Research Article: 2022 Vol: 26 Issue: 5

Green Financing Initiative in India: Current State and Path Forward

Sumit Kumar, Indian Institute of Management, Kozhikode

Citation Information: Kumar, S. (2022). Green financing initiative in india: current state and path forward. Academy of Accounting and Financial Studies Journal, 26(5), 1-11.

Abstract

The purpose of issuing green bonds is to raise money for finding answers to the problem of global warming. The most important part is that the money goes to environmentally friendly investments. Central and local governments, banks, or enterprises can all issue them. Sukuk, covered bonds, and other types of green debt can all bear the green bond designation if they meet the Green Bond Principles (GBP) or the Green Loan Principles (GLP). The purpose of this research is to examine the numerous green finance efforts implemented by Indian financial institutions, as well as the potential and problems they present. Aspects of the report that are particularly noteworthy include the advances and prospects for green financing in India. We concluded that Green Bond market is still in its nascent stage in India but due to favorable environmental policies and a push to ESG based thematic investment is fueling the growth of Green Bond Market in India. Green bond can be a great fixed income investment instrument for retail as well as institutional Investors.

Keywords

Green Bonds, Sustainable Bonds, Social Bonds, Masala Bonds, ESG, UNSDG.

Introduction

Green bonds are fixed-income debt instruments with long-term maturity to specifically fund environmental and climate projects exclusively (Garcia-Zarate, 2021). In essence, green bonds are just like regular bonds. They represent a loan made by an investor to a borrower, in exchange for regular interest payments over a set period of time. When the bond reaches maturity, the money is then returned to the investor. Like regular bonds, green bonds also undergo the same rules, legal framework, documentation, and financial disclosure requirements, as well as issuance and placement process (ICMA, 2021). The only difference really is the emphasis of “green” which requires additional disclosure and procedural obligations in order to provide assurance to its investors that the raised funds will be used to its intended purpose, which is to finance projects that will positively impact the environment (Corporate Finance Institute, 2021).

For example, before green bonds are issued, they must be able to conform to the Green Bond Principles (GBP). Established in 2014 by a consortium of investment banks including but not limited to the Bank of America, Merrill Lynch, Citi, JPMorgan Chase, Goldman Sachs, Deutsche Bank, and HSBC, the GBP is a set of voluntary process guidelines that recommend transparency and disclosure in order to strengthen the integrity of the bond (Climate Bonds Initiative, 2021a). In order to be in alignment with the GBP, the following core components of the bond are scrutinized:

The Use of Proceeds

One of the cornerstones of a bond being eligible to be called “green” is the utilization of the proceeds of the bonds for the main purpose of environmental objectives such as climate change mitigation and/or adaptation, natural resource and biodiversity conversation, and pollution prevention and control. The use of proceeds must indicate and described in the legal documentation of the bond including clear and quantifiable environmental benefits (ICMA, 2021).

The Process for Project Evaluation and Selection

The issuer of the green bond should also clearly communicate the environmental sustainability objectives of the eligible green projects, as well as the process by which it fits within the eligible green project category, and additional complementary information of the process by which it identifies and manages perceived social and environmental risks (ICMA, 2021).

The Management of Proceeds

In order to keep track of the proceeds, there should be a sub-account or a sub-portfolio, with which should be periodically adjusted to match the allocations to the eligible green fund made during that period (ICMA, 2021).

Reporting

Lastly, it is highly encouraged that green bonds have a high level of transparency, wherein issuers of the green bond make and keep readily available updated information on the use of proceeds, which need to be reviewed by an external auditor annually until full allocation (ICMA, 2021).

Bonds, whether they are “green” or not, are issued by private companies (i.e., corporate bonds), supranational institutions like multilateral development banks (e.g., World Bank), and public entities, which can be either federal, state, or municipal levels (i.e., government bonds) (World Bank, 2015). At present, there are seven types of green bonds including the “use of proceeds” bond (e.g., EIB Climate Awareness Bond), “use of proceeds” revenue bond (e.g., Hawaii State backed by fee on electricity bills of the state utilities), project bond (e.g., Invenergy Wind Farm), securitization bond (e.g., Tesla Energy), covered bond (Berlin Hyp green Pfandbrief), loan (e.g., MEP Werke), and other debt instruments (e.g., convertible bonds or notes) (Climate Bonds Initiative, 2021b).

Global Green Market

The market for green bonds has certainly grown since the very first green bond, also known as the Climate Awareness Bond, was issued in 2007 by the European Investment Bank (Pham, 2016). However, it was not until 2014 wherein it started to gain traction and since then, it has demonstrated all-time highs (Climate Bonds Initiative, 2021b). According to Ehlers & Packer (2017), this traction can be attributed to the introduction of the International Capital Market Association’s (ICMA) Green Bond Principles, which has become the basis for many of the existing green projects today.

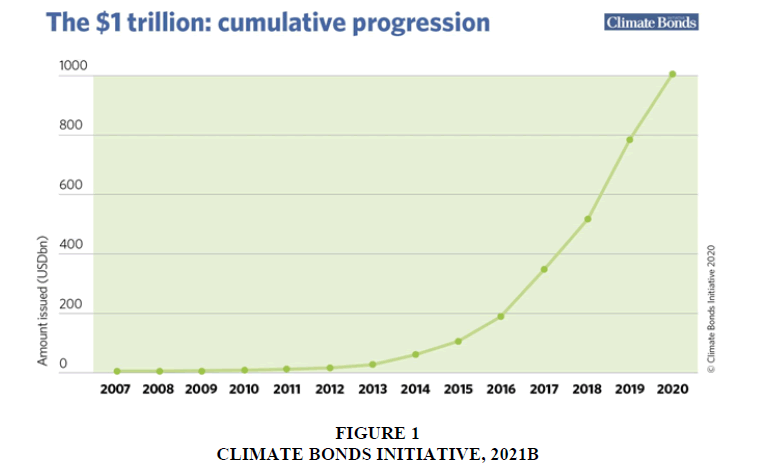

From only US$1.5 billion in 2007, the market for green bonds has grown outstandingly with a higher number and larger sizes of issuance belonging from a broader group of investors catering to a wider investor base (Deschryver & de Mariz, 2020). In fact, cumulative issuance since market inception in 2007 (Climate Bonds Initiative, 2021b). As of December 2020, the green bond market reached a record milestone of US$1 trillion in Figure 1.

Figure 1: Climate Bonds Initiative, 2021b.

From the investor’s point of view, green bonds simply do not just raise awareness on climate change issues but allow them to support these environmental initiatives through liquid investments without giving up financial returns (World Bank, 2019). It should be highlighted though that while the market for green bond has significantly increased over the years, it remains to be a niche market. As of 2021, its share in the wider global bond market remains to be small with only 1 percent of the total global bond market (Garcia-Zarate, 2021).

As of 2021, the United States remain to be occupied the top spot of green bond issuance in terms of the volume share (17% issuance or US$37.6 billion) and number of deals (n=495). This is followed by Germany (13% issuance or US$28.5 billion; n=102), France (10% issuance or US$22.8 billion; n=20), and China (10% issuance or US$22 billion; n=92). Meanwhile, Spain took the fifth spot (5% issuance or US$ 11.7 billion: n=34). A large bulk of green bond issuers continue to come from the corporate sector (non-financial = 28% and financial = 22%), followed by government-back entities, (15%), sovereign (11%), development banks (10%), ABS (8%), loan (4%), and the local government (2%) (Climate Bonds Initiative, 2021c).

India’s Green Energy Financing

With the effects of climate change slowly becoming more evident than ever before, countries all over the world are looking for ways in order to mitigate climate change so that future generations can enjoy a more sustainable living condition. India, for example, has been looking at renewable energy in their efforts to combat their high consumption of energy. In 2018, the BP’s Statistical Review of World Energy reported India to have its primary energy consumption to have reached over 800 million tons of oil equivalent, just in third place following China and the United States. For this reason, India has set itself some highly ambitious targets 450 gigawatts (GW) of renewable energy capacity by 2030 and at least 175 GW by 2022 (Frangoul, 2020).

More than a year into that commitment, Prime Minister Narenda Modi reaffirms their commitment during the UN Assembly in New York a month ago (World Resources Institute, 2021). As of August 2021, India has reached an important milestone of its clean energy mission through the installation of 100 GW of renewable energy capacity in the country. While considered an achievement in itself, the country has a long way to go to reach its target of 175 GW. It should be highlighted though that the COVID-19 pandemic has also significantly affected the country’s installation drive of renewable energy capacity in the country, as India was one of the countries severely hit by the virus (Singh et al., 2021).

In terms of the cost of renewable energy in India, the country has some cost advantages (i.e., lower labor and construction costs) in installing renewable energy capacity compared to other countries like Germany or the United States. The country is also blessed with good renewable energy resources like the sun and wind. However, Nelson et al. (2012) noted that the cost of renewable energy highly depends on the costs of financing. Thus, it is very important that the country have some good financial foundations in order to offer affordable renewable energy for the masses.

According to Gupta (2020) recently, there have been a large interest in India’s renewable energy sector. During the initial stage, the country’s renewable energy sector was primarily financed by concessional loans from multilateral agencies such as the Asian Development Bank and the World Bank. However, today, there has been a growing number of commercial financing options, coming from both the banking and non-banking institutions (Gupta, 2020).

On the other hand, the government plays a key role in mobilizing the funds needed for renewable energy projects through the National Clean Energy and Environmental Fund (NCEEF), previously known as National Clean Energy Fund, which comes from the carbon tax on coal. This fund has been used to loan out renewable energy projects at a concessional interest rate (Gupta, 2020).

It is also important to note that because India’s renewable energy targets are actually aligned with climate change mitigation, the country can tap into green bonds to provide them with the capital that they need to finance their green projects (Banga, 2019). Given the nature of the green technologies, green bonds are well suited for these projects because of three reasons. First, these projects are highly capital-intensive fixed investments in nature. Second, these projects tend to have low variable cost throughout the lifetime of the project. Lastly, these projects generate steady returns and low-risk revenue streams over a long period of time once the projects are up and running (Agarwal & Singh, 2018).

As India aims to become a major renewable energy player, with a target of 450 gigawatts (GW) of renewable energy capacity by 2030, green bonds provide a very promising future in terms of getting the funds it needs. As of August 2019, India has already issued US$8.6 billion worth of bonds, with which 80 percent was used to finance its renewable energy projects (Gupta, 2020). Nevertheless, there are several challenges worth mentioning in their financing, one of which is the relatively high costs associated with the loans, making it an expensive destination for many investors. In addition, the renewable energy sector is also surrounded with a variety of risks including policy framework, particularly on safeguard duty and taxation (Gupta, 2020).

Issuance of Green Bonds for Green / Renewable Energy Financing in India

As early as 2007, India has already recognized and acknowledged the significance of global warming and climate change in the context of sustainable development with an emphasis on green finance through the Reserve Bank’s issuance of a notification on “Corporate Social Responsibility and Non-financial Reporting – Role of Banks”. Over the years, several policies have been enacted to combat climate change and integrate them in the financial world such as:

1. The development of the National Action Plan on Climate Change in 2008 in order to have a broad policy framework for mitigating the impact of climate change (Jain, 2020),

2. The creation of the Climate Change Finance Unit within the Ministry of Finance in 2011 as the coordinating agency for various institutions responsible for green finance in India,

3. The implementation of the sustainability disclosure requirements in 2012 by Securities and Exchange Board of India (SEBI) (Ghosh et al., 2021),

4. Further disclosure requirements for green bonds listed on Indian stock exchanges (SEBI, 2017).

In 2016, the Reserve Bank of India also introduced several corporate bond measures in order to develop the bond market in the country such as:

1. Raising the ceiling limit for partial credit enhancement from 20% of issue size to 50%.

2. Permitting banks to issue rupee denominated bonds overseas under the existing structure of incentivizing the banks’ issuance of long-term bonds for financing infrastructure and affordable housing.

3. Allowing brokers to participate in corporate bond repo market; and

4. Allowing foreign portfolio investments (FPIs) to directly transact without involving brokers (Agarwal & Singh, 2018).

Despite these, there is still no dedicated law on the issuance of green bonds in India. Hence, many investors continue to have some apprehensions and perceive green bonds as generally riskier than conventional bonds. In fact, this is especially true if the bond is not issued by a more recognized green sector such as renewable energy (Agarwal & Singh, 2018).

India’s Situation / Status in Green Bond Market

As of 2021, India has become the second largest emerging green bond market following China. Nevertheless, it should be highlighted that the majority of these green bonds have been issued overseas as the government is still struggling to attract investors to the domestic bond market (Prakash & Sethi, 2021). The green bond market in India is also still at the emerging stage and there remains several barriers that impede the growth of domestic green bonds in the country.

For example, as mentioned earlier, there remains some ambiguity on the definition of “green”. Under the SEBI Circular for the disclosure requirements for green bonds, there is still no clear definition what constitutes being “green” (Govindrajan, 2021). The lack of accepted taxonomies, especially of the definition of “green” across different asset classes and industries can create problems as it opens wide inconsistencies in the interpretation of exactly what constitutes a green bond (Agarwal & Singh, 2021). Banga (2019) also highlighted the issue of lack of technical skills, especially in developing countries as to the monitoring and assessment of the use of proceeds throughout the project’s lifecycle, to ensure that the projects are implemented in accordance with the GBP.

There is also the issue of minimum size, the currency of issuance, and the high transaction costs associated with green bond issuance (Banga, 2019). In many emerging market economies such as India, there remains underdeveloped capital markets with insufficient liquidity (Amundi & IFC, 2021). So, if green bonds were to offer an opportunity to tap into private capital for the purpose of financing sustainable infrastructures, the size must be large enough in order to entice green bond purchasers. Unfortunately, many of the green projects in developing countries tend to be smaller in sizes, resulting in smaller issue sizes, which does not meet the minimum size required by investors for a green bond transaction.

Meanwhile, there are also several costs associated with the issuance of a green bond. Aside from the additional monitoring, disclosure and impact reporting that needs to be done in alignment with the GBP, prior to the issuance of a green bond, issuers need to have the right knowledge and skills concerning ESG issues, environmental and sustainability reporting for investors, shareholders, and customers. Even if the project fits with the GBP, issuance of a green bond can fail or be unsuccessful if the issuer does not meet the criteria or standards set. Prior to the issuance, they may also need to get a second-party opinion, which can add up to the costs (Deschryver & de Mariz, 2020). For small bond issuers, issuance alone can become costly and can become a barrier for many. Moreover, the currency of issuance can also become a concern as there are some risks associated with it for both lender and borrower (Banga, 2019). The good news is that more bonds are now issued under local currencies in order to cater to more markets.

One of the ways to address these barriers has been to establish local green banks in emerging and developing countries. In general, a green bank is such that promotes and enact green technologies in banking operations in order to facilitate environmental management as well as minimize carbon footprint (Bose et al., 2017). As green banks are specifically built for green financing, green banks are seen as an effective mechanism to channel private investments towards green projects (Banga, 2019). This means that green banks can use funds in a more flexible manner that not only leverages private capital but at the same time, lower the lending cost to its customers.

It should be noted that green banks are not built to replace traditional commercial banks but rather to gather more private capital and finance underserved markets, which can be used for projects that promote environmental sustainability. In practice, this may vary per country due to the differences in each country’s goals and resource endowment, as well as market opportunities and market risks (Jaiswal et al., 2016). Nevertheless, green banks can potentially decrease their loan rates and implement more flexible terms as transaction costs can become considerably cheaper. Since green banks have been specifically made for green finance, aside from their green investment mandate, they will have the necessary green underwriting knowledge and expertise. This also paves the way in bridging the gap between the perceived risks associated with green investments and private lender expectations through products like insurance, partial credit guarantees, loan-loss reserves, and subordinated debt (Jaiswal et al., 2016).

Presently, there are two dedicated clean energy finance institutions in India—the Indian Renewable Energy Development Agency (IREDA), a public institution, with plans on developing the Green Window under the green bank framework to cater to underserved markets, and the Tata Cleantech Capital Limited (TCCL), the world’s first private sector green bank (Sanhu & Chourasia, 2021).

Details of Green Bond Issuance in India

While reports have indicated that the very first green bond issued in India was from the country’s fourth largest private bank, Yes Bank, which reportedly raised INR 10 billion (US$ 160 million) in 2015 (Yes Bank, 2018), the prior year, Greenko Dutch BV (GBV) issued an “unlabeled” bond worth US$ 550 million with a maturity of 5 years. Despite the fact that the bond was not labeled as green, given the nature of the company as a “pureplay” renewable energy company, the bond is still considered as a green corporate bond, making it India’s very first green bond. The funds raised was used to refinance the company’s secured, existing local debt as well as finance existing clean energy projects. This bond had an 8 percent coupon and a rating of B from Fitch’s (Kidney, 2014).

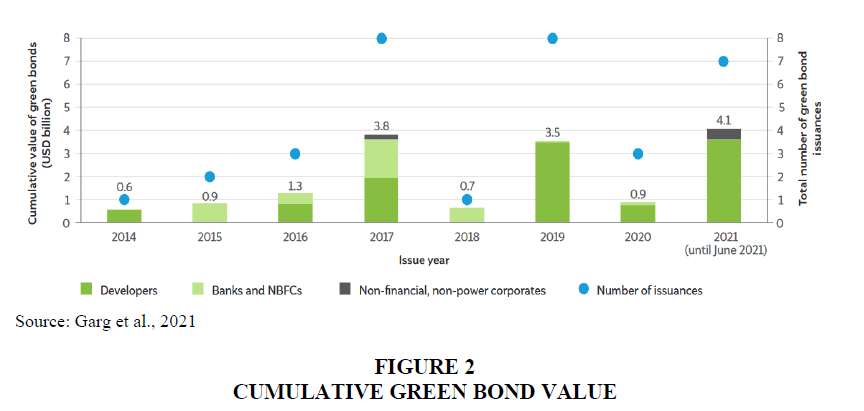

Since the first Indian green bonds issued, renewable energy developers, financiers, and other non-financial, non-energy corporations from India have raised an accumulated US$ 15.6 billion as of the first half of 2021. Among these, more than 70 percent are from the renewable energy sector. As seen in Figure 2, since 2019, project developers have been the leading runners in terms of Indian green bond issuance. As of June 2021, issuance of green bonds have already surpassed previous record highs at 4.1 billion issuance. In the renewable energy sector, Greenko and ReNew Power dominate the Indian developer-issued green bonds at 40 percent and 28 percent respectively in terms of the cumulative green bond value (Garg, et al., 2021).

These bonds can either be guaranteed by the organization, backed by assets, or hybrid. An organization-guaranteed bond is also known as the general obligation bonds, wherein the creditworthiness of the bond is based on the issuing organization, and not just on the financed asset. As it is guaranteed by the organization, the lenders are repaid by all sources of the company’s cash flow and not just on the currently financed project. In some cases, lenders of these bonds are given the option to convert the bonds into equity at a later date. An example of this bond are those issued by Greenko (Bagaria, 2020).

Meanwhile, in asset-backed bonds, the creditworthiness is based only on the expected revenue of the project. It does not based on the cash flows of the issuer and the repayment to the lenders will be made from the revenue earned from the project only. Some examples of these are those by Renew Power and Hero Future Energies. Lastly, the hybrid bonds, also known as covered bonds, are dual-recourse bonds, which can be structured in two ways. The project (i.e., solar farm) can either be in the books of the issuer or in a special purpose entity (SPE). The general idea is that in cases when the issuer defaults payments, the lender can own the farm and if the value of the farm is not enough to cover the default, the lender will have a claim on the issuer’s other assets (Bagaria, 2020).

Tables 1 and 2 summarizes the key green bonds issued by Indian renewable energy developers and lenders in international bond markets (Garg, et al. 2021).

| Table 1 Key Green Bonds Issued By Indian Renewable Energy Developers In International Bond Markets |

|

|---|---|

| Developer | Bond Details |

| Greenko | US$ 550 million; Issued August 2014 due in 5 years at 8.00% |

| Greenko | US$ 500 million; Issued August 2016 due in 7 years at 4.88% |

| Greenko | US$ 350 million; Issued July 2017 due in 5 years at 4.88% US$ 650 million; Issued July 2017 due in 7 years at 5.25% |

| Greenko | US$ 500 million; Issued July 2019 due in 6 years at 5.55% US$ 450 million; Issued July 2019 due in 7 years at 5.95% US$ 85 million; Issued September 2019 due in 7 years at 5.95% |

| Greenko | US$ 435 million; Issued August 2019 due in 4 years at 6.25% |

| Greenko | US$ 940 million; Issued March 2021 due in 5 years at 3.85% |

| NTPC | INR 20,000 million; Issued August 2016 due in 5 years at 7.38% |

| ReNew Power | US$ 475 million; Issued February 2017 due in 5 years at 6.00% |

| ReNew Power | US$ 435 million; Issued March 2019 due in 5 years at 6.67% US$ 90 million; Issued September 2019 due in 5 years at 6.67% |

| ReNew Power | US$ 300 million; Issued September 2019 due in 3 years at 6.45% |

| ReNew Power | US$ 450 million; Issued January 2020 due in 7 years at 5.88% |

| ReNew Power | US$ 325 million; Issued October 2020 due in 4 years at 5.38% |

| ReNew Power | US$ 460 million; Issued February 2021 due in 6 years at 4.00% |

| ReNew Power | US$ 585 million; Issued April 2021 due in 7 years at 4.50% |

| Azure Power | US$ 500 million; Issued July 2017 due in 5 years at 5.50% |

| Azure Power | US$ 350.101 million; Issued September 2019 due in 5 years at 4.63% |

| Adani Green Energy | US$ 500 million; Issued May 2019 due in 5 years at 6.25% |

| Adani Green Energy | US$ 362.5 million; Issued October 2019 due in 20 years at 4.63% |

| Continuum Green Energy | US$ 561 million; Issued February 2021 due in 6 years at 4.50% |

| Hero Future Energies | US$ 363 million; Issued March 2021 due in 6 years at 4.25% |

| JSW Hydro | US$ 707 million; Issued Mary 2021 due in 10 years at 4.50% |

| Table 2 Key Green Bonds Issued By Indian Lenders In International Bond Markets |

|

|---|---|

| Bank | Bond Details |

| Exim Bank | US$ 500 million due 2020 at 2.75% |

| IDBI Bank | US$ 350 million due 2020 at 4.25% |

| Axis Bank | US$ 500 million due 2021 at 2.88% |

| Jain Irrigation | US$ 200 million due 2022 at 7.125% |

| REC | US$ 450 million due 2027 at 3.97% |

| IREDA | INR 19,500 million due 2022 at 7.13% |

| Power Finance Corp. | US$ 400 million due 2027 at 3.75% |

| Indian Railway Finance Corp. | US$ 500 million due 2027 at 3.84% |

| State Bank of India | US$ 650 million due 2023 at 4.50% |

| State Bank of India | US$ 100 million due 2022 |

| Axis Bank | US$ 40 million due 2024 at 3.82% |

| Delhi International Airport | US$ 450 million due 2025 at 6.25% |

Municipal Green Bonds Initiatives

Just as ordinary municipal bonds enable local governments to finance basic projects in their respective locations, municipal green bonds also finance projects that ultimately help the environment. In India, the first municipal bond was issued by the Bangalore Municipal Corporation in 1997, amounting to 125 crore with state guarantee. The following year, the Ahmedabad Municipal Corporation also issued bonds worth 100 crore, but without government guarantee. Nevertheless, the Ahmedabad Municipal Corporation was the first to make a public offering in 1998. Since then, several urban local bodies (ULBs) and utility organizations such as those in Nashik, Nagpur, Ludhiana and Madurai have issued bonds mobilizing over US$205 million (IRN 12,316 million) through either taxable or tax-free bonds and pooled financing. However, the share of municipal bonds in the total debt market continue to be insignificant as only one percent of the financial needs of these ULBs are met through municipal bonds (Chaturvedi, 2017; Sarma, 2020).

Nevertheless, in April 2021, Ghaziabad Nagar Nigam announced that it successfully raised and listed India’s first municipal green bond issue. The raised funds amounting to 150 crore will be used to build a tertiary water treatment plant to supply water to places like Sahibabad (Ghaziabad issues India’s first municipal green bonds, 2021). One of the things that makes Ghaziabad highly attractive for bonds is its high credit worthiness. Prior to the issuance of any debt instrument (e.g., bonds), it is a general requirement that the issuer obtains a credit rating from any of the agencies registered with SEBI. This credit rating is one of the major factors that will affect the investors’ decision whether to subscribe to a particular bond issue (Chaturvedi, 2017).

The bond is offered at 8.1 percent with AA ratings from India Ratings and AA(CE) by Brickworks and a maturity of 10 years. According to India Ratings, the city is debt-free, at the same time, has maintained a revenue surplus position in the last few years (Ghaziabad issues India’s first municipal green bonds, 2021). Low credit worthiness has been one of the main challenges encountered by most of the smaller urban cities in trying to access capital markets, which is usually attributed to slow government reforms, as well as poor accounting standards and low institutional capabilities (Sarma, 2020).

Moreover, municipal bonds are generally very attractive because these bonds are issued by municipal corporations. While there is no 100 percent guarantee, there is implicit guarantee from the state government to honor their commitment for both principal and interest (Yadav, 2021). In the case of the Ghaziabad bonds, significant interest was shown through its oversubscription with at least 40 bids worth over 401 crore.

Following this successful feat by the Ghaziabad Nagar Nigam, the Indian market for municipal green bonds is expected to grow further as other cities like Kanpur, Agra, and Varanasi are already expected to issue municipal bonds in the coming year (Ghaziabad issues India’s first municipal green bonds, 2021).

We therefore see an activism in municipal Green Bond issuance across the country. These bonds with a protected principal and also a commitment to environment and sustainability attracts retail as well as institutional Investors.

Conlcusion

According to the BSE's annual report for fiscal year 2019-20, the total amount raised through green bonds at the BSE was INR 18.03 billion in fiscal year 2019-20, up from INR 8.65 billion in fiscal year 2018-19. Within a year, there has been a noticeable increase in green finance via green bonds issued by the domestic market. As the market shifts toward rewarding companies that adhere to ESG principles, it will be interesting to see how policymakers address issues such as greenwashing, investor distrust, funding of unconventional green projects, and lowering the cost of green bonds to make green finance viable for smaller companies. Public transportation, particularly electric cars, and solar energy are two major green industries that might gain considerably from the issuing of green bonds. Policymakers may consider offering incentives to enterprises in these growing industries in order to encourage them to raise capital in the global and local bond markets, therefore accelerating their growth. This would assist sectors other than essential energy projects in gaining momentum through green finance, hence moving India closer to meeting its INDC targets. India will require enormous money to achieve its climate obligations. India's energy industry is one of the fastest expanding industries in the country, and neither government funding nor only domestic investment would be sufficient to sustain this growth. India would require huge investments in green technology and infrastructure, estimated at US$200 billion yearly for infrastructure alone, to fulfill the Paris Climate Agreement's 1.5-degree Celsius objective and grow to a US$5 trillion economy. How and where India will obtain green funding are therefore critical debate points.

References

Agarwal, S., & Singh, T. (2018). Unlocking the green bond potential in India.

Amundi & IFC. (2021). Emerging market green bonds report 2020: On the road to green recovery.

Bagaria, R. (2020). Everything you need to know about green bonds in India.

Indexed at, Google Scholar, Cross Ref

Banga, J. (2019). The green bond market: A potential source of climate finance for developing countries. Journal of Sustainable Finance and Investment, 9(1), 17-32.

Indexed at, Google Scholar, Cross Ref

Bose, S., Khan, H., Rashid, A., & Islam, S. (2017). What drives green banking disclosure? An institutional and corporate governance perspective. Asia Pacific Journal of Management, 35(2), 501-527.

Indexed at, Google Scholar, Cross Ref

Chaturvedi, A. (2017). Green municipal bonds in India: Potential, barriers and advantages.New Delhi: Deutsche Gesellshaft fur Internationale Zusammenarbeit (GIZ) GmbH.

Climate Bonds Initiative. (2021a). Green bond principles and climate bonds standard.

Climate Bonds Initiative. (2021b). Explaining green bonds.

Climate Bonds Initiative. (2021c). Sustainable debt market: Summary H1 2021.

Corporate Finance Institute. (2021). What is a green bond?

Deschryver, P., & de Mariz, F. (2020). What future for the green bond market? How can policymakers, companies, and investors unlock the potential of the green bond market? Journal of Risk and Financial Management, 13, 61-87.

Indexed at, Google Scholar, Cross Ref

Ehlers, T., & Packer, F. (2017). Green bond finance and certification. BIS Quarterly Review, 89-104.

Frangoul, A. (2020). India has some huge renewable energy goals. But can they be achieved? CNBC.

Garcia-Zarate, J. (2021). What are green bonds? How to consider whether they might be a good fit for your portfolio. Morningstar.

Garg, S., Jain, R., & Sidhu, G. (2021). Financing India’s energy transition through international bond markets. New Delhi: Council on Energy, Environment and Water.

Ghaziabad issues India’s first municipal green bonds. (2021). Retrieved from https://www.thehindubusinessline.com/news/ghaziabad-issues-indias-first-municipal-green-bonds/article34271175.ece.

Ghosh, S., Nath, S., & Ranjan, A. (2021). Green finance in India: Progress and Challenges. RBI Bulletin January 2021, 61-72.

Indexed at, Google Scholar, Cross Ref

Govindrajan, G. (2021). “Bond, green bond:” Examining the regulation of green bonds in India. Indian Journal of Projects, Infrastructure and Energy Law.

Gupta, A.R. (2020). Financing India’s Renewable Energy Vision. ORF Issue Briefs and Special Reports, no. 336.

ICMA. (2021). Green bond principles: Voluntary process guidelines for issuing green bonds.

Jain, S. (2020). Financing India’s Green Transition. ORF Issue Briefs and Special Reports, no. 338.

Jaiswal, A., Kwatra, S., Kaur, N., Deol, B., Weiner, E., Ghosh, A. . . . & Aggarwal, M. (2016). Greening India’s Financial Market: Opportunities for a green bank in India.

Kidney, S. (2014). Indian clean energy player Greenko issues $550m, 5 year, high-yield (B) corporate bond to re-finance portfolio of wind farms. 3x oversubscribed gives 50bps pricing benefit. Unlabeled, but still green.

Nelson, D., Shrimali, G., Goel, S., Konda, C., & Kumar, R. (2012). Meeting India’s renewable energy targets: The financing challenge.

Pham, L. (2016). Is it risky to go green? A volatility analysis of the green bond market. Journal of Sustainable Finance and Investment, 6(4), 263-291.

Indexed at, Google Scholar, Cross Ref

Prakash, N., & Sethi, M. (2021). Green bonds driving sustainable transition in Asian economies: The case of India. Journal of Asian Finance, Economics and Business, 8(1), 723-732.

Indexed at, Google Scholar, Cross Ref

Sanhu, P., & Chourasia, M. (2021). The green bank movement: Enabling green infrastructure through national institutions. India Times.

Sarma, N. (2020). Municipal bonds: A sustainable source of finance for Indian cities.

SEBI. (2017). Disclosure requirements for issuance and listing of green debt securities (Circular No. CIR/IMD/DF/51/2017).

Singh, G., Sinha, P., Ghosh, A., & Meenawat, H. (2021). The green race: India’s ambitious renewable energy target.

World Bank. (2015). What are green bonds?

World Bank. (2019). 10 years of green bonds: Creating the blueprint for sustainability across capital markets.

World Resources Institute. (2021). Statement: India reaffirms ambitious renewable energy target at United Nations.

Yadav, R. (2021). Three things you should know about municipal bond listings.

Yes Bank. (2018). The green bond impact report FY 2017-18: Prioneering green bonds in India.

Received: 19-Apr-2022, Manuscript No. AAFSJ-22-11797; Editor assigned: 22-Apr-2022, PreQC No. AAFSJ-22-11797(PQ); Reviewed: 06-May-2022, QC No. AAFSJ-22-11797; Revised: 13-Jun-2022, Manuscript No. AAFSJ-22-11797(R); Published: 20-Jun-2022