Research Article: 2022 Vol: 26 Issue: 2S

Impact of Covid-19 vaccination on airline business in Indonesia

Nawang Kalbuana, Politeknik Penerbangan Indonesia Curug

Pribadi Asih, Politeknik Penerbangan Indonesia Curug

Suse Lamtiar Simbolon, Politeknik Penerbangan Indonesia Curug

Solihin, Politeknik Penerbangan Indonesia Curug

Zulina Kurniawati, Politeknik Penerbangan Indonesia Curug

Citation Information: Kalbuana, N., Asih, P., Simbolon, S.L., Solihin, & Kurniawati, Z. (2022). Impact of Covid-19 vaccination on airline business in Indonesia. Accounting and Financial Studies Journal, 26(S2), 1-10.

Abstract

Objective: The purpose of this study was to look at the comparison between the stock price and transaction volume (company size) of airline business in Indonesia after and before the first coronavirus (Covid-19) vaccination in Indonesia. Design/methodology/approach: The research will use quantitative methodology by collecting secondary data on stock prices and transaction volumes on airline business in Indonesia. The population in this study is the airline business in Indonesia listed on the Indonesia Stock Exchange (IDX). The samples in this study used purposive sampling techniques and used the paired sample t-test technique and data process using the SPSS application version 25. Findings: The share price of airlines in Indonesia after and before the implementation of COVID-19 vaccination in Indonesia is very significant with sig value. (2tailed) the result is 0,000 (p<0.05), meaning a significant change (mean). However, the conditions are not in line with expectations; enthusiastic investors to invest their shares in the airline company continue to fall. It also has an impact on the decline in the stock price. Transaction volume as a proxy of Firm's Size on airline in Indonesia after and before the implementation of COVID-19 vaccination in Indonesia in Indonesia is very significant with sig value. (2tailed) the result is that 0,000 (p<0.05) still undergoes significant changes (meaningful). Still, the conditions are not by expectations/predictions, where the vaccination has not interested investors in buying shares in this airline. Implications: The existence of this research is expected to be able to provide input to investors in the airline business and more sensitive to what things can be used in investor decision making in this business which is currently decreasing enthusiasm in buying shares. Originality: The research was conducted after the first vaccination in Indonesia; previous studies were more into the impact of the covid-19 pandemic so that the research is expected to provide an overview and input to investors to invest in the airline business.

Keywords

Airline Business, Covid-19 Vaccination, Investor

Introduction

Based on data from worldometers pandemic COVID-19 until September 2021 has reached more than 222,784,021 while the country of Indonesia came in 13th with 4,140,634 cases of Covid-19 and is currently still growing (Worldometers, 2021). This pandemic has triggered a wave of bankruptcy in all fields of work including in the field of aviation (Amankwah-Amoah, 2020; Amankwah-Amoah, Khan & Osabutey, 2021; Jyoti-Gogoi, 2021; Kökény, Kenesei & Neszveda, 2021; Vinod, 2021a, 2021b). Digitalization of revolution 4.0 also adds to the situation to be more difficult (Amankwah-Amoah et al., 2021). Revitalization efforts to survive this pandemic situation continue to be done in order to survive. (Bakhtiar, Farild & Wahyudi, 2020; Devi, Devi, Warasniasih, Masdiantini & Musmini, 2020; Febriyanti & Febriyanti, 2020; Olivia, Gibson & Nasrudin, 2020a; Sparrow, Dartanto & Hartwig, 2020; Suryahadi, Al Izzati & Suryadarma, 2020; Vinod, 2021b).

Interestingly, this unexpected COVID-19 pandemic was able to cause the collapse of many companies. (Aliyyah & Prasetyo, 2021; Endarto, 2021; Jannah, 2020; Prasetyo & Aliyyah, 2021; Nartasari, 2021a; Prasetyo, 2021; Susanto, 2021) and potentially long-term effects on the aviation industry (Amankwah-Amoah, 2020). Conditions faced by airlines in Indonesia at this time, among others: The purchasing power of air freight services decreased; "financial difficulties"; not all aircraft are operated or will be operated after Covid-19; laying off or laying off employees or withholding salaries; barriers to payment of debt and/or payment of aircraft leases due to financial difficulties and weak rupiah exchange rates; Airlines cannot optimally perform their functions as a "driver" of the national/regional economy and as an airport "production engine" (Pamuraharjo, 2020).

A company's state can be seen by its stock price as well as its income. The stock price reflects the supply and demand of the stock. If demand for these shares increases, so does the stock price (Abadi, 2021; Aliyyah, 2021; Siswomihardjo, 2021; Endarto, 2021; Hastomo, 2021; Indrawati, Utari, Prasetyo, Rusdiyanto & Kalbuana, 2021; Jannah et al., 2020; Kalbuana & Prasetyo, 2021; Kalbuana & Suryati, 2021; Luwihono, 2021; Prasetio, 2021; Prasetyo, 2021; Prasetyo, Aliyyah, Rusdiyanto & Nartasari, 2021a, 2021b; Susanto, 2021; Wahyudin, Sari, Ardiansari, Raharja & Kalbuana, 2021).

Meanwhile, if the demand for the stock falls, then the price of the stock will also fall. Aside from the stock price, the company's health can be gauged by the number of stock sales. The number of stock transactions demonstrates investor interest in buying and selling business stock. The volume of stock transactions shows the worth of many of these transactions. Travelers' decisions are heavily influenced by things like safety and security. Travel volumes fell quickly even in the early stages of the epidemic as countries blocked their borders to travelers from countries affected by COVID-19 (Kökény et al., 2021). In the investment market, this information becomes one of the important factors as an investor consideration to make investments in aviation.

More than 200 COVID-19 vaccines are currently being developed worldwide, and the government has reached an agreement to get an initial dose of the vaccine. But the willingness to receive the COVID-19 vaccine when available still varies widely across countries during pandemics. In Indonesia alone the vaccination process was first held at the Presidential Palace, Jakarta, on Wednesday, January 13, 2021 (Today, 2021). The existence of the Covid 19 vaccination is welcome in the world of aviation whose condition is still suspended during the pandemic (last year) due to the large operating costs of the airline that must be borne that are not proportional to the revenue/income received by the company. The focus of this paper is due to the first vaccination in Indonesia, especially in the field of airlines in Indonesia based on transaction volume and stock price.

Literature Review

This section summarizes the literature on COVID-19's influence on the travel sector and past crises on the aviation market. We examined the features of airlines and how these could be utilized to build airline groupings.

Signal Theory

According to (Yohana, 2020) signal theory explains the reason companies present information for the capital market. Signal theory shows an information asymmetry between management and interested parties. Theoretically, corporations should provide signals to financial statement users. According to (Herwany, Febrian, Anwar & Gunardi, 2021; Nurwasari, 2020; Olivia, Gibson & Nasrudin, 2020b) the quality of an investor's decision is influenced by the quality of information the company discloses in its financial statements. The quality of the information aims to reduce the information asymmetry that arises when managers are more aware of the company's internal information and future prospects than external parties of the company.

Stock

As evidence of participation in capital ownership, shares traded on the Stock Exchange are grouped into 2, namely common stock and preferred stock (Wenno, 2020). Share ownership in this company is used as one of the indicators of investors to make a profit when the stock price rises and bear the risk of loss when the stock price decreases. Some investors also expect dividends when the Company experiences profits that will be distributed to investors (Bakhtiar et al., 2020; Luwihono et al., 2021; Prasetyo, Utami, Abdusshomad, Wijaya & Kalbuana, 2021). With uncertain economic conditions at the time of the covid-19 pandemic, it is not easy for issuers to attract investors to be willing to invest their capital, because each investor has different criteria in assessing an investment. The amount of stock price also affects the transaction of stock volume, where basically the stock price is the reference of investors in making investment decisions. Very rapid changes in stock prices are influenced by the level of supply as well as demand. Demand for shares is influenced by various information owned or known by investors about the company issuer, one of which is the company's financial information reflected in the company's financial statements.

Transaction Volume

The transaction volume of shares is the number of shares sold in a given period. The amount of the volume of stock transactions shows how much interest investors have to make transactions both buying and selling shares of a company. The value of the transaction volume is high, not necessarily indicating a high stock price. The value of this transaction volume can change due to events that occur both inside itself and other events that occur outside the company.

Transaction volume is defined as the number of shares traded on the Stock Exchange in a given period. The amount of investor interest in making sales and purchases of company shares can be shown by the large volume of stock transactions, while at a high stock price does not necessarily indicate a high transaction value as well. The amount of transaction volume is influenced by events/events both inside and outside the company (Nurwasari, 2020).

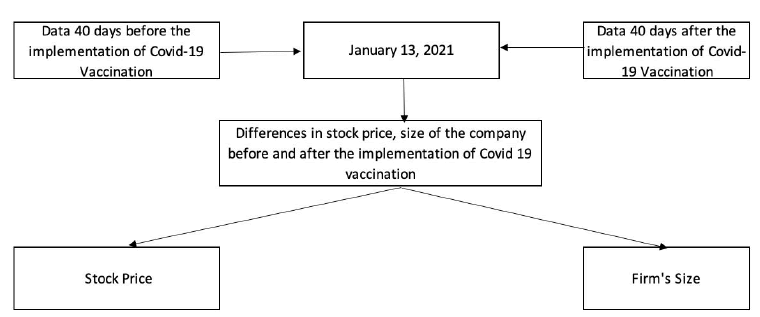

Covid-19 Pandemic

The term pandemic comes from the Greek meaning (pan) meaning all and (demos) means people, thus the meaning of pandemic is a disease that infects many people and spreads over a wide area or spreads throughout the world. As human civilization developed, so did infectious diseases. Large numbers of human populations living side by side in communities of neighbors and animals, often with poor sanitation and nutrition, are the source of these diseases developing. Then the cross-border trading system became a way of spreading infections and creating a global pandemic (Nursastri, 2020). According to the World Health Organization (WHO), Corona Virus Disease 2019 (COVID-19) is a new type of disease that has never previously been identified in humans; the virus attacks the respiratory tract and causes high fever, cough, flu, shortness of breath, sore throat, diarrhea and leads to death. The virus is very aggressively attacked from people who have been infected with the coronavirus to others who have not been infected. Coronavirus cases that occurred in Indonesia were first announced on March 2, 2020, the virus attacked very quickly until now, giving a threat not only to health but to threaten economic growth not only in Indonesia but to the entire country. The frame of mind used in this research is as follows (Figure 1):

Hypothesis

According to Sugiyono: The hypothesis is a temporary answer to the formulation of the problem in a study, where the formulation of the research problem is expressed in the form of a question sentence (Wenno, 2020). In this study there are two hypotheses, including the following:

H1: It is suspected that there is a difference in the share price of airlines after and before the implementation of the first COVID-19 vaccination in Indonesia.

H2: It is suspected that there is a difference in transaction volume on airlines after and before the first COVID-19 vaccination in Indonesia.

Research Methodology

This study uses secondary data on stock prices and transaction activity on Indonesian airlines 40 days after and before the Covid-19 vaccination on January 13, 2021. This study used stock price and transaction volume data from https://finance.yahoo.com/. The stock price utilized is the closing price. The daily closing price data of the shares used. A paired sample t-test was utilized. This test measures how much the stock price and volume of stock transactions on Indonesian airlines have changed, before the implementation and after the implementation of the covid-19 vaccination in Indonesia. The SPSS version 25 was used to analyze the data. The variables in this study were:

1. Share Price Data prior to the implementation of the first covid-19 vaccination in Indonesia (X1). Data for the first time in Indonesia prior to the introduction of Covid-19 vaccine contain data on stock prices and volume of transaction on airlines in Indonesia. In this study, the data gathered in Indonesia before immunization with Covid 19 are 40.

2. Data after the implementation of the first covid-19 vaccination in Indonesia (X2). Data after the first covid-19 vaccine in Indonesia includes stock prices and transaction volume on airlines. The data collected after the adoption of covid-19 immunization in Indonesia included 40.

3. Announcement of the implementation of Covid-19 vaccination in Indonesia for the first time starting from January 13, 2021, which is when the government carries out the first vaccination in Indonesia

Analysis and Discussion

Descriptive Statistics Research Variables

Descriptive statistics can be used to see how a data is portrayed. The Paired Sample t-test shows whether a paired sample undergoes significant changes. The significant values of the Paired Sample t-test findings are determined. The study's decisions are based on this number. A difference of 0.05 or more between the initial and final variables is considered significant. A significant influence on the treatment differences for each variable. This means that the beginning and final variables are not significantly different. This had no effect on the treatment differences between variables.

Paired Samples Statistics

Each variable in a paired sample is described in the Paired Samples Statistics table. Here's the Paired Samples Statistics table 1 in this study:

| Table 1 Paired Samples Statistics |

|||||

|---|---|---|---|---|---|

| Mean | N | Std. Deviation | Std. Error Mean | ||

| Pair 1 | Stock Price Before Vaccine | 295.4500 | 80 | 115.91353 | 12.95953 |

| Stock Price After Vaccine | 265.1500 | 80 | 84.18712 | 9.41241 | |

| Pair 2 | Transaction Volume Before Vaccine | 5.329E+10 | 80 | 8.181E+10 | 9.15E+09 |

| Transaction Volume After Vaccine | 1.042E+10 | 80 | 1.902E+1 10 | 2.13E+09 | |

Stock price prior to COVID-19 immunization pair 1.1 averages 295.45 out of 80 data points. The standard deviation of the data is 115,913, with a standard error of 12.96. (Stock price following COVID-19 immunization) averages 265.15 out of 80 data points. The standard deviation of the data is 84.19, with a standard error of 9.41. The data in pair 1.1 is higher than in pair 1.2. Pair 1.1 has a broader spread range than pair 1.2, and its standard error is higher than pair 1.2. 5 329 out of 80 data points for pair 2.1 (Transaction volume prior to COVID-19 immunization). The standard deviation of the data is 8,181, with a standard error of 9.147. 1 042 out of 80 data points in pair 2.2 (Transaction volume following COVID-19 immunization). The standard deviation of the data is 1,902, with a standard error of 2.126. The data in pair 2.2 is higher than in pair 2.1. Pair 2.2's spread range is greater than pair 2.1's, and its standard error is lower than pair 2.

Paired Samples Test

The Paired Samples Test table is the main table of outputs that show the results of the tests performed. This can be seen from the significance value (2-tailed) in the table 2 below:

| Table 2 Paired Samples Test |

||||||||

|---|---|---|---|---|---|---|---|---|

| Mean | Std. Deviation |

Std. Error Mean |

95% Confidence Interval of the Difference | t | df | Sig.(2- tailed) |

||

| Lower | Upper | |||||||

| Pair 1 Stock Price Before Vaccine - Stock Price After Vaccine | 30.30000 | 53.86537 | 6.02233 | 18.31285 | 42.28715 | 5.031 | 79 | 0.000 |

| Pair 2 Transaction Volume Before Vaccine - Transaction Volume After Vaccine | 4.287E+10 | 7.775E+10 | 8.6927E+9 | 2.557E+10 | 6.017E+10 | 4.932 | 79 | 0.000 |

The significance value (2-tailed) above the result for pair 1 (Stock price after and before the COVID-19 vaccination) result is 0.000 (p<0.05). So that the results undergo significant changes. The significance value (2-tailed) above the result for pair 2 (Transaction volume after and before the COVID-19 vaccination) result is 0.000 (p<0.05). So that the results undergo significant changes.

Paired Samples Correlations

Paired Samples Correlations show correlation values that indicate the relationship of the two variables in a paired sample. This is derived from the Pearson bivariate correlation coefficient (with a two-sided significance test) for each pair of variables entered. The following Table of Paired Samples Correlations can be seen in Table 3.

| Table 3 Paired Samples Correlations |

||||

|---|---|---|---|---|

| N | Correlation | Sig. | ||

| Pair 1 | Stock Price Before Vaccine & Stock Price After Vaccine | 80 | 0.903 | 0.000 |

| Pair 2 | Transaction Volume Before Vaccine & Transaction Volume After Vaccine | 80 | 0.324 | 0.003 |

Discussion

Differences in Share Prices in Indonesian Airlines after and before the First Vaccination in Indonesia

Table 2 shows the results of the data from the paired sample t-Test of stock prices operated with SPSS version 25. In table 2, it is seen that the signification value is 0.00. The signification result is less than 0.05. This value indicates that Ha1 was accepted and H01 was rejected, which means that there is a significant difference between the share price of the Indonesian Airline Company, after and before the airline in Indonesia after and before the implementation of the covid-19 vaccination. Table 2 also indicates an average stock price difference in Indonesia airlines after and before the execution of the Covid-19 immunization at 30.30 a.m. This value is positive, indicating that the stock price before the vaccine is greater than the average stock price after the vaccine. The covid-19 vaccine has decreased the average share price of Indonesian airlines.

Airlines have suffered a considerable drop in inventory prices in Indonesia owing to covid-19 immunization. The government is asking people to stay home to prevent the spread of Covid 19 so that Indonesian airlines begin to decrease to have an influence on stock price declines. This is obviously negative for investors because investors have a big possibility not to collect a dividend and may suffer higher losses.

Conditions faced by airlines in Indonesia at this time, among others: The purchasing power of air freight services decreased; "financial difficulties"; not all aircraft are operated or will be operated after covid-19; Payment of aircraft rental due to financial difficulties and weak rupiah exchange rate is also considered to be very influential on changes in stock prices.

Difference in Transaction Volume at Indonesian Airlines after and before the Implementation of the First Vaccination in Indonesia

The results of descriptive statistical calculations of transaction volume after and before the implementation of vaccination for the first time in Indonesia, indicated by table 1. From the table, it shows that the average value of transaction volume before the first vaccination in Indonesia is 5.329E+10 and the average value of transaction volume after the first vaccination in Indonesia is 1.042E+10. The data taken is 40 data before and 40 data after the announcement of the implementation of the first vaccination in Indonesia in Indonesia. If we look at the average value in table 1, there is a decrease in the volume of transactions of shares sold after the implementation of the first vaccination in Indonesia. To see the difference in transaction volume after and before the implementation of vaccination for the first time in Indonesia is done using the paired sample t-Test. This test is processed using SPSS version 25, which can be seen in table 2. In the table, it appears that the signification value is 0.00, this value is smaller than 0.05. Based on the signification value, H02 is rejected and Ha2 is accepted. From the results of the test means that there is a significant difference between the volume of transactions on Indonesian airlines after and before the implementation of the first vaccination in Indonesia. Table 2 also indicates the difference between the average transaction volume value on Indonesian Airlines and the top 4.287E+10 vaccines. The amount is positive, which means that the average value of the transaction value after implementation is less than the average value before the first immunization in Indonesia. This figure illustrates that the average number of share transactions in Indonesian airlines has increased for the first time due to vaccinations.

At this Indonesian Airline, there was a significant decrease in the volume of stock transactions due to the implementation of the first vaccination. The decrease in the volume of stock transactions occurred because investors were not sure to buy and sell shares on Indonesian airlines. This decrease in the volume of stock transactions, followed by a decrease in the stock price. The event showed that many investors were selling their shares, due to concerns that investors would suffer losses caused by the impact of the covid-19 pandemic despite vaccinations. Conditions faced by airlines in Indonesia at this time, among others: IATA predictions that predict new flights will begin to stabilize in 2023, uncertain economic conditions, employee job cuts or salary cuts; barriers to payment of debts and/or payment of aircraft leases due to financial difficulties; airlines cannot optimally carry out their functions as allegedly to influence the activity of this stock transaction in the investor's decision to conduct the transaction.

Conclusion

The conclusion obtained from this study is by the paired sample t-test, from the stock price of Indonesian Airlines. After and before the first vaccination, they showed significant differences. This is indicated by a signification value of 0.00<0.05. Likewise for the volume of Indonesian airline stock transactions. There is a significant difference from before the first vaccination with after the implementation of vaccination. This is indicated by a signification value of 0.01<0.05.

With the implementation of this vaccination has not been able to boost the stock price or transaction volume of the company. Therefore, for the company needs to make changes in the strategy of air ticket sales so that it will increase revenue and be able to attract investors to buy shares of the company. So that the stock price can rise again.

Conditions faced by airlines in Indonesia today include: Purchasing power of air freight services decreases; "Financial difficulties"; not all aircraft are operated or will be operated after covid-19; laying off or laying off employees or withholding salaries; barriers to payment of debt and/or payment of aircraft leases due to financial difficulties and a weak rupiah exchange rate; Airlines cannot optimally carry out their functions as "drivers" of the national/regional economy and as the "production engine" of the airport, digitization of the industrial revolution 4.0 also influences investor decisions to carry out activities in this aviation business.

Acknowledgment

This research was funded from DIPA Politeknik Penerbangan Indonesia Curug Fiscal Year 2021 with a contract with number 004/SPK/Penelitian/PPK/2/PPI-2021 dated February 1, 2021. Correspondents authors Nawang Kalbuana and can be contacted through nawang.kalbuana@ppicurug.ac.id.

References

Abadi, S., Endarto, B., Aji, T.R.B., Kurniawan, W., Daim, N.A., & Kalbuana, N. (2021). Indonesian desirious finality of the community in regard. Journal of Legal, Ethical and Regulatory Issues, 24(1), 1–10.

Aliyyah, N., Prasetyo, I., Rusdiyanto, R., Endarti, E.W., Mardiana, F., Winarko, R., … & Tjaraka, H. (2021). What affects employee performance through work motivation??Journal of Management Information and Decision Sciences, 24(1), 1–14.

Aliyyah, N., Siswomihardjo, S.W., Prasetyo, I., Rusdiyanto, I., Rochman, A.S., & Kalbuana, N. (2021). The effect of types of family support on startup activities in Indonesia with family cohesiveness as moderation. Journal of Management Information and Decision Sciences, 24(S1), 1–15.

Amankwah-Amoah, J. (2020). Note: Mayday, Mayday, Mayday! Responding to environmental shocks: Insights on global airlines’ responses to COVID-19. Transportation Research Part E: Logistics and Transportation Review, 143.

Amankwah-Amoah, J., Khan, Z., & Osabutey, E.L.C. (2021). COVID-19 and business renewal: Lessons and insights from the global airline industry. International Business Review, 30(3), 101802.

Bakhtiar, F., Farild, M., & Wahyudi, W. (2020). The impact of Covid 19 on the comparison of share prices and transaction volume of shares of telecommunication companies listed on the IDX. Journal of Iqtisaduna, 6(2), 167–174.

Devi, S., Devi, S., Warasniasih, N.M.S., Masdiantini, P.R., & Musmini, L.S. (2020). The impact of COVID-19 pandemic on the financial performance of firms on the Indonesia stock exchange. Journal of Economics, Business, & Accountancy Ventura, 23(2), 226–242.

Endarto, B. (2021). Global perspective on capital market law development In Indonesia. Journal of Management Information and Decision Sciences, 24, 1–8.

Endarto, B., Suhartono, S., Setyadji, S., Abadi, S., Aji, R.B., & Kalbuana, N. (2021). The obligations of legal consultants in the independent legal diligence of the capital market supporting proportion of legal prepparement. Journal of Legal, Ethical and Regulatory Issues, 24(1), 1–8.

Febriyanti, G., & Febriyanti, G.A. (2020). The impact of the Covid-19 pandemic on stock prices and trading volume activity (Case study of LQ-45 shares on the Indonesia Stock Exchange). Indonesia Accounting Journal, 2(2), 204–214.

Hastomo, W., Karno, A.S.B., Kalbuana, N., Meiriki, A., & Sutarno (2021). Characteristic parameters of epoch deep learning to predict Covid-19 data in Indonesia. Journal of Physics: Conference Series, 1933(1), 12050.

Herwany, A., Febrian, E., Anwar, M., & Gunardi, A. (2021). The influence of the COVID-19 pandemic on stock market returns in Indonesia stock exchange. Journal of Asian Finance, Economics and Business, 8(3), 39–47.

Indrawati, M., Utari, W., Prasetyo, I., Rusdiyanto, & Kalbuana, N. (2021). Household business strategy during the Covid 19 pandemic. Journal of Management Information and Decision Sciences, 24(1), 1–12.

Jannah, M., Fahlevi, M., Paulina, J., Nugroho, B.S., Purwanto, A., Subarkah, M.A., … Cahyono, Y. (2020). Effect of ISO 9001, ISO 45001 and ISO 14000 toward financial performance of Indonesian manufacturing. Systematic Reviews in Pharmacy, 11(10), 894–902.

Jyoti, G.B. (2021). Article ID: IJM_12_03_052 Cite this Article: Bidyut Jyoti Gogoi, Brand Performance in the COVID-19 Period. International Journal of Management (IJM), 12(3), 550–561.

Kalbuana, N., Prasetyo, B., Asih, P., Arnas, Y., Simbolon, S.L., Abdusshomad, A., … Mahdi, F.M. (2021). Earnings management is affected by firm size, leverage and Roa: Evidence from Indonesia. Academy of Strategic Management Journal, 20(2), 1–12.

Kalbuana, N., Suryati, A., Rusdiyanto, Azwar, Rudy, Yohana, … & Hidayat, W. (2021). Interpretation of Sharia accounting practices in Indonesia. Journal of Legal, Ethical and Regulatory Issues, 24(1), 1–12.

Kokeny, L., Kenesei, Z., & Neszveda, G. (2021). Impact of COVID-19 on different business models of European airlines.

Luwihono, A., Suherman, B., Sembiring, D., Rasyid, S., Kalbuana, N., Saputro, R., … Rusdiyanto. (2021). Macroeconomic effect on stock price: Evidence from Indonesia. Accounting, 7(5), 1189–1202.

Nursastri, S.A. (2020). How did the world's 5 worst pandemics end? History Recording. Tribunnews. com.

Nurwasari, I. (2020). The Impact of Covid-19 on changes in stock prices. Journal of Securities (Stocks, Economics, Finance and Investment), 3(3), 230–236. Crossref, Google scholar, Indexed at

Olivia, S., Gibson, J., & Nasrudin, R. (2020b). Indonesia in the time of Covid-19. Bulletin of Indonesian Economic Studies, 56(2), 143–174.

Pamuraharjo, H. (2020). Airlines as the "national air bridge" of the Republic of Indonesia, 1.

Prasetio, J.E., Sabihaini, B.B., Susanto, A.A., Rahmanda, G.A., Rusdiyanto., & Kalbuana, N. (2021). Corporate social responsibility community development and empowerment program In Indonesia. Journal of Management Information and Decision Sciences, 24(S1), 1–10.

Prasetyo, B., Utami, S., Abdusshomad, A., Wijaya, M., & Kalbuana, N. (2021). Effect of company value, leverage, and company size on profit persistence In Jakarta Islamic Index (JII) listed companies. International Journal of Economics, Business and Accounting Research (IJEBAR), 5(1), 128–136.

Prasetyo, I., Aliyyah, N., Rusdiyanto, Kalbuana, N., & Rochman, A.S. (2021). Corporate social responsibility practices in Islamic Studies in Indonesian. Journal of Legal, Ethical and Regulatory Issues, 24(1), 1–15.

Prasetyo, I., Aliyyah, N., Rusdiyanto, Nartasari, D.R., Nugroho, S., Rahmawati, Y., … & Rochman, A.S. (2021a). Impact financial performance to stock prices: Evidence from Indonesia. Journal of Legal, Ethical and Regulatory Issues, 24(1), 1–11.

Prasetyo, I., Aliyyah, N., Rusdiyanto, R., Nartasari, D.R., Nugroho, S., Rahmawati, Y., … & Rochman, A.S. (2021b). What affects audit delay in Indonesia?Academy of Entrepreneurship Journal, 27, 1–15.

Prasetyo, I., Aliyyah, N., Rusdiyanto, Suprapti, S., Kartika, C., Winarko, R., … & Al-asqolaini, M.Z. (2021). Performance is affected by leadership and work culture: A case study from Indonesia. Academy of Strategic Management Journal, 20(2), 1–15.

Prasetyo, I., Aliyyah, N., Rusdiyanto, Tjaraka, H., Kalbuana, N., & Rochman, A.S. (2021). Vocational training has an influence on employee career development: A case study Indonesia. Academy of Strategic Management Journal, 20(2), 1–14.

Prasetyo, I., Aliyyah, N., Rusdiyanto, Utari, W., Suprapti, S., Kartika, C., … & Kalbuana, N. (2021). Effects of organizational communication climate and employee retention toward employee performance. Journal of Legal, Ethical and Regulatory Issues, 24(1), 1–11.

Sparrow, R., Dartanto, T., & Hartwig, R. (2020). Indonesia under the new normal: Challenges and the way ahead, 56(3), 269–299.

Suryahadi, A., Al Izzati, R., & Suryadarma, D. (2020). Estimating the Impact of Covid-19 on Poverty in Indonesia.

Susanto, H., Prasetyo, I., Indrawati, T., Aliyyah, N., Rusdiyanto, Tjaraka, H., … & Zainurrafiqi. (2021). The impacts of earnings volatility, net income and comprehensive income on share price: Evidence from Indonesia stock exchange. Accounting, 7(5), 1009–1016.

(2021). Jokowi: Vaccination as an effort to free Indonesia from pandemic | antarnews.com | LINE TODAY.

Vinod, B. (2021a). Airline revenue planning and the COVID-19 pandemic. Journal of Tourism Futures.

Vinod, B. (2021b). The Evolution of Yield Management in the Airline Industry.

Wahyudin, A., Sari, M.P., Ardiansari, A., Raharja, S., & Kalbuana, N. (2021). Instrument design of small industry performance measurement in Semarang city with balanced scorecard concept. Academy of Accounting and Financial Studies Journal, 25(3), 1–9.

Wenno, M. (2020). The Impact of COVID-19 on changes in share prices and transaction volume (Case Study at PT. Bank Mandiri. Tbk). SOSOQ Journal Number, 2(8), 84–91.

(2021). COVID live update: 222,784,021 cases and 4,600,242 deaths from the Coronavirus - Worldometer.

Yohana., Kalbuana, N., Solihin., & Yanti, D.R. (2020). The Influence of capital intensity, firm size, and leverage on tax avoidance on companies registered In Jakarta Islamic Index (JII) Period 2015-2019. International Journal of Economics, Business and Accounting Research (IJEBAR), 4(03).

Received: 26-Nov-2021, Manuscript No. AAFSJ-21-8402; Editor assigned: 29- Nov -2021, PreQC No. AAFSJ-21-8402 (PQ); Reviewed: 17-Nov-2021, QC No. AAFSJ-21-8402; Revised: 25-Dec-2021, Manuscript No. AAFSJ-21-8402 (R); Published: 03-Jan-2022