Research Article: 2021 Vol: 20 Issue: 2S

Healthcare Industry Challenges and Potential Opportunities in the Uae. A Review Paper

Salama Jamal Rafeea, UniversitiTeknikal Malaysia Melaka

Samer Ali Al-Shami, UniversitiTeknikal Malaysia Melaka

Khaled Mohammed Alkaabi, UniversitiTeknikal Malaysia Melaka

Nurulizwa Rashid, UniversitiTeknikal Malaysia Melaka

Keywords

Healthcare, Industry, Challenges, Opportunities, UAE

Abstract

The development of the health sector is one of the most important priorities of policy-makers in the United Arab Emirates (UAE), as it has a direct impact on the citizens 'well-being and productivity. However, it is fraught with challenges due to the overlapping and complexity of operations that require capital and high technology, which may exceed the state's capabilities. Despite the theoretical enrichment about the development of the health system, there is a contradiction in the methods on the one hand, and a discrepancy in the studies, especially in focusing on the developed and western countries on the other hand. Therefore, this paper aims to review and discuss the challenges and opportunities of the health system in developing countries, especially the UAE by through the interaction between leadership and corporate entrepreneurship, which is the key driver for innovation and healthcare sustainability.

Introduction

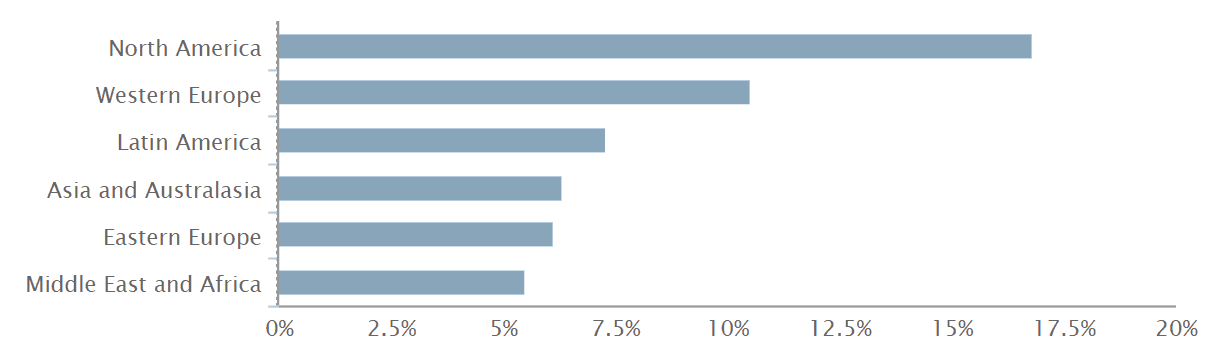

Healthcare industry witnesses a rapidly growth in both capacity and quality. According to (Alix partners, 2016) current trends in the sector include data science exploitation, a revolution towards precision medicine, and enhanced communication technologies. Globally, healthcare spending continues to grow rapidly, driven by developed economies such as the USA where healthcare expenditure forms a whopping 17.9% of annual GDP, with a global expenditure hitting 9.3 trillion United States Dollars (USD) as of 2018 (Mahroum, 2018). (Figure 1). The USA alone, for instance, accounts for 3.5 trillion or 32.55% of this total global expenditure. Among the global regions, The Middle East and Africa have the least in terms of healthcare assets; 127 billion USD compared with 393 billion USD in Latin America and 3,471.2 billion USD in North America (Mahroum, 2018). Despite these trends, the healthcare sector continues to experience great uncertainty from diverse perspectives including the lack of proper funding in Research and Development (R&D), poor population health, inadequate insurance coverage among others. These challenges a particularly present in developing economies (Alix partners, 2016).

With the UAE as part of the Middle East and Africa estimates, this is highly worrying. In these regions, healthcare expenditure accounts for less than 4% for some selected countries. Despite low proportion of healthcare assets, the Economic Intelligence Unit – World Health Organization observe that the MENA region, including the UAE, registers the “highest growth potential” of 9% year-on-year compared with 1.8% for Latin America, 5% for North America, and 5% on the global average (Economic Intelligence Unit – World Health Organization, 2019). This potential can however only be realized if resources are adequately dedicated and the sector achieved economic self-sustainability. Despite this surge of growth and the major efforts that made by the UAE government, several challenges still existent and form obstacles to meet the 2021 vision to be a world high class healthcare. Therefore, this paper aims to provide an extensive review about the healthcare in the Arab countries of the Gulf Cooperation Council and discuss the challenges and potential opportunities.

Healthcare in the Gulf Arab

The growth in health spending stands at about -0.8 in Western Europe and yet accounts for over 10% of the GDP of the MENA region. Despite minimal assets coupled with high growth potential, the readiness of the region to make good use of this potential depends heavily on the ability to curb regional and national challenges associated with the sector (Economic Intelligence Unit – World Health Organization, 2019). With the highest growth potential, and yet the smallest percentage of GDP to healthcare as shown in Figure 1, the MENA region and the UAE, in particular, is poised for significant expansion in the healthcare sector if necessary measures are implemented ( Economic Intelligence Unit – World Health Organization, 2019). The operational needs of the sector and healthcare providers have become increasingly complex, compelling investors and operators to make challenging decisions (Ian & Mansoor, 2013). Within the GCC, the growth potential of healthcare investment is driven by favourable demographics and population dynamics, as indicators on beds and healthcare human capital remain lagging (Mahroum, 2018).

Figure 1: Comparison Of Mena (Including UAE) Healthcare Assets With Other Global Regions – Healthcare Spending 2019 As % Of GDP

Source: (Economic Intelligence Unit – World Health Organization, 2019)

Despite an integrated effort by both private and public parties, indicators such as the density of bed provisions remain considerably low when compared with other developed countries. In addition, the number of doctors, nurses and general medical staff is below that of developed economies. The average number of beds per 1000 population stands at about 1.9 as of 2013 (Khoja et al., 2017). In Singapore, the UK and the USA, this index stands at 3 beds per 1000 population; In Germany, 8 beds for 1000 population (Global health care, 2014). Overall average healthcare expenditure as a percentage of GDP in the GCC stands at about 2.3% (World Bank Development Indicators, 2013). Building on the latest indicators, health spending as a percentage of GDP in the MENA stands at about 5.6% against the global average of 10% as at 2017 (World Bank Development Indicators, 2019).

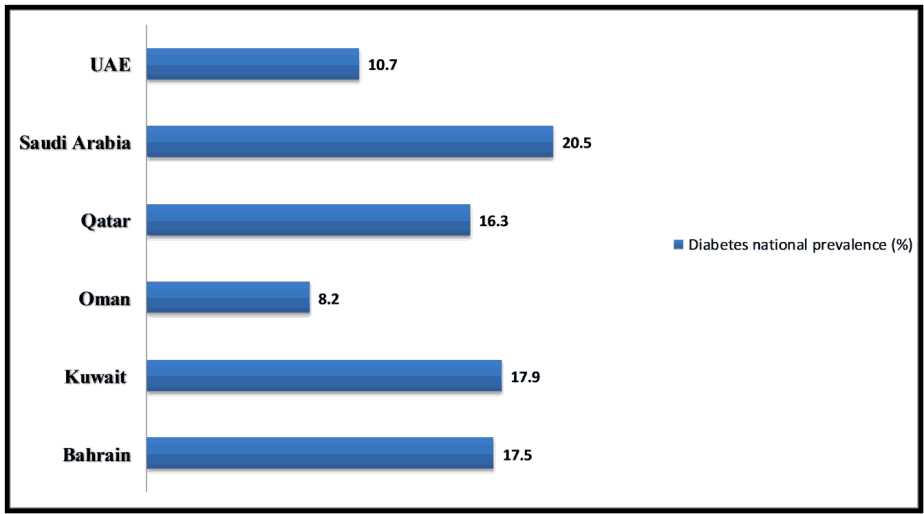

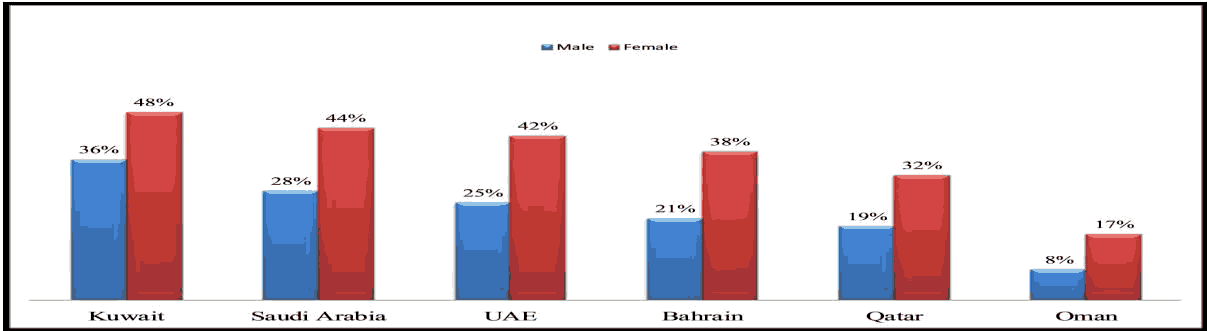

Aside from the elaborated challenges in terms of healthcare delivery, the region has unique trends in terms of population health challenges. Overall life expectancy has increased dramatically from 62 in the 1970s to 77 in 2012, with child mortality also reducing from 62 per 1000 to less than 9 over the same period (Gulf Immigration, 2016; Population Reference Bureau, 2016). The region, however, ranks highest globally in terms of lifestyle ailments including diabetes, cardiovascular diseases and obesity (International Diabetes Federation, 2019). National prevalence of diabetes is one of the highest recorded globally as reported by the International Diabetes Federation (2017) (Figure 2). Obesity in the region is also one of the highest in the world (Khoja et al., 2017) (Figure 3) These unhealthy lifestyles including lack of physical activity, lack of attention to health prevention and disease management and weak primary care infrastructure further complicates the health situation.

Figure 2: The National Prevalence Rate of Diabetessource: International Diabetes Federation (2017) Cited By (Khoja Et Al., 2017)

Figure 3: Prevalence of Obesity in The Gulf Cooperation Council (Gcc): Prevalence of Obesity in Gulf Cooperation Council (GCC) Source: (Khoja Et Al., 2017)

In recent developments a number of initiatives including the education of the young population have been implemented, the government also aspires to identify ways to tackle emerging healthcare challenges by changing the lifestyle of the people through education and smoking control (Khoja et al., 2017). Significant opportunities including public-private partnerships and healthcare financing gaps exist through which the region can boost overall healthcare standing and resolve some of the pertinent challenges (Al-Hanawi, Almubark, Qattan, Cenkier & Kosycarz, 2020).

The UAE Healthcare

The UAE hhealthcare has increased steadily over the last few years mainly for the Emirate of Dubai as Abu Dhabi attempts to catch up in terms of attractiveness to international medical standards (Al-Neyadi, Abdallah & Malik, 2018). In the UAE, the country has expressed its keen interest in the promotion of entrepreneurship as fundamental to the healthcare market. Focus on healthcare is not only part of the government’s strategic vision but has as well been demonstrated in the government’s efforts to reshape the economic structure of the country and avoid single commodity dependence (Koornneef, Robben & Blair, 2017). In Dubai, the Healthcare Free zones introduced have served as a hub for healthcare innovation and medical tourism (Al-Talabani, Kilic, Ozturen & Qasim, 2019). In Abu Dhabi, a unified patient database was also introduced to consolidate data from over 2000 public and private institutions at a population scale (Orion Health, 2019). On the introduction of these reforms, an economic interest in healthcare has been of particular interest to the Emirate of Abu Dhabi, where oil proceeds from about 80% of government expenditure (Arabian business global, 2008). Key reforms have been introduced by the UAE in general to position the country as a preferred destination of healthcare tourism and healthcare innovation hub (UAE_cabinet, 2010). In the United Arab Emirates, as part of the Vision 2020, seeks to establish an excellent healthcare service (UAE_cabinet, 2010).

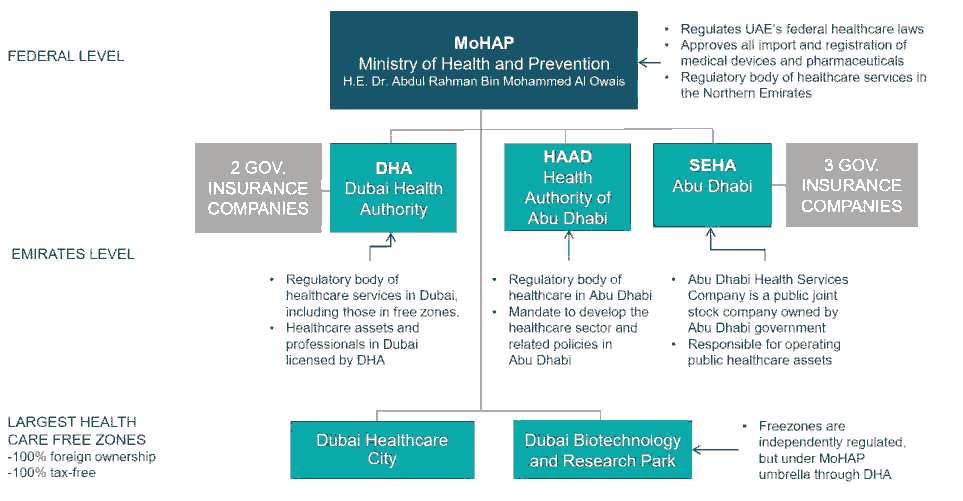

The government seeks to ensure that the healthcare sector witnesses an extended period of growth, driven by the unmatched demand (Mahroum, 2018). In specific terms, the strategic document states that: “the UAE [will] …invest continually to build world-class healthcare infrastructure, expertise and services in order to fulfil citizens’ growing needs and expectations.” (UAE_cabinet, 2010). Over the years, the regulators in the Five (5) Northern Emirates have been combined into the Ministry of Health and Preventive Medicine (MoHAP) formerly known as the Ministry of Health (MoH). The MoHAP nonetheless has some interests in Dubai and Abu Dhabi, even though these two Emirates have their own regulatory systems. In total, the UAE Healthcare system entails five main regulatory bodies including the Free Zones (Figure 4).

Figure 4: The UAE Healthcare Sector Regulators At The Federal and Local Levels Source: Business Sweden (2017)

The Ministry of Health and Prevention (MoHAP) plays the role of a Federal Healthcare regulatory institution and oversees healthcare mainly in the five (5) Northern Emirates. At the local Emirates level, the Dubai Health Authority (DHA) is the main regulatory body for healthcare in Dubai. The two largest Free zones in the UAE operate in Dubai and include the Dubai Healthcare City and the Dubai Biotechnology and Research Park. In Abu Dhabi, Health Authority – Abu Dhabi (HAAD), and the Abu Dhabi Health Services Co. (SEHA) at the Emirate level. Both Dubai and Abu Dhabi operate key government insurance companies as part of the regulatory systems. Each of these regulatory bodies is responsible for a group of facilities, licensing of doctors and nurses and as well as market regulation within its jurisdiction (Mahroum, 2018).

In the area of healthcare innovation, the UAE has demonstrated a culture of willingness to adopt new ideas, the population dynamics have also proven very useful to the effective management of healthcare, and overall trust of the healthcare system remains impressive (Mahroum, 2018). Healthcare tourism has increased steadily over the last few years mainly for the Emirate of Dubai as Abu Dhabi attempts to catch up in terms of attractiveness to international medical travellers (Mahroum, 2018). Overall dedication to the sector and the degree to which the private sector can overtake the public sector to become an engine of growth and development, has been drawn into question.

Healthcare Challenges and Potential Solution in the UAE

Despite this surge of growth and the major efforts that made by the UAE government, several challenges still existent and form obstacles to meet the 2021 vision to be a world high class healthcare. For example, the health care service delivery still lack to effective and efficient system (Alblooshi, Al-shami & Sidek, 2019). These weaknesses include a shortage of specialists and nurses. Others include low quality of skills by nurses and low motivation levels among health care stakeholders. This has led to low innovativeness, which results poor service delivery, and man patients are opting to pursue health care services abroad. As a key to develop a sustainable healthcare industry, corporate entrepreneurship has been recognized as an effective development strategy due to its significant effect on innovation and commercialization development in both the local and international markets. Therefore, there is increasing attention in understanding the mechanisms to enhance corporate entrepreneurship (i.e., the sum of a firm’s product innovation, business venturing, and strategic renewal activities (Kuratko, Hornsby & Hayton, 2015).

As a key weakness, the UAE shares much of the problem of the Arab and MENA region, with the lack of capital dedication, low human capital and low entrepreneurial activity. To resolve these challenges, (Mahroum, 2018), assert that leadership is critical to open up sources of opportunities in the healthcare sector and facilitate a continuous improvement culture and facilitate overall growth and competitiveness of the UAE healthcare sector within the global economic terrain.

To address these challenges, the government aspires to innovate and create a healthcare environment that spurs opportunities for capitalising and aligning the current efforts between across entities and the industry (Mahroum, 2018; Hosseini et al., 20220). In a typical instance, the Abu Dhabi Government pioneered the Abu Dhabi healthcare strategy in an attempt to open up opportunities to make fast and effective changes to boost the sector. Notably, the government is keen to improve private sector involvement in the healthcare industry by encouraging foreign investment and entrepreneurship.

According to the 2016 INSEAD’s Global Talent Competitiveness, the UAE continues to lead in attracting, recruiting and retaining talent within the entire Middle East region (Lanvin, Evans & Eduardo, 2016). The government is keen on developing a ‘knowledge economy’ by attracting foreign expertise and talent, especially in the healthcare industry. Maintaining this trend of innovation is critical for improvement in the sector. It is important to add that the UAE Government led by the Abu Dhabi Emirate seeks to attract more young Emiratis into the healthcare industry in the midst of persisting challenges (Lanvin et al., 2016).

The section seeks to revolutionise the sector through technology adoption and promotion of entrepreneurship concept in the healthcare industry. Leadership, innovation and technology have been considered fundamental to revamp the sector and create a viable avenue for performance improvement. With the support of literature on this area, the study seeks to empirically support a model of entrepreneurship to help innovatively transform the sector in the UAE’s quest to diversify its economy whilst achieving some returns from the healthcare investments made over the years.

Entrepreneurship in Healthcare

To understand the urgent need of entrepreneurship to spur growth in the UAE Healthcare sector, it is first critical to understand the unique elements within the healthcare environment which could serve as barriers and drivers of sectorial growth. A number of perspectives may be considered ranging from the level of insurance coverage to overall economic make-up. Entrepreneurship is of critical relevance to ensure that the current system which depended heavily on over 60% government financing is economically sustained in a country where expatriates make up over 83% (Moideen, 2018).

On a brief elaboration on such existing innovation programs directed at achieving overall economic sustainability, SEHA’s Electronic Medical Records (EMR) system is one of such attempts to link the Emirates institutions with over 27,000 others globally, in addition to the earlier example mentioned by (Kabha, Salameh, Kamel, Elbahi & Mustafa, 2019) called the Malaffi system to link over 2000 facilities within the Emirate. In the DoH, the ‘eclaim’ is another typical example in this case introduced to hasten health insurance claim. In Dubai, several DHA Apps have been launched to support healthcare delivery. One other very significant area is the attempts made to bridge international partnerships between local and international healthcare organizations.

The UAE continues to make significant strides in innovation to boost overall entrepreneurship in the sector, including the adoption of the latest technology as part of the medical practice (Mahroum, 2018). (Mahroum, 2018) assert that the UAE is open to innovation, technology and other essential factors necessary to drive entrepreneurial orientation. As part of the National Vision, the healthcare sector remains one of the prioritized sectors with keen government interest (UAE_cabinet, 2010). The government aspires to build a world-class healthcare system that is economically sustainable and resilient in supporting population health.

In one final elaboration, a quick observation at some of the UAE entrepreneurship indicators outside of the context of healthcare reveals that the number of people thinking of entrepreneurship as a good career and self- employment is emerging as an alternative to Emiratization in the country’s private sector (Kabha et al., 2019). The Global Entrepreneurship Monitor (GEM) placed the UAE in an advanced position on the “Entrepreneurial Environment Scoreboard”; a rating indicating that the UAE has one of the most supportive environments for entrepreneurial activities. Nonetheless, the fear of failure, lack of knowledge and requisite skills to start a business (Khaleej Times, 2007). In the healthcare domain, the sector continues to attract significant shares of government expenditure in wait of revenue and performance improvement yet to occur.

Conclusion

Closing the healthcare sustainability gap through the interaction between leadership and corporate entrepreneurship development is the proxyto provide grounds for future researchers and other scholars to explore the area of entrepreneurship and innovation as applied to the context of healthcare service provision. Key contributions of the study is established as follows:

First, the transformational leadership has yet to be studied in depth in promoting healthcare in public sector through corporate entrepreneurship development such as innovation, new venture and others. This research will arrive with a model in how to develop healthcare sector through the interaction between transformational leadership and corporate entrepreneurship. Additional research is needed to understand how context impacts of transformational leadership and the development of healthcare dynamic capabilities absorptive capacity. Discovering the relationship between these leadership styles will result in a significant contribution to the leadership literature through developing a new understanding of how the combination of leadership styles can facilitate organizational performance.

Second, building on the above point, the need to provide insight into how transformational leadership can be achieved in the field of healthcare. This will help provide insight into the academic field in training health practitioners who are entrepreneurial. It will help provide insight on which constructs to comment and build on healthcare leaders will be properly impacted to produce in the field.

Third, for already existing institutions, especially within the region of Abu Dhabi and UAE, the results of the study will help connect the dimensions of leadership innovation and technology through innovation transformation towards improvements performance of the healthcare institutions. Finally, as part of the UAE strategic vision, the aspiration to improve healthcare remains integral to the UAE Vision 2021. This is also relevant to the UAE Government’s attempt to establish the UAE as a medical tourism site, and to diversify the economy with healthcare as one of the main pillars of economic transformation.

Acknowledgement

We would like to thank Universiti Teknikal Malaysia Melaka for supporting us in publishing this paper.

References

- Al-Hanawi, M.K., Almubark, S., Qattan, A.M.N., Cenkier, A., & Kosycarz, E.A. (2020). Barriers to the implementation of public-private partnerships in the healthcare sector in the Kingdom of Saudi Arabia. PLoS ONE, 15(6).

- Al-Neyadi, H.S., Abdallah, S., & Malik, M. (2018). Measuring patient’s satisfaction of healthcare services in the UAE hospitals: Using SERVQUAL. International Journal of Healthcare Management, 11(2), 96-105.

- Al-Talabani, H., Kilic, H., Ozturen, A., & Qasim, S.O. (2019). Advancing medical tourism in the United Arab Emirates: Toward a sustainable health care system. Sustainability (Switzerland), 11(230).

- Alblooshi, H., Al-shami, S.A., & Sidek, S. (2019). The advantages and challenges of mobile health service quality system in UAE and future research. Annals of Tropical Medicine & Public Health, 22(1).

- Alix partners. (2016). The healthcare sector in the united arab emirates healthcare on the home front. Global Healthcare Sector Is Growing Rapidly, 4(9).

- Arabian business global. (2008). Abu Dhabi GDP to hit $300bn by 2025.

- Global health care. (2014). 2014 Global health care outlook. Shared challenges, shared opportunities.

- Hosseini, S.B., Baghbanian, M., & Shafaie, R. (2020). Determining the relationship between ethical environment climate and tending to desertion in the small and medium industries. ALKHAS. The Journal of Environment, Agriculture and Biological Sciences, 2(3), 13-18.

- Indicators, W.B.D. (2013). World bank development indicators. In analysis of income and welfare level of farmer households, 53.

- Indicators, W.B.D. (2019). World bank development indicators.

- International Diabetes Federation. (2019). (International Diabetes Federation, 2017).

- Kabha, R., Salameh, F., Kamel, A., Elbahi, M., & Mustafa, H. (2019). M-Health applications use amongst mobile users in Dubai- UAE. International Journal of Innovative Technology and Exploring Engineering, 9(2), 5100–5110.

- Khaleej Times. (2007). UAE 2007 inflation hit 10.9 percent: report.

- Khoja, T., Rawaf, S., Qidwai, W., Rawaf, D., Nanji, K., & Hamad, A. (2017). Health care in gulf cooperation council countries: A review of challenges and opportunities. Cureus.

- Koornneef, E., Robben, P., & Blair, I. (2017). Progress and outcomes of health systems reform in the United Arab Emirates: A systematic review. BMC Health Services Research, 17(1), 672.

- Kuratko, D.F., Hornsby, J.S., & Hayton, J. (2015). Corporate entrepreneurship: The innovative challenge for a new global economic reality. Small Business Economics, 45(2), 245–253.

- Lanvin, B., Evans, P., & Eduardo, R.M. (2016). The global talent competitiveness index talent and technology 2017. In the global talent competitiveness index 2017.

- Mahroum. (2018). The healthcare sector in the united Arab emirates healthcare on the home front. In global healthcare sector is growing rapidly.

- Moideen, T. (2018). Why changes in the UAE healthcare sector are an economic boost for everyone.

- Organization, E.I.U. – W. H. (2019). healthcare.

- Orion Health. (2019). Orion health and abu dhabi health data services announce partnership to deliver the first health information exchange in the middle east.

- UAE_cabinet. (2010). UAE_cabinet_decision_No.28_of_2010-english.pdf.