Research Article: 2021 Vol: 25 Issue: 2

Growth and development of the banking industry in Babcock University: An analysis of the socio-economic achievements and challenges, 2010-2020

Alexander C. Ugwukah, Babcock University

Oladimeji A. Depiver, Babcock University

Abstract

This research aims at assessing the growth and development of the banking industry through the various banks situated in Babcock University in Nigeria in the period 2010–2020. Previous studies on Babcock University have concentrated on other aspects of development, agricultural, infrastructural, spiritual and educational attainments of the institution without much focus on the banking industry. As at 2020, there were no fewer than 10 banks in the University offering various services to students, staff and the administration of the University. It is pertinent to note that in spite of this development, there has been a total neglect of research attention on these banks growth and development. Indeed, up till this current period, there's been no focus on the campus banks and its economic implications on the University system leaving an apparent gap to fill in scholarship. The problem which confronts this study is therefore to give an authentic assessment of the role and impact of the banks in Babcock University to the socio-economic development of the community as a whole. In fulfillment of this objective, the study adopted a Mixed Method Research (MMR) design involving elements of qualitative and quantitative research approaches. Although the work is qualitative dominant in historical research methodology, elements of quantitative drives were derived from the data which corroborated findings from the oral interviews and secondary sources from journals, library search, books and other literature. The paper's findings revealed that the banks have positively contributed to job creation and income generation in Ilishan Remo and its environs. The study also discovered that the presence of the banks in the University has led to poverty alleviation through generated funds for business in the community. The study concluded that effective and efficient mobilisation of funds had brought better living conditions to students, staff, and the University community.

Keywords

Banking Industry, Growth and Development, Socio-economic Achievements and Challenges

Introduction

In the past few years on the University campus of Babcock University, banking activities have increasingly filled a clear gap of ensuring that all financial engagements in the community are carefully taken care of without recourse to external operations. In the light of this assertion, it can be asserted that the critical role of the financial institutions (especially the commercial banks) towards the growth and development of the University economy and that of the country cannot be over emphasised. For sustainable growth in any given economy, financial resources must be effectively and efficiently mobilised and allocated in such a way to harness the synergies between human, material and organisational resources for optimal economic output. Given that scant attention has been given to the growth and development of banking operations in Babcock University, it has become very apparent that the need to understudy and attempt an economic, historical examination of the industry is long overdue. This evident gap that is requisite to be filled is given many vents. The goal of every nation, organisation, and individual is to achieve a desired and sustained level of development. From the above, it can therefore be argued that every administration, management or government's priority is to ensure a beneficial state and improve the lives of its citizenry in this wise captured by the Babcock University community. Innovative products and production processes are tools to achieve this objective of maintaining a first-class faith-based institution of the nature of Babcock University.

As conceived by this work, economic development involves improving the citizens' economic well-being and standard of living by creating jobs and reducing poverty. Increasing national income, increasing gross domestic product, increasing education and labour force, skills and supporting technological innovation, among other factors of consideration as emergent results from the banking industry in Babcock University. The Ikenne Local Government in which Babcock University is located is filled with a diverse background comprising the university staff in its entirety and other personnel, contractors and workers of these financial institutions in the Babcock University.

The nexus between finance and economic growth has been given considerable interest by scholars starting with the pioneering study of Schumpeter (1911), who envisaged the role of banks in facilitating technological innovation through their intermediary role. The mobilisation of funds for productive economic activities could be measured by the operations, stability, reliability and growth of the financial institutions in a given environment. According to Schumpeter, in 1911, efficient allocation of savings through identification and funding entrepreneurs with the best chances of successfully implementing Nigeria's citizenry and which the banks in Babcock University offer their services. It is essential to categorically establish to what extent the banking industry has impacted small-scale businessmen, women, the manufacturing sectors, agriculture, and funds to improve infrastructures in Babcock University. The ultimate goal of the findings would be to generate insights, which would showcase the importance of the relationship between the banks and the community.

Fundamentally, therefore, the importance of this research is to show that within the context of the financial institutions in Babcock University, some reasonable developmental efforts have been achieved through operations of banks that operate in Babcock University. More importantly, because of the absence of studies within this framework, it may be asserted that the gap created in understudying the banking industries in the University has generated the current research, which to a reason is a pioneering effort in the history of banks development in Babcock University. The study has also attempted to ascertain the challenges these banks face in their operations within the higher institutions of learning and that their experiences have generated a different perspective of banking operation in the country.

Conceptual and Theoretical Clarifications

Relevant to this study are the concepts of Economic and Social Development and Growth. At the same time, development involves the transformation of an entity or organisation through growth and change. Development transcends economic growth. It involves the conditions in which people have adequate food, job, peace and justice, and the conditions where income inequality among citizens is significantly reduced.

Obasanjo (1990), in an article, Key to Africa's Enduring Development' in the Nigerian conceived development as a process concerned with people's capacity in a defined geographical area (Babcock University) over a specified period to manage and induce change process and serve as an input for further change. Without any doubt, therefore, development focuses on both the individual and the society. In addition, change is crucial to development as it is to modern science and technology; sustainable development is thus a function of successful group living. Economic and social development is the process by which the economic well-being and quality of life of a nation, region, local community or individual are improved following targeted goals and objectives (as applicable in this work through the prism of the Banks in Babcock University through their challenges and achievements). Development and urban studies scholar Karl Seidman highlights the elements of economic development as "a process of creating and utilising physical, human, financial and social assets to generate improved and broadly shared economic well-being and quality of life for a community or region. Other protagonists of the concepts, Daphine Greenwood & Richard Holt, distinguish economic development from economic growth on the basis that economic development is a broadly based and sustainable increase in the overall standard of living for individuals within a community and measures of change such as par capita income do not necessarily correlate with improvements in quality of life.

Further, the University of Iowa's Centre for International Finance and Development states that: Economic development is a term that practitioners, economists, politicians and others have used frequently to attain effective change. Modernisation, westernisation and industrialisation are other associated terms people have used while discussing economic development. Thus, although there may be specific inadequacies that may arise in applying this conceptual framework, especially that of measuring the human capital development in the system under the study, the study complemented this concept through other sources of historical analysis.

In this work, therefore, the concept of economic development must be considered a theory that documents the state of an organisation's economic well-being at a particular time. Schumpeter & Backhaws add that changes that may alter the changes in this equilibrium state may be caused by intervening factors that may come from the outside. Bearing in mind that certain external factors may interfere in the outcome of this study, the work daringly will expect to balance these factors in the light of the intervening results to arrive at positive results to advance not just the institution but the community as a whole.

A Brief History of Babcock University

As it is now known, Babcock University began on September 17, 1959, as Adventist College of West Africa (ACWA). The Seventh-day Adventist Church established the college as a training institution for church workers for the West African sub-region. The college opened its door for academics with only seven students in 1959, who were initially hosted at the home of Chief Olufemi Okulaja.

The University is located at Ilishan Remo in Ogun State. Ilishan Remo, the quiet, peaceful town where the University is located, is one of the 33 Remo division towns chosen as the University's location because of its geographical equidistance between Ibadan and Lagos, two major capital cities of Oyo and Lagos with high population density. The University's motto is knowledge, truth and service, and it's a private institution of higher learning under the National Universities Commission (NUC). The University is part of the Seventh-day Adventist education, the world's most extensive Christian school system. The University for an American Missionary named David C. Babcock, who pioneered the work of the Seventh-day Adventist Church in Nigeria in 1914. In 1975, the college's name (ACWA) was changed to Adventist Seminary of West Africa (ASWA) to retain its administration by the Seventh-day Adventist. The government wanted its take over at the period. For a long time as Adventist Seminary of West Africa (ASWA), the institution was administered under the capable hand of Prof. A. A. Alalade, under whose care the University was officially inaugurated as Babcock University on April 20, 1999. In 1999, the University status transited to a full-fledged academic institution with various faculties/schools reflecting a transformation hitherto unknown in its history up till that moment. This development implies that while it was ACWA, ASWA, the number of courses offered for students' education was limited and strictly restricted to the Bachelors' degree in theology and Religion. As a full-fledged University, the University eventually had 46 departments with various courses in Accounting, Economics, Political Science, Religious Studies, Public Administration, Mass Communication, Law with its school at the Iperu Campus, Education and Humanities, School of Agriculture and Technology, Computer Science and the College of Medicine, Anatomy, Nursing Sciences, Postgraduate studies and so on.

The next President/Vice-Chancellor after Professor A. A. Alalade was Professor Kayode James Makinde, who eventually took the University to its current enviable heights through his transformation in academic excellence and infrastructural development and student enrolment. His administration ensured that Babcock University transformed into one of the best private institutions in Nigeria, maintaining its Adventist culture, but yet accessible by non-Adventists, thereby offering competitive academic innovation unparalleled in the country, Nigeria, and transcending to worldwide academic standards.

Currently, the University administration is being steered by yet another tested and trusted, capable academic in the person of Prof. Ademola Tayo, who succeeded Professor Makinde. It is germane to state that Professor Ademola Tayo and his capable assistant, the Deputy Vice-Chancellor, Professor Iheanyichukwu Okoro, birthed the Babcock University Teaching Hospital, bringing medical education to new height and sophistication in Nigeria. The state of the art medical equipment and facilities in the Teaching hospital had contributed immensely to the training of medical students. Professor Ademola Tayo changed the University's landscape with several infrastructural developments such as the Centre for Distance Learning, the Amphi Theatre, and Hostel accommodations for the University students. Several banks have transformed from their skeletal accommodation facilities to modern complex banking facilities infrastructures.

The construction of the banks' branches in the University is conspicuous because of their location between the University Babcock Supermarket and the Education and Humanities buildings. The researcher intends to show the level of development that these banking facilities have attained on campus. This is not just to fill a historical gap but also to highlight the socio-economic transformations and opportunities offered by these commercial banks on campus, especially in providing different banking services to support both staff and students of the University.

The Banking Industry in Nigeria

The banking industry is composed of an organised system or body of institutions set up to manage money for safekeeping, savings, or lending or borrowing money to their clients or customers. Banking institutions are concerned with the management of funds through commercial and central banks. Central banking and commercial banking are vital institutions in any economy.

As Aderinto & Abdullahi further emphasised, there are different banking institutions: the Central Bank of a country, the apex bank of the Central Bank of Nigeria, known as the Central Bank of Nigeria (CBN). The chain of financial developments in Nigeria started with establishing the CBN equipped with various powers, including the traditional function of issuing means of payment and controlling the money supply. Since its establishment, the CBN has transformed into a dynamic agent and catalyst of investment and economic growth in the Nigerian economy. The CBN has been able to implement monetary and exchange measures to strengthen the institutional infrastructures of Nigeria's financial system.

The second type of banking institutions is Commercial Banks which governments and private investors jointly own. Modern commercial banks in Nigeria dates back to the early colonial period when the African Banking Corporation opened an office in Lagos in 1892. Being the oldest unit of the Nigerian financial system, it has been one of the most advanced financial institutions. Since the 1970s, when the oil revenue surged in Nigeria, the commercial banks have continued to experience rapid expansion and growth, which has benefited every sphere of the Nigerian economy.

The third type of banking institution is the Development Bank which is restricted in its activity and capital resources. Their functions are different from that of the Central Bank and Commercial Banks. Examples of such banks include the Nigerian Industrial Development Bank (NIDB), the Federal Mortgage, Nigeria Bank for Commerce and Industry, Merchant Banks and the Nigeria Agricultural and Cooperative (NACB). There are two types of Development Banks, namely Community Development Banks and Regional Development Banks. They may also include Microfinance local banks that deal primarily with individuals and small organisations in their immediate areas of operations. They are private, principally, non-governmental institutions that share the common goal of combatting poverty and economic hardship by infusing capital into the local economies. The Regional Development Banks, also known as Multi-lateral Development Banks, operate in various parts of the world through the support of national governments–such as the African Development Bank (ADB). These banks aim to accelerate growth and development in different regions of the world.

However, these particular typologies, which catch our attention most, are the commercial banks and the microfinance banks, representing this study's consideration in Babcock University. However, the three types mentioned here in this study are interlinked and cooperate in their interbank services. Commercial banks in Nigeria include First Bank, Wema Bank, Zenith Bank, Guaranty Trust Bank, Union Bank, United Bank for Africa, Access Bank, etc. There used to be numerous banks in Nigeria, but there are twenty-two commercial banks in Nigeria with recent reconsideration.

The general role of commercial banks is to provide financial services to the general public and businesses, ensuring economic and social stability and sustainable growth of the economy. In this respect, credit creation is the most significant function of commercial banks. The scopes of commercial banks are related to the size of Microfinance banks nowadays. The importance of Microfinance institutions is that they provide much needed financial services such as deposits, loans, payment services, money transfers and insurance. However, both Commercial and the Microfinance Banks are under the Central Bank of Nigeria (CBN). The apex monetary authority of Nigeria established by the Act of 1958 and commercial operations on July 1, 1959. The Central Bank of Nigeria (CBN) mandate is rooted in the 1958 Act of Parliament, as amended in 1991, 1993, 1997, 1998, 1999 and 2007.

The CBN Act of 2007 of the Federal Republic of Nigeria charges the bank with the overall control and administration of the Federal government’s monetary and financial sector policies. The CBN objectives include; ensuring monetary and price stability, issuing legal tender currency in Nigeria, maintaining external reserves, providing a sound financial system in Nigeria, acting as the banker of other banks, and providing economic and financial advice to the Federal government. Consequently, CBN is responsible for administering the Banks and Financial institutions (BOFI/Act, 1991) as amended. It has the sole aim of ensuring high standards of banking practice and financial stability through its surveillance activities and the promotion of an efficient payment system. One main difference between a commercial bank and a central bank is that commercial banks are usually joint-stock companies, i.e., shareholders. As commercial ventures, they aim at making a profit. A Central Bank, on the other hand, is owned entirely by the Central government. While individuals, groups of individuals, federal and state governments can and do own commercial banks, only the national or federal government can own a Central Bank. Thus, our study will focus on the available commercial banks in Babcock University, and one Microfinance Banks called the Babcock University Microfinance Bank Ltd.

Although these banks differ in the provision of their services, commercial banks generally provide certain general conditions highlighted as follows: Acceptance of deposits from customers is the oldest function of commercial banks. In the early days, commercial banks used to change customers, some amount for the safekeeping of their money. Nowadays, the banks pay some interest to customers for saving their money in the bank. There are different types of accounts offered at a bank. The Current Account is also called the demand deposit. Money saved or deposited in this account can be drawn anytime using a cheque or through the Automated Teller Machine (ATM) without prior notice. Current account holders do not receive any interest on their deposits, and instead, the bank makes some charges for the safekeeping of the money. Fixed deposit is another deposit where money is kept for a stated time, say nine months or a year and above. It earns some interests.

The interests are usually higher than the interest payable on savings accounts. The third type of deposits is the Savings Account, making it possible for smaller savers to keep money without a cheque. Little interest is earned on the savings account, too, since cheques not required for withdrawal as this can be done through withdrawal slips. Commercial Banks also act as Agents for payments by honouring cheques or effecting payments on behalf of their clients or customers to avoid their carrying large sums of money. Commercial banks also carry out direct debits to make regular payments such as school fees and monthly insurance premiums. Also, another important function of commercial banks is lending to customers, which is one of the most profitable services of commercial banks. These loans could be disbursed by crediting the account of the borrower with the amount of the loan. It could also be done through overdrafts to a customer who operates a current account to overdraw their account to a particular approved amount above his balance. Also, through discounting bills of exchange, the bank makes payment to someone (the creditor) who sells some goods to his customer on the promise to pay later. Other services of the bank include serving as trustees or executors of wills. They also transact foreign exchange business by buying foreign exchange from the Central Bank and sell to customers. They also issue travellers' cheques and provide safe places to keep valuables such as jewellery and documents at their charges.

Focus on Banks Operating in Babcock University

Eight commercial banks are operating at Babcock University. These are First Bank, Guaranty Trust Bank Plc, Wema Bank PLC, and Access Bank, United Bank for Africa (UBA), Zenith Bank of Nigeria and the latest Bank on campus, Union Bank of Nigeria. The eight banks were the Ecobank which operated at the Iperu Campus of the University but have stopped its operations due to reasons best known to the bank headquarters. Apart from these banks is the ninth bank on the campus, the Babcock University Microfinance Bank Ltd. The Babcock Microfinance Bank is the University's Bank; it engages in all banking activities, receives and collects payments for school fees, official charges of the University, and other financial intermediation. An attempt will be made to give a historical account of the operations of these banks in general and in Babcock University mainly.

First Bank of Nigeria PLC

First Bank of Nigeria PLC (First Bank) was founded in 1894 as the premier Bank in West Africa. As a result of its year of establishment, Nigeria's number one bank and one of the leading financial services solution providers. The bank was started by Sir Alfred Jones, a shipping magnate from Liverpool, England. With its head office, originally in Liverpool, the bank commenced business on a modest scale in Lagos, Nigeria, under British West Africa (BBWA). In 1912, the bank acquired its first competitor, the Bank of Nigeria, the Bank of Nigeria (previously called Anglo-African Bank), established in 1899 by the Royal Niger Company. In 1959, the bank changed its name from Bank of British West Africa (BBWA) to Bank of West Africa (BWA). In 1966, following its merger with Standard Bank, UK, the bank adopted the name Standard Bank of West Africa. In 1969, it was incorporated locally as the Standard Bank of Nigeria Limited in line with the Companies Decree of 1968. Further changes

Changes in the bank's name also occurred in 1979 and 1991 to First Bank of Nigeria Limited and First Bank of Nigeria Plc, respectively. In 2012, the bank changed its name again to First Bank of Nigeria Limited, having detached its commercial business from other businesses in the First Bank Group, in compliance with the new regulation by the Central Bank of Nigeria (CBN).

First Bank had 1.3 million shareholders globally, quoted on The Nigerian Stock Exchange (NSE), where it was one of the most capitalised companies.

Building on its solid foundation, the bank has consistently broken new ground in the domestic financial sector for over a century and two decades. First Bank is present in the United Kingdom and France through its subsidiary, Banque International de Credit (BIC), one of the leading banks in the Democratic Republic of Congo. In November 2013, Frist Bank acquired 1CB in the Gambia, Sierra Leone, Ghana and Guinea, and in 2014, the bank acquired 1CB in Senegal. The bank has kept pace, responding to the dynamic needs of its customers, investors, regulators, host communities, employees and other stakeholders.

Leveraging its experience spanning over a century of dependable services, the bank established its Babcock Branch in 2015. With over 750 locations in Nigeria, all online and real-time, the bank has one of the largest domestic sales networks in the country. As a market leader in the financial sector, First Bank pioneered initiatives in international money transfer, electronic banking in the century, serving more than 14 million accounts.

Guaranty Trust Bank (GTB)

Guaranty Trust Bank PLC was incorporated as a Limited Liability company licensed to provide commercial and other banking services to the Nigerian public in 1990. The bank commenced operations in February 1991 and has since grown to become one of Nigeria's most respected and service-focused banks. The bank was formed in 1988 by over 35 young Nigerians in their thirties, spearheaded by Tayo Aderinokun & Fola Adeola, but also included Femi Pedro, Gbolade Osibodu, Kanu Akingbe, Akin Opeodu and others. It has over 10,000 and workers as of December 2020 and a total asset of ?4.945trillion. The mission and vision of the bank are to become a platform for enriching lives by building strong, value-adding relationships with customers, stakeholders and the communities in which it operates. GT Bank became the first Nigerian Bank to establish subsidiaries in other West African economies, The Gambia and Sierra Leone, in 2002* and has expanded to Ghana, UK, Kenya, Liberia, Uganda, Rwanda and Tanzania, with over 300 offices in Nigeria, Africa and the UK. The GTB, Babcock University bank, was established in 2015.

Wema Bank PLC

From a small organisation known as Agbonmagbe Bank Limited way back in 1945, the same year the Second World War ended, Wema Bank rose into prominence in the financial services sector in Nigeria. Wema Bank became a regional financial powerhouse in 2009 and rose to national prominence in six years. Wema Bank is Nigeria's oldest surviving indigenous bank. It has been celebrated globally for adopting digital technology, which led to the launching of ALAT, Nigeria's first fully digital bank, as a revolutionary Wema Bank product in 2017. With over 150 business offices and digital platforms, Wema Bank provides retail, SME, trade, treasury, business advisory and corporate banking services to millions of Nigerians and foreigners. In Babcock University, Wema Bank established its branch in 2012 and has grown since then with 24 members of staff currently.

Access Bank PLC

Access Bank PLC has over 25 years of profitable growth, environmental responsibility and social relevancies. Access Bank was issued a banking licence on December 19, 1988. It was incorporated as a privately owned commercial bank on February 8, 1989. By February 5, 2001, I obtained a Universal Banking Licence from the Central Bank of Nigeria. By 2013, Access Bank had become one of the top five banks in Nigeria. Building a robust retail bank that was digitally-led, the bank saw the opportunity to accelerate its five-year plan with the merger of Diamond Bank, Nigeria's leading retail bank with 19 million customers in 2018. The bank equally had about 10 million mobile customers and a strong reputation for data analytics and technological innovation. The merger of Diamond Bank was completed in March 2019. The current branch of Access Bank in Babcock University started as Diamond Bank and remained so until this merger. Diamond Bank operated on the campus from its establishment date in 2013 until its transformation to Access Bank in 2019.

United Bank for Africa (UBA)

The bank was established in 1949 as the British and French Bank Limited. On February 23 1961, UBA was incorporated as a Limited Liability Company under the Compliance Ordinance (Cap. 37) 1922. UBA, therefore, took over the assets and liabilities of BFB. As it is presently constituted, the bank was reengineered by Tony O. Elumelu, now the Bank Chairman. However, the GMD of the Bank is Kennedy Usoka, with the headquarters of the bank at 57 Marina Street, Lagos. The bank's products include - Internet Banking, Mobile Banking, Corporate Banking, Investment Banking, Consumer Banking, Collections, Treasury, Trade Finance, Savings Account, Current Accounts, Domiciliary and Non-Resident African Banking, Money Transfer and Debit Cards. In 1970, UBA listed its shares on the Nigerian Stock Exchange in an IPO, being the first Nigerian bank to make an initial push offering. In 2005, UBA merged with the Standard Trust Bank (STB) PLC, a Nigerian institution that had a subsidiary in Ghana. Since then, the group has expanded to include 20 sub-Saharan countries and offices in the United Kingdom, France, and the United States. It has other branches in Cameroon, Chad, Ivory Coast, Gabon, Republic of Guinea, Kenya, Mali, Mozambique, Senegal, Tanzania, Zambia, Ghana, Democratic Republic of Congo, Burkina Faso. UBA established its Babcock University branch in 2007. The Babcock University branch was the first Bank in Babcock University, then Standard Trust Bank (STB), which United Bank later acquired for Africa. It may appear that UBA was the first bank to have a branch in Babcock University.

Union Bank of Nigeria

Union Bank of Nigeria's rich history can be traced to 1917, when it was first established as Colonial Bank. In 1925, the bank became known as Barclays Bank DCO (Dominion Colonial and Overseas), resulting from its acquisition by Barclays Bank. Following Nigeria's independence and enacting the Companies Act of 1968, the bank was opened its shop as Barclays Bank of Nigeria Limited (BBNL established 1969). Between 1971 and 1979, the bank went through a series of changes, including its listing on the NSE and share acquisitions/transfers are driven by the Nigerian Enterprises Promotion Acts (1972 and 1977); this resulted in its evolution into a new wholly Nigerian-owned entity. To reflect the new ownership structure and comply with the Companies and Allied Matters Act of 1990, it assumed the name Union Bank of Nigeria PLC (UBN, the Bank of "Union Bank").

In 1993, in line with its privatisation/commercialisation drive, the Federal Government divested by selling its controlling shares (51.67%) to private investors. Thus, Union Bank became wholly owned by Nigerian citizens and organisations all within the private sector. During the Central Banking of Nigeria (CBN) banking sector consolidation policy, Union Bank of Nigeria acquired the former Universal Trust Bank PLC and Broad Bank LTD. It absorbed its former subsidiary, Union Merchant Bank Ltd. At Babcock University, the bank commenced operations on November 23, 2020.

Zenith Bank PLC

Zenith Bank was established in May 1990 and commenced operations in July 1990 as a commercial bank. The bank became a Public Limited Company on June 17, 2004, and was listed on the Nigerian Stock Exchange (NSE) on October 21, 2004, following a highly successful initial public offering (IPO). Jim Ovia founded the bank, while Dr Adaora Umeoji is the Deputy Managing Director of Zenith Bank with her over 20 years cognate and broad executive management experience. The Group Managing Director/CEO is Mr Ebenezer N. Onyeagwu. The Zenith Bank, Babcock University branch, was opened in 2015.

Eco Bank

Ecobank Transnational Incorporated (ETI), a Public Limited Liability Company, was established as a bank holding company in 1985 under a private sector initiative spearheaded by the Federation of West African Chambers of Commerce and Industry the Economic Community of West African States (ECOWAS). With over 1,300 branches in 36 countries, Ecobank has one of the most extensive branch networks on the continent. Patrick Akinwunmitan is managing Director of Ecobank Plc. Cameroonian finance professor, Alian Nkoctchou, replaces Nigeria's Emmanuel Ikzaoboh as Chairman of the African banking group, Ecobank. Ecobank is one of the earliest banks in Babcock University, Iperu Campus, and it commenced operations in 2009. The bank served every banking financial purpose for the campus. Students need and for salaries of staff who used it as their salary account. However, it was not too long before the bank moved into their branch in Sagamu, Ogun State. It continued to operate a skeletal ATM centre there until that eventually was stopped. Currently, the Ecobank branch has ceased to function at Babcock University.

Growth and Development of the Banks in Babcock University

Out of the nine banks highlighted in this study, only eight of them are currently operational, given that Ecobank, one of the banks at the Iperu Campus of the University, did not return since it exited in 2015. The functional banks, First Bank PLC, Guaranty Trust Bank (GTB), Wema Bank, Access Bank, United Bank for Africa (UBA), Union Bank of Nigeria (UBN), Zenith Bank PLC and Babcock Microfinance Bank (BMB), have continued to make remarkable progress in their various services to the Babcock University community and its environs.

Apart from ensuring that they meet the teeming demands of their clientele with various financial packages, the management style of these banks has continued to work in compliance with the University standards to ensure a hitch-free environment for banking activities.

As one of the managers of the banks who preferred anonymity stated, most of the banks offer similar products to their customers with varying options and capabilities depending on the nature and calibre of business approaches that come their way. Aside from granting are co loans, other regular activities include cash and cheque deposits, handling customers' complaints and engaging and working on alternative delivery channels, investments, loans, and other business relations/transactions of banks on the long-run profit-oriented. Since the banks operate within the University system, the advancement of education of students, staff welfare and community patronage becomes the paramount focus of the banks on campus. Thus, to measure the banks' growth and development rate, how the major participants and beneficiaries of the banking services would have to take into account. Growth can be measured through the capital and asset base of these banks and the total profits declared by the banks at the end of every year's operations. However, the indices that matter most to this study have been the objective of advancing the educational progress of Babcock University students, the staff members and the business community which benefit from the operations in the University. Undoubtedly, evidence shared by the graduating students and those currently running their programmed shows that these banks had helped render critical financial services when the students needed them most in conjunction with their parents. The loan bonds have enabled students to move ahead with their studies through structured repayment packages. When these students graduate and can make progress in society, it is evident that these are clear manifestations of the efforts of these banks in the University.

Another level of the services extended by the banks are advances given to Babcock University staff for various purposes but mainly for the execution of building projects in the Ilishan, Ikenne & Irolu environs, which assisted many become house owners and landlords. Some have taken such loans to build in their villages or cities such as Ibadan or Lagos, Aba, Enugu etc. The staff salaries collateralise such loans. Such loans are often given in installments of two to three years repayment packages, making it easier for the faculty staff to repay and renew until the projects are finished.

Another form of the loans given is those given to public members in the vicinity of the Babcock University campus. These are indigenes of Ilishan, Ikenne, Irolu & Ilara and even further down who equally use banking facilities to expand their businesses. In contrast, others use it to execute business projects or contracts. According to Mr Nnachetta, "my relationship with my Bank, Wema, has touched on virtually all aspects of my life in Ilishan. My children's school fees, their graduation, the building of my house in the village in the East and the most recent celebration of their marriage ceremonies". It has been a most rewarding experience, given that the terms given to me have ensured that my family and I have a fulfilled life. Another respondent, Mr Fasasi, a university worker, narrated his experience of completing his PhD and purchasing his dream car through a steady loan scheme from one of the banks. He noted that he steadily ensures that he paid back at the earmarked time, which further qualified him for subsequent higher loan amounts

For Mrs Bernice Allison; I arrived at Babcock University through my brother to start farming about ten years ago with little or nothing and hopeless with God only being my collateral. I began as Ugo (Pumpkin) vegetable planter. I continued from a small scale until it started making progress as I sold my vegetables locally, first at Ilishan and in Lagos with time. This phase of my life and business was fluctuating until I was introduced to Access Bank loans. From the N500,000 loan I got in 2017, I was able to get into bigger farming fields and buy more seedlings, which ensured that I had a higher production for my line of business by 2018. With the profits made, which I reinvested after paying back the loan capital, I was able to divest into other farming/agricultural ventures such as Poultry and Fish farming with the aid of my children. Ever since I prudently invested, I have had no cause to regret my engagement to access ever since.

The success record of these banks activities has extended to the Ikenne-Ilishan local government indigenes members. The only banks in the Ilishan-Ikenne axis are the Ilishan and Ikenne Microfinance Banks. After armed robbers that attacked both Wema Bank and Ilishan town, the only safe environment for banking operations has been the banks on campus. The influx of locals from Ilishan-Ikenne and environs to banks in the University opened another vista for developing services tailored to these customers. From these customers, some good businessmen, contractors, small scale farmers and industrialists and parents seeking loans for their wards' education have benefitted from banking service in the University.

In 2012, there was a phenomenal bank robbery in Babcock University as distinct from the theft in Ilishan town, which changed the face of security mode in Babcock University. At this instance, a highly equipped robbery gang invaded the University campus and brought all activities incommunicado until they escaped from the campus with their sporadic shootings and lootings. The University security was only lucky not to have recorded any fatality as bullets rained on several buildings on campus.

After this raid on the campus, the University authority hired private security from King David, who look to bring out best practices into surveillance and security for the University. With effective manning of security, more banks could bring in their services to the University for operations. With the effective manning of facilities on campus by this outfit, banking operations were to return sanity to the security of the University campus for banks organisations once again. Some of the banks on campus stopped operation at some points, operating from their Sagamu branches alone, that is GTB, Wema Bank, UBA and the First Bank, all went to their Sagamu offices.

However, it may be asserted that effective banking operations once again returned to the University during the tenure of Prof. Ademola S. Tayo, when the old models of makeshift banks made way for permanent buildings. All of the listed banks came back in full force with solid, well-designed buildings for their operations. Thus, as the researcher engages in this work, all the eight commercial banks, including the Babcock University Microfinance Bank, have completed their campus branch offices. Their staffs are operating in a settled environment and give out their respective roles in their seats.

Ikenne Local Government consists of three urban towns and two rural villages. The urban towns are Iperu, where the Ogun State governor hails from, Ikenne, the hometown of Chief Obafemi Awolowo and Nigeria's Vice President, Prof. Yemi Osinbajo and Ilishan, where Babcock University is situated. At the same time, the rural villages are Irolu and Ogere. In Ogere, there operates a Union Bank branch, while there is a Microfinance Bank and Wema Bank branch at Iperu too. Thus, with these few banks operating in the local government, it would seem that the banks in Babcock University have been the major financial centres for business and financial transactions in the local government. The transactions are multifarious from loans to daily operations of savings for the farmers, entrepreneurs; paying various bills, transfers, and ATM use has led many people into the University daily and at even odd times to make withdrawals other transactions on the University campus. Thus, it can safely be stated that the prevalence of these banks in Babcock University has contributed in no fewer means for the University community and the entire Ikenne Remo Local Government. The implication of this is that the rural dwellers of Irolu Remo and Ogere and even those from the Ikenne community prefer to use the Babcock University bank branches. One needs to confirm these assertions through the number of customers hanging out to gain entrance to these banks, especially during the Covid-19 pandemic, which restricted many people in their banking halls. The crowd is not limited to any bank; all are actively engaged from 8: am to 4.00 pm daily. The Automated Teller Machine (ATMs) resume further works in the evenings when the official hours of operations are over. The ATMs continue to service the customers after the close of work by 4.00 pm; till about 7:pm for non-campus residents and till later for campus residential faculty staff and the students.

In these periods of the Covid-19 pandemic, digital banking services and e-channels have been very helpful. Online banking through Android phones and other effective platforms prevents people from contracting the symptoms or the sickness.

Analysis/Discussion of Findings

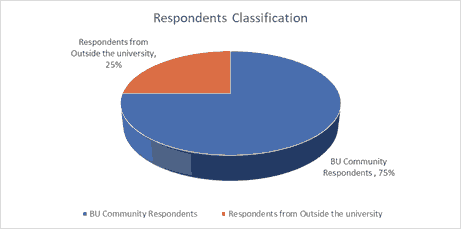

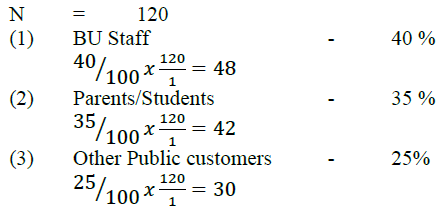

Out of the eight banks on campus, 24 staff members of the various banks were consulted, interviewed through unstructured questionnaires, which gave them room for reflective views in their responses. Another 100 questionnaires were administered to respondents from the Babcock university community (Staff and Students). They were purposively contacted for interviews because they had their salary accounts with these banks and have taken loans from one time or another. The last categories of respondents were 50 locals of the banks who patronised from outside the University. The majorities of those consulted at the Banking Halls preferred anonymity but were of mixed backgrounds. Out of the 100 persons from the Babcock university community, the banking staff consulted. About 70 respondents who gave their views had high academic standards, mostly with first degrees and chartered professional certificates, while some had a master’s degree. Of the customers consulted, there were few graduates. At the same time, about 10 were local entrepreneurs, including businesswomen with interests in commodity trading, poultry and fish farming schemes, who got loans from the various banks, farmers, especially vegetable planters and cash crops grower’s kolanuts, palm oil traders were interviewed. Only 120 out of the 150 questionnaires was completed and analysed for this study.

In the long run, the study ensured that at least three customers were interviewed from each of the eight banks on campus. The majority of the university staff consulted was lecturers and non-academic staff members. At the same time, a few lower cadre staff was also interviewed to cross-check if they sought some self-help developmental loans from the banks.

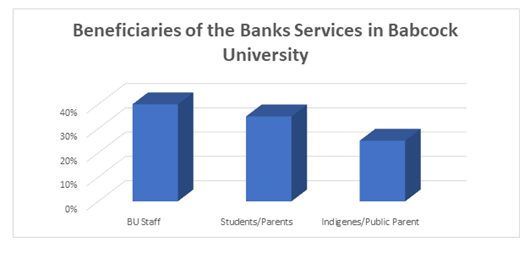

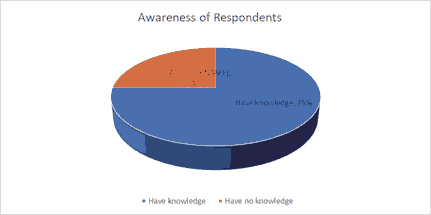

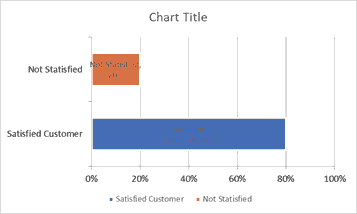

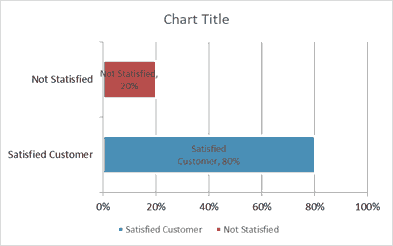

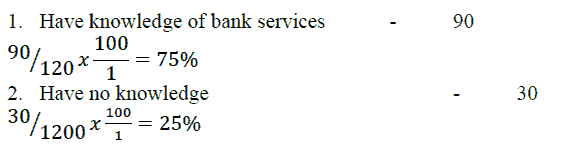

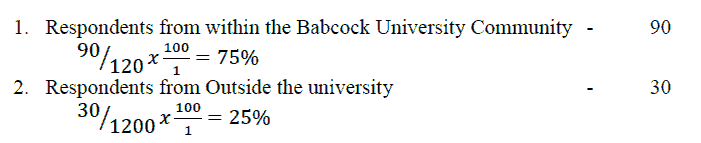

The study adopted a Mixed-Method Research (MMR) design involving elements of qualitative and quantitative research approaches. The research is, however, qualitative dominant through a historical methodology. At the same time, quantitative deductions have been represented through the bar charts, and additional recourse was made to the conceptual frameworks of growth and development indices. The beneficiaries' satisfaction levels reflected Babcock University Community 90% and indigenous/public patronage of bank services in Babcock, which stood at 80%. The other client (figure 2) reflected the number of people who knew about the banks' services, while 25% stated they have no knowledge of banking lending services nor benefitted from it other than coming to save their money.

Further interpretations of these figures corroborated the unstructured interviews conducted on banks, staff, university lecturers, non-academic staff, and other artisans. All together led to the following findings.

Beneficiaries of the Banks Services in Babcock University (Respondents)

1. BU Staff - 48

2. Students/Parents - 42

3. Indigenes/Public Parent - 32

Source: Outcome of Questionnaire for Research

Awareness of Respondents to the Banks' Services

Have knowledge of the Banks' Services -75%

Have no knowledge -25%

Number of Respondents per Sample Classification

Respondents from within the Babcock University Community - 75%

Respondents from outside University Community - 25%

Achievements and Challenges of the Banks Operating in Babcock University

Going by our indices of economic growth and development, which altogether can be measured by the impact of the bank's lending to entrepreneurs, students' loans through their parents and those awarded to the staff of Babcock University. It may be safe to posit that the commercial banks have contributed significantly to the growth and development of the Babcock University community and its environs. From the interviews and responses generated from the Questionnaire, it can be concluded that all the banks at one time or the other gave out loans for agricultural development, retail and for petty trading; ranging from to buy and sell outfits, fashion shops, loans for the development of nursery and primary schools in five towns of Ikenne Local Government and as well as personal loans for self-development.

If therefore, the economic growth of the Babcock University community can be researched through the increase in the output of goods and services at the particular period of study, then the achievements of banks contributed to the development of the Ikenne Local Government has been optimal. More importantly, it may be asserted that the level of sustained growth has improved the lives and health of the community's people. It can also be stated that through the concerted efforts of the banks, operations in Babcock University has effectively led to the effective and efficient mobilisation of the community's harnessing of synergies between human, material and organisational resources for optimal economic development.

There is no doubt that there is a strong understanding between the University authorities in their cooperation with the banks for funds management, especially in achieving most of the universities' developmental projects. The University authority gave consent for the establishment of the banks in the first place. As such, there must be some collaborative financial arrangements between these banks and the University. Projects have been endless in a University like Babcock University, and most of them are multi-million Naira projects. Another achievement of the banks is how the developmental projects have been carried out harmoniously without any disagreements. A lot has been said earlier about helping the Ilishan and environs indigenes to have accessibility to solicited funds for their projects in agricultural development sponsored by one of the customers of the Babcock Microfinance. Another indigene, Tunde Ojelabi, is grateful for the project finance he accessed from one of the banks on campus that enabled him to execute the contract he won to paint and supply certain materials for a new Secondary School in Ondo State. Building and supply contractors in various capacities have also benefited from the University banks in lending facilities. This cooperation between the banks' funding projects has opened up vast resources generation on the part of both clients and contractors

Given all these attainments and achievements of the banks on Babcock University campus, one cannot but conclude that the impact of the financial access given by the banks has contributed in no small measure to the growth and development of not just Babcock University but also the environs. Particularly Ikenne, Irolu, Iperu, Ogere and the Ilisan main town itself. No doubt, these banks have also contributed their quota by giving back to the environment through developmental projects to show their responsibilities. One of the bankers asserted that it is impossible to run at a loss, given the amount of patronage from the banks in Babcock University daily. He, however, pointed out that there are challenges all the same. Some of the obstacles acknowledged by most of the banks had to do with debt recovery for those awarded loans that could not honour the appropriate time for their refunds of the loans granted them earlier. While some pay dates later than their signed agreements, others have been quite difficult to recoup/regain. Some have been written off as bad debts at the demise of the borrowers. As attempts to get such monies from their guarantors always became problematic.

Other challenges faced by the banks has to do with power generation as they run the banking operations with generators when power becomes insufficient on the University campus. Another challenge has to do with the banks' recapitalisation so that banks can have a greater capacity to finance projects, especially for the small scale enterprises in the vicinity of Babcock University. A manager with the Access Bank on campus asserted that despite the birthing of about "636 branches of the bank all over the federation, Babcock University Branch is a treasured branch". With over 20 bankers staff, she noted no major challenge with the bank's operations as they have demonstrated genuine services with opportunities for students, staff and individuals from the towns and environs. However, there is a problem with our confined space, and we are hoping the university authority can still give a bigger land for more expansion soon.

Summary and Conclusion

This work has examined the banking industry's role as represented by the banks operating in Babcock University and their contributions to the growth and development of the University community as a whole. The role these banks plays in the growth and development of the economy of the University and its environs cannot be over emphasised.

Through its research, the work confirmed that effective and efficient mobilisation of funds had brought better living conditions to students, staff, and the University community. On the one hand, the assessment on the growth of University infrastructures and business operations achieved through effective leadership and God-given understanding by the leaders of Babcock University and harmonious relationship with the banking industry in the University. On the other hand, the university community has assumed that economic development has been achieved in ten years (2009–2020) which the research has beamed its searchlight. The harmonious relationship between these banks and the entire University community and its environs depicts that more developmental projects and personal achievements would continue to develop. More importantly, this shows that the harmonious relationship between these financial providers and the people in the community they serve would continue to engender as growth and development would continue to be unprecedented in the years to come. The work further argued that the banking sector in Babcock University, despite its growth and developmental efforts, could still consciously improve on their current status of service provision.

The paper's findings revealed that the banks have positively contributed to job creation and income generation in Ilishan Remo and its environs. The paper also attempted to address different factors that proved as challenges and are deterring the satisfactory contribution of the banks to growth and poverty alleviation in the University. On the part of the banks, giving access to some of the banks' customers has been one problem confronting those coming from the town. The study also discovered that the presence of the banks in the University has led to poverty alleviation through generated funds for business in the community.

Furthermore, the study revealed that the expansion and development of infrastructures of their banking institutions with standard offices have in due course elevated not just the banks' status but the image of the University as a result. Also, some of the challenges highlighted by the customers as deficient of their expectations of the banks to them include improvement of credit facilities and not giving such to selected people alone. Pre-business training awareness and efficient package marketing are not well-developed as obtainable from the banks outside the University. On the whole, the study revealed that the banking staff itself had delivered sustainable employment growth and economic work output. This is confirmed by the fact that some branches have up to 15-20 man team on the average from what used to be a skeletal staff of four or five. Many importantly, local staff have been employed and security men, cleaners and other support staff. Small scale entrepreneurs have benefitted from the banks' finances. There is a consensus among the bank staff that metal workers, woodworkers, carpenters, food vendors, and building construction companies benefitted from the bank loans.

Recommendations

The following recommendations are suggested to enhance the performance of these banks in Babcock University:

• There's a need to establishing a harmonious relationship or strengthening cooperation between the University administration and the banks' executives, rather than the landlord-rentier state acclaimed by the banks. This would further harness a closer relationship between the university staff and the banks.

• The study also recommends that traditional financial system options be explored and enhanced to enhance local patronage. In essence, market feasibility studies should be embarked upon with the genuine interest of the community's local indigenes and take active participation to discover how they make more profitable investments with the bank's assistance.

• A unique credit scheme with reasonable collateral requirements, a fast loan processing system, reasonable interests, and an extended repayment period should be instituted in place of the above.

• The banks should enhance collaboration with the university authority to develop new infrastructures in the University. Especially at the School of Law and Security Studies at Iperu and more strategically at the new site of the Babcock University Teaching Hospital (BUTH), which is fast attaining an enviable eminent position in the provision of invaluable health services not just to the locality but to the country, Nigeria as a whole.

References

Schumpeter, J., & Backhaus, U. (2003). The theory of economic development in joseph Aloi Schumpeter, 61-116.

Khalil, M., Chokri, T., & Ali, B. (2017). Banking sector development and economic growth in developing countries: A bootstrap panel granger casuality analysis.

Aderinto, A., & Abdullahi, S.H. (2012). Comprehensive certificate economics. Ibadan: University Press 194.

www.cbn.com

Aderinto, A., & Abdullahi, S.H. (N.D.). Comprehensive certificate, 195.

Ibid

Anyanwu, F.A., Aranmende, A.C., Okoye, N. (N.D.). An empirical assessment of the impact of commercial banks leading on economic development of Nigeria. International Journal of Applied Economics, Finance and Accounting, 1(1), 14-29.

Ayodele, J.B. (n.d). The Nigerian cultural heritage: Implications for development in essays on Nigerian peoples culture and policies, Panaf Press, Abuja, 20-21.

Saidman, K.F. (2005). Economic development finance. Thousand Oaks Sage Publications.

Agu, C.C. (1988). The banking system’s contribution to economic development African. FEP Publishers Ltd, 11.

List of Banks in Nigeria.

Daphine, G., & Richard, H. (n.d). The theory of economic development. University of Iowa Centre for International Finance and Development. www.development.com

See Sen, A. (1983). Development: Which way forward in economic? Economic Journal, 93(373), 745-762.

Interview with Access Bank Manager

Interview with Mr. Nnachetta

Interview with Mr. Fasasi

Bernice Allison. Others include other banking staff and Babcock University staff who prefer anonymity.

Yemi Ogunbiyi Orange Chronicles: The Gtbank story: Lagos 2002, xi

https://www.firstbanknigeria.com/home/about/our-history/

https://www.gtbank.com/uploads/annual-reports/2020-annual-report/2020-Annual-Report.pdf

Received: 25-Nov-2021, Manuscript No. aafsj-21-6622; Editor assigned: 27-Nov-2021; PreQC No. aafsj-21-6622(PQ); Reviewed: 14-Dec-2021, QC No. aafsj-21-6622; Revised: 20-Dec-2021, Manuscript No. aafsj-21-6622(R); Published: 22-Dec-2021