Research Article: 2022 Vol: 21 Issue: 3

Identifying and Ranking the Components Entrepreneurial Ecosystem Suitable For Growing Startups in the Smart City

Abuzar Allah Karami, Islamic Azad University

Saeid Kamiabi, Islamic Azad University

Mohammad Reza Zand Moghadam, Islamic Azad University

Citation Information: Karami, A.A., Kamiabi, S., & Moghadam, M.R.Z. (2022). Identifying and ranking the components entrepreneurial ecosystem suitable for growing start-ups in the smart city. Academy of Strategic Management Journal, 21(S3), 1-19.

Abstract

This study is conducted to identify the components of the entrepreneurial ecosystem suitable for the growth of start-ups in the smart field. This study is applied in terms of purpose and descriptive-survey in terms of data collection. Key factors in the development process of start-up growth in the smart city are identified using the library research method, i.e. reviewing scientific articles and texts. A field study is used to distribute the questionnaires to prioritize the factors using the best-worst method (BWM) and a formula is used to calculate the inconsistency ratio to check the validity of the relevant comparisons. The statistical population includes business experts and managers of academic knowledge-based companies throughout Iran. Cochran's formula is used to calculate the sample size. The sample consisted of 215 experts who are selected by the fuzzy Delphi method and 138 knowledge-based companies. Data are analyzed using operational research (OR) techniques. Criteria and indicators are prioritized using ANP and DEMATEL fuzzy multi-criteria decision-making models. Excel software is used to perform calculations related to the DEMATEL technique, and the ANP technique is performed using Super Decision software. The components are examined from four aspects. The results indicate that the optimal portfolio composition ranks first, taking the advantage of the expert opinions ranks second, allocating and lending rank third, directing loans and facilities to production ranks fourth, bank arrears rank fifth, human resource management (HRM) ranks sixth, the capital market of start-up entrepreneurial ecosystem ranks seventh, and liquidity creation ranks eighth.

As a result, it can be stated that; Establishing stable stability in the foreign exchange market, controlling foreign exchange fluctuations and transition to the same exchange rate system after providing the necessary prerequisites, facilitating foreign exchange transfers and streamlining the flow of exports and imports of goods and services in order to reduce the concentration of trade model Reducing the harms in this area is one of the most important policies of start-ups along with social responsibility in order to develop entrepreneurship in the framework of the realization of the document of components of the entrepreneurial ecosystem suitable for the growth of start-ups.

Keywords

Ecosystem, Entrepreneurship, Start-up, Smart City.

Introduction

In recent years, there has been no appropriate and sustainable growth in the field of entrepreneurship and small and medium-sized enterprises (SMEs) in Iran, despite the efforts made to develop entrepreneurship. Many entrepreneurs in Iran, unfortunately, face obstacles such as changing government policies, applying tasteful policies, unhealthy business environment, instability of government managers and employers, inappropriate and unsupportive laws, lack of environmental security, lack of business infrastructure, lack of support for entrepreneurship by social and cultural norms, inadequate market, high interest rates on bank loans, and so on. These barriers have created an unfavorable business environment for them. These problems prevent most potential entrepreneurs from starting their business, or cause those who have started a business to stop or in the middle of the road or, eventually, leave. Therefore, in Iran, only 10% of entrepreneurs succeed in starting their business activities, and the remaining 90% stop at the startup stage. In general, the political, social, cultural, and economic conditions of today's Iranian society do not motivate people to become entrepreneurs. Therefore, just encouraging some people to become entrepreneurs and supporting incubators are not enough to promote entrepreneurship. The development of entrepreneurship in the smart city requires preparation in various cultural and social fields, cooperation of educational systems, administrative and financial structures, and other support mechanisms so that economic, cultural, social, and regulatory factors related to entrepreneurship are considered simultaneously, and all dimensions are taken into account in formulating entrepreneurship development policies. Development is always the main axis of policies and programs of different countries, and the two important ways to pursue it are to provide optimal conditions for entrepreneurship and technology development (Isenberg, 2011; Cross-border virtual incubator, 2013; Aspen Network of Development Entrepreneurs (ANDE, 2013). Although the pursuit of these two categories (entrepreneurship and technology) is important in itself, their combination, known as technology entrepreneurship, has the greatest impact on development, competitiveness, prosperity, progress, and even justice in different societies. The development of technology entrepreneurship depends on the existence of favorable conditions and a suitable context that must be identified and explained according to specific national or regional characteristics.

Iran, with its special features such as vast natural resources, young and educated human resources, and the quasi-governmental economic structure that strives to achieve efficiency-oriented growth (World Economic Forum, 2016; Monitor, 2016), faces relative backwardness in general in terms of entrepreneurship and technology, and in particular in terms of technology entrepreneurship as an important path to endogenous growth and development. Some significant problems in this regard include severe weaknesses in government policies and operational plans, underdeveloped commercial and legal infrastructure, inadequate funding (Global Entrepreneurship Research Association (GERA, 2016) as well as weaknesses in innovation indicators (Cornell University, 2016; Global Development and Entrepreneurship Institute (GDEI), 2017) and technological readiness (World Economic Forum, 2016). Such shortcomings have also been mentioned in field studies such as the report of the Iran Entrepreneurship Association (IEA) (2013). These conditions indicate the need for comprehensive and appropriate attention to the context and environment of entrepreneurship and technology in Iran, which has been strongly emphasized in the upstream documents of the country, such as science and technology policies as well as the resistive economy.

One of the important steps in the development of technology entrepreneurship in the country is to adopt an ecosystem approach, which means considering the interaction system between entities and their environment (Tansley, 1935). Although this approach has not yet been precisely conceptualized in the field of technology entrepreneurship, attention to other related areas, including the Entrepreneurial Ecosystem such as the Isenberg (2010) Framework and Ahmad & Hoffman (2008), the innovation ecosystem such as the European Commission (2014) and technology entrepreneurship models such as Hartlapp et al. (2014) Storm et al. (2017) can be an important basis for understanding and structuring this ecosystem to have a positive impact on development and reform strategies, policies, and programs.

From one perspective, the issue of an entrepreneurial ecosystem can be considered in environmental research and the field of entrepreneurship. However, it is worth noting that the introduction of the concept of the ecosystem in the field of entrepreneurship is accompanied by the development of theoretical foundations and fundamental approaches (including the complexity theory) that differentiate the category of the entrepreneurial ecosystem from research in the entrepreneurial environment. Whitehurst et al. (1988) was one of the first researchers to use the term entrepreneurial ecosystem in the informal report of his study. In addition to pointing to the factors affecting the formation of startups, including the talented entrepreneur, the state of the environment, and market conditions, by adopting an approach focused on entrepreneurial personality traits and their effect on the ecosystem, he describes the entrepreneur as a person with complex characteristics who has a special tendency to take risks and is aware of opportunities and resources. Neck et al. (2004) conducted a study on the roles of incubators in the formation and development of startups in the Boulder area. They identified environmental factors that accelerate entrepreneurship in an area, such as informal networks, universities, government, support services, corporate finance, talent, physical infrastructure, and culture, and finally provided an evolutionary perspective on entrepreneurial ecosystems. According to various references, Daniel Isenberg is the first researcher to study the entrepreneurial ecosystem (and not the entrepreneurial environment) systematically and specifically. Based on his extensive experience in a 2010 study in Harvard Magazine, he introduced the core idea of the entrepreneurial ecosystem as a set of specific and necessary components for entrepreneurial activities such as leadership, culture, finance, and capital, which are intricately intertwined. He argued that the general components of this ecosystem consisted of six main dimensions, including

1. Politics (leadership and government),

2. Financial resources,

3. Culture (entrepreneurial success stories and social norms),

4. Infrastructural, professional, and non-public support,

5. Human capital (education and staff), and

6. Markets (networks and primary customers), which generally have about 5 components (Isenberg, 2011).

Suresh & Ramraj (2012) focused on the most basic question in the field of entrepreneurship, i.e. the inherent nature of entrepreneurship or the possibility of training entrepreneurs, and by pointing to the importance of environmental factors in entrepreneurial decision-making; they developed an ecosystem conceptual framework that encourages people to start a new business. They identified the main factors of this ecosystem using the text review method and then categorized the main components of the entrepreneurial ecosystem into 4 groups: moral support, financial support, technology support, market support, social support, network support, government support, and environmental support by conducting qualitative case interviews (in-depth interviews with entrepreneurs) as well as a pilot study. Referring to the importance and role of entrepreneurial ecosystems in the emergence of high-growth entrepreneurship, Spigel (2017), introduced eleven specific features (factors) in three groups for such an ecosystem, including

1. Cultural (cultural attitude and history of entrepreneurship),

2. Social (networks, financial capital, mentors, liaisons, and work talents), and

3. Material (universities, services, support facilities, politics, government, and open markets).

The innovation ecosystem includes a set of local factors and dynamic processes that interact to meet complex challenges. This ecosystem is a dynamic and interactive network that leads to the development of innovations and can refer to local hubs, global networks, and even technology platforms. Hwang & Harowitt (2012) introduced a special approach called tropical forests in the field of the innovation ecosystem, which consists of hard factors (people, professionals, infrastructure, and politics) and soft factors (diversity, meta-rational motivations, social trust, tropical forest rules, and interpretation of rules). Texts related to the innovation ecosystem and extracted 9 main dimensions from their analysis including resources, governance, strategy, leadership, organizational culture, human resource management, people, technology, and partners to explain the success factors in implementing the innovation ecosystem. Accordingly, governance was the most important dimension, followed by strategy, leadership, culture, and partners, respectively, as key factors in the success of the innovation ecosystem, which are also closely related to the governance dimension. In a comprehensive review of the literature, Rabelo et al. (2015) identified 9 specific dimensions as factors affecting the evolutionary development of innovation ecosystems, including actors (government, academia, industry, support institutions, entrepreneurs, financial system, individuals, and customers), capital, infrastructure, rules, knowledge, ideas, communication channel, culture, and structural principles.

Technology Entrepreneurship has been conceptually broader and more evolved since the topic was introduced in the academic literature at the 1970 Entrepreneurship Conference at Purdue University, USA (Lotz, 2006; C?t?lin et al., 2017) so that it is necessary to take a comprehensive approach to study it. Byers et al. (2011) defined technology entrepreneurship as the establishment of new companies to take advantage of technological innovations, including the identification of attractive and commercializable technological opportunities, resource gathering, rapid growth management, and risk management.

In addition to grading studies on technology entrepreneurship at the individual, organizational, and systemic levels, Gupta et al. (2015) included the technology entrepreneurial ecosystem in the systemic research, which means the interaction and exchange of resources between different actors in the ecosystem. Referring to some previous studies, they categorized the factors of entrepreneurial success into two groups: individual factors (customer interaction and networking, technical skills, success, etc.) and environmental factors (government policies, public investors, business angels, culture, transnational society, etc.). Emphasizing the technology entrepreneurial ecosystem and the relationship between information technology and this ecosystem in a specific region in Romania, Roja pointed to the importance of technology and entrepreneurship growth in economic and social growth and sustainability of countries and stressed the need for a competitive business environment to create new organizations, create value, ideation, and optimal implementation of ideas. He referred to such an environment as the technology entrepreneurial ecosystem and introduced two sets of factors for this ecosystem, including non-entrepreneurial factors (markets, innovation system, infrastructure, regional factors, policies, laws, and startups) and entrepreneurial factors (education, culture, support services, promotion, transparency, networks, communities, capital, financing, incubators, and accelerators) with reference to the opinions of some reputable researchers in the field of entrepreneurship (Feld, 2020; Storebø et al., 2015). Therefore, entrepreneurship development requires a network of different elements that Isenberg refers to as the entrepreneurial ecosystem. The entrepreneurial ecosystem in a smart city refers to elements, individuals, organizations, or institutions that can act as motivators or barriers for individuals to become entrepreneurs. Such an ecosystem contains many elements that can be grouped into six main categories, including markets, politics, financial capital, culture, support, and human capital. In this regard, this study is conducted to answer the following questions:

1. What is the model of the entrepreneurial ecosystem for the growth of startups along with the promotion of corporate social responsibility (CSR) in the smart city?

2. What are the dimensions of the entrepreneurial ecosystem for the growth of startups along with the promotion of CSR in the smart city?

3. What are the components of each dimension of the entrepreneurial ecosystem for the growth of startups along with the promotion of CSR in the smart city?

What is the importance of components of each dimension of the entrepreneurial ecosystem for the growth of startups along with the promotion of CSR in the smart city?

Theoretical Foundations

Entrepreneurship refers to the process of creating new material or spiritual values through a committed effort, taking into account the risks involved (Wilke et al., 2017).

An ecosystem is a set of centralized cultural perspectives, social networks, financial support, universities, and active economic policies that create risky business support environments.

The entrepreneurial ecosystem refers to elements (individuals, organizations, or institutions) outside the entrepreneur who are the stimuli or obstacles to a person's decision to become an entrepreneur or the probability of his/her success if he/she starts an entrepreneurial business. The entrepreneurial ecosystem creates an environment that encourages entrepreneurial endeavors. It can also be described as a physical environment where relatively large elements affect the emergence and growth of businesses. However, there is not a single combination of these elements that make up the entrepreneurial ecosystem.

According to Longmore et al. (2013) an entrepreneurial ecosystem includes a variety of components that strongly affect entrepreneurship. These components include three categories, which are described below (Tables 1 and 2):

| Table 1 Factors other than the Entrepreneur | |

| Infrastructure | Government laws and regulations |

| Physical infrastructure | Political frameworks |

| Educational institutions (such as universities) | Immigration and labor law |

| Energy, Telecommunications, and ICT | Property rights |

| Transportation and logistics | Freedom of the people |

| Workspace | Economic development and location of the geographical area |

| Innovation | Potential for living in the area |

| Knowledge and skills | Market living costs |

| Research and development | Customers |

| IP | Competitors |

| Published scientific papers | Distribution channels |

| Technology transfer | supply |

| New processes and methods | Large companies (as customers or strategic partners) |

| Entrepreneurship level | |

| Support | Financing |

| Accounting and Legal | Accelerators |

| Instructors and consultants | Business Angels, FFFS, and VCS |

| Export support | Debt |

| Work and talent | Microfinancing |

| Cluster (Science and Technology Park) | Private Equity |

| Foundations of education | Loans and first aid |

| Entrepreneurship degree | Smart investment |

| Skills training, and network certifications | Cultural investment |

| Formal Networks: Organizations, and Institutions | Mentality, ambition, drive, and creativity. |

| Informal Networks: Friends, Family, and Colleagues | Models of knowledge |

| Entrepreneurship Associations and Organizations | Self-improvement skills |

| Group networks (e.g., Women Entrepreneurs Networks) | Entrepreneurial social status |

| Tolerance of failure and risk of tolerance towards success | |

| Role of Entrepreneurs | |

| Entrepreneurial actors | |

| Entrepreneurial actors | |

| Serial Entrepreneurs | |

| Table 2 Entrepreneurial Ecosystem Health Indicators | ||

| Risk acceptance | Startup skills | Understanding the opportunity |

| Cultural support | Opportunity-based business | Networking |

| Human capital | High-growth businesses | Technology absorption |

| Process innovation | Product innovation | Competition |

| Venture capital | Internationalization | |

1. Non-entrepreneurial areas such as organizational infrastructure, governments, regulation, market, innovation, and geographical location;

2. Entrepreneurial areas such as financing, education, startups, etc.;

3. Entrepreneurial factors at the individual level.

The role of educational institutions (universities) in the ecosystem of entrepreneurship In the meantime, the key role is played by educational institutions that have the ability to develop and promote entrepreneurial innovation at all levels and in all communications. In this position, educational institutions can play a constituent role in motivating and creating an entrepreneurial ecosystem. Considering the importance of health, and the dynamism of the entrepreneurial ecosystem in fostering change and creating positive social effects on a larger scale, Babson's approach to entrepreneurship education, including traditional entrepreneurship programs that involve startups through organizations and resources through clusters. It changes the creation of an entrepreneurial approach and attitude through entrepreneurial thinking and behavior. In this way, we can stimulate economic growth, development, and improve prosperity by creating more entrepreneurship in the region, and sustaining it over the years. Babson Entrepreneurship Ecosystem Project supports and motivates entrepreneurship and grows the entrepreneurial environment. Studies show that new businesses are the main drivers of economic growth, social inclusion, innovation, and quality of life. It is necessary to create innovative activities through the creation of entrepreneurial universities.

Rizwan et al. (2014) in the field of entrepreneurship ecosystem has explained the development path of this view. Entrepreneurial ecosystem approach has been formed over the past 4 years. Its main distinguishing feature is the focus of the entrepreneurial approach, not the organization.

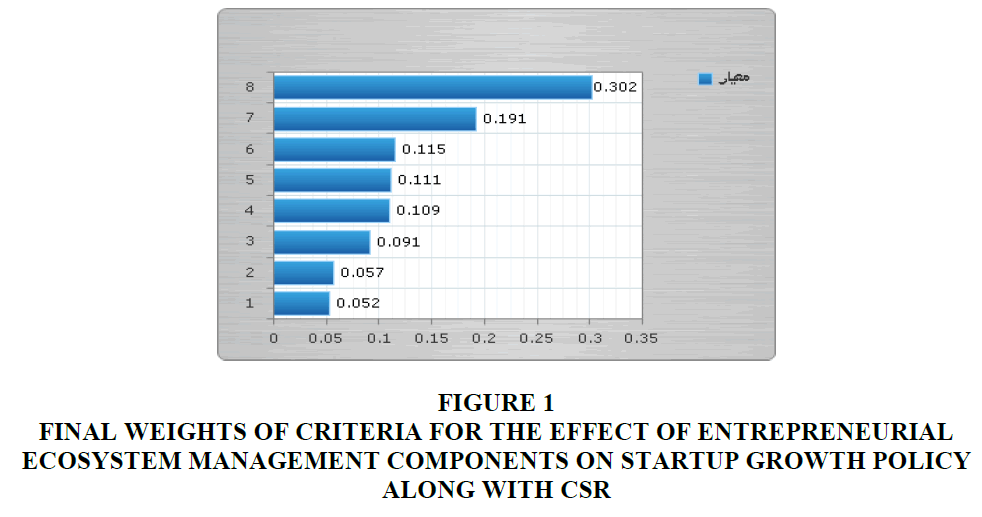

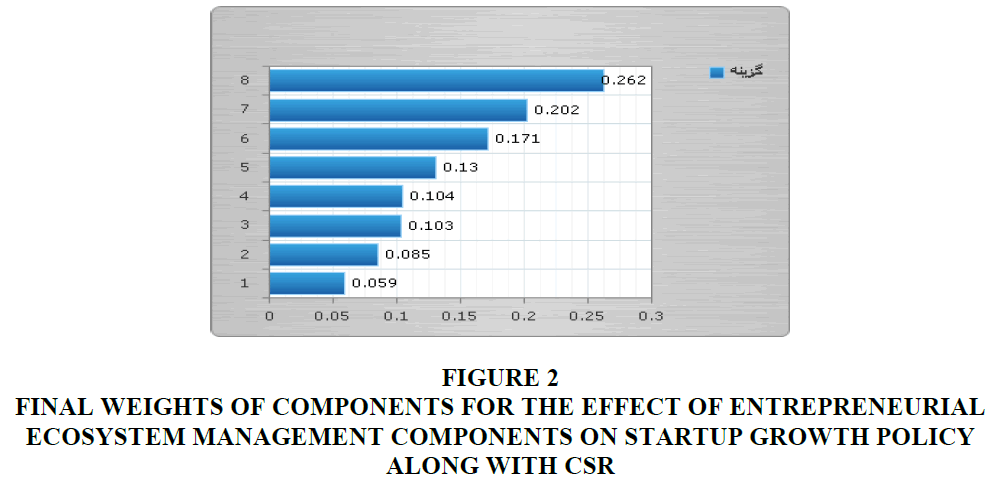

Manyika et al. (2011) consider the following key characteristics as the prerequisites for the emergence and growth of higher-growth firms. Entrepreneurial ecosystems are usually created in neighborhoods that are area-specific assets. The growth of the entrepreneurial ecosystem is due to the entrepreneurial output process. Cultural aspects, such as giving, before taking something that facilitates the sharing of knowledge, also play an important role in shaping an entrepreneurial ecosystem. According to Funke, the eleven main axes are the builders of the entrepreneurial ecosystem, which is drawn in Figures 1 and 2.

Figure 1 Final weights of Criteria for the Effect of Entrepreneurial Ecosystem Management Components on Startup Growth Policy along with CSR

Figure 2 Final Weights of Components for the effect of Entrepreneurial Ecosystem Management Components on Startup Growth Policy along with CSR

Rizwan et al. (2014) state that entrepreneurship development must be comprehensive, holistic and sustainable. Entrepreneurship development requires the provision of various cultural, social, economic, and, on the other hand, cooperation systems, educational systems, structures, administration, finance, and other support mechanisms. The authors also explored various aspects of technological entrepreneurship, including Mohammadi and Momayez, which identified the key factors in the success of social technology entrepreneurship in providing services to the disabled. The results of this study, access to six groups of factors related to education, standardization, monitoring and feedback systems, networking, technological innovation, technology management, alliance with growth centers, team dynamics and marketing were selected as key success factors.

The main category of the process is the intention to control the old technology, which is formed by causal factors such as understanding the weakness of technology and its lack of support. The infrastructure, incubators, academia, and its role in establishing the university's reproductive companies. Growth centers can improve their performance by following the example of top centers, communicating with institutions such as universities and government agencies, and having a holistic approach. Growing importance of these companies necessitates the development of a comprehensive set of supportive policies to assist in the formation, growth and removal of barriers. The indicators of "university entrepreneurship" are units of "strategic information" in the planning of academic entrepreneurship development. To achieve the research goal, Delphi technique was used in three periods. Indicators were classified and ranked in the form of five components: Investing in University Entrepreneurship (1 Indicators), Performance of Academic Entrepreneurial Activities (2 Indicators) and Outcomes and Consequences (3 Indicators).

Methodology

The study is conducted using a type of partially integrated mixed based on the view of Tashakkori & Teddelie (2009) and Teddlie & Tashakykori (2011). The collected data are analyzed according to their type by content analysis, descriptive statistics, and combined coding. In the following, according to the obtained data from library resources and entrepreneurship documents in smart cities, two design and planning tools "Fuzzy ANP" and "Expert Choice" are used to advance entrepreneurship programs, which are reviewed in detail below.

The statistical population includes business experts and managers of academic knowledge-based companies throughout Iran, and Cochran's formula is used to calculate the sample size. The sample consisted of 215 experts who are selected by the fuzzy Delphi method and 138 knowledge-based companies (Table 3 and 4).

| Table 3 Demographic Characteristics of the Interview Participants | ||||

| Raw | Key informant | Field of Study | Academic level | Gender |

| 1 | Policymaker and a member of the Academy of Sciences | Physics | Professor | Male |

| 2 | Former Deputy Minister of Science, Research and Technology and former Member of Parliament | Physics | Professor | Male |

| 3 | President of the mother university of the province | Urban Planning | Professor | Male |

| 4 | President of the mother university of the province | Ecology | Associate Professor | Male |

| 5 | Director-General of the Cultural Heritage, Handicrafts and Tourism Organization of Iran | Islamic knowledge | Assistant Professor | Female |

| 6 | Expert Professor | Higher Education Management | Assistant Professor | Male |

| 7 | Expert Professor and Vice-Chancellor of the University | Educational Management | Associate Professor | Male |

| 8 | Expert Professor | Systems Management | Associate Professor | Male |

| 9 | Director of the University Incubator | Telecommunication Engineering | Assistant Professor | Male |

| 10 | Director of the University Incubator | Biotechnology | Assistant Professor | Female |

| 11 | President of the University Entrepreneurship Center | Public Administration | Associate Professor | Male |

| 12 | Director of the Office of Scientific, Industrial, and Technological Cooperation | Chemical Engineering | Associate Professor | Male |

| 13 | President of the University Science and Technology Park | Metallurgical Engineering | Professor | Male |

| 14 | President of the University Science and Technology Park | Information Engineering | Assistant Professor | Male |

| 15 | Deputy of Planning of Industrial Company | Industrial Engineering | Ph.D. | Male |

| 16 | Quality Manager of the Industrial Company | Electrical Engineering | Masters | Male |

| 17 | Ph.D. by Research | Higher Education Development Planning | Ph.D. student | Female |

| 18 | Ph.D. by Research | Higher Education Development Planning | Ph.D. student | Female |

| 19 | Ph.D. by Research | Higher Education Development Planning | Ph.D. student | Male |

| 20 | Ph.D. by Research | Higher Education Management | Ph.D. student | Male |

| Table 4 Sample Size by Faculty and Industry | ||||

| Frequency | Sample Departments | Managers and faculty members | Ph.D. by Research | Total |

| Shahid Beheshti University | Political Science and Economics | 27 | 12 | 39 |

| Physics | 29 | 16 | 26 | |

| Entrepreneurship | 22 | 6 | 28 | |

| University of Tehran | Educational Sciences and Psychology | 33 | 18 | 51 |

| Trabiat Modares University | Agriculture | 44 | 17 | 41 |

| Law | 10 | 7 | 17 | |

| Industry Department | - | - | - | 13 |

| Total | - | 165 | 76 | 215 |

Data collection methods in this study are generally divided into two categories: library research and field. Data related to the subject literature are collected by the library research method, and data to confirm or reject the hypotheses are collected by the field method. The tools used to collect data include interviews and questionnaires. The fuzzy Delphi technique is used to identify, screen, and finalize the value creation indicators of knowledge-based companies for entrepreneurship development.

The percentage of agreement within the topic is used as an indicator of the reliability of the analysis. The acceptable minimum for the instrument's reliability coefficient is 2%. This value is considered by most researchers as a percentage of reliability. It is the weight agreement between the two coders that determines the data's reliability. The identified criteria and indicators are prioritized using a technique based on pairwise comparisons, namely fuzzy ANP. Internal and causal relationships between the identified criteria are determined based on the fuzzy DEMATEL technique. According to what was stated in Theoretical Foundations, the following components are extracted as components of the entrepreneurial ecosystem for the growth of startups along with the promotion of CSR in the smart city:

Results

Pairwise comparison questionnaires are designed and distributed among experts to achieve the objectives of the study. Due to the fuzzy approach used, the verbal expressions and fuzzy numbers listed in Table 5 are used.

| Table 5 Fuzzy Spectrum and Corresponding Verbal Expressions | ||

| Code | Verbal expressions | Fuzzy number |

| 1 | Equal preference | (1,1,1) |

| 2 | Low to moderate preference | (1,1.5,1.5) |

| 3 | Moderate preference | (1,2,2) |

| 4 | Moderate to high preference | (3,3.5,4) |

| 5 | High preference | (3,4,4.5) |

| 6 | High to very high preference | (3,4.5,5) |

| 7 | Very high preference | (5,5.5,6) |

| 8 | Very high to quite high preference | (5,6,7) |

| 9 | Quite high preference | (5,7,9) |

In this software, the method proposed by Gogos and Butcher is used to calculate the inconsistency ratio, which is described below.

The names of the items and their notations are shown in Table 6.

| Table 6 The Names of the Items and Their Notations | |

| Item | Notation |

| A1 | |

| A2 | |

| A3 | |

| A4 | |

| A5 | |

| A6 | |

| A7 | |

| A8 | |

In this software, the method proposed by Gogos & Butcher is used to calculate the inconsistency ratio, which is described below.

Two matrices (median and fuzzy number range) are derived from each fuzzy matrix and that the inconsistency ratio of each matrix be calculated based on the method proposed by Saaty to calculate the inconsistency ratio. The steps for calculating the inconsistency ratio of fuzzy pairwise comparison matrices are as follows:

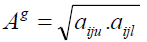

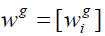

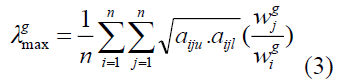

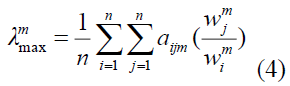

Step 1. In the first step, the fuzzy triangular matrix is divided into two matrices. The first matrix consists of the middle numbers of triangular judgments  and the second matrix consists of the geometric mean of the upper and lower limits of triangular numbers

and the second matrix consists of the geometric mean of the upper and lower limits of triangular numbers

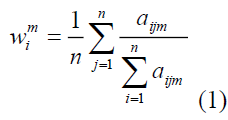

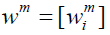

Step 2. The weight vector of each matrix is calculated using the method proposed by Saaty as follows.

Where

Where

Step 3. The largest eigenvalue for each matrix is calculated using the following equations.

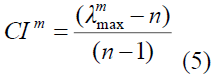

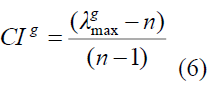

Step 4. The consistency index (CI) is calculated using the following equations:

Step 5. CI is divided by the value of the random index (RI) to calculate the inconsistency ratio (CR). If the resulting value is less than 0.1, the matrix is consistent and usable. Saaty formed 100 matrices with random numbers under the condition that the matrices were reciprocal, and calculated their inconsistency ratios and averages to obtain the RI values. However, since the numerical values of fuzzy pairwise comparisons are not always integers, and even if they are, the geometric mean generally converts them to integers, even if the method proposed by Saaty is used, Saaty's RI table cannot be used. So Gogus & Butcher again generated the Random Index (RI) Table 7 for fuzzy pairwise comparison matrices by generating 400 random matrices.

| Table 7 Random Indices (RIs) | ||

| Matrix size | RIm | RIg |

| 1 | 0 | 0 |

| 2 | 0 | 0 |

| 3 | 4890/0 | 1796/0 |

| 4 | 7937/0 | 2627/0 |

| 5 | 0720/1 | 3597/0 |

| 6 | 1996/1 | 3818/0 |

| 7 | 2874/1 | 4090/0 |

| 8 | 3410/1 | 4164/0 |

| 9 | 3793/1 | 4348/0 |

| 10 | 4095/1 | 4455/0 |

| 11 | 4181/1 | 4536/0 |

| 12 | 4462/1 | 4776/0 |

| 13 | 4555/1 | 4691/0 |

| 14 | 4913/1 | 4804/0 |

| 15 | 4986/1 | 4880/0 |

Fuzzy ANP Steps (Buckley's Geometric Mean Method)

Step 1 (aggregation of expert opinions): In this step, the geometric mean of the pairwise comparisons of the respondents is calculated.

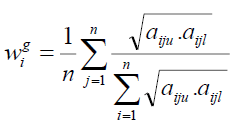

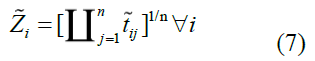

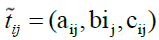

Step 2 (calculating the geometric mean of the rows): In this step, the geometric mean of the rows of each pairwise comparison table is calculated according to Equation 7.

Where  is a triangular fuzzy number that is in the tables for the geometric mean expert opinions?

is a triangular fuzzy number that is in the tables for the geometric mean expert opinions?

The geometric mean of the experts' opinion can be seen in the following tables, where the last column shows the geometric mean of each row.

The optimal portfolio composition ranks first, taking the advantage of the expert opinions ranks second, allocating and lending rank third, directing loans and facilities to production ranks fourth, bank arrears rank fifth, human resource management (HRM) ranks sixth, the capital market of startup entrepreneurial ecosystem ranks seventh, and liquidity creation ranks eighth (Tables 8-10).

| Table 8 The Normalized Geometric Mean of the Effect of Entrepreneurial Ecosystem Management Components on Startup Growth Policy along with CSR | |

| The Effect of Entrepreneurial Ecosystem Management Components on Startup Growth Policy along with CSR | Normalized geometric mean |

| The capital market of startup entrepreneurial ecosystem | (0.037,0.05,0.071) |

| Liquidity creation | (0.042,0.054,0.077) |

| Bank arrears | (0.073,0.109,0.151) |

| Allocating and lending | (0.076,0.102,0.154) |

| HR Management | (0.085,0.109,0.158) |

| The optimal portfolio composition | (0.127,0.193,0.25) |

| Directing loans and facilities to production | (0.066,0.085,0.129) |

| Taking the advantage of the expert opinions | (0.212,0.297,0.401) |

| Table 9 Final Weights Matrix of Criteria for the Effect of Entrepreneurial Ecosystem Management Components on Startup Growth Policy along with CSR | ||

| Component | Final Fuzzy Weight | The final weight of the components |

| The capital market of startup entrepreneurial ecosystem | (0.037,0.05,0.071) | 0.052 |

| Liquidity creation | (0.042,0.054,0.077) | 0.057 |

| Bank arrears | (0.073,0.109,0.151) | 0.111 |

| Allocating and lending | (0.076,0.102,0.154) | 0.109 |

| HR Management | (0.085,0.109,0.158) | 0.115 |

| The optimal portfolio composition | (0.127,0.193,0.25) | 0.191 |

| Directing loans and facilities to production | (0.066,0.085,0.129) | 0.091 |

| Taking the advantage of the expert opinions | (0.212,0.297,0.401) | 0.302 |

| Table 10 Final weight Matrix of Criteria for the effect of Entrepreneurial Ecosystem Management Components on Startup Growth Policy along with CSR | |||

| Component | Final Fuzzy Weight | The final weight of the components | Prioritization based on final weight |

| A1 | (0.027,0.05,0.107) | 0.059 | 8 |

| A2 | (0.05,0.092,0.183) | 0.104 | 5 |

| A3 | (0.039,0.075,0.149) | 0.085 | 7 |

| A4 | (0.047,0.092,0.182) | 0.103 | 6 |

| A5 | (0.06,0.117,0.225) | 0.13 | 4 |

| A6 | (0.08,0.154,0.298) | 0.171 | 3 |

| A7 | (0.091,0.185,0.347) | 0.202 | 2 |

| A8 | (0.119,0.236,0.454) | 0.262 | 1 |

The Table 11 below shows the diffuzificated values of the complete relationship matrix.

| Table 11 Complete Relationship Matrix | ||||||||

| Taking the advantage of the expert opinions | Directing loans and facilities to production | The optimal portfolio composition | HR Management | Allocating and lending | Bank arrears | Liquidity creation | The capital market of startup entrepreneurial ecosystem | |

| Taking the advantage of the expert opinions | 0.332 | 0.446 | 0.4 | 0.425 | 0.401 | 0.462 | 0.423 | 0.429 |

| Directing loans and facilities to production | 0.399 | 0.342 | 0.298 | 0.412 | 0.348 | 0.487 | 0.421 | 0.42 |

| The optimal portfolio composition | 0.416 | 0.393 | 0.267 | 0.414 | 0.399 | 0.433 | 0.435 | 0.387 |

| HR Management | 0.384 | 0.387 | 0.309 | 0.292 | 0.321 | 0.36 | 0.417 | 0.373 |

| Allocating and lending | 0.366 | 0.416 | 0.342 | 0.437 | 0.272 | 0.388 | 0.428 | 0.346 |

| Bank arrears | 0.38 | 0.444 | 0.321 | 0.405 | 0.33 | 0.343 | 0.49 | 0.381 |

| Liquidity creation | 0.34 | 0.446 | 0.261 | 0.343 | 0.314 | 0.417 | 0.311 | 0.377 |

| The capital market of startup entrepreneurial ecosystem | 0.357 | 0.382 | 0.292 | 0.353 | 0.318 | 0.397 | 0.364 | 0.276 |

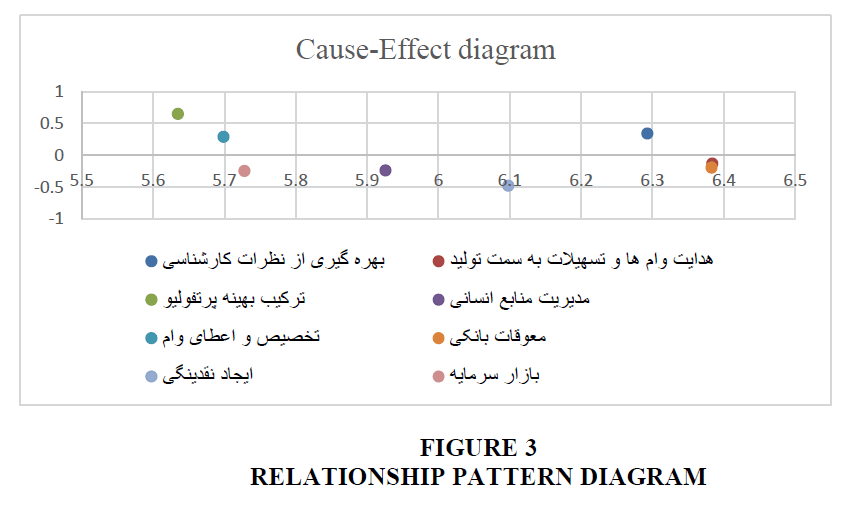

Step 6. Final output and generating a cause-effect diagram

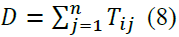

The next step is to get the sum of the rows and columns of the T matrix. The sum of rows (D) and columns (R) is obtained according to the following equations.

According to D and R, the values of D+R and D-R are then obtained, which indicate the degree of interaction and the effect of the factors, respectively. The final output is shown in the Table 12 below.

| Table 12 Final Output | ||||

| D-R | D+R | D | R | |

| 0.342 | 6.293 | 3.317 | 2.976 | Taking the advantage of the expert opinions |

| -0.129 | 6.384 | 3.128 | 3.256 | Directing loans and facilities to production |

| 0.653 | 5.635 | 3.144 | 2.491 | The optimal portfolio composition |

| -0.237 | 5.926 | 2.844 | 3.082 | HR Management |

| 0.293 | 5.699 | 2.996 | 2.703 | Allocating and lending |

| -0.193 | 6.383 | 3.095 | 3.288 | Bank arrears |

| -0.481 | 6.098 | 2.808 | 3.289 | Liquidity creation |

| -0.248 | 5.728 | 2.74 | 2.988 | The capital market of startup entrepreneurial ecosystem |

The pattern of significant relationships can be seen in the Figure 3 below. This pattern is in the form of a diagram in which the longitudinal axis is D + R and the transverse axis is D-R. The position and relationships of each factor are determined by a point with coordinates (D+R, D-R) in the system.

Step 7. Interpretation of results

According to the figure and table above, each factor is examined from four aspects:

The optimal portfolio composition ranks first, taking the advantage of the expert opinions ranks second, allocating and lending rank third, directing loans and facilities to production ranks fourth, bank arrears rank fifth, human resource management (HRM) ranks sixth, the capital market of startup entrepreneurial ecosystem ranks seventh, and liquidity creation ranks eighth.

The results of any scientific study are very important because the results can be a basis for solving existing problems or improving the current situation to the desired situation. On the other hand, the users of the study pay more attention to the results than anything else. In this study, the components of the entrepreneurial ecosystem suitable for the growth of startups in the smart city are identified and ranked. For this purpose, a comprehensive study is conducted on the studied variables including entrepreneurial ecosystem, startup growth, and smart city mentioned in previous studies, and a list of effective factors is prepared and becomes the basis for the development of the questionnaire. These factors are designed and distributed based on the pairwise comparison method after the analysis. These factors are then ranked by pairwise comparison and entropy methods. Finally, a summary of the study is provided, and the methodology and results are briefly stated. In the next step, the recommendations from the results and findings are presented in the hope that they will help managers find solutions to implement the components of the entrepreneurial ecosystem suitable for the growth of startups in the banking system in addition to providing a basis for future studies.

Factors affecting the development of components of the entrepreneurial ecosystem suitable for the growth of startups are ranked as follows according to the final weight of each factor (Table 13):

| Table 13 Results | |

| Components | Rank |

| The pattern of entrepreneurial ecosystem components suitable for the growth of startups | 7 |

| Liquidity absorption | 8 |

| Intellectual capital management | 4 |

| Allocating and lending | 2 |

| HR Management | 6 |

| The optimal portfolio composition | 1 |

| Directing loans and facilities to production and determining interest rates based on the employment rate | 3 |

| Taking the advantage of the expert opinions of the Council of Economic Experts outside the officials of the smart city ecosystem to present scientific theories | 5 |

The results suggest that the optimal financial composition ranks first and the absorption of liquidity ranks eighth.

Some of the most important policies of startups along with CSR for entrepreneurship development within the framework of realization of the components of the entrepreneurial ecosystem suitable for the growth of startups are creating lasting stability in the foreign exchange market, curbing currency fluctuations and increasing the variety of methods of providing foreign exchange resources. Iran's Supreme Leader has developed a theoretical framework for the components of the entrepreneurial ecosystem suitable for the growth of startups. Iran's economy must become an economy with high growth, controlled inflation, and low unemployment in the global economy in a logical process. Achieving these goals requires policymakers to have an efficient financial system:

1. It is recommended that the degree of importance and priority of criteria be considered as important and effective dimensions on the realization of components of the entrepreneurial ecosystem suitable for the growth of startups to be examined more carefully to implement the components of the entrepreneurial ecosystem suitable for the growth of startups;

2. In this study, non-government intervention in the decisions of entrepreneurial startups is the priority among the main criteria. Therefore, banks and financial institutions are recommended to pay special attention to the independence of entrepreneurial startups as a major economic pillar in the country;

3. The results indicate that among the sub-criteria, the effectiveness of the communication of the components of the entrepreneurial ecosystem suitable for the growth of startups and the support of academic knowledge-based are of the greatest importance, respectively. Therefore, banks are recommended to put the provision of facilities to knowledge-based companies on their agenda.

The need for appropriate allocation and lending as an important infrastructure for networking, entrepreneurship, technology, with an emphasis on teamwork, and acceptance of changes was key. One of the hallmarks of an entrepreneurial ecosystem is having flexible or entrepreneurial lending and lending. This type of lending is referred to as entrepreneurial lending. Another important factor in the field of entrepreneurial ecosystem based on new technologies is human capital. In order to confirm this question and the role and importance of human capital in the entrepreneurial ecosystem, we can refer to the results of research (Yefei et al., 2012; Suresh & Ramraj, 2012). The young company pointed out the high quality, social, human and capital, capable and interested manpower. They see human capital as a skill and knowledge that is gained through investing in school experience. Groups that are more capable of teamwork are more likely to form affiliate companies.

Findings Obtained in the Field of Production Loans and Facilities

In this research, support (legal advice for start-up companies, receiving tax and economic advice), technological consulting for start-up companies, improving the appropriate infrastructure, various services for start-up companies, providing financial support, development Supporting associations and institutions, government organizations' support for start-ups, environmental support, university support for student entrepreneurship, support laws were identified as one of the dimensions affecting the entrepreneurial ecosystem of new technologies. In this regard, he introduced support as one of the components of the entrepreneurial ecosystem (coaches/consultants, professional services, growth/accelerators and networks of entrepreneurial counterparts).

Findings Obtained in the Field of using Expert Opinions

The results obtained in the field of politics show as one of the dimensions of the main research framework, namely the Eisenberg model (1). This dimension includes features such as policies, support for start-up companies, ease of obtaining licenses, appropriate regulatory incentive to start startups, ease of entry-level laws, and government support programs for start-up companies, and development of support laws. Improving entrepreneurship development policies becomes governments. Numerous authors have also referred to this dimension in studies of the entrepreneurial ecosystem. In fact, the existing regulations in the country do not facilitate entrepreneurship. Financial and administrative laws and regulations, contracts and legal, entrepreneurial, academic and commercial support, knowledge, and intellectual property rights need further strengthening. In fact, the government can provide the necessary legal infrastructure for the development of academic entrepreneurship by strengthening laws aimed at protecting intellectual property rights. Also, in order to validate the policy dimension, I would like to support the support dimension as one of the components of the entrepreneurial ecosystem (ease of starting a business, tax incentives, business-friendly rules/policies, access to basic infrastructure, access to communications Introduced Remote/Bandwidth and Access to Transport (ISTM, 2). In response to this question, various authors have emphasized the importance of allocating and lending to startups.

Findings Obtained in the Field of Liquidity Creation

The results obtained in the field of capital show as one of the dimensions of the main research framework, namely the model (Eisenberg, 4). This was later mentioned in other research. For example, it introduced the creation of liquidity as one of the components of the entrepreneurial ecosystem (friends and family, venture capitalists and business angels, private equity, investment, and access to debt) (Stem, 2). In confirmation of this question, it can be said that the weakness of financial strength and consequently the limited resources is one of the reasons for the weakness of universities, which cannot present detailed and solid proposals to the industry in the initial stages. They send it to the industry, which is not so problem-oriented and needy. Reducing government budgets can lead to financial independence for universities, as well as the development of new technology-based entrepreneurial ecosystems (Siegel et al., 2004; Venkataraman, 2004).

Findings Obtained in the Field of Markets

Dimensions of access to markets, including increasing market readiness, market effects on encouraging entrepreneurial action, having the right supply chain to partner with startups, creating entrepreneurial networks in the ecosystem, international opportunities, customers, consumers, innovation, discovery and creation. Opportunity was identified in this study as a dimension of the university-based entrepreneurial ecosystem. The market map is crucial because customers do not know about it. Although the field of technology and entrepreneurship has a wide variety of applications in many fields of industry, the lack of knowledge of investors and applicants about these applications can increase the risk of creating future entrepreneurial ecosystems for academic researchers for fear of failure. Among the dimensions of market access factors identified in this study has already been confirmed by researchers. He then introduced the market into two main categories (domestic market and foreign market). In response to this question, various authors have emphasized the importance of markets.

Findings in the field of Optimal Portfolio Composition in the Present Study

A new dimension of technology is being added to the framework for developing an entrepreneurial ecosystem in Spain. This new dimension includes indicators such as level of readiness, technology, companies and manufacturing. The technology dimension has also been highlighted in past research in the technology-based entrepreneurial ecosystem, only in Roja. The number and quality of programs, educational institutions, product and business development, and the rate of commercialization have a major impact on the development of a technology-based entrepreneurial ecosystem. The presence of skilled manpower such as faculty members and graduate students specializing in technology, entrepreneurship is an important factor.

Therefore, according to the obtained result, the following suggestions are presented in line with the research:

Entrepreneurial development must be comprehensive, holistic and sustainable. Development of entrepreneurship requires the provision of various cultural, social, economic, and, on the other hand, cooperation of educational systems. It is suggested that for the formation of an entrepreneurial ecosystem, much attention be paid to its constituent components. Allocation and lending in the ecosystem is the basic foundation of the entrepreneurial ecosystem. It is better to create a social-role model for technology entrepreneurs in the community. Financial support, development of associations and support institutions, and improved infrastructure for start-ups are suggested.

The pace of technology development and transfer is very important in terms of the level of readiness of companies, commercialization rate of technology, infrastructure, and professional services. On the other hand, access to markets through increasing market readiness, market effects on encouraging entrepreneurial action, having a suitable supply chain to work with start-ups, and international opportunities are also important. Entrepreneurial ecosystems are the result of diagnosis and geographic areas and individuals who influence entrepreneurial change. The emphasis of the ecosystem approach is on the assets, problems and opportunities available. Policy-making and legislation can take important steps to facilitate the factors affecting the entrepreneurial ecosystem.

Micro-policymakers such as the Technology Development Headquarters, universities and research centres, science and technology centres, and other technology-related policymakers can also provide specialized human resources. University administrators should pay attention to proper organization with regard to changes in the allocation and lending of institutional loans and job incentives. Entrepreneurship education and activities, knowledge transfer in incubators to professors and trainers should be promoted by providing general rewards, privileges and competitions. Barriers to cooperation between universities and industry should be removed so that the result will be the smoothing of the path between the scientific base of the country and business.

Conclusion

New subject and lack of scientific resources in the field of research background The lack of permission for a number of samples to be recorded during the interview and the difficulty of the researcher's work for the correct transmission of information Lack of similar research in the field of the present study The limited statistical population and the difficult access of the researcher to the sample.

References

Ahmad, N., & Hoffmann, A. (2008). A framework for addressing and measuring entrepreneurship.

Indexed at, Google Scholar, Cross ref

C?t?lin, G., Sorin-George, T., & R?zvan, P. (2017). Entrepreneurship in the world: The analysis of the Global Entrepreneurship Index in the period 2015-2017. Ovidius University Annals: Economic Sciences Series, (2), 14-18.

Feld, B. (2020). Startup communities: Building an entrepreneurial ecosystem in your city. John Wiley & Sons.

Gupta, S., Lian, X., Zhang, W., & Liu, J. (2015). Staleness-aware async-sgd for distributed deep learning. arXiv preprint arXiv:1511.05950.

Hartlapp, M., Metz, J., & Rauh, C. (2014). Which policy for Europe?: power and conflict inside the European Commission. OUP Oxford.

Hwang, V.W., & Horowitt, G. (2012). The rainforest: The secret to building the next Silicon Valley.

Isenberg, D. (2011). How to foment an entrepreneurial revolution. The Babson Entrepreneurship Ecosystem Project, 781(7).

Longmore, S.N., Bally, J., Testi, L., Purcell, C.R., Walsh, A.J., Bressert, E., Pestalozzi, M., Molinari, S., Ott, J., Cortese, L., & Battersby, C. (2013). Variations in the Galactic star formation rate and density thresholds for star formation. Monthly Notices of the Royal Astronomical Society, 429(2), 987-1000.

Indexed at, Google Scholar, Cross ref

Lotz, S.L., Eastlick, M.A., & Warrington, P. (2006). Understanding online B-to-C relationships: An integrated model of privacy concerns, trust, and commitment. Journal of Business Research, 59(8), 877-886.

Indexed at, Google Scholar, Cross ref

Manyika, J., Chui, M., Brown, B., Bughin, J., Dobbs, R., Roxburgh, C., & Hung Byers, A. (2011). Big data: The next frontier for innovation, competition, and productivity. McKinsey Global Institute.

Monitor, G.E. (2016). Global entrepreneurship monitor. Entrepreneurship in Brazil (National Report). Curitiba: Brazilian Institute of Quality and Productivity, Paraná .

Neck, H.M., Meyer, G.D., Cohen, B., & Corbett, A.C. (2004). An entrepreneurial system view of new venture creation. Journal of Small Business Management, 42(2), 190-208.

Indexed at, Google Scholar, Cross ref

Storm, J.F., Boly, M., Casali, A.G., Massimini, M., Olcese, U., Pennartz, C.M., & Wilke, M. (2017). Consciousness regained: disentangling mechanisms, brain systems, and behavioral responses. Journal of Neuroscience, 37(45), 10882-10893.

Indexed at, Google Scholar, Cross ref

Rabelo, R.J., Bernus, P., & Romero, D. (2015). Innovation ecosystems: A collaborative networks perspective. In Working conference on virtual enterprises (323-336). Springer, Cham.

Indexed at, Google Scholar, Cross ref

Rizwan, S., Naqshbandi, A., Farooqui, Z., Khan, A.A., & Khan, F. (2014). Protective effect of dietary flaxseed oil on arsenic-induced nephrotoxicity and oxidative damage in rat kidney. Food and chemical toxicology, 68, 99-107.

Indexed at, Google Scholar, Cross ref

Spigel, B. (2017). The relational organization of entrepreneurial ecosystems. Entrepreneurship Theory and Practice, 41(1), 49-72.

Indexed at, Google Scholar, Cross ref

Storebø, O.J., Ramstad, E., Krogh, H.B., Nilausen, T.D., Skoog, M., Holmskov, M., Rosendal, S., Groth, C., Magnusson, F.L., Moreira?Maia, C.R., Gillies, D. (2015). Methylphenidate for children and adolescents with attention deficit hyperactivity disorder (ADHD). Cochrane Database of Systematic Reviews, (11).

Suresh, J., & Ramraj, R. (2012). Entrepreneurial ecosystem: Case study on the influence of environmental factors on entrepreneurial success. European Journal of Business and Management, 4(16), 95-101.

Tansley, A.G. (1935). The use and abuse of vegetational concepts and terms. Ecology, 16(3), 284-307.

Indexed at, Google Scholar, Cross ref

Tashakkori, A., & Teddlie, C. (2009). Integrating qualitative and quantitative approaches to research. The SAGE handbook of Applied Social Research Methods, 2, 283-317.

Teddlie, C., & Tashakkori, A. (2011). Mixed methods research. The Sage handbook of qualitative research, 4, 285-300.

Venkataraman, S. (2004). Regional transformation through technological entrepreneurship. Journal of Business Venturing, 19(1), 153-167.

Wilke, T., Bauer, S., Mueller, S., Kohlmann, T., & Bauersachs, R. (2017). Patient preferences for oral anticoagulation therapy in atrial fibrillation: a systematic literature review. The Patient-Patient-Centered Outcomes Research, 10(1), 17-37.

Indexed at, Google Scholar, Cross ref

Whitehurst, G.J., Falco, F.L., Lonigan, C.J., Fischel, J.E., DeBaryshe, B.D., Valdez-Menchaca, M.C., & Caulfield, M. (1988). Accelerating language development through picture book reading. Developmental Psychology, 24(4), 552.

Yefei, Z.H.O.U., Yulin, Y.A.N.G., Xiaowen, Q.I., Jiang, Y., Jian, Y.A.N.G., Xuejun, R.E.N., & Qingxiang, Y.A. N.G. (2012). Influence of La2O3 addition on microstructure and wear resistance of Fe-Cr-C cladding formed by arc surface welding. Journal of Rare Earths, 30(10), 1069-1074.

Indexed at, Google Scholar, Cross ref

Received: 11-Jan-2022, Manuscript No. ASMJ-21-10834; Editor assigned: 13-Jan-2022, PreQC No. ASMJ-21-10834(PQ); Reviewed: 20-Jan-2022, QC No. ASMJ-21-10834; Revised: 24-Jan-2022, Manuscript No. ASMJ-21-10834(R); Published: 31-Jan-2022