Review Article: 2022 Vol: 26 Issue: 6

Impact of Digital Audit on Improving Performance Quality and Reduce Costs an Applied Research in a Sample of Private Auditing Firms and Offices

Imtithal Rasheed Batchai, University of Baghdad

Raghad Rasheed Batchai, Federal Board of Supreme Audit

Citation Information: Batchai, I.R., & Batchai, R.R. (2022). Impact of digital audit on improving performance quality and reduce costs an applied research in a sample of private auditing firms and offices. Academy of Accounting and Financial Studies Journal, 26(6), 1-09.

Abstract

The research explores the impact of use of digital audit on improving performance quality and Reduce costs which are essential aspects of auditing .The research problem is "ignoring the use digital audit via Information Technology in auditing to avoid shortages of some human resources and hence affecting performance quality and costs. The research aims at introducing digital audit, its goals and its impact on performance quality improvement and cost reduction of audit .The most important recommendation proposed by the researchers is training auditors to efficiently utilize IT so as to save time and efforts and to cut costs when carrying out audits.

Keywords

Digital Audit, Reduce Cost, Performance Quality.

Introduction

IT utilization has become a prerequisite given the rapid business development and it is needed in all aspects of life namely IT based audit (digital audit) which promptly provide timely, high quality data and with a reasonable cost. Digital audit addresses the professional judgment issue, i.e. the human failure, to improve opinion quality and consequently coming up with a sound audit report. We stresses the importance of digital transformation in work procedures and approach by benefiting from the technological progress.

Methodology

The research Problem

The research problem is non-utilization of digital audit and IT in audit firms and offices to improve performance quality and reducing audit costs.

The Research Objective

The research aims at:

1. Introducing digital audit and its goals;

2. Defining digital audit impact on performance quality improvement ;

3. Defining digital audit impact on cost Reduce.

The Research Hypothesis

The research hypothesizes that "utilizing digital audit leads to performance quality improvement and cost Reduce”.

Research Importance

The value of the research stems from the importance of IT utilization in auditing by means of digital audit and examines its effect on performance quality improvement and consequently cutting audit costs. It enables auditors to express a neutral audit opinion via designing sound audit procedures and obtaining audit evidence. Thus, relevant fair information is provided and is relied upon when auditing.

The Research Sample

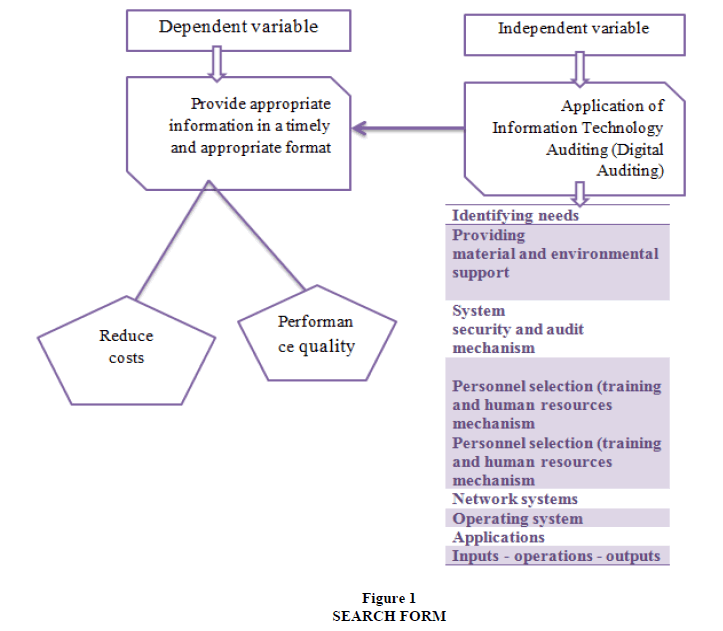

Private auditing firms and offices, Iraq, Baghdad, for a year, 2020 Figure 1.

Digitalization

It is creating a digital image where the information included in a printed document is converted to a soft copy saved on a computer, (Al-Salami, 2002, p: 57). Digital transformation: it is the process an entity uses such as IT, communication and Internet to upgrade its various activities and procedures and transfer them to internal and external parties that need them. This depends on the following elements:

1. Availability of data flow;

2. Use of IT;

3. Qualified human resources (Mohamed, 2002).

Digital Audit (IT Audit)

WGITA- IDI, (2014, p:14) is testing the implementation of IT systems and the controls applied to ensure meeting the work needs of the entity and keeping security ,privacy, cost and other significant work aspects intact .

Digital Transformation Objectives

The purpose behind IT audit is to make sure that IT resources lead to the achievement of organizational goals effectively and to utilize resources efficiently.IT audit may include information systems, obtaining business solutions, system development and continuity of business which are considered as areas of applying Information systems such as:

1. Reviewing IT controls to verify their accuracy and effectiveness.

2. Evaluating specific business - related processes.

3. Internal controls and accounting system.

4. Evaluating system performance and security.

5. Checking the process of developing the system and procedures.

6. IT emergence has contributed to changing the way we used to work .It assists us to achieve success and excellence .Computers are being used almost everywhere .It is considered a competition priority.

Competitive priorities are summarized below (Al-Shabani, 2010):

1. Reduced or reasonable cost: If optimally carried out, a reduced or reasonable cost constitutes an important competitive tool .It is defined as the amount of resources spent to achieve a specific goal.

2. Quality: this priority affects the entity's performance and continuity.

3. Time: time is vital for decision making and the prompt response to client needs.

4. Flexibility: Entity’s ability to change especially staff flexibility i.e. an entity has a staff with diverse experienced and skilled members.

5. Innovation: The rapid development ,competitiveness and advanced technologies that enable an entity to catch up with novel advancements,

a. Auditing is an essential pillar for an entity and it is an ongoing dynamic process. Auditing needs informed procedures to ensure compliance with plans and policies on which an entity relies in carrying out its operations .Auditing strikes a balance between means and goals, efforts and results .Its aim is to realize consistency between actual and planned performance.

b. Auditing means reviewing the performance of someone by another .It is a kind of verification whether everything is being carried out in accordance with the plan, issued regulations and set principles. The purpose behind is to diagnose weaknesses and errors in order to overcome and avoid them in the future (Al-Quraishi, 2011).

For digital audit to be effective and goal achieving, it should have the following qualities:

1. Relevance: It is important for the audit system to be consistent to entity's activity, size and objectives.

2. Promptness: The prompt infringements detection or prevention enables auditing to avoid their serious negative impacts.

3. Flexibility: It allows control systems to adapt to changes witnessed by internal and external environment.

4. Clarity: For the audit to be efficient and effective, it must be clear and easily understood by those responsible for performance.

5. Continuity: Continuous auditing enables the timely infringement detection, addressing and correction.

6. Objectivity: Auditing must be free from personal factors (personal judgment) when measuring and evaluating performance. Thus, the process of judging and evaluating performance is carried out objectively not subjectively (Al-Sayrafi,2014) .

ISA 220- Quality Control for an Audit of Financial Statement-stresses the concept of quality control as a set of policies and procedures applied in audit offices to verify that audits are carried out in accordance with applicable audit standards (Standard (220),2019).

Quality control is achieved when the following conditions are met:

1. Auditors should comply with all applicable auditing standards, code of ethics and quality control standards .They should disclose any misstatements and infringements detected in financial statements.

2. Auditors should meet financial statements users' needs and desires.

Audit quality is a good competitive tool .However, competition to get the best fees is considered a risk for auditing profession due to its adverse impact on auditor independence, audit procedures scope and audit quality. COHEN Committee, in turn, warned from the effect of competition on audit quality, therefore, quality is a good strategic tool to enable auditors to have a competitive advantage in the market of audit services. To judge audit quality, it is crucial to develop performance measures.

A Performance measurement is defined as a digital description of the entity activity and its resultant outcomes by relying upon data that is used to clarify the nature of that activity, the extent to which the goals are achieved and its progress. At the beginning the focus was on financial measures based on the following approaches

1. Financial statement analysis approach: It aims at obtaining significant information related to an entity's activities, efficiency, profitability and risks.

2. Cost analysis approach: It aims at realizing cost reduction given the fact that cost reduction is one of the entity's strategic goals. Due to the rabid developments witnessed by work environment, these approaches alone fall short of measuring performance. Accordingly, other measures such as customer satisfaction, reputation and the like are being used .To conclude, financial and non-financial measures need to be used together (Bosphorus, 2015).

The Practical Framework of the Research

The research is applied to a sample of private audit firms and offices Table 1.

| Table 1 Depicts Details Of These Firms And Offices |

|

|---|---|

| Details | Number |

| Audit firms | 20 |

| Audit offices (class 1) | 111 |

| Audit offices (class 2) | 71 |

Source: researchers based on Board of Auditing Profession.

In Iraq ,there are 20 audit firms and 182 audit offices .61%of the total number is listed in class 1 and 39% is in class 2.This is a positive indicator i.e. there are entities specialized in auditing private sector. Table 2 depicts the audit experience required for each class:

Professional experience depends on the period during which auditing is practiced from the date of granting the license, the continuous professional work under the supervision of an auditor with consent and approval of Board of Auditing Profession or from the date of obtaining the scientific qualification in case of working at the FBSA .Also auditors whose practice of the profession in state offices and public sector is confirmed by a Board of Audit Profession decision.

| Table 2 Auditor Professional Experience |

||

|---|---|---|

| Class | Category | Professional Experience |

| 1 | A | 15+ years |

| B | 10+ years | |

| 2 | C | 5+ years |

| D | Less than 5 years | |

Source: Board of Auditing Profession.

To apply IT based audit (digital audit), we selected two audit firms from class 1 categories A and B as depicted in Table 3 – Traditional Audit Costs for firms A and B below. The names of the firms are not disclosed for secrecy reasons and under both firms request:

| Table 3 Traditional Audit Costs For The Year 2020 |

||

|---|---|---|

| Details | Firm A Amount /IQD |

Firm B Amount /IQD |

| Accountants salaries | 90000000 | 66600000 |

| Auditors salaries | 228000000 | 144000000 |

| Administrative services salaries | 14400000 | 9000000 |

| rewards | 31200000 | 24600000 |

| Indirect costs | 108000000 | 86760000 |

| total | 471600000 | 330960000 |

Source: the researchers based on the two audit firms.

The highest costs percentages for firms A and B (48% and 44% respectively) are for auditors salaries while the lowest for both firms is 3% for administrative services salaries.

Utilizing digital audit that is based on IT Requires:

1. Purchasing the automated operating system (software) to audit inputs, processes and outputs.

2. The cost of training auditors to use operating systems (software).

3. The cost of modern hardware.

4. The cost of hiring IT experts.

Digital audit starts with audit planning and ends with report writing and expressing auditor opinion through the use of IT and in collaboration with the auditee. A link is maintained between the audit firm and the auditee. Information updating is the responsibility of authorized persons known to senior management of the auditee and the audit firm is directly notified through the control over processes.

Financial Statement Digital Audit Procedures Table 4:

| Table 4 Digital Audit Costs For The Year 2020 |

||

|---|---|---|

| Details | Firm A Amount /IQD | Firm B Amount /IQD |

| Software Experts Salaries | 15000000 | 14000000 |

| Accountants Salaries | 36000000 | 266640000 |

| Auditors Salaries | 91200000 | 57600000 |

| Administrative Services Salaries | 14400000 | 9000000 |

| Rewards | 32100000 | 24600000 |

| Software Costs | 7000000 | 7000000 |

| Auditors and Accountants Training Costs | 20000000 | 20000000 |

| Indirect Costs | 109200000 | 87760000 |

| Total | 324000000 | 246600000 |

Source: The researchers based on information provided by firms A and B.

1. Checking inputs of financial Statements (financial statements and management report).

2. Verifying whether the entity complies with the Electronically Acceptable accounting standards and principles.

3. Verifying whether there are analytical statements for each account of financial statements on the dual or triple level.

4. Verifying the existence of electronic accounting entries, trail balances and accounting records.

5. Verifying that electronic internal control reports are in place.

6. Verifying the electronic updating of accounts by the authorized persons, its date and impacts on financial statements.

7. Electronically verifying the accuracy of totals and balances.

8. Verifying controls over applications (input, rejection and processing).

9. Verifying the controls of operation completeness and reliability.

10. Verifying the corrective procedures concerning inputs, processes and outputs.

11. Verifying the signatures of persons authorized by law.

12. Verifying controls over outputs.

13. Electronically verifying controls Over Information Security and Quality.

The direct costs percentages for Firms A and B are 66% and 64% respectively and the indirect costs percentages are 34% and36% respectively .The difference in costs between traditional and digital audit is shown in the Table 5:

| Table 5 Difference In Costs Between Traditional And Digital Audit |

||

|---|---|---|

| Details | Firm A Amount /IQD |

Firm B Amount /IQD |

| Traditional Audit | 471600000 | 330960000 |

| Digital Audit | 324000000 | 246600000 |

| Difference | 147600000 | 84360000 |

Source: The researchers based on tables 3 and 4

As shown in the table 5, there is a decrease in the costs especially for auditors and accountants salaries due to the use of IT based audit .Auditors and accountants number is reduced and replaced by computers to carry out audits. It is worth mentioning that the two firms incurred costs for purchasing the hardware but these costs are capital costs that are made use of for more than one fiscal year and are included within inventory. Only depreciation is accounted for. As for indirect costs, they are the costs of (stationary, common supplies, furniture depreciation, water and electricity fees and building rents).

| Table 6 Traditional Audit Activity Result For The Year 2020 |

||

|---|---|---|

| Capital | Audit fees IQD | |

| Less than 100 million IQD | 1 Million | |

| Less than 1 billon IQD | 1.5 million | |

| More than I billion IQD | 2 million | |

| Details | Firm A IQD | Firm B IQD |

| Audit revenues | 518760000 | 357436800 |

| Traditional audit | 471600000 | 330960000 |

| Activity result | 47160000 | 26476800 |

| Rate % | 9% | 7% |

Source: the researchers based on information provided by firms A and B

Audit fees in firms in Iraq, according to Board of Audit Profession are as follows:

1. Auditees have capital;

2. Basic audit fees;

3. Supplementary audit fees – a rate of annual activity set by Board of Audit Profession;

4. In case the firm, branch or foreign organizations have no capital, basic fees are a lump sum of 1.5 million IQD.

Accordingly, the result of firms A and B activity is as shown in Table 6:

As shown in table 6 ,the total profitable activity result rate for Firms A and B are 9% and 7% respectively .The rate indicates that firm A performance and profitability are better than those of firm B. Despite the fact that both firms achieved total profit, Firm A outperforms firm B. As for digital audit activity result, it is depicted in Table 7:

Table 7 shows that total profitable digital audit activity result is greater than that of the traditional audit by a difference represented by a percentage of 29% for Firm A and 24% for firm B. This indicates that digital audit is better than traditional audit because its profitability is greater than costs.

| Table 7 Digital Audit Activity Result For The Year 2020 |

||

|---|---|---|

| Details | Firm A IQD | Firm B IQD |

| Audit revenues | 518760000 | 357436800 |

| Traditional audit | 471600000 | 246600000 |

| Activity result | 194760000 | 110836800 |

| Rate % | 38% | 31% |

Source: The researchers based on information provided by firms A and B

Building on the above, we can measure firms A and B performance quality as in table 8:

The cost per unit = total cost / number of audit services

Number of audit services for firms A and B is 520 and 358 respectively

The Table 8 mentioned above and performance quality measurement indicators (profitability, completion time and cost) show that digital audit is better than traditional audit, building on the realized results. Moreover, Firm A outperforms Firm B because it realizes a total profit of 38% while firm B realizes a total profit of 31% .There is also a difference in the completion time indicator in terms of audit service per entity .Firm An audit completion time is 20 days per unit while firm B takes 25 days to complete its audit engagement .As for cost indicator, firm A incurred a cost of 623077 IQD per unit while Firm B incurred a cost of 688827IQD per unit.

| Table 8 Audit Firms’ Performance Quality For The Year 2020 |

|||

|---|---|---|---|

| Details | Firm A | Firm B | |

| Profitability indicator | |||

| Traditional audit | 9% | 7% | |

| Digital audit | 38% | 31% | |

| Completion time indicator | |||

| Traditional audit | 60 days per entity | 90 days per entity | |

| Digital audit | 20 days per entity | 25 days per entity | |

| Cost indicator | |||

| Traditional audit | A cost of 906923 per unit | A cost of 924469 per unit | |

| Digital audit | A cost of 623077 per unit | A cost of 688827 per unit | |

Source: The researchers based on the above mentioned tables and the information provided by firms A and B.

To sum up ,digital audit achieved positive results in terms of profitability increase, time saving and cost cutting due to reliance upon IT .IT contributes to timely provision of relevant information that, in turn , assist audit firms to express the neutral technical opinion concerning the financial statements by means of automated audit procedures and with high quality and reduced cost.

Conclusion and Recommendations

The research has come up with the following conclusions:

1. Applying digital audit to audit firms and offices improves performance quality of audit engagements starting from planning and ending with report writing;

2. The proper design and sound implementation of financial statement digital audit play an active role in reducing audit completion time to avoid weaknesses of traditional audit;

3. Utilizing IT based audit saves effort and time and cuts cost.

Recommendations

1. Auditors need to be trained to efficiently use IT to save time and efforts and cuts cost when carrying out auditing engagements;

2. IT experts need to be hired to soundly carry out digital audit procedures;

3. Feedback need to be relied upon to take proper corrective actions in the right time to prevents and solve problems.

References

Al-Quraishi, I.R. (2011). External Auditing, A Scientific Approach, Theoretical and the Practice, Publishing House for Printing and Publishing, Iraq, Baghdad.

Al-Salami, A. (2002). Management of Excellence, Models and Techniques of Management in the Age of Knowledge, Garbel Publishing House, Cairo.

Al-Sayrafi, M. (2014). Governmental Administrative Professional, Publishing House for Printing and Publishing, Fajr.

Al-Shabani, S.I. (2010). The Role of Integrated (ICMS) Cost Management Information in Supporting Competitive Priorities.

Bosphorus, A. (2015). Regulatory Oversight and its Role in Improving Workers' Performance, Algeria.

Mohamed, M.A.H. (2002). The digital organization in a changing year. Research presented to the first Arab Conference on Information Technology and Management, for the period from 1-4 October, in Cairo, the Arab Organization for Administrative Development.

WGITA- IDI. (2014). Hand Book ON IT Audit for supreme Audit institutions intosai development initiative.

Received: 17-Nov-2021, Manuscript No. AAFSJ-21-9812; Editor assigned: 19-Nov-2021, PreQC No. AAFSJ-21-9812(PQ); Reviewed: 03-Dec-2021, QC No. AAFSJ-21-9812; Revised: 07-Sep-2022, Manuscript No. AAFSJ-21-9812(R); Published: 14-Sep-2022