Review Article: 2023 Vol: 27 Issue: 5

ICT for Enhanced Competitiveness of Micro Enterprises in Digital India: A Tool for Women Empowerment and Rural Development

Jacob Joju, Cochin University of Science and Technology, Kerala

Palanivel RV, Berlin School of Business and Innovation, Berlin

Balu J, Saintgits Institute of Management, Kerala

Manoj PK, Cochin University of Science and Technology, Kerala

Sijin TC, LEAD College of Management, Dhoni, Palakkad, Kerala

Citation Information: Joju, J., Palanivel, R.V., Balu, J., Manoj, P.K., Sijin, T.C. (2023). ICT for Enhanced Competitiveness of Micro Enterprises in Digital India: A Tool for Women Empowerment and Rural Development. Academy of Marketing Studies Journal, 27(5), 1-16.

Abstract

Keywords

Micro Enterprises, ICT, Social Media, CSOs, eWOM, eCRM, AI, Competitiveness.

Introduction

There has been an unprecedented pace in ICT adoption in India in the recent past. This falls in line with the much publicized ‘Digital India’ drive of the Govt. of India (GOI) and similar ones by the States, like, ‘Kerala Knowledge Economy Mission’ (KKEM) of Govt. of Kerala (GOK). ICT thrusts in Governmental policies continue and the budgets for 2023-2024 are no exception. As the positive policy stance continues, at the Union and State levels, this study seeks to analyse as to how ICT adoption can be meaningfully used for enhanced competitiveness of micro enterprises (MEs) in India, especially those run by women. MEs can ensure employment and livelihood for those at the ‘Bottom of the Pyramid’ – the marginalised and deprived groups, including the physically challenged or the differently abled etc. Promotion of MEs by such segments, including poor rural women, ensures balanced and equitable economic development. In view of the multiple limitations that women suffer from, lack of representation in the societal decision making bodies including in familial decision-making, and hence her poor status in the society and family, and also lack of asset-ownerships, women empowerment is a national priority across world nations, including India. So also is the case of adequate thrust on rural development for ensuring balanced development of rural areas too, along with urban areas. Promotion of MEs and encouraging ICT-adoption by the MEs can ensure women empowerment and rural development, as ICT is an enabler of cost savings and competitiveness. This in turn can ensure balanced, equitable and sustainable economic growth.

Relevance and Significance of the Study

Women play an equally significant role as men, if we go by the evolution of human societies. In fact, women’s status, their employment level, working conditions etc. in a society is an indicator of the human development of the society or the respective nation. Sanswomen’sparticipation, the economic activities of any nation, its social, economic and political advancement would be grossly incomplete. Though women represent only about a half of the human society theycould work for two-thirds of total global working hours. Paradoxically, theyearnonly one-third of the total global earnings and own only less than one-tenth of the global resources. Due to their poor entitlements, women suffer frommany sorts of deprivations in the social, economic,familial, cultural and political fronts, especially in the developing countries, includingIndia.Going by global experiences of effective financial inclusion through use of mobile phones (Pickens, 2009), properadoption of ICT and other technological advances, like, artificial intelligence (AI), could help womento get rid of their diverse deprivations and handicaps, while they undertake their own economic units, like, micro enterprises (MEs). The growing affordability of ICT-based tools and devices (like, Mobile phones, internet facility etc.) and favourable Governmental policies (like, Digital India policy of the GOI and Kerala Knowledge Economy Mission of GOK) give a conducive environment for ICT-adoption even by small enterprises, like, MEs run by women. Civil Society Organisations (CSOs), like, the world renowned Kudumbashree (under the GOK) promote women’s initiatives, like, MEs. The relevance of ICT-integration, including use of AI and other modern technological advances, for women empowerment and rural development, and hence balanced, equitable and sustainable economic growth in India is attempted in this study using the latest Governmental policies and findings of empirical studies.

Objectives and Methodology of the Study

This paper aims to study the need for adoption of ICT and advanced technologies like artificial intelligence (AI) for the purpose of women empowerment and rural development in India and hence equitable and sustained national economic growth. As a minor objective the case of Kerala is studied closely. This study is descriptive-analytical and is exploratory too. The data used were primarily secondary data from authentic sources, like, the latest policy documents and reports of the Union and State Governments in India, especially those of the GOI and GOK. The publications of the Government-owned undertakings like the Kudumbashree mission under the GOK are also used. Common statistical tools and technics are employed for data analysis.

Literature Survey

Sen (1993) has pointed out that women empowerment involves “adjusting relations of power” that limits their choices and freedom, and also that it would “horribly impact prosperity and thriving". A report on gender mainstreaming by ADB (Asian Development Bank) (2015) relating to Kerala State, with reference to KSUDP (Kerala Sustainable Urban Development Project) has pointed out the positive effect of KSUDP initiatives, especially its positive effect on women and girls, and that gender mainstreaming could positively influence women’s livelihood. The active role played by the co-ordinating agency, i.e. ‘Kudumbashree’, under Govt. of Kerala (GOK), a world renowned CSO controlled by GOK– has been specifically noted in the above ADB report.

Jejeebhoy (2000) hasnoted self-administration and empowerment to be identical concepts andthatof these the first one is a static concept and thus quantifiable while the second is an incredible co-operation that is not quantifiable.Keller and Mbwewe (1991) have noted that women empowerment encompasses co-operation and through co-operation women couldorganize their own efforts, make their own choices, control their resources, etc.A paper by PK Manoj (2012), “Potential of micro enterprises in women empowerment: A critical study of micro enterprises run by women under the KudumbashreeProgramme in Kerala” in International Journal of Business Policy and Economicshas observed that micro enterprises (MEs) run by women members of Kudumbashree could lead to their empowerment. A study by Dr. Manoj P.K(2013), ‘Prospects and Challenges of Green Buildings and Green Affordable Homes: A Study with Reference to Ernakulam, Kerala’ in Global Research Analysis, has pointed out the vital need for eco-friendly housing for sustained economic growth in Kerala.The vast scope of ICT for financial inclusion has been noted by Pickens, Mark (2009), as he has observed a common ICT tool viz. mobile phone could ensure banking services to the unbanked masses.

A paper by Manoj (2007), ‘ICT industry in India: A SWOT analysis’, in Journal of Global Economy has elaborated the pros and cons of ICT industry in India. Another study by P.K. Manoj (2010), ‘Environment-friendly tourism for sustainable economic development in India’, in International Journal of Commerce and Business Managaement has noted the need for promotion of eco-friendly tourism for India’s sustained economic growth. A study by P.K. Manoj (2010), ‘Impact of technology on the efficiency and risk management of old private sector banks in India: Evidence from banks based in Kerala’, in European Journal of Social Sciences has noted the vital need for ICT adoption for better performance and customer service by banks.

A study by Manoj (2012), ‘Information and communication technology (ICT) for effective implementation of MGNREGA in India: An analysis”, in Digital Economy in India: Security and Privacyhasnotedthe vitalrole of ICT in duly implementing MGNREGA. A study by James &Manoj, (2014), ‘Relevance of E-Banking Services in Rural Area – An Empirical Investigation’in Journal of Management and Science, has observed thevital needforE-Banking in rural Kerala to hasten rural development and to empower women, and suggested for its expansion. A study by VidyaViswanath and Manoj,(2015), ‘Socio-Economic Conditions of Migrant Labourers- An Empirical Study in Kerala’ in Indian Journal of Applied Research has noted the need for improving the working and living situations of migrant workers.Astudy by William George &Manoj (2013) ‘Customer Relationship Management in Banks: A Comparative Study of Public and Private Sector Banks in Kerala’ International Journal of Scientific Research, has noted thathigh-tech private banks are ahead of public banks in customer service and in CRM.A study by Manoj(2016), ‘Bank Marketing in India in the ICT Era: Strategies for Effective Promotion of Bank Products’ in International Journal of Advance Research in Computer Science and Management Studies, has noted the need for ICT-adoption by banks. A paper by Joju, et al. (2017), ‘Electronic CRM & ICT-based banking services: An empirical study of the attitude of customers in Kerala, India’ in International Journal of Economic Research has pointed out the favorable influence of E-CRM on banking performance. A study by Manoj & Nasar (2013), ‘Customer satisfaction on service quality of real estate agencies: An empirical analysis with reference to Kochi Corporation Area of Kerala in International Journal of Management, IT and Engineering, has noted the service quality aspects of real estate agencies based in Kochi. A study by Manoj, (2015), ‘Socio-Economic Impact of Housing Microfinance: Findings of a Field based Study in Kerala, India’ in International Research Journal of Finance and Economics, as pointed out the positive impact of housing micro finance (HMF) on the poor. Another paper by Manoj, (2015), “Deterrents to the Housing Microfinance: Evidence from a Study of the Bankers to ‘Bhavanashree’ in Kerala, India” in International Research Journal of Finance and Economics, the deterrents to HMF are discussed along with remedial strategies.A study byDr.Vasantha S, Dr.Manoj, P.K. & Jacob Joju (2015), ‘E-CRM: A Perspective of Urban & Rural Banks in Kerala’, International Journal of Recent Advances in Multidisciplinary Research, has compared the impact of E-CRM on rural and urban customers, and suggested E-CRM strategies.

EIU (2022) in its Industry Outlook 2023 has pointed out the immensepotential of technology and telecommunications with the arrival of metaverse (instead of web3) and the vital need for adopting such latest technologies.A paper by S Rajesh &Dr.Manoj P.K(2015) ‘Women Employee Work-life and Challenges to Industrial Relations: Evidence from North Kerala’ in IPASJ International Journal of Management has noted the utmost relevance of WLB (work-life balance) for good industrial relations and hence betterindustrial productivity also. An earlier study by the UN (2005) has clearly noted the vast women empowerment potential of ICT which has cited the example of radio networking experience through ‘CEMINA’ in Brazil.

In view of the foregoing discussions, it is observed that ICT is a vital factor for any sector, particularly for rural development includingwomen empowerment, and hence equitable and sustained economic development. ICT enhances the competitiveness of businesses and supports women and other marginalized groups to keep themselves abreast of the developments, and hence get rid of their deprivations, earn livelihood and escape from over-dependence on others. Since studies focusing on ICTand its role in rural development and women empowerment are scarce, this study looks into this key role of ICT including its allied technologies like AI, ML etc.

ICT for Empowering Women, Rural Development and Equitable Economic Growth

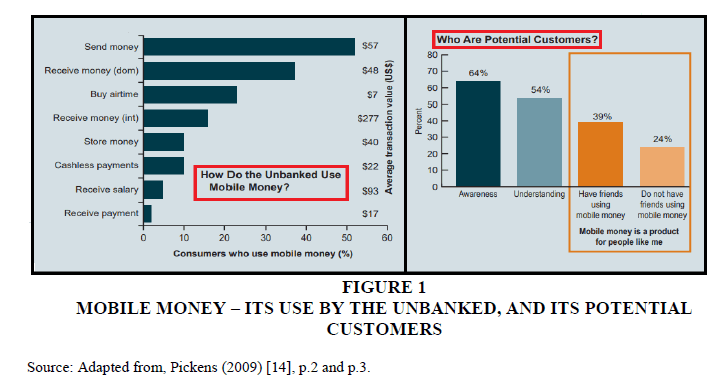

Many papers have noted that Civil Society Organisations (CSOs) areinstrumental in women empowerment, rural development and thus balanced as well as equitable economic development. For instance, UNRISD (2000)hasnoted that CSOs have become increasingly influential players in the society and that CSOs could ensure essential services to the poor and the marginalised, including women, like, access to the formal banking facilities, housing credit etc. Studies havenoted the need for CSOs to ensure their own specific contribution to the societal growth rather than simply acting as Government’s contracting agents. It is also noted that even diverse CSOs with varied ideologies and activities can function effectively as NGOs and collectively work for the common social causes. A field study in Philippines has noted half of the mobile phone users of Philippines to be unbanked and that potential mobile money users include those whose friends use mobile money (39 percent) and those whose friends do not use mobile money (24 percent).Given the basic fact that three out of four in Philippines were unbanked, this study has suggested four strategies:properlymarketing the bank products by targeting influential segments; clearlyknowing the financial profile of customers (as low-income people have low willingness to pay); forming a strong agent’ network; exploring diverse typesof services.(Pickens, 2009).(Figure 1).

Figure 1: Mobile Money – Its Use by the Unbanked, and Its Potential Customers.

Source: Adapted from, Pickens (2009) [14], p.2 and p.3.

A report by the United Nations (UN) (2005) on Gender equality and empowerment of women through ICT, has pointed out numerous examples of successful women empowerment by way of effectively using ICT. Such successful experiences include many cases from India itself. Selected among such ICT-based women empowerment cases in the world are listed in Table 1.

| Country | ICT-Based Women Empowerment Model |

|---|---|

| Brazil | CEMINA (Communication, Education, and Information on Gender) –is an organisation that seeks to improve education on gender equality, health and environment. It strives to empower women through ICT / Communication. |

| Senegal (West Africa) | Sonatel (a Senegalese telephone company) and Manobi (a French company) could provide Cell phones with WAP (Web Access Protocol) to Senegalese rural women engaged in agricultural production thus ensuring internet access. |

| South Asia (Telecentres) | UNESCO studied the potential of ICT to contribute to poverty reduction in five countries in South Asia (nine locations) - Noted that gender played a key role in deciding the boon and bane of ICT, a tool for empowerment. Gender-based limits were found which restricted women’s interaction with others, thus underscoring the need for special attention to them in ICT centres. |

| E-homemakers (Malaysia) |

E-homemakers in Malaysia, work since 1998, to support women who choose to work from home to balance their gender roles and responsibilities, in collaboration with Malaysia’s Ministry of Women and Family Development. |

| Republic of Korea | Korean Govt. has started several schemes for the economic empowerment of women, e.g. Kyonggi Province Program for training as IT professionals. |

| Latin America | Various women’s movements ensure relevant Spanish content on the internet. (e.g. Women’s Agenda, Women Today –provide vital women’s information). |

| UN (Inter-agency site) | UN’s inter-agency website, WomenWatch, seeks to promote gender equality- a “gateway” to information on gender equality promotion within the UN system. |

| US -Violence against women | An Online module on the violence against women in the US region was given by the Berkman Center for Internet and Society, Harvard University, US. |

| Zimbabwe | Women’s radio clubs (52 or more) enables interaction among rural women. |

| Lima (Peru) | Indigenous communities are building up their own communication networks. |

| Uganda | Nakasake (Uganda)–CD-ROM with ICT-based materials for the rural women. |

| Argentina | PRODEMU (NGO) trains rural women-Using ICT for design and marketing |

| Ghana | Using radio to develop functional literacy and to provide information on local language on diverse topics on women (HIV/AIDS, teenage pregnancy, etc.) |

| African Countries (4) | World Links noted gender-based inequalities in the access to ICT facilities; girls have only lower access in Africa (Ghana, Mauritania, Senegal & Uganda) |

| Uganda | RESCUER project aims to reduce the high maternal mortality rate by ensuring high frequency radios, health units, referral hospital, walkie-talkies etc. |

| Western Kenya | AIDS Intervention Prevention Project Group–Started Community-based informal learning centres in Kenya, with priority to the poor, widows, women |

| Fiji | Women’s community media initiative in Suva pioneered a community-based radio project with the help of mobile suitcase having 100 Watt transmitter. |

| Stability Pact Region (SPR) | Women’s Mayor’s Link-an initiative covering 12 countries/territories of SPR, direct beneficiaries were 50 women Mayors – Aims to use ICT effectively. |

| Slovakia | The Fifth Women Campaign –nation-wide campaign violence against women. |

| Malawi | ‘Farmwise’ – help women farmers so as to improve production through ICT. |

| Caribbean | GENARDIS Grant–provided to women engaged in Organic Farming, a highly knowledge intensive sector –Women farmers greatly need information inputs. |

| UN’s Division (Use of ICT) |

UN’s Division for Advancement of Women – seeks to enhance the capacity of national machineries for advancement of women in Africa through ICT. |

Source: UN (2005), Gender Equality and Empowerment of Women through ICT, Sept.

Table 1: Selected ICT-based Women Empowerment Initiatives in the World (except India).

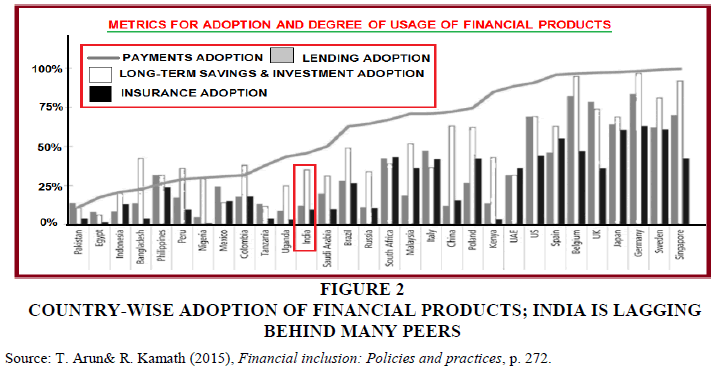

Asian Development Bank (ADB) (2015) in its report on gender mainstreaming in the Kerala context with reference to Kerala Sustainable Urban Development Project (KSUDP) has noted the positive effect of KSUDP’s initiatives on the five intended city Corporations in Kerala, particularly its positive impact on women and girls. The gender mainstreaming has had positive impact on the livelihood of women. The active and appreciable role played by the co-ordinating agency viz. ‘Kudumbashree’project– a world renowned CSO under Govt. of Kerala (GOK)– has been specifically noted in this report.A cross-country comparative study on Financial Inclusion by Arun, T. & R. Kamath (2015) has noted that India is lagging behind most of its peers, viz.developing nations like Brazil, China, Russia, South Africa etc. in adopting financial products, though it is ahead of the neighboring nations like Pakistan and Bangladesh (Figure 2).

Figure 2: Country-wise Adoption of Financial Products; India is Lagging behind Many Peers.

Source: T. Arun& R. Kamath (2015), Financial inclusion: Policies and practices, p. 272.

Figure 2 suggests the need for expanding the adoption of financial products in a nation like India for its faster national economic growth and that too in an equitable manner, especially by way of using financial adoption for uplifting the poor, including women. Many Indian and global studies have clearly noted the significant positive effect of extending banking and other financial products to the poor, including women. Because, this results in poverty reduction and equitable and balanced economic growth; thus greatly empowering the rural poor, especially the women. Moreover, GOI has already mandated to embrace ICT in a big way in the ongoing Digital India regime whereby all-pervasive digitization of all sectors of the economy is of top priority. So also is the focus underlying the GOI’s policy towards JAM (Jan Dhan, Aadhaar, Mobile) trinity.

Digital Financial Inclusion in India: A Comparative Perspective

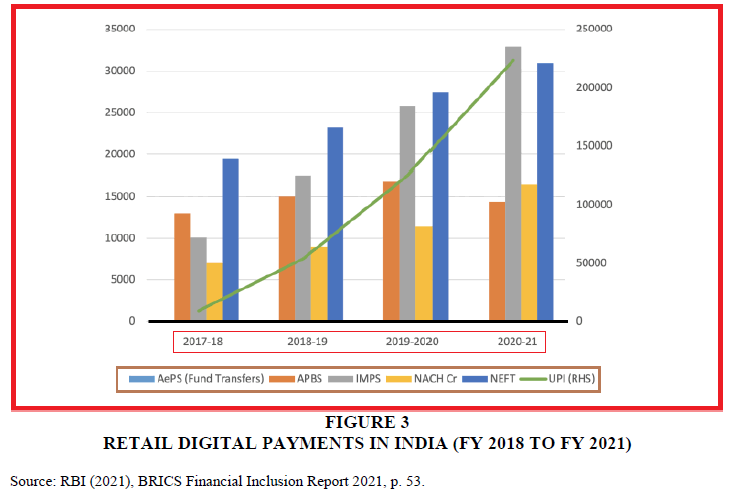

Now, let us consider the digital financial inclusion in India vis-à-vis elsewhere in the world, especially the most comparable nations viz. the BRICS group (Brazil, Russia, India, China, and South Africa).In India, the GOI’s DBT (Direct Benefit Transfer) scheme has been transferring welfares using channels such as Aadhaar enabled Payment System (AePS), Aadhaar Payment Bridge System (APBS),Immediate Payment System (IMPS), National Automated Clearing House (NACH), National Electronic Funds Transfer (NEFT), United Payment Interface (UPI) etc. There has been steady growth in Digital Retail Payments in India (Figure 3).

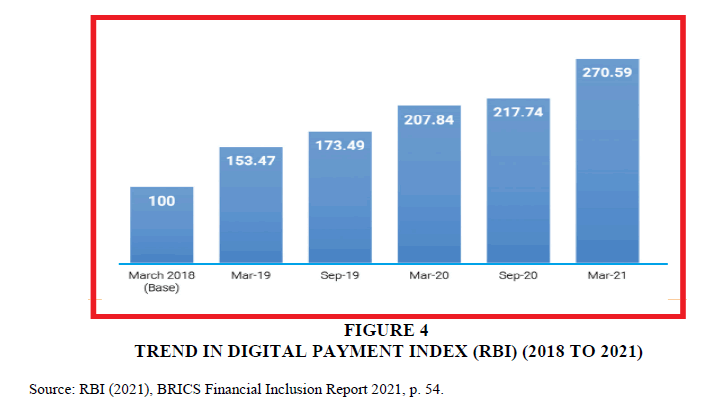

The steady rise is Retail Digital Payments in India (Figure 3) is clearly reflected in the composite index maintained by the central bank of the country viz. RBI, right from the year 2018 – the base year. The trend in this index which is termed as “RBI-Digital Payment Index” over the last few years is depicted in Figure 4. From 100 in 2018 (the Base Year), the above index has more than doubled in 2020 to 207.84 and has reached the level of 270.59 in 2021.

Figure 3: Retail Digital Payments in India (FY 2018 to FY 2021).

Source:RBI (2021), BRICS Financial Inclusion Report 2021, p. 53.

This is an obvious indication of the fast growth momentum for digital transactions in India over the last few years the trend in RBI-Digital Payment Index is shown in Figure 4.

Figure 4: Trend in Digital Payment Index (RBI) (2018 to 2021).

Source:RBI (2021), BRICS Financial Inclusion Report 2021, p. 54.

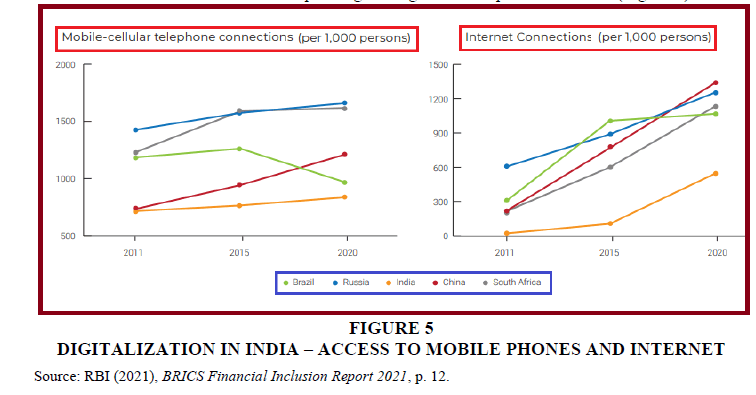

Despite the top priority accorded to digitalization in India, India’s relative position within the BRICS nations in respect of vital parameters like Mobile phone access (per 1000 persons) and Internet connectivity (per 1000 persons) is much below the rest of the BRICS nations. This indicates the utmost need for further pushing the digitalization process in India (Figure 5).

Figure 5: Digitalization in India – Access to Mobile Phones and Internet.

Source:RBI (2021), BRICS Financial Inclusion Report 2021, p. 12.

It may be pointed out that the thrust for digitalization that is already prevalent in India in this Digital India regime with added focus on digital financial inclusion through promoting JAM trinity and such other ICT-focused schemes and programmes, the harsh reality is that India is nowhere within the BRICS group of developing nations. Now, let us consider the case of various States within India, with a focus on Kerala – the State with the highest literacy and along with a very high level of ICT infrastructure in the whole of India.

Digital Financial Inclusion in India:AnAnalysis with a Focus on Kerala State

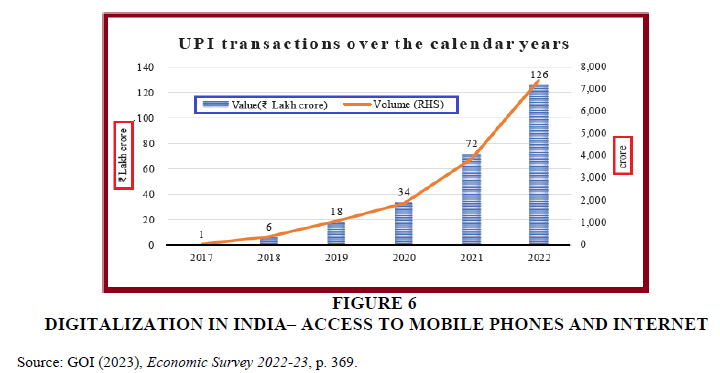

Based on the more recent GOI data (Economic Survey 2022-23, Jan. 2023) on digital transactions in India, there has been a rapid growth in UPI transactions in CY 2022 vis-à-vis CY 2021, both in value (121 percent growth) and in volume (nos.)(115 percent growth)(Figure 6).

Figure 6: Digitalization in India – Access to Mobile Phones and Internet.

Source:GOI (2023), Economic Survey 2022-23, p. 369.

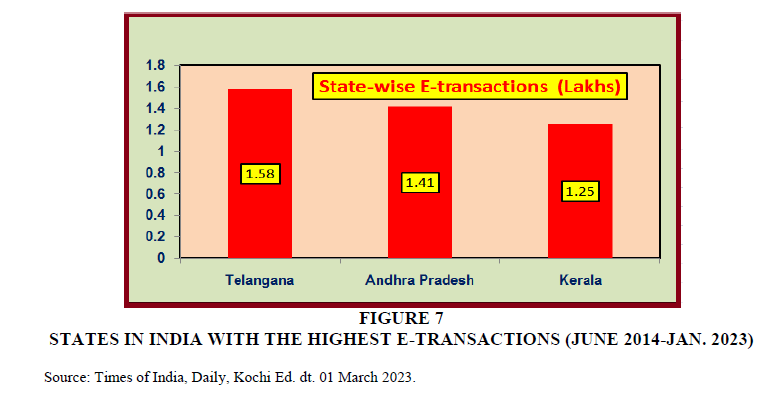

Regarding digital transactions for the purpose of e-Governance, the State of Telangana has been the leader in India, followed by Andhra Pradesh at the second slot and thirdly comes Kerala State. Only these three States in India have had ‘over one lakh’ e-transactions per every 1,000 population during the period June 2014 to January 2023 (Table 2); (Figure 7).

| Sl. No. | Name of the State | No. of e-transactions |

|---|---|---|

| 01. | Telangana | 1.58 lakhs |

| 02. | Andhra Pradesh | 1.41 lakhs |

| 03. | Kerala | 1.25 lakhs |

Table 2: States in India with Highest e-transactions (June 2014 to Jan. 2023).

Figure 7: States in India with the Highest e-transactions (June 2014 to Jan. 2023)

Source: Times of India, Daily, Kochi Ed. dt. 01 March 2023.

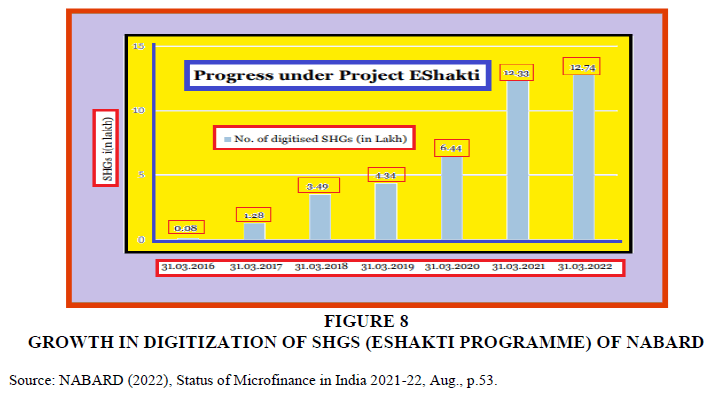

Given the unprecedented level of ICT globally, including in India, modern ICT-based technologies like AI, nations like India should leverage on such developments by targeting more on the rural poor, especially women, so that it can create equitable and sustainableeconomic development. The SHG-Bank Linkage Programme (SHG-BLP, in short) of NABARD, the apex regulatory agency of agriculture and rural development, is a classic example. SHG-BLP basically focuses on empowering the rural poor, especially the women, and nearly 90 percent or more of these are “All Women” SHGs also. In March 2015, NABARDstarted digitization of SHGs by way of ICT adoption through its E-Shaktiproject for which there is steady growth (Figure 8).

Figure 8:Growth in Digitization of SHGs (EShakti Programme) of NABARD.

Source: NABARD (2022), Status of Microfinance in India 2021-22, Aug., p.53.

As of FY 2022 end, 12.74 lakhs SHGs in India have been digitized. EShakti project seeks to reinforce the SHG-BLP by way of ICT adoption; because SHG digitization is preferred by the banks and other financial institutions, while they provide credit to such SHGs. In fact, NABARDcould promote MEDP (Micro-enterprise Development Program), LEDP (Livelihood Enterprise Development program) and similar programs also for the purpose of supporting the employable skills of the rural people India, particularly women. Such programmes accelerate the process of financial inclusion in India. As of FY 2022 end, MEDP programmecumulatively covered as high as 4.66 lakh SHG members while LEDP covered 1.06 lakhs SHG members. ICT adoption forms the basis for fast proliferation of the innovative developmental initiatives as noted above.

Govt. of Kerala (GOK) itself has sponsored a CSO viz. Kudumbashree which is actively engaged in wide range of activities for livelihood and thus empowering the poor, especially women. Kudumbashree NHGs (neighbour hood groups), spread across Kerala undertake almost all Government sponsored schemes, like, MGNREGA, Housing etc. Many of its members could start their own economic (income generating) units, including micro enterprises. This GOK-sponsored CSO is active in every facet of Kerala society and its members have vast representation in Panchayatiraj and other local self-government (LSG) institutions in Kerala. Wide representation of its member women among elected representatives indicates its huge political empowerment potential. This CSO has got a major role in helping the poor and other disadvantaged groups in Kerala, especially the rural poor women. The details of the NHGs under Kudumbashree, number of Bank-linked NHGs etc. are given in Table 3.

| Particulars | FY 2019-20 | FY 2020-21 | FY 2021-22 |

|---|---|---|---|

| No. of NHGs | 287723 | 294436 | 306551 |

| No. of NHG Members (Lakhs) | 45.1 | 45.85 | 45.86 |

| Amount of Thrift (Crore) | 443.7 | 406.71 | 514 |

| No. of Bank-Linked NHGs | 73522 | 250018 | 52837 |

| Total Amount Disbursed(Crore) | 2670 | 4070.26 | 3436 |

| Women Enterprises (Nos) (Cumulative) | 26448 | 46240 | 54471 |

| Women Members (Nos) (Cumulative) | 87239 | 157848 | 175006 |

Table III: Financial Inclusion through Kudumbashree NHGs and Kudumbashree Enterprises.

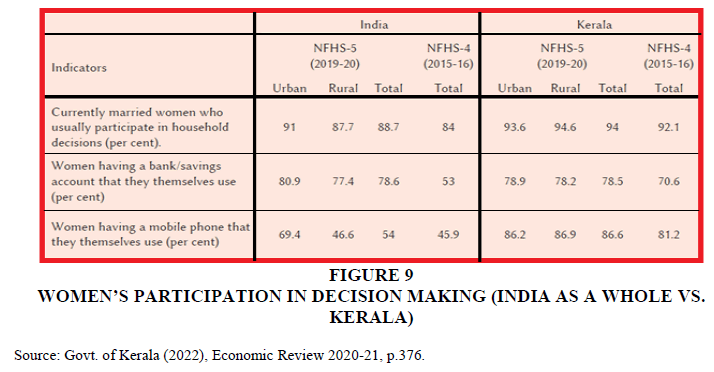

From Table 3, steady improvement in the Kudumbashree activities in Kerala, resulting in the formation of large number of NHGs, and also enterprises. This results in empowering the masses, especially the poor rural women, in the State. Further, Table 3 suggests that women in Kerala much higher influence (say) in familial decision making than elsewhere in India. In respect of holding own bank accounts, Kerala women had much higher share till 2015-16 than women elsewhere in India, but by 2019-20, other parts of India improved very fast and caught up with Kerala; and hence at present there is a uniform ratio of about 78.5 percent women with own bank accounts in India as a whole, including Kerala. So, there is no difference between Kerala State in particular and India as whole in respect of possession of own bank accounts. Regarding the possession of own mobile phone that they themselves use, women in Kerala is much ahead of their counterparts elsewhere in India; their share being about 30 percent more in Kerala than elsewhere in India. Details of ‘Kerala Vs. India’ comparison of women are shown in Figure 8.

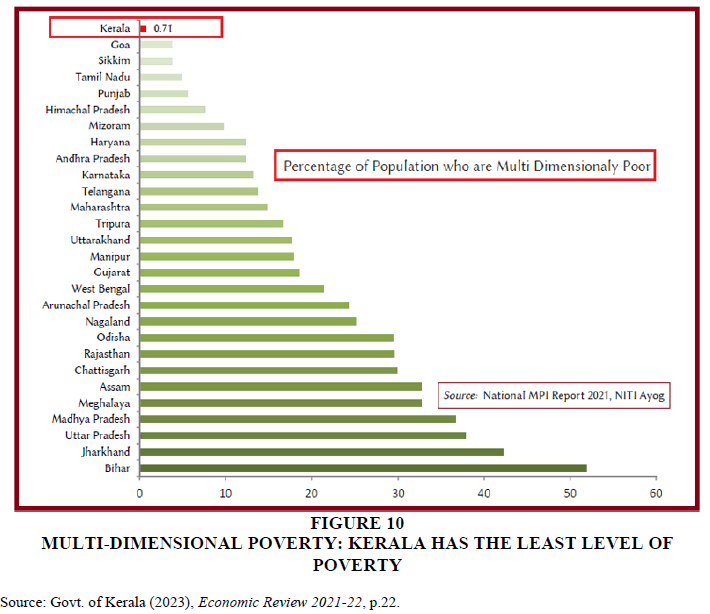

Digital Financial Inclusion: Results in Equitable and Sustained Economic Growth

Now let us consider if digital financial inclusion results in equitable, balanced and sustained economic growth or not. As already noted, only three States in India (Telengana, Andhra Pradesh and Kerala) have ‘More than 1 lakh’ e-transactions per 1000 population (Figure 9). The recent NFHS 2019-21 Report has placed Kerala in the first place (along with Telengana and Tamil Nadu) in respect of Inclusivity in growth. Based on Multi-Dimensional Poverty, the recent MPI Report 2021 (NITI Ayog) has placed Kerala at the top slot (least poverty) while Telengana, Tamil Nadu, Andhra Pradesh etc. too have relatively high positions (Figure 10).

Figure 9:Multi-Dimensional Poverty: Kerala has the least Level of Poverty

Source: Govt. of Kerala (2023), Economic Review 2021-22, p.22.

Figure 10: Women’s Participation in Decision Making (India as a Whole Vs. Kerala).

Source: Govt. of Kerala (2022), Economic Review 2020-21, p.376.

From the forgoing discussions, it follows that wherever digital financial inclusion is high there is relatively lower prevalence of poverty and higher per-capita revenue, higher gender equality etc. Thus, digital financial inclusion becomes instrumental in bringing about equitable and sustained economic growth of the respective States. The steady growth in micro enterprises run by Kudumbashree women, fast digitization of Kudumbashree NHGs, linking such NHGs with banks etc. could lead to fast socio-economic empowerment of Kudumbashree women. These outcomes of digital financial inclusion results in faster and equitable economic growth.

Suggestions and Conclusion

ICT and other technologies like Artificial Intelligence (AI) can help empowerment of the poor, especially women in diverse ways. For instance, ICT and other technologies like AI enable women to retrain, upskill and equip themselves and keep s abreast of the times. Such modern technologies enhance better business success for women who start their micro enterprises (MEs).

ICT and other technologies like AI, can bridge about gender equality because whatever the men perform can be done equally well by the women also in this ICT era. As the likes and dislikes of customers are increasingly being shared in the social media, eWOM (electronic Word of Mouth) has become a powerful tool for marketing of products. The poor who venture into their own enterprises, especially women can take advantage of eWOMand such other modern ICT-based tools for the effective promotion of their products, so that their own enterprises can sustain and also flourish as ICT provides them an edge in the market. This is because ICT enables them to do their business in a cost-effective and qualitative manner in this digital regime. The active CSOs (GOK-promoted Kudumbashree, and many other privately sponsored CSOs) as well as the Governmental support creates an environment for the survival and faster growth of women-owned enterprises or those of other disadvantaged social groups in Kerala.

In view of the foregoing, the following are the suggestions: (i) Initiatives for women empowerment and gender equality, rural development, etc. should strive for effectively using ICT for the mutual benefit of the target groups (like, NHGs or SHGs, and their enterprises) as well as other stakeholders including the customers, bankers, Government agencies, CSOs etc.;(ii) Digital Literacy – the barest minimum infrastructure to impart financial literacy, like, mobile phones, internet connectivity be provided to the poor so that these facilitate enhancing their digital literacy; (iii) Concerted and deliberate efforts to improve the digital literacy, financial literacy, and allied skills and capabilities like TR (technology readiness), preferably through the support and co-operation of CSOs, like, Kudumbashree in Kerala; (iii) Specialized training courses for the proper use of modern ICT-based devices, tools and applications be initiated by the Governments at the State and Union levels, either directly or through CSOs or such other agencies, including formal sector banks and financial institutions; (iv) Encouraging the adoption of ICT and such other modern technologies like AI by the entrepreneurs so as to ensure better competitiveness for their businesses and hence their sustainability; (v) To support the rural poor, like those engaged in agriculture-based occupation, like, production and sale of agricultural produce, there should special arrangements for mobile-phone based agricultural information services as well as mobile-phone based market information (e.g. manure-based information based on soil type, actions required as per climate changes, market price of agricultural goods, etc.); (vi) Encouraging the use of social media by the entrepreneurs directly, using ICT-based (online) channels, eWOM, etc. for effective marketing of their products, without middle-men.

Concludingly, it may be pointed out that the rural poor, especially women, having digital and financial literacy are much more empowered (independent) that others in this ICT era. Through the effective use of ICT-enabled tools and applications they can run their enterprises more cost-effectively and with greater competitiveness. Models like SHG-BLP are fast picking up and digitization initiatives such as EShaktihave another dimension to their bright prospects. Apart from the favourable policies of the GOI, the conditions are much more conducive in States like Kerala. Kerala’s rich ICT infrastructure and good track-record, universal literacy, conducive policies of the GOK (like, the KFON project that is being implemented now), high tele-density and internet penetration etc. deserve mention. Let’s hope that India in general and States like Kerala, Telengana etc. in particular would reap rich dividends from ICT adoption in the future.

References

Arun, T., & Kamath, R. (2015). Financial inclusion: Policies and practices.IIMB Management Review,27(4), 267-287.

Indexed at, Google Scholar, Cross Ref

James, N., & Manoj, P.K. (2014). Relevance of E-Banking Services in Rural Area–An Empirical Investigation.Journal of Management and Science,5, 1-14.

Jejeebhoy, S.J. (2000).Women's autonomy in rural India: Its dimensions, determinants, and the influence of context. na.

Joju, J., & Manoj, P.K. (2019). Banking Technology and Service Quality: Evidence from Private Sector Banks in Kerala.International Journal of Recent Technology and Engineering,8(4), 12098-12103.

Indexed at, Google Scholar, Cross Ref

Joju, J., Vasantha, S., & Manoj, P.K. (2015). E-CRM: A perspective of Urban and Rural Banks in Kerala.International Journal of Recent Advances in Multidisciplinary Research,2(09), 0786-0791.

Joju, J., Vasantha, S., & Manoj, P.K. (2017). Electronic CRM & ICT-based banking services: An empirical study of the attitude of customers in Kerala, India.International Journal of Economic Research,14(9), 413-423.

Keller, B., & Mbewe, D.C. (1991). Policy and planning for the empowerment of Zambia's women farmers.Canadian Journal of Development Studies/Revue canadienne d'études du développement,12(1), 75-88.

Indexed at, Google Scholar, Cross Ref

Lakshmi, L., & Manoj, P. K. (2017). Service quality in rural banking in north Kerala: A comparative study of Kannur district co-operative bank and Kerala Gramin bank.International Journal of Applied Business and Economic Research,15(18), 209-220.

Manoj, P.K. (2013). Research paper economics prospects and challenges of green buildings and green affordable homes-concept: a study with reference to Ernakulam, Kerala.Economics,2(12), 45-49.

Manoj, P.K. (2015). Deterrents to the Housing Microfinance: Evidence from a Study of the Bankers to ‘Bhavanashree’in Kerala, India.International Research Journal of Finance and Economics,138, 44-53.

Manoj, P.K. (2016). Bank marketing in India in the current ICT era: Strategies for effective promotion of bank products.International Journal,4(3), 103-113.

Manoj, P.K. (2010). Impact of technology on the efficiency and risk management of old private sector banks in India: Evidence from banks based in Kerala.European Journal of Social Sciences,14(2), 278-289.

Manoj, P.K. (2017). Construction costs in affordable housing in Kerala: relative significance of the various elements of costs of affordable housing projects.International Journal of Civil Engineering and Technology,8(9), 1176-1186.

Manoj, P.K. (2018). CRM in old private sector banks and new generation private sector banks in Kerala: A comparison.Journal of Advanced Research in Dynamical and Control Systems,10(2), 846-853.

Manoj, P.K. (2010). Determinants of Successful Financial Performance of Housing Finance Companies in India and Strategies for Competitiveness: a Multivariate Discriminant Analysis.Middle Eastern Finance and Economics,7, 199-210.

Manoj, P.K. (2010). Environment-friendly tourism for sustainable economic development in India.International Journal of Commerce and Business Managaement,2(2), 139-147.

Manoj, P.K. (2011). Determinants of Profitability of Housing Finance Companies in India and Strategies for Competitiveness: a Multiple Partial Correlation Approach.International Journal of Business Intelligence and Management,3(2), 121-137.

Manoj, P.K. (2012). Potential of micro enterprises in women empowerment: A critical study of micro enterprises run by women under the Kudumbashree Programme in Kerala.International Journal of Business Policy and Economics,5(2), 1-16.

Manoj, P.K. (2016). Bank marketing in India in the current ICT era: Strategies for effective promotion of bank products.International Journal,4(3), 103-113.

Manoj, P.K. (2019). Dynamics of human resource management in banks in the ICT era: A study with a focus on Kerala based old private sector banks.Journal of Advanced Research in Dynamical and Control Systems,11(7), 1667-1680.

Manoj, P.K. (2019). Social banking in India in the reforms era and the case of financial inclusion: Relevance of ICT-based policy options.Journal of Advanced Research in Dynamical and Control Systems,11(7), 1654-1666.

Manoj, P.K. (2007). ICT industry in India: a swot analysis.Journal of Global Economy,3(4), 263-278.

Indexed at, Google Scholar, Cross Ref

Manoj, P.K. (2012). Information and communication technology (ict) for effective implementation of mgnrega in india: An analysis.Digital Economy of India–Security and Privacy, Serials Publications, New Delhi, 145-150.

Manoj, P.K., & Viswanath, V. (2015). Socio-economic conditions of migrant labourers—An empirical study in Kerala.Indian Journal of Applied Research,5(11), 88-93.

Manoj, P.K. (2015). Socio-Economic Impact of Housing Microfinance: Findings of a Field based Study in Kerala, India.International Research Journal of Finance and Economics,137, 32-43.

Nasar, K.K., & Manoj, P.K. (2013). Customer satisfaction on service quality of real estate agencies: An empirical analysis with reference to Kochi Corporation Area of Kerala State in India.International Journal of Managment, IT and Engineering,3(6), 213-227.

Pickens, M. (2009). Window on the unbanked: Mobile money in the Philippines.

Rajesh, S., & Manoj, P. K. (2014). Politicization of Trade Unions and Challenges to Industrial Relations in India: A Study with a Focus on Northern Kerala.International Journal of Business and Administration Research Review,1(2), 45-54.

Rajesh, S., & PK, D. (2015). Women Employees work life and challenges to Industrial Relations: Evidence from North Kerala.IPASJ International journal of Managment (IIJM), 3, 5,6.

Sen, A. (1993). Capability and well-being73.The quality of life,30, 270-293.

Received: 10-Mar-2023, Manuscript No. AMSJ-23-13318; Editor assigned: 11-Mar-2023, PreQC No. AMSJ-23-13318(PQ); Reviewed: 24-May-2023, QC No. AMSJ-23-13318; Revised: 27-Jun-2023, Manuscript No. AMSJ-23-13318(R); Published: 07-Jul-2023