Research Article: 2023 Vol: 26 Issue: 1S

How does Porter?s Business-level Strategies affect Competitive advantage in the Food and Beverage Industries?

Hajar Mohammad Alhosseiny, Misr University for Science and Technology

Citation Information: Alhosseiny, H.M. (2023). How Does Porter’s Business-Level Strategies Affect Competitive Advantage In The Food And Beverage Industries?. Journal of Entrepreneurship Education, 26(S1),1-18.

Abstract

Adopting an appropriate competitive strategy by any firm is a crucial issue since it determines the approach the firm has to follow in order to achieve sustainable competitive advantage. The objective of this research work is to find out the best-practice competitive strategy in order to be adopted by the firms in the Egyptian Food and Beverage sector so that it can achieve sustainable competitive advantage and join the successful and good profit-making firms of this sector globally. Porter’s model was taken as a basis of this research work. The model suggests that there are two main strategies firms can adopt either: Low Cost-leadership strategy or Differentiation strategy. In the Cost-leadership strategy, a firm strives to be low-cost producer of traditional products. On the other hand, in the Differentiation strategy, a firm is to produce products with unique features that are not imitated by other competitors and hence are sold only by this firm. Porter’s model also showed that firms can combine both strategies together forming a new strategy that can be called Hybrid or Integrated strategy The current study, being a survey desk research, chose to investigate the Food and Beverage sector as it is considered the world’s biggest industries and the largest contributing sector in the world’s Gross Domestic Product (GDP). Due to the availability of data, the research work encompasses the top twenty-seven (27) large food and beverage firms in the U.S and Canada. Eight years data about these firms have been collected and analyzed. Such a period is assumed to be a sufficient time to judge their status considering their sustainable competitive advantage. Several variables affect achieving competitive advantage, the most influential variable is the business-level strategy adopted by the firm. The sustainable competitive advantage of a firm is judged by studying the companies’ performance throughout the years with the adopted strategy. Analyzing sales and revenues of the companies’ accounting statements enabled the researcher to estimate the percentage of market share of each firm as a measure of the success of its strategy. Results showed that Differentiation strategy adopters have achieved the highest market share, and got a sustainable advanced ranking in the global competition.

Keywords

Business-level strategy, Competitive advantage.

Introduction

“The pursuit of competitive advantage is at the root of organizational performance and hence understanding the source of sustained competitive advantage has become a major area of study in the field of strategic management”. The process of developing a sustainable competitive advantage for any company is considered as a critical, challenging, and time-consuming process. It requires the company to maintain a determined way or approach to follow in order to occupy a privileged market position, gain customer satisfaction, and ensures high profitability. The increasing competitions whether in markets upstream (dealing with suppliers of raw materials) or downstream (processing of the materials and actual selling of finished goods to customers) give rise to more concentration on setting an appropriate business strategy that is suitable to deal with the changing business environs.

Porter’s Generic Competitive Strategies Framework forms a main influence in the strategic management literature. His main focus was on how the firm would compete in the targeted marketplace Auka (2014). Competitive strategies concentrate on ways that help the firm create a value proposition.

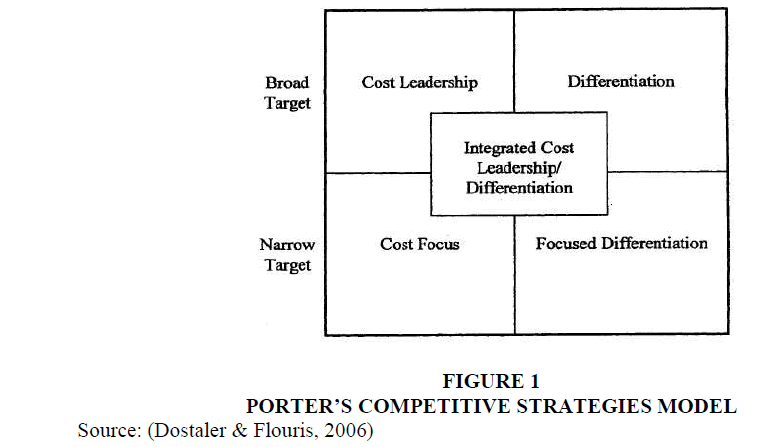

In Porter’s modeling of “Generic Strategy Options”, he maintains that firms may possess a myriad of interesting and unique strengths and weaknesses Awade (2014). However, their competitive advantage is determined by adopting one of two strategies: low cost or differentiation. The context in which this advantage is pursued can be either broad or focused (based on the size of the market or the range of the market segments penetrated), creating an additional set of strategic approaches.

The current study, being a survey desk research, chose to investigate the Food sector as it is considered the world’s biggest industries and the largest contributing sector in the world’s Gross Domestic Product (GDP).

Literature Review

Competitive Advantage

“Competitive advantage grows out of value (increase the worth of goods/services) a firm is able to create for its buyers that exceed the firm's cost of creating it. Value is what buyers are willing to pay, and superior value stems from offering lower prices than competitors for equivalent benefits or providing unique benefits that more than offset a higher price. There are two basic types of competitive advantage: cost leadership and differentiation.”

Michael Porter, Competitive Advantage, 1985 Competitive advantage is a benefit achieved over rivals or having an edge over competitors through providing customers a superior value, whether by offering lower prices or offering extra benefits that leads to superior prices. Maintaining competitive advantage results in increased returns and a prosperous firm over the long run. It has to justify why customers should buy from our company, not from our competitors. Prosperous companies rely mainly on having a strong competitive advantage that allows them to create and maintain a loyal customer base that can be grown over years (Ehmke, 2008).

Therefore, a company gains a competitive advantage when it adopts a strategy that is hard to imitate by rivals, and this is considered as the main indicator of the company’s success. The rapidity with which rivals are capable to attain the skills required to facsimile the advantages of a company’s value-creating strategy decides how long the competitive advantage will last.

Sustainable Competitive advantage refers to an advantage that allows a business to be more successful than its competitors over a long period of time.

Creating and sustaining competitive advantage requires companies to ripen a distinctive competence in executing its value-added activities. Remembering that a “distinctive competence is something a firm does well compare to its rivals “. It is considered as the backbone of business competitive strategy. The value of the firm’s strategy is determined by what it creates different from its competitors.

The importance of distinctive competence relies on owning an exclusive proficiency, skill, or resource that differentiates the company from its rivals. This differentiation is critical when introducing new products or exploring market chances in the surrounding environs. Widerange characteristics of “distinctive competence” encompasses the following: superior operating process, high-quality service, speedy product improvement, expert awareness of customer buying behaviors, skillful human assets, expert dispersal systems (Bordes, 2009). Companies should find ways to continuously pursue its distinctive competence and develop it. Companies should also be conscious about substitutes or surrounding threats from its competitors.

Business Strategy

The term strategic is derived from the Greek word (strategia) and means leading army. It refers to the leader’s capability to take the required and necessary action towards achieving the desired goal.

So, strategy is an integrated and unified long-term plan that helps the organization adapt to the environmental challenges and ensure that the organizational objectives are achieved. Following a strategy involves establishing an exclusive and valued position through applying a different set of activities (Lainos, 2011). It involves creating value and taking action steps that will help the firm to differentiate its outputs through producing superior products in terms of quality, design, features, and functionalities.

Business-Level (competitive) Strategies

Business-level strategies involve the determination of how the firm will compete in an industry. (Mitchell, 2009)

Porter indicated that competitive strategies consider improving different aspects of the firm that distinguish it and the value it generates among its competitors. In addition, “the core idea is about how the firm best can compete in the marketplace”.

The business strategy determines how the company is going to compete with its rivals in a specific market, and how it will increase its market share and create a sustainable competitive advantage. The strategy could be either “cooperative”, by beating competitors through alliances, or “single”, which means fighting for bigger market share on its own (Lainos, 2011; Michail, 2011). It encompasses a combined and coordinated set of obligations and actions that the company uses to gain competitive advantage relying on its core competency.

The Business Strategy Should Answer the Following Questions

1. How are we competing in the market today?

2. How will we compete in this market in the future?

Porter’s Generic Strategies Model

Porter’s generic model, which indicates Differentiation and Cost-leadership as the two main options for companies, has controlled business competitive strategy during the last thirty years (Pretorius, 2008). The company that wants to have a competitive advantage has to select how it likes to compete based on its target market and the type of competitive advantage as the main elements of choice according to this model (Alan et al., 2006).

The main approaches to competitive strategy based on porter’s model fall into two primary categories and three secondary ones:

Figure 1 shows these strategies as follow:

Main Categories

1. Striving to be the overall low-cost producer in the industry (a low-cost leadership strategy).

2. Seeking to differentiate one's product/process offering from rivals' products (a differentiation strategy).

Secondary Categories

1. Focusing on a narrow portion of the market rather than the whole market through applying Cost-leadership strategy (a focus cost-leadership strategy).

2. Focusing on a narrow portion of the market rather than the whole market through applying Differentiation strategy (a focus differentiation strategy).

3. Integrating both Cost-leadership and Differentiation strategies together (Hybrid strategy).

Cost-Leadership Strategy

The aim of this strategy is to offer low-cost products by the company in an industry (Valipour et al., 2012).

In other words, it involves becoming the lowest cost producer among the others in the same market, and therefore, outperforming competitors by providing lower price products or services. The strategy requires the Firm to continually cut its costs all the way through the value chain, and it has to find a way to gain a cost- advantage that is hard to be imitated by competitors. The costs should be reduced without affecting the product quality or features that are required by customers, because eliminating some of the main features with the aim of reducing costs will lead to poor-quality product.

Cost reduction could be achieved through focusing on cost control and efficiency in all areas of operation and carrying out value chain activities at lower cost than others which is considered as the competitive advantage of cost leadership.

Scale of economies and cost -effective management skills, creation of efficient scale of facilities (efficient scale of production is the lowest production volume where the plant or firm can produce such that its long run average costs are minimized), and reducing costs in areas like advertising, R&D, services, are ways for cost reduction especially if the firm produces highly standardized products.

Cost- leadership usually serves producing generic, standardized, and high-volume products at the most viable price to customers (Li & Li, 2008). It might be suitable to be applied in developing countries where having low-labor cost, and therefore lower cost of production.

“Cost leadership tends to be more competitors oriented rather than customer oriented”. Since it demands an adhesive concentration on the supply side rather than the demand side. Therefore, firms adopting cost- leadership have to always benchmark themselves against competitors in order to be able to evaluate the profitability and the market position relative to them.

Low-cost strategy works best when there is:

• Strong competition of prices,

• Standardized Products (repetitive processes and units and cyclical),

• Minimize equipment downtime,

• Most products are used in the same way by the buyers,

• Low switching cost experienced by the buyers if they decided to change, and - When industry new entrants introduce low prices for building customer base.

Differentiation Strategy

Differentiation strategy involves establishing competitive advantage by creating “different” products/ services rather than producing products similar to the other products offered in the market. The product will be based on better characteristics, good performance, or any other aspects that are indirectly associated with the cost and hence the price. The variation should be one that is hard to imitate and is achieved through investing heavily in R&D activities by the firms in order to increase its innovation capabilities, and improving the features of its products/ services. They aim to let the customers perceive them as valuable and unique which suit their preferences, achieving a leading market position all over its field, and to cope with their competitor’s novelties.

The firms that adopt product differentiation strategy may be engaged in riskier activities as they focus on the non- traditional activities such as newer technology (Dirisu et al., 2013). Hence, incurring higher production costs than others, so as to persuade the customers paying premium prices. However, an effective differentiator firm has to balance product benefits and costs to the customers in comparing to other’s competitive products.

A differentiation firm strives for creating a special image for itself and letting customers perceive its products/services as unique ones in terms of features, performance, quality, design, product delivery, customer service, distribution network, creativity and novelty, and other aspects that will be explained later.

Differentiation could be considered as a strategy aims to adjust companies’ attributes responding to customers’ needs of the selected segments. It encompasses many benefits for the company that uses it, but one of the dilemmas maybe to forecast if extra costs involved in differentiation can actually be retrieved from customers through high prices.

However, other competitors may be encouraged to enter the market by imitating the differentiated product. That is why there is a strong attention to intellectual property rights as to protect the owner of the substantial competitive advantage and to allow them to increase their earnings. By considering the case of Microsoft Software, the end user has to renew the license agreement every year in order to use the software, hence, it can detect any forged software. Also, besides maintaining high quality in Rolex manufacturing, Rolex has formed a worldwide network of qualified experts to guarantee the validity of their watch and its reliability in order to protect its reputation.

Many companies in the developed countries have successfully adopted and applied differentiation strategy, and entered the less developed countries in a strong position and gain more advantages over the national firms. The foreign companies have better atmosphere to apply differentiation strategy as they enjoy having more benefits as groundbreaking production methods. Such as: product innovation, process innovation, and business model innovation. They may also enjoy availability of different resources, and up-to-date management system.

Attaining a successful differentiation strategy requires exclusivity (which unluckily impedes market share), robust marketing abilities, process innovation, product innovation, Intensive R&D, and customer care.

Differentiation is considered as a defendable strategy for attaining higher earnings because of many reasons. First, it isolates the Firm from competition through creating brand loyalty. And also reduces the price demand elasticity through letting customer be lessersensitive to price variations. Second, “Uniqueness”; establishes barriers and diminishes substitutes that results in extra price margins, which accordingly lessens the need for a low-cost advantage. Finally, above- average earnings protects the company from the power of buyers because of the limited alternatives to the customers.

Focus Strategies

It refers to concentrating on a specific market niche classified by geographical area, level of income, gender, age, and group or product specialization. This can be with either cost or differentiation strategies (Singh, 2014; Nayyar, 1993). In other words, it will provide specific products for a quite smaller segment or market area where the least competition occurred and tend to build strong brand loyalty for its products. This strategy allows the Firm to set a superior price, superior quality (differentiation focus), or through providing a low-priced product to a limited and specific group of buyers (low-cost focus).

“Focus low-cost strategy” focuses on narrow, precise, identifiable segment of customers and challenging with the lowest price. It aims to make the firm the cost leader in its niche. However, “Focused differentiation strategy” refers to the firm’s ability to offer value-added products that are considered to be more suitable than other companies’ products because of their unique features, and are targeted to a small group of customers. Pursuing focused low-cost strategy offer certain products using well-known technology and processes, while those who pursue focused differentiation need specific resources and capabilities.

Ferrari and Rolls-Royce are typical examples of niche strategy adopters in the car industry. Both of them own a limited percentage of the market all over the world, and offer superior products at premium prices and make massive profits.

Hybrid (Integrated) Strategy

Companies adopting hybrid strategies are those that makes low-cost and differentiation aspects in the same time. It aims to offer customers with ideal cost/benefit mix. It has a dual strategic effect, attractive to customers who are both sensitive to both price and value. The strategy involves providing improved benefits to the customers with low price and at the same time gaining adequate return to be re-invested to improve the bases of differentiation. In another words, providing higher money value through providing up market or classy products at lower cost than competitors. Many companies tend to adopt the combination of both strategies approach to satisfy the customers who don't want to pay a high price and get differentiated product at the same time.

One of the main reasons for adopting a hybrid strategy is the fluctuating business environs that need companies to implement flexible integration of strategies. Hybrid strategy help the companies to adapt easily to environmental changes and acquire new expertise rather than relying on a single generic strategy. Smith (1995) argued that companies that follow integrated strategy may attain more advanced performance than those who pursue a single one.

Implementation of hybrid strategy will result in gaining many competitive advantages at the same time such as: economies of scale and brand/ customer loyalty comparing to benefits gained by pursuit of a single strategy. Some prosperous example that used hybrid strategy and achieved a great success like Toyota approached the hybrid strategy through improving quality and reducing price (Baroto et al., 2012). It enhances the Business core competencies that allow it to create differentiated products with differentiated characteristics at lower costs.

Research Model

Research Variables and Methodology

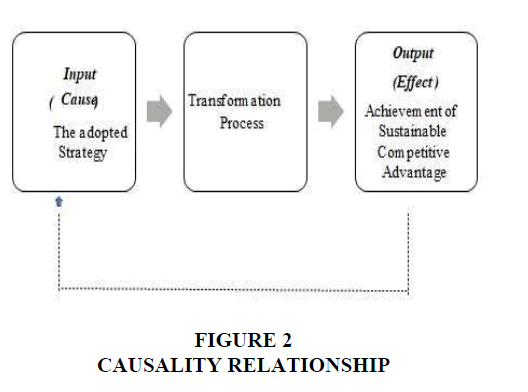

Several variables affect achieving the competitive advantage, the most influential variable is the business-level strategy adopted by the company Figure 2. The sustainable competitive advantage is judged through measuring the companies’ continuous performance under certain strategy through a reasonable period of time. By analyzing sales and revenues of the companies’ accounting statements, we obtain the percentage of market share of each company. The best-practice strategy will be then identified.

The methodology pursued in this study is collection and analysis of published data within a period of time regarding a selected set of large international companies (Desk survey study) in the F&B sector as it is considered the world’s biggest industries and the largest contributing sector in the world’s GDP. The research work encompasses the top (27) of large F&B companies in the U.S and Canada.

The top fifty (50) multinational companies in the food and beverage sector were selected to be used as the research sample. After deep investigation, the researcher succeeded to find the business-level strategies of only thirty-two (32) of them. The sample will be examined during the latest eight years (2009-2016) due to the availability of data. Only twenty-seven (27) companies out of the (32) succeeded to keep their position on the top throughout the eight years continuously, and this became the actual sample of this study Table 1.

| Table 1 Sample Companies |

|||

|---|---|---|---|

| No. | Company | Total Assets by the end of 2016 | Number of employees by 2016 (worldwide) |

| 1 | Tyson Foods Inc. | 28.05 billion | 116,000 |

| 2 | PepsiCo Inc. | 79.8 billion | 263,000 |

| 3 | Nestle U.S and Canada | Couldn’t be obtained for that specific segment | 323,000 |

| 4 | Coca-Cola Co. | 87.9 billion | 61,800 |

| 5 | Kraft Foods Inc. | 43.3 billion | 39,000 |

| 6 | JBS USA | 122.502 | 233,797 |

| 7 | Anheuser-Busch | 246.13 | 182,915 |

| 8 | Smithfield Foods Inc. | 43,954,852 | 50,200 |

| 9 | General mills Inc. | 30.38 billion | 38,000 |

| 10 | Conagra Foods Inc. | 10.46 billion | 12,600 |

| 11 | Mars Inc. | 3 billion | 80,000 |

| 12 | Kellogg Co. | 16.35 billion | 33,000 |

| 13 | Hormel Foods Corp. | 7.859 billion | 20,100 |

| 14 | Dean Foods Co. | 2.504 billion | 17,000 |

| 15 | J.M. Smucker Co. | 15.33 billion | 7,140 |

| 16 | Pilgrim’s Pride Corp. | 6.249 billion | 35,700 |

| 17 | Hershey Co. | 5.554 billion | 15,360 |

| 18 | Dr. Pepper Snapple group | 10.022 billion | 21,000 |

| 19 | Campbell soup | 8.336 billion | 23,000 |

| 20 | Agropur Cooperative | Couldn’t be obtained | 8,300 |

| 21 | Perdue Farms | 58,566,359 | 21,000 |

| 22 | Flowers Foods Inc. | 2.660 billion | 9,800 |

| 23 | Uniliver North America | 72.32 billion | 172,000 |

| 24 | Sanderson Farms | 1.722 billion | 14,000+ |

| 25 | Rich products Corp. | Couldn’t be obtained | 10,500 |

| 26 | Maple Leaf Foods | 2.154 billion | Couldn’t be obtained |

| 27 | H.J Heinz Co. | (Kraft announced its merger with Heinz in 2015) | -- |

Data about these companies are available over eight years which is considered a sufficient time to assess their sustainable competitive advantage.

Data are collected from (FoodProcessing.com) which is the go-to (the most appropriate) information source for the food and beverage industry (FBI). It is considered as the main source of data because it provides valuable information about FBI including an annual list of the top 100 food and beverage companies in the United States and Canada.

Data Analysis and Interpretation

The following Table 2 was constructed considering the companies, their business-level strategies, their rank in the order of their revenues, and an index representing the total sales revenues of the company products divided by the industry’s total revenues as in the sample studied (which is the total revenues of the 27 companies selected, keeping in mind that in 2015, Kraft announced its merger with Heinz, however their data are included under Kraft-Heinz company, hence 26 companies).

| Table 2 Shows The Yearly Data For The Companies From 2009 Till 2016 |

|||||

|---|---|---|---|---|---|

| Year | Company | Strategy | Rank (among the top 50) | 2009 food sales (million $) |

The Index (Company revenues/total industry’s revenues) |

| 2009 | Nestle (U.S & Canada) | Hybrid | 1 | $28,000 | 10.90% |

| Tyson Foods Inc. | Differentiation | 2 | $25,903 | 10.10% | |

| Kraft Foods Inc. | Hybrid | 3 | $23,666 | 9.24% | |

| Pepsico Inc. | Differentiation | 4 | $22,000 | 8.50% | |

| Anheuser-Busch InBev | Focus costleadership | 5 | $15,486 | 6% | |

| General Mills Inc. | Differentiation | 6 | $12,094 | 4.70% | |

| Dean Foods Co. | Cost-leadership | 7 | $11,000 | 4.20% | |

| JBS USA | Differentiation | 8 | $11,000 | 4.20% | |

| Mars Inc. | Differentiation | 9 | $10,000 | 3.90% | |

| Smithfield Foods Inc. | Differentiation | 10 | $9,326 | 3.60% | |

| Kellogg Co. | Differentiation | 12 | $8,510 | 3.30% | |

| Coca-Cola Co. | Differentiation | 13 | $8,191 | 3.20% | |

| ConAgra Foods Inc. | Cost-leadership | 14 | $8,002 | 3.10% | |

| Pilgrim’s Pride Corp. | Differentiation | 15 | $7,088 | 2.70% | |

| Unilever North America | Differentiation | 18 | $6,540 | 2.50% | |

| Hormel Foods Corp. | Differentiation | 19 | $6,534 | 2.50% | |

| Campbell Soup Co. | Differentiation | 22 | $5,630 | 2.20% | |

| Dr Pepper Snapple Group | Cost-leadership | 23 | $5,531 | 2.10% | |

| Hershey Co. | Differentiation | 24 | $5,299 | 2.07% | |

| Maple Leaf Foods | Cost-leadership | 25 | $5,222 | 2.04% | |

| H.J. Heinz Co. | Hybrid | 26 | $4,622 | 1.80% | |

| J.M. Smucker Co. | Hybrid | 27 | $4,605 | 1.70% | |

| Perdue Farms | Differentiation | 28 | $3,900 | 1.50% | |

| Agropur Cooperative | Cost-leadership | 36 | $2,954 | 1.15% | |

| Flowers Foods Inc. | Cost-leadership | 38 | $2,601 | 1.01% | |

| Rich Products Corp. | Differentiation | 45 | $2,200 | 0.85% | |

| Total | $255,904 | ||||

| Year | Company | Strategy | Rank (among the top 50) | 2010 food sales (million $) |

The Index (Company revenues/total industry’s revenues) |

| 2010 | PepsiCo.Inc. | Differentiation | 1 | $35,600 | 12.40% |

| Nestle (U.S. & Canada) | Hybrid | 2 | $29,600 | 10.30% | |

| Kraft Foods Inc. | Hybrid | 3 | $29,524 | 10.30% | |

| Tyson Foods Inc. | Differentiation | 4 | $27,293 | 9.50% | |

| Anheuser-Busch InBev | Focus costleadership | 5 | $15,296 | 5.30% | |

| JBS USA | Differentiation | 6 | $13,342 | 4.60% | |

| General Mills Inc. | Differentiation | 7 | $12,005 | 4.10% | |

| Dean Foods Co. | Cost-leadership | 8 | $11,758 | 4.10% | |

| Mars Inc. | Differentiation | 9 | $10,500 | 3.60% | |

| Smithfield Foods Inc. | Differentiation | 10 | $10,264 | 3.50% | |

| Kellogg Co. | Differentiation | 12 | $8,402 | 2.90% | |

| Coca-Cola Co. | Differentiation | 13 | $8,273 | 2.80% | |

| ConAgra Foods Inc. | Cost-leadership | 14 | $8,002 | 2.70% | |

| Hormel Foods Corp. | Differentiation | 15 | $7,221 | 2.50% | |

| Pilgrim's Pride Corp. | Differentiation | 18 | $6,882 | 2.40% | |

| Unilever North America | Differentiation | 20 | $6,688 | 2.30% | |

| Campbell Soup Co. | Differentiation | 22 | $5,675 | 1.90% | |

| Hershey Co. | Differentiation | 23 | $5,671 | 1.90% | |

| Dr Pepper Snapple Group | Cost-leadership | 24 | $5,636 | 1.90% | |

| Maple Leaf Foods | Cost-leadership | 25 | $4,968 | 1.70% | |

| J.M. Smucker Co. | Hybrid | 26 | $4,826 | 1.60% | |

| H.J. Heinz Co. | Hybrid | 27 | $4,679 | 1.60% | |

| Perdue Farms | Differentiation | 29 | $3,900 | 1.30% | |

| Agropur Cooperative | Cost-leadership | 34 | $3,345 | 1.16% | |

| Flowers Foods Inc. | Cost-leadership | 38 | $2,574 | 0.89% | |

| Rich Products Corp. | Differentiation | 45 | $2,250 | 0.78% | |

| Sanderson Farms | Cost-leadership | 50 | $1,925 | 0.67% | |

| Total | $286,099 | ||||

| Year | Company | Strategy | Rank (among the top 50) | 2011 food sales (million $) | The Index (Company revenues/total industry’s revenues) |

| 2011 | Pepsico.Inc. | Differentiation | 1 | $38,396 | 13.10% |

| Tyson Foods Inc. | Differentiation | 2 | $30,975 | 10.60% | |

| Nestle (U.S. & Canada) | Hybrid | 3 | $26,200 | 8.90% | |

| Kraft Foods Inc. | Hybrid | 4 | $25,171 | 8.60% | |

| Anheuser-Busch InBev | Focus costleadership | 5 | $15,304 | 5.20% | |

| JBS USA | Differentiation | 6 | $14,000 | 4.80% | |

| Dean Foods Co. | Cost-leadership | 7 | $12,698 | 4.30% | |

| General Mills Inc. | Differentiation | 8 | $12,464 | 4.20% | |

| Smithfield Foods Inc. | Differentiation | 9 | $11,093 | 3.80% | |

| Mars Inc. | Differentiation | 10 | $10,500 | 3.60% | |

| Coca-Cola Co. | Differentiation | 11 | $9,861 | 3.30% | |

| Kellogg Co. | Differentiation | 12 | $8,873 | 3.04% | |

| ConAgra Foods Inc. | Cost-leadership | 14 | $8,377 | 2.80% | |

| Hormel Foods Corp. | Differentiation | 16 | $7,895 | 2.70% | |

| Pilgrim's Pride | Differentiation | 19 | $6,779 | 2.30% | |

| Hershey Co. | Differentiation | 20 | $6,081 | 2.08% | |

| Unilever North America | Differentiation | 21 | $5,986 | 2.05% | |

| Dr. Pepper Snapple Group | Cost-leadership | 22 | $5,903 | 2.02% | |

| J.M. Smucker Co. | Hybrid | 23 | $5,526 | 1.80% | |

| Maple Leaf Foods | Cost-leadership | 24 | $4,894 | 1.60% | |

| H.J. Heinz Co. | Hybrid | 26 | $4,661 | 1.50% | |

| Perdue Farms | Differentiation | 27 | $4,500 | 1.50% | |

| Campbell Soup Co. | Differentiation | 30 | $4,060 | 1.30% | |

| Agropur Cooperative | Cost-leadership | 32 | $3,651 | 1.20% | |

| Flowers Foods Inc. | Cost-leadership | 38 | $2,773 | 0.95% | |

| Rich Products Corp. | Differentiation | 42 | $2,400 | 0.82% | |

| Sanderson Farms | Cost-leadership | 54 | $1,978 | 0.67% | |

| Total | $291,521 | ||||

| Year | Company | Strategy | Rank (among the top 50) | 2012 food sales (million $) | The Index (Company revenues/total industry’s revenues) |

| 2012 | Pepsico.inc | Differentiation | 1 | $37,618 | 12.70% |

| Tyson Foods Inc. | Differentiation | 2 | $31,614 | 10.70% | |

| Nestle (U.S. & Canada) | Hybrid | 3 | $27,200 | 9.20% | |

| JBS USA | Differentiation | 4 | $20,979 | 7.10% | |

| Anheuser-Busch InBev | Focus costleadership | 5 | $16,028 | 5.40% | |

| Kraft Foods Inc. | Hybrid | 6 | $14,426 | 4.80% | |

| General Mills Inc. | Differentiation | 7 | $12,547 | 4.20% | |

| Smithfield Foods Inc. | Differentiation | 8 | $11,753 | 3.90% | |

| Dean Foods Co. | Cost-leadership | 9 | $11,462 | 3.80% | |

| Mars Inc. | Differentiation | 10 | $11,000 | 3.70% | |

| Coca-Cola Co. | Differentiation | 11 | $10,515 | 3.50% | |

| ConAgra Foods Inc. | Cost-leadership | 12 | $10,324 | 3.40% | |

| Kellogg Co. | Differentiation | 13 | $9,539 | 3.20% | |

| Hormel Foods Corp. | Differentiation | 15 | $8,231 | 2.70% | |

| Pilgrim’s Pride | Differentiation | 17 | $7,249 | 2.40% | |

| Unilever North America | Differentiation | 18 | $7,111 | 2.40% | |

| Hershey Co. | Differentiation | 20 | $6,644 | 2.25% | |

| Dr. Pepper Snapple Group | Cost-leadership | 23 | $5,995 | 2.03% | |

| J.M. Smucker Co. | Hybrid | 24 | $5,898 | 1.99% | |

| Maple Leaf Foods | Cost-leadership | 25 | $4,865 | 1.60% | |

| H.J. Heinz Co. | Hybrid | 27 | $4,570 | 1.54% | |

| Campbell Soup Co. | Differentiation | 29 | $4,110 | 1.39% | |

| Perdue Farms | Differentiation | 31 | $3,860 | 1.30% | |

| Agropur Cooperative | Cost-leadership | 34 | $3,640 | 1.20% | |

| Flowers Foods Inc. | Cost-leadership | 37 | $3,046 | 1% | |

| Rich Products Corp. | Differentiation | 40 | $2,500 | 0.84% | |

| Sanderson Farms | Cost-leadership | 42 | $2,386 | 0.80% | |

| Total | $295,110 | ||||

| Year | Company | Strategy | Rank (among the top 50) |

2013 food sales | The Index (Company revenues/total industry’s revenues) |

| 2013 | PepsiCo Inc. | Differentiation | 1 | $37,806 | 12% |

| Tyson Foods Inc. | Differentiation | 2 | $32,999 | 10.60% | |

| Nestle (U.S. & Canada) | Hybrid | 3 | $27,300 | 8.70% | |

| JBS USA | Differentiation | 4 | $22,140 | 7.10% | |

| Coca-Cola Co. | Differentiation | 5 | $21,600 | 6.90% | |

| Anheuser-Busch InBev | Focus costleadership | 6 | $16,023 | 5.15% | |

| Kraft Foods Inc. | Hybrid | 7 | $14,346 | 4.60% | |

| Smithfield Foods Inc. | Differentiation | 8 | $12,531 | 4.02% | |

| General Mills Inc. | Differentiation | 9 | $12,524 | 4% | |

| ConAgra Foods Inc. | Cost-leadership | 10 | $11,511 | 3.70% | |

| Mars Inc. | Differentiation | 11 | $11,000 | 3.50% | |

| Kellogg Co. | Differentiation | 12 | $9,716 | 3.10% | |

| Dean Foods Co. | Cost-leadership | 13 | $9,016 | 2.80% | |

| Hormel Foods Corp. | Differentiation | 14 | $8,752 | 2.80% | |

| Pilgrim's Pride | Differentiation | 18 | $7,500 | 2.40% | |

| Hershey Co. | Differentiation | 19 | $7,146 | 2.20% | |

| Unilever North America | Differentiation | 21 | $6,876 | 2.20% | |

| Dr. Pepper Snapple Group | Cost-leadership | 23 | $5,997 | 1.90% | |

| J.M. Smucker Co. | Hybrid | 24 | $5,611 | 1.80% | |

| Campbell Soup Co. | Differentiation | 25 | $4,910 | 1.50% | |

| H.J. Heinz Co. | Hybrid | 27 | $4,530 | 1.40% | |

| Maple Leaf Foods | Cost-leadership | 28 | $4,406 | 1.40% | |

| Perdue Farms | Differentiation | 30 | $4,140 | 1.30% | |

| Flowers Foods Inc. | Cost-leadership | 33 | $3,751 | 1.20% | |

| Agropur Cooperative | Cost-leadership | 35 | $3,630 | 1.10% | |

| Sanderson Farms | Cost-leadership | 42 | $2,683 | 0.86% | |

| Rich Products Corp. | Differentiation | 43 | $2,661 | 0.85% | |

| Total | $311,105 | ||||

| Year | Company | Strategy | Rank (among the top 50) |

2014 food sales (million $) |

The Index (Company revenues/total industry’s revenues) |

| 2014 | Pepsico.inc. | Differentiation | 1 | $38,224 | 12% |

| Tyson Foods Inc. | Differentiation | 2 | $36,077 | 11.30% | |

| Nestle (U.S. & Canada) | Hybrid | 3 | $27,978 | 8.80% | |

| JBS USA | Differentiation | 4 | $24,000 | 7.50% | |

| Coca-Cola Co. | Differentiation | 5 | $21,462 | 6.70% | |

| Anheuser-Busch InBev | Focus costleadership | 6 | $16,093 | 5% | |

| ConAgra Foods Inc. | Cost-leadership | 7 | $15,832 | 4.90% | |

| Kraft Foods Inc. | Hybrid | 8 | $14,343 | 4.50% | |

| Smithfield Foods Inc. | Differentiation | 9 | $13,426 | 4.22% | |

| General Mills Inc. | Differentiation | 10 | $12,502 | 3.90% | |

| Mars Inc. | Differentiation | 11 | $11,000 | 3.40% | |

| Dean Foods Co. | Cost-leadership | 12 | $9,503 | 2.90% | |

| Kellogg Co. | Differentiation | 13 | $9,499 | 2.99% | |

| Hormel Foods Corp. | Differentiation | 14 | $9,316 | 2.93% | |

| Pilgrim's Pride | Differentiation | 18 | $7,111 | 2.20% | |

| Hershey Co. | Differentiation | 21 | $6,353 | 2% | |

| Dr Pepper Snapple Group | Cost-leadership | 22 | $6,121 | 1.90% | |

| J.M. Smucker Co. | Hybrid | 23 | $5,693 | 1.70% | |

| Campbell Soup Co. | Differentiation | 25 | $5,048 | 1.50% | |

| H.J. Heinz Co. | Hybrid | 27 | $4,200 | 1.30% | |

| Agropur Cooperative | Cost-leadership | 28 | $4,170 | 1.30% | |

| Perdue Farms | Differentiation | 29 | $4,150 | 1.30% | |

| Flowers Foods Inc. | Cost-leadership | 31 | $3,749 | 1.10% | |

| Unilever U.S. | Differentiation | 32 | $3,612 | 1.10% | |

| Sanderson Farms | Cost-leadership | 41 | $2,775 | 0.87% | |

| Rich Products Corp. | Differentiation | 42 | $2,700 | 0.85% | |

| Maple Leaf Foods | Cost-leadership | 43 | $2,696 | 0.84% | |

| Total | $317,633 | ||||

| Year | Company | Strategy | Rank (among the top 50) | 2015 food sales (million $) |

The Index (Company revenues/total industry’s revenues) |

| 2015 | Tyson Foods | Differentiation | 1 | $40,132 | 12.60% |

| PepsiCo Inc. | Differentiation | 2 | $37,943 | 11.90% | |

| Nestle (U.S. & Canada) | Hybrid | 3 | $27,659 | 8.70% | |

| Coca-Cola Co. | Differentiation | 4 | $21,784 | 6.80% | |

| Kraft Heinz Co. | Hybrid | 5 | $21,670 | 6.80% | |

| JBS USA | Differentiation | 6 | $20,100 | 6.30% | |

| Anheuser-Busch InBev | Focus costleadership | 7 | $15,603 | 4.90% | |

| Smithfield Foods Inc. | Differentiation | 8 | $14,005 | 4.40% | |

| General Mills Inc. | Differentiation | 9 | $11,931 | 3.70% | |

| Conagra Brands Inc. | Cost-leadership | 10 | $11,643 | 3.60% | |

| Mars Inc. | Differentiation | 11 | $11,000 | 3.40% | |

| Kellogg Co. | Differentiation | 12 | $9,094 | 2.80% | |

| Hormel Foods Corp. | Differentiation | 14 | $8,729 | 2.70% | |

| Dean Foods Co. | Cost-leadership | 16 | $8,122 | 2.50% | |

| J.M. Smucker Co. | Hybrid | 17 | $7,811 | 2.40% | |

| Pilgrim's Pride | Differentiation | 19 | $7,143 | 2.20% | |

| Hershey Co. | Differentiation | 22 | $6,468 | 2% | |

| Dr Pepper Snapple Group | Cost-leadership | 23 | $6,282 | 1.90% | |

| Campbell Soup Co. | Differentiation | 24 | $5,007 | 1.50% | |

| Agropur Cooperative | Cost-leadership | 26 | $4,511 | 1.40% | |

| Perdue Farms Inc. | Differentiation | 27 | $4,340 | 1.30% | |

| Flowers Foods Inc. | Cost-leadership | 32 | $3,779 | 1.10% | |

| Unilever U.S. | Differentiation | 33 | $3,738 | 1.10% | |

| Sanderson Farms | Cost-leadership | 43 | $2,803 | 0.88% | |

| Rich Products Corp. | Differentiation | 44 | $2,700 | 0.85% | |

| Maple Leaf Foods | Cost-leadership | 48 | $2,363 | 0.70% | |

| Total | $316,360 | ||||

| Year | Company | Strategy | Rank (among the top 50) | 2016 food sales (million $) |

The Index (Company revenues/total industry’s revenues) |

| 2016 | PepsiCo Inc. | Differentiation | 1 | $39,425 | 12.90% |

| Tyson Foods Inc. | Differentiation | 2 | $36,281 | 11.80% | |

| Nestle (U.S. & Canada) | Hybrid | 3 | $28,782 | 9.40% | |

| Kraft Heinz Co. | Hybrid | 4 | $20,950 | 6.80% | |

| Coca-Cola Co. | Differentiation | 5 | $19,899 | 6.50% | |

| Anheuser-Busch InBev | Focus costleadership | 6 | $15,698 | 5.10% | |

| JBS USA | Differentiation | 7 | $15,000 | 4.90% | |

| Smithfield Foods Inc. | Differentiation | 8 | $14,300 | 4.60% | |

| General Mills Inc. | Differentiation | 10 | $12,067 | 3.90% | |

| Mars Inc. | Differentiation | 11 | $11,500 | 3.70% | |

| Hormel Foods Corp. | Differentiation | 12 | $9,012 | 2.90% | |

| Kellogg Co. | Differentiation | 13 | $8,941 | 2.90% | |

| Pilgrim's Pride | Differentiation | 15 | $7,931 | 2.50% | |

| Conagra Brands Inc. | Cost-leadership | 16 | $7,827 | 2.50% | |

| Dean Foods Co. | Cost-leadership | 17 | $7,710 | 2.50% | |

| J.M. Smucker Co. | Hybrid | 18 | $7,392 | 2.40% | |

| Hershey Co. | Differentiation | 22 | $6,533 | 2.10% | |

| Dr Pepper Snapple Group | Cost-leadership | 23 | $6,440 | 2.10% | |

| Campbell Soup Co. | Differentiation | 25 | $5,397 | 1.70% | |

| Agropur Cooperative | Cost-leadership | 28 | $4,417 | 1.40% | |

| Perdue Farms Inc. | Differentiation | 29 | $4,300 | 1.40% | |

| Flowers Foods Inc. | Cost-leadership | 31 | $3,927 | 1.20% | |

| Unilever U.S. | Differentiation | 34 | $3,775 | 1.20% | |

| Sanderson Farms | Cost-leadership | 41 | $2,816 | 0.92% | |

| Rich Products Corp. | Differentiation | 46 | $2,500 | 0.81% | |

| Maple Leaf Foods | Cost-leadership | 47 | $2,474 | 0.80% | |

| Total | $305,294 | ||||

Table 3, is a detailed table that has been constructed to clarify the market share of each company and for each category. The schedule is classified into four categories: Differentiation, cost-leadership, Hybrid, and focus cost-leadership since the sample fall into these four categories only.

| Table 3 Market Share Of Companies For Each Strategy |

|||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | Average | Number of companies | ||||

| Differentiation | 15 |

||||||||||||

| 1. PepsiCo | 8.5% | 12.4% | 13.1% | 12.7% | 12% | 12% | 11.9% | 13% | 11.95% | ||||

| 2. Tyson | 10.1% | 9.5% | 10.6% | 10.7% | 10.6% | 11.3% | 12.6% | 11.8% | 10.9% | ||||

| 3. JBS | 4.2% | 4.6% | 4.8% | 7.1% | 7.1% | 7.5% | 6.3% | 4.9% | 5.8% | ||||

| 4. Coca-Cola | 3.2% | 2.8% | 3.3% | 3.5% | 6.9% | 6.7% | 6.8% | 6.5% | 4.9% | ||||

| 5. General mills | 4.7% | 4.1% | 4.2% | 4.2% | 4% | 3.9% | 3.7% | 3.9% | 4.08% | ||||

| 6. Smithfield | 3.6% | 3.5% | 3.8% | 3.9% | 4% | 4.2% | 4.4% | 4.6% | 4% | ||||

| 7. Mars | 3.9% | 3.6% | 3.6% | 3.7% | 3.5% | 3.4% | 3.4% | 3.7% | 3.6% | ||||

| 8. Kellogg | 3.3% | 2.9% | 3.04% | 3.2% | 3.1% | 3% | 2.8% | 2.9% | 3.03% | ||||

| 9. Hormel | 2.5% | 2.5% | 2.7% | 2.7% | 2.8% | 2% | 2.7% | 2.9% | 2.6% | ||||

| 10. Pilgrim | 2.7% | 2.4% | 2.3% | 2.4% | 2.4% | 2.2% | 2.2% | 2.5% | 2.38% | ||||

| 11. Hershey | 2.07% | 1.9% | 2.08% | 2.25% | 2.2% | 2% | 2% | 2.1% | 2% | ||||

| 12. Unilever | 2.5% | 2.3% | 2.05% | 2.4% | 2.2% | 1.1% | 1.1% | 1.2% | 1.85% | ||||

| 13. Campbell soup | 2.2% | 1.9% | 1.3% | 1.39% | 1.5% | 1.5% | 1.5% | 1.7% | 1.6% | ||||

| 14. Perdue Farms | 1.5% | 1.3% | 1.5% | 1.3% | 1.3% | 1.3% | 1.3% | 1.4% | 1.36% | ||||

| 15. Rich products | 0.85% | 0.78% | 0.82% | 0.84% | 0.85% | 0.85% | 0.85% | 0.8% | 0.83% | ||||

| Percentage | 55.7% | 52.7% | 59.2% | 62.2% | 64% | 62.9% | 63.7% | 63.9% | 60.88% | ||||

| Cost-Leadership | |||||||||||||

| 1. Dean foods | 4.2% | 4.1% | 4.3% | 3.8% | 2.8% | 2.9% | 2.5% | 2.5% | 3.38% | ||||

| 2. Conagra | 3.1% | 2.7% | 2.8% | 3.4% | 3.7% | 4.9% | 3.6% | 2.5% | 3.33% | ||||

| 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | Average | Number of companies | ||||

| 3. Dr.pep per | 2.1% | 1.9% | 2.02% | 2.03% | 1.9% | 1.9% | 1.9% | 2.1% | 1.98% | 7 | |||

| 4. Maple leaf | 2.04% | 1.7% | 1.6% | 1.6% | 1.4% | 0.84% | 0.7% | 0.8% | 1.33% | ||||

| 5. Agropur | 1.1% | 1.16% | 1.2% | 1.2% | 1.1% | 1.3% | 1.4% | 1.4% | 1.23% | ||||

| 6. Flowers | 1% | 0.89% | 0.95% | 1% | 1.2% | 1.1% | 1.1% | 1.2% | 1% | ||||

| 7. Sander son | -- | 0.67% | 0.67% | 0.8% | 0.86 | 0.87% | 0.9% | 0.9% | 0.81% | ||||

| Percentage | 13.54% | 13.1% | 13.5% | 13.8% | 13% | 13.8% | 12.1% | 11.4% | 13% | ||||

| Hybrid | |||||||||||||

| 1. Nestle | 10.9% | 10.3% | 8.9% | 9.2% | 8.7% | 8.8% | 8.7% | 9.4% | 9.36% | 4 |

|||

| 2. Kraft | 9.2% | 10.3% | 8.6% | 4.8% | 4.6% | 4.5% | 6.8%** | 6.8%** | 6.95% | ||||

| 3. H.J.Heinz | 1.8% | 1.6% | 1.5% | 1.5% | 1.4% | 1.3% | -- | -- | 1.51% | ||||

| 4. J.M. Smucker | 1.7% | 1.6% | 1.8% | 2% | 1.8% | 1.7% | 2.4% | 2.4% | 1.92% | ||||

| Percentage | 27% | 23.8% | 20.8% | 17.5% | 16.5% | 16% | 18% | 18.5% | 19.74% | ||||

| Focus cost leadership | |||||||||||||

| 1. Anheu Buschser | 6% | 5.3% | 5.2% | 5.4% | 5.1% | 5% | 4.9% | 5% | 5.23% | 1 | |||

| Percentage | 6% | 5.3% | 5.2% | 5.4% | 5.1% | 5% | 4.9% | 5% | 5.23% | ||||

The researcher has studied thoroughly each company’s statements, activities, and performance.

Conclusions are shown in the end.

Results

As seen from the Table 2 and Table 4, the number of companies applying Cost-leadership strategy were seven companies, those that followed Differentiation strategy were fifteen, Hybrid strategy followers were four companies, and only one company was following Focus costleadership according to the study.

| Table 4 The Share Of Each Strategy |

|

|---|---|

| Strategy | Sum of Averages |

| Differentiation | 61% |

| Hybrid | 20% |

| Cost-leadership | 13% |

| Focus cost-leadership | 6% |

1. The top companies adopted Differentiation strategy have achieved the highest sales and market share (about 61% of the market), and occupied the top places in the international competition in the examined period from 2010-2017.

2. Hybrid strategy adopters achieved the second-place (about 20%) in realizing high sales and market share, as the Hybrid strategy followers applied differentiation strategy partially, however in few aspects only, not overall differentiation.

3. Cost-leaders achieved about 13% of the market.

4. Focused cost-leaders with about 6%.

Conclusion

The researcher concludes that most of the companies (61%) that had achieved the highest revenues, market share, and great weight in the global competition adopted the Differentiation strategy.

Few differentiation adopters were lagged behind some cost-leaders, because successful use of a differentiation strategy depends not only on offering unique features, but also communicating the value of these features to potential customers. As a result, advertising in general and brand building in particular are important to this strategy.

Recommendations

As the Differentiation Strategy occupied the first-place in achieving the highest sales and market share according to the study, it is recommended for the Egyptian food and beverage sector to start applying Differentiation strategy through adopting any of the forms that has already been mentioned in the theoretical section of the thesis, in order to be able to compete globally and hence locally.

References

Auka, D.O. (2014). Porter’s generic competitive strategies and customer satisfaction in commercial banks in Kenya.Eurasian Business & Marketing Research Journal,1(1), 1-31.

Awade, P.R. (2014). Implementation of combination strategy based on porter’s model: success built on lost opportunity in industrial lubricants.Asian journal of management research,4(4), 699-710.

Baroto, M.B., Abdullah, M.M.B., & Wan, H.L. (2012). Hybrid strategy: A new strategy for competitive advantage.International Journal of Business and Management,7(20), 120.

Bordes, J. (2009). Building and sustaining competitive advantage.Atlantic International University Honolulu, Hawaii.

Dirisu, J.I., Iyiola, O., & Ibidunni, O.S. (2013). Product differentiation: A tool of competitive advantage and optimal organizational performance (A study of Unilever Nigeria PLC).European Scientific Journal,9(34).

Dostaler, I., & Flouris, T. (2006). Stuck in the middle revisited: The case of the airline industry.Journal of Aviation/Aerospace Education & Research,15(2), 6.

Indexed at, Google Scholar, Cross Ref

Ehmke, C. (2008). Strategies for competitive advantage.Western Extension Marketing Committee,5, 1-8.

Lainos, I.A.S.O.N.A.S. (2011). Red ocean vs blue ocean strategies.University of Piraeus Master Thesis.

Michail, A. (2011). Porter's differentiation strategy and ways of achieving it.

Mitchell, R.C. (2009). Strategy formulation.

Nayyar, P.R. (1993). On the measurement of competitive strategy: Evidence from a large multiproduct US firm.Academy of Management Journal,36(6), 1652-1669.

Indexed at, Google Scholar, Cross Ref

Singh, S.S. (2014). International management strategy: An empirical study.Global Journal of Management and Business Research: Administrative and Management,14, 50-56.

Smith, W.R. (1995). Product differentiation and market segmentation as alternative marketing strategies.Marketing management,4(3), 63.

Valipour, H., Birjandi, H., & Honarbakhsh, S. (2012). The effects of cost leadership strategy and product differentiation strategy on the performance of firms.Journal of Asian Business Strategy,2(1), 14-23.

Received: 30-Sep-2022, Manuscript No. AJEE-22- 12630; Editor assigned: 03-Oct -2022, Pre QC No. AJEE-22- 12630(PQ); Reviewed: 17- Oct-2022, QC No. AJEE-22- 12630; Published: 24-Oct-2022