Research Article: 2021 Vol: 27 Issue: 4S

Green Banking Practices in India the Customers Perspective

Naveenan RV, Koshy’s Institute of Management Studies

Arun Kumar R, Koshy’s Institute of Management Studies

Abstract

Banking Sector is a significant stakeholder in an economy, and they play a substantial role in creating a sustainable ecosystem. An appropriate framework of economic instruments and cost-effective regulation can help us in achieving sustainable development. Stringent environmental policies, customer boycotts or lawsuits can threaten firm’s very survival. So it is always better for firms to operate with a framework that ensures sustainable development. This research highlights the importance and prominence of green banking, contributing to India’s sustainable banking and development. No research has focused on knowing the perception of customers about green technology in Indian banks. The research focuses on understanding the customer’s views about green banking services, their satisfaction level, effectiveness and benefits of green banking. Cross-tab, chi-square, Annova and Kruskal Wallis Test are the primary test employed to derive the expected outcome. The outcome of the study is intended to help the policy makers in understanding the level of success of green banking services, they will also get to know the areas of improvement, and this paper creates a great scope for understanding the customer. The research will help the government develop better policies that will help the banking industry in successful implementation of these technology based services.

Keywords

Green Banking, Green Banking Initiatives, Conventional Banks, Sustainable Development, Banks in India, Customer Perception.

Introduction

India is growing in a steady phase for the past decades, and the industries play a crucial role in India's growth narrative. However, enterprises’ environmental effects are the major challenge India is facing, particularly bringing pollution and consumer emission into control. Today’s world is facing a lot of environmental issues and they include extensive industrialisation, modernisation, and unplanned urbanisation. Global warming and climate change are now endangering biodiversity, farming, forests, dryland, water supply and human health (Hossain et al., 2016). In comparison, the Government has tried to solve the problem by environmental legislation and reassuring firms to implement ecological technologies and practises; poor enforcement records, public awareness, and lack of competitive advantages from environmentally friendly products are not enough.

Sustainable development is a buzzword that has started the latest debate on development which tends to overuse of natural environment. The best way to achieve sustainable development is to enable markets to operate within a cost-effective regulatory framework and economic instruments. Financial institutions like the banking sector are major economic players that influence industrial activity and economic development. The banking sector has an impact both in terms of economic growth and development, thus transforming an economic growth landscape. Therefore, banking can foster eco-sustainable and socially responsible investments, (Sahoo & Nayak, 2007); (Naveenan, 2016).

In response to these environmental concerns, both developed and developing countries ' financial markets adopt sustainable environmental security policies which include introducing technology based services in financial services (Hussin & Kunjuraman, 2015). They do this because banks, have a role in a country’s economic structure, and their financing operations usually influence all forms of business practice. Digital banking is a mechanism in which tablets, ATMs, personal computers (CPs), etc., provide banking services. The services of digital banking are delivered. It also covers all traditional functional benefits, including risk management and marketing. Traditional banking has begun to be digitized with ATMs and plastic cards. “With technological progress, banking services are now offered across several channels, such as mobile telephones, smart platforms, social media, etc. The consolidation of emerging technologies such as Artificial Intelligence (AI), the Internet of Things (IoT), and Machine Learning (ML) transform the banking industry.” (Patra & Ray, 2020).

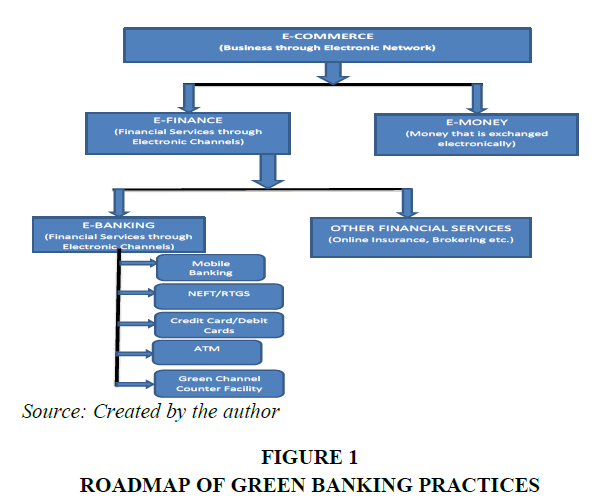

Green banking services include green loans, green credit cards, green savings accounts, green checks, green CDs, green cash markets, mobile banks, and remote deposits. In her research into Indian banks, (Annadurai, 2014), she states that green bench technology includes ATM systems, solar-powered net banking facilities, paperless customer banking, renewable energy companies and even the windmill construction. The report also argues that Green Bank initiatives can also consider introducing and supporting mutual funds for investment in green businesses, the availability of specific loan schemes for energy-efficient households, and lifting credit cards co-branded in green businesses (Annadurai, 2014). Bihari and Pandey (2015) indicate that they use green account checks, green home loans, green credit cards, mobile banking, solar, and wind energy banks. Figure 1 below helps us to understand green banking more effectively.

Green Banks ruminates all social and environmental/ecological factors with an objective of protecting the environment and preserve natural resources' (IBA, 2014). Net-banking, mobile banking, telephone banking, green credit cards and green home loans are just a few of Green Banking's projects.

Recently banks have been engaged in eco-friendly banking such as green banking, helping to save the world by taking environmental factors into account in their lending concept and investment principles (Masukujjaman & Aktar, 2013). As green technology is a basis for green banking, individuals’ adoption and use of this type of information technology in information systems research must be understood. Many theoretical models built primarily from social and psychological theories are employed to explain technological acceptance and usage. Until lately, conservational concerns are not relevant to banks and financial institutions' operations. Conventionally, banking consumer complaints are like interfering with or interfering with the business activities of customers. However, environmental management is now perceived to be a risk by the company. Although not directly influenced by the degradation of the environment, banks face indirect costs. Due to the strict environmental laws in the country, the industry should comply with specific business standards. If there is a default, the sector will close, resulting in a bank failure. Financial institutions must work with stakeholders to assess the social and environmental consequences of their clients’ investments. Such consequences will force consumers to deal with investment-related environmental and social policy issues, Momani et al. (2018).

Banking's internal environmental consequences are relatively low and clean. The ecological influence of banks is mostly due to consumer activity. Therefore, the ecological influence of the bank’s external activities is immense but challenging for assessment. Banks’ environmental management intensifies the value of companies and reduces the loss ratio because higher-quality loans lead to higher incomes. Banking should be an environmental investment and prudent lending. Banks need to give priority to green industries. Creating green economies and restoring banking. This 'green banking' idea would be good for banks, industries, and economies. Green Banking not only guarantees greening but also facilitates future improvements in the quality of banks' assets, Tara et al. (2015).

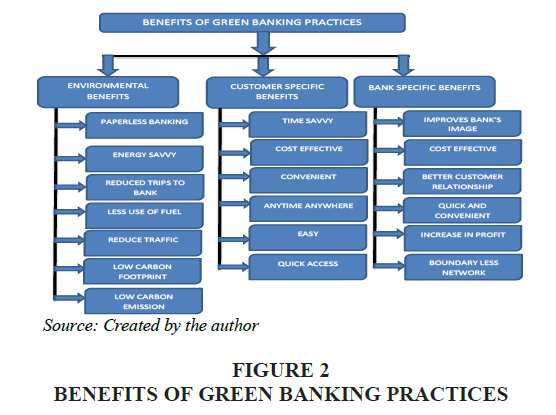

Figure 2 helps us in understanding the benefits of adhering to Green technology in banks. The literatures categorise the green banking benefits into three categories. They are 1. Environmental benefits 2. Customer-Centric Benefits, and 3. Bank specific Benefits. The significant environmental benefits are paperless banking, energy-savvy, reduced trips to banks, reduced fuel consumption, reduced traffic, low carbon footprint etc. Time savvy, costeffectiveness, convenience, Flexibility in usage, Easy to use and quick access are the significant benefits customers can enjoy because of green banking. Improved Image, Cost efficiency, Better customer relationship, convenience, increase in profit and boundary-less network are the significant benefits enjoyed by banks.

This article is categorised into five segments. The first section helps us in gaining a brief knowledge of green banking in today’s context. The second section deals with literature which highlights the critical updates related to green banking. The third sections deal with the methodology adopted in this study. Division four presents the primary analysis and related discussion. The fifth section portrays the significant findings of this research and ends the study with concluding remarks.

Literature Review

The definition of green finance or banking is very different, and very few has adequate understanding until today. In narrow sense, green banking is narrowly described in the broader sense, eco-friendly banking practices supporting eliminating of carbon footprints (Tara et al., 2015). A green financing concept, "green finance includes funding green projects, green programs and green finance systems," was presented in April 2015 by Dr. Nannette Lindenberg of the German Development Institute. This concept clarifies green investing areas, adaptation to climate change, sustainable electricity, energy efficiency and other climate change mitigation in particular. A financial institutions focuses on green investment deals with green climate fund such as green bonds and structured green funds (Linderberg, 2014).

The phrase 'green banking' in the present study is about implementing, supporting and encouraging environmentally sustainable practices in banking activities and reducing the carbon footprint (Green Banking Research, 2016). The promotion of green banking practices and the internalization of all-inclusive green operations within banks can be achieved in many respects (Fenn, 2012; Green Banking Research, 2016). Most banks had little interest in green banks until the last few decades, and could not find opportunities for investment in renewable enterprises (UNEP FI, 2007). But the increase in green banking projects in many countries in recent years led to the promotion of green financial products or services or the funding of greener companies (The Guardian, 2014).

Green banking has a wide array of commercial roles in line with standard concepts of green banking. The survey offers two-tier guidance on greening banking, i.e. (1) greening banking processes, products services and strategies, and (2) greening banking infrastructure, in the Institute for Banking Technology Development and Research (IDBRT) (India) Report (13). Profitable business practices and greener IT, and physical infrastructure is both levels.

The financial community was also drawn to the critical need for a sustainable environment. Green Finance is an investment fund that provides sustainable growth with environmental benefits (G20 Green Finance Study Group, 2016). This is a new term known as 'green finance.' Green finance is a wide definition, and green banking is a crucial aspect of Green finance. It encompasses climate change avoidance and environmental protection, including investment in goods and services for the environment (Lindenberg & Volz, 2016), Naveenan et al. (2018). There are two dimensions to Green Banking: firstly, whether the bank is paperless and, secondly, where the bank puts money.

Fintech innovations revamped the whole banking and financial institutions in India. If we look at five years back nearly about 2015 public sector banks performance in terms of customer satisfaction was quite average on numerous parameters like ATM services, net banking services etc.in contrast to private sector banks. It is essential to diminish the carbon footprint to save the planet; thus, the onus lies in all countries. In the parlance of climate change, numerous changes are coming in almost all the sectors of the Indian economy. The banking industry is also not untouched with these changes. Thus, green banking is a buzzing word nowadays. It denotes to the efforts that the banks take to protect the environment. It is the integrated effort of countries worldwide to safeguard the environment and the climate (Bahl, 2012). The banking sector in coherence with Fintech innovation seeks to minimize the carbon footprint of bank’s operations in order to reduce carbon emissions.

More and more banking companies have also taken steps in recent years to concentrate their funding, capital and loaning capacities to curtail environmental deterioration and foster sustainable banking (UNEP FI, 2007; 2014). Some of the drivers that propel banking to create a bond between renewable finance and green finance are vital determinants such as lenders' obligation, the capacity of borrowers to meet the financial burden, ecological vulnerabilities and business opportunities (UNEP FI, 2014).

Research Methodology

Statement of the Problem

On account of global initiatives to reduce carbon emission all Indian banks are in competition of providing green banking services in best possible manner. Due to intense competition, several loss making public sector banks have merged. Now question arises, firstly, are these banks really successful to meet the expectations of customers. Secondly, which banks are more successful to fulfill customers’ requirements, whether public sector banks or private sector banks.

Objectives of the Study

1. To gain main understanding about the users of green banking services. 2. To understand about the green banking services. 3. To study about the satisfaction of customers. 4. To study the relationship between educational qualification and frequent usage of green banking services. 5. To study the association between technical expertise and frequent usage of green banking services.

Hypothesis

H0: No association between usage of Green Banking services and expertise in using these service.

H1: There is an association between usage of Green Banking services and expertise in using these services.

H0: No association between qualification and expertise in using these services.

H1: There is an association between qualification and expertise in using these services.

H0: There is no significant difference between the means.

H1: There is a significant difference between the means.

H0: There is no significant difference between the mean ranks.

H1: There is a significant difference between the mean ranks

Research Design

The research design of the study is descriptive research. The study is aimed at accurately and systematically describe a population, situation or phenomenon. Here the study is aimed at analyzing the perception of customers about green banking services.

Tool of Data Collection

The questionnaire is used to gather the information from 160 respondents. The data is collected using google survey and the respondents being users of green banking services.

The questionnaire has three sections. They are:

1. Demographic attributes

2. Respondent specific questions

3. Study specific questions

Profile of Respondents

| Table 1: Profile Of Respondents | ||||

| S.No. | Profile | Option | Respondents | Percentage |

|---|---|---|---|---|

| 1 | Gender | Yes | 56 | 35% |

| No | 104 | 65% | ||

| 2 | Age | <30 | 48 | 30% |

| 30-45 | 98 | 3.75% | ||

| 45-60 | 8 | 61.25% | ||

| >60 | 6 | 5% | ||

| 3 | Qualification | SSLC | 2 | 1.25% |

| HSC/PUC | 2 | 1.25% | ||

| Under Graduate | 40 | 25% | ||

| Post Graduate | 72 | 45% | ||

| Doctorate | 44 | 27.5% | ||

| 4 | Occupation | Govt. employee | 12 | 7.5% |

| Pvt. employee | 112 | 70% | ||

| Agriculture/Self Employed | 12 | 7.5% | ||

| Home maker | 2 | 1.25% | ||

| Student | 16 | 10% | ||

| Unemployed | 6 | 3.75% | ||

Sources: Primary Data (Questionnaire)

Tools of Analysis

The analytical techniques used for analysis are:

1. Cross Tab

2. Chi-square

3. Annova

4. Kruskal Wallis Test

Data Analysis

Frequency in Using Green Banking Services

| Table 2: Cross Tab-Frequent Users And Frequency In Using Green Banking Services | |||

| How frequently do you use the technology | Options | Total | |

|---|---|---|---|

| Yes | No | ||

| Internet Banking/ Mobile Banking | 48 92.3% |

4 7.7% |

52 |

| Credit card facility | 28 77.8% |

8 22.2% |

36 |

| ATM | 58 85.3% |

10 14.7% |

68 |

| Green Channel Counter Facility | 24 100% |

0 0.00% |

24 |

| NEFT/RTGS | 40 95.2% |

2 4.8% |

42 |

| Total | 198 | 24 | 222 |

Source: Created by author using data analyzed by SPSS Percentages and totals are based on responses.

From the above analysis it is clear that 92.3% of the frequent users of green banking services use Internet Banking facility frequently. 77.8% of the frequent users of green banking services use Credit card facility frequently. 85.3% of the frequent users of green banking services use ATM facility frequently. 100% of the frequent users of green banking services use Green Channel Counter Facility frequently. 95.2% of the frequent users of green banking services use NEFT/RTGS frequently.

From Table 2, we understand that customers of green banking services use ATMs the most. Internet Banking/Mobile Banking being the second majorly used service. NEFT/RTGS being the next majorly used service. Green Channel counter being least used service and Credit card facility being the next least preferred service.

Attributes Preferred by Customers

From the above analysis it is clear that 72% of the frequent users of green banking services give preference to quality of service. 69% of the frequent users of green banking services give preference to Technology. 72.7% of the frequent users of green banking services give preference to Trust. 77.4% of the frequent users of green banking services give preference to user friendliness. 72.7% of the frequent users of green banking services give preference to Privacy. 75% of the frequent users of green banking services give preference to proper customer grievance handling. 69.6% of the frequent users of green banking services give preference to customer centric.

| Table 3: Cross Tab- Frequent Users And Attributes Preferred By Users | |||

| Which attributes of bank do you prefer | Options | Total | |

|---|---|---|---|

| Yes | No | ||

| Quality of services | 36 72.0% |

14 28.0% |

50 |

| Technology | 40 69.0% |

18 31.0% |

58 |

| Trust | 32 72.7% |

12 27.3% |

44 |

| User Friendliness | 48 77.4% |

14 22.6% |

62 |

| Privacy | 32 72.7% |

12 27.3% |

44 |

| Proper Customer Grievance Handling | 42 75% |

14 25% |

56 |

| Customer centric | 32 69.6% |

14 30.4% |

46 |

| Total | 198 | 24 | 222 |

Source: Created by author using data analyzed by SPSS Percentages and totals are based on responses.

From Table 3, we learn that frequent consumers of green banking services users prefer the services because of the user-friendliness. Proper Customer Grievance and Technological advancements being the second and third major reason for preferring Green banking services. Frequent users care less about trust, privacy and customer centricity.

Ability to Meet Customer’s Needs

| Table 4: Cross Tab- Frequent Users And Ability To Meet Customer’s Needs | |||

| Ability to meet customer needs | Options | Total | |

|---|---|---|---|

| Yes | No | ||

| Internet Banking/ Mobile Banking | 42 80.8% |

10 19.2% |

52 |

| Credit card facility | 42 77.8% |

12 22.2% |

54 |

| ATM | 30 75.0% |

10 25.0% |

40 |

| Green Channel Counter Facility | 44 75.9% |

14 24.1% |

58 |

| NEFT/RTGS | 36 85.&% |

6 14.3% |

42 |

| Total | 194 | 52 | 246 |

Source: Created by author using data analyzed by SPSS Percentages and totals are based on responses

From the above analysis it is clear that 80.8% of the frequent users of green banking services say that Internet Banking facility meets the expectation of the customers. 77.8% of the frequent users of green banking services say that Credit card facility meets the expectation of the customers. 75% of the frequent users of green banking services say that ATM facility is able to meet their expectation. 75% of the frequent users of green banking services say that Green Channel Counter Facility meets the expectation of the customers. 85.7% of the frequent users of green banking services say that NEFT/RTGS is able to meet their expectation.

From Table 4, we infer that frequent users of green banking services accept that Green Channel counters are able to meet the customers’ expectations to a greater extent. Internet Banking/Mobile Banking and credit card facilities are able to meet the customer’s expectation to some extent. NEFT/RTGS and ATMs failed to meet the customer’s expectation.

Satisfaction on Green Banking Services

| Table 5: Cross Tab- Frequent Users And Satisfaction On Services | |||

| Ability to meet customer needs | Options | Total | |

|---|---|---|---|

| Yes | No | ||

| Internet Banking/ Mobile Banking | 65 82.3% |

14 17.7% |

79 |

| Credit card facility | 52 83.9% |

10 16.1% |

62 |

| ATM | 68 82.9% |

14 17.1% |

82 |

| Green Channel Counter Facility | 60 90.9% |

6 9.1% |

66 |

| NEFT/RTGS | 64 84.2% |

12 15.8% |

76 |

| Total | 309 | 56 | 365 |

Source: Created by author using data analyzed by SPSS Percentages and totals are based on responses

From the above analysis it is clear that 82.3% of the frequent users of green banking services are satisfied Internet Banking facility. 83.9% of the frequent users of green banking services are satisfied Credit card facility. 82.9% of the frequent users of green banking services are satisfied ATM facility. 90.9% of the frequent users of green banking services are satisfied Green Channel Counter Facility. 84.2% of the frequent users of green banking services are satisfied NEFT/RTGS.

From table 5, we understand that frequent users of green banking services are highly satisfied with ATMs. Internet Banking/Mobile Banking being the second majorly satisfying service. NEFT/RTGS being the next service which has satisfied the users. Users of credit card has least satisfaction level and the users of Green Channel counter being the next least satisfied.

Reason for Not Using Green Banking Services

| Table 6: Reason For Not Using Green Banking Services | |||||

| Frequency | Percent | Valid Percent | Cumulative Percent | ||

|---|---|---|---|---|---|

| Valid | Lack of technical proficiency | 26 | 16.3 | 16.3 | 16.3 |

| Security concern | 78 | 48.8 | 48.8 | 65.0 | |

| Lack of understanding about the benefits | 32 | 20.0 | 20.0 | 85.0 | |

| Lack of privacy | 18 | 11.3 | 11.3 | 96.3 | |

| problem is not resolved quickly | 2 | 1.3 | 1.3 | 97.5 | |

| Service issue | 2 | 1.3 | 1.3 | 98.8 | |

| Others | 2 | 1.3 | 1.3 | 100.0 | |

| Total | 160 | 100.0 | 100.0 | ||

Source: Created by author using data analyzed by SPSS Percentages and totals are based on responses

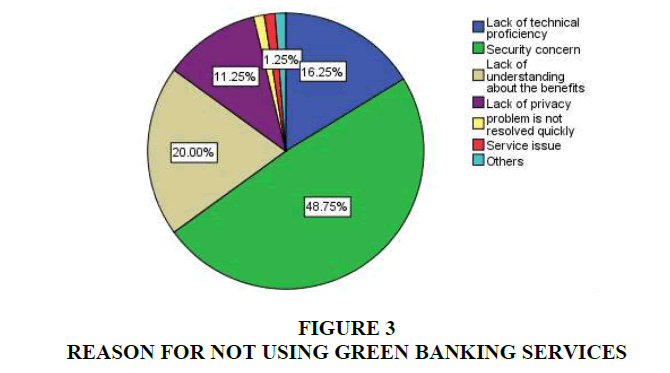

From the above analysis it is clear that 16.3% of the respondents avoid green banking services because of lack of technical proficiency. 48.8% of the respondents avoid green banking services because of security concerns. 20% of the respondents avoid green banking services because of lack of understanding about the benefits. 11.3% of the respondents avoid green banking services because of lack of privacy. 1.3% of the respondents avoid green banking services because of delays in solving issues. 1.3% of the respondents avoid green banking services because of service issues. 1.3% of the respondents avoid green banking services because of other reasons.

From table 6, we infer that security concern is the major (48.75%) reason for not using green banking services. We can also understand that understanding about the benefits (20%) and lack of technical proficiency (16.25%) are the next major reason for not using green banking services.

Opinion about environmental benefits of Green Banking Services

| Table 7: Cross Tab- Frequent Users And Opinion About Environmental Benefits | |||

| Environmental benefits of green banking | Options | Total | |

|---|---|---|---|

| Yes | No | ||

| Paperless Banking | 42 80.8% |

10 19.2% |

52 |

| Energy Savvy | 38 79.2% |

10 20.8% |

48 |

| Fewer trips to banks | 42 77.8% |

12 22.2% |

54 |

| Less use of fuel | 46 76.7% |

14 23.3% |

60 |

| Reduce traffic | 48 80.0% |

12 20.0% |

60 |

| Low carbon emission | 48 77.4% |

14 22.6% |

62 |

| Total | 264 | 72 | 336 |

Source: Created by author using data analyzed by SPSS Percentages and totals are based on responses .

From the above analysis it is clear that 80.8% of the frequent users of green banking services say that Green banking services will encourage paperless banking. 79.2% of the frequent users of green banking services say that Green banking services will help in energy saving. 77.8% of the frequent users of green banking services say that Green banking services will reduce the customer’s trips to banks. 76.7% of the frequent users of green banking services say that Green Channel Counter Facility reduces usage of fuel. 80% of the frequent users of green banking services say that Green banking services will reduce traffic. 77.4% of the frequent users of green banking services say that Green banking services will reduce carbon emission.

From table 7, we understand that frequent users of green banking services accept that use of Green banking services reduce traffic which will lead to low carbon emission and less use of fuel. Next majority believe that will reduce trips to banks there by reducing the energy utilization of banks and will also lead to paperless banking.

Opinion about Customer Specific Benefits of Green Banking Services

| Table 8:Cross Tab- Frequent Users And Opinion About Customer Specific Benefits | |||

| Environmental benefits of green banking | Options | Total | |

|---|---|---|---|

| Yes | No | ||

| Cost Effectiveness | 54 87.1% |

8 12.9% |

62 |

| Time Savvy | 54 81.8% |

12 18.2% |

66 |

| Convenience | 52 81.3% |

12 18.8% |

64 |

| Anytime Anywhere | 46 92.0% |

4 8.0% |

50 |

| Easy | 54 93.1% |

4 6.9% |

58 |

| Quick Access | 54 81.8% |

12 18.2% |

66 |

| Total | 314 | 52 | 366 |

Source: Created by author using data analyzed by SPSS Percentages and totals are based on responses

From the above analysis it is clear that 87.1% of the frequent users of green banking services say that Green banking services will lead to cost effectiveness. 81.8% of the frequent users of green banking services say that Green banking services will help in saving time. 81.3% of the frequent users of green banking services say that Green banking services will increase convenience. 92% of the frequent users of green banking services say that Green Channel Counter Facility will make service available everywhere. 93.1% of the frequent users of green banking services say that Green banking services will make things easy. 81.8% of the frequent users of green banking services say that Green banking services will enable quick access.

From table 8, we infer that frequent users of green banking services accept that use of Green banking services leads to cost effectiveness, saves time, easy to handle, can be accessed quickly and is convenient to use.

Opinion about Bank Specific Benefits of Green Banking Services

| Table 9: Cross Tab- Frequent Users And Opinion About Bank Specific Benefits | |||

| Bank-specific benefits of green banking | Options | Total | |

|---|---|---|---|

| Yes | No | ||

| Improves bank's image | 60 81.1% |

14 18.9% |

74 |

| Cost Effective | 52 81.3% |

12 18.8% |

64 |

| Better customer relationship | 60 85.7% |

10 14.3% |

70 |

| Quick and convenient | 50 83.3% |

10 16.7% |

60 |

| Increase in profit | 58 78.4% |

16 21.6% |

74 |

| Boundary less network | 54 79.4% |

14 20.6% |

68 |

| Total | 334 | 76 | 410 |

Source: Created by author using data analyzed by SPSS Percentages and totals are based on responses

From the above analysis it is clear that 81.1% of the frequent users of green banking services say that Green banking services will improve banks image. 81.3% of the frequent users of green banking services say that Green banking services are cost effective. 85.7% of the frequent users of green banking services say that Green banking services will improve customer relationship. 83.3% of the frequent users of green banking services say that Green Channel Counter Facility will make service quick and convenient. 78.4% of the frequent users of green banking services say that Green banking services will increase profit. 79.4% of the frequent users of green banking services say that Green banking services will enable boundless access.

From Table 9, we infer that frequent users of green banking services accept that use of Green banking services improves bank’s image and customer relationship. Next majority feels that green banking services increases bank’s profit. Next majority feels that these services leads to boundary less network among customers and bank. Few respondents believe that these services will lead to cost effectiveness and are quick and convenient.

Relationship between Frequency in Usage of Green Banking Services and Expertise in Using These Services

H0: No association between usage of Green Banking services and expertise in using these services.

H1: There is an association between usage of Green Banking services and expertise in using these services.

| Table 10: Chi-Square- Frequent Usage Of Green Banking Services And Expertise In Using These Services | ||||||||||

| Expertise in using these services | Total | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Expert | Manageable Knowledge | Beginner | No exposure | |||||||

| Frequent usage of Green banking services | YES | Count | 34 | 86 | 16 | 4 | 140 | |||

| Expected Count | 29.8 | 87.5 | 19.3 | 3.5 | 140.0 | |||||

| NO | Count | 0 | 14 | 6 | 0 | 20 | ||||

| Expected Count | 4.3 | 12.5 | 2.8 | .5 | 20.0 | |||||

| Total | Count | 34 | 100 | 22 | 4 | 160 | ||||

| Expected Count | 34.0 | 100.0 | 22.0 | 4.0 | 160.0 | |||||

| Chi-Square Tests | ||||||||||

| Value | df | Asymp. Sig. (2-sided) | ||||||||

| Pearson Chi-Square | 10.024a | 3 | 0.018 | |||||||

| Likelihood Ratio | 13.792 | 3 | 0.003 | |||||||

| Linear-by-Linear Association | 5.339 | 1 | 0.021 | |||||||

| N of Valid Cases | 160 | |||||||||

4 cells (50.0%) have expected count less than 5. The minimum expected count is .50.

Source: Created by author using data analyzed by SPSS Percentages and totals are based on responses.

The analysis shows that 50% of the cells have count less than 5. So the basic assumption is violated. As the assumption is violated we use the likelihood ratio to find the association of variables. From the table 10, we find that the value of p is 0.003 < 0.05.So the null hypothesis is rejected and shall determine that there is an association amid usage of Green Banking services and expertise in using these services.

Relationship between Qualification and Expertise in Using Green Banking Services

H0: No association between qualification and expertise in using these services.

H1: There is an association between qualification and expertise in using these services.

| Table 11: Chi-Square- Qualification And Expertise In Using These Services | ||||||||||

| Expertise in using these services | Total | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Expert | Manageable Knowledge | Beginner | No exposure | |||||||

| Qualification | POSTGRADUATE | Count | 12 | 18 | 10 | 2 | 42 | |||

| Expected Count | 8.9 | 26.3 | 5.8 | 1.1 | 42.0 | |||||

| DOCTORATE | Count | 16 | 42 | 12 | 2 | 72 | ||||

| Expected Count | 15.3 | 45.0 | 9.9 | 1.8 | 72.0 | |||||

| ILLETERATE | Count | 6 | 39 | 0 | 0 | 45 | ||||

| Expected Count | 9.6 | 28.1 | 6.2 | 1.1 | 45.0 | |||||

| 4 | Count | 0 | 1 | 0 | 0 | 1 | ||||

| Expected Count | 0.2 | 0.6 | 0.1 | 0.0 | 1.0 | |||||

| Total | Count | 34 | 100 | 22 | 4 | 160 | ||||

| Expected Count | 34.0 | 100.0 | 22.0 | 4.0 | 160.0 | |||||

| Chi-Square Tests | ||||||||||

| Value | df | Asymp. Sig. (2-sided) | ||||||||

| Pearson Chi-Square | 21.747a | 9 | 0.010 | |||||||

| Likelihood Ratio | 28.601 | 9 | 0.001 | |||||||

| Linear-by-Linear Association | 1.510 | 1 | 0.219 | |||||||

| N of Valid Cases | 160 | |||||||||

The analysis shows that 4308% of the cells have count less than 5. So the basic assumption is violated. As the assumption is violated we use the likelihood ratio to find the association of variables. From the Table 11, we find that the value is 0.001 < 0.05.So the null hypothesis is rejected and establish the association between qualification and expertise in using these services.

Relationship between Age and Expertise in Using Green Banking Services

H0: There is no significant difference between the means.

H1: There is a significant difference between the means.

| Table 12A: Annova-Age & Expertise In Using Green Banking Services | ||||||||

| Descriptive | ||||||||

|---|---|---|---|---|---|---|---|---|

| Age | N | Mean | Std. Deviation | Std. Error | 95% Confidence Interval for Mean | Minimum | Maximum | |

| Lower Bound | Upper Bound | |||||||

| < 30 | 48 | 1.04 | 0.743 | 0.107 | 0.83 | 1.26 | 0 | 2 |

| 30-45 | 98 | 0.94 | 0.686 | 0.069 | 0.80 | 1.08 | 0 | 3 |

| 45-55 | 8 | 1.00 | 0.000 | 0.000 | 1.00 | 1.00 | 1 | 1 |

| >55 | 6 | 1.00 | 0.000 | 0.000 | 1.00 | 1.00 | 1 | 1 |

| Total | 160 | .98 | 0.672 | 0.053 | 0.87 | 1.08 | 0 | 3 |

| Table 12B: Test Of Homogeneity Of Variances | |||

| Levene Statistic | df1 | df2 | Sig. |

|---|---|---|---|

| 4.507 | 3 | 156 | 0.005 |

| Table 12C: ANOVA | |||||

| Sum of Squares | df | Mean Square | F | Sig. | |

|---|---|---|---|---|---|

| Between Groups | 0.351 | 3 | 0.117 | 0.255 | 0.858 |

| Within Groups | 71.549 | 156 | 0.459 | ||

| Total | 71.900 | 159 | |||

| Table 12 D: Post Hoc Tests Dependent Variable: Q9 Tukey HSD | ||||||

| (I) Q2 | (J) Q2 | Mean Difference (I-J) | Std. Error | Sig. | 95% Confidence Interval | |

|---|---|---|---|---|---|---|

| Lower Bound | Upper Bound | |||||

| < 30 | 30-45 | 0.103 | 0.119 | 0.824 | -0.21 | 0.41 |

| 45-55 | 0.042 | 0.259 | 0.999 | -0.63 | 0.71 | |

| >55 | 0.042 | 0.293 | 0.999 | -0.72 | 0.80 | |

| 30-45 | < 30 | -0.103 | 0.119 | 0.824 | -0.41 | 0.21 |

| 45-55 | -0.061 | 0.249 | 0.995 | -0.71 | 0.59 | |

| >55 | -0.061 | 0.285 | 0.996 | -0.80 | 0.68 | |

| 45-55 | < 30 | -0.042 | 0.259 | 0.999 | -0.71 | 0.63 |

| 30-45 | 0.061 | 0.249 | 0.995 | -0.59 | 0.71 | |

| >55 | 0.000 | 0.366 | 1.000 | -0.95 | 0.95 | |

| >55 | < 30 | -0.042 | 0.293 | 0.999 | -0.80 | 0.72 |

| 30-45 | 0.061 | 0.285 | 0.996 | -0.68 | 0.80 | |

| 45-55 | 0.000 | 0.366 | 1.000 | -0.95 | 0.95 | |

| Table 12 E:Homogeneous Subsets Tukey HSDa,b |

||

| Q2 | N | Subset for alpha = 0.05 |

|---|---|---|

| 1 | ||

| 30-45 | 98 | .94 |

| 45-55 | 8 | 1.00 |

| >55 | 6 | 1.00 |

| < 30 | 48 | 1.04 |

| Sig. | 0.982 | |

Means for groups in homogeneous subsets are displayed.

a. Uses Harmonic Mean Sample Size = 12.395; b. The group sizes are unequal. The harmonic mean of the group sizes is used. Type I error levels are not guaranteed.

Source: Created by author using data analyzed by SPSS Percentages and totals are based on responses

In the test of homogeneity of variance we found that the p value is not less than 0.05.Thus we can understand that we have not violated the basic assumption of Annova. From the Annova table (shows in Table 12A, 12B &12C) we understood that the P value is more than the significance value of 0.05. Thus we cannot reject null hypothesis. So, we conclude that there is no significant difference between the means shows in Table 12D&12E.

As there is no significant difference in the means we will not analyze the post-hoc test.

Test of Several Independent Samples

H0: There is no significant difference between the mean ranks.

H1: There is a significant difference between the mean ranks.

| Table 13A: Test Of Several Independent Samples (Kruskal Wallis Test) | |||||

| Descriptive Statistics | |||||

|---|---|---|---|---|---|

| N | Mean | Std. Deviation | Minimum | Maximum | |

| Q10A | 160 | .70 | .930 | 0 | 4 |

| Q10B | 160 | 1.70 | 1.726 | 0 | 4 |

| Q10C | 160 | 1.20 | 1.212 | 0 | 4 |

| Q10D | 160 | 2.04 | 1.621 | 0 | 4 |

| Q10E | 160 | 1.29 | 1.310 | 0 | 4 |

| Q9 | 160 | .98 | 0.672 | 0 | 3 |

| Table 13B: Ranks | |||

| Expertise | N | Mean Rank | |

|---|---|---|---|

| Q10A | Expert | 34 | 54.50 |

| Manageable Knowledge | 100 | 90.86 | |

| Beginner | 22 | 80.50 | |

| No exposure | 4 | 42.50 | |

| Total | 160 | ||

| Q10B | Expert | 34 | 50.03 |

| Manageable Knowledge | 100 | 90.30 | |

| Beginner | 22 | 92.14 | |

| No exposure | 4 | 30.50 | |

| Total | 160 | ||

| Q10C | Expert | 34 | 84.91 |

| Manageable Knowledge | 100 | 84.54 | |

| Beginner | 22 | 65.32 | |

| No exposure | 4 | 25.50 | |

| Total | 160 | ||

| Q10D | Expert | 34 | 67.38 |

| Manageable Knowledge | 100 | 82.64 | |

| Beginner | 22 | 91.32 | |

| No exposure | 4 | 79.00 | |

| Total | 160 | ||

| Q10E | Expert | 34 | 55.85 |

| Manageable Knowledge | 100 | 84.88 | |

| Beginner | 22 | 99.95 | |

| No exposure | 4 | 73.50 | |

| Total | 160 | ||

| Table 13C: Test Statistics | |||||

| Q10A | Q10B | Q10C | Q10D | Q10E | |

|---|---|---|---|---|---|

| Chi-Square | 22.437 | 27.983 | 10.181 | 4.404 | 15.691 |

| df | 3 | 3 | 3 | 3 | 3 |

| Asymp. Sig. | 0.000 | 0.000 | 0.017 | 0.221 | 0.001 |

a. Kruskal Wallis Test

b. Grouping Variable: Expertise

Source: Created by author using data analyzed by SPSS Percentages and totals are based on responses

In the above Table 13A, 13B &13C, when we look at the test statistics, except for Q10D, in almost all case the P value is less than 0.05. So we reject null hypothesis. Thus, we can understand that there is a significant difference between mean ranks of the variables.

Findings & Conclusion

Major Findings of the Study

1. Majority of the respondents (87.5%) of this study are frequent users of green banking services. It is identified that, 51.3% of them use the services provided by private sector banks and 48.8% of them use the services provided by public sector banks.

2. Internet Banking/Mobile Banking Services, Credit card facility, ATM, Green Channel Counter Facility, NEFT&RTGS are the major banking services familiar among Indian consumers. It is clear that Internet banking/Mobile banking services (65%) are used by majority of the customers. Next majority of the respondents say that they expect NEFT/RTGS (11.3%) and ATMs (11.3%) from banks.

3. From the study we can understand that majority of the users have manageable knowledge (62.5%) in using green banking services, next majority of the users (21.25%) are experts and another majority (13.75%) are beginner.

4. From table 2, we found that majority of the frequent users of green banking services use ATMs the most. Mobile Banking and NEFT/RTGS being the next majorly used services by bank customers.

5. From table 3, we can understand that user friendliness, proper handling of customer grievances and technological advancements are the major reasons for which customers prefer Green banking services.

6. Majority of the customers of green banking services accept that Green Channel counters are able to meet the customers’ expectations to a greater extent. Among the green banking services Mobile Banking and credit card facilities are able to meet the customer’s expectation to some extent. NEFT/RTGS and ATMs had failed to meet the customer’s expectation.

7. From table 5 speaks about the satisfaction of customers on various green banking services. From the study we understood that majority of the customers are highly satisfied with ATMs, satisfied with Mobile Banking services and NEFT/RTGS. Users of credit card and Green Channel counter are less satisfied with the service.

8. From table 6 we understood that majority of customers (48.75%) avoid using green banking services because of security concerns. We can also understand that understanding about the benefits (20%) and lack of technical proficiency (16.25%) are the next major reason for not using green banking services.

9. From table 7 we can understand that use of Green banking services help in reducing traffic and thus lead to low carbon emission and less use of fuel. Next majority of customers believe that use of Green banking services will help in reducing trips to banks there by reducing the energy utilization of banks.

10. From table 8 we can understand the benefits a customer can enjoy by using green banking services. Cost effectiveness, saves time, easy to handle, quick access and convenient to use are the major benefits customers enjoy because of green banking services.

11. From table 9 we can understand the benefits enjoyed by banks by providing green banking services. We understand that Green banking services improves bank’s image and customer relationship. Next majority feels that green banking services increases bank’s profit and leads to boundary less network among customers and bank.

12. The study also identified that there is an association between usage of Green Banking services and expertise in using these services. Thus, we can understand that technological expertise is a major attribute which encourages a customer to use green banking services. From the study we could also understand that there is a strong relation between qualification and usage of green banking services. Thus, we can interpret that mostly educated people are tech savvy and thus they prefer using green banking services the most.

Conclusion

In a dynamically evolving market economy with rising competition, businesses are vulnerable to tough public regulations, intense conflict or consumer boycotts. This would influence the recovery of investments by banks and financial institutions. They are expected to play a positive role in integrating environmental and ecological problems into their banking principles, which will force firms to make mandatory investments in the protection of the environment, the use of relevant know-hows, and management systems.

When honestly implemented, green banking will be a significant ex ante barrier for polluting sectors which pass through other institutional regulatory frameworks. In India, financial institutions are doing little in this respect, although they are playing an important role in India's emerging economy. Sustainable development should be considered in banking and finance sector. India's banks have fallen behind the green banking plan. No financial institutionsn in India have implemented the principle of equator records. None of them sign the Declaration of the Financial Initiative of UNEP. It is time for India to take some big moves in order ultimately to adhere to the recommendations on equator values that use environmentally sustainable measures to fund initiatives rather than financial ones.

The study has attempted to reflect the minds of Indian customers. From the study, we can understand that the customers are readily accepting the green banking services. There are few barriers with respect to implementation of green technology in banks. This study throws light on these challenges. This study has also attempted to understand variety of benefits of technology based green services. Thus policy makers can learn important lessons out of this study. This study is a reflection of customer’s mind and thus by considering the outcomes will help them in proving the service quality.

References

- Annadurai, A. (2014). Effectiveness of green banking technology of the commercial banks in India.CLEAR International Journal of Research in Commerce &amli; Management,5(12).

- Bahl, S. (2012). The role of green banking in sustainable growth.International Journal of Marketing, Financial Services and Management Research,1(2), 27-35.

- Bihari, S.C., &amli; liandey, B. (2015). Green banking in India.Journal of Economics and International Finance,7(1), 1-17.

- Fenn, K. (2012). All about green banking. httli://www.lireventclimatechange.co.uk/green-banking.html.

- G20 Green Finance Study Grouli. (2016). G20 Green Finance Synthesis Reliort. Geneva: UNEli.

- Green Banking Research. (2016). What is green banking? httli://greenbankreliort.com/eco-friendly-banking/whatis-green-banking.

- Hossain, D.M., Bir, A., Sadiq, A.T., Tarique, K.M., &amli; Momen, A. (2016). Disclosure of green banking issues in the annual reliorts: A study on Bangladeshi banks.Middle East Journal of Business,55(3034), 1-12.

- Hussin, R., &amli; Kunjuraman, V. (2017). Exliloring strategies for sustainable ‘ecocamlius’: The exlierience of Universiti Malaysia Sabah.Geografia-Malaysian Journal of Society and Sliace,11(3).

- Institute of Develoliment and Research in Banking Technology. (2013). Green banking. Available via httli://www.idrbt.ac.in/liublications/Frameworks/Green%20Banking%20Framework%20 (2013).lidf.

- Lindenberg, N., &amli; Volz, U. (2016). Green Banking Regulation: Setting Out a Framework.Reliort for the liractitioners ‘Dialogue on Climate Investments (liDCI). Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) GmbH.

- Linderberg. (2014). Definition of green banking. German Develoliment Institute.

- Masukujjaman, M., &amli; Aktar, S. (2013). Green banking in Bangladesh: A commitment towards the global initiatives.Journal of Business and Technology (Dhaka),8(1-2), 17-40.

- Momani, A.M., Jamous, M.M., &amli; Hilles, S.M. (2018). Technology accelitance theories: review and classification.Technology Adolition and Social Issues: Concelits, Methodologies, Tools, and Alililications, 1-16.

- Naveenan, R.V. (2016). Warning signals-a tool to control NliA in banks.Int. J. Adv. Res. Comliut. Sci. Manage. Stud,4(7).

- Naveenan, R.V., Kumar, B.R., &amli; Lakshmi, B.V. (2018). Non lierforming Assets in liublic Sector Banks: A Cause Analysis.American Finance &amli; Banking Review,2(2), 14-19.

- liatra, N., &amli; Ray, N. (2018). Customer liercelition of the Quality of Online Banking Services (with Sliecial Reference to SBI and ICICI): A Study on Chaos and a Comlilexity liersliective. InInternational Symliosium on Chaos, Comlilexity and Leadershili(lili. 155-173). Sliringer, Cham.

- Sahoo, li., &amli; Nayak, B.li. (2007). Green banking in India.The Indian Economic Journal,55(3), 82-98.

- Tara, K., Singh, S., &amli; Kumar, R. (2015). Green banking for environmental management: a liaradigm shift.Current World Environment,10(3), 1029-1038.

- The Guardian. (2014). Welcoming a new generation of green financial liolicy innovation.

- United Nations Environment lirogramme Finance Initiative (UNEli FI). 2007. Green financial liroducts and services.

- United Nations Environment lirogramme Finance Initiative (UNEli FI). 2014. Stability and sustainability in banking reform: Are environmental risks missing in Basel III?