Research Article: 2020 Vol: 24 Issue: 5

Implications of Share Ownership of Regionally Owned Enterprises (PERSERO) by Several Regions Together

Busyra Azheri, Faculty of Law Andalas University Padang, Indonesia

Almaududi, Faculty of Law Andalas University Padang, Indonesia

Abstract

This study aims to determine and analyze the ownership arrangements of 51% shares in BUMD Persero by 1 (one) region and the implications of ownership of BUMD (Persero) shares by several regions jointly. In the end, the results of this study can provide policy advice to the government regarding the obligation to share ownership of BUMD Persero and can be a consideration before BUMD Persero adjusts its share ownership with Law 23/2014 or PP 54/2017. The research will be carried out using a juridical-normative design, in which research is carried out on legal norms related to BUMD Persero.

Keywords

BUMD, Stock, Region, Entreprises.

Introduction

Regional-Owned Enterprises (BUMD) are business entities whose capital is wholly or mostly owned by the region. This is as regulated in Article 1 number 40 of the Law of the Republic of Indonesia Number 23 of 2014 concerning Regional Government (Law 23/2014). Furthermore, Article 331 paragraph 4 of Law 23/2014 stipulates that the establishment of BUMD aims to: (a) provide benefits for regional economic development in general; (b) providing public benefits in the form of providing quality goods and / or services to fulfill the livelihoods of the community in accordance with the conditions, characteristics and potential of the region concerned based on good corporate governance; and (c) earn profits and / or profits.

Prior to the issuance of Law 23/2014, BUMD regulation was contained in Law No. 5 of 1962 concerning Regional Companies ("Law 5/1962") and Permendagri No. 3 of 1998 concerning the Form of Regional Company Legal Entities ("Permendagri 3/1998"). However, at that time Law 5/1962 jo. Permendagri 3/1998 has not made it easy for BUMD to face business competition with agile because it is very dependent on the Regional Budget (“APBD”) (Ambar B 2015, 56). In the period before the existence of regional autonomy to be precise at the beginning of Pelita (1997), the development of BUMD quantitatively was not so fast, namely there were only 122 BUMDs, this number increased to 651 BUMDs in 1996 (Harefa 2010, 199). The number of BUMDs throughout Indonesia has more than doubled in 2014 to reach 1700 BUMD (Cahyaningrum 2018, 60).

The increase in the number of BUMDs has not been accompanied by quality performance. Taking into account the report of the Financial and Development Supervisory Agency (“BPKP”) in August 2019, the profit obtained from a total of 1,097 BUMDs is IDR 10.37 trillion. This amount is around 3 percent of the total BUMD assets, namely Rp. 340.12 trillion. Of the 3 percent, almost all of them were obtained from the profits of 26 Regional Development Banks (“BPD”) which incidentally also rely on consumption credit for civil servants (Rahayu, 2019).

Thus, it can be seen that the quality of the BUMD's performance is not as great as increasing its quantity. Of course many factors lead to this. One of these factors is related to the substance (regulation) of law which still causes debate and problems. In fact, one of the problems that arises is related to the ownership of BUMD shares in the form of Limited Liability Companies (hereinafter referred to as “BUMD Persero”). Article 339 paragraph (1) of Law 23/2014 explicitly states that BUMD Persero is a BUMD in the form of a limited liability company whose capital is divided into shares wholly or at least 51% (fifty one percent) of its shares are owned by 1 (one) Region. Similar arrangements were then reaffirmed by derivative regulations of Law 23/2014, to be precise in Article 5 paragraph (2) of the Government Regulation of the Republic of Indonesia Number 54 of 2017 concerning Regional Owned Enterprises (“PP 54/2017”).

Before the issuance of Law 23/2014, share ownership in BUMD Persero was not limited to controlling at least 51% (fifty one percent) of its shares owned by 1 (one) Region. Article 8 Permendagri 3/1998 only regulates the following:

1. Limited Liability Company shares may be owned by Regional Governments, Regional Companies, the private sector and the public.

2. The largest portion of shares of a Limited Liability Company is owned by the Regional Government and Regional Companies.

PP 54/2017, further emphasizes that for BUMD Persero whose share ownership by 1 (one) Region is below 51% (fifty one percent), it is obliged to adjust its share ownership to at least 51% (fifty one percent). The regulation is clearly written in Article 139 PP 54/2017 in the Transitional Provisions chapter. As the following quote:

1. Regional companies that have been established before the enactment of this Government Regulation can be converted into BUMD;

2. For regional companies as referred to in paragraph (1) whose share ownership in 1 (one) Region is below 51% (fifty one percent), the Region is obliged to adjust its share ownership to be at least 51% (fifty one percent).

3. Provisions regarding the adjustment of share ownership as referred to in paragraph (2) shall be regulated in a Regulation of the Minister of Home Affairs.

Until now, there is still no Regulation of the Minister of Home Affairs which regulates the adjustment of share ownership by that 1 (one) region. In addition, PP 54/2017 also does not regulate when at the latest the adjustment of share ownership by 1 (one) region will be carried out by BUMD Persero. It is also not regulated as a legal consequence if an adjustment is not made regarding share ownership by that 1 (one) Region.

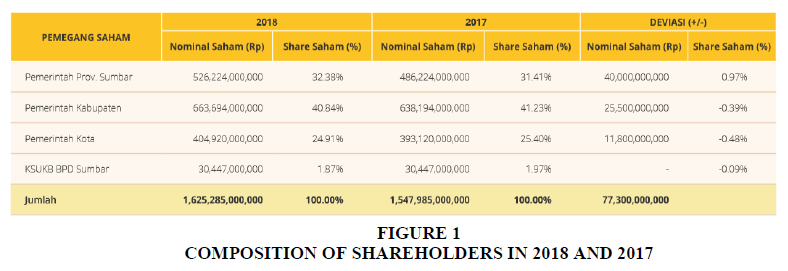

In fact, there are still BUMD Persero whose share ownership is not up to 51% by 1 (one) Region but is owned by several Regions. For example, PT Bank Pembangunan Daerah Sumatra Barat (“Bank Nagari”). The share ownership of Bank Nagari is as follows (PT Bank Pembangunan Daerah Sumatera Barat (Bank Nagari) 2018, 179):

Taking into account the data above (Figure 1), it is clear that there is no 1 (one) Region that controls at least 51% of the shares in Bank Nagari. The shareholders of Bank Nagari are several regions together. Until now, Bank Nagari has not adjusted its share ownership to Law 23/2014 or PP 54/2017. This of course can lead to new legal problems.

Therefore, the aim of this objective is to analyze all regulations and further provide policy recommendations related to Share Ownership in Bank BUMD (Persero) by Several Regions Collectively. Based on this background, the issues to be examined in this study are as follows: (1) What is the urgency of controlling 51% ownership of Bank BUMD Persero by 1 (one) region? (2) What are the implications of share ownership in Bank BUMD (Persero) by several regions jointly?

The Table 1 for the development of Bank Nagari's share composition in 2018 and 2017 is as follows (PT Bank Pembangunan Daerah Sumatera Barat (Bank Nagari) 2018, 180).

| Table 1 Composition of Bank Nagari Shareholders | ||

| No | Region Name | Percentage (%) of Shares |

| 1 | West Sumatra Provincial Government | 32,38 % |

| 2 | District Government (Kab. Fifty Cities, Kab. Agam, Kab. Tanah Datar, District. Pesisir Selatan, Kab. Padang Pariaman, District. Solok, District. Sijunjung, Kab. Pasaman, Kab. Mentawai Islands, Kab. West Pasaman, South Solok Regency, Dharmasraya Regency) | 40,84 % |

| 3 | City Government (Padang City, Bukittinggi City, Payakumbuh City, Solok City, Sawahlunto City, Padang Panjang City, Pariaman City | 24,91 % |

| 4 | Large Family Business Multipurpose Cooperative of West Sumatra Regional Development Bank | 1,87 % |

| Total | 100% | |

Literature Study

There have been many studies related to Regional Owned Enterprises (“BUMD”) that have been carried out since the issuance of Law of the Republic of Indonesia Number 23 of 2014 concerning Regional Government (“Law 23/2014”). The research includes: (1) Changes in Regional Companies in the Perspective of Law 23/2014 on Regional Government (Sumadiyono & Rostarum 2018). (2) Persero's BUMD Strategies to Realize the Principles of Good Corporate Governance (Kusumastuti & Samadi 2019s). (3) Adjustment of BUMD Legal Forms Post Enforcement of PP 54/2017 concerning BUMD (Ambar, 2015). (4) Adjustment of BUMD Legal Forms Post Enforcement of PP 54/2017 concerning BUMD (Sipayung, 2018). (5) Limitation of Equity Participation in Regional Public Companies that are Changed to Regional Companies Owned by More Than One Region (Fadlye et al. 2019). (6) The Existence and Juridical Construction of Regional Owned Enterprises Post Government Law Regions of 2014 (Syam et al. 2018).

However, there is no research that discusses the implications of share ownership of BUMD (Persero) by several regions jointly. For this reason, this study is expected to provide input to policy makers related to the minimum share ownership requirement of 51% by 1 (one) region in BUMD (Persero). Therefore, it can be ascertained that there has not been a study that analyzes the implications of share ownership of BUMD (Persero) by several regions jointly.

Legal Entity Theory

In accordance with PP 54/2017, BUMD is a business entity which is wholly or most of its capital owned by the region. BUMD can be classified into two types. First, the Regional Public Company (hereinafter referred to as "Perumda"). Second, Regional Government Companies (hereinafter referred to as “Perseroda”). Both Perseroda and Perumda are legal companies. In a sense, BUMD is established, carries out activities and is dissolved based on the applicable law. For this reason, it is important to first explain the theories about legal entities.

The first theory of legal entities is the theory of fiction (Rido 1986, 9). According to Friedrich Carl von Savigny's theory, a legal entity is an imaginary business entity. Legal entities are a fiction that actually does not exist, but were created and designed as artificial humans through laws as if they existed. The parties consider a legal entity as an outward entity and meet the legal requirements to do something (Entity). Therefore, legal entities can carry out legal actions like humans who have minds and feelings. Because a legal entity was born and created based on a legal process, its destruction must also go through a legal process. As stated by MC Oliver and EA Marshal, legal entities can only be destroyed by a legal process (Harahap, 2008).

The second theory of legal entities is the theory that explains legal entities is the theory of organs, which was put forward by Otto von Gierke. (Rido, 1986). According to this theory, a legal entity is not mere fiction or delusion, but is real like humans who have a sense of thought and feeling. For example, a Limited Liability Company organ consisting of the General Meeting of Shareholders (GMS), the Board of Directors and the Board of Commissioners is a forum for internal and external interactions for interested parties. Von Gierke assumes it is the same as human organs that are used to communicate with other parties such as the mouth, hands, feet and brain. For this reason, legal entities through their corporate organs can enter into agreements with other parties.

BUMD as a Regional Company

Regulations related to Regional Companies in Indonesia are regulated in the Law of the Republic of Indonesia Number 5 of 1962 concerning Regional Companies (hereinafter referred to as "Law 5/1962"). In the consideration section, it is explained that the presence of Law 5/1962 is a general program of the Government in the economic field as outlined in the Political Manifesto of the Republic of Indonesia dated 17 August 1959 which has been further strengthened by the Decree of the Provisional People's Consultative Assembly of the Republic of Indonesia No. I / MPRS / 1960 and No. II / MPRS / 1960 regarding the necessity of holding a reorganization of the means of production and distribution aimed at implementing Article 33 of the Constitution. The regulation is in the framework of the implementation of granting real and broad contents of autonomy to the Region.

However, with the promulgation of Law 23/2014, Law 5/1962 was declared revoked and declared invalid. Thus, the legal basis for regional companies is Law 23/2014. In addition, PP 54/2017 was also issued as an implementing provision of Law 23/2014. Based on this regulation, BUMD is divided into BUMD Perum and BUMD Persero.

BUMD Perum all of its capital is owned by one region and is not divided into shares. In the event that a Regional public company will be owned by more than one region, the BUMD Perum must change its legal form to a Regional company. BUMD Perum can form subsidiary companies and / or own shares in other companies.

The profit of BUMD Perum is determined by the regional head as the regional representative as the owner of capital in accordance with the provisions of the articles of association and the provisions of laws and regulations. The profit of the BUMD Perum which is the right of the Region is deposited in the Regional treasury after being legalized by the regional head as the Regional representative as the owner of the capital. The profit of BUMD Perum can be withheld with the approval of the regional head as the regional representative as the owner of capital which can be used for reinvestment purposes in the form of addition, improvement and expansion of physical and non-physical infrastructure and service facilities as well as to increase the quantity, quality and continuity of public services. basic services and start-up businesses. Furthermore, related to the dissolution of a legal entity BUMD Perum can be dissolved which is stipulated by a Perda. The assets of BUMD Perum that have been dissolved and become Regional rights are returned to the Regions.

BUMD Persero is a limited liability company whose capital is divided into shares which are wholly or at least 51% (fifty one percent) of the shares owned by one region. For this reason, the establishment of a BUMD Persero legal entity is carried out based on the provisions of the laws and regulations regarding limited liability companies. In the event that the shareholders of a Regional limited liability company consist of several Regions and not regions, one of the Regions is the majority shareholder. Furthermore, in connection with the dissolution of the Company's BUMD legal entity, it can be dissolved which results from the dissolution of the company which become the right of the Region to be returned to the Region.

Regarding BUMD Management, it is regulated in Article 343 of Law 23/2014. In paragraph (1) of the article it is stipulated that the management of BUMD must at least fulfill the following elements:

a. procedures for capital participation;

b. organs and staffing;

c. evaluation procedures;

d. good corporate governance;

e. planning, reporting, coaching, monitoring;

f. cooperation;

g. use of profit;

h. the assignment of the Regional Government;

i. loan;

j. internal supervisory unit, audit committee and other committees;

k. health level assessment, restructuring, privatization;

l. change of legal form;

m. bankruptcy; and

n. merger, consolidation and acquisition

This paper also takes an approach based on 2 (two) legal principles, namely, laws of higher level take precedence over lower regulations (lex superior derogat legi inferiori) and principles of special / special laws take precedence over laws. the common ones (lex specialis derogat legi generali). The principle of lex superior derogat legi inferiori is synonymous with Hans Kelsen's theory called "Reine Rechtslehre" or "The pure theory of law" (pure theory of law). Hans Kelsen's theory, among other things, states that, every rule of law is an arrangement of rules (stufenbau), thus a legal system is a hierarchical system of rules (Soekanto, 1984).

Research Methodo

To answer the two problems raised above, the author uses a juridical-normative research design (Soekanto,1984). This design is a study of the legal norms related to BUMD Persero contained in the laws and regulations in Indonesia. Includes research on legal principles, legal systematics, legal synchronization both vertically and horizontally. The data that will be used in this research are obtained through library research, namely by collecting secondary data, both in the form of primary, secondary and tertiary legal materials such as concepts, doctrines and legislation or legal principles relating to this research (Soekanto, 1984).

Secondary data obtained will be presented qualitatively, namely in the form of text descriptions and analyzed by technical descriptive and critical analysis. The secondary data to be analyzed consists of primary and secondary legal materials. The data that has been collected and is considered valid (valid) will be constructed through a strategy that rests on a conceptualist-induced logic approach (conceptualization induction) on the one hand, and emic logic of thought that is supported through a hermeneutic approach. Then the researcher will construct all the data, both primary and secondary data, to build concepts, hypotheses or develop existing theories.

Analysis Results

The urgency of setting 51% ownership of bank BUMD persero by 1 (one) region

Article 339 paragraph (1) of Law 23/2014 explicitly states that BUMD Persero is a BUMD in the form of a limited liability company whose capital is divided into shares wholly or at least 51% (fifty one percent) of its shares are owned by 1 (one) Region. As the following quote:

Regional Limited Liability Companies are BUMDs in the form of limited liability companies whose capital is divided into shares wholly or at least 51% (fifty one percent) of the shares are owned by one region.

A similar arrangement was later reaffirmed by Article 5 paragraph (2) PP 54/2017. As the following quote:

Regional limited liability company is a BUMD in the form of a limited liability company whose capital is divided into shares wholly or at least 51% o (fifty one percent) of the shares are owned by 1 (one) Region.

Based on the transitional rules in Article 402 paragraph (2) of Law 23/2014, it is stipulated that BUMDs that had existed before Law 23/2014 came into effect are required to adjust to the provisions of this Law within a maximum period of 3 (three) years.

BUMDs that existed before this Law came into effect are required to comply with the provisions of this Law within a period of 3 (three) years from the promulgation of this Law.

Furthermore, based on the transitional rules in Article 139 PP 54/2017 it is stipulated that regional companies whose share ownership by 1 (one) Region is below 51% are required to adjust share ownership. As the following quote:

1. Regional companies that have been established before the enactment of this Government Regulation can be converted into BUMD;

2. For regional companies as referred to in paragraph (1) whose share ownership in 1 (one) Region is below 51% (fifty one percent), the Region is obliged to adjust its share ownership to be at least 51% (fifty one percent).

3. Provisions regarding the adjustment of share ownership as referred to in paragraph (2) shall be regulated in a Regulation of the Minister of Home Affairs.

If you only pay attention to the provisions of Law 23/2014, it can be interpreted that within 3 (three) years after the enactment of Law 23/2014, existing BUMD Persero are required to adjust their share ownership to at least 51% by 1 (one) region. The problem is that until now there is still no Regulation of the Minister of Home Affairs which regulates the adjustment of share ownership by that 1 (one) region. It is also not regulated as a legal consequence if an adjustment is not made regarding share ownership by that 1 (one) Region. Of course, this can lead to legal uncertainty.

Besides that, it can also trigger conflicts between BUMD Persero shareholders who are the Regency or Provincial Government. There must be a region that is willing to relinquish its share ownership rights in a BUMD and there must also be a region willing to buy up to 51% of the company's shares.

The Urgency of Arranging 51% Share Ownership by 1 (one) Region in terms of the Position of Controlling Shareholders

Shareholder structure is usually distinguished in terms of majority shareholder and minority shareholder. Majority shareholders are addressed to those who control or own 50 percent plus 1 or more so that they become controlling shareholders. In contrast, minority shareholders are another group whose share ownership is below 50 percent. This understanding is not wrong, but it is so simple that the understanding is blurred. In practice, there are many companies whose shareholders are not only two parties. Many companies have more than two shareholders with various ownership compositions. In many cases, shareholders who only own 25 percent or 30 percent can appear as the majority shareholder as well as controlling shareholders.

In fact, sometimes the majority shareholder is not necessarily the controlling shareholder. For example, a company XYZ, its shareholders consist of four parties A, B, C and D. Its share composition consists of shareholders A by 20 percent, B by 30 percent, C by 35 percent, and D by 15 percent. In plain view, it cannot be denied that C is the majority shareholder. However especially in the decision-making mechanism at the General Meeting of Shareholders (GMS), shareholders A, B, and D may form a coalition and appear as controlling shareholder (Indonesia Stock Exchange 2012).

In the management of BUMN, there are also certain share privileges that show control even though the shares owned are only 1 (one) share. In practice this is known as Series A Shares (Dwiwarna). The Ministry of BUMN has regulated the Standardization of BUMN Articles of Association through. Based on the letter of the Ministry of BUMN No. S-163 / MBU / 03/2017 dated March 10, 2017 concerning Submission of the Standard Draft of the Articles of Association of BUMN Tbk in the Non-Banking Sector. ("S-BUMN 163/2017") it is known that Series A Dwiwarna shares are shares owned specifically by the State with special rights (Hukum Online, 2020). With the ownership of these shares, even if only with the ownership of 1 share, the State has the privilege to:

1. appointment of members of the Board of Directors and members of the Board of Commissioners;

2. amendments to the articles of association;

3. changes in share ownership structure;

4. merger, consolidation, separation and dissolution, as well as takeover of the company by another company.

Furthermore, the term controlling shareholders is basically unknown in the Law No. 40/2007. If you pay attention to the Regulation of the Financial Services Authority of the Republic of Indonesia Number 12 /POJK.03/2020 concerning the Consolidation of Commercial Banks, it is explained that:

Controlling Shareholder, hereinafter referred to as PSP, is a legal entity, individual, and / or business group owning company or bank shares amounting to 25% (twenty five percent) or more of the number of shares issued and having voting rights, or owning company shares. or the Bank is less than 25% (twenty five percent) of the number of shares issued and has voting rights, but it can be proven that it has exercised control over the company or the Bank, either directly or indirectly.

Furthermore, Article 1 point 13 of the POJK defines control as an action that aims to influence the management and / or policies of companies, including Banks, in any way, either directly or indirectly. Thus, the controlling shareholder is the shareholder who can directly or indirectly determine the company's policy direction.

Considering the juridical provisions and general practice, it is true that holding 51% shares can be interpreted as the majority and controlling shareholder, but in reality, this is not always the case. Control over the company can also depend on the privileges of the shares or the coalition between shareholders in making decisions at the General Meeting of Shareholders (GMS). It is useless if the local government holds 51% shares in BUMD, but the BUMD is apparently controlled by another party having special share ownership based on the Company's Articles of Association.

The Urgency of Setting 51% Shares Ownership by 1 (one) Region in terms of Regional Government

Taking into account Article 1 Number 2 Law of the Republic of Indonesia Number 19 of 2003 concerning State-Owned Enterprises (Law 19/2003), it is stipulated that a Limited Liability Company, hereinafter referred to as a Persero, is a BUMN in the form of a limited liability company whose capital is divided into shares which are entirely or at most at least 51% (fifty one percent) of its shares are owned by the Republic of Indonesia whose main objective is to pursue profit. Considering that the Republic of Indonesia is a single subject (by itself), the ownership arrangement of at least 51% is important and in accordance with existing conditions.

If this arrangement then inspires an arrangement that a company can be called a BUMD if at least 51% of its shares are owned by 1 (one) Region, then the regulation is inappropriate and does not pay attention to existing conditions. The term "Region" in Indonesia is no single but is divided into several provinces and many districts/cities. This is in accordance with the provisions of Law 23/2014 as the following quote:

1. The Unitary State of the Republic of Indonesia is divided into provincial regions and provincial regions are divided into regencies and cities.

2. District / city areas are divided into Districts and Districts divided into sub-districts and / or villages.

3. Article 3

4. Provincial and regency / municipal regions as meant in Article 2 paragraph (1) are Regions and each has a Regional Government.

5. Provincial and district / city regions as referred to in paragraph (1) are established by law.

Since the term “Daerah” is not singular, it is better if BUMD Persero's ownership arrangements accommodate 51% share ownership by the Regions together. In other words, BUMD Persero can be defined as a limited liability company whose capital is divided into shares wholly or at least 51% (fifty one percent) of the shares are owned by one region or by several regions jointly. This arrangement is far more beneficial.

The urgency of regulation of ownership of 51% of shares by 1 (one) region in terms of sectoral regulations

If the ownership of 51% Shares by 1 (one) Region is still being enforced, then the arrangement may conflict with other sectoral provisions. For example, the arrangement of share ownership in the banking sector.

With the issuance of Financial Services Authority Regulation Number 56 /POJK.03/2016 concerning Share Ownership for Commercial Banks ("POJK 56/03/2016"), bank share ownership has become increasingly restricted, namely:

1. Maximum 40% (forty percent) of Bank Capital, for the category of shareholders in the form of legal entities, bank financial institutions and non-bank financial institutions (both Indonesian legal entities and foreign legal entities);

2. Maximum 30% (thirty percent) of Bank Capital, for the category of shareholders in the form of non-financial institution legal entities, both Indonesian legal entities and foreign legal entities); and

3. Maximum 20% (twenty percent) of Bank Capital, for the category of individual shareholders (either Indonesian citizens or foreign nationals).

In accordance with Article 14 POJK 56/03/2016, Regional Governments that already have BPD shares can adjust to the maximum share ownership limit stipulated in Article 3 POJK 56/03/2016. For this reason, share ownership by 1 (one) Region can be adjusted to a maximum of 30% in the BPD. Meanwhile, local governments who are new to becoming prospective bank shareholders must pay attention to the provisions of the Financial Services Authority Circular Letter Number 12 /SEOJK.03/2017 concerning Share Ownership for Commercial Banks (“SEOJK 12/03/2017”). Chapter II letter A.2. SEOJK 12/03/2017 regulates that the maximum limit of share ownership for prospective Bank shareholders in the form of Regional Governments is equal to the maximum limit of Bank share ownership for legal entities that are not financial institutions, namely 30% (thirty percent) of Bank Capital for each Regional Government.

If you pay attention to Article 339 paragraph (1) of Law 23/2014 on Regional Government, the share ownership of 1 (one) Region in a BPD or BUMD is at least 51% (fifty one percent). This provision is certainly not in line with POJK 56/03/2016 jo. SEOJK 12/03/2017.

Considering that the provisions in the banking sector are more specific (lex specialis) than those in the BUMD sector (lex generalis), of course the provisions of Law 23/2014 can be set aside. So that share ownership by local governments in banks must comply with applicable banking regulations, namely POJK 56/03/2016.

The application of the lex specialist derogate lex generalis principle can indeed solve the problem of conflict between Law 23/2014 and sectoral regulations. However, the arrangement should have 51% ownership of shares by 1 (one) region has the potential to cause new problems related to BUMD business activities engaged in certain sectors.

Implications of share ownership in bank BUMD (persero) jointly by several regions

Observing the provisions of Law 23/2014 it can be interpreted that within 3 (three) years after the enactment of Law 23/2014, existing BUMD Persero are required to adjust their share ownership to at least 51% by 1 (one) region. If an adjustment of share ownership is not made, the logical consequence is that the BUMD Persero which is jointly owned by the regions cannot be classified as BUMD. In this case, the BUMD becomes an ordinary limited liability company that is no longer subject to the provisions of Law 23/2014. However, these consequences do not automatically apply because there are no normative provisions that explicitly regulate this.

Conclusion

In connection with the problems raised in the background, the following conclusions are presented:

If you only pay attention to the provisions of Law 23/2014 it can be interpreted that within 3 (three) years after the enactment of Law 23/2014, existing BUMD Persero are required to adjust their share ownership to at least 51% by 1 (one) region. However, until now there is still no Regulation of the Minister of Home Affairs which regulates the adjustment of share ownership by that 1 (one) region. It is also not regulated as a legal consequence if an adjustment is not made regarding share ownership by that 1 (one) Region. This of course can cause legal uncertainty and can lead to conflicts between BUMD Persero shareholders who are the District or Provincial Government. Therefore, the regulation on the requirement for BUMD shareholders by 1 (one) region does not have a clear urgency, considering:

It is true that holding 51% shares can be interpreted as the majority and controlling shareholder, but this is not always the case. Control over the company can also depend on the privileges of the shares or the coalition between shareholders in making decisions at the General Meeting of Shareholders (GMS). It is useless if the local government holds 51% shares in BUMD, but the BUMD is apparently controlled by another party having special share ownership based on the Company's Articles of Association.

The term "region" is not singular like "the Republic of Indonesia". For this reason, the ownership arrangement of BUMD Persero should accommodate 51% share ownership by the Regions together. In other words, BUMD Persero can be defined as a limited liability company whose capital is divided into shares wholly or at least 51% (fifty one percent) of the shares are owned by one region or by several regions collectively. This arrangement is far more beneficial.

If you pay attention to Article 339 paragraph (1) of Law 23/2014 on Regional Government, the share ownership of 1 (one) Region in a BPD or BUMD is at least 51% (fifty one percent). Of course, these provisions may conflict with other sectoral regulations, for example in the banking sector. This arrangement is not in line with POJK 56/03/2016 jo. SEOJK 12/03/2017.

The application of the lex specialist derogate lex generalis principle can indeed solve the problem of conflict between Law 23/2014 and sectoral regulations. However, the arrangement should have 51% ownership of shares by 1 (one) region has the potential to cause new problems related to BUMD business activities engaged in certain sectors.

If the share ownership adjustment is not made to at least 51% by 1 (one) region, then the logical consequence is that BUMD Persero that are jointly owned by the regions cannot be classified as BUMD. In this case, the BUMD becomes an ordinary limited liability company that is no longer subject to the provisions of Law 23/2014. However, these consequences do not automatically apply because there are no normative provisions that explicitly regulate this.

References

- Ambar, B., Yudho, T.M., & Anjar Sri, C.N. (2015). Regional Owned Enterprise (BUMD) Management Strategy to Realize Good Corporate Governance Principles. Privat Law, 57-66.

- Cahyaningrum, D. (2018). Implications of BUMD Legal Forms on BUMD Management. Negara Hukum, 59-78.

- Fadly., Amelia, K.D., Dan Reka, D. (2019). Limitation of equity participation in regional public companies that are changed to regional companies owned by more than one region. Legal Journal, 1-15.

- Harahap, M.Y. (2008). Limited Liability Company Law. Jakarta: Sinar Grafika.

- Harefa, M. (2010). Management of BUMD/Regional Companies in Provnsi West Sumatra, West Nusa Tenggara and South Kalimantan. The Study, 199-226.

- Kusumastuti, D., & Dan Wibowo, M.S. (2019). Changes in regional companies in the perspective of law 23/2014 on regional Government. Unisri Research Fair, 237-247.

- Rahayu., Kurnia, Y. (2019). BUMD Instead Burdens the Government Budget. 31 August. https://bebas.kompas.id/baca/utama/2019/08/28/bumd-justru-membebani-anggaran-pemerintah/.

- Rido, Ali. (1986). legal entities and positions of legal entities of associations, associations, cooperatives, foundations, endowments, (Bandung: Alumni, 1986), and Chidir Ali, Legal Entity. Bandung: Alumni.

- Sipayung, B. (2018). Adjustments to the legal form of bumd after the enactment of pp number 54 of 2017 concerning BUMD. East kalimantan: legal subdivision of the supreme audit agency of the republic of Indonesia.

- Soekanto, S. (1984). Introduction to legal research. Jakarta: UI-Press.

- Sumadiyono, S., Dan Triamy, R. (2018). Juridical construction of regionally owned enterprises according to law 23/2014 on regional Government. Legality , 10(1), 1-8.

- Syam, F., Elita, R., & Dan Arsyad. (2018). The existence and juridical construction of regional owned enterprises after the 2014 regional government Law. Invite: Legal Journal, 296-322.