Research Article: 2022 Vol: 21 Issue: 2S

Government policy on determination of coal sale price: How will the market respond?

Chistiana Noviolla, University of Merdeka

Supramono Supramono, University of Merdeka

Sunardi Sunardi, Satya Wacana Christian University

Keywords

Domestic Market Obligation, Coal Stock, Abnormal Return, Overreaction

Citation Information:

Noviolla, C., Supramono, S., Sunardi, S. (2022). Government policy on determination of coal sale price: how will the market respond?. Academy of Strategic Management Journal, 21(S2), 1-8.

Abstract

This study aims to test (a) the market's response to the announcement of the Domestic Market Obligation which regulates the selling price of coal and (b) test the occurrence of overreaction for coal sector shares ?. This study analyzes daily stock returns for 21 days of the observation period, which are 10 days before, during and 10 days after the DMO announcement on shares of companies engaged in coal and listed on the Stock Exchange in 2018. The analysis uses one sample t-test . The study results show that the market gave a negative response to the announcement of the Domestic Market Obligation and even a negative abnormal return has occurred since 8 days before the announcement. In addition, this study also found a significant price reversal process shortly after the DMO announcement that led to short-term overreaction.

Introduction

On March 9, 2018, Indonesian government through the Ministry of Energy and Minerals announced the domestic market obligation (DMO) which set coal selling prices for power plants at US $ 70 per metric ton, which apply retroactively from January 2018 to December 2019. This figure is below the Price Reference Coal (PRC), which at the time reached US $ 101.86 per metric ton. In addition, if the PRC is less than US $ 70 then the price follows the price of the PRC. The policy that regulates coal prices in the context of meeting the supply of domestic coal needs is a response to PT. PLN, that coal prices have continued to increase to close to the level of US $ 100 per metric ton since semester II / 2016 (Figure 1.) so that it will burden PLN's production costs because 60% of its electricity is powered by coal.

Figure 1: Coal Market Price Fluctuations In 2015 - 2018 According To The Newcastle Global Coal Index, Cv 6,322 Kcal / Kg Gar Fob Vessel (In Us $ Per Tonne)

This DMO coal selling price determination policy does not only affect PT. PLN as a coal consumer, but also has an impact on the financial performance of coal companies. It can even impact the market performance of mining companies because the DMO policy can be seen as "bad news" for companies engaged in coal. Therefore, it is interesting to analyze how the market responds to the DMO policy. Several studies on pernal government policy have been conducted including monetary policy (Okpara, 2010; Bisson et al., 2016) and oil price policies (Kelikume & Muritala, 2019) and policies (Hayashida & Ono, 2016). Whereas in Indonesia also carried out such as tax amnesty policies (Widyasari et.al, 2017; Trisnayari & Noviari, 2018) and Indonesian economic package policies in 2015-2017 (Gursido & Indrayono, 2019). However, this research has not analyzed the potential for overreaction so that government policies can cause prolonged market turmoil. According to De Bondt and Thaler (1985), there is a possibility for the market to over-respond to information, causing overreaction. This phenomenon of overreaction is an embodiment of market inefficiencies in responding to information.

This study aims to (a) test the market's response to the DMO announcement governing coal selling prices and; (b) test the overreaction of coal sector shares? This study is expected to contribute to broadening knowledge about the consequences of government policy from a market perspective and the potential for overreaction that has not been explored so far. Practically, this study is expected to provide input for policy makers and investors regarding the announcement of government policies.

Literature Review

In an efficient market condition, the market must respond immediately to information so that prices will be formed that reflect the real condition of the company's fundamentals (Fama, 1970). Market conditions refer to the assumption that investors act rationally. The information can come from events that occur both inside and outside the company (Sirait et al., 2012). Information coming from within the company regarding corporate actions such as dividend policy, replacement of directors, mergers and acquisitions. Whereas information from companies both that can have an impact on the broad market and certain companies or sectors such as government policies on DMO.

Changes in prices produce positive or negative returns depending on how the market responds to information that comes as a good news or a bad news. For example, a number of previous studies in the market gave a negative response to political events (Gul et al., 2013; Manzoor, 2013), a terrorism moaning event (Baker; 2014; Najaf, 2017) because the perceived information coming to the market was bad news. Whereas government policies can be responded positively and negatively by the market depending on whether the government policies are pro-market or not. Monetary policy (Okpara, 2010) and oil pricing (Kelikume & Muritala, 2019) are responded positively by the market. While the monoteric policy on rising interest rates (Bisson et al., 2016) and the Indonesian economic package policy (Gursido & Indrayono, 2019) responded negatively. DMO policy is likely to be considered a bad news event by the market, because it has potential to decrease profit of coal companies and affect the company's performance so that it is expected that the market will respond negatively to coal company shares that can be seen from the presence or absence of negative abnormal returns on the day of the event and around the day of the DMO announcement.

Is the stock price movement against the DMO announcement is fast and not excessive when information is received by the market so that there is no process of price reversal or overreaction. This depends on the dominance of the type of investor. DeLong et. al (1990) revealed that in the market there are two types of investors: rational investors, free of sentiment and irrational investors, tend to experience sentiment. If there is an irrational domination of investors, it will lead to excessive market response so that prices are too high or too low so the market becomes inefficient. The concept of overreaction begins with experimental psychology research by Kahneman and Tversky (1982) which proves that humans have the nature of overreaction to some unexpected and dramatic events. Market participants tend to overestimate stock prices when receiving information that is considered good, and assess stock prices too low when receiving bad information (De Bondt & Thaler, 1985). Research conducted by Fang (2013) also found that investors tend to underreact to good news and overreaction to bad news. The phenomenon of overreaction is also influenced by factors influenced by investor psychology (Kaestner, 2011; Michel, 2017; Ali et al., 2012). Yull and Kirmizi (2012) found that there was overreaski, but then investors quickly realized that they had overreacted so as to make a correction that caused a price reversal. Previous studies using price reversals due to new information are indicative of overreaction (Clare & Thomas, 1995; De Bondt & Thaler, 1987; Yull & Kirmizi, 2012). Overreaction can occur in a long or short time span (Chen & Sauer, 1997; Nam, Pyun & Avard, 2001). For example Smith (2016) analyzes the daily Dow stock returns in a short 10 day period. The government's policy in setting the DMO coal selling price that is far below the HBA can be considered as bad news, it is also thought to make investors overreact.

Research Methodology

Research Design

This study uses an event study approach to detect market responses to events that are reflected in changes in stock prices (MacKinlay, 1997). The event chosen in this study was the announcement of the DMO on March 9, 2018 which regulates the selling price of coal for domestic interests at a price of US $ 70 below the HBA price so that it can say events that are bad news for companies in the coal sector and can lead to negative abnormal returns. For the purposes of analysis, this study utilizes data from Yahoo Finance (https://finance.yahoo.com), corporate action data and company IPO obtained from the IDX's official website (http://idx.co.id).

Population and Samples

The population in this study are coal companies listed on the Indonesia Stock Exchange (ISE) in 2018. Sample selection based on (a) shares actively traded during the study period from 4 December 2017 to 23 March 2018; (b) the company does not carry out corporate actions during the observation period such as stock splits, dividend announcements, rights issues, mergers or other corporate actions. This is done to avoid any confounding effect due to corporate actions (c) listed on the stock exchange at least one year before the announcement. Based on these criteria, of the 27 coal companies listed on the Stock Exchange there were 6 shares that were no longer actively traded and 1 share listed on 15 February 2018, so that 20 companies were obtained.

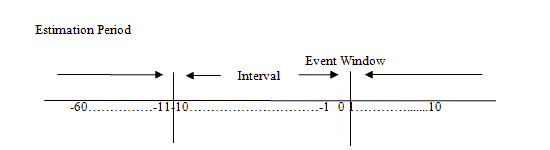

Analysis Techniques

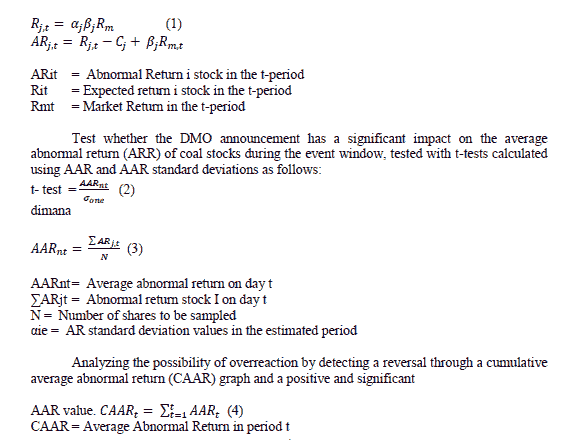

The analysis phase begins by determining the observation period of 21 days, which is 10 days before the event, the day of the event and 10 days after the event (23 February-23 March 2018). This study uses a non-overlapping window, as conducted by Spyrou, Kassimatis and Galariotis (2007) with an estimated 50-day period (t-60, t-11) that starts 60 days and ends 10 days before the event day to avoid the possibility of price increases before the event as in Figure 2.

Calculates abnormal return (AR) which is the difference between actual return and expected return..

Analysis and Discussion

Table 1 shows the AAR by using market adjusted capital shows a tendency to continue to increase from before, until until after the announcement of the DMO, each was -0.006; 0.019 and 0.026. The lowest and highest AAR values were -0.019 and 0.199, respectively, before the announcement.

| Table 1 Statistik Deskriptif Abnormal Return Dan Average Abnornal Return |

||||||

|---|---|---|---|---|---|---|

| N | Min | Max | Mean | Std. Deviation | Skewness | |

| AR Before | 200 | -0.191 | 0.199 | -0.006 | 0.032 | 1.695 |

| AR Day of events | 20 | -0.025 | 0.052 | 0.005 | 0.019 | 0.972 |

| AR After | 200 | -0.115 | 0.106 | 0.005 | 0.026 | -0.057 |

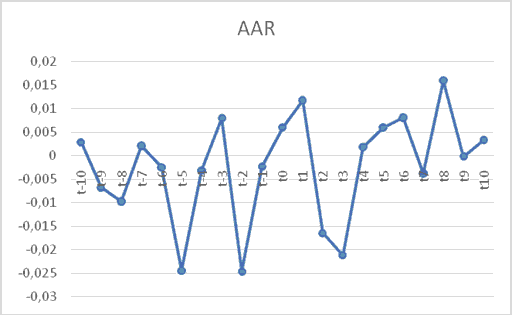

The AAR movement during the 21 day observation period around the DMO announcement is presented in Graph 1. In the period before the announcement of the AAR it was negative at t-8, t-5 and t-2 and had experienced a positive increase at t-3. Whereas in the period after the announcement of the AAR it was negative at t + 2 and t + 3. Then at t + 4 AAR has increased again.

Before testing the market's response to the announcement of the DMO on coal company shares, whether a significant first occurrence is normal. The normality test results are based on Kolmogov-Smirnov (0.140, sign = 0.112) and Shapiro Wilk. (0.948, sign 0.316) is greater than the significance value> 0.05 so it indicates that the data is normally distributed.

Market Responses around DMO Announcements

Testing the market response to the DMO announcement using one sample t-test as presented in Table 2. Significant negative ARR occurred at t-8, t-5, t-2, t + 2 and t + 3. This shows the negative reaction given by the market to the DMO announcement made by the Indonesian government.

| Table 2 Significance Of Average Abnormal Return During The Observation Period |

||||

|---|---|---|---|---|

| t | AAR | CAAR | t-test | (Sig) |

| t-10 | 0.002 | 0.002 | 0.499 | 0.623 |

| t-9 | -0.006 | -0.003 | -1.876 | 0.076 |

| t-8 | -0.009 | -0.013 | -3.249 | 0.004* |

| t-7 | 0.002 | -0.011 | 0.603 | 0.553 |

| t-6 | -0.002 | -0.014 | -0.429 | 0.629 |

| t-5 | -0.024 | -0.038 | -2.393 | 0.027* |

| t-4 | -0.003 | -0.041 | -0.272 | 0.788 |

| t-3 | 0.008 | -0.033 | 1.965 | 0.064 |

| t-2 | -0.024 | -0.047 | -3.011 | 0.007* |

| t-1 | -0.002 | -0.050 | -0.336 | 0.740 |

| t0 | 0.005 | -0.044 | 1.355 | 0.191 |

| t1 | 0.011 | -0.003 | 1.845 | 0.081 |

| t2 | -0.016 | -0.048 | -2.718 | 0.014* |

| t3 | -0.021 | -0.069 | -3.379 | 0.003* |

| t4 | 0.001 | -0.068 | 0.254 | 0.802 |

| t5 | 0.005 | -0.062 | 1.217 | 0.239 |

| t6 | 0.008 | -0.054 | 1.612 | 0.123 |

| t7 | -0.003 | -0.057 | -1.411 | 0.174 |

| t8 | 0.015 | -0.041 | 2.508 | 0.021* |

| t9 | -0.002 | -0.041 | -0.036 | 0.972 |

| t10 | 0.003 | -0.038 | 0.894 | 0.383 |

It is interesting to analyze that significant negative ARR has occurred since eight days before the announcement of the DMO regulating the selling price of coal. This shows that the announcement was not only responded negatively but it was also suspected that information leakage had occurred or the market had taken anticipative action before the rules on knowing coal prices were announced on March 9, 2018. In January 2018 when the Minister of Energy and Mineral Resources had informed the public that he was considering new scheme to include coal prices as a reference in setting the basic electricity tariff in 2018. At the end of February 2018, the Ministry of Energy and Mineral Resources seeks to find a common ground on setting coal prices for domestic electricity needs.

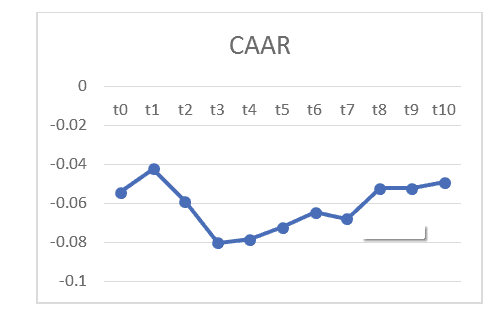

DMO Announcement Overreaction

zTo detect whether there is an overreaction, it is necessary to analyze whether there is a positive and significant AAR around the DMO announcement so that it gives an indication of the price reversal process. In Table 2 it can be seen that AAR is significantly positive at t8 (sign = 0.021). These results can also be seen through the CAAR graph in graph 2 after the announcement of the DMO. Actually the price reversal process has started at t4, t5, t6 where prices have increased even though at t7 it had experienced a slight decrease, but only at t8 prices experienced a significant increase.

DMO announcements are considered bad news and cause excessive market response. This is in line with the research of De Bondt and Thaler (1845) and Fang (2013) who found that market participants tend to overestimate prices when they receive bad information, so investors tend to sell shares excessively and cause an unnatural price decrease. Significant negative reactions after the events only occurred on the second day to the third day indicate that the market only reacted for a moment or short term, and the next day the stock price began to rise. These results are in line with the research of Nam, Pyun & Avard (2001) who found that overreaction can occur in a short span of time.

Conclusion

This study analyzes the market reaction and overreaction in the DMO announcement which regulates the selling price of coal for domestic interests at a price of US $ 70 per metric ton far below the HBA price of US $ 101.86 per metric ton. The study results show that the DMO announcement is considered a bad news market responds negatively to the prices of shares of companies engaged in the Coal sector. In addition, the market also overreacted marked by negative abnormal returns around the day of the event, although it is short-term as evidenced by a price reversal that occurred on the eighth day after the announcement.

The results of the study have academic and practical implications. Academically reinforce empirical evidence that the market does not always respond to an event or announcement only when the event occurs so that it leads to inefficient markets as stated by De Bondt & Thaler (1985). Based on the behavioral finance approach, overreaction occurs because transaction decisions tend to be influenced by psychological factors rather than corporate funds. Whereas in practical terms, policy makers should prioritize fair policy making and conduct public communication before a policy is issued so that it does not cause market shock and even cause overreaction. As for investors, it is advisable not to rush to sell action against government policies, because based on research results it is proven that overreaction is only short term.

References

Ali, R., Ahmad, Z., & Anusakumar, S.V. (2012). Stock market overreaction and trading volume: Evidence from Malaysia. Asian Academy of Management Journal of Accounting and Finance, 7(2), 103–119.

Baker, D.M.A. (2014). The effects of terrorism on the travel and tourism industry. International Journal of Religious Tourism and Pilgrimage, 2(1), 57-67.

Bissoon, R., Seetanah, B., Bhattu-Babajee, R., Gopy-Ramdhany, N., & Seetah, K. (2016). Monetary policy impact on stock return: Evidence from growing stock markets. Theoretical Economics Letters, 6, 1186-1195.

Chen, C.R., & Sauser, D.A. (1997). Is stock market overreaction persistent over time?, Journal & Financial Business and Accounting, 24(1), 27-50.

Clare, A., & Thomas, S. (1995). The Overreaction Hypothesis and the Uk Stockmarket. Journal of Business Finance & Accounting, 22(7), 961–973.

De Bondt, W.F.M., & Thaler, R. (1985). Does the stock market overreact?The Journal of Finance, 40(3), 793–805.

De Bondt, W.F.M., & Thaler, R. (1987). Further evidence on investor overreaction and stock market seasonality. The Journal of Finance, 42(3), 557–581.

DeLong, J.B., Shleifer, A., Summers, L.A., & Wald- mann, R.J. (1990). Noise trader risk in financial markets. Journal of Political Economy, 98(4), 703–38.

Fama, E.F. (1970). Efficient capital market: A review of theory and empirical work. The Journal of Finance, 25(2), 384–417.

Gursida, H., & Indrayono ,Y. (2019) Understanding capital market responses to government economic policy announcements: An event study on Indonesia’s Economic Policy Package. Management Science Letters, 9, 1887–1900

Gul, S., Khan, M.T., Saif, N., Rehman, S.U. (2013). Stock market reaction to political events (evidence from Pakistan). Journal of Economics and Sustainable Development, 4(1), 165-174

Hayashida, M., & Ono, H. (2016). Tax reforms and stock return volatility: The case of Japan. Journal of Asian Economics, 45(3), 1-14.

Fang, Y. (2013). Pengaruh Variabel Return On Assets, Return On Equity, Net Profit Margin and Earning Per.

Kaestner, M. (2011). Anomalous price behavior following earnings surprises: Does representativeness cause overreaction? SSRN Electronic Journal.

Kelikume, I., & Muritala, O. (2019). The impact of changes in oil price on stock market: Evidence from Africa, International Journal of Management, Economics and Social Sciences, 8(3), 169 – 194.

MacKinlay, A.C. (1991). Event studies in economics and finance. Journal of Economic Literature, 35(1), 13-39.

Manzoor, H. (2013). Impact of pak-us relationship news on kse-100 index. Basic Research Journal of Business Management and Accounts, 2(2), 24-29.

Michel, J.S. (2017). Investor overreaction to analyst reference points. Journal of Behavioral Finance, 18(3), 329–343.

Najaf, R. (2017). Effect of terrorism on the international business in Pakistan. Journal of Accounting & Marketing, 6(1), 1-3.

Nam, K., Pyun, C.S., & Avard, S.L. (2001). Asymmetric reverting behavior of short-horizon stocks returns: An evidence of stock market overreaction. Journal of Banking and Finance, 25, 807–824

Okpara, G.C. (2018). Monetary policy and stock market returns: Evidence from Nigeria. Journal of Economics, 1(1), 13-21.

Smith, G. (2016). Overreaction of Dow stocks Gary Smith. Financial Economics, 4, 1251831.

Sirait, R.S., Tiswiyanti, W, & Mansur, F. (2012). The impact of the change of the minister of finance of the republic of Indonesia in 2010 on the Abnormal Return of Banking Companies Listed on the IDX. e-Jurnal Binar Accounting, 1(1), 14-22.

Spyrou, S., Kassimatis, K., & Galariotis. (2007). Short-term overreaction, under reaction and efficient reaction: evidence from the London Stock Exchange. Applied Financial Economics 17(3), 221-23.

Trisnayanti, N.P.M., & Noviari, N. (2018). Market Reaction to tax amnesty policy at the time of announcement, Period I, Period II, and Period III. E-Journal of Accounting, 23, 296.

Widyasari, T.N., Suffa, I.F., Amalia, N., & Praswati, A.N. (2018). Analysis of the capital market reaction to the 2016 Amanesti Pakjak (Indonesian Capital Market Efficiency Study). Journal of Business Administration, 6(2), 137.

Yull, E., & Kirmizi. (2012). Overreaction hypothesis analysis and the effect of firm size, Bid-Ask Pread, and Stock Liquidity on the Price Reversal Phenomenon (Empirical Study on Companies listed on the IDX). Pekbis Journal, 4(1), 1–16.

Received: 23-Nov-2021, Manuscript No. asmj-21- 8385; Editor assigned: 25- Nov -2021, PreQC No. asmj-21- 8385 (PQ); Reviewed: 30- Nov -2021, QC No. asmj-21- 8385; Revised: 11-Dec-2021, Manuscript No. asmj-21- 8385 (R); Published: 05-Jan-2022