Research Article: 2020 Vol: 26 Issue: 5

Health Crisis Covid-19 and the French Economy

Salha Ben Salem, University of Monastir, Tunisia

Nadia Mansour, University of Sousse, Tunisia & University of Salamanca, Spain

Mariem Haddad, University of Monastir, Tunisia

Abstract

COVID-19 (Coronavirus) pandemic has created surge demand for essential healthcare equipment, Software along with the requirement for digital applications. This health crisis has started with the applications of advanced manufacturing and digital information technologies witch used for distance education, for firms, and banking strategies. Several analysts assume that this digitalization acceleration can be viewed as a proactive weapon to respond to the crisis. The companies in French ahead with digitalization confirmed the validity of this notion.

Keywords

Coronavirus, Digital, Education, Finance, Economics, France.

Introduction

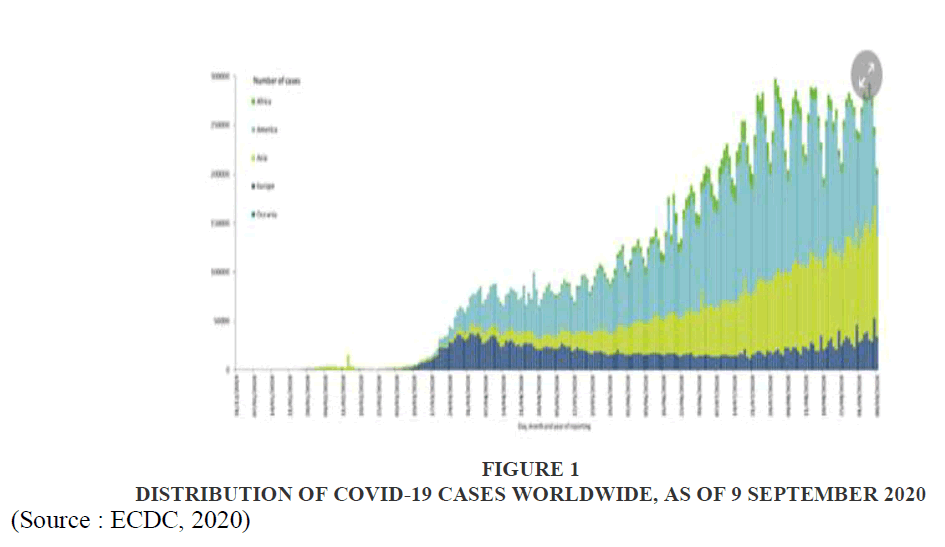

Since the first confirmed case of COVID-19 in Wuhan, China, at the end of 2019, COVID-19 has rapidly spread throughout the Word. According to a report from the World Health Organization (WHO), COVID-19 has affected 27,605,560 people in 213 countries around the world and 898,269 people died (9/9/2020). Europe remains strongly affected by 3 969 077 cases (9/9/2020); the five countries reporting most cases are Russia (1 035 789), Spain (534 513), United Kingdom (352 560), France (335 524), and Italy (280 153) Figure 1.

This horrible propagation of Covid-19 was recorded in the countries of the rest of the world outside China, where the latter shows a decrease since the month of February.

In this context, the COVID-19 (Aubry, 2020) pandemic is a major shock to the European and global economies.

Member states have already adopted or are in the process of adopting fiscal policy and liquidity support measures to increase the capacity of their health systems and to assist citizens and sectors particularly affected.

Our article aims to describe and analyze three points. First, it aims to analyze the macroeconomic and financial implications of COVID on the French economy. Second, it put the attention on the service sector (such as education, and Tourism) dynamics in response to COVID-19. Then, it examines how the European Central Bank and the Government of France support the economy during the crisis. Third, it presents the effectiveness of these measures in the post-crisis period.

In this paper, we are adopting a case study for the French economy and how the coronavirus pandemics impacted it. Our methodology thus consists of a descriptive analysis of the volatility of macroeconomic fundamentals and their implication on the European Central Bank’s decision.

The Macroeconomic and Financial Impact of COVID-19 on the French Economy

The economic impact will be felt through multiple channels. To contain the spread of the virus, first of all, the imposed closures of physical shops and stores, and other emergency measures have strongly affected many sectors, including retail, leisure, tourism, transport, and events.

If all sectors are on average negatively affected, the decline in sales or the discontinuation of sales puts at risk the companies and in particular the smaller structures that do not have sufficient cash to face a crisis that continues. Taking into account that all economic sectors are strongly interconnected, this creates a domino effect and reinforces the economic recession

The specificity of this crisis is the uncertainty of prediction; all is related to the continuity of coronavirus, which is unknown.

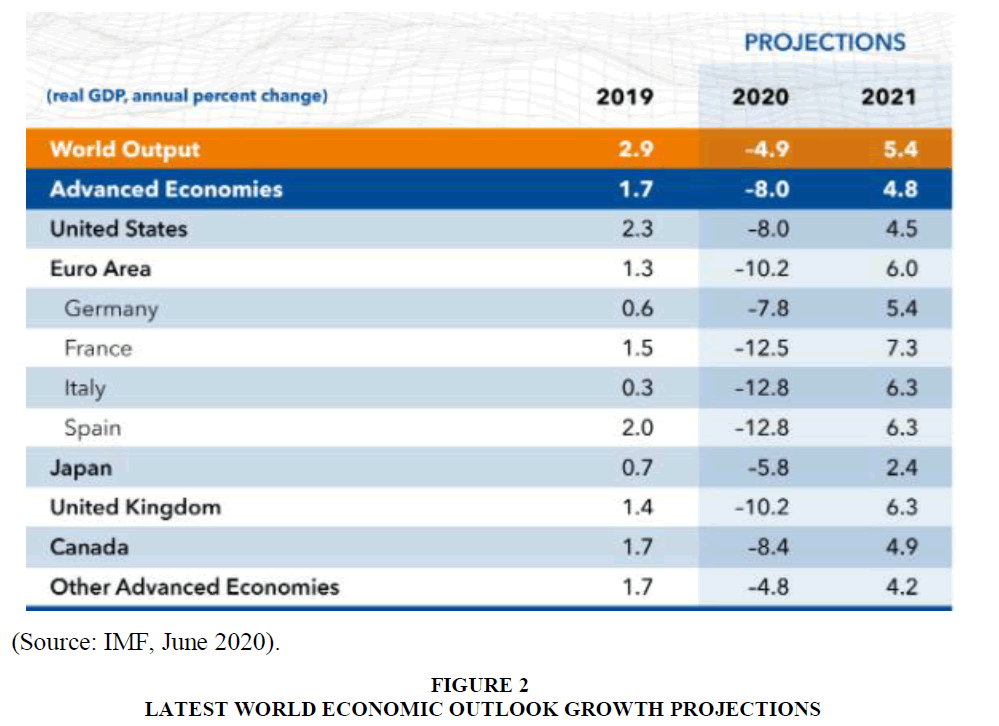

The forecasts for 2020 GDP vary from week to week; on 1st April, the INSEE forecast a minimum decline of 6%, while the IMF predicted a fall of 7.2% on 9 April, and on 14 April, the French government predicted that the fall was about 8%. And during July, the rate cut was as follows 14%.

In comparison, the recession due to the subprime crisis caused a 3% drop in GDP in 2009 while the Great Depression caused a cumulative loss of about 15% between 1929 and 1933.

Financial Impact

Economic turmoil associated with the COVID-19 pandemic has wide-ranging and severe impacts upon financial markets, including stock, bond, and commodity (including crude oil and gold) markets. As stated by the IMF report, April 2020, many equity markets around the world experienced their fastest price drop in history.

Several factors amplified the historic plunge in retail sales, a slump in factory output, and the sharp movement of the asset price, contributing to a sudden tightening of financial conditions. On February 24, 2020, the Dow Jones Industrial Average and FTSE 100 decreased more than 3% and the S&P 500 dropped more than two percent (New York Times, May 2020). This significantly drops remedied by the US government secured the Coronavirus Aid, Relief, and Economic Security (CARES) Act in Figure 2.

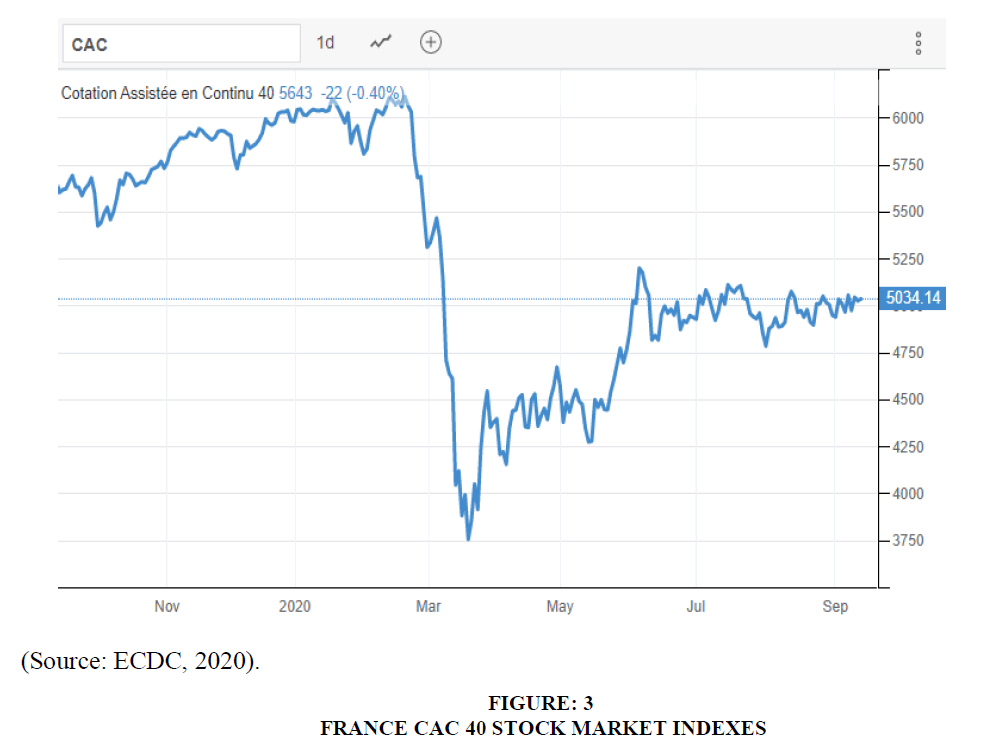

Similarly, the European stock market recognized its brutal fall has never registered. London's FTSE 100, France' CAC 40, Germany’s DAX, and the Euronext 100, were all down in the first period of coronavirus but rose moderately after the EU’s rescue package agreed on April 2020.

Though still far from the record reached before the COVID 19 crisis, the French stock market, CAC 40, rise by 1.4 % to 5,034 during the latest week, rebounding from a 0.8% gain in the previous period, propelled by hopes for global economic recovery and prospects of coronavirus vaccines and treatments (Trading Economics, September 2020).

For instance Amazon, Rachel (2020) announced that will temporarily suspend operations in France follow a ruling from a French court decision prohibiting all shipments of non-essential goods as part of the coronavirus shutdown. This company has six warehouses in France employing 10,000 people. Employees will receive their full salary through a state partial unemployment program (Sandler, 2020).

In this context, Vito & Gómez (2020) examine the effect of the Coronavirus health crisis on the liquidity of 14250 firms across 26 countries. Among these companies, 452 French companies were introduced. They find that a semi-annual tax deferral will not prevent any French company from becoming illiquid within six months.

On the other hand, the government facilitates a bridge loan to 6 (14) firms in the moderate-risk (high risk) scenario to shore up all their cash burn rates to −0.5. Furthermore, their study shows that 99.87% (98.68) moderate-risk firms (high risk) of companies have the amount needed to avoid a tightening of cash within six months in Figure 3.

Also, market liquidity deteriorated considerably: The spread of the virus has triggered massive sales in the financial markets following investors' decision to liquidate some of their positions to respond to margin calls and rebalance their portfolios. Naturally, that liquidity tightens will increases pressure from businesses and households.

However, in this terrible period, the pressure can be transmitted to a systemic panic following the contagion effect; Firms demand payment from creditors but delay payments to suppliers. However, this harms the liquidity position of the supplier and so on down the line. The defaults of one firm could trigger a chain of further defaults triggering a rapid increase in the unemployment rate.

Markets have pared back some of the losses after Pandemic Emergency Purchase Program aimed to stabilize investor sentiment. According to the IMF report, Europe spent 750 billion euros to purchase private and public sector securities, until the end of 2020. Enlarged ECB Asset Purchase Program, with an additional EUR 120 billion in asset purchases concentering on the corporate sector (Luca & Alberto, 2020)

Impact of COVID -19 on the Service Sector

Several sectors are affected by a slowdown in activity, due to the quarantine and containment measures put in place to limit the spread of the coronavirus. The education sector is no exception.

Education

At the end of February, as alarm bells began to sound on the growing spread of the COVID-19 virus Julien (2020), the World Bank established a multi-sectorial global task force to support country response and coping measures.

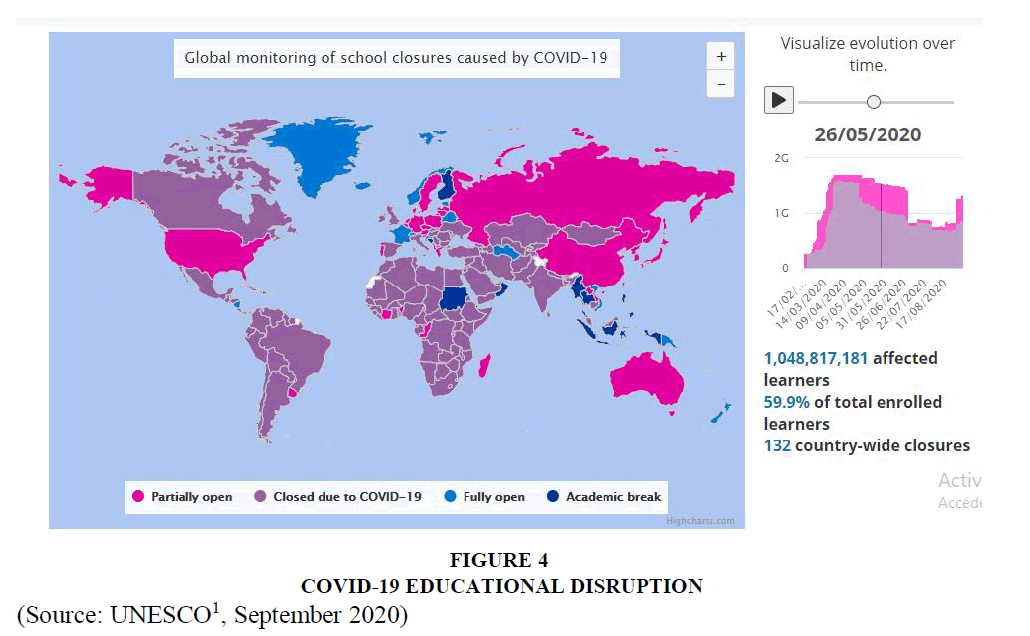

At the time, only China and a handful of schools in other affected countries were enforcing social distancing through school closures. A little over two weeks later, 120 countries have closed schools impacting almost a billion students across the globe that have seen their schools close for varying lengths of time.

Similarly in France, on March 12th, 2020, the president of the Republic announced the closure of schools, colleges, and high schools, as a security measure, from Monday, March 16 and until further notice, on the whole of the metropolitan territory.

While school closures seem to present a logical solution to enforcing social distancing within communities, prolonged closures tend to have a disproportionately negative impact on the most vulnerable students. They have fewer opportunities for learning at home, and their time out of school may present economic burdens for parents who may face challenges finding prolonged childcare, or even adequate food in the absence of school meals in Figure 4.

Figure 4: Covid-19 Educational Disruption

(Source: UNESCO1, September 2020)

Unfortunately, the disruptions continue to this day. In fact, after the start of the school year on 9/20/2020, France has closed 28 schools so far because of the positive cases of coronavirus.

Covid-19 Disrupts Indoor and Outdoor Movements

For the transport service, it suffers directly from the shutdown of these firms and reflects an extremely precarious reality of activity in France. If food transport works, whole sectors of the activity were stopped.

86% of transport companies experience a total or partial cessation of their activity and, on average, 59% of trucks no longer travel due to lack of orders. A paradoxical situation, which demonstrates the complexity of the context in which economic actors find themselves.

Border closings were among the first measures taken by states to prevent the spread of the coronavirus.

The consequences were immediate for airports and airlines, which saw their activity drop sharply. Today, most planes in the world are grounded, and a group like Air France has introduced several restrictions for travelers since the opening of the borders.

According to a document published, on May 7 by the Directorate General of Customs, French exports fell by 7.3% and imports by 6.2%. This is mainly due to the fall in exports of aeronautical and space products, which weigh heavily on the French trade balance. This deterioration is mainly concentrated in two areas, the United States and Asia, and is mainly explained by the fall in exports to China, the United States, and India.

Contributing to 2.700 billion dollars to the world economy (3.6% of the GDP), according to figures from IATA (International Air Transportation Association), air transport is a major industry particularly affected by the Covid-19 Monier (2020) pandemic. Thus, the level of global passenger traffic affects an important economic ecosystem ranging from airlines to aircraft manufacturers through airports and all the subcontractors, who depend on these economic heavy goods vehicles.

The account should also be taken off the closure of the borders of the countries of the Schengen area. The European Union has gradually restored the free movement of people within the Schengen countries and associated countries including Bulgaria, Croatia, Cyprus, Romania, Iceland, Liechtenstein, Norway, and Switzerland, a total of 30 countries. And afterward, for the rest of the world.

Similarly, the maritime transport sector is suffering the brunt of the pandemic of this virus which complicates the movement of goods, even reviving the specter of shortages, tempered by the start of the Chinese recovery (Corinne & Patrice, 2020).

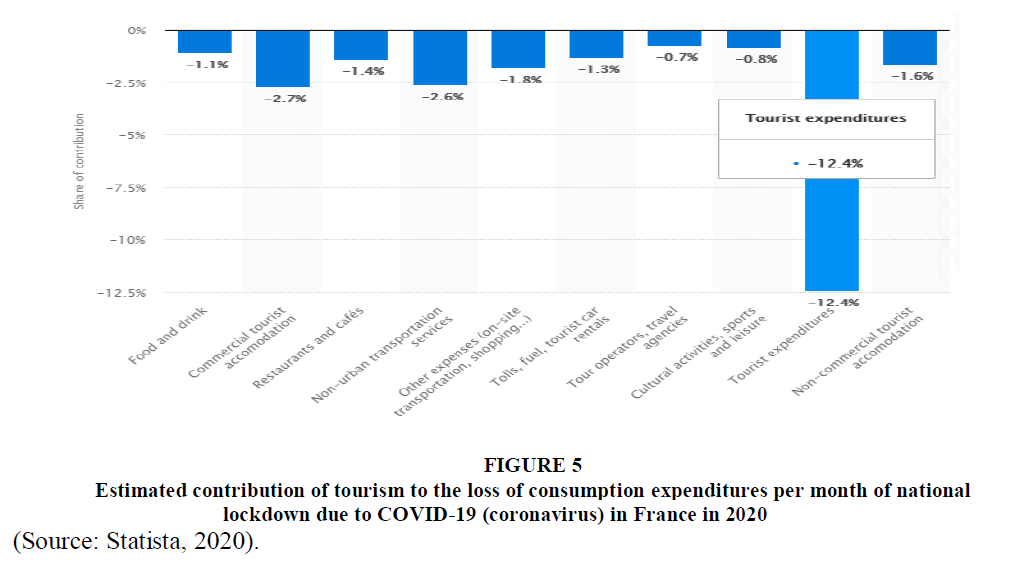

Shipping companies, a major driver of globalized economies, find themselves in a complex situation faced with the coronavirus pandemic. The weapon of supply reduction is currently maintaining freight rate but is likely to stymie the recovery, in a normal way. Especially since it will not resist the inevitable injection of new capacities in Figure 5.

Figure 5: Estimated Contribution of Tourism to the Loss of Consumption Expenditures Per Month of National Lockdown Due to Covid-19 (Coronavirus) in France in 2020

(Source: Statista, 2020).

The Most Affected Sector: Tourism

The health crisis caused by the distribution of Covid-19 leaves the specter of a major economic crisis that some, like the French Minister of the Economy, Bruno Le Maire, were already comparing that of 1929. The sector tourist is, particularly at risk. After the early closure of ski resorts, the cancellation of the Easter holidays suffered a sharp decline.

Certainly, the Covid-19 crisis is without comparison with the previous ones due to the confinement imposed on nearly a third of the world's population.

However, trying to pierce similarities with the periods of war seems all the more acceptable than the term has now entered the term through, in particular, the President of the Republic Emmanuel Macron in his televised address on March 16 latest.

She said that around 500 tourism businesses, cafes, hotels, and restaurants had requested provincial aid for a total of 170 million FCFP (1.4 million euros), due to the impact of local confinement from March 24th to April 20th and the suspension of air traffic

The sudden drop in spending related to tourism compared to other sectors clearly shows the collapse of the latter because of containment decisions.

How the European Central Bank (ECB) Support the Economy during the Crisis

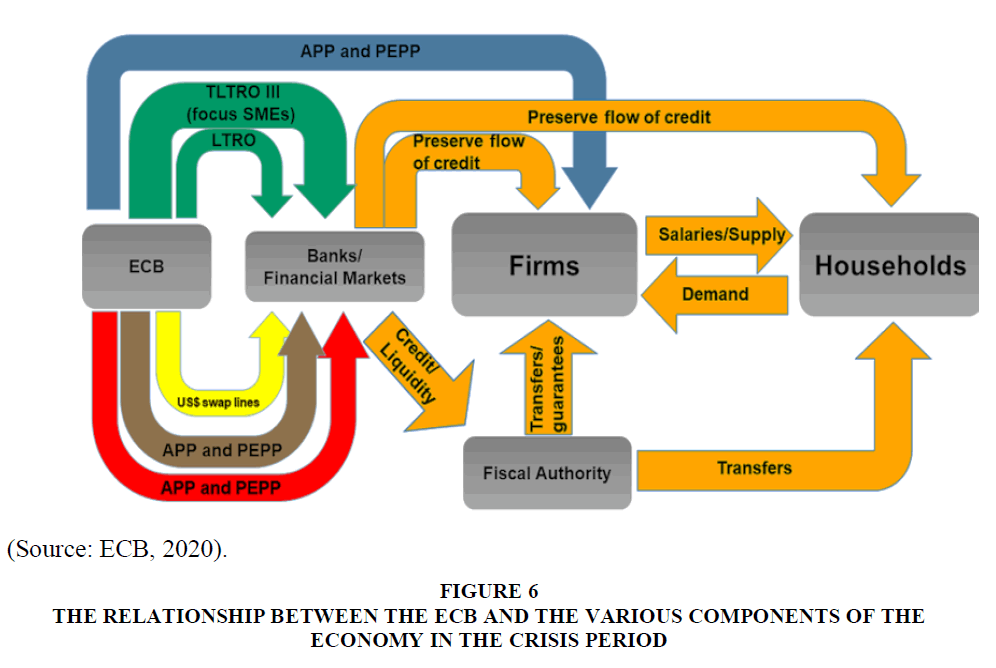

ECB has taken bold and decisive actions by easing monetary policy, purchasing a range of assets, and providing liquidity to the financial system to lean against the tightening in financial conditions and maintain the flow of credit to the economy. As policy rates were near or below zero in many major advanced economies, unconventional measures and forward guidance about the expected policy path are becoming the main tools for these central banks going forward. Central banks may also consider further measures to support the economy during these challenging times (Moatti, 2020) in Figure 6.

Figure 6: (Source: ECB, 2020).

The Relationship Between the ECB and the Various Components of the Economy in the Crisis Period

In the meeting carried out by the ECB in July 2020, the Governing Council took the following monetary policy decisions:

“The interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility would remain unchanged at 0.00%, 0.25%, and -0.50% respectively.

The Governing Council would continue its purchases under the pandemic emergency purchase program (PEPP) with a total envelope of €1,350 billion.

Net purchases under the asset purchase program (APP) would continue at a monthly pace of €20 billion, together with the purchases under the additional €120 billion temporary envelope until the end of the year.

The Governing Council continued to expect monthly net asset purchases under the APP to run for as long as necessary to reinforce the accommodative impact of its policy rates, and to end shortly before it started raising the key ECB interest rates.

The Governing Council would also continue to provide ample liquidity through its refinancing operations.

The Governing Council continued to stand ready to adjust all of its instruments, as appropriate, to ensure that inflation moved towards its aim in a sustained manner, in line with its commitment to symmetry”.

The Next Step After With the Post-Containment Period

Given that events are still unfolding, it is not possible to fully assess the effectiveness of policies implemented so far, although market sentiment has shown signs of improvement in response to policymakers’ actions, and risk asset prices have retraced through early April some of their earlier declines.

Although market sentiment has shown signs of improvement in response to policymakers’ actions, and risk asset prices have retraced through early April some of their earlier declines.

A combination of monetary, fiscal, and financial sector policies will continue to be needed going forward to support the stability of the global financial system and to preserve the soundness of financial institutions, especially if economic activity remains paralyzed for longer than expected. Some difficult questions, such as maintaining adequate capital at banks, as needed, and providing liquidity support to a broad range of market participants, including nonbank financial institutions, may have to be addressed if the situation evolves according to a more severe scenario (Saadat et al., 2020).

Fiscal measures to stimulate demand become increasingly effective as people are allowed to leave their homes and work.

Interest rates and inflation were expected to below for an extended period in most advanced countries before the pandemic. Preventing major disruptions in supply chains will help avoid inflation during the emergency and recovery phases. Under these circumstances, fiscal stimulus will be appropriate and highly effective in most advanced countries. And it will facilitate the withdrawal of the extraordinary measures that were adopted during the crisis.

Since the summer, business surveys have been pointing to the risk of a significant demand shock. Many companies fear the loss of business opportunities. In industry, order books - especially from abroad - are only slowly filling up again. And household confidence in the economic situation remains below its pre-crisis level. While the surge in savings recorded during the period of containment may help to sustain demand in the coming quarters, its use remains uncertain at this stage: it does not come from increased income, but occasional hampered consumption, and may turn into precautionary savings. Moreover, this forced saving is currently measured at the macroeconomic level, but household situations can be diverse.

Also, more than 700,000 salaried jobs were lost in the first half of 2020. This represents a 2.3% year-on-year decline in employment in the second quarter. This lag is largely due to the measures put in place to preserve employment. In the early stages of containment, the largest losses were in the temporary sector, before rebounding with deconfinement.

In the second half of the year, the rebound in activity would translate into a moderate rebound in employment in most sectors, except for those most affected by the health crisis.

Overall, salaried employment would be virtually stable in the second half of the year, but the unemployment rate would rise sharply, after a deceptive drop during the period of containment when a large number of unemployed people had interrupted their search. It could reach about 9.5 percent of the labor force by the end of the year. The halo around unemployment, which had surged in the second quarter, would diminish in the second half of the year but could remain higher at the end of 2020 than its level at the end of 2019.

Conclusion

The national accounts for the second quarter of 2020 have highlighted, in many countries, the harshness of the economic shock linked to the health situation. However, without minimizing it, the data collected since the beginning of deconfinement show how quickly and to what extent the economy is recovering from this shock. Thus, the French economy would have been operating in August at about 95% of its pre-crisis level. In other words, it would have already closed five-sixths of the gap of about 30 GDP points that separated it, at the bottom of the containment, from its pre-crisis level.

What is new is certainly the extent of the shock triggered by the health crisis, but also the massive nature of the public policies implemented to counter its economic effects, whether immediate or longer-term.

After this partly mechanical rebound phase, the French economy is approaching the start of the new school year as a driving force that is both restrained and boosted.

This is the case, moreover, for many economies around the world: health constraints, albeit eased, continue to weigh on supply, while demand risks being wiped out by the health and economic Bleak (2020) uncertainties that persist. At the same time, monetary and fiscal policies will massively support economic activity.

Faced with this situation, support measures are massive in France as in most countries. Monetary policies remain very accommodating worldwide, and fiscal policies are not lagging. In France, after the measures implemented during the period of containment, aimed at preserving the productive fabric and household incomes as much as possible, the recently announced stimulus plan will have effects on both supply and demand, which will be felt above all beyond our forecast horizon, which is limited to the end of 2020.

Limitation and Study Forward

This study is very important since it describes and analyses the impact of the Coronavirus crisis on the entire economic sector of the French countryside, and especially it take more attention to the bold and decisive measures taken by the European Central Bank during and after this crisis. Nevertheless, this study can be enriched with an empirical part, which concerns the provisional anticipation of the dynamics of the variables in the post-crisis period. This point can work with a DSGE model that allows us to estimate the trend of financial and macroeconomic variables in the economy as a whole. It can also improve by a comparative analysis by which we can compare the reaction of two or more countries in the European zone follows to this pandemic.

End Notes

1Figures correspond to number of learners enrolled at pre-primary, primary, lower-secondary, and upper-secondary levels of education [ISCED levels 0 to 3], as well as at tertiary education levels [ISCED levels 5 to 8].

References

- Aubry, E. (2020). Covid-19: Une leçon géopolitique. ARTE, Available from https://www.arte.tv/fr/videos/ 096952-006-A/ covid-19-une-lecon-de-geopolitique-06-le-monde-aerien-face-au-virus/

- Bleak Data Shows Extent of Economic Damage. (2020). New York Times. Available from https://www.nytimes. com/ 2020/04/15/business/stock-market-today-coronavirus.html

- CAC 40 Index. (2020). Boursorama. Available from https://www.boursorama.com/bourse/indices/cours/1rPCAC/-Corinne, B., and G. Patrice. (2020). Maritime transport in the French economy and its impact on air pollution: An input-output analysis. Marine Policy. Volume 116, June 2020.

- Julien, A. (2020). Le transport aérien face au COVID-19: de a crise à la transformation. Available from https://www.latribune.fr/opinions/tribunes/le-transport-aerien-face-au-covid-19-de-la-crise-a-la-transformation-846540.html

- Luca G, Alberto M, Working Paper Series The macroeconomic impact of the ECB's expanded asset purchase program (APP), N 2075, European Central Bank

- Moatti, J.P. (2020). The French response to COvid-19: intrinsic difficulties at the interface of science, public health, and policy. Lancet Public Health.

- Monier, S. (2020). Perspectives d’investissement, Le coupe-circuit COVID-19. Available from https://www. lombardodier.com/fr/contents/corporate-news/investment insights/2020/march/circuit-breaking-covid-19.html?skipWem=true

- Rachel, S. (2020). Amazon Temporarily Suspends Operations In France. Available from: https://www.forbes. com/sites/rachelsandler/2020/04/15/amazon-temporarily-suspends-operations-in-france/#30a7ca485745

- Saadat, S., R. Deepak & M.H. Chaudhery. (2020). Environmental perspective of COVID 19. Science of The Total Environment, Volume 728, 1 August 2020.

- Viktoria, D., C. Nikos., & S. Milda. (2020). EU Finance Chiefs Agree on $590 Billion Virus Rescue Package. Economics., Available from https://www.bloomberg.com/news/articles/2020-04-09/eu-finance-chiefs-agree-on-590-billion-virus-rescue-package