Research Article: 2018 Vol: 17 Issue: 2

Implementing Innovation Management on Market Attractiveness and Unique Resources to Enhance Business Performance on Organic Fertilizer Industries in Indonesia

Yanto Ramli, Mercu Buana University

Mochamad Soelton, Mercu Buana University

Keywords

Market Attractiveness, Unique Resources, Innovation Management, Business Performance.

Background

Indonesia is an agricultural country where most of the people are working in the agricultural business or as a farmer. Indonesia is endowed with natural supported conditions, large area of lands and abundance of biodiversity and also located in the tropical area which are sufficient to support the growing of plant and agriculture throughout the year.

Agriculture is the process of using biological resources by human being to produce food, industrial raw materials or energy resources, as well as to manage the environment. The event of utilizing biological resources is included in the agricultural cultivation or farming. Indonesia has along historical story since the colonial time until this decade which is inseparable from agricultural and plantation sectors, as these sectors contributed a great significance in determining the formation of various economic and social realities in different regions of Indonesia.

Fertilizer, basically is also part of the history effect of agriculture and is estimated to be utilized since the beginning of human being starting to know farming, which is approximately 5,000 (five thousand) years ago. Fertilizer is utilized as the growing media for plants to provide the necessary plant nutrients so that they can produce accordingly. The resources of fertilizer can be either organic or non-organic (synthetic). Fertilizers are different from food supplements normally given to plants, fertilizers contain raw materials that are needed for plant growing and developing, while food supplements such as plant hormones only help to smooth the process of metabolism.

There are two types of fertilizers circulated and traded around the agriculture sector as we know which are namely chemical fertilizer and organic fertilizer. Chemical fertilizer is widely spreaded and traded because of the advantage of the usage that can be measured precisely according to the requirement for plants and the usage are more appropriate and provide prompt effect compare to organic fertilizer. The disadvantages are that Chemical fertilizers do not contain micro nutrients; therefore the usage of chemical fertilizer must also include organic fertilizer because it contains micro nutrients. The other disadvantage of chemical fertilizer is when the chemical fertilizer is excessively used, it may harm the soil nutrients and also deficient the growth of plants.

Organic fertilizer is normally made up of natural materials such as: Weathering of plants, animal waste, industrial waste, rubbish and so forth. The advantage of organic fertilizer is proven to improve the structure of soil and nutrients, because it contains macro and micro elements to form the process of organism. Organic fertilizer contains both macro and micro nutrients, but the level of nutrients are not as high as chemical fertilizers and the growing process of organic fertilizers for plants is also considered to be slow compare to chemical fertilizers. But in order to maintain the soil with fertility and contain nutrients, chemical fertilizer must be properly controlled and organic fertilizer must be properly utilized to balance the nutrients of the soil.

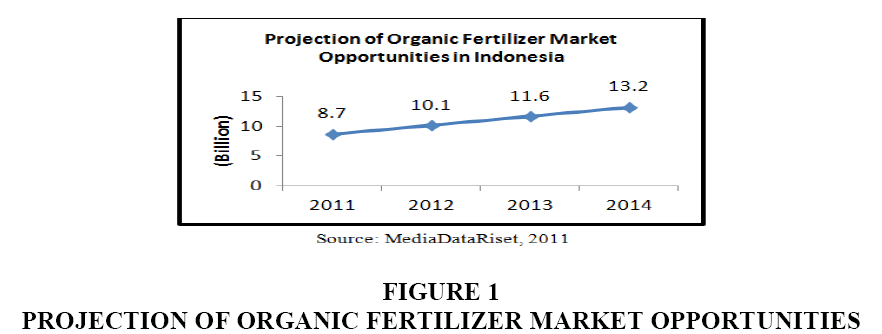

Indonesia Government has started to persuade agriculture department to implement using organic fertilizer as one of the media crop for organic farming. This has triggered a huge business opportunities that is widely opened in Indonesia, this may also incur a huge demand of organic fertilizer throughout the Indonesia territory along with the community awareness of demanding healthy food. This statement is supported by the Table 1 shown below based on the projections demand of organic fertilizer from Data Media Research done in 2011 (Figure 1).

| Table 1 Numbers of Fertilizers Producers Registered in the Ministry of Agriculture |

|||

| Fertilizer | Types of Fertilizer | Year | |

| 2010 | 2015 | ||

| Liquid | Organic + Biological | 250 | 254 |

| Soil Repair | 16 | 50 | |

| Powder | Organic + Biological | 113 | 105 |

| Soil Repair | 49 | 50 | |

| Granular | Organic + Biological | 160 | 167 |

| Soil Repair | 66 | 50 | |

| Total | 654 | 676 | |

| Chemical | |||

| Total | 519 | 440 | |

Source: List of “chemical, organic, soil repair and biological” (2010 & 2015)

Looking at the projection organic fertilizer market opportunities from Media Data Research done in 2011, it shows that the demand of organic fertilizer is increasing significantly from year to year, starting from year 2011 which almost reached 8.7 billion rupiah, then increased to 10.1 billion rupiah in 2012. In 2013 it increased again to 11.6 billion rupiah and in 2014 it touched 13.2 billion rupiah. From the analysis of fertilizer market share, organic fertilizer will continue and remain to be huge opportunities for market share and the requirement for organic agriculture are still widely open from 6.86 billion rupiah in 2011 to 8.60 billion rupiah in 2014.

This research is done on the organic fertilizer industries registered in the Ministry of Agriculture in Indonesia and from the preliminary survey done earlier, it was detected that a lot of organic fertilizers industries are unable to survive the business due to the bad performance and even some of them have closed down the business. Actually the decision of closing down the business of the industries in producing organic fertilizer is very tough, as the process of obtaining the production license from the Ministry of Agriculture must go through a long process until the license can be approved.

The process of obtaining the production license starts from the registration of the product brand to the Ministry of Law and Human Rights. The process will be followed with the laboratory test on the contents of the organic fertilizer and then continue with the testing of the organic fertilizer product on several commodities of agriculture to verify the competences of the organic fertilizer tested on the plants. This process is based on the regulations No. 08/Kpts/SR.140/2/2001 pertaining the term and procedures for registrations and regulations No. 28/Permentan/SR.130/5/2009 pertaining the term and condition of organic fertilizer, biological fertilizer and soil repair materials.

In accordance with the regulation of Ministry of Agriculture, No.70/Permentan/SR.140/10/2011 pertaining on Organic Fertilizer, Biological Fertilizer and Soil Repair, the organic fertilizer are classified into two types of organic fertilizers: Solid Organic Fertilizer and Liquid Organic Fertilizer.

From the list of “Chemical, organic and soil repair and biological fertilizer” printed in 2010, the number of organic fertilizer producers which was registered in the Ministry of Agriculture are consisted of 519 producers of chemical fertilizers and 654 organic fertilizers producers. And from the List of “Chemical, organic and soil repair and biological fertilizer” printed in 2015, the number of organic fertilizer producers was 440 chemical fertilizers producers and 676 organic fertilizers producers, so the total number of 676 producers is consisted of 3 types of organic fertilizer: Liquid, Powder and Granular. And this research is only focus and analysing the phenomenon problem on powder organic fertilizer.

Based on the above information, it was detected that from the number of 113 organic fertilizer producers registered in the year 2010 that only 61 producers was re-registered on the List of “Chemical, organic and soil repair and biological fertilizer” printed in the year 2015, the rest of 52 producers was not on the List. This occurrence may be the effect of low businesses and unable to survive through hard times. However, on the List of 2015 there are 44 new producers registered which make the total of registered organic fertilizer producers become 105 producers in 2015.

Based on the survey, observation and interview done on the site at the organic fertilizer factories, the researcher obtained several findings from the production managers of each of the industries such as: (1) The basic resources of productions are almost similar, (2) the production process of the organic fertilizer are only slightly differ from each of the producers, (3) the cost of production and pricing are slightly different, (4) the products offered to the customer are almost the same, (5) the buyer of the products are limited to certain customers. These are the observations collected by the researcher which may be the effect of low business performance on the organic fertilizer industries.

With these simple business processes, the organic fertilizer industries may encounter the problem of competition and competitive advantage, which might contribute low optimal business performance and the cause of disruption of business process. There is no proper business process or proper business management process to handle the business in order to be able to compete properly and obtain competitive advantage to survive the business. This may be the reasons of the discontinuation of the business mentioned earlier.

In order to be able to survive in the business of organic fertilizers industries, the management have to take into consideration of implying strategic management by looking into several criteria of strategic management process such as, analysing, formulating and implementing the proper strategy to be able to compete, grow and survive the business and finally control and evaluate the strategy implemented. No businesses will survive if there is no proper handle of business strategy involved.

According to Wheelen & Hunger (2015) that business performance of a company can be measured by Sales Growth, Market Share and Profitability. In order to be able to achieve high sales and penetrating in the market share, the company must be able to obtain an extinct product with specific differences from the competitors; this can only be achieved by implementing innovation management based on the resources of the company and the potential market.

Resources can be defined as anything owned by a company that can be utilized by the industries to optimize the market strategy in order to improve the company's performance. Unique resources can also be classified as something which is valuable and strategic that can be utilized by the company to improve efficiency and productive, rare, difficult to imitate and also difficult to be replaced by the resources owned by the competitors. With the low optimum of business performance of the organic fertilizer industries registered in the List of Ministry of Agriculture may be the effect of the undeveloped company resources into unique resources to improve the business performance.

Referring to the resources mentioned above, according to David (2015) that most of the resources owned by the company can simply be grouped into three categories such as: Physical Resources, Human Resources and Organizational Resources. These three resources must be elaborated clearly to suit the strategy implemented based on each of the categories of each of the three dimension above.

Beside the resources of the company, market practice is also another issue that can contribute to the business performance and according to Best (2013) explains that what makes a segment interested or not is depending on how the response of a company to the business in these markets, but when we look closely at this matter, there are several factors which may make the segment become more interested and more attractive based on three aspects: Market Forces, Competitive Environment and Market Access.

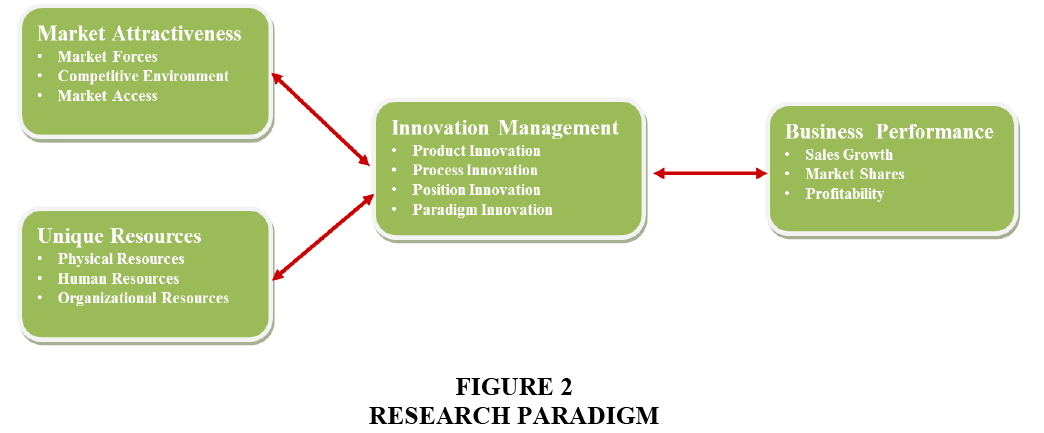

By looking at the phenomenon matter described above, the intention of this research is to analyse and examine the influence of Innovation Management on Unique Resources and Market Attractiveness towards the Business Performance of the organic fertilizer industries in Indonesia. The purpose of this research is to find out whether Unique resources or Market attractiveness have the most significant influence from Innovation management that may contribute positively on the business performance.

Literature Review

Best (2013) explain that we need a systematic way to assess market attractiveness by using a common set of criteria against which to compare to the product-markets. The factors that typically shape the market attractiveness are categories into several sections such as: Market size, market growth, competition, margin potential, market access and a “good fit” with the company's core capabilities. These factors which were mentioned earlier that can be meaningfully grouped into three dimensions of market attractiveness, these three dimensions are as follow: Market Forces, Competitive Environment and Market Access.

Based on the previous research related to the above variable (Market Attractiveness), Mensah in his research explains that there are two constraints that bind most influential which was identified in the small factories in the business sector in Ghana. The first constraint is the limited access to technology and the second constraint is the limited access to the market. The results of this study based on a survey done on 85 small factories in Berekum District and Sunyani Municipality of Ghana. Low demand for merchandise is the factor of the company's ability to access the market. To overcome the problem of low demand, the Government is expected to start in creating the necessary coordination of externally and demonstrate the capability of a successful country.

David (2015) comment that in a world where customer preferences are volatile, the identity of customers is changing and the technologies for serving customer requirements are continually evolving; and externally focused orientation does not provide a secure foundation for formulating long term strategy. When the external environment is in a state of flux, the firm's own resources and capabilities may be a much stable basis on which to define its identity. Hence, a definition of a business in term of which it is capable of doing may offer a more durable basis for strategy.

According to David (2015) that resources can be grouped into three categories such as: Physical Resources, Human Resources and Organizational Resources. Physical resources include: Physical assets such as land, equipment and location; Human resources include the number of staff and expertise; Organizational resources include culture and reputation.

Based on the previous research related to the above variable (Resources), Marius-Dan Dakota described that in order to determine whether innovation and human resource management have relationship. Conversely, human resource management affects the level of innovation of the company. The conclusion proposed research shows a close relationship between human resources with innovation.

Tidd & Bessant (2013) explain that what organizations have in common is that their success derives in large measure from innovation. Whilst competitive advantage can come from size or possession of assets and so on, the pattern is increasingly coming to favour those organizations which can mobilize knowledge and technological skills and experience to create novelty in their offerings (product/service) and the ways in which they create and deliver those offering. Innovation matters, not only at the level of individual enterprises, but increasingly as the wellspring for national economic growth.

According to Tidd & Bessant (2013) that innovation are essentially talking about change and this can take several forms, for the purposes of this discussion will focus on four broad dimensions:

1. Product Innovation-changes in the things (products/services) that an organization offers.

2. Process Innovation-changes in the ways in which they are created and delivered.

3. Position Innovation-changes in the context in which the products/services are introduced.

4. Paradigm Innovation-changes in the underlying mental models which frame what the organization does.

Based on the previous research related to the above variable (Innovation Management), Andrea Maier in their research explains that all companies will face radical changes continuously; innovation becomes a condition that can help the company to survive in the era of globalization market today. Innovation becomes mostly important and necessary to contribution in improving productivity, competitiveness, economic performance and social goals. In this study, the proposed framework for the management of innovation, which focus on marketing innovation, product innovation, process innovation, innovation networks, innovation in human resource development, administrative innovation, strategic innovation and vision and policy innovation? This framework aims to cover all the major components of business systems, to achieve a real performance of an organization.

The measurement of a company performance will not be objective based on financial calculation such as Sales, Revenues, Net Profit, Return on Sales, Assets as a percentage of Sales and Return On Assets that may not be reliable based on the calculation of internal financial performance, because the above calculation does not provide external performance and outlook based on the market. The calculation must also take External benchmarks of market growth, Competitive Pricing, Relative Products and Service Quality and the Ability to satisfy and retain customers (Table 2) (Best, 2013).

| Table 2 The Business Performance Measurement Model |

|

| Internal Financial measure of Performance | External/Market-based view of performance |

| Sales Revenue | External benchmarks of market growth |

| Net Profit | Competitive Pricing |

| Return on Sales | Relative Product and Service Quality |

| Assets as a percentage of Sales | Ability to satisfy and retain customers |

| Return on Assets | - |

Source: Best (2013)

Best (2013) explains that the purpose of the assessment of the portfolio of a company is to strategically determine where a business at this time and the purpose of the business for the future with a portfolio of current products and the products that will be developed in the future. A portfolio analysis provides a strategic snapshot of the current situation. Strategic market plans are forward looking and enable a company to make strategic changes to its product portfolio that is in line with the company’s strategic vision and performance objectives. Each product-market in a business’s portfolio in some way affects both the short and long-run performance of the business.

According to Best (2013) that on the basis of a portfolio analysis and performance objectives, a business selects either an offensive or defensive strategic market plan. Offensive strategic market plans are geared to deliver above-average performance in the areas of sales growth, share position and long-run profit performance. Defensive strategic market plans, in contrast, are intended to protect important share positions and produce short-run profit performance, while also contributing to long-run profit. The business may want to increase its investment in some product-market, depending on their current and potential share positions and their performance levels, in order to grow or defend important strategic market positions.

According to Wheelen & Hunger (2012) that the performance of a company can be measured from three dimensions which are: Sales growth, market share and profitability.

Based on the research of Abolfazl confirmed from the hypothesis testing, found out that a significant positive relationship between innovation, market orientation, knowledge management and financial performance are closely related to each other to increase the business performances (Figure 2).

According to several measurements of business performance, most of them are discussing most of the financial factors such as: ROE, Sales Growth, Profit Margin Revenues and Profits, Return on Investment (David, 2015) Sales Growth, Market Share, Profitability (Wheelen & Hunger, 2015).

Research Objective

The basic objective of this research is to analyse the influence of Market Attractiveness, Unique Resources and Innovation Management that may contribute significant effect on the Business Performance of organic fertilizer industries in Indonesia. This phenomenon arises from the review of the potential market and the potential resources which are widely opened, hence many organic fertilizer industries do not survive.

Methodology

The research designed in this study is to test the influence and relationship of the related variables described earlier. This research use both descriptive and verificative research with the causality type of investigation to analyse the effect and influence of both exogenous and endogenous variables. The analysis unit in this study is the industries of organic fertilizer in Indonesia and the observation unit is the management of the company. The design of analysis utilized in this study is Partial Least Square (PLS) which is an alternative method of variance analysis from Structural Equation Modelling (SEM). The reason of choosing this design method is because of the target population defined. There are two types of organic fertilizer industries in Indonesia, which are solid organic fertilizer and liquid organic fertilizer. This research is limited to the solid organic fertilizer industries with the amount of 51 companies (as the populations) registered in the Ministry of Agriculture.

Result and Discussion

The Goodness of Fit model is measured by using R2 of the dependent latent variables with the same interpretation to regression. Q2 predictive relevance for the structural model will measures how good the observed values generated by the model and estimation parameters. According to Chin (1998), the value of R square of 0.67 (strong), 0.33 (moderate) and 0.19 (weak). Prediction value relevance (Q square) at 0.02 (small), 0.15 (medium) and 0.35 (large).

The measurement model of analysis show above are the link between manifest variables (indicators) and each of the latent variables. Analysis of the measurement model in this case aim to test the validity and reliability of each of the dimensions and the indicators utilized to measure each of the variables that were constructed earlier. The analysis of the measurement model can be explained by the describing the value of discriminant validity by looking at the value of square root of Average Variance Extracted (AVE) with a suggested value above 0.5, loading factor (>0.5), constructed Composite Validity and Reliability (Cronbach’s Alpha>0.70) (Nunnaly, 1994), can be concluded that the dimensions and indicators stated are classified as reliable in the measurement of the research variables. As showed in the Table 3 below.

| Table 3 Goodness of Fit Model (Gof) |

|||||

| Variables | AVE | Composite Reliability | Cronbach’s Alpha | R Square |

Q Square |

| Market Attractiveness | 0.534 | 0.872 | 0.835 | - | 0.238 |

| Unique Resources | 0.586 | 0.903 | 0.885 | - | 0.279 |

| Innovation Management | 0.514 | 0.893 | 0.861 | 0.633 | 0.354 |

| Business Performance | 0.602 | 0.913 | 0.888 | 0.554 | 0.602 |

Source: From data processing (2015)

The value of R2 shows that the criterion is strong, with large Q value, this can be concluded that the propose model is supported by the empirical research where the model is classified as fit. Similarly, the values of AVE is >0.5, which indicate that all the variables in the model were estimated to meet the criteria of discriminant validity. The value of both Composite Reliability and Cronbach's Alpha for each of the variables is >0.70 (above 0.70) which means that all the researched variable are classified as reliable.

The result of measurement based on the data processing of model analysis on the dimensions based on the indicators indicates that the overall indicator processed in the above Table 4 are classified as valid where most of the value of loading factors is greater than >0.70 (above 0.70).

| Table 4 Loading Factor of Dimension-Indicator |

||||

| Dimension-Indicator | Loading Factor (λ) | Standard Error (SE) | T Statistics (|λ/SE|) | Conclusion |

| Market Forces → X11 | 0.736 | 0.050 | 14.790 | Valid |

| Market Forces → X12 | 0.594 | 0.114 | 5.212 | Valid |

| Market Forces → X13 | 0.811 | 0.059 | 13.749 | Valid |

| Competitive Environment → X21 | 0.764 | 0.062 | 12.246 | Valid |

| Competitive Environment → X22 | 0.691 | 0.064 | 10.804 | Valid |

| Competitive Environment → X23 | 0.839 | 0.033 | 25.311 | Valid |

| Market Access → X31 | 0.741 | 0.061 | 12.183 | Valid |

| Market Access → X32 | 0.757 | 0.044 | 17.122 | Valid |

| Market Access → X33 | 0.672 | 0.089 | 7.581 | Valid |

| Physical Resources → X41 | 0.681 | 0.051 | 13.334 | Valid |

| Physical Resources → X42 | 0.768 | 0.053 | 14.567 | Valid |

| Physical Resources → X43 | 0.654 | 0.065 | 10.000 | Valid |

| Physical Resources → X44 | 0.619 | 0.074 | 8.384 | Valid |

| Physical Resources → X45 | 0.724 | 0.063 | 11.524 | Valid |

| Human Resources → X51 | 0.733 | 0.052 | 14.043 | Valid |

| Human Resources → X52 | 0.788 | 0.046 | 17.268 | Valid |

| Human Resources → X53 | 0.687 | 0.041 | 16.708 | Valid |

| Human Resources → X54 | 0.705 | 0.044 | 16.207 | Valid |

| Human Resources → X55 | 0.796 | 0.041 | 19.493 | Valid |

| Organizational Resources → X61 | 0.710 | 0.046 | 15.279 | Valid |

| Organizational Resources → X62 | 0.653 | 0.064 | 10.175 | Valid |

| Organizational Resources → X63 | 0.833 | 0.031 | 26.824 | Valid |

| Organizational Resources → X64 | 0.763 | 0.050 | 15.284 | Valid |

| Organizational Resources → X65 | 0.762 | 0.041 | 18.487 | Valid |

| Product Innovative → Y11 | 0.893 | 0.019 | 46.857 | Valid |

| Product Innovative → Y12 | 0.864 | 0.030 | 29.295 | Valid |

| Process Innovation → Y21 | 0.860 | 0.020 | 43.361 | Valid |

| Process Innovation → Y22 | 0.770 | 0.051 | 14.958 | Valid |

| Position Innovation → Y31 | 0.789 | 0.041 | 19.180 | Valid |

| Position Innovation → Y32 | 0.871 | 0.017 | 51.756 | Valid |

| Paradigm Innovation → Y41 | 0.794 | 0.062 | 12.888 | Valid |

| Paradigm Innovation → Y42 | 0.831 | 0.031 | 26.496 | Valid |

| Share Performance → Z11 | 0.852 | 0.031 | 27.594 | Valid |

| Share Performance → Z12 | 0.925 | 0.009 | 107.642 | Valid |

| Sales Growth → Z21 | 0.859 | 0.023 | 37.562 | Valid |

| Sales Growth → Z22 | 0.868 | 0.018 | 47.687 | Valid |

| Profit Performance → Z31 | 0.863 | 0.027 | 31.922 | Valid |

| Profit Performance → Z32 | 0.829 | 0.034 | 24.667 | Valid |

| Profit Performance → Z33 | 0.888 | 0.026 | 34.761 | Valid |

Source: From data processing (2015)

Based on the test results in the above Table 5, it was figured out that there is a significant influence indirectly from both the research variable of Market Attractiveness and Unique Resources towards Business Performance through Innovation Management. Unique Resources has a higher influence on Business Performance with the result of 12.676 compare to the influence of Market Attractiveness on Business Performance with the result of 6.647.

| Table 5 Hypothesis Testing |

|||

| Hypothesis | gβ | t count | Conclusion |

| Market Attractiveness ® Innovation Management ® Business Performance | 0.118 | *6.647 | H0 accepted |

| Unique Resources ® Innovation Management ® Business Performance | 0.211 | *12.676 | H0 accepted |

Source: From data processing (2015) *significant at α=0.05 (t table=2.01)

The results of the calculation show that an increase in the Market Attractiveness and Unique Resources will partially influence the Innovation Management to imply the improvement on the Business Performance of Organic fertilizer industries in Indonesia. Thus, indirectly the Market Attractiveness and Unique Resources will influence Business Performance due to the effect of each category on Innovation Management. Hence, the result will finally conclude a significant influence on Business Performance.

The explanation from the above Table 5 shows the test results of the variables, from the above test results show that the Unique Resources variable provides an indirect influence and the most significant effect towards Business Performance through Innovation Management, which is 21.12%, compared to the indirect effect of Market Attractiveness towards Business Performance through Innovation Management, which is 11.77%.

From the above test results, it was clearly define that the variable Unique Resources will contribute significantly to Business Performance if the company resources were developed properly through the dimension of Innovation Management to become unique. On the other hand, Market Attractiveness also provides contribution to Business Performance even though which is lower compare to Unique Resources.

Conclusion and Recommendation

Conclusion

Based on the quantitative research through the method of questionnaire distribution and the survey carry on with the production manager of the organic fertilizers industries in Indonesia as the respondent done on 2015, several factors can be concluded as follows:

1. The survey done on the organic fertilizer industries has detected that the level of production and resources used in the industries are relatively similar among the industries, no specific form of process in the production and the competition was also very low.

2. The research finding shows that most of the organic fertilizer industries in Indonesia do not implement innovation management on the company resources and possess no significant value to attract the market; this is the result of the low business performance.

3. In order to be able to compete and attract the product in the market, the company of the industries must develop innovatively on the product and process on the company resources and transform them into uniqueness and penetrate them to gain the attractive market, hence will contribute to enhance the business performance.

Recommendation

The organic fertilizers industries must develop their company resources, starts from the factory, equipment, machinery productions, develop new product with different resources and implementing new technology on the production, human resources and form organizational resources.

The role of Government in this case is fully required to support the implementation of using organic fertilizer as recommended in the regulation No. 64/Permentan/OT.140/5/2013 pertaining the system of organic agriculture.

It is also urgently needed for the Government to create large numbers of Field Agricultural Instructors the help the farmers and agricultural businessman to have a good understanding of how to implement the organic agriculture to improve the agriculture system and provide a better production of healthy foods to the society and also the business management side to assist them to achieve competitive advantage.

References

- Best, R.J. (2013). Market-based management (Sixth Edition). Strategies for growing customer value and profitability.

- Busse, C. & Carl, M.W. (2011). Innovation management of logistics service providers. International Journal of Physical Distribution & Logistics Management, 41(2), 187-218.

- Chin, W.W. (1998). The partial least squares approach to structural equation modelling. Modern method for business research.

- Dalota, M.D. (2013). SMS’s innovation and human resources management, Romanian economic and business review. Romanian Economic and Business Review, (Special issue), 203-210.

- David, F.R. (2015). Strategic management: Concepts & cases (Fifteenth Edition). Pearson Education Limited, England.

- Dwyer, R.J. (2007). Utilizing simple rules to enhance performance measurement competitiveness and accountability growth. Business Strategy Series, 8(1), 72-77.

- Ghozali, I. (2014). Structural equation modelling: Metode alternatif dengan Partial Least Square (PLS). Badan Penerbit Universitas Diponegoro Semarang.

- Grant, R.M. (2010). Contemporary strategy analysis (Seventh Edition). John Wiley & Sons, Ltd., New York.

- Hair, J.F. (1998). Multivariate data analysis. New Jersey Prentice-Hall.

- Ireland, R.D., Hoskisson, R.E. & Hitt, M.A. (2013). Strategic management: Competitiveness and globalization (Tenth Edition). Cincinnati: Cengage Learning.

- Kagochi, J.M. (2007). Evaluating the competitiveness of United States agricultural market commodities. Auburn University, ProQuest, UMI Dissertations Publishing.

- Maier, A., Marieta, O., Maier, D.M. & Mihai. (2013). Achieving performance of organization by developing a model of innovation management. A Journal of Technical University of Cluj Napoca, Romania, the Bucharest University of Economic Studies, Romania.

- Moghaddam, A.G., Imani, Y.A., Erteza, N. & Setayeshi, L. (2013). Mediating role of innovation & market-orientation in the relationship between knowledge management & financial performance: A case study of small & entrepreneur business. Interdisciplinary Journal of Contemporary Research in Business, 5(3), 688-697.

- Norman, G. (2010). Likert scales, levels of measurement and the “laws” of statistics. Advances in Health Science Education, 15(5), 625-632.

- Ortt, J.R., Patrick, A. & Van der, D. (2008). The evolution of innovation management towards contextual innovation. European Journal of Innovation Management, 11(4), 522-538.

- Pearce II., J.A. & Robinson, R.B. (2011). Strategic management: Formulation, implementation and control. McGraw Hill: New York.

- Tidd, J. & Bessant, J. (2013). Managing innovation: Integrating technological, market and organizational change (Fifth Edition). John Wiley & Sons.

- Ushakov, D.S. (2012). Innovative capacity as a modern factor of countries investment attractiveness dynamic. International Journal of Organizational Innovation, 4(4), 6-20.

- Wheelen, T.L. & Hunger, J.D. (2015). Strategic management and business policy: Concepts (Fourteenth Edition). Pearson/Prentice Hall.