Research Article: 2022 Vol: 26 Issue: 6

Impact of Environment Performance on Financial Performance

Renuka, GITAM (Deemed to be University)

Padmaja, Andhra University

Citation Information: Renuka., & Padmaja. (2022). Impact of environment performance on financial performance. Academy of Marketing Studies Journal, 26(6), 1-10

Abstract

Todays’ Dynamic world has changed the pace of measuring the performance of the companies on the sole basis of financial performance. With mandatory ESG disclosure norms now the performance is measured on the basis of their compliance to ESG and also ESG disclosure index. Environmental performance is how strongly the companies comply with the environment while doing their business operations. This compliance requires a huge commitment of financial resources and this commitment has an impact on financial performance. This paper tries to answer the question of Does stronger environmental performers really more profitable by examining the relationship between environmental responsibility and financial performance of select Indian companies. The companies for the study were taken from BSE listed companies list and their environmental and financial performance was taken from CMIE PROWESS online database. The relationship between the two variables was tested by using statistical tests of correlation and regression. Through this paper it was found that there exists a significant relationship between the two variables. Based on the study results a regression model was proposed.

Keywords

Environmental Performance/Responsibility, Financial Performance, Profitability, Relationship.

JEL Classifications

L25, Q55, Q56.

Introduction

Invention of new technology, processes, products and work space caused the emergence of globalisation which can further been classified in to economic, political and financial globalisation. The determinancts that cause a momentum in globalisation are movement of funds in the form of investnments and finance, movement of goods in the form of trade, madoption of new technology and movement of people which further lead to economic, social and environmental repercussions Aslam & Azhar (2013) The stakeholders are very much concerned about sustainable development as they believe that the exploitation to meet the human needs and to satisfy them caused a huge damage to the Mother Nature Musyarofah (2012).

Sustainable development has been defined in many ways but the standard definition is taken from the Brundtland Report (about, 2018) which says that “Sustainable development is development that meets the needs of the present without compromising the ability of future generations to meet their own needs. With the growing globalisation and urbanisation the emission of GHGs is also increasing. This leads to a concept of global warming. There is an alarming increase in the temperature that made UNFCCC meet on these climate changes in Paris in the year 2015. This Paris agreement has come into force dealing with Greenhouse Gas emissions mitigation, adaptation and fiancé. As of March, 2017 194 member countries of UNFCCC have signed and 141 of them have ratified. This agreement has come into force with an objective of holding the increase in temperature of the planet well below 2 degrees. With this aim all the participating countries have intensified the steps to achieve this and India has started the necessary steps well ahead of this agreement. As a part of this framework it has initiated transforming the Financial System. Now all the companies in the financial system are supposed to disclose their ESG (Environmental, Societal, and Governance) scores sebi data meeting files (2018) SEBI in 2012 mandated the Annual Business Responsibility Reporting (ABRR), a reporting framework based on Environmental, social and economic responsibilities released by the Ministry of Corporate Affairs2. Indian companies are now transformed to disclose their environmental sustainability reports both for SEBI regulations of complying ABRR and also BSE has initiated to calculate ESG in collaboration with IFC.

There has been long-standing debate over whether or not firms gain economic competitiveness from reducing their impact on the environment. Firms' marginal net benefits are reduced as they implement environmental initiatives since their expenses rise. Firms have a variety of goals and responsibilities to meet the requirements and interests of many stakeholders, both internal and external. Consumer markets, as well as financial markets, put pressure on businesses to develop innovative environmentally friendly products and practices. Moneva & Cuellar (2009), investors and creditors are now considering the company's environmental performance as part of corporate governance. This initiative and mandatory disclosure is not free of cost.

To comply with the environmental sustainability norms companies need to invest in those projects which are planet friendly without compromising on economic profit (triple bottom line approach says that company has to consider planet, people and profit). Also known as corporate social responsibility (CSR) in general, these are sources of expense for the company that are unrelated to performance. Assessing if gaining environmental performance has an impact on a company's costs, revenues, and profitability motivates companies to invest more on environmental performance Pinteaa et al. (2014).

This was an interesting context that led to undertaking this study to research the financial performance effects of environmental sustainability and vice versa.

Many empirical social scientific studies have looked at the impact of corporate environmental performance (CEP) on corporate financial performance (CFP) in terms of product innovation, resource reduction, and emission reduction, among other things. There are at least 150 to 200 researches on this topic, according to previous reviews. Although economic studies contribute significantly to this literature, research in management, accounting, corporate strategy, and industrial ecology, among other topics, also make significant contributions.

Review of Literature

Porter & Van der Linde (1995) advocated that emissions reduction opportunities arise as reductions provide potential cost savings by improving performance, mitigating future costs and also cost of compliance. In 1995, Jaffe et al. (1995) theorised that managers lack the skills and knowledge to grasp the full pollution costs. (Stuart l. hart, does it pay to be green? an empirical examination of the relationship between emission reduction and firm performance, 1996) indicated that excess returns (i.e. income above the market average) derive from variations in firms' underlying environmental capabilities. Managers can have specific resources or skills to use profitable environmental policies that are difficult to replicate.

Murphy (2002) performed a literature review of research conducted within the time frame of 1994-2001 and confirmed a significant positive relationship between environmental performance of a firm and its financial profitability.

Nor et al. (2016) did a study to see how environmental practices disclosure affected the financial performance of 100 Malaysian enterprises. Return on Asset (ROA), Earnings per Share (EPS), Return on Equity (ROE), and profit margin were all subjected to a content analysis based on annual reports from a group of 100 corporations. The study established 20 independent factors to assess chosen companies' environmental performance and found a strong link between overall environmental disclosure and profit margin.

Mahoney & Roberts (2007) made a study to find an association between corporate social performance (CSP) and financial performance. The study was carried out on publicly listed Canadian firms with respect to several measures of environmental activities and the findings showed a significant relationship between CSP and environmental activities and product quality.

Sarumpaet (2005) established a connection between environmental performance and financial performance to understand their relationship in Indonesian companies. The study considered return on assets as the financial measure and the environmental ratings of the respective companies. The statistical tests showed a negative relationship between the variables as consumers are still not embracing green products.

Some studies measure environmental performance directly, whereas others look at pollutant emissions and/or waste generation. Many of the research in this set make use of data from the Toxic Release Inventory (TRI) database in the United States (T., 1995) Other investigations look into whether environmental protection legislation based on performance-based requirements, such as effluent limitations, are being Russo & Fouts (1997). Some research, on the other hand, use measurements that directly capture environmental behavior. Several studies look into environmental management activities, such as the number of environmental management practices, expenditures on environmental practices, and the adoption of environmental management systems (Karagozoglu & Lindell 2000,Watson et al. 2004). King & Lenox (2001) observed in their study that companies with high environmental performance have higher profits. The study related financial measures ROA, ROE and ROI with environmental measures like total emissions, environmental management standards, disposal of hazardous waste, environmental performance, etc. The results showed association between total emissions and superior financial performance, cleaner industries have higher Tobin’s q. The study concludes that firm attributes and environment strategies will moderate their relationship.

Statement of The Problem

Earlier Research Studies in the area of Environmental performance and disclosure on Financial performance have indicated that the impact and the relationship varies among different sectors depending on various factors. one such vital factor is the company’s pollution levels over a period of time. In India studies were conducted based on Environmental performance variables such as environmental rating on stock prices , Gupta & Goldar (2003) and perceptual data on discharge of the impact of a company's environmental stewardship on its bottom line. Environmental sustainability has a good and considerable impact on financial performance, customer performance, internal business process performance, and learning and growth performance, according to Gupta and Gupta (2020). Mehta et al. (2018) assess Indian enterprises that make up a sustainability index based on efficiency scores and compare one company's performance in terms of energy savings and profit. As a result, most research in India are cross-sectional and short-term event studies.

Therefore this study is taken to examine the relationship between environmental performance and financial performance by taking variables to measure the environmental performance other than mentioned and conducted in the Indian context. The study was spread over a period of 10 years so a longitudinal study to measure the long term effect and new variables as total emissions, relative emissions and energy intensity were studied to measure the environmental performance. The select companies are from most polluting industries such as mining, manufacturing, cement, fossil fuel and transportation.

Need for the Study

The majority of studies on business sustainability have broken down performance into metrics of corporate environmental performance (CEP) and corporate social performance (CSP) Wagner (2010) Ziegler & Schröder (2006). Due to the necessity for business plans to be realigned to address natural environmental concerns such as resource scarcity, pollution, and climate change, CEP has grown in relevance. Wagner (2010) uses sensitivity analysis to examine the relationship between corporate sustainability performance (which includes independent measures of social and environmental performance) and economic performance, finding that only environmental performance has a direct impact.on economic performance. According to Epstein and Freedman (1994), 82.17 percent of responding investors want environmental disclosures, and information about environmental initiatives is more desirable in annual reports than information about any other social activity. Walls et al. (2012) found that CEP is subject to different regulatory and reporting requirements than CSP, and that the empirical findings of CEP–CFP linkage and CSP–CFP linkage are reported to be different (Schreck, 2011).The majority of the studies conducted on regarding relation between financial performance and environment performance on mature market economies, very few were made on transitional economies, so there is a need to take a study in Indian Context in most polluting sectors. the strategies undertaken at their operations to reduce the environmental pollution in the long run might have yielded a positive impact on firms performance. The same might have yielded a negative relationship on firms’ financial performance in the short run.

Objectives

Based on the review the following objectives are set for the present study.

1. To study and analyse the impact of environmental performance on financial performance.

2. To Determine the relationship between environmental performance and financial performance by regression

model.

Hypothesis of the Study

Investors utilize the information in financial statements to make estimates about future earnings and dividends, as well as the risk associated with this valuation (Brigham and Houston, 2006). As a result, financial performance measurement from financial statements can be used as a tool to measure shareholder and investor wealth growth, which is consistent with stakeholder theory. Companies that perform well will attract the attention of stakeholders who can help them enhance their financial results.

According to legitimacy theory, if the corporate environment performs well, it will get the legitimacy of the community, which is a strategy for the company's development. Various studies relating to environmental performance and financial performance have been undertaken with varying outcomes, with Al-Tuwajri et al. (2003), Tuan (2012), and Iqbal et al. (2013) proving the research result that environmental performance has a beneficial effect on financial performance. Meanwhile, Sarumpaet (2005) and (Naila, 2013) conclude that there is no link between environmental and financial performance in their studies.

H1: there is no significant association between financial performance and environmental performance.

Research Methodology and Data Collection

Sample Selection

This paper for the study purpose used extensive secondary data of the select companies. The companies under study are taken from S&P BSE 500 list and from most polluting industries as mining, manufacturing, cement, fossil fuel and transportation during 2010-20. The required data is collected from their websites and PROWESS corporate online data base provided by CMIE during the time period 2010-2020. Depending on the data availability only 151 companies are selected for the study.

Sources of the data: the present study is primarily based on extensive secondary data collected from the respective company websites, BSE list and Prowess CMIE.

Period of the study: the period of the study is 2010 to 2020. ten years of data was taken for the study.

Tools Used in the Study

basic Descriptive statistics were calculated to understand the nature of the data. A correlation analysis was then run to determine the association between the variables.

A regression analysis was then employed to understand the relationship between the two variables.

All the tests were conducted using SPSS 20 software.

Frame work:

For the present study environmental performance of the select companies is calculated on the basis of total emissions, energy intensity and relative emissions.

Return on Assets, Return on Equity, Return on Capital employed, Tobin’s q and P/E ratio were employed as measures of financial performance of the select companies.

Calculation of environmental efficiency, which is measured as the total emission of GHGs, is used for this total emission. This measure was taken as prior research has assessed a company's environmental performance as the degree to which, given its scale, that company emits toxic pollution Hart & Ahuja (1996) we have used relative pollution as an indicator which measures the ability of the firm to manage and reduce its pollution by comparing the extent to which the facilities of a business are more or less polluting than other facilities in the same industry.

Another indication that EI is calculated as the ratio of power and fuel costs to sales is Energy Intensity. Based on the analysis of the work by (Ruyin Long, 2020)this indicator was taken. The emission intensity was adopted to assess environmental efficiency. It is decided that the company's environmental impact can be calculated by ranking, index or environmental score.

Tung (2014) emphasised that the best metrics for assessing the company's environmental efficiency are the effective use of the material. (Santosh Kumar Sahu, 2011)stated that energy consumption and demand is effectively calculated in industry by taking into account the company's EI Sahu & Narayanan (2010).

The financial output of the selected firms is taken to calculate the company's profitability, which is the ability of businesses to earn further returns on their investment. We've implemented ROE, ROCE, ROA, Tobin 's q and P / E ratios for this. Tobin's q is the ratio that compares the firm's stock value to the company 's overall cost of replacing assets (book value). It is determined as the total of firm’s equity, book value of long term debt and current liabilities divided by book value of total assets. P/E ratio measures market price of stock relative to its earnings by determining the ratio as MPS divided by the EPS. ROE, ROCE and ROA provide the detailed information on ability of the firm in earning profitability Long et al. (2020).

To test the hypothesis correlation and regression coefficient were adopted.

Data Analysis

Finding of the Study

The basic statistical data of the sample was calculated by measuring mean and standard deviation of the variables Tobin’s q, P/E, ROE, ROCE, ROA, Total emissions, Relative emissions and energy intensity. The sample has a mean of 1.29 tobin’s q measure and standard deviation of 0.89. The other variables data was also given in Table 1.

| Table 1 Descriptive Statistics of the Sample Variables | ||

| Variable | Mean | Std. Deviation |

| Tobin’s q | 1.29 | 0.89 |

| P/E | 0.98 | 0.72 |

| ROE | 0.19 | 0.25 |

| ROCE | 0.48 | 0.78 |

| ROA | 0.25 | 0.86 |

| Total Emissions | 4.58 | 2.51 |

| Relative Emissions | 0.54 | 0.65 |

| Energy intensity | 0.0559 | 0.0125 |

Mean and Standard deviation of the variables are calculated using SPSS 20 version.

Analysis of Correlation Coefficient

The correlation analysis of financial performance variables and environmental performance variables was run using SPSS 20 version and found significant at P<0.05 level. There is a clear association between the variables. Both environmental variables and financial performance variables are related as the p value is 0.05. This rejects the null hypothesis that there is no significant association between the variables. We tested the hypothesis using correlation and found that there is a significant relation between the variables. Correlation only specifies the relation either positive or negative but does not specify the intensity/magnitude and direction of the relation. A positive sign represents a direct relationship between the variables and a negative correlation specifies inverse relation (Aron et al., 2009; Steinberg, 2011). In the study all financial performance variables (Tobin’q, P/E, ROE, ROA, and ROCE) are in inverse relation with the environment performance variables. The negative correlation signifies that the profitability measures increase with the reduction in total emissions, relative emissions and energy intensity Table 2.

| Table 2 Correlation Analysis of Environmental Performance Variables and Financial Performance Variables | ||||||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | |

| Tobin’s q | 1.00 | |||||||

| P/E | 0.05 | 1.00 | ||||||

| ROE | 0.71 | 0.22 | 1.00 | |||||

| ROCE | 0.26 | 0.41 | 0.421 | 1.00 | ||||

| ROA | 0.31 | 0.32 | 0.78 | 0.30 | 1.00 | |||

| Total Emissions | -0.21 | -0.25 | -0.41 | -0.12 | -0.03 | 1.00 | ||

| Relative Emissions | -0.35 | -0.010 | -0.53 | -0.21 | -0.51 | 0.39 | 1.00 | |

| Energy intensity | -0.62 | -0.23 | -0.123 | -0.011 | -0.032 | 0.97 | 0.62 | 1.00 |

Analysis of Regression Coefficient

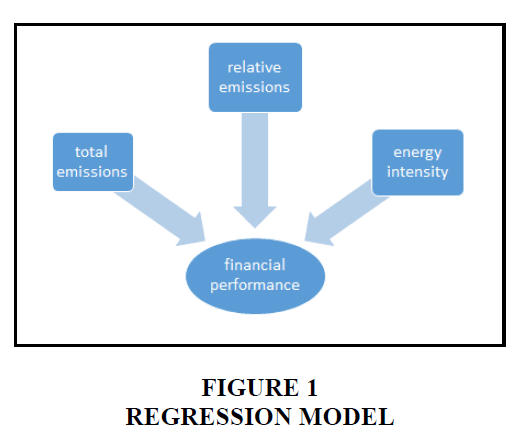

Correlation analysis of the variables during the study period signified a relationship between the two variables and later these variables are subjected to regression analysis to find the linear relation between the two variables. For the present study financial performance is taken as a dependent variable and environmental performance as independent variable Hamilton (1995).

Regression analysis represented in Table 3 shows that tobin’s q, a dependent variable, depends on independent variables as total emissions with a beta of -0.395, relative emissions with beta -0.91 and energy intensity with -0.25 beta. This analysis had proved the relation between financial performance and environmental performance (p<0.05). Based on these regression results we proposed the following model Table 3.

| Table 3 Regression Coefficient of Dependent Variables on Independent Variables | |||

| Standardised coefficients | |||

| Beta | t | Sig | |

| Total emissions | -0.345 | 5.21 | 0.01 |

| Relative emissions | -0.91 | 3.21 | 0.034 |

| Energy intensity | -0.25 | 1.19 | 0.021 |

Proposed Model

Y = constant + B1 X1 + B2 X2 + B3 X3 +e

Where in our model,

Y= dependent variable, which we took tobin’s q that represents financial performance

X1-3= independent variables, total emission, relative emission, energy intensity.

B1-3= beta coefficients of independent variables

e= residual error

Regression Model:

Based on the regression analysis a model was proposed as shown in Figure 1 in which financial performance depends upon the environmental performance.the hypothesis was tested to find the association and then regression was carried on the variables to find the relationship amongst them.Environmental performance measured via variables taken in the study total emissions, relative emissions and energy intensity has an effect on the financial performance variable Tobin’s q Figure 1.

Conclusion

Based on our study it is concluded that Tobin's financial performance indicator Tobin’s q depends on environmental performance and could establish association between other financial performance indicators and environmental performance indicators. Companies in India are now going to phase of ESG scores and mandatory disclosure of environmental strategies eg., ABRR. The Government of India even proposed a hike in Carbon Tax from Rs100 to Rs 200 per tonne. This eventually attracts companies to reduce their emissions especially CO2 and improve climate change policy. All these measures aimed at companies to revisit their environmental strategy. We found that companies need to think of environmental expenses as investment that will improve economic profitability. As stakeholders are becoming more aware towards these ESG measures, the firm's environment strategy disseminates into the market leading to enhanced reputation, increased market value (which could be a probable reason for a negative correlation between P/E ratio and environment performance implying reduction in emissions yield better P/E). Managers must be wary in designing environmental policy as now it established the relationship with the financial performance. Through this paper we found that the change in the profitability of firms across industries is related to their environmental performance measures but not as the only reason.

We believe that Indian businesses should examine the medium and long-term benefits of investing in environmental performance, particularly in light of the current economic climate. Most successful economic entities around the world place a high emphasis on environmental performance. Companies can achieve long-term economic success by including environmental factors into their strategy, which is referred to as "sustainable management."

The government should also lend a hand in promoting corporate social responsibility by encouraging executives to overcome opportunism and concentrate on non-financial goals. Eco-innovation, on the other hand, may well lead to a shift in government policy, as related activities may be subsidized and a legal and budgetary framework that protects them introduced.

Suggestions: the implications of the present study include for both corporates as well as policy makers. Especially in most polluting industries it is suggested for policy makers to emphasize more on eco-friendly strategies that aim at reducing carbon footprint, emissions of GHGs that improve their financial and environmental performance index.

Scope for Further Research

The direction of relationship with other financial performance variables could not be tested except their association with the environment performance variables. Other factors such as firm size, growth rate, industry emission, capital structure are not considered whose impact on profitability cannot be overruled. For this purpose further regression can be done keeping these variables in control. Then a better regression model can be proposed. And also the impact of other variables on both environmental performance and profitability can be studied in depth.

A comparative study of the same sample in short-run and long-run period will let us know the impact of environment performance on corporate finance effectiveness and efficiency based on time period.

Time series data would also help to understand the direction in which corporate investment in environment is yielding results and impact on pollution reduction.

References

Aslam, M.H., & Azhar, S.M. (2013). Globalisation and development: challenges for developing countries. International Journal of Economic Policy in Emerging Economies, 6(2), 158-167.

Gupta, S., & Goldar, B. (2003). Do stock markets penalise environment-unfriendly behaviour? Evidence from India. Evidence from India (March 2003). Centre for Development Economics Working Paper, (116).

Indexed at, Google Scholar, Cross Ref

Hamilton, J.T. (1995). Pollution as news: Media and stock market reactions to the toxics release inventory data. Journal of environmental economics and management, 28(1), 98-113.

Indexed at, Google Scholar, Cross Ref

Hart, S.L., & Ahuja, G. (1996). Does it pay to be green? An empirical examination of the relationship between emission reduction and firm performance. Business strategy and the Environment, 5(1), 30-37.

Indexed at, Google Scholar, Cross Ref

Jaffe, A.B., Peterson, S.R., Portney, P.R., & Stavins, R.N. (1995). Environmental regulation and the competitiveness of US manufacturing: what does the evidence tell us?. Journal of Economic literature, 33(1), 132-163.

King, A.A., & Lenox, M.J. (2001). Does it really pay to be green? An empirical study of firm environmental and financial performance: An empirical study of firm environmental and financial performance. Journal of industrial ecology, 5(1), 105-116.

Indexed at, Google Scholar, Cross Ref

Long, R., Zhang, Q., Chen, H., Wu, M., & Li, Q. (2020). Measurement of the energy intensity of human well-being and spatial econometric analysis of its influencing factors. International Journal of Environmental Research and Public Health, 17(1), 357.

Indexed at, Google Scholar, Cross Ref

Mahoney, L., & Roberts, R.W. (2007, September). Corporate social performance, financial performance and institutional ownership in Canadian firms. In Accounting forum (Vol. 31, No. 3, pp. 233-253). No longer published by Elsevier.

Indexed at, Google Scholar, Cross Ref

Moneva, J.M., & Cuellar, B. (2009). The value relevance of financial and non-financial environmental reporting. Environmental and Resource Economics, 44(3), 441-456.

Murphy, C.J. (2002). The profitable correlation between environmental and financial performance: a review of the research. Light Green Advisors, 1-18.

Musyarofah, S. (2012). The need for new paradigm of sustainability reporting in higher education. International Journal of Economic Policy in Emerging Economies, 5(4), 342-352.

Nor, N.M., Bahari, N.A.S., Adnan, N.A., Kamal, S.M.Q.A.S., & Ali, I.M. (2016). The effects of environmental disclosure on financial performance in Malaysia. Procedia Economics and Finance, 35, 117-126.

Indexed at, Google Scholar, Cross Ref

Pintea, M.O., Stanca, L., Achim, S.A., & Pop, I. (2014). Is there a Connection among Environmental and Financial Performance of a Company in Developing Countries? Evidence from Romania. Procedia Economics and Finance, 15, 822-829.

Indexed at, Google Scholar, Cross Ref

Porter, M.E., & Van der Linde, C. (1995). Toward a new conception of the environment-competitiveness relationship. Journal of economic perspectives, 9(4), 97-118.

Indexed at, Google Scholar, Cross Ref

Russo, M.V., & Fouts, P.A. (1997). A resource-based perspective on corporate environmental performance and profitability. Academy of management Journal, 40(3), 534-559.

Indexed at, Google Scholar, Cross Ref

Sahu, S., & Narayanan, K. (2010). Determinants of energy intensity in Indian manufacturing industries: a firm level analysis.

Sarumpaet, S. (2005). The relationship between environmental performance and financial performance of Indonesian companies. Jurnal Akuntansi dan Keuangan, 7(2), 89-98.

Indexed at, Google Scholar, Cross Ref

Sebi data meeting files. (2018). Retrieved from sebi:

Tung, A., Baird, K., & Schoch, H. (2014). The relationship between organisational factors and the effectiveness of environmental management. Journal of environmental management, 144, 186-196.

Wagner, M. (2010). The role of corporate sustainability performance for economic performance: A firm-level analysis of moderation effects. Ecological economics, 69(7), 1553-1560.

Indexed at, Google Scholar, Cross Ref

Ziegler, A., & Schröder, M. (2006). What determines the inclusion in a sustainability stock index? a panel data analysis for European companies. A panel data analysis for European Companies, 06-041.

Indexed at, Google Scholar, Cross Ref

Received: 01-Jul-2022, Manuscript No. AMSJ-22-12284; Editor assigned: 04-Jul-2022, PreQC No. AMSJ-22-12284(PQ); Reviewed: 18-Aug-2022, QC No. AMSJ-22-12284; Revised: 28-Aug-2022, Manuscript No. AMSJ-22-12284(R); Published: 16-Sep-2022