in Figure 1 and Table 1.

| Table 1 Variables Abbreviation And Indicators |

|||

|---|---|---|---|

| Variables | Variables Adopt | Types of variable | Measurement |

| Independent Director | IDTR | Observed variable | Independent Director |

| Director's Relative | DTRR | Observed variable | Director's relative ratio |

| Corporate Governance Disclose | CGD | Latent variable | Number of items disclosure |

| Board’s Role | CG1 | Observed variable | Number of items disclosure |

| Good Corporate Governance Policy | CG2 | Observed variable | Number of items disclosure |

| Profitability | PFBR | Observed variable | Profitability Ratio |

| Capital Structure | DTER | Observed variable | Debt to equity ratio |

Research Hypotheses

H1: Structure of independent director has positive direct effect on corporate governance.

H2: Structure of director’s relative has positive direct effect on corporate governance.

H3: Corporate governance has positive direct effect on profitability.

H4: Corporate governance has positive direct effect on capital structure.

Methodology

Population

Population in this research is a number of 970 listed companies in the Stock Exchange of Thailand in the year 2018 (as of January 1, 2019, The Stock Exchange of Thailand, 2019). There are five criteria of the selection as follows:

1. The companies are not listed in Market Alternative Investment (MAI) because companies listed in MAI cannot identify specific aim of fund raising and these will effect on corporate social responsibility disclosure and data analysis (Booth et al. 2000, Sukeharoensin, 2003).

2. The companies are not listed companies in the financial sector industry because the companies in financial sector industry have different operational structure, finance structure and transaction from other sector industry. The Bank of Thailand has the accounting regulations for financial institutions to set accounting standards for financial institutions to comply with the standard in the same way in addition to the requirements of accounting standards set by the Federation of Accounting Professions (Announcement of Bank of Thailand on Financial Reporting Standard, Bank of Thailand, 2013).

3. The companies are not withdrawn from the Stock Exchange of Thailand because the order of withdrawal from the SET implies the termination of the status of listed companies. The companies cannot do any transaction in SET (Regulations of SET on a withdrawal from the SET, SET, 1999).

4. The companies are not in a stage of recovery or the SET committee ordered to revise financial statement. These companies cannot perform any transactions until reaching a success of the recovery ) Guideline of CSR Disclosure of the listed companies entering into a process of recovery according to Bankruptcy Act, the Stock Exchange of Thailand, 2000). or a revision of the financial statement and submit the correct financial statement in order to be able to perform the transaction in SET (Information Disclosure according to specified period, SET, 2003).

5. The companies can disclose corporate social responsibility report and financial statement because these two kinds of data are important for an analysis (Booth et al. 2000, Sukcharoensin, 2003).

From above mentioned criteria of the selection, there are a number of 698 listed companies in the Stock Exchange of Thailand meeting the criteria and being suitable for a process of data analysis.

Sample

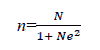

The researcher calculated sample size based on a formula of Yamane (1973) as follows:

Formula

Where

n is a number or a size of sample population

N is a number or a size of population (698 companies)

e is a deviant probability value (0.05)

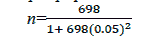

Therefore,

A size of sample population is

= a number of 254.28 companies. Hence, the researcher specified a number of sample size of population as 254 companies.

Research Format

The researcher collected statistical data of corporate governance disclosure from the 2018 corporate governance reports concerning board structures (independent director and director’s relative), profitability and capital structure by checking and collecting data disclosure from annual report (56-1) and financial statements of the listed companies in the Stock Exchange of Thailand, the fiscal year 2018.

The Statistics Used to Analyze Data

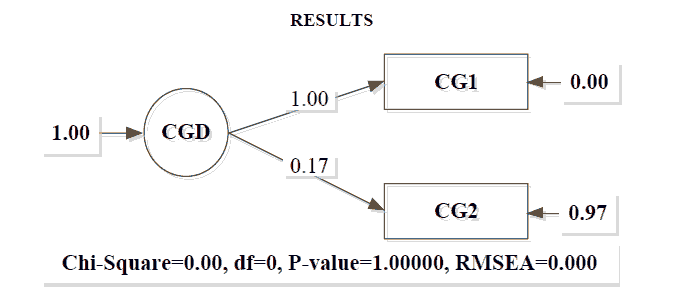

The researcher analyzed data by utilizing Structural Equation Model (SEM) and Multiple Indicators and Multiple Causes (MIMIC) model. as shows in Figure 2 and Table 2.

| Table 2 Confirmatory Factor Analysis |

||||

|---|---|---|---|---|

| Variables | Factor | R2 | ||

| b | SE | t | ||

| CG1 | 1.00 | - | - | 1.00 |

| CG2 | 0.17 | 1.65 | 3.45 | 0.03 |

| x2=0.00, df =0, p-value=1.00, RMSEA=0.00 | ||||

The result of measurement model by factor analysis of corporate governance disclosure (CGD) revealed a consistent result between hypothetical model and empirical result without deleting any variables from the model. The statistical results are as follows: Chi-square value=0.00, p-value=1.00, df=1, RMSEA and SRMR=0.00, and GFI, CFI and AGFI are same as 1.00.

In other words, Corporate Governance Disclosure (CGD) consists of two factors: board’s role (CG1) and good corporate governance policy (CG2). The results revealed that a factor of board’s role (CG1) is the most significant, followed by good corporate governance policy (CG2). as shows in Figure 3 ,Figure 4, Table 3 and Table 4.

Analysis of Direction of Influence

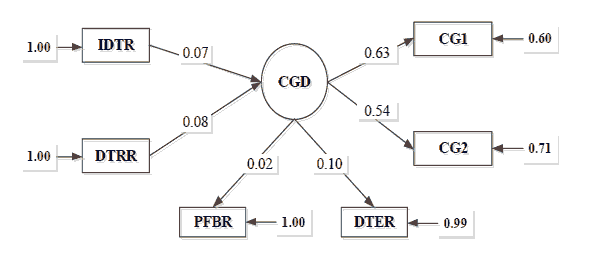

Analysis of Hypothetical Model before Adjusting the Direction of Influence

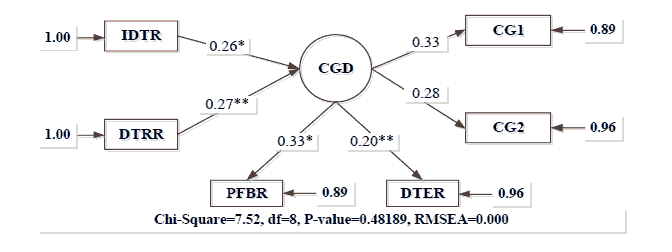

Analysis of Hypothetical Model after Adjusting the Direction of Influence

| Table 3 Result Of Direction Of Influence Analysis |

|||||||||

|---|---|---|---|---|---|---|---|---|---|

| Dependent Variables Independent Variables |

CGD | PFBR | DTER | ||||||

| TE | DE | IE | TE | DE | IE | TE | DE | IE | |

| IDTR | 0.26* (0.01) |

0.26* (0.01) |

- | ||||||

| DTRR | 0.27** (0.05) |

0.27** (0.05) |

- | ||||||

| CGD | 0.33* (3.24) |

0.33* (3.24) |

0.20** (3.14) |

0.20** (3.14) |

- | ||||

| x2=7.52, df =8, x2/2=0.94, p-value=0.48, RMSEA=0.00 | |||||||||

| Table 4 Analysis Of The Fit Indexes In Correspondence With Model |

|||

|---|---|---|---|

| Fit indexes | Threshold | Observed value | Fit level |

| χ2/2 | < 2.00 | 0.94 | Accepted |

| CFI | = 0.95 | 1.00 | Accepted |

| GFI | = 0.95 | 0.99 | Accepted |

| AGFI | = 0.90 | 0.99 | Accepted |

| RMSEA | < 0.05 | 0.00 | Accepted |

| SRMR | < 0.05 | 0.025 | Accepted |

The testing result of the causal relationship on company’s characteristics showed the consistency between hypothetical model and empirical analysis. The statistical results are as follows: Chi-square value=7.52, p-value=0.48, df=8, x2/2=0.94, RMSEA=0.00, SRMR=0.025, and GFI and AGFI are same as 0.99 and CFI=1.00.

Latent variable of Independent Director (IDTR) and Director’s Relative (DTRR) have positive direct effect on Corporate Governance Disclose (CGD) with statistical significance of 0.05 and 0.01 and coefficient value of 0.26 and 0.27 respectively.

Latent variable of Corporate Governance Disclose (CGD) have positive direct effect on Profitability (PFBR) and Capital Structure (DTER) with statistical significance of 0.05 and 0.01 and coefficient value of 0.33 and 0.20 respectively.

In sum, the research result revealed that independent director and director’s relative have positive direct effect on profitability and capital structure of the listed companies in the Stock Exchange of Thailand (SET) as shown in Table 5.

| Table 5 Results Of Hypothetical Testing |

||

|---|---|---|

| Research Hypothesis | Results of Hypothetical Testing | Direction/ Influence |

| H1: Structure of independent director has positive direct effect on corporate governance. | Accepted | +(*) |

| H2: Structure of director’s relative has positive direct effect on corporate governance. | Accepted | +(**) |

| H3: Corporate governance has positive direct effect on profitability. | Accepted | +(*) |

| H4: Corporate governance has positive direct effect on capital structure. | Accepted | +(**) |

Note: + means positive effect with statistical significance - means negative effect with statistical significance # means have influence without statistical significance

Conclusions and Research Discussion

The research result revealed that independent director and director’s relative have positive direct effect on profitability which implies that the more degree of independence of the directors, the more level of performance. Also, the study of Beiner, Drobetz, Schmid & Zimmermann (2004) showed that a ratio of shareholder and a degree of independence of directors have positive direct effect on value of companies. Specifically, director’s relative has positive direct effect on profitability. On the contrary, the study of Connelly, et al., (2012) revealed the companies managed by family or relative member would have lower performance than that of professional executives. The research viewed that the different results from these two studies may result from the difference in period of study. In current period, the adherence to good corporate governance by the executive is more important. Therefore, all types of director have to comply with the regulations.

Additionally, good corporate governance has positive direct effect on profitability which implies that the better the corporate governance, the higher the potential of companies’ profitability. This research result has consistent with the previous study revealing that the degree of independence of director has influence on good corporate governance, and increase performance and profitability with statistical significance (Mohammad, 2008; Kajola, 2008). Also, the studies of Cheung, et al., (2007); Ammann, et al., (2011) showed that good corporate governance has influence on companies’ performance with the better the corporate governance, the better the performance. This research result can confirm with reliability. Therefore, good corporate governance is the critical success factor on the profitability and the capital structure of the companies.

Recommendations

1. Future study can explore the relationship between independent variable of good corporate governance by adding more kinds of financial measurements, such as growth rate of income.

2. Future study can do qualitative analysis and in-depth empirical case studies especially in terms of profitability and capital structure.

3. Future study can use this conceptual framework with a sample population of the listed companies in the Market for Alternative Investment (MAI) to confirm the research results.

4. Future study can use this conceptual framework by categorizing a sample population into type of industry to deepen analysis and confirm the research results.

5. Future study can use this conceptual framework and focus on corporate sustainability to confirm the research results.

Acknowledgement

Kittisak Jermsittiparsert, Professor of Dhurakij Pundit University, Thailand and Adjunct Professor of Universitas Muhammadiyah Makassar & Universitas Muhammadiyah Sinjai, Indonesia is the corresponding author.

References

- Ammann, M., Oesch, U., & Schmid, M.M. (2011). Corporate governance and firm value: International evidence. Journal of Empirical Finance, 18, 36-55.

- Beiner, R., Drobetz, P., Schmid, F., & Zimmermann, H. (2004). Is board size an independent corporate governance mechanism? Kilos, 57(3), 327-356.

- Bonna, A.K. (2012). The impact of corporate governance on corporate financial performance. Doctoral dissertation, Walden University, MN.

- Booth, T., Ainscow, M., Black-Hawkins, K., Vaughan, M., & Shaw, L. (2000). Index for inclusion: Developing learning and participation in schools. bristol, centre for studies on inclusive education.

- Chatchawanchanchanakij, P., Arpornpisal, C., & Jermsittiparsert, K. (2019). The role of corporate governance in creating a capable supply chain: A case of Indonesian tin industry. International Journal of Supply Chain Management, 8(3), 854-864.

- Cheung, Y.L., Connelly, J.T., Limpaphayom, P., & Zhou, L. (2007). Do investors really value corporate governance? Evidence from the Hong Kong Market. Journal of International Financial Management and Accounting, 18(2), 86-122.

- Connelly, J.T., Limpaphayom, P., & Nagarajan, N.J. (2012). Form versus substance: The effect of ownership structure and corporate governance on firm value in Thailand. Journal of Banking & Finance, 36, 1722-1743.

- Dhaliwal, D., Li, O.Z., Tsang, A., & Yang, G.Y. (2011). Voluntary nonfinancial disclosure and the cost of equity capital: The initiation of corporate social responsibility reporting. The Accounting Review, 86, 59-100.

- Freeman, R. (1984). Strategic management: A stakeholder approach. Pitman Publishing Inc., Boston

- Gleason, C.A., & Mills, L.F. (2007). Evidence of differing market responses to beating targets through tax expense decreases. Retrieved August 25, 2011, from http://papers.ssrn. com/sol3/ papers.cfmfabstract _id=983612

- Helland, E., & Sykuta, M. (2005). Who’s monitoring the monitor? Do outside directors protect shareholders’ interests? The Financial Review, 40, 155-172.

- Heng, L.C.C., & Noronha, C. (2011). The impact of the new Accounting Standards for Business Enterprises (ASBE) on financial results of mainland Chinese listed Companies. Advances in Accounting, incorporating Advances in International Accounting, 27, 156-165.

- Kajola, R.O. (2008). Corporate governance and firm performance: The case of Nigerian listed firms. European Journal of Economics, Finance and Administrative Sciences, 14.

- Klinphanich, W., Puangyanee, S., Phoprachak, D., & Jermsittiparsert, K. (2019). Influence of representative factors on tax planning through corporate governance of listed companies in the stock exchange of Thailand. International Journal of Innovation, Creativity and Change, 7(1), 300-316.

- Lanis, R., & Richardson, G. (2011). The effect of board of director composition on corporate tax aggressiveness. Journal Account. Public Policy, 30, 50-70.

- Lee, R.K., & Carlson, L.R. (2007). The changing board of directors: Board independence in S & P 500 firms. Journal of Organizational Culture, Communication and Conflict, 77(1), 31-41.

- McWilliams, A., & Siegel, D. (2001). Corporate social responsibility: A theory of the firm perspective. The Academy of Management Review, 26, 117-127.

- Mohammad, A.R. (2008). Impact of corporate governance on financial performance of firms: Evidence from Pakistan. The Business Review, 11, 282-289.

- Pham, P.K., Suchard, J.A., & Zein, J. (2007). Corporate governance and alternative performance measures: Evidence from Australian firms. Retrieved from SSRN: http://ssrn.com/abstractM 015985.

- Price, R., Roman, F.J., & Rountree, B. (2011). The impact of governance reform on performance and transparency. Journal of Financial Economics, 99, 76-96.

- Puangyanee, S., Yaowapanee, P., Duangsawang, K., & Jermsittiparsert, K. (2019). The influence of the shareholding structure on economic performance through good corporate governance of listed companies in the stock exchange of Thailand. International Journal of Innovation, Creativity and Change, 7(8), 116-133.

- Sukcharoensin, S. (2003). Essays on corporate governance, outside directors, and firm performance. Unpublished DBA dissertation, Thammasat University, Chulalongkorn University, and National Institute Development Administration, Thailand.

- The Stock Exchange of Thailand, Corporate Social Responsibility Institute (CSRI), Thaipat Institute (2012). Guideline of Sustainability Report. Bangkok: The First Edition.