Research Article: 2021 Vol: 20 Issue: 3

Guidelines for Promoting SME Entrepreneurs Access to Financial Services in the Digital Economy

Wasan Kardkarnklai, King Mongkut’s University of Technology North Bangkok

Anucha Thapayom, King Mongkut’s University of Technology North Bangkok

Pairat Pornpundejwittaya, King Mongkut’s University of Technology North Bangkok

Abstract

Aim: The main aim of this research was to examine the guidelines for promoting SME entrepreneurs’ access to financial services in the digital economy.

Methodology: This research was an inductive research. The mixed-methodology including in-depth interview (qualitative research) and quantitative data collection (quantitative research) from 500 managers of the state-owned commercial banks and special financial institutions in Thailand. The data analysis was employed the structural equation model (SEM). Finally, the structural equation model was fit an in accordance with empirical data.

Finding: The results revealed that the guidelines for promoting SME entrepreneurs’ access to financial services in the digital economy. The highest means consisted of (1) financial product development, i.e. providing a complete and clear product description, introducing resources where clients can gain more product knowledge; (2) financial infrastructure management, i.e. assigning different levels of user access, allowing role-based access to the information as per user roles; (3) human resource management, i.e. promoting effective teamwork rather than individual focus; and (4) multichannel access, i.e. continuously and continually engage clients in multi-channel access plan. For the hypothesis test, the research found that commercial banks and special financial institutions weighed the guidelines for promoting SME entrepreneurs’ access to financial services in the digital economy with no difference at 0.05 of statistically significant level.

Conclusion: This research could be assumed that the main point to promote SME entrepreneurs’ access to financial services of the financial institutions in the digital economy. This is very important to organizational management guidelines to create the business opportunities. The firm should aware of the values the adaptation in the digital age under today’s rapidly changing technological environment. The analysis results of the structural equation model were satisfied through the evaluation criteria with the empirical data with the Chi-square probability of 0.055, the relative Chi-square of 1.142, the correlation index of 0.953, and the root index of the mean square of the error estimate of 0.017.

Keywords

Structural Equation Model, Promoting Financial Access, Small and Medium Enterprises

Introduction

The financial system has been defined as the set of regulations, standards, institutions and instruments that operate in and constitute the capital market, with activities mainly concerning savings and consumption, through money supply and demand. This market provides a channel of Communication between savers and users, enabling them to allocate capital productively (Mankiw & Ball, 2011). Over time, the financial system has undergone increasing competition, provoking the appearance of new strategic applications seeking better efficiency. In consequence, many financial decisions are now based on locating and retaining elements offering high added value, while those not providing the profitability needed by the industry are “excluded” from consideration (Gálvez-Sánchez et al., 2021). Greater access to the financial system increases savings reduces income inequality and poverty, improves employment levels, favors educational development, and facilitates business start-up (Banerjee et al., 2015). Despite their advantages, there are many SMEs lack financial access due to significant challenges such as unaffordable account fees, lack of financial institutions nearby, and lack of requisite qualifications to open an account (Varnakomala & Thapayom, 2020).

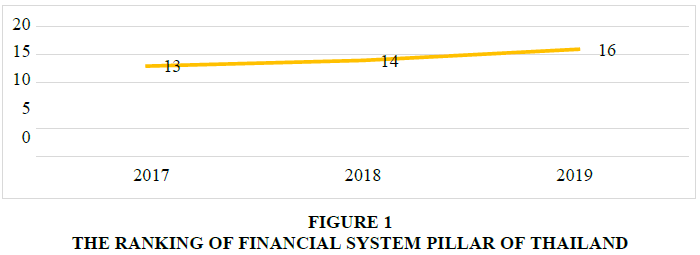

In Thailand, there are many problems and obstacles to access the financial services for small and medium enterprises. This let, the business loan growth rate of the commercial banking system in 2019 found that the growth rate of SMEs in the banking system contracted by 2.1 percent (Bank of Thailand, 2020a). Consistent with the World Economic Forum (WEF), WEF has introduced the Global Competitiveness Index (GCI), which is used to compare the competitiveness of each country in various fields (12 pillars). The GCI represented that the financial system pillar of Thailand in 2019 has an overall score of 85.1 points, ranked 16th, with a continuous decline in ranking as shown in Figure 1.

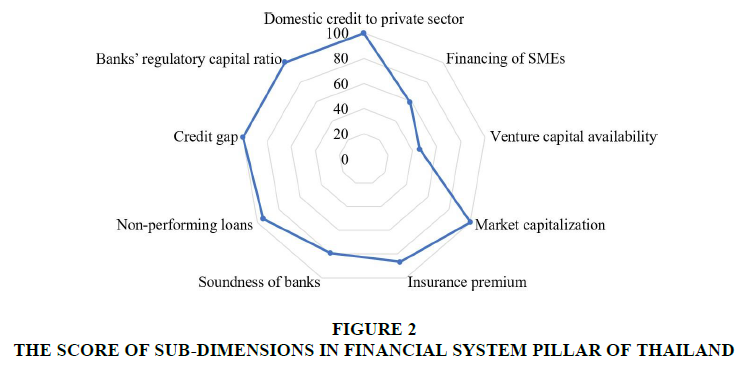

When classified into sub-dimensions in the financial system pillar (9 sub-dimensions), it was found that the financing of SMEs dimension had a score of 58.7 and the venture capital availability dimension had a score of 46.1 as shown in Figure 2. The results revealed the problem of financial access among SME entrepreneurs in Thailand (World Economic Forum, 2019).

From the aforementioned, the problem of access to financial services in Thailand is still an issue that relevant agencies still need to find ways to close the gap. Closing the financial access gap is the equilibrium between demand and supply. An important issue for financial access is the availability of financial services that can meet the needs of all groups of entrepreneurs. Nowadays, the banking system can adequately meet the needs of large enterprises. However, small and medium enterprises cannot get into financial services from the commercial banking system or specialized financial institutions for various reasons. Therefore, this research focuses on providing guidelines for financial institutions in promoting SME entrepreneurs’ access to financial services in the digital economy.

The approach elements of the promoting SME entrepreneurs’ access to financial services in the digital economy consists of four key components: financial product development, financial infrastructure management, human resource management, and multichannel access.

Financial Product Development

Effective Financial product development is an essential to survive, expand and profit of the financial institutions. The financial industry is now fraught with hurdles, insecurities and risks depend on the dynamic demands of customers. This led to the need to introduce new products that enable effective risk management, and increase liquidity and diversify investment portfolios. Financial institutions need to ensure that all constraints of new product developments are essentially defined to reduce the likelihood of new product failures (Marszk & Lechman, 2019).

Financial Infrastructure Management

An effective information technology infrastructure allows organizations to respond quickly, increase organizational learning, improving productivity, coordination and flexibility. The development of technology in the financial sectors has led to new and rapidly developing financial innovations that benefit financial users. Especially, electronic payments help customers to reduce fees and access easily (Wadesango et al., 2017).

Human Resource Management

Human resource management improves the ability of employees to apply knowledge effectively to make a positive difference in the firm. Personnel competency development is a collaboration of three key components of competence: process, people and technology. An organization with 80% sustainable competitive advantage prioritizes intangible assets including human capital, knowledge, and expertise (Silpcharu & Wantanakomol, 2017).

Multichannel Access

Online technologies have been developed that allow users access from a variety of channels. As a result, customer service in the digital world becomes more complex. Today’s customers rely on multiple channels to interact with a particular brand when making purchase decisions. The complexity makes a difference for banks. New access channels such as online banking are becoming increasingly popular (Murowaniecki, 2015).

Objective

The main aim of this research was to develop the structural equation model for promoting SME entrepreneurs’ access to financial services in the digital economy.

Hypotheses

Due to the main aim and related literature, the researchers established six hypotheses based on the related theories as follows.

H1 The financial infrastructure management variable directly influences the financial product development variable.

Most customers want products that are accessible, affordable, and meet their needs. As a result, financial institutions should offer digital financial services and make the most of their customers’ information. Especially, behavioral data to analyze and develop products to meet the needs of each customer. Therefore, financial infrastructure management is a significant part in the development of big data, artificial intelligence, and other technologies and innovations as important information for financial product development (Hou, 2020).

H2 The financial infrastructure management variable directly influences the multichannel access variable.

To manage each access channel to be efficient and reliable, financial institutions must have an appropriate financial infrastructure management. In addition, the information received from the financial infrastructure management is the heart of banking in the 4.0 era, helping to develop and improve access to each channel. A financial institution that can collect information and analyze customer needs accurately. The bank will get the competitive edge by offering the products that best meet the needs of its customers (Victor, 2017).

H3 The financial infrastructure management variable directly influences the human resource management variable.

The financial infrastructure management is essential to provide timely and critical information to the HR department to optimize human resource management. The use of information from ICT systems ensures the productivity of human resource management. Therefore, firms should regularly improve the training and development of information and communication technologies to ensure proper interactions between the HR department and other departments, which may reach the efficiency of the organization (Piabuo et al., 2017).

H4 The financial product development variable directly influences the multichannel access variable.

Offering a wide range of new products through multiple channels benefits customers with easier access, faster approvals and lower fees. Therefore, the financial institution has various products to support the development of customer access channels. This is consistent with Florén et al. (2018) that found that firms focus on the consistency of their channel strategy with the types of products they offer. It was found that the appearance of the product is an important factor in determining the channel to the customer.

H5 The financial product development variable directly influences the human resource management variable.

Using technology to create new financial innovations to offer differentiated services is a solution to financial problems. As a result, financial product technology covers almost all levels of service. The diversity of financial products technology requires staffs to learn and understand in order to benefit their customers. This is consistent with O’Neill (2019), product knowledge is essential for employees to totally understand and to communicate excellently with customers about the product, its characteristics, subsidies, and functionality. Therefore, banks must provide an appropriate program to approach the human resource management in accordance with the developed financial product.

H6 The multichannel access variable directly influences the human resource management variable.

At present, financial institution with a variety of service channels offers customers more options to access financial services. However, the newly developed channels are not accepted by customers because they are unfamiliar and not ready to learn new things. Thus, financial institution must use communication methods to promote those channels to customers as much as possible. The way to reach customers is to have the bank’s staff provide advices and answers that arises from the use of each channel. As a result, financial institutions have to manage their human resources to be competent enough for their assigned tasks (Ahammad, 2017).

Methodology

This study was designed as an inductive research with mixed-methodology

1. The qualitative research with in-depth interview: population in this research included nine experts who were selected through the purposive sampling method with the criteria of qualifications of experts undertaken by the doctor of Business Administration Program, Faculty of Administration, King Mongkut’s University of Technology North Bangkok. There were three groups of these experts: (1) three representatives of business organization, (2) three representatives of government sector, and (3) three representatives of academic institutions.

2. The quantitative research: population in this research included executives of financial institutions in Thailand and registered with the Bank of Thailand with a total population of 6,436 bank branches (Bank of Thailand, 2020b). The 500 samples were selected (Comrey & Lee, 2013) by using a multi- stage sampling method for statistical analysis, comprising 250 data from commercial bank and 250 data from specialized financial institutions.

3. The qualitative research with group discussion to support the model: population in this research included 11 experts who were selected through the purposive sampling method with the criteria of qualifications of experts undertaken by the doctor of Business Administration Program, Faculty of Business Administration, King Mongkut’s University of Technology North Bangkok.

Results

The results of analysis of the guidelines for promoting SME entrepreneurs’ access to financial services in the digital economy were explained as follows.

1. Table 1 presents factors in the guidelines for promoting SME entrepreneurs’ access to financial services in the digital economy showing high importance of both commercial bank and specialized financial institutions at 3.90 and 3.96, respectively. When considering each aspect for commercial banks, the importance is on every factor with the highest on financial infrastructure management at 4.01 followed by financial products development at 3.97 then human resource management at 3.85, and multichannel access at 3.78 respectively. For specialized financial institutions the business executive gave high importance on every factor with highest on financial infrastructure management at 4.06 followed by financial products development at 4.00, human resource management at 3.90, and multichannel access at 3.88, respectively.

| Table 1 Mean and Standard Deviation the Guidelines for Promoting SME Entrepreneurs’ Access to Financial Services in the Digital Economy | ||||||

| Guidelines for promoting SME entrepreneurs’ access to financial services in the digital economy |

Commercial Bank | Specialized Financial Institutions | ||||

| ¯? | SD. | Significant level | ¯? | SD. | Significant level | |

| Overall | 3.90 | 0.47 | High | 3.96 | 0.48 | High |

| 1. Financial Products Development | 3.97 | 0.49 | High | 4.00 | 0.51 | High |

| 2. Financial Infrastructure Management | 4.01 | 0.49 | High | 4.06 | 0.49 | High |

| 3. Human Resource Management | 3.85 | 0.52 | High | 3.90 | 0.52 | High |

| 4. Multichannel Access | 3.78 | 0.58 | High | 3.88 | 0.58 | High |

2. The comparison of important level of the guidelines for promoting SME entrepreneurs’ access to financial services in the digital economy between commercial bank and specialized financial institutions using independent t-test statistic in SPSS showed no significant difference in statistical at level 0.05 between mean of important level of commercial bank and specialized financial institutions.

3. The evaluation of structural equation modelling of the guidelines for promoting SME entrepreneurs’ access to financial services in the digital economy showed that the Chi-square probability (CMIN-p) level was at 0.000, relative Chi-square (CMIN/DF) at 3.124, goodness of fit index (GFI) at 0.568, and root mean square error of approximation (RMSEA) at 0.065 which still could not pass the criteria of the model as criteria shown in Table 2.

| Table 2 Criteria for Assessing the Empirical of the Model | |||

| Evaluating the Data-Model Fit | Criteria | Reference | |

| 1 | CMIN-p | Value > 0.05 | Arbuckle (2016) IBM SPSS AMOS v.21 |

| 2 | CMIN/DF | Value < 2 | Arbuckle (2016) IBM SPSS AMOS v.21 |

| 3 | GFI | Value > 0.90 | Arbuckle (2016) IBM SPSS AMOS v.21 |

| 4 | RMSEA | Value < 0.08 | Arbuckle (2016) IBM SPSS AMOS v.21 |

The results of the structural equation model analysis of the guidelines for promoting SME entrepreneurs’ access to financial services in the digital economy were described as follows.

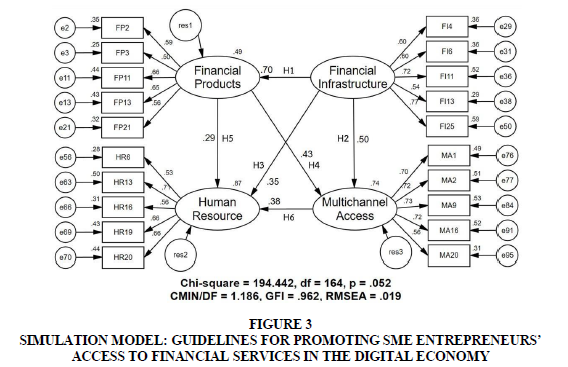

The researcher adjusted the model regarding the modification indices as suggested by Arbuckle through considering the results of the software with academic theory to exclude some inappropriate observed variables one by one and evaluate the new model. The model has been checked and adjusted until the basic assumptions met. Then, the model, it was found that there were (1) the chi-square probability (CMIN-p) of 0.052 and this was >0.05 indicating a statistical insignificance, (2) the relative chi-squared (CMIN/DF) of 1.186 which was <2, (3) the goodness of fit index (GFI) of 0.962 which was >0.90, and (4) the root mean square error of approximation (RMSEA) of 0.019 which was <0.08 so these all statistical results passed the evaluation criteria. Thus, the structural equation model of the guidelines for promoting SME entrepreneurs’ access to financial services in the digital economy after adjusted perfectly fit the empirical data as shown in Figure 3.

Figure 3 Simulation Model: Guidelines for Promoting SME Entrepreneurs’ Access to Financial Services in the Digital Economy

From Figure 3, it was found that the structural equation model of the guidelines for promoting SME entrepreneurs’ access to financial services in the digital economy after adjusted consisted of four latent variables; (1) one exogenous latent variable which was the financial infrastructure management variable, and (2) three endogenous latent variables which were the financial product development, human resource management and multichannel access variables.

From Table 3, the financial infrastructure management variable was found to have a variance of 0.28. It directly influenced (1) the financial product development with a standardized regression weight of 0.70, at a statistically significant level of 0.001, a squared multiple correlation (R2) of 0.49 and a variance of 0.12, (2) the multichannel access variable with a standardized regression weight of 0.50, at a statistically significant level of 0.001, a squared multiple correlation (R2) 0.74, and a variance of 0.09, and (3) the human resource management variable with a standardized regression weight of 0.35, at a statistically significant level of 0.001, a squared multiple correlation (R2) 0.87, and a variance of 0.03.

| Table 3 Statistically of Structural Equation Model After Adjusted | ||||||

| Variables | Estimate | ?? | Variance | C.R. | P | |

| Standardized | Unstandardized | |||||

| Financial Infrastructure Management | 0.28 | |||||

| Financial Product Development | 0.70 | 0.64 | 0.49 | 0.12 | 8.84 | *** |

| Multichannel Access | 0.50 | 0.56 | 0.74 | 0.09 | 6.50 | *** |

| Human Resource Management | 0.35 | 0.30 | 0.87 | 0.03 | 4.10 | *** |

| Financial Product Development | 0.49 | 0.12 | ||||

| Multichannel Access | 0.44 | 0.54 | 0.74 | 0.09 | 5.69 | *** |

| Human Resource Management | 0.29 | 0.28 | 0.87 | 0.03 | 3.48 | *** |

| Multichannel Access | 0.74 | 0.09 | ||||

| Human Resource Management | 0.38 | 0.30 | 0.87 | 0.03 | 3.81 | *** |

| Financial Infrastructure Management | 0.28 | |||||

| FI4 | 0.60 | 1.00 | 0.36 | 0.50 | ||

| FI6 | 0.60 | 0.94 | 0.36 | 0.43 | 10.78 | *** |

| FI11 | 0.72 | 1.17 | 0.52 | 0.35 | 12.25 | *** |

| FI13 | 0.54 | 0.90 | 0.29 | 0.56 | 9.86 | *** |

| FI25 | 0.77 | 1.13 | 0.59 | 0.25 | 12.71 | *** |

| Financial Product Development | 0.49 | 0.12 | ||||

| FP2 | 0.59 | 1.00 | 0.35 | 0.43 | ||

| FP3 | 0.50 | 0.86 | 0.25 | 0.53 | 8.95 | *** |

| FP11 | 0.66 | 1.10 | 0.44 | 0.36 | 11.03 | *** |

| FP13 | 0.65 | 1.09 | 0.43 | 0.37 | 10.93 | *** |

| FP21 | 0.57 | 0.98 | 0.32 | 0.48 | 9.87 | *** |

| Human Resource Management | 0.87 | 0.03 | ||||

| HR6 | 0.53 | 1.00 | 0.28 | 0.57 | ||

| HR13 | 0.71 | 1.21 | 0.51 | 0.31 | 10.91 | *** |

| HR16 | 0.56 | 0.91 | 0.31 | 0.40 | 9.44 | *** |

| HR19 | 0.66 | 1.38 | 0.43 | 0.55 | 10.44 | *** |

| HR20 | 0.66 | 1.07 | 0.44 | 0.31 | 10.50 | *** |

| Multichannel Access | 0.74 | 0.09 | ||||

| MA1 | 0.70 | 1.00 | 0.49 | 0.37 | ||

| MA2 | 0.71 | 0.98 | 0.51 | 0.32 | 14.43 | *** |

| MA9 | 0.73 | 0.97 | 0.53 | 0.29 | 14.70 | *** |

| MA16 | 0.72 | 1.01 | 0.52 | 0.33 | 14.54 | *** |

| MA20 | 0.56 | 1.04 | 0.31 | 0.86 | 11.38 | *** |

The financial product development variable was found to have a variance of 0.12. It directly influenced (1) the multichannel access variable with a standardized regression weight of 0.44, at a statistically significant level of 0.001, a squared multiple correlation (R2) 0.74, and a variance of 0.09, and (2) the human resource management variable with a standardized regression weight of 0.29, at a statistically significant level of 0.001, a squared multiple correlation (R2) 0.87, and a variance of 0.03.

The multichannel access variable was found to have a variance of 0.09. It directly influenced the human resource management variable with a standardized regression weight of 0.38, at a statistically significant level of 0.001, a squared multiple correlation (R2) 0.87, and a variance of 0.03.

Discussion

The most important issues derived from this research results of the guidelines of the adaptation of financial institutions to support the digital economy can be the ways for businesses to study and learn to establish the guidelines for promoting SME entrepreneurs’ access to financial services in the digital economy with a rapidly technological changes and an increase in a competitiveness to lead new business growth and opportunities. From the research results, the researcher discussed the results together with the review of related literatures in three points described as follows.

1. From the research results, when comparing the components of the guidelines for promoting SME entrepreneurs’ access to financial services in the digital economy among the commercial bank and specialized financial institutions in overall aspect, there were no statistically different at a significant level of 0.05. It shows that the current competition of financial institutions is intense. Financial institutions are trying to find ways to offer and deliver good services to their customers in order to satisfy their customers, repeat service and loyalty. Therefore, it makes no difference in promoting financial access of financial institutions (Noorit et al., 2020).

2. From the results of hypothesis testing, it was found that the financial infrastructure management variable directly influenced the financial product development variable with the highest standardized regression weight of 0.70. Based on past research, financial infrastructure management enhances the new product development process. Financial infrastructure management capabilities optimize the new product development process by reducing the cycle time and cost of new product development projects and improve the quality of new product development processes (Hou, 2020). In addition, the development of product development capabilities over competitors depends on the ability to procure and deploy appropriate IT and appropriate strategic conditions, structure and organizational culture (Mauerhoefer et al., 2017).

3. The mean of the guidelines for promoting SME entrepreneurs’ access to financial services in the digital economy on the financial infrastructure management variable was at the highest level of 4.04. Currently, to access financial services such as deposits, withdrawals, transfers, loans or other services, customers must be able to use these services through a variety of channels, such as bank branches, ATMs, mobile phones, the Internet, etc. To be able to manage each access channel efficiently and reliably, financial institutions must have an appropriate financial infrastructure for support to develop appropriately in each channel. In addition, the information obtained from the financial infrastructure system is the heart of banking business in the 4.0 era. This information will create the ability to compete over competitors by providing products that meet the most customer needs (Victor, 2017).

Conclusions

Transitioning to the digital economy has numerous key factors that firms should consider such as people, processes, and technology. They are the key balanced approach to drive organizational change. The initial element is financial infrastructure management that directly and indirectly affects other elements, in line with empirical data. Financial infrastructure management plays a role in initiating organizational change. It is providing big data, artificial intelligence, machine learning, along with various technologies and innovations, has transformed banking business. Financial institutions should shift their business models to be more online and constantly develop new products. This because the customers want products that are easily accessible, cheap and that meet their customer needs (Customization). For this reason, financial institutions should try to offer digital financial services and make the most of customer data, especially behavioral data to analyze and develop products that meet the needs of each customer. Also, information technology skills and competencies are important and essential. Firm must improve their staffs’ skill in accordance with the direction and technology applied by the firm. Digital literacy is an ability to understand and use digital technology. It is a fundamental digital skill that will serve as a vital aid in the practice, communication, and collaboration with others in adapting to the context of change. Adaptation is not only a revenue winner, but also imperative in today’s context where firms are challenged by digital technology. Those who can adapt will still survive in the business; those who cannot adapt will be replaced. The trend of digital transformation and Covid-19 is the catalyst for today’s organizations to be more adaptive, as they see the benefits of using information technology to help them operate in times of crisis. And forming new business models, where new innovations will lead to new business growth and opportunities.

Recommendations for Further Research

Future research may need to review more literature relating to these financial services access issues and their characteristics, relationships and effects to verify the current research. To expand the research results and prove the generalizability of the research, future research may need to collect data from larger samples and various businesses/industries.

References

- Ahammad, T. (2017). Personnel Management to Human Resource Management (HRM): How HRM Functions? Journal of Modern Accounting and Auditing, 13(9), 412-420.

- Arbuckle, J.L. (2016). IBM SPSS Amos user’s guide.

- Bank of Thailand. (2020a). Performance of the Thai Banking System in 2019. Retrieved May 19, 2020 from https://www.bot.or.th/English/PressandSpeeches/Press/2020/Pages/n0863.aspx

- Bank of Thailand. (2020b). Number of Branches and Service points. Retrieved June 4, 2020, from https://www.bot.or.th/English/Statistics/FinancialInstitutions/Pages/StatNumberofBranches.aspx

- Banerjee, A., Duflo, E., Glennerster, R. & Kinnan, C. (2015). The miracle of microfinance? Evidence from a randomized evaluation. American Economic Journal: Applied Economics, 7(1), 22-53.

- Comrey, A.L. & Lee, H.B. (2013). A first course in factor analysis. Psychology press.

- Florén, H., Frishammar, J., Parida, V. & Wincent, J. (2018). Critical success factors in early new product development: a review and a conceptual model. International Entrepreneurship and Management Journal, 14, 411-427.

- Gálvez-Sánchez, F.J., Lara-Rubio, J., Verdú-Jóver, A.J. & Meseguer-Sánchez, V. (2021). Research advances on financial inclusion: A bibliometric analysis. Sustainability, 13, 3156.

- Hou, C.K. (2020). The effects of IT infrastructure integration and flexibility on supply chain capabilities and organizational performance: An empirical study of the electronics industry in Taiwan. Information Development, 36(4), 576-602.

- Mankiw, N.G. & Ball, L. (2011). Macroeconomics and the financial system. Macmillan Education: London, UK.

- Marszk, A., & Lechman, E. (2019). New technologies and diffusion of innovative financial products: Evidence on exchange-traded funds in selected emerging and developed economies. Journal of Macroeconomics, 62.

- Mauerhoefer, T., Strese, S. & Brettel, M. (2017). The impact of information technology on new product development performance. The Journal of Product Innovation Management, 34(6), 719-738.

- Murowaniecki, L. (2015). Banking services and distribution channels – evolution and prospects. Journal of Applied Computer Science Methods, 7(2), 105-115.

- Noorit, N., Thapayom, A. & Pornpundejwittaya, P. (2020). Guidelines for adaptation of the Thai industrial business to support the digital economy. Academy of Strategic Management Journal, 19(6), 1-15.

- O’Neill, E. (2019). How to develop product knowledge training for your business. Retrieved August 15, 2020 from Available from: https://www.learnupon.com/blog/product-knowledge/

- Piabuo, S.M., Piendiah, N.E., Njamnshi, N.L. & Tieguhong, P.J. (2017). The impact of ICT on the efficiency of HRM in Cameroonian enterprises: Case of the Mobile telephone industry. Journal of Global Entrepreneurship Research, 7(7), 1-18.

- Silpcharu, T., & Wantanakomol, S. (2017). A structure equation modeling of guidelines for sustainable OTOP production management, using sufficiency economy theory. International Journal of Applied Business and Economic Research, 15(22), 863-872.

- Varnakomala, P., & Thapayom, A. (2020). Strategy of productivity management for Thailand manufacturing. Academy of Marketing Studies Journal, 24(2), 1-13.

- Victor, R. (2017). How technology affects modern product distribution. Retrieved August 29, 2020 from https://www.hollingsworthllc.com/technology-affects-modern-product-distribution/

- Wadesango, N., Lora, N., & Charity, M. (2017). A literature review on the effects of liquidity constraints on new financial product development. Academy of Accounting and Financial Studies Journal, 21(3), 1-11.

- World Economic Forum. (2019). The global competitiveness report 2019. Retrieved August 14, 2020, from http://reports.weforum.org/global-competitiveness-report-2019/