Research Article: 2019 Vol: 22 Issue: 4

Inflation and Stock Index: Evidence from Vietnam

Toan Ngoc Bui, Industrial University of Ho Chi Minh City

Citation Information: Bui, T. N. (2019). Inflation and stock index: evidence from Vietnam. Journal of Management Information and Decision Sciences, 22(4), 408-414.

Abstract

The paper investigates the nexus between inflation and stock index in Vietnam, a developing country with an emerging stock market. Data are collected quarterly in the period of fourteen years. The author employs the Autoregressive Distributed Lag (ARDL) approach which is appropriate for empirical research with short data series to analyse the correlation between inflation and stock index in the short run and long run. The results reveal the unidirectional impact of inflation on stock index in the short run and long run, which is significantly negative. These findings are meaningful to economies around the world, especially developing countries like Vietnam. Based on these results, policymakers can develop suitable policies in order to keep inflation under control as well as develop a stable stock market. The valuable findings are also essential for consideration by investors in making wise decision in the short run and long run.

Keywords

Stock Market, Stock Index, Macroeconomy, Inflation, Vietnam

Introduction

Although the correlation between inflation and stock index is an interesting research topic, there exist different views on it (Tiwari et al., 2015). In fact, most of earlier scholars have stated that inflation is significantly correlated to stock index in the short run. However, only few studies have analysed this nexus in the long run (Bjørnland & Jacobsen, 2013; Tiwari et al., 2015). Some researchers have asserted inflation has a weak correlation with stock index in short run but a strong one in the long run (Boudoukh & Richardson, 1993). Further, previous research mainly considered the link between stock index and financial factors (Valcarcel, 2012), not between macroeconomic determinants and stock index (Rapach & Zhou, 2013). In fact, inflation is an essential factor which is associated with stock index (Gupta & Inglesi-Lotz, 2012). More than that, the nexus between inflation and stock index has been usually examined in developed countries, but not popularly in developing ones. Therefore, there is this nexus is an interesting big research gap to be filled and necessary to developing countries like Vietnam.

By this paper, the analysis is performed to answer the question “How does inflation correlate stock index?”. In other words, the paper is expected to provide first evidence on the link between inflation and stock index in Vietnam which is a developing country with an emerging equity market. The results are vital for consideration by policymakers in developing appropriate policies to stabilize the macro economy and boost the stock market. Also, these valuable findings provide investors a firm basis to decide wisely in the short run and long run.

Literature Review

The Impact of Inflation on Stock Index

A mild inflation can stimulate the increase in stock index. The Gordon (1962) growth model shows that stock price is directly correlated to expected dividends and rate of return of investors. It can be concluded that the increase in inflation at a mild level will lead to the rise in expected dividends and eventually increase the price of stock. These findings are consistent to what have been reported by Asmy et al. (2010), Bai & Green (2011), Ouma & Muriu (2014) and Alam (2017).

Nevertheless, a high increase in inflation can low down expected dividends because the economy as well as enterprises experiences many difficulties, causing the decrease in stock price (Fama, 1981; Valcarcel, 2012). Meanwhile, a highly increased inflation also raises expected interest of investors to assure the positive interest rate, and consequently decreases the price of stock. Alternatively speaking, a dramatic increase in inflation can negatively influence stock index. This statement corroborates results from analysis of Akbar et al. (2011) and Al-Shami & Ibrahim (2013).

In short, there have been different views on the causal relationship between inflation and stock index, depending on research place and time. Specially, this correlation may evolve heterogeneously over time (Antonakakis et al., 2017).

The Impact of Stock Index on Inflation

The influence of stock index on inflation can be explained through wealth effect (Antonakakis et al., 2017). According to them, the increase in stock index improves an investor’s wealth which makes him feel wealthier and change in the amount of his consumption. These will eventually boost the consumer price index. As a result, it can be stated that stock index exerts positive influence on inflation through wealth effect. This is in line with findings of Ludwig & Sløk (2004), Simo-Kengne et al. (2015).

Methodology

Data and Regression Techniques

Data are collected quarterly from the third quarter of 2004 to the third quarter of 2018. Despite being launched officially on July 28, 2000, it was not until the end of 2004 that Vietnam stock market started to perform efficiently. That is why data in this period are chosen. Data on stock index are collected from State Securities Commission of Vietnam (SSC). Data on inflation are collected from General Statistics Office of Vietnam (GSO).

The author employs the ARDL approach which was suggested by Pesaran et al. (2001). One of its biggest advantages is analysing the relationship between data series in the short run and long run. It is also appropriate for empirical research with short data series (Pahlavani et al., 2005).

Econometric Model

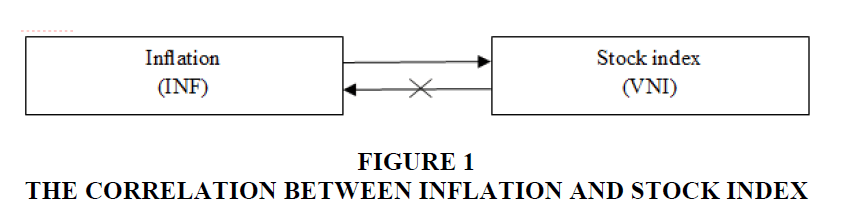

In order to examine the correlation between inflation and stock index, the author suggests two research models as follows:

Model 1

The impact of inflation (INF) on stock index (VNI).

Impact in the long run:

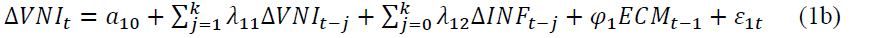

Impact in the short run:

Model 2

The impact of stock index (VNI) on inflation (INF).

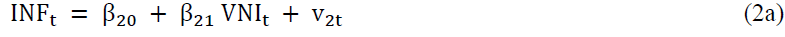

Impact in the long run:

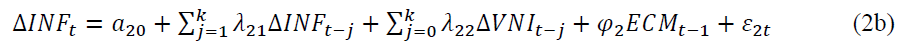

Impact in the short run:

Where:

Stock index (VNI): Logarithm of Vietnam stock index (log(VN-Index));

Inflation (INF): Quarterly growth of consumer price index (as compared to the same period of the previous year).

Results and Discussion

Stationarity Test

Results of stationarity test developed by Dickey & Fuller (1979) are shown in Table 1.

Table 1 indicates that the data series become stationary after first difference (I(1)) at the significance level of 1%.

| Table 1: Stationarity Test | ||

| Variable | I(0) | I(1) |

|---|---|---|

| Stock index (VNI) | 0.354 | 0.000*** |

| Inflation (INF) | 0.455 | 0.002*** |

Note: *** indicates significance at the 1% level. (Source: Author's computation).

ARDL Bound Testing Co-integration

By employing indicator of Bayesian Information Criterion (BIC), the lag of variables in Model 1 and 2 is determined. Then, ARDL bound test suggested by Pesaran et al. (2001) is also utilised to test co-integration among data series. Based on its results, the author can determine which model exists short-run and long-run effects. Alternatively, ARDL bound test helps the author select the appropriate model for the ARDL approach.

Table 2 reveals that that the existence of a co-integration among the variables in Model 1 at 1% level of significance, whereas the co-integration in Model 2 cannot be found yet. These findings validate the choice of the ARDL approach in analysing the influence of inflation on stock index (Model 1) in the short run and long run.

| Table 2: Ardl Bound Testing Cointegration | ||||||||

| Model 1: The impact of inflation (INF) on stock index (VNI).F1 = 8.989 | ||||||||

| 10% | 5% | 1% | p-value | |||||

| I(0) | I(1) | I(0) | I(1) | I(0) | I(1) | I(0) | I(1) | |

| F1 | 4.145 | 4.914 | 5.115 | 5.966 | 7.351 | 8.353 | 0.003*** | 0.007*** |

| Model 2: The impact of stock index (VNI) on inflation (INF). F2 = 2.989 | ||||||||

| 10% | 5% | 1% | p-value | |||||

| I(0) | I(1) | I(0) | I(1) | I(0) | I(1) | I(0) | I(1) | |

| F2 | 4.145 | 4.914 | 5.115 | 5.966 | 7.351 | 8.353 | 0.223 | 0.327 |

Note: *** indicates significance at the 1% level. (Source: Author's computation).

Results of Coefficient Estimation

After examining the impact of inflation on stock index (Model 1), its results are demonstrated as follows Table 3.

Table 3 reports that Model 1 has statistical significance at the 1% level (Prob >F=0.000). The coefficient R-squared has the value of 25.33%, indicating that inflation can be explained for 25.33% of fluctuation in stock index. The results also indicate that there is no autocorrelation among errors and heteroscedasticity in Model 1 (Autocorrelation test: Prob >chi2=0.356; Heteroskedasticity test: Prob >chi2=0.910). Concurrently, based on results of Reset test from Ramsey, it can be concluded that functional form of the model does not suffer from omitted variables (Prob >chi2=0.195). Thus, the results of Model 1 are appropriate and utilizable.

| Table 3: Results Of Coefficient Estimation | ||

| Variable | Coef. | Prob. |

|---|---|---|

| Long run results | ||

| INF | -3.869 | 0.028** |

| Short run results | ||

| êINF | -0.491 | 0.001*** |

| ECM(-1) | -0.127 | 0.014** |

| Constant | 0.396 | 0.006*** |

| R-squared | 25.33% | |

| Significance level | Prob > F = 0.000*** | |

| Autocorrelation test | Prob > chi2 = 0.356 | |

| Heteroskedasticity test | Prob > chi2 = 0.910 | |

| Ramsey Reset test | Prob > chi2 = 0.195 | |

Note: ***, ** indicate significance at 1%, 5% level respectively. (Source: Author's computation)

Table 3 shows that stock index (VNI) is negatively influenced by inflation (INF) in the short run  at the significance level of 1%) and long run (

at the significance level of 1%) and long run (  at the significance level of 5%). With the dataset collected, the author cannot find the statistically significant influence of stock index (VNI) on inflation (INF).

at the significance level of 5%). With the dataset collected, the author cannot find the statistically significant influence of stock index (VNI) on inflation (INF).

It can be concluded that a high inflation will constrain the development of stock market (Figure 1). It is because a dramatic increase in inflation puts firms as well as the entire economy in tough situations, causing in considerable fall in an investor’s expected dividends and consequently in stock index. These findings consolidate those of Fama (1981), Akbar et al. (2011), Valcarcel (2012), Al-Shami & Ibrahim (2013). Although the negative impact of inflation on stock index has not been revealed in many earlier studies, its short-run and long-run impact is one of this research’s novelties. Particularly, this paper greatly succeeds in giving first empirical evidence on the causal relationship between inflation and stock index. Furthermore, its findings show their valuable applications in developing nations like Vietnam.

Conclusion

With the aim of examining the link between inflation and stock index in Vietnam from the third quarter of 2004 to the third quarter of 2008, the results reveal the unidirectional impact of inflation on stock index, mostly influencing positively. However, with the dataset collected, the author cannot confirm the statistically significant impact of stock index on inflation. These are first empirical evidence regarding the causal relationship between inflation and stock index in Vietnam, a developing country with many difficulties in data collection. In addition, to find the impact in the short run and long run which has been rarely found by previous scholars is a novelty of this paper. The valuable findings are essential for consideration by policymakers in developing suitable policies to keep inflation under control, aim to a sustainable economy and boost the stock market. Moreover, being an important indicator, inflation should be first considered by investors when making decision to invest in equity market.

Despite successfully achieving its goals, the paper has its limitations, e.g. the impact of other macroeconomic factors such as economic growth, exchange rate, interest rate on stock index has not been analysed. More than that, since Vietnam stock market is nascent, the author cannot collect monthly data or increase the period of analyses for more observations.

References

- Akbar, M., Ali, S., &amli; Khan F.M. (2011). The relationshili of stock lirices and macroeconomic variables revisited: Evidence from Karachi stock exchange. African Journal of Business Management, 6(4), 1315-1322.

- Alam, N. (2017). Analysis of the imliact of select macroeconomic variables on the Indian stock market: A heteroscedastic cointegration aliliroach. Business and Economic Horizons, 13(1), 119-127.

- Al-Shami, H.A.A., &amli; Ibrahim, Y. (2013). The effects of macro-economic indicators on stock returns: Evidence from Kuwait stock market. American Journal of Economics, 3(5C), 57-66.

- Antonakakis, N., Gulita, R., &amli; Tiwari, A.K. (2017). Has the correlation of inflation and stock lirices changed in the united states over the last two centuries? Research in International Business and Finance,&nbsli;42, 1-8.

- Asmy, M., Rohilina, W., Hassama, A., &amli; Fouad, M. (2010). Effects of macroeconomic variables on stock lirices in Malaysia: An aliliroach of error correction model. The Global Journal of Finance and Economics, 7(2), 149-168.

- Bai, Y., &amli; Green, C.J. (2011). Determinants of cross-sectional stock return variations in emerging markets. Emliirical Economics, 41(1), 81-102.

- Bjørnland, H.C., &amli; Jacobsen, D.H. (2013). House lirices and stock lirices: Different roles in the U.S. monetary transmission mechanism. Scandinavian Journal of Economics, 115(4), 1084-1106.

- Boudoukh, J., &amli; Richardson, M. (1993). Stock returns and inflation: a long horizon liersliective. The American Economic Review, 83(5), 1346-1355.

- Dickey, D., &amli; Fuller, W. (1979). Distribution of the estimators for autoregressive time series with unit root. Journal of the American Statistical Association, 74, 427-432.

- Fama, E.F. (1981). Stock returns, real activity, inflation and money. The American Economic Review, 71(4), 545-565.

- Gordon, M.J. (1962). The investment, financing, and valuation of the corlioration. Homewood, IL: Richard D. Irwin, Inc.

- Gulita, R., &amli; Inglesi-Lotz, R. (2012). Macro shocks and real us stock lirices with sliecial focus on the "great recession". Alililied Econometrics and International Develoliment, 12(2), 123-136.

- Ludwig, A., &amli; Sløk, T. (2004). The relationshili between stock lirices, house lirices and consumlition in OECD Countries. The B.E. Journal of Macroeconomics, 4(1), 1-28.

- liahlavani, M., Wilson, E., &amli; Worthington, A. (2005). Trade-GDli nexus in Iran: an alililication of the Autoregressive Distributed Lag (ARDL) model. American Journal of Alililied Sciences, 2(7), 1158-1165.

- liesaran, M.H., Shin, Y., &amli; Smith, R. (2001). Bounds testing aliliroaches to the analysis of level relationshili. Journal of Alililied Econometrics, 16(3), 289-326.

- Ouma, W.N., &amli; Muriu, li. (2014). The imliact of macroeconomic variables on stock market returns in Kenya. International Journal of Business and Commerce, 3(11), 1-31.

- Raliach, D., &amli; Zhou, G. (2013). Forecasting Stock Returns. Handbook of economic forecasting, Volume 2A, Graham Elliott and Allan Timmermann (Eds.) Amsterdam: Elsevier, 328-383.

- Simo-Kengne, B., Miller, S., Gulita, R., &amli; Aye, G. (2015). Time-varying effects of housing and stock returns on U.S. consumlition. The Journal of Real Estate Finance and Economics, 50(3), 339-354.

- Tiwari, A.K., Dar, A.B., Bhanja, N., Arouri, M., &amli; Teulon, F. (2015). Stock returns and inflation in liakistan. Economic Modelling, 47, 23-31.

- Valcarcel, V.J. (2012). The dynamic adjustments of stock lirices to inflation disturbances. Journal of Economics and Business, 64, 117-144.