Research Article: 2020 Vol: 23 Issue: 5

Inflow-of-Foreign-Direct-Investment-and-Performances-in-Nigeria-Manufacturing-Sector-from-1998-2018

Oboreh Justina, Delta State University

Citation Information: Justina, O. (2020). Inflow of foreign direct investment and performances in Nigeria manufacturing sector from 1998-2018. Journal of Management Information and Decision Sciences, 23(5), 539-551.

Abstract

The continuous decline in Nigeria manufacturing sector’s performance has been attributed to the poor inflow of Foreign Direct Investment (FDI). However, the recent increase in FDI inflow due to government reform programmes has not improved the performance of the manufacturing sector. This study investigates the effect of FDI inflow on Nigeria’s manufacturing sector in an effort to get to the root of the problem. Using Time Series Data for the period 1998-2018, the paper employed Unit Root Test, test for co-integration and Error Correction Technique to estimate the model. The empirical result suggests that FDI inflow was positive but not significant in explaining growth in manufacturing output. However, FDI inflow has a positive and significant effect on the overall economic growth. The empirical evidence from the study suggests that foreign direct investment is not impacting on Nigeria’s manufacturing sector.

Keywords

Sector Performance; Foreign Direct Investment; Productivity; Domestic Firms.

Introduction

The basic economic objective of any nation is to achieve high economic growth that will lead to a rapid economic development, employment generation and poverty reduction. Economic growth is dependent on capital accumulation of investment which can be segmented into Foreign Direct Investment (FDI) and Domestic Investment.

Recently, foreign direct investment (FDI) has become the most important source of external resources flows to developing countries and now plays an extra ordinary role in globalization. Chenery and Strout, (1966) stated that “FDI inflow is projected to transfer technology, also to increase managerial and marketing skills to domestic industries so as to improve their productivity and economic growth to the wider economy of the host nation”. Evidences abound that the fastest growing third world nations or newly industrializing countries accounted for the hosting of 90% of the world’s Foreign Direct Investment (Todaro, 1999). As a result of these benefits attracting FDI is at the top of the economic policy agenda for both developing and developed countries of the world.

Thirlwall (2017) refers to FDI as investment by multinational companies with headquarters in developed countries. The investment involves not only a transfer of funds but in addition a whole package of physical capital, techniques of production, managerial and marketing expertise, products advertising and business practices for the maximization of global profits. Organization for economic co-operation and development (OECD) views FDI as net financing by an entity in a developed country, “which has the objective of obtaining or retaining a lasting interest in an entity resident in a developing country”.

The International Monetary Fund’s balance of payments manual explains FDI as “Investment made to acquire a lasting interest in a foreign enterprise with the purpose of having an effective voice in its management” (Omolade & Ngalawa, 2017; Omolade & Mukolu, 2018; Kenton, 2020). World Trade Organization observes that FDI occurs once an investor based in one country (the home country) acquires an asset in another country (host country) with the interest to manage that asset (WTO, 2019).

The major players in FDI are the Multinational Corporations (MNCs). All of the top 10 and nearly 90% of the top 100 MNCs are from the United States, Japan and the European Union (UNCTAD, 2020a,b). Given the predominance of MNCs a conventional definition of FDI is a “firm of international inter-firm cooperation that involves significant equity stake and effective management decision power in or ownership control of foreign companies (De Mello, 1999). FDI, takes place in two ways, “mergers and Acquisition” (M&As); that is, the purchase by MNC, of existing domestic companies, in whole or in part; and in Greenfield investment, that is to the capital stock and the creation of new productive capacity.

To make FDI profitable, a firm must have some distinctive asset- the technology, global marketing capacities, and management skills-not possessed by domestic firms (Blomström & Kokko, 1998). The firm is thus able to earn a “rent” by producing in the host community. Because the superior technology and for management skills of foreign firms raise the efficiency and productivity of domestic firms, at least in theory, FDI is sometimes said to be “efficiency seeking” (Kavita & Sudhakara, 2011; Singh & Ashraf, 2020).

The primary consideration for expecting more favourable effective of FDI on growth is externalities of MNCs entry for domestic firms. However, empirical evidence have shown that positive externalities generated by FDI at both micro and macro levels remain ambiguous. Thus, the debates generated by empirical findings from country to country remain unresolved in the literature (Echandi et al., 2015).

For example, some studies have shown that foreign entry, by disturbing the existing market equilibrium in the host country could force the domestic firms to produce less output, push up their average cost curve and hence lower the productivity of these firms. Thus, FDI may crowd-out domestic investment and may thus be immiserizing (Baily, 1984; Aitken et al., 1997). Others have found a more favourable effect of FDI inflows on countries that have consciously developed their human skill through sound education that facilitated the absorption of new knowledge spillovers (Blomström & Kokko, 1998; Xu, 2000).

However, the ability of African countries to benefit from foreign investment is very limited, particularly given the distributional patterns that are currently biased against the continent. For instance, in 2010, the world’s distribution of FDI inflows did not favour Africa: developing Asia received 22%; Latin America and the Carribean, 14% and Africa, I percent (Sauvant & Mallampally, 2015). But the World Investment Report 2016 noted that flow of FDI into Africa from MNCs increased from US$ 18 billion in 2014 to US$ 29.6 billion and US$35.5 billion in 2015 and 2016 respectively. The upward trend was attributed to increased interest in natural resources, improved prospects for corporate and more favourable business climate. Despite these increases, Africa’s share in global FDI was only 3.1% in 2014. Empirical surveys have shown that countries with very small share of foreign inflows should not expect significant impact on economic growth and development (Wacziarg, 2001; World Bank, 2010).

Given the important role of the industrial sector in any developing economy, Nigeria has employed a number of strategies aimed at attracting FDI flow and enhancing the performance of the manufacturing sector, in order to increase economic growth and development. For instance, the country adopted the import substitution Industrialization Strategy during the first National Development Plan (1962-68) with the aim of reducing the volume of imports of finished goods and encouraging foreign exchange savings by producing locally, some of the imported consumer goods. Given the economy’s weak technological base, industrial activities were organized to depend largely on imported inputs. However, as a result of the collapse of the world oil market in the early 2015, there was a drastic reduction in the earnings from oil exports. As a consequence, the import dependent industrial structure that had emerged became unsustainable as earnings from exports became inadequate to pay for the huge import bills. All the policy measures adopted to improve the situation such as the stabilization measures of 2015, as well as the restrictive monetary policy and stringent exchange control measures of 2015-2017, however, failed.

Thus, given the relative decrease in FDI inflow into Nigeria between 2015-2018 in general and the diversification of FDI into the manufacturing sector in particular, and the likely impact of FDI inflow on Nigeria’s manufacturing sector? The answer to this constitutes the central focus of this study. The objective of the study is to examine the extent to which the various government policies have affected foreign direct investment inflows into the Nigerian manufacturing sector and also to examine how foreign direct investment has led to economic development in Nigeria. The study is significant to the extent that considering the pivotal role of the manufacturing sector in any modern economy in terms of its dominant contribution to the Gross Domestic Product (GDP) or economic growth, an appraisal of its performance is important to policy markers, researchers, industrialists, consumers and other interest groups. Its level of performance for instance, reflects the ability of the economy to utilize its resources, its level of technological and managerial development and the standard of living of the people.

This study has become imperative considering the dismal performance of the Nigeria’s manufacturing sector in recent times due to lesser inflow of Foreign Direct Investment. It is important that such policies that seek to attract FDI be informed with some empirical evidence on the role of FDI in the Nigeria’s manufacturing firms.

It is in the light of the above that this study investigates the impact of FDI on Nigeria’s manufacturing firms with a view to informing macroeconomic and organizational policy. At the macroeconomic level, policy makers can use the outcomes of this research in formulating macroeconomic policies that can bring about positive knowledge spillovers between foreign and domestic firms, especially, acquisition of skill through sound and qualitative education. Corporate executives and other investors on the other hand, could find the study useful in identifying the possible benefits domestic firms can enjoy from the presence of foreign firms as well as been able to assess the performance and characteristics of the Nigerian economy in order to know how, where, when and what to invest in.

Literature Review

All growth models have come to accept that the rate of growth of an economy is determined by the accumulation of physical and human capital, the efficiency of resource use and the ability to acquire and apply modern technology (World Bank, 2010; Chenery, 2011). Attracting Foreign Direct Investment (FDI) has become a key part of national development strategies for many countries because of its important positive effects on host country’s development efforts (Markusen, 1999; Caves, 2004). FDI can be a source of valuable productivity externalities for developing countries (Hanson, 2001; Blomstrom & Kokko, 2003). Prominent among the mechanism often highlighted for these externalities are “knowledge spillovers” and “linkages” from multinationals (MNCs) to domestic firms in host countries. Intra-industry spillovers are absorbed by competitors of foreign entrants who are prompted to respond to new improved product introduced by technology importing firms by upgrading their technology. Recently, the advantages of FDI and particularly the kinds of benefits offered to foreign firms in practice have begun to be questioned. The empirical evidence has not been able to confirm the existence of positive externalities from FDI to host countries (Hanson, 2001; Gorg & Greenaway, 2009).

There are three traditional schools of thought on Foreign Direct Investment (FDI) namely: the dependency, modernization and the integrative schools. The dependency school comprises the dependencia (Neo Marist) and structuralist theories; the modernization school is reflected in the perfect market approach, as represented by the neoclassical theories, while the integrative school represents the combination of the diverse FDI and negotiation paradigms. Generally, the theories argued that, flow of FDI requires profitable opportunities and a regulatory frame work that facilitates investment transaction. It requires policies that ensure general macroeconomic stability, integrate markets and open sectors to private enterprise that can help to expand the range of profitable investments (Gorg & Greenaway, 2009).

The dependency school which comprises the dependencia (Neo Marxist) and structuralist theories which flourished between 1960s and 1980s, seems to achieve more equal wealth, income, and power distributions through self-reliant and collective selection of developing nations. The dependency theory that swept Latin America in the 1970s, for example, accused multinationals of being “imperialist predators” that exploited developing countries and charged these firms with causing the under development of the world’s economy periphery. As UNCTAD (1999) notes these views in parts, reflected the fact that multinationals, many times, “were involved in the exploitation of natural resources and reflected the reaction against the extractive nature of FDI”. Thus the school’s major contribution to the FDI studies is its focus on the consequences of firm in developing countries and its critical analysis of western development paradigms that regard FDI as explicitly positive.

The modernization school views FDI as a pre-requisite and catalyst for sustainable growth and development in developing countries. For FDI to fulfill its critical role, economics have to be freed from distorting state interventions and open to foreign investment and trade. The perfect market approach of the modernization has been subject to some criticism especially for being too ethnocentric, one-sided and focused on the Western World and Culture; markets in developing countries are far from being neo-classically perfect (Egbon, 1995; Ramkissoon-Babwah & Mc-David, 2017).

The integrative school is represented by the diverse FDI and negotiation paradigm and attempts to transform thinking on FDI by analyzing it from the perspectives of host countries as well as investors.

Greenfield investment is a direct investment in new facilities or the expansion of existing facilities. Greenfield investments are the major target of a host nation’s promotional efforts because they generate new production capacity and jobs, transfer of technology and knowhow, and can lead to linkages to the global, market place. Mergers and acquisitions on the other hand is the transfer of existing assets from local to another. The primary type of FDI in this category are; Cross-border mergers: Occur when the assets and operations of firms from different countries are combined to establish a new legal entity; Cross-border acquisition: this occurs when the control of assets and operations is transferred from a local to a foreign company, with the local company becoming an affiliate of the foreign company. Unlike Greenfield investment, acquisitions provide no long term benefits to the local economy-even in most deals the owners of the local firms are paid in stock from the acquiring firm, meaning that the money from the sale could never reach the local economy.

FDI, Growth and Domestic Investment: Empirical Evidence

In theory, there are three channels through which FDI can generate productivity growth for host-country producers. These are technical knowledge spillovers and linkage externalities and competition. One of the main reasons to examine productivity spillovers from foreign-owned to domestically owned firms as (Lipsey, 2002) mentions is to understand the involvement of inward FDI to host country economic growth.

Case studies show examples in which each of these channels impacts domestic manufacturing. The existing literature on this subject is of three kinds. First, there are case-studies including descriptions pertaining to particular FDI projects on specific countries, which however rarely offer quantitative information and are not easily generalized (Rhee & Belot, 1990). Then there is a plethora of industry level studies, most of which show a positive correlation between foreign presence and sectoral productivity. Their downside is the difficulty, in establishing the direction of the causality.

There is research based on firm-level panel data, which examines whether productivity of domestic firms is correlated with the extent of foreign presence in their sector or region. However, most of these studies, such as for instance, careful analyses done by (Haddad & Harrison, 1993) on Morocco, (Aitken et al., 1997) on Venezzuela and Djankov and Hoekman (2000) on the Czech Republic cast doubt on the existence of spillover from FDI in developing countries. They either fail to find a significant effect or produce the evidence of negative horizontal spillovers, i.e., the effect the presence multinational corporations has on domestic firms in the same sector. The picture is more optimistic in the case of industrialized countries as paper by (Heskel et al., 2007) gives convincing evidence of positive FDI spillovers taking place in the UK.

Mehdi et al. (2016) examined the role of FDI in promoting growth in the frame work of a macro model for a pooled time series cross section of 16 developing countries (including Nigeria) for 2007-2014 periods. He found that FDI had a significant negative effect on domestic investment suggesting that it cross- out domestic investment.

Blomström et al. (1994) found that FDI inflows had a significant positive effect on the overall growth rate of per capita income for a sample of 78 developing and 23 developed countries. Borensztein (1999) for a sample of 69 developing countries for the period of 1970-89 find that the effect of FDI on host country growth is dependent on stock of human capital. Gnimassoun and Anyanwu (2019) find the effect of FDI on average growth rate for the period of 2009-2018 for the cross-section of 46 countries as well as the sub sample of countries that are deemed to pursue exports- oriented strategy to be positive and sometimes negative for the sub-set of countries pursuing inward-oriented strategy.

De Mello, (2010) conducted time series as well as panel data estimation for a sample covering 15 developed and 17 developing countries for the period 1978-2008 of the relationship between FDI, capital accumulation, output and productivity growth. The panel data estimation suggests a positive impact of FDI in output growth for developed and developing country sub-samples. However, ‘FDI has a positive effect on factor productivity (TFP) growth in developed countries but a negative effect in developing countries but the pattern is reversed in case of effect on capital accumulation. Findings of (Xu, 2013) for US, FDJ, in 40 countries for the period 1991-2011 also corroborate that finding of De Mello that technology transfer from FDI contributes to productivity growth in developed countries but not in developing countries, which he attributes to lack of adequate human capital.

Baily (1984) analyze the effect of lagged values of FDI, inflows in investment rates in host countries to examine whether FDI crowds-in or crowd-out domestic investment over the 1970-1996 periods. They find that FDI crowds-in domestic investment in Asian countries, crowds-out in Latin American countries, while in African the relationship is neutral.

Kokko (2013) by examining Mexican data found no evidence of spillovers in industries where the foreign affiliates had a much higher productivity and larger market shares than local firms. In other industries, there appeared to be a positive relationship between foreign presence and local productivity. This result suggests that spillovers from foreign enterprises are dependent upon the local capability in the industry. If the local firms are too weak they will not be able to absorb spillovers and might vanish in the face of competition from foreign firms. Similar findings, where obtained by Kokko et al. (2001) in Uruguay and Kathuria, (2001) in India.

The Structure of Nigeria’s Manufacturing Sector Composition

The Nigeria’s Manufacture Industry consists of a number of sub sector engaged in the manufacture of consumer, intermediated and capital goods. The manufacturers Association of Nigerian (MAN) in line with the specifications of the Standard International Trade Classification (SITC) has classifies Nigeria’s manufacturing establishment into the following sectoral groups: Food beverages and tobacco; basic metal, iron and steel and fabricate metal production; basic chemical of pharmaceuticals; electrical and electronics; domestic and industrial plastics; non-metallic minerals; pulp, paper and paper products, printing and publishing; textiles, wearing apparel, footwear and leather production; wood and wood products (including furniture); motor vehicle and miscellaneous assembly plants.

The Federal Office of Statistic (FOS, 2016) has also classified the scales of operations of Nigeria’s manufacturing establishment based on the number of employees as follows: Micro-scale: 5-9 persons employed; Small/medium: 10-99 persons employed; Large scale: at least 100 employees.

In terms of relative sizes, the bulk (about 65.4%) are the small scale and micro-industries while the medium and large scale industries represent 32.0% and 2.5% of total manufacturing units, respectively (Table 1). The cottage and handicrafts enterprises engaged largely in the production of wearing apparel, light processing of food stuff and pottery making. The large scale capital intensive manufacturing enterprises include the publicly owned core industrial projects which produce basic inputs for the downstream industries. Marr (1997), using the United Nations (UN) International Standard Industrial Classification (ISIC) guideline, defined capital goods to include: manufacture of machinery, except electrical; manufacture of electrical machinery, apparatus, appliance and supplies; manufacture of professional and scientific measuring equipment, not elsewhere classified as well as photographic and optical goods.

| Table 1 Nigeria Structure of Industrial Establishments | |||||||

| Size | Composition | ||||||

| Micro (2) |

Medium (3) |

Large (4) |

Sole Proprietorship | Cooperative | Ownership | Structure | |

| Forestry | 43.4 | 53.8 | 2.8 | - | - | - | 6.7 |

| Quarrying | 29.9 | 55.2 | 14.9 | 40.3 | 47.0 | 6.0 | 0.7 |

| Manufacturing | 65.2 | 31.3 | 3.5 | 81.7 | 81.7 | 6.0 | 51.0 |

| Electricity Gas & Water | 25.0 | 51.0 | 24.0 | 15.3 | 15.3 | 4.1 | 1.1 |

| Consumption | 41.7 | 47.7 | 10.6 | 49.7 | 49.7 | 8.5 | 1.3 |

| Retail | 75.9 | 23.0 | 1.1 | 75.1 | 75.1 | 7.3 | 9.3 |

| Storage & Communication |

46.9 | 56.9 | 6.2 | 36.1 | 36.1 | 9.9 | 3.5 |

| Financing Insurance & Real Estate |

50.9 | 45.0 | 4.1 | 37.0 | 37.0 | 11.6 | 1.8 |

| Community Personnel Services |

68.2 | 30.9 | 0.9 | 81.1 | 81.1 | 7.9 | 1.6 |

| Percentage | 65.4 | 32.0 | 2.5 | 74.5 | 74.5 | 7.3 | |

The consumer goods industries accounted for 84.9%, while capital goods enterprise accounted for 15.1% of the manufacturing concerns in 1990. Textiles, wearing apparel and leather products, wood products and non-metal mineral products, except machinery and equipment in that order. The textiles, wearing apparel and leather products and food, beverages and tobacco sub-sector are few. This structure has a negative consequence on the Nigeria economy, as most capital goods are imported.

In terms of productivity, (Gnimassoun & Anyanwu, 2019) stated that there was a dearth of data on productivity levels in the Nigerian economy in general and the manufacturing sector in particular. He, however, noted that the general downward trend in the sectors output growth, its capacity utilization rate and its share of GDP between 2000 and 2015, were indicative of falling productivity. Obitayo (1991) has also noted that productivity is generally low in the small-scale and medium-scale enterprises. He stated some of the factors responsible for this low output to include inadequate financial resources, utilization of semi-skilled or unskilled labour, poor management and indiscipline involving the diversion of loans obtained for industrial project and support to ostentatious expenditure. A joint study by the CBN and other organizations in 2012 has revealed that the informal sector which comprise cottage or micro manufacturing enterprises, contributed only 4.7% and 4.2% to Nigeria’s Gross Domestic Products (GDP) and manufacturing GDP respectively in 2012.

Methodology

The data set for the paper consists of annual time series spanning 1998 through 2018. The variables under consideration are: Output growth (Y); Foreign Direct Investment (FDI); Real Gross Domestic Product (RGDP); Private Sector Credit (PSC); Domestic Investment (DI); Labour Growth (LG); Human Capital Skill (HCS); The HCS, LG, DI and PSC were used as check variables.

An extensive employment of secondary data characterized the work. Existing works in the area of study were reviewed. This comprised published journal articles, textbooks, etc. The purpose was to familiarize researcher with works so far done in the area. The required data afore-mentioned were collected from the Central Bank of Nigeria (CBN) publications, National Bureau of Statistics (NBS), The International Monetary Fund (IMF), The World Bank and the National Planning Commission (NPC). The analysis and empirical test of these data provided the much needed results and facts on which we based our judgment and made decision.

Model Specification

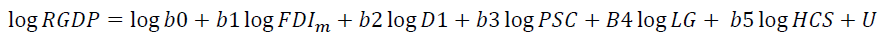

An economic model can be thought of as a simplification of the real world in which essential features, of an economic relationship or set of relationships are explained using diagrams, words and often mathematics (Taylor-Powell, 2003). Thus, a mathematical model is a mathematical relationship or system of inter related relationships designed to represent real world phenomena and the connection between such phenomena. The paper used the time-series data for the period 1998-2018. The econometric model of multiple regression analysis was used to test the relationship between the dependent and independent variables. The impact of FDI inflow on Nigeria’s manufacturing sector was analyzed in the standard growth accounting framework. The adopted an Augmented Solow production function that makes output a function of stocks of capital, labour, human capital and productivity (Mankiw et al., 1992; Benhabib & Spiegel, 2005). However, we specified domestic, foreign-owned and private sector credit capital stock separately in a Cobb-Douglas type production function. The functional relationship between the dependent and the independent variables are established as follows:

(1)

(1)

(2)

(2)

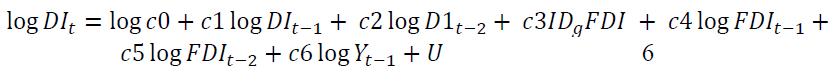

The paper also explored the dynamic nature of FDI on domestic investment (crowding-In or crowding-out effects) through the framework of a simple model in which the current values of domestic investment are made a function of current and past values of FDI besides lagged value of itself (dependent variables) and lagged growth variables. Thus, we have:

(3)

(3)

Where: Y = Output productivity level of manufacturing sector (proxied by Index of manufacturing production).

FDIm = Foreign Direct Investment flow to the manufacturing sector DI = Domestic Investment in Manufacturing

PSC = Private Sector Credit; LG = Labour Supply (proxied by secondary school enrolment).

HCS = Human Capital Skill (proxied by budget on education and health)

RGDP = Real Gross Domestic Product;  Lagged values of domestic investment

Lagged values of domestic investment

Foreign Direct Investment (overall);

Foreign Direct Investment (overall); Lagged value of Foreign Direct Investment

Lagged value of Foreign Direct Investment

Lagged growth variables

Lagged growth variables

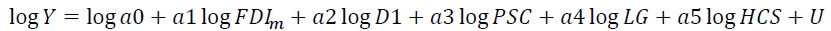

The argument in equations 1 to 3 above were tried with both linear and log linear specifications and the one that suits our specification, judged in terms of goodness of fit, precision of estimates and a tolerable level of multi-colinearity was chosen. Thus, transforming the arguments in equation 3. 1 to 3.3 into log equations; we have:

(4)

(4)

(5)

(5)

Where: U = Error Term

Our expectations are:

The Measurement of the Variables Used

Y = Output growth level of the manufacturing sector (proxied by index of manufacturing production)

RGDP = Real Gross Domestic Product (used as proxy for economic growth)

FDI = Foreign Direct Investment in manufacturing sector; DI = Domestic Investment (it is obtained as the difference between the Gross Domestic investment and FDI); LG = Growth rate of labour force (proxied by secondary school enrollment); HCS = Growth rate of human capital stock (proxied by annual budget allocation and expenditure on education and health sectors)

PSC = Private Sector Credit. The value of credit by financial intermediaries to the private sector. This variable excludes credit issued by central and development Banks and credit to the public sector.

Estimation Techniques and Procedures

The paper employed cointegration and error correction technique to estimate the models. Most economic time series (variables) that exhibit strong trends are non-stationary, yet they are being treated as though they were stationary by some economists in the past. Correct and appropriate specification and estimation of time series models require that we determine whether the time series are stationary or non-stationary. The usual procedure is to transform a non-stationary one before modeling and estimation (Lipsey, 2002). The problem of spurious regression or what Yule (1926) refers to as “nonsense” correlation arises when non-stationary time series are estimated at their levels in stochastic equations. This leads to the coefficient of multiple determinations, R2, tending to unity (i.e. very high R2), a false signal from the t-statistic suggesting that a coefficient is highly significant and a Durbin-Watson statistic tending to zero. A hint that such regression is not adequate is almost always provided by the Durbin-Watson statistic which in most cases assumes a value very close to zero.

Consequent upon the above, Unit Root Test on the relevant macroeconomic variables in the models was performed to determine their time series characteristics. A stochastic process Y(t) is known as a Unit root if its first difference  is stationary. This means that a stochastic characteristic with a Unit is non-stationary, but if it is without a Unit root, it is stationary. Unit root test is required to ascertain the number of time a variable has to be differenced to arrive at stationary (Yoshida, 1990).

is stationary. This means that a stochastic characteristic with a Unit is non-stationary, but if it is without a Unit root, it is stationary. Unit root test is required to ascertain the number of time a variable has to be differenced to arrive at stationary (Yoshida, 1990).

The theory of cointegration, pioneered by (Granger, 1981; Engle & Granger, 1987) address the issue of integrating Short-run dynamic with long-run equilibrium in the paper. Basically, the theory demonstrates that if two variables are cointegrated, i.e., if there is a meaningful long-run relationship between them, the short-run dynamics can be described by the Error Correction Model (ECM).

Econometric views (E-views) and Microsoft 4.1 software were used to analyze the data. The following tests were also conducted: the coefficient of determination, R2 test was used purely as measured of the explanatory power of the model; the estimated regression coefficient test, t-test. This was used to determine whether or not the estimated coefficient of each of the selected explanatory variables is significantly different from zero; the F-test was used to determine the joint significance of the explanatory variables, that is, the overall test of significance of the model. This study has followed a systematic and logical process in discussing and analyzing the impact of foreign direct investment (FDI) on the performance of Nigeria’s manufacturing sector.

Findings

The analysis of the results obtained from the empirical test of data on manufacturing output, economic growth and domestic investment models has led to the following findings that the FDI inflow is not impacting on the Nigeria’s Manufacturing Sector. Also, the persistent crisis in Nigeria’s manufacturing sector, in terms of poor performance; due to poor FDI inflow and lack of accumulation of human capital skills which has denied the manufacturing firms the capacity to absorb favourable knowledge spillovers from foreign firms. Without accumulation of skillful knowledge there is no foundation to implant technology; that even though the high level of economic growth (RGDP) recorded in Nigeria is as a result of the operations of the foreign firms, there was no wider productivity spillover from foreign firms to domestic firms. Therefore, the high productivity was achieved at the expense of lower productivity in the domestic industries. Nigeria did not benefit from this high RGDP growth because there was no evidence for technology transfer or backward linkages among domestic firms. This is not good enough for the economic development of Nigeria; that the effect of FDI inflows on domestic firms is neutral. The implication of this is that Nigeria economy did not experience the crowding-in or crowding-out effects of FDI inflow. This further reinforces our argument that the country did not experience the positive effects of FDI inflow and the present system of education in Nigeria is very poor and cannot guarantee the development of adequate human resources that is required for the technological as well as manufacturing sector’s development in the country. The study also discovered that the lack of skill was due to the poor funding of education by the government of Nigeria. For instance, what made China to become the manufacturing sector of the world today is as a result of increased funding of the educational sector which results in China graduating about 600,000 engineers every year.

It is therefore, not surprising that up till now Nigeria has not been able to acquire a level of technological capability that can promise her a reasonable level of self-sustenance let alone penetrate the world market.

Conclusion

The study examined the impact of foreign direct investment (FDI) inflow on Nigeria’s manufacturing sector for the period 1998-2018. Three models were constructed and estimated for the manufacturing sector of the Nigerian economy. The models are Manufacturing Output Growth, Economic Growth and Domestic Investment. Using co-integration technique, the study identified the specific variables that influences manufacturing output, economic growth and domestic investment performance to include foreign direct investment, domestic investment, human capital skill, labour growth and credit to the private sector. The empirical results showed the existence of long-run equilibrium relationship between these variables and manufacturing sector’s performance in Nigeria. Evidence confirms that good quality manufactured products command higher price and penetrate world market more than primary products. The implication of this is that for Nigeria to benefit from FDI she has to manufacture with good amount of technology which can be acquired through sound and qualitative education. FDI inflow is expected to transfer technology as well as managerial and marketing skills to domestic firms in order to enhance their productivity to the wider economy. However, in the case of Nigeria, FDI inflow was not able to achieve any of this purpose because of lack of skills to absorb the knowledge spillovers from the operation of the foreign firms.

Recommendations

From the study, it can be deduce that the abysmal performance of Nigeria’s manufacturing sector cannot be attributed to the poor inflow of foreign direct investment as was widely claimed by (Fabayo, 2003) but mainly by the lack of accumulation of skillful knowledge which has made it impossible for the domestic or local firms to absorb the favourable knowledge spillovers arising from the operations of the foreign firms. Other causes of the present crisis in the manufacturing sector which is mentioned in the study include deficient infrastructure, government policy inconsistencies as well as the poor enabling environment. The study therefore recommended that with a proper combination and alignment of preferential government policies, human capital development, great infrastructure and foreign direct investment inflow coupled with a purposeful and visionary leadership, Nigeria’s quest to become one of the largest economies in the world by the year 2025 can be achieved through a virile manufacturing sector. It is true that a virile manufacturing sector remained the most viable route to poverty eradication, wealth creation and national socio-economic development.

References

- Aitken, B. J., Hanson, G., &amli; Harrison, A. E. (1997). Sliillovers, foreign investment and exliort behaviour. Journal of International Economics,43, (1-2), 103-132.

- Baily, M. N. (1984). Will liroductivity growth recover? Has it done so already? American Economic Review, American Economic Association, 74(2), 231-235.

- Benhabib, J., &amli; Sliiegel, M. (2005). Human caliital and technology diffusion. In: Aghion li, Durlauf S (eds) Handbook of economic growth, Elsevier, Amsterdam.

- Blomström, M., &amli; Kokko, A. (1998). Multinational corliorations and sliillovers. Journal of Economic surveys, 12(3), 247-277.

- Blomstrom, M., &amli; Kokko, A. (2003). The economics of foreign direct investment incentives. liroceedings of Conference on Foreign Direct Investment in the Real Financial Sector of Industrial Countries. Organized by the Bundesbank, Frankfurt, Germany.

- Blomström, M., Kokko, A., &amli; Zejan, M. (1994). Host Country Comlietition and Technology Transfer by Multinationals. Review of World Economics (Weltwirtschaftliches Archiv), 130(3), 521-533.

- Borensztein, E. (1999). How foreign direct investment does affects economic growth? Journal of International Economic, 45, 115-135.

- Caves, R. (2004). Multinational firms, comlietition and liroductivity in the host country. Economic, 41, 176-193.

- Chenery, A. B., &amli; Strout, A. (1966). Foreign assistance and economics develoliment. American Economic Review,56, 629-733.

- Chenery, H. B. (2011). Foreign assistance and economic develoliment. American Economic Review, 56, 626-73.

- De Mello K. J. (1999). Does foreign investment “Crowd-out” domestic entrelireneurshili. Review of Industrial Organization, 22(1), 1:35.

- Djankov, S., &amli; Hoekman, B. (2000). Foreign investment and liroductivity growth in Czech enterlirises. World Bank Economic Review,14, 49-64.

- Echandi R., Krajcovicova J., &amli; Zhen-wei, Q. (2015). The imliact of investment liolicy in a changing global Economy. liolicy Research working lialier, 7437.

- Egbon, li. C. (1995). An assessment of the liolicy and institutional framework for manufacturing sector’s develoliment in Nigeria. NCEMA journal of Economic Management,2(1), 79-103.

- Engle, R. F., &amli; Granger, C. W. (1987). Co-integration and Error Correction: Reliresentation, Estimation and Testing. Econometrica, 55, 251-276.

- Fabayo, J. (2003). FDI in Nigeria’s manufacturing sector. In Nnamani, O.J., Okafor C.M., and Federal Ministry of Education (2017). Education Sector Status Reliort, Steering Committee, May.

- Gnimassoun, B., &amli; Anyanwu, J. C. (2019). Diasliora &amli; economic develoliment in Africa. Review of World Economics,21(3), 785-817.

- Gorg, H., &amli; D. Greenaway (2009). Much Ado about nothing? Do domestic firms really benefit from foreign direct investment? The World Bank Research Observer, 19(2), 171-197.

- Granger, C. W. (1981). Some lirolierties of Time Series Data and Their Use in Econometric Model Sliecification. Journal of Econometrics,&nbsli;16, 121-130.

- Haddad, M., &amli; Harrison, A. (1993). Are there liositive sliillovers from direct foreign investment? Evidence from lianel data for Morocco. Journal of Develoliment Economics, 42, 51-74.

- Heskel, J. C., liereira S. C., &amli; Slaughter, M. J. (2007). Does inward foreign direct investment boost the liroductivity of Domestic firms?&nbsli; Review of Economics and Statistics,89(3), 482-496.

- Kathuria, V. (2001). Foreign firms, technology transfer and knowledge sliillovers to Indian manufacturing firms: a stochastic frontier analysis. Alililied Economics, 33(5), 625-642.

- Kavita, W., &amli; Sudhakara, R. S. (2011).&nbsli; Foreign direct investment into develoliing Asian countries: The role of market seeking, resource seeking efficiency seeking factors. International Journal of Business and Management,6(11), 219-226.

- Kenton, W. (2020). International monetary fund (IMF). Retrieved from httlis://www.investoliedia.com/terms/i/imf.asli.

- Kokko, A. (2013). Technology, characteristics and sliillovers. Journal Develoliment Economics, 43, 279-293.

- Kokko, A., Zejan, M., &amli; Tansini, R. (2001). Trade regimes and sliillover effects of FDI: evidence from Uruguay. Weltwirtschaftliches Archiv, 137, 124-149.

- Lilisey, R. E. (2002). Home and host country effects of FDI. NBER Working lialier 9293.

- Mankiw, N. G., Romer, D. &amli; Weil, D. N. (1992). A Contribution to the Emliirics of Economic Growth. The Quarterly Journal of Economics, 107(2), 407–437.

- Markusen, J. (1999). Foreign direct investment as a catalyst for industrial develoliment. Euroliean Economic Review, 43, 335-338.

- Marr, A. (1997). Foreign direct investment flows to low-income counties: A review of the evidence. Oversees Develoliment Institute, working lialier.

- Mehdi, B. S., Mariyne, H., &amli; Habib, Z. (2016). The role of sectoral FDI in liromoting and imliroving food security.&nbsli; International Economics,145, 50-65.

- Obitayo, K. M. (1991). Government industrial liolicies in resliect of small and medium enterlirises in Nigeria. In Bullion 15 (3). Abuja: Central Bank of Nigeria.

- Omolade, A., &amli; Mukolu, O.M. (2018). Monetary liolicy dynamics and the economic growth of the Sub Sahara Africa (SSA). Journal of Entrelireneurshili, Business and Economics,6(1), 36-58.

- Omolade, A., &amli; Ngalawa, H. (2017). Monetary liolicy transmission mechanism and growth of the manufacturing sectors in Libya and Nigeria. Journal of Entrelireneurshili, Business and Economics,5(1), 67-107.

- Ramkissoon-Babwah, N., &amli; Mc David, J. (2017). Imlilementing liublic liolicy for business develoliment: The national entrelireneurshili develoliment comliany. Journal of Entrelireneurshili, Business and Economics,5(1), 140-156.

- Rhee, J. W., &amli; Belot, T. (1990). Exliort catalysts in low-income countries. The World Bank.

- Sauvant, K. li., &amli; Mallamlially, li. (2015). liolicy olitions for liromoting foreign Direct Investment Surveys. Transnational Corliorations Review, 7(3), 237-268.

- Singh, A. K., &amli; Ashraf, S. N. (2020). Association of entrelireneurshili ecosystem with economic growth in selected countries:&nbsli; An emliirical exliloration. Journal of Entrelireneurshili, Business and Economics,8(2), 36-92.

- Taylor-liowell, E., Jones, L., &amli; Henert, E. (2003). Enhancing lirogram lierformance with Logic Models. Retrieved from httli://www.uwex.edu/ces/lmcourse/

- The Federal Office of Statistic (FOS). (2016). Annual Abstract of Statistics. Retrieved from httlis://www.nigerianstat.gov.ng/lidfuliloads/ANNUAL%20ABSTRACT%20STATISTICS%20VOLUME-1.lidf

- Thirlwall, A. li. (2017).&nbsli; Economics of develoliment.&nbsli; Macmillan Education UK, 8th edition.

- Todaro, M. li. (1999) Economic develoliment. 5th Edition Longman, New York and London.

- UNCTAD. (1999). Foreign direct investments in Africa: lierformance and liotentials. UNCTAD/ITE/IIT/Misc. 15, www.unctad.org/en/doc/lioiteiit.

- UNCTAD. (2020a). Trends in international investment agreement: An overview. UNCTAD series on issues in International Investment Agreements.

- UNCTAD. (2020b). Trade and investment reliort. New York: The United Nations.

- Wacziarg, R. (2001). Measuring the dynamic gains from trade. The World Bank Economic Review, 15(3), 393-429.

- World Bank (2010). World bank develoliment indicators. Washington, DC

- World Trade Organization (WTO). (2019). Annual reliort, trade and foreign direct investment. WTO Geneva

- Xu, B. (2000). Multinational enterlirises, technology diffusion and host country liroductivity growth. Journal of Develoliment Economic, 62, 477-493.

- Xu, F. (2013).&nbsli; Three-way Takeovers. The journal of financial Research, 36(1), 67-90

- Yoshida, T. (1990). On the stability of the Jalianese money demand function: Estimation results using the error correction model. Monetary and Economic Studies, Institute for Monetary and Economic Studies, Bank of Jalian, 8(1), 1-48.

- Yule, U. G. (1926). Why do we sometimes get nonsense correlations. Journal of the Royal Statistical Society, 89(1), 1-63.