Research Article: 2023 Vol: 27 Issue: 3

Green, climate, and sustainable finance: A bibliometric analysis

Michel Becker, Federal University of Santa Catarina

Marcus Vinicius Andrade de Lima, Federal University of Santa Catarina

Juliana Baldessar Webbe, Federal University of Santa Catarina

Citation Information: Becker, M., Vinicius Andrade de Lima, M., Baldessar Webbe, J., (2023). Green Climate and Sustainable Finance: A Bibliometric Analysis, International Journal of Entrepreneurship ,27(3),1-12

Abstract

Climate change has imposed challenges, tackling of which has become a priority. Finance plays a fundamental role in the economy and can adapt and incorporate devices to help in this confrontation. In this context, sustainability, climate, and green finance are emerging themes, with an increasing interest from scholars. However, there is no consensus on their definitions, making it fundamental to understand and analyse the related scientific production. This study expands the understanding of these themes through a bibliometric study, highlighting f authors, magazines, keywords, and relevant studies. This study emphasized the authors J. Timmons Roberts and Farhad Taghizadeh-Hesary, as well as the Journal of Sustainable Finance & Investment; Climate Policy; and Sustainability, as the most prolific journals and presented a set of studies and keywords that can support future work.

Keywords

Green Finance, Sustainable Finance, Climate Finance, Bibliometric Analysis.

Introduction

Climate change is a relatively new challenge, and if adequate measures are not taken quickly, it will compromise future development capacity. It is imperative that considerable innovations in different sectors and business models reduce the carbon footprint so that the negative impacts of these changes can be mitigated (Lenox & Duff, 2021).

In October 2021, after assessments indicated that climate targets were compromised, jeopardising the Paris Agreement, Climate Change Conference of the Parties (COP26) focused global attention on a fundamental target: limiting global temperature rise to 1.5°C, and halving global emissions by 2030 (Mendiluce, 2022; Streck, Keenlyside & Von Unger, 2016). Globally, this scenario made companies go through unprecedented demands to take quick and far-reaching measures to meet established climate targets, making them an absolute priority (Mendiluce, 2022).

Businesses and financial actors play a key role in the global economy through their influence on extractive economic activities and changes in biomes, thus interfering with climate stability (Galaz et al., 2018). Consequently, influencing capital allocation decisions is one of the best ways to promote the much-needed transition to a new economy. This is closely followed by sustainable finance (Ricas & Baccas, 2022).

Sustainable finance is considered the future of finance and investment, and it supports the global fight against climate change and its impacts(Zhang, Zhang & Managi, 2019). It is established in a format in which it can effectively allocate financial resources and guide the flow of capital through green financial products such as green credit, green bonds, green insurance, green investment, and carbon finance, promoting the transformation of economic structures and optimising the relationship between the environment and economy(Ricas & Baccas, 2022).

Given the emergence of sustainable finance, scholars have shown an exponential interest in the topic in recent years making it opportune to establish an adequate understanding of conceptual issues, generate knowledge with scientific recognition, and, in a systematic way, to subsidise future research in an important and emerging topic (Lagoarde-Segot, 2019; Yu et al., 2021; Zhang et al., 2019).

Thus, this study aims to expand the understanding of green, climate, and sustainable finance, especially by:

I. Select bibliographical references on green, climate and sustainable finance; and

II. Perform bibliometric analyses on selected articles.

To achieve these objectives, a systematic bibliometric study was adopted, as it is considered an effective method to offer a deep and comprehensive understanding of emerging research areas (Yu et al., 2021). The concept of bibliometric analysis, popularised by Pritchard (1969), consists of a set of methods and techniques for viewing information with the aim of creating maps that can adequately represent the quantitative and cognitive aspects of science. The observable parameters in this research were the chronology of publications, highly recurrent keywords, and highlights of prominent studies, authors, and journals on this topic.

With greater attention to global climate challenges, exposure on how to achieve and finance targets related to the Paris Agreement and the UN Sustainable Development Goals has been at the forefront of international discussions, and sustainability in finance joins these motivating factors that are more prominent on the climate agenda (Clark, Reed & Sunderland, 2018).

Although there are other reviews that encapsulate fragments contained in this study, it is essential to admit that the scholar’s perspective influences the analysed object and the decisions of terms and bases used, making the result unique (Ensslin et al., 2017). No research has addressed the terms green finance, climate finance, and sustainable finance in an integrated manner, complied from multiple databases, allowing the generation of integrated knowledge on the subject.

The remainder of this study is structured as follows: Section 2 contains the theoretical foundation; Section 3 contains the methodological process, with the procedures used in this research; Section 4 describes the analyses and bibliometric results; conclusions and notes are mentioned in Section 5; and the last section is devoted to bibliographical references.

Theoretical References

Sustainable Finance

According to Guimarães (2022), one of the most important support for a green economy is the financial sector through sustainable finance. This encourages a new approach to be developed and explored by all market actors and can be defined as “finance that incorporates both climate, environmental and social aspects as well as broader considerations about the long-term economic sustainability of funded organisations and the stability of the financial system in general” (p.18).

For the German agency Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ), sustainable finance can be understood as the union of some factors such as ‘aspects of sustainability in the decision-making processes of financial market actors, financial market policies, and financial arrangements, institutional and market factors that contribute to the achievement of strong, sustainable, balanced and inclusive growth’ (Ricas & Baccas, 2022). In business, finance and sustainability connect finance and investment practices to Environmental, Social, and Governance (ESG) aspects (Barua & Chiesa, 2019), and the shareholder wealth maximisation approach has been challenged for sustainable wealth creation (Fatemi & Fooladi, 2013).

Therefore, by covering itself with a comprehensive concept (Debrah, Darko & Chan, 2022), sustainable finance encompasses both climate finance and green finance, each designed and focused on specific instruments that are often integrated, as can be seen in the details below.

Climate Finance

Climate finance is defined by the United Nations Framework Convention on Climate Change (UNFCCC, 2021, 2022) as ‘local, national, or transnational financing – from public, private and alternative sources of finance – that seeks to support mitigation and adaptation actions to address climate change’. Demanding financial support from parties with more financial resources to the most vulnerable. These require investments from households, businesses, and governments to implement a low-carbon economic transition, reduce greenhouse gas concentration levels, and build the resilience of nations (Hong, Karolyi & Scheinkman, 2020).

Seeking to achieve better results in mitigating and adapting to climate change, the United Nations, through its financial operators, chose eight areas to centralise the action of the climate fund: generation and access to energy; transport; buildings, cities, industries, and electronics; forests and land use; livelihoods and communities; health, food, and water security; infrastructure and built environment; and ecosystems and their services (Green Climate Fund, 2022).

A significant portion of the academic literature on climate finance focuses on reporting on existing climate finance flows and articulating options for expanding financing, whereas other authors have advocated broadening the scope to address more holistic sustainable development (Steckel et al., 2017).

Green Finance

Green finance is a strategic approach to incorporate the financial sector into the low-carbon transformation process and optimise resources in the face of climate change adaptation (Soundarrajan & Vivek, 2016). It has a broad concept, trying to promote environmentally responsible investments, carbon finance, and climate finance, making it fundamental to achieving the Paris Agreement, Sustainable Development Goals (Debrah et al., 2022), and climate-resilient infrastructure(Taghizadeh-Hesary & Yoshino, 2019).

It works as a new financial instrument proposed to solve environmental problems and maintain the main characteristics of traditional finance (Zhou, Tang & Zhang, 2020). Green finance products are divided into four broad groups: retail finance securities, asset management, corporate finance, and safe (Soundarrajan & Vivek, 2016).

Backed by environmental protection, green finance proposes providing investment, financing, operating funds, and other financial resources for environmentally sound projects (Abbas et al., 2021).

Methodology

A bibliometric analysis approach was used in this study. It was first used in 1969 by Alan Pritchard and has gained wide popularity to aid quantitative and objective analysis in understanding the literature, and is often used to systematise the literature information in a particular thematic field (Pritchard, 1969).

The procedures described in this study were performed in August 2022, and only articles and reviews indexed in selected databases were searched.

Two scientific databases were defined: Scopus and the Web of Science (WoS). Both are considered relevant exponents in the international scientific community, in addition to offering search possibilities and advanced filters such as the use of Boolean expressions. Therefore, the authors believe that the selected databases are suitable for the purpose of this research.

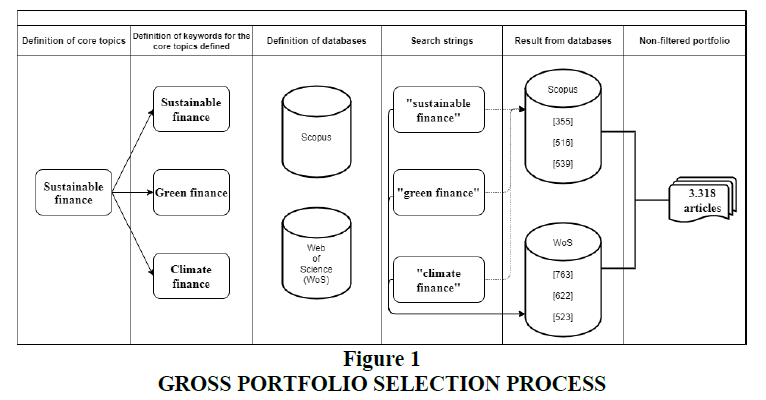

The main terms of this study, that is, green finance, climate finance and sustainable finance, were transformed into the search strings ‘green finance’, ‘climate finance’, and ‘sustainable finance’, which subsidised the search in the selected databases. The details of this process can be viewed in Figure 1.

As a result, 3,318 articles were obtained, which started to compose the gross articles bank.

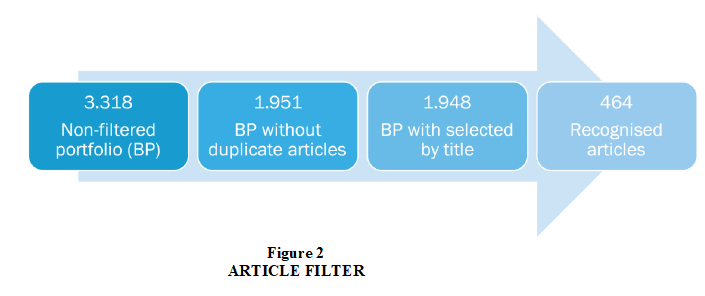

With the help of the EndNote20 software, the next step was to identify and exclude duplicate articles, resulting in the elimination of 1,361 references. In the remaining 1,951 documents, the titles of the articles were read to eliminate those that were misaligned with the initially defined research axes, resulting in 1,948 articles. The process with all steps of filtering the raw bibliographic portfolio articles is illustrated in Figure 2.

The next step included the analysis of the scientific recognition from 1948 articles, based on the number of citations of each article, with the help of the online tool identified by Google Scholar and with the support of the Zotero software. These articles were classified in descending order, allowing the identification of the most relevant ones. The authors of this research adopted the indicator of 80% of the volume of citations for the cut-off value, which corresponds to 464 most cited articles.

From the filters presented and with the support of software such as MSExcel and VOSvier, bibliometric analyses were carried out at different stages, which supported the results of this research.

Results

First, by identifying that most publications were carried out in the last two years (2021 and 2022), more precisely in the last 20 months, it was determined that the bibliometric analyses will be presented in two blocks: A and B. The first was performed on an expanded portfolio of 1,948 articles, disregarding elimination by the number of citations. In the second block, only 464 articles included in the final portfolio were evaluated.

A - Annual publications

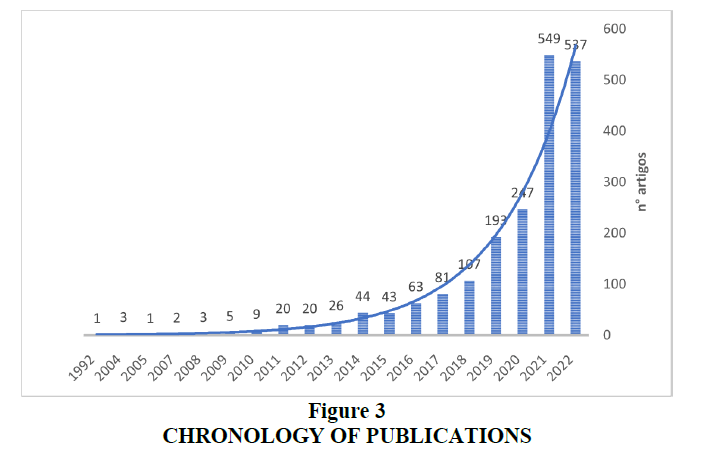

Observing the distribution of annual publications on the subject addressed, it is noted that the beginning is relatively recent, with the first publication in 1992, returning only after 12 years in 2004. In more recent times, the number of publications has increased exponentially, as shown in Figure 3, with more than 50% of them occurring in the last two years (2021 and 2022). This trend demonstrates that studies in this area have grown steadily, and that the research area has received more academic attention. Furthermore, by 2022, it will be possible to observe the largest number of publications on the subject.

A - Authors

The Table presents 11 authors with the highest number of publications. Of the 4,538 authors who had their work indexed and selected in this study, the most prolific researchers were Yun Wang from Zhejiang Gongshang University, China, and FarhadTaghizadeh-Hesary from the Social Science Research Institute, Tokai University, Japan, with 14 selected articles Table 1.

| Table 1 Authors With Major Publications |

||

|---|---|---|

| Ranking | Author | No. Publications |

| 1st | Wang, Y. | 14 |

| 1st | Taghizadeh-Hesary, F. | 14 |

| 2nd | Steffen, B. | 13 |

| 3rd | Polzin, F. | 12 |

| 4th | Roberts, JT. | 10 |

| 4th | Schmidt, TS. | 10 |

| 5th | Shrimali, G. | 9 |

| 5th | Gollier, C. | 9 |

| 5th | Miciula, I. | 9 |

| 5th | Volz, U. | 9 |

| 5th | Hoepner, AGF. | 9 |

A - Journals

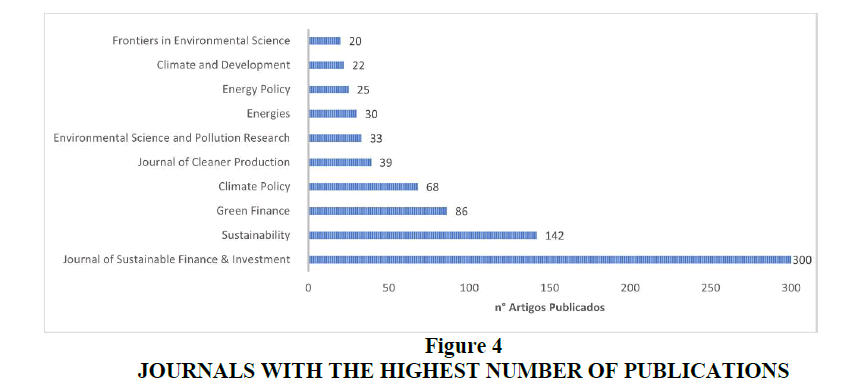

Figure 4 shows the ten journals most cited by the selected articles. First on the list is the Journal of Sustainable Finance & Investment with 300 articles, followed by Sustainability with 142 articles, and Green Finance with 86. Thematic multidisciplinary was also verified, with studies gathered in different areas, such as business and economics, finance and investments, energy, policies, and environment.

THE–Words-key

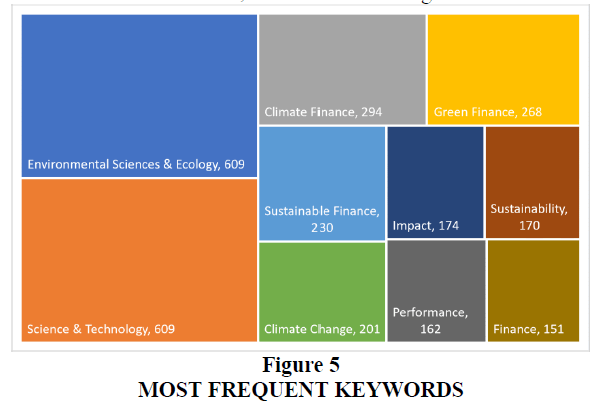

Keywords indicate the main content of published research and portray the scope of the research area within a domain, contributing to the identification of the main areas of research (Debrah et al., 2022). Therefore, we analysed the most cited words and their co-occurrence networks of co-occurrence.

Among the 20,582 keywords mentioned in the evaluated articles, the terms ‘Environmental sciences and ecology’ and ‘science and technology’, emerge among the most cited, followed by climate finance, green finance and sustainable finance, the latter being the ones that guided this research. Research, as can be seen in Figure 5.

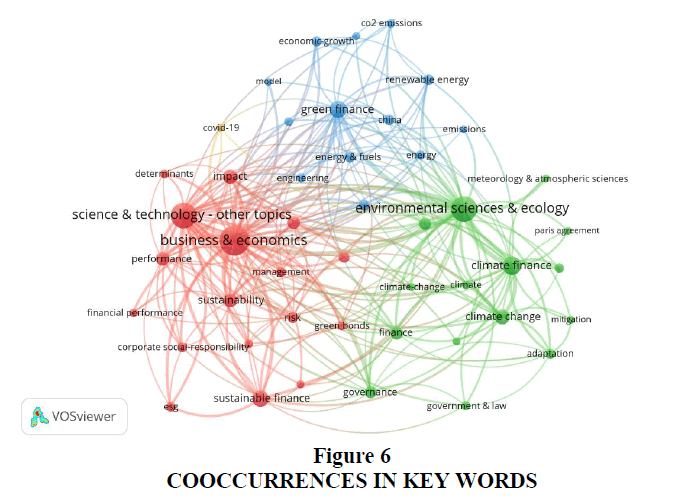

To contribute to the identification of the main areas of research, the VOSviewer software was used to create a network of co-workers. The occurrence of keywords is where we can observe the influence and relationship between the main terms, as shown in Figure 6.

With a view to improving the identification of articles highlighted in the context of this research, their respective authors, and journals in which they were published, the 464 most cited articles in the portfolio were reanalysed, the results of which are presented below.

B - Citation Factor

The number and frequency of citations of an article provide a useful measure of its scientific influence and impact (Debrah et al., 2022). Table 2 presents the ranking of the most-cited articles in this study, containing all documents with more than 200 citations.

| Table 2 Most Cited Articles |

||

|---|---|---|

| Title | Author | No. Citations |

| Environmental Externalities and Cost of Capital | Chava (2014) | 741 |

| Socially responsible funds and market crises | Nofsinger & Varma (2014) | 579 |

| Do Investors Value Sustainability? A Natural Experiment Examining Ranking and Fund Flows | Hartzmark & Sussman (2019) | 547 |

| Country-level institutions, firm value, and the role of corporate social responsibility initiatives | El Ghoul, Guedhami & Kim (2017) | 428 |

| Resiliency of Environmental and Social Stocks: An Analysis of the Exogenous COVID-19 Market Crash | Albuquerque et al. (2020) | 410 |

| Hedging Climate Change News | Engle et al. (2020) | 369 |

| The Influence of Firm Size on the ESG Score: Corporate Sustainability Ratings Under Review | Drempetic, Klein & Zwergel (2020) | 293 |

| The way to induce private participation in green finance and investment | Taghizadeh-Hesary & Yoshino (2019) | 281 |

| Attention to Global Warming | Choi, Gao & Jiang (2020) | 266 |

| Sustainable business model archetypes for the banking industry | Yip & Bocken (2018) | 262 |

| Bonus Culture: Competitive Pay, Screening, and Multitasking | Benabou & Tirole (2016) | 255 |

| Does Climate Change Affect Real Estate Prices? Only If You Believe In It | Baldauf, Garlappi & Yannelis (2020) | 250 |

| Equitable mitigation to achieve the Paris Agreement goals | Robiou du Pont et al. (2017) | 239 |

| The green bond market: a potential source of climate finance for developing countries | Banga (2019) | 233 |

| Climate-smart agriculture global research agenda: Scientific basis for action | Steenwerth et al. (2014) | 216 |

| Financing renewable energy in Africa - Key challenge of the sustainable development goals | Schwerhoff & Sy, (2017) | 215 |

B – Authors of the most cited articles

A list of authors with more than five publications is presented in Table 3. Researcher J. Timmons Roberts from the Climate and Development Laboratory, Institute of Environment and Society, Brown University, USA, stands out with 10 selected articles, followed by FarhadTaghizadeh-Hesary with eight articles.

| Table 3 Most Prolific Researcherss |

||

|---|---|---|

| Ranking | Author | No. Publications |

| 1st | Roberts, J. T | 10 |

| 2nd | Taghizadeh-Hesary, F. | 8 |

| 3rd | Crifo, P. | 6 |

| 3rd | Volz, U. | 6 |

| 4th | Monasterolo, I. | 5 |

| 4th | Weikmans, R. | 5 |

| 4th | Polzin, F. | 5 |

| 4th | Stadelmann, M. | 5 |

B – Journals of the most cited articles

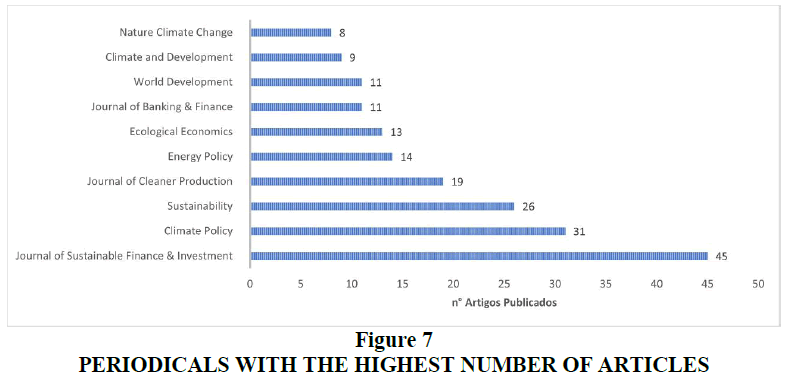

Figure 7 shows the ten journals with the most cited articles. Again, at the top of the list is the Journal of Sustainable Finance & Investment, with 45 articles, followed by Climate Policy with 31 and Sustainability with 26, all of which have their scope geared towards sustainability.

Although prominent journals, in the field of sustainability, were highlighted in this study, it was observed that important journals, whose focus is equivalent to the theme of this research, finance, were not highlighted. The financial economists are late in relation to sustainable finance, and there are many important issues for which they are naturally apt to assess ‘We are confident that the involvement of the broader academic finance community in these issues will undoubtedly lead to valuable contributions to improving the usefulness of the field of finance’ (Hong et al., 2020).

Conclusion

Finance, whether called climate, sustainable, or green, emerges as an innovative and beneficial financial tool for facing and meeting established climate goals, favouring measures to mitigate the impacts of global warming. This topic shows a rising trend, indicating a trend of growth and interest of international scholars assessed through indicators and bibliometric analyses, to broaden the understanding of the subject, offering insights into publication and citation trends and highlighting the most prolific authors. The authors J. Timmons Roberts and Farhad Taghizadeh-Hesary stood out, as well as the journals Journal of Sustainable Finance& Investment, Climate Policy, and Sustainability.

A set of articles with scientific recognition was presented, providing support for future studies. Similar to Zhang et al. (2019), we observed a limited number of publications on the subject in main economics and finance journals, which may present an opportunity to reconcile the focus for future research. The analyses were limited to articles indexed in the Scopus and WoS databases.

Declaration

Conflicts of Interest/ Competing Interests: No conflicts of interest to the best of our knowledge;

Funding/ Grants/ Financial Support

This study was financed in part by the Coordenação de Aperfeiçoamento de Pessoal de Nível Superior - Brasil (CAPES) - Finance Code 001.

References

Abbas, M. G., Wang, Z. Q., Bashir, S., Iqbal, W., & Ullah, H. (2021). Nexus between energy policy and environmental performance in China: The moderating role of green finance adopted firms. Environmental Science and Pollution Research, 28(44), 63263-63277.

Indexed at, Google Scholar, Cross Ref

Albuquerque, R., Koskinen, Y., Yang, S., & Zhang, C. D. (2020). Resiliency of environmental and social stocks: An analysis of the exogenous COVID-19 market crash. Review of Corporate Finance Studies, 9(3), 593-621.

Indexed at, Google Scholar, Cross Ref

Baldauf, M., Garlappi, L., & Yannelis, C. (2020). Does climate change affect real estate prices? Only if you believe in it. Review of Financial Studies, 33(3), 1256-1295.

Indexed at, Google Scholar, Cross Ref

Banga, J. (2019). The green bond market: a potential source of climate finance for developing countries. Journal of Sustainable Finance & Investment, 9(1), 17-32.

Indexed at, Google Scholar, Cross Ref

Barua, S., & Chiesa, M. (2019). Sustainable financing practices through green bonds: What affects the funding size? Business Strategy and the Environment, 28(6), 1131-1147.

Indexed at, Google Scholar, Cross Ref

Benabou, R., & Tirole, J. (2016). Bonus Culture: Competitive Pay, Screening, and Multitasking. Journal of Political Economy, 124(2), 305-370.

Indexed at, Google Scholar, Cross Ref

Chava, S. (2014). Environmental Externalities and Cost of Capital. Management Science, 60(9), 2223-2247.\

Indexed at, Google Scholar, Cross Ref

Choi, D., Gao, Z. Y., & Jiang, W. X. (2020). Attention to Global Warming. Review of Financial Studies, 33(3), 1112-1145.

Indexed at, Google Scholar, Cross Ref

Clark, R., Reed, J., & Sunderland, T. (2018). Bridging funding gaps for climate and sustainable development: Pitfalls, progress and potential of private finance. Land Use Policy, 71, 335-346.

Indexed at, Google Scholar, Cross Ref

Debrah, C., Darko, A., & Chan, A. P. C. (2022). A bibliometric-qualitative literature review of green finance gap and future research directions. Climate and Development, 1-24.

Indexed at, Google Scholar, Cross Ref

Drempetic, S., Klein, C., & Zwergel, B. (2020). The influence of firm size on the ESG Score: Corporate sustainability ratings under review. Journal of Business Ethics, 167, 333-360.

Indexed at, Google Scholar, Cross Ref

El Ghoul, S., Guedhami, O., & Kim, Y. (2017). Country-level institutions, firm value, and the role of corporate social responsibility initiatives. Journal of International Business Studies, 48, 360-385.

Indexed at, Google Scholar, Cross Ref

Engle, R. F., Giglio, S., Kelly, B., Lee, H., & Stroebel, J. (2020). Hedging climate change news. Review of Financial Studies, 33(3), 1184-1216.

Indexed at, Google Scholar, Cross Ref

Ensslin, L., Ensslin, S. R., Dutra, A., Nunes, N. A., & Reis, C. (2017). BPM governance: A literature analysis of performance evaluation. Business Process Management Journal, 23(1), 71-86.

Indexed at, Google Scholar, Cross Ref

Fatemi, A. M., & Fooladi, I. J. (2013). Sustainable finance: A new paradigm. Global Finance Journal, 24(2), 101-113.

Indexed at, Google Scholar, Cross Ref

Galaz, V., Crona, B., Dauriach, A., Scholtens, B., & Steffen, W. (2018). Finance and the Earth system – Exploring the links between financial actors and non-linear changes in the climate system. Global Environmental Change, 53, 296-302.

Indexed at, Google Scholar, Cross Ref

Guimarães, G. C. P. (2022). Finanças sustentáveis: análise entre a taxonomia da União Europeia e a taxonomia verde da Febraban Escola Brasileira de Administração Pública e de Empresas. Dissertação de mestrado não publicada, Fundação Getulio Vargas. Retrieved February 22, 2023,

Hartzmark, S. M., & Sussman, A. B. (2019). Do investors value sustainability? A natural experiment examining ranking and fund flows. Journal of Finance, 74(6), 2789-2837.

Hong, H., Karolyi, G. A., & Scheinkman, J. A. (2020). Climate Finance. Review of Financial Studies, 33(3), 1011-1023.

Lagoarde-Segot, T. (2019). Sustainable finance. A critical realist perspective. Research in International Business and Finance, 47, 1-9.

Indexed at, Google Scholar, Cross Ref

Lenox, M., & Duff, R. (2021). The decarbonization imperative: Transforming the Global Economy by 2050. Stanford: Stanford University Press.

Mendiluce, M. (2022). Setting Science-Based Targets to Combat Climate Change. Harvard Business Review. Retrieved February 22, 2023,

Nofsinger, J., & Varma, A. (2014). Socially responsible funds and market crises. Journal of Banking & Finance, 48, 180-193.

Indexed at, Google Scholar, Cross Ref

Pritchard, A. (1969). Statistical bibliography, an interim bibliography. Springfield: Clearing House for Federal Scientific and Technical Information.

Ricas, D., & Baccas, D. (2022). Taxonomia em finanças sustentáveis: panorama e realidade nacional. Bonn: Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ). Retrieved February 22, 2023,

Robiou du Pont, Y., Jeffery, M. L., Gutschow, J., Rogelj, J., Christoff, P., & Meinshausen, M. (2017). Equitable mitigation to achieve the Paris Agreement goals. Nature Climate Change, 7, 38-43.

Indexed at, Google Scholar, Cross Ref

Schwerhoff, G., & Sy, M. (2017). Financing renewable energy in Africa: Key challenge of the sustainable development goals. Renewable & Sustainable Energy Reviews, 75, 393-401.

Indexed at, Google Scholar, Cross Ref

Soundarrajan, P., & Vivek, N. (2016). Green finance for sustainable green economic growth in India. Agricultural Economics-Zemedelska Ekonomika, 62(1), 35-44.

Indexed at, Google Scholar, Cross Ref

Steckel, J. C., Jakob, M., Flachsland, C., Kornek, U., Lessmann, K., & Edenhofer, O. (2017). From climate finance toward sustainable development finance. WIREs Climate Change, 8(1), e437.

Indexed at, Google Scholar, Cross Ref

Steenwerth, K. L., Hodson, A. K., Bloom, A. J., Carter, M. R., Cattaneo, A., Chartres, C. J., . . . Jackson, L. E. (2014). Climate-smart agriculture global research agenda: Scientific basis for action. Agriculture and Food Security, 3, 11.

Indexed at, Google Scholar, Cross Ref

Streck, C., Keenlyside, P., & Von Unger, M. (2016). The Paris agreement: A new beginning. Journal for European Environmental and Planning Law, 13(1), 3-29.

Indexed at, Google Scholar, Cross Ref

Taghizadeh-Hesary, F., & Yoshino, N. (2019). The way to induce private participation in green finance and investment. Finance Research Letters, 31, 98-103.

Indexed at, Google Scholar, Cross Ref

United Nations Framework Convention on Climate Change. (2021). Introduction to Climate Finance. Retrieved February 22, 2023,

United Nations Framework Convention on Climate Change. (2022). Annual report 2021. Retrieved February 22, 2023,

Yip, A. W. H., & Bocken, N. M. P. (2018). Sustainable business model archetypes for the banking industry. Journal of Cleaner Production, 174, 150-169.

Indexed at, Google Scholar, Cross Ref

Yu, X. B., Mao, Y., Huang, D. M., Sun, Z. B., & Li, T. L. (2021). Mapping global research on green finance from 1989 to 2020: A bibliometric study. Advances in Civil Engineering, 2021, 9934004.

Indexed at, Google Scholar, Cross Ref

Zhang, D. Y., Zhang, Z. W., & Managi, S. (2019). A bibliometric analysis on green finance: Current status, development, and future directions. Finance Research Letters, 29, 425-430.

Indexed at, Google Scholar, Cross Ref

Zhou, X., Tang, X., & Zhang, R. (2020). Impact of green finance on economic development and environmental quality: a study based on provincial panel data from China. Environmental Science and Pollution Research, 27(16), 19915-19932.

Indexed at, Google Scholar, Cross Ref

Received: 01-Mar-2023, Manuscript No. IJE-23-13324; Editor assigned: 04-Mar-2023, Pre QC No. IJE-23-13324 (PQ); Reviewed: 18-Mar-2023, QC No. IJE-23-13324; Revised: 22-Mar-2023, Manuscript No. IJE-23-13324(R); Published: 29-Mar-2023