Research Article: 2021 Vol: 20 Issue: 6S

Impact of Integrity and Internal Audit Transparency on Audit Fraud Risk Mitigation: Moderating Role of Blockchain Technology

Mohammad Rokibul Kabir, East Delta University

Farid A. Sobhani, United International University

Norhayati Mohamed, Universiti Teknologi MARA

Abstract

Fraud is regarded as one of the most severe issues and difficulties in today's business world. Though auditing is thought to be the check mechanism to prevent fraud, it is encountered with fraud risks like asset misappropriation and fraudulent reporting. The integrity of the accounts and audit management and a transparent internal audit system can play a significant role in ensuring audit quality. Again, emerging Blockchain Technology (BT) plays a vital role by providing a triple entry accounting system with its immutable nature. This paper, thus, aims at explaining the impact of integrity and effectiveness and transparency on audit fraud risk mitigation (AFR). It also evaluates the moderating role of blockchain technology in AFR. This research applies the Partial Least Square Structural Equation Model (PLS-SEM) to explain the causal relationship. Primary data are collected for this research from Bangladesh's accounts and audit professionals through a structured questionnaire. The findings of the study refer that the integrity and transparency in the accounting system and audit process significantly impact AFR. Again, the application of blockchain is found to moderate the relationship between integrity and AFR. Similarly, blockchain application moderates the relation between transparency and AFR. The study delves into evolving BT and its applications in the accounting and auditing landscape. Thus, with its original contribution to unveiling the moderating role of BT between integrity, transparency, and AFR, this research can help policymakers mitigate fraud and increase audit quality.

Keywords

Audit Fraud Risk, Blockchain Technology, Integrity, Internal Audit Transparency, PLS-SEM

Introduction

An audit serves an essential function as an effective corporate governance tool, and auditing quality reflects good governance. The key objectives of the audit are to acquire strong evidence that no substantial misstatements of accounting records are caused by fraudulent activity and to provide reports in compliance with auditing standards (Xiao et al., 2020). However, many forms of fraud risks are commonly observed during the audit process. Assessing fraudulent risk factors, which are described by ISA 240 as "circumstances that suggest a motive or compulsion of misconduct or give an incentive to engage in fraudulent activities," is an efficient way to analyze significant misrepresentation resulting from fraud (IFAC, 2016, ISA240). Audit fraud risk can cause a misallocation of audit resources, resulting in an unsuccessful and unproductive audit (Low, 2004; Hajiha, 2012). It may even have a detrimental impact on the audit design procedure (Bedard & Graham, 2002). As a result, auditors must organize their assessment activities to improve audit quality and lowering the incidence of dispute (Arens et al., 2014; Bell et al., 2005).

Auditing risk analysis methods are designed to detect and analyze the possibilities of significant misrepresentation in the accounting reports. The comprehension of the business and even its surroundings, the appropriate corporate accounting structure, and the organization's reporting structure form the foundation of auditing evaluation methods. The audit risk evaluation processes are carried out to offer a foundation for planning and carrying out additional control activities (IAASB, 2019, ISA 315 (Revised 2019)). Thus, the organization's integrity and internal audit transparency are significant to mitigate audit risk (Hanim et al., 2017). Integrity is usually described as utmost diligence in performing assigned responsibilities, acting without corrupting or misusing official power (Armstrong, 2005). Attachment to professional ethics, like morality and truthfulness, is characterized as integrity. Integrity can be explained as the extent to which individuals or groups meet the reasonable beliefs and assumptions of the environment surrounding those (Lobnikar & Meko, 2015).

Whereas internal auditing is a significant and independent control procedure, external parties have neither the immediate, specific data about the activity accessible to internal members nor have other control techniques such as external auditing (Archambeault et al., 2008). Internal audit effectiveness and transparency can aid in overcoming the problem of asset misappropriation and fraudulent financial reporting generated by Audit Fraud Risk (AFR). Carcello, et al., (2020) investigated how the audit function adds value to businesses by mitigating risk. They discovered that companies with effective and transparent internal audit units report a higher reduction in risk and improved audit efficiency.

Blockchain Technology (BT) arose with the booming advent of information technology for many uses. BT presents companies with good innovation to create and value proposition, unique information-sharing protocols and business applications, and revolutionary organization structure (Chin et al., 2021, Kabir et al., 2021a; Kabir et al., 2021b). Bonsón & Bednárová's (2019) research gave comprehensive thoughts on BT and the degree to which it may change the accounting and auditing frameworks. They argued that the use of BT in auditing might result in profound improvements. Kabir (2021) argued that the application of blockchain could bring transparency to the process. Again, transparency can ensure better risk management (Kabir et al., 2019). Different studies show the importance of integrity and internal audit effectiveness for risk mitigation and quality audit (Archambeault et al., 2008; Arens et al., 2014; Bell et al., 2005; Carcello et al. 2020). Similarly, research highlights the application of blockchain technology for accounting, auditing, and taxation (Bonsón & Bednárová, 2019; Kabir, 2021). However, not many studies are available that combine the effects of integrity, transparency, and technology adoption on fraud risk mitigation. Moreover, the exploration of moderating role between transparency, integrity, and AFR made this study a unique endeavor.

Literature Review

Literature on Audit Fraud Risk

In general, auditing is defined as the process of gathering, analyzing, assessing, and reporting investigations (Gibbins, 1984). Embracing organizational entrustment, organizing auditing, detecting, assessing, and acting to significant misrepresentation risk, and generating audit reports are all part of the auditing. The audit goals are to acquire confidence that there were no substantial misrepresentations in financial statements resulting from fraud or mistake and provide audit reports in line with audit principles (Xiao et al., 2020). Fraud is described as "a purposeful act by an individual or group of persons within the administration, those who are in control of governing, workers, or third - party, involving the use of deceit to achieve an unfair or unlawful benefit" (IFAC, 2016, ISA240; Par.11). As a result, auditors must create an audit action plan and carry out auditing whose type, timeliness, and scope are based on and reactive to the estimated fraud risks (IFAC, 2016, ISA330). Luo (2021) conducted a study using a fuzzy analysis methodology to assess the number of misstatements; Xia & Qingling (2011) also made a holistic fuzzy analysis approach to analyze risk exposure at the policy level. An inappropriate, fraudulent risk evaluation, on the other hand, might result in a misallocation of audit resources and, finally, an unsuccessful and unproductive investigation (Hajiha, 2012; Low, 2004).

According to ISA 240, there is a danger of failing to discover a significant misrepresentation in the audit process due to managerial or staff malfeasance. Management fraud manifests itself as false accounting and reporting practices, whereas staff frauds manifest itself as asset misappropriation (Alssabagh, 2020). Both types of fraud entail motivations or compulsion to conduct fraudulent activities and explain such actions (IFAC, 2016, ISA240). Committing frauds necessitate at least one of the three primary intentions: motivation or coercion, opportunity, and stance or justifications, collectively described as the "fraud triangle" (Jans et al., 2010).

According to Alssabagh (2016), correct evaluation of misstatements risk, particularly fraud risk, culminated in a balance between auditing quality and productivity by enabling auditors to determine the right degree of specified audit processes. Numerous research (Blay et al., 2008; Chang et al., 2008; Colbert, 1996; De Martinis et al., 2007; Razak et al., 2018) show that identifying important risk variables can assist auditors in guaranteeing quality audits, and therefore fraud risk mitigation is essential (Alssabagh, 2020).

Literature on Integrity and Internal Audit Effectiveness and Transparency

Currently, integrity is frequently debated, and different ideas have been conceived. Integrity is derived from the Latin word "integrate," that meaning "complete" (Irianto et al., 2012). The term "complete" denotes that there are no flaws in the auditing process. Akir & Malie (2012) divided integrity into three categories: protection, accountability, and compliance. According to Githui (2014), persons with inadequate integrity and honesty are more likely to be involved in fraudulent acts. It is because persons with integrity are thought to be trustworthy, competent, professional, and confident. As a result, all of these characteristics will prevent individuals from engaging in deceptive practices. Therefore, it is possible to assert that integrity negatively correlates with the prevalence of fraud in an organization. Chen, et al., (2013) confirmed the above conclusion with their observations that CEOs' deficient in integrity are likely to disregard guidelines and standards to seek personal benefits at the expense of others; as a result, immoral judgments and frauds are more prevalent amongst them.

Internal auditing has historically been a component of excellent company governance (Bowen, 2008; Crawford, 2007; Mallin, 2011). Today's company governance reform, an increasing board size, independent auditors, and management teams see internal auditing as a critical governance function that provides substantial advantages to the business. And to realize its role, internal auditing must demonstrate outstanding efficiency and effectiveness. Internal auditing is a crucial control measure that differs from other control procedures such as external auditing (Deloitte 2006; Jackson 2007; Rezaee, 2008; Rosenstein & Rose, 2006). Internal auditing functions are frequently the primary defense against disclosing mistakes, detecting inadvertent flaws produced by deficiencies in a firm's internal control system, as well as purposeful errors generated by deception. As a result, businesses with an excellent internal auditing division might have better reporting quality. Internal auditing must show its efficacy through an assessment system linked to its stakeholder groups' aspirations (Feizizadeh, 2010). (2012). Internal users have access to the relevant auditing details. External parties such as investors, lenders, experts, clients, and vendors do not have immediate and comprehensive evidence of past investigation positioning, accountabilities, and functions to accomplish assurance regarding financial reporting, conformance, and operational activities. Instead, existing governance reports accessible to external parties concentrate on administration, the supervisory board, and the audit firms. This disclosure imbalance has the effect of undermining stakeholders' faith in transparency as a fundamental component of good governance (Brancato & Plath, 2003; Holt & DeZoort, 2008).

Literature on the Application of Blockchain in Accounting and Auditing

Blockchain is a decentralized, shared database used to store and exchange data over a peer-to-peer channel (Ducas & Wilner, 2017). BT network participants manage and authenticate exact copies of the database collaboratively, with modules appended in blocks linked to a sequential loop of formerly verified blocks, using a unique hash. Every block newly created is displayed sequentially to align with the development of new and unalterable information. The product includes information that alludes to the node that presaged it, guaranteeing that every effort to change the blockchain will necessitate the modification of every block already developed, which is incredibly difficult provided the distributed feature of BT (Buterin, 2014).

Due to the considerable effect of the development of BT on accounting and audit professions, the American Institute of Certified Public Accountants (AICPA) has been tracking the present status of legislative issues to determine how CPA firms' activity might be impacted (AICPA, 2018). According to the AICPA's February 2018 bulletin, state governments of the USA like Arizona, New York, and Tennessee have filed blockchain-related policy in domains including bookkeeping, consensus mechanism, digital signature, and the legitimacy of BT transactional activities. BT has also piqued the curiosity of the Big 4 accounting firms. Consequently, several initiatives have begun. Coordination among leading financial and professional organizations has resulted in many projects focused on investigating the possibilities of BT for accounting and auditing. For example, Deloitte created Rubix, the first-ever BT-based interface that permits customers to develop a tailored database and consensus mechanism (Minichiello, 2015). Deloitte stated in 2017 that it had completed a BT-based audit using current audit standards to analyze a distributed ledger system (Das, 2017). Despite the promise of this issue in the accounting and auditing fields, there is a shortage of research in this area. Recent academic research worth mentioning is a brief description of how blockchain allows for real-time accountancy and auditing (Yermack, 2017). Fanning 7 Centers (2016) have identified the advantages of a BT-based auditing process (2016). Kiviat (2015) pioneered the concept of "triple-entry accounting" by applying a distributed system. Peters and Panay showed its use in banking transaction handling (2016). Kokina, et al., (2017); O'Leary (2017) discussed the impact of BT on accountancy by describing the fundamental ideas and background and the activities undertaken in this sector.

Research Gap

To achieve audit goals, the main course of auditing in the current risk-based audit system involves audits to recognize, analyze, and address the risk of significant misrepresentation. In the auditing process, auditors gather reasonable assurance by carrying out audit processes to discover substantial misrepresentations in financial statements (Xiao et al., 2020). According to Napel (2013), to minimize fraudulent activities and mitigate those risks, it is essential to note why an individual commits crimes. Nonetheless, identifying fraud is a complicated process that needs an extensive understanding of the complexities of fraud, why someone would do it, and how this might be executed and disguised (Dellaportas, 2013). Cressey (1950) proposed the fraud triangle model that describes the variables contributing to persons' engaging in fraud. Cressey's idea has become famous as the "fraud triangle theory" overages (Kassem & Higson, 2012). Numerous researches have been conducted to explain this model and see how it could be utilized as a predictive tool for organizations to predict or prevent fraud. According to the research conducted by Steven Dellaportas (2013), each part of the "fraud triangle" is the result of deceitful acts done by the convicts involved in the research (Dellaportas, 2013). Though the "fraud triangle" successfully identifies the factors influencing fraud risks, it is crucial to determine the factors playing the role to mitigate such risks. Several studies have been conducted to demonstrate the significance of integrity and internal audit effectiveness in risk mitigation and audit quality assurance (Archambeault et al., 2008; Arens et al., 2014; Bell et al., 2005; Carcello et al., 2020). Likewise, studies have emphasized the use of blockchain technology in accounting, auditing, and taxation (Bonsón & Bednárová, 2019; Kabir, 2021). However, there aren't many researches that combine the impacts of integrity, transparency, and technological innovation on audit fraud risk mitigation. Specifically, this research is a unique endeavor to explain the factors called integrity and audit effectiveness, and transparency which can play a significant role in audit fraud risk mitigation considering the moderating effect of blockchain application in the audit process.

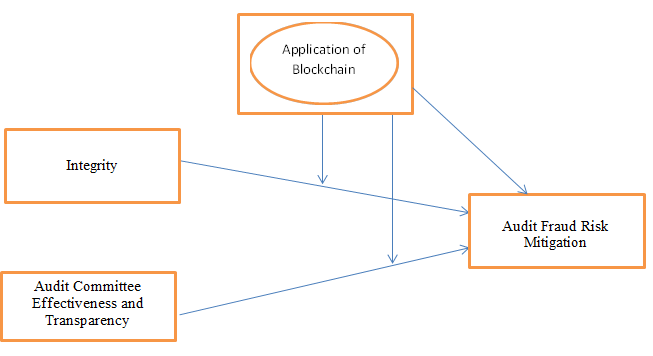

Conceptual Framework

Based on the literature review highlighting the need of identifying the factors including audit risk fraud mitigation, a conceptual model has been developed considering the role of integrity, internal audit effectiveness, and transparency as shown in Figure 1.

Research Hypotheses

Integrity and Audit Fraud Risk (AFR)

Employee integrity is critical for a firm to protect its people from engaging in fraudulent activities (Hanim et al., 2017). Many researchers discovered that transparency could discourage dishonest behavior. Integrity entails operating ethically and according to the firm's regulations and practices (Rosalina & Firmanto, 2012). When individuals have integrity, they are less likely to commit fraud because they feel that specific behavior is improper and would affect their confidence in operating fairly. Several researchers agree that having a high degree of integrity amongst managers would assist the firm in preventing immoral conduct amongst their staff. Morality and integrity are considered to have substantial impacts on fraud instances in Githui (2014)'s study. According to Chen, et al., (2013), a lack of Chief executive integrity in a firm is positively associated with the occurrence of fraud. The article examines leaders' fraudulent behaviors to gauge the extent of integrity in the organizations. The Louis (2004) investigation validated that if the accounts and audit personnel are honest, there will be no fraudulent activity. Based on the above discussion, we hypothesized:

H1: Integrity has a positive impact on AFR mitigation.

Internal Audit Effectiveness and Transparency (TR) and Audit Fraud Risk (AFR)

Internal audit must comprehend and match its operations with the aspirations of its key stakeholders, top executives, and the supervisory board for auditing (Mallin, 2011). If it comes to setting internal auditing resources to risk supervision and controlling, this congruence guarantees that internal auditing and relevant parties have the same goals. Administrative transparency is defined by Bushman, et al., (2004) as the accessibility and scope of regulation information. This concept differentiates administrative transparency from financial transparency, which includes the availability and scope of financial disclosures of the company. Administration transparency is crucial in this setting because stakeholders depend on company-specific governance data to increase trust and policy decisions. According to Aghghaleh, et al., (2014), an inefficient non-transparent audit committee has a favorable influence on fraud in many businesses since the audit committee members lack oversight, allowing staff to commit frauds. Hence, ensuring an effective and transparent internal audit process is essential to minimize audit fraud risk. Thus the following hypothesis is developed.

H2: TR has a positive impact on AFR mitigation.

Moderating Role of Blockchain Application (APB) and Audit Fraud Risk (AFR)

Blockchain records areencrypted and unchangeable. BTis anticipated to be the “unique centerof truth” (Appelbaum & Smith, 2018). A complete evaluation process may be offered, as well as the capacity to evaluate anomalies from a whole population instead of a percentage and perform audits on a regular schedule relying on trustworthy information on the blockchain platform (Kokina et al., 2017). As a result, operations like consolidations and affirmations might not be required in the future if BT is adopted. KPMG has also recognized the promise of blockchain, stating that it enables quick and smart contracts, improves back-office activities, and cuts expenses (KPMG, 2017). KPMG collaborated with Microsoft to create its distributed blockchainledgers. Their primary emphasis is on developing design options to handle blockchain deployment issues in financial services and governmental agencies (Kokina et al., 2017). Similarly, another BT-based initiative, Libra, a blockchain start-up (Allison, 2015) has created interest in its application in different business areas. According to Cai & Zhu (2016), BT-based transaction recording is less mistake-prone as it ensures automatic operations and monitoring. Some researchers arguedthat BT can assist to minimize fraudulent activitiesand manipulations in audit operations (Cai & Zhu, 2016; Swan, 2015), and mitigate fraud risk(Kshetri, 2017), since an encrypted record cannot be changed. In the blockchain, records are kept in various locations, and each user receives a shared ledger; therefore, all records are accessible to each node in the network. This improves transparency, auditability, and efficacy allows for good accessibility while lowering the risk of fraud (Atzori, 2015; Palfreyman, 2015; Tapscott & Tapscott, 2016;Swan, 2015; Underwood, 2016). Hence, considering the role of blockchain in audit fraud risk mitigation the following hypotheses are considered.

H3: APB has a positive impact on AFR mitigation.

H4: APB moderates the relationship between Integrity and AFR mitigation.

H5: APB moderates the relationship between TR and AFR mitigation.

Methodology

This study employs a quantitative way of evaluation to investigate the impact of integrity and internal audit transparency, with a focus on blockchain application as a moderator. The deductive technique was used in this research since it is connected to "creating an established theory-based idea (or hypothesis) and then designing a testprocedure to demonstrate the applicability" (Wilson, 2010). This research is divided into two segments. First, the Measurement Model (MM) was tested to guarantee the study's consistency, accuracy, and acceptance. In the second section, a Structural Equation Model (SEM) is presented to analyze the influence of teacher and student preparedness.

Variable Measurement

This research framework includes three explicit and two moderating relationships. Two exogenous constructs called integrity and internal audit effectiveness and Transparency (TR) have been evaluated to find the direct impact of those on Audit Fraud Risk Mitigation (AFR) along with the direct impact of the Application of Blockchain (APB). The moderating role of APB on the relationship between integrity and AFR, TR, and AFR is also measured. Integrity is measured with items highlighting the honesty and trustworthiness of account and audit division's employees, the respect of account and audit division's employees towards the organizational policies and procedures, and the organizational culture of fair accounting practices. TR is represented by items including internal audit effectiveness, transparency, and acceptability. APB is explored with the items referring to blockchain's ability in ensuring a reliable accounting system, transparent accounting, auditing practices, and immutable features confirming no manipulation in accounting and auditing. Finally, AFR is measured with three items, including risk mitigation in asset misappropriation and fraudulent financial reporting.

The hypotheses are tested employing information gathered with a five-point Likert scale. The scale has five levels of answers, with '1' representing 'strongly disagree' and '5' representing 'strongly agree.'

Research Data and Sampling

Data for this study were gathered from professional accountants and auditors from different institutions in Bangladesh. When the issue is fresh, primary information is always appropriate for this type of investigation, as secondary data is rarely sufficient to investigate a problem like this. Hence, this study employs primary data to assess the impact of Integrity and TR on AFR considering the moderating role of APB. A total of 99 respondents from the accountant and auditor categories have been selected as the sample size of the study. We applied the convenient sampling technique for the study.

Data Collection Procedure and Period

A structured questionnaire was created to analyze and forecast the influence of the independent variable on AFR to better identify audit risk mitigation factors. A survey was administered using a Google form. Face-to-face surveys are inconvenient in this COVID 19 epidemic scenario, which is the reason for the online survey. It is easier and healthier for both participants and investigators. It also gave access to experienced accountants and auditors from all around Bangladesh. Furthermore, two academics, two accountants, and two auditors participated in phone interviews, ensuring the questionnaire's validity. The Google form survey link was distributed to the target respondents via email and social media applications. The survey using Google form eased the process of collecting data from various respondents from all over Bangladesh to get the needed replies. The survey began on June 25, 2021, and ended on July 9, 2021. Hence, the survey period included a 15-day response time.

Results and Discussions

Demographic Statistics

Table 2 provides the response frequencies and percentages of the cohort across the demographic variables of the study. Table 1 shows that 100%of respondents have complete graduation. More than 72% of them have master's degrees or doctoral. Hence the respondents of the study are highly qualified. It also illustrates that 97% of the respondents are business graduates and around 72% of them are specialized in accounting and finance. About 34 of the respondents hold senior managerial positions and around 11% out of them are holding the positions of either chief accountant or CFO. Thus, a good portion of the respondents is holding decision-making positions. More than 67% of the respondents have experiences of 3 years and more. About 74% of the respondents are either professional accountants or have relevant post-graduate diplomas. To be specific, 36.5% of the respondents holding professional affiliations like ACCA, CA, CIMA, and CMA.

| Table 1 Demographic Statistics |

|||

|---|---|---|---|

| Area | Frequency | Percentage | |

| Academic Degree | Higher Secondary | 0 | 0 |

| Graduation | 27 | 27.3 | |

| Master’s | 70 | 70.6 | |

| Doctoral | 2 | 2.1 | |

| Total | 99 | 100 | |

| Area of Concentration | Accounting | 47 | 47.4 |

| Banking & Finance | 24 | 24.3 | |

| Management | 13 | 13.1 | |

| Other Business Discipline | 12 | 12.1 | |

| Non-Business Discipline | 3 | 3.0 | |

| Total | 99 | 100 | |

| Professional Designation | Accounts Executive | 35 | 35.3 |

| Accounts Manager | 15 | 15.2 | |

| Chief of Accounts | 5 | 5.1 | |

| Audit’ Executive | 31 | 31.2 | |

| Audit Manager | 7 | 7.1 | |

| CFO | 6 | 6.1 | |

| Total | 99 | 100 | |

| Years of experience | < 3 years | 32 | 32.3 |

| 3–6 years | 31 | 31.3 | |

| 6–10 years | 15 | 15.2 | |

| >10 years | 21 | 2.1 | |

| Total | 99 | 100 | |

| Professional Qualification | CA | 14 | 14.1 |

| CMA | 17 | 17.2 | |

| ACCA | 3 | 3.1 | |

| CIMA | 2 | 2.1 | |

| PGD in in the relevant field | 37 | 37.3 | |

| No professional degree | 26 | 26.2 | |

| Total | 99 | 100 | |

Assessment of Outer Model

The measurement Model (MM)in Partial Least Squares Structural Equation Modeling (PLS-SEM), according to Hair, et al., (2016), is a component of a route model which contains the measures and associated connection with the latent constructs. Internal consistency, convergent validity, and discriminant validity must be used to evaluate the MM.

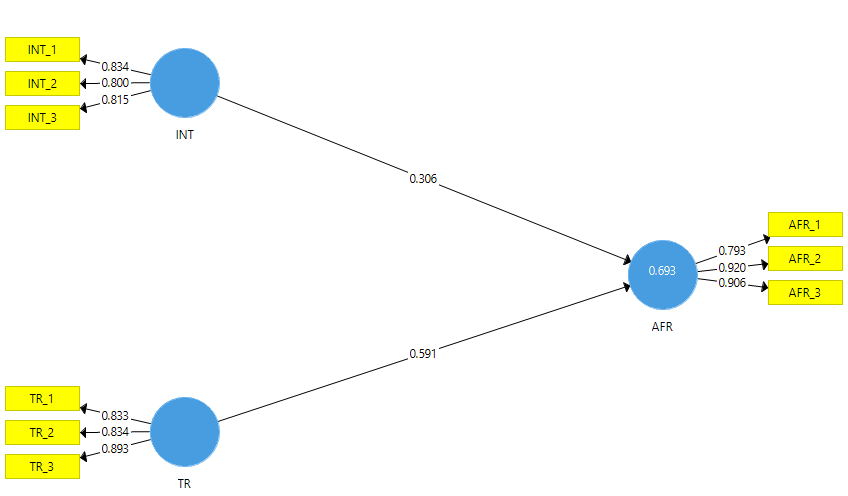

Indicators Reliability

The magnitude of the Outer Loading (OL)is generally knownas indicator reliability (Hair et al., 2016). SmartPLS 3.0 has been applied to analyze the OLs. Higher OL suggests that the indicators in a construct have more prevalent which has been represented by the construct (Hair et al., 2016; Henseler et al., 2015). According to Vinzi et al. (2010), the acceptable range for OLsshould be 0.5, and the Average Variance Extracted (AVE) needs to be greater than 0.5. Hair et al. (2016) recommended removing the indicators with OL less than 0.5 whenever the removal of the indicator results in an increase in AVE over the cutoff point of 0.5. Consequently, all of the items ensure the reliability of the analysis as shown in Table 2 andFigure 2. (Table 2).

| Table 2 Reliability and Validity Measures |

||||||

|---|---|---|---|---|---|---|

| Construct | Item | Loadings | Cronbach’s Alpha | Rho_A | Composite Reliability | AVE |

| Audit Fraud Risk | AFR1 | 0.785 | 0.845 | 0.907 | 0.765 | |

| AFR2 | 0.923 | 0.860 | ||||

| AFR3 | 0.910 | |||||

| Application of Blockchain | APB1 | 0.904 | 0.838 | 0.903 | 0.757 | |

| APB2 | 0.795 | 0.845 | ||||

| APB3 | 0.908 | |||||

| Integrity | INT1 | 0.834 | 0.754 | 0.857 | 0.666 | |

| INT2 | 0.800 | 0.771 | ||||

| INT3 | 0.814 | |||||

| Transparency | TR1 | 0.833 | 0.814 | 0.890 | 0.729 | |

| TR2 | 0.834 | 0.822 | ||||

| TR3 | 0.893 | |||||

Internal Consistency and Convergent Validity

Internal consistency is a type of dependability used to evaluate if the questions used to test a concept have similar values (Hair et al., 2014). Hair, et al., (2016) propose composite reliability (CRI) score of more than 0.70 with laxity of 0.60-0.70 as the accepted level in a causal study based on Nunnally & Bernstein's (1994) reliability parameters. The CRIs (see Table 2) for all latent constructs in this investigation are greater than 0.7, reaching and surpassing the minimal cutoff scoreindicated by different studies (Hair et al., 2016; Nunally & Bernstein, 1994; Fornel & Larcker, 1981). Cronbach's alpha is also employed as a measurement of internal consistency dependability, which indicates consistency based on the correlation matrix of the measured constructs'indicators. Cronbach's alpha of 0.7 is considered satisfactory by Liouville & Bayad (1998); Sureshchandar, et al., (2002); Hair, et al., (1998), whereas Cronbach's alpha of 0.80 suggests excellent trustworthiness of the research findings. Similarly, Nunnaly and Bernstein (1994) proposed that alpha values of 0.7 or higher imply excellent consistency. In this survey, each Cronbach's alpha score is greater than 0.7 (see Table 2), indicating that it meets the standard.

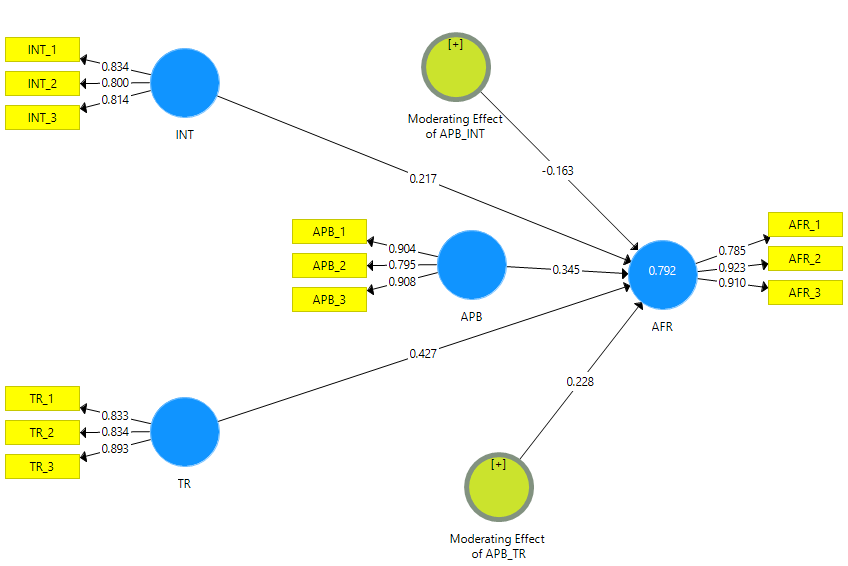

The level of conformity among the questions in assessing a given notion is referred to as convergent validity. Investigators often evaluate the outer loadings of the indicators and the AVE to demonstrate convergent validity based on Hair, et al., (2016); Fornell & Larcker (1981) guidelines. Hair, et al., (2016) went on to claim that convergent validity is attained when the factor loading of all the items is more than 0.5 and no loading of any item from the other latent constructs is greater than the one being assessed. The scores in Table 2 meet the convergent validity requirements of Hair, et al., (2016). (Figure 3).

Discriminant Validity

Discriminant Validity (DV)describes the degreeto which a latent construct is empirically different from another construct(Hair et al.,2014). There have traditionally been two frequently used measurements of DV. The first technique is to assess cross-loadings. To be more precise, an indicator's OLon the related latent construct should be larger than its cross-loadings on other constructs (Hair et al., 2016). The Fornell-Larcker criteria contrast the square root of AVEwith the construct correlations as the second method of measuring DV. The square root of each latent variable's AVE ought to be higher than the constructwith which it has the best association (Venkatesh & Morris, 2000;Hair et al., 2016). The cross-loading in Table 3and Fornell-Larcker scores in Table 4fulfill the needed criteria because no indicator demonstrated greater loading in any other construct other than its parent construct (Chin, 1998; Hair et al., 2016).

| Table 3 Cross Loadings |

||||

|---|---|---|---|---|

| AFR | APB | INT | TR | |

| AFR1 | 0.788 | 0.597 | 0.570 | 0.631 |

| AFR2 | 0.923 | 0.770 | 0.631 | 0.740 |

| AFR3 | 0.910 | 0.789 | 0.668 | 0.729 |

| APB1 | 0.758 | 0.904 | 0.632 | 0.721 |

| APB2 | 0.659 | 0.795 | 0.480 | 0.640 |

| APB3 | 0.739 | 0.908 | 0.670 | 0.674 |

| INT1 | 0.680 | 0.642 | 0.834 | 0.614 |

| INT2 | 0.463 | 0.424 | 0.800 | 0.469 |

| INT3 | 0.568 | 0.578 | 0.814 | 0.582 |

| TR1 | 0.675 | 0.625 | 0.508 | 0.833 |

| TR2 | 0.624 | 0.598 | 0.637 | 0.834 |

| TR3 | 0.748 | 0.765 | 0.624 | 0.893 |

| Table 4 Fornell-Larcker Criterion |

||||

|---|---|---|---|---|

| AFR | APB | INT | TR | |

| AFR | 0.875 | |||

| APB | 0.827 | 0.870 | ||

| INT | 0.714 | 0.687 | 0.816 | |

| TR | 0.802 | 0.781 | 0.689 | 0.854 |

Although the Fornell-Larcker criterion is a legitimate measure of DV, this can give a further theoretical explanation. As a result, academics have proposed a technique known as the Heterotrait-Monotrait Ratio(HTMT) to assess DV(Henseler et al., 2015). This method involves comparing a set threshold value to the correlations between the constructs. Teo, et al., (2008) proposed a 0.90 criterion to provide an appropriate HTMT for DV. Table 5shows that all of the HTMT ratios are less than 0.90. Hence, it is claimed that all constructs in the study are different from one another and exhibit required DV.

| Table 5 Heterotrait-Monotrait Ratio (HTMT) |

||||

|---|---|---|---|---|

| AFR | APB | INT | TR | |

| AFR | ||||

| APB | 0.877 | |||

| INT | 0.873 | 0.839 | ||

| TR | 0.863 | 0.840 | 0.867 | |

Assessment of Inner Model

PLS-SEMdepicts the core ideas of the path model by incorporating latent constructand their path connections (Hair et al., 2016). The key criteria for evaluating theinner model in PLS-SEM are non-collinearity, the degree of R2 values, the f2 effect size, predictive relevance Q2, and path coefficient relevance (Hair et al., 2016). The coefficient of determination (R2) is utilized by the determinants to measure the variation in the endogenous construct (Chin, 1998). Furthermore, the effect sizes suggested by f2 for each independent variable were calculated and assessed using Cohen's criterion (1988). Q2's predictive capacity was determined using the bootstrapping technique (Chin, 1998; Fornell & Cha, 1994; Hair et al., 2011; Henseler et al., 2015). Finally, the resulting route coefficients indicate the predicted connections between the variables, and their standardized values vary from –1 to + 1 (Hair et al., 2016).

Non-collinearity Test

In evaluating the inner model, first, we checked the probable multicollinearity (Hair et al., 2016). To identify the unavailability of correlations among the items, we examined the collinearity of the indicators. Collinearity is assessed using the variance inflation factor (VIF). To assert that there is no collinearity, VIFs need to be less than 3.3 (Henseler et al., 2015). Following that, the VIFs areexamined using a bootstrapping method. Non-collinearity is assured for this research as shown in Table 6(Hair et al., 2016).

| Table 6 Collinearity (VIF) Statistics |

|

|---|---|

| Statistic | VIF |

| AFR1 | 1.554 |

| AFR2 | 3.142 |

| AFR3 | 2.922 |

| APB1 | 2.700 |

| APB2 | 1.536 |

| APB3 | 2.779 |

| INT1 | 1.408 |

| INT2 | 1.638 |

| INT3 | 1.564 |

| TR1 | 1.672 |

| TR2 | 1.798 |

| TR3 | 2.086 |

Coefficient of Determination (R2)

R2 is a parameter that describes a model's forecasting accuracy. The coefficients indicate the exogenous constructs' cumulative influence on the endogenous construct. If the R2 scoreexceeds 15%, it is deemed good (Falk and Miller, 1992). Cohen (1988) and Chin (1998a)proposed three degrees of SEM: poor (0.02 to 0.19), medium (0.13 to 0.33), and substantial(0.26 to 0.67). For this research, the R2 scores both with and without moderating effects are shown to be substantial.

| Table 7 R Square |

||

|---|---|---|

| R Square | R-Square Adjusted | |

| AFR (Without Moderating Effect) | 0.762 | 0.755 |

| AFR (With Moderating Effect) | 0.792 | 0.781 |

Effect Size (f2)

The change in R2 for the elimination of a particular exogenous construct from the model is measured by f2. It reflects whether the removed predictor has a statistically significant influence on the endogenous construct(Hair et al., 2016; Callaghan et al., 2007). The f2 isclassified as big, moderate, and smaller based on the scores of0.350, 0.150, and 0.020, respectively (Cohen, 1988).

| Table 8 Effect Size (F-Square) |

||

|---|---|---|

| AFR (f2) | Effect Size | |

| AFR | ||

| APB | 0.293 | Medium |

| INT | 0.064 | Large |

| TR | 0.158 | Medium |

According to the standard set by Cohen (1988), Table 8 ensures that both of APB and TR have medium effects on AFR. On the other hand, integrity has a large impact on AFR.

Predictive Relevance (Q2)

Stone-Geisser's values of Q2 shouldbe assessed as thepredictive accuracy criteria (Geisser, 1974; Stone, 1974). To evaluate the Q2 of cross-validated redundancy and cross-validated communality, the blindfolding technique was utilized. As per Hair, et al., (2016), Q2 values larger than zero for a given reflecting outcome variable in an SEM shows the route model's predictive significance. Child (2006), on the other hand, suggests that values of communlaity less than 0.2 need to be eliminated.

| Table 9 Construct Cross Validated Communality |

|||

|---|---|---|---|

| SSO | SSE | Q² (=1-SSE/SSO) | |

| AFR | 297.000 | 145.215 | 0.511 |

| APB | 297.000 | 150.435 | 0.493 |

| INT | 297.000 | 198.518 | 0.332 |

| TR | 297.000 | 165.294 | 0.443 |

| Table 10 Construct Cross Validated Redundancy |

|||

|---|---|---|---|

| SSO | SSE | Q² (=1-SSE/SSO) | |

| AFR | 297.000 | 129.110 | |

| APB | 297.000 | 297.000 | 0.562 |

| INT | 297.000 | 297.000 | |

| TR | 297.000 | 297.000 | |

The Q2 value was measured using a blindfolding procedure and all the Q2 values satisfy the required criteria as per Child (2006); Hair, et al., (2016).

Results of Direct Hypothesis

Five hypotheses are tested for this research out of which three are direct and two are moderating. With 5000 bootstrappingsamples, PLSwas used to determine the p-values. P-values were derived from SmartPLS 3 at a 95% confidencelevel,which is the accepted threshold in social science researches(Bickel, 2012; Cox & Hinley, 1979; Tacq & Tacq, 1997).

| Table 11 Path Coefficients (Direct Effect) |

||||||

|---|---|---|---|---|---|---|

| MetricsHypotheses | Original Sample | Sample Average | StandardDeviation | TValues | P Values | Hypothesis Decision |

| INT -> AFR | 0.180 | 0.172 | 0.088 | 2.053 | 0.000 | Accepted |

| TR -> AFR | 0.330 | 0.360 | 0.141 | 2.345 | 0.019 | Accepted |

| APB -> AFR | 0.447 | 0.423 | 0.112 | 4.003 | 0.000 | Accepted |

The data shown in table 11 indicate that allthe direct hypotheses are acceptedat a 95% confidencelevel. The beta value (β=0.180) suggests that integrity and AFR have a positive connection. TR, with a beta of 0.330, also has a favorable effect on AFR. As a result, hypotheses 1 (H1) and 2 (H2) are confirmed. Similarly, with a beta value of 0.447, APB has a favorable influence on AFR. Thus, hypothesis 3(H3)is also supported.

Result of Moderating Hypotheses

Chin, et al., (2003) presented a two-stage strategy to assessing the moderating impact. We applied the two-stage approach to our study. The results in Table 12 show that both hypotheses 4 (H4) and 5 (H5) are accepted at a 5% level of significance. Hence, we can conclude that the Application of Blockchain (APB) has a significant role in moderating the relationship between integrity and AFR. Similarly, APB positively moderates the relationship between TR and AFR.

| Table 12 Path Coefficients With Moderating Effects |

||||||

|---|---|---|---|---|---|---|

| MetricsHypotheses | Original Sample | Sample Average | StandardDeviation | TValues | P Values | Hypothesis Decision |

| INT -> AFR | 0.217 | 0.207 | 0.073 | 2.959 | 0.003 | Accepted |

| TR -> AFR | 0.427 | 0.446 | 0.094 | 4.541 | 0.003 | Accepted |

| APB -> AFR | 0.345 | 0.336 | 0.084 | 4.115 | 0.000 | Accepted |

| Moderating Effect of APB_INT | 0.228 | 0.208 | 0.070 | 3.271 | 0.001 | Accepted |

| Moderating Effect of APB_TR | 0.233 | 0.166 | 0.108 | 2.150 | 0.032 | Accepted |

Research Implications

The research's theoretical implication is evolving in the notion that it offered a novel paradigm for Audit Fraud Risk Mitigation (AFR). First, this study evaluated the role of integrity and audit committee Transparency (TR) in mitigating fraud risk. The findings demonstrated that integrity has a role in understanding AFR. Similarly, TR is a strong predictor of AFR. The finding supports the earlier research results where the role of integrity and internal audit effectiveness and transparency are explained separately (Aghghaleh et al., 2014; Blay et al., 2008; Bushman, 2004; Chang et al., 2008; Colbert, 1996; De Martinis et al., 2007; Githui, 2014; Malin, 2011; Razak et al., 2018). Second, this paper evaluated the role of Application of Blockchain (APB) as a moderator. The role of APB in moderating the relationship between integrity and AFR is significant. Likewise, APB positively moderates the relationship between TR and AFR. Though earlier studies found the role of APB in accounting and auditing functions (Bonsón & Bednárová, 2019; Chin et al., 2021; Kabir, 2021), this research is a unique attempt to examine the moderating role of APB. Thus, we developed a new conceptual framework using integrity, TR, and APB as predictors, adding a fresh perspective to identifying the areas to focus on in audit fraud risk mitigation. This study filled the research gap by developing a new conceptual model.

This study is anticipated to offer policymakers guidelines for ensuring quality audits while reducing the chances of fraud. It will aid in understanding the significance of establishing internal audit transparency and effectiveness. It also guides the application of modern technology like BT for auditing to ensure integrity and transparency, which ultimately will mitigate audit fraud risk and assure quality audit.

Conclusion and Scope for Future Research

The primary objective of this paper was to assess the impact of integrity and internal audit effectiveness transparency on Audit Fraud Risk mitigation (AFR). The unique feature of the study is the inclusion of the Application of Blockchain technology (APB) as a determinant of AFR. In evaluating the suggested study model, data were collected from professional accountants and auditors from different institutions in Bangladesh. Data are analyzed using SmartPLS version 3.0. The study's findings showed significant empirical confirmation of all our presented assumptions when employing the moderating role of blockchain applications. The results confirm that APB has the highest impact on AFR with a beta of 0.447.

Similarly, internal audit effectiveness and transparency positively affect AFR with a beta of 0.330, while integrity has a beta of 0.180, positively impacting AFR. The moderating role of APB between integrity and AFR, and TR and AFR is also statistically significant. Most importantly, the exogenous constructs can explain the variation in AFR 79.2% while considering the moderating effect of APB. The research findings support the assumptions of the importance of integrity and internal audit effectiveness and transparency in dealing with audit fraud risk as found in the earlier research of Bonsón & Bednárová (2019); Chin et al., (2021); Kabir et al., (2021a); Kabir et al., (2021b). Again, the significance of moderating role of APB proves the earlier research (Blay et al., 2008; Chang et al., 2008; Colbert, 1996; De Martinis et al., 2007; Razak et al., 2018) claims where blockchain technology is thought to be an essential addition for quality of accounting and auditing. However, our research is distinct from all the other studies mentioned, as we proposed a unique model incorporating the moderating role of blockchain.

This study is limited by a few aspects that have provided room for further investigations. This research is only being done in Bangladesh, a newly graduating developing nation; therefore, it cannot accurately represent other developing nations. Thus, it is proposed that research comparing emerging nations be initiated. A comparison between emerging and developed countries is also possible. More research may be needed to address significant issues about the use of surveying; a longitudinal survey technique might be used in this regard. Moreover, investigating unobserved heterogeneity in the use of SEM to study the influence of integrity and TR on AFR would be fascinating.

References

- AICPA (2018). Blockchain & cryptocurrency legislation emerging in state legislatures. Available at: https://www.aicpa.org/advocacy/cpaadvocate/2018/blockchain-andcryptocurrency-legislation-emerging-in-state-legi.html (Accessed 0n 23 July 2021).

- Akir, O., & Malie, S. (2012). Integrity dimensions and religious orientation in aspect of employees job conduct: an exploratory model building.Procedia-Social and Behavioral Sciences,62, 167-174.

- Allison, I. (2015). Deloitte, Libra, Accenture: The work of auditors in the age of Bitcoin 2.0 technology.International Business Times. Available at: www.ibtimes.co.uk/deloitte-libra-accenture-workauditors-

- age-bitcoin-2-0-technology-1515932 (Accessed 0n 23 July 2021).

- Atzori, M. (2015). Blockchain technology and decentralized governance: is the state still necessary?. Available at: SSRN 2709713. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2709713 (accessed 23 July 2021).

- Alssabagh, S.H. (2016). The Effect of Quantification Risks of Material Misstatements in Improving the Accuracy of Audit Risk Assessment: An Applied Study. (Unpublished PhD Dissertation of Accounting), Syria: Damascus University.

- Alssabagh, S.H. (2020). Fraud Risk Factors that Affect the Audit Program Plan: The Case of Kurdistan Region, Iraq.UKH Journal of Social Sciences,4(2), 9-19.

- Appelbaum, D., & Smith, S.S. (2018). Blockchain basics and hands-on guidance: taking the next step toward implementation and adoption.The CPA Journal,88(6), 28-37.

- Aghghaleh, S.F., & Mohamed, Z.M. (2014). Fraud risk factors of fraud triangle and the likelihood of fraud occurrence: Evidence from Malaysia.Information Management and Business Review,6(1), 1-7.

- Archambeault, D.S., DeZoort, F.T., & Holt, T.P. (2008). The need for an internal auditor report to external stakeholders to improve governance transparency.Accounting

- Arens, A.A., Elder, R.J., & Mark, B. (2014). Auditing and assurance services: an integrated approach.USA, NY, Pearson Education, Inc. Horizons,22(4), 375-388.

- Armstrong, E. (2005). Integrity, transparency and accountability in public administration: Recent trends, regional and international developments and emerging issues.United Nations, Department of Economic and Social Affairs, 1-10.

- Bedard, J.C., & Graham, L.E. (2002). The effects of decision aid orientation on risk factor identification and audit test planning. Auditing: A Journal of Practice & Theory, 21(2), 39-56.

- Bell, T. B., Peecher, M. E., & Solomon, I. (2005). The 21st century public company audit. New York, NY: KPMG LLP.

- Bickel, R. (2012). Multilevel analysis for applied research: It's just regression! London: Guilford Press.

- Blay, A., Kizirian, T., & Dwight, S. (2008). Evidential effort and risk assessment in auditing. Journal of Business & Economics Research, 6(9), 39-52.

- Bonsón, E., & Bednárová, M. (2019). Blockchain and its implications for accounting and auditing.Meditari Accountancy Research.

- Bowen, W.G. (2008).The board book: An insider's guide for directors and trustees. WW Norton & Company.

- Brancato, C.K., & Plath, C.A. (2003). Corporate governance best practices: A blueprint for the post-Enron era. Conference Board.

- Bushman, R.M., Piotroski, J.D., & Smith, A.J. (2004). What determines corporate transparency?.Journal of accounting research,42(2), 207-252.

- Buterin, V. (2014). A next-generation smart contract and decentralized application platform.white paper,3(37).

- Available at: _ generation_smart_contract_and_decentralized_application_platform-vitalik-buterin.pdf (accessed on 23 July 2021).

- Cai, Y., & Zhu, D. (2016). Fraud detections for online businesses: a perspective from blockchain technology.Financial Innovation,2(1), 1-10.

- Callaghan, W., Wilson, B., Ringle, C.M., & Henseler, J. (2007). Exploring Causal Path Directionality for a Marketing Model Using Cohen’s Path Method. Aas, Norway: MATFORSK.

- Carcello, J.V., Eulerich, M., Masli, A., & Wood, D.A. (2020). Are internal audits associated with reductions in perceived risk?.Auditing: A Journal of Practice & Theory,39(3), 55-73.

- Chang, S.I., Tsai, C.F., Shih, D.H., & Hwang, C.L. (2008). The development of audit detection risk assessment system: Using the fuzzy theory and audit risk model. Expert Systems with Applications, 35(3), 1053-1067.

- Chen, J., Cumming, D., Hou, W., & Lee, E. (2013). Executive integrity, audit opinion, and fraud in Chinese listed firms.Emerging Markets Review,15, 72-91.

- Child, D. (2006). The essentials of factor analysis. A&C Black.

- Chin, W.W. (1998). The partial least squares approach to structural equation modeling. Modern Methods for Business Research, 295(2), 295-336.

- Chin, W.W. (1998a). Commentary: Issues and opinion on structural equation modeling. MIS quarterly, 22(1), 7-16. 259.

- Chin, W.W., Marcolin, B.L., & Newsted, P.R. (2003). A partial least squares latent variable modeling approach for measuring interaction effects: Results from a Monte Carlo simulation study and an electronic-mail emotion/adoption study.Information systems research,14(2), 189-217.

- Chin, T., Wang, W., Yang, M., Duan, Y., & Chen, Y. (2021). The moderating effect of managerial discretion on blockchain technology and the firms’ innovation quality: Evidence from Chinese manufacturing firms.International Journal of Production Economics, 108219.

- Cohen, J. (1988). Statistical power analysis for the behavioral sciences (2 ed.). Hillsdale, New Jersey: Lawrence Erlbaum Associates, Inc.

- Colbert, J.L. (1996). International and US Standards-audit risk and materiality. Managerial Auditing Journal, 11(8), 31-35.

- Cox, D.R., & Hinkley, D.V. (1979). Theoretical statistics (2nd Edition). Florida, US: CRC Press.

- Crawford, C.J. (2007). The reform of corporate governance: major trends in the US corporate boardroom, 1977-1997.Capella University.

- Cressey, D.R. (1950). The criminal violation of financial trust.American sociological review,15(6), 738-743.

- Das, S. (2017). Big four giant Deloitte completes successful blockchain audit. Available at: www. cryptocoinsnews.com/bigfour-giant-deloitte-completes-successful-blockchain-audit/. (Accessed 0n 23 July 2021).

- De Martinis, M., Fukukawa, H., & Mock, T.J. (2007). Exploring audit planning responsiveness to client risk assessments for private and public sector audits. Working Paper, 2007 AFAANZ C

- Dellaportas, S. (2013). Conversations with inmate accountants: Motivation, opportunity and the fraud triangle.Accounting fórum,37(1), 29-39.

- Deloitte, G. (2006). Optimizing the Role of Internal Audit in the Sarbanes-Oxley Era.Deloitte Development LLC.

- Ducas, E., & Wilner, A. (2017). The security and financial implications of blockchain technologies: Regulating emerging technologies in Canada.International Journal,72(4), 538-562.

- Falk, R.F., & Miller, N.B. (1992). A primer for soft modeling. University of Akron Press.

- Feizizadeh, A. (2012). Strengthening internal audit effectiveness.Indian Journal of Science and Technology,5(5), 2777-2778.

- Fornell, C., & Cha, J. (1994). Partial least squares. Advanced methods of marketing research, 407, 52-78. doi: 10.1002/0471667196.ess1914.pub2.

- Fornell, C., & Larcker, D.F. (1981). Structural equation models with unobservable variables and measurement error: Algebra and statistics. Journal of Marketing Research, 18(3), 382-388.

- Geisser, S. (1974). A predictive approach to the random effect model. Biometrika, 61(1), 101-107. doi: 10.1093/biomet/61.1.101.

- Gibbins, M. (1984). Propositions about the psychology of professional judgment in public accounting.Journal of Accounting Research, 103-125.

- Githui, D.M. (2014). An empirical study to measuring corruption and integrity in Kenyan police agency: An ethical perspective.

- Hair, J.F., Black, W.C., Babin, B.J., Anderson, R.E., & Tatham, R.L. (1998). Multivariate data analysis, 5. Prentice hall Upper Saddle River, NJ.

- Hair, J.F., Ringle, C.M., & Sarstedt, M. (2011). PLS-SEM: Indeed a silver bullet. The Journal of Marketing Theory and Practice, 19(2), 139-152. doi: 10.2753/MTP1069-6679190202.

- Hair, J.F., Hult, G.T.M., Ringle, C.M., & Sarstedt, M. (2014). A prima on partial least squares structural equation modeling (PLS-SEM) (1st Edition). Los Angeles: Sage.

- Hair, J.F., Hult, G.T.M., Ringle, C.M., & Sarstedt, M. (2014). A prima on partial least squares structural equation modeling (PLS-SEM) (1st Edition Los Angeles: Sage.

- Hair Jr, J.F., Hult, G.T.M., Ringle, C., & Sarstedt, M. (2016). A primer on partial least squares structural equation modeling (PLS-SEM). Sage publications.

- Hajiha, Z. (2012). Application of Delphi method for determining the affecting factors upon audit risk model. Management Science Letters, 2(1), 379-390.

- Hanim, H., Bakri, M., Mohamed, N., & Said, J. (2017). Mitigating asset misappropriation through integrity and fraud risk elements: evidence emerging economies.Journal of Financial Crime,24(2), 242-255.

- Henseler, J., Ringle, C.M., & Sarstedt, M. (2015). A new criterion for assessing discriminant validity in variance-based structural equation modeling. Academy of Marketing Science. Journal, 43(1), 115.

- Holt, T.P., & DeZoort, T. (2009). The effects of internal audit report disclosure on investor confidence and investment decisions.International Journal of Auditing,13(1), 61-77.

- IAASB, 2019, ISA 315 (Revised 2019). Identifying and Assessing the Risks of Material Misstatement. https://www.iaasb.org/publications/isa-315-revised-2019-identifying-and-assessing-risks-material-misstatement

- IFAC [International Federation of Accountants]. (2016). The Auditor’s Responsibilities Relating to Fraud in an Audit of Financial Statements. International Standard on Auditing No. 240. New York, NY: IFAC.

- IFAC [International Federation of Accountants].(2016). The Auditor’s Responses to Assessed Risks. International Standard on Auditing No. 330. New York, NY: IFAC.

- Irianto, G., Novianti, N., Rosalina, K., & Firmanto, Y. (2012). Integrity, unethical behavior, and tendency of fraud.EKUITAS (Jurnal Ekonomi dan Keuangan),16(2), 144-163.

- Jackson, R. A. (2007). A heavier weight to carry: despite initial pressures to emphasize financial controls more than governance, internal auditors are now bearing additional responsibility for both--and raising their stature as a result.Internal Auditor,64(3), 38-44.

- Jans, M., Lybaert, N., & Vanhoof, K. (2010). Internal fraud risk reduction: Results of a data mining case study. International Journal of Accounting Information Systems, 11(1), 17-41

- Kabir, M.R., Sobhani, F.A., Omar, N., & Mohamad, N. (2019). Corporate governance and risk disclosures: A comparative analysis between Bangladeshi and Malaysian Islamic banks.International Journal of Financial Research,11(5), 110-125.

- Kabir, M.R. (2021). Behavioural intention to adopt blockchain for a transparent and effective taxing system.Journal of Global Operations and Strategic Sourcing, 14(1), 170-201.

- Kabir, M.R., Islam, M., Marniati, & Herawati (2021a). Application of Blockchain for Supply Chain Financing: Explaining the Drivers Using SEM.Journal of Open Innovation: Technology, Market, and Complexity,7(3), 167.

- Kabir, M.R., & Islam, M. (2021b). Behavioural intention to adopt blockchain technology in Bangladeshi banking companies, AIP Conference Proceedings,2347, 020025. https://doi.org/10.1063/5.0051654

- Kassem, R., & Higson, A. (2012). The new fraud triangle model.Journal of emerging trends in economics and management sciences,3(3), 191-195.

- Kokina, J., Mancha, R., & Pachamanova, D. (2017). Blockchain: Emergent industry adoption and implications for accounting.Journal of Emerging Technologies in Accounting,14(2), 91-100.

- KPMG (2017). Digital ledger services at KPMG: seize the potential of blockchain today. Available at: https://home.kpmg.com/xx/en/home/insights/2017/02/digital-ledger-servicesat-kpmg-fs.html (Accessed 0n 23 July 2021).

- Liouville, J., & Bayad, M. (1998). Human resource management and performances: Proposition and test of a causal model.Human Systems Management,17(3), 183-192.

- Lobnikar, B., & Meško, G. (2015). Perception of police corruption and the level of integrity among Slovenian police officers.Police Practice and Research,16(4), 341-353.

- Louis, H. (2004). Earnings management and the market performance of acquiring firms.Journal of financial economics,74(1), 121-148.

- Low, K.Y. (2004). The effects of industry specialization on audit risk assessments and audit-planning decisions. The accounting review, 79(1), 201-219.

- Luo, W. (2021). Proposed analytical framework to assess audit risks.Open Journal of Accounting,10(02), 42.

- Mallin, C.A. (2011). Corporate governance development in the UK.Handbook on International Corporate Governance, 1.

- Minichiello, N. (2015). Deloitte launches Rubix, a one stop blockchain software platform. Aavailable at:https://bravenewcoin.com/news/deloitte-launches-rubix-a-one-stop-blockchain-software-platform/ (accessed on 23 July 2021).

- Napel, T.K. (2013).Risk factors of occupational fraud: A study of member institutions of the National Association of Independent Colleges and Universities. University of South Dakota.

- Nunnally, J.C., & Bernstein, I.H. (1994). Psychometric theory (3rd ed.). New York: McGraw-Hill

- O'Leary, D. E. (2017). Configuring blockchain architectures for transaction information in blockchain consortiums: The case of accounting and supply chain systems.Intelligent Systems in Accounting, Finance and Management,24(4), 138-147.

- Palfreyman, J. (2015). Blockchain for government. Available at: www.ibm.com/blogs/insights-onbusiness/government/blockchain-for-government/ (Accessed on 23 July 2021).

- Peters, G.W., & Panayi, E. (2016). Understanding modern banking ledgers through blockchain technologies: Future of transaction processing and smart contracts on the internet of money. InBanking beyond banks and money(pp. 239-278). Springer, Cham.

- Razak, L., Ramly, A., & Fe, H. (2018). Effect of fraud risk assessment, auditor independence of audit of the quality of financial inspectorate regional authorities (Case Study in South Sulawesi Provincial Inspectorate).

- Rezaee, Z. (2008).Corporate governance and ethics. John Wiley & Sons.

- Rosalina, K., & Firmanto, Y. (2012). Integrity, unethical behavior, and tendency of fraud. Journal Ekonomi Dan Keuangan, 16(2), 110.

- Rosenstein, D., & Rose, W. (2006). Internal audit quality assessments: Helping hands for new demands.NACD: Directors Monthly (January), 6-7.

- Stone, M. (1974). Cross-validatory choice and assessment of statistical predictions. Journal of the Royal Statistical Society. Series B (Methodological), 36(2), 111-147.

- Sureshchandar, G.S., Rajendran, C., & Anantharaman, R.N. (2002). The relationship between service quality and customer satisfaction–a factor specific approach. Journal of services marketing.

- Swan, M. (2015).Blockchain: Blueprint for a new economy. " O'Reilly Media Inc, Sebastopol, CA.

- Tacq, J.J., & Tacq, J. (1997). Multivariate analysis techniques in social science research: From problem to analysis (1st Edition) London: Sage Pbulications Limited.

- Tapscott, D., & Tapscott, A. (2016). The impact of blockchain goes beyond financial services, Harvard business review. Available at: https://hbr.org/2016/05/the-impact-of-theblockchaingoes-beyond-financial-services (Accessed on 23 July 2021).

- Underwood, S. (2016). Blockchain beyond bitcoin.Communications of the ACM,59(11), 15-17.

- Vinzi, V.E., Trinchera, L., & Amato, S. (2010). PLS path modeling: from foundations to recent developments and open issues for model assessment and improvement. In Handbook of partial least squares, 47-82. Springer, Berlin, Heidelberg.

- Wilson, J. (2010) “Essentials of business research: A guide to doing your research project” SAGE Publications, 7.

- Xia, L., & Qingling, L. (2011, September). Application of Risk-Oriented Audit in the Process of Informatization in SMEs of Anhui Province. InInternational Conference on Information and Management Engineering,24-29. Springer, Berlin, Heidelberg.

- Xiao, T., Geng, C., & Yuan, C. (2020). How audit effort affects audit quality: An audit process and audit output perspective.China Journal of Accounting Research,13(1), 109-127.

- Yermack, D. (2017). Corporate governance and blockchains.Review of finance,21(1), 7-31.