Research Article: 2018 Vol: 22 Issue: 2

Impact of Network Competence on Firms Performances among Chinese and Indian Entrepreneurs: A Multigroup Analysis

Zuhaib Hassan Qureshi, Universiti Kuala Lumpur Business School

T Ramayah, Universiti Sains Malaysia and Universiti Malaysia Sarawak

Abstract

The aim of the current study was to analyse and compare the impact of network competence on four types of firms’ performances-perceived financial performance, perceived non-financial performance, perceived business growth and perceived performance relative to competitors-among Malaysian Small and Medium-Sized Enterprises (SMEs) run by Chinese and Indian entrepreneurs. A total of 200 retailers and wholesale owners in Klang Valley, Malaysia participated in a face-to-face survey. The collected data were analysed using Partial Least Squares Structural Equation Modelling (PLS-SEM) and multigroup analysis was performed to test the hypotheses developed. Findings revealed network competence to have a positive impact on all four types of firms’ performances among Chinese entrepreneurs. However, for Indian entrepreneurs, network competence was found to have a positive impact only on perceived financial performance and perceived performance relative to competitors. A significant difference was also found between Chinese and Indian entrepreneurs regarding the impact of network competence on perceived business growth.

Keywords

Network Competence, Perceived Financial Performance, Perceived Non-Financial Performance, Perceived Business Growth, Perceived Performance Relative to Competitors.

Introduction

Every business aims to achieve superior firm performance in its respective industry. However, for the small and medium-sized enterprises (SMEs) that lack essential resources including capital, competencies, technology, relevant knowledge and information required to run their business more successfully (Tehseen and Sajilan, 2016), the biggest challenge is to survive and grow in current competitive business environment. These firms therefore develop and execute different strategies to attain superior business performances. The strategic decisions assist the managers to predict changes in the external business environment and the effective strategies enable them to access and use critical resources in order to attain competitive advantage (Salamzadeh et al., 2016). Specifically, the knowledge management strategies have the positive impact on firms’ performances and on the performance of firms’ networks (Centobelli et al., 2018; Bhatt, 2000). This is because current and updated knowledge is critical for the success of any business. Thus, firms keep on striving for developing close relationships with other parties to minimize the uncertainties by mutually joining and increasing their resources’ levels including knowledge resources as well (Salamzadeh et al., 2016).

Thus, they need to depend on their networks constituting customers, suppliers and other external parties to get access to essential resources (Ritter, 1999; Ritter et al., 2002). Network competence has been viewed as the ability to develop and use external networks via social interactions (Brinckmann, 2008). It is considered very important for the success of any business as it indicates the ability of entrepreneurs to build and then maintain close as well as long-term relationships with other parties.

The inability of SMEs’ owners in establishing good relationships with relevant parties results in a lack of access to financial resources as well as required knowledge and information (Kheng and Minai, 2016), leading to poor performance. It has been acknowledged that Malaysian SMEs are far behind in terms of gross domestic product (GDP) and export contribution as compared to SMEs in advanced countries such as the United States and United Kingdom (Chuen et al., 2018; Hassan et al., 2014; Hassim et al., 2011; Kheng and Minai, 2016). The lack of access to essential resources may be one of the reasons for the poor contribution of Malaysian firms (Razali et al., 2018). Hence, researchers believe that developing network competence could assist entrepreneurs in obtaining access to these critical resources held by others to achieve superior firms’ performance (Canning and Szmigin, 2016).

Malaysia is a multicultural country in which Malays, Chinese, and Indians dominate a majority of businesses. Studies have mentioned that majority of Malaysian SMEs are managed and controlled by the Chinese community (Kheng and Minai, 2016; Hassan et al., 2014), with the concept of guanxi (Chinese networks or relationships) being the critical success factor in their businesses (Kheng and Minai, 2016; Luo and Child, 2015). Chinese networks are pivotal to business success in Chinese society (Chu, 1996), but there are limited studies on their characteristics among Chinese owner-managers in Malaysia (Kheng and Minai, 2016).

Among Malay entrepreneurs, a few studies have provided statistical evidence for the positive influence of network competence on their firms’ performance (Surin et al., 2017; Surin et al., 2015). On the other hand, not much is known about the role of network competence among Indian entrepreneurs. Moreover, there is a lack of comparative studies between Indian entrepreneurs and other entrepreneurs in terms of their firms’ performances. As both the Chinese and Indian entrepreneurs contribute a large extent towards the country’s economic progress (Alam et al., 2015; Mohamed et al., 2012), there is a need to study this research gap.

According to Muniandy et al. (2015), existing research on network competence in Malaysia revealed contradictory findings in terms of its impact on firms’ performance. Moreover, these studies were mostly conducted on businesses in the manufacturing industry (Muniandy et al., 2015). The current study aims to analyse the impact of network competence on different types of firms’ performances namely perceived financial performance, perceived nonfinancial performance, perceived business growth and perceived performance relative to competitors. The main question this study seeks to answer is “what is the impact of network competence on different types of firms’ performances among Chinese and Indian entrepreneurs”?

The next section describes the theoretical framework and development of hypotheses followed by a section on methodology, results, discussion and finally conclusion and future recommendations.

Theoretical Framework And Development Of Hypotheses

The current study’s theoretical framework has been developed based on Social Network Theory (SNT), Institutional Theory (IT) and Resource Dependence Theory (RDT). SNT explains the influence of the social structure of relationships on human behaviours that surround a group, a person, or an organisation (Barnes, 1954). It focuses on the relationships among people, rather than on people’s attributes and characteristics. In business, the network competence of ownermanagers with relevant parties such as customers, suppliers, government agencies, friends, social organisations and trade organisations assists in accessing critical resources. Furthermore, IT as pointed out by Scott (1991) focuses on the importance of owner-managers in developing and managing institutional networks that involve various parties such as trade organisations, social organisations, and government agencies in their business environment. These institutional networks enable owner-managers to attain resources to resolve their firms’ problems.

The basic assumption of RDT is that managers of a firm try their best to ensure the survival of the firm. RDT argues that organisational survival is possible due to the ability of managers in acquiring and maintaining critical resources from external parties including customers, suppliers and other relevant parties (Pfeffer and Salancik, 1978). RDT recognises the influence of external factors on the firm’s behaviour and provides a direction for the managers to reduce the uncertainty of these factors in the firm’s external environment. This is because the external factors could influence the organisational success and growth as well. It has been argued that firms have to indeed manage their relationships with external parties, whom they depend on directly or indirectly, because the uncertain or unpredictable actions of these parties can affect organisational survival and success (Hillman et al., 2009; Pfeffer, 1988). For example, a supplier that provides key or critical resources to the firm could provide the same resources to its rivals or competitors. Therefore, it is important for the firm to develop a closer relationship with the supplier through a merger to obtain a competitive advantage and more power over its rivals by controlling critical resources (Pfeffer and Nowak, 1976). Firms strive to build relationships with other firm to get access to needed assets and critical resources (Pfeffer and Salancik, 1978; Nohria and Garcia-Pont, 1991).

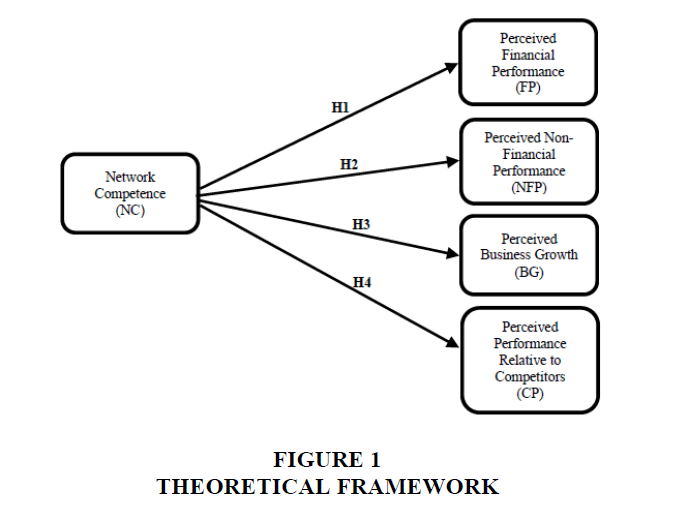

Based on the aforementioned theories, network competence is considered as an important factor for superior firms’ performances and hence, is taken as the independent variable examined in the current study. The four types of firms’ performances namely firm’s perceived financial performance, perceived non-financial performance, perceived business growth, and perceived performance relative to competitors are taken are the dependent variables. Figure 1 reveals the theoretical framework developed for this study.

Relationship between Network Competence and Perceived Financial Performance

The ability of a firm to manage its network linkages is an important source for achieving sustainable business performance (Eisingerich and Bell, 2008). Moreover, majority of existing studies have focused on the positive impacts of networking on firms’ performance (Mort and Weerawardena, 2006). The process of decision making and collaboration with external parties resulting in access to new resources can minimise financial risks that directly impact the financial outcomes of the firm (Wang et al., 2015). A number of studies have found the ability to network to have a positive impact on firms’ financial performance (Lechner and Gudmundsson, 2016; Semrau and Sigmund, 2012). Likewise, earlier researchers have also provided statistical evidence for the positive relationship between entrepreneurs’ networking ability and firms’ financial performance (Thrikawala, 2011; Chen et al., 2007). Conversely, it was also posited that a weak relationship with other parties negatively influence the performance of firms (Kenny, 2009). Thus, it is hypothesised that:

H1: The network competence positively impacts the perceived financial performance among Chinese and Indian entrepreneurs.

Relationship between Network Competence and Perceived Non-Financial Performance

Employees’ retention as well as their satisfaction is the key to success of any firm. Since employee management is the task of a firm’s human resources, it is very important to adopt sophisticated human resource practices to ensure the long-term retention as well as satisfaction of employees. SMEs can polish their knowledge on human resource practices by developing strong network ties with other parties including organisations and consultants (Erickson and Jacoby, 2003). There are four network linkages between external organisations and SMEs that may assist the latter in learning and implementing appropriate human resource practices (Bacon and Hoque, 2005). These four network linkages include corporate governance and control of proprietary; impacts from the huge business community; relationships and connections as suppliers to large firms; as well as recognition of the trade union. Additionally, external networks that provide the possession and practice of new external knowledge for firms can empower them to perform their activities more effectively, reach a higher degree of customer satisfaction, recognise new opportunities, and reduce costs (Perin et al., 2016). Therefore, it is hypothesised that:

H2: The network competence positively impacts the perceived non-financial performance among Chinese and Indian entrepreneurs.

Relationship between Network Competence and Perceived Business Growth

Information networks are most essential when they provide access to individuals who hold appropriate information that entrepreneurs could not otherwise achieve through their private contacts or experiences (West and new knowledge to entrepreneurs which will help them to start, manage and grow their businesses (Ezuma and Ismail, 2017). From a large longitudinal database, a significant positive relationship was found between formal networks and firms’ survival and growth, but not with return on equity (Watson, 2007). Likewise, results from another study indicated that various formal as well as informal networks are positively related to the survival of firms but only formal networks were found to be related to firms’ growth (Watson, 2012). Similarly, using a large panel data, it was found that formal networks of entrepreneurs are significantly and positively correlated with firms’ growth (Schoonjans et al., 2013). Thus, it is hypothesised that:

H3: The network competence positively impacts the perceived business growth among Chinese and Indian

Relationship between Network Competence and Perceived Performance Relative to Competitors

Studies have found that network competence enables firms to remain competitive in the market (Parida et al., 2017). Firms obtain knowledge resources from their networks, such as the understanding of starting up new firms, how to manage people and processes and how to attain growth and maintain a competitive position (Wiklund and Shepherd, 2003; Brush et al., 2001). A firm’s networks are able to provide it with essential information or knowledge regarding new trends, products, and markets. The availability of critical resources makes it possible for firms to compete successfully with their potential rivals as they can formulate and execute the most effective strategies against their rivals. Studies also revealed that knowledge resources may lead to the development of other valuable resources, which is helpful for new firms that find it difficult to obtain resources (Gilbert et al., 2006). Hence, it is hypothesised that:

H4: The network competence positively impacts the perceived performance relative to competitors among Chinese and Indian entrepreneurs.

Methodology

Data Collection

A face-to-face survey was used to collect data from 200 retailers and wholesale owners, comprising 100 Chinese owners and 100 Indian owners, from the Klang Valley in Malaysia. The demographic information revealed that majority of respondents were female (61%), aged between 31-40 years old (45%), hold a Bachelor degree (70%) and belonged to the upper middle classes (55%). In addition, 57.5% of respondents have been running their businesses for 6-10 years, with 80% and 55% respondents belonging to small-sized businesses and retail industry respectively.

Respondents and their firms were selected for the survey based on the definition of SMEs provided by the SME Corporation Malaysia (2015). According to the definition, firms in the service sector that have 5 to 30 employees and an annual sales turnover of RM 300,000 to less than RM 3 million are considered small-sized while firms with 30 to 75 employees and have an annual sales turnover of RM 3 million to less than RM 20 million are considered medium-sized. These respondents were recruited through non-probability methods including convenience and quota sampling. Prior to this, a pre-test and pilot test were conducted on a convenience sample of 8 and 12 respondents respectively.

According to Chin (2010), a sample size of 100 to 200 respondents is adequate for partial squares structural equation modelling (PLS-SEM) analysis. Furthermore, G*Power was also used to assess sample size sufficiency (Faul et al., 2007). Based on Cohen’s (1988) recommended minimum values (i.e. statistical power of 80% and medium size f2 effect of 0.15) with one predictor, G*Power analysis showed that the required minimum sample size is 55 respondents. Hence, the sample size of this study is more than the minimum requirement.

Construct Measures

The constructs’ measures were adopted from existing studies. Network competence (NC) was measured using six items adapted from a study by Verbeke and van Tulder (2011). Four items measuring perceived financial performance (FP), three items measuring perceived nonfinancial performance (NFP), and four items measuring perceived performance relative to competitors (CP) were adapted from Ahmad (2007) and Chandler and Hanks (1993). Finally, four items measuring perceived business growth (BG) were adapted from Brinckman (2008), Ahmad (2007); Chandler and Hanks (1993).

Data Analysis

In line with suggestions by Abdullahi et al. (2015) to use second generation techniques such as SEM to investigate the impact of different variables on firms’ performance, this study used PLS-SEM to test the hypotheses. PLS-SEM was carried out via SmartPLS version 3.2.7 (Ringle et al., 2015), which included the analysis of the measurement as well as structural models. Moreover, the structural model was also analysed across the Chinese and Indian samples using Henseler’s MGA and permutation tests (Henseler et al., 2009; Chin and Dibbern, 2010).

Results

Evaluation of the Measurement Model

Table 1 shows the first-order constructs’ reliabilities and convergent validities to be adequate, as their values are above the suggested threshold values of Hair et al. (2017). Moreover, the values of the outer loadings were found to be above 0.60 for each item.

| Table 1: Constructs’ Reliabilities And Convergent Validities | |||||

| Sample | Construct | Cronbach's Alpha | Rho A | Composite Reliability | Average Variance Extracted (AVE) |

|---|---|---|---|---|---|

| Chinese Sample (n=100) |

NC | 0.905 | 0.919 | 0.926 | 0.677 |

| FP | 0.725 | 0.773 | 0.813 | 0.524 | |

| NFP | 0.715 | 0.772 | 0.826 | 0.617 | |

| BG | 0.663 | 0.691 | 0.797 | 0.518 | |

| CP | 0.680 | 0.703 | 0.781 | 0.509 | |

| Indian Sample (n=100) |

NC | 0.933 | 0.952 | 0.947 | 0.748 |

| FP | 0.754 | 0.763 | 0.842 | 0.571 | |

| NFP | 0.737 | 0.916 | 0.833 | 0.628 | |

| BG | 0.728 | 0.742 | 0.822 | 0.538 | |

| CP | 0.829 | 0.947 | 0.882 | 0.654 | |

Note: Composite reliability=(square of the sum of factor loadings)/{(square of the sum of factor loadings)+(square of the sum of error variances)}. Rho A is known as true reliability according to Hair et al. (2017).

The discriminant validity was also established across all latent variables using the heterotrait-monotrait ratio (HTMT) criterion as shown in Table 2. The values of HTMT’s confidence intervals of the correlations between constructs were less than 0.85 and did not include the value of 1 (Hair et al., 2017), which further support the adequacy of the discriminant validity.

| Table 2: Results Of Htmt Criterion | ||||||

| Chinese Sample (n=100) | BG | CP | FP | NC | NFP | |

|---|---|---|---|---|---|---|

| BG | ||||||

| CP | 0.647 | |||||

| (0.445, 0.789) | ||||||

| FP | 0.765 | 0.474 | ||||

| (0.376, 0.675) | (0.274, 0.671) | |||||

| NC | 0.528 | 0.254 | 0.285 | |||

| (0.297, 0.700) | (0.092, 0.390) | (0.155, 0.433) | ||||

| NFP | 0.714 | 0.537 | 0.522 | 0.224 | ||

| (0.380, 0.792) | (0.275, 0.736) | (0.309, 0.751) | (0.105, 0.346) | |||

| Indian Sample (n=100) | BG | CP | FP | NC | NFP | |

| BG | ||||||

| CP | 0.694 | |||||

| (0.489, 0.837) | ||||||

| FP | 0.663 | 0.765 | ||||

| (0.458, 0.820) | (0.445, 0.679) | |||||

| NC | 0.18 | 0.285 | 0.248 | |||

| (0.091, 0.300) | (0.14, 0.419) | (0.112, 0.401) | ||||

| NFP | 0.718 | 0.696 | 0.717 | 0.126 | ||

| (0.559, 0.860) | (0.536, 0.830) | (0.447, 0.789) | (0.060, 0.213) | |||

Inner Model Analysis

Prior to hypotheses testing, the values of the variance inflation factor (VIF) were determined. The VIF values were less than 5, ranging from 1 to 3.7. Thus, there were no colinearity issues among the predictor latent variables (Hair et al., 2017).

| Table 3: Significance Of The Path Coefficients (Bootstrapped) |

||||||

| Relationship | Chinese Sample (n=100) | Indian Sample (n=100) | ||||

|---|---|---|---|---|---|---|

| Std beta | SE | t-value | Std beta | SE | t-value | |

| H1: NC à FP | 0.284 | 0.087 | 3.270*** | 0.224 | 0.072 | 3.089*** |

| H2: NC à NFP | 0.212 | 0.118 | 1.792** | 0.122 | 0.124 | 0.981 |

| H3: NC à BG | 0.425 | 0.086 | 4.917*** | 0.164 | 0.105 | 1.555 |

| H4: NC à CP | 0.247 | 0.088 | 2.796*** | 0.290 | 0.062 | 4.645*** |

Note: Critical t-values at*1.65 (significance level=10%), **1.96 (significance level=5%) and ***2.57 (significance level=1%).

The results of hypotheses testing are revealed in Table 3, showing that there is a statistically significant positive influence of network competence on perceived financial performance (β=0.284, t-value=3.270***), perceived non-financial performance (β=0.212, tvalue= 1.792**), perceived business growth (β=0.425, t-value=4.917***) and perceived performance relative to competitors (β=0.247, t-value=2.796***) in the Chinese sample. Thus, H1, H2, H3 and H4 have been supported for the Chinese sample. However, a statistically significant positive influence of network competence was only found on perceived financial performance (β=0.224, t-value=3.089***) and perceived performance relative to competitors (β=0.290, t-value=4.645***) in Indian sample. While, network competence was found to have a statistically non-significant positive influence on perceived business growth (β=0.122, t value= 0.981) and perceived non-financial performance (β=0.164, t-value=1.555). Thus, only H1 and H4 were supported in the Indian sample.

After testing the hypotheses, the Stone-Geisser Q2 value of the constructs was also determined using the blindfolding procedure as shown in Table 4. Since all values were more than 0, this indicates that the model has predictive relevance (Hair et al., 2017).

| Table 4: Results Of The Model’s Predictive Relevance | ||||||||||

| Construct | Chinese Sample (n=100) | Indian Sample (n=100) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| SSO | SSE | Q2 | SSO | SSE | Q2 | |||||

| FP | 600 | 582.549 | 0.029 | 600 | 590.182 | 0.016 | ||||

| NFP | 450 | 442.747 | 0.016 | 450 | 450.089 | 0.001 | ||||

| BG | 600 | 553.386 | 0.078 | 600 | 594.745 | 0.009 | ||||

| CP | 600 | 591.217 | 0.015 | 600 | 574.767 | 0.042 | ||||

Statistical Remedies for Common Method Variance

The systematic error variance shared among constructs is known as common method variance (CMV), which occurs due to the constructs being measured by a similar method or source (Richardson et al., 2009). CMV or same source bias, has been considered as a third variable that affects the relationships between latent constructs either by inflating or deflating these relationships (Jakobsen and Jensen, 2015), and shows the spurious correlations among the constructs (Tehseen et al., 2017). Therefore, it is important to control the impact of CMV. As recommended by Tehseen et al. (2017) and Chin et al. (2013), two effective statistical techniques namely construct level correction (CLC) and item level correction (ILC) were used to control the effects of CMV after calculating the path coefficients. Table 5 shows that CMV impact was controlled because no significant differences in t-values were found among the original PLS estimation, CLC estimation, and ILC estimation. Therefore, the findings of the study are reliable to draw implications as well as further conclusions from.

| Table 5: Comparison Among T-Values Of Original Pls Estimates, Clc Estimates And Ilc Estimates | ||||||

| Path | Chinese Sample (n =100) | Indian Sample (n =100) | ||||

|---|---|---|---|---|---|---|

| ILC Estimations | CLC Estimations | Original PLS Estimations | ILC Estimations | CLC Estimations | Original PLS Estimations | |

| NC à FP | 3.499*** | 2.608*** | 3.270*** | 3.235*** | 2.979*** | 3.089*** |

| NC à NFP | 2.071** | 2.262** | 1.7928* | 0.897 | 1.461 | 0.981 |

| NC à> BG | 5.082*** | 5.157*** | 4.917*** | 1.486 | 1.255 | 1.555 |

| NC à CP | 2.949*** | 2.187** | 2.796*** | 4.611*** | 3.291*** | 4.645*** |

Note: Critical t values*1.65 (significance level=10%), **1.96 (significance level=5%), and ***2.57 (significance level=1%).

Multi-Group Analysis (MGA)

The multiple-group analysis’ aim is to compare the explained variance among groups (Hernández-Perlines, 2016). However, measurement invariance is essential to be established before conducting multiple-group analysis (Henseler et al., 2016). Because false conclusions may result due to lack of measurement invariance (Henseler et al., 2016). Thus, MICOM was utilised to test the measurement invariance as suggested by Hair, Sarstedt, Ringle and Gudergan, (2018) and Hair et al. (2017).

| Table 6: Results Of Hypotheses Testing And Differences Among The Chinese And Indian Samples | ||||||||

| Relationship | Path Coefficients | Confidence Interval (95%) | Difference in Path Coefficient | p-value Difference (one-tailed) |

Supported | |||

|---|---|---|---|---|---|---|---|---|

| Chinese Sample | Indian Sample | Chinese Sample | Indian Sample | Henseler’s MGA | Permutation Test | |||

| NC à FP | 0.284 | 0.224 | (0.103, 0.405) | (-0.071, 0.322) | 0.061 | 0.264 | 0.530 | yes/yes |

| NC à NFP | 0.212 | 0.122 | (-0.228, 0.339) | (-0.261, 0.236) | 0.090 | 0.244 | 0.386 | yes/yes |

| NC à BG | 0.425 | 0.164 | (0.220, 0.555) | (-0.297, 0.258) | 0.261 | 0.015 | 0.022 | no/no |

| NC à CP | 0.247 | 0.290 | (-0.282, 0.374 ) | (0.165, 0.398) | -0.043 | 0.661 | 0.648 | yes/yes |

Note: In Henseler’s MGA, p-values lower than 0.05 or higher than 0.95 indicate significant difference at 5% level between specific path coefficients across two groups. *p<0.05, **p<0.01.

The partial measurement invariance was established that was the basic requirement to compare as well as interpret the PLS-SEM’s findings for examining the specific MGA group’s differences (Henseler et al., 2016). Table 6 indicates the structural models’ results and MGA by using nonparametric methods including Henseler’s MGA as recommended by Henseler et al. (2009) and permutation test suggested by Chin and Dibbern (2010). Both methods are considered as the most conservative techniques of PLS-SEM for assessing the differences between the two groups’ path coefficients (Rasoolimanesh et al., 2016). Henseler’s MGA compares the bootstrap estimates of groups from each bootstrap sample (Rasoolimanesh et al., 2016). Additionally, Henseler’s MGA method and permutation method only show significant difference for the impact of NC on BG across both samples.

Discussion

The current study aimed to investigate and compare the influence of network competence on four types of firms’ performances-perceived financial performance, perceived non-financial performance, perceived business growth and perceived performance relative to competitorsamong Chinese and Indian entrepreneurs in Malaysia. To achieve this research objective, four hypotheses were developed. H1 and H4, which hypothesised network competence to have a positive impact on perceived financial performance and perceived performance relative to competitors respectively, were found to be supported across both Chinese and Indian samples. However, findings revealed network competence to have a positive impact on perceived nonfinancial performance (H2) and perceived business growth (H3) only among Chinese entrepreneurs but not among Indian entrepreneurs. Thus, H2 and H3 were supported only for the Chinese sample but not for the Indian sample.

The positive influence of network competence on firms’ performances is in line with the findings of previous studies (Parida et al., 2017; Perin et al., 2016; Thrikawala, 2011). On the other hand, the statistically non-significant influence of network competence on firms’ performances is also consistent with a few studies such as Yu and Chiu (2010) and Watson (2007) who also found negative impact of network competence on firms’ performance In addition, MGA revealed significant positive difference only for the impact of network competence on perceived business growth across both Chinese and Indian samples.

Conclusion And Future Recommendations

From the results of this study, it can be concluded that network competence has significant influence on the various types of firms’ performances. However, its impacts vary among Chinese and Indian entrepreneurs. This leads to the practical implication for Indian entrepreneurs that they need to focus more on strengthening their networking capabilities to achieve superior non-financial performance and business growth as well. This is because it may possible that Indian entrepreneurs do not utilise their networking capabilities at their best level to achieve non-financial performance and business growth, and thus, therefore are not perceived as much successful compared to Chinese entrepreneurs in Malaysia. Although this study contributed to the existing body of knowledge to some extent, it is recommended to conduct further comparative studies to assess the influence of various factors on firms’ performances under different contexts. This would provide deeper insights regarding the significant influence of key variables on the firms’ performances of certain groups relative to others.

This study has theoretical, empirical as well as methodological contributions. Theoretically, it integrated three theories-SNT, IT, and RDT-in explaining the concept of network competence on firms’ performance. This study proposed and then tested a parsimonious model by considering the most important and relevant variables (Whetten, 1989) in a unique context (Whetten, 1989) which is the multicultural context of Malaysia. Thus, the main theoretical contribution of this study is that it has provided useful insights regarding the influence of network competence on four types of firms’ performances in the multi-cultural context of Malaysia. This study adds to the current knowledge of ethnic entrepreneurship by determining different impact of network competence on firms’ performances among Chinese and Indian entrepreneurs. Additionally, this study is believed to be the very first to scrutinize these relationships among Chinese and Indian entrepreneurs.

Empirically, it provided statistical evidence regarding the influence of network competence on firms’ performances, as well as revealed differences between these two groups. Methodically, the study used the most effective statistical remedies namely CLC and ILC methods as recommended by Koay (2018), Tehseen et al. (2017) and Chin et al. (2013) to control the impact of CMV from the study’s result. Furthermore, MGA which is an advanced technique to assess the differences among groups (Hair et al., 2018), was also employed. Additionally, the main implication of this study is that the proposed results should be of help in identifying specific policies to support the competitiveness of SME networks.

References

- Abdullahi, M.S., Abubakar, A., Aliyu, R.L. & Umar, M.B. (2015). Empirical review on the determinants influencing firm performance in developing countries.International Journal of Scientific and Research Publications,5(6), 1-10.

- Ahmad, N.H. (2007).A cross cultural study of entrepreneurial competencies and entrepreneurial success in SMEs in Australia and Malaysia.Unpublished doctoral dissertation, University of Adelaide, Australia.

- Alam, S.S., Mohd, R., Kamaruddin, B.H. & Nor, N.G.M. (2015). Personal values and entrepreneurial orientations in Malay Entrepreneurs in Malaysia: Mediating role of self-efficacy.International Journal of Commerce and Management,25(4), 385-401.

- Bacon, N. & Hoque, K. (2005). HRM in the SME sector: Valuable employees and coercive networks.The International Journal of Human Resource Management,16(11), 1976-1999.

- Barnes, J.A. (1954). Class and committees in a Norwegian Island parish.Human Relations,7(1), 39-58.

- Bhatt, G.D. (2000). Organizing knowledge in the knowledge development cycle.Journal of Knowledge Management,4(1), 15-26.

- Brinckmann, J. (2008).Competence of top management teams and success of new technology-based firms: A theoretical and empirical analysis concerning competencies of entrepreneurial teams and the development of their ventures. Germany: Deutscher Universitätsverlag.

- Brush, C.G., Greene, P.G., Hart, M.M. & Haller, H.S. (2001). From initial idea to unique advantage: The entrepreneurial challenge of constructing a resource base.The Academy of Management Executive,15(1), 64-78.

- Canning, L. & Szmigin, I. (2016). Radical innovation, network competence and the business of body disposal.Journal of Business & Industrial Marketing,31(6), 771-783.

- Chandler, G.N. & Hanks, S.H. (1993). Measuring the performance of emerging businesses: A validation study.Journal of Business Venturing,8(5), 391-408.

- Chen, C.N., Tzeng, L.C., Ou, W.M. & Chang, K.T. (2007). The relationship among social capital, entrepreneurial orientation, organizational resources and entrepreneurial performance for new ventures.Contemporary Management Research,3(3), 213-232.

- Chin, W.W. (2010). How to write up and report PLS analyses. In V. E. Vinzi, W. W. Chin, J. Henseler, H. Wang (Eds.),Handbook of partial least squares: Concepts, methods and applications.(pp. 655–690). Berlin, Heidelberg: Springer.

- Chin, W.W., Thatcher, J.B., Wright, R.T. & Steel, D. (2013). Controlling for common method variance in PLS analysis: The measured latent marker variable approach. In H. Abdi, W.W. Chin, V.E. Vinzi, G. Russolillo. & L. Trinchera (Eds.),New perspectives in partial least squares and related methods(pp. 231–239). New York, NY: Springer.

- Chu, P. (1996). Social network models of overseas Chinese entrepreneurship: The experience in Hong Kong and Canada.Canadian Journal of Administrative Sciences/Revue Canadienne des Sciences de l'Administration,13(4), 358-365.

- Chuen, P.W., Mohammad, O. & Yusoff, W.F.W. (2018). The impact of behavioral complexity on exploitative and explorative behavior among owners-managers of SMEs in Malaysia. Academy of Strategic Management Journal, 17(1), 1-13.

- Cohen, J. (1988). Statistical power analysis for the behavioral sciences (2nd ed.). US: Lawrence Earlbaum Associates.

- Centobelli, P., Cerchione, R. & Esposito, E. (2018a). Aligning enterprise knowledge and knowledge management systems to improve efficiency and effectiveness performance: A three-dimensional Fuzzy-based decision support system.Expert Systems with Applications,91, 107-126.

- Centobelli, P., Cerchione, R. & Esposito, E. (2018b). How to deal with knowledge management misalignment: a taxonomy based on a 3D fuzzy methodology.Journal of Knowledge Management,22(3), 538-566.

- Eisingerich, A.B. & Bell, S.J. (2008). Managing networks of interorganizational linkages and sustainable firm performance in business-to-business service contexts. Journal of Services Marketing, 22(7), 494-504.

- Erickson, C.L. & Jacoby, S.M. (2003). The effect of employer networks on workplace innovation and training. Industrial and Labor Relations Review, 56(2), 203-224.

- Ezuma, K.E. & Ismail, M. (2017). Conceptualizing the influence of network competence on entrepreneurship growth in small and medium enterprises.Global Business and Management Research,9(2), 30-44.

- Fansuree, E. Wahab, I., Hussin, M.H.F., Saad, M.N. & Harun, M.H.M. (2015). Using the social network for business sustainability: Examining start-up SME firms in Malaysia.Information Management and Business Review,7(5), 18-26.

- Faul, F., Erdfelder, E., Lang, A.G. & Buchner, A. (2007). G*Power 3: A flexible statistical power analysis program for the social, behavioral and biomedical sciences.Behavior Research Methods,39(2), 175-191.

- Gilbert, B.A., McDougall, P.P. & Audretsch, D.B. (2006). New venture growth: A review and extension. Journal of Management, 32(6), 926-950.

- Hair, J.F., Hult, G.T.M., Ringle, C.M. & Sarstedt, M. (2017). A primer on partial least squares structural equation modeling (PLS-SEM) (2nd ed.). Thousand Oaks, CA: Sage.

- Hair, J.F., Sarstedt, M., Ringle, C.M. & Gudergan, S.P. (2018). Advanced issues in partial least squares structural equation modeling (3rd ed.). Thousand Oaks, CA: Sage.

- Hassan, T.M.R.T., Yaacob, M.R. & Abdullatiff, N.K. (2014). Sustaining SMEs wood-based product manufacturing through best practices-The case of indigenous entrepreneurs in Kelantan. Procedia-Social and Behavioral Sciences, 115, 221-234.

- Hassim, A.A., Asmat-Nizam, A.T., Rahim, A. & Bakar, A.R.A. (2011). The effects of entrepreneurial orientation on firm organisational innovation and market orientation towards firm business performance.International on Sociality ND Economics Development, IPEDR,10, 280-284.

- Henseler, J., Ringle, C.M. & Sarstedt, M. (2016). Testing measurement invariance of composites using partial least squares. International Marketing Review, 33(3), 405-431.

- Henseler, J., Ringle, C.M. & Sinkovics, R.R. (2009). The use of partial least squares path modelling in international marketing. In R. R. Sinkovics &P. N. Ghauri (Eds.), New Challenges to International Marketing, 20(pp. 277–319). UK: Emerald Group Publishing Limited.

- Hernández-Perlines, F. (2016). Entrepreneurial orientation in hotel industry: Multi-group analysis of quality certification.Journal of Business Research,69(10), 4714-4724.

- Hillman, A.J., Withers, M.C. & Collins, B.J. (2009). Resource dependence theory: A review.Journal of Management,35(6), 1404-1427.

- Jakobsen, M. & Jensen, R. (2015). Common method bias in public management studies.International Public Management Journal,18(1), 3-30.

- Kenny, B.C. (2009). A network perspective on international business: Evidence from SMEs in the telecommunications sector in Ireland.Unpublished doctoral dissertation, University of Limerick, Ireland.

- Kheng, L.K. & Minai, M.S. (2016). The network characteristic of Chinese SMEs in Malaysia and their performance. In N. Z. Mohd Sidek, S. M. Ali, & M. Ismail (Eds.),Proceedings of the ASEAN Entrepreneurship Conference 2014(pp. 39-47). Singapore: Springer.

- Koay, K.Y. (2018). Understanding consumers’ purchase intention towards counterfeit luxury goods: An integrated model of neutralisation techniques and perceived risk theory.Asia Pacific Journal of Marketing and Logistics, 30(2), 495-516.

- Lechner, H.T.C.C. & Gudmundsson, S.V. (2016). The interplay of networks and firm performance within high-tech clusters. InC. Boari, T. Elfring, & X.F. Molina-Morales (Eds.), Entrepreneurship and Cluster Dynamics(pp. 143-161). UK: Routledge.

- Luo, Y. & Child, J. (2015). A composition-based view of firm growth.Management and Organization Review,11(3), 379-411.

- Yunos, R., Ismail, Z. & Smith, M. (2012). Ethnicity and accounting conservatism: Malaysian evidence. Asian Review of Accounting, 20(1), 34-57.

- Mort, G.S. & Weerawardena, J. (2006). Networking capability and international entrepreneurship: How networks function in Australian born global firms. International Marketing Review, 23(5), 549-572.

- Muniady, R., Al Mamun, A., Mohamad, M.R., Permarupan, P.Y. & Zainol, N.R.B. (2015). The effect of cognitive and relational social capital on structural social capital and micro-enterprise performance. SAGE Open, 5(4), 1-9.

- Nohria, N. & Garcia‐Pont, C. (1991). Global strategic linkages and industry structure.Strategic Management Journal,12(S1), 105-124.

- Parida, V., Pesämaa, O., Wincent, J. & Westerberg, M. (2017). Network capability, innovativeness and performance: A multidimensional extension for entrepreneurship. Entrepreneurship & Regional Development, 29(1-2), 94-115.

- Perin, M.G., Sampaio, C.H., Jiménez-Jiménez, D. & Cegarra-Navarro, J.G. (2016). Network effects on radical innovation and financial performance: An open-mindedness approach. BAR-Brazilian Administration Review, 13(4), 1-24.

- Pfeffer, J. (1988). A resource dependence perspective on intercorporate relations.In M. S. Mizruchi & M. Schwartz (Eds.), Intercorporate relations: The structural analysis of business (pp. 25-55). UK: Cambridge University Press.

- Pfeffer, J. & Nowak, P. (1976). Joint ventures and interorganizational interdependece.Administrative Science Quarterly, 21(3), 398-418.

- Pfeffer, J. & Salancik, G.R. (1978). The external control of organizations: A resource dependence perspective. New York, NY: Harper & Row.

- Rasoolimanesh, S.M., Roldán, J.L., Jaafar, M. & Ramayah, T. (2016). Factors influencing residents’ perceptions toward tourism development differences across rural and urban world heritage sites. Journal of Travel Research, 26(1), 28-38.

- Razali, R., Saraih, U.N., Shaari, M.S., Rani, M.J.A. & Abashah, A. (2018). The influences of effectiveness, competitive advantages and market accessibility on SME Performance in Malaysia. MATEC Web of Conferences, 150, 05023.

- Richardson, H.A., Simmering, M.J. & Sturman, M.C. (2009). A tale of three perspectives: Examining post hoc statistical techniques for detection and correction of common method variance.Organizational Research Methods,12(4), 762-800.

- Ringle, C.M., Wende, S. & Becker, J.M. (2015). SmartPLS 3. Bönningstedt: SmartPLS.

- Ritter, T. (1999). The networking company: Antecedents for coping with relationships and networks effectively. Industrial Marketing Management, 28(5), 467-479.

- Ritter, T., Wilkinson, I.F. & Johnston, W.J. (2002). Measuring network competence: Some international evidence. Journal of Business & Industrial Marketing, 17(2-3), 119-138.

- Salamzadeh, Y., YousefNia, M., Radovic Markovic, M. & Salamzadeh, A. (2016). Strategic management development: The role of learning school on promotion of managers' competence. 1-25.

- Salamzadeh, Y., Salamzadeh, A. & Radovic Markovic, M. (2016). Cultural intelligence and network organizations in society: Case of Tehran neighborhood councils. Faculty of Business Economics and Entreprenuership, (1-2), 46-58.

- Schoonjans, B., Van Cauwenberge, P. & Vander Bauwhede, H. (2013). Formal business networking and SME growth. Small Business Economics, 41(1), 169-181.

- Scott, J. (1991). Social Network Analysis. London: Sage.

- Semrau, T. & Sigmund, S. (2012). Networking ability and the financial performance of new ventures: A mediation analysis among younger and more mature firms. Strategic Entrepreneurship Journal, 6(4), 335-354.

- SME Corporation Malaysia (2015). SME definitions.

- Surin, E.F., Edward, O.T., Hussin, H.F. & Wahab, I.A. (2017). Recognising the importance of strategic business network on business performance of SME manufacturing firm in Malaysia: Analysing the moderating influence of human capital and business environment.International Journal of Arts & Sciences, 9(4), 31-44.

- Tehseen, S., Ramayah, T. & Sajilan, S. (2017). Testing and controlling for common method variance: A review of available methods.Journal of Management Sciences,4(2), 146-175.

- Tehseen, S. & Sajilan, S. (2016). Network competence based on resource-based view and resource dependence theory. International Journal of Trade and Global Markets, 9(1), 60-82.

- Thrikawala, S. (2011). Impact of strategic networks for the success of SMEs in Sri Lanka. World Journal of Social Sciences, 1(2), 108-119.

- Verbeke, A. & van Tulder, R. (2011). Entrepreneurship in the global firm (Vol. 6). UK: Emerald Group Publishing.

- Wang, G., Dou, W., Zhu, W. & Zhou, N. (2015). The effects of firm capabilities on external collaboration and performance: The moderating role of market turbulence. Journal of Business Research, 68(9), 1928-1936.

- Watson, J. (2007). Modeling the relationship between networking and firm performance. Journal of Business Venturing, 22(6), 852-874.

- Watson, J. (2012). Networking: Gender differences and the association with firm performance. International Small Business Journal, 30(5), 536-588.

- West, G.P. & Noel, T.W. (2009). The impact of knowledge resources on new venture performance. Journal of Small Business Management, 47(1), 1-22.

- Whetten, D.A. (1989). What constitutes a theoretical contribution?.Academy of management review,14(4), 490-495.

- Wiklund, J. & Shepherd, D. (2003). Knowledge-based resources, entrepreneurial orientation, and the performance of small and medium-sized businesses. Strategic Management Journal, 24(13), 1307-1314.

- Yu, S.H. & Chiu, W.T. (2010). Social capital and firm performance: The impact of technical uncertainty. AAA 2011 Management Accounting Section (MAS) Meeting Paper.