Research Article: 2021 Vol: 25 Issue: 6

Free Cash Flow, Leverage and Audit Fees

Sandra Alves, GOVCOPP, University of Aveiro

Citation Information: Alves, S. (2021). Free Cash Flow, Leverage and Audit Fees. Academy of Accounting and Financial Studies Journal, 25(6), 1-11.

Abstract

This study examines the relationship between free cash flow (FCF) and audit fees using the FCF theory of Jensen (1986). Additionally, we examine whether the level of leverage moderates the relationship between FCF and audit fees. This study uses OLS regression model to examine the effect of FCF on audit fees and to test whether leverage levels moderate that relationship for samples of Portuguese and Spanish listed companies for the period 2010-2018. Consistent with the FCF hypothesis of Jensen (1986), this study suggests that firms with high FCF pay more audit fees. Further, the results also suggest that the positive impact of FCF on audit fees progressively reduces at higher levels of leverage. This study contributes to the literature by examining how FCF affects the audit pricing and by shedding light on the mediating effect of leverage on the relationship between FCF and audit fees.

Keywords

Free Cash Flow, Audit Fees, Leverage and Agency Theory.

Introduction

FCF is cash flow in excess of that required to fund all of a firm’s projects that have positive net present values when discounted at the relevant cost of capital (Jensen 1986, 1989). Ideally, managers of firms with FCF are expected to invest excessive cash in profitable investment in order to generate high returns to shareholders. However, the decisions of managers may not always be in the interests of shareholders. Really, Jensen (1986, 1989) suggests that managers of high FCF firms are more likely involved in non-value-maximizing activities. This non-value maximizing behavior includes overinvestment due to investment in projects with negative net present value, excessive consumption of perquisites, misappropriation of assets, and salary enhancement, which result in increased agency costs (Amihud & Lev, 1981; Jensen 1986; Jensen & Meckling, 1976; Christie & Zimmerman 1994; Rediker & Seth 1995; Cai, 2013; Chen et al., 2016; Wang, 2010). The non-value maximizing behavior eventually increase inherent risks and will result in higher audit fees. Accordingly, auditors of high FCF firms are likely to assess higher levels of inherent risk that leads to higher audit effort and resulting higher fees (Gul & Tsui, 1998).

Previous studies suggest that the companies with high FCF pay higher audit fees (Griffin et al., 2010; Gul & Tsui, 1998, 2001). This higher audit fees due to higher FCF may however be mitigated through the use of effective governance structures, such as the leverage which will act to reduce the amount of FCF available to corporate managers. According to Jensen (1986), leverage is helpful for reducing FCF in the hands of company managers as well as reducing agency cost. The interest and principal payments reduce the cash available to management for non-optimal spending. When a firm employs debt financing, it undergoes the scrutiny of lenders and is often subject to lender-induced spending restriction (Jensen, 1986). Therefore, leverage reduces the agency costs of FCF by reducing the cash flow available for spending at the discretion of managers. Thus, the positive association between FCF and audit fees is expected to be weaker for firms with high leverage.

Using a sample of non-financial listed Portuguese and Spanish firms-year from 2011 to 2018, this study aims to test whether audit fees is higher for firms with more FCF. Additionally, this study examines how leverage influence the impact of FCF on audit fees.

The study makes some contributions to the existing literature. First, although many studies have examined the determinants of audit fees mainly in the US or UK contexts, the relationship between FCF and audit fees in Portugal and Spain has not been studied. Second, to our knowledge, this study is also the first to investigate the role of leverage on the association between FCF and audit fees in the Portuguese and Spanish contexts. Using data from Portuguese and Spanish listed firms, our paper fills these two gaps in the literature. Third, the findings of this study can provide useful information mainly for shareholders and auditors whether FCF affects audit fees, and especially whether leverage moderate the relationship between FCF and audit fees. Finally, findings based on Portuguese and Spanish data also help build a more expansive international understanding of the relation between FCF, audit fees and leverage debate.

Literature Review and Testable Hypotheses

Free Cash Flow and Audit Fees

Firms with a large amount of FCF are normally affected with major agency problems (Lanhane & Mahakud, 2016; Wang, 2010). Jensen (1986, 1989) argues that managers of firms with high FCF are more likely to act opportunistically and engage in non-value maximizing activities. Thus, managers of firms with high FCF act opportunistically for personal gain, and tend to get involved in unprofitable projects, overinvestments, misuse the funds and earnings management. In fact, firms with high FCF tend to overinvest (Richardson, 2006; Shi, 2019; Yeo, 2018; Zhang et al., 2016), reduce disclosure quality (Cheung & Jiang, 2016), to exhibit poor future profitability (Chung et al., 2005) to act sub-optimally in acquisition (Lang et al., 1991) and engage in earnings management (Astami et al., 2017; Friska et al., 2019; Jones & Sharma, 2001; Raeisi & Vaez, 2016; Rusmin et al., 2014; Toumeh et al., 2020; Yendrawati & Asy’ari, 2017). This may result in a perceived high audit risk for auditors. High audit risk will inevitably lead to increased audit effort and to a higher audit fees.

Therefore, Jensen’s FCF problem is likely to influence audit fees. Auditors are likely to assess firms with high FCF and “non-value-maximizing managers” as having high levels of inherent risk. Such risk assessment is likely to influence their planning of audit efforts as well as the audit fees. Griffin et al. (2010) and Gul & Tsui (1998, 2001) find that high FCF firms have higher audit fees. In the same sense, Gleason et al. (2017) and Salehi et al. (2020) document that auditors perceive excess cash holdings as a risk factor, and thus, they are likely to put more effort to cover audit risk, which ultimately results in higher audit fees.

Accordingly, we expected that high FCF will increase audit risk and, by extension, lead to an addiction in audit effort and hence in increased audit fees. Hence, under Jensen’s (1986) FCF hypothesis it is expected that firms with high FCF pay more audit fees:

H1: The level of FCF will be positively associated with audit fees.

The Role of Leverage in the Relationship between Free Cash Flow and Audit Fees

Agency theory suggests that leverage can act as a self-disciplining internal governance mechanism to mitigate the agency conflict of manager-shareholders (Grossman & Hat, 1982; Jensen, 1976, 1986). Leverage limits management’s engagement in self-dealing activities (Ghorbani & Salehi, 2021; Jensen, 1986; Stulz, 1990; Harvey et al., 2004). The presence of leverage causes the management to pay out cash flow as interest and repayments, which reduce the cash available to management for non-optimal spending. Therefore, leverage is expected to minimize agency costs of FCF by reducing the cash flow available for spending at the discretion of managers (Jensen, 1986). Indeed, previous studies support the role of leverage as a mechanism which reduces the overinvestment problem by decreasing the FCF under managerial discretionary control (Ahn et al., 2006; Ding et al., 2020; D’Mello & Miranda, 2010; Fernandez, 2011; Firth et al., 2008; Harvey et al., 2004; Park & Jang, 2013; Trong & Nguyen, 2021; Yeo, 2018).

Since debt mitigates the amount of FCF, it reduces the amount of liquid resources under managers’ control, increases the monitoring activity by financial markets and commits future cash flows to debt-related payments. Thus, in the presence of high FCF, leverage can help inhibit the overinvestment problem and better monitoring tasks from outside parties (Jensen, 1986; Al-Najjar & Kilincarslan, 2019; Cho et al., 2019; Yeo, 2018). So, leverage may mitigate the impact of FCF problem on audit fees.

As referred previously, auditors are likely to charge higher fees in response to the higher audit risk associated with the agency problems in firms with high FCF. Leverage can alleviate the agency problems of FCF by requiring payments and acting as a monitoring mechanism. Consequently, leverage can mitigate the non-value-maximizing activities conducted by managers of firms with high FCF. Thus, the positive high FCF/audit fees association is expected to be weaker for firms with high leverage than for firms with low leverage. Griffin et al. (2010) and Gul & Tsui (1998) find that leverage interacts with high FCF firms to reduce audit fees.

So, in the presence of high FCF, we expect that, when leverage is high, auditors will charge lower audit fees than when leverage is low. This leads to our second hypothesis:

H2: Leverage moderates the relationship between FCF and audit fees

Sample and Research Design

Sample Selection

Our sample includes all the non-financial listed firms of Euronext Lisbon and the Madrid Stock Exchange for the period 2010-2018. The data used in this paper come from the following sources. The Amadeus, a database managed by Bureau Van Dijk and Informa D&B, S.A., the Portuguese Securities Market Supervisory Authority [Comissão de Mercado de Valores Mobiliários (CMVM)] and the Spanish Securities Market Supervisory Authority [Comisión Nacional del Mercado de Valores (CNVM)], which provide the accounting information from annual accounts.

Table 1 details how the selection criteria resulted in a final total unbalanced panel of 934 firm-year observations over the 2010 to 2018 period.

| Table 1 Sample Selection Criteria During the Years 2010-2018 | |||

| Sample selection | Number of firm years | ||

| Portugal | Spain | Total | |

| Non-financial firms listed | 483 | 1 | 1.483 |

| (-) Football club companies | -36 | - | -36 |

| (-) Firms with missing data | -135 | -378 | -513 |

| Number of firm-year observations in the final sample | 312 | 622 | 934 |

Research Design

Measuring audit fees

Consistent with recent studies on audit fees (e.g. Barroso et al., 2018; Ghafran & O’Sullivan, 2017; Stanley, 2011), our dependent variable is the natural log of audit fees (Audit_Fee). This variable considers the total fee paid by the company for audit services during the year.

Measuring free cash flow

Following prior studies (Astami et al., 2017; Bhundia, 2012; Cheung & Jiang, 2016; Toumeh et al., 2020), this study uses the model of Lehn & Poulsen (1989) to measure the amount of free cash flow (Free_Cash). Thus, Free_Cash is measured by operating income before depreciation minus expenses such as tax expense, interest expense and dividend (Lehn & Poulsen, 1989).

Control variables

Based on earlier research on audit fees, we also include some control variables to isolate other factors that may influence the audit fees. Audit risk, Aud_Risk, is included to control for the potential correlation between audit risk and audit fees, with positive expected coefficient (Chan et al., 1993; Gandía & Huguet, 2019; Habib et al. 2018; Stanley, 2011). We include Big4, Big4, to control for the big audit firm effect on audit fees. Prior research documents that Big audit firms charge high audit fees (Fleischer & Goettsche, 2012; Francis, 2004; Gandía & Huguet, 2019; Mohammadi et al., 2018; Shailer et al., 2004; Simunic, 1980; Tee et al., 2017). We also include firm size, Size, because larger firms are normally more complex and difficult to control, which require more audit effort, resulting in higher audit fees (Al-Najjar, 2018; Chen et al., 2005; Gandía & Huguet, 2019; Mohammadi et al., 2018; Palmrose, 1986; Simunic, 1980).

Regression Model

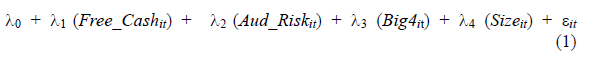

To test the hypothesis 1, the impact of FCF on audit fees, it is estimated the following OLS regression:

Audit_Feeit=

Where:

Audit_Feesit = is the natural log of audit fees paid by the firm for audit services during the year;

Free_Cashit = is measured by operating income before depreciation minus expenses such as tax expense, interest expense and dividend divided by market value of equity of firm i for period t;

Aud_Riskit = is the sum of inventories and accounts receivables divided by total assets for firm i for period t;

Big4it = value of 1 if firm is audited by a Big 4 audit firm and 0 otherwise;

Sizeit = logarithm of total assets of firm i for period t.

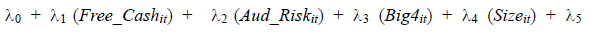

To test hypothesis 2, the effect of the level of leverage on the relationship between FCF and audit fees, it is expanded equation (1) by including the leverage level and an interaction term between Free_Cash and Leverage level:

Audit_Feeit=

Where:

Leverageit = ratio between the book value of long-term debt and the total assets;

Free_Cashit*Leverageit = Interaction variable of FCF and leverage

Results and Discussion

Descriptive Statistics and Correlations

Table 2 presents the sample descriptive statistics for the variables used in this research.

| Table 2 Summary of Descriptive Statistics | ||||

| Mean | Median | Min. | Max. | |

| Panel A – Portugal: Number of observations: 312 | ||||

| Audit_Fee (th EUR) | 640 | 263 | 0.492 | 8.325 |

| Free_Cash | 0.103 | 0.071 | -5.987 | 3.015 |

| Leverage | 0.471 | 0.462 | 0.001 | 2.517 |

| Aud_Risk | 0.049 | 0.003 | 0 | 0.609 |

| Big4 | 0.721 | 1 | 0 | 1 |

| Size (th EUR) | 1.322 | 144 | 0.3 | 16.345 |

| Panel B – Spain: Number of observations: 622 | ||||

| Audit_Fee (th EUR) | 1.535 | 256 | 0.4 | 30.809 |

| Free_Cash | 0.164 | 0.086 | -7.254 | 4.122 |

| Leverage | 0.6 | 0.606 | 0.003 | 3.721 |

| Aud_Risk | 0.188 | 0.16 | 0 | 0.698 |

| Big4 | 0.811 | 1 | 0 | 1 |

| Size (th EUR) | 4.969 | 514 | 0.306 | 95.167 |

Regarding Portugal, Panel A in Table 2 shows that the mean of audit fee (Audit_Fee) is about EUR 640 million with a minimum of EUR 492 thousand and a maximum of EUR 8.325 million. While Free_Cash, ranges between about 5.987 and 3.015, the mean and median are about 0.103 and 0.071. Leverage variable represents on average 0.471 of the to tal assets of the company (with a median of 0.462). The mean (median) audit risk is 4.9% (0.3%), with a minimum of 0.0% and a maximum of 60.9%. Big 4 auditors are used by 72.1% of the sample firms. Panel A in Table 2 also shows that the mean of firm size ( Size) is about EUR 1.322 million with a minimum of EUR 300 thousand and a maximum of EUR 16.345 million.

Regarding Spain, Panel B in Table 2 shows that the mean of audit fee (Audit_Fee) is about EUR 1.536 million with a minimum of EUR 400 thousand and a maximum of EUR 30.809 million. The mean (median) for free cash flow (Free_Cash) is 0.164 (0.086), with a minimum of -7.254 and a maximum of 4.122. Leverage variable represents on average 0.6 of the total assets of the company (with a median of 0.606). The mean (median) audit risk is 18.8% (16%), with a minimum of 0.0% and a maximum of 69.8%. Big 4 auditors are used by 81.1% of the sample firms. Panel B in Table 2 also shows that the mean of firm size (Size) is about EUR 4.969 million with a minimum of EUR 306 thousand and a maximum of EUR 95.167 million

Regression Results

Table 3 presents the results from OLS regression for the equation 1 (hypothesis 1) and Table 4 presents the results for the equation 2 (hypothesis 2).

| Table 3 OLS Regression Results | ||||||

| Portugal | Spain | Total sample | ||||

| Dependent variable | Audit_Fee | Audit_Fee | Audit_Fee | |||

| Independent variables | Coefficient | t-values | Coefficient | t-values | Coefficient | t-values |

| Constant | 0.015 | 0.632 | 0.007 | 1.012 | 0.150 | 0.733 |

| Free_Cash | 0.081 | 2.196** | 0.165 | 2.109*** | 0.201 | 3.067*** |

| Aud_Risk | 0.193 | 1.093 | 0.392 | 2.453** | 0.486 | 3.565*** |

| Big4 | 0.289 | 1.812* | 0.193 | 2.012** | 0.235 | 2.209*** |

| Size | 0.435 | 3.744*** | 0.565 | 3.978*** | 0.786 | 5.171*** |

| Observations | 312 | 622 | 934 | |||

| R-squared | 29.24% 22.281*** |

45.31% 35.919*** |

55.30% | |||

| F-statistic | 49.165*** | |||||

|

Table 4 OLS Regression Results |

||||||

| Portugal | Spain | Total sample | ||||

| Dependent variable | Audit_Fee | Audit_Fee | Audit_Fee | |||

| Independent variables | Coefficient | t-values | Coefficient | t-values | Coefficient | t-values |

| Constant | 0.036 | 0.572 | 0.035 | 1.511 | 0.050 | 0.541 |

| Free_Cash | 0.081 | 2.833** | 0.102 | 3.037*** | 0.255 | 3.691*** |

| Aud_Risk | 0.087 | 0.453 | 0.240 | 2.776*** | 0.272 | 3.075*** |

| Big4 | 0.298 | 1.890* | 0.344 | 2.408** | 0.346 | 2.354** |

| Size | 0.572 | 3.197*** | 0.656 | 3.572*** | 0.706 | 3.960*** |

| Leverage | 0.477 | 1.773* | 0.287 | 2.089** | 0.366 | 2.209** |

| Free_Cash*Leverage | -0.563 | -2.582** | -0.219 | -3.488*** | -0.391 | -3.094*** |

| Observations | 312 | 622 | 934 | |||

| R-squared | 38.52% 31.755*** |

55.70% 47.063*** |

74.32% | |||

| F-statistic | 58.971*** | |||||

Tables 3 and 4 present the results from OLS regression for the equations 1 and 2. To both Portugal and Spain, the results show that FCF is positively related to audit fees. The findings support the hypothesis 1, which predicts a positive relationship between FCF and audit fees. Therefore, the results of this study support the Jensen’s (1986) FCF hypothesis. Accordingly, audit fees are higher among companies with high FCF. The results are also consistent with the argument that auditors charge higher fees in response to then higher inherent risk associated with the non-value-maximizing activities of managers of high FCF firms.

One other explanation of the positive relationship between FCF and audit fees is that auditors may also charge higher audit fees in high FCF firms, because those clients can pay more (available excess cash). From the demand side, one alternative explanation of the positive relationship between FCF and audit fees is that shareholders may demand for higher quality audits to mitigate the agency problems of FCF (Griffin et al., 2010; Gul & Tsui, 1998, 2001).

As in other studies (Joshi & AL-Bastaki, 2000; Tee et al., 2017; Al-Najjar, 2018), the coefficient for Leverage is positive and significant, suggesting that high leverage pays more audit fees. This result is consistent with the premise that high levered firms can rise the likelihood of financial distress, which increases audit risk. Thus, the higher the level of leverage, the more the audit risk and thus higher audit fees.

To Portugal, Spain and total sample, the coefficient on Free_Cash*Leverage is negative and statistically significant, suggesting that leverage affects the relationship between FCF and audit fees. Thus, the positive relationship between FCF and audit fees is attenuated when leverage is higher. This suggest that leverage acts more as a self-disciplining internal governance mechanism to mitigate the agency conflict of manager-shareholders in high FCF firms than in low FCF firms. Thus, auditors of high FCF/high leverage firms assessing lower levels of inherent risk and, therefore, supplying lower levels of audit effort (and lower audit fees) than auditors of high FCF/low leverage firms.

Overall, this study suggests that (1) FCF intensifies the agency problem (higher audit fees); and (2) in the presence of high FCF, leverage can act as a monitoring mechanism to alleviate the agency cost of FCF.

Regarding the control variables, audit risk, is positively and significantly associated with audit to Spain, suggesting that higher risk firms pay higher audit fees (Habib et al. 2018; Stanley, 2011). Big 4 is positively and significantly associated with audit fees, which is in line with the argument that Big audit firms charge high audit fees (Barroso et al., 2018; Francis, 2004; Mohammadi et al., 2018; Shailer et al., 2004). As in other studies (Fleischer & Goettsche, 2012; Ghafran & O’Sullivan, 2017; Joshi & AL-Bastaki, 2000; Mohammadi et al., 2018; Sellami & Cherif, 2020), to both Portugal and Spain, the results suggest that larger firms tend to pay greater audit fees.

Further analysis

According to the results in the table 4, the coefficient for Leverage is positive and significant, suggesting that high leverage pays more audit fees. However, the coefficient on Free_Cash*Leverage is negative and statistically significant, suggesting that the positive relationship between FCF and audit fees progressively reduces at higher levels of leverage.

Thus, further analyses are performed to compare (1) the impact of leverage on audit fees for the low and high FCF groups and (2) the impact of FCF on audit fees for the low and high leverage groups. To compare the impact of leverage on audit fees for the low and high FCF groups, we divide the sample into two groups, according to whether their level of FCF is greater or less than the overall mean of FCF variable. Firms with high FCF are coded as “1” if its level of FCF is more than the overall mean of FCF variable, and “0” otherwise. Thus, we re-estimate the equation (1) for each of the sub-samples (high FCF and low FCF). Table 5 reports the results of the regression of equation (1) of the sample firms split between firms with high FCF and firms with low FCF.

| Table 5 Regressions Results: High FCF Versus Low FCF |

||||||||||||

| Portugal | Spain | Total sample | ||||||||||

| Audit Fee | Audit Fee | Audit Fee | ||||||||||

| Dependent variable | High FCF | Low FCF | High FCF | Low FCF | High FCF | Low FCF | ||||||

| Independent variables | Coefficient | t-values | Coefficient | t-values | Coefficient | t-values | Coefficient | t-values | Coefficient | t-values | Coefficient | t-values |

| Constant | 0.041 | 0.218 | 0.051 | 0.394 | 0.064 | 0.468 | 0.080 | 0.502 | 0.097 | 0.672 | 0.079 | 0.498 |

| Leverage | -0.071 | -2.038*** | 0.109 | 1.890* | -0.105 | -2.823*** | 0.152 | 2.308** | -0.178 | -3.037*** | 0.189 | 2.592*** |

| Control variables | Yes | Yes | Yes | Yes | Yes | Yes | ||||||

| R-squared F-statistic |

26.57% 21.463*** |

23.96% 18.982*** |

37.73% 31.601*** |

31.46% 28.879*** |

43.70% 38.063*** |

39.81% 33.031*** |

||||||

The results do not differ from results presented previously in Table 4. The results presented in Table 5 suggest that, for the firms with high FCF, the coefficient of Leverage is negative and significant, whilst for firms with low FCF the coefficient is positive and significant. Results from table 6 suggest that, for the firms with high leverage, the coefficient of Free_Cash is negative and significant, whilst for firms with low leverage the coefficient is positive and significant. The findings, therefore, corroborate that, in the presence of high FCF, firms with high leverage appear to decrease the agency cost of FCF. Thus, in the presence of high FCF, a higher leverage may be beneficial to firm, because leverage reduces the FCF under managerial discretionary control.

| Table 6 Regressions Results: High Leverage Versus Low Leverage | ||||||||||||

| Portugal | Spain | Total sample | ||||||||||

| Audit Fee | Audit Fee | Audit Fee | ||||||||||

| Dependent variable | High Leverage | Low Leverage | High Leverage | Low Leverage | High Leverage | Low Leverage | ||||||

| Independent variables | Coefficient | t-values | Coefficient | t-values | Coefficient | t-values | Coefficient | t-values | Coefficient | t-values | Coefficient | t-values |

| Constant | 0.019 | 0.370 | 0.011 | 0.241 | 0.022 | 0.415 | 0.017 | 0.365 | 0.024 | 0.511 | 0.031 | 0.408 |

| Free_Cash | -0.059 | -1.927** | 0.086 | 1.510** | -0.084 | -2.011*** | 0.092 | 1.955*** | -0.158 | -2.626*** | 0.109 | 2.247*** |

| Control variables | Yes | Yes | Yes | Yes | Yes | Yes | ||||||

| R-squared F-statistic |

28.72% 25.728*** |

26.52% 23.071*** |

32.02% 28.909*** |

29.92% 26.871*** |

37.66% 31.063*** |

35.09% 33.074*** |

||||||

The results also suggest that low FCF firms with high leverage have higher audit fees. High leverage firms, in the presence of low FCF, can increase financial distress and liquidity risks. Further, higher leverage may induce misstatements by managers to avoid violations of accounting-based debt covenants and, hence, increase audit fees. Firms with low FCF and high leverage may impose more risk because low FCF, by definition, indicates that it is likely that these high leverage firms are close to debt covenant violations (Gul & Tsui, 1998, 2001). Overall, this increases auditors’ assessment of clients’ audit risk and audit effort, thereby increasing audit fees.

Thus, this study suggests leverage moderates the increased audit fees only in firms with high FCF. As Jensen (1986) emphasizes, the control function of leverage is more important for high FCF firms rather than low FCF firms.

Conclusion

Our paper offers support for the view that high FCF may affect audit fees and that this impact may be contingent to the level of leverage of the firm. In particular, this study aims to evaluate the relationship between FCF and audit fees, based on the Jensen’s (1986) FCF hypothesis. This research also examines whether the level of leverage moderate the relationship between FCF and audit fees. To the author’s knowledge, the relationship between FCF and audit fees in Portugal and Spain has not been studied. This study is also the first to examine this mediating effect of leverage levels on the relationship between FCF and audit fees in the Portuguese and Spanish contexts.

Consistent with the FCF hypothesis of Jensen (1986), this study suggests that firms with high FCF pay more audit fees, supporting the notion that high FCF intensifies the agency problem. Therefore, auditors will charge higher fees to compensate for the additional work needed to ensure audit quality if they recognize the non-value-maximizing activities of managers of high FCF firms and perceive they as an audit risk factor. This study also shows that the level of leverage has a moderating negative effect on audit fees in the presence of high FCF. Therefore, this study suggests that in high FCF firms, higher leverage levels moderate the increased fees, consistent with the role of debt as a monitoring mechanism. However, we find that low FCF firms with high leverage have higher audit fees, suggesting that leverage seems not interact with low FCF firms to reduce audit fees. Therefore, auditors perceive low FCF/high leverage firms more difficult to audit and, therefore, charging higher fees.

The results of this study make the following contributions. First, this study contributes to the literature by examining how FCF affects audit pricing in the Portuguese and Spanish contexts. The results show that the agency problems of companies with high FCF induce auditors of listed firms in Portugal and Spain to charge higher audit fees to compensate for the additional risk and effort, which is consistent with the FCF hypothesis of Jensen (1986). Second, this study shows that leverage moderates the increased audit fees in firms with high FCF. Therefore, in high FCF firms leverage seems to serve as an external control mechanism to alleviate the agency cost of FCF.

Finally, the findings based on this study provide useful information to investors and corporate boards in evaluating/understanding the impact of FCF on audit fees and the mediating effect of leverage on this relationship. Results suggest that firms with high FCF pay more audit fees. In addition, results also suggest that leverage can reduce the agency cost of high FCF firms as reflected in audit fees. Therefore, investors and boards of directors are recommended to pay attention to high FCF and high leverage, because the additional auditing resources needed to compensate the inefficient use of FCF by managers represents a deadweight cost to investors/shareholders. While high levels of leverage, in presence of high FCF, may mitigate the cost of increased audit fees.

This study has also implications for auditors, which can consider the findings when determine the main factors affecting the audit fees. Indeed, auditors should consider the agency costs of high FCF with low leverage into auditors’ assessment of audit risks. Auditors may also identify this situation (high FCF/low leverage firms) as a “red flag” factor.

Acknowledge

This work was financially supported by the research unit on Governance, Competitiveness and Public Policy (UIDB/04058/2020) + (UIDP/04058/2020), funded by national funds through FCT Fundac?ãão para a Cie?ncia e a Tecnologia

References

- Ahn, S., Denis, D.J., & Denis, D.K. (2006). Leverage and investment in diversified firms. Journal of Financial Economics, 79(2), 317-337.

- Al-Najjar, B. (2018). Corporate governance and audit features: SMEs evidence. Journal of Small Business and Enterprise Development, 25(1), 163-179.

- Al-Najjar, B., & Kilincarslan, E. (2019). What do we know about the dividend puzzle? - A literature survey. International Journal of Managerial Finance, 15(2), 205-235.

- Amihud, Y., & Lev, B. (1981). Risk Reduction as a Managerial Motive for Conglomerate Mergers. The Bell Journal of Economics, 12(2), 605-617.

- Astami, E.W., Rusmin, R., & Hartadi, B. (2017). The role of audit quality and culture influence on earnings management in companies with excessive free cash flow – Evidence from the Asia-Pacific region. International Journal of Accounting and Information Management, 25(1), 21-42.

- Barroso, R., Ali, C.B., & Lesage, C. (2018). ‘Blockholders’ ownership and audit fees: The impact of the corporate governance model. European Accounting Review, 27(1), 149-172.

- Bhundia, A. (2012). A comparative study between free cash flows and earnings management. Business Intelligence Journal, 5(1), 123-129.

- Cai, J. (2013). Does corporate governance reduce the overinvestment of free cash flow? Empirical evidence from China. Journal of Finance and Investment Analysis, 2(3), 97-126.

- Chan, P., Ezzamel, M., & Gwilliam, D. (1993). Determinants of audit fees for quoted UK companies. Journal of Business, Finance and Accounting, 20(6), 765-785.

- Chung, R., Firth, M., & Kim, J.B. (2005). Earnings management, surplus free cash flow, and external monitoring. Journal of Business Research, 58, 766-776.

- Chen, X., Sun, Y., & Xu, X. (2016). Free cash flow, over-investment and corporate governance in China. Pacific-Basin Finance Journal, 37, 81-103.

- Cheung, W.M., & Jiang, L. (2016). Does free cash flow problem contribute to excess stock return synchronicity?. Review of Quantitative Finance and Accounting, 46(1), 123-140.

- Cho, E.J., Lee, J.H., & Park, J.S. (2019). The impact of leverage and overinvestment on project financing: evidence from South Korea. Asia-Pacific Journal of Accounting and Economics, 1-23.

- Christie, A.A., & Zimmerman, J. (1994). Efficient and opportunistic choices of accounting procedures: corporate control contests. The Accounting Review, 69 (4), 539-566.

- Chung, R., Firth, M., & Kim, J.-B. (2005). Earnings management, surplus free cash flow, and external monitoring. Journal of Business Research, 58, 766-776.

- Ding, N., Bhat, K., & Jebran, K. (2020). Debt choice, growth opportunities and corporate investment: evidence from China. Financial Innovation, 6(31), 1-22.

- D’Mello, R., & Miranda, M. (2010). Long-term debt and overinvestment agency problem. Journal of Banking & Finance, 34(2), 324-335.

- Fernandez, R. (2011). Explaining the decline of the Amsterdam financial centre: Globalizing finance and the rise of a hierarchical inter-city network. PhD Thesis, University of Amsterdam, The Netherlands.

- Fernandez, R. (2011). Explaining the decline of the Amsterdam financial centre: Globalizing finance and the rise of a hierarchical inter-city network. PhD Thesis, University of Amsterdam, The Netherlands.

- Fernandez, V. (2011). The Driving Factors of Firm Investment: Latin American Evidence. Emerging Markets Finance and Trade, 47(5), 4-26

- Firth, M., Lin, C., & Wong, S.M.L. (2008). Leverage and investment under a state-owned bank lending environment: Evidence from China. Journal of Corporate Finance, 14(5), 642-653.

- Fleischer, R., & Goettscha, M. (2012). Size effects and audit pricing: Evidence from Germany. Journal of International Accounting, Auditing and Taxation, 21(2), 156-168.

- Francis, J.R. (2004). The Effect of Auditor Firm Size on Audit Prices: A study of the Australian Market. Journal of Accounting and Economics, 6(2), 131-151.

- Friska, F., Kashan, P., & Budiman. (2019). Company Characteristics, Corporate Governance, Audit Quality Impact on Earnings Management. Accounting & Finance Review, 4(2), 43-49.

- Gandi´a, J.L., & Huguet, D. (2019). Audit fees and cost of debt: differences in the credibility of voluntary and mandatory audits. Economic Research-Ekonomska Istraz?ivanja,

- Ghafran, C., & O´Sullivan, N. (2017). The impact of audit committee expertise on audit quality: Evidence from UK audit fees. The British Accounting Review, 49(6), 578-593.

- Ghorbani, A., & Salehi, N. (2021). Earnings management and the informational and disciplining role of debt: evidence from Iran. Journal of Asia Business Studies, 15(1), 72-87.

- Gleason, K.C., Greiner, A.J., & Kannan, Y.H. (2017). Auditor Pricing of Excess Cash Holdings. Journal of Accounting, Auditing & Finance, 32(3), 423-443.

- Griffin, P.A., Lont, D.H., & Sun, Y. (2010). Agency problems and audit fees: further tests of the free cash flow hypothesis. Accounting and Finance, 50(2), 321-350.

- Grossman, S., & Hart, O. (1982). Corporate financial structure and managerial incentives, in John J. Mc-Call (ed.), The Economics of Information and Uncertainty, University of Chicago Press, Chicago, 107-140.

- Gul, F.A., & Tsui, J.S.L. (1998). A test of the free cash flow and debt monitoring hypotheses: Evidence from audit pricing. Journal of Accounting and Economics, 24(2), 219-237.

- Gul, F.A., & Tsui, J.S.L. (2001). Free Cash Flow, Debt Monitoring, and Audit Pricing: Further Evidence on the Role of Director Equity Ownership. Auditing: A Journal of Practice & Theory, 20(2), 71-84.

- Habib, A., Bhuiyan. B.U., & Rahman, A. (2018). “Problem” directors and audit fees. International Journal of Auditing, 23(1), 125-143.

- Harvey, C.R., Lins, K.V., & Roper, A. H. (2004). The effect of capital structure when expected agency costs are extreme. Journal of Financial Economics, 74(1), 3-30.

- Jensen, M.C. (1986). Agency costs of free cash flow, corporate finance, and takeovers. American Economic Review, 76(2), 323-329.

- Jensen, M.C. (1989). Eclipse of the public corporation. Harvard Business Review, 5, 61-74.

- Jensen, M.C., & Meckling, W. H. (1976). Theory of the Firm: Managerial Behavior, Agency and Ownership Structure. Journal of Financial Economics, 3(4), 305-360.

- Jones, S., & Sharma, R. (2001). The impact of free cash flow, financial leverage and accounting regulation on earnings management in Australia’s “old” and “new” economies. Managerial Finance, 27(12), 18-39.

- Joshi, P.L., & AL-Bastaki, H. (2000). Determinants of Audit Fees: Evidence from the Companies Listed in Bahrain. International Journal of Auditing, 4(2), 129-138.

- Lang, H.P., RenéM Stulz, L., & Walkling, R.A. (1991). A test of the free cash flow hypothesis: The case of Bidder returns. Journal of Financial Economics, 29(2), 315-335.

- Lehn, K., & Poulsen, A. (1989). Free Cash Flow and Stockholder Gains in Going Private Transactions. The Journal of Finance, 44(3), 771-787.

- Mohammadi, M.T., Kardan, B., & Salehi, M. (2018). The relationship between cash holdings, investment opportunities and financial constraint with audit fees. Asian Journal of Accounting Research, 3(1), 15-27.

- Palmrose, Z. (1986). Audit fees and auditor size. Journal of Accounting Research, 24(1), 97-110.

- Park, K., & Jang, S. (2013). Capital structure, free cash flow, diversification and firm performance: A holistic analysis. International Journal of Hospitality Management, 33, 51-63.

- Raeisi, A., & Vaez, S.A. (2016). An evaluation of the relationships between the corporate governance mechanisms, the free cash flow, and earnings management in Tehran stock exchange listed companies. International Journal of Humanities and Cultural Studies, 122-140.

- Rediker, K.J. & Seth, A. (1995). Boards of Directors and Substitution Effects of Alternative Governance Mechanisms. Strategic Management Journal, 16(2), 85-99.

- Richardson, S. (2006). Over-investment of free cash flow. Review of Accounting Studies, 11, 159-189.

- Rusmin, R., W. Astami, E., & Hartadi, B. (2014). The impact of surplus free cash flow and audit quality on earnings management: The case of growth triangle countries. Asian Review of Accounting, 22(3), 217-232.

- Salehi, M., BehrouziYekta, M., & Ranjbar, H.R. (2020). The impact of changes in cash flow statement items on audit fees: evidence from Iran. Journal of Financial Reporting and Accounting, 18(2), 225-249.

- Sellami, Y.M., & Cherif, I. (2020). Female audit committee directorship and audit fees, Managerial Auditing Journal, 35(3), 398-428.

- Shailer, G., Cummings, L., Vatuloka, E., & Welch, S. (2004). Discretionary Pricing in a Monopolistic Audit Market. International Journal of Auditing, 8(3), 263-277.

- Shi, M. (2019). Overinvestment and corporate governance in energy listed companies: Evidence from China. Finance Research Letters, 30, 436-445.

- Simunic, D.A. (1980). The pricing of audit services, theory and evidence. Journal of Accounting Research, 18(1), 161-190.

- Stanley, J.D. (2011). Is the Audit Fee Disclosure a Leading Indicator of Clients’ Business Risk?, Auditing: A Journal of Practice & Theory, 30(3), 157-179.

- Stulz, R. (1990). Managerial discretion and optimal financing policies. Journal of Financial Economics, 26(1), 3-27.

- Tee, C.M., Gul, F.A., Foo, Y.B., & The, C.G. (2017). Institutional Monitoring, Political Connections and Audit Fees: Evidence from Malaysian Firms. International Journal of Auditing, 21(2), 164-176.

- Toumeh, A.A., Yahya, S., & Amran, A. (2020). Surplus Free Cash Flow, Stock Market Segmentations and Earnings Management: The Moderating Role of Independent Audit Committee. Global Business Review, 1-30.

- Trong, N.N., & Nguyen, C.T. (2021). Firm performance: the moderation impact of debt and dividend policies on overinvestment”, Journal of Asian Business and Economic Studies, 28(1), 47-63.

- Wang, G.Y. (2010). The impacts of free cash flows and agency costs on firm performance. Journal of Service Science and Management, 3, 408-418.

- Yendrawati, R., & Asy’ari, E.F. (2017). The Role of Corporate Governance as a Leverage Moderating and Free Cash Flow on Earnings Management. Jurnal Keuangan dan Perbankan, 21(3), 412-424.

- Yeo, H.J. (2018). Role of free cash flows in making investment and dividend decisions: The case of the shipping industry. The Asian Journal of Shipping and Logistics, 34(2), 113-118.

- Zhang, D. Cao, H., Dickinson, D.G., Kutan, A. (2016). Free cash flows and overinvestment: Further evidence from Chinese energy firms. Energy Economics, 58, 116-124.