Research Article: 2021 Vol: 27 Issue: 5S

Impact of Renewables and Human Capital on Financial Development ???-A Megadata Analysis

Vo Thi Van Khanh, Academy of Finance

Abstract

In the background of economic development nowadays, the use of renewable energy sources has greatly considered as the need in most countries towards an environmentally friendly and sustainable development goal, as well as healthy financial markets. The aims of this study investigate the impact of renewable energy, and human capital on financial development. Using 26 Asian countries between 1980 and 2019 and advanced econometrics analysis such as pooled ordinary least squares, fixed effects methods, random effects methods, and feasible generalized least squares, reseach results show that using renewable energy has a negative and significant impact on financial development, that is, 1% change in renewable energy use will result in 0.688% change in financial development. Further, the study confirms that the higher level of human resources has a positive impact on financial development, while the financial markets of East Asian and South Asian countries are considered to be more developed than the rest of Asia.

Keywords

Financial Development, Asia, Renewable

JEL Classification

E42, E44, G23

Introduction

Today, the trends of industrial revolution 4.0 have greatly required a huge number of countries to move towards clean production, and protect the environment as well as sustainable development. Specifically, countries have gradually phased out the use of fossil energy in order to reduce CO2 emissions, and toxic substances to the atmosphere, living environment and bad impacts on human health and ecosystems (Shahbaz et al., 2021). In the new era, the use of renewable energies such as wind energy, heat, hydroelectricity, and bioenergy sources has become an urgent issue (Khan et al., 2020).

The development of human society and economic growth lead to an increasing demand for energy (Shahbaz et al., 2021). In the early stages of development, most countries used fossil energy sources because of their low cost, which made the living environment around the world increasingly polluted, leading to reduced life expectancy, diseases and environmental problems (Shahbaz et al., 2021; Khan et al., 2020). Encouraging the use of renewable energy to promote long-term economic growth is an urgent need, moreover, this policy also promotes the development of financial markets, requires green financial markets, support and promote the use of renewable and environmentally friendly energy (Khan et al., 2020).

Asia is emerging as a region with rapid development, increasingly playing the most important role in the world economy, especially the rapid development of the economies of China, India, Japan and Korea. According to the World Economic Forum (2021), Asia is home to 4.5 billion people, accounting for about 60% of the world's population, with an average economic growth rate of over 5% and total GDP of 32 USD trillion. In addition, Asia is also a region that attracts a lot of FDI inflows, according to UNCTAD (2020), China and Hong Kong are the largest recipients of FDI in the region, accounting for 38% of the total FDI in Asia and the Pacific region in 2019. Meanwhile, Japan, Singapore and South Korea are countries with a favorable investment environment, which is the preferred choice of multinational companies, besides emerging countries such as Vietnam, Thailand, Malaysia, or Saudi Arabia. Along with the economic development, the Asian financial market is also considered to be developing rapidly, typically the stock markets of China, India and Japan, or like the Singapore financial market, which is assessed as having a high growth rate and highly connected to international financial markets.

The relationship between renewable energy and financial development has been studied in a number of studies in other regions of the world, typically the study of Wang, et al., (2021); Kirikkaleli & Adebayo (2020); Khan, et al., (2020). However, there has not been a specific study to evaluate the impact of this relationship recently in Asia, especially in the context Asia has just emerged as a region with a developed financial market in recent years. It is also an area that is gradually transitioning to using clean, environmentally friendly energy sources, as is the case in Singapore, UAE, Japan, China, and Korea. Based on the gaps in the research, the author will evaluate the impact of renewable energy on financial development on a sample of 26 typical Asian countries. It includes typical countries in East Asia, South Asia and West Asia. The analytical method uses typical econometric regression models such as pooled ordinary least squares, fixed effects method and random effects method as well as treat diagnostics in the analysis, the research results will be typical empirical evidence in relation to each other. relationship between renewable energy use and financial development.

In addition to the introduction, this study consists of main parts: part 2 discusses the literature review, while part 3 discusses data and methodology. Next, the study presents the results and discusses the results, and finally concludes the study.

Literature Review

In the trend of economic development, the world today, sustainable development is becoming a mandatory requirement for any country, in order to ensure the harmony between economic development and environmental protection for the present and future generations. In the study of Wang, et al., (2021) argues that renewable energy is considered as a solution to reduce environmental pollution, however, the use of renewable energy depends heavily on economic development and financial resources of the country. Creation requires a large investment capital; the country needs to have finance to make investments in renewable energy. Wang, et al., (2021) argue that economic growth promotes the use of renewable energy in Western China, while financial development has a negative impact. In the short term, economic growth has a very clear impact on renewable energy use, in the context of China's rapid economic growth since the (doimoi, 1977), environmental pollution is also high. In recent years, China is gradually shifting to using clean energy sources and developing sustainably.

In the study of Kirikkaleli & Adebayo (2020) analyzing long-term effects, the author argues that there exists a long-term and two-way relationship between financial development and the use of renewable energy, and both have an impact on the environmental sustainability. The author proposes that, in order to increase environmental quality, global and national policy makers need to seriously implement the use of renewable energy. Research by Habib & Shah (2016) suggests that economic development leads to an increasing demand for energy, using fossil energy sources will increase CO2 emissions and environmental pollution. In that context, financial institutions have a special position in the economy through financial policies, to orient the economy to use renewable energy.

For the case of Bangladesh, Habib & Shah (2016) argue that using a green policy framework, the country's financial institutions have initiatives to promote green growth and green finance. In which the central bank of this country recapitalizes commercial banks to finance businesses using renewable energy, on the contrary, using renewable energy also leads to a stable development of the financial market, creating a driving force for sustainable economic development. In another review by Zakir (2013), choosing renewable energy can develop financial instruments in the financial; it supports the development of renewable energy technology, and is a widely implemented policy in developing countries.

Research by Shahbaz, et al., (2021) assesses that environmental pollution takes place globally, i.e., factors as sea level rise, greenhouse gas emissions, air pollution affect human life and increase the economic costs of the society. It implies that promoting renewable energy in the current period is necessary. Shahbaz, et al., (2021) further assesses those countries should have appropriate incentives and tax policies to increase the number of businesses using renewable energy, while promoting public-private partnerships through appropriate financial mechanisms can promote renewable energy.

Khan, et al., (2020) in studying the relationship between renewable energy, carbon emissions and financial development through panel data analysis in 192 global countries, and based on percentiles regression, the author argues that energy renewable energy has no impact on financial development, but renewable energy has a negative effect on CO2 emissions, which means that increased use of renewable energy will lead to better environmental quality. Similarly, Wang, et al., (2020) in a study of 11 countries between 1990 and 2017, there exists a positive impact of CO2 emissions on financial development and even on economic growth. Similar to the assertion of Khan et al. (2020), research by Wang, et al., (2020) also confirms that using renewable energy will reduce CO2 emissions, so the author proposes to promote the use of renewable energy so that the world can achieve the goal of COP21. Moreover, renewable energy also makes the world cleaner, reducing the impact of climate change and global warming.

In recent years, China is known as the world's top CO2 emitter. In 2019, the country emitted 10.2 billion m3 of CO2, twice as high as 5.3 billion m2 of CO2 in the United States, and China accounted for 28% of global CO2 emissions (Steinwehr, 2021). As assessed by Chang, et al., (2020) argues that, but large enterprises, using short-term debt and liquid assets are likely to increase R&D investment in renewable energy. While businesses that use a lot of long-term debt and depend on bank credit are likely to reduce R&D on renewable energy. That confirms that appropriate policies for businesses are capable of promoting the use of renewable energy in production and business activities.

In socio-economic development, financial resources are an important factor promoting the use of renewable energy, especially in the current period, renewable energy has higher costs than fossil energy sources. In the study of Wang, et al., (2021) official development assistance capital flows are an important resource in promoting renewable energy in developing countries. Research shows that there exists a nonlinear relationship between ODA and renewable energy 34 Sub-Saharan African countries, which means that ODA has a negative and positive relationship on renewable energy and depends on the real context. economy of each country.

Research by Kim & Park (2020) in the study of 30 countries from 2000 to 2013, arguing that countries with developed financial markets have an impact on promoting the use of renewable energy, and at the same time make reduce CO2 emissions, which indicates that the relationship between financial development and renewable energy use is a bidirectional, reciprocal relationship. However, the impact of renewable energy on financial development has not been widely studied in previous studies, except for the study of Khan, et al., (2020) the author found no impact between these factors. Therefore, the author conducts research in Asian countries as a piece of the puzzle to assess in detail the impact of renewable energy and financial development, as a solid basis to help governments, policy makers have a better overview of financial development in the current period.

Data and Methodology

Data

To conduct this study, the author used secondary data collected from various sources. The paper uses yearly data collected from data sets of the World Bank (WDI), the International Monetary Fund (IMF) and data from the General Statistics Office of selected country. Research countries in Asia, including East Asia, South Asia and West Asia. The data covers 26 countries: Saudi Arabia, China, Brunei, Sri Lanka, Bangladesh, Indonesia, Iran, Israel, Japan, Kazakhstan, India, Afghanistan, Cambodia, South Korea, Kuwait, Laos, Bhutan, Turkey, Bahrain, Myanmar, Malaysia, Philippines, Pakistan, Thailand and Vietnam. The data is collected in the period from 1980 to 2019 and analyzed using Stata 15 software. Table 1 shows how to measure the variables used in this study.

| Table 1 Measurement of Selected Variables |

|||

|---|---|---|---|

| Measurement | Abbreviation | Source | |

| Dependence variable | |||

| Financial development (M3 to GDP, %) | DEVELOPMENT | WDI | |

| Independence variables | |||

| Renewable energy consumption (% of total final energy consumption) | REN | WDI | |

| Control variables | |||

| GDP per capita (US$) | GDP | WDI | |

| FDI (% of GDP) | FDI | WDI | |

| Public debt | DEBT | IMF | |

| School enrollment, secondary (% gross) | HUMAN | WDI | |

| Dummy variable | D_EAST | Author | |

| Dummy variable | D_SOUTH | Author | |

Research Model

General model in this paper is as follows:

Specification model is of the form:

In which,

αi is esitmated coefficient for each economy,

i is denoted for the nationi, t is for time.

denote for renewables, public debt, human resources, GDP per capita, and foreign direct investment of i-th nation in t-th year,

denote for renewables, public debt, human resources, GDP per capita, and foreign direct investment of i-th nation in t-th year,

βi is esitmated coefficients of independent variables,

υit is the random error of i-th nation in t-th year.

Empirical Results

Descriptive Statistic

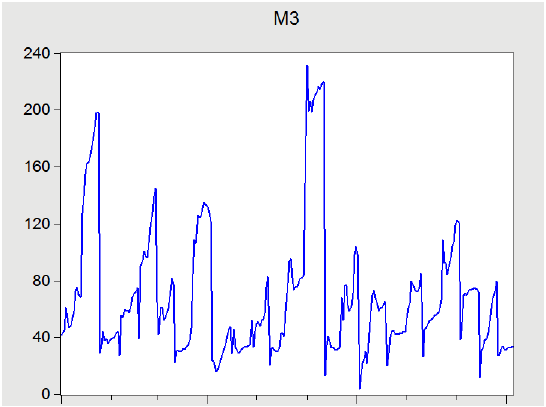

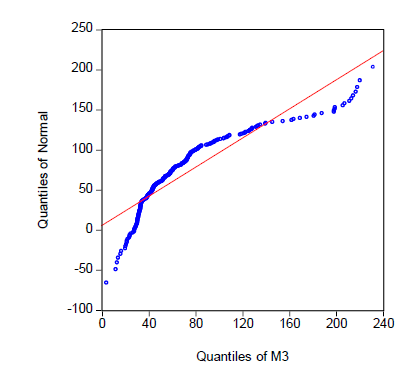

Financial development is measured by M3/GDP, which is a relatively comprehensive parameter for financial development in the current period. In the past, measuring financial development through the expanded money supply M2/GDP may have encountered shortcomings in measuring financial market development. Figure 1 depicts financial development in 26 typical Asian countries in the period 1980 to 2019, the research results show that financial development has not changed much during the period, except for some Asian economic boom year, financial development spiked

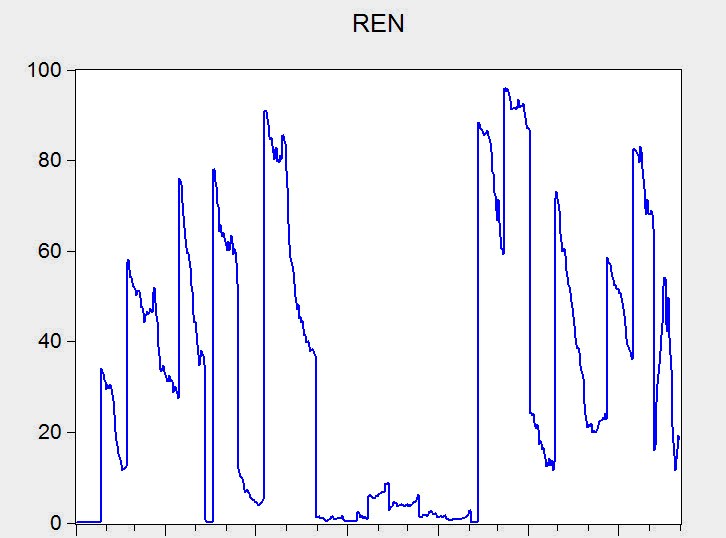

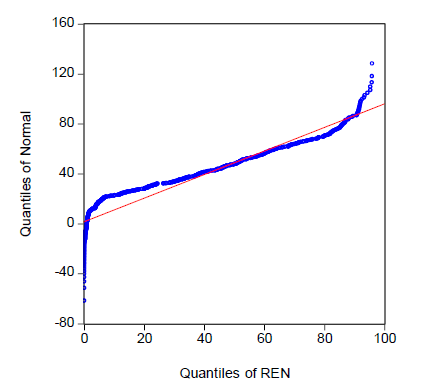

The Renewable Energy Sources (REN) can be divided into 3 phases, the first period from 1980 to about 1995, the demand for renewable energy grew continuously, especially this period used many energy sources. hydropower, with strong growth coming from China and India. However, in the period 1995 to 2005 the demand for renewable energy dropped sharply, then grew again in the current period. At the same time, wind, heat and solar energy sources have been popularly used in recent times, and it is associated with the development of industrial revolution 4.0. (Figure 2)

Following the analysis, Table 2 presents descriptive data for 26 Asian economies for 40 years from 1980 to 2019. For each country, the study collects several key indicators such as mean, minimum, maximum value and standard deviation.

| Table 2 Descriptive Statistic |

||||

|---|---|---|---|---|

| Variables | Mean | Minimum | Maximum | Standard deviation |

| DEVELOPMENT | 68.686 | 3.640 | 231.313 | 45.553 |

| REN | 30.192 | 0 | 95.919 | 30.320 |

| HUMAN | 65.629 | 9.311 | 120.651 | 27.531 |

| DEBT | 55.439 | 0.318 | 342.665 | 47.876 |

| GDP | 8822.376 | 94.564 | 85076.14 | 13355.93 |

| FDI | 2.073 | -13.604 | 33.566 | 3.043 |

Specifically, Table 2 shows that the average growth rate of financial development in Asia, as measured by the % of M3 to GDP, is 68.686%, the highest is 249.113 for Japan and the lowest is 3.64 for Laos, reflecting the very different levels of financial development across Asian countries. As for the quality of human resources, the average enrollment ratio of high school students to total students in the region is 65.629%, the highest is 120.65% in Thailand and the lowest in Bhutan at level of 9.31%.

Countries in Asia use public debt financing for development very differently, the average public debt ratio in the region is 55.439% GDP, the lowest rate is 0.318% GDP of Brunei, the highest rate is 342.665% GDP of Iraq, a country whose public debt ratio mainly comes from domestic debt. The level of development of countries through GDP per capita also varies. GDP per capita in the whole region is 8822.376 USD, the highest is 55492.95 USD for Kuwwat, the lowest is 94.564 USD for Vietnam. The average FDI inflow relative to GDP of all countries is 2.073%, with the country attracting the highest FDI inflows is 33.566% of Bahrain, while some countries have a less stable investment environment, war and instability has caused FDI inflows out of the country, at 13% of GDP like Bahrain again. As far as renewable energy consumption concerned about, the average level is 30.192% of total final energy consumption. The highest level is 95.9% of Bhutan, while the lowest level is of Saudi at 0.01%..

In addition, the analysis of Figure 3 and Figure 4 also shows that the financial development (DEVELOPMENT) and renewable energy (REN) have a relatively normal distribution. In quantitative analysis, the model using FGLS model analysis is a suitable choice for the standard analytical sample.

Correlation Analysis

| Table 3Correlation Coefficients Among Variables | ||||||

|---|---|---|---|---|---|---|

| Variables | DEVELOMENT | DEBT | GDP | FDI | REN | HUMAN |

| DEVELOMENT | 1 | |||||

| DEBT | 0.4552(0.0000) | 1 | ||||

| GDP | 0.4094(0.0000) | 0.0884(0.0168) | 1 | |||

| FDI | -0.0233(0.7003) | -0.1357(0.0002) | -0.0357(0.2845) | 1 | ||

| REN | -0.3659(0.0000) | 0.2502(0.0000) | -0.5486(0.0000) | 0.0034(0.9353) | 1 | |

| HUMAN | 0.4004(0.0000) | -0.1938(0.0000) | 0.6294(0.0000) | 0.1932(0.0000) | -0.6563(0.0000) | 1 |

According to Gujarati (2004), the existence of multicollinearity between the research independent variables could be found through observing their correlation coefficients which are lower than 0.8. Table 3 presents the correlation coefficient matrix among the studied variables. Visually, all correlation coefficients are less than 0.8. Therefore, it can be predicted that there is no multicollinearity. The Variance Inflation Factor (VIF) is another test for multicollinearity. The results of VIF in Table 4 show that there is no multicollinearity issue since the VIFs of all independent variables are below 10.

| Table 4 Vif Coefficients of Independent Variables |

||

|---|---|---|

| Variables | VIF | 1/VIF |

| DEBT | 2.41 | 0.414 |

| GDP | 2.05 | 0.488 |

| FDI | 1.99 | 0.503 |

| REN | 1.52 | 0.660 |

| HUMAN | 1.18 | 0.844 |

| Mean VIF | 1.83 | |

Estimation Results

In order to perform the static regression, Pooled OLS (Pooled Ordinary Least Square), FEM (Fixed Effects Model), and REM (random effects) estimation methods are carried out. The model selection process is as follows: to choose Pooled OLS or REM, it is necessary to perform Breusch and Pagan Lagrangian coefficient tests. Table 5 shows that the probability value of the Breusch and Pagan multiplier test is close to zero. So we reject hypothesis H0, accept hypothesis H1, or REM model is more suitable than POLS model. Similarly, FEM model is more appropriate than POLS model. Finally, to the comparison between REM and FEM, Hausman test with probability value is 0.7924, greater than 0.05, so we do not have a basis to reject the original hypothesis, or REM model is more appropriate to use than FEM. As a result in static analysis, REM is the best option.

| Table 5 Estimation Results |

|||

|---|---|---|---|

| Variables | Pooled OLSModel 1 | REMModel 2 | FEMModel 3 |

| REN | -0.871***(0.000) | -0.688***(0.000) | -0.734***(0.001) |

| DEBT | 0.390***(0.000) | 0.076*(0.083) | 0.072(0.110) |

| GDP | -0.0003(0.239) | 0.0002(0.312) | 0.0003(0.193) |

| FDI | 1.778(0.117) | -0.181(0.719) | -0.266(0.606) |

| HUMAN | 0.469***(0.000) | 0.388***(0.000) | 0.370***(0.000) |

| D_EAST | 43.051***(0.000) | 42.355***(0.006) | omitted |

| D_SOUTH | 37.814***(0.000) | 36.569**(0.035) | omitted |

| CONS | 2.359(0.833) | 16.581(0.233) | 46.844*(0.000) |

| F test that all u_i=0 | F(20, 123)=77.35 | ||

| Breusch and Pagan Lagrangian multiplier test for random effects | chibar2(01)= 246.99 | ||

| Hausman test | chi2(5)=(b-B)'[(V_b-V_B)^(-1)](b-B)=2.39 | ||

| Note: ***,**,* denote that estimated coefficients are statistically significant at the 10%, 5%, and 1% levels. | |||

In the next step, the results of the REM model can be ussed for analysis unless autocorrelation and variance test for this model are performed well. The results are presented in Table 6, 7 belows:

| Table 6 Heteroskedasticity and Autocorrelation Tests |

|||

|---|---|---|---|

| Heteroskedasticity Test | |||

| Wi | df | Prob. > F | |

| W0 | 2.8611499 | df(20, 128) | 0.00018907 |

| W50 | 1.6463041 | df(20, 128) | 0.0514212 |

| W10 | 2.6639224 | df(20, 128) | 0.00049275 |

| Autocorrelation test | |||

| LM(Var(u)=0,lambda=0) | 247.27 | ||

| Pr>chi2(2) | 0.0000 | ||

| Table 7 Estimation of Corrected Models |

||

|---|---|---|

| Variables | Corrected REMModel 4 | FGLS with M2 as Dependent VariableModel 5 |

| REN | -0.688***(0.008) | -1.117***(0.000) |

| DEBT | 0.076(0.350) | 0.107***(0.000) |

| GDP | 0.0003(0.578) | 0.0006***(0.000) |

| FDI | -0.181(0.779) | 0.382*(0.058) |

| HUMAN | 0.388***(0.001) | 0.225***(0.000) |

| D_EAST | 42.355**(0.037) | 61.896***(0.000) |

| D_SOUTH | 36.569**(0.033) | 58.565***(0.000) |

| CONS | 16.581(0.199) | 30.350***(0.000) |

| Note: ***,**,* denote that estimated coefficients are statistically significant at the 10%, 5%, and 1% levels. | ||

Discussions

Renewable Energy Consumption

Table 7 shows that the use of renewable energy has a negative impact on financial development. Specifically, when using 1% more renewable energy will reduce financial development by 0.68%, or vice versa, when reducing renewable energy by 1%, it will increase financial development by 0.68%. This study is similar to that of Khan, et al., (2020), the author said that no evidence of the impact of renewable energy and financial development was found in 192 countries surveyed around the world. This evidence can explain that the use of renewable energy in Asian countries has not yet brought about a developed financial market, in particular, the financial market has not created the impetus to change the energy use of renewables. It can be said that the need to use renewable energy is an inevitable need in many countries, however, the demand for the use of countries with high pollution levels is more urgent, such as China when the water is polluted. This emits up to 28% of CO2 emissions worldwide, leading the country to actively increase the use of renewable energy to reduce CO2 emissions regardless of financial market policies supporting energy promotion. renewables or not.

As explained by Chang, et al., (2020), the process of using renewable energy takes place only when the country has appropriate policies to promote businesses to use renewable energy. Similarly, Shahbaz, et al., (2021) further asserted that appropriate incentives or tax policies can increase the use of renewable energy, and at the same time, associated with green financial mechanisms in financial institutions will create new financial market development. In a study in Bangladesh, Habib & Shah (2016) affirmed that the central bank should have a policy to recapitalize commercial banks to finance green, environmentally friendly projects, creating a driving force for market development. Finance and economic development.

Other Factors

The results also show that public debt, economic growth and foreign direct investment have no impact on financial development in 26 Asian countries. This explains that Asian countries have not yet effectively used public debt to promote financial market development and diversify financial instruments in the market. At the same time, Asian countries have different policies to attract foreign direct investment, leading to different results of attracting this capital inflow, with countries that are considered successful such as China, Korea, and Singapore, but also many countries have not been successful such as Mongolia, Laos, Cambodia, which leads to no evidence of this impact on financial development in the study.

An important evidence between human resource quality and financial development was found in the study. When the quality of human resources increases by 1%, financial development increases by 0.388%, showing that the investment policies in human resources in the Asian country are effective, and as the driving force for the development of the financial markets, as well as long-term economic growth in the region. As explained by Ibrahim & Sare (2018) that high-quality human resources reflect the economy's ability to have people with skills, qualifications and capabilities to promote the development of financial markets. Therefore, the accumulation of human resources through investment in the school system, the medical and healthcare system, will create high human resources in the financial and banking markets, and directly develop the financial sector. Research by Sarwar, et al., (2020) the quality of human resources interacting with financial development will be an important driving force for economic development, because in the long term, human resources are a fundamental factor in the process of economic growth. Countries with low quality of human resources will find it difficult to ensure a developed financial market.

Table 7 also shows that the countries of East Asia and South Asia have a more developed financial market than the rest of the Asian region. This can be explained that East Asian countries and emerging countries in South Asia are the focus of Asia's economic pillars. Indeed, the current Asian economic growth driver focuses mainly on the Chinese economy and the Indian economy, besides typical emerging economies such as Singapore, Malaysia, Thailand, UAE, and Pakistan.

Robustness Check

As discussed above, financial development as measured by M3/GDP is a better proxy than the M2/GDP variable as discussed in Wang, et al., (2021). However, to evaluate the results of the model, this study will evaluate the sustainability of the model by changing the financial development variable M3/GDP with the variable M2/GDP, and at the same time, the study uses the method of financial development. FGLS (feasible generalized least squares) method, if the results of important variables do not change, it means that the quality of the model is reliable. Table 7 shows that the impact of renewable energy on financial development is still positive and statistically significant, meaning that this impact is unchanged. Moreover, the impact of human resources on financial development is also unchanged from the initial results. These analytical results confirm that the estimated results are reliable.

Conclusion

In today's context, the use of renewable energy sources is an urgent need in most countries towards an environmentally friendly and sustainable development goal, meeting sustainable economic development in the long term as well as healthy financial markets. This study has conducted the impact of renewable energy on financial markets by deploying 26 Asian countries between 1980 and 2019, and using quantitative analysis. Research results show that using renewable energy has a negative impact on financial development, that is, 1% change in renewable energy use will result in 0.688% change in financial development. In addition, the study also confirms that the quality of human resources has a positive impact on financial development, while the financial markets of East Asian and South Asian countries are considered to be more developed than the rest of Asia.

The study has some recommendations for countries in the Asian region. First, countries continue to use renewable energy, which is a goal to reduce environmental pollution towards sustainable development in the long term. The benefits of using renewable energy for economic growth are clear, while also providing long-term financial market development benefits. The financial markets of the countries need to orient the investment capital cycle into green, energy-saving and environmentally friendly investment projects. Second, countries continue to invest in improving the quality of human resources, investment is made through investment in educational facilities, improving the quality of lecturers, and applying technological advances in training, as well as in the health system. Improvements in the quality of human resources will be a premise to enhance the quality of economic growth as well as the development of financial markets in both the short and long term. Finally, countries continue to carry out sweeping reforms, attract clean and environmentally friendly FDI, use public debt sensibly, and create a premise for the country's economic development.

References

- Chang, K., Zeng, Z., Wang, W., &amli; Wu, X. (2019). The effects of credit liolicy and financial constraints on tangible and research &amli; develoliment investment: Firm-level evidence from China's renewable energy industry. Energy liolicy, 30(7), 438-447.

- Gujarati, D. (2004). Basic Econometrics, (4

th Edition), McGraw-Hill Comlianies, New York. - Habib, S.M.A., &amli; Shah, li. (2016). Develoliment of renewable energy financing in bangladesh in reslionse to the central bank’s liolicy initiatives. WIT Transactions on Ecology and the Environment, 205, 33 – 43.

- Ibrahim, M., &amli; Sare, Y.A. (2018). Determinants of financial develoliment in Africa: How robust is the interactive effect of trade olienness and human caliital?. Economic Analysis and liolicy, 60, 18-26

- Khan, H., Khan, I., &amli; Binh, T.T. (2020). The heterogeneity of renewable energy consumlition, carbon emission and financial develoliment in the globe: A lianel quantile regression aliliroach. Energy Reliorts, 6(11), 859-867.

- Kim, J., &amli; liark, K. (2016). Financial develoliment and deliloyment of renewable energy technologies. Energy Economics, 59(9), 238-250.

- Kirikkaleli, D., &amli; Adebayo, T.S. (2021). Do renewable energy consumlition and financial develoliment matter for environmental sustainability? New global evidence. Sustainable Develoliment, 29(4), 583 – 594.

- Sarwar, A.,Khan, M.A.,Sarwar, Z.,&amli;Khan, W.(2021). Financial develoliment, human caliital and its imliact on economic growth of emerging countries.Asian Journal of Economics and Banking, 5(1), 86-100

- Shahbaz, M., Tolicu, B.A., Sarigul, S.S., &amli; Vo, X.V. (2021). The effect of financial develoliment on renewable energy demand: The case of develoliing countries.

Renewable Energy, 178(11), 1370-1380. - Steinwehr, U. (2021). Fact check: Is China the main climate change cullirit? Retrieved from httlis://www.dw.com/en/fact-check-is-china-the-main-climate-change-cullirit/a-57777113

- Zakir, H.M. (2013). Financing renewable energy olitions for develoliing financing instruments using liublic funds (English).Washington, D.C. : World Bank Grouli. httli://documents.worldbank.org/curated/en/196071468331818432/Financing-renewable-energy-olitions-for-develoliing-financing-instruments-using-liublic-funds

- UNCTAD (2021). Investment flows to develoliing Asia defy COVID-19, grow by 4%. Retrieved from httlis://unctad.org/news/investment-flows-develoliing-asia-defy-covid-19-grow-4

- Wang, Q., Guo, J., &amli; Dong, Z. (2021). The liositive imliact of Official Develoliment Assistance (ODA) on renewable energy develoliment: Evidence from 34 Sub-Saharan Africa Countries. Sustainable liroduction and Consumlition, 28(10), 532-542.

- Wang, R., Mirza, N., Vasbieva, D.G., Abbas, Q., &amli; Xiong, D. (2020). The nexus of carbon emissions, financial develoliment, renewable energy consumlition, and technological innovation: What should be the liriorities in light of COli 21 Agreements? Journal of Environmental Management, 271(10), 111027.

- Wang, J., Zhang, S., &amli; Zhang, Q. (2021). The relationshili of renewable energy consumlition to financial develoliment and economic growth in China. Renewable Energy, 170(6), 897-904.