Review Article: 2025 Vol: 29 Issue: 2

Herbert Simon Revisited: Behaviouralism in Consumers Purchase Decision Making in Case of Life Insurance Products

Sarvesh Kumar, Central University of Himachal Pradesh

Gaganpreet Ahluwalia, Indira School of Business Studies PGDM

Siddharth Karale, Sinhgad Business School, Pune

Deepali Desai, Suryadatta Institute of Business Management & Technology (SIBMT)

Jayant Tambade, DY Patil Institute of MCA and Management

Kumar D., Saibalaji International Institute of Management Sciences

Citation Information: Kumar, S., Ahluwalia, G., Karale, S., Desai, D., Tambade, J. & Kumar, D. (2025). Herbert simon revisited: Behaviouralism in consumers purchase decision making in case of life insurance products. Academy of Marketing Studies Journal, 29(2), 1-8.

Abstract

Purpose: The consumer decisions over the years have evolved in different ways. The management as a discipline initially evolved as a social science but later on with the application of mathematics and statistics, the scholars tried to make it more scientific and logical. The attempt was made to make the consumer decisions making as rational as possible. However in trying to attain rationality, the decision maker is only near to perfect rationality instead of perfectly rational. The authors in this paper have tried to fact check this based on study of life insurance products in order to illustrate the theory of Herbert Simon’s bounded rationality in terms of consumer decision making. Design/Methodology/Approach: The research design for the study is descriptive in nature. The study is based on primary and secondary data collected from different reports, research papers, management journals, books and other publications etc. Limitations/Future Implications: The pace of globalization backed by changes in technology and increase in per capita income will influence the consumption and behavioural patterns of consumers and hence there will be dynamism in behavioural patterns and decision making. Thus the factors which influence consumer’s decision making are bound to change in the near future. The authors have only considered the limited dimensions of the subject and hence future researchers can explore the subject further. Findings/Conclusions: The authors have found that in case of purchasing decisions of life insurance products, the buyers are not total rational and their buying decisions are largely influenced by certain behavioural attributes. Originality/Value: There are only few existing literatures and research papers which have considered the subject of behviouralism in consumer’s decision making. Analyzing the consumer’s decision making based on Herbert Simon’s behavioural approach will be unique of its kind.

Keywords

Decisions, Managerial, Rationality, Bounded, Consumers.

Introduction

The Managerial as well as consumers decision making have always been the subject of interest. The different schools of thought have given different perspectives on the subject matter of extent of rationality in managerial and consumer decision making. It is always assumed that a rational producer and consumer always takes rational managerial and consumer decisions. However the behavioural theorists in the recent years have questioned the extent of validity of the assumptions based on various factors such as asymmetric information, changes in technology, and dynamism in various environmental factors. The behavioural theorists such as Herbert Simon, Cyert and March have given different versions of behavioural attributes influencing decision making.

The researchers after understanding the viewpoints of various behavioural theorists have tried to understand the relevance of Herbert Simon views on consumer’s decision making. The authors have also tried to analyze different other behavioral theorists and their implications on managerial and consumer decision making. The existing behavioural theorists have been comprehensively studied in order to understand their significance in decision making. The authors have tried to draw references from different behaviourists theories in order to draw a generalized conclusion regarding its influence on consumer decision making in case of life insurance products.

Literature Review

Behavioural decision making applies cognitive, social and affective processes in selecting different alternatives. These are largely influenced by an individual’s beliefs, values and preferences. The behavioraists are of the opinion that the actions of individuals are largely influenced by environmental stimuli (Krapfl, 2016). The behaviourists further suggest that a decision maker is an economic man having three characteristics i.e. he is completely informed, infinitely sensitive and is rational. These assumptions are further advocated by rationalists as well.

(Goldfarb et al., 2012) have done review of literatures that applies behavioural economic models to managerial decisions. The authors are of the view that behavioural models have seen less application to managerial decisions as compared to consumer decisions. Hence there is a literature gap to develop new theoretical models and new field applications. Teck Hua (Ho et al., 2006) in their research paper have focused on the fact that marketing models are usually applications of economic theories based on strong assumptions of rationality of consumers and firms. Behavioural economics explores the implications of the limits of rationality. The authors have analyzed six behavioural economics models useful in marketing. The three models generalize standard preference structures while the other three models generalize the concept of game theoretic equilibrium allowing decision makers to make mistakes limiting the depth of strategic thinking. The motive of the study is to encourage marketing researchers to apply these models. Zhang, et al. (2023) have studied managerial decision making from the perspectives of behavioural science and neuroscience. The authors reviewed 24 articles from diverse range of subjects. The focus areas include consumer behavior research from the perspective of behavioural science, consumer neuroscience, business decisions beyond consumer decision making, basic studies in the field of management psychology, research trends of neuro science in marketing and information system. The authors found that past studies related to managerial decision makings pertains to consumer behavior creating a gap in the areas such as investment behavior, operations behavior etc.

The classical decision model focuses upon optimization. They emphasized upon an optimizing strategy to find out the best alternatives to maximize the objectives. However this can be considered to be an ideal but in reality seems difficult to attain. The classical model assumes a decision maker to have all the information’s, rationality and knowledge which are not fully realistic (Hoy, 2019).

(Kalantari, 2010) has studied the concept of bounded rationality of Herbert Simon in making decisions. The author has specifically focused on the role of intuition in decision making. The focus is towards understanding the behavioural approach in organizational decision making. (Barros, 2010) in his research paper has studied the concept of Herbert Simon’s concept of bounded and procedural rationality. It is argued that it is the low degree of specificity of the concept of bounded rationality as one of the reasons for its relatively greater success. Bounded rationality is consistent with our knowledge of actual human choice behaviour and the decision maker must search for alternatives and has incomplete and inaccurate knowledge about the consequences of actions and select actions that are expected to be satisfactory. The decision makers instead of trying to maximize values in a given choice aim at satisficing i.e. he selects the best alternatives but that is only near to best and he fails to attain the optimization.

Cohen, et al. (1972) have forwarded the garbage can model which illustrates decision making is based in a pluralist environment with multiple actors and conflicting goals and views. According to them, a decision is an outcome or interpretation of different independent streams in an organization. The authors have considered the set of problems, their solutions and participants define garbage but once a decision is made, the garbage is removed.

The advocates of incremental theory relies on breaking down the decision making processes into smaller steps based on combination of experience, intuition, instead of taking one major decision in one go. It focuses on incremental changes instead of a broad decision. The small and gradual changes allow space for feedback, consensus building, reduces risks and ensure continuity and ease of acceptance. Charles Lindblom (1959, 1980) was the first one to formalize the model. The model does not require objectives nor alternatives and consequences. However, the day to day business problems are more complex and dynamic which needs an urgent surgery and hence cannot fully serve the purpose advocated the mixed scanning model which has features of both satisficing and incremental models. The model is driven by organization’s mission and policies and the decisions which will drive the organization towards its mission. The author has taken a more practical approach to decision making. The model applies partial information to make satisfactory decisions with flexibility of incremental changes. In few of the complex situations such as medical sciences, alternatives, consequences and the results are difficult to predict. Hence, small steps taken in similar direction from the existing state acts as an important intervention advocated prospect theory according to which individuals assess their loss and gain in an asymmetric manner in contradiction to expected utility theory. The expected utility theory considers choices with maximum utility. In contrast, the prospect theory suggests that in case of risky choice, the consumers prefer certain outcome with lower expected utility as compared to uncertain outcome with higher expected utility (100% chance to gain 500 INR or 50% chance to gain INR 1000). When consumers faced a risky choice leading to losses, they prefer the outcome that has a lower expected utility but the potential to avoid losses (100% chance to lose INR 500 or 70% chance to lose INR 1000.). In this case people will opt for second choice as there is 30% chance that they lose nothing. The authors consider these as “availability heuristic”. In other words, an individual’s decisions are based on easily recalled information rather than on actual data when evaluating the likelihood of a particular outcome made a larger contribution to behavioural economics. He largely identified factors responsible for economic decision making. He advocated the concept of nudge in behavioural economics leading people to make better economic decisions. It takes advantage of human psychology and other concepts such as mental accounting. The mental accounting is based on the fact that consumers are more willing to drive across the city to save INR 10 on purchase of a good priced at INR 20 than INR 10 on a purchase of INR 1000 even though the amount saved will be same. A nudge is a way to manipulate consumer’s choices to make specific decisions. For example: keeping toys or chocolates nearby cash counters in retail outlets is an example of a nudge.

(Narayanan & Raj, 2020) have studied neuromarketing as the science of consumer behavior. Neuromarketing is blend of marketing, psychology and neuroscience. The term was introduced in 2002 by Professor Ale Smidts. It is an emerging tool to assess cognitive decision making based on brain activity, skin, eye stimuli and blood flow. Hyundai Motors use EEG tests to measure customer’s reactions to interior and exterior design of the cars.

(Zandstra et al., 2013) have focused that people are more comfortable with short term rewards as compared to long term. The authors are of the view that good communication can motivate consumers with an environmental benefit. Their study can be extended to other fields such as reducing obesity and cardiovascular health. (Amarnath et al., 2024) have studied about behavioural economics and consumer decision making. The authors have focused as to how consumers deviate from rationality while taking decisions related to price, risk assessment, time preferences etc. They have investigated how a particular cognitive bias including loss aversion and anchoring influence the decisions and choices made by consumers. The findings of the study show that 35% of the respondents consider happiness as the most important factor influencing buying decision followed by 30% of the respondents consider stress, 20% consider anger, 10% consider sadness as the reasons behind taking purchase decisions.

(Reisch & Zhao, 2017) in their study have focused on behavioural economics, consumer behavior and consumer policy. They have mentioned the fact that in contrast to neo classical economics which focus on utility maximization, the behavioural economics has demonstrated that people’s judgments and decisions are based on systematic biases and heuristics. The authors have focused on how behavioural economics has influenced research in consumer behavior and consumer policy. The authors have considered different set of variables such as status quo bias, the endowment effect, mental accounting and the sunk cost effect, music, temperature on consumer decisions. The authors have summarized that behavioural economics has largely influenced consumer research in the last 30 years. The different factors such as status quo bias, the endowment effect, mental accounting, sunk costs and other environmental factors such as music, temperature, warmth, physical location has larger impact on consumer decisions. These merely justify the irrational behavior in decision making.

Research Methodology

Research Gap

After reviewing different literatures and texts, the researchers have found that there are only few research papers which have tried to establish relevance of Herbert Simon decision making process in consumer buying behavior. The existing research works have not comprehensively dealt with the subject. Hence the existing research paper largely tries to fill the research gap in order to validate as to what extent the Herbert Simon’s views on decision making is relevant in consumers buying behavior in case of life insurance products.

Objectives of the Study

• To Study the different behavioural theorists and assess their relevance in terms of consumer decisions.

• To study the Herbert Simon views in particular and its relevance to consumer decision making in relation to life insurance products.

Research Questions

• What are the factors affecting consumer’s decision making process?

• To what extent customers are rational in making buying decisions?

Research Design, Data Collection and Tools of Analysis

The research design for the study is descriptive in nature as it tries to study the set of information which exists. Since the study is based on existing behavioural theories, it is largely descriptive. The researcher has collected both primary data and secondary data. The primary data has been collected from 200 respondents. Hence the sample size is 200 and the sampling design technique is simple random sampling. The secondary data has been collected from different sources such as research articles, websites, and other forms of publications. The study is largely based on analysis of different literatures and texts on the subject.

Herbert Simon Model and Consumer Decisions

Herbert Simon was of the view that decision making does not correspond with the rational theories of classical and neo classical approach. Hence he developed a new theory based on behaviours of the decision makers i.e. bounded rationality. Simon has mentioned about three types of activities in the decision making process i.e. intelligence activity, design activity and choice activity. Simon agreed that rationality is the basic premise of all types of decision making but at the same time rejects the concept of total rationality due to the unrealistic assumptions involved in it. The total rationality is based on the fact that decision makers are well informed and they know about all available alternatives and consequences. However in reality the decision is limited or bounded by cognitive limits due to unavailability of certain set of information or alternatives (Table 1).

| Table 1 Comparative Analysis of the Two Authors | |

| Herbert Simon’s view | John Devey’s View |

| Intelligence Activity (Problem Recognition) | Problem Recognition |

| Design Activity (Possible Courses of Action) | Information Search |

| Choice Activity (Selects the best alternative) | Evaluation of different alternatives |

| Evaluating Activity (Combined effort of Simon and March) | Purchase Decision |

| Post Purchase Evaluation | |

The consumer decision making process involves five steps such as problem recognition, information search, Evaluation of different alternatives, purchase decision and post purchase behavior.

Herbert Simon decision making process and Consumer decision making process by John Devey.

Comparing the decision making process of both the authors, we can largely say that Herbert Simon’s view largely focused on administrative decision making process but it can be equally applies to consumer decision making process. Hence his views on bounded rationality apply to consumer’s decision making also. A consumer while taking any decision tries to be rational but in reality he is less than the total rationality on account of certain limitations. It has been experienced that a consumer’s decision is largely influenced by behavioural factors such as perception, learning, attitudes, family, friends, age, lifestyle etc. A consumer total rationality is limited by external pressures, less knowledge, influence, conventions etc. All these factors restrict the consumers to be less than the total rationality and according to Simon, the consumer satisfices himself. In other words, instead of optimization, he tries to satisfy himself and suffice.

Data Analysis and Interpretation

Distribution of different types of Life Insurance Policies

Observations: Based on the above table, the authors are of the view that most of the respondents across different age, educational level and income level have own endowment plans followed by term plans, children education plan, unit linked plans and retirement plans. This altogether conveys a deviation from the rational decisions of opting for term plans in contrast to endowment plans. The second important finding is that around 4% of the consumers even do not know the type of insurance products they have bought which further confirms the deviation from rationality in buying life insurance products (Table 2).

| Table 2 Distribution of types of Life Insurance Products | ||||||

| Term Policies | Endowment Policies | Children Education Policy | Unit Linked Plan | Retirement Plan | Do not Know | |

| Age | ||||||

| Below 18 years | 0% | 0% | 0% | 1% | 0% | 0% |

| 18-25 years | 5% | 4% | 5% | 3% | 3% | 2% |

| 25-40 years | 32% | 36% | 8% | 6% | 3% | 1% |

| 40 years and above | 40% | 42% | 7% | 7% | 2% | 1% |

| Income | ||||||

| Less than 10K per month | 12% | 4% | 0% | 0% | 0% | 0% |

| 10K -25 K per month | 13% | 11% | 3% | 1% | 2% | 1% |

| 25 K -50 K | 25% | 35% | 9% | 9% | 3% | 1% |

| 50K and above | 27% | 32% | 8% | 7% | 3% | 2% |

| Education | ||||||

| Less than SSC | 2% | 5% | 2% | 0% | 0% | 0% |

| SSC | 15% | 7% | 6% | 1% | 0% | 1% |

| HSC | 26% | 34% | 8% | 2% | 3% | 1% |

| Graduate and above | 34% | 36% | 4% | 14% | 5% | 2% |

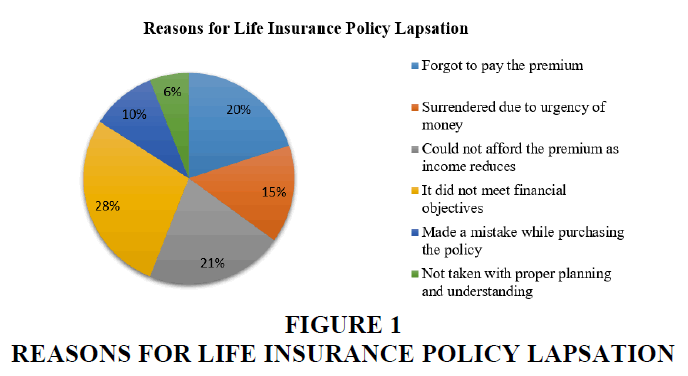

Reasons for Life Insurance Policies Lapsation

Observation: Based on the above chart, it can be said that 28% of the respondents agreed that life insurance products did not meet their financial objectives while 21% of the respondents agreed that it could not afford the premium as income reduces and hence their policies lapse. This totally justifies the deviation for total rationality behind reasons for buying a life insurance policy (Figure 1).

Your Opinion about Reasons for Buying Life Insurance Products

Friedman Test

Observations/Interpretation: Based on the above test results, it can be found that the respondents consider getting income tax relief as the major reason behind going for life insurance products as it has the highest mean rank. The second most important reason was meeting future needs such as meeting future requirements such as daughter’s marriage and education followed by persuasion by life insurance agents in order to buy life insurance products. The most important and interesting finding was that securing the future of family in case of death was the lowest mean rank (Table 3).

| Table 3 Friedman Test and Test Statistics | |

| Mean Rank | |

| Meet future requirements such as daughter’s marriage and education | 4.68 |

| Increase savings | 3.58 |

| Get Income tax relief | 5.03 |

| Persuaded by LI agents to buy | 4.16 |

| To secure the future of my family in case of death | 3.39 |

| To get a good return as suggested by LI agents | 3.74 |

| To make LI agent happy as he was relative | 3.43 |

| N | 200 |

| Chi-Square | 293.592 |

| df | 6 |

| Asymp Sig. | 0.000 |

This shows that the most rational reason of buying life insurance is securing the future of family in case of death of person insured. However the result findings show it to be the lowest mean rank. Thus the above findings show that most of the buyers of insurance products deviate from the total rationality and is influenced by certain cognitive abilities. Further the value of P (0.000) is less than the level of significance and hence can be stated that there lies significant difference between the mean ranks of different variables responsible for buying life insurance products.

Results and Discussion

Based on the various literatures review it has been found that the concept of bounded rationality as advocated by Herbert Simon is applied in case of purchase decisions in relation to various set of products including eco-friendly. The results of the findings also suggest that in case of life insurance products, the concept of bounded rationality is validated. As far as life insurance products are concerned, it only serves the most important objective of securing life and hence term insurance can be the best option. However the respondents have mostly opted for endowment and other products which clearly justify the deviation from total rationality.

Limitations and Future Scope of the Study

The authors have studied the subject and validity of Herbert Simon model with small sample size in relation to Life insurance products which can be broadened to larger sample size and in case of other types of products in order to validate and justify the viewpoint. The future researchers can take this research forward by taking various cognitive factors and its impact on buying decisions. The future researchers can also justify the validity of the Herbert Simon’s view with other behavioural theorists of 21st century.

References

B. Amarnath Reddy, G N P V Babu, R K Sant, Punam Ahlawat, Subharun Pal, Sudeshna Pahari. (2024). Behavioral Economics and Consumer Decision-Making: Insights from Experimental Research. European Economic Letters (EEL), 14(3), 1258–1265.

Barros, G. (2010). Herbert A. Simon and the concept of rationality: boundaries and procedures. Brazilian Journal of Political Economy, 30, 455-472.

Indexed at, Google Scholar, Cross Ref

Goldfarb, Avi, Teck-Hua Ho, Wilfred Amaldoss, Alexander L. Brown, Yan Chen, Tony Haitao Cui, Alberto Galasso et al. "Behavioral models of managerial decision-making." Marketing Letters 23 (2012): 405-421.

Indexed at, Google Scholar, Cross Ref

Ho, T., Lim, N., & Camerer, C. (2006). Modeling the Psychology of Consumer and Firm Behavior with Behavioral Economics. Journal of Marketing Research, 43, 307 - 331.

Indexed at, Google Scholar, Cross Ref

Hoy, W (2019), Decision Making Theory, Wayne K. Hoy | Fawcett Professor Emeritus in Educational Administration (waynekhoy.com).

Kalantari Behrooz (2010), Herbert A Simon on making decisions: enduring insights and bounded rationality, Journal of Management History, 16 (4): 509-520.

Indexed at, Google Scholar, Cross Ref

L. A., & Zhao, M. (2017). Behavioural Economics, Consumer Behaviour, and Consumer Policy: State of the Art. Behavioural Public Policy, 1(2), 190–206.

Indexed at, Google Scholar, Cross Ref

Narayanan Surya, N Raj Praveen (2020), Neuro marketing: The science of consumer behavior, 4th International Conference on Marketing, Technology and Society 2020.

Zandstra, E. H., Miyapuram, K. P., & Tobler, P. N. (2013). Understanding consumer decisions using behavioral economics. Progress in brain research, 202, 197-211.

Indexed at, Google Scholar, Cross Ref

Zhang, W., Yu, J., Diao, L., & Qi, S. (2023). Managerial decision-making from the perspectives of behavioral science and neuroscience. Frontiers in Psychology, 14, 1125333.

Indexed at, Google Scholar, Cross Ref

Received: 27-Aug-2024, Manuscript No. amsj-24-15475; Editor assigned: 28-Aug-2024, PreQC No. amsj-24-15475(PQ); Reviewed: 20-Sep-2024, QC No. amsj-24-15475; Revised: 26-Sep-2024, Manuscript No. amsj-24-15475(R); Published: 12-Oct-2024