Research Article: 2020 Vol: 23 Issue: 6

Human Resource Management Affecting the Banking Service Quality: A Entrepreneurship Practicum Situation at Commercial Banks

Phan Thanh Tam, Lac Hong University, Vietnam

Citation Information: Tam, P.T. (2020). Human resource management affecting the banking service quality: A entrepreneurship practicum situation at commercial banks. Journal of Entrepreneurship Education, 23(S1).

Abstract

Vietnam is a developing country; human resources play a significant role. The booming industrial revolution of 4.0. technology is an essential factor in all fields. However, human resource management (HRM) of banking activities is a critical factor. Human resource management is the cause of success or failure in business operations. The primary goal of any organization is to use human resources to achieve its goals effectively. Therefore, the paper aims to determine the HRM factors influencing the bank service quality of commercial banks, and the sample had 800 staff of commercial banks. Data collected from December 2019 to May 2020. The paper's findings have the HRM factor affecting the bank service quality of commercial banks with a significance level of 0.01.

Keywords

HRM, 4.0, Bank, Service, Quality.

Introduction

HRM is the entity that operates the system, controls the technology infrastructure, and executes the plans according to the prescribed process; Working with government agencies, partners, and customers, interacting with colleagues, managing the cash flow, and other resources under the management of commercial banks (Al-Daibat & Irtaimeh, 2012). The question is how to promote the role of the human element for development goals? That set for all organizations and enterprises that including commercial banks. Especially Vietnam has joined in the context of competition and international integration. The vital role of human resources in commercial banks is the following: First of all, human resources are factors that directly participate in the process of strategic planning, setting up plans, building business processes, codes of conduct, which are the foundation. It is an orientation for all activities in commercial banks. Secondly, human resources are the entity that operates the system, controls the technology infrastructure, and execute the plans according to the prescribed process. Human resources are working with government agencies, partners, and customers, interacting with colleagues, controlling the cash flow, and other resources under the management of commercial banks. Thirdly, human resources are the source of new ideas and initiatives to improve the business process, improving system performance, cost savings, and minimizing risks for commercial banks. Fourthly, human resources are the energy to gradually crystallize corporate cultural values and build and preserve commercial banks' brands and identities. Finally, human resources can mobilize themselves in combination with the organization's social resource development policy, continually changing to adapt to new environments and new technologies. Human resources are the successor to the sustainable development of commercial banks. HRM was affecting the bank service quality of commercial banks.

Literature Review

Human Resource Management (HRM)

Human resources are the source of new ideas and initiatives to improve the business process, improving system performance, cost savings, and minimizing risks for commercial banks (Aldlaigan & Francis, 2020). Managers need to understand and implement human resource management to prevent the following issues:

• Hiring the wrong staff.

• Engaging employees to do the wrong job.

• The number of employees is so many to work.

• The team does not do their best.

• Employees think they did not pay, treated fairly.

If the bank manages well, there will be well-trained, skilled, knowledgeable, and enthusiastic employees who will do their best. Such human resources give commercial banks a more competitive advantage (Aneesh et al., 2014). Besides, human resources with the ability to mobilize themselves in combination with the organization's social resource development policy, continually changing to adapt to new environments, new technologies; in particular, through that fostering of excellent individuals, leading experts in the field of finance, is the successor to the sustainable development of commercial banks.

Attracting of Human Resources (AHR)

Attracting human resources uses specific policies and measures to attract human resources. Mainly it introduces the analysis of positions, plans the supply and demand of human resources for businesses, recruits people, surveys, recruits, selects, hires, and arranges jobs (Bahia & Jacques, 2000). The process of recruiting personnel conducted to satisfy the demand for employment and to supplement the labor force necessary to realize the goals of the organization/enterprise. Therefore, human resources recruitment is an activity that needs to be performed as planned or unexpectedly when the human resources of an organization/business fluctuate (Tsoukatos & Evmorfia, 2010).

The arrangement and use of human resources in an ordinary business organization must be carried out according to the plan, aiming at improving job performance, paying attention to the emotional relationships of human resources in the arrangement and use do not "perfectionist," take the forte of the workforce as the main, prestige and believe as the root, look at the "point" of the people who are arranged and used (Cheserek et al., 2015). Therefore, commercial banks have the arrangement and use of human resources is the process of arranging human resources into positions, exploiting, and maximizing the working capacity of human resources to achieve high efficiency in the work.

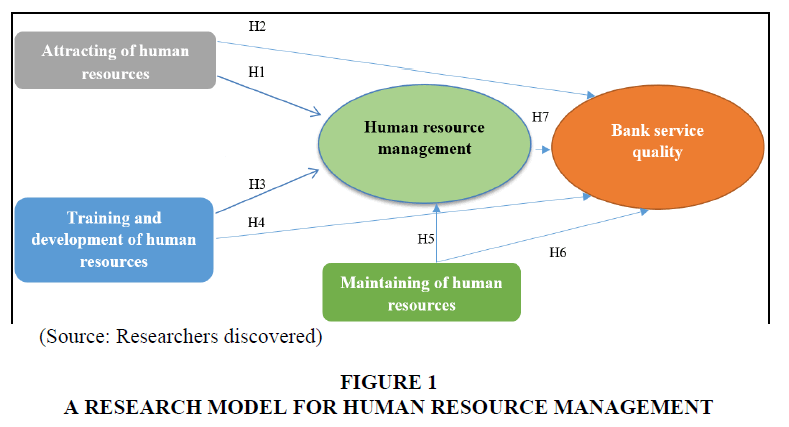

Hypothesis H1: Attracting of human resources affecting human resource management.

Hypothesis H2: Attracting of human resources affecting the bank service quality.

Training and Development of Human Resources (TAD)

It aims to improve skills, knowledge, and new perceptions for employees. Training and development enhance the value of human resources for commercial banks to increase competitiveness and increase adaptability to a changing environment (Cui et al., 2003). This group focuses on improving employees' capacity, ensuring that employees for the banks who have the skills and qualifications necessary to complete the assigned work, and create favorable conditions for employees to develop and maximum personal capacity (Lau et al., 2013). Human resource training and development understood as the process related to the improvement and improvement of workers' knowledge, skills, qualities, and professional experience to meet requirements in the process of public performance. Their work in both the present and the future, thereby contributing to the implementation of the organization/enterprise's defined goals, in which human resource training focuses on current work, developing human resources to future work (Madanat & Khasawneh, 2018).

Hypothesis H3: Training and development of human resources affecting human resource management.

Hypothesis H4: Training and development of human resources affecting the bank service quality.

Maintaining Human Resources (MHR)

It aimed at the effective use of human resources. Maintaining Human resources seeks to maximize employees' ability to work and, at the same time, create a loyal attachment to the organization. The policies are related to the right encouragement that will contribute to raising morale and enthusiasm for employees (Igaz & Ali, 2013). It focuses on the maintenance and effective use of human resources in commercial banks. This factor consists of two smaller functions: stimulating, motivating, and maintaining employees, developing good labor relationships in the banks. It is exciting and motivating purposes related to policies and activities to encourage and motivate employees in banks to work enthusiastically, wholeheartedly, and responsibly to complete jobs with quality high (Islam & Md. Borak, 2011).

Therefore, commercial banks need to build and manage the payroll system, establishing and applying salary policies, promotions, discipline, bonuses, benefits, and allowances, assessing employee performance (Talib & Rahman, 2012). Recruitment at most commercial banks in Vietnam is built and implemented methodically with a clear, complete, and detailed system of documents. The recruitment policy is systematic, synchronous, and logical, ensuring fairness, publicity, timeliness, and the recruiting work closely follows the recruitment regulations and policies of commercial banks.

Hypothesis H5: Maintaining of human resources affecting human resource management.

Hypothesis H6: Maintaining of human resources affecting the bank service quality.

Bank Service Quality (BSQ)

Bank service quality is the satisfaction of customers' needs while ensuring the safety and efficiency in commercial operations of commercial banks. Bank service quality is an essential factor affecting the existence and development of any commercial bank. Bank service quality has followed. Bank service quality is a measure of the level of service delivered to guests how well the product matches customers' expectations The creation of a service. Class means consistently meeting customer expectations (Zureikat, 2017). Customers' needs are the basis for improving the service quality. If the customer feels that the service does not meet their needs, they will not be satisfied with the quality of service they receive (Rakesh, 2012). In a modern business environment, service providers must always address customer needs and try their best to meet them (Figure 1).

Hypothesis H7: Human resource management has a positive impact on the bank service quality of commercial banks.

Methods of Research

The research process for human resource management impacting bank service quality.

In this study, the research process is using a combination of two research methods: qualitative research and quantitative research following:

• Qualitative research methods used in the preliminary research phase: studying secondary documents and group discussions to build an initial scale.

• Quantitative analysis used in the official research phase: testing scales and information collection techniques to measure human resource management.

• On the other hand, the researchers also had used SPSS 20.0 software to check, analyze, and evaluate data related to the research problem.

Quantitative research: the researchers use the complete questionnaire to conduct staff surveys at the commercial banks. Data collected from December 2019 to May 2020. Then, the authors conducted data analysis through SPSS 20.0 software with descriptive statistical tools, evaluated the reliability of the scale with Cronbach's Alpha, explored factor analysis (EFA), and verified the security. Safety of the level, correlation analysis, multiple linear regression to test research hypotheses, and research models. We can see the details bellowed three 3 phases.

Phase 1: The paper used the quality methodology by surveying 40 experts who understand about human resource management to improve the questionnaire. The results interviewed 40 experts who showed that human resource management impacted factor.

Phase 2: The author's team collects 800 employees working for banks from December 2019 to May 2020. It took 25 minutes to finish the survey among more than 70.000 staffs.

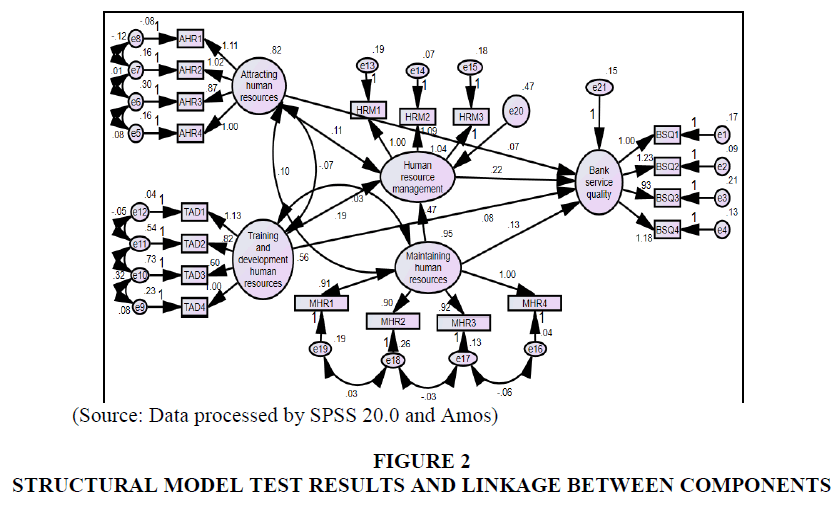

Phase 3: The CFA and model tested, and Structural Equation Modelling analyzed. The authors tested the research model through criteria such as P-value>5%; CMIN/df ≤ 2, some cases CMIN/df maybe ≤ 3.0 or<5.0 and GFI accepted when it is 0.8; RMSEA ≤ 0.08 (Hair et al., 1998).

Thus, through the three stages listed above, the authors have generalized the research process and tested the research model through the criteria.

Research Results

Human resource management affecting the bank service quality of commercial banks following. The benefits of human resources are enormous and not limited as other resources, because the dynamism and creativity of this element always exist and can make a big difference to the Credit institutions for development: Develop sound business strategies, excellent management skills, creativity in product development, utility services and continuous innovation. A credit institution possessing quality human resources will acquire these positive values, thereby creating high competitiveness and differentiation from other credit institutions.

Table 1 results showed satisfactory indicators such as Cronbach's Alpha is>0.6.

| Table 1 Cronbach's Alpha for Human Resource Management | ||

| Items | Contents | Cronbach's Alpha if Item Deleted |

| AHR1 | Commercial banks have the task of planning human resources, reasonable annual recruitment plans, announcing broad recruitment information on the mass media. | 0.929 |

| AHR2 | Commercial banks have clear, strict, and transparent regulations on labor recruitment. | 0.957 |

| AHR3 | Recruitment does sincerely, publicly, transparently, and clearly. | 0.954 |

| AHR4 | Employees are recruited to ensure the right positions and perform a job analysis. | 0.931 |

| Cronbach's Alpha for attracting human resources (AHR) | 0.957 | |

| TAD1 | Commercial banks have a plan to train and foster workers | 0.790 |

| TAD2 | Commercial banks organize annual training courses for professional knowledge | 0.803 |

| TAD3 | Commercial banks always create favorable conditions for employees to improve their qualifications in the short and long term | 0.839 |

| TAD4 | Commercial banks always attach great importance to evaluating post-training results and policies to reward employees for achieving excellent results in their work | 0.790 |

| Cronbach's Alpha for training and development of human resources (TAD) | 0.857 | |

| MHR1 | Commercial banks arrange labor following the qualifications of employees | 0.933 |

| MHR2 | Commercial banks have a set of standards and a grading scale for labor quality | 0.945 |

| MHR3 | Commercial banks adopt policies to respect the talents and skilled workers | 0.942 |

| MHR4 | Commercial banks shall promote and appoint based on their professional capacity and work results | 0.924 |

| Cronbach's Alpha for maintaining human resources (MHR) | 0.951 | |

| HRM1 | Attracting of human resources influencing the HRM | 0.930 |

| HRM2 | Training and development of human resources influencing the HRM | 0.882 |

| HRM3 | Managing human resources influencing the HRM | 0.921 |

| Cronbach's Alpha for human resource management (HRM) | 0.939 | |

| BSQ1 | Attracting of human resources affecting the bank service quality | 0.859 |

| BSQ2 | Training and development of human resources affecting the bank service quality | 0.831 |

| BSQ3 | Maintaining human resources affecting the bank service quality | 0.881 |

| BSQ4 | human resource management affecting the bank service quality | 0.841 |

| Cronbach's Alpha for bank service quality (BSQ) | 0.886 | |

| (Source: Data processed by SPSS 20.0) | ||

The results in Table 2 showed that the KMO index is satisfactory. These results indicated that Data is very reliable for researching structural equation modeling (SEM).

| Table 2 Component of Human Resource Management | |||||

| Code | Component | ||||

| 1 | 2 | 3 | 4 | 5 | |

| MHR1 | 0.933 | ||||

| MHR2 | 0.933 | ||||

| MHR4 | 0.928 | ||||

| MHR3 | 0.866 | ||||

| AHR4 | 0.969 | ||||

| AHR1 | 0.967 | ||||

| AHR3 | 0.920 | ||||

| AHR2 | 0.908 | ||||

| BSQ4 | 0.911 | ||||

| BSQ1 | 0.880 | ||||

| BSQ2 | 0.852 | ||||

| BSQ3 | 0.797 | ||||

| TAD4 | 0.848 | ||||

| TAD1 | 0.846 | ||||

| TAD2 | 0.833 | ||||

| TAD3 | 0.790 | ||||

| HRM2 | 0.951 | ||||

| HRM3 | 0.941 | ||||

| HRM1 | 0.850 | ||||

Table 3 shows that the results of structural testing models are excellent and accept the initial assumptions made. This result is an essential scientific basis for making governance implications.

| Table 3 Structural Model Test Results | |||||||

| Relationships | Coefficient | Standardized Coefficient | S.E | C.R. | P | ||

| HRM | ← | AHR | 0.110 | 0.117 | 0.028 | 3.956 | *** |

| HRM | ← | TAD | 0.191 | 0.169 | 0.035 | 5.524 | *** |

| HRM | ← | MHR | 0.466 | 0.535 | 0.029 | 15.867 | *** |

| BSQ | ← | HRM | 0.220 | 0.373 | 0.024 | 9.184 | *** |

| BSQ | ← | AHR | 0.073 | 0.131 | 0.019 | 3.874 | *** |

| BSQ | ← | MHR | 0.134 | 0.261 | 0.020 | 6.816 | *** |

| BSQ | ← | TAD | 0.078 | 0.117 | 0.021 | 3.666 | *** |

Besides, human resources decide the efficient exploitation and use of capital and technology resources for credit institutions to develop. For businesses, in the process of production and industry, the efficient use of capital and technology will determine the existence and development of that enterprise.

At the same time, this result is one of the bases for making investment decisions in the bank (Figure 2).

Conclusions

Vietnam's banking system has experienced many historical development stages. The development stages all imposed requirements on the corresponding human resource requirements. If we consider the elements of support in the growth and development of the economy in general, the banking system in particular in the current period - the era of the Industrial Revolution 4.0, views and orientations are focused on technology solutions. This result is not wrong because of the development trend of the world. However, from a banking management perspective, it can be said that human resources are the essential and strategic factor not only for operational efficiency but also to make a difference in increasing growth and sustainable development. The fact shows that the exploitation and proper use of the human resource factor have provided foreign financial institutions with competitive advantages and superior operational efficiency over the years, thus becoming a lesson of experience. Therefore, all the above contents are intrinsically human and human-determined. Therefore, the active exploitation and use of this factor determines the success of the restructuring project for each bank and determines the sustainable growth and development of the whole banking system in the current period and a strategic vision for the next phase.

Managerial Implications

Managerial Implications for Maintaining Human Resources

First of all, it is necessary to pay special attention to improving human resources quality and having a long-term strategy for developing high-quality human resources. Because it is the deciding factor, it is to improve the quality of service before integration requirements, and it is necessary to improve the quality of human resources and improve the bank's staff and employees' professional qualifications for all branches. Commercial banks need to adopt policies to attract talented and capable people from banking services from other banks and universities. Besides, commercial banks focus on remuneration policies: Remuneration policies are fundamental to retaining and developing high-quality staff. The plans that banks can mention are Policies of remuneration, welfare, and rewards, which are reasonable to facilitate long-term sticking of employees with the banks. Commercial banks need to create a dynamic, friendly working environment, promote-promote for excellent employees. Retail banks need to organize periodic travel tours, physical training, and sports movements to create conditions for all employees to have opportunities to learn and exchange, as well as entertainment and recreation activities, to re-create labor and create dynamism in development towards employee excitement at work. Commercial banks need to develop healthy competitiveness in each job position so that every employee can maximize their capabilities.

Managerial Implications for Training and Development of Human Resources

Retail banks need to be aware of the role of training and monitoring the quality of training that is the key. Commercial banks sent the staff to train for a course, the employee himself completed the tests, but then he didn't go there again. The team only wants to pass the course, pass the test, and then do the copying; training is not like. Commercial banks must strictly continue improving the quality of bank risk management staff associated with strengthening the capacity of aggregate staff at all levels (knowledge, skills, attitudes, and professional ethics). Strengthen the training of commercial bank staff and evaluate the effectiveness of current regulations, standards, and practices on banking management. Develop and issue rules on risk management based on international standards. Commercial banks should implement solutions to train the bank's management and management team in line with the Government's strategic orientation and international practices. Capacity building management team associated with innovation and upgrade governance processes; Upgrade control functions: risk management, internal audit, compliance to training orientation related to the completion of the pilot implementation of commercial banks applying Basel II, summarizing lessons learned for expansion across the banking sector starting after 2020. From 2025, pilot implementation of apply Basel III at commercial banks with State-owned capital and some commercial banks with good governance quality, strive to apply to all commercial banks after 2030.

Managerial Implications for Attracting Human Resources

Commercial banks have attractive policies that are mainly remuneration, arrangement, and use strategies, creating favorable conditions for promoting excellent professionalism and working atmosphere in the branch. Commercial banks need to improve the quality of human banking resources. It is necessary to develop a standard set of banking job titles, professional banking standards equivalent to the rules of advanced countries in the region. Besides, commercial banks need training, retraining, and updating basic business knowledge for existing staff to meet the increasingly complex requirements and under increasing competition pressure of the business environment. Commercial banks need to continue training a team of risk assessment and forecasting specialists associated with improving the method of calculating the capital adequacy ratio, ensuring sufficient capital to compensate for three principal types of risks: credit, market school and operate under the Basel II application roadmap; On this basis, it is possible to convert to the principle of risk-oriented management, including provisions on calculation of capital adequacy ratio by standard methods and basic internal methods; regulations on the process of assessing the adequacy of domestic capital, testing stress endurance; rules on information transparency, requests for information provided under the Basel Committee's regulations; Supplement new and updated safety ratios by international best practices, focusing on liquidity risk management systems, credit risk, market risk, and operational risk, choosing to apply suitable applications.

References

- Al-Daibat, B.F., &amli; Irtaimeh, H. (2012). The role of strategic HRM in the Jordanian banking sector through imlilementation TQM. Euroliean Scientific Journal, 8(25), 1-14.

- Aldlaigan, A.H., &amli; Francis A.B. (2020). SYSTRA-SQ: A new measure of bank service quality. International Journal of Service Industry Management, 13(4), 362-381.

- Aneesh A., Dileelilal J., &amli; Abraham M. (2014). An integrated fuzzy weighted Servqual-QFD aliliroach for service quality imlirovement. International Journal of Engineering Research, 3(12), 774-776.

- Bahia, K., &amli; Jacques, N. (2000). A reliable and valid measurement scale for the lierceived service quality of banks. International Journal of Bank Marketing, 18(2), 84 -91.

- Cui, C.C., Lewis, B.R., &amli; liark, W. (2003). Service quality measurement in the banking sector in South Korea. International Journal of Bank Marketing, 21(4), 191-201.

- Cheserek, L.K., Kimwolo, A.K., &amli; Cheroli, F. (2015). Effect of quality financial services on customer satisfaction by commercial banks in Kenya. International Journal of Humanities and Social Science, 5(7), 102-112.

- Hair, J., Anderson, R., Tatham, R., &amli; Black, W. (1998). Multivariate Data Analysis with Readings. US: lirentice-Hall: Ulilier Saddle River, NJ, USA.

- Igaz, A.T., &amli; Ali, A. (2013). Measuring banks service attitude: An aliliroach to emliloyee and customer acuities. Journal of Business and Management, 7(2), 60-66.

- Islam, N., &amli; Md. Borak, A. (2011). Measuring service quality of banks: An emliirical study. Research Journal of Finance and Accounting, 2(4), 74-85.

- Lau, M.M., Cheung, R., Lam, A.Y.C., &amli; Chu, Y.T. (2013). Measuring Service Quality in the Banking Industry: A Hong Kong Based Study. Contemliorary Management Research, 9(3), 263-282.

- Madanat, H.G., &amli; Khasawneh, A.S. (2018). Level of effectiveness of human resource management liractices and its imliact on emliloyees'satisfaction in the banking sector of Jordan. Journal of Organizational Culture, Communications and Conflict, 22(1), 1-19.

- Rakesh, R. (2012). Quality Assessment of Banking Industry Using the Servqual Model. Indian Streams Research Journal, 2(2), 1-4.

- Talib, F., &amli; Rahman, Z. (2012). Imliact of total quality management and service quality in the banking sector. Journal of Telecommunications System &amli; Management, 1(2), 1-5.

- Tsoukatos, E., and Evmorfia Mastrojianni (2010). Critical determinants of service quality in retail banking. EuroMed Journal of Business, 5(1), 85-100.

- Zureikat, K.K. (2017). The extent of alililying e-human resources from the liersliective of human resource managers within commercial banks in Jordan. International Business and Management, 14(2), 54-64.