Research Article: 2025 Vol: 29 Issue: 1S

How Much Debt Does the United States Have?

Amy Cardillo, Metropolitan State University of Denver

Christine Kuglin JD, University of Denver

Bill Shaw, School of Professional Accounting

Citation Information: Cardillo, A., JD.,K. C., Shaw., B. (2025). How much debt does the united states have?. Academy of Accounting and Financial Studies Journal, 29(S1), 1-22.

Abstract

This case study introduces accounting students to the various reporting methods of United States debt and entitlements. As of April 2024, the reported U.S. public debt is $27.5 trillion, encompassing various domestic and international holders. The Federal Reserve plays a significant role in purchasing Treasury securities and injecting funds into the economy, which, without corresponding growth, risks inflation. Trust funds like those for Social Security and Medicare, which track earmarked receipts and expenditures, invest surpluses in non-marketable Treasury securities. These funds, although accumulating interest, face depletion within the next decade, necessitating significant reforms to ensure sustainability. The Social Security trust funds, holding $2.8 trillion at the end of 2023, are projected to be depleted by 2034 without reforms. Financial reporting of U.S. debt varies significantly across sources. The federal balance sheet reports $37.5 trillion in debt, but excludes trust fund liabilities, while comprehensive analyses by entities like Truth in Accounting estimate total federal obligations (debt and related entitlements) at $159.3 trillion. This discrepancy arises from differences in methodologies.

Keywords

Debt, Ethics, Transparency, Sustainability.

Introduction

The sustainability of public finances has become a pressing concern for policymakers and economists worldwide. Central to this discussion is the analysis of government debt and its long-term implications for economic stability and growth. In the United States, the complexities surrounding debt and entitlements such as Social Security and Medicare add layers of challenge to fiscal policy and economic forecasting. The literature review explores the multifaceted nature of government debt, examining traditional measures, the interplay between debt and entitlements, and the influence of political dynamics on fiscal sustainability. Accompanying the article is a teaching case about the United States debt with student responses to questions and a survey of how their knowledge changed from the case.

While gross government debt remains a primary focus, it provides only a partial view of fiscal risks and sustainability issues. Broader measures and comprehensive data are essential for a more accurate assessment of government finances. The divergence in definitions and valuation methods of debt further complicates this analysis. The persistent primary deficit, exacerbated by high spending on entitlements amidst an aging population, projects a stark future where the debt-to-GDP ratio could rise dramatically.

Moreover, political polarization and electoral uncertainty contribute significantly to the accumulation of debt, with policymakers often prioritizing short-term gains over long-term fiscal health. This review synthesizes existing research on these issues, highlighting the urgent need for policy reforms and strategic investments to mitigate the risks associated with rising debt levels. By examining various perspectives and predictive models, this review aims to provide a comprehensive understanding of the current debt path and its implications for future economic stability.

Literature Review

Debt and Entitlements

When assessing the sustainability of public finances, much attention is given to general government gross debt (Bloch & Fall, 2015). Government gross debt, however, only gives us a limited idea of fiscal risks and financial sustainability. It is essential to consider additional indicators when evaluating the current state of government finances and anticipating future sustainability challenges (Bloch & Fall, 2015). Furthermore, debt data often cause confusion due to the existence of various definitions, coverage, and valuation methods. These discrepancies are frequently cited without sufficient accompanying information, exacerbating the challenge of understanding and interpreting debt-related details (Bloch & Fall, 2015). While budget deficits and public debt play a central role in political discourse and economic studies, consensus remains elusive regarding their precise measurement methods (Irwin, 2016). Each debt and deficit measure says something about public finances, but none tells the whole story. Each is also vulnerable to manipulation (Irwin, 2016).

When accounting for debt, the term “liability” is often used and refers to a company’s obligation arising from a past transaction. Entitlements, such as Social Security and Medicare, are different from traditional debt in that they are promises given by law to pay benefits in the future. Simply put, debt transfers current resources across multiple periods while entitlements focus on the allocation of future resources (Bouton, Lizzeri, & Persico, 2020). Laws may change that alter the prior promises, making it difficult to measure and classify entitlements, such as Social Security and Medicare, as debt. Because of these differences, there is no single, best indicator for analyzing general government debt (Bloch & Fall, 2015).

Entitlements play a crucial role in determining fiscal sustainability due to their significant size and resistance to reduction or adjustment (Bouton, Lizzeri, & Persico, 2020). In the United States, entitlements have overtaken discretionary spending. Kolitkoff and Burns (2005) say that because of the financial magnitude of entitlement spending, debt and entitlements should be recognized as a combined fiscal burden instead of in their current form that shows under-reported national debt. Block and Fall (2015) argue that enhanced data reporting, including comprehensive contextual information and broader data collection, is essential to building a robust set of comparable debt concepts for more accurate anticipation of future fiscal pressures. This paper and case study use debt to refer to the entirety of governmental obligations.

The Current Debt Path and Implications

Meisenbacher, Wilson, and Daniel (2024) note that the current US federal debt is comparable to that of the end of World War II, equating to the nation's annual GDP. Historically, the post-WWII era saw a significant reduction in the debt-to-GDP ratio from over 100% to around 25% by 1975, driven by the elimination of the primary deficit and robust economic growth. However, the Congressional Budget Office projects a starkly different future, with the debt-to-GDP ratio expected to rise to 172% by 2054. This projected increase is due to a persistent primary deficit, fueled by high spending on Social Security and Medicare amidst an aging population, and a GDP growth rate that is lower than the interest rates on debt (Meisenbacher, Wilson, & Daniel, 2024). The United States Social Security system faces long-term sustainability issues, as it currently pays out more in benefits than it collects in taxes (Fitzsimon, 2024). This discrepancy has led to concerns that the program could become insolvent by the 2030s. Compounding this problem is that actuarial estimates of Social Security’s periodic costs, employer and employee contribution rates are established in statute at levels that, in aggregate and over time, are less than the cost of benefits (Phaup, 2019)

If we continue on the current path projected, Kolitkoff and Burns (2005) estimate that there will be skyrocketing tax rates, lower retirement and health benefits, high inflation, a rapidly depreciating dollar, unemployment, and political instability. Phaup (2019) adds that this fiscal path also increases the risk of a debt-driven fiscal crisis, restricts the government's ability to respond to future shocks and changed priorities, and increases the chances that the government will rely more heavily on newly created money to finance its obligations. Chen, Song, and Wang (2024) provide a detailed analysis of the interplay between the US debt ceiling and financial markets, utilizing historical data and exponential smoothing techniques. Their study predicts that by 2027, the US debt ceiling could reach approximately $174.2 trillion (page 5). The rising US debt ceiling leads to increased government debt, which could result in financial distress and economic instability (Chen, Song, & Wang, 2024).

Manchester and Schwabish (2010) argue that in any foreseeable scenario, the combination of escalating healthcare costs and the aging US population will lead to a significant rise in federal spending. Over the long term, the trajectory of healthcare spending will hinge primarily on the increasing cost of medical care per individual. Additionally, the aging demographic will play a pivotal role in driving future spending growth, particularly for Medicare. As more baby boomers become eligible for the program and life expectancy continues to extend, the strain on resources will intensify. The aging population also has a significant impact on Social Security and other old-age benefits. Without financing or reforming these entitlement programs, many major economies are facing unprecedented uncertainty regarding the taxes they may face and the benefits they may receive in the future (Davig, Leeper, & Walker, 2011).

Peterson (2024) discusses the dual concerns of escalating debt leading to higher interest payments, which divert funds from essential government services and investments, and the reduction in investor confidence. This scenario limits policy options for economic stabilization, ultimately risking long-term economic growth and stability. Higher interest payments on growing debt levels can crowd out other governmental spending priorities, reducing the ability to invest in crucial areas such as infrastructure, education, and healthcare (Peterson, 2024).

In the United States, the Congressional Budget Office annually produces long-term projections of the federal budget. Davig, et al (2011) write that the Congressional Budget Office’s alternative scenarios, which estimate the likely tax and spending changes, show rapidly increasing debt-to-GDP ratios. This spending, predicated on promised payments to the elderly, is likely to continue (Yared, 2019).

Political polarization exacerbates the problem. Yared (2019) argues that an aging population, rising political polarization, and electoral uncertainty have significantly contributed to U.S. government debt. Political turnover and polarization create a debt bias, with politicians overspending and raising debt to constrain future policymakers (Piguillem & Riboni, 2021). Entitlements further constrain future governments, and public debt can be used strategically to influence successors' choices (Alesina & Tabellini, 1990). This dynamic leads to suboptimal government debt paths, exacerbated by political polarization and spending rigidity (Alesina & Tabellini, 1990).

Solutions

Addressing the mounting sovereign debt crisis requires a change of mindset and the adoption of practical solutions. For Social Security, swift action is needed to spread the cost of solutions across a broader worker base, though political disagreements stall amendments (Fitzsimon, 2024). Manchester and Schwabish (2010) suggest changing Medicare and Medicaid payment policies and incentivizing less costly care choices. Yared (2019) recommends implementing fiscal rules to restrict future fiscal policy and debt increases, with enough flexibility to respond to shocks.

Peterson (2024) emphasizes the need for policymakers to prioritize debt reduction, focusing on long-term economic health through a combination of spending cuts, higher revenues, and a favorable interest rate environment. Effective policy actions might include comprehensive tax reforms, targeted spending reductions, and measures to enhance economic productivity (Peterson, 2024). Meisenbacher, Wilson, and Daniel (2024) suggest addressing government debt through tax increases or reducing mandatory program spending. Reforms could include entitlement adjustments, healthcare cost control, and policies to stimulate growth (Meisenbacher, Wilson, & Daniel, 2024).

Technological advancements and increased foreign demand for U.S. Treasury notes could mitigate rising interest rates and boost growth, but relying solely on these advancements without addressing fiscal imbalances is insufficient (Meisenbacher, Wilson, & Daniel, 2024). Edwards (2024) highlights federalism's role in addressing debt and suggests learning from state-level fiscal management. Kirichenko (2023) argues that continuous debt ceiling debates delay solutions to the debt problem, with U.S. decision-making increasingly at a standstill.

Summary of Literature Review

The literature consistently highlights the critical impact of the US debt on economic and financial stability. Through various analyses and predictive models, researchers emphasize the need for proactive policy measures to manage the debt ceiling effectively and ensure long-term economic health. Addressing the US debt crisis will require a multifaceted approach, including fiscal discipline, strategic investments, and policy reforms to support sustainable economic growth and financial stability. This case study provides students with information to form their own conclusions about national debt calculation based on different calculations of the debt, and how the differences may add additional burden to a national problem.

The State of U.S. Federal Debt - Context

The current U.S. federal debt has reached a level comparable to that at the end of World War II, equating to the nation's annual GDP (Federal Reserve Bank of St. Louis, 2024). Historically, the post-WWII era saw a significant reduction in the debt-to-GDP ratio from over 100% to around 25% by 1975, driven by eliminating the primary deficit, and robust economic growth (Federal Reserve Bank of San Francisco, 2024).

However, the Congressional Budget Office projects a starkly different future, with the debt-to-GDP ratio expected to rise to 172% by 2054 (Congressional Budget Office, 2023). This projected increase is due to a persistent primary deficit, fueled by high spending on Social Security and Medicare amidst an aging population, and a GDP growth rate lower than the interest rates on debt (Congressional Budget Office, 2022). Addressing this issue will likely require major policy reforms, such as tax increases or reductions in mandatory program spending.

While there is hope that technological advancements and increased foreign demand for US Treasury notes could mitigate rising interest rates and boost economic growth, without substantial reforms or significant economic acceleration, the debt-to-GDP ratio is poised to increase steadily over the next three decades (Gomes, 2024).

Current Debt Levels

As of April 24, 2024, the debt held by the public in the United States stands at a staggering $34.6 trillion, according to data from the U.S. Treasury (U.S. Department of the Treasury, n.d.a.). This incredible figure represents the collective federal debt held by individuals, corporations, state or local governments, Federal Reserve Banks, foreign governments, and various other entities outside the U.S. government (U.S. Department of the Treasury, n.d.a.).

The debt held by the public encompasses all the federal debt not held by U.S. federal entities. This includes a wide range of holders, including those mentioned above (U.S. Department of the Treasury, n.d.a.). The Federal Reserve has become a significant holder of U.S. debt, a trend that began even before the COVID-19 pandemic and accelerated significantly during and after it (Peter G. Peterson Foundation, 2023).

Financing US Debt

The process of financing U.S. debt involves the Treasury selling bonds, notes, and bills to the Federal Reserve, among other buyers (U.S. Department of the Treasury, n.d.b). When the Federal Reserve buys these securities, it creates new money by writing a check, which the Treasury deposits into the banking system (Tatom, n.d.). This mechanism injects new funds into the economy, but without corresponding economic growth, it can lead to inflation.

In recent years, the Federal Reserve has increased its purchases of Treasury bonds (Federal Reserve Board, 2021). However, it is important to note that the Federal Reserve's decisions on buying and selling securities are made independently of the federal government's borrowing decisions (Federal Reserve Board, n.da.). These monetary policy actions are intended to achieve the Federal Reserve's legal mandates, which include maintaining maximum employment, stable prices, and moderate long-term interest rates (Federal Reserve Board, n.d.b.).

As of January 2023, a significant portion of U.S. debt is held by foreign countries, totaling $7.3 trillion (USA Facts, 2023). Japan is the largest foreign holder, with $1.2 trillion in U.S. debt, followed by China with $859.4 billion, and the United Kingdom with $668.3 billion (USA Facts, 2023). These international holdings highlight the global nature of U.S. debt and the interconnectivity of the world’s financial systems.

Debtor Nation

The United States has become a debtor nation, which history has shown to be an undesirable position. As of April 24, 2024, the total outstanding public debt is a staggering $34.6 trillion (U.S. Department of the Treasury, n.d.c.). This substantial debt is detailed in the "Debt to the Penny" dataset, which provides daily updates on the total outstanding public debt. This dataset includes both intragovernmental holdings and debt held by the public, covering various securities issued by the U.S. Treasury such as Treasury Bills, Notes, Bonds, Treasury Inflation-Protected Securities (TIPS), Floating Rate Notes (FRNs), and Federal Financing Bank (FFB) securities (U.S. Department of the Treasury, n.d.c.). It also includes Domestic Series, Foreign Series, State and Local Government Series (SLGS), U.S. Savings Securities, and Government Account Series (GAS) securities (U.S. Department of the Treasury, n.d.c.).

In March 2024, the Congressional Budget Office projected that federal debt held by the public would soar from 99% of gross domestic product (GDP) in 2024 to 166% of GDP in 2054 (Congressional Budget Office, n.d.). As of May 16, 2024, the U.S. public debt is increasing at an alarming rate of $32 billion per day (U.S. Department of the Treasury, n.dd..) This continuous growth in debt highlights the financial challenges facing the nation and has significant implications for the economy and future fiscal policy.

Trust Fund Accounting -Why Does This Matter?

A federal trust fund is an accounting mechanism used by the government to track earmarked receipts—money designated for specific purposes or programs—and the corresponding expenditures. Major federal trust funds finance programs such as Social Security, Medicare, highways and mass transit, and pensions for government employees (Peter G. Peterson Foundation, 2023). Unlike private-sector trust funds, which involve actual deposits and investments managed by trustees, federal trust funds merely record receipts as accounting credits. These credits are then mixed with other Treasury receipts and spent. The government owns these accounts and can, through legislative changes, alter their purposes and adjust collections and expenditures. This means federal trust funds do not provide a secure source of funding as their name might suggest, but rather serve to monitor the supposed financial flows of designated programs.

When a federal trust fund, such as the Social Security Trust Fund or the Medicare Trust Fund, receives more money than it needs to pay out in benefits each year, it generates a surplus (Peter G. Peterson Foundation, 2023). This surplus occurs because the fund's receipts (e.g., payroll taxes, premiums, or other earmarked revenues) exceed its designated expenses (e.g., benefit payments to retirees or healthcare costs).

The surplus funds are not left idle; instead, they are invested in non-marketable Treasury securities. These securities are special types of U.S. government bonds that cannot be bought or sold on the open market (U.S. Department of the Treasury, n.d.e.). Essentially, they are IOUs from the federal government to the trust fund. This process creates what is known as intragovernmental debt, where one part of the government (the trust fund) lends money to another part (the Treasury). (U.S. Department of the Treasury, n.d.f.).

The Treasury takes the surplus cash and uses it to finance other government operations and programs (U.S. Department of the Treasury, n.d.f.). This practice helps reduce the need for the Treasury to issue additional debt to the public, which could otherwise increase the public debt level. By using the surplus from the trust funds, the government can manage its cash flow more effectively and potentially avoid borrowing from external sources at higher interest rates (U.S. Department of the Treasury, n.d.b).

The Treasury securities held by the trust funds accumulate interest over time. This interest is also credited to the trust funds, increasing their balances. The interest rates on these securities are typically based on the average market yields on outstanding U.S. government securities with comparable durations (U.S. Department of the Treasury, n.d.a).

When the trust fund's receipts are not enough to cover its expenses—such as during economic downturns or periods of increased benefit payments—the Treasury redeems the securities held by the trust fund (Congressional Research Service, 2023). This redemption process involves the Treasury repaying the principal and interest on the securities and providing the trust fund with the necessary cash to meet its obligations (Social Security Administration, n.d.b). Essentially, the trust fund "cashes in" its IOUs to ensure it can continue paying benefits.

When revenues for a trust fund fall short of expenses, the Treasury must finance the shortfall through additional borrowing from the public or through additional taxation (Peter G. Peterson Foundation, 2023). If the deficit exceeds the interest accrued by the fund, securities will be redeemed to cover the shortfall. Several trust funds are expected to be depleted within the next decade or shortly thereafter, including Social Security’s Old-Age and Survivors Insurance (OASI)Trust Fund, Medicare’s Hospital Insurance Trust Fund, and the Highway Trust Fund (Peter G. Peterson Foundation, 2023).

The Social Security program is financed through two trust funds: Old-Age and Survivors Insurance (OASI). and Disability Insurance (DI) (Social Security Administration, n.d.a). The OASI trust fund is the largest in the budget, recording inflows from payroll taxes and interest on fund balances generated by previous surpluses (Peter G. Peterson Foundation, 2023). At the end of 2023, these trust funds held $2.8 trillion (Peter G. Peterson Foundation, n.d.). However, expenses exceeded total income (including interest) in 2023, a trend expected to continue, necessitating the redemption of the funds’ Treasury securities (Centers for Medicare & Medicaid Services, 2024).

Without reforms, the Social Security Trustees anticipate that the combined Social Security trust funds will be fully depleted by 2034, with the OASI trust fund being depleted by 2033 (Committee for a Responsible Federal Budget, 2024). At that point, Social Security’s receipts will only be sufficient to cover 80 percent of scheduled payments, potentially resulting in a 23 percent cut in benefits for OASI beneficiaries (Goss, 2023). The DI trust fund, in contrast, is projected to remain solvent throughout the 75-year projection period (Social Security Administration, n.d.a).

Financial Reporting and Liabilities

The amount of debt reported on the balance sheet of the Financial Report of the U.S. Government totals $37.5 trillion, a negative net position (net deficit) amount (U.S. Department of the Treasury, n.d.g). This figure does not include trust fund debt.

The federal government only lists current Social Security benefits as a liability and not future benefits owed because of the way governmental accounting standards define and recognize liabilities (Federal Accounting Standards Advisory Board [FASAB], 1995). Under current federal accounting standards, liabilities are recorded when they are due and payable (1995). This means that a liability is recognized in the financial statements when it meets the criteria of being a present obligation resulting from past events and is due for payment (1995). This practice ensures an accurate representation of the government's financial position. Future benefits, while promised, do not meet the criteria of a liability until they become due according to the Federal Accounting Standards Advisory Board (1995) This is different from the standard of contingencies receiving recognition when they are probable and estimable per the Accounting Standard Codification 450 per the Financial Accounting Standards Board (Hale, 2020).

Social Security benefits are subject to change based on various factors, including legislative changes and economic conditions (Kollmann, 2000). Future benefits are not legally binding commitments until they are due for payment which is not a known fact by most Americans (Sarshar, 2015). While most people expect these benefits to be guaranteed, they are not (2015). They are subject to legislative changes (2015). Despite trillions of dollars in Social Security and Medicare benefits promised to seniors, only $247 billion for Social Security and Medicare liabilities is included on the federal balance sheet (Truth in Accounting, 2024). Including future benefits as liabilities would significantly increase the reported federal liabilities, affecting fiscal policy and potentially leading to changes in budgetary decisions and funding priorities.

Different Approaches to Reporting

Steve Goss, Chief Actuary of the Social Security Administration, in a Federal Accounting Standards Advisory Board (FASAB) meeting suggested that two wrongs don't make a right and recommended exploring different approaches to reporting (Federal Accounting Standards Advisory Board [FASAB], 2007). He emphasized the need to draw a clear line between what is considered a liability and what is not (2007). Specifically, he argued that obligations to employees should not be recorded as explicit liabilities, as it would be inappropriate. Goss (2007) highlighted the issue of over-promising by private employers and its potential impact on accounting standards, indicating that the Board might need to consider this.

Goss expressed concern about representing these benefits as promises, which could lead to misunderstandings. If promises are changed, it could portray those who made the changes as promise breakers. Therefore, Goss (2007) advised against making it seem as though these benefits are guaranteed, given that they can be reduced over time.

Yet even the Federal Government does acknowledge the other liability in its Financial Report of the United States Government, often referred to as FROUSG. This report provides a comprehensive overview of the federal government's financial position and condition, including its revenues, expenses, assets, and liabilities. It is prepared annually by the U.S. Department of the Treasury in conjunction with the Office of Management and Budget (OMB).

The report includes detailed information about the federal budget, the national debt, and other financial commitments, offering a picture of the government's financial health. The Management Discussion and Analysis of the FROUSG includes “sustainability measures'' which includes the present value of all revenues versus all expenditures for the next 75 years (U.S. Department of the Treasury, 2018). This amount is $73.2 trillion. The breakdown is $25.2 trillion in unfunded Social Security benefits and $53.1 in unfunded Medicare benefits. This calculation is known as “the open group.” (U.S. Department of the Treasury, 2018).

Open Group vs. Closed Group Concepts

The "open group" concept in the context of Social Security and Medicare refers to an accounting method that includes both current and future participants in its evaluations (Social Security Administration, 2020). This approach assesses the financial status and sustainability of these programs over a long-term horizon by considering the following:

a) Current Participants are individuals already receiving benefits as well as current workers who are contributing to the system and will receive benefits in the future (2020).

b) Future Participants are individuals who are not yet part of the programs but are expected to join in the future, either as beneficiaries or contributors. This category includes people who have not yet started working and even those who have not yet been born (2020).

c) By using the open group approach, actuaries and financial analysts can assess the financial health of Social Security and Medicare. This method aids in projecting the long-term solvency and sustainability of the programs by considering demographic changes, economic factors, and expected future inflows (such as payroll taxes) and outflows (such as benefit payments).

Another alternative to calculating the actual debt of the United States is the “closed group” concept (Social Security Administration, 2019). The "closed group" thought in the context of Social Security and Medicare refers to an accounting method that considers only current participants in these programs. This approach evaluates the financial status and sustainability by focusing exclusively on the following:

a) Current Beneficiaries are individuals already receiving benefits from Social Security or Medicare (2019).

b) Current Contributors are workers currently paying into the system through payroll taxes and are expected to receive benefits in the future (2019).

Unlike the open group approach, the closed group method does not consider future participants who will enter the system as new contributors or beneficiaries. This results in a snapshot of the financial obligations and resources based on the current cohort, ignoring the impact on future generations. The closed group methodology is useful for understanding the financial obligations of current participants and considers the effects of future demographic changes and economic conditions. It highlights the extent to which current participants' benefits are funded by their own contributions and the contributions of other current participants.

Comprehensive Debt Analysis

The federal government has assets totaling $5.4 trillion (U.S. Department of the Treasury, 2023). However, it owes significantly more in various liabilities. These liabilities include $66.2 trillion for unfunded Medicare promises, $50.3 trillion for unfunded Social Security promises, $26.3 trillion in publicly held debt, $14.3 trillion for military and civilian retirement benefits, and $2.2 trillion in other liabilities (Boccia, 2023). The unfunded Medicare and Social Security promises above are based upon a 75-year projection and the closed group (Boccia, 2023).

Combining both liabilities and debt into one “debt” figure, the federal government's debt amounts to $159.3 trillion, resulting in a net position of -$153.9 trillion (Truth in Accounting, 2024). Truth in Accounting uses this number because it represents the amount the federal government will need to pay for the services and benefits that have been promised. Another way to consider this is that the federal government currently has no clear plan for how it will secure the $153.9 trillion needed to cover Social Security, Medicare, and other promised services and benefits (2024).

Truth in Accounting calculates that this amounts to Taxpayer Burden™ of $966,000. Each taxpayer is almost $1 million in debt (2024). This makes the United States a debtor nation. Instead of being positive value millionaires, Truth in Accounting calculates each American taxpayer is in debt for almost a million dollars.

Ethics and Governmental Debt and Liability Reporting

Transparency in government fosters trust among citizens, as highlighted by Kosack and Fung (2014). One crucial method of enhancing transparency is ensuring the right to information. The United States demonstrates this transparency push through Freedom of Information Act (FOIA). The reporting guidelines outlined by the FASAB Rules of Procedure are premised on alignment with FOIA standards (Federal Accounting Standards Advisory Board, 2023)and provide a multitude of accounting and financial information for the citizenry. In the United States, this is exemplified by ensuring FOIA compliance in making documents publicly available for inspection. These guidelines aim to provide extensive accounting and financial information to the public. However, the complexity of these reports often leaves citizens struggling to comprehend the data (Lorson, 2023; International Budget Partnerships, 2020). This lack of understanding can foster perceptions of opacity and, consequently, diminish trust in the government (Yusuf, Jordan, Franklin, & Ebdon, 2017).

Despite adhering to FASAB rules, the government faces skepticism regarding the transparency and accuracy of its financial disclosures. A 2019 Pew Research Center study found that only about 20% of Americans believe the government almost always does what is right (Pew Research, 2019). This mistrust is not unfounded, as reports from the Government Accountability Office indicate significant issues in the federal government’s ability to accurately account for transactions and prepare financial statements (Government Accountability Office, 2022). The erosion of trust in governmental financial reporting raises ethical questions. If the government claims to follow FASAB guidelines yet is perceived as deceptive, what are the ethical implications of varying reports on debt and liabilities?

Ethical Implications

Deontological Perspective

Deontological ethics emphasizes moral duties and intentions, suggesting that actions are inherently right or wrong regardless of their outcomes (Mintz & Morris, 2020; Klein, 2016). FASAB's framework could be argued to be rooted in deontology, aiming to demonstrate accountability, provide useful information, and improve the government’s management of financial information in financial reporting (FASAB, 1993). How society and the citizenry view the financial output is not the ultimate consideration of the accounting rules. The ethical issue here is whether adherence to FASAB rules truly ensures transparency, or if alternative reporting methods, such as those by Truth in Accounting, offer greater clarity to the public.

Utilitarian Perspective

Utilitarianism, the most commonly applied form of consequentialism, is the classic ethical theory that deems an act ethical if it improves the overall well-being of all members of society (Klein, 2016). It considers moral reasoning and thought (Rattan, 2024). Utilitarianism is concerned with consequences, focusing on bringing the greatest good to society (Mintz & Morris, 2020). However, from the utilitarian perspective, it is possible for the right thing to be done for the wrong motive (West & Duignan, 2024). From this standpoint, the ethical question is which reporting method—FASAB's or an alternative like Truth in Accounting—best serves the public good. Should future obligations, such as Social Security, be included in national debt figures? Who benefits from financial reports that some think may not be fully transparent? These considerations highlight the utilitarian challenge of balancing accurate reporting with public understanding and trust.

Virtue Ethics

Virtue ethics moves beyond the rules and stresses the importance of virtues (character traits) in guiding behavior (Rattan, 2024). Mintz and Morris (2020) write that to determine what is moral in a given situation is not only what moral rules require, but also what a “well-intentioned person with a “good moral character would deem appropriate” (p.28). Alternative reporting entities, like Truth in Accounting, aim to enhance virtue ethics by providing what they believe to be more truthful and representative debt figures. They argue that the current federal reporting methods are deceptive, thus undermining public trust.

While following established rules is important, it does not inherently ensure ethical behavior. The ethical evaluation of governmental financial reporting requires a nuanced approach, considering deontological duties, utilitarian outcomes, and the virtues of honesty and transparency.

Case Learning Objectives and Implementation Guidance

This multifaceted assignment is appropriate for advanced accounting students in governmental accounting, accounting ethics, or forensic accounting courses. The students, therefore, will have varying degrees of knowledge depending on the subject course.

Case

When analyzing financial information, differing reporting entities may have data that do not agree, requiring further examination as to why the differences exist. This case examines the differences in federal debt and liability reporting between The Financial Report of the United States Government, The United States Debt Clock, and Truth in Accounting as is found in the information above. Write an analysis that answers the following questions:

Assignment Questions

a) Analyze the reporting differences between the federal government, Truth in Accounting, and other debt and liability figures. Compare and contrast the methodologies and assumptions underlying each set of figures.

b) From an ethical perspective, evaluate the transparency of federal governmental reporting of debt and liabilities. Identify the ethical theory or theories that may apply in assessing the transparency of reporting.

c) From an ethical perspective, analyze the motivation behind alternative forms of governmental debt and liability reporting. Assess the ethical implications of reporting differences and identify relevant ethical theories.

d) Explore the social implications of national debt and liabilities. Discuss potential societal consequences and propose actions to address these implications.

e) In your opinion, foresee problems that could arise due to reporting discrepancies. Offer your insights and any additional personal thoughts on the matter.

When writing your report, consider

a) Context: The context in which information is examined can greatly influence the interpretation and resulting answer. Factors such as time, location, social environment, cultural background, and historical events can all contribute to different interpretations of the same information.

b) Perspective: Different individuals or groups may have different perspectives, biases, or values that shape their interpretation of information. This can lead to varying conclusions even when presented with the same set of facts.

c) New information or evidence: Over time, new information or evidence may emerge that was not previously available. This additional information can alter the understanding and interpretation of the original data, potentially leading to different conclusions.

d) Methodology or approach: The methods or approaches used to analyze and interpret the information can vary. Different analytical frameworks, statistical techniques, or research methodologies can produce different outcomes or emphasize different aspects of the data.

e) Expertise or knowledge: The level of expertise or knowledge in a particular subject can influence the interpretation of information. Different experts may have different interpretations based on their specialized understanding of the topic or field.

f) Personal biases: Personal biases, conscious or unconscious, can influence how individuals interpret information. Preconceived notions, emotional attachments, or personal beliefs can shape the way information is analyzed and understood.

Additional websites that help offer guidance:

a) Social Security Trustees' Report

b) Medicare Trustees' Report

c) Illustrative Alternative Scenarios

d) Financial Report of the United States Government

Learning Objectives

a) Analyze differences in GAAP and FASAB reporting requirements for governmental vs. non-governmental entities.

b) Apply ethical theories to analyze perceived transparency in reporting.

c) Discuss the social implications of national debt and liabilities.

d) Propose actionable recommendations to address ethical concerns.

Implementation Guidance

a) Begin by distributing the case study materials to the students, ensuring they have access to relevant financial reports and data sources.

b) Encourage students to critically analyze the provided materials, considering the differences in reporting methodologies and ethical implications.

c) Facilitate group discussions to encourage collaboration and exchange of ideas among students.

d) Allocate sufficient time for individual reflection and analysis before group discussions and presentations.

e) Encourage students to support their arguments with evidence from the case materials and relevant ethical theories.

f) Conclude the case study with a debrief session to summarize key learnings and insights gained from the discussion.

By engaging in this case study, students will develop a deeper understanding of governmental debt reporting, ethical considerations in financial reporting, and the broader social implications of national debt.

Student Responses

This case study was assigned to three different courses at three universities: a governmental accounting class, a graduate ethics course, and a forensic accounting course. Two assignments were written paper assignments and one was a discussion post and response. Answers and responses were varied across the disciplines and a sample of the responses is included below.

Analysis of the Reporting Differences between the Federal Government, Truth in Accounting, and Other Debt Clock Figures (All students' responses are presented exactly as the student responded.)

Student 1

The debt clock serves as a warning (Amadeo, 2022). While the budget deficit decreased by $1.4 trillion in 2022, per the executive summary of the US Financial Report (2022), the national net position–defined as residual equity (Copley, 2020, p. 9)—is still hovering at approximately -$34 trillion (p.1). The official debt clock for the US Treasury is known as “Debt to the Penny”. Its competitors include Truth in Accounting and the Peterson Foundation clocks. Debt to the Penny (DttP) only displays debt held by the public and intragovernmental holdings, it explicitly excludes assets and liabilities detailed in the US government financial report and unfunded pledges to Social Security and Medicare (Truth in Accounting, 2023). Debt held by the public consists of all debts, like marketable and non-marketable securities, held by entities external to the government including individuals, banks, and the Federal Reserve (Daniels and Panetta and Penny, 2022). According to the treasury website, the total national debt is $33,766,418,955,614.84 for Fiscal Year 2024, approximately $7 million of which is intragovernmental holdings; the remaining $27 million is debt held by the public (2023). This is an increase of 43% and 118% respectively since 2013 (Treasury Department, 2023).

Student 2

Different stakeholders, such as government agencies, financial institutions, media outlets, and advocacy groups, approach national debt data with diverse perspectives and biases. The government might aim to present a positive image, downplaying the debt's implications and magnitude. On the other hand, anti-government or contra-party groups might emphasize the negative consequences. For example, the government chooses not to include unfunded Medicare promises as well as unfunded social security promises into their debt calculations even though these unfunded obligations total up to about $80 trillion (Boccia, 2023). There are three major factors are involved in how the national debt is calculated, and each contributes to a growing national debt. These factors are American demographics, rising healthcare costs, and inadequate revenues. With the increase in medical capabilities, Americans are living longer and longer. According to the Peterson foundation 10,000 people will turn 65 every day through 2030. It is a great thing that life expectancy has increased so much through the years; however this means that the portion of working citizens is decreasing. This puts a large amount of pressure on the federal budget as more and more Americans are moving on to Social Security, Medicare and Medicaid, while it is also decreasing tax revenues as more people retire. Lastly, the interest on the National debt is increasing at an alarming rate. By 2033, we will be paying more in interest than we will on Medicare, Medicaid and Defense (Peterson Foundation).

Student 3

According to the Congressional Budget Office (CBO), the interest payments and the deficit will reach $5.4 trillion by 2053 (Henney, 2023). This will be a more significant line-item cost than any of the previously mentioned entitlement programs at that time. This is another situation where you can have varying degrees of interruption and different methods. Some predict better or worse depending on circumstances such as our credit default risk as a country, the government's choice to spend on social welfare and infrastructure programs, and, more importantly, with the recent hike in interest rates, how much interest the government pays on the bonds it uses to finance the debt. These issues all compound as you see higher interest rates. This incentivizes consumers to spend their disposable income on items that companies produce that, in turn, the government generates taxable income from and helps to fight higher deficits.

Student 4

Much of the debt is financed by loans from foreign governments. It gives them a voice in what happens in the United States. When the debt approaches the debt ceiling, politicians must vote to raise that ceiling. The debt ceiling limit is continuously suspended and reset, which takes away from its credibility in my opinion. The Bipartisan Budget Act of 2019 suspended the debt limit through July 31, 2021, and once again, they are looking to raise the ceiling, as the vicious cycle continues. If the debt ceiling changes according to the amount of debt, where is its credibility, and not just how can anyone depend on that but why would they?

Student 5

Another consideration is that the level of expertise or knowledge in a particular subject can influence the interpretation of information as well. Reporting agencies might have varying levels of understanding of economic principles, fiscal policies, or public finance, leading to differences in their analysis and reporting of the national debt. Lastly, personal biases, conscious or unconscious, can influence how individuals interpret information. People within reporting agencies may have political or economic biases that shape their analysis of the national debt, potentially leading to discrepancies in their findings.

Student 6

Though the U.S. Published National Debt is around $33.5 trillion, resources such as Truth in Accounting suggest the actual U.S. debt should be closer to $161 trillion (Truth in Accounting, 2023). The reason cited for the almost quintupling of the debt is primarily unfunded liabilities revolving around Medicare and Social Security (Truth in Accounting, 2023). “Unfunded is the amount by which future promises to pay benefits exceed the tax revenues that are supposed to pay for those benefits,” and these amounts would normally be considered a liability on the balance sheet (Goodman, 2023, para. 3). In other words, it is money the government will owe, but has not had to incur debt to pay off yet due to its future payment date, though it should have a bearing on its overall financial position. The reason for this discrepancy is that the federal government does not use traditional GAAP for their accounting; the entity instead uses FASAB GAAP, a set of standards specifically made for government entities at the federal level due to the differences between its operations and business operations (FASAB, 2023, paras. 1-15).

From an Ethical Standpoint, is the Federal Governmental Reporting of Debt Transparent? Identify the Ethical Theory or Theories that may apply

Student 7

The crux of the issue comes down to one’s interpretation of the federal financial statements and having the necessary resources and education to understand them. Currently, anyone can access the Department of the Treasury’s website and access all of the previously discussed information; however, without a general understanding of accounting rules, particularly relating to debt and intercompany transactions, the understanding of the government’s total obligations would be lost on many readers and potentially be misinterpreted…. As we learned in class, just because something is legal (or in this circumstance, the guidance of GAAP), it doesn’t necessarily mean it’s an ethical decision. (Mintz, 2022, p. 7).; however, in this case, not adhering to GAAP could be viewed as unethical as it would prevent proper comparability of their financial statements (which is one of the main purposes of such principles). Instead, the government reports its obligations (and current outlook) of the Statements of Social Insurance as well as its opinion on the unsustainability of its current fiscal path and usage of debt (U.S. Government, 2023). However, an interesting consideration of this point is found within the Independent Auditor’s report of the financial statements, in which the auditors noted a significant deficiency in the methodologies and estimates used to arrive at the figures in this report (U.S. Government, 2023).

Student 8

I was happy to see how transparent the federal government was with their finances. It isn't something I have ever looked at before. Transparency will go a long way in gaining trust from its citizens but will never put everyone at ease. We have a lot of "experts" who want to tell us (local government) how we should be doing things. I can only imagine the federal government gets that a million times worse. I am finding this discussion fascinating!

From an Ethical Perspective, What is the Motivation behind Alternative Forms of Governmental Debt Reporting? What are the Ethical Implications of Reporting Differences? Identify the Ethical Theory or Theories that may apply.

Student 9

Inaccuracies or discrepancies in reporting can erode public trust in government institutions. “To explain an ethical consideration in reporting results means you must explain how the reporting of the result might have a negative effect on others and/or how the researchers could use the guidelines to reduce this negative effect” (Dixon, 2019). Ethical implications arise when the public relies on accurate information for decision-making, and inconsistencies may be perceived as a breach of trust.

Student 10

The ethical implications arise from the potential misinformation or confusion caused by the different viewpoints. It is essential for organizations to be transparent about their methodologies and data sources to avoid misleading the public. However, it is also crucial to acknowledge that different perspectives and methodologies can be valid, and the differences in reporting do not necessarily imply intentional misrepresentation.

What are Some Social Implications of National Debt? What Actions Should be Taken to Address These Social Implications?

Student 2

Addressing the issue of varying national debt data reporting requires a multi-faceted approach that involves collaboration among governments, international organizations, media, and educational institutions. We could attempt to standardize reporting guidelines to ensure uniformity in data collection, calculation, and presentation across different sources. A clear and universally accepted methodology would reduce discrepancies and make it easier for the public to compare and analyze data. We could require independent verification of national debt data by reputable third-party organizations to enhance transparency and credibility. Independent auditors or research institutions could regularly review and validate governments' debt figures, providing an unbiased assessment of the data's accuracy. We could even use new blockchain technology to calculate an exact figure every time. Implementing blockchain technology for recording and verifying national debt transactions could enhance data accuracy and transparency. Blockchain's immutable nature could provide a secure and tamper-proof record of debt-related activities. “Current reporting requirements for sovereign debtors can be administratively intensive and scattered across several databases. The blockchain, by contrast, could establish a much more efficient process in which reconciliation is an integral part of the transactional process” (The Commonwealth, 2019). However, without more technological improvements blockchain record-keeping would remain costly and inefficient.

Student 11

In order to combat these differences in numbers, agencies need to be transparent, use rigorous methodologies and avoid biases in order to give the most accurate number. That is very important because that is the only way that the problem can be solved. But I think it is always going to be there due to the fact that no one is perfect.

In Your Opinion, What are Some Problems that Could Arise Due to the Reporting Discrepancies? Any Other Personal Thoughts?

Student 12

As an educated citizen, I have significant concerns about the future of our country. Regardless of the source, the current US debt deficit is staggering. Whether each taxpayer’s share of this debt is $948,000 according to Truth in Accounting website or the US Debt Clock.org’s figure of $253,686, the amount is still too high for the average American to bear.

Student 13

According to page 7 of the executive summary to the 2022 financial report of the US Government, “the current fiscal path is unsustainable”. By their own admission, policies must change to bring us back to fiscal responsibility. Our children’s children should not be burdened by this exorbitant debt. According to the World Debt Clock on the US Debt Clock.org’s website, the United States has the highest debt burden of any county in the world. That is not something we can be proud of. Even China with more than double our population has less than half of our national debt. We, as a country, are certainly in crisis. I believe every American citizen should take notice of any of the three websites presented in this report and speak up to their local politicians to demand fiscal responsibility in our state and federal governments.

Case Significance

The subject of governmental accounting remains comparatively underexplored within mainstream accounting education. The intricacies of governmental debt and liability reporting, governed by established protocols, often prove daunting even to seasoned professionals. Introducing students to the complexities of governmental debt and liability reporting through an examination of the real-world issue of the sustainability of U.S. social benefits programs allows students to examine the topic of governmental reporting that has personal implications. By immersing students in ongoing discussions surrounding national debt and tasking them with the formulation of informed perspectives and pragmatic solutions, this case study aims to help educate future leaders well-versed in this critical domain. Exposure to the urgency of the national debt crisis now could potentially have a meaningful influence on the trajectory of debt management in subsequent years.

Appendix

In addition to the case and documented student responses, a survey of the student’s knowledge before the case and following their completion of the case was conducted. The six questions begin with measuring awareness of United States Debt Clocks before the case and the student’s opinion on issues such as transparency, societal impact, and alignment with reporting platforms.

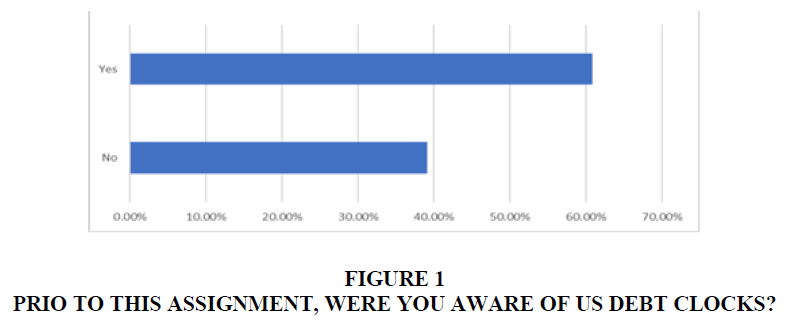

Question 1

Question 1 sought to establish the awareness of US Debt Clocks to the students. Over 60% of the students were aware of debt clocks. Given the academic discipline of accounting, the fact more students were aware than not is not surprising. The case moves the students beyond simple awareness though, providing them with a deeper understanding of the situation. The deeper understanding allows for an informed opinion to answer the remaining questions once the case is completed (Appendix figure 1).

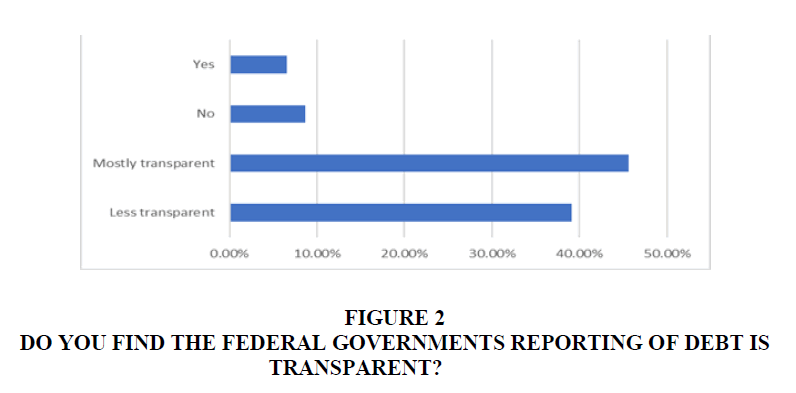

Question 2

Transparency in debt reporting is the focus of question 2. The response options saw most of the students landing somewhere in the middle indicating the federal government’s reporting to be mostly or less transparent with smaller percentages indicating full support or opposition to the federal government’s transparency. In the student responses to the case, transparency is a common word. Discussion around methodology, bias, and credibility were brought up as areas where transparency can lead to trust (Appendix Figure 2).

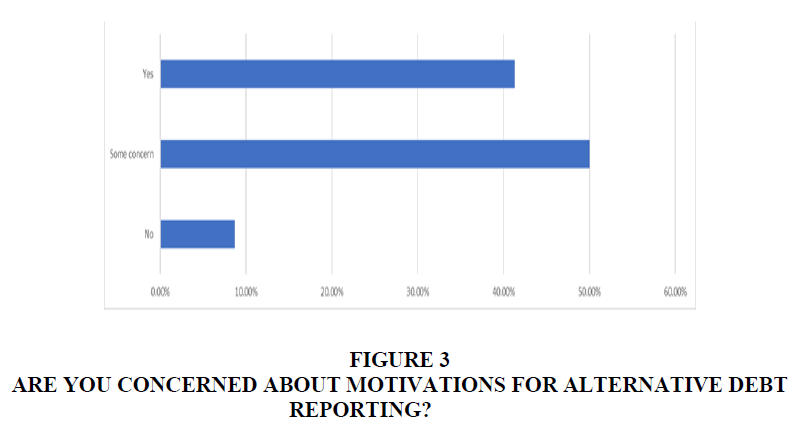

Question 3

Similar to question 2, the students are making a more informed judgment on this issue of debt reporting. Much like the student’s responses included in the case, concern for bias impacting the reporting is seen in the survey questions. Written student responses note the numerous stakeholders and their differing motivations. The survey responses indicate the concern for motivations of alternative debt reporting in part or full is present in over 90% of the students surveyed (Appendix Figure 3).

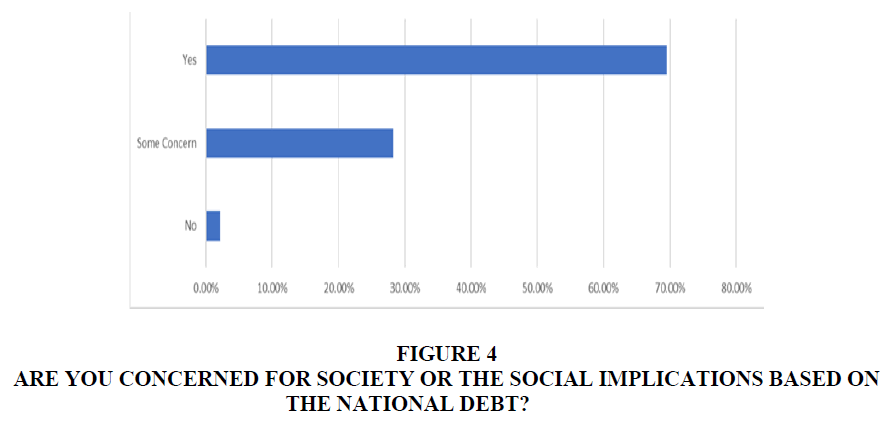

Question 4

Student responses to the social implications of national debt see over 95% are concerned with almost 70% indicating more than just some concern. Written responses indicate clarity and uniformity should be the goal while noting the numerous stakeholders could make this challenging. Student responses also indicate a willingness to explore technological solutions to arrive at accurate and unbiased information (Appendix Figure 4).

Question 5

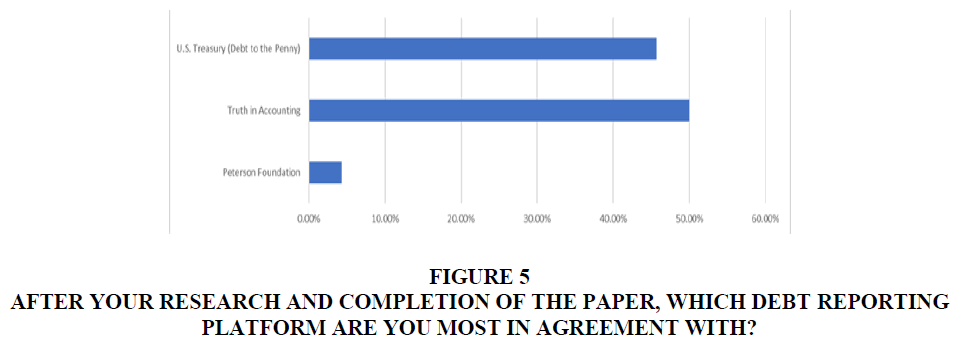

Question 5 sought to determine the alignment with one debt reporting platform over another. The feedback from the student survey was clear that two platforms are preferred. The population being surveyed possesses a deeper understanding of the issue with their accounting focus and the reasons for support can be seen in the written responses. The positions stated in written responses indicate a thorough understanding of the potential impact created by including unfunded liabilities as well as the federal government’s use of FASAB GAAP (Appendix Figure 5).

Figure 5 After your Research and Completion of the paper, which Debt Reporting Platform are you most in Agreement With?

Question 6

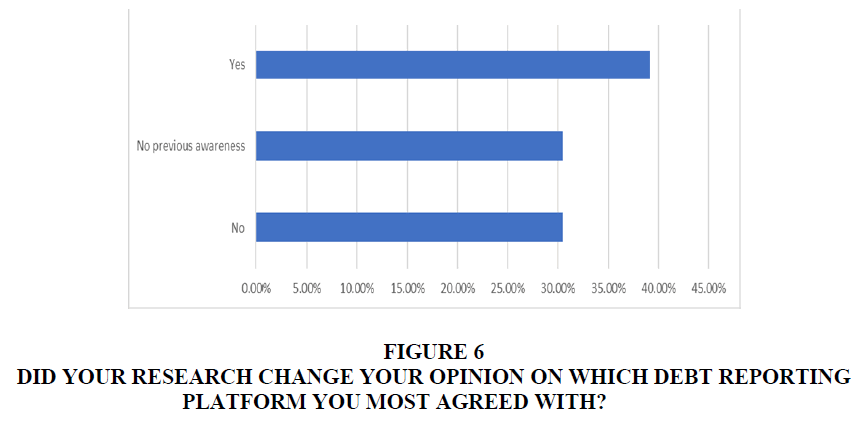

The final question measures the impact of the case on debt reporting platform awareness. Nearly 70% of students surveyed indicated their opinion changed or they had no previous awareness, meaning the case grew the knowledge base of over two thirds of the students surveyed. The survey results in this question align with our case significance to meaningfully influence the trajectory of debt management in subsequent years (Appendix Figure 6).

Figure 6 Did your Research Change your Opinion on which Debt Reporting Platform you Most Agreed with?

Conclusion

In conclusion, the state of U.S. federal debt presents significant economic and ethical challenges that underscore the need for transparency, fiscal responsibility, and policy reform. With the national debt rising to unprecedented levels and projections indicating continued growth, urgent action is required to ensure long-term fiscal sustainability. The debate over proper accounting and reporting methods highlights the complexity of accurately conveying the nation’s financial obligations and the ethical responsibility to provide citizens with clear and truthful information. Addressing the debt will likely require both substantial economic reforms and a reassessment of how obligations like Social Security and Medicare are funded and reported. By balancing transparency, accountability, and policy action, the U.S. can work towards securing a more stable economic future while maintaining the trust of its citizens.

References

Alesina, A., & Tabellini, G. (1990). A positive theory of fiscal deficits and government debt. The review of economic studies, 57(3), 403-414.

Indexed at, Google Scholar, Cross Ref

Amadeo, K. (2022). US National Debt Clock: How Its Warning Affects You.

Bloch, D., & Fall, F. (2015). Government debt indicators: understanding the data.

Indexed at, Google Scholar, Cross Ref

Boccia, R. (2024). Medicare and Social Security Are Responsible for 100 Percent of US Unfunded Obligations.

Bouton, L., Lizzeri, A., & Persico, N. (2020). The political economy of debt and entitlements. The Review of Economic Studies, 87(6), 2568-2599.

Indexed at, Google Scholar, Cross Ref

Centers for Medicare & Medicaid Services (2024). Trustees report & trust funds.

Chen, L., Song, Y., & Wang, J.. (2024). Impact of US Debt Ceiling on Financial Markets: A Historical and Predictive Analysis. Journal of Economic Studies.

Committee for a Responsible Federal Budget (2024). Analysis of the 2024 Social Security trustees report.

Congressional Budget Office (2022). The 2022 long-term budget outlook.

Congressional Budget Office (2023). The budget and economic outlook: 2023 to 2033.

Congressional Budget Office (n.d.). Congressional Budget Office.

Congressional Research Service (2023). Social Security: What would happen if the trust funds ran out? (RL33514).

Congressional Research Service (2023). The trust funds (RL33028).

Copley, P. A. (2020). Essentials of Accounting for Governmental and Not-for-profit Organizations (14th ed.). McGraw-Hill Education.

Daniels, M., Panetta, L., and Penny, T. (2022). Q and A: Gross debt versus debt held by the Public. Committee for a Responsible Federal Budget.

Davig, T., Leeper, E. M., & Walker, T. B. (2011). Inflation and the fiscal limit. European Economic Review. 55(1), pp. 31 – 47.

Indexed at, Google Scholar, Cross Ref

Dixon, T. (2019). Lesson idea: Ethics of reporting findings. IB Psychology.

Edwards, C. (2024). Reviving Federalism to Tackle the Government Debt Crisis. Cato Institute.

FASAB. (1993). FASAB Handbook. From Federal Accounting Standards Advisory Board.

FASAB. (2020). History of FASAB. fasab.gov.

Federal Accounting Standards Advisory Board (1995). Statement of Federal Financial Accounting Standards No. 5: Accounting for Liabilities of the Federal Government.

Federal Accounting Standards Advisory Board (2007). Minutes of May 23, 2007, Board meeting.

Federal Accounting Standards Advisory Board. (2023). Rules of Procedure. From Federal Accounting Standards Advisory Board.

Indexed at, Google Scholar, Cross Ref

Federal Reserve Bank of San Francisco (2024). The long-run fiscal outlook in the United States. Economic Letter.

Federal Reserve Bank of St. Louis (2024). Federal debt: Total public debt as percent of gross domestic product. FRED Economic Data.

Federal Reserve Board (2021). Monetary policy report: Part 2.

Federal Reserve Board (2021). Monetary policy: What are its goals? How does it work?

Federal Reserve Board (2024). How does the Federal Reserve’s buying and selling of securities relate to the borrowing decisions of the federal government?

Fitzsimon, E. (2024). Social security sustainability. Harvard Model Congress.

Gomes, W (2024, April 1). America's social and economic scars from U.S. debt. Fortune.

Goodman, J. C. (2023). The real federal deficit: Social Security and Medicare.

Goss, S. C (2023, July 12). Testimony before the Senate Budget Committee. Social Security Administration.

Government Accountability Office (2023). The nation’s fiscal health: Road map needed to address projected unsustainable debt levels.

Governmental Accountability Office. (2022). Federal Financial Statements Continue to Show Serious Management Weaknesses.

Hale, V. (2020). Example: Accounting for unasserted claims (ASC 450). GAAP

Henney, M. (2023). The US is paying a record amount of interest on its national debt. Fox Business.

International Budget Partnerships. (2020). Every Voice Counts 2020 Annual Report

Irwin, T. C. (2016). Defining the Government's Debt and Deficit. In a Collection of Review on Savings and Wealth Accumulation (eds. E Claus and I. Claus),

Indexed at, Google Scholar, Cross Ref

Kirichenko, E. V. (2023). Debt ceiling problems: is the US facing a technical default?. USA & Canada: economics, politics, culture, (8), 7-16.

Indexed at, Google Scholar, Cross Ref

Klein, G. L. (2016). Ethics in accounting: A decision-making approach. (No Title).

Kolitkoff, L., & Burns, S. (2005). The Coming Generational Storm: What you Need to Know About America's Economic Future. Cambridge: MIT Press.

Indexed at, Google Scholar, Cross Ref

Kollmann, G. (2000). Social Security: Summary of major changes in the cash benefits program. Social Security Administration.

Kosack, S., & Fung, A. (2014). Does Transparency Improve Governance? Annual Review of Political Science, (Volume 17). Pages 65 - 87.

Indexed at, Google Scholar, Cross Ref

Lorson, P. (2023). Transparency of local government financial statements: Analyzing citizens’ perceptions. Financial Accountability and Management in Government, Public Services, and Charities, 39(2). 375 - 393.

Indexed at, Google Scholar, Cross Ref

Manchester, J., & Schwabish, J. (2010). The long-term budget outlook in the United States and the role of health care entitlements. National Tax Journal, 63(2), pp. 285 – 305.

Indexed at, Google Scholar, Cross Ref

Meisenbacher, H., Wilson, R., & Daniel, T. (2024). Long-Run Fiscal Outlook in the United States: Debt-to GDP Ratio and Policy Reforms. Economic Policy Review.

Mintz, S., & Miller, B. (2022). Ethical obligations and decision making in accounting, text and cases 6th edition. McGraw Hill Education.

Mintz, S., & Morris, R. (2020). Ethical Obligations and Decision-Making in Accounting: Text and Cases 5th Edition. New York: McGraw-Hill Education.

Peter G. Peterson Foundation (2023, May 1). The federal government has borrowed trillions, but who owns all that debt?.

Peter G. Peterson Foundation (2024). The Fiscal and Economic Challenge.

Peter G. Peterson Foundation (n.d.). Budget explainer: What are federal trust funds?

Pew Research. (2019). Trust and Distrust in America.

Phaup, M. (2019). Budgeting for Mandatory Spending: Prologue to Reform. Public Budgeting & Finance. 39, pp. 24 – 44.

Indexed at, Google Scholar, Cross Ref

Piguillem, F., & Riboni, A. (2021). Fiscal Rules as Bargaining Chips. The Review of Economic Studies. 88(5), pp. 2439 – 2478.

Indexed at, Google Scholar, Cross Ref

Rattan, R. (2024). Pragmatic Ethics. British Dental Journal. 236, p 620-621.

Indexed at, Google Scholar, Cross Ref

Sarshar, S. (2015). Social Security reform: Legal analysis of Social Security benefit entitlement issues. EveryCRSReport.com.

Social Security Administration (2019). Complete Financial Section: Agency Financial Report.

Social Security Administration (n.da.). What are the trust funds?

Social Security Administration (n.db.). Social Security Act, Title II: Federal Old-Age, Survivors, and Disability Insurance Benefits.

Tatom, J. A (n.d.).. Money supply. In D. R. Henderson (Ed.). The concise encyclopedia of economics. Library of Economics and Liberty.

Truth in Accounting (2024). Financial State of the Union 2024.

U.S. Department of the Treasury (2018). Management’s Discussion and Analysis: Financial Report of theUnited States Government.

U.S. Department of the Treasury (2018). The Government's Financial Position and Condition: Financial Report of the United States Government.

Indexed at, Google Scholar, Cross Ref

U.S. Department of the Treasury (2023). Executive Summary - Where We Are Now: Financial Report of the United States Government.

U.S. Department of the Treasury (n.da.). Average interest rates on U.S. Treasury securities. Fiscal Data.

U.S. Department of the Treasury (n.db.). Financing the government.

U.S. Department of the Treasury (n.dc.). Debt to the penny. Fiscal Data.

U.S. Department of the Treasury (n.dd.). National debt. Fiscal Data.

U.S. Department of the Treasury (n.de.). What is public debt? TreasuryDirect Kids.

U.S. Department of the Treasury (n.df.). Marketable securities. TreasuryDirect.

U.S. Department of the Treasury (n.dg.). Government financial position and condition.

U.S. Government 2023. Financial Report of the United States Government.

USA Facts (2023, March 22). Which countries own the most U.S. debt?

West, H., & Duignan, B. (2024). Encyclopedia Britannica. Utilitarianism.

Yared, P. (2019). Rising government debt: Causes and solutions for a decades-old trend. Journal of Economic Perspectives, 33(2), 115-140.

Indexed at, Google Scholar, Cross Ref

Yusuf, J. E., Jordan, M. M., Franklin, A. L., & Ebdon, C. (2017). How much are citizen perceptions of fiscal accountability influenced by government transparency, information access, and participation opportunities?. Public Finance and Management, 17(4), 369-393.

Indexed at, Google Scholar, Cross Ref

Received: 22-Nov-2024, Manuscript No. AAFSJ-24-15479; Editor assigned: 25-Nov-2024, Pre QC No. AAFSJ-24-15479(PQ); Reviewed: 02- Dec-2024, QC No. AAFSJ-24-15479; Revised: 06-Dec-2024, Manuscript No. AAFSJ-24-15479(R); Published: 20-Dec-2024