Research Article: 2022 Vol: 28 Issue: 3

Free Economic Zones in the Republic of Uzbekistan and Ways to Attract Investment in them

Ruzibaeva Nargiza Khakimovna, Samarkand Economics And Service University

Khotamkulova Madina Sanjar kizi, Samarkand Economics And Service University

Citation Information: Khakimovna, R.N., & Sanjar kizi, K.M. (2022). Free economic zones in the republic of Uzbekistan and ways to attract investment in them. Academy of Entrepreneurship Journal, 28(3), 1-7.

Abstract

This article analyzes the Republic's Free Economic Zones (FEZs) and provides an in-depth analysis of the role of investment in this area by carrying several studies. In addition, a number of suggestions have been made for further development of this sector.

Keywords

Free Economic Zones, Economy, Investment, Technology, Investment Project, Investor, Network.

Introduction

The existence and further increase of the number of free economic zones is important in stabilizing the economy and ensuring the development of all sectors in the country. As a result of the policy pursued by the Government of the Republic of Uzbekistan, understanding the significant role of the FEZs in the national economy, many easements and possibilities have been created in this area. Following decrees and resolutions can be the proof of above given statements: Decree of the President of the Republic of Uzbekistan No. PD-4931 of January 12, 2017 "On the establishment of free economic zones" Urgut "," Gijduvan "," Kokand "and" Hazarasp "; On May 3, 2017, the President of the Republic of Uzbekistan signed a decree “On Nukus-farm”, “Zomin-farm”, “Kosonsoy-farm”, “Syrdarya-farm”, “Boysun-farm”, “Bostanliq-farm” and Decree PD-5032 "On the establishment of free economic zones" Parkent-farm; Resolution of the President of the Republic of Uzbekistan dated October 25, 2017 No PP-3356 "On additional measures to increase the efficiency of free economic zones and small industrial zones"; Resolution of the President of the Republic of Uzbekistan dated December 2, 2017 No PP-3422 "On measures to improve the transport infrastructure and diversify foreign trade routes in 2018-2021"; Decree of the President of the Republic of Uzbekistan dated December 5, 2017 "On the establishment of a free tourist zone Charvak.

Literature Review

According to Khujamkulov (2019) since the second half of the twentieth century, the free economic zone (FEZ) has been an integral part of the international economy. In world economic relations, the free economic zone is considered as a factor that accelerates economic growth due to the intensification of international trade, investment mobilization, and employment growth.

It can be stated that there is a growing interest in the organization and development of FEZs around the world. In particular, at present, in 12 out of 14 regions of the Republic of Uzbekistan, 21 FEZs have been established and their legal framework has been developed. World experience shows that FEZs, along with attracting national and foreign investment, introduce new, energy-efficient, modern high technologies into production, use advanced foreign management and marketing practices, and replace the domestic market with imports in exchange for new products and encourages the replenishment of the country's export potential, development of foreign trade, creation of new jobs in the regions, increase in foreign exchange earnings, increase in gold and foreign exchange reserves, economic growth, national currency strengthening the stability of the economy, increasing state budget revenues and, ultimately, the integration of the national economy into the world economy and the further strengthening of international competitiveness (Rybakov, 2006; Vakhabov et al., 2010) (Table 1).

| Table 1 Definitions Of The Concept Of Fez By Several Scholars |

||

|---|---|---|

| Papava (2007) | In the traditional sense, FEZs are the sovereign territory of a state where foreign goods can be stored, sold or purchased without any duties of customs | Free trade zones were emphasized |

| Ribakov et al. (2006) | FEZs are those parts of a country that are considered outside of the customs territory and are exempt from customs duties and taxes. | Free trade zones emphasized |

| Vakhabov et al. (2010) | FEZ is a specially allocated part of the country with preferential customs, currency, tax, and visa and labor regimes. | Privileges emphasized |

| Igoshin (2000) | FEZs are such a part of the national economic system that they enjoy special privileges and incentives that do not apply in other parts of the country, and their essence is reflected in the preferential customs and tax systems. | Privileges were emphasized |

| Danko & Okrut (1998) |

The FEZ is a separate organization of the economy that is artificially organized by the state and is part of the national economy, while being radically different economically. | Legal privileges were emphasized |

Methodology of The Research

Several practical methods have been used in the studies. These include economic statistics, induction, deduction, and graphical research. Statistical dates have been made based on the official websites of the Republic and the world.

Results

To gain a deeper understanding of the nature of the FEZ and its economic role, several studies have been conducted and appropriate ways to attract investment in this area have been considered Papava (2007).

Based on the research, it can be said that the establishment of the FEZ can help to industrialize one or another region of the country, alleviate the crisis on a national scale, and open a wide range of investment opportunities. The specific appearance and features of the FEZ location in the country can be illustrated by Figure 1:

In addition, a comprehensive analysis of the FEZs located in the country and their existing leading sectors were identified. It should be noted that a large-scale work is being carried out to attract foreign investment in the FEZ of the Republic, especially in order to increase its efficiency, to attract investment in existing and developing sectors in the regions. The above points can be clearly seen in the following Table 2:

| Table 2 Leading Sectors Of The Republic's Economic Potential And Priority Areas For Foreign Investmen |

||

|---|---|---|

| Regions | Existing leading and advanced networks | Priority sectors for foreign investment |

| Andijan | Agriculture, automobile industry, machinery, textiles, tourism | Textile, silk, chemistry, horticulture |

| Bukhara | Oil and gas, textiles, construction materials, tourism | Textile, construction materials, animal husbandry |

| Fergana | Agriculture, oil and gas, chemistry (petro chemistry), textile, machinery, food industry, construction materials, tourism |

Textile, silk, food industry, gardening |

| Jizzakh | Agriculture, chemistry, mechanical engineering | Construction materials, food industry, chemicals, horticulture, fisheries |

| Republic of Karakalpakstan | Power engineering, petro chemistry, chemistry, mining and metallurgy | Textile, fishery |

| Khorezm | Agriculture, light industry, food industry, construction materials, machinery, tourism | Textile, fishery |

| Namangan | Agriculture, light industry, textiles, machinery | Textile, silk, construction materials, food industry |

| Navoi | Mining and metallurgy, chemistry, construction materials, machinery, textiles | Chemistry, construction materials, energy, textiles |

| Samarkand | Agriculture, national consumption production of goods, textiles, machinery, building materials, chemicals, electrical engineering, tourism |

Textiles, food industry, chemistry, gardening |

| Syrdarya | Agriculture, food industry, textile, light industry, tourism |

Textiles, furniture, pharmaceuticals, power engineering |

| Surkhandarya | Agriculture, oil and gas, construction materials, light industry, food, machinery, tourism | Textiles, food industry, Mining industry |

| Tashkent city | Textiles, light industry, chemicals, pharmaceuticals, construction materials, tourism, food, machinery | Electrical engineering, mechanical engineering, textiles, construction materials, chemistry, pharmaceuticals |

| Tashkent region | Light industry, non-ferrous metals, construction materials, chemicals, fuel and energy | Food industry, chemistry, metallurgy, mining, power engineering, pharmaceuticals |

| Kashkadarya | Agriculture, textiles, oil and gas, construction materials, machinery, light industry, food industry | Textiles, food industry, Mining, poultry farming |

It should be noted that the development of investment activity in the national economy, the scale, direction and effectiveness of attracting domestic and foreign investment, directly depends on the investment climate. For this reason, mutual scientific discussions continue through the views and unique approaches of various economists and experts to study, elucidate and substantiate the essence of this economic term, which, in turn, attracts the attention of those who are interested in this field (Raimjonova, 2013).

The investment climate should be defined in a general and unified context, regardless of whether it is organized and implemented in the FEZ or in a particular region of the country, as well as in a separate sector or at the macro level. There are various interpretations of the content of the investment climate in the economic literature. This shows that there is no single definition. For this reason, the study of its content and significance is still relevant today.

Accordingly, in order to shed light on the economic meaning of this term, the investment environment can be defined as follows based on the study of definitions given by some economists: economic, social, political, legal, environmental, a set of conditions aimed at ensuring security. Simply put, the investment climate is a reality that embodies a set of opportunities and conveniences that can be realized in an investment relationship. The state of the investment climate requires a legal framework and its foundations, a quality structure of legislation and compliance with them. At the same time, the investment climate, which reflects the conditions for investment activities, is as follows:

1. Investment activity;

2. Investment attractiveness (investment potential and level of investment risk).

The structure of the investment climate is shown in Figure 2 below. Investment attractiveness is the evaluation of investments in a country, industry or a particular enterprise in terms of profitability, development prospects and level of investment risk.

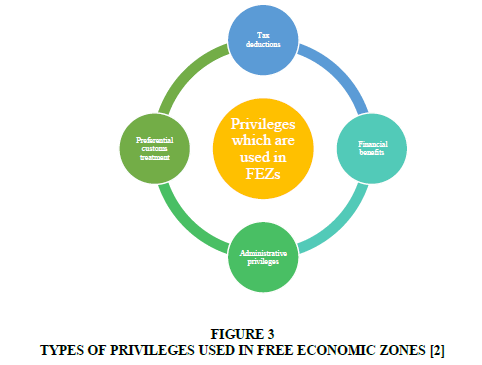

1. Preferential customs treatment includes the introduction of a special customs regime (reduction or abolition of export and import duties) in the FEZ area and the application of a simplified procedure for foreign trade operations Figure 3.

Figure 3:Types Of Privileges Used In Free Economic Zones [2]

2. Tax deductions include the norms of tax incentives related to the activities of entrepreneurs in a certain direction and clearly defined types of production. These benefits include tax holidays (five to twenty years), VAT exemption, local tax exemptions, profits, real estate, property taxes, income taxes on foreign workers, and the transfer of profits full or partial exemption from taxes on transfers.

In some cases, there are other benefits for foreign investors, such as investment loans and investment subsidies. Investment loans consist of additional income tax deductions (10-50%) for fixed assets and are applied after the end of the grace period. Investment subsidies are monetary subsidies provided to new investors on a non-refundable basis. These subsidies depend on the amount of capital investment and are usually given to low-profit enterprises with limited financial resources.

3. Financial benefits include various forms of subsidies. For example, lower tariffs for utilities, discounts on rent for the use of land and production facilities, soft loans, etc. In addition, in countries where many FEZs are successful, not only preferential lease of land, but also free sale to foreigners is used. It is perceived by foreigners as an example of serious interest on the part of the host country. This is seen as an important benefit for foreign investors

4. Administrative privileges are provided by the territorial administration for the purpose of registration of the enterprises, simplification of the procedure of entry and exit of foreign citizens and rendering of various services to the enterprises. In most countries where MIHs are established, investors have been provided with “one-stop-shop” or “24-hour” services, which allow for quick issuance of permits and licenses (Table 3).

| Table 3 Different Aspects Of Fezs Established In Developed And Developing Countries |

||

|---|---|---|

| Indicators | Developed countries | Developing countries |

| To be established core types of FEZs | Free trade zones, Technoparks |

Export production zones |

| Objectives | Strengthening foreign economic relations | Attracting foreign capital |

| Capital structure of FEZs | More national private capital |

More foreign private capital |

As can be seen from the above given table that the establishment of FEZs in developed countries is more comprehensive than in developing countries, and therefore they can have a significant impact on economic development.

Conclusion

Summing up, the FEZ is one of the important factors in the development of the country's economy and ensuring economic stability, and the attention to this area in our country is growing from year to year. It should also be noted that the following proposals are made for the further development of the FEZ and the attraction of investments to further increase the share of this sector in the national economy:

1. Improving the economic efficiency of existing free economic zones.

2. Ensuring the creation of projects to further increase the investment attractiveness of free economic zones and further improve the tax policy applied in them.

3. Ensuring the implementation of investment projects by government that encourage further development and economic stability of the Republic, and on this basis to create new jobs and increase incomes.

References

Khujamkulov, D.Y. (2019). Free economic zones. Textbook–T Economy, 2019y. 8-9.

Papava, V. (2007). The Immortal Idea of a Free Economic Zone/Georgian Foundation for Strategic and International Studies.

Rybakov, S.A. (2006). Special economic zones in Russia. Nalogovye lgoty and preimushchestva. S.A. Rybakov, N.A.Orlova. - M: Vershina, 248.

Vakhabov, A.V., Khajibakiev, Sh.X., & Muminov, N.G. (2010). Foreign investment. Study guide. T.: Finance, 180.

Igoshin, N.V. (2000). Investments. Organization, management and financing. Textbook for universities. M Finansy, YuNITI, 242.

Danko, T., & Okrug, Z. (1998). Free Economic Zones of the world: Textbook. Russian Economics Academy named after G.V. Plexanov. M .: Infra-M 168.

Raimjonova M.A. (2013). Attracting investments in free economic zones in Uzbekistan: theoretical foundations, current status and prospects. - T Extremum-press publishing house.

Received: 02-Feb-2022, Manuscript No. AEJ-22-10754; Editor assigned: 04-Feb-2022, PreQC No. AEJ-22-10754(PQ); Reviewed: 18-Feb-2022, QC No. AEJ-22-10754; Revised: 24-Feb-2022, Manuscript No. AEJ-22-10754(R); Published: 28-Feb-2022